UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the

Securities Exchange Act of 1934 (Amendment No. )

|

Filed by the Registrant |  |

Filed by a Party other than the Registrant |

| Check the appropriate box: | |

|

Preliminary Proxy Statement |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

Definitive Proxy Statement |

|

Definitive Additional Materials |

|

Soliciting Material under §240.14a-12 |

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check all boxes that apply): | |

|

No fee required |

|

Fee paid previously with preliminary materials |

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| 2023 PROXY STATEMENT AND NOTICE OF ANNUAL SHAREHOLDER MEETING |  |

2022 was another productive year at Regeneron, marked by significant achievements that positioned us to reach more patients with our medicines while advancing our robust investigational pipeline and novel technologies. We are inspired by the incredible talent and dedication of our team who relentlessly pursue our mission of turning promising science into meaningful medicines. As we mark Regeneron’s 35th year, we reflect on the fundamentals that have brought us to this point and look ahead with confidence that the best is yet to come.

We believe the business strategy we pursued for decades will continue to drive our future success: we consistently prioritize investment in Regeneron’s research capabilities, homegrown technologies, and high-performing team – and we continue to complement our internal capabilities with highly productive external collaborations. Our strong performance in 2022 represents the fruits of this strategy and fuels the virtuous cycle of continuous reinvestment into the research and development (“R&D”) engine that produced EYLEA® (aflibercept) Injection, Dupixent® (dupilumab), Libtayo® (cemiplimab), and six other Regeneron medicines approved by the U.S. Food and Drug Administration (the “FDA”). This engine is also producing the medicines of the future, generating our clinical pipeline of over 30 distinct and largely homegrown assets, which we believe bodes well for our future prospects.

Looking ahead to 2023 and beyond, we expect to retain and grow our leadership positions in ophthalmology and allergic diseases while expanding our portfolio to include best-in-class oncology bispecific and costimulatory bispecific antibodies, as well as novel genetics medicine approaches such as CRISPR, gene silencing, and gene therapy.

In 2022, Regeneron, together with its collaborators, delivered record global net product sales of EYLEA, Dupixent, and Libtayo, contributing to full-year GAAP net income of $4.34 billion and total revenues of $12.17 billion. Total revenues grew 17% compared to 2021 when excluding contributions from our COVID-19 antibody cocktail REGEN-COV®/Ronapreve™ (casirivimab and imdevimab).1 In addition to investing nearly $3.6 billion in Regeneron’s R&D capabilities in 2022, we have continued to execute on our capital allocation strategy. In 2022, we invested approximately $1.3 billion in business development initiatives and returned significant value to our shareholders through share repurchases, with $2.1 billion of our common stock repurchased in 2022 and nearly $10 billion repurchased since 2019.

These strong financial results were driven by execution on the following three strategic imperatives.

Fortify our leadership in the treatment of retinal diseases:

EYLEA continued to be the No. 1 prescribed anti-VEGF treatment for retinal diseases in 2022, capturing approximately 75% of the branded market share and reaching more than 57 million injections globally since its launch 11 years ago. Global net product sales grew 4% year-over-year to $9.65 billion in 2022.2 In February 2023, EYLEA gained FDA approval as the first pharmacological treatment for infants with prematurity of retinopathy, expanding our opportunity to help some of the most vulnerable patients with unmet needs.

In 2022, we also shared positive clinical trial results for aflibercept 8 mg, which demonstrated that extended dosing regimens in neovascular age-related macular degeneration and diabetic macular edema achieved non-inferiority in vision gains and a consistent safety profile compared to EYLEA’s eight-week dosing regimen. Given prescribers’ decade-plus experience with EYLEA, we believe that, over time, there is an opportunity for aflibercept 8 mg to significantly reduce the treatment burden for patients and to become a new standard of care for these conditions. Our Biologics License Application was accepted by the FDA for priority review, and we anticipate a decision by late June of this year.

1 |

The casirivimab and imdevimab antibody cocktail is known as REGEN-COV in the United States and Ronapreve in other countries. Regeneron records net product sales of REGEN-COV in the United States and Roche records net product sales of Ronapreve outside the United States. REGEN-COV was authorized under an emergency use authorization from the FDA for COVID-19 from November 2020 until January 2022 when the emergency use authorization was revised to exclude its use in geographic regions where infection or exposure is likely due to a variant that is not susceptible to the treatment. Revenues excluding REGEN-COV and Ronapreve is a measure not calculated in accordance with U.S. Generally Accepted Accounting Principles (“GAAP”). See Appendix A for a definition of this measure and a reconciliation of this measure to the most directly comparable GAAP financial measure. |

2 |

Our collaborator Bayer records net product sales for EYLEA outside the United States. |

| 2023 PROXY STATEMENT AND NOTICE OF ANNUAL SHAREHOLDER MEETING |  |

Maintain and grow Dupixent:

2022 was another banner year for Dupixent, which is now approved in five related type 2 inflammatory diseases. Global net product sales were approximately $8.7 billion in 2022, a year-over-year increase of 40%.3 Despite new competition in 2022, Dupixent strengthened its market-leading position in atopic dermatitis, asthma, and nasal polyps, and was also approved in new indications (eosinophilic esophagitis and prurigo nodularis), additional geographies, and patient populations as young as six months of age.

These approvals meaningfully expanded the Dupixent commercial opportunity, with potential to reach even more patients across established and new indications. Regeneron and Sanofi recently announced exciting results from a pivotal trial demonstrating the potential of Dupixent to become the first biologic to treat chronic obstructive pulmonary disease in patients with type 2 inflammation by showing significant reduction in exacerbations compared to placebo and improvement in lung function and quality of life. We look forward to discussing these results with regulatory authorities.

Advance our hematology/oncology portfolio:

We made significant progress advancing our oncology portfolio and pipeline in 2022. Full-year global net product sales for Libtayo, our homegrown PD-1 inhibitor, grew 26% year-over-year to $578 million,4 and the medicine is now FDA approved in five indications. In addition, Regeneron acquired Sanofi’s share of global rights to Libtayo, which we viewed as a necessary step toward realizing the clinical and commercial potential of our diverse oncology portfolio. We can now fully explore multiple combinations with Libtayo as our foundation – including with our LAG3 antibody, fianlimab, costimulatory CD28 bispecifics, and CD3 bispecifics, among others. In 2022, we also completed our first-ever acquisition of another biotechnology company, Checkmate Pharmaceuticals, Inc., adding a new modality to our portfolio of potential combination-ready approaches for difficult-to-treat cancers and deepening our commitment to oncology.

In 2023, we plan to report results from multiple studies and complete key regulatory submissions that will further establish our leadership in oncology.

Beyond delivering on these three strategic imperatives in 2022, we were also focused on building the next chapter of scientific leadership at Regeneron.

We made important progress in our human genetics research and genetics medicine technology efforts in 2022. The Regeneron Genetics Center® (“RGC”) marked its tenth year and has built one of the largest and most diverse genomic biobanks in the world, yielding many actionable insights – another example of strategic reinvestment that has produced tangible benefits for our preclinical and clinical pipelines. In 2022, we announced that RGC scientists uncovered rare genetic loss-of-function mutations in the CIDEB gene that are associated with substantial protection from liver disease, including nonalcoholic steatohepatitis (“NASH”) and cirrhosis. Discoveries such as this open the door to potential new medicines for notoriously hard-to-treat diseases, whether via antibody therapeutics or other modalities.

Our Regeneron Genetics Medicine group is exploring such approaches through strategic collaborations. For example, in collaboration with Intellia Therapeutics, Inc., we are working to advance potentially groundbreaking applications of CRISPR technology. In 2022, interim results from an ongoing Phase 1 study of NTLA-2001 showed our CRISPR/Cas9 therapy has the potential to become the first single-dose, in vivo treatment to halt and even reverse the underlying cause of transthyretin (ATTR) amyloidosis. We are continuing to advance this program in 2023, as well as other genetics medicine projects, including those that explore gene silencing in hard-to-treat diseases such as NASH and Alzheimer’s disease.

Finally, while we have entered a new phase of the COVID-19 pandemic, the virus is still present and disproportionately affecting people who are immunocompromised. Since need remains, we continue to identify and study novel antibodies that may provide treatment for, and protection against, new strains. We are progressing a unique candidate that appears to neutralize all known variants of the COVID-19 virus by binding to a highly conserved epitope of the spike protein, and we hope to begin clinical trials this year.

In order to advance all this exciting work across the full drug discovery and development spectrum, we need a strong and committed team. We now have more than 12,000 dedicated employees across seven countries and are honored to be ranked once again among the top employers by Science magazine. We are particularly proud of our industry-leading Industrial Operations and Product Supply team, who emphasize continual improvement and teamwork to ensure our medicines are safe and available for patients around the globe. To keep up with this talented and growing workforce,

3 |

Our collaborator Sanofi records global net product sales of Dupixent. |

4 |

Prior to July 1, 2022, our collaborator Sanofi recorded net product sales of Libtayo outside the United States. |

| 2023 PROXY STATEMENT AND NOTICE OF ANNUAL SHAREHOLDER MEETING |  |

we are taking steps to ensure we retain our nimble and innovative culture and to invest in our facilities, with a $1.8 billion project underway at our headquarters in Tarrytown, N.Y. and a new 350,000 square foot manufacturing facility in Rensselaer, N.Y.

Our employees do not just focus on getting things done, but care about how we do this – with precision, ingenuity, and the highest ethical standards. These priorities are consistent with our company motto of “Doing Well by Doing Good” and our company values and behaviors known as The Regeneron Way. We invite you to read more about our efforts to improve the lives of people with serious diseases, sustain our culture of integrity and excellence, and build sustainable communities in our 2022 Responsibility Report and our inaugural Diversity, Equity, and Inclusion (“DEI”) Annual Impact Report. Notably, we believe our DEI strategy to build a “Better Workplace, Better Science, Better World” provides a framework to cultivate talent, fuel discovery, and advance our business.

On a personal note from Roy, this will be my last letter to shareholders. I have had the privilege of serving as Chair for nearly three decades and watched with pride as Regeneron has transformed from a small biotechnology company with big ideas into a successful research-based biopharmaceutical company that improves the lives of millions of patients. I am confident that the Company under the leadership of Len, George, and Christine Poon, who will assume the role of lead independent director, will continue to bring forward value to society and shareholders.

Collectively, we remain assured in our near- and long-term growth prospects, with an increasingly diverse commercial portfolio reaching new patients and geographies, clinical trial initiations expected for numerous new therapeutic candidates, and one of the most innovative R&D engines in the industry. In our 35th year, we are proud to say that Regeneron is extremely well positioned to continue executing on our mission and delivering breakthroughs for patients and healthcare professionals around the world.

Sincerely,

|

|

|

P. Roy Vagelos, M.D., |

Leonard S. Schleifer, M.D., Ph.D., |

George D. Yancopoulos, M.D., Ph.D., |

Chair of the Board |

President and Chief Executive Officer |

President and Chief Scientific Officer |

| 2023 PROXY STATEMENT AND NOTICE OF ANNUAL SHAREHOLDER MEETING |  |

| 2023 PROXY STATEMENT AND NOTICE OF ANNUAL SHAREHOLDER MEETING |  |

REGENERON PHARMACEUTICALS, INC.

777 Old Saw Mill River Road

Tarrytown, New York 10591-6707

The 2023 Annual Meeting of Shareholders of Regeneron Pharmaceuticals, Inc. (the “Company”) will be held on Friday, June 9, 2023, commencing at 10:30 a.m., Eastern Time, virtually via the Internet at www.virtualshareholdermeeting.com/REGN2023, for the following purposes:

to elect four Class II directors for a three-year term;

to ratify the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2023;

to cast an advisory vote to approve the compensation of the Company’s Named Executive Officers as disclosed in these proxy materials (say-on-pay);

to cast an advisory vote on whether future say-on-pay votes should be held every one, two, or three years (say-on-frequency);

if properly presented, to vote on a non-binding shareholder proposal; and

to act upon such other matters as may properly come before the meeting and any adjournment(s) or postponement(s) thereof.

The board of directors has fixed the close of business on April 11, 2023 as the record date for determining shareholders entitled to notice of, and to vote at, the Annual Meeting and at any adjournment(s) or postponement(s) thereof.

Pursuant to the rules of the Securities and Exchange Commission (the “SEC”), we have elected to use the “Notice and Access” method of providing our proxy materials over the Internet. Accordingly, we will mail, beginning on or about April 21, 2023, a Notice of Internet Availability of Proxy Materials to our shareholders of record and beneficial owners as of the record date (other than (i) those who previously elected to receive proxy materials by e-mail, (ii) those who have previously asked to receive paper copies of the proxy materials, and (iii) shareholders who participate and hold shares of common stock in the Regeneron Pharmaceuticals, Inc. 401(k) Savings Plan or the Regeneron Ireland Share Participation Plan). As of the date of mailing of the Notice of Internet Availability of Proxy Materials, all shareholders and beneficial owners will have the ability to access all of the proxy materials on a website referenced in the Notice of Internet Availability of Proxy Materials.

The Notice of Internet Availability of Proxy Materials also contains a toll-free telephone number, an e-mail address, and a website where shareholders can request a paper or electronic copy of the proxy statement, our 2022 annual report, and/or a form of proxy relating to the Annual Meeting. These materials are available free of charge. The Notice also contains information on how to access and vote the form of proxy.

We have opted to hold the Annual Meeting as a virtual-only meeting, which means that you will not be able to attend the Annual Meeting in person. All shareholders will be able to attend the Annual Meeting and participate electronically, which will allow them to vote their shares on the date of the Annual Meeting and ask questions during the meeting. Please visit our website at http://newsroom.regeneron.com for the most up-to-date information about the Annual Meeting. We have designed the format of the Annual Meeting to ensure that shareholders are afforded similar rights and opportunities to participate as they would at an in-person meeting.

As Authorized by the Board of Directors,

Joseph J. LaRosa

Executive Vice President, General Counsel and Secretary

April 21, 2023

| 2023 PROXY STATEMENT AND NOTICE OF ANNUAL SHAREHOLDER MEETING |  |

| 2023 PROXY STATEMENT AND NOTICE OF ANNUAL SHAREHOLDER MEETING |  |

TABLE OF CONTENTS

| 2023 PROXY STATEMENT AND NOTICE OF ANNUAL SHAREHOLDER MEETING |  |

/ i |

TABLE OF CONTENTS (CONT.)

NOTE REGARDING FORWARD-LOOKING STATEMENTS AND NON-GAAP FINANCIAL MEASURES: See Appendix A for important information regarding forward-looking statements and financial measures not calculated in accordance with U.S. Generally Accepted Accounting Principles contained in this proxy statement.

NOTE REGARDING TRADEMARKS AND PRODUCT NAMES: “ARCALYST®,” “Evkeeza®,” “EYLEA®,” “Inmazeb®,” “Libtayo®”, “Praluent®” (in the United States), “REGEN-COV®,” Regeneron®,” “Regeneron Genetics Center®,” “VelociGene®,” “VelocImmune®,” and “ZALTRAP®” are trademarks of Regeneron Pharmaceuticals, Inc. (“Regeneron”). This proxy statement refers to products marketed or otherwise commercialized by Regeneron, its collaborators, and other parties. Consult the product label in each territory for specific information about such products.

| 2023 PROXY STATEMENT AND NOTICE OF ANNUAL SHAREHOLDER MEETING |  |

/ ii |

Meeting Date: |

Time: |

Location: |

Record Date: |

June 9, 2023 |

10:30 a.m., ET |

Online at |

APRIL 11, 2023 |

|

Matter |

Board Vote Recommendation |

1 |

Election of four Class II directors for a three-year term |

FOR each director nominee

|

2 |

Ratification of the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2023 |

FOR

|

3 |

Advisory vote to approve the compensation of the Company’s Named Executive Officers as disclosed in these proxy materials (say-on-pay) |

FOR

|

4 |

Advisory vote on the frequency of future say-on-pay votes (say-on-frequency) |

Every ONE year

|

5 |

Non-binding shareholder proposal, if properly presented |

AGAINST

|

See “General Information about the Meeting and Other Matters” starting on page 110 for questions and answers related to the annual meeting, how to vote, and other matters.

| 2023 PROXY STATEMENT AND NOTICE OF ANNUAL SHAREHOLDER MEETING |  |

/ 1 |

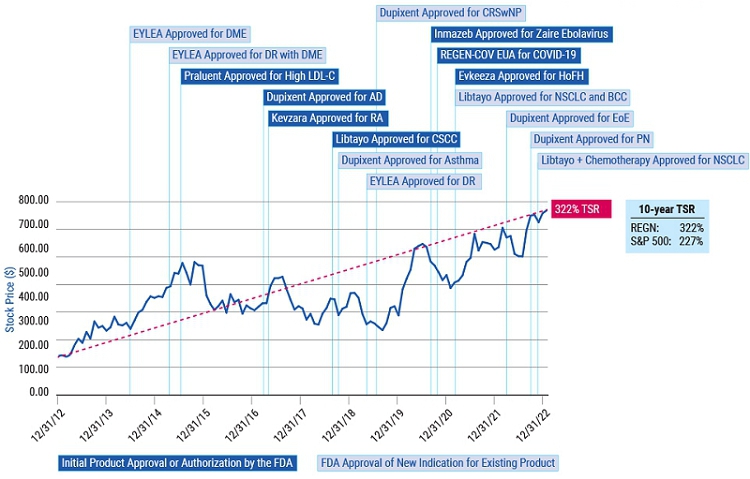

As you review this year’s proposals, we encourage you to consider our compensation and governance practices in light of our track record of long-term shareholder value creation and delivering on our mission of repeatedly bringing important new medicines to patients living with serious diseases.

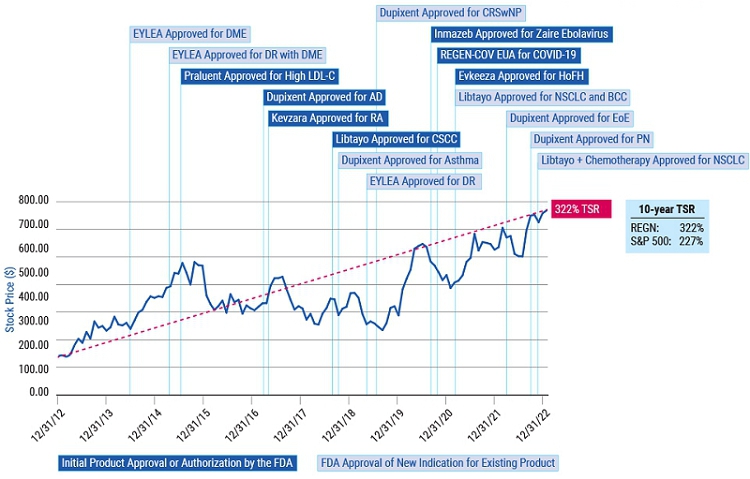

Shareholder value creation over the last decade driven by relentless innovation and product pipeline progress

DME = diabetic macular edema; DR = diabetic retinopathy; LDL-C = low-density lipoprotein cholesterol; AD = atopic dermatitis; RA = rheumatoid arthritis; CSCC = cutaneous squamous cell carcinoma; CRSwNP = chronic rhinosinusitis with nasal polyposis; EUA = Emergency Use Authorization from FDA; FDA = U.S. Food and Drug Administration; HoFH = homozygous familial hypercholesterolemia; NSCLC = non-small cell lung cancer; BCC = basal cell carcinoma; EoE = eosinophilic esophagitis; and PN = prurigo nodularis. Consult the product label in each approved territory for specific information about such products and indications.

| 2023 PROXY STATEMENT AND NOTICE OF ANNUAL SHAREHOLDER MEETING |  |

/ 2 |

In the last decade, we have actively and regularly engaged with our shareholders to receive feedback on many important areas including governance, compensation, and corporate responsibility matters. Shareholder feedback is discussed with management and, depending on the topic, relayed for consideration to the appropriate committee of the board of directors (typically the Compensation Committee or the Corporate Governance and Compliance Committee), the full board, or both. In recent years, shareholder input resulted in specific changes to our compensation and corporate governance practices and policies. For example, after careful consideration of shareholder feedback following the 2021 annual shareholder meeting, in 2022 our board of directors voluntarily changed the frequency of our say-on-pay votes from every three years to every year.

Since the 2022 annual shareholder meeting, we reached out to shareholders collectively representing over 60% of the public shares (i.e., shares of common stock outstanding as of December 31, 2022, excluding shares held by our directors and executive officers). This outreach resulted in one-on-one discussions with shareholders representing nearly 50% of our public shares.

Our 2022 outreach built on an active outreach program in prior years and focused on, among other matters:

the board’s director refreshment efforts, including how the recent election of Dr. Thompson is consistent with the board’s director refreshment philosophy (discussed further in the subsection “Board of Directors—Board Governance—Director Refreshment Philosophy”);

the Company’s classified board structure, including relevant considerations unique to the Company and its long-term orientation (discussed further in the subsection “Board of Directors—Board Governance—Board Structure”);

the Company’s dual-class capital structure, including relevant mitigating factors such as the steady decline in the number of shares of Class A stock outstanding since the Company’s initial public offering (“IPO”) and the relatively low percentage of overall votes controlled by the Class A shareholders, particularly when compared to other founder-led companies (discussed further in the subsection “The Company—Corporate Governance—Capital Structure”); and

investor views of the newly mandated “pay-versus-performance” disclosure (which we provide in the subsection “Compensation Dashboard—Additional Compensation Information—Pay Versus Performance”).

We had meaningful and candid discussions about these and other corporate governance topics in 2022, and the feedback received from shareholders was discussed in detail at the board level and has already shaped the recent meeting agenda and discussion in the boardroom. For example, as described further in the subsection “Board of Directors—Board Governance—Board Structure,” 2022 shareholder feedback led the Corporate Governance and Compliance Committee to request, review, and discuss a detailed analysis of the costs and benefits of the Company’s classified board structure in order to facilitate the Committee’s continued consideration of this feature of Regeneron’s governance. We remain committed to continued engagement with shareholders to understand your viewpoints and better convey the board’s approach to corporate governance with the goal of ensuring independent oversight of management’s execution of our business strategy and the continued creation of sustainable shareholder value.

| 2023 PROXY STATEMENT AND NOTICE OF ANNUAL SHAREHOLDER MEETING |  |

/ 3 |

From Left to Right:

Bonnie L. Bassler, Ph.D., Michael S. Brown, M.D., N. Anthony Coles, M.D., Joseph L. Goldstein, M.D., Christine A. Poon, Arthur F. Ryan, Leonard S. Schleifer, M.D., Ph.D., George L. Sing, Marc Tessier-Lavigne, Ph.D., Craig B. Thompson, M.D., P. Roy Vagelos, M.D., George D. Yancopoulos, M.D., Ph.D., Huda Y. Zoghbi, M.D.

| 2023 PROXY STATEMENT AND NOTICE OF ANNUAL SHAREHOLDER MEETING |  |

/ 4 |

As the first substantive order of business at the 2023 Annual Meeting, you have an opportunity to vote on four members of our board of directors. This is the correct starting point not only because the board oversees Regeneron, but also because understanding the Regeneron board leads to a better understanding of the Company and its business model.

At Regeneron, we lead with science as we pursue our mission of repeatedly bringing important new medicines to patients living with serious diseases. Our business is built on investment in our deep scientific and technological capabilities, which drives our research, preclinical development, clinical, and manufacturing efforts.

The composition of our board is shaped by this business model and the recognition that our board members must have predominantly science-based backgrounds to effectively provide robust, independent oversight of management. The current makeup of our board reflects this principle: Eight of our 13 directors are members of the National Academy of Sciences, and our board includes two Nobel laureates and holders of many scientific awards. In addition, the board includes individuals with experience building shareholder value through all stages of corporate development. Various members also bring substantial governance, financial, policy, and management expertise gained from their professional backgrounds and their service on other boards.

The board’s composition also reflects our commitment to ensure diversity of thought, experience, attributes, and background, as demonstrated by the fact that three of our board’s current 13 members are women and four members are racially or ethnically diverse. The following Board Diversity Matrix sets forth certain diversity information as self-reported by the current members of the board.

Board Diversity Matrix* |

||

Total Number of Directors |

13 |

|

|

Female |

Male |

Part I: Gender Identity |

|

|

Directors |

3 |

10 |

Part II: Demographic Background |

|

|

African American or Black |

- |

1 |

Asian |

1 |

1 |

White |

1 |

8 |

Directors who identify as Middle Eastern/Arab American: 1 Directors who are Military Veterans: 2 |

||

*

As of April 21, 2023. There have been no changes to this information since the publication of the Board Diversity Matrix dated as of November 14, 2022, which is posted on our website. |

||

| 2023 PROXY STATEMENT AND NOTICE OF ANNUAL SHAREHOLDER MEETING |  |

/ 5 |

|

*

As of April 21, 2023. On April 14, 2023, Dr. Vagelos notified the Company of his decision not to stand for re-election at the 2023 Annual Meeting. Following the 2023 Annual Meeting, the board is expected to be comprised of 12 members, of which 42% are diverse by gender and/or race/ethnicity. |

The board and the Corporate Governance and Compliance Committee seek to ensure that our directors as a group possesses the mix of skills and experiences to provide effective oversight and guidance to management to execute on the Company’s long-term strategy. The board and the Committee also consider succession planning for board and committee chairs for purposes of continuity and to maintain relevant expertise and depth of experience.

The table below summarizes key qualifications, skills, or attributes most relevant to the decision to nominate the director to serve on the board of directors. A mark indicates a specific area of focus or expertise on which the board of directors relies most. The lack of a mark does not mean the director does not possess that qualification or skill. Each director biography below describes these qualifications and relevant experience in more detail. We believe the table below demonstrates the breadth and diversity of the collective experience, expertise, and skills of our board of directors.

Experience, Expertise, or Attribute |

Bonnie L. Bassler, Ph.D. |

Michael S. Brown, M.D. |

N. Anthony Coles, M.D. |

Joseph L. Goldstein, M.D. |

Christine A. Poon |

Arthur F. Ryan |

Leonard S. Schleifer, M.D., Ph.D. |

George L. Sing |

Marc Tessier- Lavigne, Ph.D. |

Craig B. Thompson, M.D. |

P. Roy Vagelos, M.D. |

George D. Yancopoulos, M.D., Ph.D. |

Huda Y. Zoghbi, M.D. |

Industry Experience |

● |

● |

● |

● |

● |

● |

● |

● |

● |

● |

● |

● |

|

Executive/Leadership Experience |

● |

● |

● |

● |

● |

● |

● |

● |

● |

● |

● |

● |

● |

Science/Biotech Background |

● |

● |

● |

● |

● |

|

● |

● |

● |

● |

● |

● |

● |

Research/Academic Experience |

● |

● |

● |

● |

● |

|

● |

|

● |

● |

● |

● |

● |

Business Strategy/Operations Experience |

|

|

● |

|

● |

● |

● |

● |

● |

● |

● |

● |

|

Financial Expertise |

|

|

● |

|

● |

● |

● |

● |

|

● |

● |

|

|

Public Company CEO Experience |

|

|

● |

|

|

● |

● |

|

|

|

● |

|

|

National Academy of Sciences Membership |

● |

● |

|

● |

|

|

|

|

● |

● |

● |

● |

● |

Diverse by Gender |

● |

|

|

|

● |

|

|

|

|

|

|

|

● |

Diverse by Race/Ethnicity |

|

|

● |

|

● |

|

|

● |

|

|

|

|

● |

| 2023 PROXY STATEMENT AND NOTICE OF ANNUAL SHAREHOLDER MEETING |  |

/ 6 |

Director since: 1991 Age: 82 Independent |

|

Board and Committee Membership—2022 Attendance |

|

Board of Directors: |

7/7 |

Corporate Governance and Compliance Committee: |

5/5 |

Technology Committee: |

2/2 |

Regeneron Securities Beneficially Owned as of April 11, 2023 |

|

Common Stock: |

5,000 |

Options: |

3,537 |

Restricted Stock Units (“RSUs”): |

1,153 |

Career Highlights |

•

Professor of Molecular Genetics and Internal Medicine and Chair of the Department of Molecular Genetics at The University of Texas Southwestern Medical Center at Dallas since 1977 •

Member of the boards of trustees of The Rockefeller University and the Howard Hughes Medical Institute •

Nobel Prize for Physiology or Medicine in 1985 (jointly with Dr. Brown) •

U.S. National Medal of Science in 1988 (jointly with Dr. Brown) |

Scientific Society Memberships |

•

The National Academy of Sciences •

The National Academy of Medicine •

The Royal Society of London |

Dr. Goldstein’s extensive research experience, his distinguished scientific and academic credentials, including his receipt of the Nobel Prize for Physiology or Medicine in 1985, and his substantial understanding of the Company gained through his service as a director, led to the board’s decision to nominate Dr. Goldstein for reelection to the board. |

1 |

Biographical information is given, as of April 11, 2023, for each nominee and for each of the other directors whose term of office will continue after the 2023 Annual Meeting. All nominees are presently directors and, with the exception of Dr. Thompson, were previously elected by the shareholders. None of the corporations or other organizations referred to below with which a director has been or is currently employed or otherwise associated is a parent, subsidiary, or affiliate of the Company. |

| 2023 PROXY STATEMENT AND NOTICE OF ANNUAL SHAREHOLDER MEETING |  |

/ 7 |

Director since: 2010 Age: 70 Independent |

|

Board and Committee Membership—2022 Attendance |

|

Board of Directors: |

7/7 |

Compensation Committee (Chair): Corporate Governance and Compliance Committee: |

12/12

5/5 |

Regeneron Securities Beneficially Owned as of April 11, 2023 |

|

Common Stock: |

790 |

Options: |

62,894 |

RSUs: |

1,153 |

Career Highlights |

•

Former Executive-in-Residence in the Department of Management and Human Resources and former Dean and John W. Berry, Sr. Chair in Business at The Max M. Fisher College of Business at The Ohio State University •

Former vice chair, worldwide chair of pharmaceuticals, member of the executive committee, and director at Johnson & Johnson •

Held senior leadership positions at Bristol-Myers Squibb Company, including president of international medicines and president of medical devices •

Former member of the Supervisory Board of Royal Philips Electronics and the board of directors of Decibel Therapeutics, Inc. |

Other Public Boards |

•

Prudential Financial, Inc. •

The Sherwin-Williams Company |

Ms. Poon’s extensive expertise in domestic and international business operations, including sales and marketing and commercial operations, and her deep strategic and operational knowledge of the pharmaceutical industry, led to the board’s decision to nominate Ms. Poon for reelection to the board. |

| 2023 PROXY STATEMENT AND NOTICE OF ANNUAL SHAREHOLDER MEETING |  |

/ 8 |

Director since: 2022 Age: 70 Independent |

|

Board and Committee Membership—2022 Attendance* |

|

Board of Directors: |

2/2 |

Technology Committee: |

1/1 |

* Dr. Thompson was elected as a member of the board and the Technology Committee effective October 3, 2022. |

|

Regeneron Securities Beneficially Owned as of April 11, 2023 |

|

Common Stock: |

0 |

Options: |

2,399 |

RSUs: |

207 |

Career Highlights |

•

Former President and Chief Executive Officer of Memorial Sloan Kettering Cancer Center •

Co-founder of Agios Pharmaceuticals, Inc. •

Former director of Merck & Co., Inc. |

Scientific Society Memberships |

•

The National Academy of Sciences •

The National Academy of Medicine •

The American Academy of Arts and Sciences •

The American Society for Clinical Investigation •

The Association of American Physicians |

Other Public Boards |

•

Charles River Laboratories International, Inc. |

Dr. Thompson’s extensive research and leadership experience in the pharmaceutical and healthcare industries, as well as his experience as a corporate director, led to the board’s decision to nominate Dr. Thompson for reelection to the board. |

|

| 2023 PROXY STATEMENT AND NOTICE OF ANNUAL SHAREHOLDER MEETING |  |

/ 9 |

Director since: 2016 Age: 68 Independent |

|

Board and Committee Membership—2022 Attendance |

|

Board of Directors: |

6/7 |

Compensation Committee: |

11/12 |

Technology Committee: |

2/2 |

Regeneron Securities Beneficially Owned as of April 11, 2023 |

|

Common Stock: |

0 |

Options: |

27,289 |

RSUs: |

1,153 |

Career Highlights |

•

Professor in the departments of Pediatrics, Molecular and Human Genetics, and Neurology and Neuroscience at Baylor College of Medicine since 1994 •

Director of the Jan and Dan Duncan Neurological Research Institute at Texas Children’s Hospital •

Howard Hughes Medical Institute Investigator •

Pearl Meister Greengard Prize •

March of Dimes Prize in Developmental Biology •

Vanderbilt Prize in Biomedical Science |

Scientific Society Memberships |

•

The National Academy of Sciences •

The Institute of Medicine •

The American Association for the Advancement of Science |

Dr. Zoghbi’s extensive research experience and her scientific and academic career and accomplishments led to the board’s decision to nominate Dr. Zoghbi for reelection to the board. |

| 2023 PROXY STATEMENT AND NOTICE OF ANNUAL SHAREHOLDER MEETING |  |

/ 10 |

Director since: 2017 Age: 62 Independent |

|

Board and Committee Membership—2022 Attendance |

|

Board of Directors: |

6/7 |

Audit Committee: |

8/9 |

Regeneron Common Stock Beneficially Owned as of April 11, 2023 |

|

Common Stock: |

11 |

Options: |

3,537 |

RSUs: |

1,153 |

Career Highlights |

•

President and Chief Executive Officer since 2019 and Chair since 2018 of Cerevel Therapeutics Holdings, Inc., the parent entity of Cerevel Therapeutics, Inc. •

Chair and CEO of TRATE Enterprises LLC, a privately-held company, since 2013 •

Former Chief Executive Officer and Chair of the Board of Yumanity Therapeutics, Inc. •

Former President, Chief Executive Officer and Chair of the Board of Onyx Pharmaceuticals, Inc. •

Former President, Chief Executive Officer, and member of the board of directors of NPS Pharmaceuticals, Inc. •

Previously held various leadership positions in the biopharmaceutical and pharmaceutical industries, including at Merck & Co., Inc., Bristol-Myers Squibb Company, and Vertex Pharmaceuticals Incorporated •

Former director of Laboratory Corporation of America Holdings, Campus Crest Communities, Inc., CRISPR Therapeutics AG, and McKesson Corporation |

Other Public Boards |

•

Cerevel Therapeutics Holdings, Inc. |

Dr. Coles’s experience as a seasoned executive and corporate director with extensive knowledge of highly regulated biopharmaceutical and pharmaceutical companies, as well as his in-depth knowledge and understanding of the regulatory environment in which Regeneron operates, led the board to conclude that Dr. Coles should serve as a director. |

| 2023 PROXY STATEMENT AND NOTICE OF ANNUAL SHAREHOLDER MEETING |  |

/ 11 |

Director since: 2003 Age: 80 Independent |

|

Board and Committee Membership—2022 Attendance |

|

Board of Directors (Presiding Director): |

7/7 |

Audit Committee: |

9/9 |

Corporate Governance and Compliance Committee (Chair): |

5/5 |

Regeneron Securities Beneficially Owned as of April 11, 2023 |

|

Common Stock: |

17,800 |

Options: |

3,537 |

RSUs: |

1,153 |

Career Highlights |

•

Former Chief Executive Officer and Chair of the Board of Prudential Financial, Inc. •

President and Chief Operating Officer of Chase Manhattan Bank from 1990 to 1994 •

Managed Chase’s worldwide retail bank between 1984 and 1990 •

Non-executive director of the Royal Bank of Scotland Group plc from 2008 to 2013 •

Director of Citizens Financial Group, Inc. from 2009 to 2019 |

Mr. Ryan’s substantial leadership experience as a chief executive officer of leading companies in the banking and insurance industries, and his extensive business experience and financial expertise, led the board to conclude that Mr. Ryan should serve as a director. |

| 2023 PROXY STATEMENT AND NOTICE OF ANNUAL SHAREHOLDER MEETING |  |

/ 12 |

Director since: 1988 Age: 73 Independent |

|

Board and Committee Membership—2022 Attendance |

|

Board of Directors: |

7/7 |

Audit Committee (Chair): |

9/9 |

Compensation Committee: |

12/12 |

Regeneron Securities Beneficially Owned as of April 11, 2023 |

|

Common Stock: |

27,117 |

Options: |

50,614 |

RSUs: |

1,153 |

Career Highlights |

•

Chief Executive Officer of GanD, Inc. since 2016 •

Chair of Grace Science, LLC since 2017 •

Extensive venture capital and leadership experience in the biotechnology sector and high technology |

Mr. Sing’s extensive healthcare and financial expertise as a healthcare venture capital investor and biomedical company chief executive officer, his executive leadership experience, and his substantial knowledge of the Company led the board to conclude that Mr. Sing should serve as a director. |

| 2023 PROXY STATEMENT AND NOTICE OF ANNUAL SHAREHOLDER MEETING |  |

/ 13 |

Director since: 2011 Age: 63 Independent |

|

Board and Committee Membership—2022 Attendance |

|

Board of Directors: |

7/7 |

Technology Committee: |

2/2 |

Regeneron Securities Beneficially Owned as of April 11, 2023 |

|

Common Stock: |

1,187 |

Options: |

16,362 |

RSUs: |

1,153 |

Career Highlights |

•

President of Stanford University since 2016 •

President of The Rockefeller University and Carson Family Professor and head of the Laboratory of Brain Development at The Rockefeller University from 2011 to 2016 •

Executive Vice President and Chief Scientific Officer at Genentech, Inc. from 2003 to 2011 •

Professor at Stanford University from 2001 to 2003 and at the University of California, San Francisco from 1991 to 2001 •

Former member of the board of directors of Pfizer Inc., Agios Pharmaceuticals, Inc., and Juno Therapeutics, Inc. |

Scientific Society Memberships |

•

The National Academy of Sciences •

The National Academy of Medicine •

The Royal Society of London •

The Royal Society of Canada |

Other Public Boards |

•

Denali Therapeutics Inc. |

Dr. Tessier-Lavigne’s distinguished scientific and academic background, and his significant industry experience, including experience in senior scientific leadership roles at a leading biopharmaceutical company, led the board to conclude that Dr. Tessier-Lavigne should serve as a director. |

| 2023 PROXY STATEMENT AND NOTICE OF ANNUAL SHAREHOLDER MEETING |  |

/ 14 |

Director since: 2016 Age: 60 Independent |

|

Board and Committee Membership—2022 Attendance |

|

Board of Directors: |

7/7 |

Corporate Governance and Compliance Committee: |

5/5 |

Technology Committee: |

2/2 |

Regeneron Securities Beneficially Owned as of April 11, 2023 |

|

Common Stock: |

0 |

Options: |

20,945 |

RSUs: |

1,153 |

Career Highlights |

•

Chair of the Department of Molecular Biology since 2013 and Squibb Professor in Molecular Biology since 2003 at Princeton University •

Howard Hughes Medical Institute Investigator •

Former President of the American Society for Microbiology •

Former member of the board of the American Association for the Advancement of Science, the National Science Foundation, and the American Academy of Microbiology •

MacArthur Foundation Fellowship •

Lounsbery Award •

Shaw Prize for Life Science and Medicine •

Gruber Prize in Genetics •

Wolf Prize in Chemistry •

Canada Gairdner International Award •

Former director of Kaleido Biosciences, Inc. |

Scientific Society Memberships |

•

The National Academy of Sciences •

The National Academy of Medicine •

The American Academy of Arts and Sciences •

The Royal Society of London •

The American Philosophical Society |

Other Public Boards |

•

Cidara Therapeutics, Inc. •

Royalty Pharma plc |

Dr. Bassler’s extensive research experience and her scientific and academic career and accomplishments, as well as her experience as a corporate director, led to the board to conclude that Dr. Bassler should serve as a director. |

| 2023 PROXY STATEMENT AND NOTICE OF ANNUAL SHAREHOLDER MEETING |  |

/ 15 |

Director since: 1991 Age: 81 Independent |

|

Board and Committee Membership—2022 Attendance |

|

Board of Directors: |

7/7 |

Corporate Governance and Compliance Committee: |

5/5 |

Technology Committee (Chair): |

2/2 |

Regeneron Securities Beneficially Owned as of April 11, 2023 |

|

Common Stock: |

11,662 |

Options: |

8,656 |

RSUs: |

1,153 |

Career Highlights |

•

Distinguished Chair in Biomedical Sciences since 1989 and Regental Professor of Molecular Genetics and Internal Medicine and Director of the Jonsson Center for Molecular Genetics since 1985 at The University of Texas Southwestern Medical Center at Dallas •

Nobel Prize for Physiology or Medicine in 1985 (jointly with Dr. Goldstein) •

U.S. National Medal of Science in 1988 (jointly with Dr. Goldstein) |

Scientific Society Memberships |

•

The National Academy of Sciences •

The National Academy of Medicine •

The Royal Society of London |

Dr. Brown’s distinguished scientific and academic background, including his receipt of the Nobel Prize for Physiology or Medicine in 1985, and his significant industry experience gained through his service on the board of directors of the Company and of a leading pharmaceutical company, led the board to conclude that Dr. Brown should serve as a director. |

| 2023 PROXY STATEMENT AND NOTICE OF ANNUAL SHAREHOLDER MEETING |  |

/ 16 |

Director since: 1988 Age: 70 |

|

Board and Committee Membership—2022 Attendance |

|

Board of Directors: |

7/7 |

Technology Committee: |

2/2 |

Regeneron Securities Beneficially Owned as of April 11, 2023 |

|

Class A Stock: |

1,726,565 |

Common Stock: |

683,096 |

Options: |

852,188 |

Career Highlights |

•

Founded the Company in 1988; built and managed the Company over the past 35 years together with Regeneron’s founding scientist, Dr. Yancopoulos •

Director, President, and Chief Executive Officer of the Company since its inception •

Former Chair of the Board of the Company from 1990 through 1994 •

Licensed physician certified in Neurology by the American Board of Psychiatry and Neurology |

Dr. Schleifer’s significant industry and leadership experience, as well as his incomparable knowledge of the Company and an in-depth understanding of the complex research, drug development, and business issues facing companies in the biopharmaceutical sector, led the board to conclude that Dr. Schleifer should serve as a director. |

| 2023 PROXY STATEMENT AND NOTICE OF ANNUAL SHAREHOLDER MEETING |  |

/ 17 |

Director since: 2001 Age: 63 |

|

Board and Committee Membership—2022 Attendance |

|

Board of Directors: |

7/7 |

Technology Committee: |

2/2 |

Regeneron Securities Beneficially Owned as of April 11, 2023 |

|

Class A Stock: |

42,750 |

Common Stock: |

1,222,370 |

Options: |

795,799 |

Career Highlights |

•

Founding scientist of the Company; built and managed the Company since 1989 together with Dr. Schleifer •

President and Chief Scientific Officer of the Company •

Director of the Company since 2001 •

11th most highly cited scientist in the world in the 1990s •

Principal inventor and/or developer, together with key members of his team, of the nine FDA-approved drugs the Company has developed, EYLEA® (aflibercept) Injection, Praluent® (alirocumab), Dupixent® (dupilumab), Kevzara® (sarilumab), Libtayo® (cemiplimab), Evkeeza® (evinacumab-dgnb), Inmazeb® (atoltivimab, maftivimab and odesivimab-ebgn), ZALTRAP® (ziv-aflibercept) Injection for Intravenous Infusion, and ARCALYST® (rilonacept) Injection for Subcutaneous Use, as well as of its foundation technologies, including the TRAP technology, VelociGene®, and VelocImmune® |

Scientific Society Memberships |

•

The National Academy of Sciences |

Dr. Yancopoulos’s significant industry and scientific experience and distinguished record of scientific expertise, as well as his extensive knowledge of the Company and an in-depth knowledge of the Company’s technologies and research and development programs, led the board to conclude that Dr. Yancopoulos should serve as a director. |

| 2023 PROXY STATEMENT AND NOTICE OF ANNUAL SHAREHOLDER MEETING |  |

/ 18 |

The board has a standing Audit Committee, Compensation Committee, and Corporate Governance and Compliance Committee, each of which is comprised entirely of independent directors. The Corporate Governance and Compliance Committee is responsible for reviewing and recommending for the board’s selection candidates to serve on our board of directors and for overseeing all aspects of the Company’s compliance program other than financial compliance. The board also has a standing Technology Committee, which provides direct oversight of our research and clinical development programs, plans, and policies. The board has adopted charters for the Audit Committee, Compensation Committee, Corporate Governance and Compliance Committee, and Technology Committee, current copies of which are available on our website at www.regeneron.com under the “Corporate Governance” heading on the “Investors & Media” page.

We show below information on the membership, key functions, recent focus areas, and number of meetings of each board committee during 2022.

AUDIT |

|

Members |

Key Functions of the Committee |

George L. Sing, Chair N. Anthony Coles, M.D. Arthur F. Ryan |

•

Select the independent registered public accounting firm, review and approve its engagement letter, and monitor its independence and performance •

Review the overall scope and plans for the annual audit by the independent registered public accounting firm •

Approve performance of non-audit services by the independent registered public accounting firm and evaluate the performance and independence of the independent registered public accounting firm •

Review and approve the Company’s periodic financial statements and the results of the year-end audit •

Review and discuss the adequacy and effectiveness of the Company’s accounting and internal control policies and procedures •

Evaluate the internal audit process for establishing the annual audit plan; review and approve the appointment and replacement of the Company’s Chief Audit Executive, if applicable, and any outside entities providing internal audit services and evaluate their performance on an annual basis •

Review the independent registered public accounting firm’s recommendations concerning the Company’s financial practices and procedures •

Oversee the Company’s risk management program •

Discuss with management the Company’s major financial risk exposures and the steps management has taken to monitor and control such exposures •

Establish procedures for the receipt, retention, and treatment of complaints received by the Company regarding accounting, internal accounting controls, or auditing matters and for the confidential, anonymous submission by employees of concerns regarding questionable accounting or auditing matters •

Review and approve any related person transaction •

Prepare an annual report of the Audit Committee for inclusion in the Company’s proxy statement |

Number of Meetings Held in 2022 |

|

9 |

|

Recent Focus Areas |

|

•

Regeneron’s international expansion and related audit matters •

Impact of the Inflation Reduction Act •

Cybersecurity risk assessment •

Succession planning for the Company’s finance, information technology, and real estate & facilities management organizations |

|

| 2023 PROXY STATEMENT AND NOTICE OF ANNUAL SHAREHOLDER MEETING |  |

/ 19 |

COMPENSATION |

|

Members |

Key Functions of the Committee |

Christine A. Poon, Chair George L. Sing Huda Y. Zoghbi, M.D. |

•

Evaluate the performance of the Chief Executive Officer and other executive officers of the Company •

Recommend compensation for the Chief Executive Officer for approval by the non-employee members of the board of directors •

Approve compensation for other executive officers •

Approve the total compensation budget for all Company employees •

Oversee the Company’s compensation and benefit philosophy and programs generally •

Oversee the Company’s strategies and policies related to human capital management, including with respect to workplace environment and culture; talent recruitment, development, and retention; and employee engagement* •

Review and approve annually the corporate goals and objectives applicable to the compensation of the Chief Executive Officer and the goals and objectives of the Company’s executive compensation programs •

Review and approve the Compensation Discussion and Analysis to be included in the Company’s proxy statement •

Prepare an annual report of the Compensation Committee for inclusion in the Company’s proxy statement |

Number of Meetings Held in 2022 |

|

12 |

|

Recent Focus Areas |

|

•

Retention of key leaders •

Potential broader use of performance restricted stock units and other pay mix considerations •

Assessment of the impact of inflation on employee groups and implementation of related measures •

New “pay-versus-performance” disclosure rules •

Design of annual cash incentive program |

|

CORPORATE GOVERNANCE AND COMPLIANCE |

|

Members |

Key Functions of the Committee |

Arthur F. Ryan, Chair Bonnie L. Bassler, Ph.D. Michael S. Brown, M.D. Joseph L. Goldstein, M.D. Christine A. Poon |

•

Identify qualified individuals to become members of the board and recommend such candidates to the board •

Assess the functioning of the board and its committees and make recommendations to the board concerning the appropriate size, function, and needs of the board •

Review, and make recommendations to the board regarding, non-employee director compensation •

Make recommendations to the board regarding corporate governance matters and practices •

Oversee all aspects of the Company’s comprehensive compliance program other than financial compliance •

Oversee the Company’s key corporate responsibility initiatives and conduct a periodic review of environmental, social, and governance (“ESG”) matters* |

Number of Meetings Held in 2022 |

|

5 |

|

Recent Focus Areas |

|

•

Director refreshment efforts, including the appointment of Dr. Craig B. Thompson •

Corporate governance expectations of shareholders and other stakeholders •

Compliance program and data privacy •

ESG matters |

|

| 2023 PROXY STATEMENT AND NOTICE OF ANNUAL SHAREHOLDER MEETING |  |

/ 20 |

TECHNOLOGY |

|

Members |

Key Functions of the Committee |

Michael S. Brown, M.D., Chair Bonnie L. Bassler, Ph.D. Joseph L. Goldstein, M.D. Marc Tessier-Lavigne, Ph.D. P. Roy Vagelos, M.D. Huda Y. Zoghbi, M.D. Leonard S. Schleifer, M.D., Ph.D.** George D. Yancopoulos, M.D., Ph.D.** Number of Meetings Held in 2022 2 |

•

Oversee, review, and evaluate the Company’s research and clinical development programs, plans, and policies •

Identify and discuss emerging scientific and technology issues and trends, including their impact on Regeneron’s research and development programs, plans, or policies •

Identify and assess new leaders within research & development and global development organizations |

Recent Focus Areas |

|

•

The Company’s immuno-oncology programs •

Recent advances and discoveries of the Regeneron Genetics Center® and the Company’s research and preclinical development pipeline

|

|

*

The full board retains oversight of the Company’s strategies and policies related to diversity, equity, and inclusion. See the subsection “The Company—Corporate Governance—Corporate Responsibility” for more information. **

Ex Officio Member. |

|

| 2023 PROXY STATEMENT AND NOTICE OF ANNUAL SHAREHOLDER MEETING |  |

/ 21 |

Pursuant to the Company’s Certificate of Incorporation, the board of directors is divided into three classes, denominated Class I, Class II, and Class III, with members of each class holding office for staggered three-year terms. There are currently four members in each of Class I, Class II, and Class III. In accordance with the requirements of New York law, Dr. Thompson was not assigned to any particular class upon his election by the board in October 2022 and, if he is elected by shareholders at the 2023 Annual Meeting, he will join Class II. The respective terms of the directors expire (in all cases, subject to the election and qualification of their successors and to their earlier death, resignation, or removal) as follows:

The terms of the Class I Directors expire at the 2025 Annual Meeting;

The terms of the Class II Directors expire at the 2023 Annual Meeting; and

The terms of the Class III Directors expire at the 2024 Annual Meeting.

On April 14, 2023, Dr. Vagelos, a Class II Director, notified the Company of his decision not to stand for re-election at the 2023 Annual Meeting. Following the 2023 Annual Meeting, subject to the election of the other Class II Directors nominated for reelection at the 2023 Annual Meeting, the board is expected to be comprised of 12 members equally apportioned among the classes. See the subsection “Board Leadership Structure” below for more information.

Regeneron continues to operate with the long-term outlook required to turn rigorous scientific research into important new medicines. To deliver on this mission, we manage our business for the long term and pursue our core strategy of creating and advancing a high-quality, internally developed product pipeline. In response to shareholder feedback, in January 2023 the Corporate Governance and Compliance Committee requested, reviewed, and discussed a detailed analysis of the costs and benefits of the Company’s classified board structure in order to facilitate the Committee’s continued consideration of this feature of Regeneron’s governance. Following this review, at present the board and the Committee continue to believe that the classified board structure aligns with the Company’s long-term orientation and enables the board to provide appropriate and expert oversight of management over the course of the development cycle of our products, which the board believes ultimately drives the creation of sustainable shareholder value. Furthermore, the board believes three-year terms enhance the independence of our non-employee directors by providing continuity of service and protecting them against potential pressures from special interest groups or others who might have an agenda contrary to the long-term interests of shareholders. The board and/or the Committee will periodically review and continue to consider whether the classified board structure aligns with the Company’s long-term strategic objectives.

The board held 7 meetings in 2022, of which five were regular and two were special meetings. The Regeneron Board of Directors Corporate Governance Guidelines provide that directors are expected to attend all or substantially all meetings of the board and the committees on which they serve. All directors in office at that time attended at least 75% of the total number of meetings of the board and committees of the board on which they served.

According to the Regeneron Board of Directors Corporate Governance Guidelines, board members are expected to attend the Company’s Annual Meeting of Shareholders. All of the directors attended our 2022 Annual Meeting of Shareholders.

| 2023 PROXY STATEMENT AND NOTICE OF ANNUAL SHAREHOLDER MEETING |  |

/ 22 |

The Corporate Governance and Compliance Committee is responsible for ensuring that our board is comprised of highly qualified directors with diverse skillsets and backgrounds who will serve as stewards of investor capital and drive the Company’s scientific focus to ensure the continued creation of long-term shareholder value. The Committee seeks to ensure that our board as a whole possesses the mix of skills and experiences to provide effective oversight and guidance to management to execute on the Company’s long-term strategy. The Committee’s refreshment philosophy prioritizes skills that it considers important and desirable based on the Company’s current needs and business priorities, while recognizing that our board members must have predominantly science-based backgrounds to effectively provide robust, independent oversight of management. The Committee also works to ensure that various members of the board bring substantial governance, financial, policy, and management expertise gained from their professional backgrounds and their service on other boards.

The Committee believes it is desirable to maintain a mix of longer-tenured, experienced directors who have developed enhanced knowledge and understanding of, and valuable insight into, the Company and its operations and newer directors with fresh perspectives. As a result, we do not impose director tenure limits or a mandatory retirement age. The Committee has considered the perspectives of some shareholders regarding longer-tenured directors but believes that longer-serving directors with experience and institutional knowledge bring critical skills to the boardroom. In particular, the Committee believes that continuity on the board allows for longer-tenured directors to make meaningful contributions and provide effective oversight of management during the complete drug discovery and development cycle. Accordingly, while director tenure is taken into consideration when evaluating the board’s composition, the Committee believes that imposing arbitrary limits on director tenure would deprive the board of the valuable contributions of its most experienced members.

To ensure a robust approach to director suitability, evaluation, and refreshment, the Committee has adopted refreshment mechanisms that include the following:

A formal annual board and committee self-evaluation, as discussed further below;

A requirement to offer resignation upon material change in principal employment; and

A policy that limits director service to no more than four public boards (including Regeneron) and requires notification prior to appointment to another public or for-profit company board.

In 2022, Dr. Thompson was elected as a member of the board of directors. Dr. Thompson is a renowned healthcare business leader with exceptional senior executive experience and scientific expertise in multiple therapeutic areas, including oncology. His distinguished career, physician-scientist background, and expertise in oncology will be assets to the Company as we continue to expand our oncology footprint. Dr. Thompson was recommended for consideration by the Corporate Governance and Compliance Committee by a non-management director of the board.

The Corporate Governance and Compliance Committee will consider a nominee for election to the board of directors recommended by a shareholder of record if the shareholder submits the recommendation in compliance with the requirements of our Guidelines Regarding Director Nominations, which are available on our website at www.regeneron.com under the “Corporate Governance” heading on the “Investors & Media” page.

In considering potential candidates for the board of directors, the Corporate Governance and Compliance Committee considers factors such as whether or not a potential candidate: (1) possesses relevant expertise; (2) brings skills and experience complementary to those of the other members of the board; (3) has sufficient time to devote to the affairs of the Company; (4) has demonstrated excellence in his or her field; (5) has the ability to exercise sound business judgment; (6) has the commitment to rigorously represent the long-term interests of the Company’s shareholders; (7) possesses a diverse background and experience, including with respect to race, age, and gender; and (8) should be recommended in light of such other factors as the Corporate Governance and Compliance Committee may determine from time to time.

| 2023 PROXY STATEMENT AND NOTICE OF ANNUAL SHAREHOLDER MEETING |  |

/ 23 |

Candidates for director are reviewed in the context of the current composition of the board of directors, the operating requirements of the Company, and the long-term interests of shareholders. In conducting the assessment, the Committee considers the individual’s independence, experience, skills, background, and diversity, including with respect to race, age, and gender, along with such other factors as it deems appropriate, given the current needs of the board and the Company to maintain a balance of knowledge, experience, and capabilities. When recommending a slate of director nominees each year, the Corporate Governance and Compliance Committee reviews the current composition of the board of directors in order to recommend a slate of directors who, with the continuing directors, will provide the board with the requisite diversity of skills, expertise, experience, and viewpoints necessary to effectively fulfill its duties and responsibilities.

In the case of an incumbent director whose term of office is set to expire, the Corporate Governance and Compliance Committee reviews such director’s overall service to the Company during the director’s term and also considers the director’s interest in continuing as a member of the board. In the case of a new director candidate, the Corporate Governance and Compliance Committee also reviews whether the nominee is “independent,” based on our Corporate Governance Guidelines, applicable listing standards of the Nasdaq Stock Market LLC, and applicable SEC and other relevant rules and regulations, if necessary.

The Corporate Governance and Compliance Committee may employ a variety of methods for identifying and evaluating nominees for the board of directors. In addition, the Corporate Governance and Compliance Committee may consider candidates recommended by other directors, management, search firms, shareholders, or other sources. When conducting searches for new directors, the Corporate Governance and Compliance Committee will take reasonable steps to include diverse candidates in the pool of nominees and any search firm will affirmatively be instructed to seek to include diverse candidates. Candidates recommended by shareholders will be evaluated on the same basis as candidates recommended by our directors or management or by third-party search firms or other sources. Candidates may be evaluated at regular or special meetings of the Corporate Governance and Compliance Committee. The Committee also considers succession planning for board and committee chairs for purposes of continuity and to maintain relevant expertise and depth of experience.

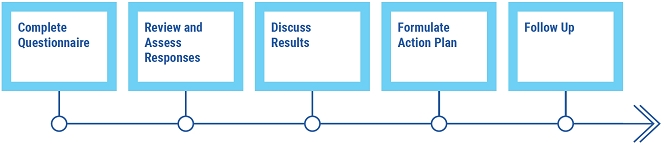

On an annual basis, the board of directors, the Audit Committee, the Compensation Committee, and the Corporate Governance and Compliance Committee conduct self-assessments to ensure effective performance and to identify opportunities for improvement. As the first step in the self-assessment process, directors complete a comprehensive questionnaire, which asks them to consider various topics related to board and committee composition, structure, effectiveness, and responsibilities, as well as satisfaction with the schedule, materials, and discussion topics. Each committee, as well as the board as a whole, then reviews and assesses the responses and presents its findings and recommendations to the board of directors. The results of the assessments are then discussed by the board of directors and the respective committees in executive session, with a view toward taking action to address any issues presented. Results requiring additional consideration are addressed at subsequent board and committee meetings, where appropriate.

| 2023 PROXY STATEMENT AND NOTICE OF ANNUAL SHAREHOLDER MEETING |  |

/ 24 |

Annual Self-Assessment Process

While this formal self-assessment is conducted on an annual basis, directors share perspectives, feedback, and suggestions year round, both inside and outside the boardroom.

Regeneron’s charter documents give shareholders the right to call a special shareholder meeting upon the written request of at least 25% of the total number of votes entitled to be cast by shareholders.

The board of directors has determined that each of the following currently serving directors is independent as defined in the listing standards of the Nasdaq Stock Market LLC and our Corporate Governance Guidelines: Bonnie L. Bassler, Ph.D., Michael S. Brown, M.D., N. Anthony Coles, M.D., Joseph L. Goldstein, M.D., Christine A. Poon, Arthur F. Ryan, George L. Sing, Marc Tessier-Lavigne, Ph.D., Craig B. Thompson, M.D., and Huda Y. Zoghbi, M.D. These individuals are affiliated with numerous educational institutions, hospitals, charities, and corporations, as well as civic organizations and professional associations. The board of directors considered each of these relationships and determined that none of these relationships conflicted with the interests of the Company or would impair their independence or judgment. In accordance with our Corporate Governance Guidelines, the board conducts executive sessions of independent directors presided by the Chair of the Corporate Governance and Compliance Committee following each regularly scheduled board meeting, as discussed further below.

The board of directors has determined that each of the current members of the Audit Committee, Messrs. Ryan and Sing and Dr. Coles, qualifies as an “audit committee financial expert” as that term is defined by SEC rules, and is independent as defined for audit committee members in the listing standards of the Nasdaq Stock Market LLC and SEC rules.

In addition, the board of directors has determined that each of the current members of the Compensation Committee, Ms. Poon, Mr. Sing, and Dr. Zoghbi, meets the additional independence criteria applicable to compensation committee members under the listing standards of the Nasdaq Stock Market LLC and qualifies as a “Non-Employee Director” pursuant to Rule 16b-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

The board of directors recognizes that one of its key responsibilities is to establish and evaluate an appropriate leadership structure for the board so as to provide effective oversight of management. The board of directors believes that a company’s board leadership structure should take into account relevant corporate governance and strategic considerations (such as board size and composition, director tenure, and experience of the management team) and that the board should maintain flexibility and adjust the leadership structure as appropriate.

Regeneron’s current board leadership structure (in effect since 1995) is based on the separation of the roles of the Chief Executive Officer and the Chair of the Board, with Dr. Vagelos serving as Chair and Dr. Schleifer serving as President and Chief Executive Officer. The board has determined that this leadership structure is currently appropriate for the Company. This determination was based in part on Dr. Vagelos’s extensive leadership experience, business acumen, and deep understanding of the healthcare industry, as well as the fact that in the board’s view Dr. Vagelos is

| 2023 PROXY STATEMENT AND NOTICE OF ANNUAL SHAREHOLDER MEETING |  |

/ 25 |

able to directly challenge senior management on both scientific and business matters. The perspectives gained from his extensive industry experience have made Dr. Vagelos an invaluable resource to both the board and the management team and have also allowed him to effectively serve as a sounding board for the other directors.

Based on the way in which he has executed his role as Chair, the board considers Dr. Vagelos to be an impartial director. However, given that Dr. Vagelos does not meet the independence requirements set forth in the listing standards of the Nasdaq Stock Market LLC, and to enable even more robust independent oversight, Mr. Ryan, an independent director and Chair of the Corporate Governance and Compliance Committee, currently serves as Presiding Director and chairs all executive sessions of independent directors (which generally follow each regularly scheduled board meeting). Mr. Ryan’s substantial leadership experience as a chief executive officer of leading companies in the banking and insurance industries, his extensive business experience and financial expertise, and his prior service as a director of several publicly traded companies have made him well suited to effectively serve as an additional layer of independent oversight.

The board believes that this governance arrangement has bolstered the board’s leadership structure and its goal of ensuring independent oversight of management’s execution of our business strategy and the continued creation of sustainable shareholder value.

On April 14, 2023, Dr. Vagelos notified the Company of his decision not to stand for re-election at the 2023 Annual Meeting. On the same day, the board of directors adopted a board leadership succession plan, based on which the board plans to elect Drs. Schleifer and Yancopoulos as Co-Chairs of the Board to succeed Dr. Vagelos as Chair and to establish the role of Lead Independent Director (with Ms. Poon expected to be designated by the independent directors as the Lead Independent Director), each effective following the conclusion of the 2023 Annual Meeting. Pursuant to this board leadership succession plan, Drs. Schleifer and Yancopoulos will retain their roles as President and Chief Executive Officer and President and Chief Scientific Officer, respectively. In planning to elect Drs. Schleifer and Yancopoulos as Co-Chairs, the board of directors considered their incomparable knowledge and demonstrated leadership of the Company for over three decades, as well as the fact that Dr. Schleifer previously served as Chair of the Board from 1990 through 1994. The board also believes that their ability to speak as Co-Chairs of the Board as well as Presidents of the Company will provide strong unified leadership for the Company. In the board’s view, electing Drs. Schleifer and Yancopoulos as Co-Chairs, combined with a strong Lead Independent Director appointed by the independent directors, will provide balanced leadership and effective oversight of management and be in the best interest of the Company and its shareholders.

The board will continue to periodically evaluate and determine, with input from the independent directors, an appropriate leadership structure for the board so as to provide effective oversight of management.

The board executes its oversight responsibility for risk management directly and through its committees, as follows:

The Audit Committee, which includes our Presiding Director as a member, oversees the Company’s risk management program. The risk management program focuses on the most significant risks the Company faces in the short-, intermediate-, and long-term timeframe. The Company’s Chief Audit Executive, who reports independently to the Committee, facilitates the risk management program. Audit Committee meetings include discussions of specific risk areas throughout the year, including, among others, those relating to cybersecurity, and reports from the Chief Audit Executive on the Company’s enterprise risk profile on an annual basis. Recently, the Audit Committee independently engaged a consultant to conduct a cybersecurity assessment and preparedness analysis.

The Compensation, Corporate Governance and Compliance, and Technology Committees oversee risks associated with their respective areas of responsibility.

As part of its overall review of the Company’s compensation policies and practices, the Compensation Committee generally considers the risks associated with these policies and practices while designing performance incentives that align executives’ interests with those of long-term shareholders. At least annually the Compensation Committee reviews and considers a compensation program risk assessment performed by its independent compensation consultant.

| 2023 PROXY STATEMENT AND NOTICE OF ANNUAL SHAREHOLDER MEETING |  |

/ 26 |

The Corporate Governance and Compliance Committee oversees all aspects of the Company’s comprehensive compliance program other than financial compliance and considers legal and regulatory compliance risks, including corporate responsibility initiatives that are expected to have a significant impact on the Company’s ability to deliver sustained growth. The Company’s Chief Compliance Officer, who reports to our Executive Vice President, General Counsel and Secretary, provides regular updates directly to the Corporate Governance and Compliance Committee (generally given at every regularly scheduled meeting of the Committee), and relevant information is shared with the full board as part of the Corporate Governance and Compliance Committee’s report to the board.

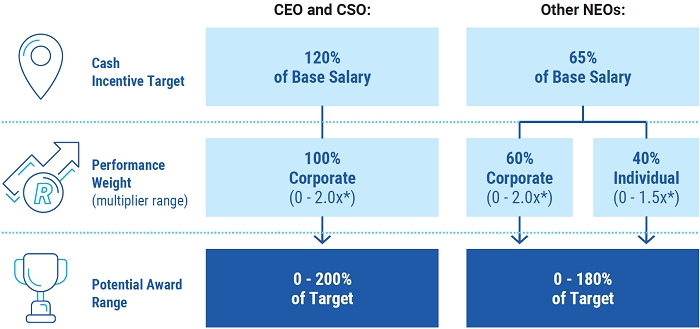

The Technology Committee considers risks associated with our research and development programs.