SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement | |

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ |

Definitive Proxy Statement | |

| ☐ |

Definitive Additional Materials | |

| ☐ |

Soliciting Material Pursuant to Section 240.14a-11(c) or Section 240.14a-12 | |

CORVEL CORPORATION

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount previously paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing party:

| |||

| (4) | Date filed:

| |||

June 19, 2020

Dear CorVel Stockholder:

We are pleased to invite you to our 2020 Annual Meeting, which will be held at CorVel’s principal executive offices at 1920 Main Street, Suite 900, Irvine, California 92614, on Friday, July 31, 2020, at 1:00 p.m. Pacific Daylight Time. Voting on election of directors and other matters is also scheduled. The items to be voted on at the 2020 Annual Meeting are addressed in the Notice of Annual Meeting of Stockholders and Proxy Statement.

Important Notice Regarding the Availability of Proxy Materials for the Annual Stockholder Meeting to Be Held on July 31, 2020: The Notice of Annual Meeting of Stockholders, Proxy Statement and Annual Report on Form 10-K are available at https://materials.proxyvote.com/221006.

We are pleased to provide proxy materials to our stockholders over the Internet, which we believe will lower the costs of delivering such materials while also reducing the environmental impact of printing and mailing. Consequently, stockholders will not receive paper copies of our proxy materials unless they request them. We will send stockholders a notice with instructions for accessing the proxy materials and voting via the Internet. The notice also provides information on how to receive a paper copy of the Annual Meeting materials, if they so choose.

Your vote is important. Whether or not you plan to attend the 2020 Annual Meeting, please vote as soon as possible to ensure that your shares will be represented and voted at the 2020 Annual Meeting. If you later decide to attend the Annual Meeting and wish to change your vote, you may do so simply by voting in person at the meeting. If you are a beneficial owner of our stock and wish to vote at the 2020 Annual Meeting, you will need to obtain a legal proxy from your bank or broker and bring this legal proxy to the meeting. If you hold your shares in the name of a broker, bank or other nominee, your nominee may determine to vote your shares at its own discretion, absent instructions from you. However, due to voting rules that may prevent your bank or broker from voting your uninstructed shares on a discretionary basis in the election of directors and on other “non-routine” matters described in the attached proxy statement, it is important that you cast your vote. Accordingly, please provide appropriate voting instructions to your broker or bank to ensure your vote will count.

We look forward to seeing you at our 2020 Annual Meeting.

Sincerely,

V. Gordon Clemons,

Chairman of the Board

CorVel Corporation

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held July 31, 2020

To the Stockholders of CorVel Corporation:

NOTICE IS HEREBY GIVEN that the 2020 Annual Meeting of Stockholders of CorVel Corporation, a Delaware corporation, will be held at our principal executive offices, at 1920 Main Street, Suite 900, Irvine, California 92614, on Friday, July 31, 2020, at 1:00 p.m. Pacific Daylight Time for the following purposes, as more fully described in the Proxy Statement accompanying this Notice:

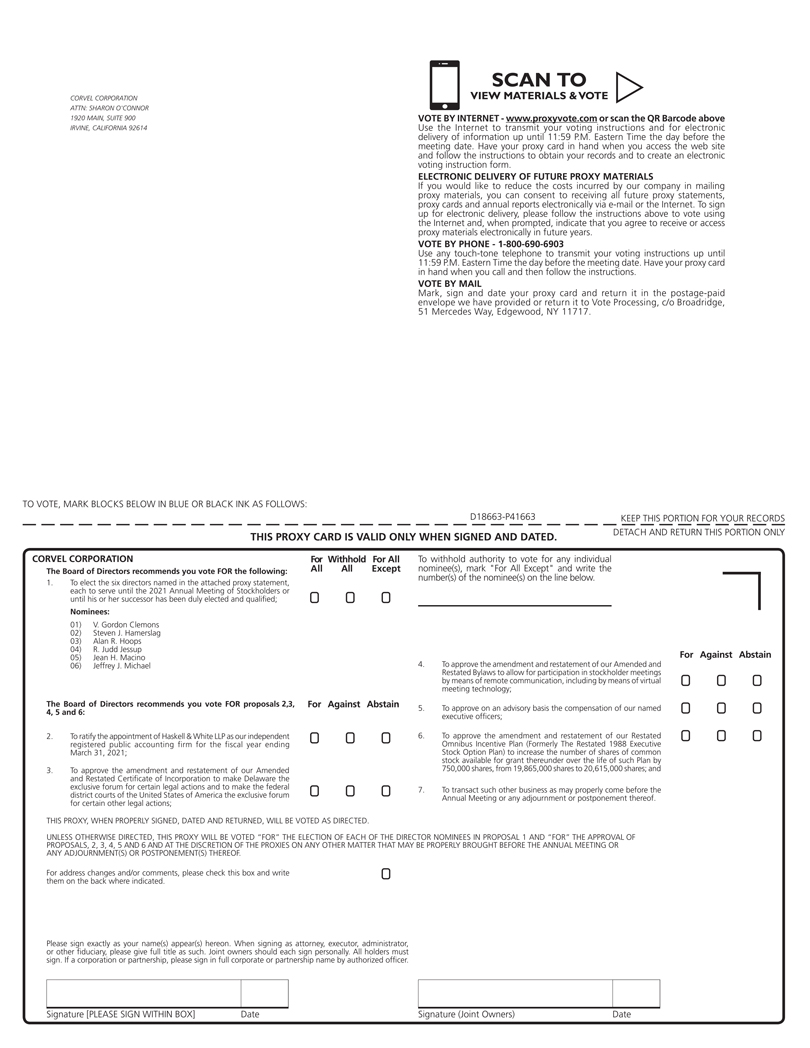

| 1. | To elect the six directors named in the attached Proxy Statement, each to serve until the 2021 annual meeting of stockholders or until his or her successor has been duly elected and qualified; |

| 2. | To ratify the appointment of Haskell & White LLP as our independent registered public accounting firm for the fiscal year ending March 31, 2021; |

| 3. | To approve the amendment and restatement of our Amended and Restated Certificate of Incorporation to make Delaware the exclusive forum for certain legal actions and to make the federal district courts of the United States of America the exclusive forum for certain other legal actions; |

| 4. | To approve the amendment and restatement of our Amended and Restated Bylaws to allow for participation in stockholder meetings by means of remote communication, including by means of virtual meeting technology; |

| 5. | To approve on an advisory basis the compensation of our named executive officers; |

| 6. | To approve the amendment and restatement of our Restated Omnibus Incentive Plan (Formerly The Restated 1988 Executive Stock Option Plan) to increase the number of shares of common stock available for grant thereunder over the life of such Plan by 750,000 shares, from 19,865,000 shares to 20,615,000 shares; and |

| 7. | To transact such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof. |

Our Board of Directors recommends that stockholders vote FOR Proposals One through Six listed above. Only stockholders of record at the close of business on June 5, 2020 are entitled to notice of and to vote at the Annual Meeting and any adjournment(s) or postponement(s) thereof. A list of stockholders entitled to vote at the Annual Meeting will be available for inspection at our principal executive offices and at our Annual Meeting.

You are cordially invited to attend the Annual Meeting in person. However, to assure your representation at the Annual Meeting, you are urged to vote your shares as soon as possible. As an alternative to voting in person at the Annual Meeting, you may vote via the Internet or, if you receive a paper proxy card in the mail, you also may vote by telephone or by mailing a completed proxy card.

If you are viewing this proxy over the Internet you may vote electronically over the Internet or in person at the Annual Meeting. If you receive a printed proxy card, you may vote over the Internet, by telephone, by mail or in person at the Annual Meeting. Please be aware that if you vote by telephone or over the Internet, you may incur costs such as telephone and Internet access charges for which you will be responsible.

Voting over the Internet. You can vote via the Internet. The website address for Internet voting is provided on your notice of Internet availability of proxy materials or, if you received one, on your proxy card. To vote via the Internet, you will need to use the control number appearing on your notice of Internet availability of proxy materials or, if you received one, on your proxy card. You can use the Internet to transmit your voting instructions up until 11:59 p.m. Eastern Time on July 30, 2020. Internet voting is available 24 hours a day.

Voting by Telephone. You can vote by telephone by calling the toll-free telephone number provided on your notice of Internet availability of proxy materials or, if you received one, on your proxy card. You will need to use the control number appearing on your proxy card to vote by telephone. You may transmit your voting instructions from any touch-tone telephone up until 11:59 p.m. Eastern Time on July 30, 2020. Telephone voting is available 24 hours a day.

Voting by Mail. If you receive a printed proxy card, you can vote by marking, dating and signing it, and returning it in the postage paid envelope provided. Please promptly mail your proxy card to ensure that it is received prior to the closing of the polls at the Annual Meeting.

Voting in Person at the Meeting. If you attend the Annual Meeting and plan to vote in person, we will provide you with a ballot at the Annual Meeting. If your shares are registered directly in your name, you are considered the stockholder of record and you have the right to vote in person at the Annual Meeting. If your shares are held in the name of your broker or other nominee, you are considered the beneficial owner of shares held in street name. As a beneficial owner, if you wish to attend the Annual Meeting and vote at the Annual Meeting, you will need to bring to the Annual Meeting a legal proxy from your broker or other nominee authorizing you to vote those shares.

You may revoke your proxy at any time prior to the closing of the polls at the Annual Meeting. You may revoke your proxy by (i) voting again using the Internet or telephone before the cut off time (your latest Internet or telephone proxy is the one that will be counted), (ii) delivering a written revocation or by presenting another properly signed proxy with a later date to our Secretary at our principal executive offices at 1920 Main Street, Suite 900, Irvine, California 92614, or (iii) attending the Annual Meeting and voting in person at the Annual Meeting by ballot (your proxy will be revoked automatically and only your vote at the Annual Meeting will be counted). If you hold your shares in the name of a broker, bank or other nominee, please provide appropriate voting instructions to that nominee. Absent such instructions, your nominee may determine to vote your shares at its own discretion. However, due to voting rules that may prevent your bank or broker from voting your uninstructed shares on a discretionary basis in the election of directors and on other “non-routine” matters described in the attached proxy statement, it is important that you cast your vote. Accordingly, please provide appropriate voting instructions to your broker or bank to ensure your vote will count. If you wish to attend the Annual Meeting and vote shares held for you by a nominee, please be sure to obtain a legal proxy from that nominee allowing you to cast your vote in person.

The holders of a majority of the outstanding shares of our Common Stock entitled to vote must be present in person or represented by proxy at the Annual Meeting in order to constitute a quorum for the transaction of business. Please vote as soon as possible in order to ensure that a quorum is obtained and to avoid the additional cost to us of adjourning the Annual Meeting until a later time and re-soliciting proxies.

Important Notice Regarding the Availability of Proxy Materials for the Annual Stockholder Meeting to Be Held on July 31, 2020: The Notice of Annual Meeting of Stockholders, Proxy Statement and Annual Report on Form 10-K are available at https://materials.proxyvote.com/221006.

YOUR VOTE IS IMPORTANT. PLEASE READ THE ATTACHED PROXY STATEMENT CAREFULLY.

By order of the Board of Directors,

RICHARD J. SCHWEPPE

Secretary

Irvine, California

June 19, 2020

CorVel Corporation

PROXY STATEMENT

Proxies are being solicited on behalf of our Board of Directors, or the Board, for use at the 2020 Annual Meeting of Stockholders, which will be held at our principal executive offices located at 1920 Main Street, Suite 900, Irvine, California 92614, on Friday, July 31, 2020, at 1:00 p.m. Pacific Daylight Time, and at any adjournment(s) or postponement(s) thereof. Stockholders of record at the close of business on June 5, 2020 are entitled to notice of and to vote at the Annual Meeting and any adjournment(s) or postponement(s) of that meeting. A list of stockholders entitled to vote at the Annual Meeting will be available for inspection at our principal executive offices and at the Annual Meeting.

On June 5, 2020, the Record Date for determination of stockholders entitled to notice of and to vote at the Annual Meeting, there were 18,002,121 shares of our Common Stock outstanding and approximately 886 holders of record according to information provided by our transfer agent. No shares of our preferred stock were outstanding as of June 5, 2020. Each stockholder is entitled to one vote on all matters brought before the Annual Meeting for each share of our Common Stock held by such stockholder on the Record Date. Stockholders may not cumulate votes in the election of directors.

The presence at the Annual Meeting, either in person or by proxy, of holders of a majority of the outstanding shares of our Common Stock entitled to vote will constitute a quorum for the transaction of business. In the election of directors under Proposal One, the six nominees receiving the highest number of affirmative votes shall be elected. The affirmative vote of the holders of our Common Stock representing a majority of the voting power present or represented by proxy at the Annual Meeting and entitled to vote is required for approval of Proposals Two and Five. The affirmative vote of the holders of a majority of the outstanding shares of Common Stock entitled to vote is required for approval of Proposal Three. The affirmative vote of the holders of 66 2/3% of the outstanding shares of Common Stock entitled to vote is required for approval of Proposal Four. Proposal Six will be approved if a majority of the total votes cast on the proposal in person or by proxy are voted in favor of such approval.

All votes will be tabulated by our inspector of election appointed for the Annual Meeting, who will separately tabulate affirmative and negative votes, abstentions and broker non-votes. Under the NYSE rules that govern brokers who have record ownership of shares that are held in “street name” for their clients (who are the beneficial owners of the shares), brokers have the discretion to vote such shares on “routine” matters (such as the ratification of the appointment of our independent registered public accounting firm (Proposal Two)), but not on “non-routine” matters (such as the election of directors (Proposal One), the non-binding advisory vote to approve our named executive officer compensation (Proposal Five) and the proposed amendment and restatement of our Restated Omnibus Incentive Plan (Proposal Six)) without specific instructions from their clients. With respect to Proposals Three and Four, we have not been advised as to whether the NYSE will deem these proposals as “routine” or “non-routine”; however, we believe that the NYSE will deem the proposed amendment and restatement of our Amended and Restated Certificate of Incorporation (Proposal Three) and the proposed amendment and restatement of our Amended and Restated Bylaws (Proposal Four) as “non-routine” matters. Because we have not been advised as to how the NYSE will designate these proposals, we recommend that stockholders cast their votes by proxy to ensure that their shares are voted in the manner they wish. Thus, because the proposals to be acted upon at the meeting consist of both “routine” and “non-routine” matters, the broker may turn in a proxy card for uninstructed shares that vote FOR the “routine” matter, but expressly states that the broker is NOT voting on the “non-routine” matters. The vote with respect to any “non-routine” matter is referred to as a “broker non-vote.” A broker non-vote may also occur with respect to “routine” matters if the broker expressly instructs on the proxy card that it is not voting on a certain matter. Abstentions and broker

1

non-votes are counted as present for purposes of determining whether a quorum exists for the transaction of business at the Annual Meeting, but broker non-votes will not be counted for purposes of determining the number of votes cast with respect to the particular proposal on which the broker has expressly not voted. With regard to Proposal One, broker non-votes and votes marked “withheld” will not be counted towards the tabulations of votes cast on such proposal presented to the stockholders, will not have the effect of negative votes, and will not affect the outcome of the election of directors. With regard to Proposal Two, brokers have the discretion to vote shares on “routine” matters such as ratification of the appointment of the independent registered public accounting firm and, therefore, broker non-votes are not expected for Proposal Two; however, if there are broker non-votes for Proposal Two, they will not be counted for purposes of determining whether such proposal has been approved and will not have the effect of negative votes. With regard to Proposals Three and Four, broker non-votes will be counted for purposes of determining whether such proposal has been approved and will have the effect of negative votes. With regard to Proposal Five, broker non-votes will not be counted for purposes of determining whether Proposal Five is approved and will not affect the outcome of Proposal Five. With regard to Proposal Six, abstentions and broker non-votes will not be counted for purposes of determining whether the proposal has been approved, and will not have the same effect as negative votes. Abstentions will be counted as present and entitled to vote for purposes of Proposals Two through Five and, therefore, will have the same effect as a vote against Proposals Two through Five.

If your shares are held by a bank or broker in street name, it is important that you cast your vote if you want it to count in the election of directors and any other “non-routine” matters proposed in this Proxy Statement. Voting rules may prevent your bank or broker from voting your uninstructed shares on a discretionary basis in the election of directors and any other “non-routine” matters. Accordingly, if your shares are held by a bank or broker in street name and you do not instruct your bank or broker how to vote in the election of directors and any other “non-routine” matters proposed in this Proxy Statement, no votes will be cast on your behalf. Your bank or broker will, however, continue to have discretion to vote any uninstructed shares on “routine” matters, such as the ratification of the appointment of our independent registered public accounting firm and other matters determined by the NYSE to be “routine”.

If a proxy is properly signed and returned, the shares represented thereby will be voted at the Annual Meeting in accordance with the instructions specified thereon. If the proxy does not specify how the shares represented thereby are to be voted, the proxy will be voted FOR the election of the directors in Proposal One unless the authority to vote for the election of such directors is withheld and, if no contrary instructions are given, the proxy will be voted as recommended by the Board with respect to Proposals Two through Six described in the accompanying Notice and this Proxy Statement. In their discretion, the proxies named on the proxy will be authorized to vote upon any other matter that may properly come before the Annual Meeting or any adjournment(s) or postponement(s) thereof. A proxy may be revoked or changed at or prior to the Annual Meeting by (i) voting again using the Internet or telephone, (ii) delivery of a written revocation or by presentation of another properly signed proxy with a later date to our Secretary at our principal executive offices at 1920 Main Street, Suite 900, Irvine, California 92614, or (iii) by attendance at the Annual Meeting and voting in person by ballot. Your attendance at the Annual Meeting will not automatically revoke your proxy unless you affirmatively indicate at the Annual Meeting your intention to vote your shares in person. Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to vote in person at the Annual Meeting, you must obtain from the record holder a legal proxy issued in your name.

Important Notice Regarding the Availability of Proxy Materials for the Annual Stockholder Meeting to Be Held on July 31, 2020: The Notice of Annual Meeting of Stockholders, Proxy Statement and Annual Report on Form 10-K are available at https://materials.proxyvote.com/221006.

Notice regarding the Internet availability of these proxy materials was first sent or given on or about June 19, 2020, to stockholders of record on the Record Date.

2

While our proxy solicitation materials are available on the Internet, we will provide, without charge, copies of our annual report on Form 10-K to each stockholder of record as of the Record Date that requests a copy in writing. Any exhibits listed in the annual report on Form 10-K report also will be furnished upon request at the actual expense we incur in furnishing such exhibit. Any such requests should be directed to our Secretary at our executive offices set forth above.

3

INTERNET AVAILABILITY OF PROXY MATERIALS

In accordance with the rules of the Securities and Exchange Commission (“SEC”), we are using the Internet as our primary means of furnishing proxy materials to stockholders. Consequently, stockholders will not receive paper copies of our proxy materials unless they request them. We will send stockholders a Notice of Internet Availability of Proxy Materials with instructions for accessing the proxy materials, including our Proxy Statement and Annual Report, and voting via the Internet. The Notice of Internet Availability of Proxy Materials also provides information on how stockholders may obtain paper copies of our proxy materials if they so choose. This makes the proxy distribution process more efficient and less costly, and helps conserve natural resources. If you previously elected to receive our proxy materials electronically, these materials will continue to be sent via email unless you change your election.

Our principal executive offices are located at 1920 Main Street, Suite 900, Irvine, California 92614. Our telephone number is (949) 851-1473.

4

MATTERS TO BE CONSIDERED AT THE ANNUAL MEETING

PROPOSAL ONE

ELECTION OF DIRECTORS

Six individuals have been nominated to serve as our directors. Our stockholders are being asked to elect these nominees to the Board at the Annual Meeting. Our Nomination and Governance Committee selected and recommended, and the Board, including its independent directors, approved the nomination of each of the six individuals listed below for election to serve for a one-year term ending on the date of our next annual meeting of stockholders or until his or her successor has been duly elected and qualified. The term may be shorter if such individual resigns, becomes disqualified or disabled, or is otherwise removed. If these nominees are elected, the Board will consist of six persons and there will be one vacancy on the Board. The Board may fill such vacancy at any time during the year.

Unless otherwise instructed or unless the proxy is marked “withheld,” the proxy holders will vote the proxies received by them FOR the election of each of the nominees named below. Each such nominee is currently serving as a director and has indicated his or her willingness to continue to serve as a director if elected. In the event that any such nominee becomes unable or declines to serve at the time of the Annual Meeting, the proxy holders may exercise discretionary authority to vote for a substitute person selected and recommended by our Nomination and Governance Committee and approved by the Board.

Director Nominees for Term Ending Upon the 2021 Annual Meeting of Stockholders

The names and certain information, as of March 31, 2020, about the nominees for director are set forth below:

| Name |

Age | Position | ||||

| V. Gordon Clemons |

76 | Chairman of the Board | ||||

| Steven J. Hamerslag (1) (3) |

63 | Director | ||||

| Alan R. Hoops (1) (2) |

72 | Director | ||||

| R. Judd Jessup (1) |

72 | Director | ||||

| Jean H. Macino (2) |

77 | Director | ||||

| Jeffrey J. Michael (2) (3) |

63 | Director | ||||

| (1) | Member of the Audit Committee |

| (2) | Member of the Compensation Committee |

| (3) | Member of the Nomination and Governance Committee |

Mr. Clemons has served as our Chairman of the Board since April 1991. He served as our Chief Executive Officer from January 1988 until August 2007 and as our President from January 1988 until May 2006. He was reappointed as our Chief Executive Officer and President in April 2012 and served in the role of Chief Executive Officer until January 2019 and President until April 2017. Mr. Clemons was President of Caremark, Inc., a home intravenous therapy company, from May 1985 to September 1987, at which time Caremark was purchased by Baxter International, Inc. From 1981 to 1985, Mr. Clemons was President of INTRACORP, a medical management company and subsidiary of CIGNA Corporation. Mr. Clemons has 42 years of experience in the healthcare and insurance industries. The Board believes Mr. Clemons is qualified to serve as Chairman of the Board given his extensive technology, industry, management and operational experience and his substantial understanding of the Company and its operations resulting from his various positions of leadership, including his position as Chief Executive Officer and President from 2012 until April 2017 and from 1988 until 2007 and his position as President from 1988 until 2006.

Mr. Hamerslag has served as one of our directors since May 1991. Mr. Hamerslag has been Managing Partner of TVC Capital, a venture capital firm, since April 2006, and Managing Director of Titan Investment Partners, also

5

a venture capital firm, since November 2002. Mr. Hamerslag served as the President and Chief Executive Officer of J2Global Communications, a publicly held unified communication services company, from June 1999 until January 2001. Mr. Hamerslag served as the CEO of MTI Technology Corporation, a publicly held manufacturer of enterprise storage solutions, from 1987 to 1996. The Board believes Mr. Hamerslag’s valuable business, leadership and executive management experience, particularly in the technology industry, qualifies him to serve as a director.

Mr. Hoops has served as one of our directors since May 2003. Mr. Hoops has been Executive Chairman of Health Essentials, a physician medical group specializing in hospice care, pharmacy and durable medical equipment services for medically complex and frail-elderly patients, since 2012. Mr. Hoops was Chairman of the Board and Chief Executive Officer of CareMore California Health Plan, a health maintenance organization, from March 2006 to March 2012. Mr. Hoops was Chairman of Benu, Inc., a regional benefits administration/marketing company, from 2000 to March 2006, and Chairman of Enwisen, Inc., a human resources services software company, from 2001 to March 2006. Mr. Hoops was Chief Executive Officer and a Director of Pacificare Health Systems, Inc., a national health consumer services company, from 1993 to 2000. Mr. Hoops has 45 years of experience in the healthcare and managed care industries. The Board believes Mr. Hoops’ experience as the Chief Executive Officer and Director of Pacificare Health Systems, Inc., combined with his strong operational and strategic background and extensive public company experience, qualifies him to serve as a director.

Mr. Jessup has served as one of our directors since August 1997. Mr. Jessup was Chief Executive Officer of CombiMatrix Corporation, a molecular diagnostics laboratory, from August 2010 to March 2013. Mr. Jessup was Chief Executive Officer of U.S. LABS, a national laboratory which provides cancer diagnostic and genetic testing services, from 2002 to 2005. Mr. Jessup was President of the HMO Division of FHP International Corporation, a diversified health care services company, from 1994 to 1996. From 1987 to 1994, Mr. Jessup was President of TakeCare, Inc., a publicly held HMO operating in California, Colorado, Illinois and Ohio, until it was acquired by FHP. Mr. Jessup has 43 years of experience in the healthcare and managed care industries. Mr. Jessup was a director of CombiMatrix Corporation from August 2010 to November 2017, a director of Xifin, Inc., a laboratory billing systems company, from January 2006 to August 2013, a director of Superior Vision Services, a national managed vision care plan, from December 2007 to April 2012, and a director of Accentcare from October 2005 to February 2008. The Board believes Mr. Jessup is qualified to serve as a director because he has significant executive experience with the strategic, financial, and operational requirements of large health care services organizations, including serving as an Audit Committee chair, and brings to the Board senior leadership, health industry, and financial experience.

Ms. Macino has served as one of our directors since February 2008. Ms. Macino was Managing Director of Marsh and McLennan Companies, an insurance broker and strategic risk advisor, from 1980 to 1995, and Office Head of the Newport Beach office of Marsh, Inc. from 1995 to 2005. Ms. Macino has served on the Board of Governors of Chapman University for the past eleven years and currently serves as Chairman of the Governorship Committee of Chapman University. Ms. Macino has 42 years of experience in the insurance brokerage industry. The Board believes Ms. Macino’s executive leadership experience, strong sales and marketing expertise in the insurance brokerage industry qualifies her to serve as a director.

Mr. Michael has served as one of our directors since September 1990. Mr. Michael has been President, Chief Executive Officer and a Director of Corstar Holdings, Inc., one of our significant stockholders and a holding company owning equity interests in CorVel since March 1996. The Board believes Mr. Michael’s experience as the President, Chief Executive Officer and Director of Corstar Holdings, Inc., combined with his strong operational and strategic background and extensive public company experience, qualifies him to serve as a director.

There are no family relationships among any of our directors, nominees or executive officers.

6

Corporate Governance, Board Composition and Board Committees

Independent Directors

The Board has determined that each of our current directors other than Mr. Clemons qualifies as an independent director in accordance with the published listing requirements of The Nasdaq Stock Market LLC. The Nasdaq independence definition includes a series of objective tests, such as that the director is not also one of our employees and has not engaged in various types of business dealings with us. In addition, as further required by the Nasdaq rules, the Board has made a subjective determination as to each independent director that no relationships exist which, in the opinion of the Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. In making these determinations, our directors reviewed and discussed information provided by us and our directors with regard to each director’s business and personal activities as they may relate to us and our management.

Board Leadership Structure, Risk Oversight and Diversity

The Board does not have a policy regarding the separation of the roles of the Chief Executive Officer and Chairman of the Board as the Board believes it is in the best interest of the Company to make that determination based on the position and direction of the Company and the membership of the Board from time to time. The Board has determined that separating the roles of the Chief Executive Officer and the Chairman of the Board is an appropriate structure at this time for our succession planning priorities.

The Company does, however, have a policy that if the Chairman of the Board of the Company does not qualify as an independent director, the independent directors of the Board will select one of the independent directors to be the “Lead Independent Director.” Since our Chairman of the Board currently does not qualify as an independent director, the Board of Directors has designated Mr. Jessup as the Lead Independent Director. The Lead Independent Director has the following duties and responsibilities: (a) acting as Chair of the meetings of the independent directors; (b) working with the Chairman of the Board and the Chief Executive Officer to ensure the Board has adequate resources, especially by way of full, timely and relevant information to support its decision-making requirements; (c) serving as a conduit of information between the independent directors and the Chairman of the Board, the Chief Executive Officer and other members of management; (d) reviewing annually the purpose of the Committees of the Board and through the Nomination and Governance Committee, recommending to the Board any changes deemed necessary or desirable to the purpose of the Committees and whether any Committees should be created or discontinued; (e) being available as a resource to consult with other Board members on corporate governance practices and policies; and (f) such other responsibilities and duties as the Board shall designate. The Board believes that this current leadership structure, in which the office of Chairman is held by one individual and an independent director acts as Lead Independent Director, provides for dynamic Board leadership and enhances the Company’s ability to execute its business and strategic plans, while maintaining strong independence for Board decisions and oversight.

The Board oversees an enterprise-wide approach to risk management that is designed to support the achievement of organizational objectives, including strategic objectives, to improve long-term organizational performance and enhance stockholder value. A fundamental part of risk management is not only understanding the risks a company faces and what steps management is taking to manage those risks, but also understanding what level of risk is appropriate for us. In setting our business strategy, the Board assesses the various risks being mitigated by management and determines what constitutes an appropriate level of risk for us.

While the Board has the ultimate oversight responsibility for the risk management process, various committees of the Board also have responsibility for risk management. In particular, the Audit Committee focuses on financial risk, including internal controls. Risks related to our compensation programs are reviewed by the compensation committee and legal and regulatory compliance risks are reviewed by the Nomination and Governance Committee. The Board is advised by the committees of significant risks and management’s response through periodic updates.

7

We believe that our compensation policies and practices do not create inappropriate or unintended significant risk to the Company as a whole. We also believe that our incentive compensation arrangements provide incentives that do not encourage risk-taking beyond the organization’s ability to effectively identify and manage significant risks; are compatible with effective internal controls and the risk management practices of CorVel; and are supported by the oversight and administration of our compensation committee with regard to executive compensation programs.

We believe that the Board as a whole should encompass a range of talent, skill, diversity and expertise enabling it to provide sound guidance with respect to our operations and interests. In addition to considering a candidate’s background and accomplishments, our nomination and governance committee reviews candidates in the context of the current composition of the Board and the evolving needs of our business. The nomination and governance committee considers many forms of diversity in identifying director nominees in an effort to nominate directors with a variety of complementary skills and backgrounds so that as a group, the Board will possess the appropriate talent, skills, insight and expertise to oversee our business.

Board Structure and Committees

The Board has established an audit committee, a compensation committee and a nomination and governance committee. The Board and its committees set schedules to meet throughout the year, and can also hold special meetings and act by written consent from time to time as appropriate. The independent directors of the Board also hold separate regularly scheduled executive session meetings at least twice a year at which only independent directors are present. The Board has delegated various responsibilities and authority to its committees as generally described below. The committees regularly report on their activities and actions to the full Board. Each member of each committee of the Board qualifies as an independent director in accordance with the Nasdaq standards described above. Each committee of the Board has a written charter approved by the Board. A copy of each charter is posted on our website at https://www.corvel.com under the Investor Relations section. The inclusion of any website address in this Proxy Statement does not include or incorporate by reference the information on that website into this Proxy Statement or our Annual Report on Form 10-K.

Audit Committee

The audit committee of the Board reviews and monitors our corporate financial statements and reporting and our internal and external audits, including, among other things, our internal controls and audit functions, the results and scope of the annual audit and other services provided by our independent registered public accounting firm and our compliance with legal matters that have a significant impact on our financial statements. Our audit committee also consults with our management and our independent registered public accounting firm prior to the presentation of financial statements to stockholders and, as appropriate, initiates inquiries into aspects of our financial affairs.

Our audit committee has established procedures for the receipt, retention and treatment of complaints regarding accounting, internal accounting controls or auditing matters, and for the confidential, anonymous submission by our employees of concerns regarding accounting or auditing matters. In addition, our audit committee is directly responsible for the appointment, retention, compensation and oversight of the work of our independent registered public accounting firm, including approving services and fee arrangements. In accordance with the audit committee’s charter and policies regarding transactions with related persons, all related person transactions are approved or ratified by our audit committee. Please see the information set forth under the heading “Policies and Procedures for Related Person Transactions” in this Proxy Statement for additional details about our policies regarding related person transactions. The current members of our audit committee are Messrs. Hamerslag, Hoops and Jessup. The audit committee held four meetings by telephonic conference calls during fiscal year 2020.

In addition to qualifying as independent under the Nasdaq rules described above, each member of our audit committee can read and understand fundamental financial statements, and each member currently qualifies as

8

independent under special standards established by the SEC for members of audit committees. Our audit committee includes at least one member who has been determined by the Board to meet the qualifications of an audit committee financial expert in accordance with SEC rules. Mr. Hamerslag is the independent director who has been determined to be an audit committee financial expert within the meaning of Item 407(d) of Regulation S-K under the Securities Act of 1933, as amended. Stockholders should understand that this designation is a disclosure requirement of the SEC related to Mr. Hamerslag’s experience and understanding with respect to certain accounting and auditing matters. In this regard, please refer to the biography of Mr. Hamerslag appearing above. The designation does not impose on Mr. Hamerslag any duties, obligations or liability that are greater than are generally imposed on him as a member of our audit committee and the Board, and his designation as an audit committee financial expert pursuant to this SEC requirement does not affect the duties, obligations or liability of any other member of our audit committee or Board.

Compensation Committee

The compensation committee of the Board reviews and approves our general compensation policies and all forms of compensation to be provided to our executive officers and directors, including, among other things, annual salaries, bonuses, and stock option and other incentive compensation arrangements. In addition, our compensation committee administers the CorVel Corporation 1991 Employee Stock Purchase Plan and the CorVel Corporation Restated Omnibus Incentive Plan (Formerly The Restated 1988 Executive Stock Option Plan), including reviewing and granting stock options. Our compensation committee also reviews and approves various other issues related to our compensation policies and matters. The compensation committee may form, and delegate any of its responsibilities to, a subcommittee so long as such subcommittee consists solely of at least two independent members of the compensation committee. The current members of our compensation committee are Messrs. Hoops and Michael and Ms. Macino. The compensation committee held one meeting and acted by unanimous written consent six times during fiscal year 2020.

Risk Assessment in Compensation Programs. We have assessed our compensation programs and have concluded that our compensation policies and practices do not create risks that are reasonably likely to have a material adverse effect on the Company. Our management assessed the Company’s executive and broad-based compensation and benefits programs to determine if the programs’ provisions and operations create undesired or unintentional risk of a material nature. This risk assessment process included a review of program policies and practices; program analysis to identify risk and risk control related to the programs; and determinations as to the sufficiency of risk identification, the balance of potential risk to potential reward, risk control, and the support of the programs and their risks to Company strategy. Although we reviewed all compensation programs, we focused on the programs with variability of payout, with the ability of a participant to directly affect payout and the controls on participant action and payout. Our egalitarian culture supports the use of base salary, performance-based compensation, and retirement plans that are generally uniform in design and operation throughout the Company and with all levels of employees. In most cases, the compensation policies and practices are centrally designed and administered, and are substantially identical at each business unit. Field sales personnel are paid a base salary and a sales commission, but all of our executive officers are paid under the programs and plans for non-sales employees. Certain internal groups have different or supplemental compensation programs tailored to their specific operations and goals.

Based on the foregoing, we believe that our compensation policies and practices do not create inappropriate or unintended significant risk to the Company as a whole. We also believe that our incentive compensation arrangements provide incentives that do not encourage risk-taking beyond the organization’s ability to effectively identify and manage significant risks; are compatible with effective internal controls and the risk management practices of CorVel; and are supported by the oversight and administration of the compensation committee with regard to executive compensation programs.

9

Nomination and Governance Committee

The nomination and governance committee of the Board reviews and reports to the Board on a periodic basis with regard to matters of corporate governance, and reviews, assesses and makes recommendations on the effectiveness of our corporate governance policies. In addition, the nomination and governance committee reviews and makes recommendations to the Board regarding the size and composition of the Board and the appropriate qualities and skills required of our directors in the context of the then current make-up of the Board. This includes an assessment of each candidate’s independence, personal and professional integrity, diversity, financial literacy or other professional or business experience relevant to an understanding of our business, ability to think and act independently and with sound judgment, and ability to serve us and our stockholders’ long-term interests. These factors, and others as considered useful by our nomination and governance committee, are reviewed in the context of an assessment of the perceived needs of the Board at a particular point in time. As a result, the priorities and emphasis of the nomination and governance committee and of the Board may change from time to time to take into account changes in business and other trends, and the portfolio of skills and experience of current and prospective directors. The nomination and governance committee does not have a formal policy with respect to diversity, but, as indicated above, diversity is one factor in the total mix of information that the nomination and governance committee and the Board consider when evaluating director candidates.

The nomination and governance committee leads the search for and selects, or recommends that the Board select, candidates for election to the Board (subject to legal rights, if any, of third parties to nominate or appoint directors). Consideration of new director candidates typically involves a series of committee discussions, review of information concerning candidates and interviews with selected candidates. Candidates for nomination to the Board typically have been suggested by other members of the Board or by our executive officers. From time to time, the nomination and governance committee may engage the services of a third-party search firm to identify director candidates. Each of the current nominees is standing for re-election at the Annual Meeting. The nomination and governance committee selected these candidates and recommended their nomination to the Board. The nomination and governance committee has not received any nominations from any stockholders in connection with this Annual Meeting. The current members of our nomination and governance committee are Messrs. Hamerslag and Michael. The nomination and governance committee held one meeting during fiscal year 2020.

Although the nomination and governance committee does not have a formal policy on stockholder nominations, it will consider candidates proposed by stockholders of any outstanding class of our capital stock entitled to vote for the election of directors, provided such proposal is in accordance with the procedures set forth in Article II, Section 12 of our Bylaws and in the charter of the nomination and governance committee. Nominations by eligible stockholders must be preceded by notification in writing addressed to the Chairman of the nomination and governance committee, care of our Secretary, at 1920 Main Street, Suite 900, Irvine, California 92614, not later than (i) with respect to an election to be held at an annual meeting of stockholders, ninety (90) days prior to the anniversary date of the immediately preceding annual meeting, or (ii) with respect to the election to be held at a special meeting of stockholders for the election of directors, the close of business on the tenth day following the date on which notice of such meeting is first given to stockholders. Our Bylaws and the charter of the nomination and governance committee require that such notification shall contain the written consent of each proposed nominee to serve as a director if so elected and the following information as to each proposed nominee and as to each person, acting alone or in conjunction with one or more other persons as a partnership, limited partnership, syndicate or other group, who participates or is expected to participate in making such nomination or in organizing, directing or financing such nomination or solicitation of proxies to vote for the nominee: (a) the name and address of the nominee; (b) the name and address of the stockholder making the nomination; (c) a representation that the nominating stockholder is a stockholder of record of our stock entitled to vote at the next annual meeting and intends to appear in person or by proxy at such meeting to nominate the person specified in the notice; (d) the nominee’s qualifications for membership on the Board of Directors; (e) all of the information that would be required in a proxy statement soliciting proxies for the election of the nominee as a director

10

pursuant to the rules and regulations of the United States Securities and Exchange Commission; (f) a description of all direct or indirect arrangements or understandings between the nominating stockholder and the nominee and any other person or persons (naming such person or persons) pursuant to whose request the nomination is being made by the stockholder; (g) all other companies to which the nominee is being recommended as a nominee for director; and (h) a signed consent of the nominee to cooperate with reasonable background checks and personal interviews, and to serve as one of our directors, if elected.

All such recommendations will be brought to the attention of our nomination and governance committee. Candidates proposed by stockholders will be evaluated by our nomination and governance committee using the same criteria as for all other candidates.

Board and Committee Meetings

The Board held four meetings in person, two telephonic meetings and acted by unanimous written consent three times during fiscal year 2020. Each director attended or participated in 75% or more of the aggregate of (i) the total number of meetings of the Board and (ii) the total number of meetings held by all committees of the Board on which such director served during fiscal year 2020. Although we do not have a formal policy regarding attendance by members of the Board at our annual meetings of stockholders, directors are encouraged and expected to attend each of our annual meetings of stockholders in addition to each meeting of the Board and of the committees on which he or she serves, except where the failure to attend is due to unavoidable circumstances or schedule conflicts. All of our directors attended our 2019 annual meeting of stockholders.

Code of Ethics and Business Conduct

The Board has adopted a code of ethics and business conduct that applies to all of our employees, officers and directors. The full text of our code of ethics and business conduct is posted on our web site at https://www.corvel.com under the Investor Relations section. We intend to disclose future amendments to certain provisions of our code of ethics and business conduct, or waivers of such provisions, applicable to our directors and executive officers, at the same location on our web site identified above. The inclusion of any web site address in this Proxy Statement does not include or incorporate by reference the information on that web site into this Proxy Statement or our Annual Report on Form 10-K.

Hedging Transactions

We have not adopted any practices or policies regarding hedging transactions with respect to our employees, officers and directors.

Communications from Stockholders to the Board

The Board has implemented a process by which stockholders may send written communications to the attention of the Board, any committee of the Board or any individual Board member, care of our Secretary at 1920 Main Street, Suite 900, Irvine, California 92614. This centralized process assists the Board in reviewing and responding to stockholder communications in an appropriate manner. The name of any specific intended Board recipient should be noted in the communication. Our Secretary, with the assistance of our Vice President of Legal Services, is primarily responsible for collecting, organizing and monitoring communications from stockholders and, where appropriate depending on the facts and circumstances outlined in the communication, providing copies of such communications to the intended recipients. Communications will be forwarded to directors if they relate to appropriate and important substantive corporate or board matters. Communications that are of a commercial or frivolous nature or otherwise inappropriate for the Board’s consideration will not be forwarded to the Board. Any communications not forwarded to the Board will be retained for a period of three months and made available to any of our independent directors upon their general request to view such communications. There were no changes in this process in fiscal year 2020.

11

Stockholder Approval

Directors are elected by a plurality of the votes present or represented by proxy at the Annual Meeting and entitled to vote. The six nominees receiving the highest number of affirmative votes cast at the Annual Meeting will be our elected directors.

The Board recommends a vote FOR each of the nominees named above.

12

PROPOSAL TWO

RATIFICATION OF APPOINTMENT OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee has appointed Haskell & White LLP to serve as our independent registered public accounting firm for the fiscal year ending March 31, 2021, and our stockholders are being asked to ratify this appointment. Stockholder ratification of the appointment of Haskell & White LLP as our independent registered public accounting firm is not required by our Bylaws or other applicable legal requirement. However, the Board is submitting the Audit Committee’s appointment of Haskell & White LLP to the stockholders for ratification as a matter of good corporate practice. If the stockholders fail to ratify the appointment by an affirmative vote of the holders of a majority of the Common Stock present or represented at the meeting and entitled to vote, the Audit Committee may reconsider whether to retain Haskell & White LLP as our independent registered public accounting firm. Even if the appointment is ratified, the Audit Committee in its discretion may direct the appointment of a different independent accounting firm at any time during the year if it determines that such a change would be in the best interest of us and our stockholders.

Representatives of Haskell & White LLP attended or participated by telephone in all meetings of the Audit Committee held during fiscal year 2020. We expect that representatives of Haskell & White LLP will attend the Annual Meeting. At the Annual Meeting, the representatives of Haskell & White LLP will have the opportunity to make a statement if they so desire and will be available to respond to appropriate questions posed by stockholders.

Principal Accountant Fees and Services

Audit Fees. Audit fees as of March 31, 2020 include the audit of our annual financial statements, review of financial statements included in our Form 10-Q quarterly reports, and services that are normally provided by our independent registered public accounting firm in connection with statutory and regulatory filings or engagements for the relevant fiscal years. Audit fees billed by Haskell & White LLP for services rendered to us in the audit of annual financial statements and the reviews of the financial statements included in our Form 10-Q quarterly reports were as follows:

| Fiscal year 2020 |

||||

| Audit and review of financial statements |

$ | 592,850 | ||

| Fiscal year 2019 |

||||

| Audit and review of financial statements |

$ | 568,950 | ||

Audit-Related Fees. Audit-related fees consist of assurance and related services provided by Haskell & White LLP that are reasonably related to the performance of the audit or review of our financial statements and are not reported above under “Audit Fees” were as follows:

| Fiscal year 2020 |

||||

| Audit of the financial statements of CorVel Incentive Savings Plan |

$ | 10,200 | ||

| Fiscal year 2019 |

||||

| Audit of the financial statements of CorVel Incentive Savings Plan |

$ | 18,140 | ||

13

Tax Fees. Tax fees consist of professional services rendered by our independent registered public accounting firm for tax compliance, tax advice and tax planning and were as follows:

| Fiscal year 2020 |

||||

| Tax consulting services |

$ | 0 | ||

| Fiscal year 2019 |

||||

| Tax consulting services |

$ | 0 | ||

All Other Fees. Fees for a retainer, travel and other miscellaneous expenses billed by Haskell & White LLP were $24,772 during fiscal year 2020 and $32,150 during fiscal year 2019.

Determination of Independence

The Audit Committee has determined that the provision of the above non-audit services by Haskell & White LLP was compatible with their maintenance of accountant independence.

Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services of Independent Registered Public Accounting Firm

The Audit Committee pre-approves and reviews audit and permissible non-audit services performed by our independent registered public accounting firm as well as the fees charged by our independent registered public accounting firm for such services. In its pre-approval and review of permissible non-audit service fees, the Audit Committee considers, among other factors, the possible effect of the performance of such services on the auditors’ independence. Under certain de minimis circumstances described in the rules and regulations of the Securities and Exchange Commission, the Audit Committee may approve permissible non-audit services prior to the completion of the audit in lieu of pre-approving such services.

Vote Sought

The affirmative vote of a majority of the shares of the Common Stock present or represented by proxy at the Annual Meeting and entitled to vote is being sought for ratification of the appointment of Haskell & White LLP as our independent registered public accounting firm for the fiscal year ending March 31, 2021.

Recommendation of the Board

The Board recommends a vote FOR ratification of the appointment of Haskell & White LLP as our independent registered public accounting firm for the fiscal year ending March 31, 2021.

14

PROPOSAL THREE

APPROVAL OF AN AMENDMENT AND RESTATEMENT OF OUR AMENDED AND RESTATED CERTIFICATE OF INCORPORATION TO MAKE DELAWARE THE EXCLUSIVE FORUM FOR CERTAIN LEGAL ACTIONS AND TO MAKE THE FEDERAL DISTRICT COURTS OF THE UNITED STATES OF AMERICA THE EXCLUSIVE FORUM FOR CERTAIN OTHER LEGAL ACTIONS

We are seeking stockholder approval of an amendment and restatement of our Amended and Restated Certificate of Incorporation to make Delaware the sole and exclusive forum for certain legal actions and to make the federal district courts of the United States of America the sole and exclusive forum for any action arising under the Securities Act of 1933. On June 1, 2020, the Board adopted an amendment and restatement of our Amended and Restated Certificate of Incorporation, subject to approval by our stockholders, to make the Delaware Court of Chancery the sole and exclusive forum for the following types of actions and proceedings involving the Company, unless otherwise consented to in writing by the Company:

| • | any derivative action or proceeding brought on behalf of the Company, |

| • | any action asserting a claim of breach of a fiduciary duty owed by any current or former director, officer, stockholder, employee or agent of the Company to the Company or the Company’s stockholders, |

| • | any action asserting a claim arising pursuant to any provision of the Delaware General Corporation Law, the Company’s Certificate of Incorporation or the Company’s Bylaws (in each case, as may be amended from time to time), |

| • | any action asserting a claim governed by the internal affairs doctrine of the State of Delaware, or |

| • | any other action asserting an “internal corporate claim” as that term is defined in Section 115 of the Delaware General Corporation Law. |

Notwithstanding the foregoing, in the event that the Delaware Court of Chancery lacks subject matter jurisdiction over any such action or proceeding, the sole and exclusive forum for such action or proceeding shall be another state or federal court located within the State of Delaware.

The amendment and restatement adopted by the Board, subject to approval by our stockholders, also provides that, unless otherwise consented to in writing by the Company, the federal district courts of the United States of America shall be the sole and exclusive forum for any action arising under the Securities Act of 1933.

The Board has determined that the proposed amendment and restatement is advisable and in the best interest of our stockholders as a whole and recommends your approval of such amendment and restatement.

The Delaware General Corporation Law authorizes Delaware corporations to adopt exclusive forum provisions in their charters. The Board believes that the Company and its stockholders as a whole benefit from having the specified corporate disputes litigated in Delaware, where the Company is incorporated and whose laws govern such disputes. The Delaware exclusive forum provision is intended to assist the Company in avoiding multiple lawsuits in multiple jurisdictions on matters relating to the General Corporation Law of Delaware, our state of incorporation. Although some plaintiffs might prefer to litigate such matters in a forum outside of Delaware because they perceive another court as more convenient or more favorable to their claims, or for other reasons, the Board believes that the substantial benefits to the Company and its stockholders as a whole from designating Delaware courts as the exclusive forum for the specified corporate disputes outweigh these concerns. Delaware courts are widely regarded as the leading courts for the determination of disputes involving a Company’s internal affairs in terms of precedent, experience and focus. The courts’ considerable expertise has led to the development of a substantial and influential body of case law interpreting the General Corporation Law of Delaware. This provides us and our stockholders with more predictability regarding the outcome of corporate disputes. In

15

addition, the Delaware courts have developed streamlined procedures and processes that help provide relatively quick decisions for litigating parties. This accelerated schedule can limit the time, cost, and uncertainty of litigation for all parties. Further, the Board believes designating the Delaware courts as the exclusive forum for the specified corporate disputes reduces the risks that we could be forced to waste resources defending against duplicative suits and that the outcome of cases in multiple jurisdictions could be inconsistent, even though each forum purports to follow Delaware law.

The Board believes that the Company and its stockholders as a whole also benefit from having actions arising under the Securities Act of 1933 litigated in federal district courts. Although some plaintiffs might prefer to litigate these matters in a state court because it may be more convenient or viewed as being more favorable to them, or for other reasons, the Board believes that the substantial benefits to the Company and its stockholders as a whole from designating federal district courts as the exclusive forum for litigation arising under the Securities Act of 1933 outweigh these concerns. The federal district courts have considerable expertise in matters arising under the Securities Act of 1933. This provides us and our stockholders with more predictability regarding the outcome of these disputes. In addition, adoption of the amendment and restatement would reduce the risk that the Company could be involved in duplicative litigation in more than one forum, as well as the risk that the outcome of cases in multiple forums could be inconsistent, even though each forum purports to follow federal law.

Although the Board believes that the designation of Delaware courts as the exclusive forum for the specified corporate disputes, and the designation of federal district courts as the exclusive forum for any action arising under the Securities Act of 1933, serves the best interests of the Company and our stockholders as a whole, the Board also believes that we should retain the ability to consent to an alternative forum on a case-by-case basis. Accordingly, the exclusive forum provisions permit us to consent in writing to the selection of an alternative forum.

The exclusive forum provisions only regulate the forum where our stockholders may file claims relating to the specified disputes. The provisions do not restrict the ability of our stockholders to bring such claims or the remedies available if these claims are ultimately successful. These exclusive forum provisions, however, may have the effect of limiting a stockholder’s ability to bring a claim in a judicial forum that it finds favorable for disputes with us or our directors, officers, employees, or agents and could increase the cost to bring claims, which may discourage such lawsuits against us and such persons. In addition, because the Company’s exclusive forum provisions will be governed by the Company’s Amended and Restated Certificate of Incorporation and not by the Company’s Bylaws, the implementation of this Proposal would prevent stockholders from amending this provision without the approval of the Board. If, however, a court were to find any or all parts of these exclusive forum provisions inapplicable to, or unenforceable in respect of, one or more of the specified types of actions or proceedings, we may incur additional costs associated with resolving such matters in other jurisdictions, which could adversely affect our business, financial condition, or results of operations.

If our stockholders approve this Proposal, the proposed amendment and restatement will become effective immediately upon the filing of the proposed amendment and restatement with the Secretary of State of the State of Delaware. The affirmative vote of the holders of a majority of the outstanding shares of Common Stock entitled to vote is needed to approve the amendment and restatement.

The text of the proposed amendment will appear as new Article XII of our Amended and Restated Certificate of Incorporation as follows:

“ARTICLE XII – FORUM FOR ADJUDICATION OF CERTAIN DISPUTES

1. Delaware Forum. Unless the Corporation consents in writing to the selection of an alternative forum (which consent may be given at any time, including during the pendency of litigation), the Court of Chancery of the State of Delaware (or, if the Court of Chancery does not have jurisdiction, another state court located within the State of Delaware or, if no state court located within the State of Delaware has jurisdiction, the federal district

16

court for the District of Delaware) shall be the sole and exclusive forum for (i) any derivative action or proceeding brought on behalf of the Corporation, (ii) any action asserting a claim of breach of a fiduciary duty owed by any current or former director, officer, stockholder, employee or agent of the Corporation to the Corporation or the Corporation’s stockholders, (iii) any action asserting a claim arising pursuant to any provision of the Delaware General Corporation Law, this Certificate of Incorporation or the Bylaws (in each case, as may be amended from time to time), (iv) any action asserting a claim governed by the internal affairs doctrine of the State of Delaware, or (v) any other action asserting an “internal corporate claim,” as defined in Section 115 of the Delaware General Corporation Law, in all cases subject to the court having personal jurisdiction over all indispensable parties named as defendants.

2. Federal Forum. Unless the Corporation consents in writing to the selection of an alternative forum (which consent may be given at any time, including during the pendency of litigation), the federal district courts of the United States of America shall be the sole and exclusive forum for the resolution of any complaint asserting a cause of action arising under the Securities Act of 1933. Any person or entity purchasing or otherwise acquiring or holding any interest in any security of the Corporation shall be deemed to have notice of and consented to this provision.

3. Personal Jurisdiction. If any action the subject matter of which is within the scope of Section 1 of this Article XII is filed in a court other than a court located within the State of Delaware (a “Foreign Action”) in the name of any stockholder, such stockholder shall be deemed to have consented to (i) the personal jurisdiction of the state and federal courts located within the State of Delaware in connection with any action brought in any such court to enforce Section 1 of this Article XII (an “Enforcement Action”) and (ii) having service of process made upon such stockholder in any such Enforcement Action by service upon such stockholder’s counsel in the Foreign Action as agent for such stockholder.

4. Enforceability. If any provision of this Article XII shall be held to be invalid, illegal or unenforceable as applied to any person, entity or circumstance for any reason whatsoever, then, to the fullest extent permitted by law, the validity, legality and enforceability of such provision in any other circumstance and of the remaining provisions of this Article XII, and the application of such provision to other persons or entities and circumstances shall not in any way be affected or impaired thereby.”

The full Amended and Restated Certificate of Incorporation containing the proposed amendment is attached to this proxy statement as Appendix A.

Vote Required

The affirmative vote of the holders of a majority of the outstanding shares of Common Stock entitled to vote is required for approval of the proposal to amend and restate our Amended and Restated Certificate of Incorporation.

Recommendation of the Board

The Board recommends that stockholders vote FOR the amendment and restatement of our Amended and Restated Certificate of Incorporation to make Delaware the exclusive forum for certain legal actions and to make the federal district courts of the United States of America the exclusive forum for certain other legal actions.

17

PROPOSAL FOUR

APPROVAL OF AN AMENDMENT AND RESTATEMENT OF OUR AMENDED AND RESTATED BYLAWS TO ALLOW FOR PARTICIPATION IN STOCKHOLDER MEETINGS BY MEANS OF REMOTE COMMUNICATION, INCLUDING BY MEANS OF VIRTUAL MEETING TECHNOLOGY

We are seeking stockholder approval of an amendment and restatement of our Amended and Restated Bylaws to allow for participation in stockholder meetings by means of remote communication, including by means of virtual meeting technology. On June 1, 2020, the Board adopted an amendment and restatement of our Amended and Restated Bylaws, subject to approval by our stockholders, to allow us to hold virtual stockholder meetings in accordance with the Delaware General Corporation Law. Specifically, the amendment and restatement adds a new Section 1 of Article II of our Amended and Restated Bylaws, and makes various other related technical revisions, to provide that the Board may, in its sole discretion, determine that a future stockholder meeting will not be held at any physical location, but instead be held by means of remote communication, including as a virtual meeting.

The Delaware General Corporation Law authorizes Delaware corporations to hold stockholder meetings by means of remote communication if authorized by the corporation’s bylaws. Under the Delaware General Corporation Law, if authorized by the board of directors in its sole discretion, and subject to such guidelines and procedures as the board of directors may adopt, stockholders and proxy holders not physically present at a future meeting of stockholders may, by means of remote communication (a) participate in a meeting of stockholders; and (b) be deemed present in person and vote at a meeting of stockholders, whether such meeting is to be held at a designated place or solely by means of remote communication (including virtual meeting technology), provided that (i) the corporation implements reasonable measures to verify that each person deemed present and permitted to vote at the meeting by means of remote communication (including virtual meeting technology) is a stockholder or proxy holder; (ii) the corporation implements reasonable measures to provide such stockholders and proxyholders a reasonable opportunity to participate in the meeting and to vote on matters submitted to the stockholders, including an opportunity to read or hear the proceedings of the meeting substantially concurrently with those proceedings; and (iii) if any stockholder or proxyholder votes or takes other action at the meeting by means of remote communication (including virtual meeting technology), a record of that vote or other action must be maintained by the corporation.

The Board has determined that the proposed amendment and restatement is advisable and in the best interest of our stockholders and recommends your approval of such amendment and restatement.

The recent COVID-19 pandemic and resulting governmental stay-at-home orders has highlighted the need for increased flexibility in designating the place of stockholder meetings, including by means of remote communication such as virtual meeting technology. The Board believes that the proposed amendment and restatement of our Amended and Restated Bylaws will give it this flexibility to take action to enhance the opportunity of our stockholders to attend and participate in stockholder meetings during times of crisis such as pandemics or natural disasters. Even if the Board is permitted to designate stockholder meetings to be held virtually, however, we currently intend that stockholder meetings will continue to be held in person at a physical location so that all stockholders will continue to be entitled to attend stockholder meetings in person if they choose to do so. The proposed amendment and restatement of our Amended and Restated Bylaws is not intended to have any effect on the ability of stockholders to vote their shares by proxy, via telephone, the Internet, or by completion of a proxy card, any time before a meeting of stockholders.

If our stockholders approve this Proposal, the proposed amendment and restatement will become effective immediately following approval by the stockholders. Pursuant to our Amended and Restated Certificate of Incorporation and Amended and Restated Bylaws, the affirmative vote of the holders of 66 2/3% of the outstanding shares of Common Stock entitled to vote is required to approve the amendment and restatement of the Amended and Restated Bylaws.

18

The text of the proposed amendment will appear as a new Section 1 of Article II of our Amended and Restated Bylaws as follows:

“Section 1. Place of Meetings. All meetings of the stockholders shall be held at such place, if any, either within or without the State of Delaware, or by means of remote communication, which may include a virtual meeting, as determined by the Board of Directors in its sole discretion and as shall be designated from time to time by resolution of the Board of Directors and stated in the notice of meeting.”

In addition, under the proposed amendment, the existing Section 1 (which shall be renumbered Section 2) and the existing Section 2 (which shall be renumbered Section 3) of Article II of our Amended and Restated Bylaws will be amended and restated in their entirety as follows, and all subsequent sections of Article II (and all related cross-references) will be renumbered in sequence:

“Section 2. Annual Meeting. The annual meeting of the stockholders for the election of directors and for the transaction of such other business as may properly come before the meeting in accordance with these Bylaws shall be held at such date, time, and place, if any, as shall be determined by the Board of Directors and stated in the notice of the meeting. Meetings of stockholders for any other purpose may be held at such date, time, and place, if any, as shall be determined by the Board of Directors and stated in the notice of the meeting or in a duly executed waiver of notice thereof.

Section 3. Notice of Annual Meeting. Written notice of the annual meeting stating the place (if any), date, hour, and means of remote communication, if any, of the meeting shall be given to each stockholder entitled to vote at such meeting not less than ten (10) nor more than sixty (60) days before the date of the meeting.”

In addition, under the proposed amendment, the last sentence of the existing Section 3 (which shall be renumbered Section 4) of Article II of our Amended and Restated Bylaws will be amended and restated in its entirety as follows:

“If the meeting is to be held at a place, the list shall also be produced and kept at the time and place of the meeting the whole time thereof and may be inspected by any stockholder who is present. If the meeting is held solely by means of remote communication, the list shall also be open for inspection by any stockholder during the whole time of the meeting as provided by applicable law.”

In addition, under the proposed amendment, the existing Section 5 (which shall be renumbered Section 6) of Article II of our Amended and Restated Bylaws will be amended and restated in its entirety as follows: