Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR/A

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-06241

Loomis Sayles Funds II

(Exact name of Registrant as specified in charter)

399 Boylston Street, Boston, Massachusetts 02116

(Address of principal executive offices) (Zip code)

Coleen Downs Dinneen, Esq.

NGAM Distribution, L.P.

399 Boylston Street

Boston, Massachusetts 02116

(Name and address of agent for service)

Registrant’s telephone number, including area code: (617) 449-2810

Date of fiscal year end: September 30

Date of reporting period: September 30, 2012

Note: This Form N-CSR/A for Loomis Sayles Funds II (the “Registrant”) is being filed solely to reflect changes to the annual report of the Loomis Sayles Strategic Income Fund. The annual reports for the other series of the Registrant contained in the Form N-CSR filed on December 4, 2012 (Accession Number 0001193125-12-490086) are not amended or modified in any way by this Form N-CSR/A. This Form N-CSR/A also updates Item 11 “Controls and Procedures” with respect to the Loomis Sayles Strategic Income Fund as required. Other than the aforementioned amendment, no other information or disclosures contained in the Registrant’s Form N-CSR filed on December 4, 2012 is being amended by this Form N-CSR/A.

Table of Contents

| Item 1. | Reports to Stockholders. |

The Registrant’s annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 is as follows:

Table of Contents

LOOMIS SAYLES STRATEGIC INCOME FUND

(the “Fund”)

Supplement dated March 4, 2013 to the Fund’s Annual Report for the period ended September 30, 2012.

The average annual total returns (with 4.50% maximum sales charge) for Class A shares of the Fund were incorrectly reported in the Fund’s annual report for the period ended September 30, 2012. The average annual total returns for Class A shares reported in the Fund’s annual report were as follows:

Average Annual Total Returns – September 30, 20126

| 1 Year | 5 Years | 10 Years | ||||||||||

| Class A (Inception 5/1/95) With 4.50% Maximum Sales Charge |

10.00 | % | 6.13 | % | 10.74 | % | ||||||

6Fund performance has been increased by fee waivers and/or expense reimbursements, if any, without which performance would have been lower.

Inadvertently, a maximum sales charge of 3.50% was applied to the originally reported average annual returns resulting in overstated performance amounts for Class A shares. The corrected average annual total returns in the table below reflect the correct maximum sales charge of 4.50% for Class A shares of the Fund.

Effective immediately, the average annual total returns information with respect to Class A within the table “Average Annual Total Returns – September 30, 2012” in the annual report is amended and restated as follows for Class A shares of the Fund:

Average Annual Total Returns – September 30, 20126

| 1 Year | 5 Years | 10 Years | ||||||||||

| Class A (Inception 5/1/95) With 4.50% Maximum Sales Charge |

8.89 | % | 5.90 | % | 10.62 | % | ||||||

6Fund performance has been increased by fee waivers and/or expense reimbursements, if any, without which performance would have been lower.

Table of Contents

ANNUAL REPORT

September 30, 2012

Loomis Sayles Strategic Income Fund

Portfolio Review page 1

Portfolio of Investments page 13

Financial Statements page 35

Notes to Financial Statements page 41

Table of Contents

LOOMIS SAYLES STRATEGIC INCOME FUND

Management Discussion

1 |

Table of Contents

among the fund’s foreign-currency-denominated issues. The New Zealand dollar, Australian dollar and Canadian dollar also posted positive results. In addition, the fund’s exposure to high-yield securities benefitted from a robust new issuance market, supported by the Fed’s assurance that interest rates would remain low into 2015. Within high yield, the industrial sector contributed the most to returns, buoyed by strong showings from individual names, while the financial and utility sectors also proved additive. Exposure to convertible securities also boosted performance. Convertibles trended higher alongside equities, which climbed during the period.

An underweight position in commercial mortgage-backed securities, which were strong performers during the period, detracted from relative returns. In addition, the fund’s allocation to sovereign issues weighed on performance, largely due to certain issues denominated in the Swiss franc and Norwegian krone. Exposure to investment-grade utilities detracted from performance, as the traditionally defensive sector was out of favor for much of the period.

Outlook

Unprecedented monetary support in both the United States and Europe continues to largely dictate market sentiment and flows, while preserving low interest rates. Investor desire for yield in this environment will most likely support sustained demand in the corporate arena. Fundamental credit quality in the corporate sector remains a source of confidence for investors. However, if economic conditions continue to deteriorate globally, the challenge of investing in stable to improving companies will become more challenging.

The U.S. elections, pending “fiscal cliff” and increasingly weakening economic conditions in Europe, China and the United States are all situations that could potentially provide market volatility and opportunities. We consider recent positive developments in the U.S. housing market along with the Fed’s latest purchase program in the mortgage market to be sources of good news on the economic front and view the sectors as continuing opportunities. Our strategy of populating the fund with individual specific-risks ideas remains an important theme, as do the concepts of yield advantage and investing with a long-term horizon in mind. Macroeconomic developments continue to dominate the headlines and market flows, but our belief that owning quality companies based on fundamentals continues to serve us well and will drive our investment process through the rest of this calendar year.

| 2

Table of Contents

LOOMIS SAYLES STRATEGIC INCOME FUND

Investment Results through September 30, 2012

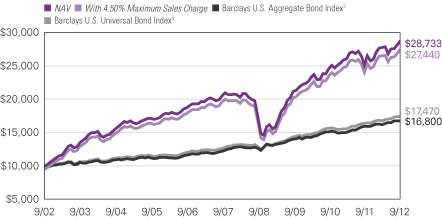

Growth of a $10,000 Investment in Class A Shares6

September 30, 2002 through September 30, 2012

3 |

Table of Contents

Average Annual Total Returns — September 30, 20126

| 1 Year | 5 Years | 10 Years | ||||||||||

| Class A (Inception 5/1/95) | ||||||||||||

| NAV | 14.02 | % | 6.89 | % | 11.13 | % | ||||||

| With 4.50% Maximum Sales Charge | 10.00 | 6.13 | 10.74 | |||||||||

| Class B (Inception 5/1/95) | ||||||||||||

| NAV | 13.15 | 6.10 | 10.31 | |||||||||

| With CDSC2 | 8.15 | 5.78 | 10.31 | |||||||||

| Class C (Inception 5/1/95) | ||||||||||||

| NAV | 13.18 | 6.10 | 10.31 | |||||||||

| With CDSC2 | 12.18 | 6.10 | 10.31 | |||||||||

| Class Y (Inception 12/1/99) | ||||||||||||

| NAV | 14.31 | 7.16 | 11.43 | |||||||||

| Admin Class (Inception 2/1/10)1 | ||||||||||||

| NAV | 13.79 | 6.59 | 10.80 | |||||||||

| Comparative Performance | ||||||||||||

| Barclays U.S. Aggregate Bond Index3 | 5.16 | 6.53 | 5.32 | |||||||||

| Barclays U.S. Universal Bond Index4 | 6.45 | 6.63 | 5.74 | |||||||||

| Morningstar Multisector Bond Fund Average5 | 12.54 | 6.69 | 7.90 | |||||||||

Past performance does not guarantee future results. The chart and table do not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. Unlike a fund, an index is not managed and does not reflect fees and expenses.

| 1 | Prior to the inception of Admin Class shares (2/1/10), performance is that of Class A shares, restated to reflect the higher net expenses of Admin Class shares. |

| 2 | Performance for Class B shares assumes a maximum 5% contingent deferred sales charge (“CDSC”) applied when you sell shares, which declines annually between years 1-6 according to the following schedule: 5, 4, 3, 3, 2, 1, 0%. Class C share performance assumes a 1% CDSC applied when you sell shares within one year of purchase. |

| 3 | Barclays U.S. Aggregate Bond Index is an unmanaged index that covers the U.S.-dollar denominated, investment-grade, fixed-rate, taxable bond market of SEC-registered securities. The index includes bonds from the Treasury, government-related, corporate, mortgage-backed securities, asset-backed securities, and collateralized mortgage-backed securities sectors. |

| 4 | Barclays U.S. Universal Bond Index is an unmanaged index that covers U.S. dollar-denominated taxable bonds, including U.S. government and investment grade debt, non-investment grade debt, asset-backed and mortgage-backed securities, Eurobonds, 144A securities and emerging market debt. |

| 5 | Morningstar Multisector Bond Fund Average is the average performance without sales charges of funds with similar investment objectives, as calculated by Morningstar, Inc. |

| 6 | Fund performance has been increased by fee waivers and/or expense reimbursements, if any, without which performance would have been lower. |

| 4

Table of Contents

ADDITIONAL INFORMATION

The views expressed in this report reflect those of the portfolio managers as of the dates indicated. The managers’ views are subject to change at any time without notice based on changes in market or other conditions. References to specific securities or industries should not be regarded as investment advice. Because the fund is actively managed, there is no assurance that it will continue to invest in the securities, countries or industries mentioned.

PROXY VOTING INFORMATION

A description of the fund’s proxy voting policies and procedures is available without charge, upon request, by calling Natixis Funds at 800-225-5478; on the fund’s website at ngam.natixis.com; and on the Securities and Exchange Commission’s (SEC’s) website at www.sec.gov. Information regarding how the fund voted proxies relating to portfolio securities during the 12-month period ended June 30, 2012 is available from the fund’s website and the SEC’s website.

QUARTERLY PORTFOLIO SCHEDULES

The fund files a complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The fund’s Forms N-Q are available on the SEC’s website at www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 800-SEC-0330.

5 |

Table of Contents

UNDERSTANDING YOUR FUND’S EXPENSES

As a mutual fund shareholder, you incur different types of costs: transaction costs, including sales charges (loads) on purchases and contingent deferred sales charges on redemptions; and ongoing costs, including management fees, distribution fees (12b-1 fees) and/or service fees, and other fund expenses. These costs are described in more detail in the fund’s prospectus. The examples below are intended to help you understand the ongoing costs of investing in the fund and help you compare these with the ongoing costs of investing in other mutual funds.

The first line in the table for each class shows the actual amount of fund expenses you would have paid on a $1,000 investment in the fund from April 1, 2012 through September 30, 2012. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual fund returns and expenses. To estimate the expenses you paid over the period, simply divide your account value by $1,000 (for example $8,600 account value divided by $1,000 =8.60) and multiply the result by the number in Expenses Paid During Period column as shown below for your class.

The second line in the table for each class provides information about hypothetical account values and hypothetical expenses based on the fund’s actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid on your investment for the period. You may use this information to compare the ongoing costs of investing in the fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown reflect ongoing costs only, and do not include any transaction costs. Therefore, the second line in the table of the fund is useful in comparing ongoing costs only, and will not help you determine the relative costs of owning different funds. If transaction costs were included, total costs would be higher.

| 6

Table of Contents

| LOOMIS SAYLES STRATEGIC INCOME FUND | BEGINNING ACCOUNT VALUE 4/1/2012 |

ENDING ACCOUNT VALUE 9/30/2012 |

EXPENSES PAID DURING PERIOD* 4/1/2012 – 9/30/2012 |

|||||||||

| Class A |

||||||||||||

| Actual |

$1,000.00 | $1,033.10 | $4.88 | |||||||||

| Hypothetical (5% return before expenses) |

$1,000.00 | $1,020.20 | $4.85 | |||||||||

| Class B |

||||||||||||

| Actual |

$1,000.00 | $1,029.60 | $8.68 | |||||||||

| Hypothetical (5% return before expenses) |

$1,000.00 | $1,016.45 | $8.62 | |||||||||

| Class C |

||||||||||||

| Actual |

$1,000.00 | $1,029.70 | $8.68 | |||||||||

| Hypothetical (5% return before expenses) |

$1,000.00 | $1,016.45 | $8.62 | |||||||||

| Class Y |

||||||||||||

| Actual |

$1,000.00 | $1,034.40 | $3.61 | |||||||||

| Hypothetical (5% return before expenses) |

$1,000.00 | $1,021.45 | $3.59 | |||||||||

| Admin Class |

||||||||||||

| Actual |

$1,000.00 | $1,032.60 | $6.15 | |||||||||

| Hypothetical (5% return before expenses) |

$1,000.00 | $1,018.95 | $6.11 | |||||||||

| * | Expenses are equal to the Fund’s annualized expense ratio: 0.96%, 1.71%, 1.71%, 0.71% and 1.21% for Class A, B, C, Y and Admin Class, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year, divided by 366 (to reflect the half-year period). |

7 |

Table of Contents

BOARD APPROVAL OF THE EXISTING ADVISORY AGREEMENT

The Board of Trustees of the Trust, including the Independent Trustees, considers matters bearing on the Fund’s advisory agreement (the “Agreement”) at most of its meetings throughout the year. Each year, usually in the spring, the Contract Review and Governance Committee of the Board meets to review the Agreement to determine whether to recommend that the full Board approve the continuation of the Agreement, typically for an additional one-year period. After the Committee has made its recommendation, the full Board, including the Independent Trustees, determines whether to approve the continuation of the Agreement.

In connection with these meetings, the Trustees receive materials that the Fund’s investment adviser (the “Adviser”) believes to be reasonably necessary for the Trustees to evaluate the Agreement. These materials generally include, among other items, (i) information on the investment performance of the Fund and the performance of a peer group of funds and the Fund’s performance benchmarks, (ii) information on the Fund’s advisory fees and other expenses, including information comparing the Fund’s expenses to the fees charged to institutional accounts with similar strategies managed by the Adviser and to those of a peer group of funds and information about any applicable expense caps and fee “breakpoints,” (iii) sales and redemption data in respect of the Fund, (iv) information about the profitability of the Agreement to the Adviser and (v) information obtained through the completion by the Adviser of a questionnaire distributed on behalf of the Trustees. The Board of Trustees, including the Independent Trustees, also consider other matters such as (i) the Adviser’s financial results and financial condition, (ii) the Fund’s investment objective and strategies and the size, education and experience of the Adviser’s investment staff and its use of technology, external research and trading cost measurement tools, (iii) arrangements in respect of the distribution of the Fund’s shares and the related costs, (iv) the procedures employed to determine the value of the Fund’s assets, (v) the allocation of the Fund’s brokerage, if any, including, if applicable, allocations to brokers affiliated with the Adviser and the use of “soft” commission dollars to pay Fund expenses and to pay for research and other similar services, (vi) the resources devoted to, and the record of compliance with, the Fund’s investment policies and restrictions, policies on personal securities transactions and other compliance policies, (vii) information about amounts invested by the Fund’s portfolio managers in the Fund or in similar accounts that they manage and (viii) the general economic outlook with particular emphasis on the mutual fund industry. Throughout the process, the Trustees are afforded the opportunity to ask questions of and request additional materials from the Adviser.

In addition to the materials requested by the Trustees in connection with their annual consideration of the continuation of the Agreement, the Trustees receive materials in advance of each regular quarterly meeting of the Board of Trustees of the Trust that provide detailed information about the Fund’s investment performance and the fees charged to the Fund for advisory and other services. This information generally includes, among other things, an internal performance rating for the Fund based on agreed-upon criteria, graphs showing the Fund’s performance and fee differentials against the Fund’s

| 8

Table of Contents

peer group/category, performance ratings provided by a third-party, total return information for various periods, and third-party performance rankings for various periods comparing the Fund against similarly categorized funds. The portfolio management team for the Fund or other representatives of the Adviser make periodic presentations to the Contract Review and Governance Committee and/or the full Board of Trustees of the Trust, and if the Fund is identified as presenting possible performance concerns it may be subject to more frequent board presentations and reviews. In addition, each quarter the Trustees are provided with detailed statistical information about the Fund’s portfolio. The Trustees also receive periodic updates between meetings.

The Board of Trustees of the Trust most recently approved the continuation of the Agreement at their meeting held in June 2012. The Agreement was continued for a one-year period for the Fund. In considering whether to approve the continuation of the Agreement, the Board of Trustees of the Trust, including the Independent Trustees, did not identify any single factor as determinative. Individual Trustees may have evaluated the information presented differently from one another, giving different weights to various factors. Matters considered by the Trustees, including the Independent Trustees, in connection with their approval of the Agreement included, but were not limited to, the factors listed below.

The nature, extent and quality of the services provided to the Fund under the Agreement. The Trustees considered the nature, extent and quality of the services provided by the Adviser and its affiliates to the Fund and the resources dedicated to the Fund by the Adviser and its affiliates.

The Trustees considered not only the advisory services provided by the Adviser to the Fund, but also the administrative services provided by NGAM Advisors, L.P. (“NGAM Advisors”) and its affiliates to the Fund.

The Trustees also considered the benefits to shareholders of investing in a mutual fund that is part of a family of funds that offers shareholders the right to exchange shares of one type of fund for shares of another type of fund, and provides a variety of fund and shareholder services.

After reviewing these and related factors, the Trustees concluded, within the context of their overall conclusions regarding the Agreement, that the nature, extent and quality of services provided supported the renewal of the Agreement.

Investment performance of the Fund and the Adviser. As noted above, the Trustees received information about the performance of the Fund over various time periods, including information which compared the performance of the Fund to the performance of similarly categorized funds and the Fund’s performance benchmarks. In addition, the Trustees also reviewed data prepared by an independent third party which analyzed the performance of the Fund using a variety of performance metrics, including metrics which also measured the performance of the Fund on a risk adjusted basis.

The Board concluded that the Fund’s performance or other relevant factors supported the renewal of the Agreement. Although the Trustees noted that the Fund had performance that lagged that of a relevant peer group median and/or category median for certain (although not necessarily all) periods, the Board concluded that other factors relevant to

9 |

Table of Contents

performance supported renewal of the Agreement. These factors included the following: (1) that underperformance was attributable, to a significant extent, to investment decisions (such as security selection or sector allocation) by the Adviser that were reasonable and consistent with the Fund’s investment objective and policies and (2) that the Fund’s performance was stronger over the long term.

The Trustees also considered the Adviser’s performance and reputation generally, the performance of the fund family generally (as noted by certain financial publications), and the historical responsiveness of the Adviser to Trustee concerns about performance and the willingness of the Adviser to take steps intended to improve performance.

After reviewing these and related factors, the Trustees concluded, within the context of their overall conclusions regarding each of the Agreement, that the performance of the Fund and the Adviser and/or other relevant factors supported the renewal of the Agreement.

The costs of the services to be provided and profits to be realized by the Adviser and its affiliates from their respective relationships with the Fund. The Trustees considered the fees charged to the Fund for advisory services as well as the total expense levels of the Fund. This information included comparisons (provided both by management and also by an independent third party) of the Fund’s advisory fees and total expense levels to those of its peer group and information about the advisory fees charged by the Adviser to comparable accounts (such as institutional separate accounts), as well as information about differences in such fees and the reasons for any such differences. In considering the fees charged to comparable accounts, the Trustees considered, among other things, management’s representations about the differences between managing mutual funds as compared to other types of accounts, including the additional resources required to effectively manage and the greater regulatory costs associated with the management of mutual fund assets. In evaluating the Fund’s advisory fee, the Trustees also took into account the demands, complexity and quality of the investment management of the Fund, as well as the need for the Adviser to offer competitive compensation and to expend additional resources as the Fund grows in size. The Trustees considered that over the past several years, management had made recommendations regarding reductions in advisory fee rates, implementation of advisory fee breakpoints and the institution of advisory fee waivers and expense caps for various funds in the fund family. They noted that, as of December 31, 2011, the Fund has an expense cap in place, and the Trustees considered that the current expenses are below the cap. The Trustees noted that the Fund had an advisory fee rate that was above the median of a peer group of funds. The Trustees considered the factors which management believed justified such relatively higher fees, including that: (1) the Fund’s advisory fee rate was only slightly above its peer group median and (2) the Fund had not yet reached asset levels at which the advisory fee breakpoints would have an impact on fees.

The Trustees also considered the compensation directly or indirectly received by the Adviser and its affiliates from their relationships with the Fund. The Trustees reviewed information provided by management as to the profitability of the Adviser’s and its affiliates’ relationships with the Fund, and information about the allocation of expenses used to calculate profitability. They also reviewed information provided by management about the effect of distribution costs and changes in asset levels on Adviser profitability,

| 10

Table of Contents

including information regarding resources spent on distribution activities. When reviewing profitability, the Trustees also considered information about court cases in which adviser compensation or profitability were issues, the performance of the Fund, the expense levels of the Fund, whether the Adviser had implemented breakpoints and/or expense caps with respect to the Fund and the overall profit margin of the Adviser compared to other investment managers.

After reviewing these and related factors, the Trustees concluded, within the context of their overall conclusions regarding the Agreement, that the advisory fee charged to the Fund was fair and reasonable, and that the costs of these services generally and the related profitability of the Adviser and its affiliates in respect of their relationships with the Fund supported the renewal of the Agreement.

Economies of Scale. The Trustees considered the existence of any economies of scale in the provision of services by the Adviser and whether those economies are shared with the Fund through breakpoints in its investment advisory fees or other means, such as expense waivers or caps. The Trustees also discussed with management the factors considered with respect to the implementation of breakpoints in investment advisory fees or expense waivers or caps for certain funds. Management explained that a number of factors are taken into account in considering the possible implementation of breakpoints or an expense cap for a fund, including, among other things, factors such as a fund’s assets, the projected growth of a fund, projected profitability and a fund’s fees and performance. With respect to economies of scale, the Trustees noted the Fund is subject to breakpoints in its advisory fees. The Trustees further noted that the Fund was subject to an expense cap or waiver. In considering these issues, the Trustees also took note of the costs of the services provided (both on an absolute and a relative basis) and the profitability to the Adviser and its affiliates of their relationships with the Fund, as discussed above.

After reviewing these and related factors, the Trustees concluded, within the context of their overall conclusions regarding the Agreement, that the extent to which economies of scale were shared with the Fund supported the renewal of the Agreement.

The Trustees also considered other factors, which included but were not limited to the following:

| · | The effect of recent market and economic events on the performance, asset levels and expense ratios of the Fund. |

| · | Whether the Fund has operated in accordance with its investment objective and the Fund’s record of compliance with its investment restrictions, and the compliance programs of the Fund and the Adviser. They also considered the compliance-related resources the Adviser and its affiliates were providing to the Fund. |

| · | The nature, quality, cost and extent of administrative and shareholder services performed by the Adviser and its affiliates, both under the Agreement and under a separate agreement covering administrative services. |

11 |

Table of Contents

| · | So-called “fallout benefits” to the Adviser, such as the engagement of affiliates of the Adviser to provide distribution, administrative and brokerage services to the Fund, and the benefits of research made available to the Adviser by reason of brokerage commissions (if any) generated by the Fund’s securities transactions. The Trustees also considered the fact that NGAM Advisors’ parent company benefits from the retention of an affiliated Adviser. The Trustees considered the possible conflicts of interest associated with these fallout and other benefits, and the reporting, disclosure and other processes in place to disclose and monitor such possible conflicts of interest. |

| · | The Trustees’ review and discussion of the Fund’s advisory arrangements in prior years, and management’s record of responding to Trustee concerns raised during the year and in prior years. |

Based on their evaluation of all factors that they deemed to be material, including those factors described above, and assisted by the advice of independent counsel, the Trustees, including the Independent Trustees, concluded that the existing Agreement should be continued through June 30, 2013.

| 12

Table of Contents

Portfolio of Investments – as of September 30, 2012

Loomis Sayles Strategic Income Fund

| Principal Amount (‡) |

Description | Value (†) | ||||||

| Bonds and Notes — 71.5% of Net Assets | ||||||||

| Non-Convertible Bonds — 63.3% | ||||||||

| ABS Car Loan — 0.0% | ||||||||

| $ | 4,093,750 | Avis Budget Rental Car Funding AESOP LLC, Series 2010-5A, Class B, 5.110%, 3/20/2017, 144A |

$ | 4,480,278 | ||||

|

|

|

|||||||

| Aerospace & Defense — 0.3% | ||||||||

| 620,000 | Bombardier, Inc., 7.350%, 12/22/2026, 144A, (CAD) | 664,985 | ||||||

| 11,800,000 | Bombardier, Inc., 7.450%, 5/01/2034, 144A | 12,036,000 | ||||||

| 2,425,000 | Ducommun, Inc., 9.750%, 7/15/2018 | 2,558,375 | ||||||

| 8,236,000 | Meccanica Holdings USA, Inc., 6.250%, 7/15/2019, 144A | 7,762,570 | ||||||

| 5,436,000 | Meccanica Holdings USA, Inc., 6.250%, 1/15/2040, 144A | 4,454,498 | ||||||

| 20,755,000 | Meccanica Holdings USA, Inc., 7.375%, 7/15/2039, 144A | 18,366,701 | ||||||

| 5,310,000 | Textron Financial Corp., (fixed rate to 2/15/2017, variable rate thereafter), 6.000%, 2/15/2067, 144A |

4,433,850 | ||||||

|

|

|

|||||||

| 50,276,979 | ||||||||

|

|

|

|||||||

| Airlines — 2.6% | ||||||||

| 35,455,000 | Air Canada, 10.125%, 8/01/2015, 144A, (CAD) | 37,326,747 | ||||||

| 38,693 | Continental Airlines Pass Through Trust, Series 1996-1, Class A, 6.940%, 4/15/2015 |

38,984 | ||||||

| 1,116,353 | Continental Airlines Pass Through Trust, Series 1997-1, Class A, 7.461%, 10/01/2016 |

1,172,171 | ||||||

| 1,777,301 | Continental Airlines Pass Through Trust, Series 1997-4, Class B, 6.900%, 7/02/2018 |

1,848,393 | ||||||

| 1,992,872 | Continental Airlines Pass Through Trust, Series 1998-1, Class B, 6.748%, 9/15/2018 |

2,092,516 | ||||||

| 3,297,567 | Continental Airlines Pass Through Trust, Series 1999-1, Class B, 6.795%, 2/02/2020 |

3,495,421 | ||||||

| 2,231,607 | Continental Airlines Pass Through Trust, Series 1999-2, Class B, 7.566%, 9/15/2021 |

2,387,819 | ||||||

| 1,273,967 | Continental Airlines Pass Through Trust, Series 2000-1, Class A-1, 8.048%, 5/01/2022 |

1,455,507 | ||||||

| 1,473,632 | Continental Airlines Pass Through Trust, Series 2000-2, Class A-1, 7.707%, 10/02/2022 |

1,646,784 | ||||||

| 2,962,404 | Continental Airlines Pass Through Trust, Series 2000-2, Class B, 8.307%, 10/02/2019 |

3,169,772 | ||||||

| 1,860,333 | Continental Airlines Pass Through Trust, Series 2001-1, Class A-1, 6.703%, 12/15/2022 |

2,020,303 | ||||||

| 1,063,631 | Continental Airlines Pass Through Trust, Series 2001-1, Class B, 7.373%, 6/15/2017 |

1,139,468 | ||||||

| 10,866,506 | Continental Airlines Pass Through Trust, Series 2007-1, Class A, 5.983%, 10/19/2023 |

12,116,154 | ||||||

| 18,741,526 | Continental Airlines Pass Through Trust, Series 2007-1, Class B, 6.903%, 10/19/2023 |

19,677,478 | ||||||

| 17,148,751 | Continental Airlines Pass Through Trust, Series 2009-1, 9.000%, 1/08/2018 | 19,806,808 | ||||||

| 15,712,916 | Continental Airlines Pass Through Trust, Series 2009-2, Class A, 7.250%, 5/10/2021 |

17,952,007 | ||||||

See accompanying notes to financial statements.

13 |

Table of Contents

Portfolio of Investments – as of September 30, 2012

Loomis Sayles Strategic Income Fund – (continued)

| Principal Amount (‡) |

Description | Value (†) | ||||||

| Airlines — continued | ||||||||

| $ | 3,980,000 | Continental Airlines Pass Through Trust, Series 2012-1, Class B, 6.250%, 10/22/2021 |

$ | 4,119,300 | ||||

| 1,285,967 | Delta Air Lines Pass Through Trust, Series 2007-1, Class A, 6.821%, 2/10/2024 |

1,420,994 | ||||||

| 6,417,317 | Delta Air Lines Pass Through Trust, Series 2007-1, Class B, 8.021%, 2/10/2024 |

6,930,702 | ||||||

| 20,642,922 | Delta Air Lines Pass Through Trust, Series 2007-1, Class C, 8.954%, 8/10/2014 |

21,185,831 | ||||||

| 1,900,639 | Northwest Airlines, Inc., Series 2002-1, Class G2, (MBIA insured), 6.264%, 5/20/2023 |

2,005,175 | ||||||

| 1,500,000 | Qantas Airways Ltd., 5.125%, 6/20/2013, 144A | 1,519,614 | ||||||

| 29,995,000 | Qantas Airways Ltd., 6.050%, 4/15/2016, 144A | 30,942,782 | ||||||

| 17,663,390 | UAL Pass Through Trust, Series 2007-1, Class A, 6.636%, 1/02/2024 | 18,458,243 | ||||||

| 8,245,091 | UAL Pass Through Trust, Series 2009-1, 10.400%, 5/01/2018 | 9,502,467 | ||||||

| 16,831,237 | US Airways Pass Through Trust, Series 2010-1B, Class B, 8.500%, 10/22/2018 |

17,252,018 | ||||||

| 40,155,931 | US Airways Pass Through Trust, Series 2010-1C, Class C, 11.000%, 10/22/2014, 144A |

41,159,829 | ||||||

| 51,235,705 | US Airways Pass Through Trust, Series 2011-1B, Class B, 9.750%, 4/22/2020 |

53,797,490 | ||||||

| 21,811,204 | US Airways Pass Through Trust, Series 2011-1C, Class C, 10.875%, 10/22/2014 |

22,356,484 | ||||||

| 14,095,000 | US Airways Pass Through Trust, Series 2012-1A, Class A, 5.900%, 4/01/2026 |

14,905,463 | ||||||

| 7,280,000 | US Airways Pass Through Trust, Series 2012-1B, Class B, 8.000%, 4/01/2021 |

7,498,400 | ||||||

| 5,680,000 | US Airways Pass Through Trust, Series 2012-1C, Class C, 9.125%, 10/01/2015 |

5,765,200 | ||||||

|

|

|

|||||||

| 386,166,324 | ||||||||

|

|

|

|||||||

| Automotive — 0.9% | ||||||||

| 265,000 | ArvinMeritor, Inc., 8.125%, 9/15/2015 | 278,250 | ||||||

| 3,800,000 | Chrysler Group LLC/CG Co-Issuer, Inc., 8.250%, 6/15/2021 | 4,047,000 | ||||||

| 19,011,000 | Ford Motor Co., 6.375%, 2/01/2029 | 20,702,789 | ||||||

| 1,220,000 | Ford Motor Co., 6.625%, 2/15/2028 | 1,319,268 | ||||||

| 74,829,000 | Ford Motor Co., 6.625%, 10/01/2028 | 83,572,170 | ||||||

| 2,365,000 | Ford Motor Co., 7.125%, 11/15/2025 | 2,672,450 | ||||||

| 1,345,000 | Ford Motor Co., 7.500%, 8/01/2026 | 1,550,113 | ||||||

| 6,000,000 | Goodyear Tire & Rubber Co. (The), 7.000%, 5/15/2022 | 6,360,000 | ||||||

| 4,977,000 | Goodyear Tire & Rubber Co. (The), 7.000%, 3/15/2028 | 4,989,442 | ||||||

|

|

|

|||||||

| 125,491,482 | ||||||||

|

|

|

|||||||

| Banking — 6.0% | ||||||||

| 1,175,000 | AgriBank FCB, 9.125%, 7/15/2019, 144A | 1,559,360 | ||||||

| 20,565,000 | Associates Corp. of North America, 6.950%, 11/01/2018 | 24,727,706 | ||||||

| 1,675,000 | Bank of America Corp., 5.420%, 3/15/2017 | 1,810,588 | ||||||

| 900,000 | Bank of America Corp., 5.490%, 3/15/2019 | 980,518 | ||||||

| 265,000 | Bank of America Corp., MTN, 5.000%, 5/13/2021 | 291,283 | ||||||

See accompanying notes to financial statements.

| 14

Table of Contents

Portfolio of Investments – as of September 30, 2012

Loomis Sayles Strategic Income Fund – (continued)

| Principal Amount (‡) |

Description | Value (†) | ||||||

| Banking — continued | ||||||||

| 1,000,000 | Bank of America Corp., MTN, 6.750%, 9/09/2013, (AUD) | $ | 1,061,917 | |||||

| 1,500,000 | Bank of America Corp., Series K, (fixed rate to 1/30/2018, variable rate thereafter), 8.000%, 12/29/2049 | 1,633,410 | ||||||

| 8,020,000 | Bank of America NA, 5.300%, 3/15/2017 | 8,905,761 | ||||||

| 1,130,000 | Barclays Bank PLC, (fixed rate to 12/15/2017, variable rate thereafter), 6.000%, 6/29/2049, (GBP) |

1,304,677 | ||||||

| 39,890,000,000 | Barclays Bank PLC, EMTN, 3.680%, 8/20/2015, (KRW) | 36,742,910 | ||||||

| 7,320,000 | Barclays Bank PLC, EMTN, (fixed rate to 3/15/2020, variable rate thereafter), 4.750%, 3/29/2049, (EUR) | 5,686,268 | ||||||

| 57,792,000,000 | Barclays Financial LLC, EMTN, 3.500%, 11/29/2016, (KRW) | 53,157,668 | ||||||

| 1,600,000 | BNP Paribas S.A., (fixed rate to 4/13/2017, variable rate thereafter), 5.019%, 4/29/2049, (EUR) |

1,727,964 | ||||||

| 5,331,000 | BNP Paribas S.A., (fixed rate to 6/29/2015, variable rate thereafter), 5.186%, 6/29/2049, 144A |

4,904,520 | ||||||

| 4,000,000 | Citigroup, Inc., 5.365%, 3/06/2036, (CAD)(b) | 3,496,857 | ||||||

| 350,000 | Citigroup, Inc., 5.850%, 12/11/2034 | 413,340 | ||||||

| 24,610,000 | Citigroup, Inc., 5.875%, 2/22/2033 | 25,992,344 | ||||||

| 8,999,000 | Citigroup, Inc., 6.000%, 10/31/2033 | 9,701,588 | ||||||

| 6,060,000 | Citigroup, Inc., 6.125%, 8/25/2036 | 6,580,263 | ||||||

| 22,091,000 | Citigroup, Inc., 6.250%, 6/29/2017, (NZD) | 18,800,082 | ||||||

| 3,350,000 | Citigroup, Inc., EMTN, (fixed rate to 11/30/2012, variable rate thereafter), 3.625%, 11/30/2017, (EUR) |

3,874,425 | ||||||

| 3,035,000 | Cooperatieve Centrale Raiffeisen-Boerenleenbank BA/Utrect, 3.375%, 1/19/2017 |

3,221,379 | ||||||

| 17,730,000 | Cooperatieve Centrale Raiffeisen-Boerenleenbank BA/Utrect, 3.875%, 2/08/2022 |

18,816,672 | ||||||

| 400,000 | Goldman Sachs Group, Inc. (The), 6.450%, 5/01/2036 | 419,108 | ||||||

| 34,060,000 | Goldman Sachs Group, Inc. (The), 6.750%, 10/01/2037 | 36,487,865 | ||||||

| 6,120,000 | HBOS PLC, 6.000%, 11/01/2033, 144A | 5,193,738 | ||||||

| 50,604,000 | HBOS PLC, GMTN, 6.750%, 5/21/2018, 144A | 51,363,060 | ||||||

| 9,090,000 | ICICI Bank Ltd., (fixed rate to 4/30/2017, variable rate thereafter), 6.375%, 4/30/2022, 144A |

9,090,000 | ||||||

| 260,000,000,000 | JPMorgan Chase & Co., EMTN, 7.070%, 3/22/2014, (IDR) | 26,994,357 | ||||||

| 227,000,000,000 | JPMorgan Chase Bank NA, 7.700%, 6/01/2016, 144A, (IDR) | 24,924,932 | ||||||

| 7,300,000 | Lloyds Banking Group PLC, (fixed rate to 10/01/2015, variable rate thereafter), 5.920%, 9/29/2049, 144A | 4,818,000 | ||||||

| 27,555,000 | Lloyds TSB Bank PLC, MTN, 6.500%, 9/14/2020, 144A | 29,026,437 | ||||||

| 3,010,000 | Merrill Lynch & Co., Inc., 5.700%, 5/02/2017 | 3,292,988 | ||||||

| 1,900,000 | Merrill Lynch & Co., Inc., 6.050%, 5/16/2016 | 2,075,987 | ||||||

| 6,700,000 | Merrill Lynch & Co., Inc., 6.110%, 1/29/2037 | 7,107,822 | ||||||

| 51,500,000 | Merrill Lynch & Co., Inc., 10.710%, 3/08/2017, (BRL) | 27,880,750 | ||||||

| 3,450,000 | Merrill Lynch & Co., Inc., EMTN, 4.625%, 9/14/2018, (EUR) | 4,411,254 | ||||||

| 5,410,000 | Merrill Lynch & Co., Inc., MTN, 6.875%, 4/25/2018 | 6,481,797 | ||||||

| 800,000 | Merrill Lynch & Co., Inc., Series C, MTN, 6.050%, 6/01/2034 | 824,814 | ||||||

| 1,235,000 | Merrill Lynch & Co., Inc., Series C, MTN, 6.400%, 8/28/2017 | 1,436,753 | ||||||

| 2,000,000 | Morgan Stanley, 0.935%, 10/15/2015(c) | 1,905,648 | ||||||

| 13,400,000 | Morgan Stanley, 5.500%, 7/24/2020 | 14,468,060 | ||||||

| 3,300,000 | Morgan Stanley, 5.750%, 1/25/2021 | 3,622,248 | ||||||

See accompanying notes to financial statements.

15 |

Table of Contents

Portfolio of Investments – as of September 30, 2012

Loomis Sayles Strategic Income Fund – (continued)

| Principal Amount (‡) |

Description | Value (†) | ||||||

| Banking — continued | ||||||||

| 74,310,000 | Morgan Stanley, 7.600%, 8/08/2017, (NZD) | $ | 64,073,193 | |||||

| 100,265,000 | Morgan Stanley, 8.000%, 5/09/2017, (AUD) | 112,462,176 | ||||||

| 950,000 | Morgan Stanley, EMTN, 5.750%, 2/14/2017, (GBP) | 1,637,671 | ||||||

| 1,000,000 | Morgan Stanley, GMTN, 4.500%, 2/23/2016, (EUR) | 1,346,383 | ||||||

| 79,700,000 | Morgan Stanley, GMTN, 7.625%, 3/03/2016, (AUD) | 87,578,969 | ||||||

| 10,000,000 | Morgan Stanley, MTN, 6.250%, 8/09/2026 | 11,251,580 | ||||||

| 6,600,000 | Morgan Stanley, Series F, GMTN, 5.625%, 9/23/2019 | 7,210,361 | ||||||

| 7,900,000 | Morgan Stanley, Series F, GMTN, 6.625%, 4/01/2018 | 9,076,626 | ||||||

| 12,100,000 | Morgan Stanley, Series F, MTN, 0.905%, 10/18/2016(c) | 11,245,365 | ||||||

| 5,210,000 | Morgan Stanley, Series F, MTN, 5.950%, 12/28/2017 | 5,852,112 | ||||||

| 4,100,000 | Morgan Stanley, Series G & H, GMTN, 5.125%, 11/30/2015, (GBP) | 6,966,111 | ||||||

| 2,850,000 | RBS Capital Trust A, 2.321%, 12/29/2049, (EUR)(c) | 2,169,967 | ||||||

| 1,905,000 | RBS Capital Trust C, (fixed rate to 1/12/2016, variable rate thereafter), 4.243%, 12/29/2049, (EUR) |

1,444,332 | ||||||

| 3,185,000 | RBS Capital Trust I, (fixed rate to 7/01/2013, variable rate thereafter), 4.709%, 12/29/2049 |

1,974,700 | ||||||

| 4,050,000 | RBS Capital Trust II, (fixed rate to 1/03/2034, variable rate thereafter), 6.425%, 12/29/2049 |

3,321,000 | ||||||

| 2,085,000 | RBS Capital Trust III, (fixed rate to 9/30/2014, variable rate thereafter), 5.512%, 9/29/2049 |

1,303,125 | ||||||

| 930,000 | Royal Bank of Scotland Group PLC, 5.250%, 6/29/2049, (EUR) | 746,935 | ||||||

| 15,100,000 | Royal Bank of Scotland Group PLC, 5.500%, 11/29/2049, (EUR) | 12,519,623 | ||||||

| 1,990,000 | Royal Bank of Scotland Group PLC, (fixed rate to 9/29/2017, variable rate thereafter), 7.634%, 3/29/2049 | 1,626,825 | ||||||

| 850,000 | Royal Bank of Scotland PLC (The), EMTN, 4.350%, 1/23/2017, (EUR) | 1,038,154 | ||||||

| 7,750,000 | Royal Bank of Scotland PLC (The), EMTN, 6.934%, 4/09/2018, (EUR) | 10,134,307 | ||||||

| 2,150,000 | Royal Bank of Scotland PLC (The), EMTN, (fixed rate to 9/22/2016, variable rate thereafter), 4.625%, 9/22/2021, (EUR) | 2,393,325 | ||||||

| 700,000 | Santander Financial Issuances Ltd., 7.250%, 11/01/2015 | 717,850 | ||||||

| 1,300,000 | Santander International Debt SAU, EMTN, 4.000%, 3/27/2017, (EUR) | 1,605,095 | ||||||

| 1,800,000 | Santander Issuances SAU, 5.911%, 6/20/2016, 144A | 1,773,000 | ||||||

| 1,500,000 | Santander Issuances SAU, (fixed rate to 8/11/2014, variable rate thereafter), 6.500%, 8/11/2019, 144A | 1,466,984 | ||||||

| 4,140,000 | SG Capital Trust III, (fixed rate to 11/10/2013, variable rate thereafter), 5.419%, 11/29/2049, (EUR) |

4,628,492 | ||||||

| 8,750,000 | Societe Generale S.A., (fixed rate to 5/22/2013, variable rate thereafter), 7.756%, 5/29/2049, (EUR) |

9,810,552 | ||||||

|

|

|

|||||||

| 874,591,931 | ||||||||

|

|

|

|||||||

| Brokerage — 0.7% | ||||||||

| 2,655,000 | Cantor Fitzgerald LP, 6.375%, 6/26/2015, 144A | 2,695,552 | ||||||

| 13,425,000 | Jefferies Group, Inc., 5.125%, 4/13/2018 | 13,626,375 | ||||||

| 19,810,000 | Jefferies Group, Inc., 6.250%, 1/15/2036 | 19,611,900 | ||||||

| 15,215,000 | Jefferies Group, Inc., 6.450%, 6/08/2027 | 15,595,375 | ||||||

| 39,040,000 | Jefferies Group, Inc., 6.875%, 4/15/2021 | 42,016,800 | ||||||

| 2,440,000 | Jefferies Group, Inc., 8.500%, 7/15/2019 | 2,799,900 | ||||||

|

|

|

|||||||

| 96,345,902 | ||||||||

|

|

|

|||||||

See accompanying notes to financial statements.

| 16

Table of Contents

Portfolio of Investments – as of September 30, 2012

Loomis Sayles Strategic Income Fund – (continued)

| Principal Amount (‡) |

Description | Value (†) | ||||||

| Building Materials — 0.8% | ||||||||

| $ | 6,995,000 | Masco Corp., 6.500%, 8/15/2032 | $ | 7,243,546 | ||||

| 5,510,000 | Masco Corp., 7.125%, 3/15/2020 | 6,272,121 | ||||||

| 2,630,000 | Masco Corp., 7.750%, 8/01/2029 | 2,778,385 | ||||||

| 35,980,000 | Owens Corning, Inc., 7.000%, 12/01/2036 | 39,479,739 | ||||||

| 46,412,000 | USG Corp., 6.300%, 11/15/2016 | 46,876,120 | ||||||

| 14,155,000 | USG Corp., 9.750%, 1/15/2018 | 15,287,400 | ||||||

|

|

|

|||||||

| 117,937,311 | ||||||||

|

|

|

|||||||

| Chemicals — 0.4% | ||||||||

| 20,070,000 | Hercules, Inc., 6.500%, 6/30/2029 | 18,364,050 | ||||||

| 5,200,000 | Hexion US Finance Corp./Hexion Nova Scotia Finance ULC, 8.875%, 2/01/2018 |

5,343,000 | ||||||

| 23,584,000 | Momentive Specialty Chemicals, Inc., 7.875%, 2/15/2023(b) | 18,395,520 | ||||||

| 8,020,000 | Momentive Specialty Chemicals, Inc., 8.375%, 4/15/2016(b) | 7,218,000 | ||||||

| 8,757,000 | Momentive Specialty Chemicals, Inc., 9.200%, 3/15/2021(b) | 7,706,160 | ||||||

|

|

|

|||||||

| 57,026,730 | ||||||||

|

|

|

|||||||

| Collateralized Mortgage Obligations — 0.0% | ||||||||

| 4,774,605 | Wells Fargo Mortgage Backed Securities Trust, Series 2005-AR4, Class 2A2, 2.690%, 4/25/2035(c) | 4,822,275 | ||||||

|

|

|

|||||||

| Commercial Mortgage-Backed Securities — 0.1% | ||||||||

| 7,940,000 | Credit Suisse Mortgage Capital Certificates, Series 2007-C5, Class AM, 5.869%, 9/15/2040 |

7,523,031 | ||||||

|

|

|

|||||||

| Construction Machinery — 0.2% | ||||||||

| 1,425,000 | Joy Global, Inc., 6.625%, 11/15/2036 | 1,603,386 | ||||||

| 10,790,000 | Terex Corp., 8.000%, 11/15/2017 | 11,167,650 | ||||||

| 525,000 | United Rentals North America, Inc., 8.375%, 9/15/2020 | 561,750 | ||||||

| 13,630,000 | UR Financing Escrow Corp., 7.625%, 4/15/2022, 144A | 14,924,850 | ||||||

|

|

|

|||||||

| 28,257,636 | ||||||||

|

|

|

|||||||

| Consumer Cyclical Services — 0.0% | ||||||||

| 670,000 | ServiceMaster Co. (The), 7.100%, 3/01/2018 | 649,900 | ||||||

| 5,500,000 | ServiceMaster Co. (The), 7.450%, 8/15/2027 | 4,578,750 | ||||||

| 1,048,000 | Western Union Co. (The), 6.200%, 6/21/2040 | 1,241,453 | ||||||

|

|

|

|||||||

| 6,470,103 | ||||||||

|

|

|

|||||||

| Electric — 2.7% | ||||||||

| 7,640,279 | AES Ironwood LLC, 8.857%, 11/30/2025 | 8,786,322 | ||||||

| 854,827 | AES Red Oak LLC, Series A, 8.540%, 11/30/2019 | 912,528 | ||||||

| 47,363,314 | Alta Wind Holdings LLC, 7.000%, 6/30/2035, 144A | 52,479,025 | ||||||

| 66,044,844 | Bruce Mansfield Unit, 6.850%, 6/01/2034 | 70,236,710 | ||||||

| 2,754,970 | CE Generation LLC, 7.416%, 12/15/2018 | 2,754,970 | ||||||

| 11,275,000 | Dynegy Holdings, Inc., 7.125%, 5/15/2018(d) | 6,398,563 | ||||||

| 10,185,000 | Dynegy Holdings, Inc., 7.625%, 10/15/2026(d) | 5,703,600 | ||||||

| 8,955,000 | Dynegy Holdings, Inc., 7.750%, 6/01/2019(d) | 5,059,575 | ||||||

| 51,405,000 | Edison Mission Energy, 7.625%, 5/15/2027 | 26,345,063 | ||||||

| 41,900,000 | EDP Finance BV, 4.900%, 10/01/2019, 144A | 38,967,000 | ||||||

| 15,100,000 | EDP Finance BV, 6.000%, 2/02/2018, 144A | 15,073,122 | ||||||

| 2,800,000 | EDP Finance BV, EMTN, 4.625%, 6/13/2016, (EUR) | 3,463,209 | ||||||

See accompanying notes to financial statements.

17 |

Table of Contents

Portfolio of Investments – as of September 30, 2012

Loomis Sayles Strategic Income Fund – (continued)

| Principal Amount (‡) |

Description | Value (†) | ||||||

| Electric — continued | ||||||||

| 500,000 | EDP Finance BV, EMTN, 4.750%, 9/26/2016, (EUR) | $ | 616,837 | |||||

| 100,000 | EDP Finance BV, EMTN, 5.875%, 2/01/2016, (EUR) | 128,120 | ||||||

| 250,000 | Empresa Nacional de Electricidad S.A. (Endesa-Chile), 8.350%, 8/01/2013 | 263,941 | ||||||

| 4,070,000 | Endesa S.A./Cayman Islands, 7.875%, 2/01/2027 | 5,025,237 | ||||||

| 15,552,000 | Enel Finance International NV, 6.000%, 10/07/2039, 144A | 13,984,483 | ||||||

| 1,435,000 | Enel Finance International NV, 6.800%, 9/15/2037, 144A | 1,390,456 | ||||||

| 5,940,000 | Energy Future Holdings Corp., 10.000%, 1/15/2020 | 6,548,850 | ||||||

| 555,000 | Enersis S.A., Cayman Islands, 7.400%, 12/01/2016 | 656,700 | ||||||

| 31,035,000 | NGC Corp. Capital Trust I, Series B, 8.316%, 6/01/2027(b)(d) | 4,034,550 | ||||||

| 16,670,000 | Texas Competitive Electric Holdings Co. LLC/TCEH Finance, Inc., 11.500%, 10/01/2020, 144A |

13,044,275 | ||||||

| 50,270,000 | TXU Corp., Series P, 5.550%, 11/15/2014 | 40,467,350 | ||||||

| 101,735,000 | TXU Corp., Series Q, 6.500%, 11/15/2024 | 60,532,325 | ||||||

| 6,675,000 | TXU Corp., Series R, 6.550%, 11/15/2034 | 3,637,875 | ||||||

| 7,300,000 | White Pine Hydro LLC, 6.310%, 7/10/2017(b)(e) | 5,767,000 | ||||||

| 10,935,000 | White Pine Hydro LLC, 6.960%, 7/10/2037(b)(e) | 7,107,750 | ||||||

|

|

|

|||||||

| 399,385,436 | ||||||||

|

|

|

|||||||

| Financial Other — 0.3% | ||||||||

| 19,005,000 | Aviation Capital Group Corp., 6.750%, 4/06/2021, 144A | 19,373,697 | ||||||

| 20,000,000 | National Life Insurance Co., 10.500%, 9/15/2039, 144A | 26,705,860 | ||||||

|

|

|

|||||||

| 46,079,557 | ||||||||

|

|

|

|||||||

| Food & Beverage — 0.0% | ||||||||

| 4,370,000 | Viterra, Inc., 6.406%, 2/16/2021, 144A, (CAD) | 4,864,787 | ||||||

|

|

|

|||||||

| Gaming — 0.3% | ||||||||

| 810,000 | MGM Resorts International, 6.625%, 7/15/2015 | 866,700 | ||||||

| 865,000 | MGM Resorts International, 6.875%, 4/01/2016 | 903,925 | ||||||

| 710,000 | MGM Resorts International, 7.500%, 6/01/2016 | 759,700 | ||||||

| 1,770,000 | MGM Resorts International, 7.625%, 1/15/2017 | 1,876,200 | ||||||

| 37,005,000 | MGM Resorts International, 8.625%, 2/01/2019, 144A | 40,335,450 | ||||||

|

|

|

|||||||

| 44,741,975 | ||||||||

|

|

|

|||||||

| Government Guaranteed — 0.5% | ||||||||

| 11,038,000 | Instituto de Credito Oficial, MTN, 5.500%, 10/11/2012, (AUD) | 11,443,618 | ||||||

| 72,695,000 | Queensland Treasury Corp., 7.125%, 9/18/2017, 144A, (NZD) | 69,089,302 | ||||||

|

|

|

|||||||

| 80,532,920 | ||||||||

|

|

|

|||||||

| Government Owned — No Guarantee — 0.6% | ||||||||

| 19,500,000 | DP World Ltd., 6.850%, 7/02/2037, 144A | 21,011,250 | ||||||

| 70,300,000,000 | Export-Import Bank of Korea, 6.600%, 11/04/2013, 144A, (IDR) | 7,342,934 | ||||||

| 499,300,000,000 | Export-Import Bank of Korea, 8.300%, 3/15/2014, 144A, (IDR) | 53,216,928 | ||||||

| 8,935,000 | Petroleos de Venezuela S.A., 5.375%, 4/12/2027 | 5,517,363 | ||||||

|

|

|

|||||||

| 87,088,475 | ||||||||

|

|

|

|||||||

| Government Sponsored — 0.1% | ||||||||

| 10,807,000 | Eksportfinans ASA, 2.000%, 9/15/2015 | 10,104,545 | ||||||

| 9,005,000 | Eksportfinans ASA, 2.375%, 5/25/2016 | 8,329,625 | ||||||

| 1,000,000 | Eksportfinans ASA, EMTN, 2.250%, 2/11/2021, (CHF) | 914,407 | ||||||

|

|

|

|||||||

| 19,348,577 | ||||||||

|

|

|

|||||||

See accompanying notes to financial statements.

| 18

Table of Contents

Portfolio of Investments – as of September 30, 2012

Loomis Sayles Strategic Income Fund – (continued)

| Principal Amount (‡) |

Description | Value (†) | ||||||

| Healthcare — 1.5% | ||||||||

| $ | 9,960,000 | HCA, Inc., 5.875%, 3/15/2022 | $ | 10,794,150 | ||||

| 14,620,000 | HCA, Inc., 7.050%, 12/01/2027 | 13,815,900 | ||||||

| 11,104,000 | HCA, Inc., 7.190%, 11/15/2015 | 12,158,880 | ||||||

| 20,447,000 | HCA, Inc., 7.500%, 12/15/2023 | 20,651,470 | ||||||

| 24,215,000 | HCA, Inc., 7.500%, 11/06/2033 | 23,730,700 | ||||||

| 46,148,000 | HCA, Inc., 7.690%, 6/15/2025 | 46,840,220 | ||||||

| 32,745,000 | HCA, Inc., 8.360%, 4/15/2024 | 34,300,387 | ||||||

| 15,815,000 | HCA, Inc., MTN, 7.580%, 9/15/2025 | 15,894,075 | ||||||

| 9,492,000 | HCA, Inc., MTN, 7.750%, 7/15/2036 | 9,420,810 | ||||||

| 32,559,000 | Tenet Healthcare Corp., 6.875%, 11/15/2031 | 29,140,305 | ||||||

|

|

|

|||||||

| 216,746,897 | ||||||||

|

|

|

|||||||

| Home Construction — 0.8% | ||||||||

| 11,265,000 | Desarrolladora Homex SAB de CV, 7.500%, 9/28/2015 | 11,265,000 | ||||||

| 13,360,000 | K. Hovnanian Enterprises, Inc., 5.000%, 11/01/2021, 144A | 11,088,800 | ||||||

| 16,075,000 | K. Hovnanian Enterprises, Inc., 6.250%, 1/15/2016 | 14,869,375 | ||||||

| 6,290,000 | K. Hovnanian Enterprises, Inc., 7.500%, 5/15/2016 | 5,881,150 | ||||||

| 11,315,000 | KB Home, 7.250%, 6/15/2018 | 12,191,912 | ||||||

| 47,260,000 | Pulte Group, Inc., 6.000%, 2/15/2035 | 42,770,300 | ||||||

| 13,190,000 | Pulte Group, Inc., 6.375%, 5/15/2033 | 12,266,700 | ||||||

|

|

|

|||||||

| 110,333,237 | ||||||||

|

|

|

|||||||

| Independent Energy — 0.3% | ||||||||

| 1,150,000 | Chesapeake Energy Corp., 6.250%, 1/15/2017, (EUR) | 1,522,141 | ||||||

| 1,375,000 | Chesapeake Energy Corp., 6.625%, 8/15/2020 | 1,417,969 | ||||||

| 1,040,000 | Chesapeake Energy Corp., 6.875%, 11/15/2020 | 1,097,200 | ||||||

| 19,645,000 | Connacher Oil and Gas Ltd., 8.500%, 8/01/2019, 144A | 16,894,700 | ||||||

| 12,635,000 | QEP Resources, Inc., 6.875%, 3/01/2021 | 14,277,550 | ||||||

| 2,780,000 | SandRidge Energy, Inc., 7.500%, 2/15/2023, 144A | 2,863,400 | ||||||

|

|

|

|||||||

| 38,072,960 | ||||||||

|

|

|

|||||||

| Industrial Other — 0.1% | ||||||||

| 10,000,000 | Worthington Industries, Inc., 6.500%, 4/15/2020 | 11,133,030 | ||||||

|

|

|

|||||||

| Life Insurance — 1.2% | ||||||||

| 34,562,000 | American International Group, Inc., 6.250%, 3/15/2087 | 34,907,620 | ||||||

| 27,655,000 | American International Group, Inc., (fixed rate to 5/15/2038, variable rate thereafter), 8.175%, 5/15/2068 | 33,842,806 | ||||||

| 19,625,000 | American International Group, Inc., Series G, MTN, 5.850%, 1/16/2018 | 22,763,685 | ||||||

| 2,855,000 | American International Group, Inc., Series MPLE, 4.900%, 6/02/2014, (CAD) |

2,974,184 | ||||||

| 23,200,000 | AXA S.A., (fixed rate to 12/14/2036, variable rate thereafter), 6.379%, 12/29/2049, 144A |

20,880,000 | ||||||

| 1,000,000 | AXA S.A., EMTN, (fixed rate to 10/16/2019, variable rate thereafter), 6.772%, 10/29/2049, (GBP) |

1,315,932 | ||||||

| 1,350,000 | AXA S.A., EMTN, (fixed rate to 4/16/2020, variable rate thereafter), 5.250%, 4/16/2040, (EUR) |

1,588,260 | ||||||

| 15,000,000 | Forethought Financial Group, Inc., 8.625%, 4/15/2021, 144A | 16,050,000 | ||||||

| 1,475,000 | MetLife Capital Trust X, 9.250%, 4/08/2068, 144A | 1,947,000 | ||||||

| 15,930,000 | MetLife, Inc., 6.400%, 12/15/2066 | 16,711,860 | ||||||

See accompanying notes to financial statements.

19 |

Table of Contents

Portfolio of Investments – as of September 30, 2012

Loomis Sayles Strategic Income Fund – (continued)

| Principal Amount (‡) |

Description | Value (†) | ||||||

| Life Insurance — continued | ||||||||

| $ | 8,145,000 | MetLife, Inc., 10.750%, 8/01/2069 | $ | 12,095,325 | ||||

| 8,920,000 | NLV Financial Corp., 7.500%, 8/15/2033, 144A | 9,189,928 | ||||||

| 3,910,000 | Penn Mutual Life Insurance Co. (The), 6.650%, 6/15/2034, 144A | 4,429,553 | ||||||

|

|

|

|||||||

| 178,696,153 | ||||||||

|

|

|

|||||||

| Local Authorities — 1.4% | ||||||||

| 3,905,000 | Manitoba (Province of), GMTN, 6.375%, 9/01/2015, (NZD) | 3,486,240 | ||||||

| 82,840,000 | New South Wales Treasury Corp., 6.000%, 2/01/2018, (AUD) | 97,142,182 | ||||||

| 66,305,000 | New South Wales Treasury Corp., Series 17RG, 5.500%, 3/01/2017, (AUD) | 75,671,077 | ||||||

| 26,730,000 | Queensland Treasury Corp., Series 14, 5.750%, 11/21/2014, (AUD) | 29,308,448 | ||||||

|

|

|

|||||||

| 205,607,947 | ||||||||

|

|

|

|||||||

| Media Cable — 0.6% | ||||||||

| 25,270,000 | Shaw Communications, Inc., 5.650%, 10/01/2019, (CAD) | 28,952,413 | ||||||

| 44,800,000 | UPC Holding BV, 6.375%, 9/15/2022, 144A, (EUR) | 57,006,040 | ||||||

|

|

|

|||||||

| 85,958,453 | ||||||||

|

|

|

|||||||

| Media Non-Cable — 0.6% | ||||||||

| 4,295,000 | Clear Channel Communications, Inc., 5.500%, 9/15/2014 | 3,865,500 | ||||||

| 64,250,000 | Clear Channel Communications, Inc., 9.000%, 3/01/2021 | 57,182,500 | ||||||

| 28,455,000 | R.R. Donnelley & Sons Co., 8.250%, 3/15/2019 | 28,881,825 | ||||||

|

|

|

|||||||

| 89,929,825 | ||||||||

|

|

|

|||||||

| Metals & Mining — 0.6% | ||||||||

| 3,949,000 | Alcoa, Inc., 5.870%, 2/23/2022 | 4,247,517 | ||||||

| 1,405,000 | Alcoa, Inc., 5.950%, 2/01/2037 | 1,405,580 | ||||||

| 4,330,000 | Alcoa, Inc., 6.750%, 1/15/2028 | 4,805,213 | ||||||

| 25,271,000 | ArcelorMittal, 7.000%, 3/01/2041 | 22,718,553 | ||||||

| 18,750,000 | Essar Steel Algoma, Inc., 9.875%, 6/15/2015, 144A | 14,859,375 | ||||||

| 16,135,000 | Russel Metals, Inc., 6.000%, 4/19/2022, 144A, (CAD) | 16,791,823 | ||||||

| 7,000,000 | United States Steel Corp., 6.050%, 6/01/2017 | 6,947,500 | ||||||

| 6,779,000 | United States Steel Corp., 6.650%, 6/01/2037 | 5,694,360 | ||||||

| 16,435,000 | United States Steel Corp., 7.000%, 2/01/2018 | 16,476,088 | ||||||

|

|

|

|||||||

| 93,946,009 | ||||||||

|

|

|

|||||||

| Non-Captive Consumer — 4.2% | ||||||||

| 63,088,000 | Residential Capital LLC, 9.625%, 5/15/2015(d) | 63,166,860 | ||||||

| 109,950(††) | SLM Corp., 6.000%, 12/15/2043 | 2,610,305 | ||||||

| 20,970,000 | SLM Corp., MTN, 5.050%, 11/14/2014 | 22,134,066 | ||||||

| 17,600,000 | SLM Corp., MTN, 7.250%, 1/25/2022 | 19,712,000 | ||||||

| 2,160,000 | SLM Corp., MTN, 8.000%, 3/25/2020 | 2,494,800 | ||||||

| 3,750,000 | SLM Corp., Series A, MTN, 0.751%, 1/27/2014(c) | 3,641,711 | ||||||

| 41,770,000 | SLM Corp., Series A, MTN, 5.000%, 4/15/2015 | 44,121,275 | ||||||

| 14,465,000 | SLM Corp., Series A, MTN, 5.000%, 6/15/2018 | 14,487,623 | ||||||

| 48,100,000 | SLM Corp., Series A, MTN, 5.625%, 8/01/2033 | 45,406,400 | ||||||

| 95,060,000 | SLM Corp., Series A, MTN, 8.450%, 6/15/2018 | 111,335,888 | ||||||

| 26,150,000 | Springleaf Finance Corp., 3.250%, 1/16/2013, (EUR) | 33,099,990 | ||||||

| 10,120,000 | Springleaf Finance Corp., MTN, 5.750%, 9/15/2016 | 8,734,774 | ||||||

| 6,900,000 | Springleaf Finance Corp., Series H, MTN, 5.375%, 10/01/2012 | 6,900,000 | ||||||

| 14,232,000 | Springleaf Finance Corp., Series I, MTN, 5.400%, 12/01/2015 | 12,782,044 | ||||||

See accompanying notes to financial statements.

| 20

Table of Contents

Portfolio of Investments – as of September 30, 2012

Loomis Sayles Strategic Income Fund – (continued)

| Principal Amount (‡) |

Description | Value (†) | ||||||

| Non-Captive Consumer —continued | ||||||||

| $ | 14,430,000 | Springleaf Finance Corp., Series I, MTN, 5.850%, 6/01/2013 | $ | 14,357,850 | ||||

| 800,000 | Springleaf Finance Corp., Series J, MTN, 6.500%, 9/15/2017 | 676,000 | ||||||

| 248,290,000 | Springleaf Finance Corp., Series J, MTN, 6.900%, 12/15/2017 | 211,046,500 | ||||||

|

|

|

|||||||

| 616,708,086 | ||||||||

|

|

|

|||||||

| Non-Captive Diversified — 4.6% | ||||||||

| 7,855,000 | Aircastle Ltd., 7.625%, 4/15/2020 | 8,699,412 | ||||||

| 32,711,000 | Ally Financial, Inc., 8.000%, 12/31/2018 | 36,799,875 | ||||||

| 29,332,000 | Ally Financial, Inc., 8.000%, 11/01/2031 | 34,201,112 | ||||||

| 25,320,000 | General Electric Capital Corp., Series A, EMTN, 5.500%, 2/01/2017, (NZD) | 21,970,404 | ||||||

| 79,035,000 | General Electric Capital Corp., Series A, EMTN, 6.750%, 9/26/2016, (NZD) | 71,145,085 | ||||||

| 58,490,000 | General Electric Capital Corp., Series A, GMTN, 7.625%, 12/10/2014, (NZD) |

52,075,396 | ||||||

| 15,305,000 | General Electric Capital Corp., Series A, MTN, 0.755%, 5/13/2024(c) | 13,127,114 | ||||||

| 245,797,000 | General Electric Capital Corp., Series A, MTN, 6.500%, 9/28/2015, (NZD) | 216,090,856 | ||||||

| 1,710,000 | International Lease Finance Corp., 5.875%, 4/01/2019 | 1,813,089 | ||||||

| 24,750,000 | International Lease Finance Corp., 5.875%, 8/15/2022 | 25,567,987 | ||||||

| 2,950,000 | International Lease Finance Corp., 6.250%, 5/15/2019 | 3,171,250 | ||||||

| 20,610,000 | International Lease Finance Corp., 7.125%, 9/01/2018, 144A | 24,010,650 | ||||||

| 10,245,000 | International Lease Finance Corp., 8.250%, 12/15/2020 | 12,191,550 | ||||||

| 2,620,000 | International Lease Finance Corp., Series R, MTN, 5.625%, 9/20/2013 | 2,701,875 | ||||||

| 2,547,000 | International Lease Finance Corp., Series R, MTN, 5.650%, 6/01/2014 | 2,668,237 | ||||||

| 23,175,000 | iStar Financial, Inc., 5.850%, 3/15/2017 | 22,016,250 | ||||||

| 20,478,000 | iStar Financial, Inc., 5.875%, 3/15/2016 | 19,761,270 | ||||||

| 8,300,000 | iStar Financial, Inc., 6.050%, 4/15/2015 | 8,134,000 | ||||||

| 35,130,000 | iStar Financial, Inc., 8.625%, 6/01/2013 | 36,183,900 | ||||||

| 2,920,000 | iStar Financial, Inc., Series B, 5.700%, 3/01/2014 | 2,923,650 | ||||||

| 44,610,000 | iStar Financial, Inc., Series B, 5.950%, 10/15/2013 | 44,610,000 | ||||||

| 19,915,000 | Ladder Capital Finance Holdings LLLP/Ladder Capital Finance Corp., 7.375%, 10/01/2017, 144A |

20,313,300 | ||||||

|

|

|

|||||||

| 680,176,262 | ||||||||

|

|

|

|||||||

| Oil Field Services — 0.1% | ||||||||

| 7,275,000 | Rowan Cos., Inc., 7.875%, 8/01/2019 | 9,019,349 | ||||||

|

|

|

|||||||

| Paper — 1.1% | ||||||||

| 14,715,000 | Georgia-Pacific LLC, 7.250%, 6/01/2028 | 18,621,053 | ||||||

| 12,410,000 | Georgia-Pacific LLC, 7.375%, 12/01/2025 | 16,425,801 | ||||||

| 47,875,000 | Georgia-Pacific LLC, 7.750%, 11/15/2029 | 63,251,588 | ||||||

| 775,000 | Georgia-Pacific LLC, 8.875%, 5/15/2031 | 1,146,348 | ||||||

| 14,520,000 | Westvaco Corp., 7.950%, 2/15/2031 | 19,070,379 | ||||||

| 25,210,000 | Westvaco Corp., 8.200%, 1/15/2030 | 33,601,880 | ||||||

| 2,840,000 | Weyerhaeuser Co., 6.950%, 10/01/2027 | 3,078,779 | ||||||

|

|

|

|||||||

| 155,195,828 | ||||||||

|

|

|

|||||||

| Pharmaceuticals — 0.4% | ||||||||

| 11,225,000 | Valeant Pharmaceuticals International, 6.375%, 10/15/2020, 144A | 11,449,500 | ||||||

| 43,165,000 | VPI Escrow Corp., 6.375%, 10/15/2020, 144A | 44,028,300 | ||||||

|

|

|

|||||||

| 55,477,800 | ||||||||

|

|

|

|||||||

See accompanying notes to financial statements.

21 |

Table of Contents

Portfolio of Investments – as of September 30, 2012

Loomis Sayles Strategic Income Fund – (continued)

| Principal Amount (‡) |

Description | Value (†) | ||||||

| Pipelines — 1.2% | ||||||||

| $ | 750,000 | El Paso Corp., GMTN, 7.800%, 8/01/2031 | $ | 871,466 | ||||

| 9,115,000 | Energy Transfer Partners LP, 6.625%, 10/15/2036 | 10,319,748 | ||||||

| 13,175,000 | Enterprise Products Operating LLC, 4.050%, 2/15/2022 | 14,401,685 | ||||||

| 8,935,000 | IFM US Colonial Pipeline 2 LLC, 6.450%, 5/01/2021, 144A | 9,969,879 | ||||||

| 41,557,104 | Maritimes & Northeast Pipeline LLC, 7.500%, 5/31/2014, 144A(b) | 44,194,733 | ||||||

| 81,710,000 | NGPL PipeCo LLC, 7.119%, 12/15/2017, 144A | 86,816,875 | ||||||

| 3,870,000 | NGPL PipeCo LLC, 7.768%, 12/15/2037, 144A | 3,870,000 | ||||||

| 3,065,000 | Rockies Express Pipeline LLC, 6.875%, 4/15/2040, 144A | 2,681,875 | ||||||

| 4,168,000 | Transportadora de Gas del Sur S.A., 7.875%, 5/14/2017, 144A | 3,553,220 | ||||||

|

|

|

|||||||

| 176,679,481 | ||||||||

|

|

|

|||||||

| Property & Casualty Insurance — 0.4% | ||||||||

| 14,855,000 | Hanover Insurance Group, Inc. (The), 6.375%, 6/15/2021 | 17,002,795 | ||||||

| 3,405,000 | Hanover Insurance Group, Inc. (The), 7.500%, 3/01/2020 | 3,977,779 | ||||||

| 6,075,000 | Marsh & McLennan Cos., Inc., 5.875%, 8/01/2033 | 7,163,257 | ||||||

| 11,865,000 | MBIA Insurance Corp., (fixed rate to 1/15/2013, variable rate thereafter), 14.000%, 1/15/2033, 144A |

6,051,150 | ||||||

| 2,275,000 | Nationwide Mutual Insurance Co., 6.600%, 4/15/2034, 144A | 2,282,587 | ||||||

| 11,200,000 | White Mountains Re Group Ltd., 6.375%, 3/20/2017, 144A | 11,849,399 | ||||||

| 3,000,000 | White Mountains Re Group Ltd., (fixed rate to 6/30/2017, variable rate thereafter), 7.506%, 5/29/2049, 144A | 3,057,480 | ||||||

| 1,425,000 | XL Group PLC, 6.375%, 11/15/2024 | 1,693,416 | ||||||

|

|

|

|||||||

| 53,077,863 | ||||||||

|

|

|

|||||||

| Railroads — 0.0% | ||||||||

| 1,153,000 | Missouri Pacific Railroad Co., 5.000%, 1/01/2045(b) | 951,225 | ||||||

|

|

|

|||||||

| Retailers — 0.8% | ||||||||

| 2,500,000 | Dillard’s, Inc., 6.625%, 1/15/2018 | 2,637,500 | ||||||

| 3,325,000 | Dillard’s, Inc., 7.000%, 12/01/2028 | 3,308,375 | ||||||

| 4,187,000 | Dillard’s, Inc., 7.130%, 8/01/2018 | 4,532,427 | ||||||

| 1,500,000 | Dillard’s, Inc., 7.750%, 7/15/2026 | 1,550,625 | ||||||

| 425,000 | Dillard’s, Inc., 7.875%, 1/01/2023 | 454,750 | ||||||

| 10,270,000 | Foot Locker, Inc., 8.500%, 1/15/2022 | 11,348,350 | ||||||

| 3,685,000 | J.C. Penney Corp., Inc., 5.750%, 2/15/2018 | 3,500,750 | ||||||

| 37,064,000 | J.C. Penney Corp., Inc., 6.375%, 10/15/2036 | 30,253,490 | ||||||

| 635,000 | J.C. Penney Corp., Inc., 7.125%, 11/15/2023 | 604,838 | ||||||

| 160,000 | J.C. Penney Corp., Inc., 7.400%, 4/01/2037 | 143,400 | ||||||

| 3,985,000 | J.C. Penney Corp., Inc., 7.625%, 3/01/2097 | 3,397,212 | ||||||

| 12,275,000 | Macy’s Retail Holdings, Inc., 6.790%, 7/15/2027 | 13,615,148 | ||||||

| 2,365,000 | Macy’s Retail Holdings, Inc., 6.900%, 4/01/2029 | 2,790,364 | ||||||

| 6,365,000 | Marks & Spencer PLC, 7.125%, 12/01/2037, 144A | 6,948,480 | ||||||

| 37,646,000 | Toys R Us, Inc., 7.375%, 10/15/2018 | 33,787,285 | ||||||

|

|

|

|||||||

| 118,872,994 | ||||||||

|

|

|

|||||||

| Sovereigns — 2.0% | ||||||||

| 47,935,000 | Hellenic Republic Government International Bond, 2.125%, 7/05/2013, (CHF) |

21,173,458 | ||||||

| 64,132,000,000 | Indonesia Treasury Bond, Series FR43, 10.250%, 7/15/2022, (IDR) | 8,725,738 | ||||||

| 10,000,000,000 | Indonesia Treasury Bond, Series FR47, 10.000%, 2/15/2028, (IDR) | 1,400,690 | ||||||

See accompanying notes to financial statements.

| 22

Table of Contents

Portfolio of Investments – as of September 30, 2012

Loomis Sayles Strategic Income Fund – (continued)

| Principal Amount (‡) |

Description | Value (†) | ||||||

| Sovereigns — continued | ||||||||

| 272,460,000,000 | Indonesia Treasury Bond, Series ZC3, Zero Coupon, 11/20/2012, (IDR) | $ | 28,240,351 | |||||

| 166,250,000 | Republic of Brazil, 8.500%, 1/05/2024, (BRL) | 95,948,946 | ||||||

| 56,700,000 | Republic of Brazil, 10.250%, 1/10/2028, (BRL) | 36,569,367 | ||||||

| 49,120,000 | Republic of Brazil, 12.500%, 1/05/2016, (BRL) | 30,420,599 | ||||||

| 18,400,000 | Republic of Croatia, 6.750%, 11/05/2019, 144A | 20,746,000 | ||||||

| 5,226,139,000 | Republic of Iceland, 6.000%, 10/13/2016, (ISK) | 28,512,127 | ||||||

| 3,178,700,000 | Republic of Iceland, 7.250%, 5/17/2013, (ISK) | 16,971,278 | ||||||

| 1,715,823,000 | Republic of Iceland, 8.750%, 2/26/2019, (ISK) | 10,082,247 | ||||||

|

|

|

|||||||

| 298,790,801 | ||||||||

|

|

|

|||||||

| Supermarkets — 0.5% | ||||||||

| 8,336,000 | American Stores Co., 7.900%, 5/01/2017 | 7,752,480 | ||||||

| 73,686,000 | New Albertson’s, Inc., 7.450%, 8/01/2029 | 41,079,945 | ||||||

| 20,250,000 | New Albertson’s, Inc., 7.750%, 6/15/2026 | 12,403,125 | ||||||

| 10,950,000 | New Albertson’s, Inc., 8.000%, 5/01/2031 | 6,460,500 | ||||||

| 3,425,000 | New Albertson’s, Inc., 8.700%, 5/01/2030 | 2,033,594 | ||||||

| 13,707,000 | New Albertson’s, Inc., Series C, MTN, 6.625%, 6/01/2028 | 7,401,780 | ||||||

|

|

|

|||||||

| 77,131,424 | ||||||||

|

|

|

|||||||

| Supranational — 1.6% | ||||||||

| 128,560,000 | European Bank for Reconstruction & Development, GMTN, 9.000%, 4/28/2014, (BRL) |

66,636,220 | ||||||

| 16,375,000 | European Investment Bank, 11.250%, 2/14/2013, (BRL) | 8,240,609 | ||||||

| 460,500,000,000 | European Investment Bank, EMTN, Zero Coupon, 4/24/2013, 144A, (IDR) | 46,622,617 | ||||||

| 60,665,000 | European Investment Bank, MTN, 6.250%, 4/15/2015, (AUD) | 66,877,927 | ||||||

| 244,840,000,000 | Inter-American Development Bank, EMTN, Zero Coupon, 5/20/2013, (IDR) | 24,729,607 | ||||||

| 24,450,000 | Inter-American Development Bank, EMTN, 6.000%, 12/15/2017, (NZD) | 22,578,727 | ||||||

| 8,300,000 | International Bank for Reconstruction & Development, 1.430%, 3/05/2014, (SGD) |

6,780,056 | ||||||

|

|

|

|||||||

| 242,465,763 | ||||||||

|

|

|

|||||||

| Technology — 0.9% | ||||||||

| 7,475,000 | Agilent Technologies, Inc., 6.500%, 11/01/2017 | 9,147,195 | ||||||

| 832,000 | Alcatel-Lucent, EMTN, 6.375%, 4/07/2014, (EUR) | 1,082,526 | ||||||

| 31,237,000 | Alcatel-Lucent France, Inc., 8.500%, 1/15/2016, (EUR) | 37,632,280 | ||||||

| 79,074,000 | Alcatel-Lucent USA, Inc., 6.450%, 3/15/2029 | 51,793,470 | ||||||

| 5,845,000 | Alcatel-Lucent USA, Inc., 6.500%, 1/15/2028 | 3,799,250 | ||||||

| 21,850,000 | Amkor Technology, Inc., 6.375%, 10/01/2022, 144A | 21,522,250 | ||||||

| 63,000 | Freescale Semiconductor, Inc., 8.875%, 12/15/2014 | 63,945 | ||||||

| 475,000 | Motorola Solutions, Inc., 6.000%, 11/15/2017 | 566,941 | ||||||

| 2,562,000 | Motorola Solutions, Inc., 6.625%, 11/15/2037 | 2,745,237 | ||||||

| 4,170,000 | Nortel Networks Capital Corp., 7.875%, 6/15/2026(d) | 4,430,625 | ||||||

| 240,000 | Samsung Electronics Co. Ltd., 7.700%, 10/01/2027, 144A | 310,113 | ||||||

|

|

|

|||||||

| 133,093,832 | ||||||||

|

|

|

|||||||

| Textile — 0.0% | ||||||||

| 2,595,000 | Jones Group, Inc. (The), 6.125%, 11/15/2034 | 2,127,900 | ||||||

| 3,450,000 | Jones Group, Inc./Apparel Group Holdings/Apparel Group USA/Footwear Accessories Retail, 6.875%, 3/15/2019 | 3,562,125 | ||||||

|

|

|

|||||||

| 5,690,025 | ||||||||

|

|

|

|||||||

See accompanying notes to financial statements.

23 |

Table of Contents

Portfolio of Investments – as of September 30, 2012

Loomis Sayles Strategic Income Fund – (continued)

| Principal Amount (‡) |

Description | Value (†) | ||||||

| Tobacco — 0.1% | ||||||||

| $ | 6,175,000 | Reynolds American, Inc., 7.250%, 6/15/2037 | $ | 7,806,046 | ||||

|

|

|

|||||||

| Transportation Services — 0.3% | ||||||||

| 10,503,000 | APL Ltd., 8.000%, 1/15/2024(b) | 8,953,808 | ||||||

| 7,403,003 | Atlas Air Pass Through Trust, Series 1998-1, Class B, 7.680%, 7/02/2015 | 7,069,868 | ||||||

| 6,862,758 | Atlas Air Pass Through Trust, Series 1998-1, Class C, 8.010%, 7/02/2011(f)(g) |

6,039,227 | ||||||

| 6,325,041 | Atlas Air Pass Through Trust, Series 1999-1, Class A-1, 7.200%, 7/02/2020 | 6,388,292 | ||||||

| 6,267,285 | Atlas Air Pass Through Trust, Series 1999-1, Class B, 7.630%, 7/02/2016 | 5,421,202 | ||||||

| 4,744,556 | Atlas Air Pass Through Trust, Series 1999-1, Class C, 8.770%, 7/02/2012(f)(g) |

3,629,585 | ||||||

| 2,815,458 | Atlas Air Pass Through Trust, Series 2000-1, Class B, 9.057%, 7/02/2017 | 2,787,303 | ||||||

| 3,280,000 | Continental Airlines Pass Through Certificates, Series 2012-2, Class B, 5.500%, 4/29/2022 |

3,362,000 | ||||||

| 3,970,000 | Erac USA Finance Co., 7.000%, 10/15/2037, 144A | 4,947,100 | ||||||

|

|

|

|||||||

| 48,598,385 | ||||||||

|

|

|

|||||||

| Treasuries — 17.1% | ||||||||

| 272,755,000 | Canadian Government, 2.250%, 8/01/2014, (CAD) | 283,336,707 | ||||||

| 201,485,000 | Canadian Government, 2.500%, 6/01/2015, (CAD) | 212,453,851 | ||||||

| 89,045,000 | Canadian Government, 3.000%, 12/01/2015, (CAD) | 95,682,390 | ||||||

| 80,216,000 | Canadian Government, 3.500%, 6/01/2013, (CAD) | 82,924,137 | ||||||

| 171,980,000 | Canadian Government, 3.750%, 6/01/2019, (CAD) | 200,300,458 | ||||||

| 25,445,000 | Canadian Government, 4.250%, 6/01/2018, (CAD) | 29,956,822 | ||||||

| 118,375,000 | Ireland Government Bond, 4.500%, 10/18/2018, (EUR) | 151,308,495 | ||||||

| 80,820,000 | Ireland Government Bond, 4.500%, 4/18/2020, (EUR) | 99,911,126 | ||||||

| 24,400,000 | Ireland Government Bond, 5.000%, 10/18/2020, (EUR) | 31,098,101 | ||||||

| 121,560,000 | Ireland Government Bond, 5.400%, 3/13/2025, (EUR) | 155,157,629 | ||||||

| 1,440,000 | Italy Buoni Poliennali Del Tesoro, 5.000%, 8/01/2034, (EUR) | 1,680,598 | ||||||

| 1,440,000 | Italy Buoni Poliennali Del Tesoro, 5.250%, 11/01/2029, (EUR) | 1,787,260 | ||||||

| 1,435,000 | Italy Buoni Poliennali Del Tesoro, 5.750%, 2/01/2033, (EUR) | 1,840,764 | ||||||

| 18,686,981(†††) | Mexican Fixed Rate Bonds, Series M-20, 8.000%, 12/07/2023, (MXN) | 176,392,731 | ||||||

| 22,670,000 | New Zealand Government Bond, 6.000%, 12/15/2017, (NZD) | 21,618,686 | ||||||

| 53,301,000 | New Zealand Government Bond, 6.500%, 4/15/2013, (NZD) | 45,110,619 | ||||||

| 457,420,000 | Norwegian Government Bond, 4.250%, 5/19/2017, (NOK) | 89,622,031 | ||||||

| 221,050,000 | Norwegian Government Bond, 5.000%, 5/15/2015, (NOK) | 42,115,602 | ||||||

| 1,520,540,000 | Norwegian Government Bond, 6.500%, 5/15/2013, (NOK) | 273,118,063 | ||||||

| 21,120,000 | Portugal Obrigacoes do Tesouro OT, 3.850%, 4/15/2021, (EUR) | 19,087,738 | ||||||

| 1,995,000 | Portugal Obrigacoes do Tesouro OT, 4.100%, 4/15/2037, (EUR) | 1,400,535 | ||||||

| 6,225,000 | Portugal Obrigacoes do Tesouro OT, 4.800%, 6/15/2020, (EUR) | 6,232,359 | ||||||

| 14,475,000 | Portugal Obrigacoes do Tesouro OT, 4.950%, 10/25/2023, (EUR) | 13,294,203 | ||||||

| 65,300,000 | Singapore Government Bond, 1.375%, 10/01/2014, (SGD) | 54,370,338 | ||||||

| 419,985,000 | U.S. Treasury Note, 0.250%, 6/30/2014 | 420,066,897 | ||||||

|

|

|

|||||||

| 2,509,868,140 | ||||||||

|

|

|

|||||||

| Wireless — 0.7% | ||||||||

| 19,004,000 | Nextel Communications, Inc., Series D, 7.375%, 8/01/2015 | 19,075,265 | ||||||

| 31,041,000 | Sprint Capital Corp., 6.875%, 11/15/2028 | 28,557,720 | ||||||

| 29,252,000 | Sprint Capital Corp., 6.900%, 5/01/2019 | 30,348,950 | ||||||

See accompanying notes to financial statements.

| 24

Table of Contents

Portfolio of Investments – as of September 30, 2012

Loomis Sayles Strategic Income Fund – (continued)

| Principal Amount (‡) |

Description | Value (†) | ||||||

| Wireless — continued | ||||||||

| $ | 6,260,000 | Sprint Capital Corp., 8.750%, 3/15/2032 | $ | 6,479,100 | ||||

| 11,309,000 | Sprint Nextel Corp., 6.000%, 12/01/2016 | 11,648,270 | ||||||

|

|

|

|||||||

| 96,109,305 | ||||||||

|

|

|

|||||||

| Wirelines — 3.7% | ||||||||