| Label |

Element |

Value |

| Oakmark Equity and Income Fund |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Risk/Return [Heading] |

rr_RiskReturnHeading |

Oakmark Equity and Income Fund

|

|

| Objective [Heading] |

rr_ObjectiveHeading |

INVESTMENT OBJECTIVE

|

|

| Objective, Primary [Text Block] |

rr_ObjectivePrimaryTextBlock |

Oakmark Equity and Income Fund seeks income and preservation and growth of capital.

|

|

| Expense [Heading] |

rr_ExpenseHeading |

FEES AND EXPENSES OF THE FUND

|

|

| Expense Narrative [Text Block] |

rr_ExpenseNarrativeTextBlock |

Below are the fees and expenses that you would pay if you buy and hold shares of the Fund.

|

|

| Shareholder Fees Caption [Text] |

rr_ShareholderFeesCaption |

Shareholder Fees (fees paid directly from your investment) None

|

|

| Operating Expenses Caption [Text] |

rr_OperatingExpensesCaption |

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment).

|

|

| Fee Waiver or Reimbursement over Assets, Date of Termination |

rr_FeeWaiverOrReimbursementOverAssetsDateOfTermination |

Jan. 27, 2020

|

|

| Portfolio Turnover [Heading] |

rr_PortfolioTurnoverHeading |

Portfolio Turnover

|

|

| Portfolio Turnover [Text Block] |

rr_PortfolioTurnoverTextBlock |

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in Annual Fund Operating Expenses or in the Example, affect the Fund's performance. During the most recent fiscal year, the Fund's portfolio turnover rate was 23% of the average value of its portfolio.

|

|

| Portfolio Turnover, Rate |

rr_PortfolioTurnoverRate |

23.00%

|

|

| Expense Example [Heading] |

rr_ExpenseExampleHeading |

Example.

|

|

| Expense Example Narrative [Text Block] |

rr_ExpenseExampleNarrativeTextBlock |

The Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund's operating expenses were those reflected in the table.

Although your actual returns and expenses may be higher or lower, based on these assumptions your expenses would be:

|

|

| Strategy [Heading] |

rr_StrategyHeading |

PRINCIPAL INVESTMENT STRATEGY

|

|

| Strategy Narrative [Text Block] |

rr_StrategyNarrativeTextBlock |

The Fund invests primarily in a diversified portfolio of U.S. equity and debt securities (although the Fund may invest up to 35% of its total assets in equity and debt securities of non-U.S. issuers). The Fund is intended to present a balanced investment program between growth and income by investing approximately 40-75% of its total assets in common stock, including securities convertible into common stock, and up to 60% of its total assets in debt securities issued by U.S. or non-U.S. governments and corporate entities rated at the time of purchase within the two highest grades assigned by Moody's Investors Service, Inc. or by S&P Global Ratings, a division of S&P Global. The Fund may invest up to 20% of its total assets in unrated or below investment grade rated debt securities, commonly called junk bonds. The Fund may invest in the securities of large-, mid-, and small-capitalization companies.

The Fund uses a value investment philosophy in selecting equity securities. This value investment philosophy is based upon the belief that, over time, a company's stock price converges with the Adviser's estimate of the company's intrinsic value. By "intrinsic value," the Adviser means its estimate of the price a knowledgeable buyer would pay to acquire the entire business. The Adviser believes that investing in securities priced significantly below what it believes is a company's intrinsic value presents the best opportunity to achieve the Fund's investment objective. A company trading below its estimated intrinsic value is sometimes referred to as trading at a discount.

The Adviser uses this value investment philosophy to identify companies that have discounted stock prices compared to what the Adviser believes are the companies' intrinsic values. In assessing such companies, the Adviser looks for the following characteristics, although the companies selected may not have all of these attributes: (1) free cash flows and intelligent investment of excess cash; (2) earnings that are growing and are reasonably predictable; and (3) high level of company management ownership.

Key Tenets of the Oakmark Value Investment Philosophy:

1. Buy businesses that are trading at a significant discount to the Adviser's estimate of the company's intrinsic value. At the time the Adviser buys a company, the Adviser wants the company's stock to be inexpensive relative to what it believes the entire business is worth.

2. Invest with companies expected to grow shareholder value over time. Value investors can sometimes fall into the trap of buying a stock that is inexpensive for a reason—because the company just does not grow. The Adviser looks for good quality, growing businesses with positive free cash flow and intelligent investment of cash.

3. Invest with management teams that think and act as owners. The Adviser seeks out companies with management teams that understand the dynamics of per share value growth and are focused on achieving such growth. Stock ownership and incentives that align managements' interests with those of shareholders are key components of this analysis.

In making its equity investment decisions, the Adviser uses a "bottom-up" approach focused on individual companies, rather than focusing on specific economic factors or specific industries. To facilitate its selection of investments that meet the criteria described above, the Adviser uses independent, in-house research to analyze each company. As part of this selection process, the Adviser's analysts typically visit companies and conduct other research on the companies and their industries.

Once the Adviser identifies a stock that it believes is selling at a significant discount to the Adviser's estimated intrinsic value and that the company has one or more of the additional qualities mentioned above, the Adviser may consider buying that stock for the Fund. The Adviser usually sells a stock when the price approaches its estimated intrinsic value. This means the Adviser sets specific "buy" and "sell" targets for each stock the Fund holds. The Adviser monitors each portfolio holding and adjusts these price targets as warranted to reflect changes in a company's fundamentals.

The Adviser believes that holding a relatively small number of stocks allows its "best ideas" to have a meaningful impact on the Fund's performance. Therefore, the Fund's portfolio typically holds thirty to sixty stocks rather than hundreds, and as a result, a higher percentage of the Fund's total assets may at times be invested in a particular sector or industry.

The proportion of the Fund held in debt securities will vary in light of the Adviser's view of the attractiveness of debt securities. In times when the Adviser believes equities provide above average absolute value, the proportion of the Fund allocated to debt securities will decline. In selecting debt securities, the Adviser considers many factors, including among other things, quality, yield-to-maturity, liquidity, current yield and call risk. The Adviser believes the role of fixed income investments in the Fund is to help buffer the volatility of the Fund's equity portfolio and generate income.

|

|

| Risk [Heading] |

rr_RiskHeading |

PRINCIPAL INVESTMENT RISKS

|

|

| Risk Narrative [Text Block] |

rr_RiskNarrativeTextBlock |

As an investor in the Fund, you should have a long-term perspective and be able to tolerate potentially wide fluctuations in the value of your Fund shares. Your investment in the Fund is subject to risks, including the possibility that the value of the Fund's portfolio holdings may fluctuate in response to events specific to the companies in which the Fund invests, as well as economic, political or social events in the United States or abroad and the Adviser's evaluation of those events, and the success of the Adviser in implementing the Fund's investment strategy. As a result, when you redeem your Fund shares, they may be worth more or less than you paid for them.

Although the Fund makes every effort to achieve its investment objective, it cannot guarantee it will attain that investment objective. The following principal investment risks can significantly affect the Fund's performance:

Market Risk. The Fund is subject to market risk—the risk that securities markets and individual securities will increase or decrease in value. Market risk applies to every market and every security. Security prices may fluctuate widely over short or extended periods in response to adverse issuer, political, regulatory, market, economic or other developments that may cause broad changes in market value and public perceptions concerning these developments, and adverse investor sentiment. In addition, securities markets tend to move in cycles. If there is a general decline in the securities markets, it is possible your investment may lose value regardless of the individual results of the companies in which the Fund invests. The magnitude of up and down price or market fluctuations over time is sometimes referred to as "volatility," which, at times, can be significant. In addition, different asset classes and geographic markets may experience periods of significant correlation with each other. As a result of this correlation, the securities and markets in which the Fund invests may experience volatility due to market, economic, political or social events and conditions that may not readily appear to directly relate to such securities, the securities' issuer or the markets in which they trade. In addition, some companies may have substantial foreign operations or holdings and may involve additional risks relating to those markets, including but not limited to political, economic, regulatory, or other conditions in foreign countries, as well as currency exchange rates.

Focused Portfolio Risk. The Fund's portfolio tends to be invested in a relatively small number of stocks—thirty to sixty rather than hundreds. As a result, the appreciation or depreciation of any one security held by the Fund will have a greater impact on the Fund's net asset value than it would if the Fund invested in a larger number of securities. Although that strategy has the potential to generate attractive returns over time, it also increases the Fund's volatility and may lead to greater losses.

Non-U.S. Securities Risk. Investments in securities issued by entities based outside the United States may involve risks relating to political, social and economic developments abroad, as well as risks resulting from the differences between the regulations to which U.S. and non-U.S. issuers and markets are subject. These risks may result in the Fund experiencing rapid and extreme value changes due to currency controls; different accounting, auditing, financial reporting, and legal standards and practices; political and diplomatic changes and developments; expropriation; changes in tax policy; a lack of available public information regarding non-U.S. issuers; greater market volatility; a lack of sufficient market liquidity; differing securities market structures; higher transaction costs; and various administrative difficulties, such as delays in clearing and settling portfolio transactions or in receiving payment of dividends. These risks may be heightened in connection with investments in issuers located in developing and emerging countries, and in issuers in more developed countries that conduct substantial business in such developing and emerging countries. Fluctuations in the exchange rates between currencies may negatively affect an investment in non-U.S. securities.

Investments in securities issued by entities domiciled in the United States also may be subject to many of these risks.

Debt Securities Risk. Debt securities are subject to credit risk, call risk, interest rate risk and liquidity risk.

Credit Risk. Credit risk is the risk the issuer or guarantor of a debt security will be unable or unwilling to make timely payments of interest or principal or to otherwise honor its obligations.

Call Risk. Upon the issuer's desire to call a security, or under other circumstances where a security is called, including when interest rates are low and issuers opt to repay the obligation underlying a "callable security" early, the Fund may have to reinvest the proceeds in an investment offering a lower yield and may not benefit from any increase in value that might otherwise result from declining interest rates.

Interest Rate Risk. The Fund's yield and share price will fluctuate in response to changes in interest rates and there is a risk of loss due to changes in interest rates. In general, the prices of debt securities rise when interest rates fall, and the prices fall when interest rates rise. The Fund may be subject to a greater risk of rising interest rates due to the current period of historically low rates.

Liquidity Risk. Liquidity risk is the risk a particular security may be difficult to purchase or sell and that the Fund may be unable to sell such security at an advantageous time or price and may be forced to sell a security at a discount to the Adviser's estimated value of such a security.

U.S. Government Securities Risk. Some securities issued or guaranteed by U.S. government agencies or instrumentalities are not backed by the full faith and credit of the United States and may only be supported by the right of the agency or instrumentality to borrow from the U.S. Treasury. There can be no assurance that the U.S. government will always provide financial support to those agencies or instrumentalities.

Sovereign Debt Risk. Sovereign debt instruments, including U.S. and non-U.S. debt instruments, are subject to the risk that a governmental entity may delay, refuse, or be unable to pay interest or repay principal on its debt, due, for example, to cash flow problems, insufficient foreign currency reserves, political considerations, the size of the governmental entity's debt position in relation to the economy, its policy toward international lenders or the failure to put in place economic reforms required by multilateral agencies. If a governmental entity defaults, it may ask for more time in which to pay or for further loans. There is no legal process for collecting sovereign debt that a government does not pay, nor are there bankruptcy proceedings through which all or part of the sovereign debt that a government entity has not repaid may be collected.

Lower-Rated Debt Securities Risk. Below investment grade securities (commonly called junk bonds) are regarded as having predominately speculative characteristics with respect to the issuer's continuing ability to pay principal and interest and carry a greater risk that the issuer of such securities will default in the timely payment of principal and interest. Issuers of securities that are in default or have defaulted may fail to resume principal or interest payments, in which case the Fund may lose its entire investment.

Common Stock Risk. Common stocks are subject to greater fluctuations in market value than other asset classes as a result of such factors as a company's business performance, investor perceptions, stock market trends and general economic conditions. The rights of common stockholders are subordinate to all other claims on a company's assets including, debt holders and preferred stockholders; therefore, the Fund could lose money if a company in which it invests becomes financially distressed.

Sector or Industry Risk. If the Fund has invested a higher percentage of its total assets in a particular sector or industry, changes affecting that sector or industry, or the perception of that sector or industry, may have a significant impact on the performance of the Fund's overall portfolio. Individual sectors or industries may be more volatile, and may perform differently, than the broader market.

Market Capitalization Risk. Investing primarily in issuers in one market capitalization category (large, medium or small) carries the risk that due to current market conditions, that category may be out of favor with investors. Larger, more established companies may be unable to respond quickly to new competitive challenges or attain the high growth rate of successful smaller companies. Smaller companies may be more volatile due to, among other things, narrower product lines, more limited financial resources and fewer experienced managers. In addition, there is typically less publicly available information about such companies, and their stocks may have a more limited trading market than stocks of larger companies.

Value Style Risk. Investing in "value" stocks presents the risk that the stocks may never reach what the Adviser believes are their full market values, either because the market fails to recognize what the Adviser considers to be the companies' intrinsic values or because the Adviser misjudged those values. In addition, value stocks may fall out of favor with investors and underperform other investments during given periods.

Convertible Securities Risk. The value of a convertible security, which is a form of hybrid security (i.e., a security with both debt and equity characteristics), typically increases or decreases with the price of the underlying common stock. In general, a convertible security is subject to the market risks of stocks when the underlying stock's price is high relative to the conversion price and is subject to the market risks of debt securities when the underlying stock's price is low relative to the conversion price. The general market risks of debt securities that are common to convertible securities include, but are not limited to, interest rate risk and credit risk. Many convertible securities have credit ratings that are below investment grade and are subject to the same risks as an investment in lower-rated debt securities (commonly called junk bonds). To the extent the Fund invests in convertible securities issued by mid- or small-cap companies, it will be subject to the risks of investing in such companies.

Your investment in the Fund is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. You may lose money by investing in the Fund. The likelihood of loss may be greater if you invest for a shorter period of time.

|

|

| Risk Lose Money [Text] |

rr_RiskLoseMoney |

You may lose money by investing in the Fund

|

|

| Risk Not Insured Depository Institution [Text] |

rr_RiskNotInsuredDepositoryInstitution |

Your investment in the Fund is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

|

|

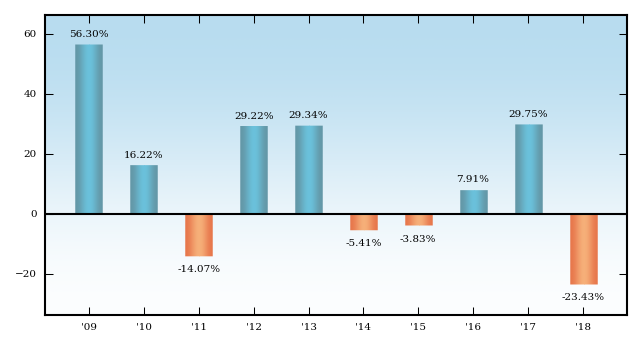

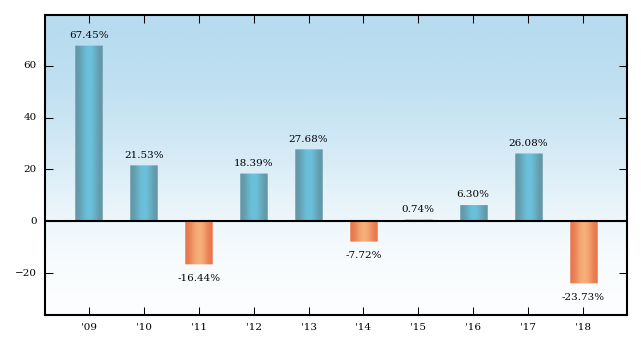

| Bar Chart and Performance Table [Heading] |

rr_BarChartAndPerformanceTableHeading |

PERFORMANCE INFORMATION

|

|

| Performance Narrative [Text Block] |

rr_PerformanceNarrativeTextBlock |

The bar chart and performance table below can help you evaluate the potential risk and reward of investing in the Fund by showing changes in the performance of the Fund's Investor Class Shares from year to year. The Fund's past performance (before and after taxes), as provided by the bar chart and performance table that follow, is not an indication of how the Fund will perform in the future. The performance table illustrates the volatility of the Fund's historical returns over various lengths of time and shows how the Fund's annual average returns compare with those of a broad measure of market performance. The Fund's Advisor Class and Institutional Class each commenced operations on November 30, 2016. Updated performance information is available on Oakmark.com or by calling 1-800-OAKMARK (625-6275).

|

|

| Performance Information Illustrates Variability of Returns [Text] |

rr_PerformanceInformationIllustratesVariabilityOfReturns |

The bar chart and performance table below can help you evaluate the potential risk and reward of investing in the Fund by showing changes in the performance of the Fund's Investor Class Shares from year to year. The performance table illustrates the volatility of the Fund's historical returns over various lengths of time and shows how the Fund's average annual returns compare with those of a broad measure of market performance.

|

|

| Performance Availability Phone [Text] |

rr_PerformanceAvailabilityPhone |

1-800-OAKMARK (625-6275)

|

|

| Performance Availability Website Address [Text] |

rr_PerformanceAvailabilityWebSiteAddress |

Oakmark.com

|

|

| Performance Past Does Not Indicate Future [Text] |

rr_PerformancePastDoesNotIndicateFuture |

The Fund's past performance (before and after taxes), as provided by the bar chart and performance table that follow, is not an indication of how the Fund will perform in the future.

|

|

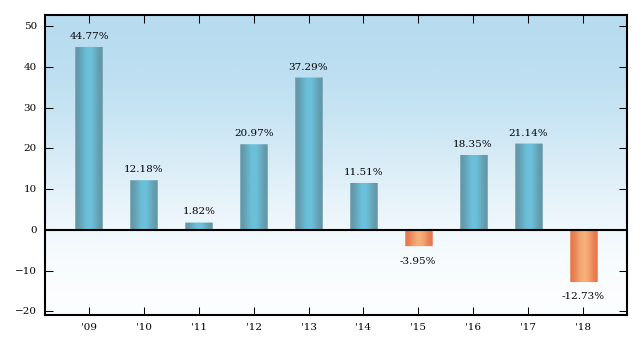

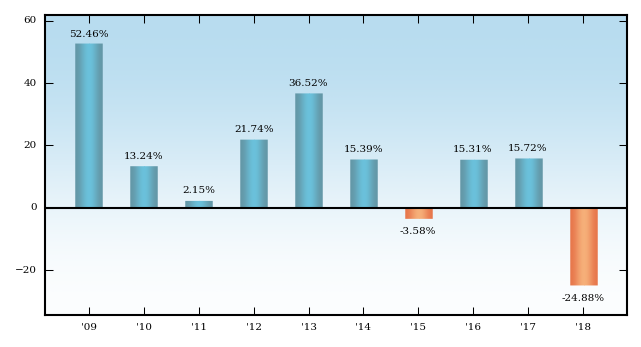

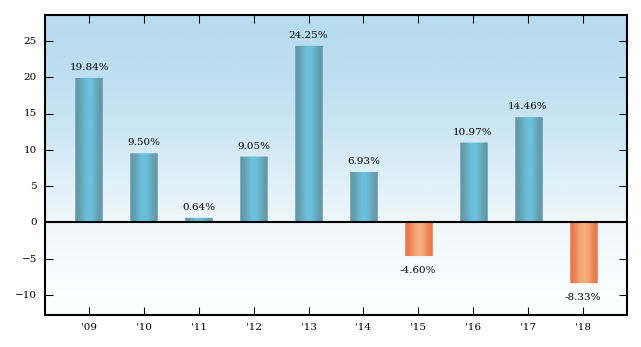

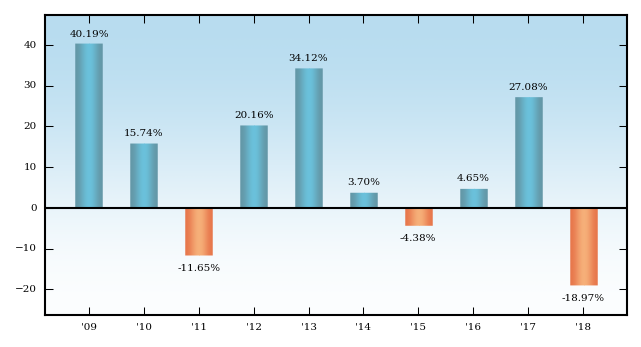

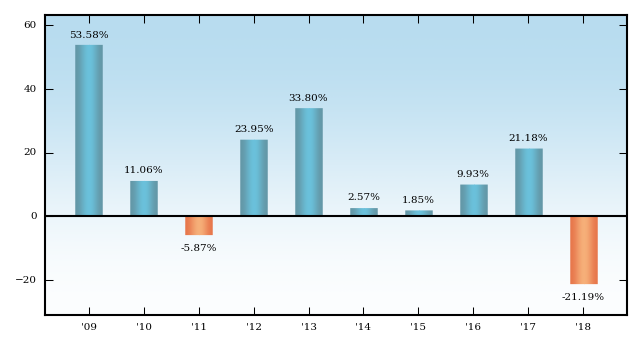

| Bar Chart [Heading] |

rr_BarChartHeading |

Investor Class Shares Total Returns for Years Ended December 31 (%)

|

|

| Bar Chart Closing [Text Block] |

rr_BarChartClosingTextBlock |

| | | Since 2009, the highest and lowest quarterly returns for the Fund's Investor Class Shares were:

• Highest quarterly return: 10.6%, during the quarter ended September 30, 2009

• Lowest quarterly return: -12.8%, during the quarter ended September 30, 2011 | |

|

|

| Highest Quarterly Return, Label |

rr_HighestQuarterlyReturnLabel |

Highest quarterly return:

|

|

| Highest Quarterly Return, Date |

rr_BarChartHighestQuarterlyReturnDate |

Sep. 30, 2009

|

|

| Highest Quarterly Return |

rr_BarChartHighestQuarterlyReturn |

10.60%

|

|

| Lowest Quarterly Return, Label |

rr_LowestQuarterlyReturnLabel |

Lowest quarterly return:

|

|

| Lowest Quarterly Return, Date |

rr_BarChartLowestQuarterlyReturnDate |

Sep. 30, 2011

|

|

| Lowest Quarterly Return |

rr_BarChartLowestQuarterlyReturn |

(12.80%)

|

|

| Index No Deduction for Fees, Expenses, Taxes [Text] |

rr_IndexNoDeductionForFeesExpensesTaxes |

(does not reflect the deduction of fees, expenses or taxes)

|

|

| Performance Table Uses Highest Federal Rate |

rr_PerformanceTableUsesHighestFederalRate |

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes.

|

|

| Performance Table Not Relevant to Tax Deferred |

rr_PerformanceTableNotRelevantToTaxDeferred |

After-tax returns shown are not relevant to investors who hold their shares through tax-deferred arrangements, such as 401(k) plans, qualified plans, education savings accounts or individual retirement accounts.

|

|

| Performance Table One Class of after Tax Shown [Text] |

rr_PerformanceTableOneClassOfAfterTaxShown |

After-tax returns are shown only for Investor Class Shares. After-tax returns for Service Class Shares, Advisor Class Shares, and Institutional Class Shares will vary from returns shown for Investor Class Shares.

|

|

| Performance Table Explanation after Tax Higher |

rr_PerformanceTableExplanationAfterTaxHigher |

In some cases, the after-tax returns may exceed the return before taxes due to an assumed tax benefit from any losses on a sale of Fund shares at the end of the measurement period.

|

|

| Performance Table Closing [Text Block] |

rr_PerformanceTableClosingTextBlock |

The Lipper Balanced Fund Index measures the equal weighted performance of the 30 largest U.S. balanced funds as defined by Lipper. This index is unmanaged and investors cannot invest directly in this index. The S&P 500 Total Return Index is a float-adjusted, capitalization-weighted index of 500 U.S. large-capitalization stocks representing all major industries. It is a widely recognized index of broad U.S. equity market performance. Returns reflect the reinvestment of dividends. This index is unmanaged and investors cannot invest directly in this index. The Barclays U.S. Government / Credit Index measures the non-securitized component of the U.S. Aggregate Index. It includes investment grade, U.S. dollar-denominated, fixed-rate Treasuries, government-related and corporate securities. This index is unmanaged and investors cannot invest directly in this index. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor's tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their shares through tax-deferred arrangements, such as 401(k) plans, qualified plans, education savings accounts or individual retirement accounts. In some cases, the after-tax returns may exceed the return before taxes due to an assumed tax benefit from any losses on a sale of Fund shares at the end of the measurement period. After-tax returns are shown only for Investor Class Shares. After-tax returns for Service Class Shares, Advisor Class Shares, and Institutional Class Shares will vary from returns shown for Investor Class Shares.

|

|

| Caption |

rr_AverageAnnualReturnCaption |

Average Annual Total Returns for Periods Ended December 31, 2018

|

|

| Oakmark Equity and Income Fund | Lipper Balanced Funds Index (does not reflect the deduction of fees, expenses or taxes) |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Average Annual Returns, 1 Year |

rr_AverageAnnualReturnYear01 |

(4.68%)

|

|

| Average Annual Returns, 5 Years |

rr_AverageAnnualReturnYear05 |

4.48%

|

|

| Average Annual Returns, 10 Years |

rr_AverageAnnualReturnYear10 |

8.47%

|

|

| Oakmark Equity and Income Fund | S&P 500 Index (does not reflect the deduction of fees, expenses or taxes) |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Average Annual Returns, 1 Year |

rr_AverageAnnualReturnYear01 |

(4.38%)

|

|

| Average Annual Returns, 5 Years |

rr_AverageAnnualReturnYear05 |

8.49%

|

|

| Average Annual Returns, 10 Years |

rr_AverageAnnualReturnYear10 |

13.12%

|

|

| Oakmark Equity and Income Fund | Barclays U.S. Government/Credit Index (does not reflect the deduction of fees, expenses or taxes) |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Average Annual Returns, 1 Year |

rr_AverageAnnualReturnYear01 |

(0.42%)

|

|

| Average Annual Returns, 5 Years |

rr_AverageAnnualReturnYear05 |

2.53%

|

|

| Average Annual Returns, 10 Years |

rr_AverageAnnualReturnYear10 |

3.46%

|

|

| Oakmark Equity and Income Fund | Investor Class |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Management fees |

rr_ManagementFeesOverAssets |

0.68%

|

|

| Distribution (12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

none

|

|

| Other expenses |

rr_OtherExpensesOverAssets |

0.20%

|

|

| Total Annual Fund Operating Expenses |

rr_ExpensesOverAssets |

0.88%

|

|

| Less: Fee waivers and/or expense reimbursements |

rr_FeeWaiverOrReimbursementOverAssets |

0.10%

|

[1] |

| Total Annual Fund Operating Expenses after fee waivers and/or expense reimbursements |

rr_NetExpensesOverAssets |

0.78%

|

|

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

$ 80

|

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

249

|

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

433

|

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

$ 966

|

|

| Annual Return 2009 |

rr_AnnualReturn2009 |

19.84%

|

|

| Annual Return 2010 |

rr_AnnualReturn2010 |

9.50%

|

|

| Annual Return 2011 |

rr_AnnualReturn2011 |

0.64%

|

|

| Annual Return 2012 |

rr_AnnualReturn2012 |

9.05%

|

|

| Annual Return 2013 |

rr_AnnualReturn2013 |

24.25%

|

|

| Annual Return 2014 |

rr_AnnualReturn2014 |

6.93%

|

|

| Annual Return 2015 |

rr_AnnualReturn2015 |

(4.60%)

|

|

| Annual Return 2016 |

rr_AnnualReturn2016 |

10.97%

|

|

| Annual Return 2017 |

rr_AnnualReturn2017 |

14.46%

|

|

| Annual Return 2018 |

rr_AnnualReturn2018 |

(8.33%)

|

|

| Average Annual Returns, 1 Year |

rr_AverageAnnualReturnYear01 |

(8.33%)

|

|

| Average Annual Returns, 5 Years |

rr_AverageAnnualReturnYear05 |

3.50%

|

|

| Average Annual Returns, 10 Years |

rr_AverageAnnualReturnYear10 |

7.83%

|

|

| Oakmark Equity and Income Fund | Investor Class | After Taxes on Distributions |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Average Annual Returns, 1 Year |

rr_AverageAnnualReturnYear01 |

(10.31%)

|

|

| Average Annual Returns, 5 Years |

rr_AverageAnnualReturnYear05 |

1.74%

|

|

| Average Annual Returns, 10 Years |

rr_AverageAnnualReturnYear10 |

6.57%

|

|

| Oakmark Equity and Income Fund | Investor Class | After Taxes on Distributions and Sale of Fund Shares |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Average Annual Returns, 1 Year |

rr_AverageAnnualReturnYear01 |

(3.51%)

|

|

| Average Annual Returns, 5 Years |

rr_AverageAnnualReturnYear05 |

2.65%

|

|

| Average Annual Returns, 10 Years |

rr_AverageAnnualReturnYear10 |

6.33%

|

|

| Oakmark Equity and Income Fund | Advisor Class |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Management fees |

rr_ManagementFeesOverAssets |

0.68%

|

|

| Distribution (12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

none

|

|

| Other expenses |

rr_OtherExpensesOverAssets |

0.06%

|

|

| Total Annual Fund Operating Expenses |

rr_ExpensesOverAssets |

0.74%

|

|

| Less: Fee waivers and/or expense reimbursements |

rr_FeeWaiverOrReimbursementOverAssets |

0.10%

|

[1] |

| Total Annual Fund Operating Expenses after fee waivers and/or expense reimbursements |

rr_NetExpensesOverAssets |

0.64%

|

|

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

$ 65

|

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

205

|

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

357

|

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

$ 798

|

|

| Average Annual Returns, 1 Year |

rr_AverageAnnualReturnYear01 |

(8.20%)

|

|

| Average Annual Returns, 5 Years |

rr_AverageAnnualReturnYear05 |

none

|

|

| Average Annual Returns, 10 Years |

rr_AverageAnnualReturnYear10 |

none

|

|

| Oakmark Equity and Income Fund | Institutional Class |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Management fees |

rr_ManagementFeesOverAssets |

0.68%

|

|

| Distribution (12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

none

|

|

| Other expenses |

rr_OtherExpensesOverAssets |

0.01%

|

|

| Total Annual Fund Operating Expenses |

rr_ExpensesOverAssets |

0.69%

|

|

| Less: Fee waivers and/or expense reimbursements |

rr_FeeWaiverOrReimbursementOverAssets |

0.10%

|

[1] |

| Total Annual Fund Operating Expenses after fee waivers and/or expense reimbursements |

rr_NetExpensesOverAssets |

0.59%

|

|

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

$ 60

|

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

189

|

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

329

|

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

$ 738

|

|

| Average Annual Returns, 1 Year |

rr_AverageAnnualReturnYear01 |

(8.15%)

|

|

| Average Annual Returns, 5 Years |

rr_AverageAnnualReturnYear05 |

none

|

|

| Average Annual Returns, 10 Years |

rr_AverageAnnualReturnYear10 |

none

|

|

| Oakmark Equity and Income Fund | Service Class |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Management fees |

rr_ManagementFeesOverAssets |

0.68%

|

|

| Distribution (12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

none

|

|

| Other expenses |

rr_OtherExpensesOverAssets |

0.47%

|

|

| Total Annual Fund Operating Expenses |

rr_ExpensesOverAssets |

1.15%

|

|

| Less: Fee waivers and/or expense reimbursements |

rr_FeeWaiverOrReimbursementOverAssets |

0.10%

|

[1] |

| Total Annual Fund Operating Expenses after fee waivers and/or expense reimbursements |

rr_NetExpensesOverAssets |

1.05%

|

|

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

$ 107

|

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

334

|

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

579

|

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

$ 1,283

|

|

| Average Annual Returns, 1 Year |

rr_AverageAnnualReturnYear01 |

(8.57%)

|

|

| Average Annual Returns, 5 Years |

rr_AverageAnnualReturnYear05 |

3.20%

|

|

| Average Annual Returns, 10 Years |

rr_AverageAnnualReturnYear10 |

7.50%

|

|

|

|