Document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

____________________________________

FORM 10-K

_____________________________________

|

| |

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended December 31, 2017

-OR-

|

| |

¨ | TRANSITION REPORT FILED PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| COMMISSION FILE NUMBER 1-12291 |

THE AES CORPORATION

(Exact name of registrant as specified in its charter)

|

| | |

Delaware | | 54 1163725 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

4300 Wilson Boulevard Arlington, Virginia | | 22203 |

(Address of principal executive offices) | | (Zip Code) |

Registrant's telephone number, including area code: (703) 522-1315 |

Securities registered pursuant to Section 12(b) of the Act: |

Title of Each Class | | Name of Each Exchange on Which Registered |

Common Stock, par value $0.01 per share | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No o

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15 (d) of the Act. Yes x No o

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one): |

| | | | | | |

Large accelerated filer x | | Accelerated filer ¨ | | Smaller reporting company ¨ | | Emerging growth company ¨ |

| | | | | | |

Non-accelerated filer ¨ | | (Do not check if a smaller reporting company) |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates on June 30, 2017, the last business day of the Registrant's most recently completed second fiscal quarter (based on the adjusted closing sale price of $10.75 of the Registrant's Common Stock, as reported by the New York Stock Exchange on such date) was approximately $7.10 billion.

The number of shares outstanding of Registrant's Common Stock, par value $0.01 per share, on February 21, 2018 was 660,449,495.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of Registrant's Proxy Statement for its 2018 annual meeting of stockholders are incorporated by reference in Parts II and III

THE AES CORPORATION FISCAL YEAR 2017 FORM 10-K

TABLE OF CONTENTS

GLOSSARY OF TERMS

The following terms and abbreviations appear in the text of this report and have the definitions indicated below:

|

| |

Adjusted EPS | Adjusted Earnings Per Share, a non-GAAP measure |

Adjusted PTC | Adjusted Pre-tax Contribution, a non-GAAP measure of operating performance |

AES | The Parent Company and its subsidiaries and affiliates |

AOCL | Accumulated Other Comprehensive Loss |

ASC | Accounting Standards Codification |

ASEP | National Authority of Public Services |

BACT | Best Available Control Technology |

BART | Best Available Retrofit Technology |

BOT | Build, Operate and Transfer |

BTA | Best Technology Available |

CAA | United States Clean Air Act |

CAMMESA | Wholesale Electric Market Administrator in Argentina |

CCGT | Combined Cycle Gas Turbine |

CDPQ | La Caisse de dépôt et placement du Quebéc |

CEO | Chief Executive Officer |

CHP | Combined Heat and Power |

COFINS | Contribuição para o Financiamento da Seguridade Social |

CO2 | Carbon Dioxide |

COSO | Committee of Sponsoring Organizations of the Treadway Commission |

CP | Capacity Performance |

CPI | United States Consumer Price Index |

CPP | Clean Power Plan |

CRES | Competitive Retail Electric Service |

CSAPR | Cross-State Air Pollution Rule |

CWA | U.S. Clean Water Act |

DG Comp | Directorate-General for Competition of the European Commission |

Dodd-Frank Act | Dodd-Frank Wall Street Reform and Consumer Protection Act |

DP&L | The Dayton Power & Light Company |

DPL | DPL Inc. |

DPLER | DPL Energy Resources, Inc. |

DPP | Dominican Power Partners |

EBITDA | Earnings before Interest, Taxes, Depreciation & Amortization |

EPA | United States Environmental Protection Agency |

EPC | Engineering, Procurement, and Construction |

ERC | Energy Regulatory Commission |

ERCOT | Electric Reliability Council of Texas |

ESP | Electric Security Plan |

EU ETS | European Union Greenhouse Gas Emission Trading Scheme |

EURIBOR | Euro Inter Bank Offered Rate |

EUSGU | Electric Utility Steam Generating Unit |

EVN | Electricity of Vietnam |

EVP | Executive Vice President |

FASB | Financial Accounting Standards Board |

FERC | Federal Energy Regulatory Commission |

FONINVEMEM | Fund for the Investment Needed to Increase the Supply of Electricity in the Wholesale Market |

FPA | Federal Power Act |

FX | Foreign Exchange |

GAAP | Generally Accepted Accounting Principles in the United States |

GHG | Greenhouse Gas |

GRIDCO | Grid Corporation of Odisha Ltd. |

GWh | Gigawatt Hours |

HLBV | Hypothetical Liquidation Book Value |

IBEX | Independent Bulgarian Power Exchange |

IDEM | Indiana Department of Environmental Management |

IPALCO | IPALCO Enterprises, Inc. |

IPL | Indiana, Indianapolis Power & Light Company |

IPP | Independent Power Producers |

ISO | Independent System Operator |

IURC | Indiana Utility Regulatory Commission |

|

| |

LIBOR | London Inter Bank Offered Rate |

LNG | Liquefied Natural Gas |

MATS | Mercury and Air Toxics Standards |

MISO | Midcontinent Independent System Operator, Inc. |

MRE | Energy Reallocation Mechanism |

MW | Megawatts |

MWh | Megawatt Hours |

NCI | Noncontrolling Interest |

NCRE | Non-Conventional Renewable Energy |

NEK | Natsionalna Elektricheska Kompania (state-owned electricity public supplier in Bulgaria) |

NEPCO | National Electric Power Company |

NERC | North American Electric Reliability Corporation |

NM | Not Meaningful |

NOV | Notice of Violation |

NOX | Nitrogen Dioxide |

NPDES | National Pollutant Discharge Elimination System |

NSPS | New Source Performance Standards |

NYSE | New York Stock Exchange |

O&M | Operations and Maintenance |

ONS | National System Operator |

OPGC | Odisha Power Generation Corporation, Ltd. |

Parent Company | The AES Corporation |

Pet Coke | Petroleum Coke |

PIS | Partially Integrated System |

PJM | PJM Interconnection, LLC |

PM | Particulate Matter |

PPA | Power Purchase Agreement |

PREPA | Puerto Rico Electric Power Authority |

PSD | Prevention of Significant Deterioration |

PSU | Performance Stock Unit |

PUCO | The Public Utilities Commission of Ohio |

PURPA | Public Utility Regulatory Policies Act |

QF | Qualifying Facility |

RGGI | Regional Greenhouse Gas Initiative |

RMRR | Routine Maintenance, Repair and Replacement |

RSU | Restricted Stock Unit |

RTO | Regional Transmission Organization |

SADI | Argentine Interconnected System |

SBU | Strategic Business Unit |

SCE | Southern California Edison |

SEC | United States Securities and Exchange Commission |

SEM | Single Electricity Market |

SIC | Central Interconnected Electricity System |

SIN | National Interconnected System |

SING | Northern Interconnected Electricity System |

SIP | State Implementation Plan |

SNE | National Secretary of Energy |

SO2 | Sulfur Dioxide |

SSO | Standard Service Offer |

TECONS | Term Convertible Preferred Securities |

U.S. | United States |

VAT | Value Added Tax |

VIE | Variable Interest Entity |

Vinacomin | Vietnam National Coal-Mineral Industries Holding Corporation Ltd. |

YPF | Argentina state-owned gas company |

PART I

In this Annual Report the terms “AES,” “the Company,” “us,” or “we” refer to The AES Corporation and all of its subsidiaries and affiliates, collectively. The terms “The AES Corporation” and “Parent Company” refer only to the parent, publicly held holding company, The AES Corporation, excluding its subsidiaries and affiliates.

FORWARD-LOOKING INFORMATION

In this filing we make statements concerning our expectations, beliefs, plans, objectives, goals, strategies, and future events or performance. Such statements are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Although we believe that these forward-looking statements and the underlying assumptions are reasonable, we cannot assure you that they will prove to be correct.

Forward-looking statements involve a number of risks and uncertainties, and there are factors that could cause actual results to differ materially from those expressed or implied in our forward-looking statements. Some of those factors (in addition to others described elsewhere in this report and in subsequent securities filings) include:

| |

• | the economic climate, particularly the state of the economy in the areas in which we operate, including the fact that the global economy faces considerable uncertainty for the foreseeable future, which further increases many of the risks discussed in this Form 10-K; |

| |

• | changes in inflation, demand for power, interest rates and foreign currency exchange rates, including our ability to hedge our interest rate and foreign currency risk; |

| |

• | changes in the price of electricity at which our generation businesses sell into the wholesale market and our utility businesses purchase to distribute to their customers, and the success of our risk management practices, such as our ability to hedge our exposure to such market price risk; |

| |

• | changes in the prices and availability of coal, gas and other fuels (including our ability to have fuel transported to our facilities) and the success of our risk management practices, such as our ability to hedge our exposure to such market price risk, and our ability to meet credit support requirements for fuel and power supply contracts; |

| |

• | changes in and access to the financial markets, particularly changes affecting the availability and cost of capital in order to refinance existing debt and finance capital expenditures, acquisitions, investments and other corporate purposes; |

| |

• | our ability to manage liquidity and comply with covenants under our recourse and non-recourse debt, including our ability to manage our significant liquidity needs and to comply with covenants under our senior secured credit facility and other existing financing obligations; |

| |

• | changes in our or any of our subsidiaries' corporate credit ratings or the ratings of our or any of our subsidiaries' debt securities or preferred stock, and changes in the rating agencies' ratings criteria; |

| |

• | our ability to purchase and sell assets at attractive prices and on other attractive terms; |

| |

• | our ability to compete in markets where we do business; |

| |

• | our ability to manage our operational and maintenance costs, the performance and reliability of our generating plants, including our ability to reduce unscheduled down times; |

| |

• | our ability to locate and acquire attractive "greenfield" or "brownfield" projects and our ability to finance, construct and begin operating our "greenfield" or "brownfield" projects on schedule and within budget; |

| |

• | our ability to enter into long-term contracts, which limit volatility in our results of operations and cash flow, such as PPAs, fuel supply, and other agreements and to manage counterparty credit risks in these agreements; |

| |

• | variations in weather, especially mild winters and cooler summers in the areas in which we operate, the occurrence of difficult hydrological conditions for our hydropower plants, as well as hurricanes and other storms and disasters, and low levels of wind or sunlight for our wind and solar facilities; |

| |

• | our ability to meet our expectations in the development, construction, operation and performance of our new facilities, whether greenfield, brownfield or investments in the expansion of existing facilities; |

| |

• | the success of our initiatives in other renewable energy projects and energy storage projects; |

| |

• | our ability to keep up with advances in technology; |

| |

• | the potential effects of threatened or actual acts of terrorism and war; |

| |

• | the expropriation or nationalization of our businesses or assets by foreign governments, with or without adequate compensation; |

| |

• | our ability to achieve reasonable rate treatment in our utility businesses; |

| |

• | changes in laws, rules and regulations affecting our international businesses; |

| |

• | changes in laws, rules and regulations affecting our North America business, including, but not limited to, regulations which may affect competition, the ability to recover net utility assets and other potential stranded costs by our utilities; |

| |

• | changes in law resulting from new local, state, federal or international energy legislation and changes in political or regulatory oversight or incentives affecting our wind business and solar projects, our other renewables projects and our initiatives in GHG reductions and energy storage, including tax incentives; |

| |

• | changes in environmental laws, including requirements for reduced emissions of sulfur, nitrogen, carbon, mercury, hazardous air pollutants and other substances, GHG legislation, regulation, and/or treaties and coal ash regulation; |

| |

• | changes in tax laws, including U.S. tax reform, and the effects of our strategies to reduce tax payments; |

| |

• | the effects of litigation and government and regulatory investigations; |

| |

• | our ability to maintain adequate insurance; |

| |

• | decreases in the value of pension plan assets, increases in pension plan expenses, and our ability to fund defined benefit pension and other postretirement plans at our subsidiaries; |

| |

• | losses on the sale or write-down of assets due to impairment events or changes in management intent with regard to either holding or selling certain assets; |

| |

• | changes in accounting standards, corporate governance and securities law requirements; |

| |

• | our ability to maintain effective internal controls over financial reporting; |

| |

• | our ability to attract and retain talented directors, management and other personnel, including, but not limited to, financial personnel in our foreign businesses that have extensive knowledge of accounting principles generally accepted in the United States; and |

| |

• | cyber-attacks and information security breaches. |

These factors in addition to others described elsewhere in this Form 10-K, including those described under Item 1A.—Risk Factors, and in subsequent securities filings, should not be construed as a comprehensive listing of factors that could cause results to vary from our forward-looking information.

We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise. If one or more forward-looking statements are updated, no inference should be drawn that additional updates will be made with respect to those or other forward-looking statements.

ITEM 1. BUSINESS

Item 1.—Business is an outline of our strategy and our businesses by SBU, including key financial drivers. Additional items that may have an impact on our businesses are discussed in Item 1A.—Risk Factors and Item 3.—Legal Proceedings. Executive Summary

Incorporated in 1981, AES is a power generation and utility company, providing affordable, sustainable energy through our diverse portfolio of thermal and renewable generation facilities and distribution businesses. Our vision is to be the world's leading sustainable power company that safely provides reliable, affordable energy. We do this by leveraging our unique electricity platforms and the knowledge of our people to provide the energy and infrastructure solutions our customers need. Our people share a passion to help meet the world's current and increasing energy needs, while providing communities and countries the opportunity for economic growth due to the availability of reliable, affordable electric power.

In 2017, we announced the sale or retirement of 4.3 GW of mostly merchant coal-fired generation, representing 30% of our coal-fired capacity.

Future growth across our company will be heavily weighted toward less carbon-intensive wind, solar and gas generation. In 2017, AES and AIMCo completed the joint acquisition of sPower, the leading independent solar developer in the United States. sPower has 1.3 GW of solar and wind projects and an additional 10 GW of renewables in its development pipeline. sPower's robust development pipeline and expertise position AES to significantly grow our renewables portfolio in the coming years.

Growth in renewables not only provides an opportunity for direct investments in solar and wind generation, but also presents significant potential for energy storage. We are a leader in lithium-ion, battery-based energy storage, with approximately 400 MW in operation, under construction or in advanced development across seven countries. We believe that battery-based energy storage will play a critical role in an increasingly renewables-based generation mix. In January 2018, we partnered with Siemens to form Fluence, a new global energy storage technology and services company. Through a sales partnership with Siemens' global sales force, Fluence will be able to sell energy storage solutions and services in 160 countries as this market grows.

AES continues to invest in LNG opportunities to provide cleaner alternatives to countries with oil-fired power generation. Specifically, AES introduced LNG in the Dominican Republic in 2003 and currently has a 380 MW

CCGT and LNG storage and regasification facility under construction in Panama.

In the United States, primarily at IPL, we completed a multi-year rate base investment in environmental upgrades to our coal plants and are in the process of re-powering several units from coal to gas.

As a result of our efforts to decrease our exposure to coal-fired generation and increase our portfolio of renewables, energy storage and natural gas capacity, we are significantly reducing our carbon dioxide emissions per MWh of generation. Under our current strategy, we anticipate a reduction of carbon intensity levels by 25% from 2016 to 2020 and by 50% from 2016 to 2030.

In February 2018, we announced a reorganization as a part of our on-going strategy to simplify our portfolio, optimize our cost structure and reduce our carbon intensity. Reflecting this simplified portfolio, we will manage our global operations separate from our growth and commercial activities.

Strategic Priorities

We have made significant progress towards meeting our strategic goals to maximize value for our shareholders.

|

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | Leveraging Our Platforms | | |

| | Focusing our growth in markets where we already operate and have a competitive advantage to realize attractive risk-adjusted returns | | |

| | | |

| | ● | In 2017, brought on-line seven projects for a total of 279 MW | | |

| | ● | 4,401 MW currently under construction and expected to come on-line through 2021 | | |

| | ● | Will continue to advance select projects from our development pipeline | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | Reducing Complexity | | |

| | Exiting businesses and markets where we do not have a competitive advantage, simplifying our portfolio and reducing risk | | |

| | ● | Since 2011 | | |

| | | ○ | Announced or closed $5.4 billion in equity proceeds from sales or sell-downs | | |

| | | ○ | Decreased total number of countries where we have operations from 28 to 16 | | |

| | ● | In 2017, announced or closed $1.1 billion in equity proceeds from sales or sell-downs of three businesses | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | Performance Excellence | | |

| | Striving to be the low-cost manager of a portfolio of assets and deriving synergies and scale from our businesses | | |

| | ● | Since 2012, achieved $300 million in cost savings and revenue enhancements, including $50 million in 2017 | | |

| | | ○ | Includes overhead reductions, procurement efficiencies and operational improvements | | |

| | | ○ | Expect to achieve an additional $50 million in 2018 and another $50 million from 2019 to 2020, for a total of $400 million in annual savings in 2020 | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | Expanding Access to Capital | | |

| | Optimizing risk-adjusted returns in existing businesses and growth projects | | |

| | ● | Adjust our global exposure to commodity, fuel, country and other macroeconomic risks | | |

| | ● | Building strategic partnerships at the project and business level with an aim to optimize our risk-adjusted returns in our business and growth projects | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | Allocating Capital in a Disciplined Manner | | |

| | Maximizing risk-adjusted returns to our shareholders by investing our free cash flow to strengthen our credit and deliver attractive growth in cash flow and earnings | | |

| | ● | In 2017, we generated substantial cash by executing on our strategy, which we allocated in line with our capital allocation framework | | |

| | | | |

| | | ○ | Used $341 million to prepay and refinance Parent Company debt | | |

| | | ○ | Returned $317 million to shareholders through quarterly dividends | | |

| | | | ■ | Increased our quarterly dividend by 8.3% to $0.13 per share beginning in the first quarter of 2018 | | |

| | | ○ | Invested $481 million in our subsidiaries | | |

| | | | | | | |

| | | | | | | |

_____________________________

| |

(1) | Investments in subsidiaries excludes $2.2 billion investment in DPL |

| |

(2) | Excludes working capital adjustments and growth activity prior to the close of the acquisition. |

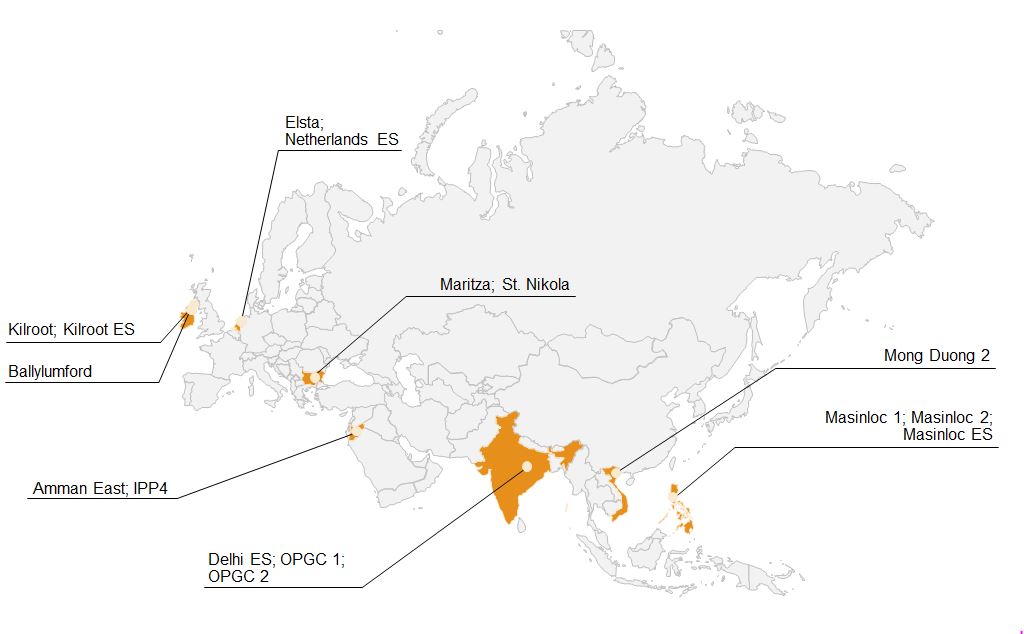

Segments

We are organized into five market-oriented SBUs: US (United States), Andes (Chile, Colombia, and Argentina), Brazil, MCAC (Mexico, Central America, and the Caribbean), and Eurasia (Europe and Asia) — which are led by our SBU Presidents. The Eurasia SBU resulted from the merger of the Europe and Asia SBUs in Q3 2017, in order to leverage scale. Within our five SBUs, we have two lines of business. The first business line is generation, where we own and/or operate power plants to generate and sell power to customers, such as utilities, industrial users, and other intermediaries. The second business line is utilities, where we own and/or operate utilities to generate or purchase, distribute, transmit and sell electricity to end-user customers in the residential, commercial, industrial and governmental sectors within a defined service area. In certain circumstances, our utilities also generate and sell electricity on the wholesale market.

The Company measures the operating performance of its SBUs using Adjusted PTC and Consolidated Free Cash Flow ("Free Cash Flow"), both non-GAAP measures. The Adjusted PTC and Free Cash Flow by SBU for the year ended December 31, 2017 are shown below. The percentages for Adjusted PTC and Free Cash Flow are the contribution by each SBU to the gross metric, i.e., the total Adjusted PTC by SBU, before deductions for Corporate. See Item 7.—Management's Discussion and Analysis of Financial Condition and Results of Operations—SBU Performance Analysis of this Form 10-K for reconciliation and definitions of Adjusted PTC and Free Cash Flow.

The following summarizes our businesses within our five SBUs.

Overview

Generation

We currently own and/or operate a generation portfolio of 34,905 MW, including our integrated utility. Our generation fleet is diversified by fuel type. See discussion below under Fuel Costs.

Performance drivers of our generation businesses include types of electricity sales agreements, plant reliability and flexibility, fuel costs, seasonality, weather variations and economic activity, fixed-cost management, and competition.

Contract Sales — Most of our generation businesses sell electricity under medium- or long-term contracts ("contract sales") or under short-term agreements in competitive markets ("short-term sales"). Our medium-term contract sales have terms of 2 to 5 years, while our long-term contracts have terms of more than 5 years.

In contract sales, our generation businesses recover variable costs, including fuel and variable O&M costs, either through direct or indexation-based contractual pass-throughs or tolling arrangements. When the contract does not include a fuel pass-through, we typically hedge fuel costs or enter into fuel supply agreements for a similar contract period (see discussion below under Fuel Costs). These contracts are intended to reduce exposure to the volatility of fuel and electricity prices by linking the business's revenues and costs. These contracts also help us to fund a significant portion of the total capital cost of the project through long-term non-recourse project-level financing.

Capacity Payments in Contract Sales — Most of our contract sales include a capacity payment that covers projected fixed costs of the plant, including fixed O&M expenses, and a return on capital invested. In addition, most of our contracts require that the majority of the capacity payment be denominated in the currency matching our fixed costs. We generally structure our business to eliminate or reduce foreign exchange risk by matching the currency of revenue and expenses, including fixed costs and debt. Our project debt may consist of both fixed and floating rate debt for which we typically hedge a significant portion of our exposure. Some of our contracted businesses also receive a regulated market-based capacity payment, which is discussed in more detail in the Capacity Payments and Short-Term Sales sections below.

Thus, these contracts, or other related commercial arrangements, significantly mitigate our exposure to changes in power and fuel prices, currency fluctuations and changes in interest rates. In addition, these contracts generally provide for a recovery of our fixed operating expenses and a return on our investment, as long as we operate the plant to the reliability and efficiency standards required in the contract.

Short-Term Sales — Our other generation businesses sell power and ancillary services under short-term contracts with average terms of less than 2 years, including spot sales, directly in the short-term market or at regulated prices. The short-term markets are typically administered by a system operator to coordinate dispatch. Short-term markets generally operate on merit order dispatch, where the least expensive generation facilities, based upon variable cost or bid price, are dispatched first and the most expensive facilities are dispatched last. The short-term price is typically set at the marginal cost of energy or bid price (the cost of the last plant required to meet system demand). As a result, the cash flows and earnings associated with these businesses are more sensitive to fluctuations in the market price for electricity. In addition, many of these wholesale markets include markets for ancillary services to support the reliable operation of the transmission system. Across our portfolio, we provide a wide array of ancillary services, including voltage support, frequency regulation and spinning reserves.

Capacity Payments — Many of the markets in which we operate include regulated capacity markets. These capacity markets are intended to provide additional revenue based upon availability without reliance on the energy margin from the merit order dispatch. Capacity markets are typically priced based on the cost of a new entrant and the system capacity relative to the desired level of reserve margin (generation available in excess of peak demand). Our generating facilities selling in the short-term markets typically receive capacity payments based on their availability in the market. Our most significant capacity revenues are earned by our generation capacity in Ohio and Northern Ireland.

Plant Reliability and Flexibility — Our contract and short-term sales provide incentives to our generation plants to optimally manage availability, operating efficiency and flexibility. Capacity payments under contract sales are frequently tied to meeting minimum standards. In short-term sales, our plants must be reliable and flexible to capture peak market prices and to maximize market-based revenues. In addition, our flexibility allows us to capture ancillary service revenue while meeting local market needs.

Fuel Costs — For our thermal generation plants, fuel is a significant component of our total cost of generation. For contract sales, we often enter into fuel supply agreements to match the contract period, or we may hedge our

fuel costs. Some of our contracts have periodic adjustments for changes in fuel cost indices. In those cases, we have fuel supply agreements with shorter terms to match those adjustments. For certain projects, we have tolling arrangements where the power offtaker is responsible for the supply and cost of fuel to our plants.

In short-term sales, we sell power at market prices that are generally reflective of the market cost of fuel at the time, and thus procure fuel supply on a short-term basis, generally designed to match up with our market sales profile. Since fuel price is often the primary determinant for power prices, the economics of projects with short-term sales are often subject to volatility of relative fuel prices. For further information regarding commodity price risk please see Item 7A.—Quantitative and Qualitative Disclosures about Market Risk in this Form 10-K. 37% of the capacity of our generation plants are fueled by natural gas. Generally, we use gas from local suppliers in each market. A few exceptions to this are AES Gener in Chile, where we purchase imported gas from third parties, and our plants in the Dominican Republic, where we import LNG to utilize in the local market.

33% of the capacity of our generation fleet is coal-fired. In the U.S., most of our plants are supplied from domestic coal. At our non-U.S. generation plants, and at our plant in Hawaii, we source coal internationally. Across our fleet, we utilize our global sourcing program to maximize the purchasing power of our fuel procurement.

26% of the capacity of our generation plants are fueled by renewables, including hydro, solar, wind, energy storage, biomass and landfill gas, which do not have significant fuel costs.

4% of the capacity of our generation fleet utilizes pet coke, diesel or oil for fuel. Oil and diesel are sourced locally at prices linked to international markets, while pet coke is largely sourced from Mexico and the U.S.

Seasonality, Weather Variations and Economic Activity — Our generation businesses are affected by seasonal weather patterns and, therefore, operating margin is not generated evenly throughout the year. Additionally, weather variations, including temperature, solar and wind resources, and hydrological conditions, may also have an impact on generation output at our renewable generation facilities. In competitive markets for power, local economic activity can also have an impact on power demand and short-term prices for power.

Fixed-Cost Management — In our businesses with long-term contracts, the majority of the fixed O&M costs are recovered through the capacity payment. However, for all generation businesses, managing fixed costs and reducing them over time is a driver of business performance.

Competition — For our businesses with medium- or long-term contracts, there is limited competition during the term of the contract. For short-term sales, plant dispatch and the price of electricity are determined by market competition and local dispatch and reliability rules.

Utilities

AES' six utility businesses distribute power to 2.4 million people in two countries. AES' two utilities in the U.S. also include generation capacity totaling 5,373 MW. Our utility businesses consist of IPL (an integrated utility), DPL, including DP&L (transmission and distribution) and AES Ohio Generation (generation), and four utilities in El Salvador (distribution).

In general, our utilities sell electricity directly to end-users, such as homes and businesses, and bill customers directly. Key performance drivers for utilities include the regulated rate of return and tariff, seasonality, weather variations, economic activity, reliability of service and competition. Revenue from utilities is classified as regulated on the Consolidated Statements of Operations.

Regulated Rate of Return and Tariff — In exchange for the right to sell or distribute electricity in a service territory, our utility businesses are subject to government regulation. This regulation sets the framework for the prices ("tariffs") that our utilities are allowed to charge customers for electricity and establishes service standards that we are required to meet.

Our utilities are generally permitted to earn a regulated rate of return on assets, determined by the regulator based on the utility's allowed regulatory asset base, capital structure and cost of capital. The asset base on which the utility is permitted a return is determined by the regulator and is based on the amount of assets that are considered used and useful in serving customers. Both the allowed return and the asset base are important components of the utility's earning power. The allowed rate of return and operating expenses deemed reasonable by the regulator are recovered through the regulated tariff that the utility charges to its customers.

The tariff may be reviewed and reset by the regulator from time to time depending on local regulations, or the utility may seek a change in its tariffs. The tariff is generally based upon usage level and may include a pass-through of costs that are not controlled by the utility, such as the costs of fuel (in the case of integrated utilities) and/or the costs of purchased energy, to the customer. Components of the tariff that are directly passed through to the

customer are usually adjusted through a summary regulatory process or an existing formula-based mechanism. In some regulatory regimes, customers with demand above an established level are unregulated and can choose to contract with other retail energy suppliers directly and pay non-bypassable fees, which are fees to the distribution company for use of its distribution system.

The regulated tariff generally recognizes that our utility businesses should recover certain operating and fixed costs, as well as manage uncollectible amounts, quality of service and non-technical losses. Utilities, therefore, need to manage costs to the levels reflected in the tariff, or risk non-recovery of costs or diminished returns.

Seasonality, Weather Variations, and Economic Activity — Our utility businesses are affected by seasonal weather patterns and, therefore, operating margin is not generated evenly throughout the year. Additionally, weather variations may also have an impact based on the number of customers, temperature variances from normal conditions, and customers' historic usage levels and patterns. Retail sales, after adjustments for weather variations, are affected by changes in local economic activity, energy efficiency and distributed generation initiatives, as well as the number of retail customers.

Reliability of Service — Our utility businesses must meet certain reliability standards, such as duration and frequency of outages. Those standards may be explicit, with defined performance incentives or penalties, or implicit, where the utility must operate to meet customer expectations.

Competition — Our integrated utility, IPL, and our regulated utility DP&L, operate as the sole distributors of electricity within their respective jurisdictions. IPL owns and operates all of the businesses and facilities necessary to generate, transmit and distribute electricity. DP&L owns and operates all of the businesses and facilities necessary to transmit and distribute electricity. Competition in the regulated electric business is primarily from the on-site generation for industrial customers. IPL is exposed to the volatility in wholesale prices to the extent our generating capacity exceeds the native load served under the regulated tariff and short-term contracts. See the full discussion under the US SBU.

At our distribution business in El Salvador, we face relatively limited competition due to significant barriers to entry. At many of these businesses, large customers, as defined by the relevant regulator, have the option to both leave and return to regulated service.

Development and Construction

We develop and construct new generation facilities. For our utility business, new plants may be built or existing plants retrofitted in response to customer needs or to comply with regulatory developments. The projects are developed subject to regulatory approval that permits recovery of our capital cost and a return on our investment. For our generation businesses, our priority for development is platform expansion opportunities, where we can add on to our existing facilities in our key platform markets where we have a competitive advantage. We make the decision to invest in new projects by evaluating the project returns and financial profile against a fair risk-adjusted return for the investment and against alternative uses of capital, including corporate debt repayment and share buybacks.

In some cases, we enter into long-term contracts for output from new facilities prior to commencing construction. To limit required equity contributions from The AES Corporation, we also seek non-recourse project debt financing and other sources of capital, including partners where it is commercially attractive. We typically contract with a third party to manage construction, although our construction management team supervises the construction work and tracks progress against the project's budget and the required safety, efficiency and productivity standards.

Segments

US SBU

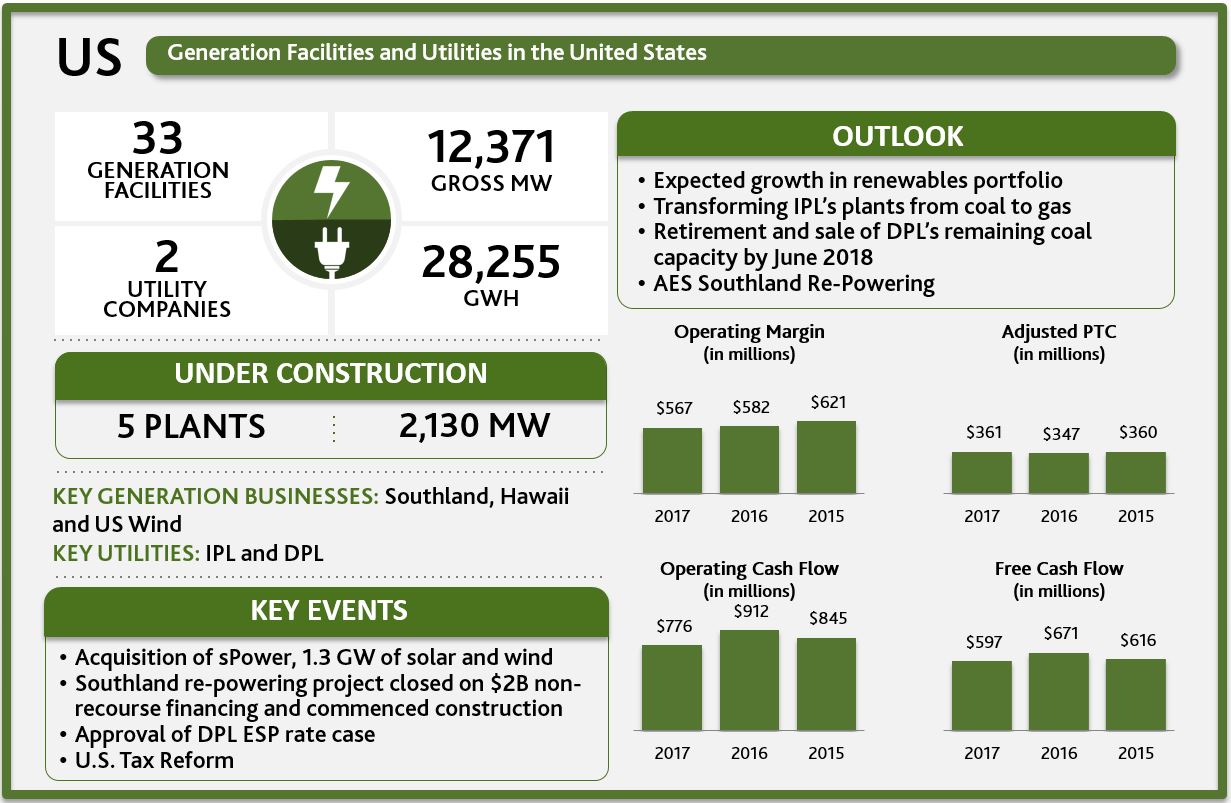

Our US SBU has 18 generation facilities and two utilities in the United States.

Generation — Operating installed capacity of our US SBU totals 12,371 MW. IPL's parent, IPALCO Enterprises, Inc., and DPL Inc. are SEC registrants, and as such, follow public filing requirements of the Securities Exchange Act of 1934. The following table lists our US SBU generation facilities:

|

| | | | | | | | | | | | | | | | |

Business | | Location | | Fuel | | Gross MW | | AES Equity Interest | | Year Acquired or Began Operation | | Contract Expiration Date | | Customer(s) |

Southland—Alamitos | | US-CA | | Gas | | 2,075 |

| | 100 | % | | 1998 | | 2019-2020 | | Southern California Edison |

Southland—Redondo Beach | | US-CA | | Gas | | 1,392 |

| | 100 | % | | 1998 | | 2018 | | Southern California Edison |

sPower (1)(2) | | US-Various | | Solar | | 1,245 |

| | 50 | % | | 2017 | | 2028-2046 | | Various |

Southland—Huntington Beach | | US-CA | | Gas | | 474 |

| | 100 | % | | 1998 | | 2019-2020 | | Southern California Edison |

Shady Point | | US-OK | | Coal | | 360 |

| | 100 | % | | 1991 | | 2018 | | Oklahoma Gas & Electric |

Buffalo Gap II (3) | | US-TX | | Wind | | 233 |

| | 100 | % | | 2007 | |

| |

|

Hawaii | | US-HI | | Coal | | 206 |

| | 100 | % | | 1992 | | 2022 | | Hawaiian Electric Co. |

Warrior Run | | US-MD | | Coal | | 205 |

| | 100 | % | | 2000 | | 2030 | | First Energy |

Buffalo Gap III (3) | | US-TX | | Wind | | 170 |

| | 100 | % | | 2008 | |

| |

|

sPower (2) | | US-Various | | Wind | | 142 |

| | 50 | % | | 2017 | | 2036 | | Various |

Distributed PV - Commercial & Utility (3) | | US-Various | | Solar | | 126 |

| | 100 | % | | 2015-2017 | | 2029-2042 | | Utility, Municipality, Education, Non-Profit |

Buffalo Gap I (3) | | US-TX | | Wind | | 119 |

| | 100 | % | | 2006 | | 2021 | | Direct Energy |

Laurel Mountain | | US-WV | | Wind | | 98 |

| | 100 | % | | 2011 | |

| |

|

Mountain View I & II | | US-CA | | Wind | | 65 |

| | 100 | % | | 2008 | | 2021 | | Southern California Edison |

Mountain View IV | | US-CA | | Wind | | 49 |

| | 100 | % | | 2012 | | 2032 | | Southern California Edison |

Laurel Mountain ES | | US-WV | | Energy Storage | | 27 |

| | 100 | % | | 2011 | |

| |

|

Warrior Run ES | | US-MD | | Energy Storage | | 10 |

| | 100 | % | | 2016 | |

| |

|

Advancion Applications Center | | US-PA | | Energy Storage | | 2 |

| | 100 | % | | 2013 | |

| |

|

| | | | | | 6,998 |

| | | | | | | | |

_____________________________

| |

(1) | sPower solar MW shown in Direct Current. |

| |

(2) | Unconsolidated entity, accounted for as an equity affiliate. |

| |

(3) | AES owns these assets together with third-party tax equity investors with variable ownership interests. The tax equity investors receive a portion of the economic attributes of the facilities, including tax attributes, that vary over the life of the projects. The proceeds from the issuance of tax equity are recorded as noncontrolling interest in the Company's Consolidated Balance Sheets. |

Under construction — The following table lists our plants under construction in the US SBU:

|

| | | | | | | | | | | | |

Business | | Location | | Fuel | | Gross MW | | AES Equity Interest | | Expected Date of Commercial Operations |

Eagle Valley CCGT | | US-IN | | Gas | | 671 |

| | 70 | % | | 1H 2018 |

Distributed PV - Commercial | | US-Various | | Solar | | 27 |

| | 100 | % | | 1H-2H 2018 |

Lawai | | US-HI | | Solar/Energy Storage | | 48 |

| | 100 | % | | 1H 2019 |

Southland Re-powering | | US-CA | | Gas | | 1,284 |

| | 100 | % | | 1H 2020 |

Alamitos Energy Center | | US-CA | | Energy Storage | | 100 |

| | 100 | % | | 1H 2021 |

| | | | | | 2,130 |

| | | | |

Utilities — The following table lists our U.S. utilities and their generation facilities:

|

| | | | | | | | | | | | | | | | | | |

Business | | Location | | Approximate Number of Customers Served as of 12/31/2017 | | GWh Sold in 2017 | | Fuel | | Gross MW | | AES Equity Interest | | Year Acquired or Began Operation |

DPL (1) | | US-OH | | 521,000 |

| | 14,771 |

| | Coal/Gas/Diesel/Solar | | 2,125 |

| | 100 | % | | 2011 |

IPL (2) | | US-IN | | 490,000 |

| | 13,484 |

| | Coal/Gas/Oil | | 3,248 |

| | 70 | % | | 2001 |

| | | | 1,011,000 |

| | 28,255 |

| | | | 5,373 |

| | | | |

_____________________________

| |

(1) | As of December 31, 2017, DPL's subsidiary AES Ohio Generation, LLC owned the following plants (the Peaker Assets): Tait Units 1-7 and diesels, Yankee Street, Yankee Solar, Monument, Montpelier, Hutchings and Sidney. AES Ohio Generation jointly-owned the following plants: Conesville Unit 4, Killen and Stuart. DPL subsidiary DP&L also owned a 4.9% equity ownership in OVEC, an electric generating company. OVEC has two plants in Cheshire, Ohio and Madison, Indiana with a combined generation capacity of approximately 2,109 MW. DP&L’s share of this generation is approximately 103 MW. AES’ share of the AES Ohio Generation jointly-owned plants, Conesville Unit 4, Stuart and Killen, represents 1,152 MW. |

| |

(2) | CDPQ owns direct and indirect interests in IPALCO which total approximately 30%. AES owns 85% of AES US Investments and AES US Investments owns 82.35% of IPALCO. IPL plants: Georgetown, Harding Street, Petersburg and Eagle Valley (new CCGT currently under construction). 3.2 MW of IPL total is considered a transmission asset. |

The following map illustrates the location of our U.S. facilities:

U.S. Businesses

U.S. Utilities

IPL

Regulatory Framework and Market Structure — IPL is subject to comprehensive regulation by the IURC with respect to its services and facilities, retail rates and charges, the issuance of long-term securities, and certain other matters. The regulatory power of the IURC over IPL's business is typical of regulation generally imposed by state public utility commissions. The IURC sets tariff rates for electric service provided by IPL. The IURC considers all allowable costs for ratemaking purposes, including a fair return on assets used and useful to providing service to customers.

IPL's tariff rates consist of basic rates and approved charges. In addition, IPL's rates include various adjustment mechanisms, including, but not limited to: (i) a rider to reflect changes in fuel and purchased power costs to meet IPL's retail load requirements, and (ii) a rider for the timely recovery of costs incurred to comply with environmental laws and regulations. These components function somewhat independently of one another, and are subject to review at the same time as any review of IPL's basic rates and charges.

IPL is one of many transmission system owner members in MISO, an RTO which maintains functional control over the combined transmission systems of its members and manages one of the largest energy and ancillary services markets in the U.S. MISO operates on a merit order dispatch, considering transmission constraints and other reliability issues to meet the total demand in the MISO region. IPL offers electricity in the MISO day-ahead and real-time markets.

Business Description — IPL is engaged primarily in generating, transmitting, distributing and selling electric energy to retail customers in the city of Indianapolis and neighboring areas within the state of Indiana. IPL has an exclusive right to provide electric service to those customers. IPL's service area covers about 528 square miles with an estimated population of approximately 941,000. IPL owns and operates four generating stations all within the state of Indiana. IPL’s largest generating station, Petersburg, is coal-fired. The second largest, Harding Street, is natural gas-fired and uses natural gas and fuel oil to power combustion turbines. In addition, IPL operates a 20 MW battery-based energy storage unit at this location. The third, Eagle Valley, retired its coal-fired units in April 2016

and the new CCGT is expected to be completed in the first half of 2018 with installed capacity of 671 MW. The fourth, Georgetown, is a small peaking station that uses natural gas to power combustion turbines.

In December 2017, IPL filed an updated petition with the IURC requesting an increase to its basic rates and charges primarily to recover the cost of the new CCGT at Eagle Valley. The requested increase is proposed to coincide with the completion of the CCGT, which is expected in the first half of 2018. IPL’s proposed increase was $125 million annually, or 9%. In February 2018, IPL filed an update to the petition to reflect the newly enacted U.S. tax law, which reduced the revenue increase IPL is seeking to $97 million, or 7%. An order on this proceeding will likely be issued by the IURC by the first quarter of 2019.

Key Financial Drivers — IPL's financial results are driven primarily by retail demand, weather, generating unit availability, outage costs and, to a lesser extent, wholesale prices. In addition, IPL's financial results are likely to be driven by many factors, including, but not limited to:

| |

• | Timely completion of major construction projects and recovery of capital expenditures through base rate growth |

| |

• | Passage of new legislation or implementation of or changes in regulations |

Construction and Development — IPL's construction program is composed of capital expenditures necessary for prudent utility operations and compliance with environmental laws and regulations, along with discretionary investments designed to replace aging equipment or improve overall performance.

DPL

Regulatory Framework and Market Structure — DPL is an energy holding company whose principal subsidiaries include DP&L and AES Ohio Generation, LLC, both of which operate in Ohio. Electric customers within Ohio are permitted to purchase power under contract from a CRES Provider or from their local utility under SSO rates. The SSO generation supply is provided by third parties through a competitive bid process. Ohio utilities have the exclusive right to provide transmission and distribution services in their state certified territories.

DP&L is regulated by the PUCO for its distribution services and facilities, retail rates and charges, reliability of service, compliance with renewable energy portfolio requirements, energy efficiency program requirements, and certain other matters. The PUCO maintains jurisdiction over the delivery of electricity, SSO, and other retail electric services.

While Ohio allows customers to choose retail generation providers, DP&L is required to provide retail generation service at SSO rates to any customer that has not signed a contract with a CRES provider. SSO rates are subject to rules and regulations of the PUCO and are established through a competitive bid process for the supply of power to SSO customers. DP&L's distribution rates are regulated by the PUCO and are established through a traditional cost-based rate-setting process. DP&L is permitted to recover its costs of providing distribution service as well as earn a regulated rate of return on assets, determined by the regulator, based on the utility's allowed regulated asset base, capital structure and cost of capital. DP&L's rates include various adjustment mechanisms including, but not limited to, the timely recovery of costs incurred to comply with alternative energy, renewables, energy efficiency, and economic development costs. DP&L's wholesale transmission rates are regulated by the FERC.

DP&L is a member of PJM, an RTO that operates the transmission systems owned by utilities operating in all or parts of Pennsylvania, New Jersey, Maryland, Delaware, D.C., Virginia, Ohio, West Virginia, Kentucky, North Carolina, Tennessee, Indiana and Illinois. PJM also runs the day-ahead and real-time energy markets, ancillary services market and forward capacity market for its members.

As a member of PJM, AES Ohio Generation is subject to charges and costs associated with PJM operations as approved by the FERC. The capacity construct of PJM operates under the Capacity Performance ("CP") program, which offers capacity revenues combined with penalties for non-performance or under-performance during certain periods identified as "capacity performance hours." This linkage between non- or under-performance during specific hours means that a generation unit that is generally performing well on an annual basis, may incur substantial penalties if it happens to be unavailable for service during some capacity performance hours. Similarly, a generation unit that is generally performing poorly on an annual basis may avoid such penalties if its outages happen to occur only during hours that are not capacity performance hours. An annual “stop-loss” provision exists that limits the size of penalties to 150% of the net cost of new entry, which is a value computed by PJM. This level is

likely to be larger than the capacity price established under the CP program, so that there is potential that participation in the CP program could result in capacity penalties that exceed capacity revenues. The purpose of the CP program is to enable PJM to obtain sufficient resources to reliably meet the needs of electric customers within the PJM footprint. PJM conducts an auction to establish the price by zone.

Business Description — DP&L transmits, distributes and sells electricity to retail customers in a 6,000 square mile area of West Central Ohio. Ohio consumers have the right to choose the electric generation supplier from whom they purchase retail generation service; however, retail transmission and distribution services are still regulated. DP&L has the exclusive right to provide such transmission and distribution services to those customers. Additionally, DP&L procures retail SSO electric service on behalf of residential, commercial, industrial and governmental customers.

In October 2017, the PUCO approved DP&L's most recent ESP. The agreement establishes a six year settlement, an updated framework to provide retail services including rate structures, non-bypassable charges, and other specific rate recovery true-up mechanisms. The settlement also establishes a three-year non-bypassable distribution modernization rider designed to collect $105 million in revenue per year which could be extended by PUCO for an additional two years.

In October 2017, DP&L transferred its interest in its coal-fired and certain other generating units to AES Ohio Generation. AES Ohio Generation, solely or through jointly-owned facilities, owns coal-fired and peaking generation units representing 2,125 MW located in Ohio and Indiana. AES Ohio Generation sells all of its energy and capacity into the wholesale market.

In January 2017, Stuart Unit 1 failed and was retired. In March 2017 it was decided to retire the Stuart coal-fired and diesel-fired generating units and Killen coal-fired generating unit and combustion turbine on or before June 1, 2018. In December 2017, AES Ohio Generation sold its undivided interests in Zimmer and Miami Fort, and entered into an agreement to sell its 973 MW of peaking capacity.

Key Financial Drivers — DPL's financial results are primarily driven by retail demand, weather, energy efficiency, generating unit availability, outage costs, and wholesale prices. In addition, DPL financial results are likely to be driven by many factors, including, but not limited to:

| |

• | Outcome of DP&L's pending distribution rate case |

| |

• | Recovery in the power market, particularly as it relates to an expansion in dark spreads |

| |

• | DPL's ability to reduce its cost structure |

Construction and Development — Planned construction additions primarily relate to new investments in and upgrades to DPL's power plant equipment and transmission and distribution system. Capital projects are subject to continuing review and are revised in light of changes in financial and economic conditions, load forecasts, legislative and regulatory developments, and changing environmental standards, among other factors.

DPL is projecting to spend an estimated $359 million in capital projects for the period 2018 through 2020 with 94% attributable to Transmission and Distribution. DPL's ability to complete capital projects and the reliability of future service will be affected by its financial condition, the availability of internal funds and the reasonable cost of external funds. We expect to finance these construction additions with a combination of cash on hand, short-term financing, long-term debt and cash flows from operations.

U.S. Generation

Business Description — In the U.S., we own a diversified generation portfolio in terms of geography, technology and fuel source. The principal markets and locations where we are engaged in the generation and supply of electricity (energy and capacity) are the Western Electric Coordinating Council, PJM, Southwest Power Pool Electric Energy Network and Hawaii. AES Southland, in the Western Electric Coordinating Council, is our most significant generating business.

Many of our U.S. generation plants provide baseload operations and are required to maintain a guaranteed level of availability. Any change in availability has a direct impact on financial performance. The plants are generally eligible for availability bonuses on an annual basis if they meet certain requirements. In addition to plant availability, fuel cost is a key business driver for some of our facilities.

AES Southland

Business Description — In terms of aggregate installed capacity, AES Southland is one of the largest generation operators in California, with an installed gross capacity of 3,941 MW, accounting for approximately 5% of the state's installed capacity and 17% of the peak demand of SCE. The three coastal power plants comprising AES Southland are in areas that are critical for local reliability and play an important role in integrating the increasing amounts of renewable generation resources in California.

All of AES Southland's capacity is contracted through a long-term agreement (the “Tolling Agreement”), expiring on May 31, 2018. In 2017, the California Public Utilities Commission approved the Resource Adequacy Purchase Agreements (the “RAPAs”) between the SCE and AES Huntington Beach, LLC and AES Alamitos, LLC for the period of June 1, 2018 through 2020, and the SCE and AES Redondo Beach for the period of June 1, 2018 through December 31, 2018. Under the RAPAs, the generating stations will only provide resource adequacy capacity, and have no obligation to produce or sell any energy to SCE. However, the generating stations may bid energy into the California ISO markets.

Under the current Tolling Agreement, approximately 98% of AES Southland's revenue comes from availability. Historically, AES Southland has generally met or exceeded its contractual availability requirements under the Tolling Agreement and may capture bonuses for exceeding availability requirements in peak periods.

Under the Tolling Agreement, the offtaker provides gas to the three facilities thus AES Southland is not exposed to significant fuel price risk. If the units operate better than the guaranteed efficiency, AES Southland gets credit for the gas that is not consumed. Conversely, AES Southland is responsible for the cost of fuel in excess of what would have been consumed had the guaranteed efficiency been achieved. The business is also exposed to replacement power costs for a limited period if dispatched by the offtaker and not able to meet the required generation.

Re-powering — In November 2014, AES Southland was awarded 20-year contracts by SCE to provide 1,284 MW of combined cycle gas-fired generation and 100 MW of interconnected battery-based energy storage. Under the contracts, all capacity will be sold to SCE in exchange for a fixed monthly capacity fee that covers fixed operating cost, debt service and return on capital. In addition, SCE will reimburse variable costs and provide the natural gas and charging electricity.

In April 2017, the California Energy Commission unanimously approved the licenses for the new combined cycle projects at AES Alamitos and AES Huntington Beach. In June 2017, AES closed the financing of $2.0 billion, funded with a combination of non-recourse debt and AES equity. The construction of this new capacity started during 2017 and commercial operation of the gas-fired capacity is expected in 2020 and the energy storage capacity in 2021.

Key Financial Drivers — AES Southland's contractual availability is the single most important driver of operations. Its units are generally required to achieve at least 86% availability in each contract year. AES Southland has historically met or exceeded its contractual availability.

Additional U.S. Generation Businesses

Regulatory Framework and Market Structure — For the non-renewable businesses, coal and natural gas are used as the primary fuels. Coal prices are set by market factors internationally, while natural gas is generally set domestically. Price variations for these fuels can change the composition of generation costs and energy prices in our generation businesses.

Many of these generation businesses have entered into long-term PPAs with utilities or other offtakers. Some businesses with PPAs have mechanisms to recover fuel costs from the offtaker, including an energy payment partially based on the market price of fuel. When market price fluctuations in fuel are borne by the offtaker, revenue may change as fuel prices fluctuate, but the variable margin or profitability should remain consistent. These businesses often have an opportunity to increase or decrease profitability from payments under their PPAs depending on such items as plant efficiency and availability, heat rate, ability to buy coal at lower costs through AES' global sourcing program and fuel flexibility.

Several of our generation businesses in the U.S. currently operate as QFs, including Hawaii, Shady Point and Warrior Run, as defined under the PURPA. These businesses entered into long-term contracts with electric utilities that had a mandatory obligation to purchase power from QFs at the utility's avoided cost (i.e., the likely costs for

both energy and capital investment that would have been incurred by the purchasing utility if that utility had to provide its own generating capacity or purchase it from another source). To be a QF, a cogeneration facility must produce electricity and useful thermal energy for an industrial or commercial process or heating or cooling applications in certain proportions to the facility's total energy output and meet certain efficiency standards. To be a QF, a small power production facility must generally use a renewable resource as its energy input and meet certain size criteria.

Our non-QF generation businesses in the U.S. currently operate as Exempt Wholesale Generators as defined under EPAct 1992. These businesses, subject to approval of FERC, have the right to sell power at market-based rates, either directly to the wholesale market or to a third-party offtaker such as a power marketer or utility/industrial customer. Under the Federal Power Act and FERC's regulations, approval from FERC to sell wholesale power at market-based rates is generally dependent upon a showing to FERC that the seller lacks market power in generation and transmission, that the seller and its affiliates cannot erect other barriers to market entry and that there is no opportunity for abusive transactions involving regulated affiliates of the seller.

The U.S. wholesale electricity market consists of multiple distinct regional markets that are subject to both federal regulation, as implemented by the FERC, and regional regulation as defined by rules designed and implemented by the RTOs, non-profit corporations that operate the regional transmission grid and maintain organized markets for electricity. These rules, for the most part, govern such items as the determination of the market mechanism for setting the system marginal price for energy and the establishment of guidelines and incentives for the addition of new capacity. See Item 1A.—Risk Factors for additional discussion on U.S. regulatory matters. Business Description — Additional businesses include thermal, wind, and solar generating facilities, of which our U.S. Renewables businesses and AES Hawaii are the most significant.

U.S. Renewables

sPower owns and/or operates more than 150 utility and distributed electrical generation systems across the U.S., actively buying, developing, constructing and operating renewable assets in the United States.

AES Distributed Energy develops, constructs and sells electricity generated by photovoltaic solar energy systems to public sector, utility, and non-profit entities through PPAs.

Excluding sPower wind plants, AES has 734 MW of wind capacity in the U.S., located in California, Texas and West Virginia. Mountain View I & II, Mountain View IV and Buffalo Gap I sell under long-term PPAs through which the energy price on the entire production of these facilities is guaranteed. Laurel Mountain, Buffalo Gap II and Buffalo Gap III are exposed to the volatility of energy prices and their revenue may change materially as energy prices fluctuate in their respective markets of operations.

AES manages the U.S. Renewables portfolio as part of its broader investments in the U.S., leveraging operational and commercial resources to supplement the experienced subject matter experts in the renewable industry to achieve optimal results. A portion of U.S. Solar projects and the majority of wind projects have been financed with tax equity structures. Under these tax equity structures, the tax equity investors receive a portion of the economic attributes of the facilities, including tax attributes that vary over the life of the projects. Based on certain liquidation provisions of the tax equity structures, this could result in variability to earnings attributable to AES compared to the earnings reported at the facilities.

AES Hawaii

AES Hawaii receives a fuel payment from its offtaker under a PPA expiring in 2022, which is based on a fixed rate indexed to the Gross National Product — Implicit Price Deflator. Since the fuel payment is not directly linked to market prices for fuel, the risk arising from fluctuations in market prices for coal is borne by AES Hawaii.

To mitigate the risk from such fluctuations, AES Hawaii has entered into fixed-price coal purchase commitments that end in December 2018; the business could be subject to variability in coal pricing beginning in January 2019. To mitigate fuel risk beyond December 2018, AES Hawaii plans to seek additional fuel purchase commitments on favorable terms. However, if market prices rise and AES Hawaii is unable to procure coal supply on favorable terms, the financial performance of AES Hawaii could be materially and adversely affected.

Key Financial Drivers — U.S. thermal generation's financial results are driven by fuel costs and outages. The Company has entered into long-term fuel contracts to mitigate the risks associated with fluctuating prices. In

addition, major maintenance requiring units to be off-line is performed during periods when power demand is typically lower. The financial results of U.S. Wind are primarily driven by increased production due to faster and less turbulent wind and reduced turbine outages. In addition, PJM and ERCOT power prices impact financial results for the wind projects that are operating without long-term contracts for all or some of their capacity. The financial results of U.S. Solar are primarily driven by the amount of sunshine hours available at the facilities, cell maintenance and growth in projects. Tax reform enacted December 22, 2017 will change the taxation of U.S. Generation’s operations beginning in 2018. For additional details see Key Trends and Uncertainties in Item 7.— Management’s Discussion and Analysis of Financial Condition and Results of Operations. Construction and Development — Planned capital projects include the AES Southland re-powering described above. In addition to the new construction project, U.S. Generation performs capital projects related to major plant maintenance, repairs and upgrades to be compliant with new environmental laws and regulations.

Andes SBU

Generation — Our Andes SBU has generation facilities in three countries — Chile, Colombia and Argentina. AES Gener, which owns all of our assets in Chile, Chivor in Colombia and TermoAndes in Argentina, as detailed below, is a publicly listed company in Chile. AES has a 66.7% ownership interest in AES Gener and this business is consolidated in our financial statements.

Operating installed capacity of our Andes SBU totals 9,326 MW, of which 44%, 45% and 11% are located in Argentina, Chile and Colombia, respectively. The following table lists our Andes SBU generation facilities:

|

| | | | | | | | | | | | | | | | |

Business | | Location | | Fuel | | Gross MW | | AES Equity Interest | | Year Acquired or Began Operation | | Contract Expiration Date | | Customer(s) |

Chivor | | Colombia | | Hydro | | 1,000 |

| | 67 | % | | 2000 | | Short-term | | Various |

Tunjita | | Colombia | | Hydro | | 20 |

| | 67 | % | | 2016 | | | | |

Colombia Subtotal | | | | | | 1,020 |

| | | | | | | | |

Guacolda (1) | | Chile | | Coal | | 760 |

| | 33 | % | | 2000 | | 2018-2032 | | Various |

Electrica Santiago (2) | | Chile | | Gas/Diesel | | 750 |

| | 67 | % | | 2000 | |

| |

|

Gener-SIC (3) | | Chile | | Hydro/Coal/Diesel/Biomass | | 690 |

| | 67 | % | | 2000 | | 2020-2037 | | Various |

Electrica Angamos | | Chile | | Coal | | 558 |

| | 67 | % | | 2011 | | 2026-2037 | | Minera Escondida, Minera Spence, Quebrada Blanca |

Cochrane | | Chile | | Coal | | 550 |

| | 40 | % | | 2016 | | 2030-2034 | | SQM, Sierra Gorda, Quebrada Blanca |

Gener-SING (4) | | Chile | | Coal | | 277 |

| | 67 | % | | 2000 | | 2018-2037 | | Minera Escondida, Codelco, SQM, Quebrada Blanca |

Electrica Ventanas (5) | | Chile | | Coal | | 272 |

| | 67 | % | | 2010 | | 2025 | | Gener |

Electrica Campiche (6) | | Chile | | Coal | | 272 |

| | 67 | % | | 2013 | | 2020 | | Gener |

Andes Solar | | Chile | | Solar | | 21 |

| | 67 | % | | 2016 | | 2037 | | Quebrada Blanca |

Cochrane ES | | Chile | | Energy Storage | | 20 |

| | 40 | % | | 2016 | | | | |

Electrica Angamos ES | | Chile | | Energy Storage | | 20 |

| | 67 | % | | 2011 | |

| |

|

Norgener ES (Los Andes) | | Chile | | Energy Storage | | 12 |

| | 67 | % | | 2009 | |

| |

|

Chile Subtotal | | | | | | 4,202 |

| | | | | | | | |

TermoAndes (7) | | Argentina | | Gas/Diesel | | 643 |

| | 67 | % | | 2000 | | Short-term | | Various |

AES Gener Subtotal | | | | | | 5,865 |

| | | | | | | | |

Alicura | | Argentina | | Hydro | | 1,050 |

| | 100 | % | | 2000 | | 2017 | | Various |

Paraná-GT | | Argentina | | Gas/Diesel | | 845 |

| | 100 | % | | 2001 | |

| |

|

San Nicolás | | Argentina | | Coal/Gas/Oil | | 675 |

| | 100 | % | | 1993 | |

| |

|

Guillermo Brown (8) | | Argentina | | Gas/Diesel | | 576 |

| | — | % | | 2016 | | | | |

Los Caracoles (8) | | Argentina | | Hydro | | 125 |

| | — | % | | 2009 | | 2019 | | Energia Provincial Sociedad del Estado (EPSE) |

Cabra Corral | | Argentina | | Hydro | | 102 |

| | 100 | % | | 1995 | |

| | Various |

Ullum | | Argentina | | Hydro | | 45 |

| | 100 | % | | 1996 | |

| | Various |

Sarmiento | | Argentina | | Gas/Diesel | | 33 |

| | 100 | % | | 1996 | |

| |

|

El Tunal | | Argentina | | Hydro | | 10 |

| | 100 | % | | 1995 | |

| | Various |

Argentina Subtotal | | | | | | 3,461 |

| | | | | | | | |

| | | | | | 9,326 |

| | | | | | | | |

_____________________________

| |

(1) | Guacolda plants: Guacolda 1, 2, 3, 4, and 5 are unconsolidated entities for which the results of operations are reflected in Net equity in earnings of affiliates. The Company's ownership in Guacolda is held through AES Gener, a 67%-owned consolidated subsidiary. AES Gener owns 50% of Guacolda, resulting in an AES effective ownership in Guacolda of 33%. |

| |

(2) | Electrica Santiago plants: Nueva Renca, Renca, Los Vientos and Santa Lidia. AES Gener announced the sale of this business in December 2017. |

| |

(3) | Gener-SIC plants: Alfalfal, Laguna Verde, Laguna Verde Turbogas, Laja, Maitenes, Queltehues, Ventanas 1, Ventanas 2 and Volcán. |

| |

(4) | Gener-SING plants: Norgener 1 and Norgener 2. |

| |

(5) | Electrica Ventanas plant: Ventanas 3. |

| |

(6) | Electrica Campiche plant: Ventanas 4. |

| |

(7) | TermoAndes is located in Argentina, but is connected to both the SING in Chile and the SADI in Argentina. |

| |

(8) | AES operates these facilities through management or O&M agreements and owns no equity interest in these businesses. |

Under construction — The following table lists our plants under construction in the Andes SBU:

|

| | | | | | | | | | | | |

Business | | Location | | Fuel | | Gross MW | | AES Equity Interest | | Expected Date of Commercial Operations |

Alto Maipo | | Chile | | Hydro | | 531 |

| | 62 | % | | 1H 2019 (1) |

_____________________________

The following map illustrates the location of our Andes facilities:

Andes Businesses

Chile

Regulatory Framework and Market Structure — Chile has operated a single power market, managed by CISEN, since November 2017. Previously, Chile had two main power systems, the SIC and SING, largely as a result of its geographic shape and size. The SIC served approximately 92% of the Chilean population, including the densely populated Santiago Metropolitan Region, representing 75% of the country's electricity demand. The SING, which mainly supplied mining companies, served about 6% of the Chilean population, representing 25% of Chile's electricity demand.

CISEN coordinates all generation and transmission companies previously in the SIC and SING. CISEN minimizes the operating costs of the electricity system, while maximizing service quality and reliability requirements. CISEN dispatches plants in merit order based on their variable cost of production, allowing for electricity to be supplied at the lowest available cost. In the SIC, thermoelectric generation is required to fulfill demand not satisfied by hydroelectric output and is critical to guaranteeing reliable and dependable electricity supply under dry hydrological conditions. In the SING, which includes the Atacama Desert, the driest desert in the world, thermoelectric capacity represents the majority of installed capacity as hydroelectric generation is not feasible. The

fuels used for thermoelectric generation, mainly coal, diesel and LNG, are indexed to international prices. In 2017, the generation installed capacity in the Chilean market was composed primarily of the following:

|

| | | | | | |

| | SIC | | SING | | CISEN |

Thermoelectric | | 44% | | 84% | | 54% |

Hydroelectric | | 38% | | — | | 29% |

Solar | | 8% | | 11% | | 9% |

Wind | | 7% | | 3% | | 6% |

Other | | 3% | | 2% | | 2% |

In the SIC, where hydroelectric plants represent a large part of the system's installed capacity, hydrological conditions influence reservoir water levels and largely determine the dispatch of the system's hydroelectric and thermoelectric generation plants and, therefore, influence spot market prices. Precipitation in Chile occurs principally in the southern cone mostly from June to August, and is scarce during the remainder of the year. During 2017 spot prices were also affected by a 14% increase in installed renewable energy capacity, totaling 564 MW, bringing total installed capacity to 4,719 MW.

The Ministry of Energy has primary responsibility for the Chilean electricity system directly or through the National Energy Commission and the Superintendency of Electricity and Fuels. The electricity sector is divided into three segments: generation, transmission and distribution. Generally, generation and transmission growth is subject to market competition, while transmission operation and distribution are subject to price regulation. In July 2016, modifications to the Transmission Law were enacted. This law establishes that the transmission system will be completely paid for by the end-users, gradually allocating the costs on the demand side from 2019 through 2034.