Portions of the schedules and exhibits to this Exhibit 10.1 have been omitted pursuant to a request for confidential treatment filed with the Securities and Exchange Commission. The omissions have been indicated by asterisks (“*****”) and the omitted text has been filed separately with the Securities and Exchange Commission.

Exhibit 10.1

[EXECUTION COPY]

$250,000,000

THIRD AMENDED AND RESTATED CREDIT AGREEMENT

April 23, 2008

ANNTAYLOR, INC.,

ANNCO, INC.,

ANNTAYLOR DISTRIBUTION SERVICES, INC.

and

ANNTAYLOR RETAIL, INC.,

as the Borrowers,

BANK OF AMERICA, N.A.,

as Administrative Agent and as Collateral Agent,

JPMORGAN CHASE BANK, N.A.,

WACHOVIA BANK, NATIONAL ASSOCIATION,

and

RBS CITIZENS, N.A.,

as Syndication Agents

and

THE FINANCIAL INSTITUTIONS NAMED HEREIN,

as Lenders

BANC OF AMERICA SECURITIES LLC,

JPMORGAN SECURITIES, INC.

as Joint Lead Arrangers

TABLE OF CONTENTS

| Page | ||||||

| ARTICLE 1 |

LOANS AND LETTERS OF CREDIT | 1 | ||||

| 1.1 |

Total Facility | 1 | ||||

| 1.2 |

Revolving Loans | 2 | ||||

| 1.3 |

Letters of Credit | 5 | ||||

| 1.4 |

Bank Products | 9 | ||||

| 1.5 |

Increase in Commitments | 10 | ||||

| ARTICLE 2 |

INTEREST AND FEES | 11 | ||||

| 2.1 |

Interest | 11 | ||||

| 2.2 |

Continuation and Conversion Elections | 12 | ||||

| 2.3 |

Maximum Interest Rate | 13 | ||||

| 2.4 |

Fees | 13 | ||||

| 2.5 |

Unused Line Fee | 14 | ||||

| 2.6 |

Letter of Credit Fee | 14 | ||||

| ARTICLE 3 |

PAYMENTS AND PREPAYMENTS | 14 | ||||

| 3.1 |

Revolving Loans | 14 | ||||

| 3.2 |

Termination of Facility | 15 | ||||

| 3.3 |

Payments by the Borrowers | 15 | ||||

| 3.4 |

Payments as Revolving Loans | 15 | ||||

| 3.5 |

Apportionment, Application and Reversal of Payments | 15 | ||||

| 3.6 |

Indemnity for Returned Payments | 17 | ||||

| 3.7 |

Agent’s and Lenders’ Books and Records; Monthly Statements | 17 | ||||

| ARTICLE 4 |

TAXES, YIELD PROTECTION AND ILLEGALITY | 18 | ||||

| 4.1 |

Taxes | 18 | ||||

| 4.2 |

Illegality | 20 | ||||

| 4.3 |

Inability to Determine Rates | 21 | ||||

| 4.4 |

Increased Costs | 21 | ||||

| 4.5 |

Compensation for Losses | 22 | ||||

| 4.6 |

Mitigation Obligations | 23 | ||||

| 4.7 |

Survival | 23 | ||||

| 4.8 |

Replacement of Lenders | 23 | ||||

| ARTICLE 5 |

BOOKS AND RECORDS; FINANCIAL INFORMATION; NOTICES | 24 | ||||

| 5.1 |

Books and Records | 24 | ||||

| 5.2 |

Financial Information | 24 | ||||

| 5.3 |

Notices to the Lenders | 27 | ||||

-i-

TABLE OF CONTENTS

(continued)

| Page | ||||||

| ARTICLE 6 |

GENERAL WARRANTIES AND REPRESENTATIONS | 29 | ||||

| 6.1 |

Authorization, Validity, and Enforceability of this Agreement and the Loan Documents | 29 | ||||

| 6.2 |

Validity and Priority of Security Interest | 30 | ||||

| 6.3 |

Organization and Qualification | 30 | ||||

| 6.4 |

Corporate Name; Prior Transactions | 30 | ||||

| 6.5 |

Subsidiaries and Affiliates | 30 | ||||

| 6.6 |

Financial Statements and Projections | 31 | ||||

| 6.7 |

Capitalization | 31 | ||||

| 6.8 |

Solvency | 31 | ||||

| 6.9 |

Debt | 31 | ||||

| 6.10 |

Distributions | 31 | ||||

| 6.11 |

Real Estate; Store Locations | 31 | ||||

| 6.12 |

Trade Names | 32 | ||||

| 6.13 |

Litigation | 32 | ||||

| 6.14 |

Labor Disputes | 32 | ||||

| 6.15 |

Environmental Laws | 32 | ||||

| 6.16 |

No Violation of Law | 33 | ||||

| 6.17 |

No Default | 33 | ||||

| 6.18 |

ERISA Compliance | 34 | ||||

| 6.19 |

Taxes | 34 | ||||

| 6.20 |

Regulated Entities | 34 | ||||

| 6.21 |

Use of Proceeds; Margin Regulations | 35 | ||||

| 6.22 |

Copyrights, Patents, Trademarks and Licenses, etc | 35 | ||||

| 6.23 |

No Material Adverse Effect | 35 | ||||

| 6.24 |

Full Disclosure | 35 | ||||

| 6.25 |

Bank Accounts and Credit Card Processors | 35 | ||||

| 6.26 |

Governmental Authorization | 35 | ||||

| 6.27 |

Tax Shelter Regulations | 36 | ||||

| ARTICLE 7 |

AFFIRMATIVE AND NEGATIVE COVENANTS | 36 | ||||

| 7.1 |

Taxes and Other Obligations | 36 | ||||

| 7.2 |

Legal Existence and Good Standing | 36 | ||||

| 7.3 |

Compliance with Law and Agreements; Maintenance of Licenses | 36 | ||||

| 7.4 |

Maintenance of Property; Appraisals and Inspection of Property | 37 | ||||

| 7.5 |

Insurance | 37 | ||||

| 7.6 |

Insurance and Condemnation Proceeds | 38 | ||||

| 7.7 |

Environmental Laws | 39 | ||||

| 7.8 |

Compliance with ERISA | 40 | ||||

| 7.9 |

Debt | 40 | ||||

-ii-

TABLE OF CONTENTS

(continued)

| Page | ||||||

| 7.10 |

Sales of Assets; Liens | 41 | ||||

| 7.11 |

Investments | 43 | ||||

| 7.12 |

Accommodation Obligations | 45 | ||||

| 7.13 |

Restricted Payments | 46 | ||||

| 7.14 |

Conduct of Business | 47 | ||||

| 7.15 |

Transactions with Affiliates | 47 | ||||

| 7.16 |

Restriction on Fundamental Changes | 47 | ||||

| 7.17 |

ERISA | 47 | ||||

| 7.18 |

Sales and Leasebacks | 48 | ||||

| 7.19 |

Margin Regulations | 48 | ||||

| 7.20 |

Change of Fiscal Year | 48 | ||||

| 7.21 |

Subsidiaries | 48 | ||||

| 7.22 |

Fixed Charge Coverage Ratio | 49 | ||||

| 7.23 |

Further Assurances | 49 | ||||

| 7.24 |

Pledge of After-Acquired Property; Additional Borrowers | 49 | ||||

| 7.25 |

Cash Collateral and Deposit Accounts | 51 | ||||

| ARTICLE 8 |

CONDITIONS OF LENDING | 52 | ||||

| 8.1 |

Conditions Precedent to Making of Loans on the Effective Date | 52 | ||||

| 8.2 |

Conditions Precedent to Each Loan | 54 | ||||

| ARTICLE 9 |

DEFAULT; REMEDIES | 55 | ||||

| 9.1 |

Events of Default | 55 | ||||

| 9.2 |

Remedies | 57 | ||||

| ARTICLE 10 |

TERM AND TERMINATION | 59 | ||||

| 10.1 |

Term and Termination | 59 | ||||

| ARTICLE 11 |

AMENDMENTS; WAIVERS; PARTICIPATIONS; ASSIGNMENTS; SUCCESSORS | 59 | ||||

| 11.1 |

Amendments and Waivers | 59 | ||||

| 11.2 |

Assignments; Participations | 61 | ||||

| ARTICLE 12 |

THE AGENT | 63 | ||||

| 12.1 |

Appointment and Authorization | 63 | ||||

| 12.2 |

Delegation of Duties | 64 | ||||

| 12.3 |

Liability of Agent | 64 | ||||

-iii-

TABLE OF CONTENTS

(continued)

| Page | ||||||

| 12.4 |

Reliance by Agent | 64 | ||||

| 12.5 |

Notice of Default | 65 | ||||

| 12.6 |

Credit Decision | 65 | ||||

| 12.7 |

Indemnification | 65 | ||||

| 12.8 |

Agent in Individual Capacity | 66 | ||||

| 12.9 |

Successor Agent | 66 | ||||

| 12.10 |

Collateral Matters | 66 | ||||

| 12.11 |

Restrictions on Actions by Lenders; Sharing of Payments | 68 | ||||

| 12.12 |

Agency for Perfection | 68 | ||||

| 12.13 |

Payments by Agent to Lenders | 68 | ||||

| 12.14 |

Settlement | 69 | ||||

| 12.15 |

Letters of Credit; Intra-Lender Issues | 72 | ||||

| 12.16 |

Concerning the Collateral and the Related Loan Documents | 74 | ||||

| 12.17 |

Field Audit and Examination Reports; Disclaimer by Lenders | 74 | ||||

| 12.18 |

Relation Among Lenders | 75 | ||||

| 12.19 |

Co-Agents | 75 | ||||

| ARTICLE 13 |

GUARANTEES | 75 | ||||

| 13.1 |

Guaranty | 75 | ||||

| 13.2 |

Contribution | 76 | ||||

| 13.3 |

Waivers; Other Agreements | 77 | ||||

| 13.4 |

Guarantee Absolute and Unconditional | 80 | ||||

| 13.5 |

Reinstatement | 81 | ||||

| 13.6 |

Payment | 82 | ||||

| ARTICLE 14 |

MISCELLANEOUS | 82 | ||||

| 14.1 |

No Waivers; Cumulative Remedies | 82 | ||||

| 14.2 |

Severability | 82 | ||||

| 14.3 |

Governing Law; Choice of Forum; Service of Process | 83 | ||||

| 14.4 |

WAIVER OF JURY TRIAL | 83 | ||||

| 14.5 |

Survival of Representations and Warranties | 84 | ||||

| 14.6 |

Other Security and Guaranties | 84 | ||||

| 14.7 |

Fees and Expenses | 84 | ||||

| 14.8 |

Notices | 85 | ||||

| 14.9 |

Waiver of Notices | 86 | ||||

| 14.10 |

Binding Effect | 86 | ||||

| 14.11 |

Indemnity of the Agent and the Lenders by the Borrowers | 87 | ||||

| 14.12 |

Limitation of Liability | 87 | ||||

| 14.13 |

Final Agreement | 88 | ||||

| 14.14 |

Counterparts | 88 | ||||

-iv-

TABLE OF CONTENTS

(continued)

| Page | ||||||

| 14.15 |

Captions | 88 | ||||

| 14.16 |

Right of Setoff | 88 | ||||

| 14.17 |

Confidentiality | 89 | ||||

| 14.18 |

Conflicts with Other Loan Documents | 90 | ||||

| 14.19 |

No Lender Reliance on Margin Stock | 90 | ||||

| ARTICLE 15 |

AMENDMENT AND RESTATEMENT | 90 | ||||

| 15.1 |

Amendment and Restatement | 90 | ||||

| 15.2 |

Assignment and Acceptance | 90 | ||||

-v-

ANNEXES, EXHIBITS AND SCHEDULES

| ANNEX A |

- | DEFINITIONS | ||

| EXHIBIT A |

- | FORM OF COMPLIANCE CERTIFICATE | ||

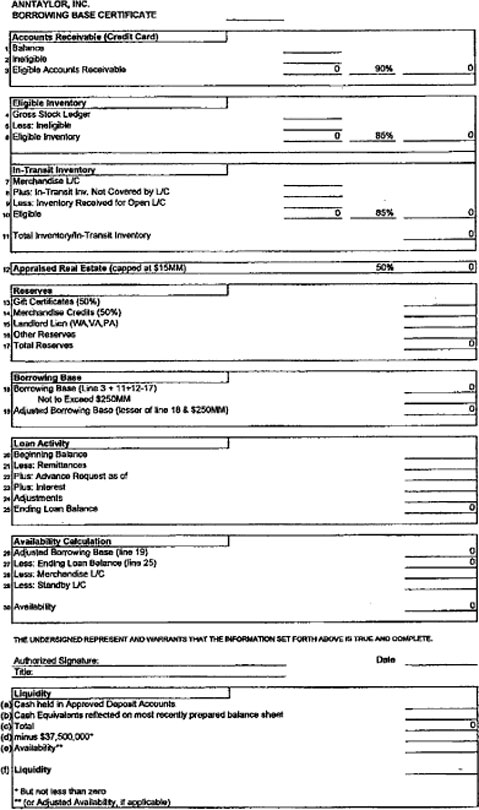

| EXHIBIT B |

- | FORM OF BORROWING BASE CERTIFICATE | ||

| EXHIBIT C |

- | [INTENTIONALLY OMITTED] | ||

| EXHIBIT D |

- | FORM OF NOTICE OF BORROWING | ||

| EXHIBIT E |

- | FORM OF NOTICE OF CONTINUATION/CONVERSION | ||

| EXHIBIT F |

- | FORM OF ASSIGNMENT AND ACCEPTANCE AGREEMENT | ||

| EXHIBIT G |

- | FORM OF SECURITY AGREEMENT | ||

| EXHIBIT H |

- | FORM OF PARENT GUARANTY | ||

| SCHEDULE 1.1 |

– | COMMITMENTS | ||

| SCHEDULE 1.3 |

– | EXISTING LETTERS OF CREDIT | ||

| SCHEDULE 5.2(j) |

– | ADDITIONAL FINANCIAL AND COLLATERAL REPORTS | ||

| SCHEDULE 6.5 |

– | SUBSIDIARIES AND AFFILIATES | ||

| SCHEDULE 6.7 |

– | SUBSIDIARY CAPITALIZATION | ||

| SCHEDULE 6.9 |

– | DEBT | ||

| SCHEDULE 6.10 |

– | DISTRIBUTIONS | ||

| SCHEDULE 6.11 |

– | REAL ESTATE | ||

| SCHEDULE 6.12 |

– | TRADE NAMES | ||

| SCHEDULE 6.13 |

– | LITIGATION | ||

| SCHEDULE 6.15 |

– | ENVIRONMENTAL LAW | ||

| SCHEDULE 6.18 |

– | ERISA COMPLIANCE | ||

| SCHEDULE 6.25 |

– | BANK ACCOUNTS AND CREDIT CARD PROCESSORS | ||

| SCHEDULE 7.10(b) |

– | PERMITTED EXISTING LIENS | ||

| SCHEDULE 7.11 |

– | INVESTMENTS | ||

-vi-

THIRD AMENDED AND RESTATED CREDIT AGREEMENT

This THIRD AMENDED AND RESTATED CREDIT AGREEMENT, dated as of April 23, 2008 (this “Agreement”), is made by and among the financial institutions from time to time parties hereto (such financial institutions, together with their respective successors and assigns, are referred to hereinafter each individually as a “Lender” and collectively as the “Lenders”), BANK OF AMERICA, N.A., as Administrative Agent and Collateral Agent for the Lenders (in such capacities, the “Agent”), JPMORGAN CHASE BANK, N.A., WACHOVIA BANK, NATIONAL ASSOCIATION, and RBS CITIZENS, N.A., as Syndication Agents, ANNTAYLOR, INC., a Delaware corporation (“ATI”), ANNCO, INC., a Delaware corporation (“ANNCO”), ANNTAYLOR DISTRIBUTION SERVICES, INC., a Delaware corporation (“AT Distribution”), and ANNTAYLOR RETAIL, INC., a Delaware corporation (“AT Retail”; ATI, ANNCO, AT Distribution and AT Retail may be referred to individually herein as a “Borrower” or collectively as the “Borrowers”).

W I T N E S S E T H:

WHEREAS, ATI, the lenders referred to therein, the syndication agents named therein, the issuing banks named therein and the administrative agent named therein have entered into that certain Original Credit Agreement (as defined in Annex A hereto);

WHEREAS, ATI has requested that the Lenders continue to make available to it a revolving line of credit for loans and letters of credit in an amount not to exceed $250,000,000 by amending the terms of the Original Credit Agreement, and restating such terms in their entirety, as set forth herein;

WHEREAS, capitalized terms used in this Agreement and not otherwise defined herein shall have the meanings ascribed thereto in Annex A which is attached hereto and incorporated herein; the rules of construction contained therein shall govern the interpretation of this Agreement and the other Loan Documents (except as otherwise provided for therein), and all Annexes, Exhibits and Schedules attached hereto are incorporated herein by reference; and

WHEREAS, the Lenders have agreed to continue to make available to the Borrowers a revolving credit facility upon the terms and conditions set forth in this Agreement;

NOW, THEREFORE, in consideration of the mutual conditions and agreements set forth in this Agreement, and for good and valuable consideration, the receipt of which is hereby acknowledged, the Lenders, the Agent and the Borrowers hereby agree that the Original Credit Agreement is hereby amended and restated in its entirety, effective as of the Effective Date, as follows.

ARTICLE 1

LOANS AND LETTERS OF CREDIT

1.1 Total Facility. Subject to all of the terms and conditions of this Agreement, the Lenders agree to make available a credit facility (the “Facility”) of up to $250,000,000, or such greater amount as may be established pursuant to Section 1.5 (the “Total Facility Amount”), to the Borrowers from time to time during the term of this Agreement. The Facility shall be composed of a revolving line of credit consisting of Revolving Loans and Letters of Credit.

1.2 Revolving Loans.

(a) Amounts. Subject to the satisfaction of the conditions precedent set forth in Article 8, each Lender severally, but not jointly, agrees, upon any Borrower’s request from time to time on any Business Day during the period from the Effective Date to the Termination Date, to make revolving loans (the “Revolving Loans”) to such Borrower in amounts not to exceed such Lender’s Pro Rata Share of Availability, except for Non-Ratable Loans and Agent Advances. The Lenders, however, in their unanimous discretion, may elect to make Revolving Loans or issue or arrange to have issued Letters of Credit in excess of the Borrowing Base on one or more occasions, but if they do so, neither the Agent nor the Lenders shall be deemed thereby to have changed the limits of the Borrowing Base or to be obligated to exceed such limits on any other occasion. If any Borrowing would exceed Availability, the Lenders may refuse to make or may otherwise restrict the making of Revolving Loans as the Lenders determine until such excess has been eliminated, subject to the Agent’s authority, in its sole discretion, to make Agent Advances pursuant to the terms of Section 1.2(i).

(b) Procedure for Borrowing.

(i) Each Borrowing (other than an L/C Borrowing or Agent Advance) shall be made upon a Borrower’s irrevocable written notice delivered to the Agent in the form of a notice of borrowing (“Notice of Borrowing”), which must be received by the Agent prior to (i) 11:00 a.m. (New York City time) three Business Days prior to the requested Funding Date, in the case of LIBOR Loans and (ii) 11:00 a.m. (New York City time) on the requested Funding Date, in the case of Base Rate Loans, specifying:

(A) the amount of the Borrowing, which in the case of a LIBOR Loan must equal or exceed $1,000,000 (and increments of $1,000,000 in excess of such amount);

(B) the requested Funding Date, which must be a Business Day;

(C) whether the Revolving Loans requested are to be Base Rate Loans or LIBOR Loans (and if not specified, it shall be deemed a request for a Base Rate Loan); and

(D) the duration of the Interest Period for LIBOR Loans (and if not specified, it shall be deemed a request for an Interest Period of one month);

provided, however, that with respect to the Borrowing to be made on the Effective Date, such Borrowings will consist of Base Rate Loans only.

2

(ii) In lieu of delivering a Notice of Borrowing, any Borrower may give the Agent telephonic notice of such request for advances to the Designated Account on or before the deadline set forth above. The Agent at all times shall be entitled to rely on such telephonic notice in making such Revolving Loans, regardless of whether any written confirmation is received.

(c) Reliance upon Authority. Prior to the Effective Date, each Borrower shall deliver to the Agent, a notice setting forth the account of such Borrower (“Designated Account”) to which the Agent is authorized to transfer the proceeds of the Revolving Loans requested hereunder. Any Borrower may designate a replacement account from time to time by written notice from a Responsible Officer. All such Designated Accounts must be reasonably satisfactory to the Agent. The Agent is entitled to rely conclusively on any person’s request for Revolving Loans on behalf of such Borrower, so long as the proceeds thereof are to be transferred to the Designated Account. The Agent has no duty to verify the identity of any individual representing himself or herself as a person authorized by such Borrower to make such requests on its behalf.

(d) No Liability. The Agent shall not incur any liability to any Borrower as a result of acting upon any notice referred to in Sections 1.2(b) and (c), which the Agent reasonably believes in good faith to have been given by an officer or other person duly authorized by such Borrower to request Revolving Loans on its behalf. The crediting of Revolving Loans to the Designated Account conclusively establishes the obligation of such Borrower to repay such Revolving Loans as provided herein.

(e) Notice Irrevocable. Any Notice of Borrowing (or telephonic notice in lieu thereof) made pursuant to Section 1.2(b) shall be irrevocable. The applicable Borrower shall be bound to borrow the funds requested therein in accordance therewith.

(f) Agent’s Election. Promptly after receipt of a Notice of Borrowing (or telephonic notice in lieu thereof), the Agent shall elect to have the terms of Section 1.2(g) or the terms of Section 1.2(h) apply to such requested Borrowing. If the Bank declines in its sole discretion to make a Non-Ratable Loan pursuant to Section 1.2(h), the terms of Section 1.2(g) shall apply to the requested Borrowing.

(g) Making of Revolving Loans. If Agent elects to have the terms of this Section 1.2(g) apply to a requested Borrowing, then promptly after receipt of a Notice of Borrowing or telephonic notice in lieu thereof, the Agent shall notify the Lenders by telecopy, telephone or e-mail of the requested Borrowing. Each Lender shall transfer its Pro Rata Share of the requested Borrowing available to the Agent in immediately available funds, to the account from time to time designated by Agent, not later than 12:00 noon (New York City time) on the applicable Funding Date. After the Agent’s receipt of all proceeds of such Revolving Loans, the Agent shall make the proceeds of such Revolving Loans available to the applicable Borrower on the applicable Funding Date by transferring same day funds to the applicable Designated Account; provided, however, that the amount of Revolving Loans so made on any date shall not exceed the Availability on such date.

3

(h) Making of Non-Ratable Loans.

(i) If Agent elects, with the consent of the Bank, to have the terms of this Section 1.2(h) apply to a requested Borrowing, the Bank shall make a Revolving Loan in the amount of that Borrowing available to the applicable Borrower on the applicable Funding Date by transferring same day funds to such Borrower’s Designated Account. Each Revolving Loan made solely by the Bank pursuant to this Section is herein referred to as a “Non-Ratable Loan”, and such Revolving Loans are collectively referred to as the “Non-Ratable Loans.” Each Non-Ratable Loan shall be subject to all the terms and conditions applicable to other Revolving Loans except that all payments thereon shall be payable to the Bank solely for its own account. The aggregate amount of Non-Ratable Loans outstanding at any time shall not exceed $20,000,000. The Agent shall not request the Bank to make any Non-Ratable Loan if (A) the Agent has received written notice from any Borrower or any Lender that one or more of the applicable conditions precedent set forth in Article 8 will not be satisfied on the requested Funding Date for the applicable Borrowing, or (B) the requested Borrowing would exceed Availability on that Funding Date.

(ii) The Non-Ratable Loans shall be secured by the Agent’s Liens in and to the Collateral and shall constitute Base Rate Loans and Obligations hereunder.

(i) Agent Advances.

(i) Subject to the limitations set forth below, the Agent is authorized by the Borrowers and the Lenders, from time to time in the Agent’s sole discretion after notice to and consultation with ATI, (A) after the occurrence of a Default or an Event of Default, or (B) at any time that any of the conditions precedent set forth in Article 8 have not been satisfied, to make Base Rate Loans to one or more of the Borrowers on behalf of the Lenders which the Agent, in its reasonable business judgment, deems necessary or desirable (1) to preserve or protect the Collateral, or any portion thereof, (2) to enhance the likelihood of, or maximize the amount of, repayment of the Loans and other Obligations (other than Bank Product Obligations) (including to provide cash collateral for outstanding Letters of Credit to the extent not otherwise Fully Supported by the Borrowers in accordance with Section 1.3(b) or (g)), or (3) to pay any other amount chargeable to any Borrower pursuant to the terms of this Agreement, including costs, fees and expenses as described in Section 14.7 (any of such advances are herein referred to as “Agent Advances”); provided, that (A) the aggregate amount of Agent Advances shall not exceed 10% of the Borrowing Base on the date any Agent Advance is made, (B) at no time shall the aggregate amount of Agent Advances plus Aggregate Outstandings exceed the Total Facility Amount, and (C) the Required Lenders may at any time revoke the Agent’s authorization to make Agent Advances. Any such revocation must be in writing and shall become effective prospectively upon the Agent’s receipt thereof.

(ii) As of the date of any Agent Advance made hereunder, the Agent shall have made arrangements with the Borrowers intended to eliminate or repay such Agent Advance within a reasonable time thereafter but in no event later than sixty (60) days following the date such Agent Advance is made.

4

(iii) The Agent Advances shall be secured by the Agent’s Liens in and to the Collateral and shall constitute Base Rate Loans and Obligations hereunder.

(iv) Each Lender shall automatically be deemed to have irrevocably and unconditionally purchased, without recourse or warranty, a participation in each Agent Advance when made based on such Lender’s Pro Rata Share,

1.3 Letters of Credit.

(a) Agreement to Issue or Cause To Issue. Subject to the terms and conditions of this Agreement and the applicable Issuing Bank Agreement, upon request of any Borrower a Letter of Credit Issuer will issue for the account of any Borrower one or more Letters of Credit.

(b) Amounts; Outside Expiration Date; Automatic Renewal. No Letter of Credit Issuer shall have any obligation to issue any Letter of Credit at any time if: (i) the maximum face amount of the requested Letter of Credit is greater than the Unused Letter of Credit Subfacility at such time; (ii) the maximum undrawn amount of the requested Letter of Credit and all commissions, fees, and charges due from such Borrower in connection with the opening thereof would exceed Availability at such time; (iii) such Letter of Credit has an expiration date less than four (4) Business Days prior to the Stated Termination Date or more than 12 months from the date of issuance for Standby Letters of Credit and 180 days (subject to extension for a maximum period of sixty (60) days) for Commercial Letters of Credit; or (iv) any applicable condition precedent in Article 8 has not been satisfied. If Letter of Credit Outstandings at any time exceed the lesser of the Borrowing Base or the Letter of Credit Subfacility, the Borrowers shall immediately upon notice cause Letters of Credit to be Fully Supported in the amount of such excess to be held by the Agent until such time that no such excess amount exists.

The Letter of Credit Issuers and the Lenders agree that, while a Standby Letter of Credit is outstanding and prior to the Termination Date, at the option of the applicable Borrower and upon the written request of the applicable Borrower received by the applicable Letter of Credit Issuer at least five (5) days (or such shorter time as such Letter of Credit Issuer may agree in a particular instance in its sole discretion) prior to the proposed date of notification of renewal, such Letter of Credit Issuer shall be entitled to authorize the automatic renewal of any Standby Letter of Credit issued by it so long as, immediately after the renewal thereof, the aggregate amount of Letter of Credit Outstandings does not exceed the Letter of Credit Subfacility and Aggregate Outstandings do not exceed the lesser of the Total Facility Amount or the Borrowing Base. Each such request for renewal of a Letter of Credit shall specify in form and detail satisfactory to the applicable Letter of Credit Issuer (i) the Letter of Credit to be renewed, (ii) the proposed date of notification of renewal of the Letter of Credit (which shall be a Business Day), (iii) the revised expiry date of the Letter of Credit, and (iv) such other matters as such Letter of Credit Issuer may require. No Letter of Credit Issuer shall so renew any Letter of Credit if (A) such Letter of Credit Issuer has actual knowledge that it would have no obligation at such time to issue or amend a Letter of Credit under the terms of Section 1.3(b) or (c) or Section 8.2, or (B) the beneficiary of any such Letter of Credit does not accept the proposed renewal of the Letter of Credit.

5

(c) Other Conditions. In addition to conditions precedent contained in Article 8, the obligation of any Letter of Credit Issuer to issue any Letter of Credit is subject to the following conditions precedent having been satisfied in a manner reasonably satisfactory to such Letter of Credit Issuer and the Agent:

(i) The applicable Borrower shall have delivered to the applicable Letter of Credit Issuer, at such times and in such manner as such Letter of Credit Issuer may prescribe, an application in form and substance reasonably satisfactory to such Letter of Credit Issuer and reasonably satisfactory to the Agent for the issuance of the Letter of Credit and such other documents as may be required pursuant to the terms thereof, and the form and terms of the proposed Letter of Credit shall be reasonably satisfactory to the Agent and such Letter of Credit Issuer; and

(ii) As of the date of issuance, no order of any court, arbitrator or Governmental Authority shall purport by its terms to enjoin or restrain money center banks generally from issuing letters of credit of the type and in the amount of the proposed Letter of Credit, and no law, rule or regulation applicable to money center banks generally and no request or directive (whether or not having the force of law) from any Governmental Authority with jurisdiction over money center banks generally shall prohibit, or request that the proposed Letter of Credit Issuer refrain from, the issuance of letters of credit generally or the issuance of such Letters of Credit.

(d) Issuance of Letters of Credit.

(i) Request for Issuance. The Borrower for whose account the Letter of Credit is to be issued must notify the Agent and the applicable Letter of Credit Issuer of a requested Letter of Credit on or prior to the proposed issuance date. Such notice shall be irrevocable and must specify the original face amount of the Letter of Credit requested, the Business Day of issuance of such requested Letter of Credit, whether such Letter of Credit may be drawn in a single or in partial draws, the Business Day on which the requested Letter of Credit is to expire, the purpose for which such Letter of Credit is to be issued, and the beneficiary of the requested Letter of Credit. In the case of Standby Letters of Credit, the full text of any certificate to be presented by the beneficiary in case of any drawing thereunder shall be delivered to the applicable Letter of Credit Issuer on the date of such request. Such notice shall comply with any additional requirements as are set forth in the relevant Issuing Bank Agreement or as the relevant Letter of Credit Issuer may require. Such Borrower shall attach to such notice the proposed form of the Letter of Credit.

(ii) Responsibilities of the Borrowers; Issuance. As of the requested issuance date of the Letter of Credit, the requesting Borrower shall determine the amount of the Unused Letter of Credit Subfacility and Availability and that all conditions to the obligation of any Letter of Credit Issuer to issue a Letter of Credit under Sections 1.3(b) and (c)

6

and Section 8.2 have been satisfied. If (i) the face amount of the requested Letter of Credit is less than the Unused Letter of Credit Subfacility and (ii) the amount of such requested Letter of Credit and all commissions, fees, and charges due from the requesting Borrower in connection with the opening thereof would not exceed Availability, such Borrower may apply to a Letter of Credit Issuer to issue the requested Letter of Credit on the requested issuance date so long as the other conditions hereof and under the applicable Issuing Bank Agreement are met.

(e) Payments Pursuant to Letters of Credit. Not later than 3:00 p.m. on the Business Day of any payment made by a Letter of Credit Issuer in respect of a drawing under a Letter of Credit, the Borrowers shall reimburse the applicable Letter of Credit Issuer for such draw under any Letter of Credit issued for the account of such Borrower and pay the applicable Letter of Credit Issuer the amount of all other charges and fees payable to such Letter of Credit Issuer in connection with such Letter of Credit immediately when due, irrespective of any claim, setoff, defense or other right which such Borrower may have at any time against such Letter of Credit Issuer or any other Person; provided, that such payment obligation may be discharged and replaced by a Revolving Loan incurred in accordance with the following sentence. Upon notice by a Borrower, or otherwise if not reimbursed by the Borrowers in accordance with the foregoing sentence, the drawing under such Letter of Credit shall give rise to a Borrowing of a Base Rate Loan in the amount of such drawing; provided that if the conditions precedent set forth in Section 8.2 cannot be satisfied as of such date, the Borrowers shall be deemed to have incurred from the applicable Letter of Credit Issuer an L/C Borrowing in the unreimbursed amount of each unreimbursed payment under such Letter of Credit, which L/C Borrowing shall be due and payable on demand (together with interest). In any such event described in the proviso to the preceding sentence, each Lender’s payment to the Agent for the account of the applicable Letter of Credit Issuer pursuant to this Section 1.3(e) shall be deemed to be a payment in respect of its participation in such L/C Borrowing and shall constitute an L/C Advance from such Lender in satisfaction of its participation obligations under this Section 1.3. The Funding Date with respect to such borrowing shall be the date of such drawing.

(f) Indemnification; Exoneration; Power of Attorney.

(i) Indemnification. In addition to amounts payable as elsewhere provided in this Section 1.3, each Borrower agrees to protect, indemnify, pay and save the Lenders and the Agent harmless from and against any and all claims, demands, liabilities, damages, losses, costs, charges and expenses (including reasonable attorneys’ fees) which any Lender or the Agent (other than the Agent or any Lender in its capacity as a Letter of Credit Issuer) may incur or be subject to as a consequence, direct or indirect, of the issuance of any Letter of Credit for the account of such Borrower, except to the extent it is determined in a final, non-appealable judgment of a court of competent jurisdiction that such amounts arose as a direct result of the gross negligence or willful misconduct of the Agent or such Lender. The Borrowers’ obligations under this Section shall survive payment of all other Obligations (other than Bank Product Obligations).

(ii) Assumption of Risk by the Borrowers. As among the Borrowers, the Lenders, and the Agent, each Borrower assumes all risks of the acts and

7

omissions of, or misuse of any of the Letters of Credit by, the respective beneficiaries of such Letters of Credit. In furtherance and not in limitation of the foregoing, the Lenders (other than the Agent or any Lender in its capacity as a Letter of Credit Issuer) and the Agent shall not be responsible for: (A) the form, validity, sufficiency, accuracy, genuineness or legal effect of any document submitted by any Person in connection with the application for and issuance of and presentation of drafts with respect to any of the Letters of Credit, even if it should prove to be in any or all respects invalid, insufficient, inaccurate, fraudulent or forged; (B) the validity or sufficiency of any instrument transferring or assigning or purporting to transfer or assign any Letter of Credit or the rights or benefits thereunder or proceeds thereof, in whole or in part, which may prove to be invalid or ineffective for any reason; (C) the failure of the beneficiary of any Letter of Credit to comply duly with conditions required in order to draw upon such Letter of Credit; (D) errors, omissions, interruptions, or delays in transmission or delivery of any messages, by mail, cable, telegraph, telex or otherwise, whether or not they be in cipher; (E) errors in interpretation of technical terms; (F) any loss or delay in the transmission or otherwise of any document required in order to make a drawing under any Letter of Credit or of the proceeds thereof; (G) the misapplication by the beneficiary of any Letter of Credit of the proceeds of any drawing under such Letter of Credit; (H) any consequences arising from causes beyond the control of the Lenders or the Agent, including any act or omission, whether rightful or wrongful, of any present or future de jure or de facto Governmental Authority or (I) a Letter of Credit Issuer’s honor of a draw for which the draw or any certificate fails to comply in any respect with the terms of the Letter of Credit. None of the foregoing shall affect, impair or prevent the vesting of any rights or powers of the Agent or any Lender under this Section 1.3(f).

(iii) Exoneration. Without limiting the foregoing, no action or omission whatsoever by Agent or any Lender (excluding the Agent or any Lender in its capacity as a Letter of Credit Issuer) shall result in any liability of Agent or any such Lender to any Borrower as of the result of or in connection with the issuance of any Letter of Credit, or relieve any Borrower of any of its obligations hereunder to any such Person under any Letter of Credit; provided, however, that anything in this Agreement to the contrary notwithstanding, the Borrowers may have a claim against the Agent or any Lender in its capacity as a Letter of Credit Issuer to the extent, but only to the extent, of any direct, as opposed to consequential or exemplary, damages suffered by a Borrower which were caused by the such Letter of Credit issuer’s willful misconduct or gross negligence or such Letter of Credit Issuer’s willful failure to pay under any Letter of Credit after the presentation to it by the beneficiary of a sight draft and certificate(s) strictly complying with the terms and conditions of a Letter of Credit. In furtherance and not in limitation of the foregoing, any Letter of Credit Issuer may accept documents that appear on their face to be in order, without responsibility for further investigation, regardless of any notice or information to the contrary, and no Letter of Credit Issuer shall be responsible for the validity or sufficiency of any instrument transferring or assigning or purporting to transfer or assign a Letter of Credit or the rights or benefits thereunder or proceeds thereof, in whole or in part, which may prove to be invalid or ineffective for any reason.

8

(iv) Rights Against Letter of Credit Issuers. Nothing contained in this Agreement is intended to limit or increase any Borrower’s rights, if any, with respect to a Letter of Credit Issuer which arise as a result of the Issuing Bank Agreement, the letter of credit application and related documents executed by and between such Borrower and a Letter of Credit Issuer.

(v) Account Party. Each Borrower hereby authorizes and directs any Letter of Credit Issuer to name such Borrower as the “account party” in a Letter of Credit requested by such Borrower and to deliver to the Agent all instruments, documents and other writings and property received by such Letter of Credit Issuer pursuant to the Letter of Credit, and to accept and rely upon the Agent’s instructions and agreements with respect to compliance with all matters relating to this Agreement arising in connection with the Letter of Credit or the application therefor.

(g) Support of Letters of Credit. If, notwithstanding the provisions of Section 1.3(b) and Section 10.1, any Letter of Credit is outstanding 30 days prior to the termination of this Agreement, or upon such termination of this Agreement, then each applicable Borrower shall cause such Letter of Credit to be Fully Supported.

(h) Letter of Credit Reporting. Each Letter of Credit Issuer shall notify the Agent and the Agent shall notify the Lenders on the first Business Day of each week of the total face amount of all of the Letters of Credit issued by it during the preceding week; provided however, the failure of any Letter of Credit Issuer or the Agent to deliver such notice shall not affect the obligations of the Lenders under Section 12.16.

1.4 Bank Products. Each Borrower may request and the Bank, the Bank’s Affiliates and each other Lender may, in its sole and absolute discretion, arrange for such Borrower to obtain from the Bank, its Affiliates or such Lender Bank Products, although the Borrower is not required to do so. If Bank Products are provided by an Affiliate of the Bank to a Borrower, the Borrowers, jointly and severally, agree to indemnify and hold harmless the Agent, the Bank and the other Lenders from any and all costs and obligations now or hereafter incurred by the Agent, the Bank or any of the Lenders which arise from any indemnity (which shall not extend to gross negligence or willful misconduct of such Affiliates) given by the Bank to its Affiliates related to such Bank Products; provided, however, nothing contained in this Section 1.4 is intended to limit any Borrower’s rights with respect to any Lender, the Bank or its Affiliates, if any, which arise as a result of the execution of documents by and between such Borrower and a Lender or the Bank or its Affiliates which relate to Bank Products and to the extent the terms of indemnity of such documents are different from the terms of indemnity set forth above, the terms of such documents shall control; and provided further, that nothing contained in this Section 1.4 is intended to obligate any Lender, the Bank or its Affiliates or any Borrower to provide any indemnity in connection with any Bank Products other than the indemnity of the Borrowers specifically provided for above. The agreement contained in this Section shall survive termination of this Agreement. Each Borrower acknowledges and agrees that the obtaining of Bank Products from a Lender, the Bank or the Bank’s Affiliates (a) is in the sole and absolute discretion of such Lender, the Bank or the Bank’s Affiliates, and (b) is subject to all rules and regulations of such Lender, the Bank or the Bank’s Affiliates.

9

1.5 Increase in Commitments

(a) Provided no Default or Event of Default exists, upon written notice to the Agent (which shall promptly notify the Lenders), the Borrowers may from time to time, request an increase in the Facility and the aggregate Commitments hereunder by an amount (for all such requests that are satisfied) not exceeding $100,000,000. Such notice shall specify the time period within which each Lender is requested to respond (which shall in no event be less than ten (10) Business Days from the date of delivery of such notice to the Lenders). Each Lender shall notify the Agent within such time period whether or not it agrees to increase its Commitment and, if so, whether by an amount equal to, greater than, or less than its Pro Rata Share of such requested increase. Any Lender not responding within such time period shall be deemed to have declined to increase its Commitment. No Lender declining to increase its Commitment in connection with such a request shall be entitled to fees, if any, paid in connection with such Commitment increase. The Agent shall notify the Borrowers and each Lender of the Lenders’ responses to each request made hereunder. To achieve the full amount of a requested increase, the Borrowers may also invite additional Eligible Assignees to become Lenders pursuant to a joinder agreement in form and substance acceptable to the Agent and subject to a $5,000,000 minimum Commitment amount for each such Eligible Assignee. Any increase in the aggregate Commitments may require the agreement of the Borrowers to pay additional arrangement, upfront and/or Agent’s fees to the Agent or the Lenders, as applicable, and may require a proportionate increase in all Liquidity and Availability thresholds hereunder, including, without limitation, the Availability threshold for the Applicable Margin and the Liquidity thresholds for reporting requirements, covenant limitations and cash dominion triggers under the Blocked Account Agreement.

(b) If the aggregate Commitments are increased in accordance with this Section, the Agent and the Borrowers shall determine the effective date (the “Increase Effective Date”) and the final allocation of such increase. The Agent shall promptly notify the Borrowers and the Lenders of the final allocation of such increase and the Increase Effective Date. As a condition precedent to such increase, the Borrowers shall deliver to the Agent a certificate of each Credit Party dated as of the Increase Effective Date (in sufficient copies for each Lender) signed by a Responsible Officer of such Credit Party (i) certifying and attaching the resolutions adopted by such Credit Party approving or consenting to such increase, and (ii) in the case of the Borrowers, certifying that, before and after giving effect to such increase, (A) the representations and warranties made to the Agent, the Letter of Credit Issuers or the Lenders by any Credit Party contained in Article 6 and the other Loan Documents are true and correct on and as of the Extension Effective Date, except to the extent that such representations and warranties specifically refer to an earlier date, in which case they are true and correct as of such earlier date, and except that for purposes of this Section 1.5, the representations and warranties contained in subsection (a) of Section 6.6 shall be deemed to refer to the most recent statements furnished pursuant to subsections (a) and (b), of Section 5.2, and (B) no Default or Event of

10

Default exists. On the Increase Effective Date, Schedule 1.1 shall be deemed to be deleted in its entirety and replaced with a new Schedule 1.1 reflecting the increased Commitments. The respective Lenders shall fund and/or be pre-paid, as applicable, any Loans outstanding on the Increase Effective Date (and the Borrowers shall pay any additional amounts required pursuant to Section 4.4) to the extent necessary to keep the outstanding Loans ratable with any revised Pro Rata Shares arising from any non-ratable increase in the Commitments under this Section.

(c) This Section shall supersede any provisions in Sections 11.1 or Section 12.11(b) to the contrary.

ARTICLE 2

INTEREST AND FEES

2.1 Interest.

(a) Interest Rates. Except as otherwise provided herein, all outstanding Obligations (other than Bank Product Obligations) shall bear interest on the unpaid principal amount thereof (including, to the extent permitted by law, on interest thereon not paid when due) from the date made (or due, in the case of Obligations other than Revolving Loans) until paid in full in cash at a rate determined by reference to the Base Rate or the LIBOR Rate plus the Applicable Margins as set forth below, but not to exceed the Maximum Rate. If at any time Loans are outstanding with respect to which the applicable Borrower has not delivered to the Agent a notice specifying the basis for determining the interest rate applicable thereto in accordance herewith, those Loans shall bear interest at a rate determined by reference to the Base Rate until notice to the contrary has been given to the Agent in accordance with this Agreement and such notice has become effective. Except as otherwise provided herein, the outstanding Obligations (other than Bank Product Obligations) shall bear interest as follows:

(i) For all Base Rate Loans, at a fluctuating per annum rate equal to the applicable Base Rate plus the Applicable Margin; and

(ii) For all LIBOR Loans at a per annum rate equal to the LIBOR Rate plus the Applicable Margin.

Each change in the Base Rate shall be reflected in the interest rate applicable to Base Rate Loans as of the effective date of such change. All interest charges shall be computed on the basis of a year of 365 or 366 days, as applicable, and actual days elapsed.

(b) Payment of Interest. The Borrowers shall pay to the Agent, for the ratable benefit of Lenders, interest accrued on all Base Rate Loans in arrears on the first day of each month hereafter and on the Termination Date. The Borrowers shall pay to the Agent, for the ratable benefit of Lenders, interest on all LIBOR Loans in arrears on each applicable LIBOR Interest Payment Date.

11

(c) Default Rate. Notwithstanding the rates of interest specified in Section 2.1(a) and the payment dates specified in Section 2.1(b), effective at the direction of the Agent after the occurrence of any Event of Default or after acceleration of maturity pursuant to Section 9.2(a) and for so long thereafter as any such Event of Default or acceleration shall be continuing, the principal balance of all Obligations (other than Bank Product Obligations) then due and payable (including all amounts due and payable pursuant to Section 9.2(a)), shall bear interest payable upon demand at the applicable Default Rate.

2.2 Continuation and Conversion Elections.

(a) Each Borrower may, except to the extent an Event of Default has occurred and is continuing:

(i) elect, as of any Business Day, in the case of Base Rate Loans to convert any Base Rate Loans (or any part thereof in an amount not less than $1,000,000, or that is in an integral multiple of $1,000,000 in excess thereof) into LIBOR Loans; or

(ii) elect, as of the last day of the applicable Interest Period, to continue any LIBOR Loans having Interest Periods expiring on such day (or any part thereof in an amount not less than $1,000,000, or that is in an integral multiple of $1,000,000 in excess thereof);

provided, that if at any time the aggregate amount of LIBOR Loans in respect of any Borrowing is reduced, by payment, prepayment, or conversion of part thereof to be less than $1,000,000, such LIBOR Loans shall automatically convert into Base Rate Loans; provided further that if the notice shall fail to specify the duration of the Interest Period, such Interest Period shall be one month.

(b) The applicable Borrower shall deliver a notice of continuation/conversion (“Notice of Continuation/Conversion”) to the Agent not later than 12:00 noon (New York City time) at least three (3) Business Days in advance of the Continuation/Conversion Date, if the Loans are to be converted into or continued as LIBOR Loans and specifying:

(i) the proposed Continuation/Conversion Date;

(ii) the aggregate amount of Loans to be converted or renewed;

(iii) the type of Loans resulting from the proposed conversion or continuation; and

(iv) the duration of the requested Interest Period, provided, however, such Borrower may not select an Interest Period that ends after the Stated Termination Date.

12

(c) If upon the expiration of any Interest Period applicable to any LIBOR Loans, the applicable Borrower has failed to select timely a new Interest Period to be applicable to such LIBOR Loans and no Event of Default has occurred and is continuing, such Borrower shall be deemed to have elected to convert such LIBOR Loans into LIBOR Loans having a one-month Interest Period effective as of the expiration date of such Interest Period. At any time during the continuation of an Event of Default, each Borrower shall be deemed to have elected to convert all LIBOR Loans into Base Rate Loans effective as of the expiration date of their respective Interest Periods.

(d) The Agent will promptly notify each Lender of its receipt of a Notice of Continuation/Conversion. All conversions and continuations shall be made ratably according to the respective outstanding principal amounts of the Loans with respect to which the notice was given held by each Lender.

(e) There may not be more than five (5) different LIBOR Loans in effect hereunder at any time.

2.3 Maximum Interest Rate. In no event shall any interest rate provided for hereunder exceed the maximum rate legally chargeable by any Lender under applicable Requirements of Law for such Lender with respect to loans of the type provided for hereunder (the “Maximum Rate”). If, in any month, any interest rate, absent such limitation, would have exceeded the Maximum Rate, then the interest rate for that month shall be the Maximum Rate, and, if in future months, that interest rate would otherwise be less than the Maximum Rate, then that interest rate shall remain at the Maximum Rate until such time as the amount of interest paid hereunder equals the amount of interest which would have been paid if the same had not been limited by the Maximum Rate. In the event that, upon payment in full of the Obligations (other than Bank Product Obligations), the total amount of interest paid or accrued under the terms of this Agreement is less than the total amount of interest which would, but for this Section 2.3, have been paid or accrued if the interest rate otherwise set forth in this Agreement had at all times been in effect, then such Borrower shall, to the extent permitted by applicable law, pay the Agent, for the account of the Lenders, an amount equal to the excess of (a) the lesser of (i) the amount of interest which would have been charged if the Maximum Rate had, at all times, been in effect or (ii) the amount of interest which would have accrued had the interest rate otherwise set forth in this Agreement, at all times, been in effect over (b) the amount of interest actually paid or accrued under this Agreement. If a court of competent jurisdiction determines that the Agent and/or any Lender has received interest and other charges hereunder in excess of the Maximum Rate, such excess shall be deemed received on account of, and shall automatically be applied to reduce, the Obligations (other than Bank Product Obligations) other than interest, and if there are no Obligations (other than Bank Product Obligations) outstanding, the Agent and/or such Lender shall refund to such Borrower such excess.

2.4 Fees. The Borrowers agree, jointly and severally, to pay the Agent the fees payable as set forth in the fee letter dated March 26, 2008, between the Agent and ATI (the “Fee Letter”).

13

2.5 Unused Line Fee. On the first day of each month and on the Termination Date the Borrowers agree, jointly and severally, to pay to the Agent, for the account of the Lenders, in accordance with their respective Pro Rata Shares, an unused line fee (the “Unused Line Fee”) equal to the Applicable Margin for the Unused Line Fee times the amount by which the Total Facility Amount exceeded the sum of the average daily outstanding amount of Revolving Loans and the average daily undrawn face amount of outstanding Letters of Credit, during the immediately preceding month or shorter period if calculated for the first month hereafter or on the Termination Date. The Unused Line Fee shall be computed on the basis of a year of 365 or 366 days, as applicable, for the actual number of days elapsed. All principal payments received by the Agent shall be deemed to be credited to the applicable Borrower’s Loan Account immediately upon receipt for purposes of calculating the Unused Line Fee pursuant to this Section 2.5.

2.6 Letter of Credit Fee. The Borrowers, jointly and severally, agree (a) to pay to the Agent, for the account of the Lenders, in accordance with their respective Pro Rata Shares, (i) for each Commercial Letter of Credit issued for the account of such Borrower, a fee (the “Commercial Letter of Credit Fee”) at a per annum rate equal to the Applicable Margin for the Commercial Letter of Credit Fee multiplied by the average daily undrawn amount available to be drawn on such Commercial Letter of Credit during the immediately preceding month and (ii) for each Standby Letter of Credit issued for the account of such Borrower, a fee (the “Standby Letter of Credit Fee”) at a per annum rate equal to the Applicable Margin for LIBOR Loans multiplied by the average daily undrawn amount available to be drawn on such Standby Letter of Credit during the immediately preceding month, (b) to pay to the applicable Letter of Credit Issuer a fronting fee (the “Fronting Fee”) of one-eighth of one percent (.125%) of the undrawn face amount of each Letter of Credit issued for the account of such Borrower, and (c) to pay to the applicable Letter of Credit Issuer, such out-of-pocket costs, fees and expenses incurred by each Letter of Credit Issuer in connection with the application for, processing of, issuance of, or amendment to any Letter of Credit issued for the account of such Borrower, as the applicable Letter of Credit Issuer and such Borrower shall agree upon, but which costs, fees and expenses shall not include the Fronting Fee. The Commercial Letter of Credit Fee and the Standby Letter of Credit Fee shall be payable monthly in arrears on the first day of each month following any month in which such a Letter of Credit is outstanding and on the Termination Date. The Fronting Fee shall be payable on each date of issuance or renewal (automatic or otherwise) of each Letter of Credit. All fees described in this Section 2.6 shall be computed on the basis of a year of 365 or 366 days, as applicable, for the actual number of days elapsed.

ARTICLE 3

PAYMENTS AND PREPAYMENTS

3.1 Revolving Loans. The Borrowers shall repay the outstanding principal balance of the Revolving Loans made to them, plus all accrued but unpaid interest thereon, on the Termination Date. Any Borrower may prepay Revolving Loans at any time, and reborrow subject to the terms of this Agreement. In addition, and without limiting the generality of the foregoing, upon demand by the Agent the Borrowers shall pay to the Agent, for account of the Lenders, the amount, without duplication, by which the Aggregate Outstandings exceeds the lesser of the Borrowing Base or the Total Facility Amount.

14

3.2 Termination of Facility. The Borrowers may terminate this Agreement upon at least five (5) Business Days’ notice to the Agent and the Lenders, upon (a) the payment in full of all outstanding Revolving Loans, together with accrued interest thereon, and the cancellation and return of all outstanding Letters of Credit or such Letters of Credit being Fully Supported, (b) the payment in full in cash of all reimbursable expenses and other Obligations, and (c) with respect to any LIBOR Loans prepaid, payment of the amounts due under Section 4.4, if any, in each case on or prior to the Termination Date.

3.3 Payments by the Borrowers.

(a) All payments to be made by the Borrowers shall be made without set-off, recoupment or counterclaim. Except as otherwise expressly provided herein, all payments by the Borrowers shall be made to the Agent for the account of the Lenders, at the account designated by the Agent and shall be made in Dollars and in immediately available funds, no later than 12:00 noon (New York City time) on the date specified herein. Any payment received by the Agent after such time shall be deemed (for purposes of calculating interest only) to have been received on the following Business Day and any applicable interest shall continue to accrue.

(b) Subject to the provisions set forth in the definition of “Interest Period”, whenever any payment is due on a day other than a Business Day, such payment shall be due on the following Business Day, and such extension of time shall in such case be included in the computation of interest or fees, as the case may be.

(c) If any LIBOR Loans are repaid prior to the expiration date of the Interest Period applicable thereto, the Borrowers shall pay to the Lenders the amounts described in Section 4.4.

3.4 Payments as Revolving Loans. At the election of Agent, all payments of principal, interest, reimbursement obligations in connection with Letters of Credit, fees, premiums, reimbursable expenses and other sums payable hereunder that are due but have not been paid by the Borrowers at the date and time specified herein, may be paid from the proceeds of Revolving Loans made hereunder. Each Borrower hereby irrevocably authorizes the Agent to charge the Loan Account of such Borrower for the purpose of paying all amounts from time to time due hereunder in respect of principal, interest or fees (or, during the continuance of an Event of Default, all other Obligations (other than Bank Product Obligations)) and agrees that all such amounts charged shall constitute Revolving Loans.

3.5 Apportionment, Application and Reversal of Payments.

(a) Principal and interest payments shall be apportioned ratably among the Lenders (according to the unpaid principal balance of the Loans to which such payments

15

relate held by each Lender) and payments of the fees shall, as applicable, be apportioned ratably among the Lenders, except for fees payable solely to Agent and the Letter of Credit Issuers and except as provided in Section 11.1(b).

(b) After the occurrence of an Event of Default and the exercise of any of the remedies provided for in Section 9.2(a)(v), (vi), (vii) or (viii) or 9.2(b) (or after the Loans have automatically become immediately due and payable and the Letter of Credit Obligations have been required to be Fully Supported), any amounts received on account of the Obligations shall be applied by the Administrative Agent in the following order: first, to pay any fees, indemnities or expense reimbursements then due to the Agent; second, to pay interest and principal due to the Bank in respect of all Non-Ratable Loans; third, to pay all fees, expenses and indemnities due to the Letter of Credit Issuers in respect of Letters of Credit; fourth, to pay any Obligations constituting fees due to the Lenders (other than fees relating to Bank Products); fifth, to pay interest due in respect of all Loans (other than Non-Ratable Loans); sixth, to pay or prepay principal of all Loans (other than Non-Ratable Loans) and unpaid reimbursement obligations in respect of Letters of Credit; sixth, to pay an amount to the Agent equal to all Letter of Credit Outstandings to be held as cash collateral for such Obligations; and seventh, to the payment of any other Obligation due to the Agent, any Letter of Credit Issuer, any Lender or any Affiliate of the Bank (including any Obligations arising under Bank Products).

(c) Amounts distributed with respect to any Bank Product Obligations shall be the lesser of the applicable Bank Product Amount last reported to Agent or the actual Bank Product Amount as calculated by the methodology reported to Agent for determining the amount due. The Agent shall have no obligation to calculate the amount to be distributed with respect to any Bank Products, but may rely upon written notice of the amount (setting forth a reasonably detailed calculation) from the applicable Lender. In the absence of such notice, the Agent may assume the amount to be distributed is the Bank Product Amount last reported to it.

(d) Notwithstanding anything to the contrary contained in this Agreement, unless so directed by the Borrowers, or unless an Event of Default has occurred and is continuing, neither the Agent nor any Lender shall apply any payments which it receives to any LIBOR Loan, except (a) on the expiration date of the Interest Period applicable to any such LIBOR Loan, or (b) in the event, and only to the extent, that there are no outstanding Base Rate Loans.

The Agent and the Lenders shall have the continuing and exclusive right to apply and reverse and reapply any and all such proceeds and payments to any portion of the Obligations in accordance with the first sentence of Section 3.5(b). The allocations set forth in Section 3.5(b) are solely to determine the rights and priorities of Agent and Lenders as among themselves, and may be changed by agreement among them without the consent of any Credit Party; provided that all such amounts received by the Agent shall be (i) credited upon receipt to the Loan Account and applied towards payment of Obligations hereunder and (ii) shall not be applied to the payment of Bank Product Obligations prior to the payment in full of all other amounts specified in clauses first through sixth of Section 3.5(b).

16

3.6 Indemnity for Returned Payments. If after receipt of any payment which is applied to the payment of all or any part of the Obligations, the Agent, any Lender, any Letter of Credit Issuer, the Bank or any Affiliate of the Bank (each an “Affected Payee”) is for any reason compelled to surrender such payment or proceeds to any Person because such payment or application of proceeds is invalidated, declared fraudulent, set aside, determined to be void or voidable as a preference, impermissible setoff, or a diversion of trust funds, or for any other reason, then the Obligations or part thereof intended to be satisfied shall be revived and continued and this Agreement shall continue in full force as if such payment or proceeds had not been received by the Affected Payee and the applicable Borrower or Borrowers shall be liable to pay to the Affected Payee, and hereby does indemnify the Affected Payee and holds harmless the Affected Payee, for the amount of such payment or proceeds surrendered. The provisions of this Section 3.9 shall be and remain effective notwithstanding any contrary action which may have been taken by the Affected Payee in reliance upon such payment or application of proceeds, and any such contrary action so taken shall be without prejudice to the Affected Payee’s rights under this Agreement and shall be deemed to have been conditioned upon such payment or application of proceeds having become final and irrevocable. The provisions of this Section 3.9 shall survive the termination of this Agreement.

3.7 Agent’s and Lenders’ Books and Records; Monthly Statements. The Agent shall record the principal amount of the Loans owing to each Lender, the undrawn face amount of all outstanding Letters of Credit and the aggregate amount of unpaid reimbursement obligations outstanding with respect to the Letters of Credit from time to time on its books. In addition, each Lender may note the date and amount of each payment or prepayment of principal of such Lender’s Loans in its books and records. Failure by Agent or any Lender to make such notation shall not affect the obligations of the Borrowers with respect to the Loans or the Letters of Credit. Each Borrower agrees that the Agent’s and each Lender’s books and records showing the Obligations and the transactions pursuant to this Agreement and the other Loan Documents shall be admissible in any action or proceeding arising therefrom, and shall constitute rebuttably presumptive proof thereof (absent manifest error), irrespective of whether any Obligation is also evidenced by a promissory note or other instrument. The Agent will provide to ATI, on behalf of the Borrowers, a monthly statement of Loans, payments, and other transactions pursuant to this Agreement. Such statement shall be deemed presumptively correct, accurate, and binding on the Borrowers and an account stated (except for reversals and reapplications of payments made as provided in Section 3.5 and corrections of errors discovered by the Agent), unless the Borrowers (or ATI on their behalf) notify the Agent in writing to the contrary within thirty (30) days after such statement is rendered. In the event a timely written notice of objections is given by a Borrower (or ATI on behalf of such Borrower), only the items to which exception is expressly made will be considered to be disputed by such Borrower.

17

ARTICLE 4

TAXES, YIELD PROTECTION AND ILLEGALITY

4.1 Taxes.

(a) Payments Free of Taxes. Any and all payments made to the Agent, the Letter of Credit Issuers or any Lender by or on account of any obligation of the Borrowers hereunder or under any other Loan Document shall be made free and clear of and without deduction or withholding for any Indemnified Taxes or Other Taxes, provided that if any Borrower shall be required by applicable Requirements of Law to deduct any Indemnified Taxes or Other Taxes from such payments, then (i) the sum payable shall be increased as necessary so that after making all required deductions (including deductions applicable to additional sums payable under this Section) the Agent, a Lender or a Letter of Credit Issuer, as the case may be, receives an amount equal to the sum it would have received had no such deductions been made, (ii) such Borrower shall make such deductions and (iii) such Borrower shall timely pay the full amount deducted to the relevant Governmental Authority in accordance with applicable Requirements of Law.

(b) Payment of Other Taxes by the Borrowers. Without limiting the provisions of subsection (a) above, the Borrowers shall timely pay any Other Taxes to the relevant Governmental Authority in accordance with applicable Requirements of Law.

(c) Indemnification by the Borrowers. The Borrowers shall indemnify the Agent, each Lender and each Letter of Credit Issuer, within 10 days after demand therefor, for the full amount of any Indemnified Taxes or Other Taxes (including Indemnified Taxes or Other Taxes imposed or asserted on or attributable to amounts payable under this Section) paid by the Agent, such Lender or such Letter of Credit Issuer, as the case may be, and any penalties, interest and reasonable expenses arising therefrom or with respect thereto, whether or not such Indemnified Taxes or Other Taxes were correctly or legally imposed or asserted by the relevant Governmental Authority. A certificate as to the amount of such payment or liability and in reasonable detail the basis and calculation of such amounts, delivered to any Borrower by a Lender or a Letter of Credit Issuer (with a copy to the Agent), or by the Agent on its own behalf or on behalf of a Lender or a Letter of Credit Issuer, shall be conclusive absent manifest error.

(d) Evidence of Payments. As soon as practicable after any payment of Indemnified Taxes or Other Taxes by the Borrowers to a Governmental Authority, the Borrowers shall deliver to the Agent the original or a certified copy of a receipt issued by such Governmental Authority evidencing such payment, a copy of the return reporting such payment or other evidence of such payment reasonably satisfactory to the Agent.

(e) Status of Lenders and Letter of Credit Issuers. Any Lender or Letter of Credit Issuer that is entitled to an exemption from or reduction of withholding tax under the Requirements of Law of the jurisdiction in which any Borrower is resident for tax purposes, or any treaty to which such jurisdiction is a party, with respect to payments hereunder or under any other Loan Document shall deliver to the applicable Borrower (with a copy to the Agent), at the time or times prescribed by applicable Requirements of Law or reasonably requested by such Borrower or the Agent, such properly completed and executed documentation prescribed by applicable Requirements of Law as will permit such payments to be made without withholding or at a reduced rate of withholding. In addition, any Lender or Letter of Credit Issuer, if requested by such Borrower or the Agent, shall deliver such other documentation prescribed by

18

applicable Requirements of Law or reasonably requested by such Borrower or the Agent as will enable such Borrower or the Agent to determine whether or not such Lender or Letter of Credit Issuer is subject to backup withholding or information reporting requirements.

Without limiting the generality of the foregoing, any Foreign Lender or Foreign Letter of Credit Issuer shall deliver to the applicable Borrower and the Agent (in such number of copies as shall be requested by the recipient) on or prior to the date on which, in the case of a Foreign Lender, such Foreign Lender becomes a Lender under this Agreement, or, in the case of a Foreign Letter of Credit Issuer, such Foreign Letter of Credit Issuer becomes a Letter of Credit Issuer under this Agreement, (and from time to time thereafter upon the request of such Borrower or the Agent, but only if such Foreign Lender or Foreign Letter of Credit Issuer is legally entitled to do so), whichever of the following is applicable:

(i) duly completed and executed copies of Internal Revenue Service Form W-8BEN, or any successor form, and any required attachments thereto, claiming eligibility for benefits of an income tax treaty to which the United States is a party,

(ii) duly completed and executed copies of Internal Revenue Service Form W-8ECI, or any successor form, and any required attachments thereto,

(iii) in the case of a Foreign Lender claiming the benefits of the exemption for portfolio interest under section 881(c) of the Code, (x) a certificate to the effect that such Foreign Lender is not (A) a “bank” within the meaning of section 881(c)(3)(A) of the Code, (B) a “10 percent shareholder” of the applicable Borrower within the meaning of section 881(c)(3)(B) of the Code, or (C) a “controlled foreign corporation” described in section 881(c)(3)(C) of the Code and (y) duly completed and executed copies of Internal Revenue Service Form W-8BEN, or any successor form, and any required attachments thereto, or

(iv) any other documentation prescribed by the U.S. law as a basis for claiming exemption from or a reduction in United States Federal withholding tax duly completed and executed together with such supplementary documentation as may be prescribed by the U.S. law to permit the applicable Borrower to determine the withholding or deduction required to be made.

Without limiting the generality of this Section 4.1(e), any Lender that is not a Foreign Lender or any Letter of Credit Issuer that is not a Foreign Letter of Credit Issuer shall complete and deliver to the applicable Borrower and the Agent (in such number of copies as shall be requested by the recipient) a statement signed by an authorized signatory of the Lender or the Letter of Credit Issuer to the effect that it is a United States person, for U.S. federal income tax purposes, together with duly completed and executed copies of Internal Revenue Service Form W-9, or successor form, and any required attachments thereto, establishing that the Lender or the Letter of Credit Issuer is not subject to U.S. backup withholding tax.

(f) Mitigation. Each Lender and Letter of Credit Issuer shall use reasonable efforts (in the case of a Lender, including reasonable efforts to change its applicable

19

Lending Office) to avoid the imposition of any Indemnified Taxes or Other Taxes; provided, however, that such efforts would not subject such Lender or Letter of Credit Issuer to any unreimbursed cost or expense and would not otherwise be disadvantageous to such Lender or Letter of Credit Issuer. The Borrower hereby agrees to pay all reasonable costs and expenses incurred by any Lender or Letter of Credit Issuer in connection with such mitigation efforts.

(g) Treatment of Certain Refunds. If the Agent, any Lender or any Letter of Credit Issuer determines, in its sole discretion, that it is entitled to receive a refund of any Taxes or Other Taxes as to which it has been indemnified by the Borrowers or with respect to which any Borrower has paid additional amounts pursuant to this Section 4.1, it shall use reasonable best efforts to obtain such refund and upon receipt of any such refund shall promptly pay to the Borrowers an amount equal to such refund (but only to the extent of indemnity payments made, or additional amounts paid, by the Borrowers under this Section 4.1 with respect to the Taxes or Other Taxes giving rise to such refund, plus any interest included in such refund by the relevant Governmental Authority attributable thereto), net of all reasonable out-of-pocket expenses of the Agent, such Lender or such Letter of Credit Issuer, as the case may be, and without interest (other than any interest paid by the relevant Governmental Authority with respect to such refund), provided that the Borrowers, upon the request of the Agent, such Lender or such Letter of Credit Issuer, agree to repay the amount paid over to the Borrowers (plus any penalties, interest or other charges imposed by the relevant Governmental Authority) to the Agent, such Lender or such Letter of Credit Issuer in the event the Agent, such Lender or such Letter of Credit Issuer is required to repay such refund to such Governmental Authority. This subsection shall not be construed to require the Agent, any Lender or such Letter of Credit Issuer to make available its tax returns (or any other information relating to its taxes that it deems confidential) to the Borrowers or any other Person.

4.2 Illegality. If any Lender determines that any Requirement of Law has made it unlawful, or that any Governmental Authority has asserted that it is unlawful, for any Lender or its applicable Lending Office to make, maintain or fund LIBOR Loans, or to determine or charge interest rates based upon the Eurodollar Rate, or any Governmental Authority has imposed material restrictions on the authority of such Lender to purchase or sell, or to take deposits of, Dollars in the London interbank market, then, on notice thereof by such Lender to the Borrowers through the Agent, any obligation of such Lender to make or continue LIBOR Loans or to convert Base Rate Loans to LIBOR Loans shall be suspended until such Lender notifies the Agent and the Borrowers that the circumstances giving rise to such determination no longer exist. Upon receipt of such notice, the applicable Borrowers shall, upon demand from such Lender (with a copy to the Agent), prepay or, if applicable, convert all LIBOR Loans of such Lender to Base Rate Loans, either on the last day of the Interest Period therefor, if such Lender may lawfully continue to maintain such LIBOR Loans to such day, or immediately, if such Lender may not lawfully continue to maintain such LIBOR Loans. Upon any such prepayment or conversion, the applicable Borrowers shall also pay accrued interest on the amount so prepaid or converted.

20

4.3 Inability to Determine Rates. If the Required Lenders determine that for any reason in connection with any request for a LIBOR Loan or a conversion to or continuation thereof that (a) Dollar deposits are not being offered to banks in the London interbank eurodollar market for the applicable amount and Interest Period of such LIBOR Loan, (b) adequate and reasonable means do not exist for determining the Offshore Base Rate for any requested Interest Period with respect to a proposed LIBOR Loan, or (c) that the Offshore Base Rate for any requested Interest Period with respect to a proposed LIBOR Loan does not adequately and fairly reflect the cost to such Lenders of funding such Loan, the Agent will promptly so notify the Borrowers and each Lender. Thereafter, the obligation of the Lenders to make or maintain LIBOR Loans shall be suspended until the Agent (upon the instruction of the Required Lenders) revokes such notice. Upon receipt of such notice, the Borrowers may revoke any pending request for a Borrowing of, conversion to or continuation of LIBOR Loans or, failing that, will be deemed to have converted such request into a request for a Borrowing of Base Rate Loans in the amount specified therein.

4.4 Increased Costs.

(a) Increased Costs Generally. If any Change in Law shall:

(i) impose, modify or deem applicable any reserve, special deposit, compulsory loan, insurance charge or similar requirement against assets of, deposits with or for the account of, or credit extended or participated in by, any Lender (except any reserve requirement reflected in the LIBOR Rate) or any Letter of Credit Issuer;

(ii) subject any Lender or any Letter of Credit Issuer to any tax of any kind whatsoever with respect to this Agreement, any Letter of Credit, any participation in a Letter of Credit or any LIBOR Loan made by it, or change the basis of taxation of payments to such Lender or such Letter of Credit Issuer in respect thereof (except for Indemnified Taxes or Other Taxes covered by Section 4.1 and the imposition of, or any change in the rate of, any Excluded Tax payable by such Lender or such Letter of Credit Issuer); or