UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

FOR ANNUAL AND TRANSITION REPORTS PURSUANT TO SECTIONS 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended March 31, 2014

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 0-19291

CorVel Corporation

(Exact name of registrant as specified in its charter)

| Delaware | 33-0282651 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification Number) | |

| 2010 Main Street, Suite 600, Irvine, California |

92614 | |

| (Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code:

(949) 851-1473

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class: |

Name of each exchange on which registered: | |

| Common Stock | The NASDAQ Global Select Market, LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act Yes ¨ No x

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | x | |||||

| Non-accelerated filer | ¨ | Smaller reporting company | ¨ | |||||

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the Registrant’s most recently completed second fiscal quarter:

As of September 30, 2013, the aggregate market value of the Registrant’s voting and non-voting common equity held by non-affiliates of the Registrant was approximately $410,211,000 based on the closing price per share of $36.97 for the Registrant’s common stock as reported on the Nasdaq Global Select Market on such date multiplied by 11,095,769 shares (total outstanding shares of 20,986,779 less 9,891,010 shares held by affiliates) of the Registrant’s common stock which were outstanding on such date. For the purposes of the foregoing calculation only, all of the Registrant’s directors, executive officers and persons known to the Registrant to hold ten percent or greater of the Registrant’s outstanding common stock have been excluded in that such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

Indicate the number of shares outstanding of each of the Registrant’s classes of common stock, as of the latest practicable date: As of June 6, 2014, there were 20,907,485 shares of the Registrant’s common stock, par value $0.0001 per share, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Information required by Items 10 through 14 of Part III of this Form 10-K, to the extent not set forth herein, is incorporated herein by reference to portions of the Registrant’s definitive proxy statement for the Registrant’s 2014 Annual Meeting of Stockholders, which will be filed with the Securities and Exchange Commission not later than 120 days after the end of the fiscal year ended March 31, 2014. Except with respect to the information specifically incorporated by reference in this Form 10-K, the Registrant’s definitive proxy statement is not deemed to be filed as a part of this Form 10-K.

CORVEL CORPORATION

2014 FORM 10-K ANNUAL REPORT

TABLE OF CONTENTS

i

In this report, the terms “CorVel”, “Company”, “we”, “us”, and “our” refer to CorVel Corporation and its subsidiaries.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This report contains forward-looking statements within the meaning of the Securities Act of 1933, as amended, and the Securities Exchange Act of 1934, as amended (the “Exchange Act”), including, but not limited to, the statements about our plans, strategies and prospects under the headings “Business” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and elsewhere in this report. Words such as “expects”, “anticipates”, “intends”, “plans”, “predicts”, “believes”, “seeks”, “estimates”, “potential”, “continue”, “strive”, “ongoing”, “may”, “will”, “would”, “could”, and “should”, and variations of these words or similar expressions are intended to identify forward-looking statements. These forward-looking statements are based on management’s current expectations, estimates and projections about our industry, management’s beliefs, and certain assumptions made by management, and we can give no assurance that we will achieve our plans, intentions or expectations. Certain important factors could cause actual results to differ materially from the forward-looking statements we make in this report. Representative examples of these factors include (without limitation):

| • | General industry and economic conditions, including a decreasing number of national claims due to decreasing number of injured workers; |

| • | Cost of capital and capital requirements; |

| • | Competition from other managed care companies; |

| • | The Company’s ability to renew and/or maintain contracts with its customers on favorable terms or at all; |

| • | The ability to expand certain areas of the Company’s business; |

| • | Possible litigation and legal liability in the course of operations, and the Company’s ability to settle or otherwise resolve such litigation; |

| • | The ability of the Company to produce market-competitive software; |

| • | Increases in operating expenses, including employee wages, benefits and medical inflation; |

| • | Changes in regulations affecting the workers’ compensation, insurance and healthcare industries in general; |

| • | The ability to attract and retain key personnel; |

| • | Shifts in customer demands; and |

| • | The availability of financing in the amounts, at the times, and on the terms necessary to support the Company’s future business. |

The section entitled “Risk Factors” set forth in this report discusses these and other important risk factors that may affect our business, results of operations and financial condition. The factors listed above and the factors described under the heading “Risk Factors” and similar discussions in our other filings with the Securities and Exchange Commission are not necessarily all of the important factors that could cause actual results to differ materially from those expressed in any of our forward-looking statements. Other unknown or unpredictable factors also could have material adverse effects on our future results. Investors should consider these factors before deciding to make or maintain an investment in our securities. The forward-looking statements included in this annual report on Form 10-K are based on information available to us as of the date of this annual report. We expressly disclaim any intent or obligation to update any forward-looking statements to reflect subsequent events or circumstances.

1

| Item 1. | Business. |

INTRODUCTION

CorVel is a national provider of workers’ compensation solutions for employers, third party administrators, insurance companies, and government agencies seeking to control costs and promote positive outcomes. The Company applies technology, intelligence, and a human touch to the challenges of risk management so that their clients can intervene early and often while being connected to the critical intelligence they need to proactively manage risk. CorVel specializes in applying advanced communication and information technology to improve healthcare management for workers’ compensation, group health, auto and liability claims management. With a technology platform at its core, the Company’s connected solution is delivered by a national team of associates who are committed to helping clients deliver programs that meet their organization’s performance goals.

The Company’s services include claims management, bill review, preferred provider networks, utilization management, claims management, case management, pharmacy services, directed care and Medicare services. CorVel offers its services as a bundled solution (i.e. claims management), as a standalone service, or as add-on services to existing customers. Customers of the Company that do not purchase a bundled solution generally use another provider, use an in-house solution, or choose not to utilize such a service to manage their workers’ compensation costs. When customers purchase several products from CorVel, the pricing of the products sold is generally the same as if the product were sold on an individual basis. Bundled products are generally delivered in the same accounting period.

The Company was incorporated in Delaware in 1987, and its principal executive offices are located at 2010 Main Street, Suite 600, Irvine, California, 92614. The Company’s telephone number is 949-851-1473.

INDUSTRY OVERVIEW

Workers’ compensation is a federally mandated, state-legislated, insurance program that requires employers to fund medical expenses, lost wages and other costs resulting from work-related injuries and illnesses. Workers’ compensation benefits and arrangements vary extensively on a state-by-state basis and are often highly complex. State statutes and court decisions control many aspects of the compensation process, including claims handling, impairment or disability evaluation, dispute settlement, benefit amount guidelines and cost-control strategies.

In addition to the compensation process, cost containment and claims management continue to be significant employer concerns and many look to managed care vendors and third party administrators for cost savings solutions. The Company believes that cost drivers in workers’ compensation include: implementing effective return to work and transitional duty programs, coordinating medical care, medical cost management, recognizing fraud and abuse, and improving communications with injured workers. CorVel provides solutions using a holistic approach to cost containment and by looking at a complete savings solutions. Often one of the biggest cost drivers is not recognizing a complex claim at the onset of an injury often resulting in claims being open longer and resulting in delayed return to work. CorVel uses an integrated claims model that controls claims costs by advocating medical management at the onset of the injury to decrease administrative costs and to shorten the length of the disability.

Some states have adopted legislation for managed care organizations (MCO) in an effort to allow employers to control their worker’s compensation costs. A managed care plan is organized to serve the medical needs of injured workers in an efficient and cost-effective manner by managing the delivery of medical services through appropriate health care professionals. CorVel is registered wherever legislation mandates, where it is beneficial for the Company to obtain a license, or where the MCO is an effective utilized mandate. Since MCO legislation varies by state, CorVel’s state offerings vary as well. CorVel continually evaluates new legislation to ensure it is in compliance and can offer services to its customers and prospects.

2

FISCAL 2014 DEVELOPMENTS

Company Stock Repurchase Program

During fiscal 2014, the Company continued to repurchase shares of its common stock under a plan originally approved by the Company’s Board of Directors in 1996. In August 2013, the Company’s Board of Directors increased the number of shares authorized to be repurchased over the life of the plan by 2,000,000 shares to 34,000,000 shares. During fiscal 2014, the Company spent $27.2 million to repurchase 830,460 shares of its common stock. Since commencing this program in the fall of 1996, the Company has repurchased 32,147,474 shares of its common stock through March 31, 2014, at a cost of $328 million. These repurchases were funded primarily from the Company’s operating cash flows.

Company Stock Split

During the quarter ended June 30, 2013, the Company’s Board of Directors approved a two-for-one stock split in the form of a 100% stock dividend with a record date of June 12, 2013 and a distribution date of June 26, 2013. All share and per share amounts have been adjusted retroactively in this report to reflect the stock split for all periods shown.

Data Center

The Company is in the process of migrating the Fort Worth redundancy center to Portland, Oregon, while building a new data center in Nevada.

BUSINESS — SERVICES

The Company offers services in two general categories, network solutions and patient management, to assist its customers in managing the increasing medical costs of workers’ compensation, group health and auto insurance, and monitoring the quality of care provided to claimants. CorVel reduces claims costs by advocating medical management at the onset of an injury to decrease administrative costs and to shorten the length of the disability. These solutions offer personalized treatment programs that use precise treatment protocols to advocate timely, quality care for injured workers.

Network Solutions

CorVel offers a complete medical savings solution for all in-network and out-of-network medical bills including PPO management, medical bill repricing, true line item review, professional nurse review and automated adjudication. Each feature focuses on maximizing savings opportunities and increasing efficiencies.

Bill Review

Many states have adopted fee schedules, which regulate the maximum allowable fees payable under workers’ compensation, for procedures performed by a variety of health treatment providers. Developed in 1989, CorVel’s proprietary bill review and claims management technology automates the review process to provide customers with a faster turnaround time, more efficient bill review and a higher total savings. CorVel’s artificial intelligence engine includes over ten million individual rules, which creates a comprehensive review process and greater efficiencies than traditional bill review services.

Payors are able to review and approve bills online as well as access savings reports through an online portal, CareMC. The process is paperless, through scanning and electronic data interface (“EDI”), while proving to be cost effective and efficient. CorVel’s solutions are fully customizable and can be tailored to meet unique payor requirements.

Bill Review Services include:

| • | Coding review and rebundling |

3

| • | Reasonable and customary review |

| • | Fee schedule analysis |

| • | Out-of-network bill review |

| • | Pharmacy review |

| • | PPO management |

| • | Repricing |

PPO Management

PPOs are groups of hospitals, physicians and other healthcare providers that offer services at pre-negotiated rates to employee groups. The Company believes that PPO networks offer the employer an additional means of managing healthcare costs by reducing the per-unit price of medical services provided to employees. CorVel began offering a proprietary national PPO network in 1992 and today it is comprised of over 750,000 board certified providers. The Company provides the convenience of a PPO Provider look-up mobile application for use with iPhone, iPad and Android. The application is available to the public and makes it convenient to locate a provider in the CorVel network. Users can search providers based on current location and by specialty.

CorVel has a long-term strategy of network development, providing comprehensive networks to our customers and customization of networks to meet the specific needs of our customers. The Company believes that the combination of its national PPO strength and presence and the local PPO developers’ commitment and community involvement enables CorVel to build, support and strengthen its PPO in size, quality, depth of discount, and commitment to service.

The Company has a team of national, regional and local personnel supporting the CorVel network. This team includes a national PPO manager in addition to locally based PPO developers who are responsible for local recruitment, contract negotiations, credentialing and re-credentialing of providers, and working with customers to develop customer specific provider networks. Each bill review operation has provider relations support staff to address provider grievances and other billing issues.

Providers are selected from criteria based on quality, range of services, price and location. Each provider is thoroughly evaluated and credentialed, then re-credentialed every three years. Through this extensive evaluation process, we believe the PPO networks are able to provide significant hospital, physician and ancillary medical savings, while striving to maintain high quality care. Provider network services include a national network for all medical coverages, board certified physicians, provider credentialing, patient channeling, online PPO look-up, printable directories and driving directions, and Managed Care Organizations (MCO).

CERiS

CERiS, CorVel’s enhanced bill review program, allows claim payors to adjust individual line item charges on all bills to reasonable and customary levels while removing all error and billing discrepancies with professional review. The enhanced bill review program scrutinizes each hospital line description and charge as a separate and distinct claim for reimbursement. CorVel’s proprietary Universal Chargemaster defines each code and description, enabling its registered nurses to identify errors, duplicate charges, re-bundle exploded charges, correct quantity discrepancies and remove unused supplies.

Professional Review

CorVel’s services offer a complete audit and validation of facility bill accuracy. This solution also includes review of in-network facility bills. The Company’s nurse auditors have clinical backgrounds in all areas of

4

medicine, medical billing and coding to ensure an accurate, consistent and thorough review. If a bill is identified for professional review, the bill image and its associated medical reports are routed within the system to an experienced medical nurse for review and auditing.

Provider Reimbursement

Through the bill review system, CorVel has the capability to provide check writing or provider reimbursement services for its customers. The provider payment check can be added to the bill analysis to produce one combined document.

Pharmacy Services

CorVel provides patients with a full-feature pharmacy program that offers discounted prescriptions, drug interaction monitoring and eligibility confirmation. Our pharmacy network of nationally recognized pharmacies provides savings off the retail price of prescriptions associated with a workers’ compensation claim. The Company’s pharmacy services program includes preferred access to a national pharmacy network, streamlined processing for pharmacies at point of sale, mail order, 90-day retail, out of network, medication review services and clinical modeling.

Directed Care Services

CorVel has contracted with medical imaging, physical therapy and ancillary service networks to offer convenient access, timely appointments and preferred rates for these services. The Company manages the entire coordination of care from appointment scheduling through reimbursement, working to achieve timely recovery and increased savings. The Company has directed care networks for diagnostic imaging, physical and occupational therapy, independent medical evaluations, durable medical equipment and transportation and translation.

Medicare Solutions

The Company offers solutions to help manage the requirements mandated by the Centers for Medicare and Medicaid Services (CMS). Services include Medicare Set Asides and a new service, Agent Reporting Services, to help employers comply with new CMS reporting legislation. As an assigned agent, CorVel can provide services for Responsible Reporting Entities (RRE) such as insurers and employers. As an experienced information-processing provider, CorVel is able to electronically submit files to the CMS in compliance with timelines and reporting requirements.

Clearinghouse Services

CorVel’s proprietary medical review software and claims management technology interfaces with multiple clearinghouses. The Company’s clearinghouse services provide for medical review, conversion of electronic forms to appropriate payment formats, seamless submittal of bills for payments and rules engines used to help ensure jurisdictional compliance.

Patient Management

CorVel offers a unique approach to claims administration and patient management. This integrated service model controls claims by advocating medical management at the onset of the injury to decrease administrative costs and to shorten the length of the disability. The Company offers these services on a stand-alone basis or as an integrated component of its medical cost containment services.

Claims Management

CorVel has been a third party administrator (“TPA”) offering claims management services since January 2007. The Company serves customers in the self-insured or commercially insured markets. Incidents and injuries are

5

reported through a variety of intake methods that include mobile applications, toll-free call centers and traditional methods of paper and fax reporting. They are immediately processed by CorVel’s proprietary rules engine, which provides alerts and recommendations throughout the life of a claim. This technology instantly assigns an expert claims professional, while simultaneously determining if a claim requires any immediate attention for triage.

Through this service, the Company serves clients in the self-insured or commercially insured market through alternative loss funding methods, and provides them with a complete range of services, including claims administration, case management, and medical bill review. In addition to the field investigation and evaluation of claims, the Company also may provide initial loss reporting services for claims, loss mitigation services such as medical bill review and vocational rehabilitation, administration of trust funds established to pay claims and risk management information services.

Some of the features of claims management services include: automated first notice of loss, three-point contact within 24 hours, prompt claims investigations, detailed diary notes for each step of the claim, graphical dashboards and claim history scorecards, and litigation management and expert testimony.

Case Management

CorVel’s case management and utilization review services address all aspects of disability management and recovery including utilization review (pre-certification, concurrent review and discharge planning), early intervention, telephonic, field and catastrophic case management as well as vocational rehabilitation.

The medical management components of CorVel’s program focus on medical intervention, management and appropriateness. In these cases, the Company’s case managers confer with the attending physician, other providers, the patient and the patient’s family to identify the appropriate rehabilitative treatment and most cost-effective healthcare alternatives. The program is designed to offer the injured party prompt access to appropriate medical providers who will provide quality cost-effective medical care. Case managers may coordinate the services or care required and may arrange for special pricing of the required services.

The Telephonic Case Manager (TCM) continues to impact the direction of the case, focusing on early return to work, maximum medical improvement (MMI) and appropriate duration of disability. Facilitation of appropriate treatment, assertive negotiation with medical providers and directing the care of the injured worker continues to be the Case Manager’s role until the closure criteria is met. Utilization review of provider treatment remains ongoing until discharge from treatment.

In the event that a claim may require an onsite referral, a Field Case Manager (FCM) will be assigned to the claim. Cases can be referred to CorVel based on geographic location and injury type to the most appropriate FCM. Specialized case management services include catastrophic management, life care planning, and vocational rehabilitation services. All FCMs have iPads that provide access to the Company’s proprietary mobile app that provides instant access to detailed case information and to enter case notes.

24/7 Nurse Triage

Injured workers can call at the time of injury or incident and speak with a nurse who specializes in occupational injuries. An assessment is immediately made to recommend self-care, or referral for further medical care if needed. CorVel is able to provide quick and accurate care intervention, often preventing a minor injury from becoming an expensive claim. The 24/7 nurse triage services provide channeling to a preferred network of providers, allows employer access to online case information, comprehensive incident gathering, and healthcare advocacy for injured workers.

Utilization Management

Utilization Management programs review proposed ambulatory care to determine appropriateness, frequency, duration and setting. These programs utilize experienced registered nurses, proprietary medical

6

treatment protocols and systems technology to avoid unnecessary treatments and associated costs. Processes in Utilization Management include: injury review, diagnosis and treatment planning; contacting and negotiating provider treatment requirements; certifying appropriateness of treatment parameters, and responding to provider requests for additional treatment. Utilization management services include: prospective review, retrospective review, concurrent review, second opinion, peer review and independent medical evaluation.

Vocational Rehabilitation

CorVel’s Vocational Rehabilitation program is designed for injured workers needing assistance returning to work or retaining employment. This comprehensive suite of services helps employees who are unable to perform previous work functions and who faces the possibility joining the open labor market to seek re-employment. These services are available unbundled, on an integrated basis as dictated by the requirement of each case and client preference, or by individual statutory requirements. Vocational rehabilitation services include ergonomic assessments, rehabilitation plans, transferable skills analysis, labor market services, resume’-development, job analysis and development, job placement, and expert testimony.

Life Care Planning

Life Care Planning is used to project long-term future needs, services and related costs associated with catastrophic injury. CorVel’s Life Care Plans summarize extensive amounts of medical data and compile it into a comprehensive report for future care requirements, aiding improved outcomes and timely resolution of claims. Some of the features of the Company’s Life Care Planning services include: comprehensive documentation, projecting future care requirements, customized reporting, and costs specific to local areas.

Disability Management

CorVel’s disability management programs offer a continuum of services for short and long-term disability coverages that advocate an employee’s early return to work. Disability management services include absence reporting, disability evaluations, national preferred provider organizations, independent medical examinations, utilization review, medical case management, return to work coordination and integrated reporting.

Liability Claims Management

CorVel also offers liability claims management services that can be sold as a stand-alone service or part of patient management. The Company’s services include auto liability, general liability, product liability, personal injury, professional liability and property damage, accidents and weather-related damage. This service includes claims management, adjusting services, litigation management, claims subrogation, and investigations.

Auto Claims Management

Injury claims are one of the largest components of auto indemnity costs. Effective management of these claims and their associated costs, combined with an optimal healthcare management program, helps CorVel’s customers reduce claim costs. The Company’s auto claims services include national preferred provider organization, medical bill review, first and third party bill review, first notice of loss, demand packet reviews and reporting and analytics.

SYSTEMS AND TECHNOLOGY

Infrastructure and Data Center

The Company utilizes a Tier III-rated data center as its primary processing site. Redundancy is provided at many levels in power, cooling, and computing resources, with the goal of ensuring maximum uptime and system availability for the Company’s production systems. The Company has also begun to implement use of server virtualization and consolidation techniques to push the fault-tolerance of systems even further. These technologies bring increased speed-to-production and scalability.

7

Adoption of Imaging Technologies and Paperless Workflow

Utilizing scanning and automated data capture processes allows the Company to process incoming paper and electronic claims documents, including medical bills, with less manual handling and which has improved the Company’s workflow processes. This has benefitted both the Company, in terms of cost-savings, and the Company’s customers, in improved savings results. Through the Company’s internet portal, www.caremc.com, customers can review the bills as soon as they are processed and approve a bill for payment, streamlining the customer’s own workflows and expediting the payment process.

Redundancy Center

The Company’s national data center is located near Portland, Oregon. The Company also has a redundancy center located in Ft. Worth, Texas. The redundancy center is the Company’s backup processing site in the event that the Portland data center suffers catastrophic loss. Currently, the Company’s data is continually replicated to Ft. Worth in near-real time, so that in the event the Portland data center is offline, the redundancy center can be activated with current information quickly. The Ft. Worth data center also hosts duplicates of the Company’s Websites. The Ft. Worth systems are maintained and exercised on a continuous basis as they host demonstration and pilot environments that mirror production, with the goal of ensuring their ongoing readiness. The Company is in the process of migrating the Fort Worth redundancy center to Portland, Oregon, while building a new data center in Nevada.

CareMC

CareMC (www.caremc.com) has become the application platform for all of the Company’s primary service lines and delivers immediate access to customers. CareMC offers customers direct access to the Company’s primary services. CareMC allows for electronic communication and reporting between providers, payers, employers and patients. Features of the website include: report an incident/injury, request for service, appointment scheduling, online bill review, claims information management, treatment calendar, medical bill adjudication and automated provider reimbursement.

Through the CareMC Website, users can:

| • | Request services online; |

| • | Manage files throughout the life of the claim; |

| • | Receive and relay case notes from case managers; and |

| • | Integrate information from multiple claims management sources into one database. |

The CareMC website facilitates healthcare transaction processing. Using artificial intelligence techniques, the website provides situation alerts and event triggers, to facilitate prompt and effective decisions. Users of CareMC can quickly see where event outliers are occurring within the claims management process. If costs exceed pre-determined thresholds or activities fall outside expected timelines, decision-makers can be quickly notified. Large amounts of information are consolidated and summarized to help customers focus on the critical issues.

Scanning Services

We continue to leverage our scanning technologies which include scanning, optical character recognition and document management services. We continue to expand our existing office automation service line and all offices are selling scanning and document management. We have added scanning operations to most of the Company’s larger offices around the country, designating them “Capture Centers.” Our scanning service also offers a web interface (www.onlinedocumentcenter.com) providing immediate access to documents and data called the Online Document Center (ODC). Secure document review, approval, transaction workflow and archival storage are available at subscription-based pricing.

8

Claims Processing

We continue to develop our claims system capabilities which fit well with the Company’s preference for owning and maintaining our own software assets. Integration projects, some already completed, are underway to present more of this claims-centric information available through the CareMC web portal. The Company’s goal is to continue to modernize user interfaces, and to streamline the delivery of this information to our customers, giving more rapid feedback and putting real-time information in the hands of our customers.

INDUSTRY, CUSTOMERS AND MARKETING

CorVel serves a diverse group of customers that include insurers, third party administrators, self-administered employers, government agencies, municipalities, state funds, and numerous other industries. CorVel is able to provide workers’ compensation services to virtually any size employer and in any state or region of the United States. No single customer of the Company represented more than 10% of revenues in fiscal 2012, 2013, or 2014. Many claims management decisions in workers’ compensation are the responsibility of the local claims office of national or regional insurers. The Company’s national branch office network enables the Company to market and offer its services at both a local and national account level. The Company is placing increasing emphasis on national account marketing. The sales and marketing activities of the Company are conducted primarily by account executives located in key geographic areas.

COMPETITION AND MARKET CONDITIONS

The healthcare cost containment industry is competitive and is subject to economic pressures for cost savings and legislative reforms. CorVel’s primary competitors in the workers’ compensation market include third party administrators, managed care companies, large insurance carriers and numerous independent companies. Many of the Company’s competitors are significantly larger and have greater financial and marketing resources than the Company. Moreover, the Company’s customers may establish the in-house capability of performing services offered by the Company. If the Company is unable to compete effectively, it will be difficult for the Company to add and retain customers, and the Company’s business, financial condition and results of operations will be materially and adversely affected.

The past few years have seen acceleration in the technology world, and advancements seem to be progressing at a pace that few, if any, have ever witnessed. The proliferation of smart phones and tablet computers allows the Company’s clients to stay connected at any time, from anywhere. This capability provides immediate access and begins to present business opportunities that were previously predicated on a less connected environment. The Company continues to leverage the new wave of technology in order to connect all of the parties involved in the workers’ compensation process in ways that were unimaginable in the past. As with general health, the workers compensation line continues to migrate to being a medical management business, with policymakers, employers, and carriers struggling to manage and control the costs of medical care (Source “National Council on Compensation Insurance”). The Company will continue to focus the execution of its strategy to provide industry leading claims management and cost containment solutions to the market.

GOVERNMENT REGULATIONS

General

Managed healthcare programs for workers’ compensation are subject to various laws and regulations. Both the nature and degree of applicable government regulation vary greatly depending upon the specific activities involved. Generally, parties that actually provide or arrange for the provision of healthcare services, assume financial risk related to the provision of those services or undertake direct responsibility for making payment or payment decisions for those services. These parties are subject to a number of complex regulatory requirements that govern many aspects of their conduct and operations.

9

In contrast, the management and information services provided by the Company to its customers typically have not been the subject of regulation by the federal government or the states. Since the managed healthcare field is a rapidly expanding and changing industry and the cost of providing healthcare continues to increase, it is possible that the applicable state and federal regulatory frameworks will expand to have a greater impact upon the conduct and operation of the Company’s business.

Under the current workers’ compensation system, employer insurance or self-funded coverage is governed by individual laws in each of the 50 states and by certain federal laws. The management and information services that make up the Company’s managed care program serve markets that have developed largely in response to needs of insurers, employers and large TPAs, and generally have not been mandated by legislation or other government action. On the other hand, the vocational rehabilitation case management marketplace within the workers’ compensation system has been dependent upon the laws and regulations within those states that require the availability of specified rehabilitation services for injured workers. Similarly, the Company’s fee schedule auditing services address market needs created by certain states’ enactment of maximum permissible fee schedules for workers’ compensation services. Changes in individual state regulation of workers’ compensation may create a greater or lesser demand for some or all of the Company’s services or require the Company to develop new or modified services in order to meet the needs of the marketplace and compete effectively in that marketplace.

Medical Cost Containment Legislation

Historically, governmental strategies to contain medical costs in the workers’ compensation field have been generally limited to legislation on a state-by-state basis. For example, many states have implemented fee schedules that list maximum reimbursement levels for healthcare procedures. In certain states that have not authorized the use of a fee schedule, the Company adjusts bills to the usual and customary levels authorized by the payor. Opportunities for the Company’s services could increase if more states legislate additional cost containment strategies. Conversely, the Company would be materially and adversely affected if states elect to reduce the extent of medical cost containment strategies available to insurance carriers and other payors, or adopt other strategies for cost containment that would not support a demand for the Company’s services.

Healthcare Reform

There has been considerable discussion of healthcare reform at both the federal level and in numerous state legislatures in recent years. Due to uncertainties regarding the ultimate features of reform initiatives and the timing of their enactment, the Company cannot predict which, if any, reforms will be adopted, when they may be adopted, or what impact they may have on the Company. The Company is still evaluating the impact of the health reform legislation which was enacted by Congress in March 2010 on the future results and costs of the Company. The legislation could increase the Company’s future healthcare benefit costs.

SHAREHOLDER RIGHTS PLAN

During fiscal 1997, the Company’s Board of Directors approved the adoption of a Shareholder Rights Plan. The Shareholder Rights Plan provides for a dividend distribution to CorVel stockholders of one preferred stock purchase right for each outstanding share of CorVel’s common stock under certain circumstances. In April 2002, the Board of Directors of CorVel approved an amendment to the Shareholder Rights Plan to extend the expiration date of the rights to February 10, 2012, set the exercise price of each right at $118, and enable Fidelity Management & Research Company and its affiliates to purchase up to 18% of the shares of common stock of the Company without triggering the stockholder rights, with the limitations under the Shareholder Rights Plan remaining in effect for all other stockholders of the Company. In November 2008, the Company’s Board of Directors approved an amendment to the Shareholder Rights Plan to extend the expiration date of the rights to February 10, 2022, remove the ability of Fidelity Management & Research Company and its affiliates to

10

purchase up to 18% of the shares of common stock of the Company without triggering the stockholder rights, substitute Computershare Trust Company, N.A. as the rights agent and effect certain technical changes to the Shareholder Rights Plan.

The rights are designed to assure that all shareholders receive fair and equal treatment in the event of any proposed takeover of the Company and to encourage a potential acquirer to negotiate with the Board of Directors prior to attempting a takeover. The rights have an exercise price of $118 per right, subject to subsequent adjustment. The rights trade with the Company’s common stock and will not be exercisable until the occurrence of certain takeover-related events.

Generally, the Shareholder Rights Plan provides that if a person or group acquires 15% or more of the Company’s common stock without the approval of the Board, subject to certain exception, the holders of the rights, other than the acquiring person or group, would, under certain circumstances, have the right to purchase additional shares of the Company’s common stock having a market value equal to two times the then-current exercise price of the right.

In addition, if the Company is thereafter merged into another entity, or if 50% or more of the Company’s consolidated assets or earning power are sold, then the right will entitle its holder to buy common shares of the acquiring entity having a market value equal to two times the then-current exercise price of the right. The Company’s Board of Directors may exchange or redeem the rights under certain conditions.

EMPLOYEES

As of March 31, 2014, CorVel had 3,380 employees, including nurses, therapists, counselors and other employees. No employees are represented by any collective bargaining unit. Management believes the Company’s relationship with its employees to be good.

AVAILABLE INFORMATION

Copies of our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Sections 13(a) or 15(d) of the Securities Exchange Act of 1934, and other filings made with the Securities and Exchange Commission, are available free of charge through our Web site (http://www.corvel.com, under the Investor section) as soon as reasonably practicable after such reports are electronically filed with, or furnished to, the Securities and Exchange Commission. The inclusion of our Web site address and the address of any of our portals, such as www.caremc.com and www.onlinedocumentcenter.com, in this report does not include or incorporate by reference into this report any information contained on, or accessible through, such Web sites.

11

| Item 1A. | Risk Factors. |

Past financial performance is not necessarily a reliable indicator of future performance, and investors in our common stock should not use historical performance to anticipate results or future period trends. Investing in our common stock involves a high degree of risk. Investors should consider carefully the following risk factors, as well as the other information in this report and our other filings with the Securities and Exchange Commission, including our consolidated financial statements and the related notes, before deciding whether to invest or maintain an investment in shares of our common stock. If any of the following risks actually occurs, our business, financial condition and results of operations would suffer. In this case, the trading price of our common stock would likely decline. The risks described below are not the only ones we face. Additional risks that we currently do not know about or that we currently believe to be immaterial also may impair our business operations.

If we fail to grow our business internally or through strategic acquisitions we may be unable to execute our business plan, maintain high levels of service or adequately address competitive challenges.

Our strategy is to continue internal growth and, as strategic opportunities arise in the workers’ compensation managed care industry, to consider acquisitions of, or relationships with, other companies in related lines of business. As a result, we are subject to certain growth-related risks, including the risk that we will be unable to retain personnel or acquire other resources necessary to service such growth adequately. Expenses arising from our efforts to increase our market penetration may have a negative impact on operating results. In addition, there can be no assurance that any suitable opportunities for strategic acquisitions or relationships will arise or, if they do arise, that the transactions contemplated could be completed. If such a transaction does occur, there can be no assurance that we will be able to integrate effectively any acquired business. In addition, any such transaction would be subject to various risks associated with the acquisition of businesses, including, but not limited to, the following:

| • | an acquisition may negatively impact our results of operations because it may require incurring large one-time charges, substantial debt or liabilities; it may require the amortization or write down of amounts related to deferred compensation, goodwill and other intangible assets; or it may cause adverse tax consequences, substantial depreciation or deferred compensation charges; |

| • | we may encounter difficulties in assimilating and integrating the business, technologies, products, services, personnel or operations of companies that are acquired, particularly if key personnel of the acquired company decide not to work for us; |

| • | an acquisition may disrupt ongoing business, divert resources, increase expenses and distract management; |

| • | the acquired businesses, products, services or technologies may not generate sufficient revenue to offset acquisition costs; |

| • | we may have to issue equity or debt securities to complete an acquisition, which would dilute the position of stockholders and could adversely affect the market price of our common stock; and |

| • | acquisitions may involve the entry into a geographic or business market in which we have little or no prior experience. |

There can be no assurance that we will be able to identify or consummate any future acquisitions or other strategic relationships on favorable terms, or at all, or that any future acquisition or other strategic relationship will not have an adverse impact on our business or results of operations. If suitable opportunities arise, we may finance such transactions, as well as internal growth, through debt or equity financing. There can be no assurance, however, that such debt or equity financing would be available to us on acceptable terms when, and if, suitable strategic opportunities arise.

12

If we are unable to increase our market share among national and regional insurance carriers and large, self-funded employers, our results may be adversely affected.

Our business strategy and future success depend in part on our ability to capture market share with our cost containment services as national and regional insurance carriers and large, self-funded employers look for ways to achieve cost savings. We cannot assure you that we will successfully market our services to these insurance carriers and employers or that they will not resort to other means to achieve cost savings. Additionally, our ability to capture additional market share may be adversely affected by the decision of potential customers to perform services internally instead of outsourcing the provision of such services to us. Furthermore, we may not be able to demonstrate sufficient cost savings to potential or current customers to induce them not to provide comparable services internally or to accelerate efforts to provide such services internally.

If competition increases, our growth and profits may decline.

The markets for our network services and patient management services are also fragmented and competitive. Our competitors include national managed care providers, preferred provider networks, smaller independent providers and insurance companies. Companies that offer one or more workers’ compensation managed care services on a national basis are our primary competitors. We also compete with many smaller vendors who generally provide unbundled services on a local level, particularly companies with an established relationship with a local insurance company adjuster. In addition, several large workers’ compensation insurance carriers offer managed care services for their customers, either by performance of the services in-house or by outsourcing to organizations like ours. If these carriers increase their performance of these services in-house, our business may be adversely affected. In addition, consolidation in the industry may result in carriers performing more of such services in-house.

Our sequential revenue may not increase and may decline. As a result, we may fail to meet or exceed the expectations of investors or analysts which could cause our common stock price to decline.

Our sequential revenue growth may not increase and may decline in the future as a result of a variety of factors, many of which are outside of our control. If changes in our sequential revenue fall below the expectations of investors or analysts, the price of our common stock could decline substantially. Fluctuations or declines in sequential revenue growth may be due to a number of factors, including, but not limited to, those listed below and identified throughout this “Risk Factors” section: the decline in manufacturing employment, the decline in workers’ compensation claims, the decline in healthcare expenditures, the considerable price competition in a flat-to-declining workers’ compensation market, litigation, the increase in competition, and the changes and the potential changes in state workers’ compensation and automobile managed care laws which can reduce demand for our services. These factors create an environment where revenue and margin growth is more difficult to attain and where revenue growth is less certain than historically experienced. Additionally, our technology and preferred provider network face competition from companies that have more resources available to them than we do. Also, some customers may handle their managed care services in-house and may reduce the amount of services which are outsourced to managed care companies such as CorVel. These factors could cause the market price of our common stock to fluctuate substantially. There can be no assurance that our growth rate in the future, if any, will be at or near historical levels.

In addition, the stock market has in the past experienced price and volume fluctuations that have particularly affected companies in the healthcare and managed care markets resulting in changes in the market price of the stock of many companies, which may not have been directly related to the operating performance of those companies.

Due to the foregoing factors, and the other risks discussed in this report, investors should not rely on period-to-period comparisons of our results of operations as an indication of our future performance.

13

The market price and trading volume of our common stock may be volatile, which could result in rapid and substantial losses for our stockholders.

The market price of our common stock may be highly volatile and could be subject to wide fluctuations. In addition, the trading volume in our common stock may fluctuate and cause significant price variations to occur. The stock market has in the past experienced price and volume fluctuations that have particularly affected companies in the healthcare and managed care markets resulting in changes in the market price of the stock of many companies, which may not have been directly related to the operating performance of those companies. We cannot assure you that the market price of our common stock will not fluctuate or decline significantly in the future.

We cannot assure our stockholders that our stock repurchase program will enhance long-term stockholder value and stock repurchases, if any, could increase the volatility of the price of our common stock and will diminish our cash reserves.

In 1996, our Board of Directors authorized a stock repurchase program and has periodically increased the number of shares authorized for repurchase under the repurchase program. The most recent increase occurred in August 2013 and brought the number of shares authorized for repurchase over the life of the program to 34,000,000 shares. There is no expiration date for the repurchase program. The timing and actual number of shares repurchased, if any, depend on a variety of factors including the timing of open trading windows, price, corporate and regulatory requirements, and other market conditions. The program may be suspended or discontinued at any time without prior notice. Repurchases pursuant to our stock repurchase program could affect our stock price and increase its volatility. The existence of a stock repurchase program could also cause our stock price to be higher than it would be in the absence of such a program and could potentially reduce the market liquidity for our stock. Additionally, repurchases under our stock repurchase program will diminish our cash reserves, which could impact our ability to pursue possible future strategic opportunities and acquisitions and could result in lower overall returns on our cash balances. There can be no assurance that any further stock repurchases will enhance stockholder value because the market price of our common stock may decline below the levels at which we repurchased shares of stock. Although our stock repurchase program is intended to enhance long-term stockholder value, short-term stock price fluctuations could reduce the program’s effectiveness.

If the referrals for our patient management services decline, our business, financial condition and results of operations would be materially adversely affected.

In some years, we have experienced a general decline in the revenue and operating performance of patient management services. We believe that the performance decline has been due to the following factors: the decrease of the number of workplace injuries that have become longer-term disability cases; increased regional and local competition from providers of managed care services; a possible reduction by insurers on the types of services provided by our patient management business; the closure of offices and continuing consolidation of our patient management operations; and employee turnover, including management personnel, in our patient management business. In the past, these factors have all contributed to the lowering of our long-term outlook for our patient management services. If some or all of these conditions continue, we believe that the performance of our patient management revenues could decrease.

Declines in workers’ compensation claims may materially harm our results of operations.

Within the past few years, the economy has performed below historical averages which leads to fewer workers on a national level and could lead to fewer work-related injuries. If declines in workers’ compensation costs occur in many states and persist over the long-term, it would have a material adverse impact on our business, financial condition and results of operations.

14

We provide an outsource service to payors of workers’ compensation and auto healthcare benefits. These payors include insurance companies, TPAs, municipalities, state funds, and self-insured, self-administered employers. If these payors reduce the amount of work they outsource, our results of operations would be materially adversely affected.

Healthcare providers are becoming increasingly resistant to the application of certain healthcare cost containment techniques; this may cause revenue from our cost containment operations to decrease.

Healthcare providers have become more active in their efforts to minimize the use of certain cost containment techniques and are engaging in litigation to avoid application of certain cost containment practices. Recent litigation between healthcare providers and insurers has challenged certain insurers’ claims adjudication and reimbursement decisions. Although these lawsuits do not directly involve us or any services we provide, these cases may affect the use by insurers of certain cost containment services that we provide and may result in a decrease in revenue from our cost containment business.

Our failure to compete successfully could make it difficult for us to add and retain customers and could reduce or impede the growth of our business.

We face competition from PPOs, TPAs and other managed healthcare companies. We believe that as managed care techniques continue to gain acceptance in the workers’ compensation marketplace, our competitors will increasingly consist of nationally-focused workers’ compensation managed care service companies, insurance companies, HMOs and other significant providers of managed care products. Legislative reform in some states has been considered, but not enacted to permit employers to designate health plans such as HMOs and PPOs to cover workers’ compensation claimants. Because many health plans have the ability to manage medical costs for workers’ compensation claimants, such legislation may intensify competition in the markets served by us. Many of our current and potential competitors are significantly larger and have greater financial and marketing resources than we do, and there can be no assurance that we will continue to maintain our existing customers, our past level of operating performance or be successful with any new products or in any new geographical markets we may enter.

A breach of security may cause our customers to curtail or stop using our services.

We rely largely on our own security systems, confidentiality procedures and employee nondisclosure agreements to maintain the privacy and security of our and our customers’ proprietary information. Accidental or willful security breaches or other unauthorized access by third parties to our information systems, the existence of computer viruses in our data or software and misappropriation of our proprietary information could expose us to a risk of information loss, litigation and other possible liabilities which may have a material adverse effect on our business, financial condition and results of operations. If security measures are breached because of third-party action, employee error, malfeasance or otherwise, or if design flaws in our software are exposed and exploited, and, as a result, a third party obtains unauthorized access to any customer data, our relationships with our customers and our reputation will be damaged, our business may suffer and we could incur significant liability. Because techniques used to obtain unauthorized access or to sabotage systems change frequently and generally are not recognized until launched against a target, we may be unable to anticipate these techniques or to implement adequate preventative measures.

Exposure to possible litigation and legal liability may adversely affect our business, financial condition and results of operations.

We, through our utilization management services, make recommendations concerning the appropriateness of providers’ medical treatment plans of patients throughout the country, and as a result, could be exposed to claims for adverse medical consequences. We do not grant or deny claims for payment of benefits and we do not

15

believe that we engage in the practice of medicine or the delivery of medical services. There can be no assurance, however, that we will not be subject to claims or litigation related to the authorization or denial of claims for payment of benefits or allegations that we engage in the practice of medicine or the delivery of medical services.

In addition, there can be no assurance that we will not be subject to other litigation that may adversely affect our business, financial condition or results of operations, including but not limited to being joined in litigation brought against our customers in the managed care industry. We maintain professional liability insurance and such other coverages as we believe are reasonable in light of our experience to date. If such insurance is insufficient or unavailable in the future at reasonable cost to protect us from liability, our business, financial condition or results of operations could be adversely affected.

If lawsuits against us are successful, we may incur significant liabilities.

We provide to insurers and other payors of healthcare costs managed care programs that utilize preferred provider organizations and computerized bill review programs. Health care providers have brought, against us and our customers, individual and class action lawsuits challenging such programs. If such lawsuits are successful, we may incur significant liabilities.

We make recommendations about the appropriateness of providers’ proposed medical treatment plans for patients throughout the country. As a result, we could be subject to claims arising from any adverse medical consequences. Although plaintiffs have not to date subjected us to any claims or litigation relating to the granting or denial of claims for payment of benefits or allegations that we engage in the practice of medicine or the delivery of medical services, we cannot assure you that plaintiffs will not make such claims in future litigation. We also cannot assure you that our insurance will provide sufficient coverage or that insurance companies will make insurance available at a reasonable cost to protect us from significant future liability.

If the utilization by healthcare payors of early intervention services continues to increase, the revenue from our later-stage network and healthcare management services could be negatively affected.

The performance of early intervention services, including injury occupational healthcare, first notice of loss, and telephonic case management services, often result in a decrease in the average length of, and the total costs associated with, a healthcare claim. By successfully intervening at an early stage in a claim, the need for additional cost containment services for that claim often can be reduced or even eliminated. As healthcare payors continue to increase their utilization of early intervention services, the revenue from our later stage network and healthcare management services will decrease.

An interruption in our ability to access critical data may cause customers to cancel their service and/or may reduce our ability to effectively compete.

Certain aspects of our business are dependent upon our ability to store, retrieve, process and manage data and to maintain and upgrade our data processing capabilities. Interruption of data processing capabilities for any extended length of time, loss of stored data, programming errors or other system failures could cause customers to cancel their service and could have a material adverse effect on our business and results of operations.

In addition, we expect that a considerable amount of our future growth will depend on our ability to process and manage claims data more efficiently and to provide more meaningful healthcare information to customers and payors of healthcare. There can be no assurance that our current data processing capabilities will be adequate for our future growth, that we will be able to efficiently upgrade our systems to meet future demands, or that we will be able to develop, license or otherwise acquire software to address these market demands as well or as timely as our competitors.

16

We face competition for staffing, which may increase our labor costs and reduce profitability.

We compete with other healthcare providers in recruiting qualified management and staff personnel for the day-to-day operations of our business, including nurses and other case management professionals. In some markets, the scarcity of nurses and other medical support personnel has become a significant operating issue to healthcare providers. This shortage may require us to enhance wages to recruit and retain qualified nurses and other healthcare professionals. Our failure to recruit and retain qualified management, nurses and other healthcare professionals, or to control labor costs could have a material adverse effect on profitability.

The increased costs of professional and general liability insurance may have an adverse effect on our profitability.

The cost of commercial professional and general liability insurance coverage has risen significantly in the past several years, and this trend may continue. In addition, if we were to suffer a material loss, our costs may increase over and above the general increases in the industry. If the costs associated with insuring our business continue to increase, it may adversely affect our business. We believe our current level of insurance coverage is adequate for a company of our size engaged in our business.

Changes in government regulations could increase our costs of operations and/or reduce the demand for our services.

Many states, including a number of those in which we transact business, have licensing and other regulatory requirements applicable to our business. Approximately half of the states have enacted laws that require licensing of businesses which provide medical review services such as ours. Some of these laws apply to medical review of care covered by workers’ compensation. These laws typically establish minimum standards for qualifications of personnel, confidentiality, internal quality control and dispute resolution procedures. These regulatory programs may result in increased costs of operation for us, which may have an adverse impact upon our ability to compete with other available alternatives for healthcare cost control. In addition, new laws regulating the operation of managed care provider networks have been adopted by a number of states. These laws may apply to managed care provider networks having contracts with us or to provider networks which we may organize. To the extent we are governed by these regulations, we may be subject to additional licensing requirements, financial and operational oversight and procedural standards for beneficiaries and providers.

Regulation in the healthcare and workers’ compensation fields is constantly evolving. We are unable to predict what additional government initiatives, if any, affecting our business may be promulgated in the future. Our business may be adversely affected by failure to comply with existing laws and regulations, failure to obtain necessary licenses and government approvals or failure to adapt to new or modified regulatory requirements. Proposals for healthcare legislative reforms are regularly considered at the federal and state levels. To the extent that such proposals affect workers’ compensation, such proposals may adversely affect our business, financial condition and results of operations.

In addition, changes in workers’ compensation, auto and managed health care laws or regulations may reduce demand for our services, require us to develop new or modified services to meet the demands of the marketplace or reduce the fees that we may charge for our services. One proposal which had been considered in the past, but not enacted by Congress or certain state legislatures, is 24-hour health coverage, in which the coverage of traditional employer-sponsored health plans is combined with workers’ compensation coverage to provide a single insurance plan for work-related and non-work-related health problems.

The introduction of software products incorporating new technologies and the emergence of new industry standards could render our existing software products less competitive, obsolete or unmarketable.

There can be no assurance that we will be successful in developing and marketing new software products that respond to technological changes or evolving industry standards. If we are unable, for technological or other

17

reasons, to develop and introduce new software products cost-effectively, in a timely manner and in response to changing market conditions or customer requirements, our business, results of operations and financial condition may be adversely affected.

Developing or implementing new or updated software products and services may take longer and cost more than expected. We rely on a combination of internal development, strategic relationships, licensing and acquisitions to develop our software products and services. The cost of developing new healthcare information services and technology solutions is inherently difficult to estimate. Our development and implementation of proposed software products and services may take longer than originally expected, require more testing than originally anticipated and require the acquisition of additional personnel and other resources. If we are unable to develop new or updated software products and services cost-effectively on a timely basis and implement them without significant disruptions to the existing systems and processes of our customers, we may lose potential sales and harm our relationships with current or potential customers.

The failure to attract and retain qualified or key personnel may prevent us from effectively developing, marketing, selling, integrating and supporting our services.

We are dependent, to a substantial extent, upon the continuing efforts and abilities of certain key management personnel. In addition, we face competition for experienced employees with professional expertise in the workers’ compensation managed care area. The loss of key personnel, especially V. Gordon Clemons, Chairman, President, and Chief Executive Officer, or the inability to attract, qualified employees, could have a material unfavorable effect on our business and results of operations.

If we lose several customers in a short period, our results may be materially adversely affected.

Our results may decline if we lose several customers during a short period. Most of our customer contracts permit either party to terminate without cause. If several customers terminate, or do not renew or extend their contracts with us, our results could be materially and adversely affected. Many organizations in the insurance industry have consolidated and this could result in the loss of one or more of our customers through a merger or acquisition. Additionally, we could lose customers due to competitive pricing pressures or other reasons.

We are subject to risks associated with acquisitions of intangible assets.

Our acquisition of other businesses may result in significant increases in our intangible assets and goodwill. We regularly evaluate whether events and circumstances have occurred indicating that any portion of our intangible assets and goodwill may not be recoverable. When factors indicate that intangible assets and goodwill should be evaluated for possible impairment, we may be required to reduce the carrying value of these assets. We cannot currently estimate the timing and amount of any such charges.

If we are unable to leverage our information systems to enhance our outcome-driven service model, our results may be adversely affected.

To leverage our knowledge of workplace injuries, treatment protocols, outcomes data, and complex regulatory provisions related to the workers’ compensation market, we must continue to implement and enhance information systems that can analyze our data related to the workers’ compensation industry. We frequently upgrade existing operating systems and are updating other information systems that we rely upon in providing our services and financial reporting. We have detailed implementation schedules for these projects that require extensive involvement from our operational, technological and financial personnel. Delays or other problems we might encounter in implementing these projects could adversely affect our ability to deliver streamlined patient care and outcome reporting to our customers.

18

Our Internet-based services are dependent on the development and maintenance of the Internet infrastructure.

The Internet has experienced a variety of outages and other delays as a result of damages to portions of its infrastructure, and it could face outages and delays in the future. These outages and delays could reduce the level of Internet usage, as well as the availability of the Internet to us for delivery of our Internet-based services. In addition, our customers who use our Web-based services depend on Internet service providers, online service providers and other Web site operators for access to our Web site. All of these providers have experienced significant outages in the past and could experience outages, delays and other difficulties in the future due to system failures unrelated to our systems. Any significant interruptions in our services or increases in response time could result in a loss of potential or existing users, and, if sustained or repeated, could reduce the attractiveness of our services.

We are sensitive to regional weather conditions that may adversely affect our operations.

Our operations are directly affected in the short-term by the weather conditions in certain of our regions of operation. Therefore our business is sensitive to the weather conditions of these regions. Unusually inclement weather, including significant rain, snow, sleet, freezing rain or ice can temporarily affect our operations if clients are forced to close operational centers. Accordingly, our operating results may vary from quarter to quarter, depending on the impact of these weather conditions.

Natural and other disasters may adversely affect our business.

We may be vulnerable to damage from severe weather conditions or natural disasters, including hurricanes, fires, floods, earthquakes, power loss, communications failures and similar events, including the effects of war or acts of terrorism. If a disaster were to occur, our ability to operate our business could be seriously or completely impaired or destroyed. The insurance we maintain may not be adequate to cover our losses resulting from disasters or other business interruptions.

| Item 1B. | Unresolved Staff Comments |

None.

| Item 2. | Properties. |

The Company’s principal executive office is located in Irvine, California in approximately 13,000 square feet of leased space. The lease expires in January 2020. The Company leases approximately 89 branch offices in 43 states, which range in size from 200 square feet up to 39,000 square feet. The lease terms for the branch offices range from monthly to ten years and expire through 2020. The Company believes that its facilities are adequate for its current needs and that suitable additional space will be available as required.

| Item 3. | Legal Proceedings. |

The Company is involved in litigation arising in the normal course of business. Management believes that resolution of these matters will not result in any payment that, in the aggregate, would be material to the financial position or results of the operations of the Company.

| Item 4. | Mine Safety Disclosures. |

Not applicable.

19

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities. |

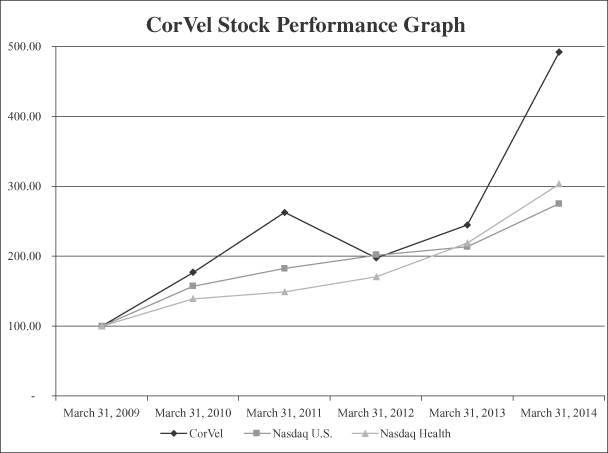

Market Information