0.04430.020.044790000003380000002922000000307700000000false--12-31Q120190000874761falseLarge Accelerated FilerAES CORPfalse23000000230000000.130.13650.010.01120000000012000000008172036918175938546622980966636949561.05000.57000.8500457000000467000000less than one year to more than 16 years32000000247000000157000000010000000270000008000000400000000001000000200000000150000001800000010000000154905595153898898<div style="font-family:Times New Roman;font-size:10pt;"><div style="line-height:120%;padding-top:12px;font-size:10pt;"><font style="font-family:Arial;font-size:10pt;font-weight:bold;">ACQUISITIONS</font></div></div>

0000874761

2019-01-01

2019-03-31

0000874761

2019-03-31

0000874761

2019-05-01

0000874761

2018-12-31

0000874761

us-gaap:VariableInterestEntityPrimaryBeneficiaryMember

2018-12-31

0000874761

us-gaap:VariableInterestEntityPrimaryBeneficiaryMember

2019-03-31

0000874761

2018-01-01

2018-03-31

0000874761

us-gaap:ElectricityGenerationMember

2018-01-01

2018-03-31

0000874761

us-gaap:ElectricityGenerationMember

2019-01-01

2019-03-31

0000874761

us-gaap:ElectricDistributionMember

2019-01-01

2019-03-31

0000874761

us-gaap:ElectricDistributionMember

2018-01-01

2018-03-31

0000874761

us-gaap:NoncontrollingInterestMember

2018-03-31

0000874761

us-gaap:CommonStockMember

2018-01-01

2018-03-31

0000874761

us-gaap:TreasuryStockMember

2018-01-01

2018-03-31

0000874761

us-gaap:NoncontrollingInterestMember

2018-01-01

2018-03-31

0000874761

us-gaap:RetainedEarningsMember

2018-01-01

2018-03-31

0000874761

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2017-12-31

0000874761

us-gaap:NoncontrollingInterestMember

2017-12-31

0000874761

us-gaap:AdditionalPaidInCapitalMember

2018-01-01

2018-03-31

0000874761

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2018-01-01

2018-03-31

0000874761

us-gaap:TreasuryStockMember

2018-03-31

0000874761

us-gaap:CommonStockMember

2018-03-31

0000874761

us-gaap:CommonStockMember

2017-12-31

0000874761

us-gaap:AdditionalPaidInCapitalMember

2017-12-31

0000874761

us-gaap:RetainedEarningsMember

2018-03-31

0000874761

us-gaap:RetainedEarningsMember

2017-12-31

0000874761

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2018-03-31

0000874761

us-gaap:TreasuryStockMember

2017-12-31

0000874761

us-gaap:AdditionalPaidInCapitalMember

2018-03-31

0000874761

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2018-12-31

0000874761

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2019-01-01

2019-03-31

0000874761

us-gaap:CommonStockMember

2019-01-01

2019-03-31

0000874761

us-gaap:NoncontrollingInterestMember

2019-01-01

2019-03-31

0000874761

us-gaap:TreasuryStockMember

2019-01-01

2019-03-31

0000874761

us-gaap:AdditionalPaidInCapitalMember

2019-01-01

2019-03-31

0000874761

us-gaap:RetainedEarningsMember

2018-12-31

0000874761

us-gaap:RetainedEarningsMember

2019-01-01

2019-03-31

0000874761

us-gaap:TreasuryStockMember

2019-03-31

0000874761

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2019-03-31

0000874761

us-gaap:TreasuryStockMember

2018-12-31

0000874761

us-gaap:NoncontrollingInterestMember

2019-03-31

0000874761

us-gaap:CommonStockMember

2018-12-31

0000874761

us-gaap:CommonStockMember

2019-03-31

0000874761

us-gaap:RetainedEarningsMember

2019-03-31

0000874761

us-gaap:AdditionalPaidInCapitalMember

2018-12-31

0000874761

us-gaap:AdditionalPaidInCapitalMember

2019-03-31

0000874761

us-gaap:NoncontrollingInterestMember

2018-12-31

0000874761

2018-03-31

0000874761

aes:FluenceMember

aes:NoncashMember

2018-01-01

2018-03-31

0000874761

aes:FluenceMember

aes:NoncashMember

2019-01-01

2019-03-31

0000874761

2017-12-31

0000874761

us-gaap:AccountingStandardsUpdate201602Member

2018-12-31

0000874761

2019-01-01

0000874761

us-gaap:AccountingStandardsUpdate201409Member

us-gaap:RetainedEarningsMember

2019-01-01

0000874761

us-gaap:AccountingStandardsUpdate201712Member

us-gaap:RetainedEarningsMember

2019-01-01

0000874761

us-gaap:ForeignExchangeContractMember

2018-01-01

2018-03-31

0000874761

us-gaap:CommodityContractMember

2018-01-01

2018-03-31

0000874761

us-gaap:ForeignExchangeContractMember

aes:OthercomprehensiveincomeDerivativeactivityMember

2018-01-01

2018-03-31

0000874761

us-gaap:InterestRateContractMember

2018-01-01

2018-03-31

0000874761

us-gaap:InterestRateContractMember

2018-03-31

0000874761

us-gaap:CommodityContractMember

2017-12-31

0000874761

us-gaap:ForeignExchangeContractMember

2018-03-31

0000874761

us-gaap:InterestRateContractMember

aes:OthercomprehensiveincomeDerivativeactivityMember

2018-01-01

2018-03-31

0000874761

us-gaap:CommodityContractMember

2018-03-31

0000874761

us-gaap:CommodityContractMember

aes:OthercomprehensiveincomeDerivativeactivityMember

2018-01-01

2018-03-31

0000874761

aes:OthercomprehensiveincomeDerivativeactivityMember

2018-01-01

2018-03-31

0000874761

us-gaap:InterestRateContractMember

2017-12-31

0000874761

us-gaap:ForeignExchangeContractMember

2017-12-31

0000874761

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2018-12-31

0000874761

us-gaap:FairValueInputsLevel1Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2018-12-31

0000874761

us-gaap:FairValueInputsLevel3Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2018-12-31

0000874761

us-gaap:FairValueInputsLevel2Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2018-12-31

0000874761

us-gaap:CarryingReportedAmountFairValueDisclosureMember

2018-12-31

0000874761

us-gaap:InterestRateContractMember

2019-03-31

0000874761

us-gaap:CommodityContractMember

2019-03-31

0000874761

currency:ARS

us-gaap:ForeignExchangeContractMember

2019-03-31

0000874761

us-gaap:InterestRateContractMember

2019-01-01

2019-03-31

0000874761

us-gaap:ForeignExchangeContractMember

2019-03-31

0000874761

us-gaap:CommodityContractMember

2019-01-01

2019-03-31

0000874761

us-gaap:CommodityContractMember

aes:OthercomprehensiveincomeDerivativeactivityMember

2019-01-01

2019-03-31

0000874761

aes:OthercomprehensiveincomeDerivativeactivityMember

2019-01-01

2019-03-31

0000874761

us-gaap:InterestRateContractMember

2018-12-31

0000874761

us-gaap:ForeignExchangeContractMember

2019-01-01

2019-03-31

0000874761

us-gaap:InterestRateContractMember

aes:OthercomprehensiveincomeDerivativeactivityMember

2019-01-01

2019-03-31

0000874761

us-gaap:ForeignExchangeContractMember

2018-12-31

0000874761

us-gaap:CommodityContractMember

2018-12-31

0000874761

us-gaap:ForeignExchangeContractMember

aes:OthercomprehensiveincomeDerivativeactivityMember

2019-01-01

2019-03-31

0000874761

us-gaap:ForeignExchangeContractMember

us-gaap:FairValueInputsLevel2Member

us-gaap:DerivativeMember

2019-03-31

0000874761

us-gaap:MutualFundMember

us-gaap:FairValueInputsLevel3Member

us-gaap:AvailableforsaleSecuritiesMember

2019-03-31

0000874761

us-gaap:CrossCurrencyInterestRateContractMember

us-gaap:FairValueInputsLevel3Member

us-gaap:DerivativeMember

2019-03-31

0000874761

us-gaap:ForeignExchangeContractMember

us-gaap:FairValueInputsLevel2Member

us-gaap:DerivativeMember

2018-12-31

0000874761

us-gaap:FairValueInputsLevel2Member

us-gaap:DerivativeMember

2019-03-31

0000874761

us-gaap:FairValueInputsLevel3Member

us-gaap:DerivativeMember

2018-12-31

0000874761

us-gaap:InterestRateContractMember

us-gaap:FairValueInputsLevel1Member

us-gaap:DerivativeMember

2019-03-31

0000874761

us-gaap:InterestRateContractMember

us-gaap:FairValueInputsLevel3Member

us-gaap:DerivativeMember

2019-03-31

0000874761

us-gaap:FairValueInputsLevel1Member

us-gaap:DebtSecuritiesMember

2018-12-31

0000874761

us-gaap:CorporateDebtSecuritiesMember

us-gaap:FairValueInputsLevel2Member

us-gaap:AvailableforsaleSecuritiesMember

2018-12-31

0000874761

us-gaap:DerivativeMember

2018-12-31

0000874761

us-gaap:CorporateDebtSecuritiesMember

us-gaap:FairValueInputsLevel1Member

us-gaap:AvailableforsaleSecuritiesMember

2019-03-31

0000874761

us-gaap:CommodityContractMember

us-gaap:DerivativeMember

2019-03-31

0000874761

us-gaap:FairValueInputsLevel3Member

us-gaap:EquitySecuritiesMember

2019-03-31

0000874761

us-gaap:MutualFundMember

us-gaap:FairValueInputsLevel2Member

us-gaap:AvailableforsaleSecuritiesMember

2019-03-31

0000874761

us-gaap:InterestRateContractMember

us-gaap:FairValueInputsLevel1Member

us-gaap:DerivativeMember

2018-12-31

0000874761

us-gaap:ForeignExchangeContractMember

us-gaap:FairValueInputsLevel3Member

us-gaap:DerivativeMember

2019-03-31

0000874761

us-gaap:ForeignExchangeContractMember

us-gaap:FairValueInputsLevel3Member

us-gaap:DerivativeMember

2019-03-31

0000874761

us-gaap:FairValueInputsLevel3Member

us-gaap:EquitySecuritiesMember

2018-12-31

0000874761

us-gaap:CrossCurrencyInterestRateContractMember

us-gaap:DerivativeMember

2019-03-31

0000874761

us-gaap:FairValueInputsLevel2Member

us-gaap:DebtSecuritiesMember

2018-12-31

0000874761

us-gaap:FairValueInputsLevel1Member

us-gaap:DerivativeMember

2019-03-31

0000874761

us-gaap:FairValueInputsLevel3Member

2019-03-31

0000874761

us-gaap:InterestRateContractMember

us-gaap:FairValueInputsLevel3Member

us-gaap:DerivativeMember

2019-03-31

0000874761

us-gaap:FairValueInputsLevel2Member

us-gaap:DerivativeMember

2018-12-31

0000874761

us-gaap:CommodityContractMember

us-gaap:FairValueInputsLevel1Member

us-gaap:DerivativeMember

2019-03-31

0000874761

us-gaap:EquityFundsMember

us-gaap:FairValueInputsLevel1Member

us-gaap:AvailableforsaleSecuritiesMember

2018-12-31

0000874761

us-gaap:ForeignExchangeContractMember

us-gaap:DerivativeMember

2018-12-31

0000874761

us-gaap:FairValueInputsLevel1Member

us-gaap:DebtSecuritiesMember

2019-03-31

0000874761

us-gaap:CommodityContractMember

us-gaap:FairValueInputsLevel2Member

us-gaap:DerivativeMember

2018-12-31

0000874761

us-gaap:FairValueInputsLevel3Member

us-gaap:DerivativeMember

2019-03-31

0000874761

us-gaap:FairValueInputsLevel2Member

2018-12-31

0000874761

us-gaap:OtherDebtSecuritiesMember

us-gaap:FairValueInputsLevel1Member

us-gaap:AvailableforsaleSecuritiesMember

2019-03-31

0000874761

us-gaap:CrossCurrencyInterestRateContractMember

us-gaap:FairValueInputsLevel2Member

us-gaap:DerivativeMember

2019-03-31

0000874761

us-gaap:OtherDebtSecuritiesMember

us-gaap:FairValueInputsLevel1Member

us-gaap:AvailableforsaleSecuritiesMember

2018-12-31

0000874761

us-gaap:FairValueInputsLevel3Member

us-gaap:DebtSecuritiesMember

2019-03-31

0000874761

us-gaap:FairValueInputsLevel2Member

us-gaap:DebtSecuritiesMember

2019-03-31

0000874761

us-gaap:CommodityContractMember

us-gaap:FairValueInputsLevel2Member

us-gaap:DerivativeMember

2019-03-31

0000874761

us-gaap:ForeignExchangeContractMember

us-gaap:FairValueInputsLevel1Member

us-gaap:DerivativeMember

2018-12-31

0000874761

us-gaap:ForeignExchangeContractMember

us-gaap:FairValueInputsLevel2Member

us-gaap:DerivativeMember

2019-03-31

0000874761

us-gaap:CorporateDebtSecuritiesMember

us-gaap:FairValueInputsLevel1Member

us-gaap:AvailableforsaleSecuritiesMember

2018-12-31

0000874761

us-gaap:OtherDebtSecuritiesMember

us-gaap:FairValueInputsLevel2Member

us-gaap:AvailableforsaleSecuritiesMember

2019-03-31

0000874761

us-gaap:ForeignExchangeContractMember

us-gaap:FairValueInputsLevel3Member

us-gaap:DerivativeMember

2018-12-31

0000874761

us-gaap:FairValueInputsLevel2Member

us-gaap:EquitySecuritiesMember

2019-03-31

0000874761

us-gaap:CorporateDebtSecuritiesMember

us-gaap:FairValueInputsLevel2Member

us-gaap:AvailableforsaleSecuritiesMember

2019-03-31

0000874761

us-gaap:FairValueInputsLevel1Member

us-gaap:DerivativeMember

2018-12-31

0000874761

us-gaap:EquityFundsMember

us-gaap:AvailableforsaleSecuritiesMember

2018-12-31

0000874761

us-gaap:CommodityContractMember

us-gaap:FairValueInputsLevel3Member

us-gaap:DerivativeMember

2018-12-31

0000874761

us-gaap:FairValueInputsLevel2Member

2019-03-31

0000874761

us-gaap:OtherDebtSecuritiesMember

us-gaap:AvailableforsaleSecuritiesMember

2018-12-31

0000874761

us-gaap:EquitySecuritiesMember

2018-12-31

0000874761

us-gaap:CrossCurrencyInterestRateContractMember

us-gaap:FairValueInputsLevel3Member

us-gaap:DerivativeMember

2019-03-31

0000874761

us-gaap:FairValueInputsLevel1Member

2018-12-31

0000874761

us-gaap:MutualFundMember

us-gaap:AvailableforsaleSecuritiesMember

2019-03-31

0000874761

us-gaap:FairValueInputsLevel1Member

us-gaap:EquitySecuritiesMember

2019-03-31

0000874761

us-gaap:InterestRateContractMember

us-gaap:DerivativeMember

2019-03-31

0000874761

us-gaap:FairValueInputsLevel3Member

2018-12-31

0000874761

us-gaap:EquitySecuritiesMember

2019-03-31

0000874761

us-gaap:FairValueInputsLevel3Member

us-gaap:DebtSecuritiesMember

2018-12-31

0000874761

us-gaap:ForeignExchangeContractMember

us-gaap:FairValueInputsLevel1Member

us-gaap:DerivativeMember

2019-03-31

0000874761

us-gaap:DebtSecuritiesMember

2018-12-31

0000874761

us-gaap:FairValueInputsLevel1Member

2019-03-31

0000874761

us-gaap:ForeignExchangeContractMember

us-gaap:FairValueInputsLevel1Member

us-gaap:DerivativeMember

2018-12-31

0000874761

us-gaap:DerivativeMember

2019-03-31

0000874761

us-gaap:OtherDebtSecuritiesMember

us-gaap:FairValueInputsLevel3Member

us-gaap:AvailableforsaleSecuritiesMember

2018-12-31

0000874761

us-gaap:InterestRateContractMember

us-gaap:DerivativeMember

2018-12-31

0000874761

us-gaap:CrossCurrencyInterestRateContractMember

us-gaap:FairValueInputsLevel1Member

us-gaap:DerivativeMember

2019-03-31

0000874761

us-gaap:InterestRateContractMember

us-gaap:FairValueInputsLevel2Member

us-gaap:DerivativeMember

2018-12-31

0000874761

us-gaap:CommodityContractMember

us-gaap:FairValueInputsLevel2Member

us-gaap:DerivativeMember

2018-12-31

0000874761

us-gaap:CrossCurrencyInterestRateContractMember

us-gaap:FairValueInputsLevel3Member

us-gaap:DerivativeMember

2018-12-31

0000874761

us-gaap:InterestRateContractMember

us-gaap:FairValueInputsLevel3Member

us-gaap:DerivativeMember

2018-12-31

0000874761

us-gaap:CommodityContractMember

us-gaap:DerivativeMember

2019-03-31

0000874761

us-gaap:CommodityContractMember

us-gaap:FairValueInputsLevel1Member

us-gaap:DerivativeMember

2019-03-31

0000874761

us-gaap:CommodityContractMember

us-gaap:FairValueInputsLevel3Member

us-gaap:DerivativeMember

2019-03-31

0000874761

us-gaap:CorporateDebtSecuritiesMember

us-gaap:AvailableforsaleSecuritiesMember

2018-12-31

0000874761

us-gaap:CrossCurrencyInterestRateContractMember

us-gaap:FairValueInputsLevel2Member

us-gaap:DerivativeMember

2019-03-31

0000874761

us-gaap:FairValueInputsLevel1Member

us-gaap:EquitySecuritiesMember

2018-12-31

0000874761

us-gaap:EquityFundsMember

us-gaap:FairValueInputsLevel2Member

us-gaap:AvailableforsaleSecuritiesMember

2018-12-31

0000874761

us-gaap:InterestRateContractMember

us-gaap:FairValueInputsLevel2Member

us-gaap:DerivativeMember

2018-12-31

0000874761

us-gaap:OtherDebtSecuritiesMember

us-gaap:AvailableforsaleSecuritiesMember

2019-03-31

0000874761

us-gaap:ForeignExchangeContractMember

us-gaap:FairValueInputsLevel3Member

us-gaap:DerivativeMember

2018-12-31

0000874761

us-gaap:CommodityContractMember

us-gaap:FairValueInputsLevel3Member

us-gaap:DerivativeMember

2019-03-31

0000874761

us-gaap:InterestRateContractMember

us-gaap:FairValueInputsLevel2Member

us-gaap:DerivativeMember

2019-03-31

0000874761

us-gaap:CommodityContractMember

us-gaap:DerivativeMember

2018-12-31

0000874761

us-gaap:DebtSecuritiesMember

2019-03-31

0000874761

us-gaap:CommodityContractMember

us-gaap:FairValueInputsLevel1Member

us-gaap:DerivativeMember

2018-12-31

0000874761

us-gaap:OtherDebtSecuritiesMember

us-gaap:FairValueInputsLevel3Member

us-gaap:AvailableforsaleSecuritiesMember

2019-03-31

0000874761

us-gaap:MutualFundMember

us-gaap:FairValueInputsLevel1Member

us-gaap:AvailableforsaleSecuritiesMember

2019-03-31

0000874761

us-gaap:InterestRateContractMember

us-gaap:FairValueInputsLevel3Member

us-gaap:DerivativeMember

2018-12-31

0000874761

us-gaap:ForeignExchangeContractMember

us-gaap:DerivativeMember

2018-12-31

0000874761

us-gaap:CrossCurrencyInterestRateContractMember

us-gaap:FairValueInputsLevel3Member

us-gaap:DerivativeMember

2018-12-31

0000874761

us-gaap:CommodityContractMember

us-gaap:FairValueInputsLevel1Member

us-gaap:DerivativeMember

2018-12-31

0000874761

us-gaap:CorporateDebtSecuritiesMember

us-gaap:FairValueInputsLevel3Member

us-gaap:AvailableforsaleSecuritiesMember

2018-12-31

0000874761

us-gaap:CrossCurrencyInterestRateContractMember

us-gaap:FairValueInputsLevel1Member

us-gaap:DerivativeMember

2019-03-31

0000874761

us-gaap:CrossCurrencyInterestRateContractMember

us-gaap:FairValueInputsLevel2Member

us-gaap:DerivativeMember

2018-12-31

0000874761

us-gaap:ForeignExchangeContractMember

us-gaap:FairValueInputsLevel2Member

us-gaap:DerivativeMember

2018-12-31

0000874761

us-gaap:CommodityContractMember

us-gaap:FairValueInputsLevel2Member

us-gaap:DerivativeMember

2019-03-31

0000874761

us-gaap:EquityFundsMember

us-gaap:FairValueInputsLevel3Member

us-gaap:AvailableforsaleSecuritiesMember

2018-12-31

0000874761

us-gaap:CorporateDebtSecuritiesMember

us-gaap:AvailableforsaleSecuritiesMember

2019-03-31

0000874761

us-gaap:ForeignExchangeContractMember

us-gaap:DerivativeMember

2019-03-31

0000874761

us-gaap:CommodityContractMember

us-gaap:FairValueInputsLevel3Member

us-gaap:DerivativeMember

2018-12-31

0000874761

us-gaap:CrossCurrencyInterestRateContractMember

us-gaap:FairValueInputsLevel1Member

us-gaap:DerivativeMember

2018-12-31

0000874761

us-gaap:FairValueInputsLevel2Member

us-gaap:EquitySecuritiesMember

2018-12-31

0000874761

us-gaap:ForeignExchangeContractMember

us-gaap:FairValueInputsLevel1Member

us-gaap:DerivativeMember

2019-03-31

0000874761

us-gaap:OtherDebtSecuritiesMember

us-gaap:FairValueInputsLevel2Member

us-gaap:AvailableforsaleSecuritiesMember

2018-12-31

0000874761

us-gaap:CorporateDebtSecuritiesMember

us-gaap:FairValueInputsLevel3Member

us-gaap:AvailableforsaleSecuritiesMember

2019-03-31

0000874761

us-gaap:CrossCurrencyInterestRateContractMember

us-gaap:DerivativeMember

2019-03-31

0000874761

us-gaap:ForeignExchangeContractMember

us-gaap:DerivativeMember

2019-03-31

0000874761

us-gaap:InterestRateContractMember

us-gaap:DerivativeMember

2019-03-31

0000874761

us-gaap:CommodityContractMember

us-gaap:DerivativeMember

2018-12-31

0000874761

us-gaap:CrossCurrencyInterestRateContractMember

us-gaap:DerivativeMember

2018-12-31

0000874761

us-gaap:CrossCurrencyInterestRateContractMember

us-gaap:FairValueInputsLevel1Member

us-gaap:DerivativeMember

2018-12-31

0000874761

us-gaap:InterestRateContractMember

us-gaap:FairValueInputsLevel1Member

us-gaap:DerivativeMember

2018-12-31

0000874761

us-gaap:CrossCurrencyInterestRateContractMember

us-gaap:FairValueInputsLevel2Member

us-gaap:DerivativeMember

2018-12-31

0000874761

us-gaap:InterestRateContractMember

us-gaap:FairValueInputsLevel2Member

us-gaap:DerivativeMember

2019-03-31

0000874761

us-gaap:CrossCurrencyInterestRateContractMember

us-gaap:DerivativeMember

2018-12-31

0000874761

us-gaap:InterestRateContractMember

us-gaap:DerivativeMember

2018-12-31

0000874761

us-gaap:InterestRateContractMember

us-gaap:FairValueInputsLevel1Member

us-gaap:DerivativeMember

2019-03-31

0000874761

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2019-03-31

0000874761

us-gaap:CarryingReportedAmountFairValueDisclosureMember

2019-03-31

0000874761

us-gaap:FairValueInputsLevel1Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2019-03-31

0000874761

us-gaap:FairValueInputsLevel2Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2019-03-31

0000874761

us-gaap:FairValueInputsLevel3Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2019-03-31

0000874761

srt:WeightedAverageMember

us-gaap:InterestRateContractMember

us-gaap:MeasurementInputEntityCreditRiskMember

2019-01-01

2019-03-31

0000874761

srt:MinimumMember

us-gaap:InterestRateContractMember

us-gaap:MeasurementInputEntityCreditRiskMember

2019-01-01

2019-03-31

0000874761

currency:ARS

srt:WeightedAverageMember

us-gaap:ForeignExchangeContractMember

2019-03-31

0000874761

currency:ARS

srt:MaximumMember

us-gaap:ForeignExchangeContractMember

2019-03-31

0000874761

srt:MaximumMember

us-gaap:InterestRateContractMember

us-gaap:MeasurementInputEntityCreditRiskMember

2019-01-01

2019-03-31

0000874761

currency:ARS

srt:MinimumMember

us-gaap:ForeignExchangeContractMember

2019-03-31

0000874761

currency:CLF

us-gaap:CrossCurrencyInterestRateContractMember

2019-03-31

0000874761

currency:CLP

us-gaap:ForeignExchangeContractMember

2019-03-31

0000874761

currency:COP

us-gaap:ForeignExchangeContractMember

2019-03-31

0000874761

currency:BRL

us-gaap:ForeignExchangeContractMember

2019-03-31

0000874761

aes:OtherunspecifiedcurrencyDomain

us-gaap:ForeignExchangeContractMember

2019-03-31

0000874761

aes:LiborandEuriborMember

us-gaap:InterestRateContractMember

2019-03-31

0000874761

us-gaap:OtherCurrentAssetsMember

2018-12-31

0000874761

us-gaap:OtherNoncurrentLiabilitiesMember

2018-12-31

0000874761

us-gaap:OtherCurrentLiabilitiesMember

2019-03-31

0000874761

us-gaap:OtherNoncurrentAssetsMember

2018-12-31

0000874761

us-gaap:OtherNoncurrentLiabilitiesMember

2019-03-31

0000874761

us-gaap:OtherNoncurrentAssetsMember

2019-03-31

0000874761

us-gaap:OtherCurrentLiabilitiesMember

2018-12-31

0000874761

us-gaap:OtherCurrentAssetsMember

2019-03-31

0000874761

us-gaap:InterestRateContractMember

us-gaap:CashFlowHedgingMember

2018-01-01

2018-03-31

0000874761

us-gaap:CashFlowHedgingMember

2019-01-01

2019-03-31

0000874761

us-gaap:CrossCurrencyInterestRateContractMember

us-gaap:CashFlowHedgingMember

2019-01-01

2019-03-31

0000874761

us-gaap:InterestRateContractMember

us-gaap:CashFlowHedgingMember

2019-01-01

2019-03-31

0000874761

us-gaap:ForeignExchangeContractMember

us-gaap:CashFlowHedgingMember

2019-01-01

2019-03-31

0000874761

us-gaap:CashFlowHedgingMember

2018-01-01

2018-03-31

0000874761

us-gaap:ForeignExchangeContractMember

us-gaap:CashFlowHedgingMember

2018-01-01

2018-03-31

0000874761

us-gaap:CommodityContractMember

us-gaap:CashFlowHedgingMember

2018-01-01

2018-03-31

0000874761

us-gaap:NondesignatedMember

2018-01-01

2018-03-31

0000874761

us-gaap:ForeignExchangeContractMember

us-gaap:NondesignatedMember

2018-01-01

2018-03-31

0000874761

us-gaap:InterestRateContractMember

us-gaap:NondesignatedMember

2018-01-01

2018-03-31

0000874761

us-gaap:ForeignExchangeContractMember

us-gaap:NondesignatedMember

2019-01-01

2019-03-31

0000874761

us-gaap:CrossCurrencyInterestRateContractMember

us-gaap:CashFlowHedgingMember

2018-01-01

2018-03-31

0000874761

us-gaap:InterestRateContractMember

us-gaap:NondesignatedMember

2019-01-01

2019-03-31

0000874761

us-gaap:CommodityContractMember

us-gaap:CashFlowHedgingMember

2019-01-01

2019-03-31

0000874761

us-gaap:OtherContractMember

us-gaap:NondesignatedMember

2019-01-01

2019-03-31

0000874761

us-gaap:OtherContractMember

us-gaap:NondesignatedMember

2018-01-01

2018-03-31

0000874761

us-gaap:NondesignatedMember

2019-01-01

2019-03-31

0000874761

us-gaap:InterestRateContractMember

us-gaap:CashFlowHedgingMember

2019-03-31

0000874761

us-gaap:CrossCurrencyInterestRateContractMember

us-gaap:NondesignatedMember

2019-03-31

0000874761

us-gaap:NondesignatedMember

2019-03-31

0000874761

us-gaap:NondesignatedMember

2018-12-31

0000874761

us-gaap:CrossCurrencyInterestRateContractMember

us-gaap:DesignatedAsHedgingInstrumentMember

2018-12-31

0000874761

us-gaap:CommodityContractMember

us-gaap:DesignatedAsHedgingInstrumentMember

2018-12-31

0000874761

us-gaap:ForeignExchangeContractMember

us-gaap:DesignatedAsHedgingInstrumentMember

2018-12-31

0000874761

us-gaap:ForeignExchangeContractMember

us-gaap:NondesignatedMember

2019-03-31

0000874761

us-gaap:InterestRateContractMember

us-gaap:NondesignatedMember

2018-12-31

0000874761

us-gaap:ForeignExchangeContractMember

us-gaap:DesignatedAsHedgingInstrumentMember

2019-03-31

0000874761

us-gaap:InterestRateContractMember

us-gaap:DesignatedAsHedgingInstrumentMember

2019-03-31

0000874761

us-gaap:CrossCurrencyInterestRateContractMember

2019-03-31

0000874761

us-gaap:CrossCurrencyInterestRateContractMember

2018-12-31

0000874761

us-gaap:CrossCurrencyInterestRateContractMember

us-gaap:DesignatedAsHedgingInstrumentMember

2019-03-31

0000874761

us-gaap:InterestRateContractMember

us-gaap:DesignatedAsHedgingInstrumentMember

2018-12-31

0000874761

us-gaap:DesignatedAsHedgingInstrumentMember

2018-12-31

0000874761

us-gaap:CommodityContractMember

us-gaap:NondesignatedMember

2019-03-31

0000874761

us-gaap:ForeignExchangeContractMember

us-gaap:NondesignatedMember

2018-12-31

0000874761

us-gaap:CrossCurrencyInterestRateContractMember

us-gaap:NondesignatedMember

2018-12-31

0000874761

us-gaap:CommodityContractMember

us-gaap:DesignatedAsHedgingInstrumentMember

2019-03-31

0000874761

us-gaap:CommodityContractMember

us-gaap:NondesignatedMember

2018-12-31

0000874761

us-gaap:DesignatedAsHedgingInstrumentMember

2019-03-31

0000874761

us-gaap:InterestRateContractMember

us-gaap:NondesignatedMember

2019-03-31

0000874761

country:BR

2018-12-31

0000874761

country:AR

2019-03-31

0000874761

country:AR

2018-12-31

0000874761

aes:OtherEntityMember

2019-03-31

0000874761

aes:MinorityOwnedAffiliatesMember

2019-01-01

2019-03-31

0000874761

aes:MinorityOwnedAffiliatesMember

2018-01-01

2018-03-31

0000874761

country:PR

aes:CovenantViolationMember

2019-03-31

0000874761

aes:AESlluminaMember

aes:CovenantViolationMember

2019-03-31

0000874761

aes:AESSouthlandDomain

aes:NonrecourseDebtMember

2019-01-01

2019-03-31

0000874761

aes:NonrecourseDebtMember

2019-01-01

2019-03-31

0000874761

aes:NonrecourseDebtMember

2019-03-31

0000874761

aes:AESTieteDomain

aes:NonrecourseDebtMember

2019-01-01

2019-03-31

0000874761

aes:AESSouthlandDomain

aes:NonrecourseDebtMember

2019-03-31

0000874761

aes:AESTieteDomain

aes:NonrecourseDebtMember

2019-03-31

0000874761

aes:A4.0SeniorNotesDue2021DomainDomain

us-gaap:UnsecuredDebtMember

aes:RecourseDebtMember

2018-01-01

2018-03-31

0000874761

aes:A5.5SeniorNotesDue2025MemberMember

2018-01-01

2018-03-31

0000874761

aes:A4.0SeniorNotesDue2021DomainDomain

us-gaap:SeniorNotesMember

2018-03-31

0000874761

aes:A8.0SeniorNotesDue2020Domain

2018-01-01

2018-03-31

0000874761

aes:A4.0SeniorNotesDue2021DomainDomain

us-gaap:UnsecuredDebtMember

2018-03-31

0000874761

aes:A4.5SeniorNotesDue2023DomainDomain

us-gaap:SeniorNotesMember

2018-03-31

0000874761

aes:A5.5SeniorNotesDue2024MemberMember

us-gaap:SeniorNotesMember

2018-03-31

0000874761

aes:A7.375SeniorNotesDue2021MemberMember

us-gaap:UnsecuredDebtMember

2018-03-31

0000874761

aes:A5.5SeniorNotesDue2024MemberMember

us-gaap:UnsecuredDebtMember

aes:RecourseDebtMember

2018-01-01

2018-03-31

0000874761

aes:A8.0SeniorNotesDue2020Domain

us-gaap:UnsecuredDebtMember

2018-03-31

0000874761

aes:A5.5SeniorNotesDue2024MemberMember

2018-01-01

2018-03-31

0000874761

aes:A7.375SeniorNotesDue2021MemberMember

2018-01-01

2018-03-31

0000874761

aes:A4.5SeniorNotesDue2023DomainDomain

us-gaap:UnsecuredDebtMember

2018-03-31

0000874761

aes:A5.5SeniorNotesDue2025MemberMember

us-gaap:SeniorNotesMember

2018-03-31

0000874761

us-gaap:SecuredDebtMember

us-gaap:FinancialStandbyLetterOfCreditMember

2019-03-31

0000874761

us-gaap:IndemnificationGuaranteeMember

2019-03-31

0000874761

srt:MaximumMember

us-gaap:IndemnificationGuaranteeMember

2019-03-31

0000874761

us-gaap:UnsecuredDebtMember

us-gaap:FinancialStandbyLetterOfCreditMember

2019-03-31

0000874761

us-gaap:GuaranteeObligationsMember

2019-03-31

0000874761

aes:LitigationMember

2019-03-31

0000874761

srt:MinimumMember

us-gaap:StandbyLettersOfCreditMember

2019-01-01

2019-03-31

0000874761

us-gaap:EnvironmentalRemediationContingencyDomain

2019-03-31

0000874761

srt:MaximumMember

aes:LitigationMember

2019-03-31

0000874761

aes:LitigationMember

2018-12-31

0000874761

srt:MaximumMember

us-gaap:EnvironmentalRemediationContingencyDomain

2019-03-31

0000874761

srt:MaximumMember

us-gaap:StandbyLettersOfCreditMember

2019-01-01

2019-03-31

0000874761

srt:MinimumMember

aes:LitigationMember

2019-03-31

0000874761

srt:MinimumMember

us-gaap:UnsecuredDebtMember

us-gaap:FinancialStandbyLetterOfCreditMember

2019-03-31

0000874761

srt:MaximumMember

us-gaap:UnsecuredDebtMember

us-gaap:FinancialStandbyLetterOfCreditMember

2019-03-31

0000874761

srt:MaximumMember

us-gaap:SecuredDebtMember

us-gaap:FinancialStandbyLetterOfCreditMember

2019-03-31

0000874761

srt:MinimumMember

us-gaap:IndemnificationGuaranteeMember

2019-03-31

0000874761

srt:MaximumMember

us-gaap:GuaranteeObligationsMember

2019-03-31

0000874761

srt:MinimumMember

us-gaap:SecuredDebtMember

us-gaap:FinancialStandbyLetterOfCreditMember

2019-03-31

0000874761

srt:MinimumMember

us-gaap:GuaranteeObligationsMember

2019-03-31

0000874761

aes:ColonDomain

2019-01-01

2019-03-31

0000874761

aes:ColonDomain

2019-03-31

0000874761

aes:IPALCOEnterprisesInc.Member

2019-03-31

0000874761

aes:IplSubsidiaryMember

2019-03-31

0000874761

aes:IPALCOEnterprisesInc.Member

2018-12-31

0000874761

aes:ColonDomain

2018-12-31

0000874761

aes:IplSubsidiaryMember

2018-12-31

0000874761

aes:ColonDomain

2018-01-01

2018-03-31

0000874761

us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember

us-gaap:AccumulatedNetGainLossFromCashFlowHedgesIncludingPortionAttributableToNoncontrollingInterestMember

2018-01-01

2018-03-31

0000874761

us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember

us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember

2019-01-01

2019-03-31

0000874761

us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember

us-gaap:AccumulatedTranslationAdjustmentMember

2018-01-01

2018-03-31

0000874761

us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember

us-gaap:AccumulatedDefinedBenefitPlansAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember

2019-01-01

2019-03-31

0000874761

us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember

us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember

2018-01-01

2018-03-31

0000874761

us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember

us-gaap:AccumulatedNetGainLossFromCashFlowHedgesAttributableToNoncontrollingInterestMember

2019-01-01

2019-03-31

0000874761

us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember

us-gaap:AccumulatedDefinedBenefitPlansAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember

2018-01-01

2018-03-31

0000874761

us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember

us-gaap:AccumulatedNetGainLossFromCashFlowHedgesIncludingPortionAttributableToNoncontrollingInterestMember

2019-01-01

2019-03-31

0000874761

us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember

us-gaap:AccumulatedTranslationAdjustmentMember

2019-01-01

2019-03-31

0000874761

us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember

us-gaap:AccumulatedNetGainLossFromCashFlowHedgesAttributableToNoncontrollingInterestMember

2018-01-01

2018-03-31

0000874761

us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember

2018-01-01

2018-03-31

0000874761

us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember

us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember

2019-01-01

2019-03-31

0000874761

us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember

2019-01-01

2019-03-31

0000874761

us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember

us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember

2018-01-01

2018-03-31

0000874761

2019-02-22

2019-02-22

0000874761

aes:ASC606ImpactMember

us-gaap:AccumulatedTranslationAdjustmentMember

2019-01-01

2019-03-31

0000874761

us-gaap:AccumulatedTranslationAdjustmentMember

2019-01-01

2019-03-31

0000874761

us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember

2019-01-01

2019-03-31

0000874761

us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember

2019-01-01

2019-03-31

0000874761

aes:ASC606ImpactMember

2019-01-01

2019-03-31

0000874761

aes:ASC606ImpactMember

us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember

2019-01-01

2019-03-31

0000874761

aes:ASC606ImpactMember

us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember

2019-01-01

2019-03-31

0000874761

us-gaap:OperatingSegmentsMember

2018-01-01

2018-03-31

0000874761

us-gaap:OperatingSegmentsMember

aes:USandUtilitiesMember

2018-01-01

2018-03-31

0000874761

us-gaap:OperatingSegmentsMember

aes:MCACMember

2019-01-01

2019-03-31

0000874761

us-gaap:OperatingSegmentsMember

aes:USandUtilitiesMember

2019-01-01

2019-03-31

0000874761

us-gaap:OperatingSegmentsMember

aes:EURASIAMember

2019-01-01

2019-03-31

0000874761

us-gaap:OperatingSegmentsMember

2019-01-01

2019-03-31

0000874761

us-gaap:OperatingSegmentsMember

aes:EURASIAMember

2018-01-01

2018-03-31

0000874761

us-gaap:OperatingSegmentsMember

aes:MCACMember

2018-01-01

2018-03-31

0000874761

us-gaap:IntersegmentEliminationMember

2019-01-01

2019-03-31

0000874761

us-gaap:OperatingSegmentsMember

aes:CorporateOtherAndOtherEliminationsMember

2019-01-01

2019-03-31

0000874761

us-gaap:OperatingSegmentsMember

srt:SouthAmericaMember

2018-01-01

2018-03-31

0000874761

us-gaap:IntersegmentEliminationMember

2018-01-01

2018-03-31

0000874761

us-gaap:OperatingSegmentsMember

aes:CorporateOtherAndOtherEliminationsMember

2018-01-01

2018-03-31

0000874761

us-gaap:OperatingSegmentsMember

srt:SouthAmericaMember

2019-01-01

2019-03-31

0000874761

aes:CorporateOtherAndOtherEliminationsMember

2019-03-31

0000874761

aes:MCACMember

2019-03-31

0000874761

aes:MCACMember

2018-12-31

0000874761

aes:USandUtilitiesMember

2019-03-31

0000874761

aes:USandUtilitiesMember

2018-12-31

0000874761

aes:CorporateOtherAndOtherEliminationsMember

2018-12-31

0000874761

aes:EURASIAMember

2018-12-31

0000874761

aes:EURASIAMember

2019-03-31

0000874761

srt:SouthAmericaMember

2019-03-31

0000874761

srt:SouthAmericaMember

2018-12-31

0000874761

aes:NonregulatedrevenueMember

aes:CorporateOtherAndOtherEliminationsMember

2018-01-01

2018-03-31

0000874761

aes:RegulatedRevenueMember

2018-01-01

2018-03-31

0000874761

aes:RegulatedRevenueMember

aes:EURASIAMember

2018-01-01

2018-03-31

0000874761

aes:RegulatedRevenueMember

aes:CorporateOtherAndOtherEliminationsMember

2018-01-01

2018-03-31

0000874761

aes:RegulatedRevenueMember

aes:MCACMember

2018-01-01

2018-03-31

0000874761

aes:RegulatedRevenueMember

aes:USandUtilitiesDomain

2018-01-01

2018-03-31

0000874761

aes:NonregulatedrevenueMember

2018-01-01

2018-03-31

0000874761

aes:USandUtilitiesDomain

2018-01-01

2018-03-31

0000874761

aes:EURASIAMember

2018-01-01

2018-03-31

0000874761

aes:RegulatedRevenueMember

srt:SouthAmericaMember

2018-01-01

2018-03-31

0000874761

aes:NonregulatedrevenueMember

aes:MCACMember

2018-01-01

2018-03-31

0000874761

aes:NonregulatedrevenueMember

aes:EURASIAMember

2018-01-01

2018-03-31

0000874761

aes:NonregulatedrevenueMember

srt:SouthAmericaMember

2018-01-01

2018-03-31

0000874761

aes:MCACMember

2018-01-01

2018-03-31

0000874761

aes:NonregulatedrevenueMember

aes:USandUtilitiesDomain

2018-01-01

2018-03-31

0000874761

aes:CorporateOtherAndOtherEliminationsMember

2018-01-01

2018-03-31

0000874761

srt:SouthAmericaMember

2018-01-01

2018-03-31

0000874761

aes:RegulatedRevenueMember

aes:MCACMember

2019-01-01

2019-03-31

0000874761

aes:NonregulatedrevenueMember

aes:USandUtilitiesDomain

2019-01-01

2019-03-31

0000874761

aes:RegulatedRevenueMember

aes:CorporateOtherAndOtherEliminationsMember

2019-01-01

2019-03-31

0000874761

aes:RegulatedRevenueMember

srt:SouthAmericaMember

2019-01-01

2019-03-31

0000874761

aes:RegulatedRevenueMember

2019-01-01

2019-03-31

0000874761

aes:NonregulatedrevenueMember

aes:MCACMember

2019-01-01

2019-03-31

0000874761

aes:CorporateOtherAndOtherEliminationsMember

2019-01-01

2019-03-31

0000874761

aes:RegulatedRevenueMember

aes:USandUtilitiesDomain

2019-01-01

2019-03-31

0000874761

aes:NonregulatedrevenueMember

srt:SouthAmericaMember

2019-01-01

2019-03-31

0000874761

aes:RegulatedRevenueMember

aes:EURASIAMember

2019-01-01

2019-03-31

0000874761

aes:MCACMember

2019-01-01

2019-03-31

0000874761

aes:NonregulatedrevenueMember

aes:CorporateOtherAndOtherEliminationsMember

2019-01-01

2019-03-31

0000874761

aes:NonregulatedrevenueMember

aes:EURASIAMember

2019-01-01

2019-03-31

0000874761

aes:NonregulatedrevenueMember

2019-01-01

2019-03-31

0000874761

srt:SouthAmericaMember

2019-01-01

2019-03-31

0000874761

aes:USandUtilitiesDomain

2019-01-01

2019-03-31

0000874761

aes:EURASIAMember

2019-01-01

2019-03-31

0000874761

us-gaap:OtherExpenseMember

2019-01-01

2019-03-31

0000874761

us-gaap:OtherIncomeMember

2018-01-01

2018-03-31

0000874761

us-gaap:OtherIncomeMember

2019-01-01

2019-03-31

0000874761

us-gaap:OtherExpenseMember

2018-01-01

2018-03-31

0000874761

us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember

aes:MasinlocSubsidiaryMember

2018-01-01

2018-03-31

0000874761

country:US

us-gaap:ChangeInAccountingEstimateTypeDomain

2019-01-01

2019-03-31

0000874761

aes:MasinlocSubsidiaryMember

2018-03-20

0000874761

us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember

2018-01-01

2018-03-31

0000874761

us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember

aes:DPLPeakingGenerationDomain

2018-01-01

2018-03-31

0000874761

us-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMember

aes:ShadyPointMember

2019-03-31

0000874761

us-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMember

aes:RedondoBeachMember

2019-03-31

0000874761

us-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMember

aes:ShadyPointMember

2018-10-01

2018-12-31

0000874761

us-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMember

aes:JordanMember

2019-01-01

2019-03-31

0000874761

us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember

aes:BeckjordFacilityMember

2018-01-01

2018-03-31

0000874761

us-gaap:DisposalGroupNotDiscontinuedOperationsMember

aes:AdvancionEnergyStorageMember

2018-01-01

2018-03-31

0000874761

us-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMember

aes:JordanMember

2019-03-31

0000874761

aes:JordanMember

2019-03-31

0000874761

us-gaap:StockCompensationPlanMember

2019-01-01

2019-03-31

0000874761

us-gaap:StockCompensationPlanMember

2018-01-01

2018-03-31

0000874761

aes:AltoSertaoIIIMember

us-gaap:SubsequentEventMember

2019-04-09

2019-04-09

0000874761

aes:SPowerMember

us-gaap:SubsequentEventMember

2019-04-18

0000874761

aes:KilrootandBallylumfordMember

us-gaap:SubsequentEventMember

2019-04-09

2019-04-09

0000874761

aes:SPowerMember

us-gaap:SubsequentEventMember

2019-04-18

2019-04-18

0000874761

aes:AltoSertaoIIIMember

us-gaap:SubsequentEventMember

2019-04-09

0000874761

aes:SPowerMember

2019-03-31

iso4217:USD

iso4217:USD

xbrli:shares

xbrli:shares

aes:segment

aes:agreement

xbrli:pure

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

______________________________________________________________________________________________

FORM 10-Q

(Mark One)

|

| |

x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Quarterly Period Ended March 31, 2019

or

|

| |

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number 1-12291

THE AES CORPORATION

(Exact name of registrant as specified in its charter)

|

| | |

Delaware | | 54 1163725 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

4300 Wilson Boulevard Arlington, Virginia | | 22203 |

(Address of principal executive offices) | | (Zip Code) |

Registrant's telephone number, including area code: (703) 522-1315 |

|

| | |

Securities registered pursuant to Section 12(b) of the Act: |

Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered |

Common Stock, par value $0.01 per share | AES | New York Stock Exchange |

______________________________________________________________________________________________

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company”, and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

| | | | | | | | |

Large accelerated filer x | | Accelerated filer ¨ | | Smaller reporting company ¨ | | Emerging growth company ¨ | | Non-accelerated filer ¨ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

______________________________________________________________________________________________

The number of shares outstanding of Registrant’s Common Stock, par value $0.01 per share, on May 1, 2019 was 663,727,053.

THE AES CORPORATION

FORM 10-Q

FOR THE QUARTERLY PERIOD ENDED MARCH 31, 2019

TABLE OF CONTENTS |

| | |

| |

| | |

| |

| | |

ITEM 1. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

ITEM 2. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

ITEM 3. | | |

| | |

ITEM 4. | | |

| |

| |

| | |

ITEM 1. | | |

| | |

ITEM 1A. | | |

| | |

ITEM 2. | | |

| | |

ITEM 3. | | |

| | |

ITEM 4. | | |

| | |

ITEM 5. | | |

| | |

ITEM 6. | | |

| |

| |

GLOSSARY OF TERMS

The following terms and acronyms appear in the text of this report and have the definitions indicated below: |

| |

Adjusted EPS | Adjusted Earnings Per Share, a non-GAAP measure |

Adjusted PTC | Adjusted Pretax Contribution, a non-GAAP measure of operating performance |

AFS | Available For Sale |

AOCI | Accumulated Other Comprehensive Income |

AOCL | Accumulated Other Comprehensive Loss |

ARO | Asset Retirement Obligations |

ASC | Accounting Standards Codification |

ASU | Accounting Standards Update |

CAA | United States Clean Air Act |

CAMMESA | Wholesale Electric Market Administrator in Argentina |

CCR | Coal Combustion Residuals, which includes bottom ash, fly ash and air pollution control wastes generated at coal-fired generation plant sites. |

COFINS | Contribution for the Financing of Social Security |

DP&L | The Dayton Power & Light Company |

DPL | DPL Inc. |

EPA | United States Environmental Protection Agency |

EPC | Engineering, Procurement and Construction |

EU | European Union |

EURIBOR | Euro Interbank Offered Rate |

FASB | Financial Accounting Standards Board |

FX | Foreign Exchange |

GAAP | Generally Accepted Accounting Principles in the United States |

GHG | Greenhouse Gas |

GILTI | Global Intangible Low Taxed Income |

GW | Gigawatts |

HLBV | Hypothetical Liquidation Book Value |

HPP | Hydropower Plant |

IPALCO | IPALCO Enterprises, Inc. |

IPL | Indianapolis Power & Light Company |

LIBOR | London Interbank Offered Rate |

LNG | Liquid Natural Gas |

MW | Megawatts |

MWh | Megawatt Hours |

NCI | Noncontrolling Interest |

NM | Not Meaningful |

NOV | Notice of Violation |

NOX | Nitrogen Oxides |

PIS | Program of Social Integration |

PPA | Power Purchase Agreement |

PREPA | Puerto Rico Electric Power Authority |

PUCO | The Public Utilities Commission of Ohio |

RSU | Restricted Stock Unit |

SBU | Strategic Business Unit |

SEC | United States Securities and Exchange Commission |

SO2 | Sulfur Dioxide |

TBTU | Trillion British Thermal Units |

TCJA | Tax Cuts and Jobs Act |

U.S. | United States |

UK | United Kingdom |

USD | United States Dollar |

VAT | Value-Added Tax |

VIE | Variable Interest Entity |

PART I: FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

THE AES CORPORATION

Condensed Consolidated Balance Sheets

(Unaudited) |

| | | | | | | |

| March 31,

2019 | | December 31,

2018 |

| (in millions, except share and per share data) |

ASSETS | | | |

CURRENT ASSETS | | | |

Cash and cash equivalents | $ | 1,426 |

| | $ | 1,166 |

|

Restricted cash | 519 |

| | 370 |

|

Short-term investments | 378 |

| | 313 |

|

Accounts receivable, net of allowance for doubtful accounts of $23 and $23, respectively | 1,564 |

| | 1,595 |

|

Inventory | 579 |

| | 577 |

|

Prepaid expenses | 111 |

| | 130 |

|

Other current assets | 703 |

| | 807 |

|

Current held-for-sale assets | 575 |

| | 57 |

|

Total current assets | 5,855 |

| | 5,015 |

|

NONCURRENT ASSETS | | | |

Property, Plant and Equipment: | | | |

Land | 450 |

| | 449 |

|

Electric generation, distribution assets and other | 24,844 |

| | 25,242 |

|

Accumulated depreciation | (8,273 | ) | | (8,227 | ) |

Construction in progress | 4,207 |

| | 3,932 |

|

Property, plant and equipment, net | 21,228 |

| | 21,396 |

|

Other Assets: | | | |

Investments in and advances to affiliates | 1,147 |

| | 1,114 |

|

Debt service reserves and other deposits | 430 |

| | 467 |

|

Goodwill | 1,059 |

| | 1,059 |

|

Other intangible assets, net of accumulated amortization of $467 and $457, respectively | 467 |

| | 436 |

|

Deferred income taxes | 108 |

| | 97 |

|

Loan receivable | 1,406 |

| | 1,423 |

|

Other noncurrent assets | 1,771 |

| | 1,514 |

|

Total other assets | 6,388 |

| | 6,110 |

|

TOTAL ASSETS | $ | 33,471 |

| | $ | 32,521 |

|

LIABILITIES AND EQUITY | | | |

CURRENT LIABILITIES | | | |

Accounts payable | $ | 1,224 |

| | $ | 1,329 |

|

Accrued interest | 265 |

| | 191 |

|

Accrued non-income taxes | 271 |

| | 250 |

|

Accrued and other liabilities | 914 |

| | 962 |

|

Non-recourse debt, including $338 and $479, respectively, related to variable interest entities | 1,265 |

| | 1,659 |

|

Current held-for-sale liabilities | 418 |

| | 8 |

|

Total current liabilities | 4,357 |

| | 4,399 |

|

NONCURRENT LIABILITIES | | | |

Recourse debt | 3,895 |

| | 3,650 |

|

Non-recourse debt, including $3,077 and $2,922 respectively, related to variable interest entities | 14,550 |

| | 13,986 |

|

Deferred income taxes | 1,302 |

| | 1,280 |

|

Other noncurrent liabilities | 2,828 |

| | 2,723 |

|

Total noncurrent liabilities | 22,575 |

| | 21,639 |

|

Commitments and Contingencies (see Note 9) | | | |

Redeemable stock of subsidiaries | 890 |

| | 879 |

|

EQUITY | | | |

THE AES CORPORATION STOCKHOLDERS’ EQUITY | | | |

Common stock ($0.01 par value, 1,200,000,000 shares authorized; 817,593,854 issued and 663,694,956 outstanding at March 31, 2019 and 817,203,691 issued and 662,298,096 outstanding at December 31, 2018) | 8 |

| | 8 |

|

Additional paid-in capital | 8,039 |

| | 8,154 |

|

Accumulated deficit | (839 | ) | | (1,005 | ) |

Accumulated other comprehensive loss | (2,107 | ) | | (2,071 | ) |

Treasury stock, at cost (153,898,898 and 154,905,595 shares at March 31, 2019 and December 31, 2018, respectively) | (1,867 | ) | | (1,878 | ) |

Total AES Corporation stockholders’ equity | 3,234 |

| | 3,208 |

|

NONCONTROLLING INTERESTS | 2,415 |

| | 2,396 |

|

Total equity | 5,649 |

| | 5,604 |

|

TOTAL LIABILITIES AND EQUITY | $ | 33,471 |

| | $ | 32,521 |

|

See Notes to Condensed Consolidated Financial Statements.

THE AES CORPORATION

Condensed Consolidated Statements of Operations

(Unaudited)

|

| | | | | | | |

| Three Months Ended March 31, |

| 2019 | | 2018 |

| | | |

| (in millions, except per share amounts) |

Revenue: | | | |

Regulated | $ | 785 |

| | $ | 722 |

|

Non-Regulated | 1,865 |

| | 2,018 |

|

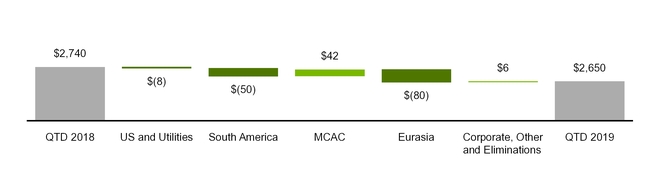

Total revenue | 2,650 |

| | 2,740 |

|

Cost of Sales: | | | |

Regulated | (635 | ) | | (601 | ) |

Non-Regulated | (1,429 | ) | | (1,483 | ) |

Total cost of sales | (2,064 | ) | | (2,084 | ) |

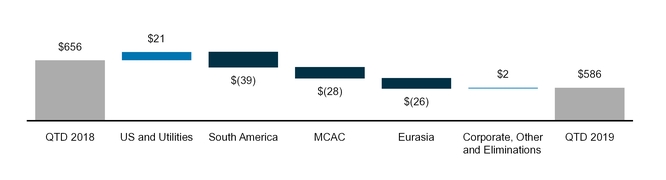

Operating margin | 586 |

| | 656 |

|

General and administrative expenses | (46 | ) | | (56 | ) |

Interest expense | (265 | ) | | (281 | ) |

Interest income | 79 |

| | 76 |

|

Loss on extinguishment of debt | (10 | ) | | (170 | ) |

Other expense | (12 | ) | | (9 | ) |

Other income | 30 |

| | 13 |

|

Gain (loss) on disposal and sale of business interests | (4 | ) | | 788 |

|

Foreign currency transaction losses | (4 | ) | | (19 | ) |

INCOME FROM CONTINUING OPERATIONS BEFORE TAXES AND EQUITY IN EARNINGS OF AFFILIATES | 354 |

| | 998 |

|

Income tax expense | (115 | ) | | (231 | ) |

Net equity in earnings (losses) of affiliates | (6 | ) | | 11 |

|

INCOME FROM CONTINUING OPERATIONS | 233 |

| | 778 |

|

Loss from operations of discontinued businesses | — |

| | (1 | ) |

NET INCOME | 233 |

| | 777 |

|

Less: Income from continuing operations attributable to noncontrolling interests and redeemable stock of subsidiaries | (79 | ) | | (93 | ) |

NET INCOME ATTRIBUTABLE TO THE AES CORPORATION | $ | 154 |

| | $ | 684 |

|

AMOUNTS ATTRIBUTABLE TO THE AES CORPORATION COMMON STOCKHOLDERS: | | | |

Income from continuing operations, net of tax | $ | 154 |

| | $ | 685 |

|

Loss from discontinued operations, net of tax | — |

| | (1 | ) |

NET INCOME ATTRIBUTABLE TO THE AES CORPORATION | $ | 154 |

| | $ | 684 |

|

BASIC EARNINGS PER SHARE: | | | |

NET INCOME ATTRIBUTABLE TO THE AES CORPORATION COMMON STOCKHOLDERS | $ | 0.23 |

| | $ | 1.04 |

|

DILUTED EARNINGS PER SHARE: | | | |

NET INCOME ATTRIBUTABLE TO THE AES CORPORATION COMMON STOCKHOLDERS | $ | 0.23 |

| | $ | 1.03 |

|

DILUTED SHARES OUTSTANDING | 667 |

| | 663 |

|

See Notes to Condensed Consolidated Financial Statements.

THE AES CORPORATION

Condensed Consolidated Statements of Comprehensive Income

(Unaudited)

|

| | | | | | | |

| Three Months Ended March 31, |

| 2019 | | 2018 |

| | | |

| (in millions) |

NET INCOME | $ | 233 |

| | $ | 777 |

|

Foreign currency translation activity: | | | |

Foreign currency translation adjustments, net of $0 income tax for all periods | (1 | ) | | 25 |

|

Reclassification to earnings, net of $0 income tax for all periods | — |

| | (16 | ) |

Total foreign currency translation adjustments | (1 | ) | | 9 |

|

Derivative activity: | | | |

Change in derivative fair value, net of income tax benefit (expense) of $18 and $(15), respectively | (68 | ) | | 57 |

|

Reclassification to earnings, net of income tax benefit (expense) of $(2) and $1, respectively | 10 |

| | 10 |

|

Total change in fair value of derivatives | (58 | ) | | 67 |

|

Pension activity: | | | |

Reclassification to earnings, net of $0 income tax for all periods | 1 |

| | 2 |

|

Total pension adjustments | 1 |

| | 2 |

|

OTHER COMPREHENSIVE INCOME (LOSS) | (58 | ) | | 78 |

|

COMPREHENSIVE INCOME | 175 |

| | 855 |

|

Less: Comprehensive income attributable to noncontrolling interests and redeemable stock of subsidiaries | (53 | ) | | (122 | ) |

COMPREHENSIVE INCOME ATTRIBUTABLE TO THE AES CORPORATION | $ | 122 |

| | $ | 733 |

|

See Notes to Condensed Consolidated Financial Statements.

THE AES CORPORATION

Condensed Consolidated Statements of Changes in Equity

(Unaudited) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, 2019 |

| Common Stock | | Treasury Stock | | Additional

Paid-In

Capital | | Retained

Earnings

(Accumulated

Deficit) | | Accumulated

Other

Comprehensive

Loss | | Noncontrolling

Interests |

| Shares | | Amount | | Shares | | Amount | | | | |

| (in millions) |

Balance at January 1, 2019 | 817.2 |

| | $ | 8 |

| | 154.9 |

| | $ | (1,878 | ) | | $ | 8,154 |

| | $ | (1,005 | ) | | $ | (2,071 | ) | | $ | 2,396 |

|

Net income | — |

| | — |

| | — |

| | — |

| | — |

| | 154 |

| | — |

| | 81 |

|

Total foreign currency translation adjustment, net of income tax | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 4 |

| | (5 | ) |

Total change in derivative fair value, net of income tax | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (37 | ) | | (18 | ) |

Total pension adjustments, net of income tax | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 1 |

| | — |

|

Total other comprehensive income (loss) | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (32 | ) | | (23 | ) |

Cumulative effect of a change in accounting principle (1) | — |

| | — |

| | — |

| | — |

| | — |

| | 12 |

| | (4 | ) | | — |

|

Fair value adjustment (2) | — |

| | — |

| | — |

| | — |

| | (6 | ) | | — |

| | — |

| | — |

|

Distributions to noncontrolling interests | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (40 | ) |

Dividends declared on common stock ($0.1365/share) | — |

| | — |

| | — |

| | — |

| | (91 | ) | | — |

| | — |

| | — |

|

Issuance and exercise of stock-based compensation benefit plans, net of income tax | 0.4 |

| | — |

| | (1 | ) | | 11 |

| | (17 | ) | | — |

| | — |

| | — |

|

Sale of subsidiary shares to noncontrolling interests | — |

| | — |

| | — |

| | — |

| | (1 | ) | | — |

| | — |

| | 1 |

|

Balance at March 31, 2019 | 817.6 |

| | $ | 8 |

| | 153.9 |

| | $ | (1,867 | ) | | $ | 8,039 |

| | $ | (839 | ) | | $ | (2,107 | ) | | $ | 2,415 |

|

| |

| See Note 1—Financial Statement Presentation—New Accounting Standards Adopted for further information. |

| |

| Adjustment to record the redeemable stock of Colon at fair value. |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, 2018 |

| Common Stock | | Treasury Stock | | Additional

Paid-In

Capital | | Retained

Earnings

(Accumulated

Deficit) | | Accumulated

Other

Comprehensive

Loss | | Noncontrolling

Interests |

| Shares | | Amount | | Shares | | Amount | | | | |

| (in millions) |

Balance at January 1, 2018 | 816.3 |

| | $ | 8 |

| | 155.9 |

| | $ | (1,892 | ) | | $ | 8,501 |

| | $ | (2,276 | ) | | $ | (1,876 | ) | | $ | 2,380 |

|

Net income | — |

| | — |

| | — |

| | — |

| | — |

| | 684 |

| | — |

| | 98 |

|

Total foreign currency translation adjustment, net of income tax | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 3 |

| | 6 |

|

Total change in derivative fair value, net of income tax | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 44 |

| | 23 |

|

Total pension adjustments, net of income tax | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 2 |

| | — |

|

Total other comprehensive income (loss) | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 49 |

| | 29 |

|

Cumulative effect of a change in accounting principle (1) | — |

| | — |

| | — |

| | — |

| | — |

| | 67 |

| | 19 |

| | 81 |

|

Fair value adjustment (2) | — |

| | — |

| | — |

| | — |

| | (6 | ) | | — |

| | — |

| | — |

|

Disposition of business interests (3) | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (249 | ) |

Distributions to noncontrolling interests | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (9 | ) |

Contributions from noncontrolling interests | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 1 |

|

Dividends declared on common stock ($0.13/share) | — |

| | — |

| | — |

| | — |

| | (86 | ) | | — |

| | — |

| | — |

|

Issuance and exercise of stock-based compensation benefit plans, net of income tax | — |

| | — |

| | (1 | ) | | 13 |

| | (12 | ) | | — |

| | — |

| | — |

|

Sale of subsidiary shares to noncontrolling interests | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 1 |

|

Balance at March 31, 2018 | 816.3 |

| | $ | 8 |

| | 154.9 |

| | $ | (1,879 | ) | | $ | 8,397 |

| | $ | (1,525 | ) | | $ | (1,808 | ) | | $ | 2,332 |

|

| |

(1) | 1—Financial Statement Presentation—New Accounting Standards Adopted for further information. |

| |

| Adjustment to record the redeemable stock of Colon at fair value. |

| |

| See Note 18—Held-for-Sale and Dispositions for further information. |

THE AES CORPORATION

Condensed Consolidated Statements of Cash Flows

(Unaudited)

|

| | | | | | | |

| Three Months Ended

March 31, 2019 |

| 2019 | | 2018 |

| | | |

| (in millions) |

OPERATING ACTIVITIES: | | | |

Net income | $ | 233 |

| | $ | 777 |

|

Adjustments to net income: | | | |

Depreciation and amortization | 246 |

| | 254 |

|

Loss (gain) on disposal and sale of business interests | 4 |

| | (788 | ) |

Deferred income taxes | 62 |

| | 180 |

|

Loss on extinguishment of debt | 10 |

| | 170 |

|

Loss on sale and disposal of assets | 7 |

| | 2 |

|

Other | 99 |

| | 72 |

|

Changes in operating assets and liabilities: | | | |

(Increase) decrease in accounts receivable | 9 |

| | (39 | ) |

(Increase) decrease in inventory | (18 | ) | | (16 | ) |

(Increase) decrease in prepaid expenses and other current assets | 47 |

| | (33 | ) |

(Increase) decrease in other assets | 2 |

| | 19 |

|

Increase (decrease) in accounts payable and other current liabilities | 25 |

| | (66 | ) |

Increase (decrease) in income tax payables, net and other tax payables | (35 | ) | | — |

|

Increase (decrease) in other liabilities | (1 | ) | | (17 | ) |

Net cash provided by operating activities | 690 |

| | 515 |

|

INVESTING ACTIVITIES: | | | |

Capital expenditures | (504 | ) | | (495 | ) |

Proceeds from the sale of business interests, net of cash and restricted cash sold | — |

| | 1,180 |

|

Sale of short-term investments | 150 |

| | 149 |

|

Purchase of short-term investments | (220 | ) | | (345 | ) |

Contributions to equity affiliates | (90 | ) | | (44 | ) |

Other investing | 1 |

| | (29 | ) |

Net cash provided by (used in) investing activities | (663 | ) | | 416 |

|

FINANCING ACTIVITIES: | | | |

Borrowings under the revolving credit facilities | 504 |

| | 881 |

|

Repayments under the revolving credit facilities | (274 | ) | | (783 | ) |

Issuance of recourse debt | — |

| | 1,000 |

|

Repayments of recourse debt | (1 | ) | | (1,774 | ) |

Issuance of non-recourse debt | 866 |

| | 757 |

|

Repayments of non-recourse debt | (428 | ) | | (510 | ) |

Payments for financing fees | (4 | ) | | (14 | ) |

Distributions to noncontrolling interests | (50 | ) | | (17 | ) |

Contributions from noncontrolling interests and redeemable security holders | 10 |

| | 11 |

|

Dividends paid on AES common stock | (90 | ) | | (86 | ) |

Payments for financed capital expenditures | (96 | ) | | (89 | ) |

Other financing | (35 | ) | | (6 | ) |

Net cash provided by (used in) financing activities | 402 |

| | (630 | ) |

Effect of exchange rate changes on cash, cash equivalents and restricted cash | (4 | ) | | 5 |

|

(Increase) decrease in cash, cash equivalents and restricted cash of discontinued operations and held-for-sale businesses | (53 | ) | | 74 |

|

Total increase in cash, cash equivalents and restricted cash | 372 |

| | 380 |

|

Cash, cash equivalents and restricted cash, beginning | 2,003 |

| | 1,788 |

|

Cash, cash equivalents and restricted cash, ending | $ | 2,375 |

| | $ | 2,168 |

|

SUPPLEMENTAL DISCLOSURES: | | | |

Cash payments for interest, net of amounts capitalized | $ | 169 |

| | $ | 207 |

|

Cash payments for income taxes, net of refunds | 65 |

| | 71 |

|

SCHEDULE OF NONCASH INVESTING AND FINANCING ACTIVITIES: | | | |

Non-cash contributions of assets and liabilities for the Fluence transaction | — |

| | 20 |

|

Dividends declared but not yet paid | 91 |

| | 86 |

|

See Notes to Condensed Consolidated Financial Statements.

THE AES CORPORATION

Notes to Condensed Consolidated Financial Statements

For the Three Months Ended March 31, 2019 and 2018

(Unaudited)

1. FINANCIAL STATEMENT PRESENTATION

Consolidation — In this Quarterly Report the terms “AES,” “the Company,” “us” or “we” refer to the consolidated entity, including its subsidiaries and affiliates. The terms “The AES Corporation” or “the Parent Company” refer only to the publicly held holding company, The AES Corporation, excluding its subsidiaries and affiliates. Furthermore, VIEs in which the Company has a variable interest have been consolidated where the Company is the primary beneficiary. Investments in which the Company has the ability to exercise significant influence, but not control, are accounted for using the equity method of accounting. All intercompany transactions and balances have been eliminated in consolidation.

Interim Financial Presentation — The accompanying unaudited condensed consolidated financial statements and footnotes have been prepared in accordance with GAAP, as contained in the FASB ASC, for interim financial information and Article 10 of Regulation S-X issued by the SEC. Accordingly, they do not include all the information and footnotes required by GAAP for annual fiscal reporting periods. In the opinion of management, the interim financial information includes all adjustments of a normal recurring nature necessary for a fair presentation of the results of operations, financial position, comprehensive income, changes in equity and cash flows. The results of operations for the three months ended March 31, 2019, are not necessarily indicative of expected results for the year ending December 31, 2019. The accompanying condensed consolidated financial statements are unaudited and should be read in conjunction with the 2018 audited consolidated financial statements and notes thereto, which are included in the 2018 Form 10-K filed with the SEC on February 26, 2019 (the “2018 Form 10-K”).

Cash, Cash Equivalents, and Restricted Cash — The following table provides a summary of cash, cash equivalents, and restricted cash amounts reported on the Condensed Consolidated Balance Sheet that reconcile to the total of such amounts as shown on the Condensed Consolidated Statements of Cash Flows (in millions):

|

| | | | | | | |

| March 31, 2019 | | December 31, 2018 |

Cash and cash equivalents | $ | 1,426 |

| | $ | 1,166 |

|

Restricted cash | 519 |

| | 370 |

|

Debt service reserves and other deposits | 430 |

| | 467 |

|

Cash, Cash Equivalents, and Restricted Cash | $ | 2,375 |

| | $ | 2,003 |

|

New Accounting Pronouncements Adopted in 2019 — The following table provides a brief description of recent accounting pronouncements that had an impact on the Company’s consolidated financial statements. Accounting pronouncements not listed below were assessed and determined to be either not applicable or did not have a material impact on the Company’s consolidated financial statements.

|

| | | |

New Accounting Standards Adopted |

ASU Number and Name | Description | Date of Adoption | Effect on the financial statements upon adoption |

2018-02, Income Statement — Reporting Comprehensive Income (Topic 220), Reclassification of Certain Tax Effects from AOCI | This amendment allows a reclassification of the stranded tax effects resulting from the implementation of the Tax Cuts and Jobs Act from AOCI to retained earnings at the election of the filer. Because this amendment only relates to the reclassification of the income tax effects of the Tax Cuts and Jobs Act, the underlying guidance that requires that the effect of a change in tax laws or rates be included in income from continuing operations is not affected. | January 1, 2019 | The Company has not elected to reclassify any amounts to retained earnings. The Company’s accounting policy for releasing the income tax effects from AOCI occurs on a portfolio basis. |