Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF

THE SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to Section 240.14a-12 |

ANN INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on the table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Table of Contents

7 TIMES SQUARE

NEW YORK, NEW YORK 10036

To Our Stockholders:

We are pleased to invite you to attend the Annual Meeting of Stockholders of ANN INC. to be held on Wednesday, May 18, 2011 at 8:00 A.M., local time, at our offices at 7 Times Square, 5th Floor, New York, New York 10036.

You may have noticed we recently changed our company name from AnnTaylor Stores Corporation to ANN INC. We believe that ANN INC. more appropriately captures our status today as a company with two distinct, leading brands across multiple channels of distribution. Our ticker symbol on the New York Stock Exchange continues to be ANN.

The following pages include a formal notice of the meeting and the proxy statement. The proxy statement describes various matters on the agenda for the meeting. Please read these materials so that you will know what we plan to do at the meeting. It is important that your shares be represented at the Annual Meeting, regardless of whether you plan to attend the meeting in person. Please vote your shares as soon as possible through any of the voting options available to you as described in this proxy statement.

On behalf of management and our Board of Directors, we thank you for your continued support of ANN INC.

Sincerely,

Kay Krill

President and Chief Executive Officer

New York, New York

April 5, 2011

Table of Contents

7 TIMES SQUARE

NEW YORK, NEW YORK 10036

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 18, 2011

To the Stockholders of ANN INC.:

The 2011 Annual Meeting of Stockholders of ANN INC. (the “Company”) will be held at 8:00 A.M., local time, on Wednesday, May 18, 2011, at the Company’s offices at 7 Times Square, 5th Floor, New York, New York 10036, for the following purposes:

| 1. | To elect to the Board of Directors of the Company the three Class II directors named in the attached proxy statement; |

| 2. | To hold an advisory non-binding vote on the Company’s executive compensation (commonly referred to as “Say on Pay”); |

| 3. | To hold an advisory non-binding vote to establish the frequency of submission to stockholders of the Say on Pay vote; |

| 4. | To ratify the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the 2011 fiscal year; and |

| 5. | To conduct such other business as may properly come before the meeting. |

Stockholders who hold our common stock at the close of business on March 24, 2011 are entitled to notice of and to vote at the Annual Meeting.

By Order of the Board of Directors,

Barbara K. Eisenberg

Secretary

New York, New York

April 5, 2011

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR

THE STOCKHOLDERS’ MEETING TO BE HELD ON MAY 18, 2011

This proxy statement and our 2010 Annual Report to stockholders are available at www.proxyvote.com.

Your vote is important. Proposals 1, 2 and 3 in this proxy statement are deemed non-routine matters, and accordingly, if you hold your shares in the name of a brokerage firm and do not provide your broker with voting instructions, the firm is not allowed to vote those shares on your behalf. For this reason, it is critical that you cast your vote if you want it to count.

Whether or not you attend the meeting in person, please follow the instructions you received to vote your shares to ensure that your shares are represented at the meeting. If you wish to attend the Annual Meeting, please see the instructions on page 2 of this proxy statement.

You may minimize impact on the environment by eliminating paper proxy mailings. With your consent, we will provide all future proxy voting materials and annual reports to you electronically. Instructions for consenting to electronic delivery can be found on your proxy card. Your consent to receive stockholder materials electronically will remain in effect until cancelled by you.

Table of Contents

| Page | ||||

| 1 | ||||

| 1 | ||||

| 5 | ||||

| 11 | ||||

| PROPOSAL 2—TO HOLD AN ADVISORY NON-BINDING VOTE ON THE COMPANY’S EXECUTIVE COMPENSATION |

13 | |||

| 16 | ||||

| PROPOSAL 4—RATIFICATION OF THE APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

17 | |||

| 19 | ||||

| 20 | ||||

| 21 | ||||

| 21 | ||||

| 51 | ||||

| 53 | ||||

| 55 | ||||

| 55 | ||||

| 56 | ||||

| 56 | ||||

Table of Contents

7 TIMES SQUARE

NEW YORK, NEW YORK 10036

ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 18, 2011

We are furnishing this proxy statement and the accompanying proxy to the stockholders of ANN INC., a Delaware corporation (the “Company”), in connection with solicitation of proxies by the Board of Directors of the Company (the “Board”) for use at the Annual Meeting of Stockholders of the Company and at any and all adjournments or postponements of that meeting. The Annual Meeting will be held at 8:00 A.M., local time, on Wednesday, May 18, 2011, at our offices located at 7 Times Square, 5th Floor, New York, New York 10036.

This proxy statement and the proxies solicited by this proxy statement will be made available to stockholders on or about April 5, 2011.

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING

What is the purpose of the meeting?

At the Annual Meeting, stockholders will act upon the matters outlined in the accompanying notice of meeting. In addition, the Company’s management will report on the Company’s performance during 2010 and respond to questions from stockholders.

What is a proxy?

A proxy is a document, also referred to as a proxy card, on which you authorize someone else to vote for you at the upcoming Annual Meeting in the way that you want to vote. You may also choose to abstain from voting. The Board is soliciting your vote as indicated in this proxy statement and on your proxy card.

Who is entitled to vote?

You can vote if you were a holder of our common stock at the close of business on March 24, 2011 (the “Record Date”). At the close of business on the Record Date, there were 51,841,869 shares of common stock outstanding. Each common share has one vote.

How do I vote?

If you are a stockholder of record on the Record Date and hold your shares in your own name, you have three ways to vote and submit your proxy before the Annual Meeting:

| • | By mail—If you received your proxy materials by mail, you may vote by completing, signing and returning the enclosed proxy card. |

| • | By Internet—We encourage you to vote and submit your proxy over the Internet at www.proxyvote.com. Even though you may have received paper copies of the proxy materials, you may vote online by going to www.proxyvote.com and entering your control number, which is a 12-digit number located in a box on your proxy card that is included with your proxy materials. |

1

Table of Contents

| • | By telephone—You may vote and submit your proxy by calling 1 (800) 690-6903 and providing your control number, which is a 12-digit number located in a box on your proxy card that is included with your proxy materials. |

If you hold your shares through an account with a brokerage firm or bank, your ability to vote over the Internet or by telephone depends on the voting procedures of the broker or bank. Please follow the directions provided to you by your broker or bank.

All shares that are represented by properly executed proxies and received in time for voting at the Annual Meeting (and that have not been revoked) will be voted as instructed on the proxy. Where specific choices are not indicated, the shares represented by your properly completed and executed proxy will be voted FOR the election of the Board nominees for Class II directors (Proposal 1), in favor of Proposals 2 and 4, and for three years for Proposal 3, unless your shares are held through a brokerage firm, in which case your broker may not vote on Proposals 1, 2 and 3, the non-routine matters, without your instructions, as explained on page 3 of this proxy statement. Should any matter not described above be properly presented at the meeting, the persons named in the proxy form will vote in accordance with their judgment as permitted.

If you choose to vote your ANN INC. shares at the Annual Meeting and these shares are held for you in a brokerage or bank account, you must obtain a legal proxy from that entity and bring it with you to hand in with your ballot in order to be able to vote your shares at the meeting.

If you sign and submit the enclosed proxy card or vote through the Internet or by telephone before the Annual Meeting, you may still attend the meeting.

The meeting will be held at the Company’s corporate headquarters located at 7 Times Square, 5th Floor, New York, New York 10036 at 8:00 A.M., local time, on Wednesday, May 18, 2011. To attend the meeting, if you own your ANN INC. shares through a brokerage firm or bank, you must bring proof of ownership of your shares as of the Record Date, such as a statement from the broker or bank. If you are a stockholder of record and accordingly hold your ANN INC. shares in your own name, you must bring the Admissions Ticket section of the proxy card that you received with your proxy materials. If you are a stockholder of record and previously consented to electronic delivery of the proxy materials, to attend the meeting in person, you must request a paper copy of the proxy card in advance of the meeting and bring the Admissions Ticket section of the card. You may request the paper proxy card by contacting the Corporate Secretary at corporate_secretary@anninc.com or (212) 536-4229 by May 11, 2011. All shareholders must bring government-issued picture identification to enter the meeting. You may obtain directions to attend the meeting by contacting the Corporate Secretary at the same email address and phone number. In addition, if due to a disability, you need an accommodation to attend, please contact the Corporate Secretary by Friday, April 29, 2011.

Who votes for me if I own my shares through the Company’s Associate Discount Stock Purchase Plan or the 401(k) Savings Plan?

The plan custodian or trustee, as the case may be, votes in accordance with your instructions. If you own shares through the Associate Discount Stock Purchase Plan and the custodian does not receive your properly completed and executed proxy with your voting instructions by 11:59 P.M. Eastern Daylight Time (EDT) on May 16, 2011, the custodian will not vote your shares.

If you own shares through the 401(k) Savings Plan and the trustee does not receive your properly completed and executed proxy with your voting instructions by 11:59 P.M. EDT on May 15, 2011, the trustee will vote your shares in the same proportion as it voted shares for which it received instructions.

What can I vote on?

At the Annual Meeting, you will be able to vote on the:

| • | election of the three Class II directors to the Board; |

| • | Company’s executive compensation (“Say on Pay”); |

2

Table of Contents

| • | frequency of submission to stockholders of the Say on Pay vote; |

| • | ratification of the appointment of Deloitte & Touche LLP (“Deloitte”) as the Company’s independent registered public accounting firm for the 2011 fiscal year; and |

| • | transaction of any other business as may properly come before the meeting or any adjournments, continuations or postponements of the meeting. |

We do not expect any other matters requiring a vote of the stockholders to be presented at the Annual Meeting, but if another matter is properly submitted, the individuals named in the proxy intend to vote on those matters in accordance with their best judgment.

How does the Board recommend I vote?

The Board recommends a vote:

| • | FOR each of the three nominees for the Board of Directors; |

| • | FOR approval of the Company’s executive compensation (“Say on Pay”); |

| • | FOR the submission to stockholders of the Say on Pay vote every three years; and |

| • | FOR ratification of the appointment of Deloitte as the Company’s independent registered public accounting firm for the 2011 fiscal year. |

How many shares must be present to conduct a meeting?

A quorum is necessary to hold a valid meeting of stockholders. The presence, either in person or by proxy, of the holders of a majority of the shares of common stock outstanding on the Record Date is necessary to constitute a quorum at the Annual Meeting. All abstentions and broker non-votes will be included as shares that are present and entitled to vote for purposes of determining the presence of a quorum at the meeting.

What is a “broker non-vote”?

If your shares are held in the name of a brokerage firm, your shares may be voted even if you do not provide the brokerage firm with voting instructions. Brokerage firms have the authority under New York Stock Exchange rules to vote shares for which their customers do not provide voting instructions on certain “routine” matters. When a proposal is not a “routine” matter under New York Stock Exchange rules and the brokerage firm has not received voting instructions from the beneficial owner of the shares with respect to that proposal, the brokerage firm cannot vote the shares on that proposal. This is called a “broker non-vote”.

Proposal 4, the ratification of the appointment of Deloitte as the Company’s independent registered public accounting firm for the 2011 fiscal year, is a routine matter for which the brokerage firm who holds your shares can vote your shares even if it has not received instructions from you. The three other proposals in this proxy statement are non-routine matters and accordingly the brokerage firm cannot vote your shares on those proposals without your instructions.

How are broker non-votes counted?

Shares represented by broker non-votes will be counted in determining whether there is a quorum. Shares represented by broker non-votes will not be counted as shares present and voting on a specific proposal, thus having no effect on the outcome of that proposal.

3

Table of Contents

How many votes are required to pass a proposal?

| • | For Proposal 1, in order for a director nominee to be elected, the number of votes cast “for” the nominee must exceed the number of votes cast “against” the nominee; |

| • | For Proposal 2, the affirmative vote of the holders of a majority of the shares of the Company’s common stock represented in person or by proxy and entitled to vote at the Annual Meeting will be deemed to be stockholders’ non-binding approval with respect to our executive compensation; |

| • | For Proposal 3, the frequency of the stockholder vote receiving the greatest number of votes will be deemed to be stockholders’ non-binding recommendation with respect to the frequency of submission to stockholders of the Say on Pay vote; and |

| • | For Proposal 4, the affirmative vote of the holders of a majority of the shares of the Company’s common stock represented in person or by proxy and entitled to vote is required for stockholders’ ratification of the appointment of Deloitte as the Company’s independent registered public accounting firm for 2011. |

What happens if I abstain?

A share voted “abstain” with respect to any proposal is considered as present and entitled to vote with respect to that proposal, but is not considered a vote cast with respect to that proposal. Accordingly, for Proposals 1 and 3, abstentions will have no effect on the outcome of the proposal. For Proposals 2 and 4 however, because the affirmative vote of the holders of a majority of the shares present and entitled to vote is required to pass, abstentions will be counted as votes against such proposal.

Can I change my vote after I have voted?

Yes. You can change your vote at any time before your proxy is voted at the Annual Meeting. A later vote by any means will cancel an earlier vote. The last vote we receive before the Annual Meeting will be the vote counted. You may change your vote in any of the following ways:

| • | You may revoke your proxy by sending written notice before the Annual Meeting to the Company’s Corporate Secretary at ANN INC., 7 Times Square, New York, NY 10036; |

| • | You may send the Company’s Corporate Secretary (to the address indicated above) a later-dated, signed proxy before the Annual Meeting; |

| • | If you voted through the Internet or by telephone, you may vote again over the Internet or by telephone by 11:59 P.M., EDT on May 17, 2011, and if you are voting shares held through the Company’s Associate Discount Stock Purchase Plan, by 11:59 P.M., EDT on May 16, 2011 and through the Company’s 401(k) Savings Plan, by 11:59 P.M., EDT on May 15, 2011; |

| • | You may attend the Annual Meeting in person and vote. However, attending the Annual Meeting, in and of itself, will not change an earlier vote; or |

| • | If your shares are held in an account at a brokerage firm or bank, you may contact your brokerage firm or bank to change your vote or obtain a legal proxy to vote your shares if you wish to cast your votes in person at the Annual Meeting. |

Who pays for soliciting the proxies?

The Company pays the cost of soliciting the proxies. We have retained Morrow & Co., LLC (“Morrow”), a professional soliciting organization located at 470 West Ave., Stamford, CT 06902, to assist us in soliciting the proxies from brokerage firms, custodians and other fiduciaries. The Company expects the fees paid to Morrow to be approximately $8,500. In addition, the Company’s directors, officers and employees may, without additional compensation, also solicit proxies by mail, telephone, Internet, personal contact, facsimile or through similar methods.

4

Table of Contents

Board Committees

The Board of Directors has established the following committees to assist the Board in discharging its responsibilities: Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee. Each committee is composed entirely of independent directors, as defined by the New York Stock Exchange listing standards and applicable law. The committees on which the independent directors serve as of the date of this proxy statement are set forth below:

| Director |

Audit Committee |

Compensation Committee | Nominating and Corporate Governance Committee | |||

| James J. Burke, Jr. |

* | * | ||||

| Michelle Gass |

* | |||||

| Dale W. Hilpert |

** | |||||

| Ronald W. Hovsepian |

* | * | ** | |||

| Linda A. Huett |

* | |||||

| Kay Krill |

||||||

| Stacey Rauch |

* | |||||

| Michael W. Trapp |

** | |||||

| Daniel W. Yih |

* |

| * | Member |

| ** | Chair |

Independence

Under our Corporate Governance Guidelines, at least a majority of our Board members must meet the independence requirements of the New York Stock Exchange’s listed company rules and applicable law. With eight independent, non-employee directors out of nine current Board members, we have satisfied this requirement. As required by the New York Stock Exchange rules, the Board evaluates annually the independence of our directors by determining whether a director or any member of his or her immediate family has, either directly or indirectly, any material relationship with the Company.

In accordance with the New York Stock Exchange rules, a director is not independent if:

| • | The director is or has been within the last three years an employee of the Company. |

| • | An immediate family member of the director is or has been within the last three years an executive officer of the Company. |

| • | The director has received more than $120,000 in direct compensation from the Company during any twelve-month period within the last three years. This excludes director and committee fees or other forms of deferred compensation for prior service. |

| • | An immediate family member of the director has received more than $120,000 in direct compensation from the Company during any twelve-month period within the last three years. |

| • | The director or an immediate family member of the director is a current partner of the Company’s external auditor. |

| • | The director is a current employee of the Company’s external auditor. |

| • | An immediate family member of the director is a current employee of the Company’s external auditor and personally works on the Company’s audit. |

5

Table of Contents

| • | Within the last three years, the director or immediate family member of the director was a partner or employee of the Company’s external auditor and personally worked on the Company’s audit during that time. |

| • | The director or immediate family member of the director is, or has been within the last three years, employed as an executive officer of another company at which any of the Company’s present executive officers at the same time serves or served on the other company’s compensation committee. |

| • | The director is a current employee, or an immediate family member of the director is a current executive officer, of a company that has made payments to, or received payments from, the Company for property or services in an amount which, in any of the last three fiscal years, exceeds the greater of $1,000,000 or 2% of the other company’s consolidated gross revenues. |

In making its independence determinations, the Board considers and broadly evaluates all information provided by each director in response to a detailed questionnaire concerning his or her independence and any direct or indirect business, family, employment, transaction, or other relationship or affiliation of such director with the Company.

As part of its analysis to determine director independence during fiscal year 2010, the Board reviewed the Company’s arrangement with International Integrated Solutions (“IIS”), a reseller of software produced by Novell, Inc. (“Novell”). During fiscal year 2010, the Company made software maintenance payments to IIS in respect of Novell software the Company previously purchased from IIS. Mr. Hovsepian is the Non-Executive Chairman of our Board of Directors and is also a director, President and Chief Executive Officer of Novell. The Board has determined that it is in the best interests of the Company to make software maintenance payments to IIS, and that given the monetary amount involved (approximately $11,000 for fiscal year 2010), the benefit to Mr. Hovsepian is remote and the transaction does not impair his independence. The Board also considered Mr. Yih’s position as Chief Operating Officer of Starwood Capital Group (“Starwood”), which manages funds that invest in retail properties across the United States, including some malls where the Company’s stores are located. The Board of Directors has determined that Mr. Yih’s position at Starwood does not impair his independence as a director of the Company.

The independent directors during fiscal year 2010 were:

| • | James J. Burke, Jr.; |

| • | Michelle Gass; |

| • | Dale W. Hilpert; |

| • | Ronald W. Hovsepian; |

| • | Linda A. Huett; |

| • | Stacey Rauch; |

| • | Michael W. Trapp; and |

| • | Daniel W. Yih. |

Ms. Rauch joined the Board on January 26, 2011. Ms. Krill is a non-independent director.

As stated above, Mr. Hovsepian is the Chairman of the Board while Ms. Krill is the Company’s Chief Executive Officer. The Company feels this structure is appropriate at this time because it is beneficial to have an independent chairman whose responsibility is leading the Board and focusing on the Board’s oversight responsibilities, while allowing our Chief Executive Officer to focus on managing and strengthening our business as we continue to operate in a challenging and unpredictable macroeconomic environment.

6

Table of Contents

Board and Committee Oversight of Risk

The Board exercises risk oversight through its interactions with management and through extensive discussions among the Board members. The Board meets regularly with management to discuss and consider potential risks that the Company may be facing. The Audit Committee of the Board evaluates the Company’s financial risks with input from management and Deloitte, and reports any such risk matters to the entire Board for discussion and decision-making. The full Board considers operational risks of the Company. In addition, as discussed in the Compensation Discussion and Analysis section (the “CD&A”) of this proxy statement, the Compensation Committee also considers risks associated with the Company’s compensation programs and works closely with its compensation consultant to ensure that the Company’s compensation programs and practices incentivize our executives and other associates to act in the best interests of the Company’s stockholders. Mr. Hovsepian, a member of both the Audit and Compensation Committees, is able to share with each Committee any risks the other Committee is evaluating.

Board Committee Functions

The functions of the standing committees are as follows:

Audit Committee

The purpose of the Audit Committee, which has been established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), is to assist the Board of Directors in fulfilling its obligations regarding the accounting, auditing, financial reporting, internal control over financial reporting and legal compliance functions of the Company and its subsidiaries. The Audit Committee’s principal functions include assisting the Board of Directors in its oversight of the:

| • | integrity of the Company’s financial statements; |

| • | major financial risk exposures and the steps the Company is taking to monitor and control those risks; |

| • | Company’s compliance with legal and regulatory requirements; |

| • | qualifications, independence and performance of the Company’s independent registered public accounting firm; and |

| • | performance of the Company’s internal audit function. |

The Audit Committee also prepares the Audit Committee Report for inclusion in the proxy statement. See “Audit Committee Report”.

In the judgment of the Board of Directors, each member of the Audit Committee is financially literate and has accounting or related financial management expertise. In addition, the Board of Directors has determined that Messrs. Trapp and Yih each qualifies as an “audit committee financial expert” within the meaning of the applicable rules of the U.S. Securities and Exchange Commission (the “SEC”).

The Audit Committee meets from time to time in separate executive sessions with each of the representatives of Deloitte, the Company’s independent registered public accounting firm, the Chief Financial Officer, the General Counsel and the Vice President of Internal Audit.

Compensation Committee

The purpose of the Compensation Committee is to discharge the responsibilities of the Board of Directors relating to compensation for the Company’s Chief Executive Officer, senior management and such other key management employees as the Compensation Committee may determine to ensure that management’s interests are aligned with the interests of stockholders of the Company. The Compensation Committee is also responsible for determining compensation for non-employee directors. The Committee’s principal functions include:

| • | establishing the Company’s compensation philosophy and practices; |

7

Table of Contents

| • | reviewing and approving compensation of key executives to ensure that it is tied to performance; |

| • | setting compensation of non-employee directors; |

| • | reviewing the Company’s compensation programs to determine whether they incent executives to take unnecessary and excessive risks; |

| • | reviewing and approving appropriate performance metrics under the Company’s incentive compensation plans and determining amounts to be paid to key executives based on performance levels achieved; |

| • | making recommendations to the Board of Directors with respect to proposed employee benefit plans, incentive compensation plans and equity-based plans; and |

| • | reviewing and participating with management in the preparation of the CD&A and preparing the Compensation Committee Report for inclusion in the proxy statement in accordance with the rules and regulations of the SEC. |

During fiscal year 2010, the Compensation Committee retained Frederic W. Cook & Co., Inc., a nationally recognized compensation consultant, to advise it on executive compensation. See the CD&A for further information regarding processes and procedures for the determination of executive compensation and the “Director Compensation” section of this proxy statement for further information regarding non-employee director compensation.

Nominating and Corporate Governance Committee

The purpose of the Nominating and Corporate Governance Committee is to provide assistance to the Board of Directors in corporate governance matters and in determining the proper size and composition of the Board. The Nominating and Corporate Governance Committee’s principal functions include:

| • | identifying individuals qualified to become members of the Board of Directors; |

| • | recommending to the Board of Directors nominees for directors for each annual meeting of stockholders and nominees for election to fill any vacancies on the Board of Directors; |

| • | developing and recommending to the Board of Directors corporate governance principles applicable to the Company; and |

| • | leading the annual review of the Board’s performance. |

The Nominating and Corporate Governance Committee will consider (in consultation with the Chairman of the Board) and recruit candidates to fill positions on the Board, including vacancies resulting from the removal, resignation or retirement of any director, an increase in the size of the Board of Directors or otherwise. In considering potential nominees to the Board, the Nominating and Corporate Governance Committee evaluates each potential candidate against its then-current criteria for selecting new directors. Such criteria include, at a minimum, any requirements of applicable law or listing standards, as well as consideration of a candidate’s strength of character, judgment, business experience, specific areas of expertise, factors relating to the composition of the Board (including its size and structure) and principles of diversity. In addition, the Nominating and Corporate Governance Committee will consider each potential candidate in light of the core competencies that the Committee believes should be represented on the Board of Directors and will also consider the mix of directors and their individual skills, experiences and diverse perspectives to ensure that the composition of the Board is appropriate to carry out its purposes.

Diversity of the Company’s Board members is one of the principal factors that the Nominating and Corporate Governance Committee takes into account when considering potential Board nominees. Since the Company is in the women’s apparel business, the Nominating and Corporate Governance Committee as well as

8

Table of Contents

the other Board members consider that a woman’s perspective is important to the business and should be reflected in the Board composition. Ms. Rauch joined the Company’s Board on January 26, 2011, which increased the number of women serving on our Board to four women out of a total of nine directors.

The Company’s Nominating and Corporate Governance Committee also retains from time to time, at the Company’s expense, search firms to identify candidates, including for purposes of performing background reviews of potential candidates. The Committee provides guidance to search firms it retains about the particular qualifications the Board is then seeking.

Stockholders may recommend candidates for nomination to the Board of Directors for consideration by the Nominating and Corporate Governance Committee by submitting in writing to the following address the information required by our bylaws for director nominees: Corporate Secretary, ANN INC., 7 Times Square, New York, NY 10036. All the director candidates, including those recommended by stockholders, are evaluated on the same basis. The Nominating and Corporate Governance Committee will review any candidate recommended by a stockholder of the Company in light of the Committee’s criteria for selection of new directors.

Committee Charters

The charters for the Company’s Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee are available free of charge on the Company’s website at http://investor.anninc.com.

Executive Sessions of Non-Employee Directors

The Company’s independent directors meet separately in executive session without the Chief Executive Officer or other representatives of management. These meetings occur at each regularly scheduled Board meeting in accordance with the Company’s Corporate Governance Guidelines. Mr. Hovsepian, the Non-Executive Chairman of the Board, presides at the executive sessions.

Director Attendance

The Company’s Board of Directors held six meetings in fiscal year 2010. The Audit Committee held four meetings, the Compensation Committee held six meetings, and the Nominating and Corporate Governance Committee held three meetings in fiscal year 2010. Each current director attended 100% of the Board meetings and 100% of meetings of the Board Committees on which he or she served.

It is the Company’s policy that all directors attend the Company’s Annual Meeting of Stockholders. All then-current directors attended the 2010 Annual Meeting of Stockholders, and it is anticipated that all directors will attend the 2011 Annual Meeting of Stockholders.

Corporate Governance Guidelines

The Board adopted the Corporate Governance Guidelines to assist it in the exercise of its responsibilities. The Company’s Corporate Governance Guidelines are available free of charge on the Company’s website at http://investor.anninc.com.

Related Person Transactions Policy and Procedures

It is the policy of the Board of Directors to approve or ratify, based upon the recommendation of the Audit Committee, any related person transaction which is required to be disclosed under the rules of the SEC. For purposes of this policy, the terms “transaction” and “related person” have the meanings contained in Item 404 of

9

Table of Contents

Regulation S-K. In determining whether the transaction should be approved or ratified by the Board, the Audit Committee and the Board considers:

| • | the nature of the related person’s interest in the transaction; |

| • | the material terms of the transaction; |

| • | the significance of the transaction to the related person; |

| • | the significance of the transaction to the Company; |

| • | whether the transaction would impair the judgment of a Board member or an executive officer to act in the best interest of the Company; and |

| • | any other matters the Audit Committee or Board deems appropriate. |

Any Audit Committee or Board member who is a related person with respect to a transaction under review may not participate in the deliberations or vote respecting approval or ratification, provided, however, that such director may be counted in determining the presence of a quorum at the Audit Committee or Board meeting at which the transaction is being considered.

Related Person Transactions

During fiscal year 2010, the Company was not a participant in any related person transaction(s) requiring disclosure under Item 404 of Regulation S-K.

Business Conduct Guidelines

The Company has Business Conduct Guidelines that apply to all Company associates, including its Chief Executive Officer, Chief Financial Officer and Controller, as well as members of the Board of Directors. The Business Conduct Guidelines are available free of charge on the Company’s website at http://investor.anninc.com. Any updates or amendments to the Business Conduct Guidelines, as well as any waiver of such Guidelines granted to a director, executive officer (including the Company’s Chief Executive Officer or Chief Financial Officer) or the Company’s Controller, will also be posted on the website.

Communications with the Board of Directors

Stockholders and other interested parties may write to the Non-Executive Chairman of the Board or the non-employee directors as a group at the following address:

Ronald W. Hovsepian, Non-Executive Chairman

ANN INC.

7 Times Square

New York, NY 10036

Or

Non-Employee Directors

ANN INC.

7 Times Square

New York, NY 10036

You may also report issues regarding accounting, internal accounting controls or auditing matters to the Company’s Board of Directors by writing to the above address or by calling the ANN INC. Financial Integrity Reporting Line at 1 (877) 846-8915. A call to this telephone line is anonymous, free and available 24 hours per day. Information about how to contact the Board and the Financial Integrity Reporting Line is also available on the Company’s website at http://investor.anninc.com.

Information on the Company’s website is not incorporated by reference into this proxy statement.

10

Table of Contents

ELECTION OF CLASS II DIRECTORS

The Board of Directors of the Company is presently composed of nine members and the directors are divided into three classes, designated Class I, Class II and Class III, each serving staggered three-year terms.

The Board of Directors has nominated for re-election Dale W. Hilpert, Ronald W. Hovsepian and Linda A. Huett (the “Nominees”) as Class II directors to serve three-year terms ending at the Annual Meeting to be held in 2014, or until their respective successors are elected and qualified. Messrs. Hilpert and Hovsepian and Ms. Huett have consented to serve as directors if elected at the Annual Meeting. If for any reason, any of these Nominees become unable or unwilling to serve at the time of the Annual Meeting, the persons named as proxies in the proxy will have the authority to vote for substitute nominees. The Company does not anticipate that any of the Nominees will be unable or unwilling to serve.

The Board of Directors has determined that Messrs. Hilpert and Hovsepian and Ms. Huett are “independent” under the New York Stock Exchange listed company rules and applicable law.

The Board of Directors recommends that stockholders vote

“FOR” the Company’s Nominees for Class II Directors.

Set forth below is a brief biography of each Nominee for election as a Class II director and of all other members of the Board of Directors who will continue in office, which illustrates the value each brings as a director. In addition, each of our directors has a prominent professional reputation, leadership skills and extensive business expertise and possesses other key attributes necessary to be an effective director: integrity, analytical skills and a strong commitment to the Company and its shareholders.

Nominees for Election as Class II Directors

Term Expiring 2014

Dale W. Hilpert, age 68. Mr. Hilpert has been a director of the Company since 2004. From 2004 to 2006, he was Chairman, Chief Executive Officer and President of Footstar, Inc., a footwear retailer that filed under Chapter 11 of the Bankruptcy Code in 2004. Prior to joining Footstar, he was Chief Executive Officer of Williams-Sonoma, Inc., a specialty retailer of home furnishings, from 2001 to 2003. Mr. Hilpert was Chairman and Chief Executive Officer of Foot Locker, Inc., a retailer of athletic footwear and apparel, from 1999 to 2001. He is also a director of Signet Jewelers (doing business as Kay Jewelers in the United States).

Mr. Hilpert brings to the Company his significant experience in management and operations of businesses in the retail industry. As a former Chief Executive Officer of Williams-Sonoma, he led the company in significantly improving sales and profitability, while as Chairman and Chief Executive Officer of Foot Locker, he managed the business and operations of the worldwide athletic shoe retailer. Previously to Foot Locker, he spent 17 years at May Department Stores, serving in a variety of senior management positions, including Chairman and Chief Executive Officer of its Payless Shoe Source division.

Ronald W. Hovsepian, age 50. Mr. Hovsepian has been Non-Executive Chairman of the Company’s Board since 2005 and a director of the Company since 1998. Since 2006, Mr. Hovsepian has been a director, President and Chief Executive Officer of Novell, Inc., a technology company. From 2005 to 2006, he was President and Chief Operating Officer of Novell and from 2005 until then, Executive Vice President and President, Global Field Operations. From 2003 to 2005, Mr. Hovsepian was President, North America of Novell.

As the current Chief Executive Officer of Novell and previously Chief Operating Officer of that company, Mr. Hovsepian brings to ANN INC. significant knowledge and experience in the management and operations of

11

Table of Contents

a large business. Prior to Novell, Mr. Hovsepian held various management and executive positions at IBM Corporation over a 17-year period, and accordingly also brings to the ANN INC. Board his skills and expertise in information technology.

Linda A. Huett, age 66. Ms. Huett has been a director of the Company since 2005. From 2000 to 2006, she was Chief Executive Officer of Weight Watchers International, Inc., a global branded consumer company and provider of weight-loss services. Ms. Huett was also a director of Weight Watchers from 1999 to 2006 and is currently a director of RC2 Corporation, a producer of children’s and collectible products.

Through her experience as Chief Executive Officer and a director of Weight Watchers, Ms. Huett brings to ANN INC. significant experience in global sales and consumer marketing. Ms. Huett also contributes to ANN INC. her experience in managing and operating a large public company.

Incumbent Class III Directors

Term Expiring 2012

James J. Burke, Jr., age 59. Mr. Burke has been a director of the Company since 1989. He has been a partner and director of Stonington Partners, Inc., a private investment firm, since 1993 and Managing Member of J. Burke Capital Partners LLC since 2007. Mr. Burke is also a director of Lincoln Educational Services Corporation.

Mr. Burke brings to ANN INC. extensive financial and business knowledge through his engagement in private equity investing since 1981. Prior to Stonington Partners, Mr. Burke served as co-founder and investment professional with Merrill Lynch Capital Partners, Inc., for which he was President and Chief Executive Officer from 1987 until 1994, when he left to start Stonington Partners. Throughout his career, he has been responsible for sourcing and analyzing investment opportunities, where he has developed expertise and significant knowledge regarding the managerial, operational and financial aspects of a business.

Kay Krill, age 56. Ms. Krill has been Chief Executive Officer of the Company since 2005 and President of the Company and a member of the Board of Directors since 2004. She was President of LOFT from 2001 until 2004.

Ms. Krill has had an extensive career in the apparel industry. Prior to joining the Company in 1994 as vice president of merchandising, Ms. Krill held various management positions at several retailers including The Talbots, Inc. and Hartmarx Corporation. Ms. Krill created and spearheaded the growth of the LOFT division from a start-up to over a $1 billion business. She brings to ANN INC. significant leadership skills, a depth of experience in the apparel industry and a talent for shaping and building brands.

Stacey Rauch, age 53. Ms. Rauch has been a director of the Company since January 2011. From 1998 until her retirement in 2010, Ms. Rauch was a Senior Partner in the Retail and Consumer Products Practices group of McKinsey & Company, Inc. (“McKinsey”), a leading management consulting firm, and now serves as Director Emeritus of McKinsey. From 2001 to 2008, she led McKinsey’s North American Retail Practice and was the first woman to be appointed as an Industry Practice Leader at McKinsey. From 2006 to 2008, Ms. Rauch was also Co-leader of McKinsey’s Global Retail Practice. She is currently a director of Tops Holding Corporation, the parent company of the supermarket chain Tops Markets, LLC.

Ms. Rauch brings to ANN INC. extensive marketing, merchandising, business strategy and international experience in the retail industry. During her 24-year tenure at McKinsey, she developed substantial expertise working with specialty retailers, wholesale apparel manufacturers and department stores, and also acquired extensive experience in other areas of the retail sector, including grocery retail, consumer packaged goods and big-box hard goods retail.

12

Table of Contents

Incumbent Class I Directors

Term Expiring 2013

Michelle Gass, age 43. Ms. Gass has been a director of the Company since 2008. Since September 2009, she has been President of Seattle’s Best Coffee, a division of Starbucks Coffee Company (“Starbucks”). From December 2008 until then, she was Executive Vice President, Marketing and Category, at Starbucks and prior to that had been Senior Vice President, Marketing and Category since August 2008. From January 2008 to July 2008, Ms. Gass was Senior Vice President, Global Strategy and from 2004 until then, Senior Vice President, Category Management of Starbucks.

Ms. Gass brings extensive marketing and consumer branding experience to ANN INC. through her various roles at Starbucks and previously through her experience at Procter & Gamble where she worked in marketing and product development. Throughout her career, Ms. Gass has acquired expertise in product innovation and in leading the brand, creative and marketing functions of a business. In addition, through her leadership roles at Starbucks, Ms. Gass has acquired extensive managerial and operational knowledge in the retail industry.

Michael W. Trapp, age 71. Mr. Trapp has been a director of the Company since 2003. He was a partner at Ernst & Young LLP, from 1973 until his retirement in 2000, where he held various executive positions including Managing Partner for the Southeast Area. He was also a member of Ernst & Young’s Partner Advisory Council. Mr. Trapp is currently a private investor and a director of Global Payments, Inc. where he is chairman of its audit committee.

During his experience as the Managing Partner of the Southeast Area for Ernst & Young, Mr. Trapp served diverse companies, including Coca-Cola Enterprises, Lanier Business Products and Genuine Parts Company. Mr. Trapp brings to ANN INC. extensive expertise and knowledge regarding finance and accounting matters. He qualifies as an “audit committee financial expert” under the applicable SEC rules and accordingly contributes to ANN INC.’s Board his understanding of generally accepted accounting principles and his skills in auditing as well as in analyzing and evaluating financial statements.

Daniel W. Yih, age 52. Mr. Yih has been a director of the Company since 2007. He has been Chief Operating Officer of Starwood Capital Group, a private investment firm, since 2007 and previously was Chief Operating Officer and a Portfolio Principal of GTCR Golder Rauner, LLC, a private equity firm, from 2000 to 2007. Mr. Yih was also a member of the Board of Directors of Starwood Hotels & Resorts Worldwide, Inc. from 1995 to 2007.

Mr. Yih’s experience as Chief Operating Officer of Starwood Capital Group and as an executive at other companies as well as other investment companies, gives him extensive business and financial expertise. Like Mr. Trapp, Mr. Yih qualifies as an “audit committee financial expert” under the applicable SEC rules and accordingly also brings significant knowledge regarding financial statements.

TO HOLD AN ADVISORY NON-BINDING VOTE ON THE COMPANY’S

EXECUTIVE COMPENSATION

As required by the executive compensation disclosure rules of the SEC, we are offering our stockholders the opportunity to cast an advisory non-binding vote on the compensation of our named executive officers for fiscal year 2010 (the “Named Executive Officers”), as disclosed in the Compensation Discussion and Analysis (“CD&A”), compensation tables and narrative discussion in this proxy statement. Although this vote is not binding on the Company, our Compensation Committee highly values the opinions of its stockholders and will give consideration to the outcome of your vote when making future compensation decisions.

13

Table of Contents

2010 Performance

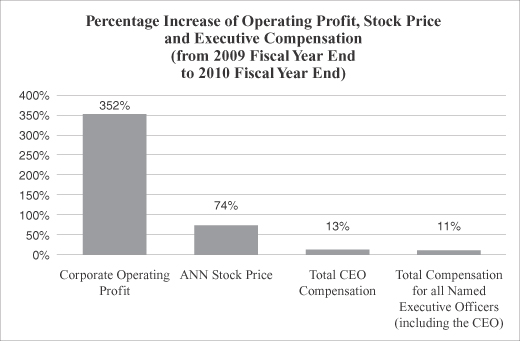

The Company’s compensation program as applied in 2010 played a significant role in our ability to drive strong financial results and retain a highly experienced and talented executive team. Our executives managed the business effectively in 2010 as they generated significant top-line growth, maximized gross margin and continued to aggressively control expenses. As explained in more detail on pages 21-23 of this proxy statement, our fiscal year 2010 accomplishments include, among other things, the following:

| • | a dramatic increase in EPS from $0.32 per diluted share in 2009 to $1.30 per diluted share in 2010, on a non-GAAP basis, and an increase from a loss of $0.32 per diluted share for fiscal year 2009 to $1.24 per diluted share for fiscal year 2010, on a GAAP basis; |

| • | a more than 350% increase in operating profit, on a non-GAAP basis, and a more than 600% increase in operating profit, on a GAAP basis; |

| • | double-digit, positive sales comparables; |

| • | a significant increase in our gross margin rate; |

| • | a successful evolution of the AnnTaylor brand; |

| • | an aggressive control of expenses; |

| • | a strong cash position of approximately $227 million at the end of fiscal year 2010, while executing an aggressive stock buyback program; and |

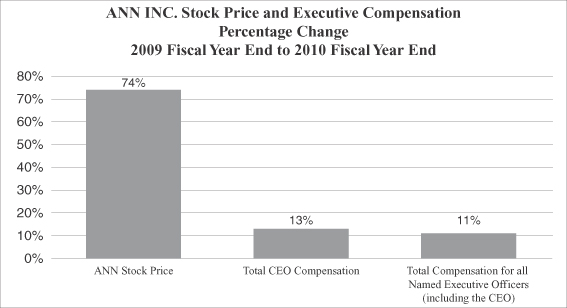

| • | an approximately 74% increase in the Company’s stock price from the end of our 2009 fiscal year to the end of our 2010 fiscal year, which outperformed the stock performance of each company in our peer group (as such group is detailed in our CD&A) during the same period. |

This outstanding performance during fiscal year 2010 was accompanied by only a modest increase in the compensation of our Chief Executive Officer and our Named Executive Officers. The chart below illustrates how the growth of the Company’s operating profit and stock price from fiscal year end 2009 to fiscal year end 2010 compared to the increase in compensation of our Chief Executive Officer and Named Executive Officers during the same period.

14

Table of Contents

Application of Our Pay for Performance Philosophy

As explained in our CD&A beginning on page 21 of this proxy statement, the Compensation Committee is committed to a pay for performance philosophy, which was reflected in our 2010 executive compensation program. Key aspects of the program, which are more fully described in the CD&A, included, but were not limited to, the following:

| • | 50% of restricted units awarded to Ms. Krill and the other Named Executive Officers in 2010 was performance-based; |

| • | Performance goals of EPS and cash balance had to be achieved for the earning of performance-based equity in 2010; |

| • | The performance-based compensation awarded to our Named Executive Officers collectively represented a higher percentage of total compensation, as compared to the percentage of performance-based compensation awarded collectively to executives with similar positions at the majority of our peer group companies; |

| • | The long-term compensation awarded to our Named Executive Officers collectively represented a higher percentage of total compensation, as compared to the percentage of long-term compensation awarded collectively to executives with similar positions at the majority of our peer group companies; |

| • | Our Named Executive Officers did not receive an annual salary increase, as was the case in the prior year; and |

| • | Our Named Executive Officers receive very limited perquisites, as shown in our Fiscal Year 2010 Summary Compensation Table on page 35 of this proxy statement. |

For all these reasons, we believe that the Company’s executive compensation program is closely aligned with stockholder interests and successfully drove the Company’s outstanding performance in 2010. Accordingly, the Board of Directors submits the following resolution for a shareholder vote at the 2011 Annual Meeting:

RESOLVED, that the compensation paid to the Company’s Named Executive Officers, as disclosed pursuant to Item 402 of Regulation S-K, including the CD&A, compensation tables and narrative discussion in this proxy statement is hereby APPROVED.

The Board of Directors recommends that stockholders vote “FOR” adoption of the resolution approving the Company’s executive compensation as detailed in the CD&A, compensation tables and narrative discussion in this proxy statement.

15

Table of Contents

TO HOLD AN ADVISORY NON-BINDING VOTE TO ESTABLISH THE FREQUENCY OF SUBMISSION TO STOCKHOLDERS OF THE ADVISORY NON-BINDING VOTE ON

EXECUTIVE COMPENSATION

As required by the executive compensation disclosure rules of the SEC, stockholders are entitled to cast an advisory non-binding vote to determine how frequently they should consider and cast an advisory vote to approve the compensation of the Company’s Named Executive Officers (commonly referred to as “Say on Pay”). Stockholders are not being asked to approve or disapprove the Board of Directors’ recommendation set forth below, but rather are being asked to select their preference for a Say on Pay vote to occur every one, two or three years, or to abstain from voting. Although this stockholder vote is not binding on the Company or the Board of Directors, the Company highly values the opinions of its stockholders and will give consideration to the outcome of your vote when making its determination regarding how frequently this vote will be held.

Board Recommendation for a Triennial Vote

Our Board believes that an advisory non-binding vote every three years would be the most appropriate option for the Company for the following reasons:

| • | Our long-term compensation, which represents over 60% of our executives’ total compensation, is structured around three-year cycles and is designed to drive long-term value creation for our stockholders and reward executive performance over a multi-year period. A triennial vote will allow stockholders to better judge our compensation programs in relation to the Company’s long-term performance; |

| • | A vote every one or two years may not allow for modifications we may make to our executive compensation programs to be in place long enough to be evaluated effectively, and any changes implemented may not be evident in the following year’s proxy statement, especially since such changes would occur after the fiscal year has commenced; and |

| • | The triennial vote would provide stockholders the ability to observe both our long-term and short-term compensation programs over a longer period of time in order to better assess their impact on the Company’s performance. |

Regardless of the frequency option selected, our stockholders are still able to provide input concerning our executive compensation programs in years when there is no Say on Pay vote. We believe that the ability of our stockholders to communicate directly with us to express their specific views on executive compensation, as well as regulatory requirements concerning stockholder approval of certain compensation-related matters, reduces the need for more frequent general advisory votes on our executive compensation.

The Board of Directors recommends that stockholders vote for submission to stockholders of the

Say on Pay vote every “THREE YEARS”.

16

Table of Contents

RATIFICATION OF THE APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee of the Board of Directors has appointed the firm of Deloitte & Touche LLP (“Deloitte”), an independent registered public accounting firm, to make an examination of the accounts of the Company for fiscal year 2011.

Independent Auditor Fees and Services

The following table presents fees billed for professional services rendered by Deloitte for fiscal years 2010 and 2009.

| 2010 | 2009 | |||||||

| Audit Fees |

$ | 1,225,000 | $ | 1,254,799 | ||||

| Audit-Related Fees (1) |

140,019 | 367,751 | ||||||

| Tax Fees (2) |

125,000 | 214,844 | ||||||

| All Other Fees |

0 | 0 | ||||||

| Deloitte Total Fees |

$ | 1,490,019 | $ | 1,837,394 | ||||

| (1) | Audit-Related Fees include fees billed in 2010 and 2009 for audits and other services related to the Company’s employee benefit plans and review of the Company’s information systems. In addition, in fiscal year 2009, fees were billed for a technical accounting update. |

| (2) | Tax Fees represent fees billed for professional services rendered by Deloitte to the Company for tax compliance (including federal, state, local and international) and related matters such as local tax planning. |

Auditor Independence

The Audit Committee has considered whether the provision of the above-noted services is compatible with maintaining the independence of the independent registered public accounting firm and has determined, based on advice from Deloitte, that the provision of such services has not adversely affected Deloitte’s independence.

Policy on Audit Committee Pre-Approval of Audit and Permitted Non-Audit Services

The Audit Committee has established policies and procedures regarding pre-approval of audit, audit-related, tax, and permitted non-audit services that the independent registered public accounting firm may perform for the Company. Under these policies, predictable and recurring services are generally approved by the Audit Committee on an annual basis. The Audit Committee must pre-approve on an individual basis any requests for audit, audit-related, tax, and permitted non-audit services not covered by the services that are pre-approved annually, subject to certain de minimis exceptions permitted under the Exchange Act for services other than audit, review or attest services. In fiscal year 2010, the Audit Committee delegated pre-approval authority to the Chair of the Audit Committee, provided that the aggregate estimated fees for all current and future periods for which the services are to be rendered are not expected to exceed a designated amount. Any such pre-approval must be reported at the next scheduled meeting of the Audit Committee. The Audit Committee may prohibit services that in its view may compromise, or appear to compromise, the independence and objectivity of the independent registered public accounting firm. The Audit Committee also periodically reviews a schedule of fees paid and payable to the independent registered public accounting firm by type of service being or expected to be provided.

17

Table of Contents

In fiscal year 2010, all fees for audit, audit-related, tax and permitted non-audit services performed by Deloitte were pre-approved by the Audit Committee.

While not required by law, the Board of Directors is asking the stockholders to ratify the selection of Deloitte as a matter of good corporate practice. If the appointment of Deloitte is not ratified, the Audit Committee of the Board of Directors will reconsider the appointment.

Representatives of Deloitte are expected to be present at the Annual Meeting. They will have an opportunity to make a statement if they desire to do so and will be available to respond to appropriate questions.

The Board of Directors recommends that stockholders vote “FOR” the ratification of the appointment of Deloitte as the Company’s independent registered accounting firm for the 2011 fiscal year.

18

Table of Contents

The purpose of the Audit Committee is to assist the Board of Directors in fulfilling its obligations regarding the accounting, auditing, financial reporting, internal control over financial reporting, financial risk management and legal compliance functions of the Company and its subsidiaries. The Audit Committee is governed by a written charter, a copy of which is available on the Company’s website at http://investor.anninc.com. In carrying out its oversight responsibilities, the Audit Committee is not responsible for planning or conducting audits or for determining that the Company’s financial statements are complete and accurate or prepared in accordance with generally accepted accounting principles. The Company’s management is responsible for preparing the Company’s financial statements, for establishing and maintaining effective internal control over financial reporting and for assessing the effectiveness of its internal control over financial reporting. Deloitte & Touche LLP (“Deloitte”), the Company’s independent registered public accounting firm, is responsible for auditing such financial statements and auditing the Company’s internal control over financial reporting in accordance with the standards of the Public Company Accounting Oversight Board of the United States (“PCAOB”), and for rendering an opinion on these financial statements and an opinion on the Company’s internal control over financial reporting.

The Audit Committee has reviewed and discussed with management and Deloitte the audited financial statements for the fiscal year ended January 29, 2011 and Deloitte’s opinions on these financial statements and the Company’s internal control over financial reporting. The Audit Committee has discussed with Deloitte the matters that are required to be discussed by Statement on Auditing Standards No. 61, as amended (AICPA, Professional Standards, Vol. 1, AU Section 380), as adopted by the PCAOB. The Audit Committee has also received the written disclosures and the letter from Deloitte required by applicable requirements of the PCAOB regarding the independent accountant’s communications with the Audit Committee concerning independence, and the Audit Committee has discussed the independence of Deloitte with that firm.

Based upon the review and discussions referred to above, the Audit Committee recommended to the Board of Directors that the audited financial statements of the Company for the fiscal year ended January 29, 2011 be included in the Company’s Annual Report on Form 10-K for that fiscal year for filing with the SEC. This report is provided by the following independent directors, who comprise the Audit Committee:

Michael W. Trapp (Chairperson)

James J. Burke, Jr.

Ronald W. Hovsepian

Daniel W. Yih

The Audit Committee Report does not constitute soliciting material, and shall not be deemed to be filed or incorporated by reference into any other Company filing under the Securities Act of 1933, as amended, or the Exchange Act, except to the extent that the Company specifically incorporates the Audit Committee Report by reference therein.

19

Table of Contents

The Compensation Committee has reviewed and discussed with management the Compensation Discussion and Analysis section (“CD&A”) of this proxy statement. Based on that review and discussion, the Compensation Committee has recommended to the Board of Directors that the CD&A be included in this proxy statement.

Dale W. Hilpert (Chairperson)

Michelle Gass

Ronald W. Hovsepian

Compensation Committee Interlocks and Insider Participation

As of the Record Date, there were no Compensation Committee interlocks.

20

Table of Contents

COMPENSATION DISCUSSION AND ANALYSIS

This year we have again divided the Compensation Discussion and Analysis (the “CD&A”) into two sections. The first, entitled “Analysis of Compensation Programs for 2010 and 2011” describes how the Compensation Committee (the “Committee”), (i) in 2010 continued to successfully apply its long-term, pay-for-performance compensation philosophy to drive profitable growth; and (ii) has continued to apply that compensation philosophy in 2011 as the Company still operates in a challenging and unpredictable macroeconomic environment.

The second part of the CD&A, entitled “Compensation Program Framework”, discusses in greater detail the principal elements of our compensation philosophy and practices and the manner in which they are tied to the Company’s performance. This CD&A addresses compensation for our named executive officers for fiscal year 2010: Ms. Krill, Mr. Nicholson, Ms. Beauchamp and Messrs. Lynch and Muto (collectively, the “Named Executive Officers”).

I. Analysis of Compensation Programs for 2010 and 2011

Fiscal Year 2010 Compensation

During 2010, as the Company emerged from the recent economic recession and the economy began to stabilize, our senior executives shifted their focus toward the growth-oriented goals of increasing the Company’s revenues and delivering positive, double-digit comparable sales growth, while still remaining disciplined in maximizing gross margin and aggressively controlling expenses. While the Company continued to face challenging macroeconomic conditions that negatively impacted the retail industry and particularly sales in the women’s apparel sector, the Company’s executives drove the growth of the Company and managed the business prudently and effectively, as shown by the following:

| • | A significant increase in earnings per share (EPS). The Company’s EPS, on a non-GAAP basis, increased from $0.32 per diluted share for fiscal year 2009 to $1.30 per diluted share for fiscal year 2010, representing more than a 300% increase. On a GAAP basis, the Company’s EPS increased from a loss of $0.32 per diluted share for fiscal year 2009 to $1.24 per diluted share for fiscal year 2010, representing an almost 500% increase; |

| • | A dramatic increase in operating profit. On a non-GAAP basis, operating profit for fiscal year 2010 increased by more than 350% from fiscal year 2009, and by more than 600% on a GAAP basis; |

| • | Double-digit, positive sales comparables. During fiscal year 2010, the Company achieved positive sales comparables of 10.7%, with the AnnTaylor brand having 18.7% positive sales comparables and the LOFT brand 5%. Online sales at the Company experienced dramatic growth in 2010, as AnnTaylor.com had sales comparables of 54.3% and LOFT.com 65.3%; |

| • | A significant increase in gross margin rate. The Company’s gross margin rate increased from 54.4% for fiscal year 2009 to 55.8% for fiscal year 2010, representing an improvement of 140 basis points, reflecting continued improvement in product assortment and a disciplined approach to inventory management; |

| • | An aggressive control on expenses. During fiscal year 2010, while the Company achieved an increase of nearly $152 million in net sales and invested approximately an incremental $20 million in marketing to drive top-line growth, the Company’s selling, general and administrative expenses increased by only $12 million from fiscal year 2009 levels. Under the Company’s strategic restructuring program, the Company achieved total ongoing annualized savings of approximately $125 million over the 2008-2010 period; |

| • | A strong cash position. Even with the Company’s aggressive stock buyback program under which the Company repurchased over $100 million of its shares in 2010, the Company had approximately $227 |

21

Table of Contents

| million in cash at the end of fiscal year 2010, as compared to approximately $205 million at the end of fiscal year 2009. Without taking into account the Company’s 2010 stock repurchases, the Company would have had approximately $327 million in cash, which would have represented a 60% increase in the Company’s cash position from the end of fiscal year 2009. The Company also continues to have no bank debt; |

| • | Continued improvement of performance of the AnnTaylor brand through a successful brand evolution. In 2010, our senior executives continued the effective repositioning of the AnnTaylor brand, which had begun with the introduction of a new collection in the Fall of 2009. This multi-season evolution of the AnnTaylor brand dramatically revitalized the brand for today’s consumer and significantly contributed to the performance of the Company for fiscal year 2010; |

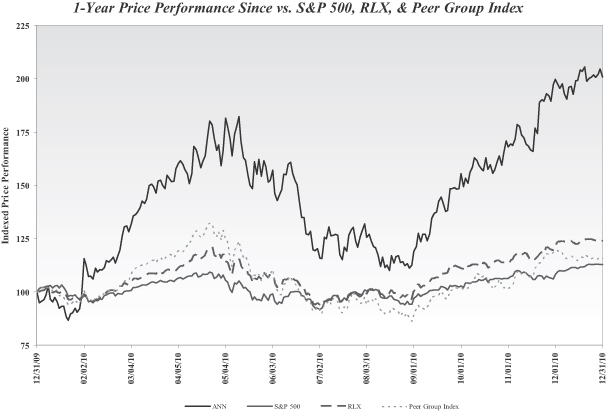

| • | A stock performance that was better than most companies in the Global Industry Classification Standard (GICS). When compared to companies within the retailing GICS group (which consists of 133 retail companies), our stock performance from December 31, 2009 to December 31, 2010 exceeded the 75th percentile; and |

| • | A stock performance that outperformed the S&P 500 and each company in our peer group. The executives’ successful management of the business helped drive the dramatic increase in the Company’s stock price from $12.56 per share at the end of fiscal year 2009 to $21.85 per share at the end of fiscal year 2010, which represented approximately a 74% increase in the Company’s share price. The Company’s stock value continues to rise, as on March 28, 2011, the Company’s stock closed at $27.34 per share. |

In addition, the Company’s stock performance during fiscal year 2010, as well as during the calendar year ended December 31, 2010, outperformed that of any of the companies in our peer group (as such group is described in this CD&A on page 27).

22

Table of Contents

The chart below compares the Company’s stock performance for the one-year period ended December 31, 2010, with the indexed price performance of the Standard & Poor’s 500 Stock Index (“S&P 500”), the Standard & Poor’s Retail Index1 (the “RLX”) and the indexed price performance of our peer group during the same period.2

| 1. | The Standard & Poor’s Retail Index is a capitalization-weighted index of domestic equities traded on the New York Stock Exchange, American Stock Exchange and the S&P 500. The stocks in the Index are high-capitalization stocks representing the retail sector of the S&P 500. |

| 2. | The indexed price for our peer group on a given day is based on the average of our peers’ closing stock prices on that day. |

Given these accomplishments, the Committee believes that the compensation programs for 2010 were effective in incentivizing management and in creating a pay for performance compensation structure that helped drive achievement of the Company’s business goals for 2010. The following are the key compensation decisions made in March of 2010 that shaped our compensation programs for fiscal year 2010:

| • | Salaries frozen for a second year. In an effort to place more emphasis on performance-based compensation and protect the Company’s cash position, Ms. Krill and the other Named Executive Officers did not receive an annual salary increase in 2010, nor did they receive an increase in 2009; |

| • | Significant portion of equity awards was performance-based; EPS added as a performance goal in addition to cash level. 50% of all restricted units awarded to Ms. Krill and the other Named Executive Officers in 2010 was performance-based and would only be earned if the Company were to achieve the respective performance goals for fiscal years 2010, 2011 and/or 2012. Consistent with the Company’s business goals of generating stronger top-line growth while still controlling expenses and maintaining a strong cash position, the Committee decided to add an EPS goal, in addition to cash on the Company’s balance sheet, as a performance metric for the earning of shares underlying the restricted units granted in 2010; |

23

Table of Contents

| • | Performance-based compensation consisting of performance-based equity and cash incentive compensation collectively represented a higher percentage of total compensation than that of our peer group. The Committee awarded performance-based compensation in the form of performance-based equity awards and incentive cash awards. These performance-based awards collectively represented in 2010 a higher percentage of total compensation, as compared to the percentage of performance-based compensation awarded collectively to executives with similar positions at the majority of our peer group companies. The Committee believes it is important to have performance-based compensation because it is tied to both Company performance and stockholder interests, and requires that the Company’s performance goals be achieved in order for the Named Executive Officers to earn this compensation; and |

| • | Long-term compensation collectively represented a higher percentage of total compensation than that of our peer group. The Committee awarded long-term cash incentive compensation in 2010 under the Company’s Restricted Cash Program, which as further explained on page 30 of this CD&A, is banked and deferred until the end of the third fiscal year following the year in which the restricted cash award is earned. This compensation, along with the long-term equity compensation awarded to our executives, collectively represented over 60% of total compensation awarded to our executives, and represented a higher percentage of total compensation, as compared to the percentage of long-term compensation awarded collectively to executives with similar positions at the majority of our peer group companies. |

The comparisons to our peer group presented above are based on the latest, publicly available information for those companies as of March 28, 2011.

Pay for Performance

The compensation programs for 2010 were successful in driving the performance of our executives in achieving the Company’s strategic goals for 2010. In addition, in 2010, while the Company’s performance improved significantly, the compensation of our Chief Executive Officer and that of the Named Executive Officers increased only modestly. The chart below illustrates how the performance of the Company’s stock compared to the compensation of our Chief Executive Officer and Named Executive Officers during the same period.

24

Table of Contents

Compensation Strategy for Fiscal Year 2011

The Compensation Committee met in March of 2011 and made its compensation decisions with respect to the Named Executive Officers for fiscal year 2011. The Committee made those decisions taking into account the successful performance of the executives as they drove profitable top-line growth during a struggling economy in 2010, as well as the business goals that the Company had established for 2011: profitable top-line sales growth and positive comparable sales performance throughout the Company’s brands and sales channels, while still maintaining a strong financial position. Key decisions made for 2011 are as follows:

| • | Continuation of salary freeze. Ms. Krill and the other Named Executive Officers, as well as all Executive Vice Presidents will not receive a salary increase for 2011. This will be the third year that salaries for our senior executives have been frozen; |

| • | Performance-based compensation continuing to comprise more than a majority of total compensation. The Named Executive Officers are eligible to participate in our Performance Compensation Plan described on pages 28-29 of this CD&A and our Restricted Cash Program, and have also been awarded performance-based restricted stock awards in 2011. As in 2010, this performance-based compensation granted to our Named Executive Officers in 2011 represents more than the majority of total compensation awarded to these executives; and |

| • | Performance-vesting restricted stock awards tied to EPS performance. In order to ensure that the Company continues to focus on driving profitable growth, the Committee established EPS as the goal in 2011 in order for performance-vesting restricted stock awards to be earned by the Company’s executives. |