UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-06243

Franklin Strategic Series

(Exact name of registrant as specified in charter)

One Franklin Parkway, San Mateo, CA 94403-1906

(Address of principal executive offices) (Zip code)

Craig S. Tyle, One Franklin Parkway, San Mateo, CA 94403-1906

(Name and address of agent for service)

Registrant’s telephone number, including area code: 650 312-2000

Date of fiscal year end: 4/30

Date of reporting period: 10/31/19

| Item 1. | Reports to Stockholders. |

|

|

Franklin Growth Opportunities Fund |

|

Franklin Small Cap Growth Fund | |||

| Franklin Select U.S. Equity Fund |

Franklin Small-Mid Cap Growth Fund | |||||

Sign up for electronic delivery at franklintempleton.com/edelivery

Internet Delivery of Fund Reports Unless You Request Paper Copies: Effective January 1, 2021, as permitted by the SEC, paper copies of the Fund’s shareholder reports will no longer be sent by mail, unless you specifically request them from the Fund or your financial intermediary. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. If you have not signed up for electronic delivery, we would encourage you to join fellow shareholders who have. You may elect to receive shareholder reports and other communications electronically from the Fund by calling (800) 632-2301 or by contacting your financial intermediary.

You may elect to continue to receive paper copies of all your future shareholder reports free of charge by contacting your financial intermediary or, if you invest directly with a Fund, calling (800) 632-2301 to let the Fund know of your request. Your election to receive reports in paper will apply to all funds held in your account.

SHAREHOLDER LETTER

| CFA® is a trademark owned by CFA Institute. | ||||

|

Not FDIC Insured | May Lose Value | No Bank Guarantee

|

| franklintempleton.com | Not part of the semiannual report | 1 | ||

| 2 |

Semiannual Report | franklintempleton.com | ||

1. Source: Bureau of Labor Statistics.

2. Source: Morningstar.

See www.franklintempletondatasources.com for additional data provider information.

| franklintempleton.com | Semiannual Report | 3 | ||

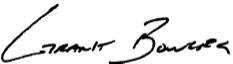

Franklin Growth Opportunities Fund

1. Source: Morningstar.

Frank Russell Company is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of Frank Russell Company.

The indexes are unmanaged and include reinvestment of any income or distributions. They do not reflect any fees, expenses or sales charges. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

See www.franklintempletondatasources.com for additional data provider information.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI).

The SOI begins on page 33.

| 4 |

Semiannual Report | franklintempleton.com | ||

FRANKLIN GROWTH OPPORTUNITIES FUND

| franklintempleton.com | Semiannual Report | 5 | ||

FRANKLIN GROWTH OPPORTUNITIES FUND

| 6 |

Semiannual Report | franklintempleton.com | ||

FRANKLIN GROWTH OPPORTUNITIES FUND

Performance Summary as of October 31, 2019

The performance table does not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses. Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities.

Performance as of 10/31/191

Cumulative total return excludes sales charges. Average annual total return includes maximum sales charges. Sales charges will vary depending on the size of the investment and the class of share purchased. The maximum is 5.50% and the minimum is 0%. Class A: 5.50% maximum initial sales charge; Advisor Class: no sales charges. For other share classes, visit franklintempleton.com.

| Share Class

|

Cumulative Total Return2

|

Average Annual Total Return3

| ||

| A4 | ||||

| 6-Month | +0.73% | -4.80% | ||

| 1-Year |

+15.65% | +9.28% | ||

| 5-Year |

+65.55% | +9.37% | ||

| 10-Year |

+257.88% | +12.96% | ||

| Advisor |

||||

|

6-Month |

+0.86% | +0.86% | ||

| 1-Year |

+15.90% | +15.90% | ||

| 5-Year |

+67.69% | +10.89% | ||

| 10-Year |

+267.74% | +13.91% | ||

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

See page 8 for Performance Summary footnotes.

| franklintempleton.com | Semiannual Report | 7 | ||

FRANKLIN GROWTH OPPORTUNITIES FUND

PERFORMANCE SUMMARY

Total Annual Operating Expenses5

| Share Class

|

With Fee Waiver

|

Without Fee Waiver

| ||

|

A |

0.95% |

0.95% | ||

| Advisor |

0.70% | 0.70% | ||

Each class of shares is available to certain eligible investors and has different annual fees and expenses, as described in the prospectus.

All investments involve risks, including possible loss of principal. Growth stock prices reflect projections of future earnings or revenues, and can, therefore, fall dramatically if the company fails to meet those projections. To the extent the Fund focuses on particular countries, regions, industries, sectors or types of investment from time to time, it may be subject to greater risks of adverse developments in such areas of focus than a fund that invests in a wider variety of countries, regions, industries, sectors or investments. Smaller, midsized and relatively new or unseasoned companies can be particularly sensitive to changing economic conditions, and their prospects for growth are less certain than those of larger, more established companies. Historically, these securities have experienced more price volatility than larger-company stocks, especially over the short term. The Fund’s prospectus also includes a description of the main investment risks.

1. The Fund has a fee waiver associated with any investment it makes in a Franklin Templeton money fund and/or other Franklin Templeton fund, contractually guaranteed through 8/31/20. Fund investment results reflect the fee waiver; without this waiver, the results would have been lower.

2. Cumulative total return represents the change in value of an investment over the periods indicated.

3. Average annual total return represents the average annual change in value of an investment over the periods indicated. Return for less than one year, if any, has not been annualized.

4. Prior to 9/10/18, these shares were offered at a higher initial sales charge of 5.75%, thus actual returns (with sales charges) would have differed. Average annual total returns (with sales charges) have been restated to reflect the current maximum initial sales charge of 5.50%.

5. Figures are as stated in the Fund’s current prospectus and may differ from the expense ratios disclosed in the Your Fund’s Expenses and Financial Highlights sections in this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

| 8 |

Semiannual Report | franklintempleton.com | ||

FRANKLIN GROWTH OPPORTUNITIES FUND

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs: (1) transaction costs, including sales charges (loads) on Fund purchases and redemptions; and (2) ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses. The table below shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The table below provides information about actual account values and actual expenses in the columns under the heading “Actual.” In these columns the Fund’s actual return, which includes the effect of Fund expenses, is used to calculate the “Ending Account Value” for each class of shares. You can estimate the expenses you paid during the period by following these steps (of course, your account value and expenses will differ from those in this illustration): Divide your account value by $1,000 (if your account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6). Then multiply the result by the number in the row for your class of shares under the headings “Actual” and “Expenses Paid During Period” (if Actual Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50). In this illustration, the actual expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Under the heading “Hypothetical” in the table, information is provided about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. This information may not be used to estimate the actual ending account balance or expenses you paid for the period, but it can help you compare ongoing costs of investing in the Fund with those of other funds. To do so, compare this 5% hypothetical example for the class of shares you hold with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transactional costs. Therefore, information under the heading “Hypothetical” is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transactional costs were included, your total costs would have been higher.

| Actual | Hypothetical | |||||||||||||||||

| (actual return after expenses) | (5% annual return before expenses) | |||||||||||||||||

| Share Class |

Beginning Account Value 5/1/19 |

Ending Account Value 10/31/19 |

Expenses Paid During Period 5/1/19–10/31/191, 2 |

Ending Account Value 10/31/19 |

Expenses Paid During Period 5/1/19–10/31/191, 2 |

Net Annualized Expense Ratio2 | ||||||||||||

| A | $1,000 | $1,007.30 | $4.79 | $1,020.36 | $4.82 | 0.95% | ||||||||||||

| C | $1,000 | $1,003.70 | $8.56 | $1,016.59 | $8.62 | 1.70% | ||||||||||||

| R | $1,000 | $1,006.10 | $6.05 | $1,019.10 | $6.09 | 1.20% | ||||||||||||

| R6 | $1,000 | $1,009.40 | $2.98 | $1,022.17 | $3.00 | 0.59% | ||||||||||||

| Advisor | $1,000 | $1,008.60 | $3.53 | $1,021.62 | $3.56 | 0.70% | ||||||||||||

1. Expenses are equal to the annualized expense ratio for the six-month period as indicated above—in the far right column—multiplied by the simple average account value over the period indicated, and then multiplied by 184/366 to reflect the one-half year period.

2. Reflects expenses after fee waivers and expense reimbursements. Does not include acquired fund fees and expenses.

| franklintempleton.com | Semiannual Report | 9 | ||

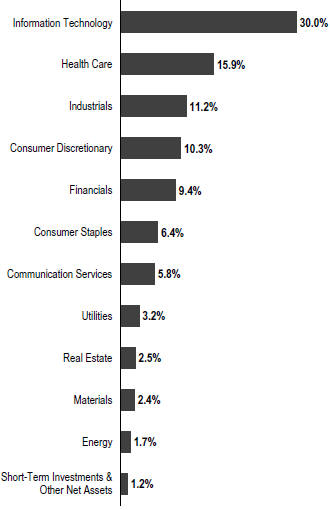

Franklin Select U.S. Equity Fund

1. Source: Morningstar.

The index is unmanaged and includes reinvestment of any income or distributions. It does not reflect any fees, expenses or sales charges. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

See www.franklintempletondatasources.com for additional data provider information.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI).

The SOI begins on page 42.

| 10 |

Semiannual Report | franklintempleton.com | ||

FRANKLIN SELECT U.S. EQUITY FUND

| franklintempleton.com | Semiannual Report | 11 | ||

FRANKLIN SELECT U.S. EQUITY FUND

| 12 |

Semiannual Report | franklintempleton.com | ||

FRANKLIN SELECT U.S. EQUITY FUND

Performance Summary as of October 31, 2019

The performance table does not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses. Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities.

Performance as of 10/31/191

Cumulative total return excludes sales charges. Average annual total return includes maximum sales charges. Sales charges will vary depending on the size of the investment and the class of share purchased. The maximum is 5.50% and the minimum is 0%. Class A: 5.50% maximum initial sales charge; Advisor Class: no sales charges. For other share classes, visit franklintempleton.com.

| Share Class

|

Cumulative Total Return2

|

Average Annual Total Return3

| ||

| A4 | ||||

| 6-Month |

+2.77% | -2.86% | ||

| 1-Year |

+13.72% | +7.47% | ||

| 5-Year |

+34.95% | +4.99% | ||

| 10-Year |

+177.49% | +10.12% | ||

| Advisor |

||||

| 6-Month |

+2.90% | +2.90% | ||

| 1-Year |

+14.08% | +14.08% | ||

| 5-Year |

+36.73% | +6.46% | ||

| 10-Year |

+185.09% | +11.04% | ||

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

See page 14 for Performance Summary footnotes.

| franklintempleton.com | Semiannual Report | 13 | ||

FRANKLIN SELECT U.S. EQUITY FUND

PERFORMANCE SUMMARY

Total Annual Operating Expenses5

| Share Class | With Fee Waiver |

Without Fee Waiver | ||

| A |

1.27% | 1.54% | ||

| Advisor |

1.02% | 1.29% | ||

Each class of shares is available to certain eligible investors and has different annual fees and expenses, as described in the prospectus.

All investments involve risks, including possible loss of principal. To the extent the Fund focuses on particular countries, regions, industries, sectors or types of investment from time to time, it may be subject to greater risks of adverse developments in such areas of focus than a fund that invests in a wider variety of countries, regions, industries, sectors or investments. The Fund may have investments in both growth and value stocks, or in stocks with characteristics of both. Growth stock prices reflect projections of future earnings or revenues, and can, therefore, fall dramatically if the company fails to meet those projections. A value stock may not increase in price as anticipated by the investment manager if other investors fail to recognize the company’s value and bid up the price, the markets favor faster-growing companies, or the factors that the investment manager believes will increase the price of the security do not occur. Foreign securities involve special risks, including currency fluctuations and economic and political uncertainties. The Fund’s prospectus also includes a description of the main investment risks.

1. The Fund has an expense reduction and a fee waiver associated with any investments it makes in a Franklin Templeton money fund and/or other Franklin Templeton fund, contractually guaranteed through 8/31/20. Fund investment results reflect the expense reduction and fee waiver; without these reductions, the results would have been lower.

2. Cumulative total return represents the change in value of an investment over the periods indicated.

3. Average annual total return represents the average annual change in value of an investment over the periods indicated. Return for less than one year, if any, has not been annualized.

4. Prior to 9/10/18, these shares were offered at a higher initial sales charge of 5.75%, thus actual returns (with sales charges) would have differed. Average annual total returns (with sales charges) have been restated to reflect the current maximum initial sales charge of 5.50%.

5. Figures are as stated in the Fund’s current prospectus and may differ from the expense ratios disclosed in the Your Fund’s Expenses and Financial Highlights sections in this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

| 14 |

Semiannual Report | franklintempleton.com | ||

FRANKLIN SELECT U.S. EQUITY FUND

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs: (1) transaction costs, including sales charges (loads) on Fund purchases and redemptions; and (2) ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses. The table below shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The table below provides information about actual account values and actual expenses in the columns under the heading “Actual.” In these columns the Fund’s actual return, which includes the effect of Fund expenses, is used to calculate the “Ending Account Value” for each class of shares. You can estimate the expenses you paid during the period by following these steps (of course, your account value and expenses will differ from those in this illustration): Divide your account value by $1,000 (if your account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6). Then multiply the result by the number in the row for your class of shares under the headings “Actual” and “Expenses Paid During Period” (if Actual Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50). In this illustration, the actual expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Under the heading “Hypothetical” in the table, information is provided about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. This information may not be used to estimate the actual ending account balance or expenses you paid for the period, but it can help you compare ongoing costs of investing in the Fund with those of other funds. To do so, compare this 5% hypothetical example for the class of shares you hold with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transactional costs. Therefore, information under the heading “Hypothetical” is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transactional costs were included, your total costs would have been higher.

| Actual | Hypothetical | |||||||||||||||||

| (actual return after expenses) | (5% annual return before expenses) | |||||||||||||||||

| Share Class |

Beginning Account Value 5/1/19 |

Ending Account Value 10/31/19 |

Expenses Paid During Period 5/1/19–10/31/191, 2 |

Ending Account Value 10/31/19 |

Expenses Paid During Period 5/1/19–10/31/191, 2 |

Net Annualized Expense Ratio2 | ||||||||||||

| A | $1,000 | $1,027.70 | $ 6.22 | $1,019.00 | $6.19 | 1.22% | ||||||||||||

| C | $1,000 | $1,023.60 | $10.02 | $1,015.23 | $9.98 | 1.97% | ||||||||||||

| R | $1,000 | $1,026.30 | $ 7.49 | $1,017.75 | $7.46 | 1.47% | ||||||||||||

| R6 | $1,000 | $1,029.50 | $ 4.39 | $1,020.81 | $4.37 | 0.86% | ||||||||||||

| Advisor | $1,000 | $1,029.00 | $ 4.95 | $1,020.26 | $4.93 | 0.97% | ||||||||||||

1. Expenses are equal to the annualized expense ratio for the six-month period as indicated above—in the far right column—multiplied by the simple average account value over the period indicated, and then multiplied by 184/366 to reflect the one-half year period.

2. Reflects expenses after fee waivers and expense reimbursements. Does not include acquired fund fees and expenses.

| franklintempleton.com | Semiannual Report | 15 | ||

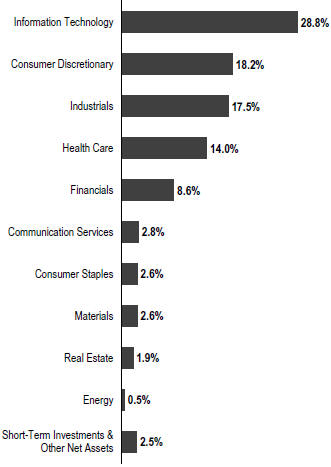

Franklin Small Cap Growth Fund

1. The Russell 2000 Index is market capitalization weighted and measures performance of the 2,000 smallest companies in the Russell 3000 Index, which represent a small amount of the total market capitalization of the Russell 3000 Index.

2. Source: Morningstar.

The indexes are unmanaged and include reinvestment of any income or distributions. They do not reflect any fees, expenses or sales charges. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

See www.franklintempletondatasources.com for additional data provider information.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI).

The SOI begins on page 49.

| 16 |

Semiannual Report | franklintempleton.com | ||

FRANKLIN SMALL CAP GROWTH FUND

| franklintempleton.com | Semiannual Report | 17 | ||

FRANKLIN SMALL CAP GROWTH FUND

| 18 |

Semiannual Report | franklintempleton.com | ||

FRANKLIN SMALL CAP GROWTH FUND

Performance Summary as of October 31, 2019

The performance table does not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses. Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities.

Performance as of 10/31/191

Cumulative total return excludes sales charges. Average annual total return includes maximum sales charges. Sales charges will vary depending on the size of the investment and the class of share purchased. The maximum is 5.50% and the minimum is 0%. Class A: 5.50% maximum initial sales charge; Advisor Class: no sales charges. For other share classes, visit franklintempleton.com.

| Share Class

|

Cumulative Total Return2

|

Average Annual Total Return3

| ||

|

A4 |

||||

| 6-Month |

+0.05% | -5.46% | ||

| 1-Year |

+12.64% | +6.45% | ||

| 5-Year |

+56.52% | +8.15% | ||

| 10-Year |

+304.16% | +14.34% | ||

| Advisor |

||||

| 6-Month |

+0.17% | +0.17% | ||

| 1-Year |

+12.87% | +12.87% | ||

| 5-Year |

+58.45% | +9.64% | ||

| 10-Year |

+315.66% | +15.31% | ||

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

See page 20 for Performance Summary footnotes.

| franklintempleton.com | Semiannual Report | 19 | ||

FRANKLIN SMALL CAP GROWTH FUND

PERFORMANCE SUMMARY

Total Annual Operating Expenses5

| Share Class | With Fee Waiver |

Without Fee Waiver | ||

| A |

1.07% | 1.08% | ||

| Advisor |

0.82% | 0.83% | ||

Each class of shares is available to certain eligible investors and has different annual fees and expenses, as described in the prospectus.

All investments involve risks, including possible loss of principal. Smaller, midsized and relatively new or unseasoned companies can be particularly sensitive to changing economic conditions, and their prospects for growth are less certain than those of larger, more established companies. Historically, these securities have experienced more price volatility than larger-company stocks, especially over the short term. Growth stock prices reflect projections of future earnings or revenues, and can, therefore, fall dramatically if the company fails to meet those projections. To the extent the Fund focuses on particular countries, regions, industries, sectors or types of investment from time to time, it may be subject to greater risks of adverse developments in such areas of focus than a fund that invests in a wider variety of countries, regions, industries, sectors or investments. From time to time, the trading market for a particular security or type of security in which the Fund invests may become less liquid or even illiquid. The Fund’s prospectus also includes a description of the main investment risks.

1. The Fund has a fee waiver associated with any investment it makes in a Franklin Templeton money fund and/or other Franklin Templeton fund, contractually guaranteed through 8/31/20. Fund investment results reflect the fee waiver; without this waiver, the results would have been lower.

2. Cumulative total return represents the change in value of an investment over the periods indicated.

3. Average annual total return represents the average annual change in value of an investment over the periods indicated. Return for less than one year, if any, has not been annualized.

4. Prior to 9/10/18, these shares were offered at a higher initial sales charge of 5.75%, thus actual returns (with sales charges) would have differed. Average annual total returns (with sales charges) have been restated to reflect the current maximum initial sales charge of 5.50%.

5. Figures are as stated in the Fund’s current prospectus and may differ from the expense ratios disclosed in the Your Fund’s Expenses and Financial Highlights sections in this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

| 20 |

Semiannual Report | franklintempleton.com | ||

FRANKLIN SMALL CAP GROWTH FUND

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs: (1) transaction costs, including sales charges (loads) on Fund purchases and redemptions; and (2) ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses. The table below shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The table below provides information about actual account values and actual expenses in the columns under the heading “Actual.” In these columns the Fund’s actual return, which includes the effect of Fund expenses, is used to calculate the “Ending Account Value” for each class of shares. You can estimate the expenses you paid during the period by following these steps (of course, your account value and expenses will differ from those in this illustration): Divide your account value by $1,000 (if your account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6). Then multiply the result by the number in the row for your class of shares under the headings “Actual” and “Expenses Paid During Period” (if Actual Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50). In this illustration, the actual expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Under the heading “Hypothetical” in the table, information is provided about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. This information may not be used to estimate the actual ending account balance or expenses you paid for the period, but it can help you compare ongoing costs of investing in the Fund with those of other funds. To do so, compare this 5% hypothetical example for the class of shares you hold with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transactional costs. Therefore, information under the heading “Hypothetical” is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transactional costs were included, your total costs would have been higher.

| Actual | Hypothetical | |||||||||||||||||

| (actual return after expenses) | (5% annual return before expenses) | |||||||||||||||||

| Share Class |

Beginning Account Value 5/1/19 |

Ending Account Value 10/31/19 |

Expenses Paid During Period 5/1/19–10/31/191, 2 |

Ending Account Value 10/31/19 |

Expenses Paid During Period 5/1/19–10/31/191, 2 |

Net Annualized Expense Ratio2 | ||||||||||||

| A | $1,000 | $1,000.50 | $5.33 | $1,019.81 | $5.38 | 1.06% | ||||||||||||

| C | $1,000 | $ 997.10 | $9.09 | $1,016.04 | $9.17 | 1.81% | ||||||||||||

| R | $1,000 | $ 999.50 | $6.58 | $1,018.55 | $6.65 | 1.31% | ||||||||||||

| R6 | $1,000 | $1,002.50 | $3.22 | $1,021.92 | $3.25 | 0.64% | ||||||||||||

| Advisor | $1,000 | $1,001.70 | $4.08 | $1,021.06 | $4.12 | 0.81% | ||||||||||||

1. Expenses are equal to the annualized expense ratio for the six-month period as indicated above—in the far right column—multiplied by the simple average account value over the period indicated, and then multiplied by 184/366 to reflect the one-half year period.

2. Reflects expenses after fee waivers and expense reimbursements. Does not include acquired fund fees and expenses.

| franklintempleton.com | Semiannual Report | 21 | ||

Franklin Small-Mid Cap Growth Fund

1. The Russell 2500 Index is market capitalization weighted and measures performance of the 2,500 smallest companies in the Russell 3000 Index, which represent a modest amount of the Russell 3000 Index’s total market capitalization. The Russell Midcap Index is market capitalization weighted and measures performance of the smallest companies in the Russell 1000 Index, which represent a modest amount of the Russell 1000 Index’s total market capitalization.

2. Source: Morningstar.

The indexes are unmanaged and include reinvestment of any income or distributions. They do not reflect any fees, expenses or sales charges. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

See www.franklintempletondatasources.com for additional data provider information.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI).

The SOI begins on page 58.

| 22 |

Semiannual Report | franklintempleton.com | ||

FRANKLIN SMALL-MID CAP GROWTH FUND

| franklintempleton.com | Semiannual Report | 23 | ||

FRANKLIN SMALL-MID CAP GROWTH FUND

| 24 |

Semiannual Report | franklintempleton.com | ||

FRANKLIN SMALL-MID CAP GROWTH FUND

Performance Summary as of October 31, 2019

The performance table does not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses. Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities.

Performance as of 10/31/191

Cumulative total return excludes sales charges. Average annual total return includes maximum sales charges. Sales charges will vary depending on the size of the investment and the class of share purchased. The maximum is 5.50% and the minimum is 0%. Class A: 5.50% maximum initial sales charge; Advisor Class: no sales charges. For other share classes, visit franklintempleton.com.

| Share Class

|

Cumulative Total Return2

|

Average Annual Total Return3 | ||||

|

A4 |

||||||

| 6-Month |

-1.48% | -6.89% | ||||

| 1-Year |

+15.47% | +9.13% | ||||

| 5-Year |

+49.31% | +7.13% | ||||

| 10-Year |

+227.02% | +11.94% | ||||

| Advisor |

||||||

| 6-Month |

-1.36% | -1.36% | ||||

| 1-Year |

+15.69% | +15.69% | ||||

| 5-Year |

+51.12% | +8.61% | ||||

| 10-Year |

+235.27% | +12.86% | ||||

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

See page 26 for Performance Summary footnotes.

| franklintempleton.com | Semiannual Report | 25 | ||

FRANKLIN SMALL-MID CAP GROWTH FUND

PERFORMANCE SUMMARY

Total Annual Operating Expenses5

| Share Class | With Fee Waiver |

Without Fee Waiver | ||

| A |

0.91% | 0.92% | ||

| Advisor |

0.66% | 0.67% | ||

Each class of shares is available to certain eligible investors and has different annual fees and expenses, as described in the prospectus.

All investments involve risks, including possible loss of principal. Growth stock prices reflect projections of future earnings or revenues, and can, therefore, fall dramatically if the company fails to meet those projections. Smaller, midsized and relatively new or unseasoned companies can be particularly sensitive to changing economic conditions, and their prospects for growth are less certain than those of larger, more established companies. Historically, these securities have experienced more price volatility than larger-company stocks, especially over the short term. To the extent the Fund focuses on particular countries, regions, industries, sectors or types of investment from time to time, it may be subject to greater risks of adverse developments in such areas of focus than a fund that invests in a wider variety of countries, regions, industries, sectors or investments. From time to time, the trading market for a particular security or type of security in which the Fund invests may become less liquid or even illiquid. The Fund’s prospectus also includes a description of the main investment risks.

1. The Fund has a fee waiver associated with any investment it makes in a Franklin Templeton money fund and/or other Franklin Templeton fund, contractually guaranteed through 8/31/20. Fund investment results reflect the expense reduction and fee waiver; without these reductions, the results would have been lower.

2. Cumulative total return represents the change in value of an investment over the periods indicated.

3. Average annual total return represents the average annual change in value of an investment over the periods indicated. Return for less than one year, if any, has not been annualized.

4. Prior to 9/10/18, these shares were offered at a higher initial sales charge of 5.75%, thus actual returns (with sales charges) would have differed. Average annual total returns (with sales charges) have been restated to reflect the current maximum initial sales charge of 5.50%.

5. Figures are as stated in the Fund’s current prospectus and may differ from the expense ratios disclosed in the Your Fund’s Expenses and Financial Highlights sections in this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

| 26 |

Semiannual Report | franklintempleton.com | ||

FRANKLIN SMALL-MID CAP GROWTH FUND

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs: (1) transaction costs, including sales charges (loads) on Fund purchases and redemptions; and (2) ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses. The table below shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The table below provides information about actual account values and actual expenses in the columns under the heading “Actual.” In these columns the Fund’s actual return, which includes the effect of Fund expenses, is used to calculate the “Ending Account Value” for each class of shares. You can estimate the expenses you paid during the period by following these steps (of course, your account value and expenses will differ from those in this illustration): Divide your account value by $1,000 (if your account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6). Then multiply the result by the number in the row for your class of shares under the headings “Actual” and “Expenses Paid During Period” (if Actual Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50). In this illustration, the actual expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Under the heading “Hypothetical” in the table, information is provided about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. This information may not be used to estimate the actual ending account balance or expenses you paid for the period, but it can help you compare ongoing costs of investing in the Fund with those of other funds. To do so, compare this 5% hypothetical example for the class of shares you hold with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transactional costs. Therefore, information under the heading “Hypothetical” is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transactional costs were included, your total costs would have been higher.

| Actual | Hypothetical | |||||||||||||||||

| (actual return after expenses) | (5% annual return before expenses) | |||||||||||||||||

| Share Class |

Beginning Account Value 5/1/19 |

Ending Account Value 10/31/19 |

Expenses Paid During Period 5/1/19–10/31/191, 2 |

Ending Account Value 10/31/19 |

Expenses Paid During Period 5/1/19–10/31/191, 2 |

Net Annualized Expense Ratio2 | ||||||||||||

| A | $1,000 | $985.20 | $4.39 | $1,020.71 | $4.47 | 0.88% | ||||||||||||

| C | $1,000 | $981.60 | $8.12 | $1,016.94 | $8.26 | 1.63% | ||||||||||||

| R | $1,000 | $984.00 | $5.59 | $1,019.51 | $5.69 | 1.12% | ||||||||||||

| R6 | $1,000 | $987.10 | $2.40 | $1,022.72 | $2.44 | 0.48% | ||||||||||||

| Advisor | $1,000 | $986.40 | $3.15 | $1,021.97 | $3.20 | 0.63% | ||||||||||||

1. Expenses are equal to the annualized expense ratio for the six-month period as indicated above—in the far right column—multiplied by the simple average account value over the period indicated, and then multiplied by 184/366 to reflect the one-half year period.

2. Reflects expenses after fee waivers and expense reimbursements. Does not include acquired fund fees and expenses.

| franklintempleton.com | Semiannual Report | 27 | ||

FRANKLIN STRATEGIC SERIES

Franklin Growth Opportunities Fund

| Six Months Ended (unaudited) |

Year Ended April 30, | |||||||||||||||||||||||

| 2019 | 2018 | 2017 | 2016 | 2015 | ||||||||||||||||||||

| Class A |

||||||||||||||||||||||||

| Per share operating performance (for a share outstanding throughout the period) |

||||||||||||||||||||||||

| Net asset value, beginning of period |

$39.57 | $38.58 | $34.81 | $30.40 | $33.13 | $28.48 | ||||||||||||||||||

| Income from investment operationsa: |

||||||||||||||||||||||||

| Net investment income (loss)b |

(0.07 | ) | (0.13 | ) | (0.10 | ) | (0.09 | ) | (0.19 | ) | (0.19 | ) | ||||||||||||

| Net realized and unrealized gains (losses) |

0.36 | 5.29 | 7.03 | 5.14 | (1.88 | ) | 5.50 | |||||||||||||||||

| Total from investment operations |

0.29 | 5.16 | 6.93 | 5.05 | (2.07 | ) | 5.31 | |||||||||||||||||

| Less distributions from: |

||||||||||||||||||||||||

| Net realized gains |

— | (4.17 | ) | (3.16 | ) | (0.64 | ) | (0.66 | ) | (0.66 | ) | |||||||||||||

| Net asset value, end of period |

$39.86 | $39.57 | $38.58 | $34.81 | $30.40 | $33.13 | ||||||||||||||||||

| Total returnc |

0.73% | 15.91% | 20.43% | 16.88% | (6.36)% | 18.87% | ||||||||||||||||||

| Ratios to average net assetsd |

||||||||||||||||||||||||

| Expenses before waiver and payments by affiliates |

0.95% | 0.94% | 1.02% | 1.05% | 1.11% | 1.18% | ||||||||||||||||||

| Expenses net of waiver and payments by affiliates |

0.95% | e,f | 0.94% | e,f | 0.99% | e | 0.97% | e | 1.10% | 1.18% | f | |||||||||||||

| Net investment income (loss) |

(0.33)% | (0.32)% | (0.27)% | (0.30)% | (0.58)% | (0.59)% | ||||||||||||||||||

| Supplemental data |

||||||||||||||||||||||||

| Net assets, end of period (000’s) |

$2,789,241 | $2,819,007 | $2,428,175 | $2,272,831 | $548,871 | $457,619 | ||||||||||||||||||

| Portfolio turnover rate |

10.75% | 24.21% | 22.68% | 47.75% | 25.56% | 40.64% | ||||||||||||||||||

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bBased on average daily shares outstanding.

cTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable, and is not annualized for periods less than one year.

dRatios are annualized for periods less than one year.

eBenefit of expense reduction rounds to less than 0.01%.

fBenefit of waiver and payments by affiliates rounds to less than 0.01%.

| 28 |

Semiannual Report | The accompanying notes are an integral part of these financial statements. | franklintempleton.com | ||

FRANKLIN STRATEGIC SERIES

FINANCIAL HIGHLIGHTS

Franklin Growth Opportunities Fund (continued)

| Six Months Ended (unaudited) |

Year Ended April 30, | |||||||||||||||||||||||

| 2019 | 2018 | 2017 | 2016 | 2015 | ||||||||||||||||||||

| Class C |

||||||||||||||||||||||||

| Per share operating performance (for a share outstanding throughout the period) |

||||||||||||||||||||||||

| Net asset value, beginning of period |

$32.47 | $32.67 | $30.12 | $26.59 | $29.27 | $25.41 | ||||||||||||||||||

| Income from investment operationsa: |

||||||||||||||||||||||||

| Net investment income (loss)b |

(0.18 | ) | (0.35 | ) | (0.33 | ) | (0.29 | ) | (0.37 | ) | (0.36 | ) | ||||||||||||

| Net realized and unrealized gains (losses) |

0.30 | 4.32 | 6.04 | 4.46 | (1.65 | ) | 4.88 | |||||||||||||||||

| Total from investment operations |

0.12 | 3.97 | 5.71 | 4.17 | (2.02 | ) | 4.52 | |||||||||||||||||

| Less distributions from: |

||||||||||||||||||||||||

| Net realized gains |

— | (4.17 | ) | (3.16 | ) | (0.64 | ) | (0.66 | ) | (0.66 | ) | |||||||||||||

| Net asset value, end of period |

$32.59 | $32.47 | $32.67 | $30.12 | $26.59 | $29.27 | ||||||||||||||||||

| Total returnc |

0.37% | 15.10% | 19.53% | 15.98% | (7.03)% | 18.04% | ||||||||||||||||||

| Ratios to average net assetsd |

||||||||||||||||||||||||

| Expenses before waiver and payments by affiliates |

1.70% | 1.69% | 1.77% | 1.80% | 1.85% | 1.88% | ||||||||||||||||||

| Expenses net of waiver and payments by affiliates |

1.70% | e,f | 1.69% | e,f | 1.74% | e | 1.72% | e | 1.84% | 1.88% | f | |||||||||||||

| Net investment income (loss) |

(1.08)% | (1.07)% | (1.02)% | (1.05)% | (1.32)% | (1.29)% | ||||||||||||||||||

| Supplemental data |

||||||||||||||||||||||||

| Net assets, end of period (000’s) |

$216,250 | $244,574 | $400,295 | $390,123 | $137,882 | $110,513 | ||||||||||||||||||

| Portfolio turnover rate |

10.75% | 24.21% | 22.68% | 47.75% | 25.56% | 40.64% | ||||||||||||||||||

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bBased on average daily shares outstanding.

cTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable, and is not annualized for periods less than one year.

dRatios are annualized for periods less than one year.

eBenefit of expense reduction rounds to less than 0.01%.

fBenefit of waiver and payments by affiliates rounds to less than 0.01%.

| franklintempleton.com | The accompanying notes are an integral part of these financial statements. | Semiannual Report | 29 | ||

FRANKLIN STRATEGIC SERIES

FINANCIAL HIGHLIGHTS

Franklin Growth Opportunities Fund (continued)

| Six Months Ended (unaudited) |

Year Ended April 30, |

|||||||||||||||||||||||

| 2019 | 2018 | 2017 | 2016 | 2015 | ||||||||||||||||||||

| Class R |

||||||||||||||||||||||||

| Per share operating performance (for a share outstanding throughout the period) |

||||||||||||||||||||||||

| Net asset value, beginning of period |

$37.57 | $36.93 | $33.52 | $29.37 | $32.10 | $27.67 | ||||||||||||||||||

| Income from investment operationsa: |

||||||||||||||||||||||||

| Net investment income (loss)b |

(0.11 | ) | (0.21 | ) | (0.18 | ) | (0.17 | ) | (0.26 | ) | (0.24 | ) | ||||||||||||

| Net realized and unrealized gains (losses) |

0.34 | 5.02 | 6.75 | 4.96 | (1.81 | ) | 5.33 | |||||||||||||||||

| Total from investment operations |

0.23 | 4.81 | 6.57 | 4.79 | (2.07 | ) | 5.09 | |||||||||||||||||

| Less distributions from: |

||||||||||||||||||||||||

| Net realized gains |

— | (4.17 | ) | (3.16 | ) | (0.64 | ) | (0.66 | ) | (0.66 | ) | |||||||||||||

| Net asset value, end of period |

$37.80 | $37.57 | $36.93 | $33.52 | $29.37 | $32.10 | ||||||||||||||||||

| Total returnc |

0.61% | 15.66% | 20.14% | 16.62% | (6.60)% | 18.63% | ||||||||||||||||||

| Ratios to average net assetsd |

||||||||||||||||||||||||

| Expenses before waiver and payments by affiliates |

1.20% | 1.19% | 1.27% | 1.30% | 1.35% | 1.38% | ||||||||||||||||||

| Expenses net of waiver and payments by affiliates |

1.20% | e,f | 1.19% | e,f | 1.24% | e | 1.22% | e | 1.34% | 1.38% | f | |||||||||||||

| Net investment income (loss) |

(0.58)% | (0.57)% | (0.52)% | (0.55)% | (0.82)% | (0.79)% | ||||||||||||||||||

| Supplemental data |

||||||||||||||||||||||||

| Net assets, end of period (000’s) |

$33,409 | $37,105 | $36,582 | $50,429 | $39,786 | $48,266 | ||||||||||||||||||

| Portfolio turnover rate |

10.75% | 24.21 | % | 22.68% | 47.75% | 25.56% | 40.64% | |||||||||||||||||

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bBased on average daily shares outstanding.

cTotal return is not annualized for periods less than one year.

dRatios are annualized for periods less than one year.

eBenefit of expense reduction rounds to less than 0.01%.

fBenefit of waiver and payments by affiliates rounds to less than 0.01%.

| 30 |

Semiannual Report | The accompanying notes are an integral part of these financial statements. | franklintempleton.com | ||

FRANKLIN STRATEGIC SERIES

FINANCIAL HIGHLIGHTS

Franklin Growth Opportunities Fund (continued)

| Six Months Ended (unaudited) |

Year Ended April 30, | |||||||||||||||||||||||

| 2019 | 2018 | 2017 | 2016 | 2015 | ||||||||||||||||||||

| Class R6 |

||||||||||||||||||||||||

| Per share operating performance (for a share outstanding throughout the period) |

||||||||||||||||||||||||

| Net asset value, beginning of period |

$43.42 | $41.78 | $37.30 | $32.39 | $35.09 | $29.98 | ||||||||||||||||||

| Income from investment operationsa: |

||||||||||||||||||||||||

| Net investment income (loss)b |

0.01 | 0.01 | 0.07 | 0.05 | (0.05 | ) | (0.03 | ) | ||||||||||||||||

| Net realized and unrealized gains (losses) |

0.40 | 5.80 | 7.57 | 5.50 | (1.99 | ) | 5.80 | |||||||||||||||||

| Total from investment operations |

0.41 | 5.81 | 7.64 | 5.55 | (2.04 | ) | 5.77 | |||||||||||||||||

| Less distributions from: |

||||||||||||||||||||||||

| Net realized gains |

— | (4.17 | ) | (3.16 | ) | (0.64 | ) | (0.66 | ) | (0.66 | ) | |||||||||||||

| Net asset value, end of period |

$43.83 | $43.42 | $41.78 | $37.30 | $32.39 | $35.09 | ||||||||||||||||||

| Total returnc |

0.94% | 16.26% | 20.98% | 17.42% | (5.94)% | 19.47% | ||||||||||||||||||

| Ratios to average net assetsd |

||||||||||||||||||||||||

| Expenses before waiver and payments by affiliates |

0.59% | 0.59% | 0.58% | 0.59% | 0.67% | 0.68% | ||||||||||||||||||

| Expenses net of waiver and payments by affiliates |

0.59% | e,f | 0.58% | e | 0.55% | e | 0.51% | e | 0.66% | 0.68% | f | |||||||||||||

| Net investment income (loss) |

0.03% | 0.04% | 0.17% | 0.16% | (0.14)% | (0.09)% | ||||||||||||||||||

| Supplemental data |

||||||||||||||||||||||||

| Net assets, end of period (000’s) |

$384,159 | $418,174 | $369,688 | $291,825 | $235,620 | $246,911 | ||||||||||||||||||

| Portfolio turnover rate |

10.75% | 24.21% | 22.68% | 47.75% | 25.56% | 40.64% | ||||||||||||||||||

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bBased on average daily shares outstanding.

cTotal return is not annualized for periods less than one year.

dRatios are annualized for periods less than one year.

eBenefit of expense reduction rounds to less than 0.01%.

fBenefit of waiver and payments by affiliates rounds to less than 0.01%.

| franklintempleton.com | The accompanying notes are an integral part of these financial statements. | Semiannual Report | 31 | ||

FRANKLIN STRATEGIC SERIES

FINANCIAL HIGHLIGHTS

Franklin Growth Opportunities Fund (continued)

| Six Months Ended (unaudited) |

Year Ended April 30, | |||||||||||||||||||||||

| 2019 | 2018 | 2017 | 2016 | 2015 | ||||||||||||||||||||

| Advisor Class |

||||||||||||||||||||||||

| Per share operating performance (for a share outstanding throughout the period) |

||||||||||||||||||||||||

| Net asset value, beginning of period |

$42.87 | $41.34 | $37.02 | $32.20 | $34.96 | $29.93 | ||||||||||||||||||

| Income from investment operationsa: |

||||||||||||||||||||||||

| Net investment income (loss)b |

(0.02 | ) | (0.03 | ) | (0.01 | ) | (0.02 | ) | (0.11 | ) | (0.10 | ) | ||||||||||||

| Net realized and unrealized gains (losses) |

0.39 | 5.73 | 7.49 | 5.48 | (1.99 | ) | 5.79 | |||||||||||||||||

| Total from investment operations |

0.37 | 5.70 | 7.48 | 5.46 | (2.10 | ) | 5.69 | |||||||||||||||||

| Less distributions from: |

||||||||||||||||||||||||

| Net realized gains |

— | (4.17 | ) | (3.16 | ) | (0.64 | ) | (0.66 | ) | (0.66 | ) | |||||||||||||

| Net asset value, end of period |

$43.24 | $42.87 | $41.34 | $37.02 | $32.20 | $34.96 | ||||||||||||||||||

| Total returnc |

0.86% | 16.16% | 20.71% | 17.21% | (6.11)% | 19.23% | ||||||||||||||||||

| Ratios to average net assetsd |

||||||||||||||||||||||||

| Expenses before waiver and payments by affiliates |

0.70% | 0.69% | 0.77% | 0.80% | 0.85% | 0.88% | ||||||||||||||||||

| Expenses net of waiver and payments by affiliates |

0.70% | e,f | 0.69% | e,f | 0.74% | e | 0.72% | e | 0.84% | 0.88% | f | |||||||||||||

| Net investment income (loss) |

(0.08)% | (0.07)% | (0.02)% | (0.05)% | (0.32)% | (0.29)% | ||||||||||||||||||

| Supplemental data |

||||||||||||||||||||||||

| Net assets, end of period (000’s) |

$488,064 | $506,964 | $583,509 | $537,193 | $256,377 | $269,887 | ||||||||||||||||||

| Portfolio turnover rate |

10.75% | 24.21% | 22.68% | 47.75% | 25.56% | 40.64% | ||||||||||||||||||

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bBased on average daily shares outstanding.

cTotal return is not annualized for periods less than one year.

dRatios are annualized for periods less than one year.

eBenefit of expense reduction rounds to less than 0.01%.

fBenefit of waiver and payments by affiliates rounds to less than 0.01%.

| 32 |

Semiannual Report | The accompanying notes are an integral part of these financial statements. | franklintempleton.com | ||

FRANKLIN STRATEGIC SERIES

Statement of Investments, October 31, 2019 (unaudited)

Franklin Growth Opportunities Fund

| Country | Shares | Value | ||||||||||

| Common Stocks 96.4% |

||||||||||||

| Communication Services 6.7% |

||||||||||||

| a Alphabet Inc., C |

United States | 100,358 | $ | 126,462,119 | ||||||||

| a Facebook Inc., A |

United States | 151,743 | 29,081,546 | |||||||||

| a Liberty Broadband Corp., C |

United States | 356,818 | 42,129,501 | |||||||||

| a Netflix Inc. |

United States | 90,227 | 25,932,142 | |||||||||

| a Pinterest Inc., A |

United States | 252,500 | 6,347,850 | |||||||||

| The Walt Disney Co. |

United States | 254,576 | 33,074,514 | |||||||||

|

|

|

|||||||||||

| 263,027,672 | ||||||||||||

|

|

|

|||||||||||

| Consumer Discretionary 10.1% |

||||||||||||

| a Amazon.com Inc. |

United States | 159,953 | 284,182,097 | |||||||||

| Aptiv PLC |

United States | 295,903 | 26,498,114 | |||||||||

| a Chipotle Mexican Grill Inc. |

United States | 18,164 | 14,134,498 | |||||||||

| Levi Strauss & Co., A |

United States | 833,386 | 14,850,939 | |||||||||

| NIKE Inc., B |

United States | 199,306 | 17,847,852 | |||||||||

| a,b Peloton Interactive Inc. A |

United States | 663,400 | 15,835,358 | |||||||||

| a Under Armour Inc., A |

United States | 975,314 | 20,140,234 | |||||||||

|

|

|

|||||||||||

| 393,489,092 | ||||||||||||

|

|

|

|||||||||||

| Consumer Staples 3.0% |

||||||||||||

| Constellation Brands Inc., A |

United States | 189,271 | 36,023,949 | |||||||||

| Lamb Weston Holdings Inc. |

United States | 558,234 | 43,564,581 | |||||||||

| a Monster Beverage Corp. |

United States | 352,068 | 19,761,577 | |||||||||

| a Nomad Foods Ltd. |

United Kingdom | 959,344 | 18,716,802 | |||||||||

|

|

|

|||||||||||

| 118,066,909 | ||||||||||||

|

|

|

|||||||||||

| Energy 0.6% |

||||||||||||

| Diamondback Energy Inc. |

United States | 274,301 | 23,524,054 | |||||||||

|

|

|

|||||||||||

| Financials 6.3% |

||||||||||||

| The Charles Schwab Corp. |

United States | 714,275 | 29,078,135 | |||||||||

| Intercontinental Exchange Inc. |

United States | 573,935 | 54,133,549 | |||||||||

| MarketAxess Holdings Inc. |

United States | 110,073 | 40,571,807 | |||||||||

| MSCI Inc. |

United States | 279,833 | 65,637,629 | |||||||||

| S&P Global Inc. |

United States | 227,424 | 58,673,118 | |||||||||

|

|

|

|||||||||||

| 248,094,238 | ||||||||||||

|

|

|

|||||||||||

| Health Care 16.7% |

||||||||||||

| AstraZeneca PLC, ADR |

United Kingdom | 310,659 | 15,231,611 | |||||||||

| a Edwards Lifesciences Corp. |

United States | 288,115 | 68,680,854 | |||||||||

| a Elanco Animal Health Inc. |

United States | 373,022 | 10,079,054 | |||||||||

| a Guardant Health Inc. |

United States | 259,017 | 18,001,682 | |||||||||

| a GW Pharmaceuticals PLC, ADR |

United Kingdom | 298,788 | 39,983,810 | |||||||||

| a Heron Therapeutics Inc. |

United States | 2,669,546 | 56,727,853 | |||||||||

| a IDEXX Laboratories Inc. |

United States | 120,554 | 34,359,096 | |||||||||

| a Illumina Inc. |

United States | 111,581 | 32,974,417 | |||||||||

| a Intuitive Surgical Inc. |

United States | 69,742 | 38,563,839 | |||||||||

| a Nevro Corp. |

United States | 492,387 | 42,443,759 | |||||||||

| a PTC Therapeutics Inc. |

United States | 582,961 | 23,837,275 | |||||||||

| a Reata Pharmaceuticals Inc. |

United States | 198,956 | 41,000,852 | |||||||||

| a Sage Therapeutics Inc. |

United States | 189,601 | 25,719,376 | |||||||||

| franklintempleton.com | Semiannual Report | 33 | ||

FRANKLIN STRATEGIC SERIES

STATEMENT OF INVESTMENTS (UNAUDITED)

Franklin Growth Opportunities Fund (continued)

| Country | Shares | Value | ||||||||||

| Common Stocks (continued) |

||||||||||||

| Health Care (continued) |

||||||||||||

| a,b SmileDirectClub Inc., A |

United States | 947,498 | $ | 11,080,989 | ||||||||

| UnitedHealth Group Inc. |

United States | 309,579 | 78,230,613 | |||||||||

| a Veeva Systems Inc. |

United States | 396,044 | 56,170,921 | |||||||||

| West Pharmaceutical Services Inc. |

United States | 419,011 | 60,270,542 | |||||||||

|

|

|

|||||||||||

| 653,356,543 | ||||||||||||

|

|

|

|||||||||||

| Industrials 11.0% |

||||||||||||

| The Boeing Co. |

United States | 98,253 | 33,397,177 | |||||||||

| a CoStar Group Inc. |

United States | 173,822 | 95,518,665 | |||||||||

| Honeywell International Inc. |

United States | 220,100 | 38,017,873 | |||||||||

| a IHS Markit Ltd. |

United States | 636,224 | 44,548,405 | |||||||||

| Raytheon Co. |

United States | 284,676 | 60,411,094 | |||||||||

| Roper Technologies Inc. |

United States | 128,568 | 43,322,273 | |||||||||

| Stanley Black & Decker Inc. |

United States | 170,015 | 25,728,370 | |||||||||

| a Univar Solutions Inc. |

United States | 950,507 | 20,397,880 | |||||||||

| Verisk Analytics Inc. |

United States | 475,500 | 68,804,850 | |||||||||

|

|

|

|||||||||||

| 430,146,587 | ||||||||||||

|

|

|

|||||||||||

| Information Technology 37.6% |

||||||||||||

| a Adobe Inc. |

United States | 289,002 | 80,322,326 | |||||||||

| Analog Devices Inc. |

United States | 288,071 | 30,717,011 | |||||||||

| Apple Inc. |

United States | 441,508 | 109,829,530 | |||||||||

| a Autodesk Inc. |

United States | 150,687 | 22,205,236 | |||||||||

| a Black Knight Inc. |

United States | 328,967 | 21,119,681 | |||||||||

| a CloudFlare Inc., A |

United States | 538,600 | 9,070,024 | |||||||||

| a Fiserv Inc. |

United States | 326,248 | 34,627,963 | |||||||||

| a Guidewire Software Inc. |

United States | 202,085 | 22,783,063 | |||||||||

| a InterXion Holding NV |

Netherlands | 563,175 | 49,683,299 | |||||||||

| Intuit Inc. |

United States | 73,846 | 19,015,345 | |||||||||

| a,c,d LegalZoom.com Inc. |

United States | 1,673,284 | 19,343,163 | |||||||||

| Mastercard Inc., A |

United States | 770,242 | 213,210,688 | |||||||||

| Microsoft Corp. |

United States | 1,566,958 | 224,654,768 | |||||||||

| Monolithic Power Systems |

United States | 238,216 | 35,713,343 | |||||||||

| NVIDIA Corp. |

United States | 172,870 | 34,750,327 | |||||||||

| a PayPal Holdings Inc. |

United States | 439,183 | 45,718,950 | |||||||||

| a Pluralsight Inc., A |

United States | 462,013 | 8,353,195 | |||||||||

| a PTC Inc. |

United States | 295,541 | 19,774,648 | |||||||||

| a salesforce.com Inc. |

United States | 258,798 | 40,499,299 | |||||||||

| a ServiceNow Inc. |

United States | 411,296 | 101,697,049 | |||||||||

| a Twilio Inc., A |

United States | 385,850 | 37,257,676 | |||||||||

| a Tyler Technologies Inc. |

United States | 97,251 | 26,113,839 | |||||||||

| Visa Inc., A |

United States | 970,899 | 173,654,995 | |||||||||

| a Workday Inc., A |

United States | 137,191 | 22,246,893 | |||||||||

| Xilinx Inc. |

United States | 327,669 | 29,732,685 | |||||||||

| a Zendesk Inc. |

United States | 522,791 | 36,935,184 | |||||||||

|

|

|

|||||||||||

| 1,469,030,180 | ||||||||||||

|

|

|

|||||||||||

| Materials 0.5% |

||||||||||||

| a Ingevity Corp. |

United States | 230,041 | 19,371,753 | |||||||||

|

|

|

|||||||||||

| 34 |

Semiannual Report | franklintempleton.com | ||

FRANKLIN STRATEGIC SERIES

STATEMENT OF INVESTMENTS (UNAUDITED)

Franklin Growth Opportunities Fund (continued)

| Country | Shares | Value | ||||||||||

| Common Stocks (continued) |

||||||||||||

| Real Estate 3.9% |

||||||||||||

| American Tower Corp. |

United States | 173,495 | $ | 37,835,790 | ||||||||

| SBA Communications Corp., A |

United States | 472,242 | 113,645,037 | |||||||||

|

|

|

|||||||||||

| 151,480,827 | ||||||||||||

|

|

|

|||||||||||

| Total Common Stocks (Cost $1,892,593,642) |

3,769,587,855 | |||||||||||

|

|

|

|||||||||||

| Preferred Stocks 3.6% |

||||||||||||

| Communication Services 0.1% |

||||||||||||

| a,c,d Tanium Inc., pfd., G |

United States | 805,800 | 5,565,263 | |||||||||

|

|

|

|||||||||||

| Consumer Discretionary 1.9% |

||||||||||||

| a,c,d ClearMotion Inc., pfd., C |

United States | 2,610,594 | 9,016,731 | |||||||||

| a,c,d ClearMotion Inc., pfd., D |

United States | 3,698,772 | 13,425,684 | |||||||||

| a,c,d Proterra Inc., pfd., 5, 144A |

United States | 2,362,202 | 20,249,183 | |||||||||

| a,c,d Proterra Inc., pfd., 6, 144A |

United States | 596,775 | 5,115,653 | |||||||||

| a,c,d Proterra Inc., pfd., 7 |

United States | 780,667 | 6,692,005 | |||||||||

| a,c,d Proterra Inc., pfd., 8 |

United States | 289,016 | 2,477,493 | |||||||||

| a,c,d Sweetgreen Inc., pfd., H |

United States | 928,488 | 14,450,552 | |||||||||

| a,c,d Sweetgreen Inc., pfd., I |

United States | 100,835 | 1,753,299 | |||||||||

|

|

|

|||||||||||

| 73,180,600 | ||||||||||||

|

|

|

|||||||||||

| Financials 0.4% |

||||||||||||

| a,c,d Bill.com, pfd., H |

United States | 1,624,999 | 15,820,859 | |||||||||

|

|

|

|||||||||||

| Health Care 0.3% |

||||||||||||

| a,c,d Tempus Labs Inc., pfd., F |

United States | 504,854 | 12,499,983 | |||||||||

|

|

|

|||||||||||

| Industrials 0.8% |

||||||||||||

| a,c,d Optoro Inc., pfd., E |

United States | 509,182 | 12,614,393 | |||||||||

| a,c,d Wheels Up Partners LLC, pfd., D |

United States | 5,028,735 | 17,297,043 | |||||||||

|

|

|

|||||||||||

| 29,911,436 | ||||||||||||

|

|

|

|||||||||||

| Information Technology 0.1% |

||||||||||||

| a,c,d GitLab Inc., pfd., E |

United States | 201,294 | 3,749,986 | |||||||||

|

|

|

|||||||||||

| Total Preferred Stocks (Cost $112,896,675) |

140,728,127 | |||||||||||

|

|

|

|||||||||||

| Total Investments before Short Term Investments |

3,910,315,982 | |||||||||||

|

|

|

|||||||||||

| Short Term Investments 0.6% |

||||||||||||

| Money Market Funds (Cost $8,229,451) 0.2% |

||||||||||||

| e,f Institutional Fiduciary Trust Money Market Portfolio, 1.56% |

United States | 8,229,451 | 8,229,451 | |||||||||

|

|

|

|||||||||||

| franklintempleton.com | Semiannual Report | 35 | ||

FRANKLIN STRATEGIC SERIES

STATEMENT OF INVESTMENTS (UNAUDITED)

Franklin Growth Opportunities Fund (continued)

| Country | Shares | Value | ||||||||||

| Short Term Investments (continued) |

||||||||||||

| g Investments from Cash Collateral Received

for Loaned Securities |

||||||||||||

| Money Market Funds 0.4% |

||||||||||||

| e,f Institutional Fiduciary Trust Money Market Portfolio, 1.56% |

United States | 15,554,345 | $ | 15,554,345 | ||||||||

|

|

|

|||||||||||

| Total Investments (Cost $2,029,274,113) 100.6% |

3,934,099,778 | |||||||||||

| Other Assets, less Liabilities (0.6)% |

(22,976,318 | ) | ||||||||||

|

|

|

|||||||||||

| Net Assets 100.0% |

$ | 3,911,123,460 | ||||||||||

|

|

|

|||||||||||

See Abbreviations on page 87.

aNon-income producing.

bA portion or all of the security is on loan at October 31, 2019. See Note 1(c).

cFair valued using significant unobservable inputs. See Note 11 regarding fair value measurements.

dSee Note 7 regarding restricted securities.

eSee Note 3(f) regarding investments in affiliated management investment companies.

fThe rate shown is the annualized seven-day effective yield at period end.

gSee Note 1(c) regarding securities on loan.

| 36 |

Semiannual Report | The accompanying notes are an integral part of these financial statements. | franklintempleton.com | ||

FRANKLIN STRATEGIC SERIES

Financial Highlights

Franklin Select U.S. Equity Fund

| Six Months Ended (unaudited) |

Year Ended April 30, |

|||||||||||||||||||||||

| 2019 | 2018 | 2017 | 2016 | 2015 | ||||||||||||||||||||

| Class A |

||||||||||||||||||||||||

| Per share operating performance (for a share outstanding throughout the period) |

||||||||||||||||||||||||

| Net asset value, beginning of period |

$15.51 | $16.32 | $15.20 | $13.12 | $15.29 | $13.38 | ||||||||||||||||||

| Income from investment operationsa: |

||||||||||||||||||||||||

| Net investment income (loss)b |

(0.02 | ) | (0.04 | ) | (0.04 | ) | (0.01 | ) | 0.07 | c | (0.01 | ) | ||||||||||||

| Net realized and unrealized gains (losses) |

0.45 | 1.41 | 1.16 | 2.09 | (1.83 | ) | 2.23 | |||||||||||||||||

| Total from investment operations |

0.43 | 1.37 | 1.12 | 2.08 | (1.76 | ) | 2.22 | |||||||||||||||||

| Less distributions from: |

||||||||||||||||||||||||

| Net investment income |

— | — | — | — | (0.06 | ) | — | |||||||||||||||||

| Net realized gains |

— | (2.18 | ) | — | — | (0.35 | ) | (0.31 | ) | |||||||||||||||

| Total distributions |

— | (2.18 | ) | — | — | (0.41 | ) | (0.31 | ) | |||||||||||||||

| Net asset value, end of period |

$15.94 | $15.51 | $16.32 | $15.20 | $13.12 | $15.29 | ||||||||||||||||||

| Total returnd |

2.77% | 10.72% | 7.37% | 15.85% | (11.70)% | 16.84% | ||||||||||||||||||

| Ratios to average net assetse |

||||||||||||||||||||||||

| Expenses before waiver and payments by affiliates |

1.52% | 1.51% | 1.54% | 1.47% | 1.46% | 1.54% | ||||||||||||||||||

| Expenses net of waiver and payments by affiliates |

1.22% | f | 1.23% | f | 1.25% | f | 1.24% | f | 1.25% | 1.28% | ||||||||||||||

| Net investment income (loss) |

(0.22)% | (0.22)% | (0.25)% | (0.04)% | 0.48% | c | (0.07)% | |||||||||||||||||

| Supplemental data |

||||||||||||||||||||||||

| Net assets, end of period (000’s) |

$73,558 | $77,230 | $65,565 | $77,733 | $100,483 | $92,612 | ||||||||||||||||||

| Portfolio turnover rate |

—% | 4.79% | 93.43% | 17.45% | 35.56% | 25.55% | ||||||||||||||||||

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bBased on average daily shares outstanding.

cNet investment income per share includes approximately $0.06 per share related to income received in the form of special dividends in connection with certain Fund holdings. Excluding this amount, the ratio of net investment income to average net assets would have been 0.02%.

dTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable, and is not annualized for periods less than one year.

eRatios are annualized for periods less than one year, except for non-recurring expenses, if any.

fBenefit of expense reduction rounds to less than 0.01%.

| franklintempleton.com | The accompanying notes are an integral part of these financial statements. | Semiannual Report | 37 | ||

FRANKLIN STRATEGIC SERIES

FINANCIAL HIGHLIGHTS

Franklin Select U.S. Equity Fund (continued)

| Six Months Ended (unaudited) |

Year Ended April 30, |

|||||||||||||||||||||||

| 2019 | 2018 | 2017 | 2016 | 2015 | ||||||||||||||||||||

| Class C |

||||||||||||||||||||||||

| Per share operating performance (for a share outstanding throughout the period) |

||||||||||||||||||||||||

| Net asset value, beginning of period |

$14.40 | $15.42 | $14.46 | $12.58 | $14.73 | $12.98 | ||||||||||||||||||

| Income from investment operationsa: |

||||||||||||||||||||||||

| Net investment income (loss)b |

(0.07 | ) | (0.15 | ) | (0.15 | ) | (0.10 | ) | (0.04 | )c | (0.11 | ) | ||||||||||||

| Net realized and unrealized gains (losses) |

0.41 | 1.31 | 1.11 | 1.98 | (1.76 | ) | 2.17 | |||||||||||||||||

| Total from investment operations |

0.34 | 1.16 | 0.96 | 1.88 | (1.80 | ) | 2.06 | |||||||||||||||||

| Less distributions from: |

||||||||||||||||||||||||

| Net realized gains |

— | (2.18 | ) | — | — | (0.35 | ) | (0.31 | ) | |||||||||||||||

| Net asset value, end of period |

$14.74 | $14.40 | $15.42 | $14.46 | $12.58 | $14.73 | ||||||||||||||||||

| Total returnd |

2.36% | 9.95% | 6.64% | 14.94% | (12.31)% | 16.12% | ||||||||||||||||||

| Ratios to average net assetse |

||||||||||||||||||||||||

| Expenses before waiver and payments by affiliates |

2.27% | 2.26% | 2.29% | 2.21% | 2.20% | 2.24% | ||||||||||||||||||

| Expenses net of waiver and payments by affiliates |

1.97% | f | 1.98% | f | 2.00% | f | 1.98% | f | 1.99% | 1.98% | ||||||||||||||

| Net investment income (loss) |

(0.97)% | (0.97)% | (1.00)% | (0.78)% | (0.26)% | c | (0.77)% | |||||||||||||||||

| Supplemental data |

||||||||||||||||||||||||

| Net assets, end of period (000’s) |

$13,465 | $15,702 | $18,103 | $20,341 | $25,119 | $18,758 | ||||||||||||||||||

| Portfolio turnover rate |

—% | 4.79% | 93.43% | 17.45% | 35.56% | 25.55% | ||||||||||||||||||

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bBased on average daily shares outstanding.

cNet investment income per share includes approximately $0.06 per share related to income received in the form of special dividends in connection with certain Fund holdings. Excluding this amount, the ratio of net investment income to average net assets would have been (0.72)%.

dTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable, and is not annualized for periods less than one year.

eRatios are annualized for periods less than one year, except for non-recurring expenses, if any.

fBenefit of expense reduction rounds to less than 0.01%.

| 38 |

Semiannual Report | The accompanying notes are an integral part of these financial statements. | franklintempleton.com | ||

FRANKLIN STRATEGIC SERIES

FINANCIAL HIGHLIGHTS

Franklin Select U.S. Equity Fund (continued)

| Six Months Ended (unaudited) |

Year Ended April 30, |

|||||||||||||||||||||||

| 2019 | 2018 | 2017 | 2016 | 2015 | ||||||||||||||||||||

| Class R |

||||||||||||||||||||||||

| Per share operating performance (for a share outstanding throughout the period) |

||||||||||||||||||||||||

| Net asset value, beginning of period |

$15.21 | $16.08 | $15.01 | $12.98 | $15.15 | $13.28 | ||||||||||||||||||

| Income from investment operationsa: |

||||||||||||||||||||||||

| Net investment income (loss)b |

(0.04 | ) | (0.08 | ) | (0.06 | ) | (0.03 | ) | 0.03 | c | (0.04 | ) | ||||||||||||

| Net realized and unrealized gains (losses) |

0.44 | 1.39 | 1.13 | 2.06 | (1.81 | ) | 2.22 | |||||||||||||||||

| Total from investment operations |

0.40 | 1.31 | 1.07 | 2.03 | (1.78 | ) | 2.18 | |||||||||||||||||

| Less distributions from: |

||||||||||||||||||||||||

| Net investment income |

— | — | — | — | (0.04 | ) | — | |||||||||||||||||

| Net realized gains |

— | (2.18 | ) | — | — | (0.35 | ) | (0.31 | ) | |||||||||||||||

| Total distributions |

— | (2.18 | ) | — | — | (0.39 | ) | (0.31 | ) | |||||||||||||||

| Net asset value, end of period |

$15.61 | $15.21 | $16.08 | $15.01 | $12.98 | $15.15 | ||||||||||||||||||

| Total returnd |

2.63% | 10.50% | 7.13% | 15.64% | (11.91)% | 16.66% | ||||||||||||||||||

| Ratios to average net assetse |

||||||||||||||||||||||||

| Expenses before waiver and payments by affiliates |

1.77% | 1.78% | 1.70% | 1.64% | 1.69% | 1.74% | ||||||||||||||||||

| Expenses net of waiver and payments by affiliates |

1.47% | f | 1.50% | f | 1.41%f | 1.41% | f | 1.48% | 1.48% | |||||||||||||||

| Net investment income (loss) |

(0.47)% | (0.49)% | (0.41)% | (0.21)% | 0.25% | c | (0.27)% | |||||||||||||||||

| Supplemental data |

||||||||||||||||||||||||

| Net assets, end of period (000’s) |