Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ¨

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

THE AES CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number.

Table of Contents

NOTICE OF 2013 ANNUAL MEETING OF STOCKHOLDERS OF THE AES CORPORATION

TO BE HELD ON THURSDAY, APRIL 18, 2013

March 5, 2013

TO THE HOLDERS OF COMMON STOCK OF THE AES CORPORATION:

Notice is hereby given that the 2013 Annual Meeting of Stockholders of The AES Corporation (the “Company” or “AES”) will be held on Thursday, April 18, 2013, at 9:30 a.m. EDT, at 4300 Wilson Boulevard, Arlington, Virginia 22203 (in the Rotunda Conference Room, 9th floor), for the following purposes, as more fully described in the accompanying Proxy Statement:

| 1. | To elect eleven members to the Board of Directors; |

| 2. | To ratify the appointment of Ernst & Young LLP (“E&Y” or the “Independent Registered Public Accounting Firm”) of the Company for the year 2013; |

| 3. | To approve, on an advisory basis, the Company’s executive compensation; and |

| 4. | To transact such other business as may properly come before the Annual Meeting. |

Doors to the meeting will open at 8:30 a.m. EDT. Stockholders of record at the close of business on February 22, 2013 are entitled to notice of, and to vote at, the Annual Meeting. If you plan to attend the Annual Meeting, please note that, for security reasons, before being admitted, you must present your admission ticket or proof of ownership and valid photo identification at the door. All hand-carried items will be subject to inspection and any bags, briefcases or packages must be checked at the registration desk prior to entering the meeting room.

Brian A. Miller

Executive Vice President, General Counsel

and Corporate Secretary

Table of Contents

| 1 | ||||

| 2 | ||||

| 3 | ||||

| Questions and Answers Regarding the Proxy Statement and Annual Meeting |

3 | |||

| 5 | ||||

| 10 | ||||

| 15 | ||||

| 15 | ||||

| 15 | ||||

| 18 | ||||

| 22 | ||||

| 24 | ||||

| 33 | ||||

| 38 | ||||

| 38 | ||||

| 39 | ||||

| 42 | ||||

| 43 | ||||

| 45 | ||||

| 47 | ||||

| 48 | ||||

| Narrative Disclosure Relating to the Non-Qualified Deferred Compensation Table |

50 | |||

| 52 | ||||

| 54 | ||||

| 56 | ||||

| 59 | ||||

| 61 | ||||

| 63 | ||||

| 64 | ||||

| 65 | ||||

| 67 | ||||

| PROPOSAL 3: TO APPROVE, ON AN ADVISORY BASIS, THE COMPANY’S EXECUTIVE COMPENSATION |

68 | |||

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS, DIRECTORS AND EXECUTIVE OFFICERS |

70 | |||

| 72 | ||||

| 76 |

2

Table of Contents

March 5, 2013

The Board of Directors (the “Board”) of The AES Corporation (the “Company” or “AES”) is soliciting Proxies to be voted on the Stockholders behalf at the 2013 Annual Meeting of Stockholders.

The Annual Meeting will commence at 9:30 a.m. EDT on Thursday, April 18, 2013. The Annual Meeting will be held in the Rotunda Conference Room on the 9th floor of the Company’s corporate offices located at 4300 Wilson Boulevard, Arlington, Virginia 22203. Any adjournment of the Annual Meeting will be held at the same address. Directions to the Annual Meeting are located on page 76 of this Proxy Statement.

This Proxy Statement provides information regarding the matters to be voted on at the Annual Meeting as well as other information that may be useful to you. In accordance with rules adopted by the United States Securities and Exchange Commission (the “SEC”), instead of mailing a printed copy of our proxy materials to each Stockholder of record, we are furnishing proxy materials to our Stockholders on the Internet. If you received a Notice of Internet Availability of Proxy Materials by mail, you will not receive a printed copy of the proxy materials other than as described below. Instead, the Notice of Internet Availability of Proxy Materials will instruct you as to how you may access and review all of the important information contained in the proxy materials. The Notice of Internet Availability of Proxy Materials also instructs you as to how you may submit your Proxy over the Internet. If you received a Notice of Internet Availability of Proxy Materials by mail and would like to receive a printed copy of our proxy materials, you should follow the instructions for requesting such materials included in the Notice of Internet Availability of Proxy Materials.

It is anticipated that the Notice of Internet Availability of Proxy Materials will first be sent to Stockholders on or about March 7, 2013. This Proxy Statement and accompanying Proxy Card, Annual Report on Form 10-K and related proxy materials will first be made available to Stockholders on or about March 7, 2013 at www.envisionreports.com/aes for registered holders of AES stock and, at www.edocumentview.com/aes for beneficial holders of AES stock. In accordance with SEC rules, the websites, www.envisionreports.com/aes and www.edocumentview.com/aes provide complete anonymity with respect to a Stockholder accessing the websites.

At the close of business on February 22, 2013, there were 745,767,100 shares of common stock outstanding. Each share of common stock is entitled to one vote.

Questions And Answers Regarding The Proxy Statement And Annual Meeting

WHAT IS THE RECORD DATE?

The record date has been established by the Board as permitted by Delaware law. Owners of record of our common stock at the close of business on the record date are entitled to receive notice of the Annual Meeting. Such owners of record are also entitled to vote at the Annual Meeting and any adjournments of the Annual Meeting. Each share of common stock is entitled to one vote. The record date for the Annual Meeting is February 22, 2013.

HOW DOES A STOCKHOLDER SUBMIT A VOTE ON A PROPOSAL?

A Stockholder may vote by marking, signing, dating and returning the enclosed Proxy Card in the enclosed prepaid envelope. Alternatively, a Stockholder may vote by telephone, via the Internet, or in person by attending the Annual Meeting. Only Stockholders registered on the books of our transfer agent may vote in person at the Annual Meeting. Instructions on how to vote by phone or via the Internet are set forth on the enclosed Proxy Card. If a Stockholder owns shares through a broker or other intermediary, voting instructions will be set forth on the voting instruction card provided by your broker or other intermediary.

WHAT ARE THE APPROVAL REQUIREMENTS?

If a Proxy is properly executed, the shares it represents will be voted at the Annual Meeting in accordance with the instructions noted on the Proxy. If no instructions are specified in the Proxy with respect to the matters to be acted upon, the

3

Table of Contents

shares represented by the Proxy will be voted in accordance with the recommendations of the Board. The recommendations of the Board regarding the matters to be acted upon at the Annual Meeting are set forth in this Proxy Statement. Each share of common stock is entitled to one vote on each proposal contained herein. For any proposal, except as otherwise provided by law, rule, AES’ Sixth Restated Certificate of Incorporation or our Amended and Restated Bylaws (“Bylaws”), the affirmative vote of a majority of the shares of common stock present in person or represented by Proxy at the meeting and entitled to vote on the matter is required for approval. In tabulating the voting results for any particular proposal, abstentions have the same effect as votes against the matter. If you hold shares beneficially in street name and do not provide your broker with voting instructions, your shares may be treated as “broker non-votes.” Generally, broker non-votes occur when a broker is not permitted to vote on a particular matter without instructions from the beneficial owner and instructions have not been given. Brokers that have not received voting instructions from their clients cannot vote on their clients’ behalf on “non-routine” proposals, such as the election of Directors and the advisory approval of the Company’s executive compensation, although they may vote their clients’ shares on “routine” proposals such as the proposal seeking ratification of E&Y as the independent registered public accounting firm for the year 2013. In tabulating the voting result for any particular proposal, shares that constitute broker non-votes are not considered entitled to vote on that proposal.

WHAT CONSTITUTES A QUORUM?

For business to be conducted at the Annual Meeting, a quorum must be present or represented by Proxy. Under our Bylaws, the presence of a majority of the outstanding shares of our common stock entitled to vote at the Annual Meeting will constitute a quorum. The number of outstanding shares of common stock entitled to vote at the Annual Meeting is determined as of the record date. Abstentions and broker non-votes will be counted in determining whether a quorum is present for the Annual Meeting. A copy of the Bylaws is available on our website (www.aes.com).

MAY A STOCKHOLDER CHANGE A VOTE?

Stockholders are entitled to revoke their Proxies at any time before their shares are voted at the Annual Meeting. To revoke a Proxy, a Stockholder must file a written notice of revocation with the Company, deliver a duly executed Proxy bearing a later date than the original submitted Proxy, submit voting instructions again by telephone or the Internet, or attend the Annual Meeting and vote in person. Attendance at the Annual Meeting will not, by itself, revoke your Proxy. If you hold shares in street name, you must contact your broker, bank or other nominee to change your vote or obtain a Proxy to vote your shares if you wish to cast your vote in person at the meeting.

ARE VOTING RECORDS CONFIDENTIAL?

We require vote tabulators and the Inspector of the Election to execute agreements to maintain the confidentiality of voting records. Voting records will remain confidential, except as necessary to meet legal requirements and in other limited circumstances such as proxy contests.

HOW DOES THE COMPANY SOLICIT PROXIES?

The Company will solicit Proxies by mail, telephone, or other means of communication. We will bear the cost of the solicitation of Proxies. The Company has retained Computershare Trust Co., N.A. and Georgeson Inc. to assist in soliciting Proxies from Stockholders and we will pay a fee estimated at $12,000, plus expenses, for such services. In addition, solicitation may be made by our Directors, Officers, and other employees. We reimburse brokerage firms, custodians, nominees, and fiduciaries in accordance with the rules of the Financial Industry Regulatory Authority for reasonable expenses incurred by them in forwarding materials to the beneficial owners of our common stock.

DO I NEED AN ADMISSION TICKET TO ATTEND THE ANNUAL MEETING?

Yes. You must present both an admission ticket or proof of stock ownership and valid photo identification to attend the Annual Meeting.

| • | If you received these materials by mail, your admission ticket is attached to your proxy card. Please detach the ticket and bring it with you to the Annual Meeting. |

4

Table of Contents

| • | If you vote electronically through the Internet, you can print an admission ticket from the online site. |

| • | If you hold shares through an account with a bank or broker, contact your bank or broker to request a legally valid proxy from the owner of record to vote your shares in person. This will serve as your admission ticket. |

| • | A recent brokerage statement or letter from your broker showing that you owned AES common stock in your account as of February 22, 2013, also serves as an admission ticket. |

If you do not have an admission ticket or proof of ownership and valid photo identification, you will not be admitted into the Annual Meeting.

Please also note that, if you attend the Annual Meeting, the use of cell phones, smartphones, pagers, recording and photographic equipment and/or computers is strictly prohibited at the Annual Meeting.

PROPOSAL 1: ELECTION OF DIRECTORS The Board has nominated eleven Directors (the “Nominees”) for election at the Annual Meeting. The Nominees are identified and discussed in the paragraphs below for election at this year’s Annual Meeting to each serve a one-year term expiring at the Annual Meeting in 2014.

Andrés R. Gluski, age 55, has been our President and Chief Executive Officer (the “CEO”) and a Director of AES since September 2011 and serves as Chairman of the Strategy and Investment Committee of the Board. Qualifications and Experience: As the chief executive of AES, he provides our Board with in-depth knowledge about the Company’s business and issues confronting our business. Prior to his current leadership position, Mr. Gluski served as Executive Vice President and Chief Operating Officer of the company from March 2007 to September 2011, Regional President for Latin America from 2006 to 2007, Senior Vice President for the Caribbean and Central America from 2003 to 2006, CEO of La Electricidad de Caracas (“EDC”) from 2002 to 2003 and CEO of AES Gener (Chile) in 2001. Before joining AES, Mr. Gluski was Executive Vice President and CFO of EDC, Executive Vice President of Banco de Venezuela (Grupo Santander), Vice President for Santander Investment, and Executive Vice President and CFO of CANTV (subsidiary of GTE). Mr. Gluski has also worked with the International Monetary Fund in the Treasury and Latin American Departments and served as Director General of the Ministry of Finance of Venezuela. Education: Mr. Gluski is a magna cum laude graduate of Wake Forest University and holds a M.A. and a Ph.D in Economics from the University of Virginia.

Directorships for the Past Five Years: Mr. Gluski currently serves on the Board of Directors of Cliffs Natural Resources (since January 2011), The Council of the Americas (since 2011), US Spain Council and The Edison Electric Institute (since 2010), and is Chairman of AES Gener (since May 2005) and AES Brasiliana (since March 2006).

Zhang Guo Bao, age 68, has been a Director of AES since December 2011. He is the Director nominee of Terrific Investment Corporation (“Investor”), a subsidiary of China Investment Corporation’s (together, “CIC”). As of February 15, 2013, Investor was the holder of approximately 17% of AES Common Stock. The nomination was made pursuant to that certain Stockholder’s Agreement dated March 12, 2010 between AES and the Investor (the “Stockholder Agreement”). Qualifications and Experience: Mr. Zhang is currently Vice-Chairman of the Chinese National Development and Reform Commission and previously served as the Administrator (Minister-Level) of the Chinese National Energy Administration from 2008-2011. Education: Mr. Zhang graduated from Xi’an Jiaotong University and is a Senior Engineer.

Directorships for the Past Five Years: Mr. Zhang is Vice Chairman of the World Energy Council (2003-Present).

Kristina M. Johnson, age 55, has been a Director of AES since January 2011, and currently serves on the Compensation Committee. Dr. Johnson previously served on the Board from April 2004 to April 2009. Qualifications and Experience: Dr. Johnson currently is the Chief Executive Officer of Enduring Hydro LLC, a company that invests in, develops, and modernizes hydroelectric facilities and provides consulting services on hydroelectric power and other clean energy projects, since April 2011 and is the former Undersecretary for Energy at the Department of Energy (May 2009 to November 2010) where she successfully brought greater cohesion to energy and environmental programs and also played a key role in ensuring that Recovery Act projects were of the highest caliber to have the greatest impact on the country. Prior to government service, Dr. Johnson was Provost and Senior Vice President for Academic Affairs at the Johns Hopkins University from September 2007 to April 2009. Previously, she served as the Chief Academic and Administrative Officer and Chief Budget Officer of the

5

Table of Contents

Edmund T. Pratt, Jr., School of Engineering at Duke (“Duke”) University, joining Duke in July 1999. Prior to joining Duke, Dr. Johnson served on the faculty of the University of Colorado at Boulder from 1985 to 1999 as a Professor of Electrical and Computer Engineering and a co-founder and director (from 1993 to 1997) of the National Science Foundation Engineering Research Center for Optoelectronic Computing Systems Center. Education: Dr. Johnson received her BS with distinction, MS and PhD from Stanford University in Electrical Engineering. She is an expert in liquid crystal electro-optics and has over forty-five patents or patents pending in this field. Dr. Johnson has received numerous recognitions for contributions to her field, including the John Fritz Metal, considered the highest award given in the engineering profession.

Directorships for the Past Five Years: Since 2006, Dr. Johnson served on the boards of directors of Minerals Technologies, Inc., Boston Scientific Corporation and Nortel Networks, until her appointment to the Department of Energy when she resigned from all public boards. After leaving the Department of Energy, she was re-elected to the board of directors of Boston Scientific Corporation (December 2010) and elected to the board of directors of Cisco Systems, Inc. in August 2012 (to present).

Tarun Khanna, age 46, has been a Director of AES since April 2009 and serves on the Nominating, Governance and Corporate Responsibility Committee and the Strategy and Investment Committee of the Board. Qualifications and Experience: Dr. Khanna is the Jorge Paulo Lemann Professor at the Harvard Business School, joining the faculty in 1993. He brings substantial expertise regarding global business, emerging markets and corporate strategy to the Board. Dr. Khanna’s scholarly work has been published in a range of economics, management and foreign policy journals and he recently published Billions of Entrepreneurs: How China and India are Reshaping their Futures, and Yours, a book focusing on the drivers of entrepreneurship in Asia. He also co-authored the book, Winning in Emerging Markets: A Roadmap for Strategy and Execution, which was published in March 2010. He was appointed a Young Global Leader (under 40) by the World Economic Forum in 2007, was elected as a Fellow of the Academy of International Business in 2009, and was appointed Director of Harvard University’s South Asia Institute in 2010. Education: Dr. Khanna received a BSE from Princeton University and PhD from Harvard University.

Directorships for the Past Five Years: Dr. Khanna is also a member of the boards of directors of SKS Microfinance (since February 2009) and the following privately-held companies: GVK Bio Sciences (since 2007) and TVS Logistics (since 2008).

John A. Koskinen, age 73, has been a Director of AES since April 2004 and serves on the Financial Audit Committee and Compensation Committee of the Board. Qualifications and Experience: Mr. Koskinen brings over thirty-five years of executive, board, government, and financial management experience to the Board. He served as the Non-Executive Chairman of Freddie Mac from September 2008 to February 2012 and served as the interim CEO and the person performing the function of Principal Financial Officer of Freddie Mac for six months during 2009. Mr. Koskinen has managed a wide range of companies and divisions engaged in a variety of activities, including mortgage securitization and investment, real estate development and management, hotel and resort operations, home building and insurance. He has also held several senior executive positions in government. Mr. Koskinen was President and a member of the Board of the United States Soccer Foundation from 2004 to 2008. Previously, he served as Deputy Mayor and City Administrator for the District of Columbia from 2000 to 2003. Prior to his election as Deputy Mayor, Mr. Koskinen occupied several positions within the U.S. Government, including service from 1994 through 1997 as Deputy Director for Management of the Office of Management and Budget. From 1998 to 2000, he served as Assistant to the President (President Clinton) and chaired the President’s Council on Year 2000 Conversion. Prior to his service with the U.S. Government, in 1973, Mr. Koskinen joined the Palmieri Company, which specialized in turnaround management, as Vice President and later served as President and Chief Executive Officer from 1979 through 1993. Mr. Koskinen was also a member of the Board of Trustees of Duke University from 1985 to 1997, serving as Chairman of the Board from 1994 to 1997. Education: Mr. Koskinen graduated with a JD, cum laude, from Yale University School of Law and a BA, magna cum laude, in physics from Duke University where he was a member of Phi Beta Kappa.

Directorships for the Past Five Years: Since 2007, Mr. Koskinen has also been a member of the board of directors of American Capital Strategies.

Philip Lader, age 67, has been a Director of AES since April 2001 and serves as Chairman of the Nominating, Governance and Corporate Responsibility Committee and a member of the Strategy and Investment Committee of the Board.

6

Table of Contents

Qualifications and Experience: Mr. Lader brings substantial executive, board and government experience to AES. The former U.S. Ambassador to the Court of St. James’s, he has served as Chairman of WPP plc, the world’s largest global advertising and marketing services company, comprised of approximately 157,000 people in 110 countries, which includes J. Walter Thompson, Young & Rubicam, and Ogilvy & Mather since 2001. A lawyer, Mr. Lader is also a Senior Advisor to Morgan Stanley, and serves as a member of the Investment Committees of Morgan Stanley’s Global Real Estate and Infrastructure Funds and was Vice Chairman of RAND Corporation. Mr. Lader served as White House Deputy Chief of Staff, Assistant to the President, Deputy Director of the Office of Management and Budget, and Administrator of the U.S. Small Business Administration during the Clinton Administration. Mr. Lader was also President of Sea Pines Company, Executive Vice President of the U.S. holdings of the late Sir James Goldsmith, and president of several universities in South Carolina and Australia. Education: Mr. Lader graduated with a BA from Duke University where he was a member of Phi Beta Kappa, an MA from the University of Michigan, completed graduate law studies at Oxford University, and received a JD from Harvard Law School.

Directorships for the Past Five Years: Mr. Lader is or has been a member of the boards of directors of WPP plc (2001-current), Lloyd’s of London (2005-2010), Marathon Oil Corporation (2002-current), UC RUSAL (2006-current), Songbird Estates, plc (2006-2009), and the following privately-held or non-profit companies: Duck Creek Technologies (2009-2011), RAND Corporation (2001-2011), Atlantic Council of US (2008-current), Smithsonian Museum of American History (since 2006), Salzburg Global Seminar (since 2008), Lader Foundation, and Bankinter Foundation for Innovation (2007-current).

Sandra O. Moose, age 71, has been a Director of AES since April 2004, and serves on the Nominating, Governance and Corporate Responsibility Committee, the Compensation Committee, and the Strategy and Investment Committee of the Board. Qualifications and Experience: Dr. Moose brings substantial executive, strategic, planning, operations, consulting, and corporate governance experience to the Board. Dr. Moose is President of Strategic Advisory Services, a global business advisory firm, and from 1975 to 2003 served as a director and Senior Vice President of The Boston Consulting Group (“BCG”). At BCG, Dr. Moose provided strategic planning, operational effectiveness and related consulting services to global clients in a variety of industries, including consumer and industrial goods, financial services and telecommunications, for over 35 years. Dr. Moose managed BCG’s New York office from 1988-1998 and was chair of the East Coast region, which accounted for approximately 20% of BCG’s overall revenues, from 1994-1999. In addition to her strategic planning expertise, Dr. Moose has been the chair or presiding director of several public companies and several charitable organizations, which has given her extensive expertise in corporate governance. Education: Dr. Moose received her PhD and MA in economics from Harvard University and BA, summa cum laude, in economics from Wheaton College.

Directorships for the Past Five Years: Dr. Moose is also a member of the boards of directors of Verizon (2000-current), serving as its presiding director (since November 2005), chairperson (since 2005) of the board of trustees of Natixis Advisor Funds (1982 to current), Loomis Sayles Funds (2003 to current), and the Alfred P. Sloan Foundation (2000-current), serving as its Chairman since July 2012. Dr. Moose also served on the board of directors of Rohm and Haas Company (1981-2009) and as its lead director from 1998.

John B. Morse, Jr., age 66, has been a Director of AES since December 2008 and serves on the Financial Audit Committee and Strategy and Investment Committee of the Board. Qualifications and Experience: Mr. Morse brings substantial executive experience to the Board, including board, investment and other finance expertise. Before his retirement in December 2008, Mr. Morse served as the Senior Vice President, Finance and Chief Financial Officer of The Washington Post Company (the “Post”), a diversified education and media company whose principal operations include educational services, newspaper and magazine print and online publishing, television broadcasting and cable television systems recording over $4.4 billion in annual operating revenues. During Mr. Morse’s 19 year tenure, the Post’s leadership made more than 100 investments in both domestic and international companies and included new endeavors in emerging markets. Prior to joining the Post, Mr. Morse was a partner at Price Waterhouse (now PricewaterhouseCoopers), where he worked with publishing/media companies and multilateral lending institutions for more than 17 years. Education: Mr. Morse graduated with a BA from the University of Virginia and an MBA from the Wharton School of Finance at the University of Pennsylvania. Mr. Morse is a Certified Public Accountant.

7

Table of Contents

Directorships for the Past Five Years: Mr. Morse is also a member of the boards of directors of Host Hotels & Resorts Corporation (2005-present), the Home Shopping Network (2008-present), Former Trustee and President Emeritus of the College Foundation of the University of Virginia (2002-2012), and completed a six-year term as a member of the Financial Accounting Standards Advisory Council (2004-2010).

Moisés Naím, age 61, is being nominated for election to the Board of Directors. Qualifications and Experience: Dr. Naím is the Senior Associate in the International Economics Program at the Carnegie Endowment for International Peace and has served in that role from June 2010 to present. For fourteen years (1996-2010), Dr. Naím served as Editor in Chief for Foreign Policy magazine (first, at The Carnegie Endowment for International Peace and subsequently, at The Washington Post Company). He has written extensively on international economics and global politics, economic development and the consequences of globalization and Dr. Naím is the chief international columnist for El País and La Repubblica, high circulation daily newspapers in Spain and Italy, respectively, and is also the host and producer of Efecto Naím, a global Spanish language news and analysis broadcast. His columns are syndicated worldwide. Dr. Naím brings substantial international economics and political expertise to AES through his tenure as Venezuela’s Minister of Industry and Trade and Director of Venezuela’s Central Bank in the early 1990s and as an Executive Director of the World Bank in the early 1990s. He is also the author of many scholarly articles and more than ten books on economics and politics. He also has broad experience as a consultant to corporations, governments and non-governmental organizations. Education: Dr. Naím holds MSc and PhD degrees from the Massachusetts Institute of Technology.

Directorships for the Past Five Years: Dr. Naím is a member of the board of directors of FEMSA (2011-present).

Charles O. Rossotti, age 72, has been a Director of AES since March 2003 and serves as Chairman of the Financial Audit Committee of the Board. Qualifications and Experience: Mr. Rossotti brings substantial executive, entrepreneurial, global business, operations, and finance experience to our Board as a result of his previous positions. He serves as a Senior Advisor with the Carlyle Group, one of the world’s largest private equity firms, since March 2003. From November 1997 until November 2002, Mr. Rossotti was the Commissioner of Internal Revenue at the United States Internal Revenue Service (“IRS”), where he was responsible for regulatory and financial and accounting functions for $2 trillion a year in tax revenues. Prior to joining the IRS, Mr. Rossotti was a founder of American Management Systems, Inc. (“AMS”), a technology and management consulting firm which grew from inception to 9,000 employees and $800 million in revenue, where he oversaw operations in the U.S., Europe, and Asia. Mr. Rossotti held the position of President of AMS from 1970 to 1989, Chief Executive Officer from 1981 to 1993 and Chairman from 1989 to 1997, where he oversaw expansion into developed international markets, risk management of contracting functions, and strategic actions. From 1965 to 1969, he held various positions in the Office of Systems Analysis within the Office of the Secretary of Defense. He is currently a member of the board of directors of Capital Partners for Education, a non-profit organization and a member of the Controller General’s Advisory Board of the U.S. Government Accountability Office. Education: Mr. Rossotti graduated magna cum laude from Georgetown University and received an MBA with high distinction from Harvard Business School.

Directorships for the Past Five Years: Mr. Rossotti is also a member of the boards of directors of Bank of America Corporation (2009-present), Booz, Allen, Hamilton (2008-present), and Merrill Lynch Corporation (2004-2008) and the following privately held companies: Apollo Global (2008-2012), Compusearch Systems, Inc. (2005-2011), Adesso Systems Corporation (2005-2006), Liquid Engines, Inc. (2004-2006), Quorum Management Solutions (2010-present), and Primatics Financial (2011-present).

Sven Sandstrom, age 71, has been a Director of AES since October 2002 and serves on the Financial Audit Committee and the Nominating, Governance and Corporate Responsibility Committee of the Board. Qualifications and Experience: Mr. Sandstrom brings substantial experience in global finance, strategy, operations, industry knowledge, as well as risk management to our Board. He is the former Managing Director of the World Bank where he served for 30 years, retiring in 2001. As Managing Director for ten years, Mr. Sandstrom was responsible for all aspects of the Bank’s work including financial policy and risk management, global strategy, and operations. Since 2001, Mr. Sandstrom has been a director and adviser at private corporations and public institutions in Europe, Africa, Asia and the U.S., including the European Commission, the African Development Bank and the International Union for the Conservation of Nature (“IUCN”). For six years, he chaired the international funding negotiations for the African Development Bank and the Global Fund to Fight AIDS, TB and Malaria. He is the CEO and Director of Hand in Hand International, a UK public charitable trust that funds and

8

Table of Contents

supports development and microfinance operations in India, Afghanistan and Eastern and Southern Africa. He is also the sole owner and operator of a small hydropower plant in northern Sweden. Education: Mr. Sandstrom graduated with a BA from the University of Stockholm, an MBA from the Stockholm School of Economics, and a DrSc from the Royal Institute of Technology in Stockholm. For three years, he was a joint Research Associate at MIT and Harvard Business School.

Directorships for the Past Five Years: Mr. Sandstrom is also a member of the board of directors of Hand in Hand International, UK (2009-present) and IUCN, Switzerland (2004-2008).

THE BOARD RECOMMENDS A VOTE FOR THE

ELECTION OF THE ELEVEN DIRECTORS DISCUSSED ABOVE.

9

Table of Contents

INFORMATION CONCERNING OUR BOARD OF DIRECTORS

Director Independence

We are required to have a majority of independent Directors serving on our Board and may only have independent Directors serving on each of our Financial Audit, Compensation and Nominating, Governance and Corporate Responsibility Committees pursuant to the rules of the New York Stock Exchange (the “NYSE”) and, with respect to our Financial Audit Committee, the rules and regulations existing under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Our Board undertook an annual review of Director and Director Nominee independence in February 2013. The purpose of this review was to determine whether any relationships or transactions involving Directors and Director nominees (including their family members and affiliates) were inconsistent with a determination that the Director or Director nominee is independent under the independence standards set forth in the NYSE rules and our Corporate Governance Guidelines and, with respect to Financial Audit Committee members and Financial Audit Committee nominees, under the independence standards for audit committee members adopted by the SEC.

In making this determination, the Board considered not only the criteria for independence set forth in the listing standards of the NYSE but also any other relevant facts and circumstances that may have come to the Board’s attention, after inquiry, relating to transactions, relationships or arrangements between a Director or a Director nominee or any member of their immediate family (or any entity of which a Director or Director nominee or an immediate family member is an Executive Officer, general partner or significant equity holder) on the one hand, and AES or any of its subsidiaries or affiliates, on the other hand, that might signal potential conflicts of interest, or that might bear on the materiality of a Director’s or a Director nominee’s relationship to AES or any of its subsidiaries. As described in the preceding sentence, the Board considered the independence issue not merely from the standpoint of the Director or Director nominee, but also from that of the persons or organizations with which the Director or Director nominee is affiliated.

Based on its review, our Board determined that Messrs. Koskinen, Lader, Morse, Rossotti and Sandstrom and Drs. Johnson, Khanna, Moose and Naím each qualify as independent under the independence standards existing under the NYSE rules. Our Board also determined that Messrs. Koskinen, Morse, Rossotti and Sandstrom qualify as “independent” under the independence standards for audit committee members adopted by the SEC.

Board Leadership Structure

Our Corporate Governance Guidelines require the separation of the offices of the Chairman of the Board (“Chairman”) and CEO. If the Chairman is independent, he or she will also serve as Lead Independent Director. Since 1993, we have separated the offices of Chairman and CEO. Since 2003, our Chairman has been an independent Director who has also acted as Lead Independent Director.

We believe the structure described above provides strong leadership for our Board, while positioning our CEO as the leader of the Company for our investors, counterparties, employees and other stakeholders. Our current structure, which includes an independent Chairman serving as Lead Independent Director, helps ensure independent oversight over the Company. Our Corporate Governance Guidelines state that the Lead Independent Director’s duties include coordinating the activities of the independent Directors, coordinating the agenda for and moderating sessions of the Board’s independent Directors, and facilitating communications among the other members of the Board. At the same time, our current structure allows the CEO to focus his energies on management of the Company.

Our Board has nine independent members. A number of our independent Board members are currently serving or have served as Directors or as members of senior management of other public companies. We have three Board Committees comprised solely of independent Directors, each with a different independent Director serving as Chairman of the Committee. We believe that the number of independent experienced Directors that make up our Board, along with the independent oversight of the Board by the non-executive Chairman, benefits our Company and our Stockholders.

10

Table of Contents

Pursuant to our Bylaws and our Corporate Governance Guidelines, our Board determines the best leadership structure for the Company. As part of our annual Board self-evaluation process, the Board evaluates issues such as independence of the Board, communication between Directors and Management, the relationship between the CEO and Chairman, and other matters that may be relevant to our leadership structure. The Company recognizes that in the event that circumstances facing the Company change, a different leadership structure may be in the best interests of the Company and its Stockholders.

THE COMMITTEES OF THE BOARD

In 2012, the Board maintained four standing Committees: the Compensation Committee, Strategy and Investment Committee, Financial Audit Committee, and the Nominating, Governance and Corporate Responsibility Committee. The Board has determined that each of the members of the Compensation Committee, Financial Audit Committee, and Nominating, Governance and Corporate Responsibility Committee meets the standards of “independence” established by the NYSE as currently in effect. A description of each Board Committee is set forth below.

STANDING COMMITTEES:

Compensation Committee

The members of the Compensation Committee are Kristina M. Johnson, John A. Koskinen, Sandra O. Moose, and Philip A. Odeen (Chairman). For information regarding the role of our Compensation Committee, including its processes and procedures for determining executive compensation, see “Information About our Compensation Committee” beginning on page 59 of this Proxy Statement. The Compensation Committee operates under the Charter of the Compensation Committee, which has been adopted and approved by the Board. The Compensation Committee may form subcommittees and delegate to those subcommittees such power and authority as the Compensation Committee deems appropriate and in compliance with law. A copy of the Compensation Committee’s Charter can be obtained from the Company’s website (www.aes.com) or by sending a request to the Office of the Corporate Secretary, The AES Corporation, 4300 Wilson Boulevard, Arlington, VA 22203.

Strategy and Investment Committee

The members of the Strategy and Investment Committee are Andrés Gluski (Chairman), Tarun Khanna, Philip Lader, Sandra O. Moose, John B. Morse, Jr., and Philip A. Odeen. The Strategy and Investment Committee focuses on the evaluation of strategic plans and evaluation of the Company’s capital deployment in the context of the Company’s corporate strategy. In addition, at the request of the Board, the Committee or Management, individual transactions may also be reviewed by the Committee including, potential investments, asset sales, proposed equity and/or debt offerings, or other transactions. The Strategy and Investment Committee operates under the Charter of the Strategy and Investment Committee adopted and approved by the Board. A copy of the Charter can be obtained from the Company’s website (www.aes.com) or by sending a request to the Office of the Corporate Secretary, The AES Corporation, 4300 Wilson Boulevard, Arlington, Virginia 22203.

Financial Audit Committee (the “Audit Committee”)

The members of the Audit Committee are John A. Koskinen, John B. Morse, Jr., Charles O. Rossotti (Chairman), and Sven Sandstrom. The Audit Committee is responsible for the review and oversight of the Company’s performance with respect to its financial responsibilities and the integrity of the Company’s accounting and reporting practices. The Audit Committee may delegate its authority to subcommittees when it deems such delegation to be appropriate and in the best interests of the Company. The Audit Committee, on behalf of the Board, also appoints the Company’s independent auditors, subject to Stockholder ratification, at the Annual Meeting. The Audit Committee operates under the Charter of the Audit Committee adopted and approved by the Board. A copy of the Charter can be obtained from the Company’s website (www.aes.com) or by sending a request to the Office of the Corporate Secretary, The AES Corporation, 4300 Wilson Boulevard, Arlington, Virginia 22203. Our Board has determined that all members of the Audit Committee are independent within the meaning of the SEC

11

Table of Contents

rules and under the current listing standards of the NYSE. The Board has also determined that each member of the Audit Committee is “financially literate” as required by the NYSE rules and an Audit Committee Financial Expert within the meaning of the SEC rules based on, among other things, the experience of such member, as described under “Proposal 1: Election of Directors” set forth on page 5 of this Proxy Statement.

Nominating, Governance and Corporate Responsibility Committee (the “Nominating Committee”)

The members of the Nominating Committee are Tarun Khanna, Philip Lader (Chairman), Sandra O. Moose and Sven Sandstrom. The Nominating Committee provides recommendations for potential Director nominees for election to the Board, establishes compensation for Directors, considers governance, social responsibility and cyber security issues relating to the Board and the Company and considers the scope of the Company’s internal environmental and safety audit programs. The Nominating Committee may form subcommittees and delegate to those subcommittees such power and authority as the Committee deems appropriate and in compliance with law. The Nominating Committee operates under the Charter of the Nominating Committee adopted and approved by the Board. A copy of the Charter can be obtained from the Company’s website (www.aes.com) or by sending a request to the Office of the Corporate Secretary, The AES Corporation, 4300 Wilson Boulevard, Arlington, Virginia 22203.

Director Qualifications. Director nominees are selected on the basis of, among other things, experience, knowledge, skills, expertise, integrity, ability to make independent analytical inquiries, understanding the Company’s global business environment and willingness to devote adequate time and effort to Board responsibilities so as to enhance the Board’s ability to oversee and direct the affairs and business of the Company.

Diversity. The Company does not maintain a separate policy regarding the diversity of the Board. However, the charter of the Nominating Committee requires that the Committee review the composition of the Board to ensure it has the “appropriate balance” of attributes such as knowledge, experience, diversity and other attributes. In addition, the Company’s Corporate Governance Guidelines establish that the size of the Board shall be nine to twelve members, a range which “permits diversity of experience without hindering effective discussion or diminishing individual accountability.”

Consistent with these governing documents, both the Nominating Committee and the full Board seek Director nominees with distinct professional backgrounds, experience and perspectives so that the Board as a whole has the range of skills and viewpoints necessary to fulfill its responsibilities. As part of our annual Board self-evaluation process, the Board evaluates whether or not the Board as a whole has the skills and backgrounds for the current issues facing the Company. The Board also evaluates its effectiveness with regard to specific areas of expertise.

Director Nomination Process. Pursuant to our Corporate Governance Guidelines, our Nominating Committee reviews the qualifications of proposed Director nominees to serve on our Board and recommends Director nominees to our Board for election at the Company’s Annual Meeting. The Board proposes a slate of Director nominees to the Stockholders for election to the Board, using information provided to the Committee.

In certain instances, a third party may assist in identifying potential Director nominees. The Nominating Committee also considers potential nominations for Director provided by Stockholders and submits any such suggested nominations, when appropriate, to the Board for approval. Stockholder nominees for Director are evaluated using the criteria described above. As described under “Proposal 1: Election of Directors,” Mr. Zhang was nominated by CIC to our Board pursuant to the Stockholder Agreement and Dr. Naím was recommended for nomination by several Board members, including our CEO. Stockholders wishing to recommend persons for consideration by the Committee as nominees for election to the Board can do so by writing to the Office of the Corporate Secretary of the Company at 4300 Wilson Boulevard, Arlington, Virginia 22203 and providing the information and following the additional procedures set forth in the Bylaws, which are described in “Stockholder Proposals and Nominations for Director” set forth on page 72 of this Proxy Statement.

12

Table of Contents

Director Compensation. The Nominating Committee periodically reviews the level and form of compensation paid to Directors, including our Director compensation program’s underlying principles. Under the Corporate Governance Guidelines, a Director who is also an Officer of AES is not permitted to receive additional compensation for service as a Director. In reviewing and determining the compensation paid to Directors, the Committee considers how such compensation relates and compares to that of companies of comparable size and/or equivalent complexity. The Committee’s review includes looking at both direct and indirect forms of compensation paid to our Directors, including any charitable contributions made by the Company, on behalf of such Directors, to organizations with which Directors are affiliated. The General Counsel’s Office assists the Nominating Committee with its review of our Director compensation program. The General Counsel’s office conducts research on other companies’ director compensation practices by reviewing broad-based director compensation studies, which generally include a hundred or more companies, and providing the Committee with a benchmarking analysis of such companies’ practices as compared to the Company’s Director compensation program. These reports are further described in “Director Compensation for Year 2012” below. Neither the General Counsel’s Office nor the Nominating Committee retains an independent compensation consultant to assist with recommending or determining Director compensation. Any proposed changes to the Director compensation program are recommended by the Nominating Committee to the Board for consideration and approval. For further information regarding our Director compensation program, see “Director Compensation for Year 2012” starting on page 62 of this Proxy Statement.

BOARD’S ROLE IN RISK MANAGEMENT

Our Management is responsible for the management and assessment of risk at the Company, including communication of the most material risks to the Board and its Committees, who provide oversight over the risk management practices implemented by Management. Our full Board provides oversight with respect to risk management, except for the oversight of risks that have been specifically delegated to a Committee of the Board. Even when the oversight of a specific area of risk has been delegated to a Committee, the full Board may maintain oversight over such risks through the receipt of reports from the Committee Chairpersons to the full Board at each regularly-scheduled full Board meeting. In addition, if a particular risk is material or where otherwise appropriate, the full Board may assume oversight over a particular risk, even if the risk was initially overseen by a Board Committee. The Board and Committee reviews occur principally through the receipt of regular reports from Management to the Board on these areas of risk, and discussions with Management regarding risk assessment and risk management.

Full Board. At its regularly scheduled meetings, the Board generally receives a number of reports which include information relating to risks faced by the Company. The Company’s Chief Financial Officer and/or Treasurer provides a report on the Company’s liquidity position, including an analysis of prospective sources and uses of funds, and the implications to the Company’s debt covenants and credit rating, if any. The Chief Operating Officer or his designee provides operational reports, which include risks related to tariffs, efficiency at our subsidiaries’ plants, construction, and related matters. The Company’s Vice President of Risk provides a report to the Board which explains the Company’s primary risk exposures, including currency, commodity and interest rate risk. Finally, the Company’s General Counsel provides a privileged dispute resolution report which provides information regarding the status of the Company’s litigation and related matters. At each regularly-scheduled Board meeting, the full Board also receives reports from Committee Chairpersons, which may include a discussion of risks initially overseen by the Committees for discussion and input from the full Board. As noted above, in addition to these regular reports, the Board receives reports on specific areas of risk from time to time, such as regulatory, geopolitical, cyclical or other risks.

Committees. The Audit Committee maintains initial oversight over risks related to the integrity of the Company’s financial statements; internal controls over financial reporting and disclosure controls and procedures (including the performance of the Company’s internal audit function); the performance of the independent auditor; and the effectiveness of the Company’s Ethics and Compliance Program. The Company’s Nominating Committee maintains initial oversight over risks related to workplace safety and cyber security, and our subsidiaries’ continuing efforts to ensure compliance with the best practices in these areas. When appropriate, the Nominating Committee also receives environmental reports regarding our subsidiaries’ compliance with environmental laws and their efforts to ensure continuing compliance with governing laws and regulations.

13

Table of Contents

The Company’s Compensation Committee maintains initial oversight over risks related to the Company’s compensation practices, including practices related to hiring and retention, succession planning (approved by the full Board), and training of employees. The Strategy and Investment Committee maintains initial oversight over risks related to our overall strategic plans and capital deployment in the context of our corporate strategy.

DIRECTOR ATTENDANCE

In 2012, our Board convened ten times, including five telephonic meetings, and our Board Committees held the following number of meetings: (i) Audit Committee—ten meetings; (ii) Compensation Committee—nine meetings; (iii) Strategy and Investment Committee—seven meetings; and (iv) Nominating Committee—six meetings.

Under our Corporate Governance Guidelines, Directors are expected to attend Board meetings and meetings of Committees on which they serve in person or by conference telephone, and Directors are also encouraged to attend the Annual Meeting. Messrs. Gluski, Koskinen, Lader, Morse, Odeen, Rossotti, and Sandstrom and Drs. Johnson, Khanna and Moose attended the 2012 Annual Meeting of Stockholders on April 19, 2012. All of our current Directors attended at least 93% of the aggregate of all meetings of the Board and the Committees on which they served, except Mr. Zhang who attended less than 75% of all meetings of the Board during 2012. Mr. Zhang has been nominated to the AES Board by CIC pursuant to the Stockholder Agreement between the Company and CIC. Additional information regarding CIC’s right to nominate a Director to the AES Board is included in “Additional Rights Provided in Stockholder Agreement” on page 74 of this Proxy Statement.

In accordance with the Company’s Corporate Governance Guidelines, non-management Directors met in executive session after each in-person meeting of the Board. Non-management Directors met five times in 2012, with Mr. Odeen presiding as Lead Independent Director.

14

Table of Contents

Compensation Discussion and Analysis (“CD&A”)

The CD&A includes compensation details for our “Named Executive Officers” (NEOs), including:

| Name | Title | |

|

Mr. Andrés Gluski |

President & Chief Executive Officer (“CEO”) | |

|

Mr. Thomas O’Flynn |

EVP & Chief Financial Officer (“CFO”) | |

|

Mr. Andrew Vesey |

EVP & Chief Operating Officer (“COO”) | |

|

Mr. Brian Miller |

EVP, General Counsel & Corporate Secretary (“General Counsel”) | |

|

Ms. Elizabeth Hackenson |

SVP, Global Business Services & CIO (“SVP, GBS & CIO”) | |

|

Ms. Mary Wood |

Interim CFO for part of 2012 and current VP, Controller (“interim CFO”) | |

|

Mr. Edward Hall |

Former EVP, COO, Global Generation (“Former COO, Global Generation”) | |

|

Ms. Victoria Harker |

Former EVP, CFO & President, Global Business Services (“Former CFO”) | |

|

Ms. Rita Trehan |

Former SVP, Human Resources, Internal Communications, Safety and AES Performance Excellence (“Former SVP, HR”) | |

Messrs. Gluski, O’Flynn, Vesey and Miller and Ms. Hackenson are the current Executive Officers of the Company and Ms. Wood remains with the Company.

Discussion of 2012 Performance

AES’ compensation philosophy emphasizes pay-for-performance. As context for understanding our 2012 compensation determinations, the following discussion summarizes the Company’s notable achievements in 2012, as well as some of the challenges we faced. Non-GAAP measures (Adjusted EPS and Adjusted Pre-Tax Contribution) are reconciled to the nearest GAAP financial measure in the section titled “Non-GAAP Measures” of this CD&A.

AES began 2012 with a firm commitment to unlock stockholder value by optimizing capital allocation, improving profitability and narrowing our geographic focus. Some of the Company’s notable achievements for 2012, generally reflected in our compensation determinations, include:

| • | Adjusted EPS of $1.24 which represented 22% growth over 2011 levels and our highest level in 10 years; |

| • | Adjusted Pre-Tax Contribution of $1,377M which represented 28% growth over 2011 levels and was above the top end of our 2012 financial guidance range; |

| • | Subsidiary Distributions of $1,332M which were nearly at the record level achieved in 2011; |

| – | Subsidiary Distributions measure the cash distributed by our subsidiaries to AES which the Company uses primarily to fund interest, principal repayments of debt, equity repurchases, stockholder dividends, parent overhead and development costs, and investment in subsidiaries. It is not a substitute for the cash flow measures in our financial statements. |

15

Table of Contents

| • | Continued investment in our balance sheet with debt prepayments and share buybacks totaling $1.1B since September 2011; |

| • | Commencement of a quarterly dividend with our first payment of $0.04 per share in November 2012; |

| • | Our Key Performance Indicator (KPI) index (described below) reached 104% of our 2012 operating goals; |

| • | Attainment of $90M in 2012 general and administrative (G&A) expense savings which exceeded our 2012 goal and on track to achieve $145M in savings by 2014; |

| • | Completed construction of 447 MW of installed capacity during 2012 and we are on schedule to complete an additional 2,181 MW of capacity under construction expected to come on-line through 2015; and |

| • | Continued execution of our portfolio management program by closing twelve asset sales since September 2011, representing equity proceeds to AES of nearly $1B. |

However, in 2012, the Company also faced challenging conditions in many markets. Low natural gas and power prices in the U.S. Midwest were key drivers of a significant impairment of Dayton Power & Light (“DP&L”). These adverse conditions negatively impacted our share price in 2012, which in turn, contributed to significant reductions to the value of our Executive Officers’ outstanding equity awards, including the forfeiture of the 2010-2012 performance stock units, as discussed further below.

2012 Compensation Highlights

Compensation determinations made in 2012 reflect our pay-for-performance philosophy and the Company’s intent to align its Executive Officer compensation with the interests of stockholders. The key compensation determinations made with respect to our NEOs are summarized below.

| • | In 2012, several of our NEOs were recently promoted into their positions and, thus, target total compensation was below our 50th percentile philosophy; |

| • | Our CEO did not receive a salary increase in 2012 because his compensation was changed in the latter part of 2011 upon being promoted to CEO; |

| • | Our other NEOs received salary increases ranging from 4% to 12.5% with the largest increases for NEOs promoted in 2011, since those NEOs did not receive a salary increase at the time of the promotion; |

| • | Annual incentive awards to our NEOs averaged 98% of the target award amount as the Company did not meet 100% of its 2012 annual objectives; |

| • | The performance stock units for the three-year period ended December 31, 2012 were forfeited because the Company did not attain the relative Total Stockholder Return performance threshold; |

| • | The performance units for the three-year period ended December 31, 2012 paid out at 84% of target because the Company performed below the target on its three-year cumulative Cash Value Added goal (described below); and |

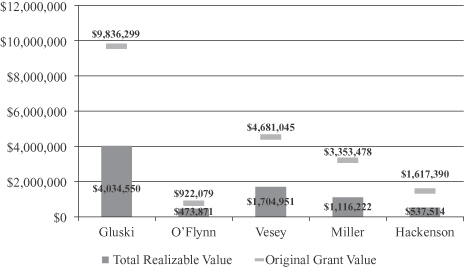

| • | The total realizable value of all long-term compensation awards granted within the past three years (2010-2012) to our current Executive Officers is significantly below the target grant date value of such awards. |

16

Table of Contents

| – | The following chart compares the original grant date target value of 2010-2012 awards to the current realizable value of such awards based on the market price of our Common Stock at December 31, 2012. |

| – | With respect to performance stock unit awards for which the performance period is not yet complete, the value is based on our current period-to-date results against the performance goals (our current period-to-date results for incomplete periods are between threshold and target). |

Our Executive Compensation Practices

The Compensation Committee frequently reviews developments in governance practices and market trends relating to executive compensation and has taken several actions intended to align the design and structure of AES’ executive compensation program, including our NEOs’ compensation, with current standards of governance and our stockholders’ interests. The actions taken by the Compensation Committee include both adopting and discontinuing practices so as to align executive compensation with stockholder interests. The following points summarize key actions taken by the Committee in recent years, with changes made in 2012 and early 2013 noted below.

| • | Target Total Compensation at 50th Percentile of Companies Comparable in Size |

Our philosophy is to target total compensation at the size-adjusted 50th percentile of survey data to ensure a competitive compensation opportunity compared to similarly-sized companies;

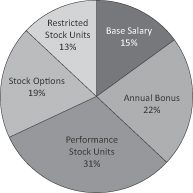

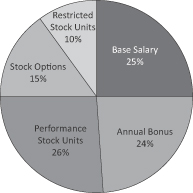

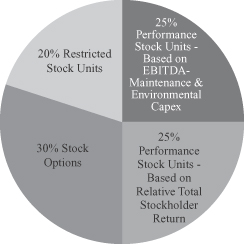

| • | Heavy Weight on Performance-based Compensation |

Our compensation program is heavily weighted to performance-based pay with a significant portion of our compensation being paid through our annual incentive and long-term compensation plans;

| • | Executive Stock Ownership Guidelines |

We maintain stock ownership guidelines to align our NEOs’ interests with those of our stockholders;

| • | Independent Consultant Retained by the Compensation Committee |

Our Compensation Committee has retained and directs an independent compensation consultant who does not provide any other services to the Company;

| • | Annual Review of Risk Related to Compensation Programs |

The Compensation Committee’s independent consultant annually conducts a review of the risks associated with our executive and incentive compensation programs and has determined that our compensation programs are not reasonably likely to have a material adverse effect on the Company;

17

Table of Contents

| • | Clawback Policy |

In early 2013, the Company adopted a “clawback” policy that provides the Compensation Committee with the discretion to seek recoupment of certain previously-paid incentive awards in the event that such awards are linked to a financial restatement caused by executive misconduct;

| • | Executive Severance Provisions Comparable to Market Practice |

The Company maintains an Executive Severance Plan which provides for severance benefits under certain termination scenarios, including termination in connection with a change-in-control. The benefits under these plans are comparable to what other companies similar in size offer to their executives;

| • | No Change-in-Control Excise Tax Gross-ups |

In 2012, the Company modified its executive change-in-control severance arrangements to entirely discontinue the provision of change-in-control excise tax gross-ups;

| • | No Perquisites for our Executive Officers |

We do not provide perquisites to any of our Executive Officers;

| • | No Special Retirement Benefit Formulas for our Executive Officers |

Our supplemental executive retirement benefits are designed primarily to restore benefits capped under our broad-based retirement plans due to statutory limits imposed by the Internal Revenue Code (the “Code”);

| • | No Backdating or Option Repricings |

We have not participated in a practice of backdating or repricing stock options, nor have we modified pre-set targets for annual incentive or performance equity awards; and

| • | No Hedging or Pledging of AES Common Stock |

In early 2013, the Board of Directors adopted a policy that prohibits Section 16 Officers, including our NEOs, and Directors of the Company from hedging their economic interest in AES Common Stock or using AES Common Stock as collateral in a financial transaction.

These practices are discussed in further detail throughout the remainder of this CD&A.

Results of 2012 Advisory Vote to Approve Executive Compensation (“2012 Say on Pay Vote”)

At its 2012 annual meeting of stockholders, AES received over 95% support for its NEO compensation based on the shares voted in favor of the 2012 Say on Pay vote. This outcome confirmed the Company’s view that the NEO compensation program is performance-based and aligns with our stockholders’ interests. In making future decisions on NEO compensation, the Compensation Committee will consider the outcome of future annual Say on Pay votes, including the vote to be taken in 2013.

Our Executive Compensation Process

The Role of Our Compensation Committee

The Compensation Committee has primary responsibility for oversight of the Company’s compensation and employee benefit plans and practices which cover our NEOs. The Compensation Committee also reviews the Company’s succession plan for the NEOs and other key positions.

Our philosophy is to provide compensation opportunities that approximate the size-adjusted 50th percentile of survey data based on our revenue size and industry. We then design our incentive plans to pay for performance with more compensation paid when performance exceeds expectations and less compensation paid when performance does not meet expectations. Thus, the actual compensation realized by an NEO could be above or below the 50th percentile based on our actual performance.

18

Table of Contents

In applying this philosophy, the Compensation Committee annually reviews the compensation of our NEOs to determine whether compensation changes are appropriate. The Compensation Committee may provide merit-based adjustments to salary and adjust target annual incentive percentages. Also, the Compensation Committee decides the grant date expected value of long-term compensation awards for which the NEOs are eligible each year. These decisions represent each NEO’s target total compensation opportunity for that year. In making these decisions, the Compensation Committee reviews survey data as described in the section titled “How We Use Survey Data in our Executive Compensation Process.”

The Compensation Committee considers the information it receives and exercises its own independent judgment in making executive compensation recommendations to our Board of Directors. The Compensation Committee’s recommendations are based on a review of: (1) survey data; (2) the individual’s performance against pre-set goals and objectives for the year and overall Company performance; (3) the individual’s experience and expertise; (4) the individual’s position and scope of responsibilities; (5) the individual’s future prospects with the Company; and (6) total compensation. Also, as discussed further below, the Compensation Committee retains an independent compensation consultant that provides advice and information that the Compensation Committee reviews in evaluating executive compensation decisions.

The Compensation Committee is also responsible for assessing Company performance to determine and recommend payouts under incentive plans. To assess Company performance, the Compensation Committee receives a detailed summary of the Company’s overall performance against its pre-set targets for the year and, in the case of long-term compensation awards with performance criteria, the Company’s performance against pre-set targets for the three-year performance period.

The Role of the Compensation Committee’s Independent Consultant

In 2012, the Compensation Committee retained the services of its own independent consultant, Meridian Compensation Partners, LLC (“Meridian”), who provided the Compensation Committee with independent knowledge and experience related to executive compensation. Throughout the year, Meridian reported directly and exclusively to the Compensation Committee and provided objective input and analysis with reference to market data, trends, regulatory initiatives, governance best practices and emerging governance norms. Meridian’s services included providing advice on determining the actual compensation amounts to be paid to the NEOs. During 2012, Meridian participated in seven Compensation Committee meetings either in person or by telephone. During 2012, Meridian provided no services to AES other than executive compensation services.

The Compensation Committee has reviewed the independence of Meridian relative to the final rules released by the SEC relating to the engagement of advisors by a compensation committee. In reviewing the six factors identified in the final rules, no information was presented which would affect Meridian’s independence.

The Role of Our Management

Our CEO participates in all Compensation Committee meetings, excluding any of the executive sessions or sessions of the Compensation Committee in which his compensation and performance are discussed and approved. His role in the process of determining executive compensation is to provide the Compensation Committee with an assessment of each NEO’s performance against his/her pre-set goals and objectives, and to provide his initial recommendations for each NEO’s compensation (other than his own).

Our VP, Human Resources develops written background and supporting materials for review by the Compensation Committee prior to its meetings and presents information relating to specific elements of our compensation program. If warranted, she also proposes changes to our annual incentive and long-term compensation plans. In addition, she attends all Compensation Committee meetings.

The CEO and VP, Human Resources also provide the Compensation Committee with information about the Company’s overall performance to enable the Compensation Committee to make compensation decisions based on the Company’s performance, consistent with our pay-for-performance philosophy.

19

Table of Contents

With the Compensation Committee’s knowledge and approval, the Human Resources team also directly interfaces with Meridian to prepare the necessary background information for the Compensation Committee.

How We Use Survey Data in our Executive Compensation Process

At the time it decides target total compensation opportunities, the Compensation Committee reviews survey data from Towers Watson. The data enables the Compensation Committee to compare compensation for our NEOs to compensation provided by similarly-sized general industry and energy companies for executives in comparable positions to our NEOs.

In 2012, we used survey data from Towers Watson’s U.S. General Industry and U.S. Energy Industry Databases.

| • | The U.S. General Industry Database consisted of 411 companies, including 91 companies with revenues from $10 to $20 billion (AES is in this size category). |

| • | The U.S. Energy Industry Database consisted of 108 companies, including 33 companies with revenues over $6 billion (AES is in this size category). Also, the majority of the companies comprising the S&P 500 Utilities Index in February 2012 were included in the U.S. Energy Industry Database. |

Survey data typically lag the year for which the compensation decision will apply and therefore are aged at an annualized rate of 3% per year.

To size-adjust market data, we used regression analysis, when available, to provide the most accurate indication of the compensation that companies with corporate revenue size comparable to AES (or business unit revenue for executives with responsibility over a portion of the Company’s operations) provide to executives in comparable roles and that have international operations which may compete with AES for talent. Regression analysis predicts the compensation paid by companies closest to us in size. Executive target total compensation more closely correlates with revenue than any other company size indicator for general and energy industry companies.

With the exceptions noted below, the Compensation Committee reviewed survey data at the time it made decisions on target total compensation for most of our NEOs in 2012. For some NEOs, a blend of general industry and energy industry data is appropriate based on the operational knowledge required of their positions and the international scope of their roles. For other NEOs, general industry data is appropriate based on the NEO’s responsibility over a major staff function within the Company (e.g., Legal, IT, HR) and the international scope of their roles. This approach is summarized below.

| NEO |

Equal Blend of General Industry and Energy Company Data |

General

Industry Data | ||

| Mr. Gluski, CEO |

ü | |||

| Mr. O’Flynn, CFO |

ü | |||

| Mr. Vesey, COO |

ü | |||

| Mr. Miller, General Counsel |

ü | |||

| Ms. Harker, former CFO |

ü | |||

| Mr. Hall, former COO, Global Generation |

ü | |||

| Ms. Trehan, former SVP, HR |

ü |

| • | During the Company’s annual performance and compensation review in 2012, neither Ms. Wood nor Ms. Hackenson were Executive Officers and, therefore, their respective 2012 compensation was set based on our internal management compensation structure. Upon becoming Executive Officers in 2012, there was no material change to their overall compensation. |

20

Table of Contents

| • | The Compensation Committee made a change to the survey data it referenced in deciding Mr. O’Flynn’s compensation compared to the data used to decide Ms. Harker’s compensation. In recruiting a new CFO, the Company’s primary search and selection criteria were prior energy industry experience and prior experience in companies with international operations. Thus, the Compensation Committee deemed that changing to a blend of general industry and energy industry data was more appropriate for our CFO role. |

To understand the full range of compensation within our relative market, the survey data reviewed by the Compensation Committee provides a market comparison at the 25th, 50th and 75th percentiles for each position in order to be consistent with market practices employed in the analysis of survey data. The Compensation Committee determines target total compensation for our NEOs after taking into account a range of factors, including (1) the survey data, (2) individual and Company performance, (3) individual experience and expertise, (4) position scope and responsibilities, (5) future prospects with the Company, and (6) total compensation.

For 2012, target total compensation for our NEOs compared to the market percentile data as summarized in the following table. As indicated previously, in 2012, several of our NEOs were new to their position and, thus, their target total compensation was below the 50th percentile.

| NEO | Market Percentile of 2012 Target Total Compensation | |

| Mr. Gluski, CEO |

At the 25th percentile (within 5%) | |

| Mr. O’Flynn, CFO |

At 50th percentile (within 5%) | |

| Mr. Vesey, COO |

Between 25th and 50th percentile | |

| Mr. Miller, General Counsel |

Above the 50th percentile (by 5-10%) | |

| Ms. Harker, former CFO |

Between 25th and 50th percentile | |

| Mr. Hall, former COO, Global Generation |

Between 25th and 50th percentile | |

| Ms. Trehan, former SVP, HR |

Between 25th and 50th percentile |

Ms. Hackenson and Ms. Wood are excluded from the above table because the Compensation Committee has not reviewed survey data for their positions. Beginning in 2013, the Compensation Committee will review survey data for Ms. Hackenson’s position.

In early 2012, the Compensation Committee was also provided with executive compensation data disclosed in proxy statements of the comparably-sized utility and power generation companies listed below. Given the detailed nature of proxy data, it provided an additional point of reference.

| AEP |

Duke Energy | GenOn Energy | Southern Company | |||

| Calpine Corporation |

Edison International | NextEra Energy | Williams Companies | |||

| CMS Energy |

Entergy Corp | NRG Energy | Xcel Energy | |||

| Consolidated Edison |

Exelon Corp | PG&E Corp | ||||

| Dominion Resources |

FirstEnergy | PSEG |

The Compensation Committee does not explicitly consider the proxy data in making its decisions based on two considerations. First, the proxy data lags the survey data by one year. Second, though these companies are comparable from an industry perspective, the international nature of AES’ operations sets it apart from these companies. Therefore, the Compensation Committee views the Towers Watson survey data as providing a complete and current view of similarly-sized companies with international operations against whom we compete for talent.

21

Table of Contents

Independent Consultant’s Review of Survey Data