|

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

|

||||

|

Pre-Effective Amendment No.

|

||||

|

Post-Effective Amendment No.

|

28

|

|||

|

and/or

|

||||

|

REGISTRATION STATEMENT UNDER THE INVESTMENT COMPANY ACT OF 1940

|

||||

|

Amendment No.

|

25

|

|||

|

It is proposed that this filing will become effective (check appropriate box):

|

|||

|

immediately upon filing pursuant to paragraph (b)

|

|||

|

x

|

on

|

April 28, 2011

|

pursuant to paragraph (b)

|

|

60 days after filing pursuant to paragraph (a)(1)

|

|||

|

on

|

pursuant to paragraph (a)(1)

|

||

|

75 days after filing pursuant to paragraph (a)(2)

|

|||

|

on

|

pursuant to paragraph (a)(2) of Rule 485

|

||

|

If appropriate, check the following box:

|

|||

|

This post-effective amendment designates a new effective date for a previously filed post-effective amendment.

|

|||

Federated Intermediate Government Fund, Inc.

PROSPECTUS

April 30, 2011

The information contained herein relates to all classes of the Fund's Shares, as listed below, unless otherwise noted.

INSTITUTIONAL

SHARES (TICKER FLDIX)

INSTITUTIONAL SERVICE SHARES (TICKER

FLDSX)

A mutual fund seeking to provide total return by investing primarily in U.S. government and government agency securities, including mortgage-backed securities issued by U.S. government agencies and instrumentalities.

As with all mutual funds, the Securities and Exchange Commission (SEC) has not approved or disapproved these securities or passed upon the adequacy of this Prospectus. Any representation to the contrary is a criminal offense.

| Contents |

Federated Intermediate Government Fund, Inc. (the “Fund”)

RISK/RETURN SUMMARY: INVESTMENT OBJECTIVE

The Fund's investment objective is to provide total return.

RISK/RETURN SUMMARY: FEES AND EXPENSES

This table describes the fees and expenses that you may pay if you buy and hold the Fund's Institutional Shares (IS) and Institutional Service Shares (SS).

| Shareholder Fees (fees paid directly from your investment) | IS | SS |

| Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) | None | None |

| Maximum Deferred Sales Charge (Load) (as a percentage of original purchase price or redemption proceeds, as applicable) | None | None |

| Maximum Sales Charge (Load) Imposed on Reinvested Dividends (and other Distributions) (as a percentage of offering price) | None | None |

| Redemption Fee (as a percentage of amount redeemed, if applicable) | None | None |

| Exchange Fee | None | None |

| Annual

Fund Operating Expenses (expenses that you pay each year as a

percentage of the value of your

investment) | ||

| Management Fee | 0.40% | 0.40% |

| Distribution (12b-1) Fee | None | 0.05% |

| Other Expenses | 1.89% | 1.89% |

| Acquired Fund Fees and Expenses | 0.01% | 0.01% |

| Total Annual Fund Operating Expenses | 2.30% | 2.35% |

| Fee Waivers and/or Expense Reimbursements1 | 1.99% | 1.79% |

| Total Annual Fund Operating Expenses After Fee Waivers and/or Expense Reimbursements | 0.31% | 0.56% |

| 1 | The Adviser and its affiliates have voluntarily agreed to waive their fees and/or reimburse expenses so that the total annual fund operating expenses (excluding Acquired Fund Fees and Expenses) paid by the Fund's IS and SS classes (after the voluntary waivers and/or reimbursements) will not exceed 0.30% and 55% (the “Fee Limit”), respectively, up to but not including the later of (the “Termination Date”): (a) May 1, 2012; or (b) the date of the Fund's next effective Prospectus. While the Adviser and its affiliates currently do not anticipate terminating or increasing these arrangements prior to the Termination Date, these arrangements may only be terminated or the Fee Limit increased prior to the Termination Date with the agreement of the Fund's Board of Directors. |

Example

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds.

The Example assumes that you invest $10,000 for the time periods indicated and then redeem all of your Shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the operating expenses are as shown in the table above and remain the same. Although your actual costs and returns may be higher or lower, based on these assumptions your costs would be:

| Share Class | 1 Year | 3 Years | 5 Years | 10 Years |

| IS | $233 | $718 | $1,230 | $2,636 |

| SS | $238 | $733 | $1,255 | $2,686 |

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund Shares are held in a taxable account. These costs, which are not reflected in Annual Fund Operating Expenses or in the Example, affect the Fund's performance. During the most recent fiscal year, the Fund's portfolio turnover rate was 49% of the average value of its portfolio.

RISK/RETURN SUMMARY: INVESTMENTS, RISKS and PERFORMANCE

What are the Fund's Main Investment Strategies?

The Fund seeks total return, which is defined as income plus capital appreciation. Under normal market conditions, the Fund invests primarily in Treasury, U.S. government securities, government agency and government agency-backed, mortgage-backed securities (MBS). The Fund will only invest in MBS that are issued or guaranteed by U.S. government agencies or U.S. government-sponsored enterprises (GSEs).

The Fund typically seeks to maintain an overall average dollar-weighted portfolio duration that is within 20% above or 50% below the Barclays Capital Intermediate Government Index (the “Index”). At times, the Adviser's calculation of portfolio duration may result in variances outside this range. Duration is a measure of the price volatility of a fixed-income security as a result of changes in market rates of interest, based on the weighted average timing of the instrument's expected fixed interest and principal payments. The Adviser seeks to create a portfolio, consisting of U.S. Government securities, MBS, derivative instruments and other securities, that outperform the Index.

Based on fundamental analysis, the Adviser will consider a variety of factors when making decisions to purchase or sell particular securities or derivative contracts. The Fund may, but is not required to, use derivative instruments, which are instruments that have a value based on another instrument, exchange rate or index, and may be used as substitutes for securities in which the Fund can invest, or to hedge against a potential loss in the underlying asset. There can be no assurance that the Fund's use of derivative instruments will work as intended.

What are the Main Risks of Investing in the Fund?

All mutual funds take investment risks. Therefore, it is possible to lose money by investing in the Fund. The primary factors that may reduce the Fund's returns include:

- MBS Risks. A rise in interest rates may cause the value of MBS held by the Fund to decline. Certain MBS issued by GSEs are not backed by the full faith and credit of the U.S. government. The Fund's investments in collateralized mortgage obligations (CMOs) may entail greater market, prepayment and liquidity risks than other MBS.

- Interest Rate Risks. Prices of fixed-income securities generally fall when interest rates rise.

- Prepayment Risks. When homeowners prepay their mortgages in response to lower interest rates, the Fund will be required to reinvest the proceeds at the lower interest rates available. Also, when interest rates fall, the prices of MBS may not rise to as great an extent as those of other fixed-income securities due to the potential prepayment of higher interest mortgages.

- Liquidity Risks. The CMOs in which the Fund invests may be less readily marketable and may be subject to greater fluctuation in price than other securities.

- Leverage Risks. Leverage risk is created when an investment exposes the Fund to a level of risk that exceeds the amount invested. Changes in the value of such an investment magnify the Fund's risk of loss and potential for gain.

- Risks of Investing in Derivative Instruments. The Fund's exposure to derivative contracts and hybrid instruments (either directly or through its investment in another investment company) involves risks different from, or possibly greater than, the risks associated with investing directly in securities and other traditional investments. The use of derivatives can lead to losses because of adverse movements in the price or value of the asset, index, rate or instrument underlying a derivative, due to failure of a counterparty, or the failure of the counterparty to meet its obligations under the contract, or due to tax or regulatory constraints. Derivatives may create investment leverage in the Fund, which magnifies the Fund's exposure to the underlying investment. Derivative instruments may be difficult to value, may be illiquid and may be subject to wide swings in valuation caused by changes in the value of the underlying instrument. Over-the-counter derivative contracts generally carry greater liquidity risk than exchange-traded contracts. The loss on derivative transactions may substantially exceed the initial investment.

- Asset Segregation Risks. The requirement to secure its obligations in connection with certain transactions, including derivatives or other transactions that expose it to an obligation of another party, by owning underlying assets, entering into offsetting transactions or setting aside cash or liquid assets, may cause the Fund to miss favorable trading opportunities, or to realize losses on such offsetting transactions.

The Shares offered by this Prospectus are not deposits or obligations of any bank, are not endorsed or guaranteed by any bank and are not insured or guaranteed by the U.S. government, the Federal Deposit Insurance Corporation, the Federal Reserve Board or any other government agency.

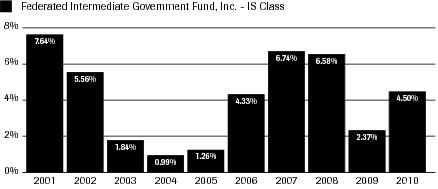

Performance: Bar Chart and Table

The bar chart and performance table below reflect historical performance data for the Fund and are intended to help you analyze the Fund's investment risks in light of its historical returns. The bar chart shows the variability of the Fund's IS class total returns on a calendar year-by-year basis. The Average Annual Total Return table shows returns for each class averaged over the stated periods, and includes comparative performance information. The Fund's performance will fluctuate, and past performance (before and after taxes) is not necessarily an indication of future results. Updated performance information for the Fund is available under the “Products” section at FederatedInvestors.com or by calling 1-800-341-7400.

The Fund's IS class total return for the three-month period from January 1, 2011 to March 31, 2011, was 0.11%.

Within the periods shown in the bar chart, the Fund's IS class highest quarterly return was 3.77% (quarter ended December 31, 2008). Its lowest quarterly return was (1.49)% (quarter ended December 31, 2010).

Average Annual Total Return Table

In addition to Return Before Taxes, Return After Taxes is shown for the Fund's IS class to illustrate the effect of federal taxes on Fund returns. After-tax returns are shown only for the IS class, and after-tax returns for the SS class will differ from those shown for the IS class. Actual after-tax returns depend on each

investor's personal tax situation, and are likely to differ from those shown. After-tax returns are calculated using a standard set of assumptions. The stated returns assume the highest historical federal income and capital gains tax rates. These after-tax returns do not reflect the effect of any applicable state and local taxes. After-tax returns are not relevant to investors holding Shares through a 401(k) plan, an Individual Retirement Account (IRA) or other tax-advantaged investment plan.(For the Period Ended December 31, 2010)

| 1 Year | 5 Years | 10 Years |

| Share Class |

| IS: |

| Return Before Taxes | 4.50% | 4.89% | 4.15% |

| Return After Taxes on Distributions | 3.90% | 3.60% | 2.85% |

| Return After Taxes on Distributions and Sale of Fund Shares | 2.93% | 3.42% | 2.77% |

| SS: |

| Return Before Taxes | 4.29% | 4.66% | 3.91% |

| Barclays Capital Intermediate Government

Index1 (reflects no deduction for fees, expenses or taxes) | 5.89% | 5.53% | 5.51% |

| 1 | Barclays Capital Intermediate Government Index is an unmanaged index comprised of all publicly issued, non-convertible domestic debt of the U.S. government or any agency thereof, or any quasi-federal corporation and of corporate debt guaranteed by the U.S. government. Only notes and bonds with minimum outstanding principal of $1 million and minimum maturity of one year and maximum maturity of ten years are included. |

The Fund's Investment Adviser (“Adviser”) is Federated Investment Management Company.

Liam O'Connell, Portfolio Manager, has been the Fund's portfolio manager since June 2005.

purchase and sale of fund shares

You may purchase, redeem or exchange Shares of the Fund on any day the New York Stock Exchange (NYSE) is open. Shares may be purchased through a financial intermediary or directly from the Fund, by wire or by check. Please note that certain purchase restrictions may apply. Redeem or exchange Shares through a financial intermediary or directly from the Fund by telephone at 1-800-341-7400 or by mail.

The minimum initial investment amount for the Fund's IS and SS classes is generally $1,000,000 and there is no required minimum subsequent investment amount.

The Fund's distributions are taxable as ordinary income or capital gains except when your investment is through a 401(k) plan, an IRA or other tax-advantaged investment plan.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase the Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund and/or its related companies may pay the intermediary for the sale of Fund Shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary's website for more information.

What are the Fund's Investment Strategies?

A statement of the Fund's investment objective and principal investment strategies and risks is set forth above in the Fund's Risk/Return Summary. There can be no assurances that the Fund will achieve its investment objective or that the investment strategies used by the Adviser will be successful.

The Fund seeks total return, which is defined as income plus capital appreciation. Under normal market conditions, the Fund invests primarily in Treasury, U.S. government agency securities and U.S. government agency-backed, mortgage-backed securities (MBS). The Fund will only invest in MBS that are issued or guaranteed by U.S. government agencies or U.S. government-sponsored enterprises (GSEs). The Fund also may invest in U.S. government securities and certain derivative instruments.

The Fund typically seeks to maintain an overall average dollar-weighted portfolio duration that is within 20% above or 50% below the Barclays Capital Intermediate Government Index (the “Index”). At times, the Adviser's calculation of portfolio duration may result in variances outside this range. Duration is a measure of the price volatility of a fixed-income security as a result of changes in market rates of interest, based on the weighted average timing of the instrument's expected fixed interest and principal payments. For example, if interest rates rise by 1% (in a parallel shift) the NAV of a fund with an average duration of five years theoretically would decline about 5.0%. Securities with longer durations tend to be more sensitive to interest rate changes than securities with shorter durations.

The Adviser seeks to create a portfolio, consisting of U.S. government securities, MBS, derivative instruments and other securities, that outperforms the Index. In implementing the Fund's investment strategy, the Adviser typically will take into consideration: (i) overall levels of interest rates; (ii) volatility of interest rates; (iii) relative interest rates of securities with longer and shorter durations (known as a “yield curve”); and (iv) relative interest rates of different types of securities (such as U.S. government securities and MBS).

Based on fundamental analysis, the Adviser will consider a variety of factors when making decisions to purchase or sell particular securities or derivative contracts, including: the securities' specific interest rate and prepayment risks, and price sensitivity to changes in market spread levels and in the level of interest rate volatility. In analyzing MBS, the Adviser also may consider the average interest rates of the underlying loans, the prior and expected prepayments.

The Fund may, but is not required to, use derivative instruments, which are instruments that have a value based on another instrument, exchange rate or index, and may be used as substitutes for securities in which the Fund can invest, or to hedge against a potential loss in the underlying asset. The Fund may use futures contracts, options, options on futures (including those relating to interest rates) and swaps as tools in the management of portfolio assets, or other elements of its investment strategy. There can be no assurance that the Fund's use of derivative instruments will work as intended.

Because the Fund refers to U.S. government securities in its name, it will notify shareholders at least 60 days in advance of any change in its investment policies that would enable the Fund to invest, under normal circumstances, less than 80% of its assets in U.S. government investments.

The Fund actively trades its portfolio securities in an attempt to achieve its investment objective. Active trading will cause the Fund to have an increased portfolio turnover rate, which is likely to generate shorter-term gains (losses) for its shareholders, which are taxed at a higher rate than longer-term gains (losses). Actively trading portfolio securities increases the Fund's trading costs and may have an adverse impact on the Fund's performance.

The Fund may temporarily depart from its principal investment strategies by investing its assets in shorter-term debt securities and similar obligations or by holding cash. It may do this in response to unusual circumstances, such as: adverse market, economic or other conditions (for example, to help avoid potential losses or during periods when there is a shortage of appropriate securities); to maintain liquidity to meet shareholder redemptions; or to accommodate cash inflows. It is possible that such investments could affect the Fund's investment returns and/or the ability to achieve the Fund's investment objectives.

What are the Fund's Principal Investments?

The following provides general information on the Fund's principal investments. The Fund's Statement of Additional Information (SAI) provides information about the Fund's non-principal investments and may provide additional information about the Fund's principal investments.

Fixed-Income Securities

The Fund may invest in the fixed-income securities described below. The Fund's fixed-income investments may include bonds, notes (including structured notes), mortgage-related securities and money market instruments. Fixed-income securities may be issued by: the U.S. government, its agencies, authorities, instrumentalities or GSEs. These securities may have all types of interest rate payment and reset terms, including fixed rate, adjustable rate and zero coupon.

U.S. government securities include U.S. Treasury obligations, which differ in their yields, maturities and times of issuance, and obligations issued or guaranteed by U.S. government agencies or instrumentalities (“agency obligations”). Agency obligations may be guaranteed by the U.S. government or they may be backed by the right of the issuer to borrow from the U.S. Treasury, the discretionary authority of the U.S. government to purchase the obligations, or the credit of the agency or instrumentality. As a result of their high credit quality and market liquidity, U.S. government securities generally provide lower current yields than obligations of other issuers. While certain U.S. government-sponsored enterprises (such as the Federal Home Loan Mortgage Corporation and the Federal National Mortgage Association) may be chartered or sponsored by acts of Congress, their securities are neither issued nor guaranteed by the U.S. Treasury.

Mortgage-Backed Securities (MBS) (A Fixed-Income Security)

An MBS is a type of pass-through security, which is a pooled debt obligation repackaged as interests that pass principal and interest through an intermediary to investors. In the case of MBS, the ownership interest is in a pool of mortgage loans. MBS represent participation interests in pools of adjustable and fixed-rate mortgage loans. The Fund will only invest in MBS that are issued or guaranteed by U.S. government agencies. Unlike conventional debt obligations, MBS provide monthly payments derived from the monthly interest and principal payments (including any prepayments) made by the individual borrowers on the pooled mortgage loans.

The MBS acquired by the Fund could be secured by fixed-rate mortgages, adjustable-rate mortgages or hybrid adjustable-rate mortgages. Adjustable-rate mortgages are mortgages whose interest rates are periodically reset when market rates change. A hybrid adjustable-rate mortgage (“hybrid ARM”) is a type of mortgage in which the interest rate is fixed for a specified period and then resets periodically, or floats, for the remaining mortgage term. Hybrid ARMs are usually referred to by their fixed and floating periods. For example, a “5/1 ARM” refers to a mortgage with a five-year, fixed interest rate period, followed by 25 annual interest rate adjustment periods.

The Fund also may invest in collateralized mortgage obligations (CMOs). CMOs are issued in multiple classes, often referred to as “tranches,” with each tranche having a specific fixed or floating coupon rate, and stated maturity or final distribution date. CMOs are subject to the uncertainty of the timing of cash flows that results from the rate of prepayments on the underlying mortgages

serving as collateral and from the structure of the particular CMO transaction (that is, the priority of the individual tranches). An increase or decrease in prepayment rates (resulting from a decrease or increase in mortgage interest rates) may cause the CMOs to be retired substantially earlier or later than their stated maturities or final distribution dates, and will affect the yields and prices of CMOs.Mortgage dollar rolls are transactions in which the Fund sells MBS for delivery in the current month with a simultaneous contract entered to repurchase substantially similar (same type, coupon and maturity) securities on a specified future date and price (a “mortgage roll”). During the roll period, the Fund foregoes principal and interest paid on the MBS. Mortgage dollar roll transactions may be used to seek to increase the Fund's income. The Fund uses repurchase agreements to secure its obligations in these transactions.

Repurchase Agreements (A Fixed-Income Security)

Repurchase agreements are transactions in which the Fund buys a security from a dealer or bank and agrees to sell the security back at a mutually agreed-upon time and price. The repurchase price exceeds the sale price, reflecting the Fund's return on the transaction. This return is unrelated to the interest rate on the underlying security. The Fund will enter into repurchase agreements only with banks and other recognized financial institutions, such as securities dealers, deemed creditworthy by the Adviser.

The Fund's custodian or subcustodian will take possession of the securities subject to repurchase agreements. The Adviser or subcustodian will monitor the value of the underlying security each day to ensure that the value of the security always equals or exceeds the repurchase price.

Repurchase agreements are subject to credit risks. The Fund invests in overnight repurchase agreements in order to maintain sufficient cash to pay for daily net redemptions and portfolio transactions. The Fund uses repurchase agreements to secure its obligations in connection with dollar roll transactions.

The Fund may enter into derivatives transactions with respect to any security or other instrument in which it is permitted to invest, or any related security, instrument, index or economic indicator (“reference instruments”). Derivatives are financial instruments the value of which is derived from the underlying reference instrument. Derivatives may allow the Fund to increase or decrease the level of risk to which the Fund is exposed more quickly and efficiently than transactions in other types of instruments. The Fund incurs costs in connection with opening and closing derivatives positions.

The Fund may engage in transactions in futures contracts and options on futures contracts. Futures are standardized, exchange-traded contracts that obligate a purchaser to take delivery, and a seller to make delivery, of a specific amount of an asset at a specified future date at a specified price. Futures contracts involve substantial leverage risk. The Fund also is authorized to purchase or sell call and put options on futures contracts. The Fund can buy or sell financial

futures (such as interest rate futures, index futures and security futures). The primary risks associated with the use of futures contracts and options are imperfect correlation, liquidity, unanticipated market movement and counterparty risk. The Fund also may enter into other derivative transactions with substantially similar characteristics and risks or over-the-counter derivatives such as interest rate swaps, caps and floors and options or other instruments.What are the Specific Risks of Investing in the Fund?

The following provides general information on the risks associated with the Fund's principal investments. The Fund may invest in other types of securities or investments as non-principal investments. Any additional risks associated with investing in such other non-principal investments are described in the Fund's SAI. The Fund's SAI also may provide additional information about the risks associated with the Fund's principal investments.

MBS have unique risks. A rise in interest rates may cause the value of MBS held by the Fund to decline. The mortgage loans underlying MBS generally are subject to a greater rate of principal prepayments in a declining interest rate environment and to a lesser rate of principal prepayments in an increasing interest rate environment. If the underlying mortgages are paid off sooner than expected, the Fund may have to reinvest this money in mortgage-backed or other securities that have lower yields. See “Prepayment Risks.” The Fund only invests in MBS issued or guaranteed by the U.S. government or government agency. Certain MBS issued by GSEs are not backed by the full faith and credit of the U.S. government, but are, however, supported through federal subsidies, loans or other benefits. The Fund also may invest in certain MBS issued by GSEs that have no explicit financial support, but that are regarded as having implied support because the federal government sponsors their activities.

Hybrid ARMs also involve special risks. Like ARMs, hybrid ARMs have periodic and lifetime limitations on the increases that can be made to the interest rates that mortgagors pay. Therefore, if during a floating rate period, interest rates rise above the interest rate limits of the hybrid ARM, the Fund will not benefit from further increases in interest rates. CMOs with complex or highly variable prepayment terms generally entail greater market, prepayment and liquidity risks than other MBS. For example, their prices are more volatile and their trading market may be more limited.

Prices of fixed-income securities rise and fall in response to interest rate changes in the interest paid by similar securities. Generally, when interest rates rise, prices of fixed-income securities fall. However, market factors, such as the demand for particular fixed-income securities, may cause the prices of certain fixed-income securities to fall while the prices of other securities rise or remain unchanged. Interest rate changes have a greater effect on the prices of fixed-income securities with longer durations.

PREPAYMENT RISKS

Unlike traditional fixed-income securities, which pay a fixed rate of interest until maturity (when the entire principal amount is due), payments on MBS include both interest and a partial payment of principal. Partial payment of principal may be comprised of scheduled principal payments, as well as unscheduled payments from the voluntary prepayment, refinancing or foreclosure of the underlying loans. These unscheduled prepayments of principal create risks that can adversely affect the Fund's MBS holdings.

The mortgage loans underlying MBS are generally subject to a greater rate of principal prepayments in a declining interest rate environment and to a lesser rate of principal prepayments in a rising interest rate environment. Under certain interest and prepayment rate scenarios, the Fund may fail to recover the full amount of its investment in MBS, notwithstanding any direct or indirect governmental or agency guarantee. Because faster-than-expected prepayments typically are invested in lower yielding securities, MBS are less effective than conventional bonds in “locking in” a specified yield rate. For premium bonds, prepayment risk may be elevated. In a rising interest rate environment, a declining prepayment rate will extend the average life of many MBS. This possibility is often referred to as extension risk. Extending the average life of an MBS increases the risk of depreciation due to future increases in market interest rates.

The secondary market for some securities held by the Fund is less liquid than for more widely traded fixed-income securities. In certain situations, the Fund could find it more difficult to sell such securities at desirable times and/or prices. Liquidity risk also refers to the possibility that the Fund may not be able to sell a security or close out a derivative contract when it wants to. If this happens, the Fund will be required to continue to hold the security or keep the position open, and the Fund could incur losses.

Leverage risk is created when an investment, which includes, for example, an investment in a derivative contract, exposes the Fund to a level of risk that exceeds the amount invested. Changes in the value of such an investment magnify the Fund's risk of loss and potential for gain. Investments can have these same results if their returns are based on a multiple of a specified index, security or other benchmark.

RISKS OF INVESTING IN DERIVATIVE INSTRUMENTS

The Fund's exposure to derivative contracts and hybrid instruments (either directly or through its investment in another investment company) involves risks different from, or possibly greater than, the risks associated with investing directly in securities and other traditional investments. The use of derivatives can lead to losses because of adverse movements in the price or value of the asset, index, rate or instrument underlying a derivative, due to failure of a counterparty, or the

failure of the counterparty to meets its obligations under the contract, or due to tax or regulatory constraints. Derivatives may create investment leverage in the Fund, which magnifies the Fund's exposure to the underlying investment. Derivative risks may be more significant when derivatives are used to enhance return or as a substitute for a position or security, rather than solely to hedge the risk of a position or security held by the Fund. Derivatives used for hedging purposes may not reduce risk if they are not sufficiently correlated to the position being hedged. A decision as to whether, when and how to use options involves the exercise of specialized skill and judgment, and even a well-conceived transaction may be unsuccessful to some degree because of market behavior or unexpected events. Derivative instruments may be difficult to value, may be illiquid and may be subject to wide swings in valuation caused by changes in the value of the underlying instrument. OTC derivative contracts generally carry greater liquidity risk than exchange-traded contracts. This risk may be increased in times of financial stress, if the trading market for OTC derivative contracts becomes restricted. The loss on derivative transactions may substantially exceed the initial investment.In order to secure its obligations in connection with derivative contracts or other transactions that expose it to an obligation of another party, the Fund will either own the underlying assets, enter into offsetting transactions or set aside cash or readily marketable securities. This requirement may cause the Fund to miss favorable trading opportunities, due to a lack of sufficient cash or readily marketable securities. This requirement also may cause the Fund to realize losses on offsetting or terminated derivative contracts.

CALCULATION OF NET ASSET VALUE

When the Fund receives your transaction request in proper form (as described in this Prospectus), it is processed at the next calculated net asset value of a Share (NAV). A Share's NAV is determined as of the end of regular trading on the New York Stock Exchange (NYSE) (normally 4:00 p.m. Eastern time), each day the NYSE is open. The Fund calculates the NAV of each class by valuing the assets allocated to the Share's class, subtracting the liabilities allocated to the class and dividing the balance by the number of Shares of the class outstanding. The Fund's current NAV and public offering price may be found at FederatedInvestors.com and in the mutual funds section of certain newspapers under “Federated.”

You can purchase, redeem or exchange Shares any day the NYSE is open.

When the Fund holds fixed-income securities that trade on days the NYSE is closed, the value of the Fund's assets may change on days you cannot purchase or redeem Shares.

In calculating its NAV, the Fund generally values investments as follows:

- Fixed-income securities acquired with remaining maturities greater than 60 days are fair valued using price evaluations provided by a pricing service approved by the Board of Directors (“Board”).

- Fixed-income securities acquired with remaining maturities of 60 days or less are valued at their cost (adjusted for the accretion of any discount or amortization of any premium).

- Derivative contracts listed on exchanges are valued at their reported settlement or closing price, except that options are valued at the mean of closing bid and asked quotations.

- Over-the-counter (OTC) derivative contracts are fair valued using price evaluations provided by a pricing service approved by the Board.

If the Fund cannot obtain a price or price evaluation from a pricing service for an investment, the Fund may attempt to value the investment based upon the mean of bid and asked quotations, or fair value the investment based on price evaluations, from one or more dealers. If any price, quotation, price evaluation or other pricing source is not readily available when the NAV is calculated, the Fund uses the fair value of the investment determined in accordance with the procedures described below. There can be no assurance that the Fund could purchase or sell an investment at the price used to calculate the Fund's NAV.

Shares of other mutual funds are valued based upon their reported NAVs. The prospectuses for these mutual funds explain the circumstances under which they will use fair value pricing and the effects of using fair value pricing.

Fair Valuation and Significant Events Procedures

The Board has ultimate responsibility for determining the fair value of investments for which market quotations are not readily available. The Board has appointed a Valuation Committee comprised of officers of the Fund and of the Adviser to assist in this responsibility and in overseeing the calculation of the NAV. The Board has also authorized the use of pricing services recommended by the Valuation Committee to provide fair value evaluations of the current value of certain investments for purposes of calculating the NAV. In the event that market quotations and price evaluations are not available for an investment, the Valuation Committee determines the fair value of the investment in accordance with procedures adopted by the Board. The Board periodically reviews and approves the fair valuations made by the Valuation Committee and any changes made to the procedures. The Fund's SAI discusses the methods used by pricing services and the Valuation Committee to value investments.

Using fair value to price investments may result in a value that is different from an investment's most recent closing price and from the prices used by other mutual funds to calculate their NAVs. The Valuation Committee generally will not change an investment's fair value in the absence of new information relating to the investment or its issuer, such as changes in the issuer's business or financial

results, or relating to external market factors, such as trends in the market values of comparable securities. This may result in less frequent, and larger, changes in fair values as compared to prices based on market quotations or price evaluations from pricing services or dealers.The Board also has adopted procedures requiring an investment to be priced at its fair value whenever the Adviser determines that a significant event affecting the value of the investment has occurred between the time as of which the price of the investment would otherwise be determined and the time as of which the NAV is computed. An event is considered significant if there is both an affirmative expectation that the investment's value will change in response to the event and a reasonable basis for quantifying the resulting change in value. Examples of significant events that may occur after the close of the principal market on which a security is traded, or after the time of a price evaluation provided by a pricing service or a dealer, include:

- With respect to price evaluations of fixed-income securities determined before the close of regular trading on the NYSE, actions by the Federal Reserve Open Market Committee and other significant trends in U.S. fixed-income markets;

- Political or other developments affecting the economy or markets in which an issuer conducts its operations or its securities are traded; and

- Announcements concerning matters such as acquisitions, recapitalizations or litigation developments or a natural disaster affecting the issuer's operations or regulatory changes or market developments affecting the issuer's industry.

The Valuation Committee uses a pricing service to determine the fair value of equity securities traded principally in foreign markets when the Adviser determines that there has been a significant trend in the U.S. equity markets or in index futures trading. For other significant events, the Fund may seek to obtain more current quotations or price evaluations from alternative pricing sources. If a reliable alternative pricing source is not available, the Valuation Committee will determine the fair value of the investment using another method approved by the Board. The Board has ultimate responsibility for any fair valuations made in response to a significant event.

The fair valuation of securities following a significant event can serve to reduce arbitrage opportunities for short-term traders to profit at the expense of long-term investors in the Fund. For example, such arbitrage opportunities may exist when the market on which portfolio securities are traded closes before the Fund calculates its NAV, which is typically the case with Asian and European markets. However, there is no assurance that these significant event procedures will prevent dilution of the NAV by short-term traders. See “Account and Share Information – Frequent Trading Policies” for other procedures the Fund employs to deter such short-term trading.

How is the Fund Sold?

The Fund offers two Share classes: Institutional Shares (IS) and Institutional Service Shares (SS), each representing interests in a single portfolio of securities. All Share classes have different sales charges and/or other expenses which affect their performance. Please note that certain purchase restrictions may apply.

Under the Distributor's Contract with the Fund, the Distributor, Federated Securities Corp., offers Shares on a continuous, best-efforts basis. The Distributor is a subsidiary of Federated Investors, Inc. (“Federated”).

The Fund's Distributor markets IS and SS classes to Eligible Investors, as described below. In connection with a request to purchase an IS or SS class, you should provide documentation sufficient to verify your status as an Eligible Investor. As a general matter, IS and SS classes are not available for direct investment by natural persons.

The following categories of Eligible Investors are not subject to any minimum initial investment amount for the purchase of IS or SS classes (however, such accounts remain subject to the Fund's policy on “Accounts with Low Balances” as discussed later in this Prospectus):

- An investor participating in a wrap program or other fee-based program sponsored by a financial intermediary;

- An investor participating in a no-load network or platform sponsored by a financial intermediary where Federated has entered into an agreement with the intermediary;

- A trustee/director, employee or former employee of the Fund, the Adviser, the Distributor and their affiliates; an immediate family member of these individuals or a trust, pension or profit-sharing plan for these individuals;

- An employer-sponsored retirement plan;

- A trust institution investing on behalf of its trust customers;

- Additional sales to an investor (including a natural person) who owned IS and/or SS classes of the Fund as of December 31, 2008;

- An investor (including a natural person) who acquired IS and/or SS classes of a Federated fund pursuant to the terms of an agreement and plan of reorganization which permits the investor to acquire such shares; and

- In connection with an acquisition of an investment management or advisory business, or related investment services, products or assets, by Federated or its investment advisory subsidiaries, an investor (including a natural person) who: (1) becomes a client of an investment advisory subsidiary of Federated; or (2) is a shareholder or interest holder of a pooled investment vehicle or product that becomes advised or subadvised by a Federated investment advisory subsidiary as a result of such an acquisition other than as a result of a fund reorganization transaction pursuant to an agreement and plan of reorganization.

The following categories of Eligible Investors are subject to applicable minimum initial investment amounts for the purchase of IS or SS classes (see “How to Purchase Shares” below):

- An investor, other than a natural person, purchasing IS and/or SS classes directly from the Fund; and

- In connection with an initial purchase of IS and/or SS classes through an exchange, an investor (including a natural person) who owned IS and/or SS classes of another Federated fund as of December 31, 2008.

Payments to Financial Intermediaries

The Fund and its affiliated service providers may pay fees as described below to financial intermediaries (such as broker-dealers, banks, investment advisers or third-party administrators) whose customers are shareholders of the Fund.

The Board has adopted a Rule 12b-1 Plan, which allows payment of marketing fees of up to 0.05% (SS class) of average net assets to the Distributor for the sale, distribution, administration and customer servicing of the Fund's SS class. When the Distributor receives Rule 12b-1 Fees, it may pay some or all of them to financial intermediaries whose customers purchase Shares. The Fund's SS class has no present intention of paying or accruing a Rule 12b-1 Fee during the fiscal year ending February 29, 2012. Because these Shares pay marketing fees on an ongoing basis, your investment cost may be higher over time than other shares with different marketing fees.

IS and SS classes may pay Service Fees of up to 0.25% of average net assets to financial intermediaries or to Federated Shareholder Services Company (FSSC), a subsidiary of Federated, for providing services to shareholders and maintaining shareholder accounts. Intermediaries that receive Service Fees may include a company affiliated with management of Federated. If a financial intermediary receives Service Fees on an account, it is not eligible to also receive Account Administration Fees on that same account.

IS and SS classes may pay Account Administration Fees of up to 0.25% of average net assets to banks that are not registered as broker-dealers or investment advisers for providing administrative services to the Funds and shareholders. If a financial intermediary receives Account Administration Fees on an account, it is not eligible to also receive Service Fees or Recordkeeping Fees on that same account.

RECORDKEEPING FEES

The Fund may pay Recordkeeping Fees on an average-net-assets basis or on a per-account-per-year basis to financial intermediaries for providing recordkeeping services to the Fund and its shareholders. If a financial intermediary receives Recordkeeping Fees on an account, it is not eligible to also receive Account Administration Fees or Networking Fees on that same account.

The Fund may reimburse Networking Fees on a per-account-per-year basis to financial intermediaries for providing administrative services to the Fund and its shareholders on certain non-omnibus accounts. If a financial intermediary receives Networking Fees on an account, it is not eligible to also receive Recordkeeping Fees on that same account.

ADDITIONAL PAYMENTS TO FINANCIAL INTERMEDIARIES

The Distributor may pay out of its own resources amounts (including items of material value) to certain financial intermediaries that support the sale of Shares or provide services to Fund shareholders. The amounts of these payments could be significant, and may create an incentive for the financial intermediary or its employees or associated persons to recommend or sell Shares of the Fund to you. In some cases, such payments may be made by or funded from the resources of companies affiliated with the Distributor (including the Adviser). These payments are not reflected in the fees and expenses listed in the fee table section of the Fund's Prospectus and described above because they are not paid by the Fund.

These payments are negotiated and may be based on such factors as: the number or value of Shares that the financial intermediary sells or may sell; the value of client assets invested; or the type and nature of services or support furnished by the financial intermediary. These payments may be in addition to payments, as described above, made by the Fund to the financial intermediary. In connection with these payments, the financial intermediary may elevate the prominence or profile of the Fund and/or other Federated funds within the financial intermediary's organization by, for example, placement on a list of preferred or recommended Funds, and/or granting the Distributor preferential or enhanced opportunities to promote the Funds in various ways within the financial intermediary's organization. You can ask your financial intermediary for information about any payments it receives from the Distributor or the Fund and any services provided.

You may purchase Shares of the Fund any day the NYSE is open. The Fund reserves the right to reject any request to purchase or exchange Shares. New investors must submit a completed New Account Form. All accounts are subject to the Fund's policy on “Accounts with Low Balances” as discussed later in this Prospectus.

Eligible investors may purchase Shares through a financial intermediary, directly from the Fund or through an exchange from another Federated fund in the manner described above under “How is the Fund Sold?”

Where applicable, the required minimum initial investment for IS and SS classes is generally $1,000,000. There is no required minimum subsequent investment amount.

THROUGH A FINANCIAL INTERMEDIARY

- Establish an account with the financial intermediary; and

- Submit your purchase order to the financial intermediary before the end of regular trading on the NYSE (normally 4:00 p.m. Eastern time).

You will receive the next calculated NAV if the financial intermediary forwards the order on the same day, and forwards your payment by the prescribed trade settlement date (typically within one to three business days) to the Fund's transfer agent, State Street Bank and Trust Company (“Transfer Agent”). You will become the owner of Shares and receive dividends when your payment is received in accordance with these time frames (provided that, if payment is received in the form of a check, the check clears). If your payment is not received in accordance with these time frames, or a check does not clear, your purchase will be canceled and you could be liable for any losses, fees or expenses incurred by the Fund or the Fund's Transfer Agent.

Financial intermediaries should send payments according to the instructions in the sections “By Wire” or “By Check.”

Financial intermediaries may impose higher or lower minimum investment requirements on their customers than those imposed by the Fund. Keep in mind that financial intermediaries may charge you fees for their services in connection with your Share transactions.

- Establish your account with the Fund by submitting a completed New Account Form; and

- Send your payment to the Fund by Federal Reserve wire or check.

You will become the owner of Shares and your Shares will be priced at the next calculated NAV after the Fund receives your wire or your check. If your check does not clear, your purchase will be canceled and you could be liable for any losses or fees incurred by the Fund or the Fund's Transfer Agent.

By Wire

To facilitate processing your order, please call the Fund before sending the wire. Send your wire to:

State

Street Bank and Trust Company

Boston, MA

Dollar

Amount of Wire

ABA Number 011000028

BNF:

23026552

Attention: Federated

EDGEWIRE

Wire Order Number, Dealer Number or Group

Number

Nominee/Institution Name

Fund Name and Number

and Account Number

You cannot purchase Shares by wire on holidays when wire transfers are restricted.

Make your check payable to The Federated Funds, note your account number on the check, and send it to:

The Federated

Funds

P.O. Box 8600

Boston, MA

02266-8600

If you send your check by a private courier or overnight delivery service that requires a street address, send it to:

The Federated

Funds

30 Dan Road

Canton, MA

02021

Payment should be made in U.S. dollars and drawn on a U.S. bank. The Fund reserves the right to reject any purchase request. For example, to protect against check fraud the Fund may reject any purchase request involving a check that is not made payable to The Federated Funds (including, but not limited to, requests to purchase Shares using third-party checks) or involving temporary checks or credit card checks.

You may purchase Fund Shares through an exchange from another Federated fund. An exchange is treated as a redemption and a subsequent purchase, and is a taxable transaction.

To do this you must:

- ensure that the account registrations are identical;

- meet any applicable minimum initial investment requirements; and

- receive a prospectus for the fund into which you wish to exchange.

The Fund may modify or terminate the exchange privilege at any time.

You may purchase Shares through an exchange from any Federated fund or share class that does not have a stated sales charge or contingent deferred sales charge, except Federated Liberty U.S. Government Money Market Trust and any R class.

BY AUTOMATED CLEARING HOUSE (ACH)

Once you have opened an account, you may purchase additional Shares through a depository institution that is an ACH member. This purchase option can be established by completing the appropriate sections of the New Account Form.

How to Redeem and Exchange Shares

You should redeem or exchange Shares:

- through a financial intermediary if you purchased Shares through a financial intermediary; or

- directly from the Fund if you purchased Shares directly from the Fund.

Shares of the Fund may be redeemed for cash, or exchanged for shares of other Federated funds as described herein, on days on which the Fund computes its NAV. Redemption requests may be made by telephone or in writing.

THROUGH A FINANCIAL INTERMEDIARY

Submit your redemption or exchange request to your financial intermediary by the end of regular trading on the NYSE (normally 4:00 p.m. Eastern time). The redemption amount you will receive is based upon the next calculated NAV after the Fund receives the order from your financial intermediary.

You may redeem or exchange Shares by simply calling the Fund at 1-800-341-7400.

If you call before the end of regular trading on the NYSE (normally 4:00 p.m. Eastern time), you will receive a redemption amount based on that day's NAV.

You may redeem or exchange Shares by sending a written request to the Fund.

You will receive a redemption amount based on the next calculated NAV after the Fund receives your written request in proper form.

Send requests by mail to:

The Federated

Funds

P.O. Box 8600

Boston, MA

02266-8600

Send requests by private courier or overnight delivery service to:

The Federated Funds

30

Dan Road

Canton, MA

02021

All requests must include:

- Fund Name and Share Class, account number and account registration;

- amount to be redeemed or exchanged;

- signatures of all shareholders exactly as registered; and

- if exchanging, the Fund Name and Share Class, account number and account registration into which you are exchanging.

Call your financial intermediary or the Fund if you need special instructions.

Signatures must be guaranteed by a financial institution which is a participant in a Medallion signature guarantee program if:

- your redemption will be sent to an address other than the address of record;

- your redemption will be sent to an address of record that was changed within the last 30 days;

- a redemption is payable to someone other than the shareholder(s) of record; or

- transferring into another fund with a different shareholder registration.

A Medallion signature guarantee is designed to protect your account from fraud. Obtain a Medallion signature guarantee from a bank or trust company, savings association, credit union or broker, dealer or securities exchange member. A notary public cannot provide a signature guarantee.

PAYMENT METHODS FOR REDEMPTIONS

Your redemption proceeds will be mailed by check to your address of record. The following payment options are available if you complete the appropriate section of the New Account Form or an Account Service Options Form. These payment options require a signature guarantee if they were not established when the account was opened:

- an electronic transfer to your account at a financial institution that is an ACH member; or

- wire payment to your account at a domestic commercial bank that is a Federal Reserve System member.

Although the Fund intends to pay Share redemptions in cash, it reserves the right to pay the redemption price in whole or in part by a distribution of the Fund's portfolio securities.

LIMITATIONS ON REDEMPTION PROCEEDS

Redemption proceeds normally are wired or mailed within one business day after receiving a request in proper form. Payment may be delayed for up to seven days:

- to allow your purchase to clear (as discussed below);

- during periods of market volatility;

- when a shareholder's trade activity or amount adversely impacts the Fund's ability to manage its assets; or

- during any period when the Federal Reserve wire or applicable Federal Reserve banks are closed, other than customary weekend and holiday closings.

If you request a redemption of Shares recently purchased by check (including a cashier's check or certified check), money order, bank draft or ACH, your redemption proceeds may not be made available for up to seven calendar days to allow the Fund to collect payment on the instrument used to purchase such Shares. If the purchase instrument does not clear, your purchase order will be canceled and you will be responsible for any losses incurred by the Fund as a result of your canceled order.

In addition, the right of redemption may be suspended, or the payment of proceeds may be delayed, during any period:

- when the NYSE is closed, other than customary weekend and holiday closings;

- when trading on the NYSE is restricted, as determined by the SEC; or

- in which an emergency exists, as determined by the SEC, so that disposal of the Fund's investments or determination of its NAV is not reasonably practicable.

You will not accrue interest or dividends on uncashed redemption checks from the Fund if those checks are undeliverable and returned to the Fund.

You may exchange Shares of the Fund. An exchange is treated as a redemption and a subsequent purchase, and is a taxable transaction. To do this, you must:

- ensure that the account registrations are identical;

- meet any applicable minimum initial investment requirements; and

- receive a prospectus for the fund into which you wish to exchange.

The Fund may modify or terminate the exchange privilege at any time.

You may exchange Shares for shares of any Federated fund or share class that does not have a stated sales charge or contingent deferred sales charge, except Federated Liberty U.S. Government Money Market Trust and any R class.

The Fund will record your telephone instructions. If the Fund does not follow reasonable procedures, it may be liable for losses due to unauthorized or fraudulent telephone instructions.

Share Certificates

The Fund no longer issues share certificates. If you are redeeming or exchanging Shares represented by certificates previously issued by the Fund, you must return the certificates with your written redemption or exchange request. For your protection, send your certificates by registered or certified mail, but do not endorse them.

CONFIRMATIONS AND ACCOUNT STATEMENTS

You will receive confirmation of purchases, redemptions and exchanges. In addition, you will receive periodic statements reporting all account activity, including dividends and capital gains paid.

The Fund declares any dividends daily and pays them monthly to shareholders. If you purchase Shares by wire, you begin earning dividends on the day your wire is received. If you purchase Shares by check, you begin earning dividends on the business day after the Fund receives your check. In either case, you earn dividends through the day your redemption request is received.

In addition, the Fund pays any capital gains at least annually, and may make such special distributions of dividends and capital gains as may be necessary to meet applicable regulatory requirements. Your dividends and capital gains distributions will be automatically reinvested in additional Shares without a sales charge, unless you elect cash payments. Dividends may also be reinvested without sales charges in shares of any class of any other Federated fund of which you are already a shareholder.

If you have elected to receive dividends and/or capital gain distributions in cash, and your check is returned by the postal or other delivery service as “undeliverable,” or you do not respond to mailings from Federated with regard to uncashed distribution checks, your distribution option will automatically be converted to having all dividends and capital gains reinvested in additional Shares. No interest will accrue on amounts represented by uncashed distribution checks.

If you purchase Shares just before the record date for a capital gain distribution, you will pay the full price for the Shares and then receive a portion of the price back in the form of a taxable distribution, whether or not you reinvest the distribution in Shares. Therefore, you should consider the tax implications of purchasing Shares shortly before the record date for a capital gain. Contact your financial intermediary or the Fund for information concerning when dividends and capital gains will be paid.

Under the federal securities laws, the Fund is required to provide a notice to shareholders regarding the source of distributions made by the Fund if such distributions are from sources other than ordinary investment income. In addition, important information regarding the Fund's distributions, if applicable, is available in the “Products” section of Federated's website at

FederatedInvestors.com. To access this information from the home page, select “View All” next to “Find Products.” Select the Fund name and share class, if applicable, to go to the Fund Overview page. On the Fund Overview page, select the “Tax Information” tab. On the “Tax Information” tab, select a year.Federated reserves the right to close accounts if redemptions or exchanges cause the account balance to fall below $25,000 for IS and SS classes. Before an account is closed, you will be notified and allowed at least 30 days to purchase additional Shares to meet the minimum.

The Fund sends an IRS Form 1099 and an annual statement of your account activity to assist you in completing your federal, state and local tax returns. Fund distributions of dividends and capital gains are taxable to you whether paid in cash or reinvested in the Fund. Dividends are taxable at different rates depending on the source of dividend income. Distributions of net short-term capital gains are taxable to you as ordinary income. Distributions of net long-term capital gains are taxable to you as long-term capital gains regardless of how long you have owned your Shares.

Fund distributions are expected to be primarily dividends. Redemptions and exchanges are taxable sales. Please consult your tax adviser regarding your federal, state and local tax liability.

Given the liquid nature of the Fund's investments and the low transaction costs associated with these investments, the Fund does not anticipate that in the normal case frequent or short-term trading into and out of the Fund will have significant adverse consequences for the Fund and its shareholders. For this reason, the Fund's Board has not adopted policies or procedures to monitor or discourage frequent or short-term trading of the Fund's Shares. Regardless of their frequency or short-term nature, purchases and redemptions of Fund Shares can have adverse effects on the management of the Fund's portfolio and its performance.

PORTFOLIO HOLDINGS INFORMATION

Information concerning the Fund's portfolio holdings is available in the “Products” section of Federated's website at FederatedInvestors.com. A complete listing of the Fund's portfolio holdings as of the end of each calendar quarter is posted on the website 30 days (or the next business day) after the end of the quarter and remains posted for at least one year. Summary portfolio composition information as of the close of each month is posted on the website 15 days (or the next business day) after month-end and remains posted for at least one year. The summary portfolio composition information may include percentage breakdowns of the portfolio by type of security.

To access this information from the “Products” section of the website's home page, select “View All” next to “Find Products.” Select the Fund name and share class, if applicable, to go to the Fund Overview page. On the Fund Overview page, select the “Portfolio Characteristics” tab for summary portfolio information or the “Documents” tab to access “Holdings.”

You may also access portfolio information as of the end of the Fund's fiscal quarters from the “Documents” tab. The Fund's Annual Shareholder Report and Semi-Annual Shareholder Report contain complete listings of the Fund's portfolio holdings as of the end of the Fund's second and fourth fiscal quarters. The Fund's Form N-Q filings contain complete listings of the Fund's portfolio holdings as of the end of the Fund's first and third fiscal quarters. Fiscal quarter information is made available on the website within 70 days after the end of the fiscal quarter. This information is also available in reports filed with the SEC at the SEC's website at www.sec.gov.

In addition, from time to time (for example, during periods of unusual market conditions), additional information regarding the Fund's portfolio holdings and/or composition may be posted to Federated's website. If and when such information is posted, its availability will be noted on, and the information will be accessible from, the home page of the website.

The Board governs the Fund. The Board selects and oversees the Adviser, Federated Investment Management Company. The Adviser manages the Fund's assets, including buying and selling portfolio securities. Federated Advisory Services Company (FASC), an affiliate of the Adviser, provides certain support services to the Adviser. The fee for these services is paid by the Adviser and not by the Fund. The address of the Adviser and FASC is Federated Investors Tower, 1001 Liberty Avenue, Pittsburgh, PA 15222-3779.

The Adviser and other subsidiaries of Federated advise approximately 136 equity, fixed-income and money market mutual funds as well as a variety of other customized, separately managed accounts and private investment companies and other pooled investment vehicles (including non-U.S./offshore funds) which totaled approximately $358.2 billion in assets as of December 31, 2010. Federated was established in 1955 and is one of the largest investment managers in the United States with approximately 1,334 employees. Federated provides investment products to approximately 5,000 investment professionals and institutions.

The Adviser advises approximately 111 fixed-income and money market mutual funds (including sub-advised funds) and private investment companies, which totaled approximately $259.5 billion in assets as of December 31, 2010.

PORTFOLIO MANAGEMENT INFORMATION

Liam O'Connell has been a portfolio manager of the Fund since June 2005. Mr. O'Connell joined Federated in September 2003 as an Investment Analyst of the Fund's Adviser. He was named an Assistant Vice President of the Adviser in January 2005. From 2001 to 2003, Mr. O'Connell attended MIT's Sloan School of Management, receiving his M.B.A. Mr. O'Connell served as an engineer with the Naval Surface Warfare Center from 1998 to 2001. Mr. O'Connell also holds a B.S. in Naval Architecture and Marine Engineering from the Webb Institute of Naval Architecture, and an M.S. from the Johns Hopkins University.

The Fund's SAI provides additional information about the Portfolio Manager's compensation, management of other accounts and ownership of securities in the Fund.

The Fund's investment advisory contract provides for payment to the Adviser of an annual investment advisory fee of 0.40% of the Fund's average daily net assets. The Adviser may voluntarily waive a portion of its fee or reimburse the Fund for certain operating expenses. The Adviser and its affiliates have also agreed to certain “Fee Limits” as described in the footnote to the “Risk/Return Summary: Fees and Expenses” table found in the “Fund Summary” section of the Prospectus.

A discussion of the Board's review of the Fund's investment advisory contract is available in the Fund's shareholder reports as they are produced.

Since February 2004, Federated and related entities (collectively, “Federated”) have been named as defendants in several lawsuits that are now pending in the United States District Court for the Western District of Pennsylvania. These lawsuits have been consolidated into a single action alleging excessive advisory fees involving one of the Federated-sponsored mutual funds (“Funds”).

Federated and its counsel have been defending this litigation. Additional lawsuits based upon similar allegations may be filed in the future. The potential impact of these lawsuits, all of which seek monetary damages, attorneys' fees and expenses, and future potential similar suits is uncertain. Although we do not believe that these lawsuits will have a material adverse effect on the Funds, there can be no assurance that these suits, ongoing adverse publicity and/or other developments resulting from the allegations in these matters will not result in increased redemptions, or reduced sales, of shares of the Funds or other adverse consequences for the Funds.

Financial Information

The Financial Highlights will help you understand the Fund's financial performance for its past five fiscal years. Some of the information is presented on a per Share basis. Total returns represent the rate an investor would have earned (or lost) on an investment in the Fund, assuming reinvestment of any dividends and capital gains.

This information has been audited by Ernst & Young LLP, an independent registered public accounting firm, whose report, along with the Fund's audited financial statements, is included in the Annual Report.

Financial Highlights – Institutional Shares

(For a Share Outstanding Throughout Each Period)

| Year Ended February 28 or 29 | 2011 | 2010 | 2009 | 2008 | 2007 |

| Net Asset Value, Beginning of Period | $9.80 | $9.58 | $9.61 | $9.36 | $9.33 |

| Income From Investment Operations: |

| Net investment income | 0.161 | 0.15 | 0.301 | 0.47 | 0.45 |

| Net realized and unrealized gain on investments and futures contracts | 0.16 | 0.22 | 0.04 | 0.26 | 0.04 |

| TOTAL FROM INVESTMENT OPERATIONS | 0.32 | 0.37 | 0.34 | 0.73 | 0.49 |

| Less Distributions: |

| Distributions from net investment income | (0.18) | (0.15) | (0.37) | (0.48) | (0.46) |

| Net Asset Value, End of Period | $9.94 | $9.80 | $9.58 | $9.61 | $9.36 |

| Total Return2 | 3.26% | 3.89% | 3.62% | 8.03% | 5.45% |

| Ratios to Average Net Assets: |

| Net expenses | 0.30% | 0.30% | 0.30% | 0.30% | 0.30% |

| Net investment income | 1.56% | 1.44% | 3.14% | 4.89% | 4.84% |

| Expense waiver/reimbursement3 | 1.74% | 1.69% | 1.50% | 1.33% | 1.23% |

| Supplemental Data: |

| Net assets, end of period (000 omitted) | $4,120 | $3,346 | $2,127 | $1,777 | $2,476 |

| Portfolio turnover | 149% | 108% | 287% | 370% | 267% |

| Portfolio turnover (excluding purchases and sales from dollar-roll transactions) | 49% | 62% | 46% | 25% | 157% |

| 1 | Per share numbers have been calculated using the average shares method. |

| 2 | Based on net asset value. |

| 3 | This expense decrease is reflected in both the net expense and the net investment income ratios shown above. |

Further information about the Fund's performance is contained in the Fund's Annual Report, dated February 28, 2011, which can be obtained free of charge.

Financial Highlights – Institutional Service Shares

(For a Share Outstanding Throughout Each Period)

| Year Ended February 28 or 29 | 2011 | 2010 | 2009 | 2008 | 2007 |

| Net Asset Value, Beginning of Period | $9.80 | $9.58 | $9.61 | $9.36 | $9.33 |

| Income From Investment Operations: |

| Net investment income | 0.141 | 0.12 | 0.281 | 0.45 | 0.44 |

| Net realized and unrealized gain on investments and futures contracts | 0.16 | 0.23 | 0.03 | 0.26 | 0.03 |

| TOTAL FROM INVESTMENT OPERATIONS | 0.30 | 0.35 | 0.31 | 0.71 | 0.47 |

| Less Distributions: |

| Distributions from net investment income | (0.16) | (0.13) | (0.34) | (0.46) | (0.44) |

| Net Asset Value, End of Period | $9.94 | $9.80 | $9.58 | $9.61 | $9.36 |

| Total Return2 | 3.05% | 3.70% | 3.40% | 7.78% | 5.21% |

| Ratios to Average Net Assets: |

| Net expenses | 0.51% | 0.49% | 0.53% | 0.53% | 0.54% |

| Net investment income | 1.35% | 1.27% | 2.91% | 4.66% | 4.66% |

| Expense waiver/reimbursement3 | 1.74% | 1.73% | 1.56% | 1.58% | 1.43% |

| Supplemental Data: |

| Net assets, end of period (000 omitted) | $24,565 | $25,386 | $28,373 | $32,371 | $34,618 |

| Portfolio turnover | 149% | 108% | 287% | 370% | 267% |

| Portfolio turnover (excluding purchases and sales from dollar-roll transactions) | 49% | 62% | 46% | 25% | 157% |

| 1 | Per share numbers have been calculated using the average shares method. |

| 2 | Based on net asset value. |

| 3 | This expense decrease is reflected in both the net expense and the net investment income ratios shown above. |

Further information about the Fund's performance is contained in the Fund's Annual Report, dated February 28, 2011, which can be obtained free of charge.

Appendix A: Hypothetical Investment and Expense Information

The following charts provide additional hypothetical information about the effect of the Fund's expenses, including investment advisory fees and other Fund costs, on the Fund's assumed returns over a 10-year period. Each chart shows the estimated expenses that would be incurred in respect of a hypothetical investment of $10,000, assuming a 5% return each year, and no redemption of Shares. Each chart also assumes that the Fund's annual expense ratio stays the same throughout the 10-year period and that all dividends and distributions are reinvested. The annual expense ratios used in each chart are the same as stated in the “Fees and Expenses” table of this Prospectus (and thus may not reflect any fee waiver or expense reimbursement currently in effect). The maximum amount of any sales charge that might be imposed on the purchase of Shares (and deducted from the hypothetical initial investment of $10,000; the “Front-End Sales Charge”) is reflected in the “Hypothetical Expenses” column. The hypothetical investment information does not reflect the effect of charges (if any) normally applicable to redemptions of Shares (e.g., deferred sales charges, redemption fees). Mutual fund returns, as well as fees and expenses, may fluctuate over time, and your actual investment returns and total expenses may be higher or lower than those shown below.

| FEDERATED INTERMEDIATE GOVERNMENT FUND, INC. - IS CLASS | |||||

| ANNUAL EXPENSE RATIO: 2.30% | |||||

| MAXIMUM FRONT-END SALES CHARGE: NONE | |||||

| Year | Hypothetical Beginning Investment | Hypothetical Performance Earnings | Investment After Returns | Hypothetical Expenses | Hypothetical Ending Investment |

| 1 | $10,000.00 | $500.00 | $10,500.00 | $233.11 | $10,270.00 |

| 2 | $10,270.00 | $513.50 | $10,783.50 | $239.40 | $10,547.29 |

| 3 | $10,547.29 | $527.36 | $11,074.65 | $245.86 | $10,832.07 |

| 4 | $10,832.07 | $541.60 | $11,373.67 | $252.50 | $11,124.54 |

| 5 | $11,124.54 | $556.23 | $11,680.77 | $259.32 | $11,424.90 |

| 6 | $11,424.90 | $571.25 | $11,996.15 | $266.32 | $11,733.37 |

| 7 | $11,733.37 | $586.67 | $12,320.04 | $273.51 | $12,050.17 |

| 8 | $12,050.17 | $602.51 | $12,652.68 | $280.90 | $12,375.52 |

| 9 | $12,375.52 | $618.78 | $12,994.30 | $288.48 | $12,709.66 |

| 10 | $12,709.66 | $635.48 | $13,345.14 | $296.27 | $13,052.82 |

| Cumulative | $5,653.38 | $2,635.67 | |||

| FEDERATED INTERMEDIATE GOVERNMENT FUND, INC. - SS CLASS | |||||

| ANNUAL EXPENSE RATIO: 2.35% | |||||

| MAXIMUM FRONT-END SALES CHARGE: NONE | |||||

| Year | Hypothetical Beginning Investment | Hypothetical Performance Earnings | Investment After Returns | Hypothetical Expenses | Hypothetical Ending Investment |

| 1 | $10,000.00 | $500.00 | $10,500.00 | $238.11 | $10,265.00 |

| 2 | $10,265.00 | $513.25 | $10,778.25 | $244.42 | $10,537.02 |

| 3 | $10,537.02 | $526.85 | $11,063.87 | $250.90 | $10,816.25 |

| 4 | $10,816.25 | $540.81 | $11,357.06 | $257.55 | $11,102.88 |

| 5 | $11,102.88 | $555.14 | $11,658.02 | $264.37 | $11,397.11 |

| 6 | $11,397.11 | $569.86 | $11,966.97 | $271.38 | $11,699.13 |

| 7 | $11,699.13 | $584.96 | $12,284.09 | $278.57 | $12,009.16 |

| 8 | $12,009.16 | $600.46 | $12,609.62 | $285.95 | $12,327.40 |

| 9 | $12,327.40 | $616.37 | $12,943.77 | $293.53 | $12,654.08 |

| 10 | $12,654.08 | $632.70 | $13,286.78 | $301.31 | $12,989.41 |

| Cumulative | $5,640.40 | $2,686.09 | |||

[Page Intentionally Left Blank]