CXPRO2889

Summary Prospectus

January 28, 2024

OAKMARK BOND FUND

| Investor Class |

Advisor Class |

Institutional Class |

R6 Class |

||||||||||||

| OAKCX |

OAYCX |

OANCX |

OAZCX |

||||||||||||

Before you invest, you may want to review the Fund's prospectus and statement of additional information, which contain more information about the Fund and its risks. You can find the Fund's prospectus and other information about the Fund online at www.Oakmark.com/prospectus. You can also get this information at no cost by calling 1-800-OAKMARK or by sending an email request to Literature@Oakmark.com. The Fund's prospectus and statement of additional information, dated January 28, 2024, and as each may be further supplemented or amended, are incorporated by reference into this Summary Prospectus.

INVESTMENT OBJECTIVE

The Fund seeks to maximize both current income and total return, consistent with prudent investment and principal protection management.

FEES AND EXPENSES OF THE FUND

Below are the fees and expenses that you would pay if you buy, hold, and sell shares of the Fund.

Shareholder Fees (fees paid directly from your investment)

None.

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment).

|

Investor Class |

Advisor Class |

Institutional Class |

R6 Class |

||||||||||||||||

|

Management fees |

0.39 |

% |

0.39 |

% |

0.39 |

% |

0.39 |

% |

|||||||||||

|

Distribution (12b-1) fees |

None |

None |

None |

None |

|||||||||||||||

|

Total Other Expenses |

0.94 |

% |

0.73 |

% |

0.69 |

% |

0.63 |

% |

|||||||||||

|

Shareholder Service Plan fees |

0.12 |

%1 |

None |

None |

None |

||||||||||||||

|

Other expenses |

0.82 |

% |

0.73 |

% |

0.69 |

% |

0.63 |

% |

|||||||||||

|

Total Annual Fund Operating Expenses |

1.33 |

% |

1.12 |

% |

1.08 |

% |

1.02 |

% |

|||||||||||

|

Less: Fee waivers and/or expense reimbursements2 |

0.59 |

% |

0.58 |

% |

0.56 |

% |

0.58 |

% |

|||||||||||

|

Total Annual Fund Operating Expenses after fee waivers and/or expense reimbursements |

0.74 |

% |

0.54 |

% |

0.52 |

% |

0.44 |

% |

|||||||||||

1 Investor Class Shares of the Fund pay a service fee not to exceed 0.25% per annum of the average daily net assets of the Fund's Investor Class Shares. This service fee is paid to third-party intermediaries who provide services for and/or maintain shareholder accounts.

2 Harris Associates L.P. (the "Adviser") has contractually undertaken to waive and/or reimburse certain fees and expenses of Investor Class, Advisor Class, Institutional Class, and R6 Class so that the total annual operating expenses (excluding taxes, interest, all commissions and other normal charges incident to the purchase and sale of portfolio securities, and extraordinary charges such as litigation costs, but including fees paid to the Adviser) ("annual operating expenses") of each class are limited to 0.74%, 0.54%, 0.52% and 0.44% of average net assets, respectively. Each of these undertakings lasts until January 27, 2025 and may only be modified by mutual agreement of the parties that, with respect to the Trust, includes a majority vote of the "non-interested" Trustees of the Trust. The Fund has agreed that each of Investor Class, Advisor Class, Institutional Class, and R6 Class will repay the Adviser for fees and expenses waived or reimbursed for the class provided that repayment

does not cause annual operating expenses to exceed 0.74%, 0.54%, 0.52% and 0.44% of the class' average net assets, respectively, or to exceed any lower limit in effect at the time of recoupment. Any such repayment must be made within three years after the year in which the Adviser incurred the expense.

Example. The Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund's operating expenses were those reflected in the table, inclusive of any fee waivers and/or expense reimbursements.

Although your actual returns and expenses may be higher or lower, based on these assumptions your expenses would be:

|

Investor Class |

Advisor Class |

Institutional Class |

R6 Class |

||||||||||||||||

| 1 Year |

$ |

76 |

$ |

55 |

$ |

53 |

$ |

45 |

|||||||||||

| 3 Years |

363 |

298 |

288 |

267 |

|||||||||||||||

| 5 Years |

672 |

561 |

541 |

507 |

|||||||||||||||

| 10 Years |

1,550 |

1,311 |

1,267 |

1,195 |

|||||||||||||||

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in Annual Fund Operating Expenses or in the Example, affect the Fund's performance. During the most recent fiscal year, the Fund's portfolio turnover rate was 75% of the average value of its portfolio.

PRINCIPAL INVESTMENT STRATEGY

The Fund invests primarily in a diversified portfolio of bonds and other fixed-income securities. These include, but are not limited to, investment grade corporate bonds; U.S. or non-U.S.-government and government-related obligations (such as, U.S. treasury securities); below investment-grade corporate bonds; agency and non-agency mortgage backed-securities; asset-backed securities; senior loans (such as, leveraged loans, bank loans, covenant lite loans, and/or floating rate loans); assignments; restricted securities (e.g., Rule 144A securities); and other fixed and floating rate instruments. Under normal market conditions, the Fund invests at least 80% of its net assets (plus borrowings made for investment purposes) in bonds and other fixed-income securities, and other investments that the Adviser believes have similar economic characteristics, including other

investment companies that provide investment exposure to such securities. The Adviser may shift the level of these allocations among the different bond and other fixed-income asset classes depending on market conditions.

Under normal market conditions, the Fund invests at least 25% of its assets in investment-grade fixed-income securities and may invest up to 35% of its assets in below investment-grade fixed-income securities (commonly known as "high-yield" or "junk bonds"). The Fund considers fixed-income securities to be investment-grade if, at the time of investment, they are rated Baa3 or higher by Moody's Investors Service ("Moody's"), BBB- or higher by S&P Global Ratings ("S&P") or Fitch Ratings, or equivalently rated by any other nationally recognized statistical rating organization ("NRSRO"), or, if unrated, deemed to be of comparable quality by the Adviser. The Fund considers fixed-income securities to be below investment-grade if, at the time of investment, they are rated Ba1 or lower by Moody's, BB+ or lower by S&P, or equivalently rated by any NRSRO, or, if unrated, determined by the Adviser to be of comparable quality. Only one rating is required and if a security is split rated, the Adviser assigns the lowest rating. The Fund invests in senior loans that are typically rated below investment-grade and to bear interest at a floating rate that periodically resets. The Fund may also invest up to 10% of its net assets in defaulted corporate securities.

In seeking to achieve the objectives of the Fund, the Adviser may purchase securities on a when-issued basis and purchase or sell delayed-delivery securities. In addition, the Fund may invest in fixed income securities structured as fixed rate debt; floating rate debt; and debt that may not pay interest at the time of issuance. The Fund may also invest in inverse floaters, as well as interest-only and principal-only securities.

The Fund will prioritize differentiation through bottom-up, single-security selection across the major fixed income asset classes with a secondary focus on top-down asset allocation and interest rate and duration management. When selecting individual securities, the Adviser uses a bottom-up approach and seeks relative price appreciation by selecting securities the Adviser believes to be undervalued based on research and fundamental analysis and by making gradual adjustment in the average duration of the Fund's portfolio. The Adviser's investment strategy is a bottom-up process that first looks for opportunities by focusing on an individual issuer's default risk pricing and then incorporates top-down considerations such as interest rate forecasting, curve selection, and other macros factors.

The Adviser utilizes an investment approach that considers a quantitative valuation model combined with a qualitative ratings framework. The Fund's portfolio selection process uses a ranking structure with a defined "buy" and "sell" discipline that allocates investments among a list of approved issuers and considers an individual investment's risk reward profile, legal structure, and/or downside risk, among other factors. The Adviser actively manages the portfolio's asset class exposure using a top-down view of sector fundamentals. The Adviser rotates Fund portfolio assets among sectors in various markets in an effort to maximize return.

Under normal market conditions, the Adviser seeks to maintain an investment portfolio with a weighted average effective duration of no less than two years and no more than eight years. The duration of the Fund's portfolio may vary materially from its target, from time to time, and there is no assurance that the duration of the Fund's portfolio will meet its target.

The Fund may invest up to 20% of its assets in equity securities, such as common stocks and preferred stocks. The

Fund may also hold cash or short-term debt securities from time to time and for temporary defensive purposes.

The Fund may invest in derivative instruments, such as futures, forwards (including forward foreign currency contracts), and swap agreements (including credit default swaps, interest rate swaps, and total return swaps), for a variety of purposes, including, but not limited to, managing the Fund's duration or its exposure to fixed income securities with different maturities, currencies, interest rates, individual issuers, or sectors. The Fund may also use options, including, but not limited to, buying and selling (writing) put and call options on individual stocks and indexes, when such use is desirable because of tax or other considerations.

In deciding which fixed income securities to buy and sell, the Adviser attempts to emphasize securities issued by companies with strong fundamentals and relatively limited anticipated volatility. These securities are selected with the same bottom-up investment process that underpins all of the Oakmark funds. The Fund uses a value investment philosophy in selecting its securities. This value investment philosophy, in the context of fixed-income securities, is based upon the belief that, over time, a company's credit default risk will converge with the Adviser's estimate of the credit default risk associated with a company's intrinsic value. By "intrinsic value," the Adviser means its estimate of the value a knowledgeable buyer would pay to acquire the entire business. The Adviser believes that investing in securities that have credit risk priced significantly below what it believes the company's intrinsic value implies, allows the best opportunity to achieve the Fund's investment objective.

In an effort to achieve its goal, the Fund may engage in active and frequent trading. The Fund's investment objective may be changed without shareholder approval. The Fund will not alter its policy to invest at least 80% of its net assets (plus borrowings made for investment purposes) in bonds and other fixed-income securities, and other investments that the Adviser believes have similar economic characteristics, including other investment companies that provide investment exposure to such securities, without providing shareholders at least 60 days' notice. This test is applied at the time the Fund invests; later percentage changes caused by a change in Fund assets, market values or company circumstances will not require the Fund to dispose of a holding.

PRINCIPAL INVESTMENT RISKS

As an investor in the Fund, you should have a long-term perspective and be able to tolerate potentially wide fluctuations in the value of your Fund shares. Your investment in the Fund is subject to risks, including the possibility that the value of the Fund's portfolio holdings may fluctuate in response to events specific to the companies in which the Fund invests, as well as economic, political or social events in the United States or abroad and the Adviser's evaluation of those events, and the success of the Adviser in implementing the Fund's investment strategy. As a result, when you redeem your Fund shares, they may be worth more or less than you paid for them.

Although the Fund makes every effort to achieve its investment objective, it cannot guarantee it will attain that investment objective. The following principal investment risks can significantly affect the Fund's performance:

Credit Risk. Credit risk is the risk the issuer or guarantor of a debt security will be unable or unwilling to make timely payments of interest or principal or to otherwise honor its obligations.

Call Risk. Upon the issuer's desire to call a security, or under other circumstances where a security is called, including when interest rates are low and issuers opt to repay the obligation underlying a "callable security" early, the Fund may have to reinvest the proceeds in an investment offering a lower yield and may not benefit from any increase in value that might otherwise result from declining interest rates.

Interest Rate Risk. The Fund's yield and share price will fluctuate in response to changes in interest rates and there is a risk of loss due to changes in interest rates. In general, the prices of debt securities rise when interest rates fall, and the prices fall when interest rates rise. The Fund may be subject to a greater risk of rising interest rates due to the current period of historically low rates. Inverse floaters earn interest at rates that vary inversely to changes in short-term interest rates. An inverse floater produces less income (and may produce no income) and may decline in value when market rates rise.

Liquidity Risk. Trading markets or a particular investment in which the Fund is invested, including securities of issuers located outside the United States, may become less liquid or even illiquid. Illiquid investments can be more difficult to purchase or sell at an advantageous price or time, and there is a greater risk that they may not be sold for the price at which the Fund is carrying them. This risk may be heightened with investments in issuers located in developing and emerging countries. The inability to sell an investment can adversely affect the Fund's value or prevent the Fund from being able to take advantage of other investment opportunities.

Government-Sponsored Entity Securities Risk. Some securities issued or guaranteed by U.S. government agencies or instrumentalities are not backed by the full faith and credit of the U.S. and may only be supported by the right of the agency or instrumentality to borrow from the U.S. Treasury. There can be no assurance that the U.S. government will always provide financial support to those agencies or instrumentalities.

Sovereign Debt Risk. Sovereign debt instruments, including U.S. and non-U.S. debt instruments, are subject to the risk that a governmental entity may delay, refuse, or be unable to pay interest or repay principal on its debt, due, for example, to cash flow problems, insufficient foreign currency reserves, political considerations, the size of the governmental entity's debt position in relation to the economy, its policy toward international lenders or the failure to put in place economic reforms required by multilateral agencies. If a governmental entity defaults, it may ask for more time in which to pay or for further loans. There is no legal process for collecting sovereign debt that a government does not pay, nor are there bankruptcy proceedings through which all or part of the sovereign debt that a government entity has not repaid may be collected.

Lower-Rated Debt Securities Risk. Below investment grade securities (commonly called junk bonds) are regarded as having predominately speculative characteristics with respect to the issuer's continuing ability to pay principal and interest and carry a greater risk that the issuer of such securities will default in the timely payment of principal and interest. Issuers of securities that are in default or have defaulted may fail to resume principal or interest payments, in which case the Fund may lose its entire investment.

Loan Interests Risk. Loan interests may be subject to restrictions on transfer. The Fund may be unable to sell its loan interests at a time when it may otherwise be desirable to do so. Therefore, at times loan interests may be illiquid. Loan interests may have extended settlement periods and also may be difficult to value. Interests in secured loans have the benefit of collateral

securing a loan in which the Fund has an interest and, typically, there are restrictive covenants limiting the ability of the borrower to further encumber its assets. The value of the collateral may decline and may become insufficient to cover the amount owed on the loan. In the case of borrower default, bankruptcy or other insolvency laws may limit or delay the Fund's access to the collateral. Further, in the event of a default, lower tier secured loans and unsecured loans will generally be paid only if the value of the collateral exceeds the amount of the borrower's obligations to the senior secured lenders, and the remaining collateral may not sufficiently cover the full amount owed on the loan in which the Fund has an interest. Interests in loans can expose the Fund to the lender's credit risk and also may expose the Fund to the credit risk of the underlying borrower.

Covenant lite loans may contain fewer or no restrictive covenants compared to other loans. Accordingly, the Fund may experience relatively greater difficulty or delays in enforcing its rights on its holdings of certain covenant lite loans than its holdings of loans or securities with more traditional financial covenants, which may result in losses to the Fund. A loan interest may also be obtained by the assignment of all or a portion of the interests in a particular loan that are held by an original lender or a prior assignee. Normally, an assignee will succeed to all rights and obligations of its assignor with respect to the portion of the loan that is assigned. However, it is possible that the rights and obligations acquired by the purchaser of a loan assignment may differ from those held by the original lender or the assignor. When the fund receives a loan assignment, it is possible that the Fund could be held liable, or may be called upon to fulfill other obligations. A loan interest may not be deemed a security and, in such case, may not be afforded the same legal protections afforded securities under the federal securities laws.

Certain debt securities, derivatives and other financial instruments have traditionally utilized LIBOR as the reference or benchmark rate for interest rate calculations. However, following allegations of manipulation and concerns regarding liquidity, in July 2017 the U.K. Financial Conduct Authority, which regulates LIBOR, announced that it would cease its active encouragement of banks to provide the quotations needed to sustain LIBOR. The ICE Benchmark Administration Limited, the administrator of LIBOR, ceased publishing most liquid U.S. LIBOR maturities on June 30, 2023. It is expected that market participants have transitioned to the use of alternative reference or benchmark rates prior to the applicable LIBOR publication cessation date. Additionally, although regulators have encouraged the development and adoption of alternative rates such as the Secured Overnight Financing Rate ("SOFR"), the future utilization of LIBOR or of any particular replacement rate remains uncertain.

Restricted Securities Risk. Restricted securities may not be listed on an exchange and may not have an active trading market. Accordingly, the prices of these securities may be more difficult to determine than publicly traded securities and these securities may involve heightened risk as compared to investments in securities of publicly traded companies. In addition, restricted securities may be illiquid, and it can be difficult to sell them at a time when it may otherwise be desirable to do so or the Fund may be able to sell them only at prices that are less than what the Fund regards as their fair market value. Transaction costs may be higher for these securities. In addition, the Fund may get only limited information about the issuer of a restricted security.

Mortgage- and Asset-Backed Securities Risk. In addition to being subject to the risks associated with investments in fixed-income securities generally (e.g., prepayment and extension, credit, liquidity and valuation risks), the values of mortgage- and asset-backed securities, including collateralized mortgage obligations ("CMOs"), are influenced by the factors affecting the assets underlying the securities. The value of these securities may be significantly affected by changes in interest rates. These securities are also subject to the risk of default on the underlying mortgages or assets, which may increase particularly during periods of market downturn. An unexpectedly high rate of defaults on the underlying assets will decrease the security's value. If borrowers pay back principal on mortgage-backed securities, before (prepayment) or after (extension) the market anticipates such payments, shortening or lengthening their duration, the Fund's performance could be impacted. In general, a mortgage-backed security might be called or otherwise converted, prepaid or redeemed before maturity due to an excess in cash flow to the issuer or due to a decline in interest rates. In the event there is a prepayment, the Fund would need to reinvest the proceeds, possibly in an investment offering a lower yield or interest rate. On the other hand, in general, slower payoffs or extension may occur if market interest rates rise, which has the effect of increasing the duration or interest rate risk of the impacted securities. In addition, CMOs typically will be issued in a variety of classes or series ("tranches"), which have different maturities and losses are first allocated to the most junior or subordinated tranches. It is possible that there will be limited opportunities for trading CMOs in the OTC market, the depth and liquidity of which will vary from time to time.

Prepayment and Extension Risk. If borrowers pay back principal on certain fixed-income securities, such as mortgage- or asset-backed securities, before (prepayment) or after (extension) the market anticipates such payments, shortening or lengthening their duration, the Fund's performance could be impacted. In general, a debt security might be called or otherwise converted, prepaid or redeemed before maturity due to an excess in cash flow to the issuer or due to a decline in interest rates. In the event there is a prepayment, the Fund would need to reinvest the proceeds, possibly in an investment offering a lower yield or interest rate. On the other hand, in general, slower payoffs or extension may occur if market interest rates rise, which has the effect of increasing the duration or interest rate risk of the impacted securities.

Other Investment Company Risk. To the extent the Fund invests in other investment companies, its performance will be affected by the performance of those other investment companies. Investments in other investment companies are subject to the risks of the other investment companies' investments, as well as to the other investment companies' expenses.

Market Risk. The Fund is subject to market risk—the risk that securities markets and individual securities will increase or decrease in value. Market risk applies to every market and every security. Security prices may fluctuate widely over short or extended periods in response to adverse issuer, political, geopolitical (including wars or acts of terrorism), regulatory, market, economic, sanctions, global health crises or pandemics, environmental, or other developments that may cause broad changes in market value, stability, and public perceptions concerning these developments, and adverse investor sentiment. In addition, securities markets tend to move in cycles. If there is a general decline in the securities markets, it is possible your investment may lose value regardless of the individual results of the companies in which the Fund invests.

The magnitude of up and down price or market fluctuations over time is sometimes referred to as "volatility," which, at times, can be significant. In addition, different asset classes and geographic markets may experience periods of significant correlation with each other. As a result of this correlation, the securities and markets in which the Fund invests may experience volatility due to market, economic, political or social events, such as global health crises or pandemics, and conditions that may not readily appear to directly relate to such securities, the securities' issuer or the markets in which they trade. In addition, some companies may have substantial foreign operations or holdings and may involve additional risks relating to those markets, including but not limited to political, economic, regulatory, or other conditions in foreign countries, as well as currency exchange rates.

Non-U.S. Securities Risk. Investments in securities issued by entities based outside the United States may involve risks relating to political, social and economic developments abroad, as well as risks resulting from the differences between the regulations to which U.S. and non-U.S. issuers and markets are subject. These risks may be difficult to predict and may result in the Fund experiencing rapid and extreme value changes due to currency controls; trade barriers, sanctions and other protectionist trade policies (including those of the U.S.); different accounting, auditing, financial reporting, and legal standards and practices; political and diplomatic changes and developments; expropriation; changes in tax policy; a lack of available public information regarding non-U.S. issuers; greater market volatility; a lack of sufficient market liquidity; differing securities market structures; higher transaction costs; and various administrative difficulties, such as delays in clearing and settling portfolio transactions or in receiving payment of dividends. These risks may be heightened in connection with investments in issuers located in developing and emerging countries, and in issuers in more developed countries that conduct substantial business in such developing and emerging countries. Fluctuations in the exchange rates between currencies may negatively affect an investment in non-U.S. securities. Different markets or regions may react to developments differently than one another or the U.S. Investments in securities issued by entities domiciled in the U.S. also may be subject to many of these risks. The Fund may hedge its exposure to foreign currencies. Although hedging may be used to protect the Fund from adverse currency movements, the use of such hedges may reduce or eliminate the potentially positive effect of currency revaluations on the Fund's total return, and there is no guarantee that the Fund's hedging strategy will be successful.

Derivatives Risk. The Fund's exposure to derivatives can involve investment techniques and risks different from those associated with investing in more traditional investments and sometimes the risks of these investments may be magnified in comparison. Derivative transactions may be volatile and can create leverage in the Fund, which may cause the Fund to lose more than the amount of assets initially invested. At times, derivatives may be highly illiquid, and the Fund may not be able to close out or sell a derivative at the desired time or price. If the Fund's derivative counterparty becomes unwilling or unable to honor its obligations, then the Fund may experience losses. This risk is greater for forward currency contracts, swaps and other over-the-counter traded derivatives. Changes in regulation relating to a mutual fund's use of derivatives and related instruments may limit the availability of derivatives, increase the costs of derivatives, or otherwise adversely affect the value of derivatives impacting the Fund's performance.

Additional risks associated with certain types of derivatives are discussed below:

Forward Contracts. Forward contracts do not have limitations on daily price movements. Changes in foreign exchange regulations by governmental authorities may affect the trading of forward contracts on currencies.

Futures. Futures contracts are subject to the risk that an exchange may impose price fluctuation limits, which may make it difficult or impossible for a fund to exit a position when desired.

Options. The use of options involves investment strategies and risks different from those associated with ordinary portfolio securities transactions. If a strategy is applied at an inappropriate time or market conditions or trends are judged incorrectly, the use of options may lower the Fund's return. There can be no guarantee that the use of options will increase the Fund's return or income. In addition, there may be an imperfect correlation between the movement in prices of options and the securities underlying them and there may at times not be a liquid secondary market for various options.

Swaps. Generally, the risk of loss associated with swaps is limited to the net amount of payments that the Fund is contractually obligated to make or, in the case of the counterparty defaulting, the net amount of payments that the Fund is contractually entitled to receive. However, if the Fund sells a credit default swap it may lose the entire notional amount of the swap.

Leverage Risk. Leverage may cause the Fund to be more volatile and can amplify changes in the Fund's net asset value Derivatives, when-issued and forward-settling securities, and borrowing may create leverage and can result in losses to the Fund that may accelerate the rate of losses and exceed the amount originally invested.

Variable and Floating Rate Instruments Risk. The value of variable and floating rate instruments may decline if market interest rates or the interest rates paid by such instruments do not fluctuate according to expectations since such instruments are less sensitive to interest rate changes than fixed rate instruments. Certain types of variable and floating rate instruments, such as interests in bank loans, may be subject to greater liquidity risk than other debt securities.

When-Issued and Forward-Settling Securities Risk. The value obtained in a when-issued or forward-settling transaction may be less favorable than the price or yield available in the market when the transaction takes place. Conversely, since the Fund is committed to buying such securities at a certain price, any change in the value of these securities, even prior to their issuance, affects the Fund's share value and therefore involves a risk of loss if the value of the security to be purchased declines before the settlement date.

Common Stock Risk. Common stocks are subject to greater fluctuations in market value than other asset classes as a result of such factors as a company's business performance, investor perceptions, stock market trends and general economic conditions. The rights of common stockholders are subordinate to all other claims on a company's assets including, debt holders and preferred stockholders; therefore, the Fund could lose money if a company in which it invests becomes financially distressed.

Sector or Industry Risk. If the Fund has invested a higher percentage of its total assets in a particular sector or industry, changes affecting that sector or industry, or the perception of that sector or industry, may have a significant impact on the performance of the Fund's overall portfolio. Individual sectors or industries may be more volatile, and may perform differently, than the broader market.

Value Style Risk. Investing in "value" stocks presents the risk that the stocks may never reach what the Adviser believes are their full market values, either because the market fails to recognize what the Adviser considers to be the companies' intrinsic values or because the Adviser misjudged those values. In addition, value stocks may fall out of favor with investors and underperform other investments during given periods.

Currency Risk. Currency risk is the risk that foreign currencies will decline in value relative to the U.S. dollar. To the extent that the Fund invests in securities or other instruments denominated in or indexed to foreign currencies, changes in currency exchange rates could adversely impact the Fund's performance. Currency exchange rates may fluctuate abruptly and significantly and can be affected unpredictably by various factors, including investor perception and changes in interest rates; intervention, or failure to intervene, by governments, central banks, or supranational entities; or by currency controls or political developments in the U.S. or abroad. The Adviser may not be able to determine accurately the extent to which a security or its issuer is exposed to currency risk.

High Portfolio Turnover Risk. The Fund may engage in active and frequent trading and may have a high portfolio turnover rate, which may increase the Fund's costs, negatively impact the Fund's performance and may generate a greater amount of capital gain distributions to shareholders than if the Fund had a low portfolio turnover rate.

Your investment in the Fund is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. You may lose money by investing in the Fund. The likelihood of loss may be greater if you invest for a shorter period of time.

PERFORMANCE INFORMATION

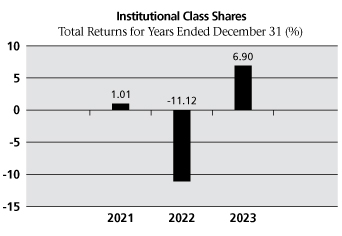

The bar chart and performance table below can help you evaluate the potential risk and reward of investing in the Fund by showing changes in the performance of the Fund's Institutional Class Shares from year to year. The Fund's past performance (before and after taxes), as provided by the bar chart and performance table that follow, is not an indication of how the Fund will perform in the future. The performance table illustrates the volatility of the Fund's historical returns over various lengths of time and shows how the Fund's average annual returns compare with those of one or more broad measures of market performance. The indices, which are described in "Descriptions of Indices" in the prospectus, have characteristics relevant to the Fund's investment strategy. The Fund's Advisor Class and Institutional Class each commenced operations on June 10, 2020, the R6 Class commenced operations on December 15, 2020 and the Investor Class commenced operations on January 28, 2022. Updated performance information is available on Oakmark.com or by calling 1-800-OAKMARK (625-6275).

Since 2020, the highest and lowest quarterly returns for the Fund's Institutional Class Shares were:

• Highest quarterly return: 7.1%, during the quarter ended December 31, 2023

• Lowest quarterly return: -5.7%, during the quarter ended June 30, 2022

Average Annual Total Returns for Periods Ended December 31, 2023

|

1 Year |

5 Years |

10 Years |

|||||||||||||

|

Bond Fund – Institutional Class |

|||||||||||||||

|

Return before taxes |

6.90 |

% |

None |

None |

|||||||||||

|

Return after taxes on distributions |

4.92 |

% |

None |

None |

|||||||||||

|

Return after taxes on distributions and sale of Fund shares |

4.05 |

% |

None |

None |

|||||||||||

|

Advisor Class |

|||||||||||||||

|

Return before taxes |

6.99 |

% |

None |

None |

|||||||||||

|

R6 Class |

|||||||||||||||

|

Return before taxes |

6.99 |

% |

None |

None |

|||||||||||

|

Investor Class |

|||||||||||||||

|

Return before taxes |

6.68 |

% |

None |

None |

|||||||||||

|

Bloomberg U.S. Aggregate Bond Index (does not reflect the deduction of fees, expenses or taxes) |

5.53 |

% |

None |

None |

|||||||||||

|

Lipper Core Plus Bond Funds Index (does not reflect the deduction of fees, expenses or taxes) |

6.41 |

% |

None |

None |

|||||||||||

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor's tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their shares through tax-deferred arrangements, such as 401(k) plans, qualified plans, education savings accounts or individual retirement accounts. In some cases, the after-tax returns may exceed the return before taxes due to an assumed tax benefit from any losses on a sale of Fund shares at the end of the measurement period. After-tax returns are shown only for Institutional Class Shares. After-tax returns for Advisor Class Shares, and R6 Class Shares will vary from returns shown for Institutional Class Shares.

INVESTMENT ADVISER

Harris Associates L.P. is the investment adviser to Bond Fund.

PORTFOLIO MANAGERS

M. Colin Hudson, CFA and Adam D. Abbas manage the Fund's portfolio. Mr. Hudson is a Vice President, portfolio manager and analyst of the Adviser. He joined the Adviser in 2005 and has managed the Fund since its inception in June 2020. Mr. Abbas is a portfolio manager and analyst of the Adviser. He joined the Adviser in 2018 and has managed the Fund since its inception in June 2020.

PURCHASE AND SALE OF FUND SHARES

The Fund's initial investment minimums generally are set forth in the table below. Once your account is open, subsequent investments may be made in any amount. Intermediaries may impose their own minimum investment requirements.

|

Through certain intermediaries held in omnibus accounts1 |

For certain retirement plan accounts |

For all other accounts |

|||||||||||||

|

Investor Class |

None |

None |

None |

||||||||||||

|

Advisor Class |

None |

None |

$ |

100,000 |

|||||||||||

|

Institutional Class |

None |

None |

$ |

250,000 |

|||||||||||

|

R6 Class |

None |

None |

$ |

1,000,000 |

|||||||||||

1 An omnibus account is a single account in the Fund held in the name of an intermediary that contains the aggregated assets for all of the intermediary's customer investments in the Fund. Consult your financial advisor or intermediary if you are unsure how your intermediary assets are held.

Shares of the Fund may be purchased and sold (redeemed) on any business day, normally any day when the New York Stock Exchange is open for regular trading. Such purchases and redemptions can be made directly with the Fund by writing to The Oakmark Funds, P.O. Box 219558 Kansas City, MO 64121-9558, or visiting Oakmark.com. Some redemptions may require a Medallion signature guarantee.

Purchases and redemptions can also be made through an intermediary, such as a broker-dealer, bank, retirement plan service provider, or retirement plan sponsor. Intermediaries may impose their own minimum investment requirements. Although the Fund does not impose any sales charges on any class of shares, you may separately pay a commission, a transaction-based fee or other fee to your intermediary on your purchase and sale of those shares, which is not reflected in this prospectus. You may be eligible to transact in the other classes of shares that are offered by the Fund that have different fees and expenses. Please contact your intermediary for additional information.

TAX INFORMATION

The Fund's distributions may be taxable to you as ordinary income and/or capital gains, unless you are invested through a tax-deferred arrangement, such as a 401(k) plan or an individual retirement account.

PAYMENTS TO BROKER-DEALERS AND OTHER FINANCIAL INTERMEDIARIES

If you purchase shares of the Fund through an intermediary, the Fund and its distributor and/or the Adviser may pay the intermediary for services provided to the Fund and its shareholders. The Adviser and/or distributor may also pay the intermediary for the sale of Fund shares. These payments may create a conflict of interest by influencing the intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your intermediary's website for more information.

This page intentionally left blank.

This page intentionally left blank.