Document

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

|

| |

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the fiscal year ended December 31, 2016 |

or

|

| |

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number: 0-19311

BIOGEN INC.

(Exact name of registrant as specified in its charter)

|

| | |

Delaware | | 33-0112644 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

225 Binney Street, Cambridge, Massachusetts 02142

(617) 679-2000

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

Title of Each Class | | Name of Each Exchange on Which Registered |

Common Stock, $0.0005 par value | | The Nasdaq Global Select Market |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files): Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

| | | | | | |

Large accelerated filer x | | Accelerated filer o | | Non-accelerated filer o | | Smaller reporting company o |

| | | | (Do not check if a smaller reporting company) | | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

The aggregate market value of the registrant’s common stock held by non-affiliates of the registrant (without admitting that any person whose shares are not included in such calculation is an affiliate) computed by reference to the price at which the common stock was last sold as of the last business day of the registrant’s most recently completed second fiscal quarter was $52,843,669,823.

As of January 27, 2017, the registrant had 215,951,945 shares of common stock, $0.0005 par value, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the definitive proxy statement for our 2017 Annual Meeting of Stockholders are incorporated by reference into Part III of this report.

BIOGEN INC.

ANNUAL REPORT ON FORM 10-K

For the Year Ended December 31, 2016

TABLE OF CONTENTS

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This report contains forward-looking statements that are being made pursuant to the provisions of the Private Securities Litigation Reform Act of 1995 (the Act) with the intention of obtaining the benefits of the “Safe Harbor” provisions of the Act. These forward-looking statements may be accompanied by such words as “anticipate,” “believe,” “could,” “estimate,” “expect,” “forecast,” “intend,” “may,” “plan,” “potential,” “project,” “target,” “will” and other words and terms of similar meaning. Reference is made in particular to forward-looking statements regarding:

| |

• | the anticipated amount, timing and accounting of revenues, contingent payments, milestone, royalty and other payments under licensing, collaboration or acquisition agreements, tax positions and contingencies, collectability of receivables, pre-approval inventory, cost of sales, research and development costs, compensation and other selling, general and administrative expenses, amortization of intangible assets, foreign currency exchange risk, estimated fair value of assets and liabilities, and impairment assessments; |

| |

• | expectations, plans and prospects relating to sales, pricing, growth and launch of our marketed and pipeline products; |

| |

• | the potential impact of increased product competition in the markets in which we compete; |

| |

• | the spin off of our hemophilia business, including its anticipated benefits, costs and tax treatment; |

| |

• | the anticipated amount and timing of payments under the Settlement and License Agreement with Forward Pharma A/S (Forward Pharma) and the timing, outcome and impact of administrative, regulatory, legal and other proceedings related to our patents and other proprietary intellectual property rights under our agreement with Forward Pharma; |

| |

• | patent terms, patent term extensions, patent office actions and expected availability and period of regulatory exclusivity; |

| |

• | the costs and timing of potential clinical trials, filing and approvals, and the potential therapeutic scope of the development and commercialization of our and our collaborators’ pipeline products; |

| |

• | the drivers for growing our business, including our plans and intent to commit resources relating to business development opportunities and research and development programs; |

| |

• | potential costs and expenses incurred in connection with corporate restructurings and to execute business transformation and optimization initiatives; |

| |

• | our manufacturing capacity, use of third-party contract manufacturing organizations and plans and timing relating to the expansion of our manufacturing capabilities, including anticipated investments and activities in new manufacturing facilities; |

| |

• | the expected financial impact of ceasing manufacturing activities and vacating our biologics manufacturing facility in Cambridge, MA and warehouse space in Somerville, MA; |

| |

• | the potential impact on our results of operations and liquidity of the United Kingdom's (U.K.'s) intent to voluntarily depart from the European Union (E.U.); |

| |

• | the impact of the continued uncertainty of the credit and economic conditions in certain countries in Europe and our collection of accounts receivable in such countries; |

| |

• | the potential impact of healthcare reform in the United States (U.S.) and measures being taken worldwide designed to reduce healthcare costs to constrain the overall level of government expenditures, including the impact of pricing actions and reduced reimbursement for our products; |

| |

• | the timing, outcome and impact of administrative, regulatory, legal and other proceedings related to patents and other proprietary and intellectual property rights, tax audits, assessments and settlements, pricing matters, sales and promotional practices, product liability and other matters; |

| |

• | lease commitments, purchase obligations and the timing and satisfaction of other contractual obligations; |

| |

• | our ability to finance our operations and business initiatives and obtain funding for such activities; and |

| |

• | the impact of new laws and accounting standards. |

These forward-looking statements involve risks and uncertainties, including those that are described in the “Risk Factors” section of this report and elsewhere in this report, that could cause actual results to differ materially from those reflected in such statements. You should not place undue reliance on these statements. Forward-looking statements speak only as of the date of this report. Except as required by law, we do not undertake any obligation to publicly update any forward-looking statements, whether as a result of new information, future developments or otherwise.

NOTE REGARDING COMPANY AND PRODUCT REFERENCES

References in this report to:

| |

• | “Biogen,” the “company,” “we,” “us” and “our” refer to Biogen Inc. and its consolidated subsidiaries; |

| |

• | “RITUXAN” refers to both RITUXAN (the trade name for rituximab in the U.S., Canada and Japan) and MabThera (the trade name for rituximab outside the U.S., Canada and Japan); |

| |

• | "ELOCTATE" refers to both ELOCTATE (the trade name for Antihemophilic Factor (Recombinant), Fc Fusion Protein in the U.S., Canada and Japan) and ELOCTA (the trade name for Antihemophilic Factor (Recombinant), Fc Fusion Protein in the E.U.); and |

| |

• | “ANGIOMAX” refers to both ANGIOMAX (the trade name for bivalirudin in the U.S., Canada and Latin America) and ANGIOX (the trade name for bivalirudin in Europe). |

NOTE REGARDING TRADEMARKS

AVONEX®, BENEPALI®, FLIXABI®, PLEGRIDY®, RITUXAN®, TECFIDERA®, TYSABRI® and ZINBRYTA® are registered trademarks of Biogen. FUMADERMTM and SPINRAZATM are trademarks of Biogen. ALPROLIX®, ELOCTATE®, ENBREL®, FAMPYRATM, GAZYVA®, HUMIRA®, OCREVUS®, REMICADE® and other trademarks referenced in this report are the property of their respective owners.

PART I

Item 1. Business

Overview

Biogen is a global biopharmaceutical company focused on discovering, developing, manufacturing and delivering therapies to people living with serious neurological, rare and autoimmune diseases.

Our marketed products include TECFIDERA, AVONEX, PLEGRIDY, TYSABRI, ZINBRYTA and FAMPYRA for multiple sclerosis (MS), FUMADERM for the treatment of severe plaque psoriasis and SPINRAZA for the treatment of spinal muscular atrophy (SMA). We also have certain business and financial rights with respect to RITUXAN for the treatment of non-Hodgkin's lymphoma, chronic lymphocytic leukemia (CLL) and other conditions, GAZYVA indicated for the treatment of CLL and follicular lymphoma and other potential anti-CD20 therapies under a collaboration agreement with Genentech, Inc. (Genentech), a wholly-owned member of the Roche Group (Roche Group).

We support our drug discovery and development efforts through the commitment of significant resources to discovery, research and development programs and business development opportunities, particularly within areas of our scientific, manufacturing and technical capabilities. For nearly two decades we have led in the research and development of new therapies to treat MS, resulting in our leading portfolio of MS treatments. Now our research is focused on additional improvements in the treatment of MS, such as the development of next generation therapies for MS, with a goal to reverse or possibly repair damage caused by the disease. We are also applying our scientific expertise to solve some of the most challenging and complex diseases, including Alzheimer's disease, Parkinson's disease and amyotrophic lateral sclerosis (ALS), and are employing innovative technologies to discover potential treatments for rare and genetic disorders, including new ways of treating diseases through gene therapy.

Our innovative drug development and commercialization activities are complemented by our biosimilar therapies that expand access to medicines and reduce the cost burden for healthcare systems. We are leveraging our manufacturing capabilities and know-how to develop, manufacture and market biosimilars through Samsung Bioepis, our joint venture with Samsung BioLogics Co. Ltd. (Samsung Biologics). Under this agreement, we are currently manufacturing and commercializing two anti-tumor necrosis factor (TNF) biosimilars in certain European Union (E.U.) countries.

Key Developments

During 2016 we had a number of key developments affecting our business.

Corporate Matters

Hemophilia Spin-Off

In May 2016 we announced our intention to spin off our hemophilia business, Bioverativ Inc. (Bioverativ), as an independent, publicly traded company. Bioverativ will focus on the discovery, development and commercialization of therapies for treatment of hemophilia and other blood disorders, including ELOCTATE for the treatment of hemophilia A and ALPROLIX for the treatment of hemophilia B. Bioverativ will also assume all of our rights and obligations under our collaboration agreement with Swedish Orphan Biovitrum AB (Sobi) and our collaboration and license agreement with Sangamo Biosciences Inc. (Sangamo).

On February 1, 2017, we completed the distribution of all the then outstanding shares of common stock of Bioverativ to Biogen stockholders, who received one share of Bioverativ common stock for every two shares of Biogen common stock. As a result of the distribution, Bioverativ is now an independent public company whose shares of common stock are trading under the symbol "BIVV" on the Nasdaq Global Select Market.

The financial results of Bioverativ are included in our consolidated results of operations and financial position in our audited consolidated financial statements for the periods presented in this Form 10-K. The financial results of Bioverativ will be excluded from our consolidated results of operations and financial position commencing February 1, 2017. For additional information regarding the separation of Bioverativ, please read Note 26, Subsequent Events to our consolidated financial statements included in this report.

Management Changes

During 2016 we appointed several new executives, each of whom has significant experience in the biopharmaceutical industry and is a leader in his or her functional area. These include Michel Vounatsos, Chief Executive Officer, Michael D. Ehlers, Executive Vice President, Research and Development and Paul McKenzie, Executive Vice President, Pharmaceutical Operations and Technology. For additional information related to these and our other Executive Officers, please read "Our Executive Officers" included in this report.

Cost Saving Initiatives

In 2016 we initiated cost saving measures intended to realign our organizational structure in anticipation of the changes in roles and workforce resulting from our decision to spin off our hemophilia business, as well as to achieve further targeted cost reductions.

In December 2016 after an evaluation of our manufacturing capacity and needs, we ceased manufacturing at our Cambridge, MA manufacturing facility and subleased our rights to this facility to Brammer Bio MA, LLC (Brammer). In addition to the sublease, Brammer purchased certain leasehold improvements and other assets at this facility and agreed to provide certain manufacturing and other transition and support services to us.

TECFIDERA Settlement and License Agreement

In January 2017 we agreed to enter into a settlement and license agreement with Forward Pharma A/S (Forward Pharma). The settlement and license agreement provides us an irrevocable license to all intellectual property owned by Forward Pharma and results in the termination of the German Infringement Litigation. Under the terms of the settlement and license agreement with Forward Pharma, we agreed to pay Forward Pharma $1.25 billion in cash. During the fourth quarter of 2016 we recognized a pre-tax charge of $454.8 million related to this matter. For more information on the settlement and license agreement please read Note 21, Commitments and Contingencies to our consolidated financial statements included in this report.

Product/Pipeline Developments

|

| |

Multiple Sclerosis |

TYSABRI (natalizumab) |

l | In June 2016 the European Commission (EC) approved a variation to the marketing authorization of TYSABRI, which extended its indication to include relapsing-remitting MS patients with highly active disease activity despite a full and adequate course of treatment with at least one disease modifying therapy. TYSABRI was previously indicated only for patients who had failed to respond to beta-interferon or glatiramer acetate in the E.U. |

| |

ZINBRYTA (daclizumab) |

l | ZINBRYTA was approved for the treatment of relapsing forms of MS in the U.S. in May 2016 and the E.U. in July 2016. |

| |

Opicinumab (Anti-LINGO-1) |

l | In June 2016 we reported top-line results from SYNERGY, our Phase 2 trial evaluating opicinumab in people with relapsing forms of MS. Opicinumab did not meet the primary endpoint or its secondary efficacy endpoint. However, based on these results, there was a subset of patients within the study that we believe have potential to benefit from treatment, and we are therefore planning another Phase 2 clinical trial related to opicinumab. |

|

| |

Neurodegeneration |

Aducanumab (BIIB037) |

l | In June 2016 we announced that aducanumab, our investigational treatment for early Alzheimer’s disease, was accepted into the European Medicines Agency's (EMA's) Priority Medicines (PRIME) program. PRIME aims to bring treatments to patients more quickly by enhancing the EMA's support for the development of investigational medicines for diseases without available treatments or in need of better treatment options. |

| |

l | In September 2016 aducanumab was granted "Fast Track" designation by the U.S. Food and Drug Administration (FDA). The FDA’s Fast Track program supports the development of new treatments for serious conditions with an unmet medical need such as Alzheimer’s disease. |

| |

l | In September 2016 we announced that efficacy and safety data from an additional interim analysis from our Phase 1b study of aducanumab in early Alzheimer's disease were consistent with results previously reported from the Phase 1b study. |

| |

l | In December 2016 we presented new data from the Phase 1b study of aducanumab, which included interim results from the titration cohort of the placebo-controlled period of the Phase 1b study as well as data from the first year of the long-term extension. The results supported the ongoing Phase 3 studies of aducanumab for early Alzheimer’s disease. |

|

| |

Rare Diseases |

SPINRAZA (nusinersen) |

l | In August 2016 we and Ionis Pharmaceuticals, Inc. (Ionis) announced that SPINRAZA met the primary endpoint for the interim analysis of ENDEAR, the Phase 3 trial evaluating SPINRAZA in infantile-onset (consistent with Type 1) SMA. Based on these results, we exercised our option under our collaboration agreement with Ionis to assume development and commercialization of SPINRAZA, and paid Ionis a $75.0 million license fee in connection with our option exercise. |

| |

l | In September 2016 we completed the rolling submission of a New Drug Application (NDA) to the FDA for the approval of SPINRAZA, and in October 2016 we filed a marketing authorization application (MAA) with the EMA, which had already granted Accelerated Assessment status to SPINRAZA. These applications have been accepted for review by the applicable regulatory authorities. |

| |

l | In October 2016 we dosed our first patient in our infantile-onset SMA Expanded Access Program to provide patient access to SPINRAZA. |

| |

l | In November 2016 we and Ionis announced that SPINRAZA met the primary endpoint for the interim analysis of CHERISH, the Phase 3 trial evaluating SPINRAZA in later-onset (consistent with Type 2) SMA. The analysis found that children receiving SPINRAZA experienced a highly statistically significant improvement in motor function compared to those who did not receive treatment. SPINRAZA demonstrated a favorable safety profile in the study. |

| |

l | In December 2016 SPINRAZA was approved by the FDA for the treatment of SMA in pediatric and adult patients in the U.S. The FDA also issued us a rare pediatric disease priority review voucher with the approval of SPINRAZA, which confers priority review to a subsequent drug application that would not otherwise qualify for priority review. |

|

| |

Biosimilars (Samsung Bioepis - Biogen's Joint Venture with Samsung Biologics) |

BENEPALI |

l | In January 2016 the EC approved Samsung Bioepis' MAA for BENEPALI, an etanercept biosimilar referencing ENBREL, for marketing in the E.U. Under our agreement with Samsung Bioepis, we are manufacturing and commercializing BENEPALI in specified E.U. countries. |

| |

FLIXABI |

l | In May 2016 the EC approved Samsung Bioepis' MAA for FLIXABI, an infliximab biosimilar candidate referencing REMICADE, for marketing in the E.U. Under our agreement with Samsung Bioepis, we are manufacturing and commercializing FLIXABI in specified E.U. countries. |

| |

Adalimumab (SB5) |

l | In July 2016 the EMA accepted Samsung Bioepis' MAA for SB5, an adalimumab biosimilar candidate referencing HUMIRA. |

|

| |

Genentech Relationships |

GAZYVA (obinutuzumab) |

l | In February 2016 the Roche Group announced that the FDA approved GAZYVA plus bendamustine chemotherapy followed by GAZYVA alone as a new treatment for people with follicular lymphoma who did not respond to a RITUXAN-containing regiment, or whose follicular lymphoma returned after such treatment. |

| |

l | In May 2016 the Roche Group announced positive results from the Phase 3 GALLIUM study, which investigated the efficacy and safety of GAZYVA in combination with chemotherapy followed by maintenance with GAZYVA alone, compared to RITUXAN in combination with chemotherapy followed by maintenance with RITUXAN alone in previously untreated patients with follicular lymphoma. Results from pre-planned interim analysis showed that GAZYVA-based treatment significantly reduced the risk of disease worsening or death compared to RITUXAN-based treatment. |

| |

l | In July 2016 the Roche Group announced that the Phase 3 GOYA study evaluating GAZYVA plus CHOP chemotherapy in people with previously untreated diffuse large B-cell lymphoma did not meet its primary endpoint of significantly reducing the risk of disease worsening or death compared to RITUXAN plus CHOP chemotherapy. Adverse events with GAZYVA and RITUXAN were consistent with those seen in previous clinical trials when each was combined with various chemotherapies. |

| |

OCREVUS (ocrelizumab) |

l | In June 2016 the Roche Group announced that the EMA validated its MAA of OCREVUS for the treatment of relapsing multiple sclerosis (RMS) and primary progressive multiple sclerosis (PPMS) in the E.U. The FDA has also accepted for review the Roche Group's Biologics License Application (BLA) for OCREVUS for the treatment of RMS and PPMS. |

| |

RITUXAN (rituximab) |

l | In November 2016 Genentech announced the FDA accepted its BLA for a subcutaneous formulation of RITUXAN. |

|

| |

Discontinued Programs |

l | During 2016 we discontinued development of amiselimod (MT-1303) under our agreement with Mitsubishi Tanabe Pharma Corporation, and IONIS-DMPKRx under one of our collaboration agreements with Ionis. Additionally, we terminated our collaboration agreements with Rodin Therapeutics, Inc. and Ataxion Inc. |

Marketed Products

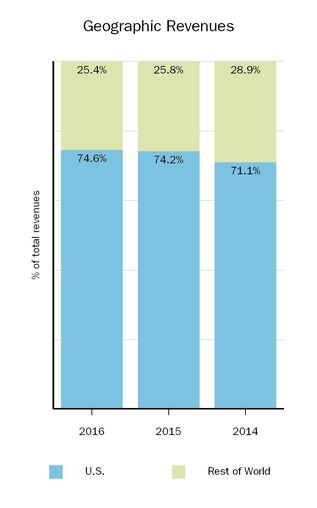

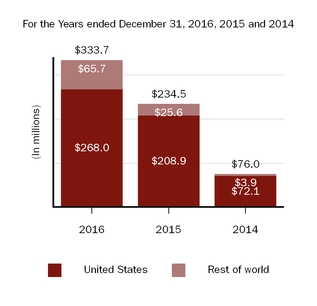

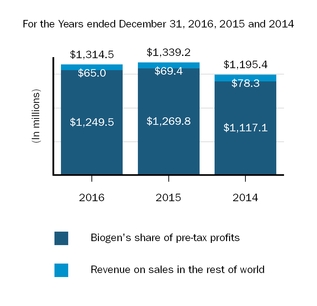

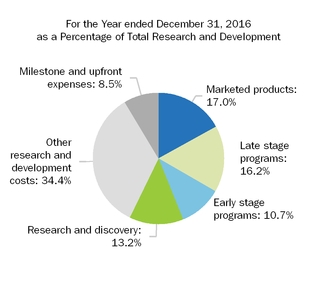

The following graphs show our revenues by product and revenues from anti-CD20 therapeutic programs and geography as a percentage of revenue for the years ended December 31, 2016, 2015 and 2014.

(1) Interferon includes AVONEX and PLEGRIDY

(2) Other includes ZINBRYTA, FAMPYRA, ELOCTATE, ALPROLIX, FUMADERM, SPINRAZA, BENEPALI and FLIXABI

Product sales for TECFIDERA, AVONEX and TYSABRI and anti-CD20 therapeutic programs for RITUXAN each accounted for more than 10% of our total revenue for the years ended December 31, 2016, 2015 and 2014. For additional financial information about our product and other revenues and geographic areas in which we operate, please read Note 24, Segment Information to our consolidated financial statements, Item 6. Selected Financial Data and Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations included in this report. A discussion of the risks attendant to our operations is set forth in the “Risk Factors” section of this report.

Multiple Sclerosis

We develop, manufacture and market a number of products designed to treat patients with MS. MS is a progressive neurological disease in which the body loses the ability to transmit messages along nerve cells, leading to a loss of muscle control, paralysis and, in some cases, death. Patients with active relapsing MS experience an uneven pattern of disease progression characterized by periods of stability that are interrupted by flare-ups of the disease after which the patient returns to a new baseline of functioning.

Our MS products and major markets include:

|

| | | | | |

Product | Indication | | Collaborator | | Major Markets |

| | | | | |

| Relapsing forms of MS in the U.S.

Relapsing-remitting MS (RRMS) in the E.U. | | None | | U.S. France Germany Italy Spain United Kingdom |

| | | | | |

| Relapsing forms of MS | | None | | U.S. France Germany Italy Spain United Kingdom |

| | | | | |

| Relapsing forms of MS in the U.S.

RRMS in the E.U. | | None | | U.S. France Germany Italy Spain United Kingdom |

| | | | | |

| Relapsing forms of MS

Crohn's disease in the U.S. | | None | | U.S. France Germany Italy Spain United Kingdom |

| | | | | |

| Relapsing forms of MS | | AbbVie Inc. (AbbVie) | | U.S. Germany |

| | | | | |

| Walking ability for patients with MS | | Acorda Therapeutics, Inc. (Acorda) | | France Germany Spain

|

Spinal Muscular Atrophy

SMA is characterized by loss of motor neurons in the spinal cord and lower brain stem, resulting in severe and progressive muscular atrophy and weakness. Ultimately, individuals with the most severe type of SMA can become paralyzed and have difficulty performing the basic functions of life, like breathing and swallowing. Due to a loss of, or defect in the SMN1 gene, people with SMA do not produce enough survival motor neuron (SMN) protein, which is critical for the maintenance of motor neurons. The severity of SMA correlates with the amount of SMN protein. People with Type 1 SMA, the most severe life-threatening form, produce very little SMN protein and do not achieve the ability to sit without support or live beyond two years without respiratory support. People with Type 2 and Type 3 produce greater amounts of SMN protein and have less severe, but still life-altering, forms of SMA.

In December 2016 the FDA approved SPINRAZA for the treatment of SMA in pediatric and adult patients. We are currently in the early stages of commercial launch in the U.S.

Our products for SMA and major markets include:

|

| | | | | |

Product | Indication | | Collaborator | | Major Markets |

| | | | | |

| Spinal muscular atrophy | | Ionis | | U.S. |

Other

|

| | | | | |

Product | Indication | | Collaborator | | Major Markets |

| | | | | |

| Moderate to severe plaque psoriasis | | None | | Germany |

Biosimilars

Biosimilars are a group of biologic medicines that are similar to currently available biologic therapies known as originators. Under our agreement with Samsung Bioepis, we manufacture and commercialize two anti-TNF biosimilars in certain countries in the E.U.: BENEPALI, an etanercept biosimilar referencing ENBREL and FLIXABI, an infliximab biosimilar referencing REMICADE: |

| | | |

Product | Indication | | Major Markets |

| | | |

| Moderate to severe rheumatoid arthritis Progressive psoriatic arthritis Axial spondyloarthritis Moderate to severe plaque psoriasis | | Denmark Germany Netherlands Norway United Kingdom |

| | | |

| Rheumatoid arthritis

Moderate to severe Crohn's disease

Severe ulcerative colitis

Severe ankylosing spondylitis

Psoriatic arthritis

Moderate to severe plaque psoriasis | | Germany Netherlands United Kingdom |

Genentech Relationships

We have a collaboration agreement with Genentech that entitles us to certain business and financial rights with respect to RITUXAN, GAZYVA and other anti-CD20 product candidates. Current products include:

|

| | | |

Product | Indication | | Major Markets |

| | | |

| Non-Hodgkin's lymphoma CLL Rheumatoid arthritis Two forms of ANCA-associated vasculitis

| | U.S. Canada |

| | | |

| In combination with chlorambucil for previously untreated CLL Follicular lymphoma | | U.S. |

For information about our anti-CD20 therapeutic programs and related agreements with Genentech, please read Note 1, Summary of Significant Accounting Policies and Note 19, Collaborative and Other Relationships to our consolidated financial statements included in this report.

Patient Support and Access

We interact with patients, advocacy organizations and healthcare societies in order to gain insights into unmet needs. The insights gained from these engagements help us support patients with services, programs and applications that are designed to help patients lead better lives. Among other things, we provide customer service and other related programs for our products, such as disease and product specific websites, insurance research services, financial assistance programs, and the facilitation of the procurement of our marketed products.

We are dedicated to helping patients obtain access to our therapies. Our patient representatives have access to a comprehensive suite of financial assistance tools. With those tools, we help patients understand their insurance coverage and, if needed, help patients compare and select new insurance options and programs. In the U.S., we have established programs that provide co-pay assistance or free marketed product for qualified uninsured or underinsured patients, based on specific eligibility criteria. We also provide charitable contributions to independent charitable organizations that assist patients with out-of-pocket expenses associated with their therapy.

Marketing and Distribution

Sales Force and Marketing

We promote our products worldwide, including in the U.S., most of the major countries of the E.U. and Japan, primarily through our own sales forces and marketing groups. In some countries, particularly in areas where we continue to expand into new geographic areas, we partner with third parties. We co-promote ZINBRYTA with AbbVie in the U.S., E.U. and Canadian territories.

We focus our sales and marketing efforts on specialist physicians in private practice or at major medical centers. We use customary pharmaceutical company practices to market our products and to educate physicians, such as sales representatives calling on individual physicians, advertisements, professional symposia, direct mail, public relations and other methods.

Distribution Arrangements

We distribute our products in the U.S. principally through wholesale distributors of pharmaceutical products, mail order specialty distributors or shipping service providers. In other countries, the distribution of our products varies from country to country, including through wholesale distributors of pharmaceutical products and third-party distribution partners who are responsible for most marketing and distribution activities.

AbbVie distributes ZINBRYTA in the U.S., and we distribute ZINBRYTA in ex-U.S. markets.

RITUXAN and GAZYVA are marketed and distributed by the Roche Group and its sublicensees.

Our product sales to two wholesale distributors, AmerisourceBergen and McKesson, each accounted for more than 10% of our total revenues for the years ended December 31, 2016, 2015 and 2014, and on a combined basis, accounted for approximately 60% of our gross product revenues for such years, respectively. For additional information, please read Note 1, Summary of Significant Accounting Policies to our consolidated financial statements included in this report.

Patents and Other Proprietary Rights

Patents are important to obtaining and protecting exclusive rights in our products and product candidates. We regularly seek patent protection in the U.S. and in selected countries outside the U.S. for inventions originating from our research and development efforts. In addition, we license rights to various patents and patent applications.

U.S. patents, as well as most foreign patents, are generally effective for 20 years from the date the earliest application was filed; however, U.S. patents that issue on applications filed before June 8, 1995 may be effective until 17 years from the issue date, if that is later than the 20 year date. In some cases, the patent term may be extended to recapture a portion of the term lost during regulatory review of the claimed therapeutic or, in the case of the U.S., because of U.S. Patent and Trademark Office (USPTO) delays in prosecuting the application. Specifically, in the U.S., under the Drug Price Competition and Patent Term Restoration Act of 1984, commonly known as the Hatch-Waxman Act, a patent that covers an FDA-approved drug may be eligible for patent term extension (for up to five years, but not beyond a total of 14 years from the date of product approval) as compensation for patent term lost during the FDA regulatory review process. The duration and extension of the term of foreign patents varies, in accordance with local law. For example, supplementary protection certificates (SPCs) on some of our products have been granted in a number of European countries, compensating in part for delays in obtaining marketing approval.

Regulatory exclusivity, which may consist of regulatory data protection and market protection, also can provide meaningful protection for our products. Regulatory data protection provides to the holder of a drug or biologic marketing authorization, for a set period of time, the exclusive use of the proprietary pre-clinical and clinical data that it created at significant cost and submitted to the applicable regulatory authority to obtain approval of its product. After the applicable set period of time, third parties are then permitted to rely upon our data to file for approval of their abbreviated applications for, and to market (subject to any applicable market protection), their generic drugs and biosimilars referencing our data. Market protection provides to the holder of a drug or biologic marketing authorization the exclusive right to commercialize its product for a set period of

time, thereby preventing the commercialization of another product containing the same active ingredient(s) during that period. Although the World Trade Organization's agreement on trade-related aspects of intellectual property rights (TRIPS) requires signatory countries to provide regulatory exclusivity to innovative pharmaceutical products, implementation and enforcement varies widely from country to country.

We also rely upon other forms of unpatented confidential information to remain competitive. We protect such information principally through confidentiality agreements with our employees, consultants, outside scientific collaborators, scientists whose research we sponsor and other advisers. In the case of our employees, these agreements also provide, in compliance with relevant law, that inventions and other intellectual property conceived by such employees during their employment shall be our exclusive property.

Our trademarks are important to us and are generally covered by trademark applications or registrations in the USPTO and the patent or trademark offices of other countries. We also use trademarks licensed from third parties, such as the trademark FAMPYRA which we license from Acorda. Trademark protection varies in accordance with local law, and continues in some countries as long as the trademark is used and in other countries as long as the trademark is registered. Trademark registrations generally are for fixed but renewable terms.

Our Patent Portfolio

The following table describes our patents in the U.S. and Europe that we currently consider of primary importance to our marketed products, including the territory, patent number, general subject matter and expected expiration dates. Except as otherwise noted, the expected expiration dates include any granted patent term extensions and issued SPCs. In some instances, there are later-expiring patents relating to our products directed to, among other things, particular forms or compositions, methods of manufacturing, or use of the drug in the treatment of particular diseases or conditions. We also continue to pursue additional patents and patent term extensions in the U.S. and other territories covering various aspects of our products that may, if issued, extend exclusivity beyond the expiration of the patents listed in the table.

|

| | | | | | | | |

Product | | Territory | | Patent No. | | General Subject Matter | | Patent Expiration(1) |

TECFIDERA | | U.S. | | 7,619,001 | | Methods of treatment | | 2018 |

| | U.S. | | 7,803,840 | | Methods of treatment | | 2018 |

| | U.S. | | 8,399,514 | | Methods of treatment | | 2028 |

| | U.S. | | 8,524,773 | | Methods of treatment | | 2018 |

| | U.S. | | 6,509,376 | | Formulations of dialkyl fumarates for use in the treatment of autoimmune diseases | | 2019 |

| | U.S. | | 8,759,393 | | Formulations | | 2019 |

| | U.S. | | 7,320,999 | | Methods of treatment | | 2020 |

| | Europe | | 1131065 | | Formulations of dialkyl fumarates and their use for treating autoimmune diseases | | 2019(2) |

| | Europe | | 2137537 | | Methods of use | | 2028(3) |

AVONEX and PLEGRIDY | | U.S. | | 7,588,755 | | Use of recombinant beta interferon for immunomodulation | | 2026 |

PLEGRIDY | | U.S. | | 7,446,173 | | Polymer conjugates of interferon beta-1a | | 2022 |

| | U.S. | | 8,524,660 | | Methods of treatment | | 2023 |

| | U.S. | | 8,017,733 | | Polymer conjugates of interferon beta-1a | | 2025 |

| | Europe | | 1656952 | | Polymer conjugates of interferon-beta-1a and uses thereof | | 2019 |

| | Europe | | 1476181 | | Polymer conjugates of interferon-beta-1a and uses thereof | | 2023 |

TYSABRI | | U.S. | | 5,840,299 | | Humanized immunoglobulins; nucleic acids; pharmaceutical compositions; methods of use | | 2017 |

| | U.S. | | 6,602,503 | | Humanized recombinant antibodies; nucleic acids and host cells; processes for production; therapeutic compositions; methods of use | | 2020 |

| | U.S. | | 7,807,167 | | Methods of treatment | | 2023 |

| | U.S. | | 9,493,567 | | Methods of treatment | | 2027 |

| | Europe | | 0804237 | | Humanized immunoglobulins; nucleic acids; pharmaceutical compositions; medical uses | | 2020(4) |

| | Europe | | 1485127 | | Methods of use | | 2023 |

FAMPYRA | | Europe | | 1732548 | | Sustained-release aminopyridine compositions for increasing walking speed in patients with MS | | 2025(5) |

| | Europe | | 23775536 | | Sustained-release aminopyridine compositions for treating MS | | 2025(6) |

ZINBRYTA | | U.S. | | 8,454,965 | | Methods of treatment | | 2024 |

| | U.S. | | 7,258,859 | | Methods of treatment | | 2024 |

| | U.S. | | 9,340,619 | | Daclizumab HYP compositions | | 2032 |

| | Europe | | 1539200 | | Anti-IL-2-receptor antibody for use in a method of treating a subject with MS | | 2023 |

SPINRAZA | | U.S. | | 6,166,197 | | Oligomeric Compounds Having Pyrimidine Nucleotide(s) | | 2017 |

| | U.S. | | 6,210,892 | | Alteration of Cellular Behavior By Antisense Modulation of MRNA Processing | | 2018 |

| | U.S. | | 7,101,993 | | Oligonucleotides Containing 2’-O-Modified Purines | | 2023 |

| | U.S. | | 7,838,657 | | SMA Treatment Via Targeting of SMN2 Splice Site Inhibitory Sequences | | 2027 |

| | U.S. | | 8,110,560 | | SMA Treatment Via Targeting of SMN2 Splice Site Inhibitory Sequences | | 2025 |

| | U.S. | | 8,361,977 | | Compositions And Methods For Modulation of SMN2 Splicing | | 2030 |

| | U.S. | | 8,980,853 | | Compositions And Methods For Modulation of SMN2 Splicing | | 2030 |

| | Europe | | 1910395 | | Compositions And Methods For Modulation of SMN2 Splicing | | 2026 |

| | Europe | | 2548560 | | Compositions And Methods For Modulation of SMN2 Splicing | | 2026 |

Footnotes follow on next page.

| |

(1) | In addition to patent protection, certain of our products are entitled to regulatory exclusivity in the U.S. and the E.U. expected until the dates set forth below: |

|

| | | | |

Product | | Territory | | Expected Expiration |

TECFIDERA | | U.S. | | 2018 |

| | E.U. | | 2024 |

PLEGRIDY | | U.S. | | 2026 |

| | E.U. | | 2024 |

TYSABRI | | U.S. | | 2016 |

| | E.U. | | 2016 |

FAMPYRA | | E.U. | | 2021 |

ZINBRYTA | | U.S. | | 2028 |

| | E.U. | | * |

SPINRAZA | | U.S. | | 2023 |

*ZINBRYTA was not designated a new active substance at the time of its approval in the E.U. and is not automatically entitled to regulatory exclusivity. Regulatory exclusivity may, however, be available for independent development of known active substances. We intend to assert the protection of its data on this basis.

| |

(2) | This patent is subject to granted SPCs in certain European countries, which extended the patent term in those countries to 2024. |

| |

(3) | This patent was revoked in a European opposition. This decision is being appealed. The patent is subject to granted SPCs in certain European countries, which extended the patent term in those countries to 2029. |

| |

(4) | Reflects SPCs granted in most European countries. |

| |

(5) | This patent is subject to granted SPCs in certain European countries, which extended the patent term in those countries to 2026. |

| |

(6) | This patent is subject to granted SPCs in certain European countries, which extended the patent term in those countries to 2026. |

The existence of patents does not guarantee our right to practice the patented technology or commercialize the patented product. Patents relating to pharmaceutical, biopharmaceutical and biotechnology products, compounds and processes, such as those that cover our existing compounds, products and processes and those that we will likely file in the future, do not always provide complete or adequate protection. Litigation, interferences, oppositions, inter partes reviews or other proceedings are, have been and may in the future be necessary in some instances to determine the validity and scope of certain of our patents, regulatory exclusivities or other proprietary rights, and in other instances to determine the validity, scope or non-infringement of certain patent rights claimed by third parties to be pertinent to the manufacture, use or sale of our products. We may also face challenges to our patents, regulatory exclusivities and other proprietary rights covering our products by manufacturers of generics and biosimilars. A discussion of certain risks and uncertainties that may affect our patent position, regulatory exclusivities and other proprietary rights is set forth in the “Risk Factors” section of this report, and a discussion of legal proceedings related to certain patents described above is set forth in Note 20, Litigation to our consolidated financial statements included in this report.

Competition

Competition in the biopharmaceutical industry is intense and comes from many sources, including specialized biotechnology firms and large pharmaceutical companies. Many of our competitors are working to develop products similar to those we are developing or already market and have considerable experience in undertaking clinical trials and in obtaining regulatory approval to market pharmaceutical products. Certain of these companies have substantially greater financial, marketing and research and development resources than we do.

We believe that competition and leadership in the industry is based on managerial and technological excellence and innovation as well as establishing patent and other proprietary positions through research and development. The achievement of a leadership position also depends largely upon our ability to maximize the approval, acceptance and use of products resulting from research and the availability of adequate financial resources to fund facilities, equipment, personnel, clinical testing, manufacturing and marketing. Another key aspect of remaining competitive within the industry is recruiting and retaining leading scientists and technicians. We believe that we have been successful in attracting and retaining skilled and experienced scientific personnel.

Competition among products approved for sale may be based, among other things, on patent position, product efficacy, safety, convenience/delivery devices, reliability, availability and price. In addition, early entry of a new pharmaceutical product into the market may have important advantages in gaining product acceptance and market share. Accordingly, the relative speed with which we can develop products, complete the testing and approval process and supply commercial quantities of products will have a significant impact on our competitive position.

The introduction of new products or technologies, including the development of new processes or technologies by competitors or new information about existing products or technologies, may result in increased competition for our marketed products or pricing pressure on our marketed products. It is also possible that the development of new or improved treatment options or standards of care or cures for the diseases our products treat could reduce or eliminate the use of our products or may limit the utility and application of ongoing clinical trials for our product candidates. We may also face increased competitive pressures as a result of generics and the emergence of biosimilars in the U.S. and E.U. If a generic or biosimilar version of one of our products were approved, it could reduce our sales of that product.

Additional information about the competition that our marketed products face is set forth below.

Multiple Sclerosis

TECFIDERA, AVONEX, PLEGRIDY, TYSABRI and ZINBRYTA each compete with one or more of the following products:

|

| | |

Competing Product | | Competitor |

AUBAGIO (teriflunomide) | | Sanofi |

BETASERON/BETAFERON (interferon-beta-1b) | | Bayer Group |

COPAXONE (glatiramer acetate) | | Teva Pharmaceuticals Industries Ltd. |

EXTAVIA (interferon-beta-1b) | | Novartis AG |

GLATOPA (glatiramer acetate) | | Sandoz, a division of Novartis AG |

GILENYA (fingolimod) | | Novartis AG |

LEMTRADA (alemtuzumab) | | Sanofi |

REBIF (interferon-beta-1) | | Merck KGaA (and co-promoted with Pfizer Inc. in the U.S.) |

FAMPYRA is indicated as a treatment to improve walking in adult patients with MS who have walking disability and is the first treatment that addresses this unmet medical need with demonstrated efficacy in people with all types of MS. FAMPYRA is currently the only therapy approved to improve walking in patients with MS.

Competition in the MS market is intense. Along with us, a number of companies are working to develop additional treatments for MS that may in the future compete with our MS products. One such product candidate is OCREVUS, a potential treatment for RMS and PPMS being developed by Genentech. While we have a financial interest in OCREVUS, future sales of our MS products may be adversely affected by the commercialization of OCREVUS, as well as by other MS products we or our competitors are developing. Future sales may also be negatively impacted by the introduction of generics, prodrugs of existing therapeutics or biosimilars of existing products.

Spinal Muscular Atrophy

SPINRAZA is the only approved treatment for SMA. We are aware of other products in development that, if successfully developed and approved, may compete with SPINRAZA in the SMA market.

Psoriasis

FUMADERM competes with several different types of therapies in the psoriasis market within Germany, including oral systemics such as methotrexate and cyclosporine.

Biosimilars

BENEPALI and FLIXABI, the two biosimilars we currently manufacture and commercialize in the E.U. for Samsung Bioepis, compete with their applicable reference products, ENBREL and REMICADE, respectively, as well as other biosimilars of those reference products.

Genentech Relationships in Other Indications

RITUXAN and GAZYVA in Oncology

RITUXAN and GAZYVA compete with a number of therapies in the oncology market, including TREANDA (bendamustine HCL), ARZERRA (ofatumumab), IMBRUVICA (ibrutinib) and ZYDELIG (idelalisib).

We also expect that over time GAZYVA will increasingly compete with RITUXAN in the oncology market. In addition, we are aware of other anti-CD20 molecules, including biosimilars, in development that, if successfully developed and approved, may compete with RITUXAN and GAZYVA in the oncology market.

RITUXAN in Rheumatoid Arthritis

RITUXAN competes with several different types of therapies in the rheumatoid arthritis market, including, among others, traditional disease-modifying anti-rheumatic drugs such as steroids, methotrexate and cyclosporine, TNF inhibitors, ORENCIA (abatacept), ACTEMRA (tocilizumab) and XELJANZ (tofacitinib).

We are also aware of other products, including biosimilars, in development that, if successfully developed and approved, may compete with RITUXAN in the rheumatoid arthritis market.

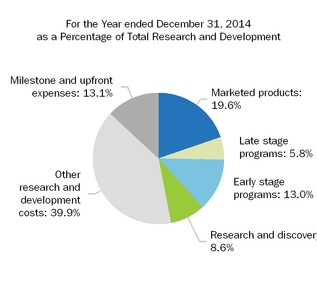

Research and Development Programs

A commitment to research is fundamental to our mission. Our research efforts are focused on better understanding the underlying biology of diseases so we can discover and deliver treatments that have the potential to make a real difference in the lives of patients with high unmet medical needs. By applying our expertise in biologics and our growing capabilities in small molecule, antisense, gene therapy, gene editing and other technologies, we target specific medical needs where we believe new or better treatments are needed.

We intend to continue committing significant resources to research and development opportunities. As part of our ongoing research and development efforts, we have devoted significant resources to conducting clinical studies to advance the development of new pharmaceutical products and technologies and to explore the utility of our existing products in treating disorders beyond those currently approved in their labels.

The table below highlights our current research and development programs that are in clinical trials and the current phase of such programs. Drug development involves a high degree of risk and investment, and the status, timing and scope of our development programs are subject to change. Important factors that could adversely affect our drug development efforts are discussed in the “Risk Factors” section of this report.

|

| | | | | | | | | | | | | |

Product Candidate | Collaborator | PHASE 1 | | PHASE 2 | | PHASE 3 | | FILED |

OCREVUS | Genentech (Roche Group) | Primary Progressive & Relapsing Multiple Sclerosis | | |

| | | | | | | | | | | | | |

Biosimilar adalimumab | Samsung Bioepis | Multiple Immunology Indications in Europe | | |

| | | | | | | | | | | | | |

GAZYVA | Genentech (Roche Group) | Front-Line Indolent Non Hodgkin’s Lymphoma | | | | | |

| | | | | | | | | | | | | |

Aducanumab | Neurimmune SubOne AG | Alzheimer's Disease | | | | | |

| | | | | | | | | | | | | |

E2609 | Eisai Co., Ltd. (Eisai) | Alzheimer's Disease | | | | | |

| | | | | | | | | | | | | |

BIIB074 | None | Trigeminal Neuralgia | | | | | | | |

| | | | | | | | | | | | | |

BIIB074 | None | Lumbosacral Radiculopathy | | | | | | | | |

| | | | | | | | | | | | | |

BIIB074 | None | Erythromelalgia | | | | | | | | |

| | | | | | | | | | | | | |

BAN2401 | Eisai | Alzheimer's Disease | | | | | | | | |

| | | | | | | | | | | | | |

Opicinumab (anti-LINGO-1) | None | Multiple Sclerosis | | | | | | | | |

| | | | | | | | | | | | | |

TYSABRI | None | Acute Ischemic Stroke | | | | | | | | |

| | | | | | | | | | | | | |

rAAV-XLRS | AGTC | X-linked Juvenile Retinoschisis | | | | | | | | |

| | | | | | | | | | | | | |

BG00011 (STX-100) | None | Idiopathic Pulmonary Fibrosis | | | | | | | | |

| | | | | | | | | | | | | |

Dapirolizumab pegol | UCB Pharma | Lupus | | | | | | | | |

| | | | | | | | | | | | | |

BIIB059 (Anti-BDCA02) | None | Lupus | | | | | | | | |

| | | | | | | | | | | | | |

BIIB061 | None | MS | | | | | | | | | | | |

| | | | | | | | | | | | | |

BIIB054 | None | PD* | | | | | | | | | | | |

| | | | | | | | | | | | | |

BIIB067 (IONIS-SOD1Rx) | Ionis | ALS** | | | | | | | | | | | |

| | | | | | | | | | | | | |

BIIB068 (BTK Inhibitor) | None | A*** | | | | | | | | | | | |

* Parkinson's Disease

** Amyotrophic Lateral Sclerosis

*** Autoimmune

For information about certain of our agreements with collaborators and other third parties, please read the subsection entitled “Business Relationships” below and Note 19, Collaborative and Other Relationships to our consolidated financial statements included in this report.

Late Stage Product Candidates

Additional information about our late stage product candidates, which includes programs in Phase 3 development or in registration stage, is set forth below.

|

| |

Neurodegeneration |

Aducanumab (BIIB037) |

l | In September 2015 we enrolled our first patient in our two global Phase 3 studies, ENGAGE and EMERGE. ENGAGE and EMERGE will assess the efficacy and safety of aducanumab, our investigational treatment for early Alzheimer's disease, in approximately 2,700 people with early Alzheimer's disease. The studies are identical in design and eligibility criteria. Each study will be conducted in more than 20 countries in North America, Europe and Asia. In October 2015 we announced that we received FDA agreement on a special protocol assessment on the Phase 3 study protocols. |

| |

l | In June 2016 we announced that aducanumab was accepted into the European Medicines Agency's (EMA's) Priority Medicines (PRIME) program. PRIME aims to bring treatments to patients more quickly by enhancing the EMA's support for the development of investigational medicines for diseases without available treatments or in need of better treatment options. |

| |

l | In September 2016 aducanumab was granted Fast Track designation by the FDA. The FDA’s Fast Track program supports the development of new treatments for serious conditions with an unmet medical need such as Alzheimer’s disease. We also announced that in a recently completed interim analysis from our Phase 1b study of aducanumab in early Alzheimer's disease efficacy and safety data were consistent with results previously reported. |

| |

l | In December 2016 we presented new data from the Phase 1b study of aducanumab, which included interim results from the titration cohort of the placebo-controlled period of the Phase 1b study as well as data from the first year of the long-term extension. The results supported the ongoing Phase 3 studies of aducanumab for early Alzheimer’s disease. |

E2609 |

l | In October 2016 Eisai announced enrollment has commenced in MISSION AD, a Phase 3 clinical program of the beta secretase cleaving enzyme (BACE) inhibitor E2609 in patients with early Alzheimer's disease in the U.S. |

|

| |

Biosimilars (Samsung Bioepis - Biogen's Joint Venture with Samsung Biologics) |

Adalimumab (SB5) |

l | In July 2016 the EMA accepted Samsung Bioepis' MAA for SB5, an adalimumab biosimilar candidate referencing HUMIRA. If approved by the EC, we will manufacture and commercialize SB5 in specified E.U. countries. |

|

| |

Genentech Relationships |

GAZYVA (obinutuzumab) |

l | The Roche Group is managing GALLIUM, a Phase 3 study examining the efficacy and safety of GAZYVA plus chemotherapy followed by GAZYVA alone for up to two years, as compared head-to-head against RITUXAN plus chemotherapy followed by RITUXAN alone for up to two years. At a pre-planned interim analysis in May 2016, an independent data monitoring committee determined that the study met its primary endpoint early. The results showed GAZYVA-based treatment significantly reduced the risk of disease worsening or death (progression-free survival) compared to RITUXAN-based treatment. |

| |

OCREVUS (ocrelizumab) |

l | In June 2015 the Roche Group announced positive results from two Phase 3 studies evaluating OCREVUS compared with interferon beta-1a in people with relapsing forms of MS. Treatment with OCREVUS compared with interferon beta-1a significantly reduced the annualized relapse rate over a two-year period; significantly reduced the progression of clinical disability; and led to a significant reduction in the number of lesions in the brain as measured by MRI. |

| |

l | In September 2015 the Roche Group announced positive results from a Phase 3 study evaluating OCREVUS in people with PPMS. Treatment with OCREVUS significantly reduced the progression of clinical disability compared with placebo, as measured by the Expanded Disability Status Scale. |

| |

l | In June 2016 the Roche Group announced that the EMA validated its MAA of OCREVUS for the treatment of RMS and PPMS in the E.U. The FDA has also accepted for review its BLA for OCREVUS for the treatment of RMS and PPMS, and has granted the application priority review designation. Under our agreement with Genentech, if OCREVUS is approved, we will receive tiered royalty payments on sales of OCREVUS in the U.S. |

Business Relationships

As part of our business strategy, we establish business relationships, including joint ventures and collaborative arrangements with other companies, universities and medical research institutions, to assist in the clinical development and/or commercialization of certain of our products and product candidates and to provide support for our research programs. We also evaluate opportunities for acquiring products or rights to products and technologies that are complementary to our business from other companies, universities and medical research institutions.

Below is a brief description of certain business relationships and collaborations that expand our pipeline and provide us with certain rights to existing and potential new products and technologies. For more information regarding certain of these relationships, including their ongoing financial and accounting impact on our business, please read Note 19, Collaborative and Other Relationships to our consolidated financial statements included in this report.

AbbVie, Inc.

We have a collaboration agreement with AbbVie aimed at advancing the development and commercialization of ZINBRYTA in MS. Under the agreement, we and AbbVie conduct ZINBRYTA co-promotion activities in the U.S., E.U. and Canadian territories, and we are responsible for manufacturing and research and development activities.

Acorda Therapeutics, Inc.

We collaborate with Acorda to develop and commercialize products containing fampridine, such as FAMPYRA, in markets outside the U.S. We also have responsibility for regulatory activities and the future clinical development of related products in those markets.

Applied Genetic Technologies Corporation

We have a collaboration agreement with Applied Genetic Technologies Corporation (AGTC) to develop gene-based therapies for multiple ophthalmic diseases. The collaboration focuses on the development of a clinical-stage candidate for X-linked Retinoschisis (XLRS) and a preclinical candidate for the treatment of X-linked Retinitis Pigmentosa (XLRP), for which we were granted worldwide commercialization rights. The agreement also provides us with options to early stage discovery programs in two ophthalmic diseases and one non-ophthalmic condition.

Eisai Co., Ltd.

We have a collaboration with Eisai to jointly develop and commercialize E2609 and BAN2401, two Eisai product candidates for the treatment of Alzheimer’s disease. Eisai serves as the global operational and regulatory lead for E2609 and BAN2401 and all costs, including research, development, sales and marketing expenses, are shared equally between us and Eisai. Following marketing approval in major markets, we will co-promote E2609 and BAN2401 with Eisai and share profits equally. In smaller markets, Eisai will distribute these products and pay us a royalty.

The agreement also provides Eisai with options to jointly develop and commercialize two of our candidates for Alzheimer’s disease, aducanumab and an anti-tau monoclonal antibody, upon the exchange or provision of clinical data. Upon exercise of the applicable option, we will execute a separate collaboration agreement with Eisai on terms and conditions that mirror the financial arrangements we have with Eisai with respect to E2609 and BAN2401.

Genentech (Roche Group)

We have a collaboration agreement with Genentech which entitles us to certain financial and other rights with respect to RITUXAN, GAZYVA and other anti-CD20 product candidates. Additionally, under our agreement with Genentech, if OCREVUS is approved, we will receive tiered royalty payments on sales of OCREVUS in the U.S.

Ionis Pharmaceuticals, Inc.

We have an exclusive, worldwide option and collaboration agreement with Ionis relating to the development and commercialization of up to three gene targets, and an exclusive worldwide option and collaboration agreement with Ionis under which both companies are developing and commercializing SPINRAZA for the treatment of SMA.

We also have a six-year research collaboration agreement with Ionis, under which both companies perform discovery level research and will develop and commercialize antisense and other therapeutics for the treatment of neurological disorders.

Samsung Bioepis

We and Samsung Biologics established a joint venture, Samsung Bioepis, to develop, manufacture and market biosimilar pharmaceuticals. We also have an agreement with Samsung Bioepis to commercialize, over a 10-year term, three anti-TNF biosimilar product candidates in specified E.U. countries and, in the case of BENEPALI, Japan. Under this agreement, we are manufacturing and commercializing BENEPALI, an etanercept biosimilar referencing ENBREL and FLIXABI, an infliximab biosimilar referencing REMICADE.

In addition to our joint venture and commercialization agreement with Samsung Bioepis, we license certain of our proprietary technology to Samsung Bioepis in connection with Samsung Bioepis' development, manufacture and commercialization of its biosimilar products. We also provide technical development and technology transfer services to Samsung Bioepis, and manufacture clinical and commercial quantities of bulk drug substance of Samsung Bioepis' biosimilar products.

University of Pennsylvania

We have a collaboration and alliance with the University of Pennsylvania to advance gene therapy and gene editing technologies. The collaboration will primarily focus on the development of therapeutic approaches that target the eye, skeletal muscle and the central nervous system. The alliance is also expected to focus on the research and validation of next-generation gene transfer technology using adeno-associated virus gene delivery vectors and exploring the expanded use of genome editing technology as a potential therapeutic platform.

Regulatory

Our current and contemplated activities and the products, technologies and processes that result from such activities are subject to substantial government regulation.

Regulation of Pharmaceuticals

Product Approval and Post-Approval Regulation in the U.S.

APPROVAL PROCESS

Before new pharmaceutical products may be sold in the U.S., preclinical studies and clinical trials of the products must be conducted and the results submitted to the FDA for approval. With limited exceptions, the FDA requires companies to register both pre-approval and post-approval clinical trials and disclose clinical trial results in public databases. Failure to register a trial or disclose study results within the required time periods could result in penalties, including civil monetary penalties. Clinical trial programs must establish efficacy, determine an appropriate dose and dosing regimen, and define the conditions for safe use. This is a high-risk process that requires stepwise clinical studies in which the candidate product must successfully meet predetermined endpoints. The results of the preclinical and clinical testing of a product are then submitted to the FDA in the form of a BLA or a NDA. In response to a BLA or NDA, the FDA may grant marketing approval, request additional information or deny the application if it determines the application does not provide an adequate basis for approval.

Product development and receipt of regulatory approval takes a number of years, involves the expenditure of substantial resources and depends on a number of factors, including the severity of the disease in question, the availability of alternative treatments, potential safety signals observed in preclinical or clinical tests, and the risks and benefits of the product as demonstrated in clinical trials. The FDA has substantial discretion in the product approval process, and it is impossible to predict with any certainty whether and when the FDA will grant marketing approval. The agency may require the sponsor of a BLA or NDA to conduct additional clinical studies or to provide other scientific or technical information about the product, and these additional requirements may lead to unanticipated delay or expense. Furthermore, even if a product is approved, the approval may be subject to limitations based on the FDA's interpretation of the existing pre-clinical or clinical data.

The FDA has developed four distinct approaches intended to make therapeutically important drugs available as rapidly as possible, especially when the drugs are the first available treatment or have advantages over existing treatments: accelerated approval, fast track, breakthrough therapy and priority review.

| |

• | Accelerated Approval: The FDA may grant “accelerated approval” status to products that treat serious or life-threatening illnesses and that provide meaningful therapeutic benefits to patients over existing treatments. Under this pathway, the FDA may approve a product based on surrogate endpoints, or clinical endpoints other than survival or irreversible morbidity. When approval is based on surrogate endpoints or clinical endpoints other than survival or morbidity, the sponsor will be required to conduct additional post-approval clinical studies to verify and describe clinical benefit. Under the agency's accelerated approval regulations, if the FDA concludes that a drug that has been shown to be effective can be safely used only if distribution or use is restricted, it may require certain post-marketing restrictions as necessary to assure safe use. In addition, for products approved under accelerated approval, sponsors may be required to submit all copies of their promotional materials, including advertisements, to the FDA at least thirty days prior to initial dissemination. The FDA may withdraw approval under accelerated approval after a hearing if, for instance, post-marketing studies fail to verify any clinical benefit, it becomes clear that restrictions on the distribution of the product are inadequate to ensure its safe use, or if a sponsor fails to comply with the conditions of the accelerated approval. |

| |

• | Fast Track Status: The FDA may grant "fast track" status to products that treat a serious condition and have data demonstrating the potential to address an unmet medical need or a drug that has been designated as a qualified infectious disease product. |

| |

• | Breakthrough Therapy: The FDA may grant “breakthrough therapy” status to drugs designed to treat, alone or in combination with another drug or drugs, a serious or life-threatening disease or condition and for which preliminary clinical evidence suggests a substantial improvement over existing therapies. Such drugs need not address an unmet need, but are nevertheless eligible for expedited review if they offer the potential for an improvement. Breakthrough therapy status entitles the sponsor to earlier and more frequent meetings with the FDA regarding the development of nonclinical and clinical data and permits the FDA to offer product development or regulatory advice for the purpose of shortening the time to product approval. Breakthrough therapy status does not guarantee that a product will be developed or reviewed more quickly and does not ensure FDA approval. |

| |

• | Priority Review: Priority Review only applies to applications (original or efficacy supplement) for a drug that treats a serious condition and, if approved, would provide a significant improvement in safety or effectiveness. Priority Review may also be granted for any supplement that proposes a labeling change due to studies completed in response to a written request from FDA for pediatric studies, for an application for a drug that has been designated as a qualified infectious disease product, or any application or supplement for a drug submitted with a priority review voucher. |

POST-MARKETING STUDIES

Regardless of the approval pathway employed, the FDA may require a sponsor to conduct additional post-marketing studies as a condition of approval to provide data on safety and effectiveness. If a sponsor fails to conduct the required studies, the agency may withdraw its approval. In addition, if the FDA concludes that a drug that has been shown to be effective can be safely used only if distribution or use is restricted, it can mandate post-marketing restrictions as necessary to assure safe use. In such a case, the sponsor may be required to establish rigorous systems to assure use of the product under safe conditions. These systems are usually referred to as Risk Evaluation and Mitigation Strategies (REMS). The FDA can impose financial penalties for failing to comply with certain post-marketing commitments, including REMS. In addition, any changes to an approved REMS must be reviewed and approved by the FDA prior to implementation.

ADVERSE EVENT REPORTING

We monitor information on side effects and adverse events reported during clinical studies and after marketing approval and report such information and events to regulatory agencies. Non-compliance with the FDA's safety reporting requirements may result in civil or criminal penalties. Side effects or adverse events that are reported during clinical trials can delay, impede, or prevent marketing approval. Based on new safety information that emerges after approval, the FDA can mandate product labeling changes, impose a new REMS or the addition of elements to an existing REMS, require new post-marketing studies (including additional clinical trials), or suspend or withdraw approval of the product. These requirements may affect our ability to maintain marketing approval of our products or require us to make significant expenditures to obtain or maintain such approvals.

APPROVAL OF CHANGES TO AN APPROVED PRODUCT

If we seek to make certain types of changes to an approved product, such as adding a new indication, making certain manufacturing changes, or changing manufacturers or suppliers of certain ingredients or components, the FDA will need to review and approve such changes in advance. In the case of a new indication, we are required to demonstrate with additional clinical data that the product is safe and effective for a use other than that initially approved. FDA regulatory review may result in denial or modification of the planned changes, or requirements to conduct additional tests or evaluations that can substantially delay or increase the cost of the planned changes.

REGULATION OF PRODUCT ADVERTISING AND PROMOTION

The FDA regulates all advertising and promotion activities and communications for products under its jurisdiction both before and after approval. A company can make only those claims relating to safety and efficacy that are approved by the FDA. However, physicians may prescribe legally available drugs for uses that are not described in the drug's labeling. Such off-label uses are common across medical specialties, and often reflect a physician's belief that the off-label use is the best treatment for patients. The FDA does not regulate the behavior of physicians in their choice of treatments, but FDA regulations do impose stringent restrictions on manufacturers' communications regarding off-label uses. Failure to comply with applicable FDA requirements may subject a company to adverse publicity, enforcement action by the FDA, corrective advertising, and the full range of civil and criminal penalties available to the government.

Regulation of Combination Products

Combination products are defined by the FDA to include products comprising two or more regulated components (e.g., a biologic and a device). Biologics and devices each have their own regulatory requirements, and combination products may have additional requirements. Some of our marketed products meet this definition and are regulated under this framework and similar regulations outside the U.S., and we expect that some of our pipeline product candidates may be evaluated for regulatory approval under this framework as well.

Product Approval and Post-Approval Regulation Outside the U.S.

We market our products in numerous jurisdictions outside the U.S. Most of these jurisdictions have product approval and post-approval regulatory processes that are similar in principle to those in the U.S. In Europe, for example, where a substantial part of our ex-U.S. efforts are focused, there are several tracks for marketing approval, depending on the type of product for which approval is sought. Under the centralized procedure, a company submits a single application to the EMA. The marketing application is similar to the NDA or BLA in the U.S. and is evaluated by the Committee for Medicinal Products for Human Use (CHMP), the expert scientific committee of the EMA. If the CHMP determines that the marketing application fulfills the requirements for quality, safety, and efficacy, it will submit a favorable opinion to the EC. The CHMP opinion is not binding, but is typically adopted by the EC. A marketing application approved by the EC is valid in all member states. The centralized procedure is required for all biological products, orphan medicinal products, and new treatments for neurodegenerative disorders, and it is available for certain other products, including those which constitute a significant therapeutic, scientific or technical innovation.

In addition to the centralized procedure, Europe also has:

| |

• | a nationalized procedure, which requires a separate application to and approval determination by each country; |

| |

• | a decentralized procedure, whereby applicants submit identical applications to several countries and receive simultaneous approval; and |

| |

• | a mutual recognition procedure, where applicants submit an application to one country for review and other countries may accept or reject the initial decision. |

Regardless of the approval process employed, various parties share responsibilities for the monitoring, detection, and evaluation of adverse events post-approval, including national authorities, the EMA, the EC, and the marketing authorization holder. In some regions, it is possible to receive an “accelerated” review whereby the national regulatory authority will commit to truncated review timelines for products that meet specific medical needs.

Good Manufacturing Practices

Regulatory agencies regulate and inspect equipment, facilities and processes used in the manufacturing and testing of pharmaceutical and biologic products prior to approving a product. If, after receiving clearance from regulatory agencies, a company makes a material change in manufacturing equipment, location or process, additional regulatory review and approval may be required. We also must adhere to current Good Manufacturing Practices (cGMP) and product-specific regulations enforced by regulatory agencies following product approval. The FDA, the EMA and other regulatory agencies also conduct periodic visits to re-inspect equipment, facilities and processes following the initial approval of a product. If, as a result of these inspections, it is determined that our equipment, facilities or processes do not comply with applicable regulations and conditions of product approval, regulatory agencies may seek civil, criminal or administrative sanctions or remedies against us, including significant financial penalties and the suspension of our manufacturing operations.

Good Clinical Practices