UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2019 | |

OR

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from: ____________________ to ____________________ | |

Commission File No. 1-13219

OCWEN FINANCIAL CORPORATION

(Exact name of registrant as specified in its charter)

Florida | 65-0039856 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

1661 Worthington Road, Suite 100 West Palm Beach, Florida | 33409 | |

(Address of principal executive office) | (Zip Code) | |

(561) 682-8000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Common Stock, $0.01 Par Value | OCN | New York Stock Exchange (NYSE) |

Securities registered pursuant to Section 12 (g) of the Act: Not applicable.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

Large Accelerated filer | o | Accelerated filer | x | |||

Non-accelerated filer | o | Smaller reporting company | o | |||

Emerging growth company | o | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act) Yes o No x

Aggregate market value of the voting and non-voting common equity of the registrant held by nonaffiliates as of June 30, 2019: $275,549,706

Number of shares of common stock outstanding as of February 21, 2020: 134,948,008 shares

DOCUMENTS INCORPORATED BY REFERENCE: Portions of our definitive Proxy Statement with respect to our Annual Meeting of Shareholders, which is currently scheduled to be held on May 27, 2020, are incorporated by reference into Part III, Items 10 - 14.

OCWEN FINANCIAL CORPORATION

2019 FORM 10-K ANNUAL REPORT

TABLE OF CONTENTS

PAGE | |||

1

FORWARD-LOOKING STATEMENTS

This Annual Report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than statements of historical fact included in this report, including, statements regarding our financial position, business strategy and other plans and objectives for our future operations, are forward-looking statements.

Forward-looking statements may be identified by a reference to a future period or by the use of forward-looking terminology. Forward-looking statements are typically identified by words such as “expect”, “believe”, “foresee”, “anticipate”, “intend”, “estimate”, “goal”, “strategy”, “plan” “target” and “project” or conditional verbs such as “will”, “may”, “should”, “could” or “would” or the negative of these terms, although not all forward-looking statements contain these words. Forward-looking statements by their nature address matters that are, to different degrees, uncertain. Our business has been undergoing substantial change, which has magnified such uncertainties. Readers should bear these factors in mind when considering forward-looking statements and should not place undue reliance on such statements. Forward-looking statements involve a number of assumptions, risks and uncertainties that could cause actual results to differ materially from those suggested by such statements. In the past, actual results have differed from those suggested by forward-looking statements and this may happen again. Important factors that could cause actual results to differ include, but are not limited to, the risks discussed in “Risk Factors” and the following:

• | uncertainty related to the adequacy of our financial resources, including our sources of liquidity and ability to fund, sell and recover advances, originate, sell and securitize forward and reverse mortgage loans, fund forward and reverse mortgage loan buyouts, repay, renew and extend borrowings and borrow additional amounts as and when required; |

• | uncertainty related to our ability to execute on our cost re-engineering initiatives and take the other actions we believe are necessary for us to improve our financial performance; |

• | uncertainty related to our ability to acquire mortgage servicing rights (MSRs) or other assets or businesses at adequate risk-adjusted returns, including our ability to allocate adequate capital for such investments, negotiate and execute purchase documentation and satisfy closing conditions so as to consummate such acquisitions; |

• | uncertainty related to our ability to grow our lending business and increase our lending volumes in a competitive market and uncertain interest rate environment; |

• | uncertainty related to our long-term relationship and remaining agreements with New Residential Investment Corp. (NRZ), our largest servicing client; |

• | our ability to execute an orderly and timely transfer of responsibilities in connection with the termination by NRZ of our legacy PHH Mortgage Corporation (PMC) subservicing agreement; |

• | the reactions of regulators, lenders and other contractual counterparties, rating agencies, stockholders and other stakeholders to the announcement of the termination of the PMC subservicing agreement; |

• | uncertainty related to claims, litigation, cease and desist orders and investigations brought by government agencies and private parties regarding our servicing, foreclosure, modification, origination and other practices, including uncertainty related to past, present or future investigations, litigation, cease and desist orders and settlements with state regulators, the Consumer Financial Protection Bureau (CFPB), State Attorneys General, the Securities and Exchange Commission (SEC), the Department of Justice or the Department of Housing and Urban Development (HUD) and actions brought under the False Claims Act regarding incentive and other payments made by governmental entities; |

• | adverse effects on our business as a result of regulatory investigations, litigation, cease and desist orders or settlements; |

• | reactions to the announcement of such investigations, litigation, cease and desist orders or settlements by key counterparties, including lenders, the Federal National Mortgage Association (Fannie Mae), the Federal Home Loan Mortgage Corporation (Freddie Mac) and the Government National Mortgage Association (Ginnie Mae); |

• | our ability to comply with the terms of our settlements with regulatory agencies and the costs of doing so; |

• | increased regulatory scrutiny and media attention; |

• | any adverse developments in existing legal proceedings or the initiation of new legal proceedings; |

• | our ability to effectively manage our regulatory and contractual compliance obligations; |

• | our ability to interpret correctly and comply with liquidity, net worth and other financial and other requirements of regulators, Fannie Mae, Freddie Mac and Ginnie Mae, as well as those set forth in our debt and other agreements; |

• | our ability to comply with our servicing agreements, including our ability to comply with our agreements with, and the requirements of, Fannie Mae, Freddie Mac and Ginnie Mae and maintain our seller/servicer and other statuses with them; |

• | our servicer and credit ratings as well as other actions from various rating agencies, including the impact of prior or future downgrades of our servicer and credit ratings; |

• | failure of our information technology or other security systems or breach of our privacy protections, including any failure to protect customers’ data; |

2

• | uncertainty related to the ability of our technology vendors to adequately maintain and support our systems, including our servicing systems, loan originations and financial reporting systems; |

• | our ability to identify and address any issues arising in connection with the transfer of loans to the Black Knight Financial Services, Inc. (Black Knight) LoanSphere MSP® servicing system (Black Knight MSP) without incurring significant cost or disruption to our operations; |

• | the loss of the services of our senior managers and key employees; |

• | uncertainty related to the actions of loan owners and guarantors, including mortgage-backed securities investors, Federal National Mortgage Association (Fannie Mae) and Federal Home Loan Mortgage Corporation (Freddie Mac) (collectively, the GSEs), Government National Mortgage Association (Ginnie Mae) and trustees regarding loan put-backs, penalties and legal actions; |

• | uncertainty related to the GSEs substantially curtailing or ceasing to purchase our conforming loan originations or the Federal Housing Administration (FHA) of the HUD or Department of Veterans Affairs (VA) ceasing to provide insurance; |

• | uncertainty related to our ability to continue to collect certain expedited payment or convenience fees and potential liability for charging such fees; |

• | uncertainty related to our reserves, valuations, provisions and anticipated realization of assets; |

• | uncertainty related to the ability of third-party obligors and financing sources to fund servicing advances on a timely basis on loans serviced by us; |

• | volatility in our stock price; |

• | the characteristics of our servicing portfolio, including prepayment speeds along with delinquency and advance rates; |

• | our ability to successfully modify delinquent loans, manage foreclosures and sell foreclosed properties; |

• | uncertainty related to the processes for judicial and non-judicial foreclosure proceedings, including potential additional costs or delays or moratoria in the future or claims pertaining to past practices; |

• | our ability to adequately manage and maintain real estate owned (REO) properties and vacant properties collateralizing loans that we service; |

• | uncertainty related to legislation, regulations, regulatory agency actions, regulatory examinations, government programs and policies, industry initiatives and evolving best servicing practices; |

• | our ability to realize anticipated future gains from future draws on existing loans in our reverse mortgage portfolio; |

• | our ability to effectively manage our exposure to interest rate changes and foreign exchange fluctuations; |

• | our ability to effectively transform our operations in response to changing business needs, including our ability to do so without unanticipated adverse tax consequences; |

• | uncertainty regarding regulatory restrictions on our ability to repurchase our own stock and limitations under our debt agreements on stock repurchases; |

• | uncertainty related to the political or economic stability of the United States and of the foreign countries in which we have operations; and |

• | our ability to maintain positive relationships with our large shareholders and obtain their support for management proposals requiring shareholder approval. |

Further information on the risks specific to our business is detailed within this report, including under “Risk Factors.” Forward-looking statements speak only as of the date they were made and we disclaim any obligation to update or revise forward-looking statements whether because of new information, future events or otherwise.

3

PART I

ITEM 1. | BUSINESS |

When we use the terms “Ocwen,” “OCN,” “we,” “us” and “our,” we are referring to Ocwen Financial Corporation and its consolidated subsidiaries.

OVERVIEW

We are a financial services company that services and originates mortgage loans. We have a strong track record of success as a leader in the servicing industry in foreclosure prevention and loss mitigation that helps homeowners stay in their homes and improves financial outcomes for mortgage loan investors. This long-standing core competency will continue to be a guiding principle as we seek to grow our business and improve our financial performance.

We are headquartered in West Palm Beach, Florida with offices in the U.S. (West Palm Beach, FL, Mount Laurel, NJ, Rancho Cordova, CA), in the United States Virgin Islands (St. Croix)), and operations in India and the Philippines. At December 31, 2019, approximately 72% of our workforce is located outside the U.S. Ocwen Financial Corporation is a Florida corporation organized in February 1988. With our predecessors, we have been servicing residential mortgage loans since 1988. In late 2018 and throughout 2019, we successfully completed our acquisition and integration of PHH Corporation (PHH). We have been originating forward mortgage loans since 2012 and reverse mortgage loans since 2013. We currently provide solutions through our primary operating, wholly-owned subsidiaries, PHH Mortgage Corporation (PMC) and Liberty Home Equity Solutions, Inc. (Liberty).

Our priority is to return to sustainable profitability in the shortest timeframe possible within an appropriate risk and compliance environment. To do so, we believe we must execute on the following key initiatives. First, we must manage the size of our servicing portfolio through expanding our lending business and acquisitions of mortgage servicing rights (MSRs) that are prudent and well-executed with appropriate financial return targets. Second, we must re-engineer our cost structure to go beyond eliminating redundant costs through the integration process and establish continuous cost improvement as a core strength. Our continuous cost improvement efforts are focused on leveraging our single servicing platform and technology, optimizing strategic sourcing and off-shore utilization, lean process design, automation and other technology-enabled productivity enhancements. Third, we must manage our balance sheet to ensure adequate liquidity and provide a solid platform for financing our ongoing business needs and executing on our other key business initiatives. Finally, we must fulfill our regulatory commitments and resolve our remaining legal and regulatory matters on satisfactory terms.

BUSINESS MODEL AND SEGMENTS

Ocwen’s business model is designed to optimize our value creation for our primary stakeholders, improve our returns and effectively allocate our resources. Over the past twelve months, in addition to our PHH integration efforts, we have continued to adjust and transform our business model to generate growth through diversification and drive operational efficiencies. Our core competencies revolve around our servicing business and we aggressively pursue growth of our servicing portfolio through origination and acquisitions of servicing volume from multiple sources.

Our servicing portfolio is comprised of three components with different economics - our owned MSRs, our subservicing portfolio, and the NRZ servicing portfolio. We invest our capital to fund acquisitions and originations of our owned MSRs and servicing advances, for which we establish a targeted return on investment. Our net return includes servicing revenue net of servicing costs, less MSR portfolio runoff and other fair value changes, and less our MSR and advance funding cost. Our subservicing portfolio generates a relatively more stable source of revenue with lower subservicing fees but without any significant capital utilization and funding of advances. Our NRZ servicing portfolio has effectively been a subservicing relationship - See New Residential Investment Corp. Relationship. We target a balanced mix of our portfolio between servicing and subservicing. Our servicing operations and customer interactions do not differentiate whether loans are serviced or subserviced.

Our growth strategy is built on our relationships with borrowers, lenders and other market participants. We develop these relationships to grow our existing owned MSR portfolio, or develop new subservicing arrangements. We acquire MSRs through bulk portfolio purchases in the open market or through flow purchase agreements with our network of mortgage companies and financial institutions, or through participation in the Agency co-issue programs. In order to diversify our sources of servicing and reduce our reliance on others, we have been developing our origination of MSRs through different channels, including our portfolio recapture channel, retail, wholesale and correspondent lending. In 2019, bulk acquisitions represented the largest volume of MSR additions.

4

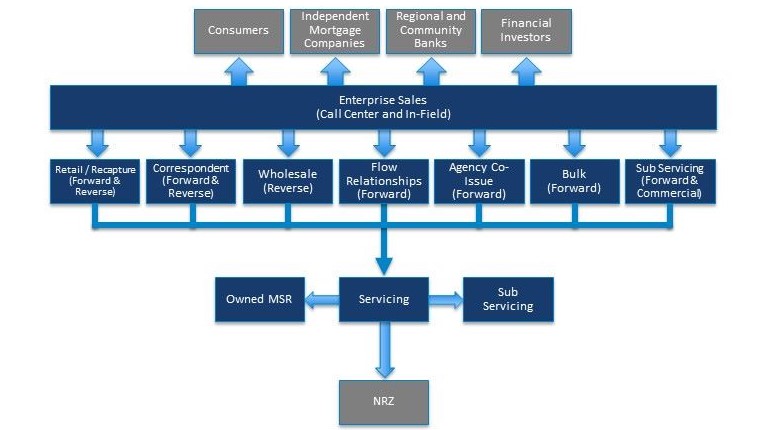

The chart below presents our current business model:

We report our activities in three segments, with Servicing and Lending being our primary segments. Our other business activities that are currently individually insignificant are included in the Corporate Items and Other segment. Our business segments reflect the internal reporting that we use to evaluate operating performance of services and to assess the allocation of our resources. The historical financial information of our segments is presented in our financial statements in Note 23 — Business Segment Reporting and discussed in the individual business operations sections of Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Servicing

Our Servicing business is primarily comprised of our core residential mortgage servicing business that currently accounts for most of our total revenues, and we also have a small commercial mortgage servicing business. Our servicing clients include some of the largest financial institutions in the U.S., including the GSEs, Ginnie Mae, NRZ and non-Agency residential mortgage-backed securities (RMBS) trusts. As of December 31, 2019, our residential servicing portfolio consisted of 1,419,943 loans with an unpaid principal balance (UPB) of $212.4 billion.

Servicing involves the collection of principal and interest payments from borrowers, the administration of tax and insurance escrow accounts, the collection of insurance claims, the management of loans that are delinquent or in foreclosure or bankruptcy, including making servicing advances, evaluating loans for modification and other loss mitigation activities and, if necessary, foreclosure referrals and the sale of the underlying mortgaged property following foreclosure (REO) on behalf of mortgage loan investors or other servicers. Master servicing involves the collection of payments from servicers and the distribution of funds to investors in mortgage and asset-backed securities and whole loan packages. We earn contractual monthly servicing fees (which are typically payable as a percentage of UPB) pursuant to servicing agreements as well as other ancillary fees relating to our servicing activities such as late fees and, in certain circumstances, REO referral commissions.

We own MSRs outright, where we typically receive all the servicing economics, and we subservice on behalf of other institutions that own the MSRs or Rights to MSRs, in which case we typically earn a smaller fee for performing the subservicing activities. Special servicing is a form of subservicing where we generally manage only delinquent loans on behalf of a loan owner. We typically earn subservicing and special servicing fees either as a percentage of UPB or on a per loan basis.

Servicing advances are an important component of our business and are amounts that we, as servicer, are required to advance to, or on behalf of, our servicing clients if we do not receive such amounts from borrowers. These amounts include principal and interest payments, property taxes and insurance premiums and amounts to maintain, repair and market real estate properties on behalf of our servicing clients. Most of our advances have the highest reimbursement priority such that we are entitled to repayment of the advances from the loan or property liquidation proceeds before most other claims on these proceeds. The costs incurred in meeting advancing obligations consist principally of the interest expense incurred in financing

5

the advance receivables and the costs of arranging such financing. Under subservicing agreements, Ocwen is promptly reimbursed by the owners of the MSRs who generally finance the advances and incur the associated financing cost.

Reducing delinquencies is important to our business because it enables us to recover advances and recognize additional ancillary income, such as late fees, which we do not recognize on delinquent loans until they are brought current. Performing loans also require less work and thus are generally less costly to service. While increasing borrower participation in loan modification programs is a critical component of our ability to reduce delinquencies, borrower compliance with those modifications is also an important factor.

We report our MSR purchases through flow, agency co-issue programs, and bulk sources in our Servicing segment. We initially recognize our MSR origination with the associated gain in our Lending business, and subsequently transfer the MSR to our Servicing segment. Our Servicing segment reflects all subsequent performance associated with the MSR, including funding cost, run-off and other fair value changes.

Our servicing portfolio naturally decreases over time as homeowners make regularly scheduled mortgage payments, prepay loans prior to maturity, refinance with a mortgage loan not serviced by us or involuntarily liquidate through foreclosure or other liquidation process. In addition, existing clients may determine to terminate their servicing and subservicing arrangements with us and transfer the servicing to others. Therefore, our ability to grow the size of our servicing portfolio depends on our ability to acquire the right to service or subservice additional mortgage loans at a rate that exceeds portfolio runoff and any client terminations. We are focused on profitably replenishing and growing our servicing and subservicing portfolios through a variety of sources, including our lending business channels (retail/recapture, wholesale and correspondent), forward flow MSR arrangements with certain business partners, GSE cash window programs, additional subservicing business arrangements, and bulk MSR acquisitions.

Lending

In 2019, our Lending business originated or purchased forward and reverse mortgage loans with a UPB of $1.2 billion and $729.4 million, respectively. These loans were acquired through three primary channels: directly with mortgage customers (retail), through correspondent lender relationships (correspondent) and through broker relationships (wholesale). Per-loan margins vary by channel, with correspondent typically being the lowest margin and retail the highest. We exited the forward lending correspondent and wholesale channels in 2017 for strategic purposes, and re-entered the correspondent channel in the second quarter of 2019. Our forward lending business is also focused on portfolio recapture (i.e., refinancing loans in our servicing portfolio).

Our forward mortgage loans are conventional (conforming to the underwriting standards of the GSEs, collectively Agency loans) and government-insured (insured by the FHA or VA). After origination, we generally package and sell the loans in the secondary mortgage market, through GSE and Ginnie Mae guaranteed securitizations and whole loan transactions. We typically retain the associated MSRs on securitizations, providing the Servicing business with a source of new MSRs to replenish our servicing portfolio and partially offset the impact of loan amortization and prepayments, i.e., portfolio runoff. Whole loan transactions are generally completed on a servicing released basis.

We also originate and purchase Home Equity Conversion Mortgages (HECM or reverse mortgage loans) through our Liberty Home Equity Solutions, Inc. (Liberty) operations. Loans originated under this program are generally guaranteed by the FHA, which provides investors with protection against risk of borrower default. The reverse mortgage business generates revenue from new originations and subsequent tail draws, scheduled and unscheduled, taken by the borrower. In the second half of 2019, we launched our non-FHA guaranteed jumbo proprietary product, EquityIQ, for borrowers in high property value areas that exceed FHA limits.

Retail Lending. We originate forward and reverse mortgage loans directly with borrowers through our retail lending business. Our forward lending business benefits from our servicing portfolio by offering refinance options to qualified borrowers seeking to lower their mortgage payments. Depending on borrower eligibility, we refinance eligible customers into conforming or government-insured products. We also are increasing our ability to originate retail loans to non-Ocwen servicing customers through various marketing channels. Through lead campaigns and direct marketing, the retail channel seeks to convert leads into loans in a cost-efficient manner. We are focused on increasing recapture rates on our existing servicing portfolio to grow this business.

Correspondent Lending. Our correspondent lending operation purchases mortgage loans that have been originated by a network of approved third-party lenders. We re-entered the forward correspondent lending channel in the second quarter of 2019.

All the lenders participating in our correspondent lending program are approved by senior management members of our lending and compliance teams. We also employ an ongoing monitoring and renewal process for participating lenders that includes an evaluation of the performance of the loans they have sold to us. We perform a variety of pre- and post-funding

6

review procedures to ensure that the loans we purchase conform to our requirements and to the requirements of the investors to whom we sell loans.

Wholesale Lending. We originate reverse mortgage loans through a network of approved brokers. Brokers are subject to a formal approval and monitoring process. We underwrite all loans originated through this channel consistent with the underwriting standards required by the ultimate investor prior to funding.

We provide customary origination representations and warranties to investors in connection with our loan sales and securitization activities. We receive customary origination representations and warranties from our network of approved originators relating to loans we purchase through our correspondent lending channel. In the event we cannot remedy a breach of a representation or warranty, we may be required to repurchase the loan or provide an indemnification payment to the investor. To the extent that we have recourse against a third-party originator, we may recover part or all of any loss we incur.

REGULATION

Our business is subject to extensive oversight and regulation by federal, state and local governmental authorities, including the CFPB, HUD and various state agencies that license and conduct examinations of our loan servicing, origination and collection activities. In addition, we operate under a number of regulatory settlements that subject us to ongoing reporting and other obligations. From time to time, we also receive requests (including requests in the form of subpoenas and civil investigative demands) from federal, state and local agencies for records, documents and information relating to the policies, procedures and practices of our loan servicing, origination and collection activities. The GSEs and their conservator, the Federal Housing Finance Authority (FHFA), Ginnie Mae, the United States Treasury Department, various investors, non-Agency securitization trustees and others also subject us to periodic reviews and audits.

In the current regulatory environment, we have faced and expect to continue to face heightened regulatory and public scrutiny as an organization as well as stricter and more comprehensive regulation of the entire mortgage sector. We continue to work diligently to assess and understand the implications of the regulatory environment in which we operate and to meet the requirements of this constantly changing environment. We devote substantial resources to regulatory compliance, while, at the same time, striving to meet the needs and expectations of our customers, clients and other stakeholders. Our actual or alleged failure to comply with applicable federal, state and local laws, regulations and licensing requirements could lead to any of the following:

• | loss of our licenses and approvals to engage in our servicing and lending businesses; |

• | governmental investigations and enforcement actions; |

• | administrative fines and penalties and litigation; |

• | civil and criminal liability, including class action lawsuits and actions to recover incentive and other payments made by governmental entities; |

• | breaches of covenants and representations under our servicing, debt or other agreements; |

• | damage to our reputation; |

• | inability to raise capital or otherwise secure the necessary financing to operate the business; |

• | changes to our operations that may otherwise not occur in the normal course, and that could cause us to incur significant costs; or |

• | inability to execute on our business strategy. |

We must comply with a large number of federal, state and local consumer protection laws including, among others, the Dodd-Frank Wall Street Reform and Consumer Protection Act (the Dodd-Frank Act), the Gramm-Leach-Bliley Act, the Fair Debt Collection Practices Act, the Real Estate Settlement Procedures Act (RESPA), the Truth in Lending Act (TILA), the Fair Credit Reporting Act, the Servicemembers Civil Relief Act, the Homeowners Protection Act, the Federal Trade Commission Act, the Telephone Consumer Protection Act, the Equal Credit Opportunity Act, as well as individual state laws pertaining to licensing, general mortgage origination and servicing practices and foreclosure, and federal and local bankruptcy rules. These statutes apply to many facets of our business, including loan origination, default servicing and collections, use of credit reports, safeguarding of non-public personally identifiable information about our customers, foreclosure and claims handling, investment of and interest payments on escrow balances and escrow payment features, and mandate certain disclosures and notices to borrowers. These requirements can and do change as statutes and regulations are enacted, promulgated, amended, interpreted and enforced.

In recent years, the general trend among federal, state and local lawmakers and regulators has been toward increasing laws, regulations and investigative proceedings with regard to residential mortgage lenders and servicers. The CFPB continues to take a very active role in the mortgage industry, and its rule-making and regulatory agenda relating to loan servicing and origination continues to evolve. Individual states have also been active, as have other regulatory organizations such as the Multistate Mortgage Committee (MMC), a multistate coalition of various mortgage banking regulators. We also believe there has been a shift among certain regulators towards a broader view of the scope of regulatory oversight responsibilities with respect to mortgage lenders and servicers. In addition to their traditional focus on licensing and examination matters, certain

7

regulators have begun to make observations, recommendations or demands with respect to areas such as corporate governance, safety and soundness and risk and compliance management.

The CFPB and state regulators have also focused on the use and adequacy of technology in the mortgage servicing industry, privacy concerns and other topical issues, such as likely discontinuation of the London Interbank Offered Rate (LIBOR). In 2016, the CFPB issued a special edition supervision report that stressed the need for mortgage servicers to assess and make necessary improvements to their information technology systems to ensure compliance with the CFPB’s mortgage servicing requirements. The NY DFS also issued Cybersecurity Requirements for Financial Services Companies, which took effect in 2017, and which required banks, insurance companies, and other financial services institutions regulated by the NY DFS to establish and maintain a cybersecurity program designed to protect consumers and ensure the safety and soundness of New York State’s financial services industry. Likewise, the NY DFS has directed New York-regulated depository and non-depository institutions, insurers and pension funds to submit their plans for managing the risks relating to the likely discontinuation of LIBOR. Similarly, the California Consumer Privacy Act, which was enacted in 2018 and became effective on January 1, 2020, created new consumer rights relating to the access to, deletion of, and sharing of personal information.

New regulatory and legislative measures, or changes in enforcement practices, including those related to the technology we use, could, either individually or in the aggregate, require significant changes to our business practices, impose additional costs on us, limit our product offerings, limit our ability to efficiently pursue business opportunities, negatively impact asset values or reduce our revenues.

Our licensed entities are required to renew their licenses, typically on an annual basis, and to do so they must satisfy the license renewal requirements of each jurisdiction, which generally include financial requirements such as providing audited financial statements or satisfying minimum net worth requirements and non-financial requirements such as satisfactorily completing examinations as to the licensee’s compliance with applicable laws and regulations. The minimum net worth requirements to which our licensed entities are subject are unique to each state and type of license. Failure to satisfy any of the requirements to which our licensed entities are subject could result in a variety of regulatory actions ranging from a fine, a directive requiring a certain step to be taken, a suspension or ultimately a revocation of a license, any of which could have a material adverse impact on our results of operations and financial condition. In addition, we receive information requests and other inquiries, both formal and informal in nature, from our state regulators as part of their general regulatory oversight of our servicing and lending businesses. We also engage with state attorneys general and the CFPB and, on occasion, we engage with other federal agencies, including the Department of Justice and various inspectors general on various matters, including responding to information requests and other inquiries. Many of our regulatory engagements arise from a complaint that the entity is investigating, although some are formal investigations or proceedings. The GSEs and their conservator, FHFA, HUD, FHA, VA, Ginnie Mae, the United States Treasury Department, and others also subject us to periodic reviews and audits. We have in the past resolved, and may in the future resolve, matters via consent orders or payment of monetary amounts to settle issues identified in connection with examinations or regulatory or other oversight activities, and such resolutions could have material and adverse effects on our business, reputation, operations, results of operations and financial condition.

In recent years, we have been subject to significant state and federal regulatory actions against us, including the following:

• | We are currently in litigation with the CFPB after the CFPB filed a lawsuit in the federal district court for the Southern District of Florida against Ocwen, Ocwen Mortgage Servicing, Inc. (OMS) and Ocwen Loan Servicing, LLC (OLS) alleging violations of federal consumer financial laws relating to our servicing business |

• | We are currently in litigation with the Florida Attorney General and the Florida Office of Financial Regulation after they filed a lawsuit in the federal district court for the Southern District of Florida against Ocwen, OMS and OLS alleging violations of federal and state consumer financial laws relating to our servicing business |

• | We have settled state regulatory actions against us by 29 states and the District of Columbia after these states and the District of Columbia alleged deficiencies in our compliance with laws and regulations relating to our servicing and lending activities |

• | We have entered into regulatory settlements with the New York Department of Financial Services (NY DFS) and the California Department of Business Oversight (CA DBO) relating to our servicing practices and other aspects of our business |

• | We have entered into a settlement agreement with the MMC and consent orders with certain state attorneys general to resolve and close out findings of an MMC examination of PMC’s legacy mortgage servicing practices |

We have incurred, and will continue to incur significant costs to comply with the terms of the settlements into which we have entered. In addition, the restrictions imposed under these settlements have significantly impacted how we run our business and will continue to do so. If we fail to comply with the terms of our settlements, additional legal or other actions could be taken against us. Such actions could have a materially adverse impact on our business, reputation, financial condition, liquidity and results of operations.

8

We continue to be subject to a number of ongoing federal and state regulatory examinations, consent orders, inquiries, subpoenas, civil investigative demands, requests for information and other actions, which could result in further adverse regulatory action against us.

To the extent that an examination, audit or other regulatory engagement identifies an alleged failure by us to comply with applicable laws, regulations or licensing requirements, or if allegations are made that we have failed to comply with applicable laws, regulations or licensing requirements or the commitments we have made in connection with our regulatory settlements (whether such allegations are made through administrative actions such as cease and desist orders, through legal proceedings or otherwise) or if other regulatory actions of a similar or different nature are taken in the future against us, this could lead to (i) administrative fines and penalties and litigation, (ii) loss of our licenses and approvals to engage in our servicing and lending businesses, (iii) governmental investigations and enforcement actions, (iv) civil and criminal liability, including class action lawsuits and actions to recover incentive and other payments made by governmental entities, (v) breaches of covenants and representations under our servicing, debt or other agreements, (vi) damage to our reputation, (vii) inability to raise capital or otherwise fund our operations, (viii) changes to our operations that may otherwise not occur in the normal course, and that could cause us to incur significant costs or (ix) inability to execute on our business strategy. Any of these occurrences could increase our operating expenses and reduce our revenues, hamper our ability to grow or otherwise materially and adversely affect our business, reputation, financial condition, liquidity and results of operations.

Finally, there are a number of foreign laws and regulations that are applicable to our operations outside of the U.S., including laws and regulations that govern licensing, employment, safety, taxes and insurance and laws and regulations that govern the creation, continuation and the winding up of companies as well as the relationships between shareholders, our corporate entities, the public and the government in these countries. Non-compliance with these laws and regulations could result in adverse actions against us, including (i) restrictions on our operations in these counties, (ii) fines, penalties or sanctions or (iii) reputational damage.

COMPETITION

The financial services markets in which we operate are highly competitive. We compete with large and small financial services companies, including bank and non-bank entities, in the servicing and lending markets. Our competitors include large banks, such as Wells Fargo, JPMorgan Chase, Bank of America and Citibank, large non-bank servicers such as Mr. Cooper and PennyMac Loan Services, market disruptors such as Quicken Loans, SunTrust Mortgage and Regions Mortgage who are aggressively investing in the digital transformation of their business platforms, and real estate investment trusts, including New Residential Investment Corp.

In the servicing industry, we compete based on price, quality and risk appetite. Potential counterparties also (1) assess our regulatory compliance track record and examine our systems and processes for maintaining and demonstrating regulatory compliance, (2) consider our customer satisfaction rankings, and (3) consider our third-party servicer ratings. Certain of our competitors, especially large banks, may have substantially lower costs of capital and greater financial resources, which makes it challenging to compete. We believe that our competitive strengths flow from our ability to control and drive down delinquencies using proprietary processes, our lower cost to service non-performing loans and our deep know-how as a long-time operator of servicing loans. Notwithstanding these strengths, we have suffered reputational damage as a result of our regulatory settlements and the associated scrutiny of our business. We believe this has weakened our competitive position against both our bank and non-bank servicing competitors.

In the lending industry, we face intense competition in most areas, including product offerings, rates, fees and customer service. Some of our competitors, including the larger banks, have substantially lower costs of capital and strong retail presence, which makes it challenging to compete. In addition, with the proliferation of smartphones and technological changes enabling improved payment systems and cheaper data storage, newer market participants, often called “disruptors,” are reinventing aspects of the financial industry and capturing profit pools previously enjoyed by existing market participants. As a result, the lending industry could become even more competitive if new market participants are successful in capturing market share from existing market participants such as ourselves. We believe our competitive strengths flow from our existing customer relationships and from our focus on providing strong customer service.

The reverse lending market faces many of the same competitive pressures as the forward market. In addition, the reverse market is significantly smaller than the forward market with a higher market share concentration among the top five Ginnie Mae HMBS issuers. These higher concentration levels can, at times, lead to significant price competition. We believe our competitive advantage flows from Liberty’s long tenure in the industry (Liberty began operations in 2004), which provides us with significant experience and contributes to our name recognition, our strategic partnerships and our use of technology to produce higher levels of productivity to drive down per-loan costs.

9

THIRD-PARTY SERVICER RATINGS

Like other servicers, we are the subject of mortgage servicer ratings or rankings (collectively, ratings) issued and revised from time to time by rating agencies including Moody’s Investors Service, Inc. (Moody’s), S&P Global Ratings, Inc. (S&P) and Fitch Ratings, Inc. (Fitch). Favorable ratings from these agencies are important to the conduct of our loan servicing and lending businesses.

The following table summarizes our key servicer ratings:

PHH Mortgage Corporation | |||||

Moody’s | S&P | Fitch | |||

Residential Prime Servicer | SQ3 | Average | RPS3 | ||

Residential Subprime Servicer | SQ3 | Average | RPS3 | ||

Residential Special Servicer | SQ3 | Average | RSS3 | ||

Residential Second/Subordinate Lien Servicer | SQ3 | Average | RPS3 | ||

Residential Home Equity Servicer | — | — | RPS3 | ||

Residential Alt-A Servicer | — | — | RPS3 | ||

Master Servicer | SQ3 | Average | RMS3 | ||

Ratings Outlook | N/A | Stable | Stable | ||

Date of last action | August 29, 2019 | December 27, 2019 | December 19, 2019 | ||

Following the merger of OLS into PMC on June 1, 2019, Ocwen submitted requests to withdraw the servicer ratings for OLS. S&P and Moody’s have transferred the Master Servicer rating for OLS to PMC, and Fitch assigned the Master Servicer rating on December 19, 2019.

In addition to servicer ratings, each of the agencies will from time to time assign an outlook (or a ratings watch such as Moody’s review status) to the rating status of a mortgage servicer. A negative outlook is generally used to indicate that a rating “may be lowered,” while a positive outlook is generally used to indicate a rating “may be raised.” There have been no new outlooks released for PMC regarding our servicer ratings.

Downgrades in servicer ratings could adversely affect our ability to service loans, sell or finance servicing advances and could impair our ability to consummate future servicing transactions or adversely affect our dealings with lenders, other contractual counterparties, and regulators, including our ability to maintain our status as an approved servicer by Fannie Mae and Freddie Mac. The servicer rating requirements of Fannie Mae do not necessarily require or imply immediate action, as Fannie Mae has discretion with respect to whether we are in compliance with their requirements and what actions it deems appropriate under the circumstances if we fall below their desired servicer ratings.

See Item 1A. Risk Factors - Risks Relating to Our Business for further discussion of the adverse effects that a failure to maintain minimum servicer ratings could have on our business, financing activities, financial condition or results of operations.

NEW RESIDENTIAL INVESTMENT CORP. RELATIONSHIP

Ocwen has a legacy relationship with NRZ and we acquired PMC’s legacy relationship with NRZ when we acquired PHH in October 2018. As a result, we service loans on behalf of NRZ under various agreements, including traditional subservicing agreements, where NRZ is the legal owner of the MSRs, and in connection with Rights to MSRs, where Ocwen retains legal title to the underlying MSRs but NRZ has generally assumed risks and rewards consistent with an MSR owner. As of December 31, 2019, we serviced loans with a UPB of $58.1 billion under legacy Ocwen subservicing agreements, loans with a UPB of $18.5 billion under legacy Ocwen Rights to MSRs agreements and loans with a UPB of $42.1 billion under a legacy PMC subservicing agreement. See Note 10 — Rights to MSRs and Note 25 — Commitments, NRZ Relationship.

NRZ is our largest servicing client, accounting for 56% of the UPB of our servicing portfolio as of December 31, 2019 and approximately 74% of all delinquent loans that Ocwen serviced. During 2019, NRZ-related servicing fees retained by Ocwen represented approximately 36% of the total servicing and subservicing fees earned by Ocwen, net of servicing fees remitted to NRZ (excluding ancillary income). We also benefit from the amortization of $334.2 million in upfront lump-sum cash payments that we received from NRZ in 2017 and 2018 when we renegotiated certain aspects of the legacy Ocwen agreements. These lump-sum cash payments were deferred and are recorded within Other income (expense) within our financial statements as they amortize through the remaining term of the original agreements (April 2020). As a result, through April 2020, we expect to recognize income of $35.4 million due to the amortization of these lump sum payments.

10

During 2019, we completed an assessment of the cost-to-service and the profitability of the NRZ servicing portfolio. Based on this analysis, in the fourth quarter of 2019, we estimated that operating expenses, including direct servicing expenses and overhead allocation, exceeded the net revenue retained for the NRZ servicing portfolio by approximately $10.0 million. As with all estimates, this estimate required the exercise of judgment, including with respect to overhead allocations, and it excludes the benefits of the lump-sum payment amortization. The estimated loss for these subservicing agreements is partially driven by the declining revenue as the loan portfolio amortizes down without a corresponding reduction to our servicing cost over time. As performing loans in the NRZ servicing portfolio have run-off, delinquencies have remained high, resulting in a relatively elevated average cost per loan. Because the NRZ portfolio contains a high percentage of delinquent accounts, it has an inherently high level of potential operational and compliance risk and requires a disproportionately high level of operating staff, oversight support infrastructure and overhead which drives the elevated average cost per loan. We actively pursue cost re-engineering initiatives to continue to reduce our cost-to-service and our corporate overhead, as well as pursue actions to grow our non-NRZ servicing portfolio to offset the losses on the NRZ sub servicing.

On February 20, 2020, we received a notice of termination from NRZ with respect to the legacy PMC subservicing agreement. This termination is for convenience (and not for cause). The notice states that the effective date of termination is June 19, 2020 for 25% of the loans under the agreement (not including loans constituting approximately $6.6 billion in UPB that were added by NRZ under the agreement in 2019) and August 18, 2020 for the remainder of the loans under the agreement. The actual servicing transfer date(s) will be determined through discussions with NRZ and other stakeholders such as GSEs. In connection with the termination, we estimate that we will receive loan deboarding fees of approximately $6.1 million from NRZ. The portfolio subject to termination accounted for $42.1 billion in UPB, or 20% of our total serviced UPB as of December 31, 2019. Under this agreement, in the fourth quarter of 2019, we estimate that operating expenses, including direct expenses and overhead allocation, exceeded the net revenue retained for this portion of the NRZ servicing portfolio by approximately $3.0 million. At this stage, we do not anticipate significant operational impacts on our servicing business as a result of this termination. The terminated servicing is comprised of Agency loans with relatively low delinquencies that do not pose a high level of operating and compliance risk or require substantial direct and oversight staffing relative to our non-Agency servicing. Nonetheless, we intend to right-size and reduce expenses in our servicing business and the related corporate support functions to the extent possible to align with our smaller portfolio.

We currently anticipate that the loan deboarding fees from NRZ will offset a significant portion of our transition and restructuring costs assuming an orderly and timely transfer. However, it is possible that the loan deboarding and other transition activities that we will undertake as a result of the termination may not occur in an orderly or timely manner, which could be disruptive and could result in us incurring additional costs or even in disagreements with NRZ relating to our respective rights and obligations. Overall, our current view is that if we can exclude the legacy PMC NRZ servicing portfolio and successfully execute on the necessary transition and expense reduction actions in an orderly and timely manner, we will be able to enhance the long-term financial performance of our servicing business.

The legacy Ocwen agreements have an initial term ending in July 2022 and the underlying loans are almost exclusively non-Agency loans. As a result, the servicing of these loans involves a higher level of operational and regulatory risk and requires substantial direct and oversight staffing relative to Agency loans. NRZ may terminate the agreements for convenience, subject to Ocwen’s right to receive a termination fee and 180 days’ notice at any time during the initial term. The termination fee is calculated as specified in the Ocwen agreements, and is a discounted percentage of the expected revenues that would be owed to Ocwen over the remaining contract term based on certain portfolio run off assumptions. After the initial term, these agreements can be renewed for three-month terms at NRZ’s option. In addition to a base servicing fee, we receive ancillary income, which primarily includes late fees, loan modification fees and Speedpay® fees. We may also receive certain incentive fees or pay penalties tied to various contractual performance metrics. NRZ receives all float earnings and deferred servicing fees related to delinquent borrower payments, as well as certain REO-related income, including REO referral commissions. As legal MSR owner, or in compliance with the Rights to MSRs agreements, NRZ is responsible for financing all servicing advance obligations in connection with the loans underlying the MSRs.

PMC and NRZ are parties to an MSR sale agreement pursuant to which $2.7 billion in UPB of MSRs and the related advances remain to be sold to NRZ as of December 31, 2019. These MSRs and the related advances have not been sold because required third-party consents have not been obtained. Ocwen and NRZ are in discussions regarding the disposition of these remaining assets.

In the ordinary course, we regularly share information with NRZ and discuss various aspects of our relationship. At times, we discuss modifications to our relationship that we believe could be to our mutual benefit as our respective businesses evolve over time. We also discuss alternatives to the outcomes contemplated under our agreements when they were originally executed as facts and circumstances change over time. Examples of these discussions include our discussions with respect to the $18.5 billion in UPB of Rights to MSRs and our discussions with respect to the $2.7 billion in UPB of MSRs and the related advances that remain to be sold to NRZ under the legacy PMC sale agreement referenced above. With respect to the Rights to MSRs, we are discussing various alternative arrangements, including those contemplated under our existing agreements which

11

provide, among other scenarios, that the Rights to MSRs could (i) remain in the existing Rights to MSR structure, (ii) be acquired by Ocwen or (iii) be sold or transferred to a third party together with Ocwen’s title to the related MSRs. As part of these discussions, we have discussed several potential changes to existing contracts. It is also possible that NRZ could exercise its rights to terminate for convenience some or all of the legacy Ocwen servicing agreements. In our business planning efforts, we have analyzed the potential impact of such an action by NRZ in light of the current and predicted future economics of the NRZ relationship generally. Because of the large percentage of our servicing business that is represented by agreements with NRZ, if NRZ exercised all or a significant portion of these termination rights, we would need to substantially restructure many aspects of our servicing business as well as the related corporate support functions to address our smaller servicing portfolio. This would likely be a complex and expensive undertaking. However, we would also receive termination fees that we would expect to offset a significant portion of our transition and restructuring costs. Overall, we believe that if we were to exclude our NRZ servicing portfolio and successfully execute on the necessary transition and restructuring actions, we would be able to enhance the long-term financial performance and reduce the client concentration and operating risk profile of our servicing business.

ALTISOURCE VENDOR RELATIONSHIP

Ocwen is a party to a number of long-term agreements with Altisource S.à r.l., and certain of other subsidiaries of Altisource Portfolio Solutions, S.A. (Altisource), including a Services Agreement, under which Altisource provides various services, such as property valuation services, property preservation and inspection services and title services, among other things. This agreement expires August 31, 2025 and includes renewal provisions. Ocwen and Altisource have also entered into a Master Services Agreement pursuant to which Altisource currently provides title services to Liberty. Ocwen also has a General Referral Fee Agreement with Altisource pursuant to which Ocwen receives referral fees which are paid out of the commission that would otherwise be paid to Altisource as the selling broker in connection with real estate sales services provided by Altisource. However, for MSRs that transferred to NRZ, as well as those subject to our Rights to MSRs agreements with NRZ, we are not entitled to REO referral commissions.

In February 2019, Ocwen and Altisource signed a Binding Term Sheet, which among other things, confirmed Altisource’s cooperation with the deboarding of loans from Altisource’s REALServicing servicing system to Black Knight MSP. The Binding Term Sheet also amends certain provisions in the Services Agreement. After certain conditions have been met and where Ocwen has the right to select the services provider, Ocwen agreed to use Altisource to provide the types of services that Altisource currently provides under the Services Agreement for at least 90% of services for all portfolios for which Ocwen is the servicer or subservicer, except that Altisource will be the provider for all such services for the portfolios: (i) acquired by Ocwen pursuant to loan servicing under agreements from Homeward (acquired in 2012) or assigned and assumed by Ocwen from Residential Capital, LLC, et al (assets acquired in 2013); and (ii) acquired from Ocwen, excluding certain portfolios in which PHH has an interest, by NRZ or its affiliates prior to the date of the Binding Term Sheet. The Binding Term Sheet also sets forth a framework for negotiating additional service level changes under the Services Agreement in the future. As specified in the Binding Term Sheet, if Altisource fails certain performance standards for specified periods of time, then Ocwen may terminate Altisource as a provider for the applicable service(s), subject to Altisource’s right to cure. For certain claims arising from service referrals received by Altisource after the effective date of the Binding Term Sheet, the provisions include reciprocal indemnification obligations in the event of negligence by either party, and Altisource’s indemnification of Ocwen in the event of breach by Altisource of its obligations under the Services Agreement. The limitations of liability provisions include an exception for losses either party suffers as a result of third-party claims.

Certain services provided by Altisource under these agreements are charged to the borrower and/or mortgage loan investor. Accordingly, such services, while derived from our loan servicing portfolio, are not reported as expenses by Ocwen. These services include residential property valuation, residential property preservation and inspection services, title services and real estate sales-related services.

USVI OPERATIONS

The majority of our USVI operations and assets were transferred to the U.S. during 2019 as a result of our legal entity simplification.

In 2012, as part of an initiative to reorganize the ownership and management of our global servicing assets and operations under a single entity and cost-effectively expand our U.S.- based origination and servicing activities, Ocwen formed OMS under the laws of the USVI where OMS was incorporated and had its principal place of business. OMS was headquartered in Christiansted, St. Croix, USVI and was located in a federally recognized economic development zone where qualified entities are eligible for certain tax benefits. We refer to these benefits as “EDC Benefits” as they are granted by the USVI Economic Development Commission (EDC). We were approved as a Category IIA service business, and are therefore entitled to receive significant benefits that may have a favorable impact on our effective tax rate. These benefits, among others, enabled us to avail ourselves of a credit of 90% of income taxes on certain qualified income related to our servicing business. The exemption was granted as of October 1, 2012 and is available for a period of 30 years until expiration on September 30, 2042. Although we are

12

eligible for a reduced tax rate in the USVI, the reduced tax rate has not provided Ocwen with a foreign tax benefit in recent tax years as we have been incurring taxable losses in the USVI.

During 2019, following our acquisition of PHH in 2018, and in connection with our overall corporate simplification and cost reduction efforts, we executed a legal entity reorganization whereby OLS, through which we previously conducted a substantial portion of our servicing business, was merged into PHH. OLS was previously the wholly-owned subsidiary of OMS, which was incorporated and headquartered in the USVI prior to its merger in November 2019 with Ocwen USVI Services, LLC, an entity which is also organized and headquartered in the USVI. As a result of this reorganization, the majority of our USVI operations and assets were transferred to the U.S. We expect the reorganization to result in efficiencies and operational cost savings through reduced complexity and a simplification of our global structure.

It is possible that we may not be able to retain our qualifications for the EDC Benefits, or that changes in U.S. federal, state, local, territorial or USVI taxation statutes or applicable regulations may cause a reduction in or an elimination of the value of the EDC Benefits, all of which could result in an increase to our tax expense, including a loss of anticipated income tax refunds, and, therefore, adversely affect our financial condition and results of operations. Additionally, although we executed a legal entity reorganization in 2019 such that the majority of our USVI operations and assets were transferred to the U.S., we plan to continue to maintain operations in the USVI until, through and after the reorganization as it is possible that our past and future EDC Benefits could be adversely impacted, which could jeopardize our ability to return to profitability.

On December 22, 2017, significant revisions to the Internal Revenue Code of 1986, as amended, were signed into law (Tax Act). The newly enacted federal income tax law, among other things, contains significant changes to corporate taxation, including reduction of the U.S. corporate tax rate from a top marginal rate of 35% to a flat rate of 21%, elimination of U.S. tax on foreign earnings (subject to certain important exceptions), and a new minimum tax enacted to prevent companies from stripping earnings out of the U.S. through U.S. tax deductible payments made to foreign affiliates. The reduction in the statutory U.S. federal rate is expected to positively impact our future U.S. after-tax earnings. However, the impact of the Tax Act on our future after tax earnings is subject to the effect of other complex provisions in the Tax Act, including the Base Erosion and Anti-Abuse Tax (BEAT), Global Intangible Low-Taxed Income (GILTI), and revised interest deductibility limitations. It is possible that the impact of these provisions could significantly reduce the benefit of the reduction in the statutory U.S. federal rate and may also negatively impact the tax advantages received from the EDC Benefits. In addition, Ocwen is continuing to evaluate the impact of the new tax legislation and recently issued regulations on its global tax position. Certain provisions of the new tax laws and regulations have resulted in an increase to our current income tax obligations.

EMPLOYEES

We had a total of approximately 5,300 and 7,200 employees at December 31, 2019 and 2018, respectively. We maintain operations in the U.S., USVI, India and the Philippines. At December 31, 2019, approximately 3,400 of our employees were located in India and approximately 400 were based in the Philippines. Of our foreign-based employees, nearly 80% were engaged in our Servicing operations as of December 31, 2019. Because of the large number of employees in India, our operations could be impacted by significant changes to the political or economic conditions in India or in the political or regulatory climate in the U.S. with respect to U.S. businesses engaging in foreign operations. If we had to curtail or cease our operations in India and transfer some or all of these operations to another geographic area, we could incur significant transition costs as well as higher future overhead costs that could materially and adversely affect our results of operations.

SUBSIDIARIES

For a listing of our significant subsidiaries, refer to Exhibit 21.1 of this Annual Report on Form 10-K.

AVAILABLE INFORMATION

Our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and all amendments to those reports are made available free of charge through our website (www.ocwen.com) as soon as reasonably practicable after such material is electronically filed with or furnished to the SEC. The SEC maintains an Internet site that contains reports, proxy and information statements and other information regarding issuers, including Ocwen, that file electronically with the SEC. The address of that site is www.sec.gov. We have also posted on our website, and have available in print upon request (1) the charters for our Audit Committee, Compensation and Human Capital Committee, Nomination/Governance Committee and Risk and Compliance Committee, (2) our Corporate Governance Guidelines, (3) our Code of Business Conduct and Ethics and (4) our Code of Ethics for Senior Financial Officers. Within the time period required by the SEC and the New York Stock Exchange, we will post on our website any amendment to or waiver of the Code of Ethics for Senior Financial Officers, as well as any amendment to the Code of Business Conduct and Ethics or waiver thereto applicable to any executive officer or director. We may post information that is important to investors on our website. The information provided on our website is not part of this report and is, therefore, not incorporated herein by reference.

13

ITEM 1A. | RISK FACTORS |

An investment in our common stock involves significant risk. We describe below the most significant risks that management believes affect or could affect us. Understanding these risks is important to understanding any statement in this Annual Report and to evaluating an investment in our common stock. You should carefully read and consider the risks and uncertainties described below together with all the other information included or incorporated by reference in this Annual Report before you make any decision regarding an investment in our common stock. You should also consider the information set forth above under “Forward Looking Statements.” If any of the following risks actually occur, our business, financial condition, liquidity and results of operations could be materially and adversely affected. If this were to happen, the value of our common stock could significantly decline, and you could lose some or all of your investment. While the following discussion provides a description of some of the important risks that could cause our results to vary materially from those expressed in public statements or documents, other factors besides those discussed within this Annual Report or elsewhere in other of our reports filed with or furnished to the SEC could also affect our business or results.

We have divided this section into the following general risk categories:

• | Legal and Regulatory Related Risks |

• | Risks Related to Our Financial Performance, Financing Our Business, Liquidity and Net Worth and the Economy |

• | Operational Risks and Other Risks Related to Our Business |

• | Tax Risks |

• | Risks Relating to Ownership of Our Common Stock |

Legal and Regulatory Risks

The business in which we engage is complex and heavily regulated. If we fail to operate our business in compliance with both existing and future regulations, our business, reputation, financial condition or results of operations could be materially and adversely affected.

Our business is subject to extensive regulation by federal, state and local governmental authorities, including the CFPB, HUD, the SEC and various state agencies that license and conduct examinations of our servicing and lending activities. In addition, we operate under a number of regulatory settlements that subject us to ongoing reporting and other obligations. See the next risk factor below for additional detail concerning these regulatory settlements. From time to time, we also receive requests (including requests in the form of subpoenas and civil investigative demands) from federal, state and local agencies for records, documents and information relating to our servicing and lending activities. The GSEs (and their conservator, the FHFA), Ginnie Mae, the United States Treasury Department, various investors, non-Agency securitization trustees and others also subject us to periodic reviews and audits.

In the current regulatory environment, we have faced and expect to continue to face heightened regulatory and public scrutiny as an organization as well as stricter and more comprehensive regulation of the entire mortgage sector. We must devote substantial resources to regulatory compliance, and we incurred, and expect to continue to incur, significant ongoing costs to comply with new and existing laws and governmental regulation of our business. If we fail to effectively manage our regulatory and contractual compliance, the resources we are required to devote and our compliance expenses would likely increase. Any significant delay or complication in fulfilling our regulatory commitments and resolving remaining legacy matters may jeopardize our ability to return to profitability.

We must comply with a large number of federal, state and local consumer protection laws including, among others, the Dodd-Frank Act, the Gramm-Leach-Bliley Act, the Fair Debt Collection Practices Act, RESPA, TILA, the Fair Credit Reporting Act, the Servicemembers Civil Relief Act, the Homeowners Protection Act, the Federal Trade Commission Act, the Telephone Consumer Protection Act, the Equal Credit Opportunity Act, as well as individual state licensing and foreclosure laws and federal and local bankruptcy rules. These statutes apply to many facets of our business, including loan origination, default servicing and collections, use of credit reports, safeguarding of non-public personally identifiable information about our customers, foreclosure and claims handling, investment of and interest payments on escrow balances and escrow payment features, and mandate certain disclosures and notices to borrowers. These requirements can and do change as statutes and regulations are enacted, promulgated, amended, interpreted and enforced. In addition, we must maintain an effective corporate governance and compliance management system. See “Business - Regulation” for additional information regarding our regulators and the laws that apply to us.

We must structure and operate our business to comply with applicable laws and regulations and the terms of our regulatory settlements. This can require judgment with respect to the requirements of such laws and regulations and such settlements. While we endeavor to engage proactively with our regulators in an effort to ensure we do so correctly, if we fail to interpret correctly the requirements of such laws and regulations or the terms of our regulatory settlements, we could be found to be in breach of such laws, regulations or settlements.

14

Our actual or alleged failure to comply with the terms of our regulatory settlements or applicable federal, state and local consumer protection laws, regulations and licensing requirements could lead to any of the following:

• | administrative fines and penalties and litigation; |

• | loss of our licenses and approvals to engage in our servicing and lending businesses; |

• | governmental investigations and enforcement actions; |

• | civil and criminal liability, including class action lawsuits and actions to recover incentive and other payments made by governmental entities; |

• | breaches of covenants and representations under our servicing, debt or other agreements; |

• | damage to our reputation; |

• | inability to raise capital or otherwise secure the necessary financing to operate the business and refinance maturing liabilities; |

• | changes to our operations that may otherwise not occur in the normal course, and that could cause us to incur significant costs; or |

• | inability to execute on our business strategy. |

Any of these outcomes could materially and adversely affect our business, reputation, financial condition, liquidity and results of operations.

In recent years, the general trend among federal, state and local lawmakers and regulators has been toward increasing laws, regulations and investigative proceedings with regard to residential mortgage lenders and servicers. The CFPB continues to take a very active role in the mortgage industry, and its rule-making and regulatory agenda relating to loan servicing and originations continues to evolve. Individual states, including New York and California, have also been active, as have other regulatory organizations such as the MMC. We also believe there has been a shift among certain regulators towards a broader view of the scope of regulatory oversight responsibilities with respect to mortgage originators and servicers. In addition to their traditional focus on licensing and examination matters, certain regulators have begun to make observations, recommendations or demands with respect to such areas as corporate governance, safety and soundness, and risk and compliance management. We must endeavor to work cooperatively with our regulators to understand all their concerns if we are to be successful in our business.

The CFPB and state regulators have also increasingly focused on the use, and adequacy, of technology in the mortgage servicing industry, privacy concerns and other topical issues, such as likely discontinuation of the London Interbank Offered Rate (LIBOR). In 2016, the CFPB issued a special edition supervision report that stressed the need for mortgage servicers to assess and make necessary improvements to their information technology systems in order to ensure compliance with the CFPB’s mortgage servicing requirements. The NY DFS also issued Cybersecurity Requirements for Financial Services Companies, effective in 2017, which require banks, insurance companies, and other financial services institutions regulated by the NY DFS to establish and maintain a cybersecurity program designed to protect consumers and ensure the safety and soundness of New York State’s financial services industry. Likewise, the NY DFS has directed New York-regulated depository and non-depository institutions, insurers and pension funds to submit their plans for managing the risks relating to the likely discontinuation of LIBOR. Similarly, the California Consumer Privacy Act, which was enacted in 2018 and became effective on January 1, 2020, created new consumer rights relating to the access to, deletion of, and sharing of personal information.

Presently, a level of heightened uncertainty exists with respect to the future of regulation of mortgage lending and servicing, including the future of the Dodd Frank Act and CFPB. We cannot predict the specific legislative or executive actions that may result or what actions federal or state regulators might take in response to potential changes to the Dodd Frank Act or to the federal regulatory environment generally. Such actions could impact the industry generally or us specifically, could impact our relationships with other regulators, and could adversely impact our business and limit our ability to reach an appropriate resolution with the CFPB, with which we are engaged to attempt to resolve certain concerns relating to our mortgage servicing practices, as described in the next risk factor.

New regulatory and legislative measures, or changes in enforcement practices, including those related to the technology we use, could, either individually or in the aggregate, require significant changes to our business practices, impose additional costs on us, limit our product offerings, limit our ability to efficiently pursue business opportunities, negatively impact asset values or reduce our revenues. Accordingly, they could materially and adversely affect our business and our financial condition, liquidity and results of operations.