|

Investment Company Act file number

|

811-06247

|

|||||

|

AMERICAN CENTURY WORLD MUTUAL FUNDS, INC.

|

||||||

|

(Exact name of registrant as specified in charter)

|

||||||

|

4500 MAIN STREET, KANSAS CITY, MISSOURI

|

64111

|

|||||

|

(Address of principal executive offices)

|

(Zip Code)

|

|||||

|

CHARLES A. ETHERINGTON

4500 MAIN STREET, KANSAS CITY, MISSOURI 64111

|

||||||

|

(Name and address of agent for service)

|

||||||

|

Registrant’s telephone number, including area code:

|

816-531-5575

|

|||||

|

Date of fiscal year end:

|

11-30

|

|||||

|

Date of reporting period:

|

11-30-2012

|

|||||

|

Emerging Markets Fund

|

|

President’s Letter

|

2

|

|

Independent Chairman’s Letter

|

3

|

|

Market Perspective

|

4

|

|

Performance

|

5

|

|

Portfolio Commentary

|

7

|

|

Fund Characteristics

|

9

|

|

Shareholder Fee Example

|

10

|

|

Schedule of Investments

|

12

|

|

Statement of Assets and Liabilities

|

15

|

|

Statement of Operations

|

16

|

|

Statement of Changes in Net Assets

|

17

|

|

Notes to Financial Statements

|

18

|

|

Financial Highlights

|

24

|

|

Report of Independent Registered Public Accounting Firm

|

26

|

|

Management

|

27

|

|

Approval of Management Agreement

|

30

|

|

Additional Information

|

35

|

|

•

|

Fund performance and client service continue to be rated among the industry’s best.

|

|

•

|

Target date and other asset allocation products continue to successfully gather assets and industry acclaim.

|

|

•

|

Compliance programs continue to function successfully with no issues impacting shareholder interests.

|

|

•

|

Fees were found to be within an acceptable competitive range, with minor fee waivers being negotiated on five funds.

|

|

International Equity Total Returns

|

||||

|

For the 12 months ended November 30, 2012 (in U.S. dollars)

|

||||

|

MSCI EAFE Index

|

12.61%

|

MSCI Europe Index

|

14.07%

|

|

|

MSCI EAFE Growth Index

|

12.66%

|

MSCI World Index

|

13.62%

|

|

|

MSCI EAFE Value Index

|

12.45%

|

MSCI Japan Index

|

3.59%

|

|

|

MSCI Emerging Markets Index

|

11.35%

|

|||

|

Total Returns as of November 30, 2012

|

||||||

|

Average Annual Returns

|

||||||

|

Ticker

Symbol

|

1 year

|

5 years

|

10 years

|

Since

Inception

|

Inception

Date

|

|

|

Investor Class

|

TWMIX

|

13.28%

|

-5.54%

|

14.22%

|

7.10%

|

9/30/97

|

|

MSCI Emerging Markets Growth Index

|

—

|

14.21%

|

-2.76%

|

13.88%

|

N/A(1)

|

—

|

|

Institutional Class

|

AMKIX

|

13.43%

|

-5.37%

|

14.43%

|

11.09%

|

1/28/99

|

|

A Class(2)

No sales charge*

With sales charge*

|

AEMMX

|

12.99%

6.45%

|

-5.76%

-6.87%

|

13.94%

13.26%

|

8.66%

8.19%

|

5/12/99

|

|

C Class

|

ACECX

|

12.13%

|

-6.49%

|

13.10%

|

10.19%

|

12/18/01

|

|

R Class

|

AEMRX

|

12.74%

|

-6.01%

|

—

|

-5.03%

|

9/28/07

|

|

*

|

Sales charges include initial sales charges and contingent deferred sales charges (CDSCs), as applicable. A Class shares have a 5.75% maximum initial sales charge and may be subject to a maximum CDSC of 1.00%. C Class shares redeemed within 12 months of purchase are subject to a maximum CDSC of 1.00%. The SEC requires that mutual funds provide performance information net of maximum sales charges in all cases where charges could be applied.

|

|

(1)

|

Benchmark data first available January 2001.

|

|

(2)

|

Prior to September 4, 2007, the A Class was referred to as the Advisor Class and did not have a front-end sales charge. Performance prior to that date has been adjusted to reflect this charge.

|

|

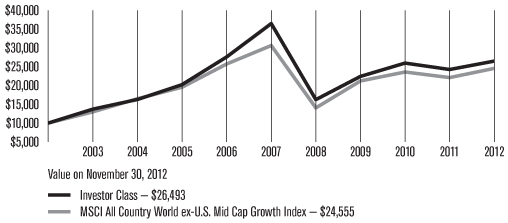

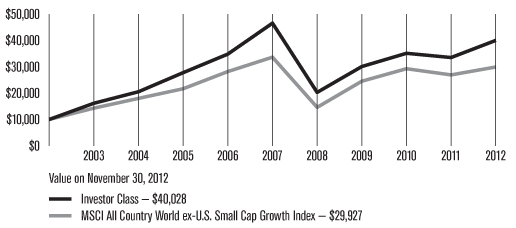

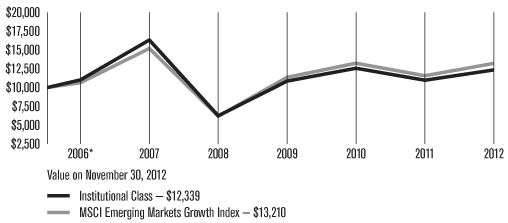

Growth of $10,000 Over 10 Years

|

|

$10,000 investment made November 30, 2002

|

|

Total Annual Fund Operating Expenses

|

||||

|

Investor Class

|

Institutional Class

|

A Class

|

C Class

|

R Class

|

|

1.72%

|

1.52%

|

1.97%

|

2.72%

|

2.22%

|

|

Portfolio Commentary

|

|

NOVEMBER 30, 2012

|

|

|

Top Ten Holdings

|

% of net assets

|

|

Samsung Electronics Co. Ltd.

|

9.0%

|

|

Taiwan Semiconductor Manufacturing Co. Ltd.

|

4.9%

|

|

Tencent Holdings Ltd.

|

2.4%

|

|

China Overseas Land & Investment Ltd.

|

2.0%

|

|

iShares MSCI Emerging Markets Index Fund

|

2.0%

|

|

Ping An Insurance Group Co. H Shares

|

1.8%

|

|

ITC Ltd.

|

1.7%

|

|

CNOOC Ltd.

|

1.7%

|

|

Hon Hai Precision Industry Co. Ltd.

|

1.7%

|

|

Kunlun Energy Co. Ltd.

|

1.6%

|

|

Types of Investments in Portfolio

|

% of net assets

|

|

Foreign Common Stocks

|

96.5%

|

|

Exchange-Traded Funds

|

2.0%

|

|

Total Equity Exposure

|

98.5%

|

|

Temporary Cash Investments

|

3.4%

|

|

Other Assets and Liabilities

|

(1.9)%

|

|

Investments by Country

|

% of net assets

|

|

China

|

17.9%

|

|

South Korea

|

15.2%

|

|

Brazil

|

10.5%

|

|

Taiwan

|

8.7%

|

|

Russia

|

5.9%

|

|

India

|

5.6%

|

|

Mexico

|

5.2%

|

|

South Africa

|

5.0%

|

|

Thailand

|

4.2%

|

|

Turkey

|

4.1%

|

|

Indonesia

|

4.0%

|

|

United Kingdom

|

2.2%

|

|

Peru

|

2.0%

|

|

United States

|

2.0%

|

|

Other Countries

|

6.0%

|

|

Cash and Equivalents*

|

1.5%

|

|

Beginning

Account Value

6/1/12

|

Ending

Account Value

11/30/12

|

Expenses Paid

During Period(1)

6/1/12 – 11/30/12

|

Annualized

Expense

Ratio(1)

|

|

|

Actual

|

||||

|

Investor Class

|

$1,000

|

$1,146.80

|

$9.34

|

1.74%

|

|

Institutional Class

|

$1,000

|

$1,147.50

|

$8.27

|

1.54%

|

|

A Class

|

$1,000

|

$1,144.30

|

$10.67

|

1.99%

|

|

C Class

|

$1,000

|

$1,139.70

|

$14.66

|

2.74%

|

|

R Class

|

$1,000

|

$1,143.10

|

$12.00

|

2.24%

|

|

Hypothetical

|

||||

|

Investor Class

|

$1,000

|

$1,016.30

|

$8.77

|

1.74%

|

|

Institutional Class

|

$1,000

|

$1,017.30

|

$7.77

|

1.54%

|

|

A Class

|

$1,000

|

$1,015.05

|

$10.02

|

1.99%

|

|

C Class

|

$1,000

|

$1,011.30

|

$13.78

|

2.74%

|

|

R Class

|

$1,000

|

$1,013.80

|

$11.28

|

2.24%

|

|

(1)

|

Expenses are equal to the class’s annualized expense ratio listed in the table above, multiplied by the average account value over the period, multiplied by 183, the number of days in the most recent fiscal half-year, divided by 366, to reflect the one-half year period.

|

|

Shares

|

Value

|

|

|

Common Stocks — 96.5%

|

||

|

BRAZIL — 10.5%

|

||

|

Anhanguera Educacional Participacoes SA

|

167,700

|

$ 2,532,609

|

|

BR Malls Participacoes SA

|

487,800

|

6,266,431

|

|

BR Properties SA

|

560,600

|

6,611,344

|

|

Brazil Pharma SA

|

420,000

|

2,604,362

|

|

CCR SA

|

447,200

|

3,842,471

|

|

Cia de Bebidas das Americas Preference Shares ADR

|

142,190

|

5,916,526

|

|

Cia de Saneamento de Minas Gerais-COPASA

|

151,967

|

3,200,353

|

|

Grupo BTG Pactual

|

170,500

|

2,393,766

|

|

Hypermarcas SA(1)

|

339,000

|

2,443,186

|

|

Klabin SA Preference Shares

|

703,100

|

3,961,683

|

|

Marcopolo SA Preference Shares

|

465,400

|

2,735,597

|

|

MRV Engenharia e Participacoes SA

|

482,800

|

2,555,442

|

|

Vale SA Preference Shares

|

427,800

|

7,347,557

|

|

52,411,327

|

||

|

CANADA — 0.4%

|

||

|

Pacific Rubiales Energy Corp.

|

100,047

|

2,182,532

|

|

CHILE — 1.3%

|

||

|

SACI Falabella

|

396,411

|

3,964,522

|

|

Sociedad Quimica y Minera de Chile SA ADR

|

42,187

|

2,387,784

|

|

6,352,306

|

||

|

CHINA — 17.9%

|

||

|

Belle International Holdings Ltd.

|

2,075,000

|

4,358,726

|

|

Brilliance China Automotive Holdings Ltd.(1)

|

3,674,000

|

4,470,313

|

|

China Communications Construction Co. Ltd. H Shares

|

5,023,000

|

4,575,673

|

|

China Minsheng Banking Corp. Ltd. H Shares

|

3,100,000

|

3,039,922

|

|

China Overseas Land & Investment Ltd.

|

3,356,000

|

9,937,834

|

|

China Railway Construction Corp. Ltd. H Shares

|

5,672,500

|

6,323,759

|

|

China Shenhua Energy Co. Ltd. H Shares

|

1,186,000

|

4,858,649

|

|

CNOOC Ltd.

|

3,964,000

|

8,480,184

|

|

Focus Media Holding Ltd. ADR

|

131,982

|

3,205,843

|

|

Haier Electronics Group Co. Ltd.(1)

|

2,538,000

|

3,484,338

|

|

Hengan International Group Co. Ltd.

|

305,500

|

2,759,284

|

|

Industrial & Commercial Bank of China Ltd. H Shares

|

7,313,645

|

4,935,403

|

|

Kunlun Energy Co. Ltd.

|

3,864,000

|

7,867,400

|

|

Ping An Insurance Group Co. H Shares

|

1,155,000

|

8,740,516

|

|

Tencent Holdings Ltd.

|

372,500

|

12,169,621

|

|

89,207,465

|

||

|

COLOMBIA — 0.6%

|

||

|

Almacenes Exito SA

|

144,215

|

2,860,148

|

|

HONG KONG — 0.7%

|

||

|

AAC Technologies Holdings, Inc.

|

957,500

|

3,595,165

|

|

INDIA — 5.6%

|

||

|

HDFC Bank Ltd.

|

515,619

|

6,672,856

|

|

ICICI Bank Ltd. ADR

|

128,848

|

5,281,480

|

|

ITC Ltd.

|

1,573,194

|

8,633,117

|

|

Tata Global Beverages Ltd.

|

1,001,074

|

3,054,108

|

|

Tata Motors Ltd.

|

827,765

|

4,161,271

|

|

27,802,832

|

||

|

INDONESIA — 4.0%

|

||

|

PT AKR Corporindo Tbk

|

9,856,000

|

4,417,658

|

|

PT Astra International Tbk

|

4,153,000

|

3,138,505

|

|

PT Bank Rakyat Indonesia (Persero) Tbk

|

3,535,000

|

2,597,774

|

|

PT Media Nusantara Citra Tbk

|

7,818,500

|

2,180,069

|

|

PT Semen Gresik (Persero) Tbk

|

3,152,500

|

4,863,397

|

|

PT XL Axiata Tbk

|

4,780,500

|

2,566,277

|

|

19,763,680

|

||

|

MALAYSIA — 1.3%

|

||

|

Axiata Group Bhd

|

3,203,600

|

6,239,103

|

|

MEXICO — 5.2%

|

||

|

Alfa SAB de CV, Series A

|

2,831,910

|

5,896,597

|

|

Cemex SAB de CV ADR(1)

|

318,501

|

2,834,659

|

|

Fomento Economico Mexicano SAB de CV ADR

|

43,549

|

4,271,286

|

|

Grupo Aeroportuario del Sureste SAB de CV B Shares

|

139,854

|

1,427,363

|

|

Grupo Financiero Banorte SAB de CV

|

687,568

|

3,923,887

|

|

Mexichem SAB de CV

|

923,598

|

4,784,575

|

|

Wal-Mart de Mexico SAB de CV

|

877,718

|

2,754,607

|

|

25,892,974

|

||

|

Shares

|

Value

|

|

PERU — 2.0%

|

||

|

Credicorp Ltd.

|

37,267

|

$ 5,213,653

|

|

Southern Copper Corp.

|

136,513

|

4,955,422

|

|

10,169,075

|

||

|

POLAND — 1.0%

|

||

|

Eurocash SA

|

232,485

|

3,238,538

|

|

Powszechny Zaklad Ubezpieczen SA

|

11,821

|

1,480,509

|

|

4,719,047

|

||

|

RUSSIA — 5.9%

|

||

|

Eurasia Drilling Co. Ltd. GDR

|

109,175

|

3,553,646

|

|

Magnit OJSC GDR

|

201,161

|

7,096,960

|

|

Mail.ru Group Ltd. GDR

|

91,525

|

3,020,325

|

|

Mobile Telesystems OJSC ADR

|

194,641

|

3,392,593

|

|

NovaTek OAO GDR

|

43,692

|

4,793,012

|

|

Sberbank of Russia

|

2,540,543

|

7,469,197

|

|

29,325,733

|

||

|

SOUTH AFRICA — 5.0%

|

||

|

Aspen Pharmacare Holdings Ltd.

|

293,078

|

5,158,139

|

|

Clicks Group Ltd.

|

639,457

|

4,531,381

|

|

Discovery Holdings Ltd.

|

708,526

|

4,447,813

|

|

Exxaro Resources Ltd.

|

107,587

|

1,869,074

|

|

Mr Price Group Ltd.

|

153,306

|

2,293,451

|

|

Naspers Ltd. N Shares

|

111,153

|

6,863,920

|

|

25,163,778

|

||

|

SOUTH KOREA — 15.2%

|

||

|

Hyundai Glovis Co. Ltd.

|

25,814

|

5,625,991

|

|

Hyundai Motor Co.

|

7,349

|

1,530,405

|

|

Hyundai Wia Corp.

|

22,569

|

3,793,284

|

|

LG Chem Ltd.

|

9,657

|

2,782,457

|

|

LG Display Co. Ltd.(1)

|

101,540

|

3,244,479

|

|

LG Household & Health Care Ltd.

|

8,716

|

5,199,738

|

|

Orion Corp.

|

6,247

|

6,478,627

|

|

Paradise Co. Ltd.

|

144,676

|

2,505,125

|

|

Samsung Electronics Co. Ltd.

|

34,452

|

44,733,354

|

|

75,893,460

|

||

|

TAIWAN — 8.7%

|

||

|

Chailease Holding Co. Ltd.

|

2,800,910

|

5,697,452

|

|

Hon Hai Precision Industry Co. Ltd.

|

2,631,232

|

8,440,518

|

|

MediaTek, Inc.

|

287,000

|

3,264,731

|

|

Taiwan Semiconductor Manufacturing Co. Ltd.

|

7,208,939

|

24,489,650

|

|

TPK Holding Co. Ltd.

|

99,000

|

1,581,056

|

|

43,473,407

|

||

|

THAILAND — 4.2%

|

||

|

CP ALL PCL

|

4,943,600

|

6,362,730

|

|

Kasikornbank PCL NVDR

|

914,100

|

5,569,785

|

|

Minor International PCL

|

5,728,900

|

3,602,730

|

|

Siam Cement PCL NVDR

|

423,200

|

5,446,856

|

|

20,982,101

|

||

|

TURKEY — 4.1%

|

||

|

BIM Birlesik Magazalar AS

|

56,317

|

2,560,795

|

|

Koza Altin Isletmeleri AS

|

163,210

|

4,073,742

|

|

TAV Havalimanlari Holding AS(1)

|

683,560

|

3,397,047

|

|

Tofas Turk Otomobil Fabrikasi

|

516,049

|

3,147,961

|

|

Turkiye Garanti Bankasi AS

|

846,950

|

4,019,440

|

|

Turkiye Halk Bankasi AS

|

354,895

|

3,436,037

|

|

20,635,022

|

||

|

TURKMENISTAN — 0.7%

|

||

|

Dragon Oil plc

|

377,660

|

3,358,129

|

|

UNITED KINGDOM — 2.2%

|

||

|

Antofagasta plc

|

179,190

|

3,697,711

|

|

Petrofac Ltd.

|

171,716

|

4,478,845

|

|

Tullow Oil plc

|

132,450

|

2,922,061

|

|

11,098,617

|

||

|

TOTAL COMMON STOCKS (Cost $352,818,199)

|

481,125,901

|

|

|

Exchange-Traded Funds — 2.0%

|

||

|

iShares MSCI Emerging Markets Index Fund (Cost $9,828,862)

|

235,066

|

9,825,759

|

|

Temporary Cash Investments — 3.4%

|

||

|

SSgA U.S. Government Money Market Fund (Cost $17,094,329)

|

17,094,329

|

17,094,329

|

|

TOTAL INVESTMENT SECURITIES — 101.9% (Cost $379,741,390)

|

508,045,989

|

|

|

OTHER ASSETS AND LIABILITIES — (1.9)%

|

(9,232,647)

|

|

|

TOTAL NET ASSETS — 100.0%

|

$498,813,342

|

|

|

Market Sector Diversification

|

|

|

(as a % of net assets)

|

|

|

Information Technology

|

20.9%

|

|

Financials

|

19.6%

|

|

Consumer Staples

|

13.2%

|

|

Consumer Discretionary

|

12.4%

|

|

Materials

|

10.0%

|

|

Energy

|

8.6%

|

|

Industrials

|

7.7%

|

|

Telecommunication Services

|

2.5%

|

|

Diversified

|

2.0%

|

|

Health Care

|

1.0%

|

|

Utilities

|

0.6%

|

|

Cash and Equivalents*

|

1.5%

|

|

(1)

|

Non-income producing.

|

|

NOVEMBER 30, 2012

|

|||

|

Assets

|

|||

|

Investment securities, at value (cost of $379,741,390)

|

$508,045,989 | ||

|

Receivable for capital shares sold

|

1,340,336 | ||

|

Dividends and interest receivable

|

149,816 | ||

| 509,536,141 | |||

|

Liabilities

|

|||

|

Payable for investments purchased

|

9,828,863 | ||

|

Payable for capital shares redeemed

|

203,204 | ||

|

Accrued management fees

|

684,871 | ||

|

Distribution and service fees payable

|

5,861 | ||

| 10,722,799 | |||

|

Net Assets

|

$498,813,342 | ||

|

Net Assets Consist of:

|

|||

|

Capital (par value and paid-in surplus)

|

$502,805,816 | ||

|

Undistributed net investment income

|

757,588 | ||

|

Accumulated net realized loss

|

(133,051,346 | ) | |

|

Net unrealized appreciation

|

128,301,284 | ||

| $498,813,342 | |||

|

Net assets

|

Shares outstanding

|

Net asset value per share

|

|

|

Investor Class, $0.01 Par Value

|

$452,331,427

|

54,109,568

|

$8.36

|

|

Institutional Class, $0.01 Par Value

|

$28,536,428

|

3,332,607

|

$8.56

|

|

A Class, $0.01 Par Value

|

$13,745,155

|

1,698,488

|

$8.09*

|

|

C Class, $0.01 Par Value

|

$3,376,132

|

439,943

|

$7.67

|

|

R Class, $0.01 Par Value

|

$824,200

|

100,138

|

$8.23

|

|

YEAR ENDED NOVEMBER 30, 2012

|

|||

|

Investment Income (Loss)

|

|||

|

Income:

|

|||

|

Dividends (net of foreign taxes withheld of $1,020,529)

|

$9,870,147 | ||

|

Interest (net of foreign taxes withheld of $5,414)

|

31,588 | ||

| 9,901,735 | |||

|

Expenses:

|

|||

|

Management fees

|

8,400,410 | ||

|

Distribution and service fees:

|

|||

|

A Class

|

35,475 | ||

|

C Class

|

36,775 | ||

|

R Class

|

3,757 | ||

|

Directors’ fees and expenses

|

17,635 | ||

|

Other expenses

|

10,195 | ||

| 8,504,247 | |||

|

Net investment income (loss)

|

1,397,488 | ||

|

Realized and Unrealized Gain (Loss)

|

|||

|

Net realized gain (loss) on:

|

|||

|

Investment transactions

|

14,209,069 | ||

|

Foreign currency transactions

|

(675,478 | ) | |

| 13,533,591 | |||

|

Change in net unrealized appreciation (depreciation) on:

|

|||

|

Investments

|

46,214,547 | ||

|

Translation of assets and liabilities in foreign currencies

|

19,489 | ||

| 46,234,036 | |||

|

Net realized and unrealized gain (loss)

|

59,767,627 | ||

|

Net Increase (Decrease) in Net Assets Resulting from Operations

|

$61,165,115 | ||

|

YEARS ENDED NOVEMBER 30, 2012 AND NOVEMBER 30, 2011

|

|||||||

|

Increase (Decrease) in Net Assets

|

November 30, 2012

|

November 30, 2011

|

|||||

|

Operations

|

|||||||

|

Net investment income (loss)

|

$1,397,488 | $938,130 | |||||

|

Net realized gain (loss)

|

13,533,591 | 49,355,393 | |||||

|

Change in net unrealized appreciation (depreciation)

|

46,234,036 | (120,227,565 | ) | ||||

|

Net increase (decrease) in net assets resulting from operations

|

61,165,115 | (69,934,042 | ) | ||||

|

Distributions to Shareholders

|

|||||||

|

From net investment income:

|

|||||||

|

Institutional Class

|

(51,371 | ) | — | ||||

|

Capital Share Transactions

|

|||||||

|

Net increase (decrease) in net assets from capital share transactions

|

(46,952,076 | ) | (106,484,925 | ) | |||

|

Redemption Fees

|

|||||||

|

Increase in net assets from redemption fees

|

11,993 | 144,876 | |||||

|

Net increase (decrease) in net assets

|

14,173,661 | (176,274,091 | ) | ||||

|

Net Assets

|

|||||||

|

Beginning of period

|

484,639,681 | 660,913,772 | |||||

|

End of period

|

$498,813,342 | $484,639,681 | |||||

|

Undistributed net investment income

|

$757,588 | $86,949 | |||||

|

Year ended November 30, 2012

|

Year ended November 30, 2011

|

||||||||||||||

|

Shares

|

Amount

|

Shares

|

Amount

|

||||||||||||

|

Investor Class/Shares Authorized

|

235,000,000 | 235,000,000 | |||||||||||||

|

Sold

|

6,929,950 | $53,455,116 | 6,538,088 | $55,636,956 | |||||||||||

|

Redeemed

|

(11,776,977 | ) | (91,432,663 | ) | (16,579,314 | ) | (141,943,249 | ) | |||||||

| (4,847,027 | ) | (37,977,547 | ) | (10,041,226 | ) | (86,306,293 | ) | ||||||||

|

Institutional Class/Shares Authorized

|

40,000,000 | 40,000,000 | |||||||||||||

|

Sold

|

765,815 | 6,099,475 | 814,282 | 7,001,115 | |||||||||||

|

Issued in reinvestment of distributions

|

6,334 | 51,366 | — | — | |||||||||||

|

Redeemed

|

(1,368,338 | ) | (10,963,145 | ) | (1,621,034 | ) | (14,518,773 | ) | |||||||

| (596,189 | ) | (4,812,304 | ) | (806,752 | ) | (7,517,658 | ) | ||||||||

|

A Class/Shares Authorized

|

40,000,000 | 40,000,000 | |||||||||||||

|

Sold

|

275,763 | 2,115,216 | 2,314,402 | 20,284,532 | |||||||||||

|

Redeemed

|

(718,945 | ) | (5,450,958 | ) | (3,764,042 | ) | (31,735,094 | ) | |||||||

| (443,182 | ) | (3,335,742 | ) | (1,449,640 | ) | (11,450,562 | ) | ||||||||

|

B Class/Shares Authorized

|

N/A | 10,000,000 | |||||||||||||

|

Sold

|

2,549 | 21,664 | |||||||||||||

|

Redeemed

|

(39,638 | ) | (294,160 | ) | |||||||||||

| (37,089 | ) | (272,496 | ) | ||||||||||||

|

C Class/Shares Authorized

|

5,000,000 | 5,000,000 | |||||||||||||

|

Sold

|

48,215 | 346,043 | 99,057 | 738,536 | |||||||||||

|

Redeemed

|

(177,535 | ) | (1,274,469 | ) | (193,003 | ) | (1,533,169 | ) | |||||||

| (129,320 | ) | (928,426 | ) | (93,946 | ) | (794,633 | ) | ||||||||

|

R Class/Shares Authorized

|

10,000,000 | 10,000,000 | |||||||||||||

|

Sold

|

36,789 | 282,556 | 42,747 | 331,354 | |||||||||||

|

Redeemed

|

(23,118 | ) | (180,613 | ) | (54,656 | ) | (474,637 | ) | |||||||

| 13,671 | 101,943 | (11,909 | ) | (143,283 | ) | ||||||||||

|

Net increase (decrease)

|

(6,002,047 | ) | $(46,952,076 | ) | (12,440,562 | ) | $(106,484,925 | ) | |||||||

|

•

|

Level 1 valuation inputs consist of unadjusted quoted prices in an active market for identical securities;

|

|

•

|

Level 2 valuation inputs consist of direct or indirect observable market data (including quoted prices for similar securities, evaluations of subsequent market events, interest rates, prepayment speeds, credit risk, etc.); or

|

|

•

|

Level 3 valuation inputs consist of unobservable data (including a fund’s own assumptions).

|

|

Level 1

|

Level 2

|

Level 3

|

|

|

Investment Securities

|

|||

|

Foreign Common Stocks

|

$37,459,246

|

$443,666,655

|

—

|

|

Exchange-Traded Funds

|

9,825,759

|

—

|

—

|

|

Temporary Cash Investments

|

17,094,329

|

—

|

—

|

|

Total Value of Investment Securities

|

$64,379,334

|

$443,666,655

|

—

|

|

2012

|

2011

|

|

|

Distributions Paid From

|

||

|

Ordinary income

|

$51,371

|

—

|

|

Long-term capital gains

|

—

|

—

|

|

Federal tax cost of investments

|

$382,600,625

|

|

Gross tax appreciation of investments

|

$128,524,862

|

|

Gross tax depreciation of investments

|

(3,079,498)

|

|

Net tax appreciation (depreciation) of investments

|

$125,445,364

|

|

Net tax appreciation (depreciation) on translation of assets and liabilities in foreign currencies

|

$(3,315)

|

|

Net tax appreciation (depreciation)

|

$125,442,049

|

|

Undistributed ordinary income

|

$778,609

|

|

Accumulated short-term capital losses

|

$(129,636,164)

|

|

Post-October capital loss deferral

|

$(576,968)

|

|

For a Share Outstanding Throughout the Years Ended November 30 (except as noted)

|

||||||||||||||

|

Per-Share Data

|

Ratios and Supplemental Data

|

|||||||||||||

|

Income From Investment Operations:

|

Distributions From:

|

Ratio to Average

Net Assets of:

|

||||||||||||

|

Net Asset

Value,

Beginning

of Period

|

Net

Investment Income

(Loss)(1)

|

Net

Realized and Unrealized

Gain (Loss)

|

Total From Investment Operations

|

Net

Investment Income

|

Net

Realized

Gains

|

Total Distributions

|

Redemption

Fees(1)

|

Net Asset

Value,

End of

Period

|

Total

Return(2)

|

Operating Expenses

|

Net

Investment Income

(Loss)

|

Portfolio Turnover

Rate

|

Net Assets,

End of Period (in thousands)

|

|

|

Investor Class

|

||||||||||||||

|

2012

|

$7.38

|

0.02

|

0.96

|

0.98

|

—

|

—

|

—

|

—(3)

|

$8.36

|

13.28%

|

1.74%

|

0.29%

|

85%

|

$452,331

|

|

2011

|

$8.46

|

0.01

|

(1.09)

|

(1.08)

|

—

|

—

|

—

|

—(3)

|

$7.38

|

(12.77)%

|

1.71%

|

0.17%

|

71%

|

$435,079

|

|

2010

|

$7.28

|

—(3)

|

1.18

|

1.18

|

—

|

—

|

—

|

—(3)

|

$8.46

|

16.21%

|

1.72%

|

(0.02)%

|

87%

|

$583,978

|

|

2009

|

$4.17

|

0.01

|

3.13

|

3.14

|

(0.03)

|

—

|

(0.03)

|

—(3)

|

$7.28

|

75.36%

|

1.78%

|

0.11%

|

126%

|

$567,248

|

|

2008

|

$12.69

|

0.09

|

(7.21)

|

(7.12)

|

(0.10)

|

(1.31)

|

(1.41)

|

0.01

|

$4.17

|

(62.66)%

|

1.66%

|

1.06%

|

121%

|

$316,695

|

|

Institutional Class

|

||||||||||||||

|

2012

|

$7.56

|

0.04

|

0.97

|

1.01

|

(0.01)

|

—

|

(0.01)

|

—(3)

|

$8.56

|

13.43%

|

1.54%

|

0.49%

|

85%

|

$28,536

|

|

2011

|

$8.65

|

0.03

|

(1.12)

|

(1.09)

|

—

|

—

|

—

|

—(3)

|

$7.56

|

(12.60)%

|

1.51%

|

0.37%

|

71%

|

$29,695

|

|

2010

|

$7.43

|

0.02

|

1.20

|

1.22

|

—

|

—

|

—

|

—(3)

|

$8.65

|

16.42%

|

1.52%

|

0.18%

|

87%

|

$40,969

|

|

2009

|

$4.26

|

0.02

|

3.18

|

3.20

|

(0.03)

|

—

|

(0.03)

|

—(3)

|

$7.43

|

75.92%

|

1.58%

|

0.31%

|

126%

|

$27,787

|

|

2008

|

$12.92

|

0.12

|

(7.35)

|

(7.23)

|

(0.13)

|

(1.31)

|

(1.44)

|

0.01

|

$4.26

|

(62.63)%

|

1.46%

|

1.26%

|

121%

|

$27,235

|

|

A Class

|

||||||||||||||

|

2012

|

$7.16

|

—(3)

|

0.93

|

0.93

|

—

|

—

|

—

|

—(3)

|

$8.09

|

12.99%

|

1.99%

|

0.04%

|

85%

|

$13,745

|

|

2011

|

$8.23

|

(0.01)

|

(1.06)

|

(1.07)

|

—

|

—

|

—

|

—(3)

|

$7.16

|

(13.00)%

|

1.96%

|

(0.08)%

|

71%

|

$15,339

|

|

2010

|

$7.10

|

(0.02)

|

1.15

|

1.13

|

—

|

—

|

—

|

—(3)

|

$8.23

|

15.92%

|

1.97%

|

(0.27)%

|

87%

|

$29,572

|

|

2009

|

$4.07

|

(0.01)

|

3.06

|

3.05

|

(0.02)

|

—

|

(0.02)

|

—(3)

|

$7.10

|

75.24%

|

2.03%

|

(0.14)%

|

126%

|

$23,260

|

|

2008

|

$12.40

|

0.07

|

(7.03)

|

(6.96)

|

(0.07)

|

(1.31)

|

(1.38)

|

0.01

|

$4.07

|

(62.78)%

|

1.91%

|

0.81%

|

121%

|

$17,105

|

|

For a Share Outstanding Throughout the Years Ended November 30 (except as noted)

|

||||||||||||||

|

Per-Share Data

|

Ratios and Supplemental Data

|

|||||||||||||

|

Income From Investment Operations:

|

Distributions From:

|

Ratio to Average

Net Assets of:

|

||||||||||||

|

Net Asset

Value,

Beginning

of Period

|

Net

Investment Income

(Loss)(1)

|

Net

Realized and Unrealized

Gain (Loss)

|

Total From Investment Operations

|

Net

Investment Income

|

Net

Realized

Gains

|

Total Distributions

|

Redemption

Fees(1)

|

Net Asset

Value,

End of

Period

|

Total

Return(2)

|

Operating Expenses

|

Net

Investment Income

(Loss)

|

Portfolio Turnover

Rate

|

Net Assets,

End of Period (in thousands)

|

|

|

C Class

|

||||||||||||||

|

2012

|

$6.84

|

(0.05)

|

0.88

|

0.83

|

—

|

—

|

—

|

—(3)

|

$7.67

|

12.13%

|

2.74%

|

(0.71)%

|

85%

|

$3,376

|

|

2011

|

$7.93

|

(0.07)

|

(1.02)

|

(1.09)

|

—

|

—

|

—

|

—(3)

|

$6.84

|

(13.75)%

|

2.71%

|

(0.83)%

|

71%

|

$3,896

|

|

2010

|

$6.89

|

(0.07)

|

1.11

|

1.04

|

—

|

—

|

—

|

—(3)

|

$7.93

|

15.09%

|

2.72%

|

(1.02)%

|

87%

|

$5,257

|

|

2009

|

$3.96

|

(0.05)

|

2.98

|

2.93

|

—

|

—

|

—

|

—(3)

|

$6.89

|

73.99%

|

2.78%

|

(0.89)%

|

126%

|

$5,372

|

|

2008

|

$12.10

|

0.01

|

(6.87)

|

(6.86)

|

—

|

(1.29)

|

(1.29)

|

0.01

|

$3.96

|

(63.09)%

|

2.66%

|

0.06%

|

121%

|

$3,217

|

|

R Class

|

||||||||||||||

|

2012

|

$7.30

|

(0.02)

|

0.95

|

0.93

|

—

|

—

|

—

|

—(3)

|

$8.23

|

12.74%

|

2.24%

|

(0.21)%

|

85%

|

$824

|

|

2011

|

$8.42

|

(0.03)

|

(1.09)

|

(1.12)

|

—

|

—

|

—

|

—(3)

|

$7.30

|

(13.30)%

|

2.21%

|

(0.33)%

|

71%

|

$631

|

|

2010

|

$7.28

|

(0.04)

|

1.18

|

1.14

|

—

|

—

|

—

|

—(3)

|

$8.42

|

15.66%

|

2.22%

|

(0.52)%

|

87%

|

$828

|

|

2009

|

$4.17

|

(0.02)

|

3.14

|

3.12

|

(0.01)

|

—

|

(0.01)

|

—(3)

|

$7.28

|

74.94%

|

2.28%

|

(0.39)%

|

126%

|

$516

|

|

2008

|

$12.68

|

0.05

|

(7.22)

|

(7.17)

|

(0.04)

|

(1.31)

|

(1.35)

|

0.01

|

$4.17

|

(62.92)%

|

2.19%

|

0.53%

|

121%

|

$144

|

|

(1)

|

Computed using average shares outstanding throughout the period.

|

|

(2)

|

Total returns are calculated based on the net asset value of the last business day and do not reflect applicable sales charges, if any. Total returns for periods less than one year are not annualized.

|

|

(3)

|

Per-share amount was less than $0.005.

|

|

Name

(Year of Birth)

|

Position(s)

Held with

Funds

|

Length

of Time

Served

|

Principal Occupation(s)

During Past 5 Years

|

Number of

American

Century

Portfolios

Overseen

by Director

|

Other

Directorships

Held During

Past 5 Years

|

|

|

Independent Directors

|

||||||

|

Thomas A. Brown

(1940)

|

Director

|

Since 1980

|

Managing Member, Associated Investments, LLC (real estate investment company); Brown Cascade Properties, LLC (real estate investment company) (2001 to 2009)

|

66

|

None

|

|

|

Andrea C. Hall

(1945)

|

Director

|

Since 1997

|

Retired

|

66

|

None

|

|

|

Jan M. Lewis

(1957)

|

Director

|

Since 2011

|

President and Chief Executive Officer, Catholic Charities of Northeast Kansas (human services organization)

|

66

|

None

|

|

|

James A. Olson

(1942)

|

Director

|

Since 2007

|

Member, Plaza Belmont LLC (private equity fund manager)

|

66

|

Saia, Inc. (2002 to 2012) and Entertainment Properties Trust

|

|

|

Donald H. Pratt

(1937)

|

Director and

Chairman of

the Board

|

Since 1995

(Chairman since 2005)

|

Chairman and Chief Executive Officer, Western Investments, Inc. (real estate company)

|

66

|

None

|

|

|

Name

(Year of Birth)

|

Position(s)

Held with

Funds

|

Length

of Time

Served

|

Principal Occupation(s)

During Past 5 Years

|

Number of

American

Century

Portfolios

Overseen

by Director

|

Other

Directorships

Held During

Past 5 Years

|

|

|

Independent Directors

|

||||||

|

M. Jeannine Strandjord

(1945)

|

Director

|

Since 1994

|

Retired

|

66

|

Euronet Worldwide Inc.; Charming Shoppes, Inc. (2006 to 2010); and DST Systems Inc. (1996 to 2012)

|

|

|

John R. Whitten

(1946)

|

Director

|

Since 2008

|

Retired

|

66

|

Rudolph Technologies, Inc.

|

|

|

Stephen E. Yates

(1948)

|

Director

|

Since 2012

|

Retired; Executive Vice President, Technology & Operations, KeyCorp. (computer services) (2004 to 2010)

|

66

|

Applied Industrial Technologies, Inc. (2001 to 2010)

|

|

|

Interested Directors

|

||||||

|

Barry Fink

(1955)

|

Director and

Executive Vice President

|

Since 2012

(Executive

Vice President

since 2007)

|

Executive Vice President, ACC (September 2007 to present); President, ACS (October 2007 to present); Chief Operating Officer, ACC (September 2007 to November 2012). Also serves as Manager, ACS

|

66

|

None

|

|

|

Jonathan S. Thomas

(1963)

|

Director and

President

|

Since 2007

|

President and Chief Executive Officer, ACC (March 2007 to present). Also serves as Chief Executive Officer and Manager, ACS; Executive Vice President, ACIM; Director, ACC, ACIM and other ACC subsidiaries

|

108

|

None

|

|

|

Name

(Year of Birth)

|

Offices with the Funds

|

Principal Occupation(s) During the Past Five Years

|

|

|

Jonathan S. Thomas

(1963)

|

Director and President since 2007

|

President and Chief Executive Officer, ACC (March 2007 to present). Also serves as Chief Executive Officer and Manager, ACS; Executive Vice President, ACIM; Director, ACC, ACIM and other ACC subsidiaries

|

|

|

Barry Fink

(1955)

|

Director since 2012 and Executive Vice President since 2007

|

Executive Vice President, ACC (September 2007 to present); President, ACS (October 2007 to present); Chief Operating Officer, ACC (September 2007 to November 2012). Also serves as Manager, ACS

|

|

|

Maryanne L. Roepke

(1956)

|

Chief Compliance Officer since 2006 and Senior Vice President since 2000

|

Chief Compliance Officer, American Century funds, ACIM and ACS (August 2006 to present). Also serves as Senior Vice President, ACS

|

|

|

Charles A. Etherington

(1957)

|

General Counsel since 2007 and Senior Vice President since 2006

|

Attorney, ACC (February 1994 to present); Vice President, ACC (November 2005 to present), General Counsel, ACC (March 2007 to present). Also serves as General Counsel, ACIM, ACS, ACIS and other ACC subsidiaries; and Senior Vice President, ACIM and ACS

|

|

|

C. Jean Wade

(1964)

|

Vice President, Treasurer and Chief Financial Officer since 2012

|

Vice President, ACS (February 2000 to present)

|

|

|

Robert J. Leach

(1966)

|

Vice President since 2006 and Assistant Treasurer since 2012

|

Vice President, ACS (February 2000 to present)

|

|

|

David H. Reinmiller

(1963)

|

Vice President since 2000

|

Attorney, ACC (January 1994 to present); Associate General Counsel, ACC (January 2001 to present). Also serves as Vice President, ACIM and ACS

|

|

|

Ward D. Stauffer

(1960)

|

Secretary since 2005

|

Attorney, ACC (June 2003 to present)

|

|

•

|

the nature, extent, and quality of investment management, shareholder services, and other services provided by the Advisor to the Fund;

|

|

•

|

the wide range of other programs and services the Advisor provides to the Fund and its shareholders on a routine and non-routine basis;

|

|

•

|

the investment performance of the fund, including data comparing the Fund’s performance to appropriate benchmarks and/or a peer group of other mutual funds with similar investment objectives and strategies;

|

|

•

|

data comparing the cost of owning the Fund to the cost of owning similar funds;

|

|

•

|

the Advisor’s compliance policies, procedures, and regulatory experience;

|

|

•

|

financial data showing the cost of services provided to the Fund, the profitability of the Fund to the Advisor, and the overall profitability of the Advisor;

|

|

•

|

data comparing services provided and charges to other investment management clients of the Advisor; and

|

|

•

|

consideration of collateral benefits derived by the Advisor from the management of the Fund and any potential economies of scale relating thereto.

|

|

•

|

constructing and designing the Fund

|

|

•

|

portfolio research and security selection

|

|

•

|

initial capitalization/funding

|

|

•

|

securities trading

|

|

•

|

Fund administration

|

|

•

|

custody of Fund assets

|

|

•

|

daily valuation of the Fund’s portfolio

|

|

•

|

shareholder servicing and transfer agency, including shareholder confirmations, recordkeeping, and communications

|

|

•

|

legal services

|

|

•

|

regulatory and portfolio compliance

|

|

•

|

financial reporting

|

|

•

|

marketing and distribution

|

|

Contact Us

|

americancentury.com

|

|

Automated Information Line

|

1-800-345-8765

|

|

Investor Services Representative

|

1-800-345-2021

or 816-531-5575

|

|

Investors Using Advisors

|

1-800-378-9878

|

|

Business, Not-For-Profit, Employer-Sponsored

Retirement Plans

|

1-800-345-3533

|

|

Banks and Trust Companies, Broker-Dealers,

Financial Professionals, Insurance Companies

|

1-800-345-6488

|

|

Telecommunications Device for the Deaf

|

1-800-634-4113

|

|

Global Growth Fund

|

|

President’s Letter

|

2

|

|

Independent Chairman’s Letter

|

3

|

|

Market Perspective

|

4

|

|

Performance

|

5

|

|

Portfolio Commentary

|

7

|

|

Fund Characteristics

|

9

|

|

Shareholder Fee Example

|

10

|

|

Schedule of Investments

|

12

|

|

Statement of Assets and Liabilities

|

15

|

|

Statement of Operations

|

16

|

|

Statement of Changes in Net Assets

|

17

|

|

Notes to Financial Statements

|

18

|

|

Financial Highlights

|

24

|

|

Report of Independent Registered Public Accounting Firm

|

26

|

|

Management

|

27

|

|

Approval of Management Agreement

|

30

|

|

Additional Information

|

35

|

|

•

|

Fund performance and client service continue to be rated among the industry’s best.

|

|

•

|

Target date and other asset allocation products continue to successfully gather assets and industry acclaim.

|

|

•

|

Compliance programs continue to function successfully with no issues impacting shareholder interests.

|

|

•

|

Fees were found to be within an acceptable competitive range, with minor fee waivers being negotiated on five funds.

|

|

International Equity Total Returns

|

||||

|

For the 12 months ended November 30, 2012 (in U.S. dollars)

|

||||

|

MSCI EAFE Index

|

12.61%

|

MSCI Europe Index

|

14.07%

|

|

|

MSCI EAFE Growth Index

|

12.66%

|

MSCI World Index

|

13.62%

|

|

|

MSCI EAFE Value Index

|

12.45%

|

MSCI Japan Index

|

3.59%

|

|

|

MSCI Emerging Markets Index

|

11.35%

|

|||

|

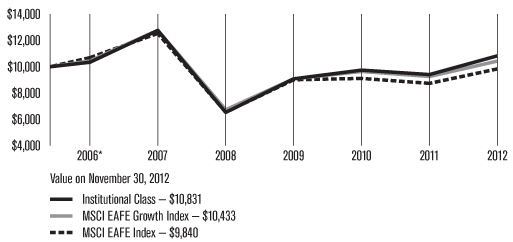

Total Returns as of November 30, 2012

|

||||||

|

Average Annual Returns

|

||||||

|

Ticker

Symbol

|

1 year

|

5 years

|

10 years

|

Since

Inception

|

Inception

Date

|

|

|

Investor Class

|

TWGGX

|

13.37%

|

-1.48%

|

8.50%

|

7.44%

|

12/1/98

|

|

MSCI World Index

|

—

|

13.62%

|

-1.80%

|

6.77%

|

3.11%(1)

|

—

|

|

Institutional Class

|

AGGIX

|

13.71%

|

-1.27%

|

8.74%

|

2.69%

|

8/1/00

|

|

A Class(2)

No sales charge*

With sales charge*

|

AGGRX

|

13.16%

6.68%

|

-1.72%

-2.88%

|

8.24%

7.59%

|

6.43%

5.97%

|

2/5/99

|

|

C Class

|

AGLCX

|

12.20%

|

-2.47%

|

7.43%

|

5.54%

|

3/1/02

|

|

R Class

|

AGORX

|

12.87%

|

-1.98%

|

—

|

4.69%

|

7/29/05

|

|

*

|

Sales charges include initial sales charges and contingent deferred sales charges (CDSCs), as applicable. A Class shares have a 5.75% maximum initial sales charge and may be subject to a maximum CDSC of 1.00%. C Class shares redeemed within 12 months of purchase are subject to a maximum CDSC of 1.00%. The SEC requires that mutual funds provide performance information net of maximum sales charges in all cases where charges could be applied.

|

|

(1)

|

Since 11/30/98, the date nearest the Investor Class’s inception for which data are available.

|

|

(2)

|

Prior to September 4, 2007, the A Class was referred to as the Advisor Class and did not have a front-end sales charge. Performance prior to that date has been adjusted to reflect this charge.

|

|

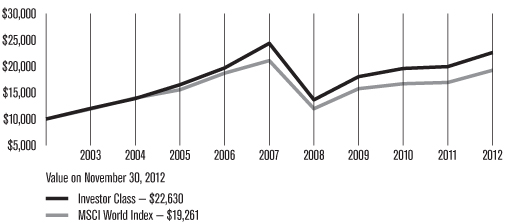

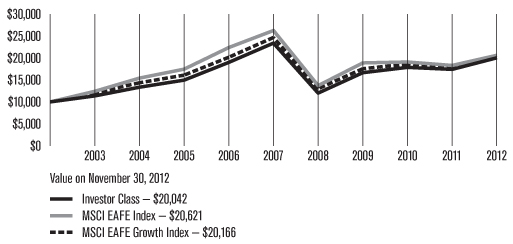

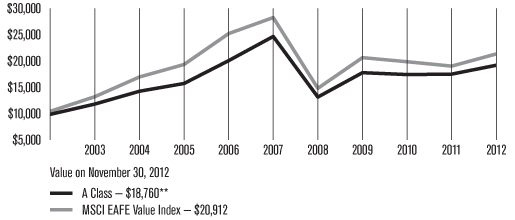

Growth of $10,000 Over 10 Years

|

|

$10,000 investment made November 30, 2002

|

|

Total Annual Fund Operating Expenses

|

||||

|

Investor Class

|

Institutional Class

|

A Class

|

C Class

|

R Class

|

|

1.11%

|

0.91%

|

1.36%

|

2.11%

|

1.61%

|

|

Portfolio Commentary

|

|

NOVEMBER 30, 2012

|

|

|

Top Ten Holdings

|

% of net assets

|

|

Apple, Inc.

|

4.0%

|

|

Google, Inc., Class A

|

2.4%

|

|

Precision Castparts Corp.

|

2.2%

|

|

Home Depot, Inc. (The)

|

2.1%

|

|

Unilever CVA

|

2.0%

|

|

eBay, Inc.

|

1.9%

|

|

Nestle SA

|

1.9%

|

|

American Tower Corp.

|

1.9%

|

|

Union Pacific Corp.

|

1.8%

|

|

MasterCard, Inc., Class A

|

1.7%

|

|

Types of Investments in Portfolio

|

% of net assets

|

|

Domestic Common Stocks

|

59.3%

|

|

Foreign Common Stocks

|

38.2%

|

|

Total Common Stocks

|

97.5%

|

|

Temporary Cash Investments

|

0.8%

|

|

Other Assets and Liabilities

|

1.7%

|

|

Investments by Country

|

% of net assets

|

|

United States

|

59.3%

|

|

United Kingdom

|

7.2%

|

|

Switzerland

|

6.1%

|

|

Japan

|

4.7%

|

|

Netherlands

|

3.0%

|

|

France

|

2.0%

|

|

Other Countries

|

15.2%

|

|

Cash and Equivalents*

|

2.5%

|

|

* Includes temporary cash investments and other assets and liabilities.

|

|

|

Beginning

Account Value

6/1/12

|

Ending

Account Value

11/30/12

|

Expenses Paid

During Period(1)

6/1/12 — 11/30/12

|

Annualized

Expense Ratio(1)

|

|

|

Actual

|

||||

|

Investor Class

|

$1,000

|

$1,086.90

|

$5.74

|

1.10%

|

|

Institutional Class

|

$1,000

|

$1,088.40

|

$4.70

|

0.90%

|

|

A Class

|

$1,000

|

$1,085.80

|

$7.04

|

1.35%

|

|

C Class

|

$1,000

|

$1,080.80

|

$10.92

|

2.10%

|

|

R Class

|

$1,000

|

$1,083.50

|

$8.33

|

1.60%

|

|

Hypothetical

|

||||

|

Investor Class

|

$1,000

|

$1,019.50

|

$5.55

|

1.10%

|

|

Institutional Class

|

$1,000

|

$1,020.50

|

$4.55

|

0.90%

|

|

A Class

|

$1,000

|

$1,018.25

|

$6.81

|

1.35%

|

|

C Class

|

$1,000

|

$1,014.50

|

$10.58

|

2.10%

|

|

R Class

|

$1,000

|

$1,017.00

|

$8.07

|

1.60%

|

|

(1)

|

Expenses are equal to the class’s annualized expense ratio listed in the table above, multiplied by the average account value over the period, multiplied by 183, the number of days in the most recent fiscal half-year, divided by 366, to reflect the one-half year period.

|

|

Shares

|

Value

|

|

|

Common Stocks — 97.5%

|

||

|

AUSTRALIA — 1.7%

|

||

|

BHP Billiton Ltd.

|

181,043

|

$ 6,497,522

|

|

CSL Ltd.

|

28,188

|

1,520,858

|

|

8,018,380

|

||

|

AUSTRIA — 0.1%

|

||

|

Erste Group Bank AG(1)

|

19,027

|

559,621

|

|

BRAZIL — 0.5%

|

||

|

BR Malls Participacoes SA

|

185,300

|

2,380,422

|

|

CANADA — 1.8%

|

||

|

Bank of Nova Scotia

|

72,249

|

4,073,030

|

|

Canadian Pacific Railway Ltd.

|

46,341

|

4,324,569

|

|

8,397,599

|

||

|

CHINA — 0.8%

|

||

|

Baidu, Inc. ADR(1)

|

40,199

|

3,871,566

|

|

DENMARK — 1.2%

|

||

|

Novo Nordisk A/S B Shares

|

34,410

|

5,464,761

|

|

FRANCE — 2.0%

|

||

|

L’Oreal SA

|

21,828

|

2,962,332

|

|

Pernod-Ricard SA

|

32,091

|

3,633,534

|

|

Sanofi

|

30,110

|

2,688,697

|

|

9,284,563

|

||

|

GERMANY — 1.6%

|

||

|

Fresenius Medical Care AG & Co. KGaA

|

42,479

|

2,916,994

|

|

Kabel Deutschland Holding AG

|

26,871

|

1,943,059

|

|

SAP AG ADR

|

34,241

|

2,670,455

|

|

7,530,508

|

||

|

INDONESIA — 0.4%

|

||

|

PT Bank Mandiri (Persero) Tbk

|

1,997,631

|

1,717,877

|

|

ISRAEL — 0.3%

|

||

|

Check Point Software Technologies Ltd.(1)

|

33,364

|

1,540,416

|

|

ITALY — 1.9%

|

||

|

Pirelli & C SpA

|

216,678

|

2,513,663

|

|

Prada SpA

|

272,600

|

2,251,090

|

|

Saipem SpA

|

84,572

|

3,764,964

|

|

8,529,717

|

||

|

JAPAN — 4.7%

|

||

|

FANUC Corp.

|

15,600

|

2,630,436

|

|

ORIX Corp.

|

42,630

|

4,276,704

|

|

Rakuten, Inc.

|

653,100

|

5,506,211

|

|

Toyota Motor Corp.

|

136,400

|

5,849,142

|

|

Unicharm Corp.

|

70,000

|

3,574,938

|

|

21,837,431

|

||

|

NETHERLANDS — 3.0%

|

||

|

ASML Holding NV

|

35,657

|

2,231,058

|

|

Koninklijke Vopak NV

|

29,908

|

2,209,731

|

|

Unilever CVA

|

243,740

|

9,248,366

|

|

13,689,155

|

||

|

PERU — 0.4%

|

||

|

Credicorp Ltd.

|

12,593

|

1,761,761

|

|

PORTUGAL — 0.6%

|

||

|

Jeronimo Martins SGPS SA

|

148,135

|

2,763,666

|

|

RUSSIA — 0.7%

|

||

|

Sberbank of Russia ADR

|

252,965

|

2,992,576

|

|

SOUTH KOREA — 0.5%

|

||

|

Hyundai Motor Co.

|

10,475

|

2,181,385

|

|

SPAIN — 0.9%

|

||

|

Grifols SA(1)

|

133,466

|

4,269,183

|

|

SWEDEN — 1.0%

|

||

|

Atlas Copco AB A Shares

|

105,750

|

2,724,274

|

|

SKF AB B Shares

|

74,925

|

1,801,799

|

|

4,526,073

|

||

|

SWITZERLAND — 6.1%

|

||

|

ABB Ltd.

|

181,916

|

3,545,271

|

|

Adecco SA

|

46,112

|

2,278,481

|

|

Nestle SA

|

134,255

|

8,786,625

|

|

Roche Holding AG

|

25,576

|

5,034,059

|

|

Syngenta AG

|

14,907

|

5,975,991

|

|

UBS AG

|

173,267

|

2,711,095

|

|

28,331,522

|

||

|

TURKEY — 0.8%

|

||

|

Turkiye Garanti Bankasi AS

|

734,843

|

3,487,404

|

|

UNITED KINGDOM — 7.2%

|

||

|

Aggreko plc

|

77,022

|

2,754,307

|

|

ARM Holdings plc

|

77,280

|

958,322

|

|

BG Group plc

|

270,643

|

4,639,637

|

|

Capita Group plc (The)

|

361,880

|

4,420,871

|

|

Compass Group plc

|

393,094

|

4,540,828

|

|

Croda International plc

|

48,186

|

1,838,161

|

|

Lloyds Banking Group plc(1)

|

3,660,780

|

2,726,988

|

|

Petrofac Ltd.

|

50,995

|

1,330,103

|

|

Reckitt Benckiser Group plc

|

47,059

|

2,959,278

|

|

Rio Tinto plc

|

60,015

|

2,974,495

|

|

Standard Chartered plc

|

168,409

|

3,925,832

|

|

33,068,822

|

||

|

UNITED STATES — 59.3%

|

||

|

Aflac, Inc.

|

81,243

|

4,305,067

|

|

Alexion Pharmaceuticals, Inc.(1)

|

23,991

|

2,303,616

|

|

Alliance Data Systems Corp.(1)

|

33,989

|

4,843,093

|

|

Shares

|

Value

|

|

American Express Co.

|

63,538

|

$ 3,551,774

|

|

American Tower Corp.

|

117,038

|

8,769,657

|

|

Apple, Inc.

|

31,719

|

18,564,496

|

|

B/E Aerospace, Inc.(1)

|

76,398

|

3,618,209

|

|

Biogen Idec, Inc.(1)

|

16,799

|

2,504,563

|

|

BorgWarner, Inc.(1)

|

50,970

|

3,379,311

|

|

Cameron International Corp.(1)

|

70,908

|

3,825,487

|

|

Celgene Corp.(1)

|

40,260

|

3,164,033

|

|

Cerner Corp.(1)

|

48,775

|

3,766,406

|

|

Charles Schwab Corp. (The)

|

302,482

|

3,962,514

|

|

CIT Group, Inc.(1)

|

171,479

|

6,353,297

|

|

Colgate-Palmolive Co.

|

44,181

|

4,793,638

|

|

Continental Resources, Inc.(1)

|

26,329

|

1,808,802

|

|

Costco Wholesale Corp.

|

39,774

|

4,136,098

|

|

Danaher Corp.

|

80,782

|

4,359,805

|

|

eBay, Inc.(1)

|

169,210

|

8,937,672

|

|

EMC Corp.(1)

|

150,420

|

3,733,424

|

|

Equinix, Inc.(1)

|

31,828

|

5,912,369

|

|

Estee Lauder Cos., Inc. (The), Class A

|

24,871

|

1,448,736

|

|

Express Scripts Holding Co.(1)

|

94,460

|

5,086,671

|

|

Facebook, Inc. Class A(1)

|

69,903

|

1,957,284

|

|

FactSet Research Systems, Inc.

|

19,545

|

1,805,763

|

|

Family Dollar Stores, Inc.

|

50,689

|

3,609,057

|

|

FedEx Corp.

|

17,903

|

1,602,856

|

|

Fortune Brands Home & Security, Inc.(1)

|

81,422

|

2,441,846

|

|

Google, Inc., Class A(1)

|

16,084

|

11,232,583

|

|

Harley-Davidson, Inc.

|

108,057

|

5,074,357

|

|

Home Depot, Inc. (The)

|

147,608

|

9,604,853

|

|

IntercontinentalExchange, Inc.(1)

|

32,066

|

4,237,522

|

|

Intuitive Surgical, Inc.(1)

|

9,344

|

4,942,976

|

|

Liberty Global, Inc. Class A(1)

|

130,203

|

7,296,576

|

|

LKQ Corp.(1)

|

79,308

|

1,738,431

|

|

MasterCard, Inc., Class A

|

16,316

|

7,973,303

|

|

Michael Kors Holdings Ltd.(1)

|

55,609

|

2,955,618

|

|

Mondelez International, Inc. Class A

|

148,553

|

3,846,037

|

|

Monsanto Co.

|

60,810

|

5,569,588

|

|

National Oilwell Varco, Inc.

|

49,124

|

3,355,169

|

|

Oceaneering International, Inc.

|

58,362

|

3,074,510

|

|

Pall Corp.

|

72,627

|

4,319,854

|

|

Precision Castparts Corp.

|

55,006

|

10,087,550

|

|

priceline.com, Inc.(1)

|

11,517

|

7,637,614

|

|

QUALCOMM, Inc.

|

106,910

|

6,801,614

|

|

Schlumberger Ltd.

|

82,135

|

5,882,509

|

|

Starbucks Corp.

|

107,667

|

5,584,687

|

|

Teradata Corp.(1)

|

38,120

|

2,267,378

|

|

Tractor Supply Co.

|

33,325

|

2,986,587

|

|

Union Pacific Corp.

|

68,273

|

8,382,559

|

|

United Rentals, Inc.(1)

|

62,727

|

2,605,052

|

|

Verisk Analytics, Inc. Class A(1)

|

52,970

|

2,640,025

|

|

Visa, Inc., Class A

|

37,688

|

5,642,270

|

|

Waters Corp.(1)

|

14,355

|

1,213,715

|

|

Wells Fargo & Co.

|

156,691

|

5,172,370

|

|

Whole Foods Market, Inc.

|

35,790

|

3,341,354

|

|

Yum! Brands, Inc.

|

45,608

|

3,059,385

|

|

273,071,590

|

||

|

TOTAL COMMON STOCKS (Cost $347,765,856)

|

449,275,998

|

|

|

Temporary Cash Investments — 0.8%

|

||

|

Repurchase Agreement, Bank of America Merrill Lynch, (collateralized by various U.S. Treasury obligations,

1.25% - 2.125%, 4/15/14 - 12/31/15, valued at $1,626,024), in a joint trading account at 0.18%, dated 11/30/12,

due 12/3/12 (Delivery value $1,593,212)

|

1,593,188

|

|

|

Repurchase Agreement, Credit Suisse First Boston, Inc., (collateralized by various U.S. Treasury obligations,

0.25%, 9/15/15, valued at $1,625,297), in a joint trading account at 0.17%, dated 11/30/12, due 12/3/12 (Delivery

value $1,593,211)

|

1,593,188

|

|

|

Repurchase Agreement, Goldman Sachs & Co., (collateralized by various U.S. Treasury obligations, 4.25%,

11/15/40, valued at $268,643), in a joint trading account at 0.15%, dated 11/30/12, due 12/3/12 (Delivery value

$263,269)

|

263,266

|

|

|

SSgA U.S. Government Money Market Fund

|

9

|

9

|

|

TOTAL TEMPORARY CASH INVESTMENTS (Cost $3,449,651)

|

3,449,651

|

|

|

TOTAL INVESTMENT SECURITIES — 98.3% (Cost $351,215,507)

|

452,725,649

|

|

|

OTHER ASSETS AND LIABILITIES — 1.7%

|

7,987,342

|

|

|

TOTAL NET ASSETS — 100.0%

|

$460,712,991

|

|

|

Market Sector Diversification

|

|

|

(as a % of net assets)

|

|

|

Information Technology

|

20.4%

|

|

Consumer Discretionary

|

17.0%

|

|

Financials

|

14.7%

|

|

Industrials

|

14.6%

|

|

Consumer Staples

|

11.0%

|

|

Health Care

|

8.9%

|

|

Energy

|

6.0%

|

|

Materials

|

4.9%

|

|

Cash and Equivalents*

|

2.5%

|

|

* Includes temporary cash investments and other assets and liabilities.

|

|

|

NOVEMBER 30, 2012

|

||||

|

Assets

|

||||

|

Investment securities, at value (cost of $351,215,507)

|

$452,725,649 | |||

|

Foreign currency holdings, at value (cost of $77,430)

|

77,656 | |||

|

Receivable for investments sold

|

1,130,920 | |||

|

Receivable for capital shares sold

|

8,054,990 | |||

|

Dividends and interest receivable

|

717,094 | |||

|

Other assets

|

16,110 | |||

| 462,722,419 | ||||

|

Liabilities

|

||||

|

Payable for investments purchased

|

814,510 | |||

|

Payable for capital shares redeemed

|

794,181 | |||

|

Accrued management fees

|

389,984 | |||

|

Distribution and service fees payable

|

10,753 | |||

| 2,009,428 | ||||

|

Net Assets

|

$460,712,991 | |||

|

Net Assets Consist of:

|

||||

|

Capital (par value and paid-in surplus)

|

$403,686,616 | |||

|

Undistributed net investment income

|

124,526 | |||

|

Accumulated net realized loss

|

(44,637,627 | ) | ||

|

Net unrealized appreciation

|

101,539,476 | |||

| $460,712,991 | ||||

|

Net assets

|

Shares outstanding

|

Net asset value per share

|

|

|

Investor Class, $0.01 Par Value

|

$373,887,040

|

38,821,575

|

$9.63

|

|

Institutional Class, $0.01 Par Value

|

$47,203,364

|

4,852,199

|

$9.73

|