UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

| FORM | ||||||||

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the Fiscal Year Ended December 31, 2020

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the transition period from to

Commission File Number: | ||||||||

(Exact name of Registrant as specified in its charter)

(State of incorporation) | (I.R.S. employer identification no.) | |||||||||||||

(Address of principal executive offices) | (Zip code) | |||||||||||||

(Registrant’s telephone number, including area code) | |||||||||||

| Securities registered pursuant to Section 12(b) of the Act: | ||||||||||||||

Title of each class | Trading Symbols | Name of each exchange on which registered | ||||||||||||

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See definition of “large accelerated filer”, “accelerated filer”, “smaller reporting company”and"emerging growth company" in Rule 12b-2 of the Exchange Act): (Check one):

☒ | Accelerated filer | ☐ | Non-accelerated filer | ☐ | Smaller reporting company | Emerging growth company | |||||||||||||||||||||||

If an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of voting stock held by non-affiliates of the Registrant as of the close of business on June 30, 2020 was $655,986,870 . As of February 26, 2021, there were 45,850,468 shares of Common Stock, par value $0.01 per share, were outstanding.

Documents Incorporated By Reference

Portions of the Registrant’s proxy statement for its 2021 annual meeting of stockholders are incorporated by reference in this Form 10-K in response to Part III Items 10, 11, 12, 13, and 14.

AMBAC FINANCIAL GROUP, INC. AND SUBSIDIARIES

TABLE OF CONTENTS

| Item Number | Page | Item Number | Page | |||||||||||||||||

| PART II (CONTINUED) | ||||||||||||||||||||

| 1 | 7A | Quantitative and Qualitative Disclosures about Market Risk | ||||||||||||||||||

| 8 | ||||||||||||||||||||

| Description of the Business | 9 | |||||||||||||||||||

| 9A | ||||||||||||||||||||

| 9B | ||||||||||||||||||||

| 1A | 10 | |||||||||||||||||||

| 1B | 11 | |||||||||||||||||||

| 2 | 12 | |||||||||||||||||||

| 3 | 13 | |||||||||||||||||||

| 4 | 14 | |||||||||||||||||||

| 5 | 15 | |||||||||||||||||||

| 6 | ||||||||||||||||||||

| 7 | ||||||||||||||||||||

| Executive Summary | ||||||||||||||||||||

| Critical Accounting Policies and Estimates | ||||||||||||||||||||

| Ambac UK Financial Results Under UK Accounting Principles | ||||||||||||||||||||

CAUTIONARY STATEMENT PURSUANT TO THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995

In this Annual Report, we have included statements that may constitute “forward-looking statements” within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Words such as “estimate,” “project,” “plan,” “believe,” “anticipate,” “intend,” “planned,” “potential” and similar expressions, or future or conditional verbs such as “will,” “should,” “would,” “could,” and “may,” or the negative of those expressions or verbs, identify forward-looking statements. We caution readers that these statements are not guarantees of future performance. Forward-looking statements are not historical facts but instead represent only our beliefs regarding future events, which may by their nature be inherently uncertain and some of which may be outside our control. These statements may relate to plans and objectives with respect to the future, among other things which may change. We are alerting you to the possibility that our actual results may differ, possibly materially, from the expected objectives or anticipated results that may be suggested, expressed or implied by these forward-looking statements. Important factors that could cause our results to differ, possibly materially, from those indicated in the forward-looking statements include, among others, those discussed under “Risk Factors” in Part I, Item 1A of this Annual Report on Form 10-K.

Any or all of management’s forward-looking statements here or in other publications may turn out to be incorrect and are based on management’s current belief or opinions. Ambac’s actual results may vary materially, and there are no guarantees about the performance of Ambac’s securities. Among events, risks, uncertainties or factors that could cause actual results to differ materially are: (1) the highly speculative nature of AFG’s common stock and volatility in the price of AFG’s common stock; (2) Ambac's inability to realize the expected recoveries, including RMBS litigation recoveries, included in its financial statements which would have a materially adverse effect on Ambac Assurance Corporation's ("AAC") financial condition and may lead to regulatory intervention; (3) failure to recover claims paid on Puerto Rico exposures or realization of losses in amounts higher than expected; (4) increases to loss and loss expense reserves; (5) inadequacy of reserves established for losses and loss expenses and possibility that changes in loss reserves may result in further volatility of earnings or financial results; (6) uncertainty concerning the Company’s ability to achieve value for holders of its securities, whether from AAC and its subsidiaries or from transactions or opportunities apart from AAC and its subsidiaries, including new business initiatives relating to the specialty property and casualty program insurance business, the managing general agency/underwriting business, or related businesses; (7) potential of rehabilitation proceedings against AAC; (8) increased fiscal stress experienced by issuers of public finance obligations or an increased incidence of Chapter 9 filings or other restructuring proceedings by public finance issuers, including an increased risk of loss on revenue bonds of distressed public finance issuers due to judicial decisions adverse to revenue bond holders; (9) our inability to mitigate or remediate losses, commute or reduce insured exposures or achieve recoveries or investment objectives, or the failure of any transaction intended to accomplish one or more of these objectives to deliver anticipated results; (10) insufficiency or unavailability of collateral to pay secured obligations; (11) credit risk throughout Ambac’s business, including but not limited to credit risk related to residential mortgage-backed securities, student loan and other asset securitizations, public finance obligations and exposures to

reinsurers; (12) the impact of catastrophic environmental or natural events, including catastrophic public health events like the COVID-19 pandemic, on significant portions of our insured and investment portfolios; (13) credit risks related to large single risks, risk concentrations and correlated risks; (14) the risk that Ambac’s risk management policies and practices do not anticipate certain risks and/or the magnitude of potential for loss; (15) risks associated with adverse selection as Ambac’s insured portfolio runs off; (16) Ambac’s substantial indebtedness could adversely affect its financial condition and operating flexibility; (17) Ambac may not be able to obtain financing or raise capital on acceptable terms or at all due to its substantial indebtedness and financial condition; (18) Ambac may not be able to generate the significant amount of cash needed to service its debt and financial obligations, and may not be able to refinance its indebtedness; (19) restrictive covenants in agreements and instruments may impair Ambac’s ability to pursue or achieve its business strategies; (20) adverse effects on operating results or the Company’s financial position resulting from measures taken to reduce risks in its insured portfolio; (21) disagreements or disputes with Ambac's insurance regulators; (22) default by one or more of Ambac's portfolio investments, insured issuers or counterparties; (23) loss of control rights in transactions for which we provide insurance due to a finding that Ambac has defaulted; (24) adverse tax consequences or other costs resulting from the characterization of the AAC’s surplus notes or other obligations as equity; (25) risks attendant to the change in composition of securities in the Ambac’s investment portfolio; (26) adverse impacts from changes in prevailing interest rates; (27) our results of operation may be adversely affected by events or circumstances that result in the impairment of our intangible assets and/or goodwill that was recorded in connection with Ambac’s acquisition of 80% of the membership interests of Xchange; (28) risks associated with the expected discontinuance of the London Inter-Bank Offered Rate; (29) factors that may negatively influence the amount of installment premiums paid to the Ambac; (30) market risks impacting assets in the Ambac’s investment portfolio or the value of our assets posted as collateral in respect of interest rate swap transactions; (31) risks relating to determinations of amounts of impairments taken on investments; (32) the risk of litigation and regulatory inquiries or investigations, and the risk of adverse outcomes in connection therewith, which could have a material adverse effect on Ambac’s business, operations, financial position, profitability or cash flows; (33) actions of stakeholders whose interests are not aligned with broader interests of the Ambac's stockholders; (34) system security risks, data protection breaches and cyber attacks; (35) changes in accounting principles or practices that may impact Ambac’s reported financial results; (36) regulatory oversight of Ambac Assurance UK Limited ("Ambac UK") and applicable regulatory restrictions may adversely affect our ability to realize value from Ambac UK or the amount of value we ultimately realize; (37) operational risks, including with respect to internal processes, risk and investment models, systems and employees, and failures in services or products provided by third parties; (38) Ambac’s financial position that may prompt departures of key employees and may impact the its ability to attract qualified executives and employees; (39) fluctuations in foreign currency exchange rates could adversely impact the insured portfolio in the event of loss reserves or claim payments denominated in a currency other than US dollars and the value of non-US dollar denominated securities in our investment portfolio; (40) disintermediation within the insurance industry that negatively impacts our managing general agency/underwriting business; (41) changes in law or in the functioning of the healthcare market that impair the business model of our accident and health managing general underwriter; and (42) other risks and uncertainties that have not been identified at this time.

| Ambac Financial Group, Inc. 1 2020 FORM 10-K |

PART I

Item 1. Business

INTRODUCTION

Ambac Financial Group, Inc. ("AFG"), headquartered in New York City, is a financial services holding company incorporated in the State of Delaware on April 29, 1991. References to “Ambac,” the “Company,” “we,” “our,” and “us” are to AFG and its subsidiaries, as the context requires. Ambac's business operations include:

•Financial Guarantee ("FG") Insurance — Ambac Assurance Corporation ("Ambac Assurance" or "AAC") and its wholly owned subsidiary Ambac Assurance UK Limited (“Ambac UK”), legacy financial guarantee businesses, both of which have been in runoff since 2008.

•Specialty Property & Casualty Program Insurance — Currently includes admitted carrier Everspan Insurance Company and nonadmitted carrier Everspan Indemnity Insurance Company (collectively, "Everspan" or the "Everspan Group"). This platform, which received an A- Financial Strength Rating from A.M. Best in February 2021, is expected to launch new underwriting programs in 2021.

•Managing General Agency / Underwriting — Currently includes Xchange Benefits, LLC and Xchange Affinity Underwriting Agency, LLC (collectively, “Xchange”) a property and casualty Managing General Underwriter of which AFG acquired 80% on December 31, 2020. Refer to Note 3. Business Combination for further information relating to this acquisition.

AFG has $366 million in net assets (excluding its investment in subsidiaries) and net operating loss carry-forwards of $3,639 million ($2,182 million of which is allocated to AAC) at December 31, 2020. See Schedule II for more information on the holding company.

As of and for the year ended December 31, 2020, management reviewed financial information, allocated resources and measured financial performance on a consolidated basis and accordingly the Company had a single reportable segment. As a result of the acquisition of Xchange and the expected launch of the Everspan Group platform, segments will be re-evaluated in 2021.

Corporate Strategy:

The Company's primary goal is to maximize shareholder value through executing the following key strategies:

•Active runoff of AAC and its subsidiaries through transaction terminations, commutations, restructurings, and reinsurance with a focus on our watch list credits and known and potential future adversely classified credits, that we believe will improve our risk profile, and maximizing the risk-adjusted return on invested assets;

•Ongoing rationalization of Ambac's capital and liability structures;

•Loss recovery through active litigation management and exercise of contractual and legal rights;

•Ongoing review of the effectiveness and efficiency of Ambac's operating platform; and

•Further expanding into specialty property and casualty program insurance, managing general agency/underwriting and potentially other insurance and insurance related businesses that will generate long-term shareholder value with attractive risk-adjusted returns and meet other preestablished criteria.

DESCRIPTION OF THE BUSINESS

Financial Guarantee Insurance Business:

Ambac's Financial Guarantee strategy is to increase the value of its investment in AAC and Ambac UK. With regards to AAC, this strategy is subject to the restrictions set forth in the Settlement Agreement, dated as of June 7, 2010 (the "Settlement Agreement"), by and among AAC, Ambac Credit Products LLC ("ACP"), AFG and certain counterparties to credit default swaps with ACP that were guaranteed by AAC, as well as the Stipulation and Order (as defined in Note 1. Background and Business Description to the Consolidated Financial Statements included in Part II, Item 8 of this Form 10-K) and in the indenture for the Tier 2 Notes (as defined in Note 1. Background and Business Description to the Consolidated Financial Statements included in Part II, Item 8 of this Form 10-K), each of which requires OCI (as defined below) and, under certain circumstances, holders of the debt instruments benefiting from such restrictions, to approve certain actions taken by or in respect of AAC. In exercising its approval rights, OCI will act for the benefit of policyholders, and will not take into account the interests of AFG. See Note 1. Background and Business Description to the Consolidated Financial Statements included in Part II, Item 8 in this Form 10-K for further information.

Financial guarantee insurance policies provide an unconditional and irrevocable guarantee which protects the holder of a debt obligation against non-payment when due of the principal and interest on the obligations guaranteed. Pursuant to such guarantees, AAC and Ambac UK make payments if the obligor responsible for making payments fails to do so when due. Financial guarantee revenues consist mostly of premiums earned from insurance contracts, net of reinsurance. Financial guarantee expenses consist of: (i) loss and commutation payments; (ii) loss adjustment expenses; (iii) interest expense on debt and (iv) insurance intangible amortization.

AAC and Ambac UK have been working toward reducing uncertainties within their insured portfolios such as exposures to financially stressed municipal entities (including Puerto Rico) and asset-backed securities (including residential mortgage-backed securities ("RMBS") and student loan-backed securities). Additionally, AAC and Ambac UK are actively prosecuting legal claims (including RMBS-related lawsuits brought by AAC), managing their regulatory frameworks, seeking to optimize capital allocation in a challenging environment that includes long duration obligations and attempting to retain key employees.

Opportunities for remediating losses on poorly performing insured transactions also depend on market conditions, including the perception of AAC’s creditworthiness, the structure of the underlying risk and associated policy as well as other

| Ambac Financial Group, Inc. 2 2020 FORM 10-K |

counterparty specific factors. AAC's ability to commute policies or purchase certain investments may also be limited by available liquidity.

The deterioration of AAC's and Ambac UK's financial condition beginning in 2007 has prevented these companies from being able to write new financial guaranty business. Not writing new business has and continues to negatively impact Ambac’s operations and financial results. AAC’s ability to pay dividends and, as a result, AFG’s liquidity, have been significantly restricted by the deterioration of AAC’s financial condition and by regulatory, legal and contractual restrictions. It is highly unlikely that AAC will be able to make dividend payments to AFG for the foreseeable future. Refer to "Dividend Restrictions, Including Contractual Restrictions" below and Note 9. Insurance Regulatory Restrictions to the Consolidated Financial Statements included in Part II, Item 8 in this Form 10-K, for more information on dividend payment restrictions.

Interest rate derivative transactions are executed through Ambac Financial Services (“AFS”), a wholly-owned subsidiary of AAC. The primary activity of AFS is to partially hedge interest rate risk in the financial guarantee insurance and investment portfolios. Accordingly, interest rate derivatives are positioned to benefit from rising rates. Under agreements governing interest rate derivative positions, AFS generally must post collateral or margin in excess of the market value of the swaps and futures contracts. All AFS derivative contracts containing ratings-based downgrade triggers that could result in collateral or margin posting or a termination have been triggered. A termination of AFS’s derivatives could result in losses. AFS has borrowed cash and securities from AAC to help support its collateral and margin posting requirements, previous termination payments and other cash needs.

Credit risks relating to interest rate derivative positions primarily relate to the default of a counterparty. AFS's interest rate derivatives generally consist of centrally cleared swaps, US treasury futures and some over-the-counter ("OTC") swaps with financial guarantee customers or bank counterparties. Counterparty default exposure is mitigated through the use of industry standard collateral posting agreements or margin posting requirements.

•Cleared swaps, futures and OTC derivatives with bank counterparties require margin or collateral to be posted up to or in excess of the market value of the interest rate derivatives. Interest rate derivative contracts entered into with financial guarantee customers are not subject to collateral posting agreements. In some cases, interest rate derivatives between Ambac and financial guarantee customers are placed through a third party financial intermediary and similarly do not require collateral posting.

•Credit risk associated with financial guarantee customer derivatives and credit derivatives, is managed through the risk management processes described in the Risk Management Group section below.

Ambac manages a variety of market risks inherent in its businesses, including credit, market, liquidity, operational and legal. These risks are identified, measured, and monitored through a variety of control mechanisms, which are in place at different levels throughout the organization. See “Quantitative

and Qualitative Disclosures About Market Risk” included in Part II, Item 7A in this Form 10-K for further information.

Segregated Account

In March 2010, AAC established a segregated account pursuant to Wisconsin Stat. §611.24(2) (the “Segregated Account”) to segregate certain segments of AAC’s liabilities. The Office of the Commissioner of Insurance for the State of Wisconsin (“OCI” (which term shall be understood to refer to such office as regulator of AAC and to refer to the Commissioner of Insurance for the State of Wisconsin as rehabilitator of the Segregated Account (the “Rehabilitator”), as the context requires)) commenced rehabilitation proceedings in the Wisconsin Circuit Court for Dane County (the “Rehabilitation Court”) with respect to the Segregated Account (the “Segregated Account Rehabilitation Proceedings”) in order to permit OCI to facilitate an orderly run-off and/or settlement of the liabilities allocated to the Segregated Account pursuant to the provisions of the Wisconsin Insurers Rehabilitation and Liquidation Act. AAC, itself, did not enter rehabilitation proceedings.

A plan of rehabilitation for the Segregated Account, as amended (the "Segregated Account Rehabilitation Plan"), became effective on June 12, 2014. On September 25, 2017 the Rehabilitator filed a motion in the Rehabilitation Court seeking entry of an order approving an amendment to the Segregated Account Rehabilitation Plan (the "Second Amended Plan of Rehabilitation"). Following the conclusion of a Confirmation Hearing on January 22, 2018, the Rehabilitation Court entered an order granting the Rehabilitator's motion and confirming the Second Amended Plan of Rehabilitation. On February 12, 2018 (the "Effective Date"), the Second Amended Plan of Rehabilitation became effective. Consequently, the rehabilitation of the Segregated Account was concluded. Refer to Note 1. Background and Business Description to the Consolidated Financial Statements included in Part II, Item 8 in this Form 10-K, for more information on the Segregated Account and the Segregated Account Rehabilitation Proceedings.

Risk Management

Ambac’s financial guarantee insurance policies and credit derivative contracts expose the Company to the direct credit risk of the assets and/or obligor supporting the guaranteed obligation. In addition, insured transactions expose Ambac to indirect risks that may increase our overall risk, such as credit risk separate from, but correlated with, our direct credit risk; market; model; economic; natural disaster and mortality or other non-credit type risks. Please refer to Item 7 “Management’s Discussion and Analysis of Financial Condition and Results of Operations - Financial Guarantees in Force” section below for details on the financial guarantee insured portfolio.

The Risk Management Group ("RMG") is primarily responsible for the development, implementation and oversight of loss mitigation strategies, surveillance and remediation of the insured financial guarantee portfolio (including through the pursuit of recoveries in respect of paid claims and commutations of policies). Our ability to execute certain risk management activities may be limited by the restrictions set forth in the Settlement Agreement, the Stipulation and Order and the indenture for the Tier 2 Notes. See Note 1. Background and

| Ambac Financial Group, Inc. 3 2020 FORM 10-K |

Business Description to the Consolidated Financial Statements included in Part II, Item 8 in this Form 10-K for further information.

Ambac’s RMG has an organizational structure designed around four primary areas of focus: Surveillance, Risk Remediation, Credit Risk Management and Loss Reserving and Analytics.

Surveillance

This group's focus is on the early identification of potential stress or deterioration in connection with credit exposures in the insured portfolio and the related credit analysis associated with these and other insured portfolio exposures. Additionally, Surveillance will evaluate the impact of changes in the economic, regulatory or political environment on the insured portfolio.

Analysts in this group perform periodic credit reviews of insured exposures according to a schedule based on the risk profile of the guaranteed obligations or as necessitated by specific credit events or other macro-economic variables. Risk-adjusted surveillance strategies have been developed for each bond type with review periods and scope of review based upon each bond type’s risk profile. The risk profile is assessed regularly in response to our own experience and judgments or external factors such as the economic environment and industry trends. The focus of a credit review is to assess performance, identify credit trends and recommend appropriate credit classifications, ratings and changes to a transaction or bond type’s review period and surveillance requirements. Please refer to Note 2. Basis of Presentation and Significant Accounting Policies to the Consolidated Financial Statements included in Part II, Item 8 in this Form 10-K for further discussion of the various credit classifications utilized by Ambac. If a problem is detected, the Surveillance group will then work with the Risk Remediation group on a loss mitigation plan, as necessary.

The insured portfolio contains exposures that are correlated and/or concentrated. RMG's surveillance activities include identifying these types of exposures and identifying the risks that would or could trigger credit deterioration across these related exposures. This is the case with student loans and RMBS, for example, which have several correlations including those associated with consumer lending, unemployment and home prices. In the future, Ambac’s portfolio may be subject to similar credit deterioration arising from concentrated and/or correlated risks. Examples of other such risks that could impact our portfolio, and that our surveillance is designed to monitor include the impact of potential municipal bankruptcy contagion, the impact of tax reform on state and municipal bond issuers, or the impact of large scale domestic military cutbacks on our privatized military housing portfolio or event risk such as pandemics (e.g., COVID-19), natural disasters or other regional stresses. Most such risks cannot be predicted and may materialize unexpectedly or develop rapidly. Although our surveillance allows us to connect the event and stress to the related exposures and assign an adverse credit classification and estimate losses across the affected credits, when necessary, we may not have adequate resources or contractual rights and remedies to mitigate loss arising from such risks.

Risk Remediation

Risk Remediation's focus is on exposure reduction, loss mitigation, avoiding defaults, and restructuring related to the insured portfolio. In particular, this group focuses on reducing exposure to credits that have current negative developing trends, have the potential for future adverse development or are already adversely classified by, among other things, securing rights and remedies, both of which may help to mitigate losses in the event of further deterioration or event of default, or, as available, working with an issuer to refinance or retire debt.

Loss mitigation and restructuring focuses on the analysis, implementation and execution of commutation and related claims reduction, defeasance or workout strategies for policies with potential future claims. Efforts are focused on minimizing claims and maximizing recoveries, typically following an event of default. The emphasis on reducing risk is centered on reducing exposure on a prioritized basis.

For certain adversely classified, survey list and watch list credits, RMG analysts will develop and implement a remediation or loss mitigation plan that could include actions such as working with the issuer, trustee, bond counsel, servicer and other interested parties in an attempt to remediate the problem and minimize AAC’s exposure to potential loss. Other actions could include working with bond holders and other economic stakeholders to negotiate, structure and execute solutions, such as commutations. In addition, reinsurance is used as a remediation tool to reduce exposure to certain targeted policies and large concentrations.

Adversely classified, survey list and watch list credits are tracked closely by RMG analysts as part of the risk remediation process and are discussed at regularly scheduled meetings with Credit Risk Management (see discussion following in “Credit Risk Management”). In some cases, the RMG will engage restructuring or workout experts, attorneys and/or other consultants with appropriate expertise in the targeted loss mitigation area to assist management in examining the underlying contracts or collateral, providing industry specific advice and/or executing strategies.

We have established cross-functional teams in key areas of focus, comprised of personnel both within the RMG and in other departments, to target proactive mitigation and remediation of losses and potential future losses associated with certain credits and sectors in the insured portfolio. An example of such efforts includes the teams of professionals focused on the review and enforcement of contractual representations and warranties ("R&W") supporting RMBS policies. Members of these cross-functional teams will often work with external experts in the pursuit of risk reduction efforts.

Credit Risk Management ("CRM")

The CRM function manages the decision process for all material matters that affect credit exposures within the insured portfolio. CRM provides a forum for independent assessments, reviews and approvals and drives consistency and timeliness. The scope of credit matters under the purview of CRM includes material amendments, consents and waivers, evaluation of remediation or loss mitigation plans, credit review scheduling, credit classifications, rating designations, review of watch list or adversely classified credits, sector reviews and overall portfolio

| Ambac Financial Group, Inc. 4 2020 FORM 10-K |

reviews. Formal plans or transactions that relate to risk remediation, loss mitigation or restructuring may also require Risk Committee approval.

Control Rights

In structured transactions, including certain structured public finance transactions, AAC may be the control party as a result of insuring the transaction’s senior class or tranche of debt obligations. The control party may direct specified parties, usually the trustee, to take or not take certain actions following contractual defaults or trigger events. Control rights and the scope of direction and remedies vary considerably among our insured transactions. Because Ambac is party to and/or has certain rights in documents supporting transactions in the insured portfolio, Ambac frequently receives requests for amendments, consents and waivers (“ACWs”). RMG reviews, analyzes and processes all requests for ACWs. The decision to approve or reject ACWs is based upon certain credit factors, such as the issuer’s ability to repay the bonds and the bond’s security features and structure. As part of the CRM process, members of the RMG review, analyze and process all requests for ACWs.

As a part of the Segregated Account Rehabilitation Proceedings, the Rehabilitation Court enjoined certain actions by other parties to preserve AAC’s control rights that could otherwise have lapsed or been compromised. Pursuant to the Second Amended Plan of Rehabilitation and orders of the Rehabilitation Court, such protections continue after the conclusion of the Segregated Account Rehabilitation Proceedings.

Watch List and Adversely Classified Credits

Watch list and adversely classified credits are tracked closely by the appropriate RMG teams and discussed as part of the CRM process. Adversely classified credit meetings include members of RMG and other groups within the Company, as necessary. As part of the review, relevant information, along with the plan for corrective actions and a reassessment of the credit’s rating and credit classification is considered. Internal and/or external counsel generally review the documents underlying any problem credit and, if applicable, an analysis is prepared outlining Ambac’s rights and potential remedies, the duties of all parties involved and recommendations for corrective actions. Ambac also meets with relevant parties to the transaction as necessary. The review schedule for adversely classified credits is tailored to the remediation plan to track and prompt timely action and proper internal and external resourcing. A summary of developments regarding adversely classified credits and credit trends is also provided to AFG’s, AAC’s and Ambac UK's Board of Directors no less than quarterly.

Ambac assigns internal credit ratings to individual exposures as part of the surveillance process. These internal credit ratings, which represent Ambac’s independent judgments, are based upon underlying credit parameters consistent with the exposure type.

Loss Reserving and Analytics ("LRA")

LRA manages the quarterly loss reserving process for insured portfolio credits with projected policy claims. It also supports the development, operation and/or maintenance of various analytical models used in the loss reserving process as well as in

other risk management functions. LRA works with surveillance and risk remediation analysts responsible for a particular credit on the development, review and implementation of loss reserve scenarios and related analysis.

Specialty Property & Casualty Program Insurance

The specialty property & casualty program insurance business currently includes admitted carrier Everspan Insurance Company and nonadmitted carrier Everspan Indemnity Insurance Company (collectively, “Everspan Group”). Everspan Group received a Class VIII, A- Financial Strength Rating from A.M. Best Rating Services, Inc. in February 2021, has capital in excess of $100 million, and is expected to begin writing new property and casualty specialty insurance programs in the first half of 2021. Everspan Group is pursuing a sustainable, long term niche property/casualty program strategy with diverse classes of risks and plans to source business through diverse channels including Managing General Agents, brokers, producers and others. Everspan Group's business model will rely on third party producers or capacity providers to provide the infrastructure associated with policy administration, claims handling and other insurance company services. Everspan Group may retain up to 30% of it gross written premiums and, to the extent applicable, will reinsure the remainder to reinsurers and other providers of risk capital. With its strong capital base, Everspan Group will be differentiated in the specialty program insurance market with its focus on underwriting results, risk retention, long-term relationships, and the avoidance of channel conflicts.

Everspan Group hired a management team with a successful track record in specialty program insurance business and relationships with Managing General Agents, brokers, producers and third party claims administrators.

The specialty property & casualty program insurance business will generate income from (i) ceding fees, by offering carrier capacity to specialty general agents and other producers who sell, control and administer books of insurance business that are supported by third parties that assume reinsurance risk and (ii) net insurance underwriting income from any retained risk. Its core expenses will include compensation, agent commissions and other overhead costs.

Everspan Group will face competition from long standing program business market participants such as State National as well as more recent entrants such as Clear Blue Insurance Group, Spinnaker Insurance Company, Trisura and Accredited Surety and Casualty Company, Inc. Everspan Group will also compete with new companies that continue to be formed to enter the insurance markets, particularly companies with new or "disruptive" technologies or business models. Competition may take the form of lower prices, broader coverages, greater product flexibility, higher coverage limits, higher quality services or higher ratings by independent rating agencies.

Few barriers exist to prevent insurers from entering target markets within the property and casualty industry. Market conditions and capital capacity influence the degree of competition at any point in time. During periods of excess underwriting capacity, as defined by the availability of capital, competition can result in lower pricing and less favorable policy terms and conditions for insurers. During periods of reduced

| Ambac Financial Group, Inc. 5 2020 FORM 10-K |

underwriting capacity, pricing and policy terms and conditions are generally more favorable for insurers. Historically, the performance of the property and casualty insurance industries has tended to fluctuate in cyclical periods of price competition and excess underwriting capacity, followed by periods of high premium rates and shortages of underwriting capacity. At any given time, Everspan Group's portfolio of insurance products could experience varying combinations of these characteristics. This cyclical market pattern can be more pronounced in the specialty insurance and reinsurance markets in which Everspan Group competes than the standard insurance market.

Managing General Agency / Underwriting

On December 31, 2020, Ambac acquired 80% of the membership interests of Xchange. Formed in 2010, Xchange is a specialty-niche, property and casualty Managing General Underwriter ("MGU") focused on accident and health ("A&H") products. Below is a description of its largest products for which it provides underwriting services:

Employer Stop Loss ("ESL") — provides protection for self-insured employers by serving as a reimbursement mechanism for catastrophic claims exceeding pre-determined levels.

Limited Medical ("LM") — designed for those not covered by traditional medical programs and sold primarily through affinity groups, providing a variety of medically related benefits such as hospital or physician visits.

Short-term Medical ("STM") — sold primarily through affinity groups, providing comprehensive medical coverage for short periods of time (i.e. less than one year).

Xchange's management team, which retained 20% ownership of the business, has significant longstanding relationships with carriers, agents, policyholders, affinity groups and reinsurers. Xchange conducts business through approximately seven insurance carriers and dozens of agents and other distributors.

Xchange is compensated for its services primarily by commissions paid by insurance companies for underwriting, structuring and/or administering polices and, in the case of ESL, managing claims under an agency agreement. Commission revenues are usually based on a percentage of the premiums paid by the insured. Xchange is also eligible to receive profit sharing contingent commissions on certain programs (mostly LM and STM) based on the underwriting results of the policies it writes, which may cause some variability in revenue and earning recognition. Business written by Xchange is generally concentrated in January and July, which may result is revenue and earnings concentrations in the first and third quarters each calendar year. Xchange's core expenses include commissions it pays to its independent agents and compensation for its management and staff, which currently total 20 individuals.

The MGU business is highly competitive and a number of firms actively compete with Xchange for customers and insurance carrier capacity. However, the ESL market is increasing in size as large companies continue to transition from fully insured to self-funded. As the market size increases, capital is flowing into the market, but prices and margins remain stable. For LM and STM, overall market conditions remain stable. The market as a whole remains vast, as entrepreneurs and the unemployed seek

options for individual insurance. Competition for Xchange's business comes from both direct carriers and other intermediaries and, depending on the product, may include Blue Cross, UnitedHealth, CIGNA, Aetna, Tokyo Marine, Houston Casualty Company, Sun Life, United Health, Axis, Chubb, and National General.

Xchange is one component of Ambac's broader Managing General Agent ("MGA")/MGU business strategy. Ambac expects to grow the MGA/MGU business using several strategies, including (i) organic growth, (ii) additional acquisitions and/or partnerships, and (iii) establishing de-novo platforms. Future expansion of the MGA/MGU business is expected to include other property and casualty products and services in addition to A&H. Insurance underwritten through Ambac's MGA/MGUs may utilize the Everspan Group as an insurance carrier, but will not necessarily be required to do so, depending on a number of strategic and operational considerations.

ENTERPRISE RISK MANAGEMENT

The Company's policies and procedures relating to risk assessment and risk management are overseen by its Board of Directors. The Board of Directors takes an enterprise-wide approach to risk management oversight that is designed to support the Company's business plans at a level of risk considered by the Board to be reasonable. A fundamental part of risk assessment and risk management is not only understanding the risks the Company faces and what steps management is taking to manage those risks, but also understanding what level of risk is appropriate for the Company. The Board of Directors periodically reviews the Company's business plan, factoring risk management into account. It also approves the Company's risk appetite statements, which articulate the Company's tolerance for certain risks and describes the general types of risk that the Company accepts, within certain parameters, or attempts to avoid.

While the Board of Directors has the ultimate oversight responsibility for the risk management process, various committees of the Board also have responsibilities related to risk assessment and risk management, and management has responsibility for managing the risks to which the Company is exposed and reporting on such matters to the Board of Directors and applicable Board committees.

•The Audit Committee oversees the management of risks associated with the integrity of Ambac’s financial statements and its compliance with legal and regulatory requirements. In addition, the Audit Committee discusses policies with respect to risk assessment and risk management, including major financial risk exposures and the steps management has taken to monitor and control such exposures. The Audit Committee reviews with management, internal auditors and independent auditors Ambac's critical accounting policies, Ambac's system of internal controls over financial reporting and the quality and appropriateness of disclosure and content in the financial statements and other external financial communications.

•The Compensation Committee oversees the management of risk primarily associated with our ability to attract,

| Ambac Financial Group, Inc. 6 2020 FORM 10-K |

motivate and retain quality talent (particularly executive talent) and with setting financial incentives that do not motivate undue risk-taking.

•The Governance and Nominating Committee oversees the management of risk primarily associated with Ambac’s ability to attract and retain quality directors, Ambac’s corporate governance programs and practices and our compliance therewith. Additionally, the Governance and Nominating Committee oversees the processes for evaluation of the performance of the Board of Directors and its committees each year and considers risk management effectiveness as part of its evaluation. The Governance and Nominating Committee also performs oversight of the business ethics and compliance program, and reviews compliance with Ambac’s Code of Business Conduct.

•The Strategy Committee oversees the management of risk and risk appetite primarily with respect to strategic plans and initiatives.

The Board of Directors also receives quarterly updates from Board committees, and the Board provides guidance to individual committee activities as appropriate.

In order to assist the Board of Directors in overseeing Ambac’s risk management, Ambac uses enterprise risk management, a company-wide process that involves the Board of Directors, management and other personnel in an integrated effort to identify, assess and manage a broad range of risks (e.g., credit, financial, legal, liquidity, market, model, operational, regulatory, reputational and strategic), that may affect the Company’s ability to execute on its corporate strategy and fulfill its business objectives. The Enterprise Risk Committee (“ERC”), which is a management committee, is comprised of senior level management responsible for assisting in the management of the Company’s risks on an individual and aggregate basis. The ERC produces the relevant risk management information for senior management and the Board of Directors.

Ambac management has established management committees to assist in managing the risks throughout the enterprise. These committees will meet monthly or as needed on an ad hoc basis.

•The AAC Risk Committee's objective is to establish an interdisciplinary team of professionals to provide oversight of the key risk remediation issues impacting AAC and Ambac UK. The purview of the committee is to review and approve risk remediation activities for the financial guarantee insured portfolio. Additionally, the Risk Committee will provide oversight and review new risk remediation structures or approaches in connection with risk remediation plans or anticipated transactions. Members of the Risk Committee include the Chief Executive Officer, Head of Risk Management, Chief Financial Officer and senior managers from throughout risk, corporate services, operations, investment management, legal and finance.

•The Asset Liability Management Committee's (“ALCO”) objective is to foster an enterprise wide culture and approach to liquidity management, asset management, asset valuation and hedging. Members of ALCO include the Chief Executive Officer, Chief Financial Officer, Head of

Risk Management and senior managers from investment management and the Risk Management Group.

•The Disclosure Committee's objective is to assist the CEO and CFO in their responsibilities to design, establish, maintain and evaluate the effectiveness of disclosure controls and procedures. Members of the Disclosure Committee include the Chief Executive Officer, Chief Financial Officer, Chief Accounting Officer, Head of Risk Management and senior managers from throughout finance, legal, risk and corporate services.

Everspan Group established an Underwriting Committee in 2021 to review the strategy, and provide oversight of the active underwriting operations of Everspan Group, and to assist the Boards of the Everspan Group companies in overseeing the integrity and effectiveness of Everspan Group’s underwriting risk management framework. Members of the committee include Ambac's Chief Executive Officer, key members of Everspan Group management and other senior managers or advisors of Ambac.

Xchange established an Underwriting Committee in 2021 for the purpose of reviewing and approving any new business initiative or product line proposed to be undertaken by Xchange. Members of the Underwriting Committee include Ambac's Chief Executive Officer, Chief Financial Officer, key members of Xchange management and other senior managers or advisors of Ambac.

AVAILABLE INFORMATION

Our Internet address is www.ambac.com. We make available through the investor relations section of our web site, annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K, and any amendments to those reports, filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, as well as proxy statements, as soon as reasonably practicable after we electronically file such material with, or furnish it to, the U.S. Securities and Exchange Commission. Our Investor Relations Department can be contacted at Ambac Financial Group, Inc., One World Trade Center, 41st Floor, New York, New York 10007, Attn: Investor Relations, telephone: 212-208-3222 email: ir@ambac.com. The reference to our website address does not constitute inclusion or incorporation by reference of the information contained on our website in this Form 10-K or other filings with the SEC and the information contained on our website is not part of this document.

INSURANCE REGULATORY MATTERS AND OTHER RESTRICTIONS

Regulatory Matters

United States

Ambac Assurance is domiciled in the state of Wisconsin and is therefore subject to the insurance laws and regulations of the State of Wisconsin and regulated by the Wisconsin Office of the Commissioner of Insurance (“OCI”). Everspan Indemnity Insurance Company ("Everspan Indemnity") and its wholly owned subsidiary, Everspan Insurance Company ("Everspan Insurance") are domiciled in the state of Arizona and are therefore subject to the insurance laws and regulations of the

| Ambac Financial Group, Inc. 7 2020 FORM 10-K |

State of Arizona and regulated by the Arizona Department of Insurance and Financial Institutions (“DIFI”). AAC and Everspan Insurance are also subject to the insurance laws and regulations of the other jurisdictions in which they are licensed. See Note 9. Insurance Regulatory Restrictions to the Consolidated Financial Statements included in Part II, Item 8 in this Form 10-K for further information on regulatory restrictions.

Xchange is a property and casualty managing general underwriter, specializing in accident and health insurance. Xchange, like other managing general agents and program administrators, is subject to licensing requirements and regulation by insurance regulators in various states in which they conduct business. Every state and Washington, D.C. have enacted a version of the NAIC Model Managing General Agents Act, which governs licensing and the relationship between insurers and managing general agents.

In addition, pursuant to the terms of the Settlement Agreement, the Stipulation and Order and the indenture for the Tier 2 Notes, AAC must seek prior approval by OCI of certain corporate actions. The Settlement Agreement, Stipulation and Order and indenture for the Tier 2 Notes include covenants which restrict the operations of AAC. The Settlement Agreement will remain in force until the surplus notes issued thereunder have been redeemed, repurchased or repaid in full. The Stipulation and Order will remain in force for so long as OCI determines it to be necessary. The indenture for the Tier 2 Notes will remain in force until the Tier 2 Notes have been redeemed, repurchased or repaid in full. Certain of the restrictions in the Settlement Agreement and indenture for the Tier 2 Notes may be waived with the approval of the OCI and/or the requisite percentage of holders of debt securities issued thereunder.

Cybersecurity and Privacy Regulation

Ambac and its subsidiaries are subject to various U.S. Federal and state laws and regulations with respect to privacy, data protection and cybersecurity that require financial institutions, including insurance companies and agencies, to safeguard personal and other sensitive information, and may provide for notice of their practices relating to the collection, disclosure and processing of personal information, and any related security breaches. For example, the National Association of Insurance Commissioners (“NAIC”), an organization of state insurance regulators, adopted the Insurance Data Security Model Law (“NAIC Model Law”) that creates rules for insurers and other covered entities addressing data security and the investigation and notification of cybersecurity events involving unauthorized access to, or the misuse of, certain nonpublic information. This includes maintaining an information security program based on ongoing risk assessment, overseeing third-party service providers, investigating data breaches and notifying regulators of a cybersecurity event. Legislation based on the NAIC Model Law has been enacted in eleven states and may be enacted in other states. Our subsidiaries, as insurance companies and agencies licensed in the State of New York, are also required to comply with the New York Department of Financial Services (“NYDFS”) cybersecurity regulation, which establishes requirements for covered financial services institutions to implement a cybersecurity program designed to protect the confidentiality, integrity and availability of information systems

of regulated entities, and information stored on those systems. The regulation imposes a governance framework for cybersecurity program, risk based minimum standards for technology systems for data protection, monitoring and testing, third-party service provider reviews, security incident response and reporting to NYDFS of certain security incidents, annual certifications of regulatory compliance to NYDFS, and other requirements.

United Kingdom

The Prudential Regulatory Authority ("PRA") and Financial Conduct Authority ("FCA") (and their predecessor regulator the Financial Services Authority (“FSA”)) exercise significant oversight of Ambac UK. In 2009, the FSA limited Ambac UK’s license to undertaking only run-off related activity. As such, Ambac UK is authorized to run-off its insurance portfolio in the United Kingdom and a number of other EU countries. EU legislation allowed Ambac UK to conduct business in EU states other than the United Kingdom through a “passporting” arrangement, which eliminated the necessity of additional licensing or authorization in those other EU jurisdictions.

On December 31, 2020, Ambac UK's authorization to run-off insurance policies in the EU through passporting arrangements ceased. This was a consequence of the end of the transition period agreed between the UK Government and the EU following the UK's exit from the EU on January 31, 2020. Ambac UK's outstanding policies in the EU were either commuted or the benefits of those policies were transferred to UK entities during the year. Ambac UK therefore no longer services any insurance policies in the EU. Ambac UK maintained a branch in Milan, Italy until December 18, 2020, but closed the branch on that date following the transfer of the last remaining policy in the branch to the UK on 1 December 2020. See Item 1A. Risk Factors in Part I, Item 1A and Note 9. Insurance Regulatory Restrictions to the Consolidated Financial Statements included in Part II, Item 8 in this Form 10-K for further information on Brexit related developments as well as other regulatory restrictions.

Regulation of change in control

Under applicable Wisconsin and Arizona law, any acquisition of control of AFG, or any other direct or indirect acquisition of control of Ambac Assurance or the Everspan Group, requires the prior approval of OCI and DIFI, respectively. “Control” is defined as the direct or indirect power to direct or cause the direction of the management and policies of a person. Any purchaser of 10% or more of the outstanding voting stock of a corporation is presumed to have acquired control of that corporation and its subsidiaries unless the OCI or DIFI, as applicable, upon application, determines otherwise. For purposes of this test, AFG believes that a holder of common stock having the right to cast 10% or more of the votes which may be cast by the holders of all shares of common stock of AFG would be deemed to have control of Ambac Assurance, Everspan Indemnity and Everspan Insurance within the meaning of the applicable Wisconsin and Arizona insurance laws and regulations. The United Kingdom has similar requirements applicable in respect of AFG, as the ultimate holding company of Ambac UK.

| Ambac Financial Group, Inc. 8 2020 FORM 10-K |

Dividend Restrictions, Including Contractual Restrictions

Due to contractual and regulatory restrictions, AAC has been unable to pay ordinary dividends to AFG since 2008 and will be unable to pay ordinary dividends in 2021. AAC’s ability to pay dividends is further restricted by the Settlement Agreement, the Stipulation and Order, the indenture for the Tier 2 Notes and the terms of its Auction Market Preferred Shares ("AMPS"). See Note 9. Insurance Regulatory Restrictions to the Consolidated Financial Statements included in Part II, Item 8 in this Form 10-K for further information on dividends. As a result of these restrictions, AAC is not expected to pay dividends to AFG for the foreseeable future.

Everspan Indemnity and Everspan Insurance are also subject to regulatory restrictions on their ability to pay dividends. Everspan Indemnity and Everspan Insurance do not have sufficient earned surplus at this time to pay ordinary dividends under the insurance laws and regulations of Arizona.

While the UK insurance regulatory laws impose no statutory restrictions on an insurer’s ability to declare a dividend, the PRA’s and FCA’s capital requirements in practice act as a restriction on the payment of dividends, where a firm has a lower level of regulatory capital than its regulatory capital requirement as is the case for Ambac UK. Further, the FSA amended Ambac UK’s license in 2010 such that the PRA must specifically approve any transfer of value and/or assets from Ambac UK to AAC or any other Ambac group company, other than in respect of certain disclosed contracts between the two parties (such as in respect of a management services agreement between AAC and Ambac UK). As a result, Ambac UK is not expected to pay any dividends to AAC for the foreseeable future.

Pursuant to the Settlement Agreement and the indenture for the Tier 2 Notes, AAC may not make any “Restricted Payment” (which includes dividends from AAC to AFG) in excess of $5 million in the aggregate per annum, other than Restricted Payments from AAC to AFG in an amount up to $7.5 million per annum solely to pay operating expenses of AFG. Concurrent with making any such Restricted Payment, a pro rata amount of AAC's surplus notes would also need to be redeemed at par. Any such payment on surplus notes would require either payment or collateralization of a proportional amount of the Tier 2 Notes (or interest thereon) in accordance with the terms of the Tier 2 Note indenture.

The Stipulation and Order requires OCI approval for the payment of any dividend or distribution on the common stock of AAC.

Under the terms of AAC’s AMPS, dividends may not be paid on the common stock of AAC unless all accrued and unpaid dividends on the AMPS for the then current dividend period have been paid, provided that dividends on the common stock may be made at all times for the purpose of, and only in such amounts as are necessary for, enabling AFG (i) to service its indebtedness for borrowed money as such payments become due or (ii) to pay its operating expenses. If dividends are paid on the common stock as provided in the prior sentence, dividends on the AMPS become cumulative until the date that all accumulated and unpaid dividends have been paid on the AMPS.

INVESTMENTS AND INVESTMENT POLICY

As of December 31, 2020, the consolidated non-VIE investments of Ambac had an aggregate fair value of approximately $3,544 million. Investments are managed both internally by experienced investment managers and externally by investment management firms. All investments are made in accordance with the general objectives, policies, and guidelines for investments reviewed or overseen by the Board of Directors of the applicable subsidiary. These policies and guidelines include liquidity, credit quality, diversification and duration objectives and are periodically reviewed and revised as appropriate. Additionally, senior credit personnel monitor the portfolio on a continuous basis.

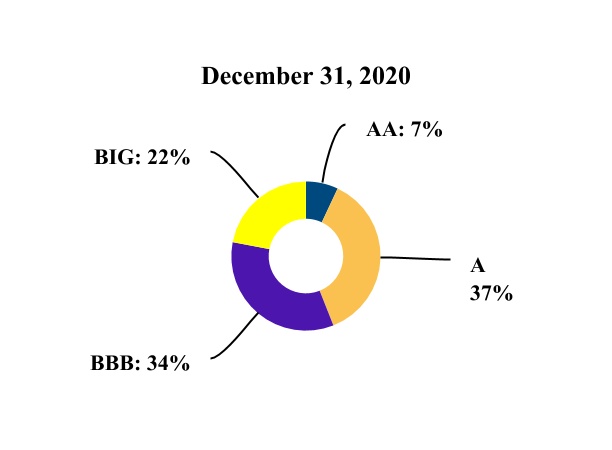

As of December 31, 2020, the AAC and Everspan Group non-VIE investment portfolios had an aggregate fair value of approximately $2,603 million. The investment objective is to achieve the highest risk-adjusted after-tax return on a diversified portfolio of fixed maturity investments and pooled investment funds consistent with the respective company's risk tolerance while employing active asset/liability management practices to satisfy all operating and strategic liquidity needs. In addition to internal investment policies and guidelines, the investment portfolio of each company is subject to limits on the types and quality of investments imposed by applicable insurance laws and regulations of the jurisdictions in which it is licensed. The Board of Directors of each respective subsidiary approves any changes to the investment policy. Within its guidelines, AAC opportunistically purchases and sells AAC and Ambac UK insured securities given their relative risk/reward characteristics. In certain instances, AAC may exceed its established credit rating or concentration limits with appropriate regulatory approval. Changes to AAC’s investment policies are subject to approval by OCI pursuant to covenants made by AAC in the Settlement Agreement, the Stipulation and Order and the indenture for the Tier 2 Notes. See Note 1. Background and Business Description to the Consolidated Financial Statements included in Part II, Item 8 in this Form 10-K for more information about the Settlement Agreement, the Stipulation and Order and the indenture for the Tier 2 Notes. Such requirements could adversely impact the performance of the investment portfolio.

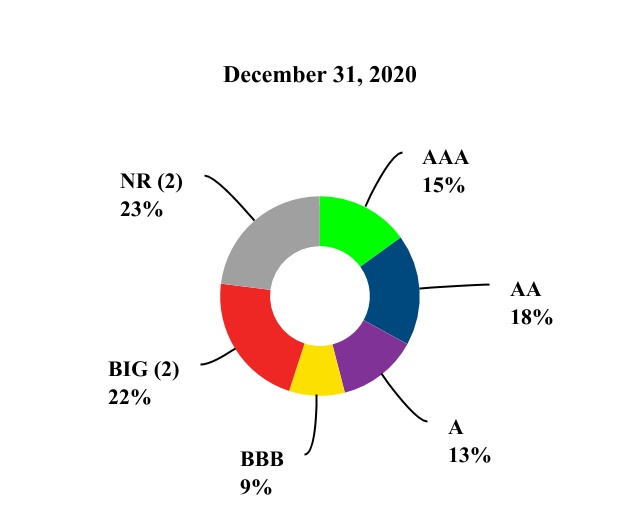

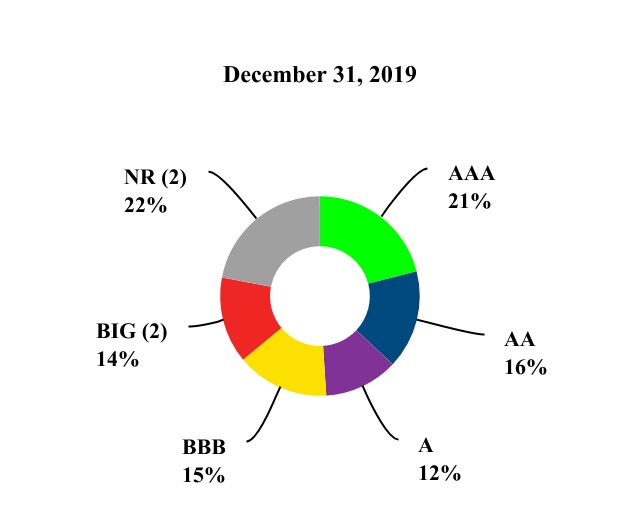

As of December 31, 2020, the non-VIE Ambac UK investment portfolio had an aggregate fair value of approximately $651 million. Ambac UK’s investment policy is designed with the primary objectives of ensuring a reasonable risk-adjusted return over the remaining runoff of the insured portfolio and that Ambac UK is able to meet its financial obligations as they fall due, in particular with respect to policy holder claims. Ambac UK’s investment portfolio is primarily diversified fixed maturity securities and pooled investment funds. The portfolio is subject to internal investment guidelines and may be subject to limits on types and quality of investments imposed by its regulator. The Board of Directors of Ambac UK approves any changes or exceptions to Ambac UK’s investment policy.

As of December 31, 2020, the non-VIE AFG (parent company only, excluding investments in subsidiaries) investment portfolio had an aggregate fair value of approximately $290 million. The primary investment objective is to preserve capital for strategic uses while maximizing income. The investment portfolio is

| Ambac Financial Group, Inc. 9 2020 FORM 10-K |

subject to internal investment guidelines. Such guidelines set forth minimum credit rating requirements and credit risk concentration limits. Included in the investment portfolio is AFG's investment in securities insured or issued by AAC, including surplus notes ($59 million fair value at December 31, 2020) that are eliminated in consolidation.

The following table provide certain information concerning the consolidated investments of Ambac:

| 2020 | 2019 | ||||||||||||||||||||||

| Investment Category ($ in millions) December 31, | Carrying Value (2) | Weighted Average Yield (1) | Carrying Value (2) | Weighted Average Yield (1) | |||||||||||||||||||

| Municipal obligations | $ | 358 | 4.8 | % | $ | 215 | 5.4 | % | |||||||||||||||

| Corporate securities | 1,077 | 3.9 | % | 1,430 | 4.6 | % | |||||||||||||||||

| Foreign obligations | 98 | 0.2 | % | 44 | 0.8 | % | |||||||||||||||||

| U.S. government obligations | 121 | 1.6 | % | 156 | 2.0 | % | |||||||||||||||||

| Residential mortgage-backed securities | 302 | 6.6 | % | 248 | 8.9 | % | |||||||||||||||||

| Asset-backed securities | 377 | 5.7 | % | 484 | 5.6 | % | |||||||||||||||||

| Total long-term fixed maturity investments | 2,332 | 4.3 | % | 2,577 | 5.0 | % | |||||||||||||||||

| Short-term investments | 617 | 0.1 | % | 737 | 1.5 | % | |||||||||||||||||

Other investments (3) | 595 | — | % | 478 | — | % | |||||||||||||||||

| Total | $ | 3,544 | 3.4 | % | $ | 3,792 | 4.2 | % | |||||||||||||||

(1) Yields are stated on a pre-tax basis, based on average amortized cost for both long and short term fixed-maturity investments.

(2) Includes investments guaranteed by AAC and Ambac UK ("Ambac insured"). Refer to Note 11. Investments of the Consolidated Financial Statements included in Part II, Item 8 in this Form 10-K for further discussion of Ambac insured securities held in the investment portfolio.

(3) Other investments include interests in pooled investment funds that are either classified as trading securities or are reported under the equity method and Ambac's interests in an unconsolidated trust created in connection with its sale of junior surplus notes on August 28, 2014.

EMPLOYEES

As of December 31, 2020, Ambac had 115 employees in the United States and 10 employees in the United Kingdom. Our 2020 voluntary turnover rate was approximately 3.3%. Ambac considers its employee relations to be satisfactory.

Ambac’s focus has been on identifying and retaining key talent through individual development programs following skills assessments. Ambac’s succession planning has identified internal candidates that could fill senior management and mid-level management positions as the need arises. The Company has established a senior advisory team to work with, and advise, senior management on key initiatives, and invested in both personal and professional growth programs to identify and prepare executives for promotion within the Company. The Company continues to rely on compensation components (such as salary, long-term incentive plan awards, deferred cash awards and short-term incentive plan awards) to support employee retention and discourage excessive risk taking. The Company incorporates performance metrics as part of the annual short-term incentive bonus offering with increased bonus potential for exceptional results. We utilize third-party benchmark data to

establish market-based compensation levels. We believe that our current compensation and incentive levels reflect high performance expectations as part of our merit pay philosophy. The targeted use of long-term equity incentive plan awards for key talent is an important element of Ambac’s long-term retention strategy.

Item 1A. Risk Factors

Capitalized terms used but not defined in this section shall have the meanings ascribed thereto in Part I, Item 1 in this Form 10-K or in Note 1. Background and Business Description to the Consolidated Financial Statements included in Part II, Item 8 in this Form 10-K unless otherwise indicated.

Our risk factors are organized in the following sections.

| Page | ||||||||

| Risks Related to AFG Common Shares | ||||||||

| Risks Related to FG Insured Portfolio Losses | ||||||||

| Risks Related to Indebtedness | ||||||||

| Risks Related to Capital, Liquidity and Markets | ||||||||

| Risks Related to Financial and Credit Markets | ||||||||

| Risks Related to the Company's Business | ||||||||

| Risks Related to International Business | ||||||||

| Risks Related to Taxation | ||||||||

| Risks Related to Strategic Plan | ||||||||

| Risks Related to Managing General Underwriting Business | ||||||||

Risks Related to AFG Common Shares

Investments in AFG's common stock are highly speculative and the price per share of AFG's common stock may be subject to a high degree of volatility, including significant price declines.

Ambac's principal business is in run-off and faces significant risks and uncertainties described elsewhere in Part I, Item 1A. Risk Factors. Although AFG's common stock is listed on the New York Stock Exchange ("NYSE"), there can be no assurance as to the liquidity of the trading market or the price at which such shares can be sold. The price of the shares may decline substantially in response to a number of events or circumstances, including but not limited to:

•adverse developments in our financial condition or results of operations;

•actual or perceived adverse developments with regards to AAC's residential mortgage-backed securities ("RMBS") litigations;

•changes in the actual or perceived risk within our FG insured portfolio, particularly with regards to concentrations of credit risk, such as in Puerto Rico;

•changes to regulatory status;

•changes in investors’ or analysts’ valuation measures for our stock;

•market perceptions of our success, or lack thereof, in pursuing our business strategy;

| Ambac Financial Group, Inc. 10 2020 FORM 10-K |

•the impact or perceived impact of any acquisition, disposition or other strategic transaction, including entry into a new line of business, on the value or long-term prospects of the Company; and

•results and actions of other participants in our industry.

In addition, the price of AFG's shares may be affected by the additional risks described below, including risks associated with AAC’s ability to deliver value to AFG. Investments in AFG's common stock should be considered highly speculative and may be subject to a high degree of volatility.

The occurrence of certain events could result in the initiation of rehabilitation proceedings against AAC, with resulting adverse consequences to holders of our securities.

Increased loss development in the FG insured portfolio or significant losses or other events resulting from litigation, including the failure to achieve expected recoveries from existing litigations concerning insured RMBS, may prompt OCI to determine that it is in the best interests of policyholders to initiate rehabilitation proceedings with respect to AAC, either preemptively or in response to any such event.

If OCI were to decide to initiate rehabilitation proceedings with respect to AAC, adverse consequences may result, including, without limitation and absent enforceable protective injunctive relief, the assertion of damages by counterparties, the acceleration of losses based on early termination triggers, and the loss of control rights in insured transactions. Any such consequences may reduce any residual value of AAC. Additionally, the rehabilitator would assume control of all of AAC’s assets and management of AAC. In exercising control, the rehabilitator would act for the benefit of policyholders, and would not take into account the interests of our security holders, which may result in material adverse consequences for our security holders.

AFG may not be able to realize value from AAC or generate earnings apart from AAC.

The value of AFG's common stock is partially dependent upon realizing residual value and/or receiving dividends from AAC; the receipt of payments to be made by AAC pursuant to the intercompany expense sharing and cost allocation agreement (the "Cost Allocation Agreement"); the receipt of payments on investments made in surplus notes issued by AAC; and the receipt of payments on other investments. There can be no assurance that AFG will be able to realize residual value and/or receive dividends from AAC, which is in run-off. AFG's ability to realize residual value and/or receive dividends from AAC will depend upon, amongst other considerations, AAC's ability to satisfy all of its obligations that are senior to AFG's equity interests, including obligations to policyholders, holders of its indebtedness (including surplus notes, the Ambac Note and the Tier 2 Notes) and holders of its preferred stock. AAC's ability to satisfy all of its obligations is dependent on a number of considerations including its ability to achieve recoveries and mitigate losses from its insured portfolio, which is subject to significant risks and uncertainties, including as a result of varying potential perceptions of the value of AAC’s guarantees and securities.

Due to the above considerations, as well as applicable legal and contractual restrictions described elsewhere herein, it is highly unlikely that AAC will be able to pay AFG any dividends for the foreseeable future. Furthermore, the payments to be made to AFG under the intercompany Cost Allocation Agreement are subject to, in certain instances, OCI approval, making the amount and timing of such payments uncertain. Specifically, the Cost Allocation Agreement provides that AAC's reimbursement of certain AFG operating expenses is subject to the approval of OCI and limited to $4.0 million per annum. We can provide no assurance as to whether OCI will approve such reimbursement or any portion thereof.

The value of AFG's common stock also depends upon the ability of Ambac to generate earnings apart from AAC. As noted below in Risks Related to Strategic Plan, Ambac is exploring further expansion into specialty property and casualty program insurance, managing general agent/underwriter, and potentially other insurance and insurance related businesses that, among other things, may permit utilization of Ambac’s net operating loss carry-forwards, but there are no assurances regarding its ability to acquire or develop any material businesses or the prospects for any such businesses.

Risks Related to FG Insured Portfolio Losses

Loss reserves may not be adequate to cover potential losses, and changes in loss reserves may result in further volatility of net income and comprehensive income.

Loss reserves are established when management has observed credit deterioration in its insured credits. Loss reserves established with respect to our non-derivative financial guarantee insurance policies are based upon estimates and judgments by management, including estimates and judgments with respect to the probability of default; the severity of loss upon default; management’s ability to execute policy commutations, restructurings and other loss mitigation strategies; and estimated remediation recoveries for, among other things, breaches by RMBS issuers of representations and warranties. The objective of establishing loss reserve estimates is not to, and our loss reserves do not, reflect the worst possible outcome. While our reserving scenarios reflect a wide range of possible outcomes (on a probability weighted basis), reflecting the significant uncertainty regarding future developments and outcomes, our loss reserves may change materially based on future developments. As a result of inherent uncertainties in the estimates and judgments made to determine loss reserves, there can be no assurance that either the actual losses in our financial guarantee insurance portfolio will not exceed such reserves or that our reserves will not increase or decrease materially over time as circumstances, our assumptions, or our models change.

Additionally, inherent in our estimates of loss severities and remediation recoveries is the assumption that AAC or its subsidiaries, as applicable, will retain control rights in respect of our insured portfolio. However, according to the terms of relevant transaction documents, AAC or its subsidiaries, as applicable, may lose control rights in many insured transactions if, among other things, the relevant insurer is the subject of delinquency proceedings and/or other regulatory actions. If AAC or its subsidiaries lose control rights, their ability to mitigate loss severities and realize remediation recoveries will

| Ambac Financial Group, Inc. 11 2020 FORM 10-K |

be compromised, and actual ultimate losses in the insured portfolio could exceed current loss reserves.

Some issuers of public finance obligations insured by AAC are experiencing fiscal stress that could result in increased losses on those obligations or increased liquidity claims, including losses or claims resulting from payment defaults, Chapter 9 bankruptcy or other restructuring proceedings or loss of market access.