| Label |

Element |

Value |

| (Loomis Sayles Global Allocation Fund) |

|

|

|

| Prospectus: |

rr_ProspectusTable |

|

|

| Objective [Heading] |

rr_ObjectiveHeading |

<div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"><b>

Investment Goal

</b></div>

|

|

| Objective, Primary [Text Block] |

rr_ObjectivePrimaryTextBlock |

The Fund's investment goal is high total investment return through a combination of capital appreciation and current income.

|

|

| Expense [Heading] |

rr_ExpenseHeading |

<div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"><b>

Fund Fees & Expenses

</b></div>

|

|

| Expense Narrative [Text Block] |

rr_ExpenseNarrativeTextBlock |

The following table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in the Natixis Fund Complex. More information about these and other discounts is available from your financial professional and in the section "How Sales Charges Are Calculated" on page 49 of the Prospectus, in Appendix A to the Prospectus and on page 108 in the section "Reduced Sales Charges" of the Statement of Additional Information ("SAI").

|

|

| Expense Breakpoint Discounts [Text] |

rr_ExpenseBreakpointDiscounts |

You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in the Natixis Fund Complex.

|

|

| Expense Breakpoint, Minimum Investment Required [Amount] |

rr_ExpenseBreakpointMinimumInvestmentRequiredAmount |

$ 50,000

|

|

| Shareholder Fees Caption [Text] |

rr_ShareholderFeesCaption |

<div style="font-size:10pt;padding-top:2;padding-bottom:8;padding-left:0;"><b>

Shareholder Fees

</b></div>

<div style="font-size:10pt;padding-top:2;padding-bottom:0;padding-left:0;"><b>(fees paid directly from your investment)</b></div>

|

|

| Operating Expenses Caption [Text] |

rr_OperatingExpensesCaption |

<div style="font-size:10pt;padding-top:2;padding-bottom:8;padding-left:0;"><b>

Annual Fund Operating Expenses

</b></div>

<div style="font-size:10pt;padding-top:2;padding-bottom:0;padding-left:0;"><b>(expenses that you pay each year as a percentage of the value of your investment)</b></div>

|

|

| Fee Waiver or Reimbursement over Assets, Date of Termination |

rr_FeeWaiverOrReimbursementOverAssetsDateOfTermination |

January 31, 2020

|

|

| Expense Example [Heading] |

rr_ExpenseExampleHeading |

<div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"><b>

Example

</b></div>

|

|

| Expense Example Narrative [Text Block] |

rr_ExpenseExampleNarrativeTextBlock |

This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods (except where indicated). The example also assumes that your investment has a 5% return each year and that the Fund's operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

|

| Expense Example by, Year, Caption [Text] |

rr_ExpenseExampleByYearCaption |

<div style="font-size:10pt;padding-top:2;padding-bottom:8;padding-left:0;"><b>

If shares are redeemed:

</b></div>

|

|

| Expense Example, No Redemption, By Year, Caption [Text] |

rr_ExpenseExampleNoRedemptionByYearCaption |

<div style="font-size:10pt;padding-top:2;padding-bottom:8;padding-left:0;"><b>

If shares are not redeemed:

</b></div>

|

|

| Portfolio Turnover [Heading] |

rr_PortfolioTurnoverHeading |

<div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"><b>

Portfolio Turnover

</b></div>

|

|

| Portfolio Turnover [Text Block] |

rr_PortfolioTurnoverTextBlock |

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes for you if your Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund's performance. During its most recently ended fiscal year, the Fund's portfolio turnover rate was 22% of the average value of its portfolio.

|

|

| Portfolio Turnover, Rate |

rr_PortfolioTurnoverRate |

22.00%

|

|

| Strategy [Heading] |

rr_StrategyHeading |

<div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"><b>

Investments, Risks and Performance

</b></div>

<div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"><b>

Principal Investment Strategies

</b></div>

|

|

| Strategy Narrative [Text Block] |

rr_StrategyNarrativeTextBlock |

Under normal market conditions, the Fund will invest at least 80% of its net assets (plus any borrowings made for investment purposes) in equity and fixed-income securities of U.S. and foreign issuers. Equity securities purchased by the Fund may include common stocks, preferred stocks, depositary receipts, warrants, securities convertible into common or preferred stocks, interests in real estate investment trusts ("REITs") and/or real estate-related securities and other equity-like interests in an issuer. Fixed-income securities purchased by the Fund may include bonds and other debt obligation of U.S. and foreign issuers, including but not limited to corporations, governments and supranational entities. The Fund will invest a significant portion of its assets outside the U.S., including securities of issuers located in emerging market countries.

The portfolio managers reallocate the Fund's assets between equity and fixed income securities based on their assessment of current market conditions and the relative opportunities within each asset class, among other factors. In deciding which equity securities to buy and sell, the Adviser generally looks to purchase quality companies at attractive valuations with the potential to grow intrinsic value over time. The Adviser uses discounted cash flow analysis, among other methods of analysis, to determine a company's intrinsic value. In deciding which fixed-income securities to buy and sell, the Adviser generally looks for securities that it believes are undervalued and have the potential for credit upgrades, which may include securities that are below investment grade (also known as "junk bonds").

The Fund may also invest in foreign currencies, collateralized mortgage obligations, collateralized loan obligations, zero-coupon securities, when-issued securities, REITs, securities issued pursuant to Rule 144A under the Securities Act of 1933 ("Rule 144A securities"), mortgage-related securities, convertible securities and structured notes. The Fund may also engage in active and frequent trading of securities and engage in options or foreign currency transactions (such as forward currency contracts) for hedging and investment purposes and futures transactions and swap transactions (including credit default swaps). Frequent trading may produce high transaction costs and a high level of taxable capital gains, including short-term capital gains taxable as ordinary income, which may lower the Fund's return. The Adviser may hedge currency risk for the Fund (including "cross hedging" between two or more foreign currencies) if it believes the outlook for a particular foreign currency is unfavorable. Except as provided above or as required by applicable law, the Fund is not limited in the percentage of its assets that it may invest in these instruments.

|

|

| Risk [Heading] |

rr_RiskHeading |

<div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"><b>

Principal Investment Risks

</b></div>

|

|

| Risk Narrative [Text Block] |

rr_RiskNarrativeTextBlock |

The principal risks of investing in the Fund are summarized below. The Fund does not represent a complete investment program. You may lose money by investing in the Fund.

Allocation Risk: The Fund's allocations between asset classes and market exposures may not be optimal in every market condition and may adversely affect the Fund's performance.

Below Investment Grade Fixed-Income Securities Risk: The Fund's investments in below investment grade fixed-income securities, also known as "junk bonds," may be subject to greater risks than other fixed-income securities, including being subject to greater levels of interest rate risk, credit/counterparty risk (including a greater risk of default) and liquidity risk. The ability of the issuer to make principal and interest payments is predominantly speculative for below investment grade fixed-income securities.

Credit/Counterparty Risk: Credit/counterparty risk is the risk that the issuer or guarantor of a fixed-income security, or the counterparty to a derivatives or other transaction, will be unable or unwilling to make timely payments of interest or principal or to otherwise honor its obligations. The Fund will be subject to credit risks with respect to the counterparties of its derivatives transactions. Many of the protections afforded to participants on organized exchanges, such as the performance guarantee of an exchange clearing house, are not available in connection with over-the-counter ("OTC") derivatives transactions, such as foreign currency transactions. As a result, in instances when the Fund enters into OTC derivatives transactions, the Fund will be subject to the risk that its counterparties will not perform their obligations under the transactions and that the Fund will sustain losses or be unable to realize gains.

Currency Risk: Fluctuations in the exchange rates between different currencies may negatively affect an investment. The Fund may be subject to currency risk because it may invest in currency-related instruments and may invest in securities or other instruments denominated in, or that generate income denominated in, foreign currencies. The Fund may elect not to hedge currency risk, or may hedge such risk imperfectly, which may cause the Fund to incur losses that would not have been incurred had the risk been hedged.

Derivatives Risk: Derivative instruments (such as those in which the Fund may invest, including options, forward currency contracts, futures transactions, structured notes and swap transactions (including credit default swaps)) are subject to changes in the value of the underlying assets or indices on which such instruments are based. There is no guarantee that the use of derivatives will be effective or that suitable transactions will be available. Even a small investment in derivatives may give rise to leverage risk and can have a significant impact on the Fund's exposure to securities markets values, interest rates or currency exchange rates. It is possible that the Fund's liquid assets may be insufficient to support its obligations under its derivatives positions. The use of derivatives for other than hedging purposes may be considered a speculative activity, and involves greater risks than are involved in hedging. The use of derivatives may cause the Fund to incur losses greater than those that would have occurred had derivatives not been used. The Fund's use of derivatives, such as options, forward currency contracts, futures transactions, structured notes and swap transactions (including credit default swaps) involves other risks, such as the credit risk relating to the other party to a derivative contract (which is greater for forward currency contracts, swaps and other OTC derivatives) the risk of difficulties in pricing and valuation, the risk that changes in the value of a derivative may not correlate as expected with changes in the value of relevant assets, rates or indices, liquidity risk, allocation risk and the risk of losing more than the initial margin required to initiate derivatives positions. There is also the risk that the Fund may be unable to terminate or sell a derivatives position at an advantageous time or price. The Fund's derivative counterparties may experience financial difficulties or otherwise be unwilling or unable to honor their obligations, possibly resulting in losses to the Fund.

Emerging Markets Risk: In addition to the risks of investing in foreign investments generally, emerging markets investments are subject to greater risks arising from political or economic instability, nationalization or confiscatory taxation, currency exchange restrictions, sanctions by the U.S. government and an issuer's unwillingness or inability to make principal or interest payments on its obligations. Emerging markets companies may be smaller and have shorter operating histories than companies in developed markets.

Equity Securities Risk: The value of the Fund's investments in equity securities could be subject to unpredictable declines in the value of individual securities and periods of below-average performance in individual securities or in the equity market as a whole. Value stocks can perform differently from the market as a whole and from other types of stocks. Value stocks also present the risk that their lower valuations fairly reflect their business prospects and that investors will not agree that the stocks represent favorable investment opportunities, and they may fall out of favor with investors and underperform growth stocks during any given period. In the event an issuer is liquidated or declares bankruptcy, the claims of owners of the issuer's bonds generally take precedence over the claims of those who own preferred stock or common stock.

Foreign Securities Risk: Investments in foreign securities may be subject to greater political, economic, environmental, credit/counterparty and information risks. The Fund's investments in foreign securities also are subject to foreign currency fluctuations and other foreign currency-related risks. Foreign securities may be subject to higher volatility than U.S. securities, varying degrees of regulation and limited liquidity.

Interest Rate Risk: Interest rate risk is the risk that the value of the Fund's investments will fall if interest rates rise. Generally, the value of fixed-income securities rises when prevailing interest rates fall and falls when interest rates rise. Interest rate risk generally is greater for funds that invest in fixed-income securities with relatively longer durations than for funds that invest in fixed-income securities with shorter durations. The value of zero-coupon securities and securities with longer maturities are generally more sensitive to fluctuations in interest rates than other fixed-income securities. In addition, an economic downturn or period of rising interest rates could adversely affect the market for these securities and reduce the Fund's ability to sell them, negatively impacting the performance of the Fund. Potential future changes in government monetary policy may affect the level of interest rates, and the current historically low interest rate environment increases the likelihood of interest rates rising in the future.

Large Investor Risk: Ownership of shares of the Fund may be concentrated in one or a few large investors. Such investors may redeem shares in large quantities or on a frequent basis. Redemptions by a large investor can affect the performance of the Fund, may increase realized capital gains, including short-term capital gains taxable as ordinary income, may accelerate the realization of taxable income to shareholders and may increase transaction costs. These transactions potentially limit the use of any capital loss carryforwards and certain other losses to offset future realized capital gains (if any). Such transactions may also increase the Fund's expenses.

Leverage Risk: Use of derivative instruments may involve leverage. Leverage is the risk associated with securities or practices that multiply small index, market or asset-price movements into larger changes in value. The use of leverage increases the impact of gains and losses on a fund's returns, and may lead to significant losses if investments are not successful.

Liquidity Risk: Liquidity risk is the risk that the Fund may be unable to find a buyer for its investments when it seeks to sell them or to receive the price it expects. Decreases in the number of financial institutions willing to make markets in the Fund's investments or in their capacity or willingness to transact may increase the Fund's exposure to this risk. Events that may lead to increased redemptions, such as market disruptions or increases in interest rates, may also negatively impact the liquidity of the Fund's investments when it needs to dispose of them. If the Fund is forced to sell its investments at an unfavorable time and/or under adverse conditions in order to meet redemption requests, such sales could negatively affect the Fund. Securities acquired in a private placement, such as Rule 144A securities, are generally subject to significant liquidity risk because they are subject to strict restrictions on resale and there may be no liquid secondary market or ready purchaser for such securities. Non-exchange traded derivatives are generally subject to greater liquidity risk as well. Liquidity issues may also make it difficult to value the Fund's investments.

Management Risk: A strategy used by the Fund's portfolio managers may fail to produce the intended result.

Market/Issuer Risk: The market value of the Fund's investments will move up and down, sometimes rapidly and unpredictably, based upon overall market and economic conditions, as well as a number of reasons that directly relate to the issuers of the Fund's investments, such as management performance, financial condition and demand for the issuers' goods and services.

Mortgage-Related Securities Risk: In addition to the risks associated with investments in fixed-income securities generally (for example, credit, liquidity and valuation risk), mortgage-related securities are subject to the risks of the mortgages underlying the securities as well as prepayment risk, the risk that the securities may be prepaid and result in the reinvestment of the prepaid amounts in securities with lower yields than the prepaid obligations. Conversely, there is a risk that a rise in interest rates will extend the life of a mortgage-related security beyond the expected prepayment time, typically reducing the security's value. The Fund also may incur a loss when there is a prepayment of securities that were purchased at a premium. The Fund's investments in other asset-backed securities are subject to risks similar to those associated with mortgage-related securities, as well as additional risks associated with the nature of the assets and the servicing of those assets.

REITs Risk: Investments in the real estate industry, including REITs, are particularly sensitive to economic downturns and are sensitive to factors such as changes in real estate values, property taxes and tax laws, interest rates, cash flow of underlying real estate assets, occupancy rates, government regulations affecting zoning, land use and rents and the management skill and creditworthiness of the issuer. Companies in the real estate industry also may be subject to liabilities under environmental and hazardous waste laws. In addition, the value of a REIT is affected by changes in the value of the properties owned by the REIT or mortgage loans held by the REIT. REITs are also subject to default and prepayment risk. Many REITs are highly leveraged, increasing their risk. The Fund will indirectly bear its proportionate share of expenses, including management fees, paid by each REIT in which it invests in addition to the expenses of the Fund.

|

|

| Risk Lose Money [Text] |

rr_RiskLoseMoney |

You may lose money by investing in the Fund.

|

|

| Bar Chart and Performance Table [Heading] |

rr_BarChartAndPerformanceTableHeading |

<div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"><b>

Risk/Return Bar Chart and Table

</b></div>

|

|

| Performance Narrative [Text Block] |

rr_PerformanceNarrativeTextBlock |

The bar chart and table shown below provide some indication of the risks of investing in the Fund by showing changes in the Fund's performance from year-to-year and by showing how the Fund's average annual returns for the one-year, five-year, ten-year and life-of-class periods (as applicable) compare to those of two broad measures of market performance. The Blended Index is an unmanaged, blended index composed of the following weights: 60% MSCI All Country World Index (Net) and 40% Bloomberg Barclays Global Aggregate Bond Index. The two indices composing the Blended Index measure, respectively, the performance of global equity securities and global investment grade fixed income securities. The Fund's past performance (before and after taxes) does not necessarily indicate how the Fund will perform in the future. Updated performance information is available online at im.natixis.com and/or by calling the Fund toll-free at 800-225-5478.

The chart does not reflect any sales charge that you may be required to pay when you buy or redeem the Fund's shares. A sales charge will reduce your return.

|

|

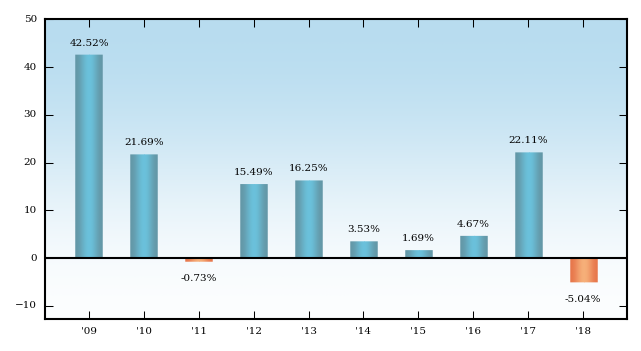

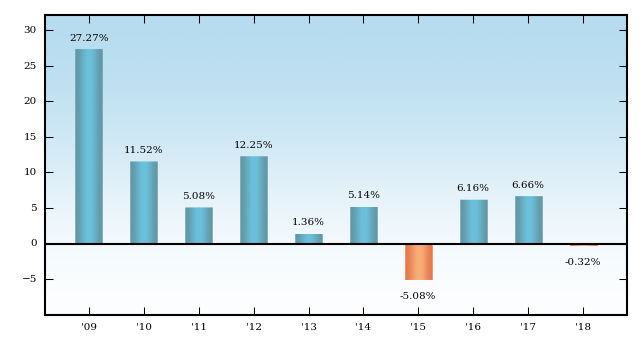

| Bar Chart [Heading] |

rr_BarChartHeading |

<div style="font-size:10pt;padding-top:5pt;padding-bottom:8;padding-left:0;"><b>

Total Returns for Class Y Shares

</b></div>

|

|

| Bar Chart Does Not Reflect Sales Loads [Text] |

rr_BarChartDoesNotReflectSalesLoads |

The chart does not reflect any sales charge that you may be required to pay when you buy or redeem the Fund's shares. A sales charge will reduce your return.

|

|

| Bar Chart Closing [Text Block] |

rr_BarChartClosingTextBlock |

Highest Quarterly Return:

Second Quarter 2009, 19.91%

Lowest Quarterly Return:

Third Quarter 2011, -14.72%

|

|

| Performance Table Heading |

rr_PerformanceTableHeading |

<div style="font-size:10pt;padding-top:2;padding-bottom:8;padding-left:0;"><b>

Average Annual Total Returns

</b></div>

<div style="font-size:10pt;padding-top:2;padding-bottom:0;padding-left:0;"><b>(for the periods ended December 31, 2018)</b></div>

|

|

| Performance Table Closing [Text Block] |

rr_PerformanceTableClosingTextBlock |

The Fund did not have Class T shares outstanding during the periods shown above. The returns of Class T shares would have been substantially similar to the returns of the Fund's other share classes because they would have been invested in the same portfolio of securities and would only differ to the extent the other share classes did not have the same expenses. Performance of Class T shares shown above is that of Class A shares, which have the same expenses as Class T shares, restated to reflect the different sales load applicable to Class T shares.

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor's tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their shares through tax-advantaged arrangements, such as 401(k) plans, qualified plans, education savings accounts, such as 529 plans, or individual retirement accounts. The Return After Taxes on Distributions and Sale of Fund Shares for the 1-year period exceeds the Return Before Taxes due to an assumed tax benefit from losses on a sale of Fund shares at the end of the measurement period. The after-tax returns are shown for only one class of the Fund. After-tax returns for the other classes of the Fund will vary. Index performance reflects no deduction for fees, expenses or taxes.

|

|

| Index No Deduction for Fees, Expenses, Taxes [Text] |

rr_IndexNoDeductionForFeesExpensesTaxes |

Index performance reflects no deduction for fees, expenses or taxes.

|

|

| Performance Table Uses Highest Federal Rate |

rr_PerformanceTableUsesHighestFederalRate |

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes.

|

|

| Performance Table Not Relevant to Tax Deferred |

rr_PerformanceTableNotRelevantToTaxDeferred |

Actual after-tax returns depend on an investor's tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their shares through tax-advantaged arrangements, such as 401(k) plans, qualified plans, education savings accounts, such as 529 plans, or individual retirement accounts.

|

|

| Performance Table Explanation after Tax Higher |

rr_PerformanceTableExplanationAfterTaxHigher |

The Return After Taxes on Distributions and Sale of Fund Shares for the 1-year period exceeds the Return Before Taxes due to an assumed tax benefit from losses on a sale of Fund shares at the end of the measurement period.

|

|

| Performance Past Does Not Indicate Future [Text] |

rr_PerformancePastDoesNotIndicateFuture |

The Fund's past performance (before and after taxes) does not necessarily indicate how the Fund will perform in the future.

|

|

| Performance Information Illustrates Variability of Returns [Text] |

rr_PerformanceInformationIllustratesVariabilityOfReturns |

The bar chart and table shown below provide some indication of the risks of investing in the Fund by showing changes in the Fund's performance from year-to-year and by showing how the Fund's average annual returns for the one-year, five-year, ten-year and life-of-class periods (as applicable) compare to those of two broad measures of market performance.

|

|

| Performance Table One Class of after Tax Shown [Text] |

rr_PerformanceTableOneClassOfAfterTaxShown |

The after-tax returns are shown for only one class of the Fund. After-tax returns for the other classes of the Fund will vary.

|

|

| Performance Availability Website Address [Text] |

rr_PerformanceAvailabilityWebSiteAddress |

im.natixis.com

|

|

| Performance Availability Phone [Text] |

rr_PerformanceAvailabilityPhone |

800-225-5478

|

|

| (Loomis Sayles Global Allocation Fund) | MSCI All Country World Index (Net) |

|

|

|

| Prospectus: |

rr_ProspectusTable |

|

|

| Past 1 Year |

rr_AverageAnnualReturnYear01 |

(9.42%)

|

|

| Past 5 Years |

rr_AverageAnnualReturnYear05 |

4.26%

|

|

| Past 10 Years |

rr_AverageAnnualReturnYear10 |

9.46%

|

|

| Life of Fund / Life of Class N |

rr_AverageAnnualReturnSinceInception |

4.71%

|

|

| (Loomis Sayles Global Allocation Fund) | Blended Index |

|

|

|

| Prospectus: |

rr_ProspectusTable |

|

|

| Past 1 Year |

rr_AverageAnnualReturnYear01 |

(6.00%)

|

|

| Past 5 Years |

rr_AverageAnnualReturnYear05 |

3.12%

|

|

| Past 10 Years |

rr_AverageAnnualReturnYear10 |

6.84%

|

|

| Life of Fund / Life of Class N |

rr_AverageAnnualReturnSinceInception |

4.07%

|

|

| (Loomis Sayles Global Allocation Fund) | Class A |

|

|

|

| Prospectus: |

rr_ProspectusTable |

|

|

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

5.75%

|

|

| Maximum deferred sales charge (load) (as a percentage of original purchase price or redemption proceeds, as applicable) |

rr_MaximumDeferredSalesChargeOverOther |

none

|

[1] |

| Redemption fees |

rr_RedemptionFee |

none

|

|

| Management fees |

rr_ManagementFeesOverAssets |

0.75%

|

|

| Distribution and/or service (12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

0.25%

|

|

| Other expenses |

rr_OtherExpensesOverAssets |

0.16%

|

|

| Total annual fund operating expenses |

rr_ExpensesOverAssets |

1.16%

|

|

| Fee waiver and/or expense reimbursement |

rr_FeeWaiverOrReimbursementOverAssets |

none

|

[2],[3] |

| Total annual fund operating expenses after fee waiver and/or expense reimbursement |

rr_NetExpensesOverAssets |

1.16%

|

|

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

$ 686

|

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

922

|

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

1,177

|

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

$ 1,903

|

|

| Past 1 Year |

rr_AverageAnnualReturnYear01 |

(10.69%)

|

|

| Past 5 Years |

rr_AverageAnnualReturnYear05 |

3.53%

|

|

| Past 10 Years |

rr_AverageAnnualReturnYear10 |

10.51%

|

|

| (Loomis Sayles Global Allocation Fund) | Class C |

|

|

|

| Prospectus: |

rr_ProspectusTable |

|

|

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

none

|

|

| Maximum deferred sales charge (load) (as a percentage of original purchase price or redemption proceeds, as applicable) |

rr_MaximumDeferredSalesChargeOverOther |

1.00%

|

|

| Redemption fees |

rr_RedemptionFee |

none

|

|

| Management fees |

rr_ManagementFeesOverAssets |

0.75%

|

|

| Distribution and/or service (12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

1.00%

|

|

| Other expenses |

rr_OtherExpensesOverAssets |

0.16%

|

|

| Total annual fund operating expenses |

rr_ExpensesOverAssets |

1.91%

|

|

| Fee waiver and/or expense reimbursement |

rr_FeeWaiverOrReimbursementOverAssets |

none

|

[2],[3] |

| Total annual fund operating expenses after fee waiver and/or expense reimbursement |

rr_NetExpensesOverAssets |

1.91%

|

|

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

$ 294

|

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

600

|

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

1,032

|

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

2,233

|

|

| Expense Example, No Redemption, 1 Year |

rr_ExpenseExampleNoRedemptionYear01 |

194

|

|

| Expense Example, No Redemption, 3 Years |

rr_ExpenseExampleNoRedemptionYear03 |

600

|

|

| Expense Example, No Redemption, 5 Years |

rr_ExpenseExampleNoRedemptionYear05 |

1,032

|

|

| Expense Example, No Redemption, 10 Years |

rr_ExpenseExampleNoRedemptionYear10 |

$ 2,233

|

|

| Past 1 Year |

rr_AverageAnnualReturnYear01 |

(6.83%)

|

|

| Past 5 Years |

rr_AverageAnnualReturnYear05 |

3.99%

|

|

| Past 10 Years |

rr_AverageAnnualReturnYear10 |

10.33%

|

|

| (Loomis Sayles Global Allocation Fund) | Class N |

|

|

|

| Prospectus: |

rr_ProspectusTable |

|

|

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

none

|

|

| Maximum deferred sales charge (load) (as a percentage of original purchase price or redemption proceeds, as applicable) |

rr_MaximumDeferredSalesChargeOverOther |

none

|

|

| Redemption fees |

rr_RedemptionFee |

none

|

|

| Management fees |

rr_ManagementFeesOverAssets |

0.75%

|

|

| Distribution and/or service (12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

none

|

|

| Other expenses |

rr_OtherExpensesOverAssets |

0.08%

|

|

| Total annual fund operating expenses |

rr_ExpensesOverAssets |

0.83%

|

|

| Fee waiver and/or expense reimbursement |

rr_FeeWaiverOrReimbursementOverAssets |

none

|

[2],[3] |

| Total annual fund operating expenses after fee waiver and/or expense reimbursement |

rr_NetExpensesOverAssets |

0.83%

|

|

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

$ 85

|

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

265

|

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

460

|

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

$ 1,025

|

|

| Past 1 Year |

rr_AverageAnnualReturnYear01 |

(4.92%)

|

|

| Life of Fund / Life of Class N |

rr_AverageAnnualReturnSinceInception |

6.38%

|

|

| Inception Date |

rr_AverageAnnualReturnInceptionDate |

Feb. 01, 2017

|

|

| (Loomis Sayles Global Allocation Fund) | Class T |

|

|

|

| Prospectus: |

rr_ProspectusTable |

|

|

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

2.50%

|

|

| Maximum deferred sales charge (load) (as a percentage of original purchase price or redemption proceeds, as applicable) |

rr_MaximumDeferredSalesChargeOverOther |

none

|

|

| Redemption fees |

rr_RedemptionFee |

none

|

|

| Management fees |

rr_ManagementFeesOverAssets |

0.75%

|

|

| Distribution and/or service (12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

0.25%

|

|

| Other expenses |

rr_OtherExpensesOverAssets |

0.16%

|

[4] |

| Total annual fund operating expenses |

rr_ExpensesOverAssets |

1.16%

|

|

| Fee waiver and/or expense reimbursement |

rr_FeeWaiverOrReimbursementOverAssets |

none

|

[2],[3] |

| Total annual fund operating expenses after fee waiver and/or expense reimbursement |

rr_NetExpensesOverAssets |

1.16%

|

|

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

$ 365

|

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

609

|

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

872

|

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

$ 1,624

|

|

| Past 1 Year |

rr_AverageAnnualReturnYear01 |

(7.62%)

|

|

| Past 5 Years |

rr_AverageAnnualReturnYear05 |

4.24%

|

|

| Past 10 Years |

rr_AverageAnnualReturnYear10 |

10.88%

|

|

| (Loomis Sayles Global Allocation Fund) | Class Y |

|

|

|

| Prospectus: |

rr_ProspectusTable |

|

|

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

none

|

|

| Maximum deferred sales charge (load) (as a percentage of original purchase price or redemption proceeds, as applicable) |

rr_MaximumDeferredSalesChargeOverOther |

none

|

|

| Redemption fees |

rr_RedemptionFee |

none

|

|

| Management fees |

rr_ManagementFeesOverAssets |

0.75%

|

|

| Distribution and/or service (12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

none

|

|

| Other expenses |

rr_OtherExpensesOverAssets |

0.16%

|

|

| Total annual fund operating expenses |

rr_ExpensesOverAssets |

0.91%

|

|

| Fee waiver and/or expense reimbursement |

rr_FeeWaiverOrReimbursementOverAssets |

none

|

[2],[3] |

| Total annual fund operating expenses after fee waiver and/or expense reimbursement |

rr_NetExpensesOverAssets |

0.91%

|

|

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

$ 93

|

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

290

|

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

504

|

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

$ 1,120

|

|

| Annual Return 2009 |

rr_AnnualReturn2009 |

42.52%

|

|

| Annual Return 2010 |

rr_AnnualReturn2010 |

21.69%

|

|

| Annual Return 2011 |

rr_AnnualReturn2011 |

(0.73%)

|

|

| Annual Return 2012 |

rr_AnnualReturn2012 |

15.49%

|

|

| Annual Return 2013 |

rr_AnnualReturn2013 |

16.25%

|

|

| Annual Return 2014 |

rr_AnnualReturn2014 |

3.53%

|

|

| Annual Return 2015 |

rr_AnnualReturn2015 |

1.69%

|

|

| Annual Return 2016 |

rr_AnnualReturn2016 |

4.67%

|

|

| Annual Return 2017 |

rr_AnnualReturn2017 |

22.11%

|

|

| Annual Return 2018 |

rr_AnnualReturn2018 |

(5.04%)

|

|

| Highest Quarterly Return, Label |

rr_HighestQuarterlyReturnLabel |

Highest Quarterly Return: Second Quarter 2009, 19.91%

|

|

| Highest Quarterly Return |

rr_BarChartHighestQuarterlyReturn |

19.91%

|

|

| Highest Quarterly Return, Date |

rr_BarChartHighestQuarterlyReturnDate |

Jun. 30, 2009

|

|

| Lowest Quarterly Return, Label |

rr_LowestQuarterlyReturnLabel |

Lowest Quarterly Return: Third Quarter 2011, -14.72%

|

|

| Lowest Quarterly Return |

rr_BarChartLowestQuarterlyReturn |

(14.72%)

|

|

| Lowest Quarterly Return, Date |

rr_BarChartLowestQuarterlyReturnDate |

Sep. 30, 2011

|

|

| Past 1 Year |

rr_AverageAnnualReturnYear01 |

(5.04%)

|

|

| Past 5 Years |

rr_AverageAnnualReturnYear05 |

5.03%

|

|

| Past 10 Years |

rr_AverageAnnualReturnYear10 |

11.44%

|

|

| (Loomis Sayles Global Allocation Fund) | Class Y | Return After Taxes on Distributions |

|

|

|

| Prospectus: |

rr_ProspectusTable |

|

|

| Past 1 Year |

rr_AverageAnnualReturnYear01 |

(6.11%)

|

|

| Past 5 Years |

rr_AverageAnnualReturnYear05 |

3.95%

|

|

| Past 10 Years |

rr_AverageAnnualReturnYear10 |

10.54%

|

|

| (Loomis Sayles Global Allocation Fund) | Class Y | Return After Taxes on Distributions and Sale of Fund Shares |

|

|

|

| Prospectus: |

rr_ProspectusTable |

|

|

| Past 1 Year |

rr_AverageAnnualReturnYear01 |

(2.27%)

|

|

| Past 5 Years |

rr_AverageAnnualReturnYear05 |

3.75%

|

|

| Past 10 Years |

rr_AverageAnnualReturnYear10 |

9.31%

|

|

| (Loomis Sayles Growth Fund) |

|

|

|

| Prospectus: |

rr_ProspectusTable |

|

|

| Objective [Heading] |

rr_ObjectiveHeading |

<div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"><b>

Investment Goal

</b></div>

|

|

| Objective, Primary [Text Block] |

rr_ObjectivePrimaryTextBlock |

The Fund's investment goal is long-term growth of capital.

|

|

| Expense [Heading] |

rr_ExpenseHeading |

<div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"><b>

Fund Fees & Expenses

</b></div>

|

|

| Expense Narrative [Text Block] |

rr_ExpenseNarrativeTextBlock |

The following table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in the Natixis Fund Complex. More information about these and other discounts is available from your financial professional and in the section "How Sales Charges Are Calculated" on page 49 of the Prospectus, in Appendix A to the Prospectus and on page 108 in the section "Reduced Sales Charges" of the Statement of Additional Information ("SAI").

|

|

| Expense Breakpoint Discounts [Text] |

rr_ExpenseBreakpointDiscounts |

You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in the Natixis Fund Complex.

|

|

| Expense Breakpoint, Minimum Investment Required [Amount] |

rr_ExpenseBreakpointMinimumInvestmentRequiredAmount |

$ 50,000

|

|

| Shareholder Fees Caption [Text] |

rr_ShareholderFeesCaption |

<div style="font-size:10pt;padding-top:2;padding-bottom:8;padding-left:0;"><b>

Shareholder Fees

</b></div>

<div style="font-size:10pt;padding-top:2;padding-bottom:0;padding-left:0;"><b>(fees paid directly from your investment)</b></div>

|

|

| Operating Expenses Caption [Text] |

rr_OperatingExpensesCaption |

<div style="font-size:10pt;padding-top:2;padding-bottom:8;padding-left:0;"><b>

Annual Fund Operating Expenses

</b></div>

<div style="font-size:10pt;padding-top:2;padding-bottom:0;padding-left:0;"><b>(expenses that you pay each year as a percentage of the value of your investment)</b></div>

|

|

| Fee Waiver or Reimbursement over Assets, Date of Termination |

rr_FeeWaiverOrReimbursementOverAssetsDateOfTermination |

January 31, 2020

|

|

| Expense Example [Heading] |

rr_ExpenseExampleHeading |

<div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"><b>

Example

</b></div>

|

|

| Expense Example Narrative [Text Block] |

rr_ExpenseExampleNarrativeTextBlock |

This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods (except where indicated). The example also assumes that your investment has a 5% return each year and that the Fund's operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

|

| Expense Example by, Year, Caption [Text] |

rr_ExpenseExampleByYearCaption |

<div style="font-size:10pt;padding-top:2;padding-bottom:8;padding-left:0;"><b>

If shares are redeemed:

</b></div>

|

|

| Expense Example, No Redemption, By Year, Caption [Text] |

rr_ExpenseExampleNoRedemptionByYearCaption |

<div style="font-size:10pt;padding-top:2;padding-bottom:8;padding-left:0;"><b>

If shares are not redeemed:

</b></div>

|

|

| Portfolio Turnover [Heading] |

rr_PortfolioTurnoverHeading |

<div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"><b>

Portfolio Turnover

</b></div>

|

|

| Portfolio Turnover [Text Block] |

rr_PortfolioTurnoverTextBlock |

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes for you if your Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund's performance. During its most recently ended fiscal year, the Fund's portfolio turnover rate was 11% of the average value of its portfolio.

|

|

| Portfolio Turnover, Rate |

rr_PortfolioTurnoverRate |

11.00%

|

|

| Strategy [Heading] |

rr_StrategyHeading |

<div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"><b>

Investments, Risks and Performance

</b></div>

<div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"><b>

Principal Investment Strategies

</b></div>

|

|

| Strategy Narrative [Text Block] |

rr_StrategyNarrativeTextBlock |

Under normal market conditions, the Fund will invest primarily in equity securities, including common stocks, convertible securities and warrants. The Fund focuses on stocks of large capitalization companies, but the Fund may invest in companies of any size.

The Fund normally invests across a wide range of sectors and industries. The Fund's portfolio manager employs a growth style of equity management, which means that the Fund seeks to invest in companies with sustainable competitive advantages, long-term structural growth drivers, attractive cash flow returns on invested capital, and management teams focused on creating long-term value for shareholders. The Fund's portfolio manager also aims to invest in companies when they trade at a significant discount to the estimate of intrinsic value.

The Fund will consider selling a portfolio investment when the portfolio manager believes an unfavorable structural change occurs within a given business or the markets in which it operates, a critical underlying investment assumption is flawed, when a more attractive reward-to-risk opportunity becomes available, when the current price fully reflects intrinsic value, or for other investment reasons which the portfolio manager deems appropriate.

The Fund may also invest up to 20% of its assets in foreign securities, including depositary receipts and emerging market securities. Although certain equity securities purchased by the Fund may be issued by domestic companies incorporated outside of the United States, the Adviser does not consider these securities to be foreign if they are included in the U.S. equity indices published by S&P Global Ratings or Russell Investments or if the security's country of risk defined by Bloomberg is the United States. The Fund may also engage in foreign currency transactions (including foreign currency forwards and foreign currency futures) for hedging purposes, invest in options for hedging and investment purposes and invest in securities issued pursuant to Rule 144A under the Securities Act of 1933 ("Rule 144A securities"). Except as provided above or as required by applicable law, the Fund is not limited in the percentage of its assets that it may invest in these instruments.

|

|

| Risk [Heading] |

rr_RiskHeading |

<div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"><b>

Principal Investment Risks

</b></div>

|

|

| Risk Narrative [Text Block] |

rr_RiskNarrativeTextBlock |

The principal risks of investing in the Fund are summarized below. The Fund does not represent a complete investment program. You may lose money by investing in the Fund.

Credit/Counterparty Risk: Credit/counterparty risk is the risk that the issuer or guarantor of a fixed-income security, or the counterparty to a derivatives or other transaction, will be unable or unwilling to make timely payments of interest or principal or to otherwise honor its obligations. The Fund will be subject to credit risks with respect to the counterparties of its derivatives transactions. Many of the protections afforded to participants on organized exchanges, such as the performance guarantee of an exchange clearing house, are not available in connection with over-the-counter ("OTC") derivatives transactions, such as foreign currency transactions. As a result, in instances when the Fund enters into OTC derivatives transactions, the Fund will be subject to the risk that its counterparties will not perform their obligations under the transactions and that the Fund will sustain losses or be unable to realize gains.

Currency Risk: Fluctuations in the exchange rates between different currencies may negatively affect an investment. The Fund may be subject to currency risk because it may invest in currency related instruments and may invest in securities or other instruments denominated in, or that generate income denominated in, foreign currencies. The Fund may elect not to hedge currency risk, or may hedge such risk imperfectly, which may cause the Fund to incur losses that would not have been incurred had the risk been hedged.

Derivatives Risk: Derivative instruments (such as those in which the Fund may invest, including foreign currency forwards, foreign currency futures and options) are subject to changes in the value of the underlying assets or indices on which such instruments are based. There is no guarantee that the use of derivatives will be effective or that suitable transactions will be available. Even a small investment in derivatives may give rise to leverage risk and can have a significant impact on the Fund's exposure to securities market values, interest rates or currency exchange rates. It is possible that the Fund's liquid assets may be insufficient to support its obligations under its derivatives positions. The use of derivatives for other than hedging purposes may be considered a speculative activity, and involves greater risks than are involved in hedging. The use of derivatives may cause the Fund to incur losses greater than those that would have occurred had derivatives not been used. The Fund's use of derivatives such as foreign currency forwards, foreign currency futures and options, involves other risks, such as the credit risk relating to the other party to a derivative contract (which is greater for forward currency contracts and other OTC derivatives), the risk of difficulties in pricing and valuation, the risk that changes in the value of a derivative may not correlate as expected with changes in the value of relevant assets, rates or indices, liquidity risk, allocation risk and the risk of losing more than the initial margin required to initiate derivatives positions. There is also the risk that the Fund may be unable to terminate or sell a derivatives position at an advantageous time or price. The Fund's derivative counterparties may experience financial difficulties or otherwise be unwilling or unable to honor their obligations, possibly resulting in losses to the Fund.

Emerging Markets Risk: In addition to the risks of investing in foreign investments generally, emerging markets investments are subject to greater risks arising from political or economic instability, nationalization or confiscatory taxation, currency exchange restrictions, sanctions by the U.S. government and an issuer's unwillingness or inability to make principal or interest payments on its obligations. Emerging markets companies may be smaller and have shorter operating histories than companies in developed markets.

Equity Securities Risk: The value of the Fund's investments in equity securities could be subject to unpredictable declines in the value of individual securities and periods of below-average performance in individual securities or in the equity market as a whole. Growth stocks are generally more sensitive to market movements than other types of stocks primarily because their stock prices are based heavily on future expectations. If the Adviser's assessment of the prospects for a company's growth is wrong, or if the Adviser's judgment of how other investors will value the company's growth is wrong, then the price of the company's stock may fall or not approach the value that the Adviser has placed on it. Value stocks also present the risk that their lower valuations fairly reflect their business prospects and that investors will not agree that the stocks represent favorable investment opportunities, and they may fall out of favor with investors and underperform growth stocks during any given period. In the event an issuer is liquidated or declares bankruptcy, the claims of owners of the issuer's bonds generally take precedence over the claims of those who own preferred stock or common stock.

Foreign Securities Risk: Investments in foreign securities may be subject to greater political, economic, environmental, credit/counterparty and information risks. The Fund's investments in foreign securities also are subject to foreign currency fluctuations and other foreign currency-related risks. Foreign securities may be subject to higher volatility than U.S. securities, varying degrees of regulation and limited liquidity.

Leverage Risk: Use of derivative instruments may involve leverage. Leverage is the risk associated with securities or practices that multiply small index, market or asset-price movements into larger changes in value. The use of leverage increases the impact of gains and losses on a fund's returns, and may lead to significant losses if investments are not successful.

Liquidity Risk: Liquidity risk is the risk that the Fund may be unable to find a buyer for its investments when it seeks to sell them or to receive the price it expects. Decreases in the number of financial institutions willing to make markets in the Fund's investments or in their capacity or willingness to transact may increase the Fund's exposure to this risk. Events that may lead to increased redemptions, such as market disruptions or increases in interest rates, may also negatively impact the liquidity of the Fund's investments when it needs to dispose of them. If the Fund is forced to sell its investments at an unfavorable time and/or under adverse conditions in order to meet redemption requests, such sales could negatively affect the Fund. Securities acquired in a private placement, such as Rule 144A securities, are generally subject to significant liquidity risk because they are subject to strict restrictions on resale and there may be no liquid secondary market or ready purchaser for such securities. Non-exchange traded derivatives are generally subject to greater liquidity risk as well. Liquidity issues may also make it difficult to value the Fund's investments.

Management Risk: A strategy used by the Fund's portfolio manager may fail to produce the intended result.

Market/Issuer Risk: The market value of the Fund's investments will move up and down, sometimes rapidly and unpredictably, based upon overall market and economic conditions, as well as a number of reasons that directly relate to the issuers of the Fund's investments, such as management performance, financial condition and demand for the issuers' goods and services.

Small- and Mid-Capitalization Companies Risk: Compared to large-capitalization companies, small- and mid-capitalization companies are more likely to have limited product lines, markets or financial resources. Stocks of these companies often trade less frequently and in limited volume and their prices may fluctuate more than stocks of large-capitalization companies. As a result, it may be relatively more difficult for the Fund to buy and sell securities of small- and mid-capitalization companies.

|

|

| Risk Lose Money [Text] |

rr_RiskLoseMoney |

You may lose money by investing in the Fund.

|

|

| Bar Chart and Performance Table [Heading] |

rr_BarChartAndPerformanceTableHeading |

<div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"><b>

Risk/Return Bar Chart and Table

</b></div>

|

|

| Performance Narrative [Text Block] |

rr_PerformanceNarrativeTextBlock |

The bar chart and table shown below provide some indication of the risks of investing in the Fund by showing changes in the Fund's performance from year-to-year and by showing how the Fund's average annual returns for the one-year, five-year, ten-year and life-of-class periods (as applicable) compare to those of a broad measure of market performance. The Fund's past performance (before and after taxes) does not necessarily indicate how the Fund will perform in the future. Updated performance information is available online at im.natixis.com and/or by calling the Fund toll-free at 800-225-5478.

The chart does not reflect any sales charge that you may be required to pay when you buy or redeem the Fund's shares. A sales charge will reduce your return.

|

|

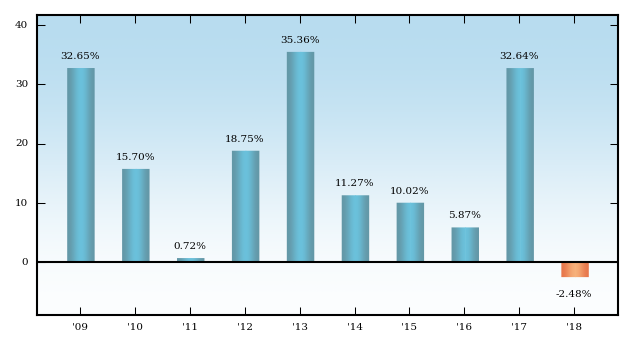

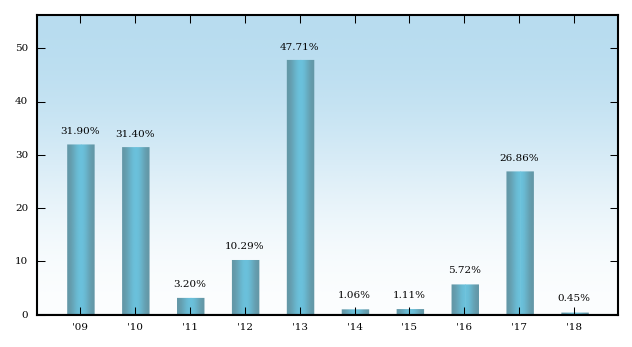

| Bar Chart [Heading] |

rr_BarChartHeading |

<div style="font-size:10pt;padding-top:5pt;padding-bottom:8;padding-left:0;"><b>

Total Returns for Class Y Shares

</b></div>

|

|

| Bar Chart Does Not Reflect Sales Loads [Text] |

rr_BarChartDoesNotReflectSalesLoads |

The chart does not reflect any sales charge that you may be required to pay when you buy or redeem the Fund's shares. A sales charge will reduce your return.

|

|

| Bar Chart Closing [Text Block] |

rr_BarChartClosingTextBlock |

Highest Quarterly Returns:

Third Quarter 2010, 15.01%

Lowest Quarterly Return:

Second Quarter 2010, -12.73%

|

|

| Performance Table Heading |

rr_PerformanceTableHeading |

<div style="font-size:10pt;padding-top:2;padding-bottom:8;padding-left:0;"><b>

Average Annual Total Returns

</b></div>

<div style="font-size:10pt;padding-top:2;padding-bottom:0;padding-left:0;"><b>(for the periods ended December 31, 2018)</b></div>

|

|

| Performance Table Closing [Text Block] |

rr_PerformanceTableClosingTextBlock |

The Fund did not have Class T shares outstanding during the periods shown above. The returns of Class T shares would have been substantially similar to the returns of the Fund's other share classes because they would have been invested in the same portfolio of securities and would only differ to the extent the other share classes did not have the same expenses. Performance of Class T shares shown above is that of Class A shares, which have the same expenses as Class T shares, restated to reflect the different sales load applicable to Class T shares.

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor's tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their shares through tax-advantaged arrangements, such as 401(k) plans, qualified plans, education savings accounts, such as 529 plans, or individual retirement accounts. The Return After Taxes on Distributions and Sale of Fund Shares for the 1-year period exceeds the Return Before Taxes due to an assumed tax benefit from losses on a sale of Fund shares at the end of the measurement period. The after-tax returns are shown for only one class of the Fund. After-tax returns for the other classes of the Fund will vary. Index performance reflects no deduction for fees, expenses or taxes.

|

|

| Index No Deduction for Fees, Expenses, Taxes [Text] |

rr_IndexNoDeductionForFeesExpensesTaxes |

Index performance reflects no deduction for fees, expenses or taxes.

|

|

| Performance Table Uses Highest Federal Rate |

rr_PerformanceTableUsesHighestFederalRate |

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes.

|

|

| Performance Table Not Relevant to Tax Deferred |

rr_PerformanceTableNotRelevantToTaxDeferred |

Actual after-tax returns depend on an investor's tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their shares through tax-advantaged arrangements, such as 401(k) plans, qualified plans, education savings accounts, such as 529 plans, or individual retirement accounts.

|

|

| Performance Table Explanation after Tax Higher |

rr_PerformanceTableExplanationAfterTaxHigher |

The Return After Taxes on Distributions and Sale of Fund Shares for the 1-year period exceeds the Return Before Taxes due to an assumed tax benefit from losses on a sale of Fund shares at the end of the measurement period.

|

|

| Performance Past Does Not Indicate Future [Text] |

rr_PerformancePastDoesNotIndicateFuture |

The Fund's past performance (before and after taxes) does not necessarily indicate how the Fund will perform in the future.

|

|

| Performance Information Illustrates Variability of Returns [Text] |

rr_PerformanceInformationIllustratesVariabilityOfReturns |

The bar chart and table shown below provide some indication of the risks of investing in the Fund by showing changes in the Fund's performance from year-to-year and by showing how the Fund's average annual returns for the one-year, five-year, ten-year and life-of-class periods (as applicable) compare to those of a broad measure of market performance.

|

|

| Performance Table One Class of after Tax Shown [Text] |

rr_PerformanceTableOneClassOfAfterTaxShown |

The after-tax returns are shown for only one class of the Fund. After-tax returns for the other classes of the Fund will vary.

|

|

| Performance Availability Website Address [Text] |

rr_PerformanceAvailabilityWebSiteAddress |

im.natixis.com

|

|

| Performance Availability Phone [Text] |

rr_PerformanceAvailabilityPhone |

800-225-5478

|

|

| (Loomis Sayles Growth Fund) | Russell 1000® Growth Index |

|

|

|

| Prospectus: |

rr_ProspectusTable |

|

|

| Past 1 Year |

rr_AverageAnnualReturnYear01 |

(1.51%)

|

|

| Past 5 Years |

rr_AverageAnnualReturnYear05 |

10.40%

|

|

| Past 10 Years |

rr_AverageAnnualReturnYear10 |

15.29%

|

|

| Life of Fund / Life of Class N |

rr_AverageAnnualReturnSinceInception |

13.18%

|

|

| (Loomis Sayles Growth Fund) | Class A |

|

|

|

| Prospectus: |

rr_ProspectusTable |

|

|

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

5.75%

|

|

| Maximum deferred sales charge (load) (as a percentage of original purchase price or redemption proceeds, as applicable) |

rr_MaximumDeferredSalesChargeOverOther |

none

|

[5] |

| Redemption fees |

rr_RedemptionFee |

none

|

|

| Management fees |

rr_ManagementFeesOverAssets |

0.50%

|

|

| Distribution and/or service (12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

0.25%

|

|

| Other expenses |

rr_OtherExpensesOverAssets |

0.15%

|

|

| Total annual fund operating expenses |

rr_ExpensesOverAssets |

0.90%

|

|

| Fee waiver and/or expense reimbursement |

rr_FeeWaiverOrReimbursementOverAssets |

none

|

[6],[7] |

| Total annual fund operating expenses after fee waiver and/or expense reimbursement |

rr_NetExpensesOverAssets |

0.90%

|

|

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

$ 662

|

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

845

|

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

1,045

|

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

$ 1,619

|

|

| Past 1 Year |

rr_AverageAnnualReturnYear01 |

(8.32%)

|

|

| Past 5 Years |

rr_AverageAnnualReturnYear05 |

9.31%

|

|

| Past 10 Years |

rr_AverageAnnualReturnYear10 |

14.34%

|

|

| (Loomis Sayles Growth Fund) | Class C |

|

|

|

| Prospectus: |

rr_ProspectusTable |

|

|

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

none

|

|

| Maximum deferred sales charge (load) (as a percentage of original purchase price or redemption proceeds, as applicable) |

rr_MaximumDeferredSalesChargeOverOther |

1.00%

|

|

| Redemption fees |

rr_RedemptionFee |

none

|

|

| Management fees |

rr_ManagementFeesOverAssets |

0.50%

|

|

| Distribution and/or service (12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

1.00%

|

|

| Other expenses |

rr_OtherExpensesOverAssets |

0.15%

|

|

| Total annual fund operating expenses |

rr_ExpensesOverAssets |

1.65%

|

|

| Fee waiver and/or expense reimbursement |

rr_FeeWaiverOrReimbursementOverAssets |

none

|

[6],[7] |

| Total annual fund operating expenses after fee waiver and/or expense reimbursement |

rr_NetExpensesOverAssets |

1.65%

|

|

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

$ 268

|

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

520

|

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

897

|

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

1,955

|

|

| Expense Example, No Redemption, 1 Year |

rr_ExpenseExampleNoRedemptionYear01 |

168

|

|

| Expense Example, No Redemption, 3 Years |

rr_ExpenseExampleNoRedemptionYear03 |

520

|

|

| Expense Example, No Redemption, 5 Years |

rr_ExpenseExampleNoRedemptionYear05 |

897

|

|

| Expense Example, No Redemption, 10 Years |

rr_ExpenseExampleNoRedemptionYear10 |

$ 1,955

|

|

| Past 1 Year |

rr_AverageAnnualReturnYear01 |

(4.36%)

|

|

| Past 5 Years |

rr_AverageAnnualReturnYear05 |

9.77%

|

|

| Past 10 Years |

rr_AverageAnnualReturnYear10 |

14.19%

|

|

| (Loomis Sayles Growth Fund) | Class N |

|

|

|

| Prospectus: |

rr_ProspectusTable |

|

|

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

none

|

|

| Maximum deferred sales charge (load) (as a percentage of original purchase price or redemption proceeds, as applicable) |

rr_MaximumDeferredSalesChargeOverOther |

none

|

|

| Redemption fees |

rr_RedemptionFee |

none

|

|

| Management fees |

rr_ManagementFeesOverAssets |

0.50%

|

|

| Distribution and/or service (12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

none

|

|

| Other expenses |

rr_OtherExpensesOverAssets |

0.08%

|

|

| Total annual fund operating expenses |

rr_ExpensesOverAssets |

0.58%

|

|

| Fee waiver and/or expense reimbursement |

rr_FeeWaiverOrReimbursementOverAssets |

none

|

[6],[7] |

| Total annual fund operating expenses after fee waiver and/or expense reimbursement |

rr_NetExpensesOverAssets |

0.58%

|

|

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

$ 59

|

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

186

|

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

324

|

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

$ 726

|

|

| Past 1 Year |

rr_AverageAnnualReturnYear01 |

(2.39%)

|

|

| Past 5 Years |

rr_AverageAnnualReturnYear05 |

10.93%

|

|

| Life of Fund / Life of Class N |

rr_AverageAnnualReturnSinceInception |

13.44%

|

|

| Inception Date |

rr_AverageAnnualReturnInceptionDate |

Feb. 01, 2013

|

|

| (Loomis Sayles Growth Fund) | Class T |

|

|

|

| Prospectus: |

rr_ProspectusTable |

|

|

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

2.50%

|

|

| Maximum deferred sales charge (load) (as a percentage of original purchase price or redemption proceeds, as applicable) |

rr_MaximumDeferredSalesChargeOverOther |

none

|

|

| Redemption fees |

rr_RedemptionFee |

none

|

|

| Management fees |

rr_ManagementFeesOverAssets |

0.50%

|

|

| Distribution and/or service (12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

0.25%

|

|

| Other expenses |

rr_OtherExpensesOverAssets |

0.15%

|

[4] |

| Total annual fund operating expenses |

rr_ExpensesOverAssets |

0.90%

|

|

| Fee waiver and/or expense reimbursement |

rr_FeeWaiverOrReimbursementOverAssets |

none

|

[6],[7] |

| Total annual fund operating expenses after fee waiver and/or expense reimbursement |

rr_NetExpensesOverAssets |

0.90%

|

|

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

$ 340

|

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

530

|

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

736

|

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

$ 1,330

|

|

| Past 1 Year |

rr_AverageAnnualReturnYear01 |

(5.13%)

|

|

| Past 5 Years |

rr_AverageAnnualReturnYear05 |

10.06%

|

|

| Past 10 Years |

rr_AverageAnnualReturnYear10 |

14.75%

|

|

| (Loomis Sayles Growth Fund) | Class Y |

|

|

|

| Prospectus: |

rr_ProspectusTable |

|

|

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

none

|

|

| Maximum deferred sales charge (load) (as a percentage of original purchase price or redemption proceeds, as applicable) |

rr_MaximumDeferredSalesChargeOverOther |

none

|

|

| Redemption fees |

rr_RedemptionFee |

none

|

|

| Management fees |

rr_ManagementFeesOverAssets |

0.50%

|

|

| Distribution and/or service (12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

none

|

|

| Other expenses |

rr_OtherExpensesOverAssets |

0.15%

|

|

| Total annual fund operating expenses |

rr_ExpensesOverAssets |

0.65%

|

|

| Fee waiver and/or expense reimbursement |

rr_FeeWaiverOrReimbursementOverAssets |

none

|

[6],[7] |

| Total annual fund operating expenses after fee waiver and/or expense reimbursement |

rr_NetExpensesOverAssets |

0.65%

|

|

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

$ 66

|

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

208

|

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

362

|

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

$ 810

|

|

| Annual Return 2009 |

rr_AnnualReturn2009 |

32.65%

|

|

| Annual Return 2010 |

rr_AnnualReturn2010 |

15.70%

|

|

| Annual Return 2011 |

rr_AnnualReturn2011 |

0.72%

|

|

| Annual Return 2012 |

rr_AnnualReturn2012 |

18.75%

|

|

| Annual Return 2013 |

rr_AnnualReturn2013 |

35.36%

|

|

| Annual Return 2014 |

rr_AnnualReturn2014 |

11.27%

|

|

| Annual Return 2015 |

rr_AnnualReturn2015 |

10.02%

|

|

| Annual Return 2016 |

rr_AnnualReturn2016 |

5.87%

|

|

| Annual Return 2017 |

rr_AnnualReturn2017 |

32.64%

|

|

| Annual Return 2018 |

rr_AnnualReturn2018 |

(2.48%)

|

|

| Highest Quarterly Return, Label |

rr_HighestQuarterlyReturnLabel |

Highest Quarterly Returns: Third Quarter 2010, 15.01%

|

|

| Highest Quarterly Return |

rr_BarChartHighestQuarterlyReturn |

15.01%

|

|

| Highest Quarterly Return, Date |

rr_BarChartHighestQuarterlyReturnDate |

Sep. 30, 2010

|

|

| Lowest Quarterly Return, Label |

rr_LowestQuarterlyReturnLabel |

Lowest Quarterly Return: Second Quarter 2010, -12.73%

|

|

| Lowest Quarterly Return |

rr_BarChartLowestQuarterlyReturn |

(12.73%)

|

|

| Lowest Quarterly Return, Date |

rr_BarChartLowestQuarterlyReturnDate |

Jun. 30, 2010

|

|

| Past 1 Year |

rr_AverageAnnualReturnYear01 |

(2.48%)

|

|

| Past 5 Years |

rr_AverageAnnualReturnYear05 |

10.89%

|

|

| Past 10 Years |

rr_AverageAnnualReturnYear10 |

15.34%

|

|

| (Loomis Sayles Growth Fund) | Class Y | Return After Taxes on Distributions |

|

|

|

| Prospectus: |

rr_ProspectusTable |

|

|

| Past 1 Year |

rr_AverageAnnualReturnYear01 |

(3.78%)

|

|

| Past 5 Years |

rr_AverageAnnualReturnYear05 |

10.33%

|

|

| Past 10 Years |

rr_AverageAnnualReturnYear10 |

15.01%

|

|

| (Loomis Sayles Growth Fund) | Class Y | Return After Taxes on Distributions and Sale of Fund Shares |

|

|

|

| Prospectus: |

rr_ProspectusTable |

|

|

| Past 1 Year |

rr_AverageAnnualReturnYear01 |

(0.57%)

|

|

| Past 5 Years |

rr_AverageAnnualReturnYear05 |

8.64%

|

|

| Past 10 Years |

rr_AverageAnnualReturnYear10 |

13.03%

|

|

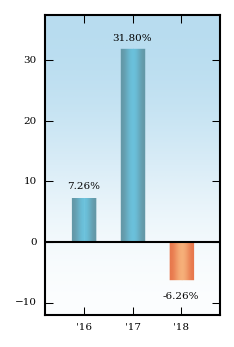

| (Loomis Sayles Limited Term Government and Agency Fund) |

|

|

|

| Prospectus: |

rr_ProspectusTable |

|

|

| Objective [Heading] |

rr_ObjectiveHeading |

<div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"><b>

Investment Goal

</b></div>

|

|

| Objective, Primary [Text Block] |

rr_ObjectivePrimaryTextBlock |

The Fund seeks high current return consistent with preservation of capital.

|

|

| Expense [Heading] |

rr_ExpenseHeading |

<div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"><b>

Fund Fees & Expenses