2014 Proxy

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

|

| | |

Filed by the Registrant | x | |

Filed by a Party other than the Registrant | ¨ |

Check the appropriate box: | |

|

| |

¨ | Preliminary Proxy Statement |

¨ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x | Definitive Proxy Statement |

¨ | Definitive Additional Materials |

¨ | Soliciting Material Pursuant to §240.14a-12 |

RADISYS CORPORATION

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

| |

x | No fee required.

|

¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

¨ Fee paid previously with preliminary materials:

¨ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1) Amount Previously Paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

TABLE OF CONTENTS

|

| |

Item | Page |

GENERAL INFORMATION | |

PROPOSAL NO. 1—ELECTION OF DIRECTORS | |

CORPORATE GOVERNANCE AND OTHER MATTERS | |

2013 DIRECTOR COMPENSATION TABLE | |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | |

EXECUTIVE OFFICERS | |

EXECUTIVE OFFICER COMPENSATION | |

Compensation Discussion and Analysis | |

2013 Summary Compensation Table | |

2013 Grants of Plan-Based Awards Table | |

2013 Outstanding Equity Awards at Fiscal Year-End Table | |

2013 Option Exercises and Stock Vested Table | |

2013 Nonqualified Deferred Compensation Table | |

Potential Post-Employment Payments | |

PROPOSAL NO. 2 - ADVISORY VOTE TO APPROVE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS | |

COMPENSATION AND DEVELOPMENT COMMITTEE REPORT | |

AUDIT COMMITTEE REPORT | |

Principal Accounting Fees and Services Table | |

PROPOSAL 3 - TO RATIFY THE AUDIT COMMITTEE'S APPOINTMENT OF KPMG LLP AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

| |

EQUITY COMPENSATION PLAN INFORMATION | |

PROPOSALS NO. 4 & 5 - TO APPROVE AN AMENDMENT TO THE RADISYS CORPORATION 2007 STOCK PLAN AND TO APPROVE THE TERMS OF THE PERFORMANCE GOALS ESTABLISHED FOR THE RADISYS CORPORATION 2007 STOCK PLAN

| |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | |

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE | |

OTHER MATTERS | |

APPENDIX A - Companies Included in the Radford Executive Survey Market Cut | |

APPENDIX B - Companies Included in the Chief Executive Officer Salary Benchmarking Data | |

APPENDIX C - Radisys Corporation 2007 Stock Plan | |

__________________

Notice of Annual Meeting of Shareholders

to be Held September 22, 2014

__________________

To the Shareholders of Radisys Corporation:

The annual meeting of shareholders of Radisys Corporation, an Oregon corporation, will be held at our headquarters located at 5435 NE Dawson Creek Drive, Hillsboro, Oregon 97124, on September 22, 2014 at 11:00 a.m., Pacific time, for the following purposes:

| |

1. | to elect six directors; |

| |

2. | to have an advisory vote to approve compensation of our named executive officers; |

| |

3. | to ratify the Audit Committee's appointment of KPMG LLP as our independent registered public accounting firm; |

| |

4. | to approve an amendment to the Radisys Corporation 2007 Stock Plan; |

| |

5. | to approve the terms of the performance goals established for the Radisys Corporation 2007 Stock Plan; and |

| |

6. | to transact any other business as may properly come before the meeting or any adjournment thereof. |

Only shareholders of record at the close of business on July 29, 2014 are entitled to receive notice of and to vote at the annual meeting or any adjournments thereof.

Please sign and date the enclosed proxy and return it promptly in the enclosed reply envelope. If you are able to attend the annual meeting, you may, if you wish, revoke the proxy and vote personally on all matters brought before the annual meeting.

A list of shareholders will be available for inspection by the shareholders commencing August 1, 2014 at our corporate headquarters located at 5435 NE Dawson Creek Drive, Hillsboro, Oregon 97124.

|

| |

| By Order of the Board of Directors, |

| |

|

|

|

| |

August 11, 2014 | Allen Muhich |

Hillsboro, Oregon | Chief Financial Officer and Corporate Secretary |

| |

| |

YOUR VOTE IS IMPORTANT. WHETHER OR NOT YOU EXPECT TO ATTEND THE ANNUAL MEETING IN PERSON, PLEASE VOTE YOUR SHARES FOLLOWING THE INSTRUCTIONS PROVIDED ON THE NOTICE OF INTERNET AVAILABILITY OF PROXY MATERIALS.

RADISYS CORPORATION

__________________

PROXY STATEMENT

__________________

SOLICITATION AND REVOCABILITY OF PROXY

This proxy statement is furnished in connection with the solicitation of proxies by the Board of Directors (the “Board” or “Board of Directors”) of Radisys Corporation, an Oregon corporation (“we,” “us”, “Radisys”, or the "Company"), to be voted at the annual meeting of shareholders to be held at our headquarters located at 5435 NE Dawson Creek Drive, Hillsboro, Oregon 97124, on September 22, 2014 at 11:00 a.m., Pacific time, for the purposes set forth in the accompanying notice of annual meeting. All proxies in the enclosed form that are properly executed and received by us before or at the annual meeting and not revoked will be voted at the annual meeting or any adjournments in accordance with the instructions on the proxy. Any proxy given pursuant to this solicitation may be revoked by the person giving it at any time before it is voted. Proxies may be revoked by (i) filing with our Corporate Secretary, at or before the taking of the vote at the annual meeting, a written notice of revocation bearing a later date than the date of the proxy, (ii) duly executing a subsequent proxy relating to the same shares and delivering it to our Corporate Secretary before the annual meeting or (iii) attending the annual meeting and voting in person (although attendance at the annual meeting will not in and of itself constitute a revocation of a proxy). Any written notice revoking a proxy should be sent to Radisys Corporation, 5435 NE Dawson Creek Drive, Hillsboro, Oregon 97124, Attention: Corporate Secretary, or hand delivered to the Corporate Secretary at or before the taking of the vote at the annual meeting.

The mailing address of our principal executive offices is 5435 NE Dawson Creek Drive, Hillsboro, Oregon 97124.

Pursuant to the rules adopted by the Securities and Exchange Commission (“SEC”) in 2007, we have elected to provide access to our proxy materials over the Internet. Accordingly, we are sending a Notice of Internet Availability of Proxy Materials (the “Notice”) to our shareholders of record and beneficial owners on or about August 11, 2014, and the proxy statement, the proxy card and the annual report to shareholders are being first given to shareholders on the same date. All shareholders will have the ability to access the proxy materials on a website referred to in the Notice or request to receive a printed set of all the proxy materials. Instructions on how to access the proxy materials over the Internet or to request a printed copy may be found in the Notice. In addition, shareholders may request to receive proxy materials in printed form by mail or electronically by email on an ongoing basis. Choosing to receive your future proxy materials by email will save us the cost of printing and mailing documents and will reduce the impact of our annual meeting on the environment.

The cost of preparing, printing and mailing this proxy statement and of the solicitation of proxies will be borne by us. Solicitation will be made by mail and, in addition, may be made by our directors, officers and employees personally or by written communication, telephone, facsimile or other means. We may request banks, brokers, fiduciaries and other persons holding shares in their names, or in the names of their nominees, to forward this proxy statement and other proxy materials to the beneficial owners and obtain voting instructions for the execution and return of the proxies. We will reimburse such banks, brokers and fiduciaries for their reasonable out-of-pocket expenses in connection with the proxy solicitation. We have retained Phoenix Advisory Partners to aid in the solicitation of proxies for a fee of approximately $8,500, plus reasonable costs and expenses.

For purposes of conducting the annual meeting, the holders of at least a majority of the shares of common stock issued and outstanding and entitled to vote at the annual meeting will constitute a quorum. Directors will be elected by a plurality of the votes of the shares present in person or represented by proxy at the annual meeting and entitled to vote on the election of directors. In a plurality voting, the nominee who receives the most votes for his or her election is elected. Each other proposal requires the approval of a majority of the votes cast on the proposal, provided a quorum is present.

At the annual meeting of shareholders held in 2011, shareholders voted to hold an advisory vote to approve the compensation of our named executive officers on an annual basis; consequently, the Board decided to provide our shareholders an opportunity to vote to approve the compensation of our named executive officers on an annual basis. Although the advisory vote to approve the compensation of our named executive officers is non-binding, the Board of Directors will review the results of the vote and will take them into account in making future determinations concerning compensation of our named executive officers.

If a broker holds your shares, the Notice and, if requested, this proxy statement and a proxy card have been sent to the broker. You may have received this proxy statement directly from your broker, together with instructions as to how to direct the broker to vote your shares. If you desire to have your vote counted, it is important that you return your voting

instructions to your broker. A broker non-vote occurs when a broker submits a proxy card with respect to shares of common stock held in a fiduciary capacity (typically referred to as being held in “street name”), but declines to vote on a particular matter because the broker has not received voting instructions from the beneficial owner. Under the rules that govern brokers who are voting with respect to shares held in street name, brokers have the discretion to vote such shares on routine matters, but not on non-routine matters, if the broker has not been furnished with voting instructions by its client at least ten days before the meeting. Routine matters include the ratification of the appointment of auditors. Non-routine matters include the matters being submitted to the shareholders in Proposals 1, 2, 4 and 5. Abstentions and broker non-votes are counted for purposes of determining whether a quorum exists at the annual meeting, but have no effect on the determination of whether a plurality exists with respect to a given nominee in directors' elections. With respect to other proposals, abstentions will count as votes cast, but will not count as votes cast in favor of the proposal and, therefore, will have the same effect as votes against the proposal. Broker non-votes will not be considered to have voted on the proposal and therefore, will have no effect. The proxies will be voted for or against the proposals or as an abstention, in accordance with the instructions specified on the proxy form. If no instructions are given, proxies will be voted for each of the proposals.

The record date for determination of shareholders entitled to receive notice of and to vote at the annual meeting is July 29, 2014. At the close of business on July 29, 2014, 36,247,405 shares of our common stock were outstanding and 36,244,629 shares of our common stock were entitled to vote at the annual meeting. Each share of common stock is entitled to one vote with respect to each matter to be voted on at the annual meeting. We reserve the right to decide, in our discretion, to withdraw any of the proposals from the agenda of the annual meeting prior to any vote thereon.

PROPOSAL 1: TO ELECT SIX DIRECTORS

Our Board of Directors currently consists of six members. The directors are elected at the annual meeting of shareholders to serve until the next annual meeting and until their successors are elected and qualified. Proxies received from shareholders, unless directed otherwise, will be voted FOR the election of the following nominees: C. Scott Gibson, Brian Bronson, Hubert de Pesquidoux, M. Niel Ransom, Lorene K. Steffes, and Vincent H. Tobkin. In June 2014, Kevin C. Melia, one of the Company’s directors, passed away. As a result, the size of the Board reduced to six directors.

If any nominee is not available as a candidate for director, the number of directors constituting our Board of Directors may be reduced before the annual meeting or the proxies may be voted for any other candidate or candidates that are nominated by the Board of Directors, in accordance with the authority conferred in the proxy.

Set forth in the table below is the name, age and position with the Company of each of our directors. Additional information about each of the directors is provided below the table and in "Security Ownership of Certain Beneficial Owners and Management." There are no family relationships among our directors and executive officers.

|

| | |

Name | Age | Position |

C. Scott Gibson | 62 | Chairman of the Board |

Brian Bronson | 43 | Director, President and Chief Executive Officer |

Hubert de Pesquidoux | 48 | Director |

M. Niel Ransom | 65 | Director |

Lorene K. Steffes | 68 | Director |

Vincent H. Tobkin | 63 | Director |

C. Scott Gibson has served as a Director since June 1993 and as Chairman of our Board of Directors since October 2002. From January 1983 through February 1992, Mr. Gibson co-founded and served as Chief Financial Officer and Senior VP of Operations, then Executive VP and Chief Operating Officer and finally President and Co-Chief Executive Officer of Sequent Computer Systems, Inc. (“Sequent”), a computer systems company. Before co-founding Sequent, Mr. Gibson served as General Manager, Memory Components Operation, at Intel Corporation. Since March 1992, Mr. Gibson has been a director to high technology companies as his full time occupation. Mr. Gibson serves on the boards of several other companies and non-profit organizations, including Triquint Semiconductor, Inc., Pixelworks, Inc., NW Natural, and non-profits St. Johns Medical Center, and Community Foundation of Jackson Hole. During the past five years, Mr. Gibson was previously a director of Verigy, Pty. Mr. Gibson holds a B.S.E.E. and a M.B.A. from the University of Illinois.

We believe that Mr. Gibson's qualifications to serve as a Director include his extensive experience in the semiconductor and computer systems industries, including co-founding and helping take public a highly successful computer systems company. In addition, his service on boards of other high technology companies, including as a member of audit and compensation committees, gives him financial expertise and understanding of compensation policies as well as extensive organizational leadership skills to assist the CEO with strategic planning.

Brian Bronson joined us in 1999 and has been an officer since 2000. From July 2011 through October 2012, he served as our President and Chief Financial Officer. In October 2012, he was named our Chief Executive Officer and President. He was also appointed to serve as a director by the Board on October 2, 2012. Prior to his being named as our Chief Financial Officer in November 2006, Mr. Bronson held the positions of our Vice President of Finance and Business Development and Treasurer and Chief Accounting Officer. Before joining Radisys, from 1995 to 1999, Mr. Bronson held a number of financial management roles at Tektronix, Inc. where he was responsible for investor relations, finance and accounting functions for both domestic and international operations. Prior to joining Tektronix, Inc., Mr. Bronson practiced as a Certified Public Accountant with the accounting firm Deloitte and Touche, LLP. Mr. Bronson holds a bachelors degree in Business Administration and Communications from Oregon State University.

We believe that Mr. Bronson's qualifications to serve as a Director include his 19 years of experience in the technology industry, which provides valuable leadership to the Board and to the Company. His 15 years of experience in key positions throughout the Company allows him to provide valuable perspective to the Board on the Company's operations and finances. Mr. Bronson also brings to the Board his experience as a Certified Public Accountant. The Board believes the combination of these experiences provides valuable insight and perspective to the Board.

Hubert de Pesquidoux has served as Director since April 2012. Mr. de Pesquidoux is the former Chief Financial Officer of Alcatel-Lucent and former President and Chief Executive Officer of the Enterprise Business Group of Alcatel-Lucent. In his nearly 20-year career at Alcatel-Lucent SA (and its predecessor, Alcatel), Mr. de Pesquidoux's executive positions included President and Chief Executive Officer of Alcatel North America; Chief Operating Officer of Alcatel USA; President and Chief Executive Officer of Alcatel Canada; Chief Financial Officer of Alcatel USA and Treasurer of Alcatel Alsthom. He joined Alcatel in 1991 after several years in the banking industry. Mr. de Pesquidoux also previously served as Chairman of the Board at Tekelec, and is a member of the Board and Chairman of the Audit Committee of Criteo and is an Executive Partner at Siris Capital. He is also a member of the Board and Chairman of the Audit Committee of Sequans Communications, and a member of the Board and Chairman of the Audit Committee of Mavenir Systems. Mr. de Pesquidoux was previously a member of the Board of Albaix Energy. Mr. de Pesquidoux holds a master's degree in law and a master's degree in business from the Institute for Political Studies (Sciences Po) in Paris and a DESS in International Affairs from Paris Dauphine University.

We believe that Mr. de Pesquidoux' qualifications to serve as director include his over 20 years of experience of financial and operational management in the telecommunications industry in the U.S., Canada and Europe. This experience gives Mr. de Pesquidoux a deep understanding of the high technology industry both on the service provider side and the large to small enterprise side, including knowledge relating to sales and marketing, R&D, finance, IT and supply chain. As the founder and owner of a private consulting and advisory firm, Mr. de Pesquidoux brings to the board additional financial and technical expertise. His experience on boards of other companies within our industry, including his former Chairman position at Tekelec, further augment his range of knowledge and understanding of Corporate Governance providing experience on which he can draw while serving as a member of our Board. He also qualifies as an "audit committee financial expert" from his experience as a Chief Financial Officer of a large public company and his professional qualifications which give him enhanced expertise to assist the Board with its financial oversight function.

M. Niel Ransom has served as a Director since August 2010. Mr. Ransom is a principal of Ransomshire Associates, Inc., an advisory firm he founded in 2005. He also serves as a board member of Cyan Inc., a provider of packet-optical transport platforms; Polatis, a provider of high performance optical switch solutions in optical communications; and MultiPhy, a provider of integrated circuits for high-speed optical communications. During the last five years, Mr. Ransom was previously a director of ECI Telecom, a provider of networking infrastructure equipment and Applied Micro, a processor and communication device manufacturer. Previously, as worldwide CTO of Alcatel and a member of its Executive Committee, he was responsible for research, corporate strategy, intellectual property and R&D investment. Prior to that, he directed Alcatel's access and metro optical business in North America. Earlier in his career, he directed the Advanced Technology Systems Center at BellSouth and various development and applied research organizations in voice and data switching at Bell Laboratories. He holds a Ph.D. in electrical engineering from the University of Notre Dame, BSEE and MSEE degrees from Old Dominion University, and an MBA from the University of Chicago.

We believe that Mr. Ransom brings to our Board significant international experience acquired during his service as worldwide CTO of Alcatel. Further, Mr. Ransom's experience at Alcatel enables him to offer valuable perspectives on Radisys' corporate planning and development. As a principal of a private advisory firm, Mr. Ransom brings to the Board significant senior leadership, operational and financial expertise. His board engagements in venture capital-based startups bring valuable insights in emerging technology trends.

Lorene K. Steffes has served as a Director since January 2005. Ms. Steffes is an independent business advisor with executive, business management and technical experience in telecommunications, information technology and high tech industries. From July 1999 to October 2003, she was an executive at IBM Corporation where she served as Vice President and General Manager, Global Electronics Industry. She was based in Tokyo for a time as IBM Vice President, Asia Pacific responsible for marketing and sales of solutions for the Telecommunications, Media & Entertainment and Energy & Utilities industries. Prior to her assignment in the Asia Pacific region, she was Vice President of software group services for IBM's middleware products. Ms. Steffes was appointed President and Chief Executive Officer of Transarc Corporation, Inc. in 1997. Prior to this appointment, she worked for 15 years in the telecommunications industry at Ameritech, AT&T Bell Laboratories and AT&T Network Systems. Ms. Steffes is a director on the board of PNC Financial Services Corporation and PNC Bank, NA, and a member of Women Corporate Directors (WCD) and the National Association of Corporate Directors (NACD). She was formerly a member of the Northern Illinois University College of Liberal Arts and Sciences advisory board and was formerly a trustee on the Carlow College Board in Pittsburgh. She holds a BS in Mathematics and MS in Computer Science from Northern Illinois University.

We believe that Ms. Steffes's qualifications to serve as a Director include her extensive technical knowledge and background, including telecommunications industry experience. Ms. Steffes's experience as a Chief Executive Officer of a high technology company and as a senior executive with a global technology company has given her an understanding of the financial, operational and other aspects of doing business globally. In addition, her service on boards of other companies gives her a deep understanding of the role of the Board of Directors in the Company's governance and operations, and broad experience in corporate strategy development.

Vincent H. Tobkin has served as a Director since May 2012. Mr. Tobkin was a Senior Advisor and Director of Bain & Company where he was a founder and practice leader for Bain's technology and telecom global practice area from 1992 to 2009. He joined Bain & Company after serving as a general partner and a founder of Sierra Ventures in 1984. He was a partner and management consultant with McKinsey & Company from 1976 to 1984 and was a founder and a leader of McKinsey’s global technology and telecom practice area. Mr. Tobkin was previously a director and Chairman of the Board of Tellabs, a telecom equipment manufacturer, and a director and Chairman of the Board of MeVC, a publicly traded venture capital firm. Mr. Tobkin holds J.D. and M.B.A. degrees from Harvard University and S.B. and S.M. degrees from the Massachusetts Institute of Technology.

We believe that Mr. Tobkin's qualifications to serve as a director include his vast knowledge of the overall global technology industry and his specific knowledge of the world-wide telecommunications industry and its business practices. He has public company board experience and has advised public companies and their executives throughout most of his career.

CORPORATE GOVERNANCE

Our Board of Directors has affirmatively determined that each of C. Scott Gibson, Hubert de Pesquidoux, M. Niel Ransom, Lorene K. Steffes and Vincent H. Tobkin are "independent directors" as defined by the SEC rules and within the meaning of the Nasdaq Listing Rule 5605(a)(2) and, therefore, a majority of our Board of Directors is currently independent as so defined.

We have implemented corporate governance policies that are designed to strengthen the accountability of our Board of Directors and management team, thereby aiming to achieve long-term shareholder value.

The Board is actively involved in oversight of risks that could affect the Company. This oversight is conducted primarily through committees of the Board, as disclosed in the descriptions of each of the committees below and in the charters of each of the committees, but the full Board has retained responsibility for general oversight of risks. The Board satisfies this responsibility through full reports by each committee chair regarding the committee's considerations and actions, as well as through regular reports directly from officers responsible for oversight of particular risks within the Company.

Our Board of Directors has adopted a Code of Ethics applicable to each of our directors, officers, employees and agents, including our Chief Executive Officer, Chief Financial Officer, Controller or persons performing similar functions. Our Code of Ethics is available on our website at www.radisys.com under Company/Investors/Corporate Governance.

In addition, our Board of Directors has implemented a process whereby shareholders may send communications directly to its attention. Any shareholder desiring to communicate with our Board of Directors, or one or more members of our Board of Directors, should communicate in writing addressed to our Corporate Secretary. Our Corporate Secretary has been instructed by our Board of Directors to promptly forward all such communications to the specified addressees. Shareholders should send communications directed to our Board of Directors to 5435 NE Dawson Creek Drive, Hillsboro, Oregon 97124, Attention: Corporate Secretary.

Our Board of Directors held four regularly scheduled meetings during the fiscal year ended December 31, 2013. The Board separates the roles of Chairman of the Board and Chief Executive Officer. The Board believes this provides an effective leadership model for the Company because it allows the Chief Executive Officer to focus his time and energy on managing and operating the Company while leveraging off of the perspectives and insights of the Chairman of the Board and other members of the Board. In 2013, independent directors met on a regularly scheduled basis in executive sessions without our Chief Executive Officer or other members of the our management present. The Chairman of the Board presides at these meetings.

Each director attended at least 75% of the regularly scheduled meetings of our Board of Directors and the committees of which he or she was a member. We encourage, but do not require, our Board of Directors' members to attend the annual shareholders meeting. Last year six of our directors attended the annual shareholders meeting.

Board Committees

Audit Committee.

We maintain an Audit Committee consisting of Hubert de Pesquidoux as Chair, C. Scott Gibson and Lorene K. Steffes. All of the members of the Audit Committee are “independent directors” within the meaning of the Nasdaq listing standards and Rule 10A-3 of the Exchange Act. In addition, our Board of Directors has determined that Hubert de Pesquidoux and C. Scott Gibson qualify as “audit committee financial experts” as defined by the SEC in Item 407(d)(5) of Regulation S-K promulgated under the Securities Act and are independent within the meaning of Rule 10A-3 of the Exchange Act. Mr. de Pesquidoux qualifies as an audit committee financial expert by virtue of his long service in a number of senior executive positions over 20 years at Alcatel-Lucent and its subsidiaries, including Chief Executive Officer, President and Chief Financial Officer. Mr. de Pesquidoux also serves on the audit committees of Sequans Communications S.A. and Mavenir Systems. Additionally, Mr. de Pesquidoux holds a master's degree in business law from Nancy Law University, is a graduate of the Institute for Political Studies (Sciences Po Paris) with a master's degree in Economics and Finance and holds a master's degree in International Finance from Paris Dauphine University. C. Scott Gibson qualifies as an audit committee financial expert by virtue of his service on our audit committee since 1993, the audit committee of Pixelworks, Inc. since 2002, the audit committee of Triquint Semiconductor, Inc. since 1992 and past service on the audit committees of Inference Corp., Integrated Measurement Systems and Verigy, Pty. Additionally, Mr. Gibson received an M.B.A. in Finance from the University of Illinois in 1976 and served as CFO and Senior VP of Operations for Sequent Computer Systems from 1983 to 1984. Further, from 1985 to 1988, the CFO of Sequent Computer Systems reported to Mr. Gibson. Mr. Gibson has significant audit committee educational experience, including speaking at several KPMG audit committee forums. Our Audit Committee assists our Board of Directors in fulfilling its oversight responsibilities relating to corporate accounting, our reporting practices and the quality and integrity of our financial reports; oversight of audit and financial risk; compliance with law and the maintenance of our ethical standards; and the effectiveness of our internal controls. The full responsibilities of our Audit Committee are set forth in its charter, a copy of which can be found on our website at www.radisys.com under Company/Investors/Corporate Governance. Our Audit Committee met thirteen times in the last fiscal year.

Compensation and Development Committee.

We maintain a Compensation and Development Committee consisting of Lorene K. Steffes as Chair, C. Scott Gibson, and Vincent H. Tobkin. Our Board of Directors has determined that all of the members of the Compensation and Development Committee are independent under applicable Nasdaq listing standards. None of the members of our Compensation and Development Committee are our current or former officers or employees. The Committee assists our Board of Directors in fulfilling its oversight responsibilities relating to our compensation policies and benefit plans, particularly policies relating to executive compensation and performance and associated risks. The Chairman of the Committee reports and reviews the Committee's activities and decisions with our Board of Directors on a regular basis. The Committee met seventeen times in the last fiscal year.

The Compensation and Development Committee is responsible for the design and management of our executive compensation programs as well as our philosophy and programs for all employee compensation, benefit, and development programs on a worldwide basis. In accordance with the Nasdaq listing standards, the Committee has the authority to engage legal counsel, compensation consultants and other advisers. The full responsibilities of the Committee are set forth in a written charter, which is formally reviewed by the Committee on an annual basis. Our Board of Directors regularly reviews the Committee charter and approves any proposed changes made by the Committee. The charter is available on our website at www.radisys.com under Company/Investors/Corporate Governance.

Our Compensation and Development Committee annually reviews and establishes executive compensation levels and makes equity grants to our officers under the Radisys Corporation 2007 Stock Plan (the “2007 Stock Plan”). The Committee has delegated its responsibility for approving non-executive employee new hire and refresher equity grants (up to a maximum grant of 10,000 shares per individual and within established guidelines) to our Chief Executive Officer, Brian Bronson. In addition, pursuant to its Charter, the Committee may delegate authority to its Chairman and one or more members, as the Committee deems necessary, provided that the decisions of such members shall be presented to the full Committee at its next scheduled meeting.

The Compensation and Development Committee engages Mercer, a subsidiary of Marsh & McLennan Companies, Inc., periodically to provide guidance on best practices in executive compensation and supplement the current executive compensation benchmarking process and analysis. Every other year, Mercer provides salary benchmarking data on the top executive officer positions (generally the Chief Executive Officer and Chief Financial Officer positions), and on Board of Director compensation, which data the Committee utilizes in fulfilling its responsibilities.

Our Compensation and Development Committee maintains a formal annual calendar and annual plan to guide the timing of the Committee's review, analysis, and decision making related to our compensation, benefits, and development programs. Our Chief Executive Officer and President and Chief Financial Officer provide inputs and recommendations to the Committee on matters of executive compensation. Under the supervision of the Committee, our Chief Executive Officer and President and Chief Financial Officer have responsibility for the execution of our compensation philosophy and related compensation elements.

Nominating and Corporate Governance Committee.

We maintain a Nominating and Corporate Governance Committee consisting of Vincent H. Tobkin as Chair, M. Niel Ransom, and Lorene K. Steffes. Our Board of Directors has determined that all of the members of the Nominating and Corporate Governance Committee are independent under applicable Nasdaq listing standards. The Committee met six times in the last fiscal year. The Committee (i) recommends for our Board of Director's selection the individuals qualified to serve on our Board of Directors (consistent with criteria that our Board of Directors has approved) for election by shareholders at each annual meeting of shareholders to fill vacancies on our Board of Directors, (ii) develops and recommends to our Board of Directors, and assesses our corporate governance policies or any risks implicated thereby, and (iii) oversees the evaluations of our Board of Directors. The full responsibilities of the Committee are set forth in its charter, a copy of which is posted on our website at www.radisys.com under Company/Investors/Corporate Governance. Our Board of Directors considers the recommendations of the Committee with respect to the nominations of directors to our Board of Directors, but otherwise retains authority over the identification of nominees. Candidates to serve on our Board of Directors are considered based upon various criteria, such as ethics, business and professional activities, diversity of relevant business expertise and education, available time to carry out our Board of Directors' duties, social, political and economic awareness, health, conflicts of interest, service on other boards and commitment to our overall performance. The Committee will make an effort to maintain representation on our Board of Directors of members who have substantial and direct experience in areas of importance to us. As noted above, when evaluating candidates for the Board of Directors, the Committee considers each candidate's diversity of relevant business expertise and education and, on an annual basis, the Board of Directors undertakes a self evaluation to help it determine whether the composition of the members of the Board of Directors satisfies appropriate criteria, including such diversity.

Strategic Oversight Committee.

We maintain a Strategic Oversight Committee (formerly the Technology and Market Development Committee) consisting of M. Niel Ransom as Chair, C. Scott Gibson, Hubert de Pesquidoux, and Vincent H. Tobkin. The Committee met three times in the last fiscal year. The Committee is responsible for evaluating the competitive landscape and analyzing global market trends, emerging new technologies and applications, and identifying and evaluating new technologies, markets and applications for the potential growth and development of the Company. The full responsibilities of the Committee are set forth in its charter, a copy of which is posted on our website at www.radisys.com under Company/Investors/Corporate Governance.

Director Nomination Policy

The Nominating and Corporate Governance Committee (the "Nominating Committee") has a policy with regard to consideration of director candidates recommended by shareholders. The Nominating Committee will consider nominees recommended by our shareholders holding no less than 10,000 shares of our common stock continuously for at least 12 months prior to the date of the submission of the recommendation. A shareholder that desires to recommend a candidate for election to our Board of Directors shall direct his or her recommendation in writing to Radisys Corporation, Attention: Corporate Secretary, 5435 NE Dawson Creek Drive, Hillsboro, Oregon 97124. The recommendation must include the candidate's name, home and business contact information, detailed biographical data and qualifications, information regarding any relationships between us and the candidate within the last three years and evidence of the recommending shareholder's ownership of our common stock. In addition, the recommendation shall also contain a statement from the recommending shareholder in support of the candidate, professional references, particularly within the context of those relevant to membership on our Board of Directors, including issues of character, judgment, diversity, age, independence, expertise, corporate experience, length of service, other commitments and the like, personal references and a written indication by the candidate of his or her willingness to serve, if elected.

Related Party Transactions Policy

The Company has established procedures regarding approval of transactions between the Company and any employee, officer, director and other related persons, including those required to be reported under Item 404 of Regulation S-K. Under the Company's Code of Conduct and Ethics, directors, officers and employees are required to evaluate their relationships, circumstances and actions, such as having a direct or indirect business connection with our customers, suppliers or competitors or being involved in a close personal relationship with an employee of a Company's business partner, and to report any potential conflict of interest situation with a manager or other appropriate person or authority. When such conflict of interest or related party transaction constitutes a transaction required to be disclosed under Item 404 of Regulation S-K, our Audit Committee Charter provides that such transaction must be approved by the Audit Committee prior to initiation of any such transaction. Each member of the Audit Committee uses his or her business judgment in light of the facts and circumstances available in determining whether to vote to approve or disapprove such related party transaction.

2013 DIRECTOR COMPENSATION

|

| | | | | | | |

| Fees Earned or Paid in Cash | Stock Awards (1) | Option Awards (1) | Non-Equity Incentive Plan Compensation | Change in Pension Value and Nonqualified Deferred Compensation Earnings (2) | All Other Compensation | Total |

C. Scott Gibson | $97,500 | $25,125 | $0 | $0 | $0 | $0 | $122,625 |

Hubert de Pesquidoux | $60,000 | $25,125 | $0 | $0 | $0 | $0 | $85,125 |

Kevin C. Melia (3) | $59,000 | $25,125 | $0 | $0 | $0 | $0 | $84,125 |

David Nierenberg (4) | $45,000 | $25,125 | $0 | $0 | $0 | $0 | $70,125 |

M. Niel Ransom | $51,000 | $25,125 | $0 | $0 | $0 | $0 | $76,125 |

Lorene K. Steffes | $53,500 | $25,125 | $0 | $0 | $0 | $0 | $78,625 |

Vincent H. Tobkin | $47,500 | $25,125 | $0 | $0 | $0 | $0 | $72,625 |

| |

(1) | The amounts included in the Stock Awards and Option Awards columns include the aggregate grant date fair value of stock and option awards granted in the fiscal year computed in accordance with ASC 718. We continue to use the Black-Scholes model to measure the grant date fair value of stock options and the amounts above do not include any |

forfeiture reserve. For a discussion of the valuation assumptions used to value the options, see Note 17 to our Consolidated Financial Statements included in our annual report on Form 10‑K for the fiscal year ended December 31, 2013. A supplemental table following these footnotes sets forth: (i) the aggregate number of stock awards and option awards outstanding at 2013 fiscal year end; (ii) the aggregate number of stock awards and options awards granted during fiscal 2013; and (iii) the grant date fair value of equity awards granted by us during fiscal 2013 to each of our directors who was not an executive officer.

| |

(2) | The 2013 Director Compensation Table only requires disclosure of above-market or preferential returns on nonqualified deferred compensation. Participants in our Non-Qualified Deferred Compensation Plan make voluntary contributions to their accounts. Participants elect to benchmark earnings on their accounts to the performance of third-party investment funds available to them under the Non-Qualified Deferred Compensation Plan. Participants select from among the funds available to them. Earnings are calculated and applied to participant accounts daily and may be positive or negative, based on individual fund performance. Although the funds offered to participants under our Non-Qualified Deferred Compensation Plan differ from those under our 401(k) plan, the number of funds and investment objectives of each fund are similar to those under the 401(k) plan. In accordance with SEC rules and publicly available interpretations of these rules by the SEC Staff, earnings on deferred compensation invested in third-party investment vehicles, such as mutual funds, need not be reported as compensation on the Director Compensation Table. |

| |

(3) | Mr. Melia passed away on June 17, 2014. |

| |

(4) | Mr. Nierenberg resigned from our Board, effective January 17, 2014. |

Additional Information With Respect to Director Equity Awards

|

| | | | | | | | | | | | |

Name | Option Awards Outstanding at 2013 Fiscal Year End (#) (1) |

Stock Awards Outstanding at 2013 Fiscal Year End (#) (2) | Option Awards Granted during Fiscal 2013 (#) (1) |

Stock Awards Granted during Fiscal 2013 (#) (2) |

Grant Date Fair Value of Option Awards Granted in Fiscal 2013 ($) (3) | Grant Date Fair Value of Stock Awards Granted in Fiscal 2013 ($) (3) |

C. Scott Gibson | 63,000 |

| 11,875 |

| — |

| 7,500 |

| — |

| 25,125 |

|

Hubert de Pesquidoux | 7,000 |

| 12,042 |

| — |

| 7,500 |

| — |

| 25,125 |

|

Kevin C. Melia | 59,000 |

| 11,875 |

| — |

| 7,500 |

| — |

| 25,125 |

|

David Nierenberg | 7,000 |

| 13,209 |

| — |

| 7,500 |

| — |

| 25,125 |

|

M. Niel Ransom | 7,000 |

| 11,875 |

| — |

| 7,500 |

| — |

| 25,125 |

|

Lorene K. Steffes | 64,000 |

| 11,875 |

| — |

| 7,500 |

| — |

| 25,125 |

|

Vincent H. Tobkin | 7,000 |

| 12,042 |

| — |

| 7,500 |

| — |

| 25,125 |

|

| |

(1) | Includes both vested and unvested options to purchase our common stock. |

| |

(2) | Stock grants to our Board are made pursuant to the terms of the 2007 Stock Plan. Grants of restricted stock unit awards in 2013 vest 25% of the total shares on each of the following dates: October 1, 2013, January 1, 2014, April 1, 2014 and July 1, 2014. |

| |

(3) | Amounts in this column represent the fair value of stock options and stock awards, calculated in accordance with ASC 718. For option awards, that number is calculated by multiplying the Black-Scholes value by the number of options awarded and the amounts above do not include any forfeiture reserve. For stock awards, that number is calculated by multiplying the fair market value on the grant date by the number of stock awards granted. |

Narrative Disclosure of Director Compensation

During 2013, each director who was not employed by us was compensated per the chart below. Director compensation is reviewed on an annual basis. Compensation adjustments, if determined appropriate, are typically effective April 1st. For 2013, there were no changes to the Board committee and chair retainers. Following a market analysis, the Committee determined board compensation was below market by approximately 12.5% and therefore approved an increase to the annual Board and Chairman of the Board retainer took effect April 1, 2014.

|

| | | | | | |

| Effective from April 1, 2012 |

| Effective April 1, 2014 |

|

Director annual retainer | $ | 35,000 |

| $ | 40,000 |

|

Chairman of the Board annual retainer | $ | 75,000 |

| $ | 80,000 |

|

Audit Committee Chairman | $ | 20,000 |

| $ | 20,000 |

|

Compensation and Development Committee Chairman | $ | 14,000 |

| $ | 14,000 |

|

Nominating and Governance Committee Chairman | $ | 11,000 |

| $ | 11,000 |

|

Strategic Oversight Committee Chairman | $ | 11,000 |

| $ | 11,000 |

|

Audit Committee membership | $ | 10,000 |

| $ | 10,000 |

|

Compensation and Development Committee membership | $ | 7,500 |

| $ | 7,500 |

|

Nominating and Governance Committee membership | $ | 5,000 |

| $ | 5,000 |

|

Strategic Oversight Committee membership | $ | 5,000 |

| $ | 5,000 |

|

Effective January 2012, non-employee directors are expected to acquire and hold a minimum of common stock worth six times the annual retainer or 20,000 shares, whichever is the lesser value, and that minimum amount is expected to be reached within three to five years of becoming a director. Directors must purchase a minimum of 10,000 shares unless it causes undue hardship. Directors must reach the minimum stock ownership guidelines prior to selling any shares of Company stock. Of our current non-employee directors, two have reached this ownership goal and three are within the three to five period to reach this goal. Directors who are our employees receive no separate compensation as directors.

In addition, non-employee directors during 2013 received an equity grant of 7,500 restricted stock units. The vesting of the restricted stock units granted in 2013 was over four fiscal quarters as described above. Effective April 1, 2014, non-employee directors will receive an annual equity grant of restricted stock units valued at $55,000. The restricted stock units will vest 25% of the total shares on July 1, 2014, October 1, 2014, January 1, 2015 and April 1, 2015. Newly appointed directors receive a similar grant of 7,000 non-qualified stock options and 4,000 restricted stock units upon appointment to the Board with “refresher” annual equity grants to commence immediately upon appointment if appointment occurs after granting of the annual Board refresher grants or during the next annual refresher cycle for the full Board if appointed prior to the granting of the annual Board refresher grants. Directors are also reimbursed for reasonable expenses incurred in attending meetings.

On February 20, 2014, the Committee adopted a standing policy with respect to outstanding awards granted to the non-employee members of the Board under the 2007 Stock Plan. Under the standing policy, pursuant to Section 16(c)(iii) of the 2007 Stock Plan, in the event of a Transaction (as defined in the 2007 Stock Plan) that results in a change of control of the Company, all time-based vesting conditions shall be accelerated immediately prior to the effective time of such a Transaction without any further action by the Committee or the Board.

During 2013 the Board approved the termination of the Radisys Corporation Deferred Compensation Plan (the “Deferred Compensation Plan”), including in respect of deferrals of compensation under the Deferred Compensation Plan prior to January 1, 2005 (such portion of the Deferred Compensation Plan, the “Grandfathered Plan”). The Deferred Compensation Plan (other than in respect of the Grandfathered Plan) is terminated effective August 31, 2013 and the Grandfathered Plan is terminated effective September 1, 2014. The distribution of plan assets and participant balances under the Grandfathered Plan will begin in September 2014 and will continue through January 2015. Participants with an account balance in the Grandfathered Plan will be paid out in the form designated by the participant at the time of deferral. All other account balances under the Deferred Compensation Plan will be paid out in a lump sum in September 2014.

Each member of our Board was previously eligible to participate in the Deferred Compensation Plan. The Deferred Compensation Plan provided the members of our Board the opportunity to defer up to 100% of compensation (includes annual

retainer and committee fees). Contributions by the members of our Board were credited on the date they would otherwise have been paid to the participant. We made no contributions on behalf of our Board members who participated in the Deferred Compensation Plan.

Participants selected from among the fund(s) available to them. Earnings were calculated and applied to participant accounts daily and could be positive or negative, based on individual fund performance.

Recommendation by the Board of Directors

THE BOARD OF DIRECTORS RECOMMENDS THAT THE SHAREHOLDERS VOTE "FOR" THE ELECTION OF EACH OF THE SIX NOMINEES FOR DIRECTOR.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information regarding the beneficial ownership of our common stock as of July 31, 2014 (or such other date as otherwise indicated in the footnotes below) by (i) each person known by us to be the beneficial owner of more than 5% of our common stock, (ii) each of our directors and nominees for directors, (iii) each “named executive officer” named in the Summary Compensation Table and (iv) all of our directors and executive officers as a group. Unless otherwise noted in the footnotes to the table, the persons named in the table have sole voting and investment power with respect to all outstanding shares of common stock shown as beneficially owned by them.

|

| | | | | |

Name | | Shares Beneficially Owned | | Percentage of Common Stock (1) |

CURRENT DIRECTORS | | | | |

C. Scott Gibson (2) (3) | | 132,924 |

| | * |

Hubert de Pesquidoux (2) | | 27,083 |

| | * |

M. Niel Ransom (2) | | 47,478 |

| | * |

Lorene K. Steffes (2) | | 95,778 |

| | * |

Vincent H. Tobkin (2) | | 26,889 |

| | * |

CURRENT NAMED EXECUTIVE OFFICERS | | | | |

Brian Bronson (2) | | 696,396 |

| | 1.89% |

Stephen Collins (2) | | 17,344 |

| | * |

Allen Muhich (2) | | 98,916 |

| | * |

All directors and officers as a group (9 persons) (2) (4) | | 1,242,127 |

| | 3.35% |

| | | | |

FORMER DIRECTORS AND EXECUTIVE OFFICERS |

Kevin C. Melia (2) (5) | | 75,778 |

| | * |

David Nierenberg (2) (6) | | 4,542,629 |

| | 12.53% |

Amit Agarwal (2) (7) | | — |

| | * |

Keate Despain (2) (8) | | 140,662 |

| | * |

| | | | |

PRINCIPAL SHAREHOLDERS | | | | |

Columbus Capital Management, LLC (9) | | 1,868,200 |

| | 5.15% |

1 Market Street, Spear Tower, Suite 3790

| | | | |

San Francisco, CA 94105

| | | | |

The D3 Family Funds, L.P. (6) | | 4,542,629 |

| | 12.53% |

Nierenberg Investment Management Company | | | | |

19605 NE 8th Street | | | | |

Camas, WA 98607 | | | | |

Wellington Management Company (10) | | 2,228,871 |

| | 6.15% |

280 Congress St. | | | | |

Boston, MA 02210 | | | | |

* Less than 1%

| |

(1) | Percentage ownership is calculated based on 36,247,405 shares of our common stock outstanding on July 31, 2014. |

| |

(2) | Includes options to purchase shares of our common stock exercisable within 60 days after July 31, 2014 or restricted stock units that will vest within 60 days after July 31, 2014 as set forth below. |

|

| | | | | | |

Name | | Options to Purchase Shares | | Restricted Stock Units |

Amit Agarwal | | — |

| | — |

|

Brian Bronson | | 536,519 |

| | 24,525 |

|

Stephen Collins | | — |

| | 12,500 |

|

Keate Despain | | 102,410 |

| | 9,800 |

|

Hubert de Pesquidoux | | 5,639 |

| | — |

|

C. Scott Gibson | | 48,000 |

| | — |

|

Kevin C. Melia | | 42,000 |

| | — |

|

Allen Muhich | | 68,487 |

| | 8,261 |

|

David Nierenberg | | — |

| | — |

|

M. Niel Ransom | | 7,000 |

| | — |

|

Lorene K. Steffes | | 52,000 |

| | — |

|

Vincent H. Tobkin | | 5,445 |

| | — |

|

| |

(3) | Includes 69,046 shares held in the Deferred Compensation Plan. |

| |

(4) | The total amount includes 26,695 shares owned by executive officer Grant Henderson, Vice President of Marketing and Product Development and 63,824 options to purchase shares of our common stock, exercisable within 60 days after July 31, 2014 and 8,800 restricted stock units that will vest within 60 days after July 31, 2014. |

| |

(5) | Includes 3,000 shares held in an irrevocable trust which are pledged as security on brokerage loan account. There was no outstanding balance on the loan as of July 31, 2014. Mr. Melia passed away on June 17, 2014. |

| |

(6) | David Nierenberg is the President of Nierenberg Investment Management Company, Inc. (“NIMCO”), which manages The D3 Family Funds. David Nierenberg, NIMCO and The D3 Family Funds have joint beneficial ownership and shared voting authority over 4,542,629 shares of our common stock. The shares reported herein are based on information set forth in Schedule 13D filed by The D3 Family Funds with the SEC on January 21, 2014. Mr. Nierenberg disclaims beneficial ownership by the four partnerships of NIMCO except to the extent of his own general partner & limited partner investments in each of the funds. Mr. Nierenberg resigned as a Director effective January 17, 2014. |

| |

(7) | Mr. Agarwal is no longer with the company. |

| |

(8) | Mr. Despain is no longer an executive officer. |

| |

(9) | Based solely on information set forth in Schedule 13G filed on April 11, 2014. According to the filing of Columbus Capital Management, LLC, Columbus Capital Management, LLC has sole voting power for zero shares, sole dispositive power for zero shares, has shared voting power for 1,868,200 shares and shared dispositive power for 1,868,200 shares. Matthew D. Ockner has sole voting power for zero shares, sole dispositive power for zero shares, has shared voting power for 1,868,200 shares and shared dispositive power for 1,868,200 shares. |

| |

(10) | Based solely on information set forth in Schedule 13G filed on April 10, 2014. According to the filings made Wellington Trust Company, NA (“Wellington Trust”) and Wellington Management Company, LLP (“Wellington Management”, and together with Wellington Trust, “Wellington”), Wellington has sole voting power for zero shares, sole dispositive power for zero shares, shared voting power for 2,228,871 shares and shared dispositive power for 2,228,871 shares. According to the filings made by Wellington, Wellington reported that in its capacity as an investment adviser, Wellington may be deemed to beneficially own 2,228,871 shares of common stock which are held of record by clients of Wellington. |

EXECUTIVE OFFICERS

Set forth in the table below is the name, age and position with the Company of each of our executive officers:

|

| | | | |

Name | | Age | | Position |

Brian Bronson | | 43 | | President and Chief Executive Officer |

Stephen Collins | | 51 | | Vice President, Global Sales |

Grant Henderson | | 49 | | Vice President, Marketing and Product Management |

Allen Muhich | | 47 | | Chief Financial Officer |

See Brian Bronson's biography above.

Stephen Collins joined us in September 2013 as Vice President, Global Sales. Before joining Radisys, Mr. Collins was the Vice President, Americas Sales with Sonus Networks from 2007 to 2013 where he managed and directed all aspects of the Americas sales organization. Mr. Collins holds a B.A. in Economics from the University of Virginia.

Grant Henderson joined us in September 2006 as Vice President, Product Marketing. He was named an executive officer in January 2014 and is currently our Vice President, Marketing and Product Management. Before joining Radisys, Mr. Henderson was Co-Founder and Executive Vice President of Marketing and Strategy at Convedia Corporation from 2000 to 2006 where he was responsible for the company's marketing, business development and product strategy. He has also held marketing and product management positions at Newbridge Networks, Bell Canada and Telecom Canada/Stentor and has published papers in IEEE Multimedia and IEEE's International Conference on Multimedia Computing and Systems. In addition, he holds a U.S. patent related to IP media processing. Mr. Henderson holds an B.Sc in Computer Science from McMaster University in Canada and has completed postgraduate work at the University of Ottawa.

Allen Muhich joined us in May 2011 as our Vice President of Finance. In October 2012, he was named our Interim Chief Financial Officer, and on February 1, 2013, he was confirmed as our Chief Financial Officer. Prior to joining us, Mr. Muhich was employed by Merix Corporation, serving as Vice President of Finance in 2007, and as Vice President and Corporate Controller from 2008 to 2010, where he was responsible for Global Finance, Accounting and Investor Relations. Mr. Muhich has also held financial management positions at Tripwire, Danaher Corporation, Xerox Corporation, and Tektronix, Inc. Mr. Muhich has over 20 years of public company experience in finance and accounting functions focused on manufacturing, growth and technology businesses. Mr. Muhich holds a B.A. degree in Accounting from Western Washington University.

Executive Officer Compensation

Executive Compensation Discussion and Analysis (CD&A)

Section I: Executive Summary

Radisys Corporation (the “Company”) continued to make tangible progress on its strategic transformation throughout 2013. The Company’s focus on business strategy, operational performance and simplification, as well as deep and fundamental restructuring and streamlining of the Company, has positioned the Company for long-term growth and we expect to return to non-GAAP profitability and positive cash flow in the second half of 2014.

The Company continued to experience revenue challenges throughout 2013 due to constrained global telecom infrastructure spending in our target markets and historical strategic decisions to focus on certain markets and products. The Company increased focus and investment in three areas: Media Processing, LTE Solutions and Services, and next generation telecommunications platforms. Also, in 2013 we initiated and substantially completed an organizational restructuring that when ultimately complete is expected to reduce annual gross expenses by over $30 million (compared to 2012). We anticipate completing these restructuring activities in the second half of 2014. The organizational restructuring includes the elimination of management layers resulting in increased span of control, the closure of our Shanghai design center and Penang operations center as well as the movement of the Company’s contract manufacturing to a different outsourcing partner located in Shenzhen, China. In 2014, we have moved much of our attention to winning new business in the three strategic areas mentioned above.

The Compensation & Development Committee (the “Committee”) believes the executive team achieved a number of strategic initiatives that established a foundation for improved financial performance and positioned the Company for long-term

earnings growth. Therefore, in order to retain and motivate essential executive team members necessary to continue the strategic transformation that is required, the Committee chose to maintain competitive base pay levels, align short term incentive compensation to the achievement of near-term financial measures and align long term incentive targets to the achievement of strategic objectives that are necessary to position the Company for improved long-term success.

Compensation Philosophy

The Committee has adopted a performance-based executive compensation philosophy that is competitive with other similarly sized technology companies. Executive compensation programs are designed to reflect the following key objectives:

| |

• | To attract and retain executives needed to achieve the Company's business objectives. This objective is achieved through no less than annual reviews of executive total compensation and benefit programs to ensure market competitiveness. |

| |

• | To substantially link executive compensation with the achievement of near-term operating plans. This is achieved through variable compensation programs which are directly aligned to key operating goals and strategic objectives. The Committee has set clear expectations that certain levels of positive operating income must be achieved to enable funding of both variable cash and equity compensation. |

| |

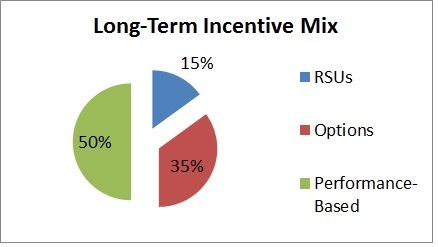

• | To provide the opportunity for additional variable compensation through the achievement of longer-term strategic objectives and the creation of shareholder value. This is achieved through the issuance of awards under equity-based compensation programs and includes the use of performance-based shares. |

The Committee believes the amount of variable or "at risk" compensation tied to meeting company objectives should increase as a percentage of an executive's overall compensation as the executive’s level of responsibility increases. An executive's target compensation is based on his/her job scope and level of responsibility, with a large portion of the opportunity tied to Company performance and shareholder return. We believe the Company’s balance between base salary and both short and long-term variable compensation is competitive with other similar companies in the industry peer group.

Pay for Performance

The Company targets to deliver above market compensation for above market company performance and below market compensation for below market company performance, resulting in executive compensation increasing or decreasing based on the overall performance of the Company. When determining the targets for executive variable compensation, the Committee selects metrics that it believes are most closely tied to the market’s expectation of both near-term financial objectives and those strategic goals necessary for long-term success. For 2013, variable cash compensation was contingent upon the achievement of non-GAAP operating income targets, while performance-based equity vesting was dependent upon achievement of key strategic objectives that the Committee believes are fundamental in preparing the Company for success in 2014 and beyond.

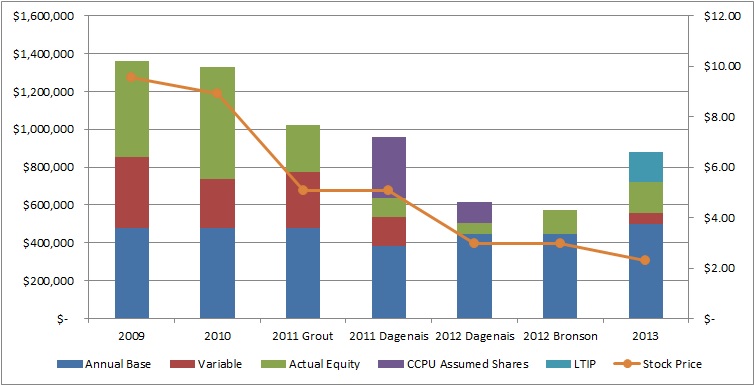

The link between pay and performance is highlighted by the trends in the Chief Executive Officer's compensation below. The Chief Executive Officer's total actual and potential compensation (sum of annual base pay, variable cash compensation earned, actual equity awards released/outstanding, Continuous Computing (“CCPU”) assumed shares and Long-Term Incentive Plan (as amended and restated, the “LTIP”), each as defined below) has generally been reflective of stock price over the last five years. More than 50% of the Chief Executive Officer's compensation has been tied to Company performance for the periods presented below. The overall increase in CEO pay in 2013 over 2012 is primarily due to the achievement of 2013 strategic initiatives that we expect will impact the financial results of the company in 2014 and beyond. Recognition of this progress has been reflected in the overall increase in 2014 average monthly stock price as compared to 2013 (January 2014 average daily closing stock price = $2.65, February 2014 average daily closing stock price = $3.37, March 2014 average daily closing stock price = $3.87, April 2014 average daily closing stock price = $3.31, May 2014 average daily closing stock price = $3.13, June 2014 average daily closing stock price = $3.25, and July 2014 average daily closing stock price = $3.34).

“Annual Base”- means the annual base salary effective at year-end.

“Variable”- means the total short-term cash incentive awards earned during the calendar plan year. For Mr. Dagenais, only his bonus payment for performance during the 2nd half of 2011, after the Continuous Computing acquisition, is included. For Mr. Grout, both 1st & 2nd half bonus payments are included for 2011.

“Actual Equity” - means the value of equity awards (other than LTIP) outstanding at year-end. For RSUs, such value is the value of unvested RSUs outstanding at year-end. For stock options (vested and unvested), such value is the difference between an option's strike price and the stock price at year-end; if an option's strike price is below the year-end stock price, the value of the option is $0.

“CCPU Assumed Shares” - means those unvested shares issued by Continuous Computing which were converted and assumed by the Company on the acquisition date.

“LTIP” - means the value of Long-Term Incentive Plan (as amended and restated) awards which are designed to be paid when the indicated performance targets are achieved within the applicable performance periods. Such value is the value at year-end of the shares earned and released under the plan during 2013.

“Stock Price” - means the closing stock price on the last day of the calendar year.

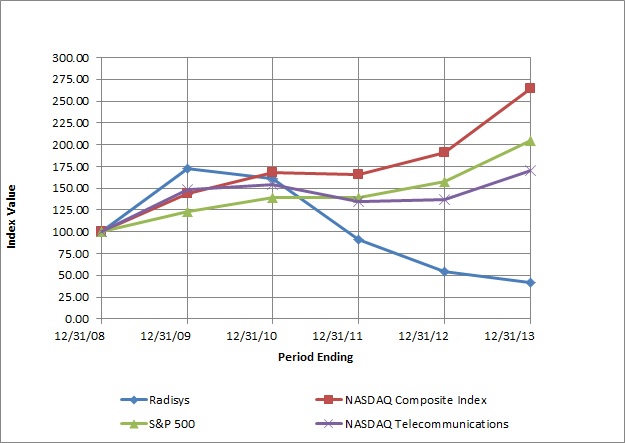

For a comparison of the Company stock performance relative to the NASDAQ Composite and other composites at the end of each calendar year, please refer to the table below.

Section II: Elements of Executive Compensation

The following table outlines elements of direct compensation of executives in 2013 and how it aligns with the Company's philosophy and business strategy.

|

| | | |

Compensation Element | What is Rewarded | How it aligns with Strategic Objectives | Fixed or Variable / Performance Related |

Base Salary | Skills and abilities critical to success of the business

Experience and performance against individual objectives

Demonstrated success in meeting or exceeding key financial and other business objectives | Competitive base salaries enable the attraction and retention of talent

Merit-based salary increases reflect pay for performance philosophy | Fixed / Merit Increases are Performance-Related |

Variable Compensation (short-term incentives) | Variable Compensation Plan:

Organizational performance during the year measured by achievement in respect of pre-defined profitability goals

Individual performance during the year measured against identified goals and objectives | Payout of awards depends on ability to fund and individual and organizational performance

Competitive, market-based variable incentive targets enables the attraction and retention of talent | Variable / Performance-Related |

| Sales Incentive Plan:

Performance during the year measured by achievement with respect to pre-defined revenue and design win goals | Payout is dependent upon overall sales organization performance

Competitive, market-based variable incentive targets enables the attraction and retention of talent | Variable / Performance-Related |

Equity Compensation (long-term incentives) | Stock Options:

Increase in stock price Retention | Value results from stock price increases

Vesting schedule supports retention | Variable / Performance-Related |

| Restricted Share Units ("RSUs"):

Increase in stock price Retention | Although RSUs always have value, the value increases or decreases as the stock price increase or decreases

Vesting schedule supports retention | Variable / Performance-Related |

| Performance Based Awards (LTIP / Overlay):

Performance relative to pre-determined strategic and financial goals (product delivery, market penetration, long-term growth/design wins and operational/financial metrics) | Payout is based on metrics important to shareholders

Performance period spans 1-2 years and supports retention | Variable / Performance-Related |

In addition to direct compensation, the Company provides executives with the following indirect compensation.

Executives are provided with the same benefit options as those provided to other employees in the same location. The U.S. based employee benefit program includes medical, dental and vision plans, an Employee Stock Purchase Plan (“ESPP”), a 401(k) plan, tuition reimbursement, life insurance and short and long-term disability coverage.

During 2013, executives, certain other senior employees and members of the Board of Directors were also eligible to participate in the Radisys Corporation Deferred Compensation Plan (the "Deferred Compensation Plan"). The gains or losses of participants in the Deferred Compensation Plan, based on their investment choices, are not a factor in determining a participant's base salary, cash incentive payments, equity awards or any other forms of reward or compensation. During 2013, the Board of Directors approved the termination of the Deferred Compensation Plan. The distribution of plan assets and participant balances will begin in September 2014 and continue through January 2015. See "Narrative Disclosure Describing Material Factors - 2013 Nonqualified Deferred Compensation Plan Table" under Summary Compensation Table for additional information regarding the termination of the Deferred Compensation Plan.

Executives do not receive any special perquisites such as club memberships, pension plans, automobile allowances or dwellings for personal use. Relocation packages to newly hired executives and other newly hired employees are defined within the Company's hiring policy and are based on standard market practices for executive-level relocation.

Section III: Compensation Determinations

2013 Individual Compensation Changes - In February 2013, the Committee approved compensation changes for Mr. Muhich in conjunction with his promotion to Chief Financial Officer and Mr. Despain and Mr. Agarwal in conjunction with their increased scope of role in managing their respective business units, including direct oversight over their respective sales organizations. In June 2013, the Committee approved a base pay change for Mr. Bronson, consistent with a planned increase that was discussed at the time of his promotion to Chief Executive Officer in October 2012.

In September 2013, in conjunction with the annual merit review process for North America employees and the annual executive compensation review process, the Committee approved compensation adjustments to base pay and variable compensation targets for Mr. Muhich, Mr. Agarwal and Mr. Despain.

In January 2014, Mr. Agarwal stepped down from his position as Vice President and General Manager of the Company’s software-solutions product group and left the Company. In connection with Mr. Agarwal’s departure, and in addition to the benefits provided to Mr. Agarwal pursuant to his executive severance agreement, the Committee exercised its discretion to accelerate the time-based vesting conditions of Mr. Agarwal’s awards under the overlay plan for which the performance-based vesting conditions had been satisfied prior to his departure. See “Potential Post-Employment Payments” under Summary Compensation Table for a summary of the benefits received by Mr. Agarwal pursuant to his executive severance agreement.

The table below reflects approximate compensation market percentiles1 of each compensation element for each Named Executive Officer (“NEO”).

|

| | | | | | |

Named Executive Officer2 | Date | Base Salary | Target Variable (% of Pay)3 | Target Total Cash Comp | Actual Total Cash Comp | Comments |

Brian Bronson, Chief Executive Officer | January 2013 | 25th-50th | 50th | 25th-50th | <25th | President and Chief Executive Officer |

June 2013 | 50th-75th | 50th | 50th-75th | <25th | Merit adjustment effective June 1, 2013 |

Amit Agarwal, Vice President & GM | January 2013 | 25th-50th | 50th | 25th-50th | <25th | Vice President and General Manager |

February 2013 | 50th-75th | 25th-50th | 25th-50th | <25th | Expanded role effective February 1, 2013 to include business unit sales responsibility |

September 2013 | 50th | 25th-50th | 25th-50th | <25th | Merit adjustment effective September 1, 2013 |

Stephen Collins, Vice President, Global Sales | September 2013 | 50th | 50th-75th 4 | 25th-50th | <25th | Vice President, Global Sales hired September 30, 2013 |

Keate Despain, Vice President & GM | January 2013 | 50th | 50th-75th | 50th-75th | <25th | Vice President and General Manager |

February 2013 | 25th-50th | 25th | 25th-50th | <25th | Expanded role effective February 1, 2013 to include business unit sales responsibility |

September 2013 | 25th-50th | 25th-50th | 25th-50th | <25th | Merit adjustment effective September 1, 2013 |

Allen Muhich, Chief Financial Officer | January 2013 | <25th | <25th | <25th | <25th | Interim Chief Financial Officer |

February 2013 | <25th | 25th | <25th | <25th | Promotion to Chief Financial Officer effective February 1, 2013 |

| September 2013 | 25th | 25th-50th | 25th-50th | <25th | Merit adjustment effective September 2, 2013 |

1 Market percentiles are approximate based on 2013 benchmark data as further explained in Section IV below.

2 Reflects September 2013 job title.

3 Target Variable excludes the targeted supplemental incentives described under Short-Term Incentive Plans below.

4 Mr. Collins receives a portion of his Target Variable pay under the company’s Variable Compensation Plan and a portion under the Sales Incentive Plan.

Short-Term Incentive Plans

The 2013 Variable Compensation Plan was designed to support the Company's pay for performance philosophy and motivate and compensate executives for the achievement of planned profitability and other pre-approved management by objective (“MBO”) goals. To meet its stated philosophy, the Committee utilized non-GAAP operating income targets as the primary measure by which to establish variable compensation funding. Actual non-GAAP operating income achievement against those targets determined first and second half 2013 funding with over or under achievement resulting in higher or lower funding based upon a pre-established linear relationship, subject to the Committee’s discretion to increase or decrease funding. In addition, a minimum level of non-GAAP operating income, or threshold, for each half of 2013 was required to be met to begin funding. Similarly, as discussed below, payout for a portion of second half 2013 funding was dependent upon the achievement of individualized MBOs by executives with a threshold set at non-GAAP operating income achievement above zero.

The first half 2013 non-GAAP operating income target was set at $2.6 million. The threshold for first half 2013 funding was set at 90% of the non-GAAP operating income target and would fund a 25% payout of first half variable compensation. A 100% achievement of the first half 2013 non-GAAP operating income target would fund a 30% payout of first half variable compensation. The maximum non-GAAP operating income achievement level was set at $6.7 million and would fund a 100% payout of first half variable compensation. In the event of non-GAAP operating income achievement above the level required for 100% funding, the amount in excess of 100%, up to a maximum non-GAAP operating income achievement of 200% or $13 million in first half funding, would be applied towards the second half 2013 funding.