Document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________________

FORM 10-Q

____________________________________

(Mark One) |

| |

ý | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2017

or

|

| |

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ____________ to ______________

Commission file number 001-13958

____________________________________

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

(Exact name of registrant as specified in its charter) |

| | |

Delaware | | 13-3317783 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

One Hartford Plaza, Hartford, Connecticut 06155

(Address of principal executive offices) (Zip Code)

(860) 547-5000

(Registrant’s telephone number, including area code) |

| | | |

Indicate by check mark: | Yes | | No |

| | | |

• whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. | ý | | ¨ |

| | | |

• whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). | ý | | ¨ |

| | | |

• whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and "emerging growth company" in Rule 12b-2 of the Exchange Act. | | | |

|

| | | | |

Large accelerated filer x | Accelerated filer ¨ | Non-accelerated filer ¨ | Smaller reporting company ¨ | Emerging growth company ¨ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

|

| | | |

• whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act.) | ¨ | | ý |

As of April 25, 2017, there were outstanding 367,360,904 shares of Common Stock, $0.01 par value per share, of the registrant.

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

QUARTERLY REPORT ON FORM 10-Q

FOR THE QUARTERLY PERIOD ENDED MARCH 31, 2017

TABLE OF CONTENTS

|

| | |

Item | Description | Page |

| | |

1. | FINANCIAL STATEMENTS | |

| REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | |

| CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS - FOR THE THREE MONTHS ENDED MARCH 31, 2017 AND 2016 | |

| CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS) - FOR THE THREE MONTHS ENDED MARCH 31, 2017 AND 2016 | |

| CONDENSED CONSOLIDATED BALANCE SHEETS - AS OF MARCH 31, 2017 AND DECEMBER 31, 2016 | |

| CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS' EQUITY - FOR THE THREE MONTHS ENDED MARCH 31, 2017 AND 2016 | |

| CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS - FOR THE THREE MONTHS ENDED MARCH 31, 2017 AND 2016 | |

| NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS | |

2. | MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | |

3. | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | |

4. | CONTROLS AND PROCEDURES | |

| | |

1. | LEGAL PROCEEDINGS | |

1A. | RISK FACTORS | |

2. | UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS | |

6. | EXHIBITS | |

| | |

| SIGNATURE | |

| EXHIBITS INDEX | |

Forward-Looking Statements

Certain of the statements contained herein are forward-looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words such as “anticipates,” “intends,” “plans,” “seeks,” “believes,” “estimates,” “expects,” “projects,” and similar references to future periods.

Forward-looking statements are based on management's current expectations and assumptions regarding future economic, competitive, legislative and other developments and their potential effect upon The Hartford Financial Services Group, Inc. and its subsidiaries (collectively, the "Company" or "The Hartford"). Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. Actual results could differ materially from expectations, depending on the evolution of various factors, including the risks and uncertainties identified below, as well as factors described in such forward-looking statements or in Part I, Item 1A, Risk Factors in The Hartford’s 2016 Form 10-K Annual Report, and those identified from time to time in our other filings with the Securities and Exchange Commission ("SEC").

| |

• | Risks Related to Economic, Political and Global Market Conditions: |

| |

◦ | challenges related to the Company’s current operating environment, including global political, economic and market conditions, and the effect of financial market disruptions, economic downturns or other potentially adverse macroeconomic developments on the demand for our products, returns in our investment portfolios and the hedging costs associated with our run-off annuity block; |

| |

◦ | financial risk related to the continued reinvestment of our investment portfolios and performance of our hedge program for our run-off annuity block; |

| |

◦ | market risks associated with our business, including changes in credit spreads, equity prices, interest rates, inflation rate, market volatility and foreign exchange rates; |

| |

◦ | the impact on our investment portfolio if our investment portfolio is concentrated in any particular segment of the economy; |

| |

• | Insurance Industry and Product-Related Risks: |

| |

◦ | the possibility of unfavorable loss development, including with respect to long-tailed exposures; |

| |

◦ | the possibility of a pandemic, earthquake, or other natural or man-made disaster that may adversely affect our businesses; |

| |

◦ | weather and other natural physical events, including the severity and frequency of storms, hail, winter storms, hurricanes and tropical storms, as well as climate change and its potential impact on weather patterns; |

| |

◦ | the possible occurrence of terrorist attacks and the Company’s inability to contain its exposure as a result of, among other factors, the inability to exclude coverage for terrorist attacks from workers' compensation policies and limitations on reinsurance coverage from the federal government under applicable laws; |

| |

◦ | the Company’s ability to effectively price its property and casualty policies, including its ability to obtain regulatory consents to pricing actions or to non-renewal or withdrawal of certain product lines; |

| |

◦ | actions by competitors that may be larger or have greater financial resources than we do; |

| |

◦ | technology changes, such as usage-based methods of determining premiums, advancement in automotive safety features, the development of autonomous vehicles, and platforms that facilitate ride sharing, which may alter demand for the Company's products, impact the frequency or severity of losses, and/or impact the way the Company markets, distributes and underwrites its products; |

| |

◦ | the Company’s ability to market, distribute and provide insurance products and investment advisory services through current and future distribution channels and advisory firms; |

| |

◦ | the uncertain effects of emerging claim and coverage issues; |

| |

◦ | volatility in our statutory and United States ("U.S.") Generally Accepted Accounting Principles ("GAAP") earnings and potential material changes to our results resulting from our risk management program to emphasize protection of economic value; |

| |

• | Financial Strength, Credit and Counterparty Risks: |

| |

◦ | risks to our business, financial position, prospects and results associated with negative rating actions or downgrades in the Company’s financial strength and credit ratings or negative rating actions or downgrades relating to our investments; |

| |

◦ | the impact on our statutory capital of various factors, including many that are outside the Company’s control, which can in turn affect our credit and financial strength ratings, cost of capital, regulatory compliance and other aspects of our business and results; |

| |

◦ | losses due to nonperformance or defaults by others, including sourcing partners, derivative counterparties and other third parties; |

| |

◦ | the potential for losses due to our reinsurers’ unwillingness or inability to meet their obligations under reinsurance contracts and the availability, pricing and adequacy of reinsurance to protect the Company against losses; |

| |

• | Risks Relating to Estimates, Assumptions and Valuations; |

| |

◦ | risk associated with the use of analytical models in making decisions in key areas such as underwriting, capital management, hedging, reserving, and catastrophe risk management; |

| |

◦ | the potential for differing interpretations of the methodologies, estimations and assumptions that underlie Company’s fair value estimates for its investments and the evaluation of other-than-temporary impairments on available-for-sale securities; |

| |

◦ | the potential for further acceleration of deferred policy acquisition cost amortization and an increase in reserve for certain guaranteed benefits in our variable annuities; |

| |

◦ | the potential for further impairments of our goodwill or the potential for changes in valuation allowances against deferred tax assets; |

| |

◦ | the significant uncertainties that limit our ability to estimate the ultimate reserves necessary for asbestos and environmental claims; |

| |

• | Strategic and Operational Risks: |

| |

◦ | risks associated with the run off of our Talcott Resolution business; |

| |

◦ | the Company’s ability to maintain the availability of its systems and safeguard the security of its data in the event of a disaster, cyber or other information security incident or other unanticipated event; |

| |

◦ | the risks, challenges and uncertainties associated with our capital management plan, expense reduction initiatives and other actions, which may include acquisitions, divestitures or restructurings; |

| |

◦ | the potential for difficulties arising from outsourcing and similar third-party relationships; |

| |

◦ | the Company’s ability to protect its intellectual property and defend against claims of infringement. |

| |

• | Regulatory and Legal Risks: |

| |

◦ | the cost and other potential effects of increased regulatory and legislative developments, including those that could adversely impact the demand for the Company’s products, operating costs and required capital levels; |

| |

◦ | unfavorable judicial or legislative developments; |

| |

◦ | the impact of changes in federal or state tax laws; |

| |

◦ | regulatory requirements that could delay, deter or prevent a takeover attempt that shareholders might consider in their best interests; and |

| |

◦ | the impact of potential changes in accounting principles and related financial reporting requirements. |

Any forward-looking statement made by the Company in this document speaks only as of the date of the filing of this Form 10-Q. Factors or events that could cause the Company’s actual results to differ may emerge from time to time, and it is not possible for the Company to predict all of them. The Company undertakes no obligation to publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise.

Part I - Item 1. Financial Statements

Item 1. Financial Statements

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Stockholders of

The Hartford Financial Services Group, Inc.

Hartford, Connecticut

We have reviewed the accompanying condensed consolidated balance sheet of The Hartford Financial Services Group, Inc. and subsidiaries (the "Company") as of March 31, 2017, and the related condensed consolidated statements of operations, comprehensive income, changes in stockholders' equity, and cash flows for the three-month periods ended March 31, 2017 and 2016. These interim financial statements are the responsibility of the Company's management.

We conducted our reviews in accordance with the standards of the Public Company Accounting Oversight Board (United States). A review of interim financial information consists principally of applying analytical procedures and making inquiries of persons responsible for financial and accounting matters. It is substantially less in scope than an audit conducted in accordance with the standards of the Public Company Accounting Oversight Board (United States), the objective of which is the expression of an opinion regarding the financial statements taken as a whole. Accordingly, we do not express such an opinion.

Based on our reviews, we are not aware of any material modifications that should be made to such condensed consolidated interim financial statements for them to be in conformity with accounting principles generally accepted in the United States of America.

We have previously audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the consolidated balance sheet of the Company as of December 31, 2016, and the related consolidated statements of operations, comprehensive income, changes in stockholders' equity, and cash flows for the year then ended (not presented herein); and in our report dated February 24, 2017, we expressed an unqualified opinion on those consolidated financial statements. In our opinion, the information set forth in the accompanying condensed consolidated balance sheet as of December 31, 2016 is fairly stated, in all material respects, in relation to the consolidated balance sheet from which it has been derived.

DELOITTE & TOUCHE LLP

Hartford, Connecticut

April 27, 2017

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

Condensed Consolidated Statements of Operations

|

| | | | | | |

| Three Months Ended March 31, |

(In millions, except for per share data) | 2017 | 2016 |

| (Unaudited) |

Revenues | | |

Earned premiums | $ | 3,473 |

| $ | 3,404 |

|

Fee income | 455 |

| 445 |

|

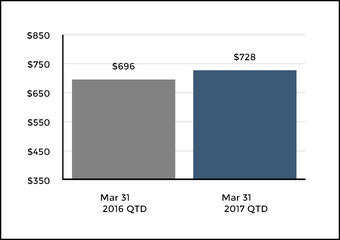

Net investment income | 728 |

| 696 |

|

Net realized capital gains (losses): |

|

|

Total other-than-temporary impairment ("OTTI") losses | (3 | ) | (27 | ) |

OTTI losses recognized in other comprehensive income (“OCI”) | 2 |

| 4 |

|

Net OTTI losses recognized in earnings | (1 | ) | (23 | ) |

Other net realized capital losses | (19 | ) | (132 | ) |

Total net realized capital losses | (20 | ) | (155 | ) |

Other revenues | 19 |

| 20 |

|

Total revenues | 4,655 |

| 4,410 |

|

Benefits, losses and expenses |

|

|

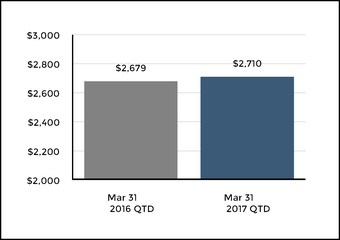

Benefits, losses and loss adjustment expenses | 2,757 |

| 2,641 |

|

Amortization of deferred policy acquisition costs ("DAC") | 363 |

| 374 |

|

Insurance operating costs and other expenses | 965 |

| 928 |

|

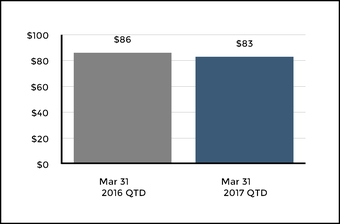

Interest expense | 83 |

| 86 |

|

Total benefits, losses and expenses | 4,168 |

| 4,029 |

|

Income before income taxes | 487 |

| 381 |

|

Income tax expense | 109 |

| 58 |

|

Net income | $ | 378 |

| $ | 323 |

|

Net income per common share |

|

|

|

Basic | $ | 1.02 |

| $ | 0.81 |

|

Diluted | $ | 1.00 |

| $ | 0.79 |

|

Cash dividends declared per common share | $ | 0.23 |

| $ | 0.21 |

|

See Notes to Condensed Consolidated Financial Statements.

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

Condensed Consolidated Statements of Comprehensive Income (Loss)

|

| | | | | | |

| Three Months Ended March 31, |

(In millions) | 2017 | 2016 |

| (Unaudited) |

Net income | $ | 378 |

| $ | 323 |

|

Other comprehensive income (loss): | | |

Changes in net unrealized gain on securities | 137 |

| 522 |

|

Changes in OTTI losses recognized in other comprehensive income | (1 | ) | (8 | ) |

Changes in net gain on cash flow hedging instruments | (18 | ) | 54 |

|

Changes in foreign currency translation adjustments | 2 |

| 6 |

|

Changes in pension and other postretirement plan adjustments | 10 |

| 9 |

|

OCI, net of tax | 130 |

| 583 |

|

Comprehensive income | $ | 508 |

| $ | 906 |

|

See Notes to Condensed Consolidated Financial Statements.

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

Condensed Consolidated Balance Sheets

|

| | | | | | |

(In millions, except for share and per share data) | March 31,

2017 | December 31, 2016 |

| (Unaudited) |

Assets | |

Investments: | | |

Fixed maturities, available-for-sale, at fair value (amortized cost of $53,908 and $53,805) | $ | 56,326 |

| $ | 56,003 |

|

Fixed maturities, at fair value using the fair value option | 160 |

| 293 |

|

Equity securities, available-for-sale, at fair value (cost of $1,135 and $1,020) (includes equity securities, at fair value using the fair value option, of $123 and $0) | 1,223 |

| 1,097 |

|

Mortgage loans (net of allowances for loan losses of $19 and $19) | 5,685 |

| 5,697 |

|

Policy loans, at outstanding balance | 1,442 |

| 1,444 |

|

Limited partnerships and other alternative investments | 2,418 |

| 2,456 |

|

Other investments | 340 |

| 403 |

|

Short-term investments | 4,595 |

| 3,244 |

|

Total investments | 72,189 |

| 70,637 |

|

Cash (includes variable interest entity assets, at fair value, of $5 and $5) | 337 |

| 882 |

|

Premiums receivable and agents’ balances, net | 3,764 |

| 3,731 |

|

Reinsurance recoverables, net | 23,405 |

| 23,311 |

|

Deferred policy acquisition costs | 1,693 |

| 1,711 |

|

Deferred income taxes, net | 3,105 |

| 3,281 |

|

Goodwill | 567 |

| 567 |

|

Property and equipment, net | 984 |

| 991 |

|

Other assets | 1,839 |

| 1,786 |

|

Assets held for sale | 923 |

| 870 |

|

Separate account assets | 116,582 |

| 115,665 |

|

Total assets | $ | 225,388 |

| $ | 223,432 |

|

Liabilities |

|

|

Unpaid losses and loss adjustment expenses | $ | 27,687 |

| $ | 27,605 |

|

Reserve for future policy benefits | 14,051 |

| 13,929 |

|

Other policyholder funds and benefits payable | 30,863 |

| 31,176 |

|

Unearned premiums | 5,609 |

| 5,499 |

|

Short-term debt | 320 |

| 416 |

|

Long-term debt | 4,817 |

| 4,636 |

|

Other liabilities (includes variable interest entity liabilities of $5 and $5) | 7,789 |

| 6,992 |

|

Liabilities held for sale | 661 |

| 611 |

|

Separate account liabilities | 116,582 |

| 115,665 |

|

Total liabilities | $ | 208,379 |

| $ | 206,529 |

|

Commitments and Contingencies (Note 12) | | |

Stockholders’ Equity | | |

Common stock, $0.01 par value — 1,500,000,000 shares authorized, 402,923,222 and 402,923,222 shares issued | 4 |

| 4 |

|

Additional paid-in capital | 5,177 |

| 5,247 |

|

Retained earnings | 13,406 |

| 13,114 |

|

Treasury stock, at cost — 33,726,771 and 28,974,069 shares | (1,371 | ) | (1,125 | ) |

Accumulated other comprehensive income ("AOCI"), net of tax | (207 | ) | (337 | ) |

Total stockholders’ equity | $ | 17,009 |

| $ | 16,903 |

|

Total liabilities and stockholders’ equity | $ | 225,388 |

| $ | 223,432 |

|

See Notes to Condensed Consolidated Financial Statements.

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

Condensed Consolidated Statements of Changes in Stockholders' Equity

|

| | | | | | |

| Three Months Ended March 31, |

(In millions, except for share data) | 2017 | 2016 |

| (Unaudited) |

Common Stock | $ | 4 |

| $ | 5 |

|

Additional Paid-in Capital, beginning of period | 5,247 |

| 8,973 |

|

Issuance of shares under incentive and stock compensation plans | (66 | ) | (124 | ) |

Stock-based compensation plans expense | 36 |

| 19 |

|

Tax benefit on employee stock options and share-based awards | — |

| 24 |

|

Issuance of shares for warrant exercise | (40 | ) | (7 | ) |

Additional Paid-in Capital, end of period | 5,177 |

| 8,885 |

|

Retained Earnings, beginning of period | 13,114 |

| 12,550 |

|

Net income | 378 |

| 323 |

|

Dividends declared on common stock | (86 | ) | (84 | ) |

Retained Earnings, end of period | 13,406 |

| 12,789 |

|

Treasury Stock, at cost, beginning of period | (1,125 | ) | (3,557 | ) |

Treasury stock acquired | (325 | ) | (350 | ) |

Issuance of shares under incentive and stock compensation plans | 72 |

| 125 |

|

Net shares acquired related to employee incentive and stock compensation plans | (33 | ) | (46 | ) |

Issuance of shares for warrant exercise | 40 |

| 7 |

|

Treasury Stock, at cost, end of period | (1,371 | ) | (3,821 | ) |

Accumulated Other Comprehensive Income (Loss), net of tax, beginning of period | (337 | ) | (329 | ) |

Total other comprehensive income (loss) | 130 |

| 583 |

|

Accumulated Other Comprehensive Income (Loss), net of tax, end of period | (207 | ) | 254 |

|

Total Stockholders’ Equity | $ | 17,009 |

| $ | 18,112 |

|

Common Shares Outstanding, beginning of period (in thousands) | 373,949 |

| 401,821 |

|

Treasury stock acquired | (6,709 | ) | (8,394 | ) |

Issuance of shares under incentive and stock compensation plans | 1,690 |

| 3,069 |

|

Return of shares under incentive and stock compensation plans to treasury stock | (674 | ) | (1,066 | ) |

Issuance of shares for warrant exercise | 940 |

| 173 |

|

Common Shares Outstanding, at end of period | 369,196 |

| 395,603 |

|

See Notes to Condensed Consolidated Financial Statements.

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

Condensed Consolidated Statements of Cash Flows

|

| | | | | | |

| Three Months Ended March 31, |

(In millions) | 2017 | 2016 |

Operating Activities | (Unaudited) |

Net income | $ | 378 |

| $ | 323 |

|

Adjustments to reconcile net income to net cash provided by operating activities: | | |

Net realized capital losses | 20 |

| 155 |

|

Amortization of deferred policy acquisition costs | 363 |

| 374 |

|

Additions to deferred policy acquisition costs | (352 | ) | (354 | ) |

Depreciation and amortization | 96 |

| 95 |

|

Other operating activities, net | 111 |

| 81 |

|

Change in assets and liabilities: | | |

(Increase) decrease in reinsurance recoverables | (7 | ) | 53 |

|

Increase (decrease) in deferred and accrued income taxes | 256 |

| (14 | ) |

Increase in reserve for future policy benefits and unpaid losses and loss adjustment expenses and unearned premiums | 293 |

| 158 |

|

Net change in other assets and other liabilities | (933 | ) | (473 | ) |

Net cash provided by operating activities | 225 |

| 398 |

|

Investing Activities | | |

Proceeds from the sale/maturity/prepayment of: | | |

Fixed maturities, available-for-sale | 8,020 |

| 5,460 |

|

Fixed maturities, fair value option | 62 |

| 19 |

|

Equity securities, available-for-sale | 216 |

| 414 |

|

Mortgage loans | 213 |

| 114 |

|

Partnerships | 83 |

| 235 |

|

Payments for the purchase of: | | |

Fixed maturities, available-for-sale | (7,809 | ) | (5,752 | ) |

Fixed maturities, fair value option | — |

| (38 | ) |

Equity securities, available-for-sale | (278 | ) | (130 | ) |

Mortgage loans | (199 | ) | (128 | ) |

Partnerships | (86 | ) | (88 | ) |

Net (payments for) proceeds from derivatives | (56 | ) | 189 |

|

Net increase in policy loans | 2 |

| 2 |

|

Net additions to property and equipment | (41 | ) | (84 | ) |

Net payments for short-term investments | (1,317 | ) | (29 | ) |

Other investing activities, net | (18 | ) | 10 |

|

Net cash provided (used) by investing activities | (1,208 | ) | 194 |

|

Financing Activities | | |

Deposits and other additions to investment and universal life-type contracts | 1,398 |

| 1,165 |

|

Withdrawals and other deductions from investment and universal life-type contracts | (3,773 | ) | (4,174 | ) |

Net transfers from separate accounts related to investment and universal life-type contracts | 2,057 |

| 2,810 |

|

Repayments at maturity or settlement of consumer notes | (7 | ) | (5 | ) |

Net increase in securities loaned or sold under agreements to repurchase | 1,115 |

| 64 |

|

Repayment of debt | (416 | ) | — |

|

Proceeds from the issuance of debt | 500 |

| — |

|

Net (return) issuance of shares under incentive and stock compensation plans | (26 | ) | 10 |

|

Treasury stock acquired | (325 | ) | (350 | ) |

Dividends paid on common stock | (87 | ) | (85 | ) |

Net cash provided (used) for financing activities | 436 |

| (565 | ) |

Foreign exchange rate effect on cash | 2 |

| 4 |

|

Net (decrease) increase in cash | (545 | ) | 31 |

|

Cash – beginning of period | 882 |

| 448 |

|

Cash – end of period | $ | 337 |

| $ | 479 |

|

Supplemental Disclosure of Cash Flow Information | | |

Income tax refunds received | $ | 132 |

| $ | — |

|

Interest paid | $ | 71 |

| $ | 71 |

|

See Notes to Condensed Consolidated Financial Statements

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Dollar amounts in millions, except for per share data, unless otherwise stated)

1. Basis of Presentation and Significant Accounting Policies

Basis of Presentation

The Hartford Financial Services Group, Inc. is a holding company for insurance and financial services subsidiaries that provide property and casualty insurance, group life and disability products and mutual funds and exchange-traded products to individual and business customers in the United States (collectively, “The Hartford”, the “Company”, “we” or “our”). Also, the Company continues to run off life and annuity products previously sold.

On July 26, 2016, the Company announced the signing of a definitive agreement to sell its United Kingdom ("U.K.") property and casualty run-off subsidiaries. For discussion of this transaction, see Note 2 - Business Disposition of Notes to Condensed Consolidated Financial Statements.

The Condensed Consolidated Financial Statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) for interim financial information, which differ materially from the accounting practices prescribed by various insurance regulatory authorities. These Condensed Consolidated Financial Statements and Notes should be read in conjunction with the Consolidated Financial Statements and Notes thereto included in the Company's 2016 Form 10-K Annual Report. The results of operations for interim periods are not necessarily indicative of the results that may be expected for the full year.

The accompanying Condensed Consolidated Financial Statements and Notes are unaudited. These financial statements reflect all adjustments (generally consisting only of normal accruals) which are, in the opinion of management, necessary for the fair presentation of the financial position, results of operations and cash flows for the interim periods. The Company's significant accounting policies are summarized in Note 1 - Basis of Presentation and Significant Accounting Policies of Notes to Consolidated Financial Statements included in the Company's 2016 Form 10-K Annual Report.

Consolidation

The Condensed Consolidated Financial Statements include the accounts of The Hartford Financial Services Group, Inc., and entities in which the Company directly or indirectly has a controlling financial interest. Entities in which the Company has significant influence over the operating and financing decisions but does not control are reported using the equity method. All intercompany transactions and balances between The Hartford and its subsidiaries and affiliates have been eliminated.

Use of Estimates

The preparation of financial statements, in conformity with U.S. GAAP, requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

The most significant estimates include those used in determining property and casualty and group long-term disability (LTD) insurance product reserves, net of reinsurance; estimated gross

profits used in the valuation and amortization of assets and liabilities associated with variable annuity and other universal life-type contracts; living benefits required to be fair valued; evaluation of goodwill for impairment; valuation of investments and derivative instruments, including evaluation of other-than-temporary impairments on available-for-sale securities and valuation allowances on mortgage loans; valuation allowance on deferred tax assets; and contingencies relating to corporate litigation and regulatory matters. Certain of these estimates are particularly sensitive to market conditions, and deterioration and/or volatility in the worldwide debt or equity markets could have a material impact on the Condensed Consolidated Financial Statements.

Reclassifications

Certain reclassifications have been made to prior year financial information to conform to the current year presentation. In particular, billing installment fees that were previously reflected as an offset to insurance operating costs and other expenses are now classified as revenues.

Adoption of New Accounting Standards

Stock Compensation

On January 1, 2017 the Company adopted new stock compensation guidance issued by the Financial Accounting Standards Board ("FASB") on a prospective basis. The updated guidance requires the excess tax benefit or tax deficiency on vesting or settlement of stock-based awards to be recognized in earnings as an income tax benefit or expense, respectively, instead of as an adjustment to additional paid-in capital. The new guidance also requires the related cash flows to be presented in operating activities instead of in financing activities. The amount of excess tax benefit or tax deficiency realized on vesting or settlement of awards depends upon the difference between the market value of awards at vesting or settlement and the grant date fair value recognized through compensation expense. The excess tax benefit or tax deficiency is a discrete item in the reporting period in which it occurs and is not considered in determining the annual estimated effective tax rate for interim reporting. The excess tax benefit recognized in earnings for the three months ended March 31, 2017 was $7 and the excess tax benefit recognized in additional paid in capital for the three months ended March 31, 2016 was $24.

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

2. Business Disposition

Sale of U.K. business

On July 26, 2016, the Company announced it had entered into an agreement to sell its U.K. property and casualty run-off subsidiaries, Hartford Financial Products International Limited and Downlands Liability Management Limited, in a cash transaction to Catalina Holdings U.K. Limited ("buyer"), for approximately $262, net of transaction costs. The Company's U.K. property and casualty run-off subsidiaries are included in the P&C Other Operations reporting segment. Revenues and earnings are not material to the Company's consolidated results of operations for the three months ended March 31, 2017 and 2016.

The pending sale resulted in a total estimated after-tax capital loss from the transaction of $5 in the year ended December 31, 2016. The accrual for the estimated before tax loss is included as a reduction of the carrying value of assets held for sale in the Company's Condensed Consolidated Balance Sheets as of March 31, 2017. The transaction is expected to close in the second quarter of 2017, subject to customary closing conditions.

Carrying Values of the Assets and Liabilities to be Transferred by the Company to the Buyer in Connection with the Sale

|

| | |

| Carrying Value as of |

| March 31, 2017 | December 31, 2016 |

Assets | | |

Cash and investments | $657 | $657 |

Reinsurance recoverables and other [1] | 266 | 213 |

Total assets held for sale | $923 | $870 |

Liabilities |

| |

Reserve for future policy benefits and unpaid losses and loss adjustment expenses | $646 | $600 |

Other liabilities | 15 | 11 |

Total liabilities held for sale | $661 | $611 |

| |

[1] | Includes intercompany reinsurance recoverables of $69 and $71 to be settled in cash or securities prior to closing as of March 31, 2017 and December 31, 2016, respectively. |

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

3. Earnings Per Common Share

|

| | | | | | |

Computation of Basic and Diluted Earnings per Common Share |

| Three Months Ended March 31, |

(In millions, except for per share data) | 2017 | 2016 |

Earnings | | |

Net income | $ | 378 |

| $ | 323 |

|

Shares | | |

Weighted average common shares outstanding, basic | 371.4 |

| 398.5 |

|

Dilutive effect of stock compensation plans | 4.2 |

| 4.2 |

|

Dilutive effect of warrants | 3.0 |

| 3.6 |

|

Weighted average common shares outstanding and dilutive potential common shares | 378.6 |

| 406.3 |

|

Net income per common share | | |

Basic | $ | 1.02 |

| $ | 0.81 |

|

Diluted | $ | 1.00 |

| $ | 0.79 |

|

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONDENSED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

4. Segment Information

The Company currently conducts business principally in six reporting segments including Commercial Lines, Personal Lines, Property & Casualty Other Operations, Group Benefits, Mutual Funds and Talcott Resolution, as well as a Corporate category. The Company's revenues are generated primarily in the United States ("U.S."). Any foreign sourced revenue is immaterial.

Net Income (Loss)

|

| | | | | | |

| Three Months Ended March 31, |

Net Income (Loss) | 2017 | 2016 |

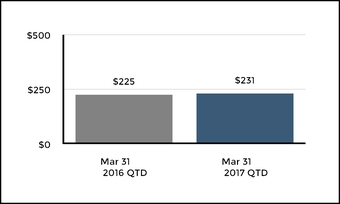

Commercial Lines [1] | $ | 231 |

| $ | 225 |

|

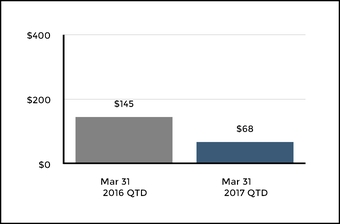

Personal Lines [1] | 33 |

| 23 |

|

Property & Casualty Other Operations | 24 |

| 17 |

|

Group Benefits | 45 |

| 50 |

|

Mutual Funds | 23 |

| 20 |

|

Talcott Resolution | 68 |

| 17 |

|

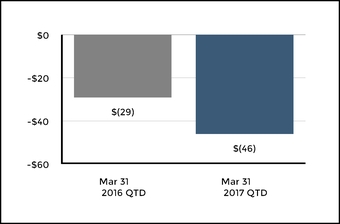

Corporate | (46 | ) | (29 | ) |

Net income | $ | 378 |

| $ | 323 |

|

| |

[1] | For the three months ended March 31, 2017 and 2016 there was a segment change which resulted in a movement from Commercial Lines to Personal Lines of $3 of net servicing revenues associated with our participation in the National Flood Insurance Program. |

Revenues

|

| | | | | | |

| Three Months Ended March 31, |

Revenues | 2017 | 2016 |

Earned premiums and fee income | | |

Commercial Lines | | |

Workers’ compensation | $ | 813 |

| $ | 759 |

|

Liability | 148 |

| 143 |

|

Package business | 314 |

| 308 |

|

Automobile | 161 |

| 158 |

|

Professional liability | 60 |

| 53 |

|

Bond | 55 |

| 53 |

|

Property | 147 |

| 159 |

|

Total Commercial Lines [1] | 1,698 |

| 1,633 |

|

Personal Lines |

|

|

|

|

Automobile | 662 |

| 685 |

|

Homeowners | 283 |

| 299 |

|

Total Personal Lines [1] [2] | 945 |

| 984 |

|

Group Benefits | | |

Group disability | 381 |

| 369 |

|

Group life | 399 |

| 375 |

|

Other | 55 |

| 51 |

|

Total Group Benefits | 835 |

| 795 |

|

Mutual Funds | | |

Mutual Fund | 167 |

| 142 |

|

Talcott | 24 |

| 25 |

|

Total Mutual Funds | 191 |

| 167 |

|

Talcott Resolution | 258 |

| 269 |

|

Corporate | 1 |

| 1 |

|

Total earned premiums and fee income | 3,928 |

| 3,849 |

|

Net investment income | 728 |

| 696 |

|

Net realized capital losses | (20 | ) | (155 | ) |

Other revenues | 19 |

| 20 |

|

Total revenues | $ | 4,655 |

| $ | 4,410 |

|

| |

[1] | Commercial Lines and Personal Lines includes installment fees of $10 and $11, respectively, for the three months ended March 31, 2017. Commercial Lines and Personal Lines includes installment fees of $10 and $9, respectively, for the three months ended March 31, 2016. |

| |

[2] | For the three months ended March 31, 2017 and 2016, AARP members accounted for earned premiums of $800 and $807, respectively. |

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

5. Fair Value Measurements

The Company carries certain financial assets and liabilities at estimated fair value. Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in the principal or most advantageous market in an orderly transaction between market participants. Our fair value framework includes a hierarchy that gives the highest priority to the use of quoted prices in active markets, followed by the use of market observable inputs, followed by the use of unobservable inputs. The fair value hierarchy levels are as follows:

| |

Level 1 | Fair values based primarily on unadjusted quoted prices for identical assets or liabilities, in active markets that the Company has the ability to access at the measurement date. |

| |

Level 2 | Fair values primarily based on observable inputs, other than quoted prices included in Level 1, or based on prices for similar assets and liabilities. |

| |

Level 3 | Fair values derived when one or more of the significant inputs are unobservable (including assumptions about risk). With little or no observable market, the determination of fair values uses considerable judgment and represents the Company’s best estimate of an amount that could be realized in a market exchange for the asset or liability. Also included are securities that are traded within illiquid markets and/or priced by independent brokers. |

The Company will classify the financial asset or liability by level based upon the lowest level input that is significant to the determination of the fair value. In most cases, both observable inputs (e.g., changes in interest rates) and unobservable inputs (e.g., changes in risk assumptions) are used to determine fair values that the Company has classified within Level 3.

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

5. Fair Value Measurements (continued)

|

| | | | | | | | | | | | |

Assets and (Liabilities) Carried at Fair Value by Hierarchy Level as of March 31, 2017 |

| Total | Quoted Prices in

Active Markets

for Identical

Assets

(Level 1) | Significant

Observable

Inputs

(Level 2) | Significant

Unobservable

Inputs

(Level 3) |

Assets accounted for at fair value on a recurring basis | | | | |

Fixed maturities, AFS | | | | |

Asset-backed-securities ("ABS") | $ | 2,265 |

| $ | — |

| $ | 2,140 |

| $ | 125 |

|

Collateralized debt obligations ("CDOs") | 2,311 |

| — |

| 1,992 |

| 319 |

|

Commercial mortgage-backed securities ("CMBS") | 5,099 |

| — |

| 4,982 |

| 117 |

|

Corporate | 25,730 |

| — |

| 24,652 |

| 1,078 |

|

Foreign government/government agencies | 1,187 |

| — |

| 1,121 |

| 66 |

|

Bonds of municipalities and political subdivisions ("municipal bonds") | 11,780 |

| — |

| 11,663 |

| 117 |

|

Residential mortgage-backed securities ("RMBS") | 3,921 |

| — |

| 1,873 |

| 2,048 |

|

U.S. Treasuries | 4,033 |

| 688 |

| 3,345 |

| — |

|

Total fixed maturities | 56,326 |

| 688 |

| 51,768 |

| 3,870 |

|

Fixed maturities, FVO | 160 |

| — |

| 160 |

| — |

|

Equity securities, trading [1] | 11 |

| 11 |

| — |

| — |

|

Equity securities, AFS | 1,223 |

| 936 |

| 188 |

| 99 |

|

Derivative assets | | | | |

Credit derivatives | 2 |

| — |

| 2 |

| — |

|

Equity derivatives | 4 |

| — |

| — |

| 4 |

|

Foreign exchange derivatives | 3 |

| — |

| 3 |

| — |

|

Interest rate derivatives | 48 |

| — |

| 43 |

| 5 |

|

GMWB hedging instruments | 80 |

| — |

| 36 |

| 44 |

|

Macro hedge program | 113 |

| — |

| 9 |

| 104 |

|

Total derivative assets [2] | 250 |

| — |

| 93 |

| 157 |

|

Short-term investments | 4,595 |

| 2,077 |

| 2,518 |

| — |

|

Reinsurance recoverable for GMWB | 60 |

| — |

| — |

| 60 |

|

Modified coinsurance reinsurance contracts | 66 |

| — |

| 66 |

| — |

|

Separate account assets [3] | 113,585 |

| 73,539 |

| 38,882 |

| 277 |

|

Total assets accounted for at fair value on a recurring basis | $ | 176,276 |

| $ | 77,251 |

| $ | 93,675 |

| $ | 4,463 |

|

Liabilities accounted for at fair value on a recurring basis | | | | |

Other policyholder funds and benefits payable | | | | |

GMWB embedded derivative | $ | (157 | ) | $ | — |

| $ | — |

| $ | (157 | ) |

Equity linked notes | (36 | ) | — |

| — |

| (36 | ) |

Total other policyholder funds and benefits payable | (193 | ) | — |

| — |

| (193 | ) |

Derivative liabilities | | | | |

Credit derivatives | (2 | ) | — |

| (2 | ) | — |

|

Equity derivatives | 37 |

| — |

| 37 |

| — |

|

Foreign exchange derivatives | (262 | ) | — |

| (262 | ) | — |

|

Interest rate derivatives | (517 | ) | — |

| (488 | ) | (29 | ) |

GMWB hedging instruments | 3 |

| — |

| 1 |

| 2 |

|

Macro hedge program | 58 |

| — |

| 3 |

| 55 |

|

Total derivative liabilities [4] | (683 | ) | — |

| (711 | ) | 28 |

|

Contingent consideration [5] | (26 | ) | — |

| — |

| (26 | ) |

Total liabilities accounted for at fair value on a recurring basis | $ | (902 | ) | $ | — |

| $ | (711 | ) | $ | (191 | ) |

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

5. Fair Value Measurements (continued)

|

| | | | | | | | | | | | |

Assets and (Liabilities) Carried at Fair Value by Hierarchy Level as of December 31, 2016 |

| Total | Quoted Prices in Active Markets for Identical Assets (Level 1) | Significant Observable Inputs (Level 2) | Significant Unobservable Inputs (Level 3) |

Assets accounted for at fair value on a recurring basis | | | | |

Fixed maturities, AFS | | | | |

ABS | $ | 2,382 |

| $ | — |

| $ | 2,300 |

| $ | 82 |

|

CDOs | 1,916 |

| — |

| 1,502 |

| 414 |

|

CMBS | 4,936 |

| — |

| 4,856 |

| 80 |

|

Corporate | 25,666 |

| — |

| 24,586 |

| 1,080 |

|

Foreign government/government agencies | 1,171 |

| — |

| 1,107 |

| 64 |

|

Municipal bonds | 11,486 |

| — |

| 11,368 |

| 118 |

|

RMBS | 4,767 |

| — |

| 2,795 |

| 1,972 |

|

U.S. Treasuries | 3,679 |

| 620 |

| 3,059 |

| — |

|

Total fixed maturities | 56,003 |

| 620 |

| 51,573 |

| 3,810 |

|

Fixed maturities, FVO | 293 |

| 1 |

| 281 |

| 11 |

|

Equity securities, trading [1] | 11 |

| 11 |

| — |

| — |

|

Equity securities, AFS | 1,097 |

| 821 |

| 177 |

| 99 |

|

Derivative assets | | | | |

Credit derivatives | 17 |

| — |

| 17 |

| — |

|

Foreign exchange derivatives | 27 |

| — |

| 27 |

| — |

|

Interest rate derivatives | (427 | ) | — |

| (427 | ) | — |

|

GMWB hedging instruments | 74 |

| — |

| 14 |

| 60 |

|

Macro hedge program | 128 |

| — |

| 8 |

| 120 |

|

Other derivative contracts | 1 |

| — |

| — |

| 1 |

|

Total derivative assets [2] | (180 | ) | — |

| (361 | ) | 181 |

|

Short-term investments | 3,244 |

| 878 |

| 2,366 |

| — |

|

Reinsurance recoverable for GMWB | 73 |

| — |

| — |

| 73 |

|

Modified coinsurance reinsurance contracts | 68 |

| — |

| 68 |

| — |

|

Separate account assets [3] | 111,634 |

| 71,606 |

| 38,856 |

| 201 |

|

Total assets accounted for at fair value on a recurring basis | $ | 172,243 |

| $ | 73,937 |

| $ | 92,960 |

| $ | 4,375 |

|

Liabilities accounted for at fair value on a recurring basis | | | | |

Other policyholder funds and benefits payable | | | | |

GMWB embedded derivative | $ | (241 | ) | $ | — |

| $ | — |

| $ | (241 | ) |

Equity linked notes | (33 | ) | — |

| — |

| (33 | ) |

Total other policyholder funds and benefits payable | (274 | ) | — |

| — |

| (274 | ) |

Derivative liabilities | | | | |

Credit derivatives | (13 | ) | — |

| (13 | ) | — |

|

Equity derivatives | 33 |

| — |

| 33 |

| — |

|

Foreign exchange derivatives | (237 | ) | — |

| (237 | ) | — |

|

Interest rate derivatives | (542 | ) | — |

| (521 | ) | (21 | ) |

GMWB hedging instruments | 20 |

| — |

| (1 | ) | 21 |

|

Macro hedge program | 50 |

| — |

| 3 |

| 47 |

|

Total derivative liabilities [4] | (689 | ) | — |

| (736 | ) | 47 |

|

Contingent consideration [5] | (25 | ) | — |

| — |

| (25 | ) |

Total liabilities accounted for at fair value on a recurring basis | $ | (988 | ) | $ | — |

| $ | (736 | ) | $ | (252 | ) |

| |

[1] | Included in other investments on the Condensed Consolidated Balance Sheets. |

| |

[2] | Includes OTC and OTC-cleared derivative instruments in a net positive fair value position after consideration of the accrued interest and impact of collateral posting requirements which may be imposed by agreements, clearing house rules and applicable law. See footnote 4 to this table for derivative liabilities. |

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

5. Fair Value Measurements (continued)

| |

[3] | Approximately $3.0 billion and $4.0 billion of investment sales receivable, as of March 31, 2017, and December 31, 2016, respectively, are excluded from this disclosure requirement because they are trade receivables in the ordinary course of business where the carrying amount approximates fair value. Included in the total fair value amount are $887 and $1.0 billion of investments, as of March 31, 2017 and December 31, 2016, for which the fair value is estimated using the net asset value per unit as a practical expedient which are excluded from the disclosure requirement to classify amounts in the fair value hierarchy. |

| |

[4] | Includes OTC and OTC-cleared derivative instruments in a net negative fair value position (derivative liability) after consideration of the accrued interest and impact of collateral posting requirements, which may be imposed by agreements, clearing house rules and applicable law. |

| |

[5] | For additional information see the Contingent Consideration section below. |

Fixed Maturities, Equity Securities, Short-term Investments, and Free-standing Derivatives

Valuation Techniques

The Company generally determines fair values using valuation techniques that use prices, rates, and other relevant information evident from market transactions involving identical or similar instruments. Valuation techniques also include, where appropriate, estimates of future cash flows that are converted into a single discounted amount using current market expectations. The Company uses a "waterfall" approach comprised of the following pricing sources and techniques, which are listed in priority order:

| |

• | Quoted prices, unadjusted, for identical assets or liabilities in active markets, which are classified as Level 1. |

| |

• | Prices from third-party pricing services, which primarily utilize a combination of techniques. These services utilize recently reported trades of identical, similar, or benchmark securities making adjustments for market observable inputs available through the reporting date. If there are no recently reported trades, they may use a discounted cash flow technique to develop a price using expected cash flows based upon the anticipated future performance of the underlying collateral discounted at an estimated market rate. Both techniques develop prices that consider the time value of future cash flows and provide a margin for risk, including liquidity and credit risk. Most prices provided by third-party pricing services are classified as Level 2 because the inputs used in pricing the securities are observable. However, some securities that are less liquid or trade less actively are classified as Level 3. Additionally, certain long-dated securities, including certain municipal securities, foreign government/government agency securities, and bank loans, include benchmark interest rate or credit spread assumptions that are not observable in the marketplace and are thus classified as Level 3. |

| |

• | Internal matrix pricing, which is a valuation process internally developed for private placement securities for which the Company is unable to obtain a price from a third-party pricing service. Internal pricing matrices determine credit spreads that, when combined with risk-free rates, are applied to contractual cash flows to develop a price. The Company develops credit spreads using market based data for public securities adjusted for credit spread differentials between public and private securities, which are obtained from a survey of multiple private placement brokers. The market-based reference credit spread considers the issuer’s financial strength and term to maturity, using an |

independent public security index and trade information, while the credit spread differential considers the non-public nature of the security. Securities priced using internal matrix pricing are classified as Level 2 because the inputs are observable or can be corroborated with observable data.

| |

• | Independent broker quotes, which are typically non-binding and use inputs that can be difficult to corroborate with observable market based data. Brokers may use present value techniques using assumptions specific to the security types, or they may use recent transactions of similar securities. Due to the lack of transparency in the process that brokers use to develop prices, valuations that are based on independent broker quotes are classified as Level 3. |

The fair value of free-standing derivative instruments are determined primarily using a discounted cash flow model or option model technique and incorporate counterparty credit risk. In some cases, quoted market prices for exchange-traded and OTC-cleared derivatives may be used and in other cases independent broker quotes may be used. The pricing valuation models primarily use inputs that are observable in the market or can be corroborated by observable market data. The valuation of certain derivatives may include significant inputs that are unobservable, such as volatility levels, and reflect the Company’s view of what other market participants would use when pricing such instruments. Unobservable market data is used in the valuation of customized derivatives that are used to hedge certain GMWB variable annuity riders. See the section “GMWB Embedded, Customized, and Reinsurance Derivatives” below for further discussion of the valuation model used to value these customized derivatives.

Valuation Controls

The fair value process for investments is monitored by the Valuation Committee, which is a cross-functional group of senior management within the Company that meets at least quarterly. The purpose of the committee is to oversee the pricing policy and procedures, as well as approving changes to valuation methodologies and pricing sources. Controls and procedures used to assess third-party pricing services are reviewed by the Valuation Committee, including the results of annual due-diligence reviews.

There are also two working groups under the Valuation Committee: a Securities Fair Value Working Group (“Securities Working Group”) and a Derivatives Fair Value Working Group ("Derivatives Working Group"). The working groups, which include various investment, operations, accounting and risk management professionals, meet monthly to review market data trends, pricing and trading statistics and results, and any proposed pricing methodology changes.

The Securities Working Group reviews prices received from third parties to ensure that the prices represent a reasonable estimate of the fair value. The group considers trading volume, new

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

5. Fair Value Measurements (continued)

issuance activity, market trends, new regulatory rulings and other factors to determine whether the market activity is significantly different than normal activity in an active market. A dedicated pricing unit follows up with trading and investment sector professionals and challenges prices of third-party pricing services when the estimated assumptions used differ from what the unit believes a market participant would use. If the available evidence indicates that pricing from third-party pricing services or broker quotes is based upon transactions that are stale or not from trades made in an orderly market, the Company places little, if any, weight on the third party service’s transaction price and will estimate fair value using an internal process, such as a pricing matrix.

The Derivatives Working Group reviews the inputs, assumptions and methodologies used to ensure that the prices represent a reasonable estimate of the fair value. A dedicated pricing team works directly with investment sector professionals to investigate the impacts of changes in the market environment on prices or valuations of derivatives. New models and any changes to current models are required to have detailed documentation and are validated to a second source. The model validation documentation and results of validation are presented to the Valuation Committee for approval.

The Company conducts other monitoring controls around securities and derivatives pricing including, but not limited to, the following:

| |

• | Review of daily price changes over specific thresholds and new trade comparison to third-party pricing services. |

| |

• | Daily comparison of OTC derivative market valuations to counterparty valuations. |

| |

• | Review of weekly price changes compared to published bond prices of a corporate bond index. |

| |

• | Monthly reviews of price changes over thresholds, stale prices, missing prices, and zero prices. |

| |

• | Monthly validation of prices to a second source for securities in most sectors and for certain derivatives. |

In addition, the Company’s enterprise-wide Operational Risk Management function, led by the Chief Risk Officer, is responsible for model risk management and provides an independent review of the suitability and reliability of model inputs, as well as an analysis of significant changes to current models.

Valuation Inputs

Quoted prices for identical assets in active markets are considered Level 1 and consist of on-the-run U.S. Treasuries, money market funds, exchange-traded equity securities, open-ended mutual funds, short-term investments, and exchange traded futures and option contracts.

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

5. Fair Value Measurements (continued)

|

| | | |

Valuation Inputs Used in Levels 2 and 3 Measurements for Securities and Freestanding Derivatives |

Level 2 Primary Observable Inputs | Level 3 Primary Unobservable Inputs |

Fixed Maturity Investments |

Structured securities (includes ABS, CDOs CMBS and RMBS) |

| • Benchmark yields and spreads • Monthly payment information • Collateral performance, which varies by vintage year and includes delinquency rates, loss severity rates and refinancing assumptions • Credit default swap indices

Other inputs for ABS and RMBS: • Estimate of future principal prepayments, derived based on the characteristics of the underlying structure • Prepayment speeds previously experienced at the interest rate levels projected for the collateral | | • Independent broker quotes • Credit spreads beyond observable curve • Interest rates beyond observable curve

Other inputs for less liquid securities or those that trade less actively, including subprime RMBS: • Estimated cash flows • Credit spreads, which include illiquidity premium • Constant prepayment rates • Constant default rates • Loss severity |

Corporates |

| • Benchmark yields and spreads • Reported trades, bids, offers of the same or similar securities • Issuer spreads and credit default swap curves

Other inputs for investment grade privately placed securities that utilize internal matrix pricing : • Credit spreads for public securities of similar quality, maturity, and sector, adjusted for non-public nature | | • Independent broker quotes • Credit spreads beyond observable curve • Interest rates beyond observable curve

Other inputs for below investment grade privately placed securities: • Independent broker quotes • Credit spreads for public securities of similar quality, maturity, and sector, adjusted for non-public nature |

U.S Treasuries, Municipals, and Foreign government/government agencies |

| • Benchmark yields and spreads • Issuer credit default swap curves • Political events in emerging market economies • Municipal Securities Rulemaking Board reported trades and material event notices • Issuer financial statements | | • Independent broker quotes • Credit spreads beyond observable curve • Interest rates beyond observable curve |

Equity Securities |

| • Quoted prices in markets that are not active | | • For privately traded equity securities, internal discounted cash flow models utilizing earnings multiples or other cash flow assumptions that are not observable; or they may be held at cost |

Short Term Investments |

| • Benchmark yields and spreads • Reported trades, bids, offers • Issuer spreads and credit default swap curves • Material event notices and new issue money market rates | | Not applicable |

Derivatives |

Credit derivatives |

| • Swap yield curve • Credit default swap curves | | • Independent broker quotes • Yield curves beyond observable limits |

Equity derivatives |

| • Equity index levels • Swap yield curve | | • Independent broker quotes • Equity volatility |

Foreign exchange derivatives |

| • Swap yield curve • Currency spot and forward rates • Cross currency basis curves | | • Independent broker quotes |

Interest rate derivatives |

| • Swap yield curve | | • Independent broker quotes • Interest rate volatility |

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

5. Fair Value Measurements (continued)

|

| | | | | | | | | |

Significant Unobservable Inputs for Level 3 - Securities |

Assets accounted for at fair value on a recurring basis | Fair

Value | Predominant

Valuation

Technique | Significant Unobservable Input | Minimum | Maximum | Weighted Average [1] | Impact of

Increase in Input

on Fair Value [2] |

As of March 31, 2017 |

CMBS [3] | $ | 76 |

| Discounted cash flows | Spread (encompasses prepayment, default risk and loss severity) | 9 bps | 1,272 bps | 463 bps | Decrease |

Corporate [4] | 438 |

| Discounted cash flows | Spread | 107 bps | 963 bps | 328 bps | Decrease |

Municipal [3] | 101 |

| Discounted cash flows | Spread | 186 bps | 241 bps | 208 bps | Decrease |

RMBS [3] | 2,038 |

| Discounted cash flows | Spread | 34 bps | 1,371 bps | 179 bps | Decrease |

| | | Constant prepayment rate | —% | 20% | 4% | Decrease [5] |

| | | Constant default rate | 1% | 10% | 5% | Decrease |

| | | Loss severity | —% | 100% | 73% | Decrease |

As of December 31, 2016 |

CMBS [3] | $ | 52 |

| Discounted cash flows | Spread (encompasses prepayment, default risk and loss severity) | 10 bps | 1,273 bps | 366 bps | Decrease |

Corporate [4] | 510 |

| Discounted cash flows | Spread | 122 bps | 1,302 bps | 359 bps | Decrease |

Municipal [3] | 101 |

| Discounted cash flows | Spread | 135 bps | 286 bps | 221 bps | Decrease |

RMBS [3] | 1,963 |

| Discounted cash flows | Spread | 16 bps | 1,830 bps | 192 bps | Decrease |

| | | Constant prepayment rate | —% | 20% | 4% | Decrease [5] |

| | | Constant default rate | —% | 11% | 5% | Decrease |

| | | Loss severity | —% | 100% | 75% | Decrease |

| |

[1] | The weighted average is determined based on the fair value of the securities. |

| |

[2] | Conversely, the impact of a decrease in input would have the opposite impact to the fair value as that presented in the table. |

| |

[3] | Excludes securities for which the Company based fair value on broker quotations. |

| |

[4] | Excludes securities for which the Company bases fair value on broker quotations; however, included are broker priced lower-rated private placement securities for which the Company receives spread and yield information to corroborate the fair value. |

| |

[5] | Decrease for above market rate coupons and increase for below market rate coupons. |

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

5. Fair Value Measurements (continued)

|

| | | | | | | | | | |

Significant Unobservable Inputs for Level 3 - Freestanding Derivatives |

| Fair

Value | Predominant

Valuation

Technique | Significant Unobservable Input | Minimum | Maximum | Impact of

Increase in Input on

Fair Value [1] |

As of March 31, 2017 |

Interest rate derivatives | | | | | | |

Interest rate swaps | $ | (29 | ) | Discounted cash flows | Swap curve beyond 30 years | 3 | % | 3 | % | Decrease |

Interest rate swaptions [2] | 5 |

| Option model | Interest rate volatility | 2 | % | 2 | % | Increase |

GMWB hedging instruments | | | | | | |

Equity variance swaps | (39 | ) | Option model | Equity volatility | 16 | % | 20 | % | Increase |

Equity options | 9 |

| Option model | Equity volatility | 26 | % | 28 | % | Increase |

Customized swaps | 76 |

| Discounted cash flows | Equity volatility | 9 | % | 30 | % | Increase |

Macro hedge program [3] | | | | | | |

Equity options | 164 |

| Option model | Equity volatility | 15 | % | 32 | % | Increase |

As of December 31, 2016 |

Interest rate derivatives | | | | | | |

Interest rate swaps | $ | (29 | ) | Discounted cash flows | Swap curve beyond 30 years | 3 | % | 3 | % | Decrease |

Interest rate swaptions [2] | 8 |

| Option model | Interest rate volatility | 2 | % | 2 | % | Increase |

GMWB hedging instruments | | | | | | |

Equity variance swaps | (36 | ) | Option model | Equity volatility | 20 | % | 23 | % | Increase |

Equity options | 17 |

| Option model | Equity volatility | 27 | % | 30 | % | Increase |

Customized swaps | 100 |

| Discounted cash flows | Equity volatility | 12 | % | 30 | % | Increase |

Macro hedge program [3] | | | | | | |

Equity options | 188 |

| Option model | Equity volatility | 17 | % | 28 | % | Increase |

| |

[1] | Conversely, the impact of a decrease in input would have the opposite impact to the fair value as that presented in the table. Changes are based on long positions, unless otherwise noted. Changes in fair value will be inversely impacted for short positions. |

| |

[2] | The swaptions presented are purchased options that have the right to enter into a pay-fixed swap. |

| |

[3] | Excludes derivatives for which the Company bases fair value on broker quotations. |

The tables above exclude the portion of ABS, CRE CDOs, index options and certain corporate securities for which fair values are predominately based on independent broker quotes. While the Company does not have access to the significant unobservable inputs that independent brokers may use in their pricing process, the Company believes brokers likely use inputs similar to those used by the Company and third-party pricing services to price similar instruments. As such, in their pricing models, brokers likely use estimated loss severity rates, prepayment rates, constant default rates and credit spreads. Therefore, similar to non-broker priced securities, increases in these inputs would generally cause fair values to decrease. For the three months ended March 31, 2017, no significant adjustments were made by the Company to broker prices received.

Transfers between Levels

Transfers of securities among the levels occur at the beginning of the reporting period. The amount of transfers from Level 1 to Level 2 was $621 and $741 for the three months ended March 31, 2017 and March 31, 2016, respectively, which represented previously on-the-run U.S. Treasury securities that are now off-the-run. For the three months ended March 31, 2017 and 2016, there were no transfers from Level 2 to Level 1. See the fair value roll-forward tables for the three months ended March 31, 2017 and 2016, for the transfers into and out of Level 3.

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

5. Fair Value Measurements (continued)

GMWB Embedded, Customized and Reinsurance Derivatives |

| |

GMWB Embedded Derivatives | The Company formerly offered certain variable annuity products with GMWB riders that provide the policyholder with a guaranteed remaining balance ("GRB") which is generally equal to premiums less withdrawals. If the policyholder’s account value is reduced to a specified level through a combination of market declines and withdrawals but the GRB still has value, the Company is obligated to continue to make annuity payments to the policyholder until the GRB is exhausted. When payments of the GRB are not life-contingent, the GMWB represents an embedded derivative carried at fair value reported in other policyholder funds and benefits payable in the Condensed Consolidated Balance Sheets with changes in fair value reported in net realized capital gains and losses. |

Free-standing Customized Derivatives | The Company holds free-standing customized derivative contracts to provide protection from certain capital markets risks for the remaining term of specified blocks of non-reinsured GMWB riders. These customized derivatives are based on policyholder behavior assumptions specified at the inception of the derivative contracts. The Company retains the risk for differences between assumed and actual policyholder behavior and between the performance of the actively managed funds underlying the separate accounts and their respective indices. These derivatives are reported in the Condensed Consolidated Balance Sheets within other investments or other liabilities, as appropriate, after considering the impact of master netting agreements. |

GMWB Reinsurance Derivative | The Company has reinsurance arrangements in place to transfer a portion of its risk of loss due to GMWB. These arrangements are recognized as derivatives carried at fair value and reported in reinsurance recoverables in the Condensed Consolidated Balance Sheets. Changes in the fair value of the reinsurance agreements are reported in net realized capital gains and losses. |

Valuation Techniques

Fair values for GMWB embedded derivatives, free-standing customized derivatives and reinsurance derivatives are classified as Level 3 in the fair value hierarchy and are calculated using internally developed models that utilize significant unobservable inputs because active, observable markets do not exist for these items. In valuing the GMWB embedded derivative, the Company attributes to the derivative a portion of the expected fees to be collected over the expected life of the contract from the contract holder equal to the present value of future GMWB claims. The excess of fees collected from the contract holder in the current period over the portion of fees attributed to the embedded derivative in the current period are associated with the host variable annuity contract and reported in fee income.

Valuation Controls

Oversight of the Company's valuation policies and processes for GMWB embedded, reinsurance, and customized derivatives is performed by a multidisciplinary group comprised of finance, actuarial and risk management professionals. This multidisciplinary group reviews and approves changes and enhancements to the Company's valuation model as well as associated controls.

Valuation Inputs

The fair value for each of the non-life contingent GMWBs, the free-standing customized derivatives and the GMWB reinsurance derivative is calculated as an aggregation of the following components: Best Estimate Claim Payments; Credit Standing Adjustment; and Margins. The Company believes the aggregation of these components results in an amount that a market participant in an active liquid market would require, if such a market existed, to assume the risks associated with the guaranteed minimum benefits and the related reinsurance and customized derivatives. Each component described in the following discussion is unobservable in the marketplace and requires subjectivity by the Company in determining its value.

Best Estimate Claim Payments

The Best Estimate Claim Payments are calculated based on actuarial and capital market assumptions related to projected cash flows, including the present value of benefits and related contract charges, over the lives of the contracts, incorporating unobservable inputs including expectations concerning policyholder behavior. These assumptions are input into a stochastic risk neutral scenario process that is used to determine the valuation and involves numerous estimates and subjective judgments regarding a number of variables.

The Company monitors various aspects of policyholder behavior and may modify certain of its assumptions, including living benefit lapses and withdrawal rates, if credible emerging data indicates that changes are warranted. In addition, the Company will continue to evaluate policyholder behavior assumptions should we implement initiatives to reduce the size of the variable annuity business. At a minimum, all policyholder behavior assumptions are reviewed and updated at least annually as part of the Company’s annual fourth-quarter comprehensive study to refine its estimate of future gross profits. In addition, the Company recognizes non-market-based updates driven by the relative outperformance (underperformance) of the underlying actively managed funds as compared to their respective indices.

Credit Standing Adjustment

The credit standing adjustment is an estimate of the additional amount that market participants would require in determining fair value to reflect the risk that GMWB benefit obligations or the GMWB reinsurance recoverables will not be fulfilled. The Company incorporates a blend of observable Company and reinsurer credit default spreads from capital markets, adjusted for market recoverability.

Margins

The behavior risk margin adds a margin that market participants would require, in determining fair value, for the risk that the Company’s assumptions about policyholder behavior could differ from actual experience. The behavior risk margin is calculated by taking the difference between adverse policyholder behavior assumptions and best estimate assumptions.

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

5. Fair Value Measurements (continued)

|

| | | |

Valuation Inputs Used in Levels 2 and 3 Measurements for GMWB Embedded, Customized and Reinsurance Derivatives |

Level 2

Primary Observable Inputs | Level 3

Primary Unobservable Inputs |

| • Risk-free rates as represented by the Eurodollar futures, LIBOR deposits and swap rates to derive forward curve rates • Correlations of 10 years of observed historical returns across underlying well-known market indices • Correlations of historical index returns compared to separate account fund returns • Equity index levels | | • Market implied equity volatility assumptions

Assumptions about policyholder behavior, including:

• Withdrawal utilization

• Withdrawal rates

• Lapse rates • Reset elections |

|

| | | |

Significant Unobservable Inputs for Level 3 GMWB Embedded Customized and Reinsurance Derivatives |

| As of March 31, 2017 |

Significant Unobservable Input | Unobservable Inputs (Minimum) | Unobservable Inputs (Maximum) | Impact of Increase in Input

on Fair Value Measurement [1] |

Withdrawal Utilization [2] | 15% | 100% | Increase |

Withdrawal Rates [3] | —% | 8% | Increase |

Lapse Rates [4] | —% | 40% | Decrease |

Reset Elections [5] | 20% | 75% | Increase |

Equity Volatility [6] | 9% | 30% | Increase |

| As of December 31, 2016 |

Significant Unobservable Input | Unobservable Inputs (Minimum) | Unobservable Inputs (Maximum) | Impact of Increase in Input

on Fair Value Measurement [1] |

Withdrawal Utilization [2] | 15% | 100% | Increase |

Withdrawal Rates [3] | —% | 8% | Increase |

Lapse Rates [4] | —% | 40% | Decrease |

Reset Elections [5] | 20% | 75% | Increase |

Equity Volatility [6] | 12% | 30% | Increase |

| |