SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K/A

(Mark One)

|

x

|

Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the fiscal year ended September 30, 2010

|

OR

|

¨

|

Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the transition period from ___ to ___

|

Commission File Number: 000-19061

USCORP

(Exact name of the Company as specified in its charter)

|

Nevada

|

|

87-0403330

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer

Identification No.)

|

4535 W. Sahara Ave, Suite 200, Las Vegas, NV 89102

(Address of principal executive offices)

(702) 933-4034

(The Company’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class

|

|

Names of each exchange

on which registered

|

|

None

|

|

None

|

Securities registered pursuant to Section 12(g) of the Act:

Common Shares, $0.01 Par Value

Indicate by check mark whether the Company (l) has filed all reports required to be filed by section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Company was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of The Company’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K/A or any amendment to this Form 10-K/A. x

Indicate by check mark whether the Registrant is a large accelerated filer, accelerated filer, a non-accelerated filer or a small departing company.

|

Large Accelerated Filer ¨

|

Accelerated Filer ¨

|

| |

|

|

Non-Accelerated Filer ¨

|

Small Reporting Company x

|

Indicate by check mark whether the Company is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

State the issuer’s revenues for its most recent fiscal year. $0.0

State the aggregate market value of the voting stock held by non-affiliates computed by reference to the price at which the stock was sold, or the average bid and asked price of such stock, as of a specified date within the past 60 days. As of December 22, 2010, the value of such stock was $5,786,312. Shares of common stock held by each executive officer and director and by certain persons who own 5% or more of the outstanding common stock have been excluded in that such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

Number of shares outstanding of Issuer’s class A common stock, $0.01 par value, outstanding on September 30, 2010: 135,955,389 shares. Number of shares outstanding of Issuer’s class B common stock, $0.001 par value, outstanding on September 30, 2010: 5,060,500 shares.

Documents Incorporated by Reference: NONE

Transitional Small Business Disclosure Format (Check one): Yes ¨; No x

Explanatory Note

We are filing this third amended Form 10-K in response to certain comments the Company received from the U.S. Securities and Exchange Commission on March 1, 2011, May 9, 2011 and August 8, 2011.

Further, Subsequent to the issuance of the financial statements for the fiscal years ended September 30, 2010 and September 30, 2009, management discovered that an incorrect statement had been filed instead of the finalized report. The original Annual Report on Form 10-K we filed incorrectly valued the Gold Bullion Loan. The following indicates those accounts in the consolidated balance sheets and the consolidated income statements affected by the restatement.

|

|

|

As Reported

|

|

|

As Restated

|

|

|

Total shareholder deficit

|

|

$

|

3,263,624

|

|

|

$

|

3,742,139

|

|

|

Net loss

|

|

$

|

(1,724,669

|

)

|

|

$

|

(2,203,184

|

)

|

FORM 10-K/A

September 30, 2008

USCORP

TABLE OF CONTENTS

|

FORWARD LOOKING STATEMENTS

|

|

|

| |

|

|

|

|

PART I

|

|

|

|

|

ITEM 1

|

Description of Business

|

|

5

|

|

Item 1A

|

Risk Factors

|

|

21

|

|

Item 1B

|

Unresolved Staff Comments

|

|

24

|

|

ITEM 2

|

Properties

|

|

24

|

|

ITEM 3

|

Legal Proceedings

|

|

24

|

|

ITEM 4

|

Submission of Matters to a Vote of Security Holders

|

|

24

|

| |

|

|

|

|

PART II

|

|

|

|

|

ITEM 5

|

Market for The Company’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

|

25

|

|

Item 6

|

Selected Financial Data

|

|

26

|

|

ITEM 7

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

|

27

|

|

Item 7A

|

Qualitative and Quantitative Disclosure about Market Risk

|

|

30

|

|

ITEM 8

|

Financial Statements

|

|

30

|

| |

|

|

|

|

ITEM 9

|

Changes in and Disagreements with Accountants

|

|

46

|

|

ITEM 9A(T)

|

Controls and Procedures

|

|

46

|

|

ITEM 9B

|

Other Information

|

|

46

|

| |

|

|

|

|

PART III

|

|

|

|

|

ITEM 10

|

Directors, Executive Officers, and Corporate Governance

|

|

46

|

|

ITEM 11

|

Executive Compensation

|

|

48

|

|

ITEM 12

|

Security Ownership of Certain Beneficial Owners and Management

|

|

49

|

|

ITEM 13

|

Certain Relationships and Related Transactions

|

|

50

|

|

ITEM 14

|

Principal Accountant Fees and Services

|

|

50

|

|

ITEM 15

|

Exhibits

|

|

51

|

|

Signatures

|

|

|

51

|

FORWARD LOOKING STATEMENTS

Some of the information contained in this Annual Report may constitute forward-looking statements or statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are based on current expectations and projections about future events. The words “estimate”, “plan”, “intend”, “expect”, “anticipate” and similar expressions are intended to identify forward-looking statements which involve, and are subject to, known and unknown risks, uncertainties and other factors which could cause the Company’s actual results, financial or operating performance, or achievements to differ from future results, financial or operating performance, or achievements expressed or implied by such forward-looking statements. Projections and assumptions contained and expressed herein were reasonably based on information available to the Company at the time so furnished and as of the date of this filing. All such projections and assumptions are subject to significant uncertainties and contingencies, many of which are beyond the Company’s control, and no assurance can be given that the projections will be realized. Potential investors are cautioned not to place undue reliance on any such forward-looking statements, which speak only as of the date hereof. The Company undertakes no obligation to publicly release any revisions to these forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events.

PART I

ITEM 1. DESCRIPTION OF BUSINESS

BACKGROUND

USCorp (hereafter, the “Company”, “we” and “our” refer to USCorp) was formed in May 1989 in the state of Nevada as The Movie Greats Network, Inc. In August 1992, the Company changed its name to The Program Entertainment Group, Inc. In August 1997, the Company changed its name to Santa Maria Resources, Inc. In September 2000, the Company changed its name to Fantasticon, Inc. and in January 2002 the Company changed its name to USCorp.

In April 2002, the Company acquired USMetals, Inc. (“USMetals”), a Nevada corporation, and holder of 141 unpatented lode mining claims by issuing 24,200,000 shares of Company Common Stock in exchange for all of the then issued and outstanding shares of USMetals. USMetals became a wholly owned subsidiary of the Company. Since being acquired by USCorp USMetals has added lode and placer claims for a total of 172 claims that we refer to as the Twin Peaks Project.

Southwest Resource Development, Inc. (“Southwest”) was formed and organized under the laws of the State of Nevada on April 3, 2004 as a wholly owned subsidiary of USCorp. On or about May 29, 2004, Southwest acquired 8 lode and 21 placer mining claims (the “Mining Claims”) in Imperial County, California. Since being formed by USCorp Southwest has added additional claims for a total of 162 claims that we refer to as the Picacho Salton Project.

Both USMetals and Southwest have acquired additional mining claims and USCorp has performed significant exploration work, including the completion of feasibility studies, environmental, ecological and biological reports and performed drilling as described more fully below (See “USMETALS - Summary of Organization and Business” and “SOUTHWEST RESOURCE DEVELOPMENT, INC. - Summary of Organization and Business”).

OVERVIEW

USCorp is an “exploration stage” company. All of the Company’s mining claims are held in the names of its wholly owned subsidiaries, USMetals, Inc. (“USMetals”) and Southwest Resource Development, Inc. (“Southwest”). The Company’s operations center on completing exploration and beginning development of USMetals’ mining property known as the Twin Peaks Project, and Southwest’s mining properties which the Company refers to as the Picacho Salton Project. The Company has realized no revenues from operations to date.

The Company, through its wholly-owned subsidiary, USMetals, owns 172 mining claims in the Eureka Mining District of Yavapai County, Arizona, called the Twin Peaks Project; and through its wholly-owned subsidiary, Southwest, owns a total of 162 mining claims in the Mesquite Mining District of Imperial County, California, called the Picacho Salton Project.

A. RECENT DEVELOPMENTS.

We have included in this discussion of Recent Developments quotes from recent press releases, without providing updating or clarifying statements within the quotations. Additional information, including updates and clarifications, if any, follow in subsequent paragraphs and in other sections of this Report.

In October 2009 we reported that, in order to facilitate ongoing negotiations with a number of mining companies, we had uploaded proprietary technical data to a secure website operated by Pandesa ShareVault for viewing by industry professionals. This data is now available on USCorp’s web site at uscorpnv.com. Access to the proprietary data is by invitation only after signing a confidentiality agreement and it is password protected. The information includes:

|

|

·

|

Feasibility Studies and Technical Reports for Twin Peaks in Arizona, USA and Picacho Salton in California, USA, Historical Assays, Drill Logs and other documents from the late 1800s through 2009

|

|

|

·

|

Maps and photographs of our properties

|

|

|

·

|

Corporate Information and SEC filings

|

Also in October 2009 our former President, Secretary and Treasurer, Larry Dietz, passed away. Larry was a friend and business associate for over 25 years. His knowledge of mineralization occurrences throughout the Southwest was unparalleled. He was a Vietnam veteran. Most importantly, Larry was a truly good man and we miss him.

In December, 2009 members of management, representatives of Geological Support Services, Wondjina Research and Laguna Mountain Environmental along with representatives from the El Centro Office of the Bureau of Land Management (BLM) participated in a conference regarding our application to conduct exploratory drilling on our Picacho Salton Project in Imperial County, California. All remaining issues were thoroughly discussed along with the steps needed to address those issues in order for the BLM to approve the company’s mining plan of operations. It is USCorp’s belief, assuming no additional comments from the BLM, that the approval may be granted during 2011.

In January 2010 we announced the reelection of Robert Dultz as Chairman of the Board of Directors and a Director, Carl O’Baugh and Spencer Eubank to the Board of Directors and the election of Michelle Seibel and B. K. Simerson as directors. We also announced officers as follows: Robert Dultz, President CEO and Acting CFO; and Spencer Eubank as Secretary-Treasurer.

Also in January we released general information about contacts with principals regarding potential financing, joint-venture, merger, acquisition or other business combinations whose purpose is development of the Company’s California and Arizona properties by or with well-financed and highly experienced miners.

In February we began advanced negotiations with two entities. Those communications had as their object one or more of the following: equity and/or debt financing in the US and Europe with our Class A and/or Class B Common, joint-venture, merger, acquisition or other combinations whose purpose is development of USCorp’s California and Arizona properties and public markets by or with well-financed and highly experienced miners and financial entities.

In July we reported that in January, USCorp entered into discussions with a European entity, and some progress was made regarding a private placement of our Common Class B shares in Europe. USCorp was not able to release any information publically or privately regarding this transaction due to the ongoing nature of the discussions. During a spike up to 24 cents per share in March of our Class A shares in the U.S. they were not able to complete their commitment, leading to a mutually agreed termination of contract.

Recently the Proprietary Information about USCorp and technical information about our properties was moved to our web site and is now available, upon request at uscorpnv.com. This is the same body of information that was previously available on the Sharevault web site. Access to the proprietary data is by invitation only after signing a confidentiality agreement and it is password protected. The information includes:

| |

·

|

Feasibility Studies and Technical Reports for Twin Peaks in Arizona, USA and Picacho Salton in California, USA, Historical Assays, Drill Logs and other documents from the late 1800s through 2009

|

| |

·

|

Maps and photographs of our properties

|

| |

·

|

Corporate Information and SEC filings

|

This information is technical in nature; it is intended for mining industry professionals and not the general public. Summaries and reports based on the proprietary information are available to the general public on our web site and in our filings with the Securities and Exchange Commission.

Meanwhile, in California we are in the final stages of obtaining approvals necessary to conduct our planned drilling program on our Picacho Salton Project. The Bureau of Land Management (BLM) has determined that all necessary studies and reports have been submitted and are complete. USCorp has entered the final step before the BLM grants approval of our Mining Plan of Operations for the Picacho site.

During the 30 day Comment Period, during which the public was offered an opportunity to voice concerns, the Quechan Tribe of Fort Yuma did object to our proposed drilling program in a letter dated 8 June 2010. The California BLM is currently working with the Quechan Tribe to resolve those objections. We have been assured by the BLM that resolution is progressing, although when resolution will come is not known.

The following are excerpts from an email received by USCorp from the California Desert District BLM Office:

"…In the process of writing the decision record we will have to respond to every issue brought up by the tribe…From the look of things we might also amend some portions of the E.A. [Environmental Assessment] while resolving some of these issues. … I believe we will be through with this process soon..."

USCorp has addressed the concerns of the Quechan Tribe and expects that approval of our California drilling program will attract the financing necessary to allow USCorp to complete the planned drilling program at the Picacho Salton Project in California.

In August we released an update that discussed how earlier in the month we had filed our Report on Form 10-Q with the U.S. Securities and Exchange Commission (SEC) with financial statements for the period ending June 30, 2010, our fiscal third quarter. A link to the filing is on our web site: http://uscorpnv.com.We also paid the annual maintenance fee for our California and Arizona Claims. We filed 172 claims in Arizona and 162 claims in California. We reduced the number of claims filed in California and therefore our cost basis, by eliminating duplicate lode and placer claims that covered the same ground and correcting or eliminating overlapping claims. Our total acreage remains the same.

In California we are very close to obtaining approvals necessary to initiate our planned drilling program for our Picacho Salton Project. In Arizona the third and final phase of the Twin Peaks drilling program is designed and necessary to generate a report that meets industry measurement reporting standards. Without the third phase completed we cannot say much regarding the results of the first two phases, except to release assay results as we have done previously. Our current projections were made without including the results from the first two phases of the drilling program because of the need for the completion of the third phase.

We continue to discuss financing options with individuals and entities regarding potential acquisition, direct investment, joint-venture, and other business combinations. We have also begun discussions concerning expanding and strengthening our mining management team.

In September we announced that USCorp had signed a non-binding Letter of Intent (LOI) with a multinational Chinese agricultural conglomerate with over USD$700 million in annual revenues. The next step was to complete a definitive agreement spelling out terms and conditions including major financing for USCorp, which we reported in October, see below.

“We believe USCorp has shown itself to be a survivor in an era of economic difficulties that have left many investors whose investments in ‘safe’ or ‘conservative’ companies left them holding the bag, in some cases an empty bag. And in an era of disappearing juniors, forced out of business by the effects of the economy, USCorp is still around, kept alive by the efforts of our management team, working hard and spending frugally, as well as the efforts of our loyal shareholders and investors. USCorp has done what it said it would do, limited only by finances available to fulfill our business plan,” stated Robert Dultz, CEO of USCorp.

On September 29, 2010 a meeting of the shareholders was held without notice pursuant to the applicable provisions of the Nevada corporate statues and the bylaws of the corporation at which meeting a majority of the shares of the company were voted in person and by proxy. A summary of the matters submitted to the security holders follow. All items were approved by majority vote:

The terms and conditions of the Company’s Series A and Series B Preferred stock were amended to read as follows: that all issued and outstanding USCorp Preferred stock, when converted to Common A Stock shall be returned to the Treasury of Preferred Stock of the Company;

The nominations for fiscal 2011 directors by the shareholders were Robert Dultz, Director and Chairman, Spencer Eubank, Director, Michelle Seibel Director, and as outside directors Carl O’Baugh, and B. K. Simerson were approved and the individuals accepted their election to their respective positions;

The Officers of the corporation for fiscal 2011 were elected by the Board of Directors: Robert Dultz CEO, President and acting CFO; Spencer Eubank Secretary-Treasurer; and Michelle Siebel Assistant Secretary;

The purchase of Series A Preferred stock by Officers and Directors of the corporation at par value was authorized by the shareholders as follows: Robert Dultz 1.5 million; Spencer Eubank 500 thousand shares; Michelle Seibel 250 thousand shares; Carl O’Baugh 50 thousand shares and B. K. Simerson 50 thousand shares;

The release of proprietary corporate information, including information regarding the corporation’s properties, to select individuals and entities after acknowledging the confidentiality of that information for the purpose of fund raising, property development, joint-ventures, mergers and acquisitions, loans and other deal making activities was approved by the shareholders;

The re-negotiation of the “Gold Bullion Loan” and Convertible Debentures to gain an extension of time to repay these from the lenders was approved;

The Board was authorized to take whatever actions are deemed necessary by the Board to protect the corporation’s rights, through its subsidiaries to explore, develop and extract the minerals at the Twin Peaks Project property and the Picacho Salton Project property;

Spinning off the corporation’s subsidiaries, USMetals, Inc., and Southwest Resource Development, Inc. when and if deemed appropriate by the Board of Directors was authorized by the Shareholders;

The Shareholders authorized distribution to the corporation’s shareholders as a dividend of shares in USMetals, Inc., and Southwest Resource Development, Inc., at a rate of 1 subsidiary share for each 10 USCorp Common A, Common B, (Regulation S share which trade only offshore, at this time in Europe), and Series A and B Preferred shares (based on conversion rate) owned, or such other rate as may be determined by the Board, and to issue USMetals, Inc., and Southwest Resource Development, Inc. shares to warrant holders of USCorp warrants when they exercise their warrants, fractions to be rounded to the next highest full share;

The determination to implement or to not implement such spin-offs, at the discretion of the Board, when and if necessary, in order to protect the investments and rights of the shareholders as well as the ownership of said properties by USMetals, Inc., and Southwest Resource Development, Inc., was authorized by the shareholders;

The Shareholders authorized the Board to raise funds by selling stock via private placement or public offering in a manner, for prices and at times to be determined by the Board;

The formation of a joint venture entity and/or a joint venture with “the Chinese Conglomerate (“TCC“) according to the Joint Venture Agreement signed by USCorp and TCC when and if TCC fulfills the conditional terms and conditions of said agreement, namely funding of the joint venture was approved by the shareholders;

The shareholders authorized the Board to extend the final cut-off date of January 15, 2011 of the Joint Venture Agreement with TCC if it is deemed by the Board to be in the best interest of the Company and its shareholders to do so; and

The shareholders approved all prior actions of the Board of Directors during fiscal 2010.

In October we signed an Agreement to form a Joint Venture that will initially provide USD$25 million in loans and loan guarantees for development of USCorp’s mining properties. The Agreement also calls for raising USD$100 million publicly or privately.

In November we provided further details with regard to USCorp’s recently announced agreement to form a joint venture to fund up to $125 million to develop gold and silver properties.

USCorp has signed an agreement with a fully reporting public US company, which is the holding company of a major Chinese-based conglomerate with revenues in excess of $700 million (USD) annually, to form a joint venture to complete exploration and begin development of USCorp’s mining properties. The US company, holding Chinese assets, has requested confidentiality until the joint venture is funded with an initial $25 million, which must take place on or before January 15, 2011.

The agreement calls for USCorp to contribute to the joint venture the claims it presently owns in Arizona and California once the $25 million has been received by the joint venture. It is the responsibility of the US company, holding Chinese assets, to secure the $25 million in funding for the joint venture. If it does, then each entity will own 50 percent of the joint venture. In the event that the necessary initial funding is unable to be raised, the agreement provides that it will be cancelled and neither USCorp nor the Chinese partner will be obligated to perform under the Agreement. Initially the joint venture is expected to carry out the following:

* Completion of the drilling program at Twin Peaks in Arizona

* Initiating and completing of the drilling program at Picacho Salton in California

* Updating the mineralization estimates in the Company’s Technical Reports on both properties

* Completion of all engineering and permitting on the two projects

* Retirement of all existing debt

* Commencement of mining operations.

This newly-formed joint venture entity will seek to raise an additional $100 million (USD) to expand its asset base but no assurance can be given that either funding will be successful.

Upon the completion of the funding the claims will be transferred to the joint venture and the joint venture is expected to complete the drilling and development of the properties. Reports from previous drilling show significant gold and silver mineralization on the properties. This joint venture should enable completion of the drilling programs in Arizona and California and commercial development of these properties. USCorp’s Twin Peaks property in Yavapai County, Arizona is near to, and on the same fault zone as the world famous Freeport-McMoRan mine in Arizona. USCorp’s Picacho Salton Property, in California, is adjacent to both NewGold’s open pit gold mine and the Goldcorp claims group in Imperial County California.

This newly-formed joint venture entity will seek to raise an additional $100 million (USD) to expand its asset base but no assurance can be given that either funding will be successful.

As of the date of this report we are awaiting further information from the Chinese Conglomerate.

B. DESCRIPTION OF CURRENT BUSINESS OPERATIONS.

The Company’s plan of operation and business objectives are to engage in (a) the precious metals exploration, mining, and refining business, and (b) the acquisition of qualified candidates engaged in businesses that would complement the Company’s existing or proposed operations. All of the Company’s mining claims are held by its wholly owned subsidiaries.

USMETALS - Summary of Organization and Business.

USMetals (“USMetals”) was formed and organized under the laws of the State of Nevada on May 3, 2000. On or about April 2, 2002, the Company acquired USMetals and its 141 lode mining claims (the “Mining Claims”). The purpose of USMetals is to engage in the business of acquiring and developing mineral properties, exploring for gold, silver, and other non-ferrous metals and minerals within the contiguous United States. It is the further intention of USMetals to mine and to process any commercially-proven reserves developed at its properties. The company has recently expanded the Twin Peaks Project to a total of 172 Lode and Placer claims.

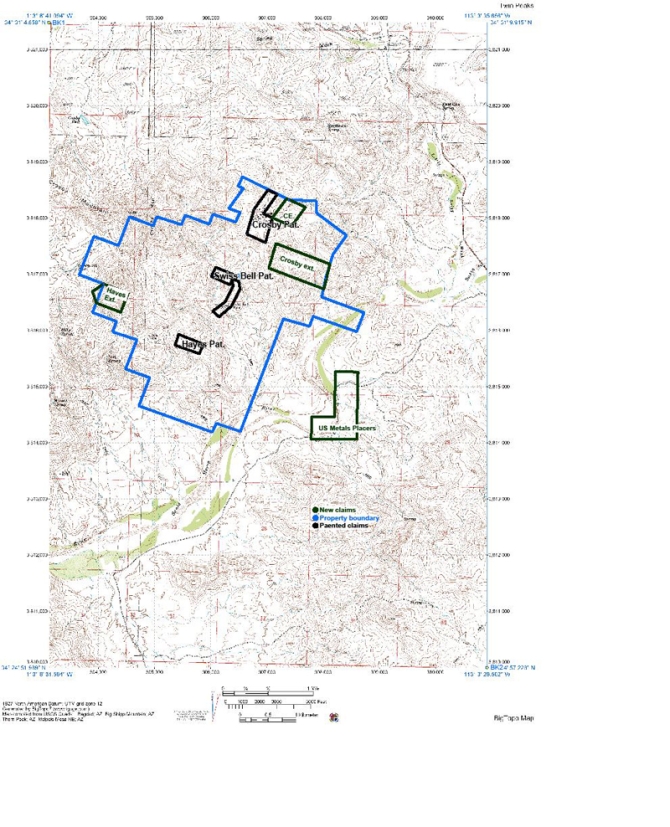

The Mining Claims of USMetals are located in West-Central Arizona, in the Eureka Mining District of Yavapai County, Arizona, approximately 42 miles west of Prescott, Arizona. Within the boundaries of USMetals’ Mining Claims, more commonly referred to as the “Twin Peaks Project”, are the historic sites of the Crosby, Hayes, Swiss Belle and Gloryhole Mines, past producers of gold and silver. The Twin Peaks Project claims are geographically located in the southwestern division of the Eureka Mining District, which includes many significant mines and prospects. There are tungsten mines in the Camp Wood area, to the northeast, the existing historic gold mines and prospects which abut USMetals’ property to the southeast along the Santa Maria River, and tungsten, copper, and zinc mines to the south and southeast. The area has a long history of mining activities. Mining companies can obtain experienced labor, affordable housing, equipment repair, and mining services within the district.

The Santa Maria River traverses the Mining Claims and USMetals is the only company that holds water rights to that section of the river, a valuable asset for a mining company in this arid country.

All of USMetals’ mining properties are unpatented mining claims; consequently, the Company has only possessory title with respect to such properties. The claims were duly transferred by official deed from the prior owner to USMetals on March 22, 2002. The real property upon which USMetals’ claims are located is subject to a paramount lien by the United States of America; all of USMetals’ claims are subject to the applicable rules and regulations of the United States Department of the Interior, Bureau of Land Management, which administers USMetals’ use and activities on said Mining Claims. The Company has paid all of the required fees in order to maintain the Company’s Mining Claims, for the current periods. All of the necessary documents and affidavits have been filed with the Yavapai County Recorder.

The Company and USMetals have had a number of strategic working relationships with various independent contractors in order to develop its Mining Claims. USMetals further relies on the declarations and valuations formed and given in past geological exploration and geochemical studies. USMetals has had consulting and/or independent contractor relationships with Boart Longyear, LLC, Geological Support Services, LLC, Harris Drilling Company, ALS Chemex, SGS Labs, Country Chemist, and the 129-year-old Jacobs Assay 1880 with offices in Tucson, AZ., is recognized by the Bureau of Land Management; Laguna Mountain Environmental, Biozone, Inc. and Wondjina Research Institute. It should be noted that if USMetals was forced to disassociate itself with one or more of the abovementioned independent contractors, it could readily secure the services of other individuals or entities to perform the work or services of equal or greater quality; the loss of any one or all of the abovementioned contractors would not cause USMetals material adverse effects; however, each of these firms has demonstrated its capability and reliability in assisting the Company and USMetals to develop the Mining Claims, and, to date, the abovementioned companies have provided invaluable assistance to The Company’s senior executive management in evaluating the potential represented by USMetals’ Mining Claims.

Geological Support Services, LLC in 2007 completed a feasibility study on the Twin Peaks Project that identified mineralized material on the property and Geological Support Services, LLC also completed a feasibility study on of the Picacho Salton Project that identified mineralized material on that property. During fiscal 2009 we completed Phase 1, Phase 2 and Phase 2.5 of a 3-phase drilling program. For a summary of the results of that drilling program please see “Recent Developments” in our Form 10-K/A for period ending September 30, 2009.

SOUTHWEST RESOURCE DEVELOPMENT, INC. - Summary of Organization and Business

Southwest Resource Development, Inc. (“Southwest”) was formed and organized under the laws of the State of Nevada on April 3, 2004 as a wholly owned subsidiary of USCorp. On or about May 29, 2004, Southwest acquired 8 lode and 21 placer mining claims (the “Mining Claims”) formerly known as the Chocolate Mountain Region Claims and the Picacho Area Claims. In 2007 this claims group was expanded to a total of 106 claims consisting of 22 placers and 84 lodes, on 5,760 acres, and in August 2008 it was again expanded to a total of 235 lode and placer claims called the Picacho Salton Project. In 2010 the claims were consolidated in order to minimize overlapping claims to 162 lode and placer claims. The purpose of Southwest is to engage in the business of acquiring and developing mineral properties, exploring for gold, silver, and other non-ferrous metals and minerals within the contiguous United States. It is the further intention of Southwest to mine and to process any commercially-proven reserves developed at its properties.

In lieu of cash payment for the original 8 lode and 21 placer claims acquired in 2004 the Company entered into what is essentially a joint venture with the former owners whereby the former owners are entitled to receive 20% of all net smelter returns of gold after expenses, whether paid in cash or in kind. All of the remaining claims are wholly owned by USCorp’s subsidiary, Southwest.

The Company has spent the last 8 years developing and implementing a plan that would bring multiple properties under Company ownership. Through its wholly owned subsidiary, Southwest, the Company has now acquired for development of a total of 162 lode and placer claims of precious metal properties located in the Chocolate Mountain region of the Mesquite Mining District in Imperial County, California: Geological testing has successfully recovered gold and silver from dry washes and feeder rills. Laboratory analysis indicates these findings warrant continued development. Geological Support Services, LLC has completed a feasibility study that identified mineralized material on the Picacho Salton Project, The Company has completed archeological and environmental and ecological reports and submitted a Mining Plan of Operations to drill to the Bureau of Land Management who completed their review of the Plan.

The Chocolate Mountains region, located in southeastern Imperial county of California, includes the Picacho State Park and surrounding areas that has a rich history of gold mining activities dating back to 1775. This property is in a district that has been producing gold since the 1800s. In 1890 a large stamp mill was built beside the Colorado River at the town of Picacho. The Picacho Mine was opened in the Picacho Basin area and a narrow gauge railroad began hauling ore from the mine to the mill. By 1904, the town of Picacho had a population of 2,500 people. The ruins of the mill are in the Picacho State Recreation Area a few miles east of the Picacho Salton Project claims. Thousands of people visit the old mill ruins each year. To the south and west of the Picacho Salton Project claims there are ruins of many old placer and lode workings as well as recently producing major mining operations.

Numerous discoveries of placer gold throughout Imperial County have remained undeveloped due to a common problem encountered by small miners. Due to the lack of an adequate water supply to support placer gold recovery operations in the region, scores of small and medium size mining operations have failed to successfully recover precious metals known to exist throughout the region. Southwest believes it has located a potentially adequate water source. Southwest intends to use a state of the art gold recovery system designed and developed for the specific conditions found on these properties. Based on the recent reports of geologists and engineers, Southwest believes this property has the potential to develop into a significant gold producing operation.

Historically, mining has been carried out in the Mesquite Mining District of Imperial County using old hard rock mining and placer methods. However, in 1984, new mining methods (“heap leaching”) were used to develop and mine low-grade ore bodies, with an economically viable cut-off grade as low as .01 to .02 ounces of gold per ton. Geological Support Services, LLC recently completed a feasibility study that has identified mineralized material on the Picacho Salton Project. Southwest intends to go into production as soon as possible after approvals and financing are obtained.

In 2008 we submitted a Mining Plan of Operations (MPO) to the Bureau of Land Management (BLM) to conduct a 3-phase drilling program. During fiscal 2010 we made progress toward gaining approval for our MPO (see “Recent Developments”)

Property descriptions, locations and nature of ownership.

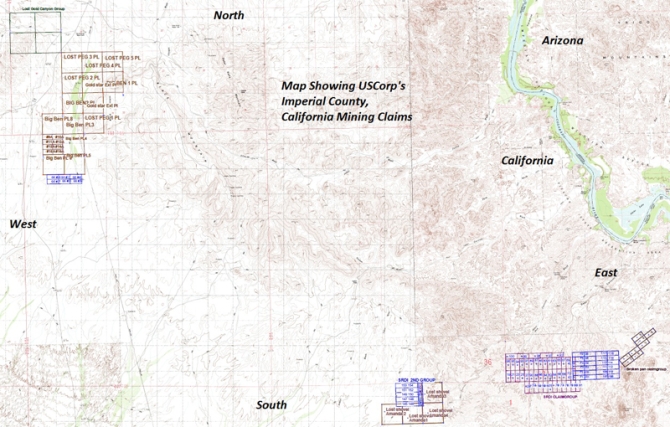

Picacho Salton Project consisting of 162 Lode and Placer Claims in the Mesquite Mining District of Imperial County, California, U.S.A. The Claims group is situated on approximately 5,760 acres consisting of 162 lode and placer mining claims of precious metal properties and located in the Mesquite Mining District of Imperial County, California (see maps below). Some of the most recently added property has common borders to Southwest’s other gold properties. Means of access to the property is by an unmarked private dirt road, south of Picacho State Park.

In Arizona the 172 unpatented lode and placer mining claims, covers 3,440 acres, which the Company refers to as the “Twin Peaks Project”. These claims are located in the Eureka Mining District of Yavapai County, Arizona, U.S.A. Access to the property from the west is by county maintained and private dirt roads from Highway 93 (connecting Phoenix, Arizona with Las Vegas, Nevada).

The Company, through its wholly owned subsidiaries, owns unpatented mining claims and pays an annual Maintenance Fee payment to the Bureau of Land Management (“BLM”) for each of its claims. Maintenance Fee payments of $140 per claim are due on or before August 31 each year.

Maps indicating the locations of our properties.

In the Map below the boxed areas represent the approximate locations of the company’s Picacho Salton Project properties in the Mesquite Mining District of Imperial County, California.

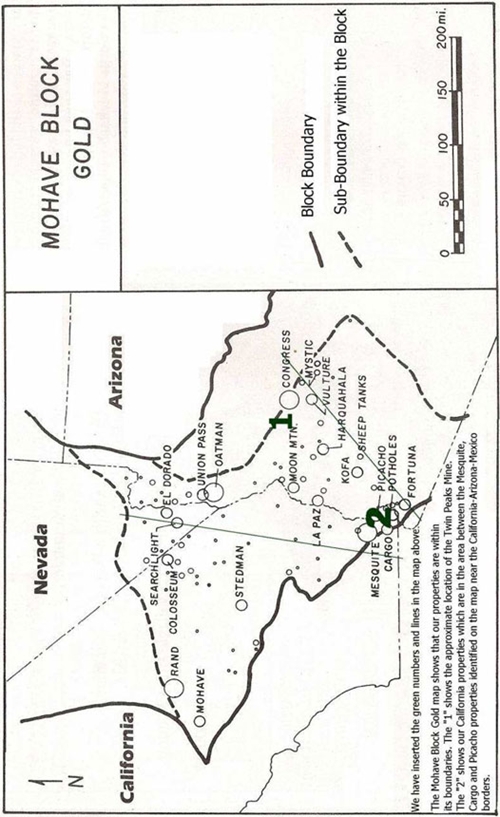

The Picacho Salton claims are represented by the number “2” in the map below. The number “1” in the map below is the approximate location of our Twin Peaks Project claims.

History of previous operations.

Twin Peaks Project claims group, in the Eureka Mining District of Yavapai County, Arizona: From a historical perspective, Spaniards arrived in the area over 400 years ago and used the Santa Maria River to gain access to the claims area. According to historical sources, the local Native Americans were used by the Spaniards to mine gold and silver in the area, which was refined and shipped to Spain. More recently, in the 1800s, John Lawler and Charles Crosby pioneered the Eureka Mining District. In 1883, John Lawler discovered the area was rich in gold, silver, lead, and zinc.

Charles Crosby first discovered the Crosby Mine and worked his claims from 1906 to 1933. His works are on a mineralized structure and flat zone. When the Crosby Mine opened in 1906, it processed 120 ounces of gold per day. It operated a 40-stamp amolotion mill until World War II. The Crosby group of claims are in the northeast corner of the Twin Peaks claims group.

From the mid-1920s to the mid-1930s, a prospector worked the Gloryhole claim, in the southwest quadrant of the Company’s Twin Peaks claims group. The ore he mined ran over 8 ounces of gold per ton. In 1941 and 1942, the claim was yielding 2.6 ounces of gold per ton. At that time, the ore was shipped to the railhead at Hillside and then by train to a smelter in El Paso, Texas.

In 1885, the Hayes Silver Mine opened. The deposit at the mine was so rich - over 300 ounces of gold and silver per ton - that the owners shipped the ore directly to England for smelting and refining. The Hayes claims group is part of the Company’s Twin Peaks claims group and located in the western quadrant of the property.

Picacho Salton Project Claims in the Mesquite Mining District of Imperial County, California: There has been no commercial scale mining on any of the Company’s claims in this region.

The present condition of the property, the work we have completed on the property, our proposed program of exploration and development, and the current state of exploration and development of the property.

Twin Peaks Project Claims Group: The Company has conducted exploration work on the property, including drilling 3,000 feet of core samples in 2002 (in addition to 10,000 feet drilled by prior owners) and road improvements to repair and create dirt road accesses to the property, and re-stake all claims using GPS. The Company relies on geological work of experts performed by us and under prior ownership in support of our reports of the presence of gold, silver, uranium and other mineralization on the property. Geological Support Services, LLC in 2007 completed a feasibility study on the Twin Peaks Project that identified mineralized material. In December 2007, we received a Cultural Resource Survey (an archeological report) for proposed drill sites as part of the Company’s application filed in August 2007 with the BLM to conduct additional drilling to prove up reserves. In August and September and October of 2008 5,000 feet of holes were drilled using reverse circulation drilling, completing Phase One, Phase Two and Phase 2.5 of our current drilling program. During the Phase 1 drilling program the Company participated in a multi-agency test program of the NITON pXRF. The handheld device is purportedly capable of analyzing an ore sample and providing an immediate analysis of all minerals present above an atomic weight of 12. Certified assay results from the labs of samples taken during the Phase 1 and 2 drilling program and the preliminary results produced by the NITON pXRF were compared. The comparison was inconclusive regarding the usefulness of the device in exploration activities. The Company is not conducting mineral extraction operations on this property yet.

Regarding the Picacho Salton Project Claims Groups in the Mesquite Mining District of Imperial County: On November 1, 2006 USCorp announced the acquisition of what we then referred to as the “Picacho Salton Mining Property”, through its wholly owned subsidiary Southwest. Situated on approximately 5,760 acres covering 162 mining claims of precious metal properties and located in the Mesquite Mining District of Imperial County, California, some of these newly acquired claims have common borders to USCorp’s Picacho Gold Property. The Company’s California properties are now collectively known as the Picacho Salton Project. The Company has performed exploration work on the property. The Company relies on geological work of experts performed by us and work performed by experts under prior ownership in support of our early reports of the presence of gold and silver on the property. Geological Support Services, LLC recently completed a feasibility study that has mineralized material on the Picacho Salton Project. The Company has completed archeological, environmental and ecological reports and submitted a mining plan of operations to the Bureau of Land Management who is currently reviewing the plan (see “Recent Developments”). There are no current mineral extraction operations on this property. The proposed program is exploratory in nature.

The physical condition of the plant and equipment and the source of power utilized with respect to each property.

At this time there are no physical plants on any of the Company’s properties. The Company owns rights to water on the Santa Maria River which traverses the Twin Peaks Project property. Power is available on properties adjacent to the Twin Peaks Project and portable generators can be used as necessary. Power is also available on properties adjacent to our placer claims in California and portable generators can be used when necessary. There are natural wells located in several places on our California claims. We will supplement well water with trucked water if necessary.

Adequate roads exist to each of our claims groups. Some existing roads have been repaired or extended.

A brief description of the rock formations and mineralization of existing or potential economic significance on the properties, including the identity of the principal metallic or other constituents.

In regards to the Twin Peaks Project, past geologic valuations have been confirmed by recent geological work as reported in Geological Support Services’ feasibility study on the project indicating mineralized material on claims within the boundaries of the Twin Peaks on the Crosby claims, Hayes claims and Gloryhole claims. The Company uses these historical and current reports in support of its determination that economically viable mineralization is present on the properties.

According to past geologic valuations the Crosby claims are within an area of banded gray schist that is surrounded by light-colored granite and intruded by pegmatite, rhyolite-porphyry, and basic dikes. The vein strikes N10E, and dips 25 to 30 degrees E, and attains a width of up to 18 inches in the old workings. Rich ore from the oxidized zone shows brecciated quartz with abundant cellular limonite. Several structural zones appear to control the mineralization within the claim group. It can be considered that an alignment of a structural trend exists, with a bearing of about N2OE between the Hayes Mine and the Crosby Mine, with the Swiss Belle Mine at midway along the trend. Another structural zone which is expressed by a dike and is reported to run from the Santa Maria River to the base of Hayes Peak has an average bearing of about N53W. The Hayes Shaft was sunk within this dike. The dike probably passes slightly west of the Gloryhole Mine and then intersects a N2OE structural zone near the base of Hayes Peak. The structural zones seem to influence wide areas adjacent to them, which is confirmed by favorable assays and also by the Very Low Frequency Electromagnetic survey. Cut off grade valuations were not performed.

Picacho Salton Project Claims Groups in the Mesquite Mining District of Imperial County: A past geochemical sampling program has indicated mineralized material at the Goldstar placer claims; tonnage and grade valuations were not performed. The Company used such reports in support of its determination that economically viable mineralization may be present on the properties as stated in various historical reports.

Geological Support Services, LLC completed a feasibility study in 2007 on the Twin Peaks Project that identified mineralized material. We have submitted a Mining Plan of Operations to the Bureau of Land Management, and progress has been toward approving our MPO. (See “Recent Developments”).

The phased nature of the exploration process, and the place in the process our current exploration activities occupy.

Phase 1 of the exploration process has been completed on a portion of the Hayes group of claims within the Twin Peaks Project. Phase I supplemented the previous exploration effort with additional geological, geochemical and geophysical surveys, drilling, excavations and road building. We also completed a scoping study. Phase I was designed to furnish pertinent data for the design of Phase II Mining Operation Plan.

Phase II has been completed as of the date of this Annual Report. We have done further exploration on our property, and designed a Test Production program on selected claims within the Twin Peaks claims group which we plan to initiate as soon as approvals and financing have been obtained. This will include an electromagnetic flyover of the entire claim group and completion of a geochemical survey using the boundaries of individual claims to establish a base grid. This sample grid would be tightened in select areas. Simultaneously, the geology will be mapped in order to determine the overall extent of pathfinder mineralization for use in planning additional drilling, gaining a more detailed understanding of the potential of the entire site, and solidifying the mineral land position.

In August 2008 we commenced with drilling and assaying in the areas previously targeted in prior geological reports. The drilling program was designed to confirm the geology and mineralization in the target areas; a broad program is not necessary due to prior geological work. Extra samples have been retained for metallurgical testing on promising zones.

The results of testing the samples has allowed us to plan the conceptual mine and milling plans, including flow-sheets that were used in the feasibility study process along with the on-going economic and cost modeling evaluation of the project. While the results were being evaluated we completed the collection of the archeological and environmental data necessary for further exploration. We submitted the Mining Plans of Operations and we received approvals. Phases 1, 2 and 2.5 of the 3-phase drilling plan have been completed. (see “Recent Developments”). We are seeking additional funding in order to complete the third phase of the drilling program that will allow new resource estimates to be formed based on new measurements.

Test Production Program Budget and Plan

We have plans for Test Production in order to perfect the methods to be used in commercial scale heap leach mining. We have received a Test Production plan and budget for the Picacho Salton Project Claims in the Mesquite Mining District of Imperial County from one of our Consulting Geologists that is summarized as follows:

“To start placer testing operations we must first purchase and modify a wash plant. The pad and setup of the wash plant is next.”

The dirt access road from the Highway to the site (approximately 2 miles) must be reworked or repaired. We will also need a Front End Loader (“F.E.L.”) with Back-Hoe attachment. For continuous hard work excavating trenches, digging test pits and carrying alluvial material back to the wash plant for processing on a daily basis. It would be used for the duration of the test production program.

The sampling method is standard in geological exploration and is confined to dry arroyo drainages and rills. Grab samples taken outside of the dry river beds and rills will be by prospectors pick or regular pick and shovel. Instruments to be used will be a VLF unit, an EM unit, microscopes, spectrometer, GPS unit, possibly an I.R. unit, a magnetometer and miscellaneous sieves. A 10 or 12 kW generator set will independently power the night lights and camper unit. We need to determine if the present wells go down a minimum of 400 feet to reach adequate water supply to support test production wash plant.

We will make a decision whether to proceed with each successive phase of the exploration program upon completion of the previous phase and upon analysis of the results of that program.

We will follow QA/QC protocols provided by the Society for Mining, Metallurgy and Exploration Guidance on best practices for Exploration www.smenet.org.”

Recent Initial Exploration and Exploitation

Although many companies and individuals are engaged in the mining business, including large established mining companies, there is a limited supply of desirable mineral lands available for claim staking, lease, or other acquisition in the United States and other areas where USCorp contemplates conducting its exploration and/or production activities. However, it has been determined by qualified geologists and mining companies that USCorp’s Arizona properties have mineralization of a variety of precious and non-precious minerals. Historically, the specific geographic region in which USCorp intends to conduct its exploratory and mining activities has been the subject of various general samplings, which were performed by the State of Arizona, the United States Department of the Interior Bureau of Mines, and the United States Department of the Interior Bureau of Land Management.

The Company has relied upon a number of studies by companies that are not presently affiliated or associated with USCorp to determine the feasibility and valuation of USCorp’s pursuit to develop the Mining Claims. These studies are comprised of several exploration techniques, such as geological and geophysical surveys, drilling, and excavations, in order to determine the economic potential, and subsequent exploration and mining, of the Claims. These different firms have utilized varied means to calculate the potential of the exploration and development of the Twin Peaks Project’s Mining Claims.

Early Exploration Conducted and Valuations.

The Twin Peaks Project: Past geological studies indicate that beginning in 1981 a geologist performed certain exploratory drillings in order to obtain samples of the contents from the Crosby Mine Site No. 6, located Yavapai County, Arizona (one of the claims in USMetals’ Twin Peaks Project). The geologist drilled 28 core drill holes on the Crosby Mine site. His report was based on 200-foot depth cores. This area was 18,519 cubic yards, or approximately 20,000 tons of mineralized material. The total area that was drilled was 1,500’ x 600’ x 200’. A total of 744 core samples were taken from the 6,000-foot of core hole drillings. The samples were assayed for gold and silver.

The results indicated the presence of mineralization of gold and silver. The core samples also revealed quartz monzonite porphyry formations throughout the area of sampling. The many faults located in this area were of considerable importance in controlling supergene enrichment; the largest quantity and highest grade of ore occurs when these faults intersect or are closely spaced. There was significant evidence of this enrichment recorded from the samples taken from the Crosby Mine site area. And, the gold and silver that was found is natural to the formations of the enrichment zone.

Recent Exploration and Samplings

The 2008 geological surveys, provided by Geological Support Services, LLC, one of USMetals’ principal advisors have confirmed prior geological reports. It was verified that the Twin Peaks Project is on a mineralized structure and flat zone with gold and silver carrying mineralization.

Historically, over 10,000 feet of core drillings were performed and over 1,500 fire assays were conducted. These assays showed gold and silver mineralization.

The geological, geophysical, and geochemical studies stated above were reviewed and evaluated by Geological Support Services LLC, an independent mining, consulting, and geologic firm that was engaged to evaluate the commercial feasibility of the claims. The report and economic study recommended the continuation of exploration and the start of production.

The geological justification for the exploration project at the Twin Peaks Project is that numerous past geological studies have found gold and silver mineralization at various locations within the boundaries of the claims group. There are also areas within the claims group that contain uranium and areas containing polymetals.

The geological justification for the exploration project at the Picacho Salton Project claims is that there is visible gold in the ground and past geological studies have found gold and silver at various locations within the boundaries of the claims groups.

In 2007 we conducted additional exploration, testing; GPS locating, surveying and re-staking of all claims; adding a total of 77 significant claims to the group of which 70 claims are primarily gold bearing and seven claims, approximately 140 acres, are Pink Rhyolite (decorative rock) and construction grade aggregate. Geological Support Services LLC completed a feasibility study covering the gold claims, it says in part: “The feasibility study operating plan assumes an open caste quarry type operation containing [mineralized material]. The plan anticipates conventional truck and shovel mining techniques. Processing to be phased according to ore type and permit approvals. Initial capital costs are anticipated to be $13,790,300 all amounts are in U.S. Dollars.”

A breakdown of the exploration timetable and budget, including estimated amounts that will be required for each exploration activity.

The exploration timetable and budget for the Twin Peaks Project is as follows:

Initial capital costs are currently estimated to be $12,974,728. All amounts are in US dollars to complete a comprehensive drilling program, road repair and extensions, design and building of a test mill. The estimate of six month time period is an estimate of time need to perform tasks only and does not take into account delays for governmental review and approval of our mining plan.

The exploration timetable and budget for the Picacho Salton Project claims is as follows:

Initial capital costs are anticipated to be $13,790,300 all amounts are in U.S. Dollars to complete an electromagnetic flyover, comprehensive road repair and extensions, design and purchase of a wash plant. The estimate of twelve week time period is an estimate of time needed to perform tasks only and does not take into account delays for governmental review and approval of our mining plan.

How the exploration program will be funded.

The Company anticipates that funding will be by equity or debt financing in the form of private placements, working interest joint venture, farm outs, sale or mergers, and/or gold bullion loans in the United States, Europe and Asia. To date we have received the proceeds from a gold bullion loan in the amount of $635,000 as previously reported in Current Report on Form 8-K dated September 27, 2005, in addition to proceeds from a private placement and $1,200,000 in proceeds from convertible debentures. At the beginning of fiscal 2009 we received a commitment in the amount of $2.19 million to finance fiscal 2009 operations. During fiscal 2009 the Company received $400,000 of the $2.19 million in commitments for 2009. The December 2008 payment was not received. We believe that due to the 2008 global financial meltdown the Company did not receive the rest of the committed funds for 2009. We continue to pursue additional sources of financing. (see “Recent Developments”)

Identification of who will be conducting any proposed exploration work, and a discussion of their qualifications.

The Company is utilizing the services of Geological Support Services, LLC, and Wondjina Research Institute and Biozone, Inc., for exploration and geological work on the Company’s properties. Given adequate financing we intend to use additional qualified mining consultants and engineers subject to their availability and willingness and our need, but we have not contracted with any other vendors as of the date of this Annual Report. A summary of the qualifications of Geological Support Services, LLC follows:

Geological Support Services, LLC, Robert A. Cameron, Ph.D. managing partner, is consulting exploration geologist to the Company. Cameron has a Ph.D. in Geophysics from Canterbury University. Since 1987 Cameron has consulted in the mining industry as a geologist in various capacities for companies and projects in the private sector in the United States, Mexico, Australia, New Zealand, West Germany, Poland and Canada. In addition to private consulting, he was a professor of geology and geosciences.

Specific Environmental Regulation.

Mining is subject to potential risks and liabilities associated with pollution of the environment and the disposal of waste products occurring as a result of mineral exploration and production. Environmental liability may result from mining activities conducted by others prior to USMetals’ ownership of a property. Insurance for environmental risks (including potential liability for pollution or other hazards as a result of the disposal of waste products occurring from exploration and production) is not generally available at a reasonable price to companies within the industry. To the extent USMetals is subject to environmental liabilities, the payment of such liabilities would reduce funds otherwise available to USMetals and could have a material adverse effect on USMetals.

In the context of environmental compliance and permitting, including the approval of reclamation plans, USMetals must comply with standards, laws and regulations which may entail greater or lesser costs and delays depending on the nature of the activity to be permitted, constructed and operated and how stringently the regulations are implemented by the applicable regulatory authority. It is possible that the costs and delays associated with compliance with such laws, regulations and permits could become such that a company would not proceed with the development of a project or the operation or further development of a mine. Laws, regulations and regulatory policies involving the protection and remediation of the environment are constantly changing at all levels of government and are generally becoming more restrictive and the costs imposed on the development and operation of mineral properties are increasing as a result of such changes. USMetals has made, and expects to make in the future, significant expenditures to comply with such laws and regulations.

The Environmental Protection Agency (“EPA”) continues the development of a solid waste regulatory program specific to mining operations under the Resource Conservation and Recovery Act (“RCRA”). The difficulty is that many Federal laws duplicate existing state regulations.

Mining companies in the United States are also subject to regulations under (i) the Comprehensive Environmental Response, Compensation and Liability Act of 1980 (“CERCLA”) which regulates and establishes liability for the release of hazardous substances and (ii) the Endangered Species Act (“ESA”) which identifies endangered species of plants and animals and regulates activities to protect these species and their habitats. Revisions to CERCLA and ESA are being considered by Congress; the impact on USMetals and Southwest of these revisions is not clear at this time. Environmental laws and regulations enacted and adopted in the future may have a significant impact upon USMetals’ future operations.

Reclamation plans which are approved by various environmental regulatory authorities are subject to on-going review and modification. Although USMetals’ and Southwest’s management believes that the reclamation plans developed and implemented for its mine sites are reasonable under current conditions, any future re-determination of reclamation conditions or requirements could significantly increase USMetals’ and Southwest’s costs of implementation of such plans.

USCorp expects to utilize “green” methods as much as possible beyond those required by existing environmental rules and regulations. We are exploring using wind and solar power to supplement our energy requirements; captured rainwater in order to reduce use of ground water and water that may have to be trucked in; solar powered conveyor belts to transport ore for processing, green fuels for vehicles, and other environment-friendly technologies that have been recently developed. USCorp principals have had preliminary discussions with international providers of such services that have been field testing the latest “green” technologies in African mines and other locations.

Competition.

There is aggressive competition within the minerals industry to discover and acquire properties considered to have commercial potential. USMetals will compete for promising gold exploration projects with other entities, many of which have greater financial and other resources than USMetals. In addition, USMetals will compete with other firms in its efforts to obtain financing to explore and develop mineral properties including the claims it already owns. Further, the mining industry is typified by companies with significantly greater financial resources and market recognition than the Company. At present, the Company is not a significant factor within this industry.

Employees and Independent Contractors.

As of the date of this Annual Report, the Company did not employ any persons other than its executive officers, an Administrative Assistant, and occasional clerical help. Administrative and clerical employees were laid off at the beginning of May, 2009 and have not been re-hired.

As of the date of this Annual Report, the Company and its wholly owned subsidiaries have utilized as principal consultant and advisor: Geological Support Services, LLC under Robert Cameron, PhD; which, in turn, may work with subcontractors that perform work indirectly for the Company and its subsidiaries; and a secondary consultant and advisor, Wondjina Research Institute under Rich Lundin which, in turn, may work with subcontractors that perform work indirectly for the Company and its subsidiaries. Independent contractors include Harris Drilling and Boart Longyear Drilling.

Item 1A. Risk Factors

Lack of Operating History and Earnings. The Company has no operating history or revenues. The Company expects to incur further losses in the foreseeable future due to significant costs associated with its business development, and the business development of its subsidiaries, including costs associated with its acquisition of new mining claims and/or operations. There can be no assurance that The Company’s operations will ever generate sufficient revenues to fund its continuing operations that The Company will ever generate positive cash flow from its operations, or that The Company will attain or thereafter sustain profitability in any future period.

Speculative Nature of The Company’s Proposed Operations; Dependence Upon Management. The success of The Company’s operations, independently and through its subsidiaries, and its proposed plan of operation will depend largely on the operations, financial condition, and management of The Company. While management intends to engage in the business purposes stated herein, there can be no assurance that it, or any of its subsidiaries, will be successful in conducting such business. Presently, the Company is totally dependent upon the personal efforts of its current management. The loss of any officer or director of The Company could have a material adverse effect upon its business and future prospects. The Company does not presently have key-man life insurance upon the life of any of its officers or directors. None of our management are chemists, metallurgists, mining engineers or geologists and as such do not have the technical experience in exploring for, starting, and/or operating a mine. Upon adequate funding management intends to hire qualified and experienced personnel, including additional officers and directors, and mining specialists, professionals and consulting firms to advise management as needed; however there can be no assurance that management will be successful in raising the necessary funds, recruiting, hiring and retaining such qualified individuals. Such consultants have no fiduciary duty to The Company or its shareholders, and may not perform as expected. The success of The Company will, in significant part, depend upon the efforts and abilities of management, including such consultants as are or may be engaged in the future.

Risks Inherent In Exploration and Mining Operations. Mineral exploration is highly speculative and capital intensive. Most exploration efforts are not successful, in that they do not result in the discovery of mineralization of sufficient quantity or quality to be profitably mined. The Company’s Mining Claims are also indirectly subject to all hazards and risks normally incidental to developing and operating mining properties. These risks include insufficient ore reserves, fluctuations in production costs that may make mining of reserves uneconomic; significant environmental and other regulatory restrictions; and the risks of injury to persons, property or the environment. In particular, the profitability of gold mining operations is directly related to the price of gold. The price of gold fluctuates widely and is affected by numerous factors that are beyond the control of any mining company. These factors include expectations with respect to the rate of inflation, the exchange rates of the dollar and other currencies, interest rates, global or regional political, economic or banking crises, and a number of other factors. If the price of gold should drop dramatically, the value of the Mining Claims could also drop dramatically, and the Company might then be unable to recover its investment in those interests or properties. Selection of a property for exploration or development; the determination to construct a mine and to place it into production, and the dedication of funds necessary to achieve such purposes, are decisions that must be made long before the first revenues from production will be received. Price fluctuations between the time that such decisions are made and the commencement of production can drastically affect the economics of a mine. The volatility of gold prices represents a substantial risk, generally, which no amount of planning or technical expertise can eliminate.

Uncertainty of Reserves and Mineralization Estimates. There are numerous uncertainties inherent in estimating proven and probable reserves and mineralization, including many factors beyond The Company’s control. The estimation of reserves and mineralization is a subjective process and the accuracy of any such estimates is a function of the quality of available data and of engineering and geological interpretation and judgment. Results of drilling, metallurgical testing and production and the evaluation of mine plans subsequent to the date of any estimate may justify revision of such estimates. No assurances can be given that the volume and grade of reserves recovered and rates of production will not be less than anticipated. Assumptions about prices are subject to great uncertainty and gold prices have fluctuated widely in the past. Declines in the market price of gold or other precious metals also may render reserves or mineralization containing relatively lower grades of ore uneconomic to exploit. Changes in operating and capital costs and other factors including, but not limited to, short-term operating factors such as the need for sequential development of ore bodies and the processing of new or different ore grades, may materially and adversely affect reserves.

Environmental Risks. Mining is subject to potential risks and liabilities associated with pollution of the environment and the disposal of waste products occurring as a result of mineral exploration and production. Insurance against environmental risks (including potential liability for pollution or other hazards as a result of the disposal of waste products occurring from exploration and production) is not generally available to The Company (or to other companies within the gold industry) at a reasonable price. To the extent The Company becomes subject to environmental liabilities, the satisfaction of any such liabilities would reduce funds otherwise available and could have a material adverse effect on The Company. Laws and regulations intended to ensure the protection of the environment are constantly changing, and are generally becoming more restrictive.

Proposed Federal Legislation. Beginning in the 1990s, the U.S. Congress adopted revisions of the General Mining Law of 1872, which governs the creation of mining claims and related activities on Federal public lands in the United States. Similarly, the U. S. Congress and the Clinton Administration eliminated the U.S. Bureau of Mines, which was the agency responsible for gathering and maintaining data on mines throughout the United States. Beyond changes to the existing laws, the Congress or the Bush Administration, or the incoming Obama Administration may propose or adopt new laws; any such revisions could also impair USMetals’ and Southwest’s ability to develop, in the future, any mineral prospects that are located on unpatented mining claims on Federal lands.

Title to Properties. The validity of unpatented mining claims, which constitute all of The Company’s property holdings, is often uncertain and such validity is always subject to contest. Unpatented mining claims are unique property interests and are generally considered subject to greater title risks than patented mining claims, or other real property interests that are owned in fee simple. The Company has not filed any patent applications for any of its properties that are located on Federal public lands in the United States, (specifically, in the States of Arizona and California), and, under changes to the General Mining Law, patents may not be available for such properties. Although management believes it has taken requisite action to acquire satisfactory title to its undeveloped properties, it does not intend to go to the expense to obtain title opinions until financing is secured to develop the property, with the attendant risk that title to some properties, particularly title to undeveloped properties, may be defective.

Competition. There is aggressive competition within the minerals industry to discover and acquire properties considered to have commercial potential. The Company will compete for promising gold exploration projects with other entities, many of which have greater financial and other resources than The Company. In addition, the Company will compete with other firms in its efforts to obtain financing to explore and develop mineral properties.

The Company’s Financial Statements Contain a “Going Concern Qualification.” The Company may not be able to operate as a going concern. The independent auditors’ report accompanying its financial statements contains an explanation that The Company’s financial statements have been prepared assuming that it will continue as a going concern. Note 1 to these financial statements indicates that The Company is in the exploration stage and needs additional funds to implement its plan of operations. This condition raises substantial doubt about its ability to continue as a going concern. The financial statements do not include any adjustments that might result from the outcome of this uncertainty. The Company’s audit report and financial statements are included herein as “PART II, Item 7”.

Uncertainty As To Management’s Ability To Control Costs And Expenses. With respect to The Company’s development of its mining properties and the implementation of commercial operations, management cannot accurately project or give any assurance, with respect to its ability to control development and operating costs and/or expenses. Consequently, if management is not able to adequately control costs and expenses, such operations may not generate any profit or may result in operating losses.

No Dividends. The Company has not paid any dividends nor, by reason of its present financial status and contemplated financial requirements, does it anticipate paying any dividends in the foreseeable future.

Risks of Low-Priced Stocks And Possible Effect of “Penny Stock” Rules on Liquidity. Currently the Company’s stock is defined as a “penny stock” under Rule 3a51-1 adopted by the Securities and Exchange Commission under the Securities Exchange Act of 1934, as amended. In general, a “penny stock” includes securities of companies which are not listed on the principal stock exchanges or the National Association of Securities Dealers Automated Quotation System (“NASDAQ”) or National Market System (“NASDAQ NMS”) and have a bid price in the market of less than $5.00; and companies with net tangible assets of less than $2,000,000 ($5,000,000 if the issuer has been in continuous operation for less than three years), or which has recorded revenues of less than $6,000,000 in the last three years. “Penny stocks” are subject to rule 15g-9, which imposes additional sales practice requirements on broker-dealers that sell such securities to persons other than established customers and “accredited investors” (generally, individuals with net worth in excess of $1,000,000 or annual incomes exceeding $200,000, or $300,000 together with their spouses, or individuals who are officers or directors of the issuer of the securities). For transactions covered by Rule 15g-9, a broker-dealer must make a special suitability determination for the purchaser and have received the purchaser’s written consent to the transaction prior to sale. Consequently, this rule may adversely affect the ability of broker-dealers to sell The Company’s stock, and therefore, may adversely affect the ability of The Company’s stockholders to sell stock in the public market.