FORM NO. 6 | Registration No. 51235 |

Given under my hand and the Seal of the REGISTRAR OF COMPANIES this 22nd day of February 2016 | |

[Seal] | /s/ Wakeel D Ming Wakeel D Ming for Registrar of Companies |

Date of Report (Date of earliest event reported): | July 25, 2016 (July 25, 2016) |

Bermuda | 1-10804 | 98-0665416 | ||

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) | ||

O'Hara House, One Bermudiana Road, Hamilton, Bermuda | HM 08 | |

(Address of principal executive offices) | (Zip Code) | |

Not Applicable |

(Former name or former address, if changed since last report) |

Ireland | 1-10804 | 98-1304974 | ||

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) | ||

XL House, 8 St. Stephen's Green, Dublin, Ireland | 2 | |

(Address of principal executive offices) | (Zip Code) | |

Not Applicable |

(Former name or former address, if changed since last report) |

¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Exhibit No. | Description | |

3.1 | Certificate of Incorporation of XL Group Ltd | |

3.2 | Certificate of Incorporation on Change of Name of XL Group Ltd | |

3.3 | Memorandum of Association of XL Group Ltd | |

3.4 | Bye-Laws of XL Group Ltd | |

3.5 | Amended and Restated Memorandum and Articles of Association of XL Group Public plc | |

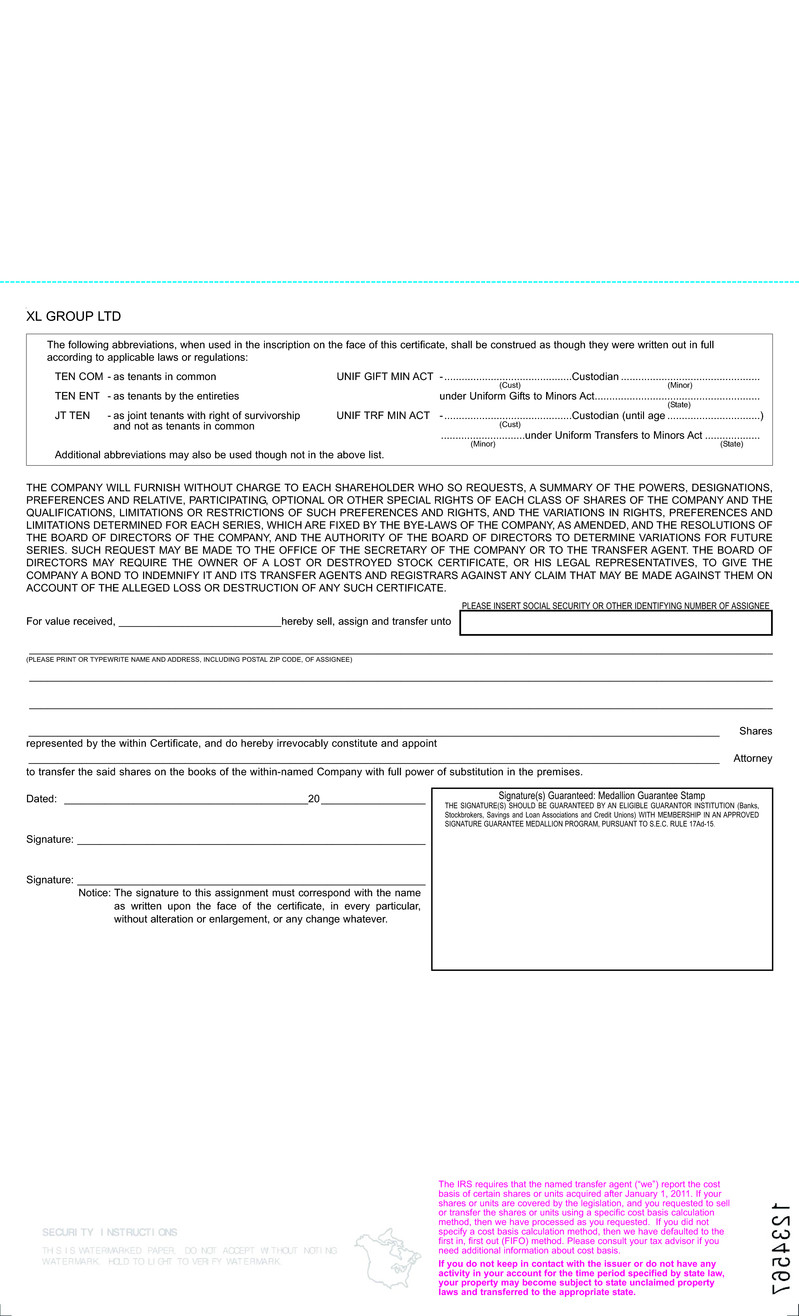

4.1 | Specimen Share Certificate (evidencing the common shares of XL Group Ltd) | |

4.2 | Third Supplemental Indenture, dated July 25, 2016, among XL Group Ltd, XL Group plc, XLIT Ltd. and Wells Fargo Bank, National Association, as Trustee, to the Senior Debt Securities Indenture dated as of September 30, 2011 | |

4.3 | Second Supplemental Indenture, dated as of July 25, 2016, among XL Group Ltd, XL Group plc, XLIT Ltd. and Wells Fargo Bank, National Association, as Trustee, to the Subordinated Debt Securities Indenture dated as of March 30, 2015 | |

10.1 | Form of Bermuda Indemnification Agreement between XL Group Ltd and each of the directors of and the corporate secretary of XL Group Ltd | |

10.2 | First Supplement to the Deed Poll of XLIT Ltd | |

23.1 | Consent of PricewaterhouseCoopers LLP | |

99.1 | XL Group plc’s Financial Statements as of December 31, 2015 and 2014 and for each of the three years in the period ended December 31, 2015, revised solely to reflect the guarantor financial information | |

99.2 | XL Group plc’s Financial Statements as of March 31, 2015 and for the three months ended March 31, 2015 and 2014, revised solely to reflect the guarantor financial information | |

99.3 | XL Group plc Unaudited Pro Forma Consolidated Financial Information for the year ended December 31, 2015 | |

99.4 | Press Release (“XL Group Ltd Completes Redomestication to Bermuda”) dated July 25, 2016 | |

99.5 | “Description of XL Group Ltd Share Capital” and “Comparison of Rights of Shareholders and Powers of the Board of Directors” (Incorporated by reference to the sections so entitled of XL Group plc’s Proxy Statement Schedule 14A filed on May 11, 2016) | |

101.INS | XBRL Instance Document | |

101.SCH | XBRL Taxonomy Extension Schema Document | |

101.CAL | XBRL Taxonomy Extension Calculation Linkbase Document | |

101.LAB | XBRL Taxonomy Extension Label Linkbase Dcoument | |

101.PRE | XBRL Taxonomy Extension Presentation Linkbase Document | |

101.DEF | XBRL Taxonomy Extension Definition Linkbase Document | |

XL Group Ltd | ||

Date: July 25, 2016 | By: | /s/ Kirstin Gould |

Name: Kirstin Gould Title: General Counsel and Secretary | ||

XL Group plc | ||

Date: July 25, 2016 | By: | /s/ Kirstin Gould |

Name: Kirstin Gould Title: General Counsel and Secretary | ||

FORM NO. 6 | Registration No. 51235 |

Given under my hand and the Seal of the REGISTRAR OF COMPANIES this 22nd day of February 2016 | |

[Seal] | /s/ Wakeel D Ming Wakeel D Ming for Registrar of Companies |

FORM NO. 3a | Registration No. 51235 |

Given under my hand and the Seal of the REGISTRAR OF COMPANIES this 29th day of February 2016 | |

[Seal] | /s/ Wakeel D Ming Wakeel D Ming for Registrar of Companies |

1. | The liability of the members of the Company is limited to the amount (if any) for the time being unpaid on the shares respectively held by them. |

2. | We, the undersigned, namely, |

Name and Address | Bermudian Status (Yes or No) | Nationality | Number of Shares Subscribed |

Federico Candiolo Crawford House 50 Cedar Avenue Hamilton HM 11 | No | Italian | 1 |

Neil Horner Crawford House 50 Cedar Avenue Hamilton HM 11 | No | British | 1 |

3. | The Company is to be an exempted Company as defined by the Companies Act 1981. |

4. | The Company, with the consent of the Minister of Finance, has power to hold land situate in Bermuda not exceeding ____in all, including the following parcels:- N/A |

5. | The authorised share capital of the Company is USD$100.00 divided into 10,000 shares of par value USD$0.01 each. |

6. | The objects for which the Company is formed and incorporated are unrestricted. |

7. | The following are provision regarding the powers of the Company: |

/s/ Federico Candiolo | /s/ Alexandra Schweizer |

Federico Candiolo | Alexandra Schweizer |

/s/ Neil Horner | /s/ Alexandra Schweizer |

Neil Horner | Alexandra Schweizer |

(Subscribers) | (Witnesses) |

1. | Interpretation |

(1) | In these Bye−laws the following words and expressions shall, where not inconsistent with the context, have the following meanings: |

(2) | In these Bye−laws, where not inconsistent with the context: |

(i) | "may" shall be construed as permissive; |

(ii) | "shall" shall be construed as imperative; and |

(3) | Expressions referring to writing or written shall, unless the contrary intention appears, include facsimile, printing, lithography, photography, electronic mail and other modes of representing words in a visible form. |

(4) | Headings used in these Bye−laws are for convenience only and are not to be used or relied upon in the construction hereof. |

(5) | In these Bye−laws, (a) powers of delegation shall not be restrictively construed but the widest interpretation shall be given thereto, (b) the word "Board" in the context of the exercise of any power contained in these Bye−laws includes any committee consisting of one (1) or more individuals appointed by the Board, any Director holding executive office and any local or divisional Board, manager or agent of the Company to which or, as the case may be, to whom the power in question has been delegated in accordance with these Bye−laws, (c) no power of delegation shall be limited by the existence of any other power of delegation and (d) except where expressly provided by the terms of delegation, the delegation of a power shall not exclude the concurrent exercise of that power by any Person who is for the time being authorised to exercise it under Bye−laws or under another delegation of the powers. |

2. | Board of Directors |

3. | Management of the Company |

(1) | In managing the business of the Company, the Board may exercise all such powers of the Company as are not, by statute or by these Bye−laws, required to be exercised by the Company in general meeting, and the business and affairs of the Company shall be so controlled by the Board. The Board also may present any petition and make any application in connection with the winding up or liquidation of the Company. |

(2) | No regulation or alteration to these Bye−laws made by the Company in general meeting shall invalidate any prior act of the Board which would have been valid if that regulation or alteration had not been made. |

4. | Power to appoint managing director or chief executive officer; power to appoint chairperson of the Board |

(1) | A managing director or chief executive officer of the Company, who may or may not be a Director, may be appointed by the Board at any time. Any managing |

(2) | The Board may elect a chairperson of the Board an determine the period for which he is to hold office. The chairperson of the Board shall vacate that office if he vacates his office as a Director (otherwise than by the expiration of his term of office at a general meeting of the Company at which he is reappointed or reelected). |

5. | Power to appoint manager |

6. | Power to authorise specific actions |

7. | Power to appoint attorney |

8. | Power to delegate to a committee |

9. | Power to appoint and dismiss employees |

10. | Power to borrow and charge property |

11. | Exercise of power to purchase shares of or discontinue the Company |

(1) | Purchase of Common Shares |

(2) | Power to discontinue the Company |

12. | Election of Directors |

(1) | The Board shall consist of not less than three (3) Directors nor more than fifteen (15) Directors with the exact number of Directors to be determined from time to time by resolution adopted by the affirmative vote of a majority of the Board. Any increase in the size of the Directors pursuant to this Bye−law 12(1) shall be |

(2) | Directors elected by the Members shall hold office for such term as the Members may determine or, in the absence of such determination, until the next annual general meeting or until their successors are elected or appointed or their office is otherwise vacated. |

(3) | No person shall be appointed a Director, unless nominated in accordance with the provisions of this Bye-law 12. Nominations of persons for appointment as Directors may be made: |

(i) | by the Board; |

(ii) | with respect to election at an annual general meeting, by any Member who holds Common Shares or other shares carrying the general right to vote at general meetings of the Company, who is a Member at the time of the giving of the notice provided for in Bye-law 12(4) and at the time of the relevant annual general meeting, and who timely complies with the notice procedures set forth in this Bye-law 12; |

(iii) | with respect to election at an extraordinary general meeting requisitioned in accordance with Bye-law 36 and Section 74 of the Act, and in compliance with the other provisions of these Bye-laws and the Act relating to nominations of Directors and the proper bringing of business before a special general meeting; and |

(iv) | by holders of any class or series of shares in the Company then in issue having special rights to nominate or appoint Directors in accordance with the terms of issue of such class or series, but only to the extent provided in such terms of issue |

(4) | Any Member who holds Common Shares or other shares carrying the general right to vote at general meetings of the Company may nominate a person or persons for election as Director at an annual general meeting only if (in addition to the requirements of Bye-law 12(3)(ii)) written notice of such Member’s intent to make such nomination is given in accordance with the procedures set forth in this Bye-law 12, either by personal delivery or by mail, postage prepaid, to the Secretary of the Company at the address of the Secretary specified in the notice of an annual general meeting or accompanying proxy statement last sent to Members prior to the delivery of such Member’s written notice of nomination (or, if no such address was specified, at the registered office of the Company) not later than the close of business not less than 90 and not more than 120 clear days prior to the |

(5) | Each notice of a Member’s intent to make a nomination delivered pursuant to Bye-law 12(4) and each requisition in writing delivered in accordance with Bye-law 36 and Section 74 of the Act that sets forth a notice of a Member’s or Members’ intent to nominate one (1) or more persons for election as a Director shall, in each case, set forth: |

(i) | as to the Member or Members giving notice and each beneficial owner, if different, on whose behalf the nomination is made, (A) the name and address of each such Member and each such beneficial owner, (B) the class or series and number of Shares of which each such Member and each such beneficial owner, respectively (and their respective Affiliates, naming such Affiliates), is, directly or indirectly, the registered or beneficial owner as of the date of such notice or requisition in writing, (C) a description of the material terms of any Covered Arrangement to which each such Member and each such beneficial owner, and their respective Affiliates, directly or indirectly, is a party as of the date of such notice or such requisition in writing, (D) any other information relating to each such Member and each such beneficial owner that would be required to be disclosed in a proxy statement in connection with a solicitation of proxies for the election of directors in a contested election pursuant to Section 14 of the Exchange Act (whether or not then applicable to the Company and whether or not any such Member or beneficial owner intends to solicit proxies) (the disclosures to be made pursuant to the foregoing clauses (i)(B), (i)(C) and (i)(D), the “Member Disclosable Interests”), and (E) a representation that each such Member is a registered holder of Shares entitled to vote at the relevant meeting of Members and intends to appear in person or by proxy at the relevant meeting to nominate the person or persons specified in the notice or requisition in writing; provided, however, that “Member Disclosable Interests” shall not include any such disclosures with respect to the ordinary course business activities of any broker, dealer, commercial bank, trust company or other nominee who is giving such notice solely as a result of being the |

(ii) | a description of all arrangements or understandings between each such Member and each such beneficial owner, and their respective Affiliates, and each nominee or any other person or persons (naming such person or persons) pursuant to which the nomination or nominations are to be made by the Member or Members; |

(iii) | as to each person whom the Member or Members propose to nominate for election as a Director, (A) all information relating to such person as would have been required to be included in a proxy statement filed in connection with a solicitation of proxies for the election of directors in a contested election pursuant to Section 14 of the Exchange Act (whether or not then applicable to the Company and whether or not the Member or Members intend to solicit proxies), (B) a description of the material terms of any Covered Arrangement to which such nominee or any of his or her Affiliates is a party as of the date of such notice or requisition in writing, and (C) the written consent of each nominee to being named in the notice or requisition in writing as a nominee and to serving as a Director if so elected; and |

(iv) | an undertaking by each such Member and each such beneficial owner to (A) notify the Company in writing of any changes in the information provided in such notice or requisition in writing pursuant to clauses (i), (ii) and (iii) above as of the record date for determining Members entitled to vote at the relevant meeting of Members promptly (and, in any event, within five (5) Business Days) following the later of the record date or the date notice of the record date is first disclosed by public announcement and (B) deliver to the Company an updated notification of such information thereafter within two (2) Business Days of any change in such information and, in any event, within five (5) hours after the close of business (at the location at which the meeting is to take place) on the Business Day preceding the meeting date updated as of such close of business. |

(6) | No person shall be eligible for election as a Director of the Company unless nominated in accordance with the procedures set forth in these Bye-laws. Except as otherwise provided by law, the Board or the chairperson of any meeting of Members to elect Directors may determine in good faith that a nomination was not made in compliance with the procedures set forth in the foregoing provisions of this Bye-law 12; and if the Board or the chairperson of the meeting should so determine, it shall be so declared to the meeting, and the defective nomination shall be disregarded. Notwithstanding anything in these Bye-laws to the contrary, unless otherwise required by law, if a Member intending to make a nomination at |

(7) | Notwithstanding the foregoing provisions of this Bye-law 12, any Member or Members intending to make a nomination at a meeting of Members in accordance with this Bye-law 12, and each related beneficial owner, if any, shall also comply with all applicable requirements of the Exchange Act with respect to the matters set forth in these articles; provided, however, that any references in these articles to the Exchange Act are not intended to and shall not limit the requirements applicable to nominations made or intended to be made in accordance with clause (ii) or clause (iii) of Bye-law 12(3). |

(8) | Nothing in this Bye-law 12 shall be deemed to affect any rights of the holders of any class or series of shares to elect or appoint Directors pursuant to any applicable terms of issue of any such shares. |

(9) | A Director shall not require a share qualification. |

13. | Defects in appointment of Directors |

14. | Alternate Directors/Observer |

15. | Removal of Directors |

(1) | Members holding a majority of the issued and outstanding shares entitled to vote at a general meeting or special meeting or conferring the right to vote on a resolution to remove a Director may, at any special general meeting convened and held in accordance with these Bye−laws, remove a Director; provided, that the notice of any such meeting convened for the purpose of removing a Director shall contain a statement of the intention so to do and be served on such Director not less than fourteen (14) calendar days before the meeting and at such meeting such Director shall be entitled to be heard on the motion for such Director's removal. Such removal shall be without prejudice to any claim such Director may have for damages for breach of any contract of service between him or her and the Company. |

(2) | A vacancy on the Board created by the removal of a Director under the provisions of Bye−law 15(1) may be filled by the Members holding at least a majority of the issued and outstanding shares entitled to vote at a general meeting or special meeting or conferring the right to vote on such resolution and, in the absence of such election or appointment, the Board may fill the vacancy in accordance with Bye−law 16. A Director so appointed shall hold office for the balance of the term of such vacant Board position, or until such Director's successor is elected or appointed or such Director's office is otherwise vacated. |

16. | Other Vacancies on the Board |

(1) | The Board shall have the power from time to time and at any time to appoint any person as a Director to fill a vacancy on the Board occurring as the result of an increase in the size of the Board pursuant to Bye−law 12(1), the death, disability, disqualification, resignation or removal of any Director or if such Director's office is otherwise vacated. A Director so appointed shall hold office for the balance of the term of such vacant Board position, or until such Director's successor is elected or appointed or such Director's office is otherwise vacated. |

(2) | The Board may act notwithstanding any vacancy in its number but, if and so long as its number is reduced below the number fixed by these Bye−laws as the quorum necessary for the transaction of business at meetings of the Board, the continuing Directors or Director may act for the purpose of (a) filling vacancies on the Board, (b) summoning a general meeting of the Company or circulating a proposed written resolution of the Members or (c) preserving the assets of the Company. |

(3) | The office of Director shall be deemed to be vacated if the Director: |

17. | Notice of meetings of the Board |

(1) | A meeting of the Board may at any time be summoned by the chairperson of the Board or by the chief executive officer, if he is a Director. The Secretary shall also summon a meeting of the Board on the requisition of a Director. Notice of a meeting of the Board must be provided with such prior notice as the Board may from time to time determine (including as to the manner of giving notice), which notice shall set forth the general nature of the business to be considered, unless notice is waived in accordance with bye-law 17(3). |

(2) | Notice of a meeting of the Board shall be deemed to be duly given to a Director if it is given to such Director verbally in person or by telephone or otherwise communicated or sent to such Director by post, electronic mail, facsimile or other mode of representing words in a legible and non−transitory form at such Director's last known address or any other address given by such Director to the Company for this purpose. |

(3) | A Director may waive notice of any meeting either prospectively or retroactively or at the meeting in question. A Director in attendance at a meeting shall be deemed to have waived notice of such meeting. The accidental omission to give notice of a meeting to, or the non−receipt of notice of a meeting by, any Director shall not invalidate the proceedings at that meeting. |

18. | Quorum at meetings of the Board |

19. | Meetings of the Board |

(1) | The Board may meet for the transaction of business, adjourn and otherwise regulate its meetings as it sees fit. |

(2) | Directors may participate in any meeting of the Board by means of such telephone, electronic or other communication facilities as permit all persons participating in the meeting to communicate with each other simultaneously and instantaneously, and participation in such a meeting shall constitute presence in person at such meeting. |

(3) | A resolution put to the vote at a meeting of the Board shall be carried by the affirmative votes of a majority of the votes cast and in the case of an equality of votes the resolution shall fail and the chairperson of the meeting shall not be entitled to a second or casting vote. |

20. | Unanimous written resolutions |

21. | Contracts and disclosure of Directors' interests |

(1) | Any Director, or any Person associated with, related to or affiliated with any Director, may act in a professional capacity for the Company and such Director or such Person shall be entitled to remuneration for professional services as if such Director were not a Director, provided, that nothing herein contained shall authorise a Director or Director's firm, partner or a company associated with, related to or affiliated with a Director to act as Auditor of the Company. |

(2) | A Director who is directly or indirectly interested in a contract or proposed contract or arrangement with the Company shall declare the nature of such interest as required by the Act. |

(3) | Following a declaration being made pursuant to this Bye−law, and unless disqualified by the chairperson of the relevant Board meeting, a Director may vote in respect of any contract or proposed contract or arrangement in which such Director is interested and may be counted in the quorum at such meeting. |

22. | Remuneration of Directors |

(1) | The remuneration of the Directors shall be determined by the Board and shall be deemed to accrue from day to day. The Directors may also be paid all travel, hotel and other expenses properly incurred by them in attending and returning from meetings of the Board, any committee appointed by the Board, general meetings of the Company, or in connection with the business of the Company or their duties as Directors generally. |

(2) | A Director may hold any other office or place of profit under the Company (other than the office of Auditor) in conjunction with his or her office of Director for such period on such terms as to remuneration and otherwise as the Board may determine. |

(3) | The Board may award special remuneration and benefits to any Director undertaking any special work or services for, or undertaking any special mission on behalf of, the Company other than his or her ordinary routine work as a Director. Any fees paid to a Director who is also counsel or attorney to the Company, or otherwise serves it in a professional capacity, shall be in addition to his or her remuneration as a Director. |

(4) | The Board may from time to time determine that, subject to the requirements of the Act, all or part of any fees or other remuneration payable to any Director of the Company shall be provided in the form of shares or other securities of the Company or any subsidiary of the Company, or options or rights to acquire such shares or other securities, on such terms as the Board may decide. |

23. | Other interests of Directors |

24. | Officers of the Company |

25. | Appointment of Secretary |

26. | Remuneration of Officers |

27. | Duties of Officers |

28. | Chairperson of meetings |

(1) | The chairperson of the Board, if any, or, in his absence, another Director designated by the chairperson of the Board shall preside as chairperson at every general meeting of the Company. If neither the chairperson of the Board nor such other Director designated by the chairperson of the Board is present within 30 minutes after the time appointed for holding the meeting, the Members present shall choose one of their number to be chairperson of the meeting. The chairperson of the meeting shall take such action as he thinks fit to promote the proper and orderly conduct of the business of the meeting as laid down in the notice of the meeting. |

(2) | At any meeting of the Board, the chairperson of the Board shall preside or, in his absence, any Director holding the position of chief executive officer. However, if no chairperson of the Board or Director holding the position of chief executive officer is present at the time appointed for holding the meeting, the Directors present may choose one of their number to be chairperson of the meeting |

29. | Register of Directors and Officers |

30. | Obligations of the Board to keep minutes |

(1) | The Board shall cause minutes to be duly entered in books provided for the purpose: |

(2) | Minutes prepared in accordance with the Act and these Bye−laws shall be kept by the Secretary at the registered office of the Company. |

31. | Indemnification of Directors and Officers of the Company |

(1) | The Directors, Secretary and other Officers (such term to include, for the purposes of Bye−laws 31 and 32, any person appointed to any committee by the Board), the Resident Representative and employees and agents of the Company or any Subsidiary of the Company who has acted or is acting in relation to any of the affairs of the Company and the liquidator or trustees (if any) who has acted or is acting in relation to any of the affairs of the Company, any person serving at the request of the Company as a director, officer or employee of another corporation, partnership, joint venture, trust or other enterprise or in a fiduciary or other capacity with respect to any employee benefit plan maintained by the Company or any Subsidiary of the Company, and every one of them, and their heirs, executors and administrators (each, an "Indemnified Person"), shall be indemnified and secured harmless out of the assets of the Company from and against all liabilities, actions, costs, charges, losses, damages and expenses (including liabilities under contract, tort and statue or any applicable foreign law or regulation and all |

(2) | No Indemnified Person shall be liable for the acts, neglects, defaults or omission of any other Indemnified Person, provided that this indemnity shall not extend to any matter prohibited by the Act. |

(3) | Expenses (including attorneys' fees) actually and reasonably incurred by any Indemnified Person in defending any civil, criminal, administrative or investigative action, suit or proceeding or threat thereof for which indemnification is sought pursuant to Bye−law 31(1) shall be paid by the Company in advance of the final disposition of such action, suit or proceeding upon receipt of an undertaking by or on behalf of such Indemnified Person to repay such amount if it shall be ultimately determined that such Indemnified Person is not entitled to be indemnified by the Company as authorised in these Bye−laws or otherwise pursuant to applicable law. Such expenses (including attorneys' fees) incurred by agents of the Company may be paid upon the receipt of the aforesaid undertaking and such terms and conditions, if any, as the Board deems appropriate. |

(4) | The indemnification and advancement of expenses provided in these Bye−laws shall not be deemed exclusive of any other rights to which those seeking indemnification and advancement of expenses may now or hereafter be entitled under any statute, agreement, vote of Members or otherwise, both as to action in an official capacity and as to action in another capacity while holding such office. |

(5) | The indemnification and advancement of expenses provided by, or granted pursuant to, this Bye−law 31 shall, unless otherwise provided when authorised or ratified, continue as to a Indemnified Person who has ceased to hold the position for which such Indemnified Person is entitled to be indemnified or advanced |

(6) | No amendment or repeal of any provision of this Bye−law 31 shall alter, to the detriment of any Indemnified Person, the right of such Indemnified Person to the indemnification or advancement of expenses related to a claim based on an act or failure to act which took place prior to such amendment, repeal or termination. |

32. | Waiver of claim by Member |

33. | Notice of annual general meeting |

34. | Notice of special general meeting |

35. | Accidental omission of notice of general meeting; Business to be conducted; Deemed notice |

(1) | The accidental omission to give notice of a general meeting to, or the non−receipt of notice of a general meeting by, any Person entitled to receive notice shall not invalidate the proceedings at that meeting. |

(2) | Subject to the Act, business to be brought before a general meeting of the Company must be specified in the notice of the meeting. Only business that the Board has determined can be properly brought before a general meeting in accordance with these Bye−laws and applicable law shall be conducted at any general meeting, and the chairperson of the general meeting may refuse to permit any business to be brought before such meeting that has not been properly brought before it in accordance with these Bye−laws and applicable law. |

(3) | The accidental omission to give notice of a meeting or (in cases where instruments of proxy are sent out with the notice) the accidental omission to send such instrument of proxy to, or the non-receipt of notice of a meeting or such instrument of proxy by, any person entitled to receive such notice shall not invalidate the proceedings at that meeting. A Member present, either in person or by proxy, at any general meeting of the Company or of the holders of any class or series of shares in the Company, will be deemed to have received notice of that meeting and, where required, of the purpose for which it was called. |

36. | Meeting called on requisition of Members |

37. | Short notice |

38. | Postponement or cancellation of meetings |

39. | Quorum for general meeting |

40. | Adjournment of meetings |

(1) | The chairperson of a general meeting may, with the consent of a majority of the voting rights of those Members present in person or by proxy (and shall if so directed by Members holding a majority of the voting rights of those Members present in person or by proxy), at any general meeting whether or not a quorum is present adjourn the meeting. Unless the meeting is adjourned to a specific date and time, fresh notice of the date, time and place for the resumption of the adjourned meeting shall be given to each Member in accordance with the provisions of these Bye−laws with respect to a special general meeting of the Company. |

(2) | In addition, the chairperson of the meeting may adjourn the meeting to another time and place without such consent or direction if it appears to him or her that: |

41. | Attendance at meetings; Security |

(1) | Members may participate in any general meeting by means of such telephone, electronic or other communication facilities as permit all persons participating in the meeting to communicate with each other simultaneously and instantaneously, and participation in such a meeting shall constitute presence in person at such meeting, provided that no such meeting shall be held if use of such telephone, electronic or other communication facilities is commenced, made, continued, relayed in or from or in any way connected to the United States, and no Member shall communicate in any meeting if such participation takes place in or from or is connected to the United States, and any business conducted at such purported meeting shall be of no force or effect. |

(2) | The Board may make any security arrangements which it considers appropriate relating to the holding of a general meeting of the Company, including arranging for any person attending a meeting to be searched and for items of personal property which may be taken into a meeting to be restricted, and any person who fails to comply with any such arrangements may be refused entry to the meeting. |

42. | Written resolutions |

(1) | Subject to Bye−law 42(6), anything which may be done by resolution of the Company in general meeting or by resolution of a meeting of any class of the Members, may, without a meeting, be done by resolution in writing signed by, or, in the case of a Member that is a corporation whether or not a company within the meaning of the Act, on behalf of, all the Members who at the date of the resolution or the record date determined pursuant to Bye−law 62 would be entitled to attend the meeting and vote on the resolution. |

(2) | A resolution in writing may be signed by any number of counterparts. |

(3) | For the purposes of this Bye−law, the date of the resolution is the date when the resolution is signed by, or, in the case of a Member that is a corporation whether or not a company within the meaning of the Act, on behalf of, the last Member to sign and any reference in any Bye−law to the date of passing of a resolution is, in relation to a resolution made in accordance with this Bye−law, a reference to such date. Any resolution in writing may be signed within or outside the United States; provided that no such resolution shall be valid unless the signature of the last Member signing such resolution is affixed outside of the United States. |

(4) | A resolution in writing made in accordance with this Bye−law is as valid as if it had been passed by the Company in general meeting or by a meeting of the relevant class of Members, as the case may be, and any reference in any Bye−law to a meeting at which a resolution is passed or to Members voting in favour of a resolution shall be construed accordingly. |

(5) | A resolution in writing made in accordance with this Bye−law shall constitute minutes for the purposes of Sections 81 and 82 of the Act. |

(6) | This Bye−law shall not apply to:− |

43. | Application of provisions; Attendance of Directors |

(1) | Subject to the Companies Act, all of the provisions of these Bye-laws (including Bye-law 52) relating to meetings and resolutions of Members (other than to meetings of any separate class or series of Members) shall apply mutatis mutandis to (a) any separate meeting of holders of Common Shares and (b) any separate meeting of any other class or series of Members, except as otherwise expressly provided in the terms of issue of such other class or series of shares. |

(2) | The Directors and Auditors shall be entitled to receive notice of and to attend and be heard at any general meeting. |

44. | Voting at meetings |

(1) | Subject to the provisions of the Act and these Bye−laws, any question proposed for the consideration of the Members at any general meeting shall be decided by the affirmative votes of a majority of the votes cast in accordance with the provisions of these Bye−laws and in the case of an equality of votes the resolution shall fail and the chairperson of the meeting shall not be entitled to a second or casting vote. |

(2) | No Member shall be entitled to vote at any general meeting unless such Member has paid all the calls on all shares held by such Member. |

(3) | At any general meeting if an amendment is proposed to any resolution under consideration and the chairperson of the meeting rules on whether or not the proposed amendment is out of order, the proceedings on the substantive resolution shall not be invalidated by any error in such ruling. |

45. | Voting on show of hands |

46. | Decision of chairperson |

47. | Demand for a poll |

(1) | Notwithstanding the provisions of Bye−laws 45 and 46, at any general meeting of the Company, in respect of any question proposed for the consideration of the Members (whether before or on the declaration of the result of a show of hands as provided for in these Bye−laws), a poll may be demanded by any of the following persons: |

(2) | Where, in accordance with the Bye−law 47(1), a poll is demanded, subject to any rights or restrictions for the time being lawfully attached to any class of shares and any other provision of these Bye−laws, every person present at such meeting shall have one (1) vote for each voting share of which such person is the holder or for which such person holds a proxy and such vote shall be counted in the manner set out in Bye−law 47(4) or in the case of a general meeting at which one (1) or more Members are present by telephone in such manner as the chairperson of the meeting may direct. The result of such poll shall be deemed to be the resolution of the meeting at which the poll was demanded and shall replace any previous resolution upon the same matter which has been the subject of a show of hands. A person entitled to more than one (1) vote need not use all of his or her votes or cast all the votes he or she uses in the same way. |

(3) | A poll demanded in accordance with the provisions of Bye−law 47(1), for the purpose of electing a chairperson of the meeting or on a question of adjournment, shall be taken forthwith and a poll demanded on any other question shall be taken in such manner and at such time and place as the chairperson of the meeting may direct and any business other than that upon which a poll has been demanded may be proceeded with pending the taking of the poll. |

(4) | Where a vote is taken by poll, each Person present and entitled to vote shall be furnished with a ballot paper on which such person shall record his or her vote in such manner as shall be determined at the meeting having regard to the nature of the question on which the vote is taken, and each ballot paper shall be signed or initialled or otherwise marked so as to identify the voter and the registered holder in the case of a proxy. At the conclusion of the poll, the ballot papers and votes cast in accordance with such directions shall be examined and counted by a committee of not less than two (2) members or proxy holders appointed by the chairperson of the meeting for that purpose. The result of the poll shall be declared by the chairperson of the meeting. |

48. | Seniority of joint holders voting |

49. | Instrument of proxy |

(1) | Every Member entitled to vote has the right to do so either in person or by one (1) or more persons authorised by a proxy executed and delivered in accordance with these Bye−laws. The instrument appointing a proxy shall be in writing under the hand of the appointor or of his or her attorney authorised by him or her in writing or, if the appointor is a corporation, either under its seal or under the hand of an officer, attorney or other person authorised to sign the same. A Member that is the holder of two (2) or more shares may appoint more than one (1) proxy to represent such Member and vote on its behalf in respect of different shares. |

(2) | The instrument appointing a proxy together with such other evidence as to its due execution as the Board may from time to time require shall be delivered at the registered office of the Company (or at such place or places as may be specified in the notice convening the meeting or in any notice of any adjournment or, in either case or the case of a written resolution, in any document sent therewith) not less than twenty-four (24) hours or such other period as the Board may determine, prior to the holding of the relevant meeting or adjourned meeting at which the individual named in the instrument proposes to vote or, in the case of a poll taken subsequently to the date of a meeting or adjourned meeting, before the time appointed for the taking of the poll, or, in the case of a written resolution, prior to the effective date of the written resolution and in default the instrument of proxy shall not be treated as valid. |

(3) | Instruments of proxy shall be in any common form or other form as the Board may approve and the Board may, if it thinks fit, send out with the notice of any meeting or any written resolution forms of instruments of proxy for use at that meeting or in connection with that written resolution. The instrument of proxy shall be deemed to confer authority to demand or join in demanding a poll and to |

(4) | A vote given in accordance with the terms of an instrument of proxy shall be valid notwithstanding the previous death or unsoundness of mind of the principal, or revocation of the instrument of proxy or of the authority under which it was executed, provided, that no notice in writing of such death, insanity or revocation shall have been received by the Company at the registered office of the Company (or such other place as may be specified for the delivery of instruments of proxy in the notice convening the meeting or other documents sent therewith) at least one (1) hour before the commencement of the meeting or adjourned meeting, or the taking of the poll, or the calendar day before the effective date of any written resolution at which the instrument of proxy is used. |

(5) | Subject to the Act, the Board may, or the chairperson of the relevant meeting may at his or her discretion (with respect to such meeting only), waive any of the provisions of these Bye−laws related to proxies or authorisations and, in particular, may accept such verbal or other assurances as it thinks fit as to the right of any person to attend and vote on behalf of any Member at general meetings or to sign written resolutions. The decision of the chairperson of any general meeting as to the validity of any appointment of a proxy shall be final. |

50. | Representation of corporations at meetings |

51. | Rights of shares |

(1) | Subject to any resolution of the Members to the contrary and without prejudice to any special rights conferred on the holders thereby of any other class or series of shares, the share capital of the Company shall consist of a single class of Common Shares. Subject to the provisions of these Bye−laws, the holders of the Common Shares shall: |

(2) | All the rights attaching to a Treasury Share shall be suspended and shall not be exercised by the Company while it holds such Treasury Share and, except where required by the Act, all Treasury Shares shall be excluded from the calculation of any percentage or fraction of the share capital, or shares, of the Company. |

52. | Limitation on voting rights of Controlled Shares. |

(1) | Notwithstanding anything to the contrary in Bye-law 51(1), if and so long as the votes conferred by the Controlled Shares of any person constitute ten percent (10%) or more of the votes conferred by the issued shares of the Company, each issued share comprised in such Controlled Shares shall confer only a fraction of a vote that would otherwise be applicable according to the following formula: |

(2) | If, as a result of giving effect to the foregoing provisions of this Bye-law 52 or otherwise, the votes conferred by the Controlled Shares of any person would otherwise represent more than ten percent (10%) of the votes conferred by all of the issued shares of the Company, the votes conferred by the Controlled Shares of such person shall be reduced in accordance with the foregoing provisions of this Bye-law 52. Such process shall be repeated until the votes conferred by the Controlled Shares of each person represent no more than ten percent (10%) of the votes conferred by all of the issued shares of the Company. |

(3) | Notwithstanding the foregoing provisions of this Bye-law 52, after having applied the provisions thereof as best as they consider reasonably practicable, the Board may make such final adjustments to the aggregate number of votes conferred by the Controlled Shares of any person that it considers fair and reasonable in all the circumstances to ensure that such votes represent less than ten percent (10%) of the aggregate voting power of the votes conferred by all of the issued shares of the Company. |

(4) | The determination by the Board of any adjustments to voting power of any shares made pursuant to this Bye−law 52 shall be final and binding on all Persons. The Company shall have no obligation to provide notice to any Member of any adjustment to its voting power that may result from the application of this Bye−law 52. |

53. | Power to issue shares |

(1) | Subject to the provisions of these Bye−laws and to any limitations prescribed by law, and without prejudice to any special rights previously conferred on the holders of any existing class or series of shares, the unissued shares (whether forming part of the original share capital or any increased share capital) shall be at the disposal of the Board, which may issue, offer, allot, exchange or otherwise dispose of shares or options, warrants or other rights to purchase shares or securities convertible into or exchangeable for shares (including any employee benefit plan providing for the issuance of shares or options, warrants or other rights in respect thereof), at such times, for such consideration and on such terms and conditions as it may determine. |

(2) | Subject to the provisions of these Bye−laws and any limitations prescribed by law, and without prejudice to any special rights previously conferred on the holders of any existing class or series of shares, the Board is authorized to issue non−voting Common Shares that do not entitle the holders thereof to voting rights. |

(3) | Subject to the provisions of these Bye−laws and any limitations prescribed by law, and without prejudice to any special rights previously conferred on the holders of any existing class or series of shares, the Board is authorized to issue any unissued shares of the Company on such terms and conditions as it may determine (including that they are to be redeemed on the happening of a specified event or on a given date or that they may be redeemed at the option of the Company or holder (the manner and terms of redemption in all cases to be set by the Board) and any class or series of shares may be issued with such preferred or other special rights as the Board may determine (including such preferred or other special rights or restrictions with respect to dividend, voting, liquidation or other rights of the shares as may be determined by the Board). The Board may establish from time to time the number of shares to be included in each such class or series, which number may be increased (except as otherwise provided by the Board in creating such class or series) or decreased (but not below the number of shares thereof then in issue) from time to time by resolution of the Board, and to fix the designation, powers, preferences, redemption provisions, restrictions and rights to such class or series and the qualifications, limitations or restrictions thereof. The terms of any class or series of shares shall be set forth in a Certificate of Designation in the minutes of the Board authorising the issuance of such shares and such Certificate of Designations shall be attached as an exhibit to these Bye−laws, but shall not form part of these Bye−laws, and may be examined by any Member on request. The rights attaching to any Common Share shall be |

(4) | The Board shall, in connection with the issue of any share, have the power to pay such commission and brokerage as may be permitted by law. |

(5) | The Company may from time to time do any one (1) or more of the following things: |

54. | Variation of rights and alteration of share capital |

(1) | If at any time the share capital is divided into different classes of shares, the rights attached to any class (unless otherwise provided by the terms of issue of the shares of that class) may, whether or not the Company is being wound−up, be varied with the consent in writing of the holders of all of the issued and outstanding shares of that class or with the sanction of a resolution passed by two-thirds (2/3) of votes cast by Members present or represented by proxy and voting at such general meeting holders of the shares of the class in accordance with Section 47(7) of the Act. The rights conferred upon the holders of the shares of any class issued with preferred or other rights shall not, unless otherwise expressly provided by the terms of issue of the shares of that class, be deemed to be varied by the creation or issue of further shares ranking pari passu therewith. |

(2) | The Company may if authorized by resolution of the Members increase, divide, consolidate, subdivide, change the currency denomination of, diminish or otherwise alter or reduce its share capital in any manner permitted by the Act; provided, a reduction of issued share capital shall require the affirmative vote of (i) seventy-five percent (75%) of votes cast by Members present or represented by proxy and voting at such general meeting. Where, on any alteration of share |

55. | Registered holder of shares |

(1) | The Company shall be entitled to treat the registered holder of any share as the absolute owner thereof and accordingly shall not be bound to recognise any equitable or other claim to, or interest in, such share on the part of any other person. This shall not preclude the Company from requiring the Members or a transferee of shares to furnish the Company with information as to the beneficial ownership of (or other interest of any person in) any share. |

(2) | Any dividend, interest or other moneys payable in cash in respect of shares may be paid by wire transfer, by cheque or draft sent through the post directed to the Member at such Member's address in the Register of Members or, in the case of joint holders, to such address of the holder first named in the Register of Members, or to such person and to such address as the holder or joint holders may in writing direct. If two or more persons are registered as joint holders of any shares, any one (1) holder can give an effectual receipt for any dividend paid in respect of such shares. |

56. | Death of a joint holder |

57. | Share certificates |

(1) | Every Member shall be entitled to a share certificate under the seal of the Company (or a facsimile thereof) specifying the number and, where appropriate, the class of shares held by such Member and whether the same are fully paid up and, if not, how much has been paid thereon. The Board may by resolution determine, either generally or in a particular case, that any or all signatures on certificates may be printed thereon or affixed by mechanical means. |

(2) | The Company shall be under no obligation to complete and deliver a share certificate unless specifically called upon to do so by the person to whom such shares have been allotted. |

(3) | If any such certificate shall be proved to the satisfaction of the Secretary to have been worn out, lost, mislaid or destroyed the Secretary may cause a new certificate to be issued and request an indemnity for the lost certificate if he or she sees fit. |

(4) | Notwithstanding any provisions of these Bye-laws: |

(i) | the Board shall, subject always to the Act and any other applicable laws and regulations and the facilities and requirements of any relevant system concerned, have power to implement any arrangement they may, in their absolute discretion, think fit in relation to evidencing of title to and transfer of uncertificated shares and to the extent such arrangements are so implemented, no provisions of these Bye-laws shall apply or have effect to the extent that it is in any respect inconsistent with the holding or transfer of shares in uncertificated form; and |

(ii) | unless otherwise determined by the Board and as permitted by the Act and any other applicable laws and regulations, no person shall be entitled to receive a certificate in respect of any share for so long as the title to that share is evidenced otherwise than by a certificate and for so long as transfers of that share may be made otherwise than by written instrument. |

58. | Calls on shares |

59. | Forfeiture of shares |

(1) | If any Member fails to pay, on the day appointed for payment thereof, any call in respect of any share allotted to or held by such Member, the Board may, at any time thereafter during such time as the call remains unpaid, direct the Secretary to forward to such Member a notice providing that if payment of the call and interest thereon in respect of such Member's shares is not paid such shares shall be liable to forfeiture. |

(2) | If the requirements of such notice are not complied with, any such share may at any time thereafter before the payment of such call and the interest due in respect thereof be forfeited by a resolution of the Board to that effect, and such share shall thereupon become the property of the Company and may be disposed of as the Board shall determine. |

(3) | A Member whose share or shares have been forfeited as aforesaid shall, notwithstanding such forfeiture, be liable to pay to the Company all calls owing on such share or shares at the time of the forfeiture and all interest due thereon. |

60. | Contents of Register of Members |

61. | Inspection of Register of Members |

(1) | The Register of Members shall be open to inspection at the registered office of the Company on every Business Day, subject to such reasonable restrictions as the Board may impose, so that not less than two (2) hours in each Business Day be allowed for inspection. The Register of Members may, after notice has been given by advertisement in an appointed newspaper to that effect, be closed for any time or times not exceeding in the whole thirty (30) calendar days in each year. |

(2) | Subject to the provisions of the Act, the Company may keep one (1) or more overseas or branch registers in any place, and the Board may make, amend and revoke any such regulations as it may think fit respecting the keeping of such registers and the contents thereof. |

62. | Determination of record dates |

(1) | Notwithstanding any other provision of these Bye−laws, the Board may fix any date as the record date for any dividend, distribution, allotment or issue and for the purpose of identifying the persons entitled to receive notices of any general meetings and to vote at any general meeting. Any such record date may be on or at any time before or after any date on which such dividend, distribution, allotment or issue is declared, paid or made or such notice is dispatched. |

(2) | In relation to any general meeting of the Company or of any class of Member or to any adjourned meeting or any poll taken at a meeting or adjourned meeting of which notice is given, the Board may specify in the notice of meeting or adjourned meeting or in any document sent to Members by or on behalf of the Board in relation to the meeting, a time and date (a "Record Date") prior to the date fixed for the meeting (the "Meeting Date") and, notwithstanding any provision in these Bye-Laws to the contrary, in such case: |

(i) | each person entered in the Register at the Record Date as a Member, or a Member of the relevant class (a "Record Date Holder") shall be entitled to attend and to vote at the relevant meeting and to exercise all of the rights or privileges of a Member, or a Member of the relevant class (in each case subject to Bye-Law 63), in relation to that meeting in respect of the Shares, or the Shares of the relevant class, registered in his name at the Record Date; |

(ii) | as regards any Shares, or Shares of the relevant class, which are registered in the name of a Record Date Holder at the Record Date but are not so registered at the Meeting Date (''Relevant Shares"), each holder of any Relevant Shares at the Meeting Date shall be deemed to have irrevocably appointed that Record Date Holder as his proxy for the purpose of attending and voting in respect of those Relevant Shares at the relevant meeting (with power to appoint, or to authorise the appointment of, some other person as proxy), in such manner as the Record Date Holder in his absolute discretion may determine; and |

(iii) | accordingly, except through his proxy pursuant to paragraph (2) of this Bye-Law, a holder of Relevant Shares at the Meeting Date shall not be entitled to attend or to vote at the relevant meeting, or to exercise any of the rights or privileges of a Member, or a Member of the relevant class, in respect of the Relevant Shares at that meeting. |

(3) | The entry of the name of a person in the Register as a Record Date Holder shall be sufficient evidence of his appointment as proxy in respect of any Relevant Shares for the purposes of this paragraph, but all the provisions of these Bye-Laws relating to the execution and deposit of an instrument appointing a proxy or any ancillary matter (including the Board's powers and discretions relevant to such matter) shall apply to any instrument appointing any person other than the Record Date Holder as proxy in respect of any Relevant Shares. |

63. | Instrument of transfer |

(1) | An instrument of transfer shall be in the form or as near thereto as circumstances admit of Form "A" in the Schedule hereto or in such other common form as the Board may accept. Such instrument of transfer shall be signed by or on behalf of the transferor and transferee, provided, that in the case of a fully paid share, the Board may accept the instrument signed by or on behalf of the transferor alone. The transferor shall be deemed to remain the holder of such share until the same has been transferred to the transferee in the Register of Members. |

(2) | The Board may refuse to recognise any instrument of transfer unless it is accompanied by the certificate (if applicable) in respect of the shares to which it relates and by such other evidence as the Board may reasonably require to show the right of the transferor to make the transfer. |

(3) | Shares may be transferred without a written instrument if transferred by an appointed agent or otherwise in accordance with the Act. |

64. | Restriction on transfer |

(1) | Subject to the Act, this Bye−law 64 and such other of the restrictions contained in these Bye−laws and elsewhere as may be applicable, any Member may sell, assign, transfer or otherwise dispose of shares of the Company at the time owned by it and, upon receipt of a duly executed form of transfer in writing, the Directors shall procure the timely registration of the same. If the Directors refuse to register a transfer for any reason they shall notify the proposed transferor and transferee within thirty (30) calendar days of such refusal. |

(2) | The Board shall decline to register a transfer of shares if it appears to the Board, whether before or after such transfer, that the effect of such transfer would be to increase the number of the Controlled Shares of any person to ten percent (10%) or any higher percentage of any class of voting shares or of the total issued shares or of the voting power of the Company. The Board may, in its discretion, advise any person that any transfer which would increase the number of such person’s Controlled Shares to ten percent (10%) or any higher percentage of any class of voting shares or the total issued shares or voting power of the Company may not be made and will not be recognized for any purpose and any such transfer purported to have been made to such person after receipt of such notice by such person shall be null and void. |

(3) | The Board in its sole discretion may decline to register the transfer of any shares if the Board determines that the transfer of shares of the Company by any Member may require registration under the Securities Act or under any blue sky or other United States state securities laws or under the laws of any other jurisdiction and such registration has not been duly effected; provided, that in the case of this Bye−law 64(4), the Board shall be entitled to request and rely on a written opinion of counsel to the transferor or the transferee, in form and substance satisfactory to the Board, that no such approval or consent is required and no such violation would occur, and the Board shall not be obligated to register any transfer absent the receipt of such an opinion. |

(4) | Without limiting the foregoing, the Board in its sole discretion may decline to register the transfer of any shares without assigning any reason therefor, subject to any limitation on such right of the Board imposed by law. |

(5) | Without limiting the foregoing, the Board shall decline to approve or register a transfer of shares unless all applicable consents, authorisations, permissions or approvals of any governmental body or agency in Bermuda, the United States or any other applicable jurisdiction required to be obtained prior to such transfer shall have been obtained. |

(6) | The registration of transfers may be suspended at such time and for such periods as the Board may from time to time determine; provided, that such registration shall not be suspended for more than thirty (30) calendar days in any year expect as may be required by applicable law. |

65. | Transfers by joint holders |

66. | Lien on shares |

(1) | The Company shall have a first and paramount lien and charge on all shares (whether fully paid−up or not or whether subject to a condition or contingency) registered in the name of a Member (whether solely or jointly with others) for all debts, liabilities or engagements to or with the Company (whether presently payable or not or whether subject to a condition or contingency) by such Member or his or her estate, either alone or jointly with any other Person, whether a Member or not, but the Board may at any time declare any share to be wholly or in part exempt from the provisions of this Bye−law. The registration of a transfer of any such share shall operate as a waiver of the Company's lien (if any) thereon. The Company's lien (if any) on a share shall extend to all dividends or other monies payable in respect thereof. |

(2) | The Company may sell or purchase, in such manner and on such terms (including price) as the Board think fit, any shares on which the Company has a lien, but no sale or purchase shall be made unless a sum in respect of which the lien exists is then presently payable, nor until the expiration of fourteen (14) calendar days after a notice in writing stating and demanding payment of such part of the amount in respect of which the lien exists as is presently payable, has been given to the relevant Member, or the Person, of which the Company has notice, entitled thereto by reason of such Member's death or bankruptcy. Effective upon such sale or purchase, any certificate representing such shares prior to such sale shall become null and void, whether or not it was actually delivered to the Company. |

(3) | To give effect to any such sale the Board may authorise some Person to transfer the shares sold to the purchaser thereof. The purchaser shall be registered as the holder of the shares comprised in any such transfer, and he shall not be bound to see to the application of the purchase money, nor shall his or her title to the shares be affected by any irregularity or invalidity in the proceedings in reference to the sale. |

(4) | The proceeds of such sale or purchase shall be received by the Company and applied in payment of such part of the amount in respect of which the lien exists as is presently payable and the residue, if any, shall (subject to a like lien for sums not presently payable as existed upon the shares before the sale) be paid to the relevant Member or the Person entitled to the shares at the date of the sale. |

67. | Representative of deceased Member |

68. | Registration on death or bankruptcy; Rights related to transmission |

(1) | Any person becoming entitled to a share in consequence of the death or bankruptcy of any Member may be registered as a Member upon such evidence as the Board may deem sufficient or may elect to nominate some person to be registered as a transferee of such share, and in such case the person becoming entitled shall execute in favour of such nominee an instrument of transfer. On the presentation thereof to the Board, accompanied by such evidence as the Board may require to prove the title of the transferor, the transferee shall be registered as a Member but the Board shall, in either case, have the same right to decline or suspend registration as it would have had in the case of a transfer of the share by that Member before such Member's death or bankruptcy, as the case may be. |

(2) | A person entitled by transmission to a share shall be entitled to the same dividends and other advantages to which he would be entitled if he were the registered holder of the share, except that he shall not, before being registered as a Member in respect of the share, be entitled to exercise any right in respect of the share in relation to meetings of the Company; provided, however, that the Board may at any time give notice requiring a person entitled by transmission to a share to elect either to be registered himself or herself or to transfer the share, and if the notice is not complied with within ninety (90) clear days after the date such notice is given, the Board may withhold payment of any dividend, other monies payable, scrip dividend or capitalisation issue of shares or other similar benefit in respect of the share until the requirements of the notice have been complied with. |

69. | Declaration of dividends by the Board |

70. | Other distributions |

71. | Reserve fund |

72. | Deduction of amounts due to the Company |

73. | Unclaimed dividends |

74. | Interest on dividend |

75. | Issue of bonus shares |

(1) | The Board may resolve to capitalise any part of the amount for the time being standing to the credit of any of the Company's share premium or other reserve accounts or funds or to the credit of the profit and loss account or otherwise available for distribution by applying such sum in paying up unissued shares to be allotted as fully paid bonus shares pro rata to the Members. |

(2) | The Company may capitalise any sum standing to the credit of a reserve account or fund or sums otherwise available for dividend or distribution by applying such amounts in paying up in full partly paid shares of those Members who would have been entitled to such sums if they were distributed by way of dividend or distribution. |

76. | Records of account |

77. | Financial year end |

78. | Financial statements |

79. | Appointment of Auditor |

80. | Remuneration of Auditor |

81. | Vacancy of office of Auditor |

82. | Access to books of the Company |

83. | Report of the Auditor |

(1) | Subject to any rights to waive laying of accounts or appointment of an Auditor pursuant to Section 88 of the Act, the accounts of the Company shall be audited at least once in every year. |

(2) | The financial statements provided for by these Bye−laws shall be audited by the Auditor in accordance with generally accepted auditing standards. The Auditor shall make a written report thereon in accordance with generally accepted auditing standards and the report of the Auditor shall be submitted to the Members in general meeting. |

(3) | The generally accepted auditing standards referred to in subparagraph (2) of this Bye−law may be those of a country or jurisdiction other than Bermuda. If so, the financial statements and the report of the Auditor must disclose this fact and name such country or jurisdiction. |

84. | Notices to Members of the Company |

85. | Notices to joint Members |

86. | Service and delivery of notice |

87. | The seal |

88. | Manner in which seal is to be affixed |

89. | Winding up/distribution by liquidator |

90. | Alteration of Bye−laws |

91. | Registered Office |

92. | Member Vote to Approve an Amalgamation or Merger |

FOR VALUE RECEIVED | [amount] | |||

. | [transferor] | |||

hereby sell assign and transfer unto | [transferee] | |||

of | [address] | |||

. | [number of shares] | |||

shares of | [name of Company] | |||

Dated | ||||

(Transferor) | ||||

In the presence of: | ||||

(Witness) | ||||

(Transferee) | ||||

In the presence of: | ||||

(Witness) | ||||

1. | The name of the Company is XL Group Public Limited Company. |

2. | The Company is to be a public limited company. |

3. | The objects for which the Company is established are: |

3.1 | To carry on the business of an investment and holding company in all of its branches, and to acquire by purchase, lease, concession, grant, licence or otherwise such businesses, options, rights, privileges, lands, buildings, leases, underleases, stocks, shares, debentures, debenture stock, bonds, obligations, reversionary interests, annuities, policies of assurance, certificates of deposit, treasury bills, trade bills, bank acceptances, bills of exchange, fixed rate securities, variable or floating rate securities, and securities of all kinds created, issued or guaranteed by any government, sovereign, ruler, commissioners, body or authority, supreme, state, municipal, local, supranational or otherwise, in any part of the world, or by any corporation, bank, association or partnership, whether with limited or unlimited liability constituted or carrying on business or activities in any part of the world, units of or participation in any unit trust scheme, mutual fund or collective investment scheme in any part of the world, policies of insurance and assurance, domestic and foreign currency and any present or future rights and interests to or in any of the foregoing and other property and rights and interests in property as the Company shall deem fit and generally to hold, manage, develop, lease, sell or dispose of the same; to subscribe for the same either conditionally or otherwise; to enter into underwriting, stocklending and repurchase and similar contracts with respect thereto, to exercise and enforce all rights and powers conferred by or incidental to the ownership thereof and from time to time to sell, exchange, lend, vary or dispose of and grant and dispose of options over any of the foregoing, to acquire, dispose of, invest in and hold by way of investment any derivative instrument relating to any of the foregoing and to deposit money (or place money on current account) with such persons in such currencies and otherwise on such terms as may seem expedient and to do all of the foregoing as principal, agent or broker; and to vary any of the investments of the Company; to establish, carry on, develop and extend investments and holdings and to sell, dispose of or otherwise turn the same to account and to coordinate the |

3.2 | To exercise and enforce all rights and powers conferred to or incidental upon the ownership of any shares, stock obligations or other securities acquired by the Company including without prejudice to the generality of the foregoing all such powers of veto or control as may be conferred by virtue of the holding by the Company of such special proportion of the issued or nominal amount thereof and to provide managerial and other executive, supervisory and consultant services for or in relation to any corporation in which the Company is interested upon such terms as may be thought fit. |

3.3 | To acquire any such shares and other securities as are mentioned in the preceding paragraphs by subscription, syndicate participation, tender, purchase, exchange or otherwise and to subscribe for the same, either conditionally or otherwise, and to guarantee the subscription thereof and to exercise and enforce all rights and powers conferred by or incidental to the ownership thereof. |

3.4 | To co-ordinate the administration, policies, management, supervision, control, research, planning, trading and any and all other activities of, and to act as financial advisers and consultants to, any corporation or corporations now or hereafter incorporated or acquired which may be or may become a Group Company of, or an Affiliate of or to any corporation or corporations now or hereafter incorporated or acquired (which are not Group Companies) with which the Company may be or may become associated. |

3.5 | To provide financing and financial investment, management and advisory services to any Group Company or Affiliate, which shall include granting or providing credit and financial accommodation, lending and making advances with or without interest to any Group Company or Affiliate and lending to or depositing with any bank funds or other assets to provide security (by way of mortgage, charge, pledge, lien or otherwise) for loans or other forms of financing granted to such Group Company or Affiliate by such bank. |

3.6 | To lease, acquire by purchase or otherwise and hold, sell, dispose of and deal in real property and in personal property of all kinds wheresoever situated. |

3.7 | To enter into any guarantee, contract of indemnity or suretyship and to assure, support or secure with or without consideration or benefit the performance of any obligations of any person or persons and to guarantee the fidelity of individuals filling or about to fill situations of trust or confidence. |

3.8 | To acquire or undertake the whole or any part of the business, property and liabilities of any person carrying on any business that the Company is authorized to carry on. |

3.9 | To apply for, register, purchase, lease, acquire, hold, use, control, license, sell, assign or dispose of patents, patent rights, copyrights, trade marks, formulae, licences, inventions, processes, distinctive marks, technology and know-how and the like conferring any exclusive or non-exclusive or limited right to use or any secret or other information as to any invention or technology which may seem capable of being used, for any of the purposes of the Company or the acquisition of which may seem calculated directly or indirectly to benefit the Company, and to use, exercise, develop or grant licences in respect of or otherwise turn to account the property rights or information so acquired. |

3.10 | To enter into partnership, merger, consolidation, amalgamation or into any arrangement for sharing of profits, union of interests, co-operation, joint venture, reciprocal concession or otherwise with any person carrying on or engaged in or about to carry on or engage in any business or transaction that the Company is authorized to carry on or engage in or any business or transaction capable of being conducted so as to benefit the Company. |

3.11 | To take or otherwise acquire and hold securities in any other corporation, including securities of XL Capital Ltd, an exempted company organized under the laws of the Cayman Islands, having objects altogether or in part similar to those of the Company or any Group Company or carrying on any business capable of being conducted so as to benefit the Company or any Group Company. |

3.12 | To lend money to any employee or to any person having dealings with the Company or any Group Company or with whom the Company or any Group Company proposes to have dealings or to any other corporation (including any Group Company) any of whose shares are held directly or indirectly by the Company or any Group Company. |

3.13 | To apply for, secure or acquire by grant, legislative enactment, assignment, transfer, purchase or otherwise and to exercise, carry out and enjoy any charter, licence, power, authority, franchise, concession, right or privilege, that any government or authority, corporation or public body may be empowered to grant, and to pay for, aid in and contribute toward carrying it into effect and to assume any liabilities or obligations incidental thereto and to enter into any arrangements with any governments, authorities or public bodies, supreme, municipal, local or otherwise, that may seem conducive to the Company’s objects or any of them. |

3.14 | To perform any duty or duties imposed on the Company by or under any enactment and to exercise any power conferred on the Company by or under any enactment. |

3.15 | To incorporate or cause to be incorporated any one or more subsidiaries (within the meaning of Section 155 of the Companies Act 1963) of the Company for the purpose of carrying on any business. |