UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________________

Form 10-K/A

(Amendment No. 1)

__________________________________

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2017 |

Or

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to . |

Commission file number 0-26844

__________________________________

RADISYS CORPORATION

(Exact name of registrant as specified in its charter)

__________________________________

Oregon | 93-0945232 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) | |

5435 N.E. Dawson Creek Drive, Hillsboro, OR | 97124 | |

(Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code | (503) 615-1100 | |

Securities registered pursuant to Section 12(b) of the Act:

Title of each Class | Name of each exchange on which registered | |

Common Stock, No Par Value | The Nasdaq Stock Market LLC | |

Securities registered pursuant to Section 12(g) of the Act:

None

____________________________________________________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to the filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or in any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non accelerated filer, a smaller reporting company or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer o | Accelerated Filer x | |

Non-accelerated filer o (Do not check if a smaller reporting company) | Smaller Reporting Company o | |

Emerging Growth Company o | ||

If an emerging growth company, indicate by check mark whether the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates (based upon the closing price of the Nasdaq Global Select Market on June 30, 2017 of $3.76) of the registrant as of June 30, 2017 was approximately $142,792,381. For purposes of the calculation executive officers, directors and holders of 10% or more of the outstanding common stock are considered affiliates.

Number of shares of common stock outstanding as of April 25, 2018: 39,430,859

DOCUMENTS INCORPORATED BY REFERENCE

None

EXPLANATORY NOTE

This Amendment No. 1 on Form 10-K/A (this "Amendment") amends Radisys Corporation's Annual Report on Form 10-K for the fiscal year ended December 31, 2017, originally filed with the Securities and Exchange Commission (the "SEC") on February 28, 2018 (the "Original Filing"). We are filing this Amendment to include the information required by Part III of Form 10-K, which was not included in the Original Filing because we planned to include such information in a definitive Proxy Statement. However, we will not file a definitive Proxy Statement with the SEC within 120 days after the end of our fiscal year ended December 31, 2017. Accordingly, such information is included in our Form 10-K by this Amendment.

This Amendment also contains new certifications pursuant to Section 302 of the Sarbanes-Oxley Act of 2002, which are attached hereto. Because no financial statements are included in this Amendment and this Amendment does not contain or amend any disclosure with respect to Items 307 and 308 of Regulation S-K, paragraphs 3, 4, and 5 of the Section 302 certifications have been omitted.

Except as described above, no other changes have been made to the Original Filing. The Original Filing continues to speak as of the date of the Original Filing, and we have not updated the disclosures contained therein to reflect any events which occurred at a date subsequent to the filing of the Original Filing. In this Amendment, unless context otherwise requires, or as otherwise indicated, "we," "us," "our" and similar terms, as well as references to the "Company" and "Radisys" refer to Radisys Corporation and include all of our consolidated subsidiaries.

2

RADISYS CORPORATION

FORM 10-K/A

TABLE OF CONTENTS

Page | ||

PART III | ||

Item 10. | Directors, Executive Officers and Corporate Governance | |

Item 11. | Executive Compensation | |

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | |

Item 13. | Certain Relationships and Related Transactions, and Director Independence | |

Item 14. | Principal Accounting Fees and Services | |

PART IV | ||

Item 15. | Exhibits and Financial Statement Schedules | |

Signatures | ||

3

PART III

Item 10. Directors, Executive Officers and Corporate Governance

Board of Directors

Our Board of Directors currently consists of four members. The directors are elected at the annual meeting of shareholders to serve until the next annual meeting and until their successors are elected and qualified.

Set forth in the table below is the name, age and position with the Company of each of our directors. Additional information about each of the directors is provided below the table and in "Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters." There are no family relationships among our directors and executive officers.

Name | Age | Position |

Stephen L. Domenik | 66 | Chairman of the Board |

Brian Bronson | 46 | Director, President and Chief Executive Officer |

Michael G. Hluchyj | 63 | Director |

M. Niel Ransom | 68 | Director |

Stephen L. Domenik joined us in February 2018 and was appointed Chairman of the Board effective February 23, 2018. Since 1995, Mr. Domenik has served as a general partner of Sevin Rosen Funds, a venture capital firm. From 2010 to 2016, Mr. Domenik served on the board of directors of Pixelworks, Inc., a video display processing technology company and, from February 2016 to April 2016, Mr. Domenik served as its Interim Chief Executive Officer. Mr. Domenik is also a member of the boards of directors of Emcore Corporation, a provider of advanced mixed-signal optics products (since 2013), and MoSys, Inc., a semiconductor company (since 2012). From 2014 to 2015, Mr. Domenik served as a member on the board of directors of Meru Networks, Inc., a cybersecurity solutions company. From 2012 to 2013, Mr. Domenik served as a member of the board of directors of PLX Technology, Inc., an integrated circuit company. Mr. Domenik holds an A.B. in Physics and M.S.E.E. from the University of California, Berkeley.

We believe that Mr. Domenik's qualifications to serve as a director include his 23 years of experience in the venture capital business, extensive board committee service as well as serving as Chief Executive Officer of public and private companies.

Brian Bronson joined us in 1999 and has been an officer since 2000. From July 2011 through October 2012, he served as our President and Chief Financial Officer. In October 2012, he was named our Chief Executive Officer and President. He was also appointed to serve as a director by the Board on October 2, 2012. Prior to his being named as our Chief Financial Officer in November 2006, Mr. Bronson held the positions of our Vice President of Finance and Business Development and Treasurer and Chief Accounting Officer. Before joining Radisys, from 1995 to 1999, Mr. Bronson held a number of financial management roles at Tektronix, Inc., a company that designs and manufactures test and measurement solutions for scientists, engineers and technicians, where he was responsible for investor relations, finance and accounting functions for both domestic and international operations. Prior to joining Tektronix, Inc., Mr. Bronson practiced as a Certified Public Accountant with the accounting firm Deloitte and Touche, LLP. Mr. Bronson holds a bachelor's degree in Business Administration and Communications from Oregon State University.

We believe that Mr. Bronson's qualifications to serve as a director include his 19 years of experience in the technology industry, which provide valuable leadership to the Board and to the Company. His 15 years of experience in key positions throughout the Company allow him to provide valuable perspective to the Board on the Company's operations and finances. Mr. Bronson also brings to the Board his experience as a Certified Public Accountant. The Board believes the combination of these experiences provides valuable insight and perspective to the Board.

Michael G. Hluchyj has served as a director since August 2015. From December 2012 through January 2015, Mr. Hluchyj served as Chief Technology Officer, Carrier Products for Akamai, a leading content delivery network services provider, with responsibilities that included carrier service provider initiatives related to Network Functions Virtualization (NFV) and its specification. Mr. Hluchyj joined Akamai through the acquisition of Verivue, a leading provider of content delivery solutions to service providers, where he was a founder and Chief Technology Officer from November 2006 through December 2012. Prior to founding Verivue, Mr. Hluchyj was a founder and Chief Technology Officer of Sonus Networks, a

4

leading global provider of voice over IP (VoIP) infrastructure solutions to carriers. Mr. Hluchyj is a Fellow of the IEEE, has been awarded 39 U.S. patents, and is widely published on subjects such as switching and traffic management in multimedia packet networks. He also serves as a board member of Uptycs, a cybersecurity startup. Mr. Hluchyj holds a B.S. in electrical engineering from the University of Massachusetts at Amherst and an M.S. and a Ph.D. in electrical engineering from the Massachusetts Institute of Technology.

We believe that Mr. Hluchyj's qualifications to serve as a director include his proven track record of building successful companies, and we believe his expertise in the area of Software-Defined Networking (SDN) and NFV will help accelerate our Software-Systems strategy, specifically our FlowEngine and MediaEngine product lines, moving forward.

M. Niel Ransom has served as a director since August 2010. Mr. Ransom is a principal of Ransomshire Associates, Inc., an advisory firm he founded in 2005. He also serves as Chairman of the Board for Saguna Networks, a provider of MobileEdge computing solutions and as a board member of MultiPhy, a provider of integrated circuits for high-speed optical communications, and OPNT, a provider of precision network timing solutions. Mr. Ransom was previously a director of ECI Telecom, a provider of networking infrastructure equipment, Applied Micro, a processor and communication device manufacturer, Cyan Inc., a provider of packet-optical and SDN solutions, and Polatis, a provider of high-performance optical switching solutions. Previously, as worldwide Chief Technology Officer of Alcatel, a company that designs, develops and markets a diversified range of mobile devices, and a member of its Executive Committee, he was responsible for research, corporate strategy, intellectual property and R&D investment. Prior to that, he directed Alcatel's access and metro optical business in North America. Earlier in his career, he directed the Advanced Technology Systems Center at BellSouth and various development and applied research organizations in voice and data switching at Bell Laboratories. He holds a Ph.D. in electrical engineering from the University of Notre Dame, BSEE and MSEE degrees from Old Dominion University, and an MBA from the University of Chicago.

We believe that Mr. Ransom brings to our Board significant international experience acquired during his service as worldwide Chief Technology Officer of Alcatel. Further, Mr. Ransom's experience at Alcatel enables him to offer valuable perspectives on Radisys' corporate planning and development. As a principal of a private advisory firm, Mr. Ransom brings to the Board significant senior leadership, operational and financial expertise. His board engagements in venture capital-based startups bring valuable insights in emerging technology trends.

Executive Officers

Set forth in the table below is the name, age and position with the Company of each of our executive officers:

Name | Age | Position | ||

Brian Bronson | 46 | President and Chief Executive Officer | ||

Jonathan Wilson | 35 | Chief Financial Officer, Vice President of Finance and Corporate Secretary | ||

See Brian Bronson's biography above.

Jonathan Wilson joined us in May 2011 as our Assistant Corporate Controller. In February 2015, he was named our Chief Financial Officer, VP of Finance and Secretary. Prior to his being named as our Chief Financial Officer, Mr. Wilson held the position of our Director of Finance where he was responsible for the corporate financial planning and analysis, sales operations, tax, treasury and legal functions. He was also previously our Corporate Controller where he held broad responsibilities which included leading the global accounting organization, SEC reporting, and corporate compliance functions. Prior to joining us, Mr. Wilson practiced as a Certified Public Accountant with the accounting firm KPMG where he worked from August 2005 to May 2011, focused on serving publicly listed software and high-tech manufacturing clients. Mr. Wilson holds a B.S. degree in Accounting from Linfield College.

Code of Ethics

Our Board of Directors has adopted a Code of Ethics applicable to each of our directors, officers, employees and agents, including our Chief Executive Officer, Chief Financial Officer, Controller or persons performing similar functions. Our Code of Ethics is available on our website at www.radisys.com under About/Corporate Responsibility. We intend to disclose future amendments to, or waivers from, certain provisions of the Code on our website or in a Current Report on Form 8-K. Information contained on the Company's website is not included as part of, or incorporated by reference into, this report.

5

Director Nomination Policy

The Nominating and Corporate Governance Committee (the "Nominating Committee") has a policy with regard to consideration of director candidates recommended by shareholders. The Nominating Committee will consider nominees recommended by our shareholders holding no less than 10,000 shares of our common stock continuously for at least 12 months prior to the date of the submission of the recommendation. A shareholder that desires to recommend a candidate for election to our Board of Directors shall direct his or her recommendation in writing to Radisys Corporation, 5435 NE Dawson Creek Drive, Hillsboro, Oregon 97124, Attention: Corporate Secretary. The recommendation must include the candidate's name, home and business contact information, detailed biographical data and qualifications, information regarding any relationships between us and the candidate within the last three years and evidence of the recommending shareholder's ownership of our common stock. In addition, the recommendation shall also contain a statement from the recommending shareholder in support of the candidate, professional references, particularly within the context of those relevant to membership on our Board of Directors, including issues of character, judgment, diversity, age, independence, expertise, corporate experience, length of service, other commitments and the like, personal references and a written indication by the candidate of his or her willingness to serve, if elected.

Audit Committee Matters

We maintain an Audit Committee currently consisting of Stephen L. Domenik as Chair, Michael G. Hluchyj, and M. Niel Ransom. All of the members of the Audit Committee are “independent directors” within the meaning of the Nasdaq listing standards and Rule 10A-3 of the Exchange Act. In addition, our Board of Directors has determined that Stephen L. Domenik qualifies as “audit committee financial expert” as defined by the SEC in Item 407(d)(5) of Regulation S-K promulgated under the Securities Act and is independent within the meaning of Rule 10A-3 of the Exchange Act. Mr. Domenik qualifies as an audit committee financial expert by virtue of his long service in a number of senior executive positions including Chief Executive Officer at Pixelworks, Inc. and Identronix, a private company. Additionally, Mr. Domenik has served on the audit committees of Emcore Corporation, MoSys, Inc., Meru Networks, Inc., PLX Technology, Inc., and Pixelworks, Inc. Our Audit Committee assists our Board of Directors in fulfilling its oversight responsibilities relating to corporate accounting, our reporting practices and the quality and integrity of our financial reports; oversight of audit and financial risk; compliance with law and the maintenance of our ethical standards; and the effectiveness of our internal controls. The full responsibilities of our Audit Committee are set forth in its charter, a copy of which can be found on our website at www.radisys.com under About/Investor Relations/Corporate Governance. Our Audit Committee met four times in the last fiscal year.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires our directors, executive officers and persons who own more than 10% of our outstanding common stock to file with the SEC reports of changes in ownership of the common stock of the Company held by such persons. Officers, directors and greater than 10% shareholders are also required to furnish the Company with copies of all forms they file under this regulation. To the Company's knowledge, based solely on a review of the copies of the reports received by the Company during and with respect to fiscal year 2017 and on written representations of certain reporting persons, no director, executive officer or beneficial owner of more than 10% of the outstanding common stock of the Company failed to file, on a timely basis, reports required by Section 16(a) of the Exchange Act.

Certifications

Certifications of our Chief Executive Officer and Chief Financial Officer, pursuant to Sections 302 and 906 of the Sarbanes-Oxley Act of 2002, were filed with the Original Filing. Currently dated certifications pursuant to Section 302, as required by the SEC, are attached to this Amendment.

6

Item 11. Executive Compensation

Executive Officer Compensation

Executive Compensation Discussion and Analysis (CD&A)

Section I: Executive Summary

This Compensation Discussion and Analysis describes the compensation program for our Named Executive Officers. During 2017, these individuals were:

• | Brian Bronson, our President and Chief Executive Officer (our “CEO”), |

• | Jonathan Wilson, our Chief Financial Officer, Vice President of Finance and Corporate Secretary (our “CFO”), and |

• | Stephen Collins, our former Vice President of Global Sales. |

This Compensation Discussion and Analysis describes the material elements of our executive compensation program during 2017. It also provides an overview of our executive compensation philosophy and objectives and discusses how and why the Compensation and Development Committee of our Board of Directors (the “Compensation Committee”) arrived at the specific compensation decisions for each of our named executive officers.

On November 16, 2017, Stephen Collins, our Vice President of Global Sales, left the Company.

The Company experienced significant business and financial headwinds in 2017 due in large part to a material shortfall in revenues relative to the Company’s operating plan from its largest customer. During the year, the Company’s largest customer elected to discontinue its internal program which leveraged the Company’s DCEngine products, and coupled with limited traction in securing new customer engagements, DCEngine revenues missed 2017 revenue objectives by nearly $65 million. Further, while the telecom industry continues to undergo significant disruption, the timing of securing new programs with customers resulted in delays in expected revenue within the Company’s Software-Systems business. Taken together, this resulted in a decline in total revenue of over $70 million from 2016 levels and a significant shortfall against the Company’s original 2017 expectations. The impact of these shortfalls resulted in significant operating losses and inventory write-downs specifically within the Company’s Hardware Solutions segment.

Our Compensation Committee and management team have had a longstanding commitment to pay-for-performance. This has been evidenced during the last several years by our efforts to align our executive compensation strategy with our business strategy with incentives, including performance-based vesting for equity awards that tie realized compensation for our executives with goals that will drive long-term shareholder return. In fiscal 2017, consistent with this pay-for-performance philosophy and due to the shortfalls relative to our operating plan, the Company missed its internal targets for cash variable and performance equity compensation and accordingly no cash variable compensation was earned, or paid, relative to 2017 results, and performance-based equity awards were unearned.

As a result of the underlying changes in its business, the Company announced material restructuring actions in early 2018 to reduce costs across the Hardware Solutions segment while also focusing strategically on the go-forward Software-Systems segment. Moving forward, the Company expects to derive an increasing proportion of its revenue from its high margin Software-Systems business and as revenue from this business scales it is expected to enable the Company to return to positive levels of earnings and cash flow in the second half of 2018. Our Compensation Committee remains committed to a strong pay-for-performance approach during this transition. The Compensation Committee regularly reviews our approach to pay, considering input from an independent compensation consultant, to deliver executive compensation in an approach that:

• | rewards for short-term performance that is critical to our long-term success; |

• | emphasizes long-term vesting equity to retain our executives and reward them for sustained value creation; and |

• | is competitive with market norms and results in a reasonable cost to shareholders. |

Fiscal 2017 Executive Compensation Highlights

Based on our overall operating environment and these results, the following key compensation actions were taken with respect to the Named Executive Officers for fiscal 2017:

• | Salary Increases for Select Named Executive Officers - The Compensation Committee did not increase the base salary levels for our President and CEO. In the case of our CFO, the Compensation Committee approved an |

7

increase in base salary to $300,000, which reflected an increase of approximately 9% from the salary rate in effect prior to the adjustment. In the case of our VP of Global Sales, the Compensation Committee approved an increase in base salary to $290,000, which reflected an increase of approximately 5% from the salary rate in effect prior to the adjustment. The Compensation Committee also approved a 5% increase in target compensation under our Variable Compensation Plan for our VP of Global Sales. The Compensation Committee approved these changes following a review of performance and to more closely align target compensation to the 50th percentile.

• | Short-Term Cash Bonuses - No cash bonuses were paid to our Named Executive Officers. The 2017 short-term cash bonus plan funding was tied to strategic revenue (Software-Systems and DCEngine) attainment, for which the Company did not meet minimum levels required to fund any payout under the plan. |

• | Continued Emphasis on Performance-Based Equity - In early 2017, the Compensation Committee modified the long-term incentive component of our executive compensation program to change the long-term incentive mix to consist of time-based restricted stock units (“RSU”) and performance-based RSU awards that may be settled for shares of our common stock based on our achievement of pre-established target levels for strategic revenue in 2017 and 2018. This mix was designed to reflect the expected stabilization of our business and an increased ability to tie our long-term incentive compensation opportunities to longer-term projected financial goals. Note that given the material reduction in go-forward DCEngine expectations, of which revenue from this product line was incorporated in the strategic revenue targets, the Company now expects the performance-based RSUs will not vest in future periods and such shares will be returned to the 2007 Stock Plan upon expiration of the performance measures. |

The changes to our compensation program in 2017 reflected our desire to maintain a strong pay-for-performance culture and to continue to align compensation program with our business strategy. Our management team and Compensation Committee are engaged on an ongoing basis in reviewing our executive compensation program and communicating with our largest shareholders to better understand their views on our business, our turnaround strategy, and how we could best position our executive compensation program to support this strategy. Feedback from our shareholders was an important consideration in the determination of the compensation strategy applicable to our Named Executive Officers in 2017.

Fiscal 2018 Executive Compensation Considerations

In order to align to the Company’s strategic direction and shareholder interests, and to retain and motivate essential executive team members necessary to further accelerate momentum in the Company’s strategic product lines, the Compensation Committee critically reviewed all aspects of the executive compensation program in late 2017 and early 2018. As a result of the material changes in the Company’s business tied predominantly to DCEngine, coupled with the challenge in predicting future revenues for purposes of establishing appropriate long-term performance targets, the Compensation Committee elected to move the mix of equity awards in 2018 to be 100% time-based stock options. In approving this change, the Compensation Committee considered that stock options are an inherently performance-based instrument for Radisys at the current stage in the Company’s development, with sustained shareholder value creation being the primary objective at this time.

Further, the short-term cash bonus program will be funded based on the attainment of non-GAAP operating income against plan targets. The Compensation Committee believes these awards align directly with the interests of shareholders by incenting management to return the Company to non-GAAP profitability near-term and then creating value for the executive management team and other key leaders longer term based on stock price appreciation.

Compensation Philosophy

As the Company has progressed through its strategic transformation over the past several years, the Compensation Committee maintained a strong pay-for-performance philosophy that is competitive with other similarly sized technology companies. In addition, the Compensation Committee set clear guiding principles for executive compensation programs to ensure strategic alignment with the business direction with a focus on building shareholder value, providing motivation and incentive for stretch performance and retention and simplicity of plan designs. The Company's executive compensation programs are designed to reflect the following key objectives:

• | To attract and retain executives needed to achieve the Company's business objectives. This objective is achieved through no less than annual reviews of executive total compensation and benefit programs to ensure market competitiveness. |

• | To substantially link executive compensation with the achievement of near-term operating plans. This is achieved through variable compensation programs which are directly aligned to short-term goals of improving levels of operating income. |

8

• | To provide the opportunity for additional variable compensation through the achievement of longer-term strategic objectives and the creation of shareholder value. This is achieved through the issuance of awards under equity-based compensation programs and includes the use of performance-based equity for which realized compensation is a function of stock price appreciation and/or financial goals such as year-on-year revenue growth. |

The Compensation Committee believes the amount of variable or "at risk" compensation tied to meeting company objectives should increase as a percentage of an executive's overall compensation as the executive’s level of responsibility increases. An executive's target compensation is based on his/her job scope and level of responsibility, with a large portion of the opportunity tied to Company performance and shareholder return. We believe the Company’s balance between base salary and both short- and long-term variable compensation is competitive with other similar companies in the industry peer group.

Pay for Performance

Our compensation program is designed to rely heavily on variable, at-risk compensation such that the value realized by our Named Executive Officers increases or decreases based on the overall performance of the Company. When determining the targets for executive variable compensation, the Compensation Committee selects metrics that it believes are most closely tied to the market’s expectation of both near-term financial objectives and those strategic goals necessary for long-term success. In 2017, variable cash compensation was contingent upon the achievement of consolidated revenue, while performance-based equity vesting was dependent upon achievement of certain levels of strategic product revenue growth and non-GAAP operating income.

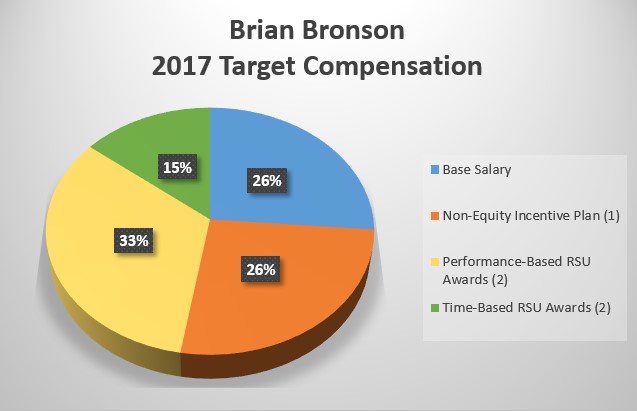

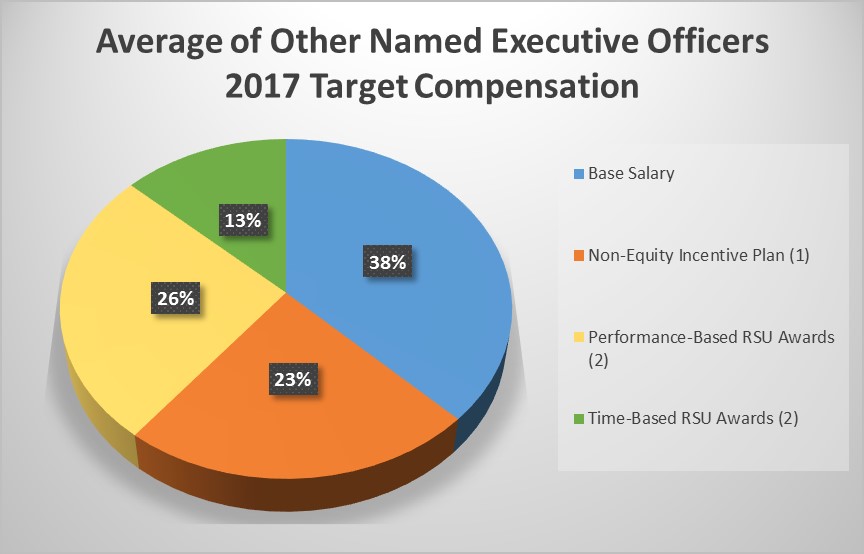

As illustrated below, a majority of the target compensation for our Named Executive Officers in 2017 was performance-based, with the ability to realize value tied to the achievement of pre-specified objectives approved by the Compensation Committee. In addition, the value of RSUs granted to our Named Executive Officers is linked directly to our shareholder return during the vesting term. At approximately 50%, the portion of compensation awarded to our Named Executive Officers in 2017 that was performance-based was above market norms among companies included in our compensation peer group. This emphasis on pay-for-performance is intended to drive the ongoing alignment of interests between our executives and shareholders, and to provide meaningful upside opportunity where results exceed expectations.

9

(1) | “Non-Equity Incentive Plan” includes targeted amounts under our Variable Compensation Plan and Sales Commission Plan. |

(2) | The value of performance-based and time-based RSU awards was targeted at $4.50 per share. |

Executive Compensation Policies and Practices

The Company's ongoing compensation practices are reflective of its compensation philosophy and align to a number of best practices and/or industry standards, including:

• | The Compensation Committee oversees all elements of compensation for the executive officers while directly retaining an independent compensation consultant that performs services solely in support of the Compensation Committee. |

• | Compensation plans are competitive with those of industry peers. Plans are monitored, evaluated and compared against trends in executive compensation on an annual basis. |

• | The variable compensation plan requires a minimum level of non-GAAP operating income performance to fund a payout. There is an opportunity for increased funding if Company and individual performance exceeds plan goals. The Compensation Committee can exercise discretion to provide for funding if targets are not achieved and special circumstances warrant, but did not exercise this discretion in 2017. |

• | Equity is a substantial component of an executive's total compensation, aligning an executive's long-term interest with that of shareholders. A combination of performance-based and time-based equity awards are used. |

• | Performance-based metrics are used to trigger and scale payment for short- and long-term incentives. |

• | Equity-based incentive plans prohibit re-pricing of stock options without shareholder approval. |

• | Our equity approval process includes internal control to ensure that there is no backdating of stock options. |

• | Executive officers' change of control agreements provide for a "double trigger" payout with stock acceleration provisions included only for the Chief Executive Officer and Chief Financial Officer. |

• | Special perquisites, tax equalization or gross-up benefits, or benefits designed solely for executive officers are not provided. |

• | The Compensation Committee reviews annually all compensation plans to ensure incentives do not promote taking undue risk. |

• | A peer group for benchmarking total shareholder return was established to measure and compare pay and performance linkage (see "Peer Group" below). |

• | A dashboard, consisting of variable compensation costs and financial performance metrics, is reviewed each quarter by the Compensation Committee to monitor and further assess the pay-for-performance model. |

• | Stock ownership guidelines promote the alignment of the long-term interests of executives with the long-term interests of the shareholders, as well as fostering long-term retention of executives; the Compensation Committee reviews stock ownership status annually. |

• | We maintain a clawback policy applicable to Section 16 officers. The policy provides the Board of Directors the ability to recover performance-based compensation paid to an executive in the event of any fraud or willful |

10

misconduct by one or more executives that results in the required restatement of any financial reporting required under the securities laws or other similar laws or regulations as applicable to the Company.

Shareholder Advisory Vote on Executive Compensation

At the annual meeting of shareholders held in 2017, shareholders voted to hold an advisory vote to approve the compensation of our Named Executive Officers on an annual basis; consequently, the Board decided to provide our shareholders an opportunity to vote to approve the compensation of our Named Executive Officers on an annual basis. Although the advisory votes to approve the compensation of our Named Executive Officers are non-binding, the Board of Directors will review the results of the votes and will take them into account in making future determinations concerning compensation of our Named Executive Officers.

The most recent shareholder advisory vote on compensation of Named Executive Officers, which was held in 2017, resulted in a 90% vote “For” the approval of the compensation of the Company's Named Executive Officers (excluding broker non-votes). Accordingly, no changes to the Company's executive compensation programs were made as a result of the shareholder advisory vote, but the Company intends to continue emphasizing its pay for performance compensation philosophy aligned with our discussions with our shareholders that focused on the turnaround strategy and changes to our executive compensation program to drive strong alignment of our compensation programs with shareholder interests.

Section II: Governance of Compensation Program

The Board of Directors has delegated responsibility to the Compensation Committee for final approval of executive base salary, variable cash compensation, equity compensation, as well as any executive employment offers, executive change of control agreements, severance agreements and other executive compensation programs. The Compensation Committee also guides executive development programs and succession planning in order to maintain and develop the Company's leadership team. The Compensation Committee maintains an annual calendar to guide the timing of its review, analysis, and decision-making related to executive compensation, benefits and development programs.

The Compensation Committee and the Chairman of the Board assess the performance of the Chief Executive Officer annually. The Chief Executive Officer's performance review process includes a Chief Executive Officer self-appraisal, a formal Board of Directors evaluation process as well as a performance appraisal delivered by the Chairman of the Board of Directors. The Chief Executive Officer is responsible for assessing the performance of each executive reporting to him.

The Compensation Committee reviews compensation recommendations provided by management and approves all final executive compensation-related decisions. Under the oversight of the Compensation Committee, the Chief Executive Officer and Vice President of Human Resources have responsibility for the implementation of executive compensation programs.

Process

The Compensation Committee conducts a formal review of each executive's compensation on an annual basis or more frequently if needed. The Compensation Committee’s review consists of the following: comparing the cash and equity components of each executive's pay to market data for similar positions; considering recommendations provided by the Chief Executive Officer and Vice President of Human Resources; assessing individual performance; and aligning any pay changes with market and company performance. The Compensation Committee reviews the mix of base salary, variable cash compensation and equity compensation, but does not attempt to target a specific percentage allocation as each compensation element is compared to market survey data.

"Tally sheets" are used to consider and evaluate the total potential compensation of executives from all sources upon various scenarios and any benefits associated with termination of employment. Based on this analysis, the Compensation Committee is able to make market-based decisions that are aligned to the Company's financial and strategic direction.

Role of the Compensation Consultant

In fulfilling its duties and responsibilities, the Compensation Committee has the authority to engage the services of outside advisers. In fiscal 2017, the Compensation Committee continued to engage Compensia, Inc., a national compensation consulting firm, to assist it with compensation matters. A representative of Compensia, Inc. regularly attended meetings of the Compensation Committee, responded to committee members’ inquiries, and provided its analysis with respect to these inquiries.

11

The nature and scope of services provided to the Compensation Committee by Compensia, Inc. in fiscal 2017 were as follows:

• | Provided advice with respect to pay levels, compensation best practices and market trends for executive officers and directors; |

• | Assisted with the design of the short-term and long-term incentive compensation plans for our executive officers; |

• | Provided ad hoc advice and support throughout the year. |

Compensia, Inc. does not provide any services to us other than the services provided to the Compensation Committee. The Compensation Committee has assessed the independence of Compensia, Inc. taking into account, among other things, the factors set forth in Exchange Act Rule 10C-1 and the listing standards of the Nasdaq Stock Market, and has concluded that no conflict of interest exists with respect to the work that Compensia, Inc. performs for the Compensation Committee.

Peer Group

In 2017, the Compensation Committee reviewed the Company’s existing peer group and did not make any material changes. The Compensation Committee reviews the peer group at least annually and anticipates making further revisions over time as the Company evolves. The Compensation Committee will utilize peer data to review total shareholder return as a part of its pay for performance linkage, Chief Executive Officer and Chief Financial Officer compensation and general compensation practices.

The following companies were selected and utilized as peer companies in 2017:

Allot Communications Ltd. | AudioCodes Ltd. | Radware |

A10 Networks | Harmonic, Inc. | RealNetworks |

Aerohive Networks | PCTEL, Inc. | Sonus Networks Inc. |

The Compensation Committee uses data from our compensation peer group as well as data from the Radford Global Technology compensation survey when determining the total direct compensation packages for our executive officers. The Radford executive compensation survey data supplements the compensation peer group data and provides additional information for the Named Executive Officers and positions for which there is limited public comparable data available.

Risk Considerations

The Compensation Committee conducted an assessment of the Company's compensation policies and practices to identify any potential risk arising from such policies and practices that could be reasonably likely to have a material adverse effect on the Company. The assessment covered all compensation elements and included an analysis of overall compensation costs (including both fixed and variable incentive components), compensation plan participation by employee group (sales vs. employees vs. senior leaders), metrics and performance goals. No potential risks that could be reasonably likely to have a material adverse effect were identified.

Section III: Elements of Executive Compensation

The following table outlines elements of direct compensation of Named Executive Officers in 2017 and how it aligns with the Company's philosophy and business strategy.

12

Compensation Element | What Is Rewarded | How It Aligns with Strategic Objectives |

Base Salary | Skills and abilities critical to success of the business Experience and performance against individual objectives Demonstrated success in meeting or exceeding key financial and other business objectives | Competitive base salaries enable the attraction and retention of talent Merit-based salary increases reflect pay for performance philosophy |

Variable Compensation (short-term incentives) | Variable Compensation Plan: Organizational performance during the year measured by achievement in respect of pre-defined profitability goals Individual performance during the year measured against identified goals and objectives | Payout of awards depends on ability of the Company to fund awards and individual and organizational performance Competitive, market-based variable incentive targets enables the attraction and retention of talent |

Sales Commission Plan: Performance during the year measured by achievement with respect to pre-defined revenue | Payout is dependent upon overall sales organization performance Competitive, market-based variable incentive targets enables the attraction and retention of talent | |

Equity Compensation (long-term incentives) | Stock Options: Increase in stock price Retention | Value results from stock price increases Vesting schedule, in harmony with minimum holding requirements for officers, supports retention |

Restricted Stock Units: Increase in stock price Retention | Although RSUs always have value, the value increases or decreases as the stock price increase or decreases Vesting schedule, in harmony with minimum holding requirements for officers, supports retention | |

Performance Based Awards: Performance relative to pre-determined strategic and financial goals (product delivery, market penetration, long-term growth and operational/financial metrics) and/or certain levels of stock price appreciation | Payout is based on metrics important to shareholders Performance period spans 1-3 years and supports retention | |

Base Salaries are reflective of the executive's job scope, background and experience level. Base salary levels are initially determined at the time of hire or promotion and are reviewed annually thereafter or in conjunction with a change in job scope or responsibility or upon the Compensation Committee's consideration of other relevant factors. The amount of any merit increase is determined based on a combination of factors, including the current position of the executive's pay against market data and the executive's experience, performance and results during the past year. The Compensation Committee may determine that an individual executive's base salary should be above or below the benchmark based on the executive officer's job responsibilities and/or experience level and may adjust an executive’s salary during the annual review process or at such other time as the Compensation Committee deems necessary or advisable.

13

In March 2017, the Compensation Committee determined to make no changes to the base salary rates for our President and CEO. The Compensation Committee approved an increase in the base salary of our Chief Financial Officer in March 2017 from $275,000 to $300,000 to move toward alignment with the 50th percentile of our peer group and Radford Global Technology survey.

In March 2017, the Compensation Committee approved an increase in the base salary of our VP, Global Sales from $278,000 to $290,000 and a 5% increase in Mr. Collins’ variable target to move toward alignment with the 50th percentile of our peer group and Radford Global Technology survey.

Short-Term Incentive Plans

Variable Cash Compensation targets are expressed as a percentage of base salary. The targets are determined at the time of hire or promotion and are typically reviewed annually against industry benchmark data for comparable positions. An executive's variable target is generally aligned to the 50th percentile of our peer group and Radford Global Technology survey. Exceptions may exist based on an executive officer's job responsibilities and/or experience level.

The table below describes the target bonus opportunities applicable to our Named Executive Officers during 2017. For executives other than Mr. Collins, bonus opportunities were tied to our 2017 Variable Compensation Plan, which is described in detail below. For Mr. Collins, 50% of the target bonus was tied to the 2017 Variable Compensation Plan and 50% was tied our Sales Commission Plan.

Named Executive Officer | Target Bonus Opportunity | Target Bonus as a Percentage of Salary |

Brian Bronson | $500,000 | 100% |

Jonathan Wilson | $165,000 | 55% |

Stephen Collins | $203,000 | 70% |

Plan performance targets (including minimum funding levels, target funding levels and maximum payout levels) are established and approved by the Compensation Committee at the beginning of the performance period, typically in conjunction with the annual operating plan process, and are based on current business and economic conditions, the financial planning process and affordability. Plan performance targets are directly tied to achieving financial performance and/or strategic objectives of the Company and may include an individual performance component.

Individual performance objectives for each executive are developed by the Chief Executive Officer in consultation with the affected executive and then reviewed and approved by the Compensation Committee. The Compensation Committee reviews the Chief Executive Officer's assessment of executive performance in relation to objectives.

The Compensation Committee ultimately decides the amounts paid to each executive with such quantitative and qualitative modifications as the Compensation Committee may make at its discretion.

The 2017 Variable Compensation Plan was designed to support the Company's pay for performance philosophy and motivate and compensate executives for the achievement of consolidated revenue (the “Variable Compensation Plan”).

The Variable Compensation Plan provided an opportunity for executives to earn from 0% to 200% of target variable compensation based on the pre-defined levels of consolidated revenue.

In 2017, the Company delivered consolidated revenue of $133.8 million, which did not meet the minimum Variable Compensation Plan funding targets and accordingly no cash variable compensation was earned or paid under the Variable Compensation Plan.

Mr. Collins had 50% of his total target incentive compensation tied to the Sales Commission Plan. Below is the breakout of the goals under that plan.

14

Sales Commission Plan 2017 Goals | ||

Goal | Weighting | |

Stephen Collins | FlowEngine Revenue | 6% |

MediaEngine Revenue | 15% | |

DC Engine Revenue | 39% | |

CellEngine/CDS | 10% | |

Embedded Products Revenue | 30% | |

100% | ||

Under the Sales Commission Plan, Mr. Collins’ annual attainment was 58% and represented a payout of $58,672 against a target 100% payout of $101,500.

A summary of the amounts earned by our Named Executive Officers under the Variable Compensation Plan and Sales Commission Plan is provided in the table below.

Actual Bonus Earned | ||||||

Named Executive Officer | Target Bonus Opportunity | Target Bonus as a Percentage of Salary | Variable Compensation Plan | Sales Commission Plan | Total Bonus Earned | Percentage of Target Earned |

Brian Bronson | $500,000 | 100% | $0 | N/A | $0 | 0% |

Jonathan Wilson | $165,000 | 55% | $0 | N/A | $0 | 0% |

Stephen Collins | $203,000 | 70% | $0 | $58,672 | $58,672 | 58% |

Changes for 2018 Variable Compensation Plan

For 2018, following a comprehensive review of our compensation programs, business strategy and pay-for-performance objectives, the Compensation Committee approved changes to the performance measurement methodology under the Variable Compensation Plan. The 2018 Variable Compensation Plan will fund 100% based upon the attainment of non-GAAP operating income per the Company’s 2018 operating plan, with funding for Named Executive Officers beginning only when the Company achieves post-variable compensation non-GAAP operating income and up to a maximum payout threshold of 200%. In addition, the 2018 Variable Compensation Plan will be funded based on annual performance. The Compensation Committee believes non-GAAP operating income is the appropriate metric to drive 2018 variable cash compensation as it aligns directly with the Company’s primary near-term objective to stabilize operating results and return to profitability. As in 2016 and 2017, the 2018 Variable Compensation Plan will include individual performance objectives that are designed to reward specific strategic objectives expected to materially advance the Company’s long-term strategy.

Equity Compensation in the form of stock options, RSUs, and/or performance-based shares are awarded to executive officers and key individuals because it is a highly effective way to align the interests of management and shareholders and motivate management to drive long-term shareholder value. The Compensation Committee intends to continue its practice of granting equity awards with vesting measures that strongly align with creating shareholder value.

Industry benchmark data for comparable executive positions is used to establish target equity values at the time of grant. The total annual grant value for an executive, which may include options, RSUs and/or performance-based equity, is targeted at the 50th percentile of market.

In addition to reviewing benchmark data to determine equity grant levels, the retentive value of past grants for each executive is reviewed to ensure that the value of unvested equity grants is in line with benchmarks and is of sufficient value to retain and provide strong performance incentive for the executive in future years.

The Black-Scholes methodology is used for valuing options and the grant date fair value is used for valuing both RSUs and performance-based shares (see Note 16 to the Consolidated Financial Statements included in our Original Filing for a description of Black-Scholes methodology and assumptions used).

15

Time-based equity incentives and performance-based incentives are granted under the 2007 Stock Plan for annual refresh, promotion and retentive purposes. Annual refresh grants are typically made during the first quarter of each fiscal year. Performance-based RSUs vest only upon achievement of certain financial or strategic metrics.

All equity grants to newly hired executives and refresher grants to existing executives are reviewed and approved by the Compensation Committee, on the recommendation of the Chief Executive Officer, using the abovementioned factors of market data, the total retention value, and the executive's projected level of future contribution.

Grants of equity awards are made at predetermined times and are not intentionally scheduled to coincide with the disclosure of favorable or unfavorable information. Each year the Compensation Committee reviews whether refresher grants are necessary to continue to motivate management and employees while providing long-term incentives.

Long-Term Incentive Grants

Equity continues to be a substantial component of the Company’s compensation strategy and is intended to attract, retain and motivate key talent to achieve the Company's strategic objectives. In support of these strategic objectives, a combination of performance and time-based shares are utilized.

2017 Grants

In March 2017, the Compensation Committee approved performance-based and time-based RSU awards under the Company’s 2007 Stock Plan to certain senior executives. The time-based RSU awards vest one-third of the total shares on May 15, 2018, May 15, 2019 and May 15, 2020.

The performance-based RSUs will vest only if certain strategic revenue targets are achieved during our 2017 and 2018 fiscal years. Specifically, 50% of shares granted to executives will be earned based on achievement of targeted levels of strategic revenue during performance periods that correspond to each of our fiscal year 2017and 2018. The strategic revenue goals for 2017 and 2018 were established at the grant date of the award in March 2017, and included threshold, target and maximum levels of performance for each fiscal year that would allow for shares to be earned between 75% and 125% of target for each performance period, if at all. In addition, shares can be earned based on achievement of threshold, target and maximum levels of strategic revenue based on the cumulative two-year period including fiscal 2017 and 2018. Fifty percent of earned shares will vest at the conclusion of the performance period during which they are earned, with the remaining 50% of earned shares vesting one year later.

As a result of the significant shortfall in DCEngine revenues relative to the Company’s initial 2017 expectations, coupled with the Company’s go-forward expectations for this product line, no shares vested related to the 2017 targets, and the Compensation Committee currently does not expect any of the performance-based equity granted in March 2017 to vest in the future.

The table below details the number of stock price-based vesting restricted stock units and RSUs granted to each of our Named Executive Officers in 2017.

Executive Officer | Shares Granted | |

Performance-Based RSU | Time-Based RSU | |

Brian Bronson | 140,000 | 60,000 |

Jonathan Wilson | 48,000 | 24,000 |

Stephen Collins | 44,000 | 22,000 |

Benefits and Perquisites

Executives are provided with the same benefit options as those provided to other employees in the same location. The U.S.-based employee benefit program includes medical, dental and vision plans, an Employee Stock Purchase Plan (“ESPP”), a 401(k) plan, tuition reimbursement, life insurance and short- and long-term disability coverage.

16

Executives do not receive any special perquisites such as club memberships, pension plans, automobile allowances or dwellings for personal use. Relocation packages to newly hired executives and other newly hired employees are defined within the Company's hiring policy and are based on standard market practices for executive-level relocation.

Stock Ownership Policy

We maintain a stock ownership policy for our Named Executive Officers to further align their interests with the interests of our shareholders and to further promote our commitment to sound corporate governance. The Company's ownership guidelines are three times base salary or 300,000 shares for the Chief Executive Officer and one times base salary or 100,000 shares for all other executive officers. All Named Executive Officers are expected to be “net” buyers, increasing total ownership after any vesting or forfeiture of shares for tax purposes, until stock ownership requirements are fulfilled within a five-year grace period. Of our current executive officers, all have reached this ownership goal.

Section IV: Employment and Termination Agreements

Executive officers are parties to various severance agreements, change of control agreements, or both, entered into pursuant to guidelines adopted by the Compensation Committee. The Compensation Committee believes these agreements may be necessary or advisable to keep executive officers focused on the best interests of shareholders at times that may otherwise cause a lack of focus due to personal economic exposure and potential change for the Company. Further, the Compensation Committee believes that they are necessary or advisable for retentive purposes to provide a measure of support to executive officers who may receive offers of employment from competitors that would provide severance or change of control benefits.

Consistent with the practice of a substantial number of companies in the peer group, the change of control agreements provide for a "double trigger" payout only in the event there is a change in control and the executive officer is either terminated from his or her position (other than for cause, death or disability) or resigns for "good reason," which generally means that he or she is moved into a position that represents a substantial change in responsibilities or is required to relocate a substantial distance within a limited period of time after the transaction (i.e. these agreements do not become operative unless both events occur).

See “Potential Post-Employment Payments” under the Summary Compensation Table for severance and change of control benefits provided to Named Executive Officers.

Section V: Deductibility of Compensation

Section 162(m) of the Internal Revenue Code of 1986 (the “Code”) limits to $1,000,000 per person the amount the Company may deduct for compensation paid to the Chief Executive Officer and the three highest compensated officers who are Named Executive Officers (other than the Chief Executive Officer or Chief Financial Officer) in any year. The level of salary and annual cash incentive payments the Company generally pays to executive officers does not exceed this limit. For taxable years prior to December 31, 2017, Section 162(m) specifically exempts certain performance-based compensation from the deduction limit. However, the exemption from Section 162(m)’s deduction limit for qualified performance-based compensation has been repealed, effective for taxable years beginning after December 31, 2017. The repeal means that compensation paid to our covered executive officers in excess of $1,000,000 will no longer be deductible even if it was intended to constitute qualified performance-based compensation unless it qualifies for transition relief applicable to certain arrangements in place as of November 2, 2017. The intent of the Compensation Committee is to design compensation that will further the purposes of the executive compensation program. The Compensation Committee will, however, take into consideration various other factors described in this Compensation Discussion and Analysis, together with Section 162(m) considerations, in making executive compensation decisions and retains the ability to authorize compensation that is not fully tax-deductible.

Section VI: Non-GAAP Financial Measures

In order to evaluate the Company's performance for purposes of determining executive compensation, the Company considers a combination of consolidated and strategic revenue, non-GAAP operating income, and non-GAAP earnings per share. Non-GAAP operating income and non-GAAP earnings per share exclude certain expenses, gains and losses, such as the effects of (a) amortization of acquired intangible assets, (b) stock-based compensation expense, (c) restructuring and other charges (reversals), net, (d) non-cash income tax expense, (e) gain on the liquidation of foreign subsidiaries, and (f) restructuring inventory write-down. The Company believes that the use of non-GAAP financial measures provides useful information to investors to gain an overall understanding of its current financial performance and its prospects for the future.

Specifically, the Company believes the non-GAAP results provide useful information to both management and investors by excluding certain expenses, gains and losses that the Company believes are not indicative of its core operating results. In

17

addition, non-GAAP financial measures are used by management for budgeting and forecasting as well as subsequently measuring the Company's performance, and the Company believes that it is providing investors with financial measures that most closely align to its internal measurement processes. These non-GAAP measures are considered to be reflective of the Company's core operating results as they more closely reflect the essential revenue-generating activities of the Company and direct operating expenses (resulting in cash expenditures) needed to perform these revenue-generating activities. The Company also believes, based on feedback provided to the Company during its earnings calls' Q&A sessions and discussions with the investment community, that the non-GAAP financial measures it provides are necessary to allow the investment community to construct their valuation models to better align its results and projections with its competitors and market sector, as there is significant variability and unpredictability across companies with respect to certain expenses, gains and losses.

The non-GAAP financial information is presented using a consistent methodology from quarter-to-quarter and year-to-year. These measures should be considered in addition to results prepared in accordance with GAAP. In addition, these non-GAAP financial measures are not based on any comprehensive set of accounting rules or principles. The Company believes that non-GAAP financial measures have limitations in that they do not reflect all of the amounts associated with the Company's results of operations as determined in accordance with GAAP and that these measures should only be used to evaluate the Company's results of operations in conjunction with the corresponding GAAP financial measures.

A reconciliation of non-GAAP information to GAAP information is included in the tables below. The non-GAAP financial measures disclosed by the Company should not be considered a substitute for or superior to financial measures calculated in accordance with GAAP, and reconciliations between GAAP and non-GAAP financial measures included in this earnings release should be carefully evaluated. The non-GAAP financial measures used by the Company may be calculated differently from, and therefore may not be comparable to, similarly titled measures used by other companies.

Year Ended | ||||||||||||

December 31, 2017 | December 31, 2016 | |||||||||||

(in thousands except per share data) | ||||||||||||

INCOME (LOSS) FROM OPERATIONS: | ||||||||||||

GAAP loss from operations | $ | (46,783 | ) | $ | (9,659 | ) | ||||||

(a) Amortization of acquired intangible assets | 10,713 | 12,747 | ||||||||||

(b) Stock-based compensation | 2,192 | 3,797 | ||||||||||

(c) Restructuring and other charges, net | 8,339 | 2,917 | ||||||||||

(f) Restructuring inventory write-down | 9,745 | — | ||||||||||

Non-GAAP income from operations | $ | (15,794 | ) | $ | 9,802 | |||||||

NET INCOME (LOSS): | ||||||||||||

GAAP net loss | $ | (52,604 | ) | $ | (10,251 | ) | ||||||

(a) Amortization of acquired intangible assets | 10,713 | 12,747 | ||||||||||

(b) Stock-based compensation | 2,192 | 3,797 | ||||||||||

(c) Restructuring and other charges, net | 8,339 | 2,917 | ||||||||||

(d) Income taxes | 2,276 | 913 | ||||||||||

(e) Loss (gain) on the liquidation of foreign subsidiaries | 313 | (421 | ) | |||||||||

(f) Restructuring inventory write-down | 9,745 | — | ||||||||||

Non-GAAP net income | $ | (19,026 | ) | $ | 9,702 | |||||||

GAAP weighted average diluted shares | 38,994 | 37,668 | ||||||||||

Dilutive equity awards included in non-GAAP earnings per share | — | 1,202 | ||||||||||

Non-GAAP weighted average diluted shares | 38,994 | 38,870 | ||||||||||

GAAP net loss per share (diluted) | $ | (1.35 | ) | $ | (0.27 | ) | ||||||

Non-GAAP adjustments detailed above | 0.86 | 0.52 | ||||||||||

Non-GAAP net loss per share (diluted) | $ | (0.49 | ) | $ | 0.25 | |||||||

Non-GAAP financial measures includes the performance of Software-Systems and Hardware Solutions. The Company excludes the following corporate and other expenses, reversals, gains and losses from its non-GAAP financial measures, when applicable:

(a) Amortization of acquired intangible assets: Amortization of acquisition-related intangible assets primarily relate to core and existing technologies, trade name and customer relationships that were acquired with the acquisitions of Continuous Computing and Pactolus. The Company excludes the amortization of acquisition-related intangible assets because it does not reflect the Company's ongoing business and it does not have a direct correlation to the operation of the Company's business. In addition, in accordance with GAAP, the Company generally

18

recognizes expenses for internally-developed intangible assets as they are incurred, notwithstanding the potential future benefit such assets may provide. Unlike internally-developed intangible assets, however, and also in accordance with GAAP, the Company generally capitalizes the cost of acquired intangible assets and recognizes that cost as an expense over the useful lives of the assets acquired. As a result of their GAAP treatment, there is an inherent lack of comparability between the financial performance of internally-developed intangible assets and acquired intangible assets. Accordingly, the Company believes it is useful to provide, as a supplement to its GAAP operating results, non-GAAP financial measures that exclude the amortization of acquired intangibles in order to enhance the period-over-period comparison of its operating results, as there is significant variability and unpredictability across companies with respect to this expense.

(b) Stock-based compensation: Stock-based compensation consists of expenses recorded under GAAP, in connection with stock awards such as stock options, restricted stock awards and restricted stock units granted under the Company's equity incentive plans and shares issued pursuant to the Company's employee stock purchase plan. The Company excludes stock-based compensation from non-GAAP financial measures because it is a non-cash measurement that does not reflect the Company's ongoing business and because the Company believes that investors want to understand the impact on the Company of the adoption of the applicable GAAP surrounding share-based payments; the Company believes that the provision of non-GAAP information that excludes stock-based compensation improves the ability of investors to compare its period-over-period operating results, as there is significant variability and unpredictability across companies with respect to this expense.

(c) Restructuring and other charges, net: Restructuring and other charges, net relates to costs associated with non-recurring events. These include costs incurred for employee severance, acquisition or divestiture activities, excess facility costs, certain legal costs, asset-related charges and other expenses associated with business restructuring activities. Restructuring and other charges are excluded from non-GAAP financial measures because they are not considered core operating activities. Although the Company has engaged in various restructuring activities over the past several years, each has been a discrete event based on a unique set of business objectives. The Company does not engage in restructuring activities in the ordinary course of business. As such, the Company believes it is appropriate to exclude restructuring charges from its non-GAAP financial measures because it enhances the ability of investors to compare the Company's period-over-period operating results.

(d) Income taxes: Non-GAAP income tax expense is equal to the Company's projected cash tax expense. Adjustments to GAAP income tax expense are required to eliminate the recognition of tax expense from profitable entities where we utilize deferred tax assets to offset current period tax liabilities. We believe that providing this non-GAAP figure is useful to our investors as it more closely represents the true economic impact of our tax positions.

(e) Loss (gain) on the liquidation of foreign subsidiaries: On a non-recurring basis we have recorded a gain or loss to reflect the realization of accumulated foreign currency translation adjustments upon the liquidation of certain international subsidiaries. This gain or loss represents the net unrealized foreign currency translation gains or losses accumulated from changes in exchange rates and the related effects from the translation of assets and liabilities of these entities. The liquidation of foreign subsidiaries occurs on an infrequent basis, and management does not view the impact of this non-cash charge as indicative of the ongoing performance of the Company. As such, the Company believes it is appropriate to exclude this gain from its non-GAAP financial measures because it enhances the ability of investors to compare the Company's period-over-period operating results.

(f) Restructuring inventory write-down: Includes inventory write-downs associated with non-recurring events, predominantly tied to the Company’s decision to end-of-life or discontinue certain products for which the Company has no future ongoing demand. During the fourth quarter of 2017, the Company recorded such charges tied to discrete product decisions within its Hardware Solutions segment associated with its DCEngine and certain legacy embedded products. Restructuring inventory write-downs are excluded from non-GAAP financial measures because they are not considered core operating activities. Although the Company has incurred various inventory write-downs over the past several years, they have generally been associated with ongoing business activities. As such, the Company believes it is appropriate to exclude end-of-life and product discontinuance inventory write-downs from its non-GAAP financial measures because it enhances the ability of investors to compare the Company's period-over-period operating results.

19

SUMMARY COMPENSATION TABLE

The following table sets forth information concerning compensation paid or accrued for services to us in all capacities for the last fiscal year for:

• | the individuals who served as our Chief Executive Officer and Chief Financial Officer during fiscal year 2017; and |

• | our most highly compensated executive officers other than the Chief Executive Officer and Chief Financial Officer whose total compensation exceeded $100,000 and who were serving as executive officers at the end of fiscal year 2017; and |

• | up to two additional individuals for whom disclosure would have been provided but for the fact that the individual was not serving as an executive officer at the end of the last completed fiscal year. |

The above individuals are referred to herein as the “Named Executive Officers.”

Name & Principal Position | Year | Salary ($) | Bonus ($) | Stock Awards (1) (2) ($) | Option Awards (1) ($) | Non-Equity Incentive Plan Compensation Earnings (3) ($) | All Other Compensation (4) ($) | Total ($) | ||||||

Brian Bronson | 2017 | 500,000 | — | 760,000 | — | — | 8,955 | 1,268,955 | ||||||

President & CEO | 2016 | 500,000 | — | 650,798 | 295,103 | 469,173 | 8,805 | 1,923,879 | ||||||

2015 | 500,000 | — | 789,750 | — | 850,000 | 8,805 | 2,148,555 | |||||||

Jonathan Wilson | 2017 | 294,986 | — | 273,600 | — | — | 8,784 | 577,370 | ||||||

Chief Financial Officer | 2016 | 275,000 | — | 216,933 | 98,368 | 151,433 | 8,577 | 750,311 | ||||||

2015 | 237,688 | — | 275,625 | 95,810 | 167,332 | 8,520 | 784,975 | |||||||

Stephen Collins (5) | 2017 | 253,418 | — | 250,800 | — | 58,672 | 39,424 | 602,314 | ||||||

Former Vice President, Global Sales | 2016 | 278,000 | — | 197,212 | 89,425 | 174,669 | 6,204 | 745,510 | ||||||

2015 | 278,000 | — | 219,375 | — | 240,055 | 8,584 | 746,014 | |||||||

(1) | The amounts included in the Stock Awards and Option Awards columns include the aggregate grant date fair value of stock and option awards granted in the fiscal year computed in accordance with FASB ASC Topic 718 ("ASC 718"). We continue to use the Black-Scholes model to measure the grant date fair value of stock options and the amounts above do not include any forfeiture reserve. For a discussion of the valuation assumptions used to value the options, see Note 16 to our Consolidated Financial Statements included in our Original Filing. We compute the grant date fair value of restricted stock as the closing price of our shares as quoted on the Nasdaq Global Select Market on the date of grant or the first date of the underlying service period, whichever occurs first. |

(2) | The amounts included in the Stock Awards column for 2017 are time-based restricted stock unit awards and performance-based restricted stock unit awards under the 2007 Stock Plan ("PRSU"). The grant date fair value for the awards is determined on the grant date. As of December 31, 2017, none of the PRSU awards were estimated to be probable of achievement at the target outcome of the performance conditions. The table below details the maximum potential value of the 2017 PRSU awards as of the grant date. |

Name | Value of PRSU Grant at Maximum Payout |

Brian Bronson | $665,000 |

Jonathan Wilson | $228,000 |

Stephen Collins | $209,000 |

(3) | The amounts in this column represent payments made under our variable compensation plans and our Sales Incentive Plan. |

20

(4) | The table below details the amounts included in the All Other Compensation column for 2017: |

401(k) Contributions | Term Life Insurance Payments | Vacation Payout | |

Brian Bronson | $8,100 | $855 | $0 |

Jonathan Wilson | $8,100 | $684 | $0 |

Stephen Collins | $5,301 | $661 | $33,462 |

(5) | Mr. Collins' employment terminated on November 16, 2017. |

2017

GRANTS OF PLAN BASED AWARDS

Estimated Future Payouts Under Non-Equity Incentive Plan Awards | Estimated Future Payouts Under Equity Incentive Plan Awards | Exercise or Base Price of Option Awards ($/sh) | Grant Date Fair Value of Stock and Option Awards ($)(3) | ||||||||||||

Name | Grant Date (1) | Approval Date | Plan (2) | Threshold ($) | Target ($) | Maximum ($) | Threshold (#) | Target (#) | Maximum (#) | ||||||

Brian Bronson | 3/10/2017 | 3/10/2017 | 2007 | — | 60,000 | — | N/A | 228,000 | |||||||

3/10/2017 | 3/10/2017 | 2007 | 105,000 | 140,000 | 175,000 | N/A | 532,000 | ||||||||

Variable Compensation Plan (4) | VCP | — | 500,000 | 1,000,000 | |||||||||||

Jonathan Wilson | 3/10/2017 | 3/10/2017 | 2007 | — | 24,000 | — | N/A | 91,200 | |||||||

3/10/2017 | 3/10/2017 | 2007 | 36,000 | 48,000 | 60,000 | N/A | 182,400 | ||||||||

Variable Compensation Plan (4) | VCP | — | 165,000 | 330,000 | |||||||||||

Stephen Collins | 3/10/2017 | 3/10/2017 | 2007 | — | 22,000 | — | N/A | 83,600 | |||||||

3/10/2017 | 3/10/2017 | 2007 | 33,000 | 44,000 | 55,000 | N/A | 167,200 | ||||||||

Sales Commission Plan | SCP | — | 101,500 | — | |||||||||||

Variable Compensation Plan (4) | VCP | — | 101,500 | 203,000 | |||||||||||

(1) | Grant Date applies only to grants of equity awards. |

(2) | The plans in this column represent: |

• | “2007” is the 2007 Stock Plan |

• | “SCP” is the Sales Commission Plan |

• | “VCP” is the Variable Compensation Plan |