| Oakmark International Fund (Prospectus Summary) | Oakmark International Fund | ||||||||||||||||||||||||||||||

| OAKMARK INTERNATIONAL FUND | ||||||||||||||||||||||||||||||

| INVESTMENT OBJECTIVE | ||||||||||||||||||||||||||||||

| Oakmark International Fund seeks long-term capital appreciation. | ||||||||||||||||||||||||||||||

| FEES AND EXPENSES OF THE FUND | ||||||||||||||||||||||||||||||

| Below are the fees and expenses that you would pay if you buy and hold shares of the Fund. |

||||||||||||||||||||||||||||||

| Shareholder Fees (fees paid directly from your investment) | ||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | ||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||

| Example. | ||||||||||||||||||||||||||||||

| The Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund's operating expenses remain the same. |

||||||||||||||||||||||||||||||

| Although your actual returns and costs may be higher or lower, based on these assumptions your expenses would be: | ||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||

| Portfolio Turnover | ||||||||||||||||||||||||||||||

| The Fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in Annual Fund Operating Expenses or in the Example, affect the Fund's performance. During the most recent fiscal year, the Fund's portfolio turnover rate was 45% of the average value of its portfolio. |

||||||||||||||||||||||||||||||

| PRINCIPAL INVESTMENT STRATEGY | ||||||||||||||||||||||||||||||

| The Fund invests primarily in a diversified portfolio of common stocks of non-U.S. companies. The Fund may invest in non-U.S. markets throughout the world, including emerging markets. Ordinarily, the Fund will invest in the securities of at least five countries outside the U.S. There are no geographic limits on the Fund's non-U.S. investments. The Fund may invest in securities of large-, mid-, and small-capitalization companies. The Fund uses a value investment philosophy in selecting equity securities. This investment philosophy is based upon the belief that, over time, a company's stock price converges with the company's intrinsic or true business value. By "true business value," we mean an estimate of the price a knowledgeable buyer would pay to acquire the entire business. We believe that investing in securities priced significantly below their true business value presents the best opportunity to achieve the Fund's investment objective. The Fund's investment adviser, Harris Associates L.P. (the "Adviser"), uses this value philosophy to identify companies that it believes have discounted stock prices compared to the companies' true business values. In assessing such companies, the Adviser looks for the following characteristics, although not all of the companies selected will have these attributes: (1) free cash flows and intelligent investment of excess cash; (2) earnings that are growing and are reasonably predictable; and (3) high level of manager ownership. Key Tenets of the Oakmark Investment Philosophy: 1. Buy businesses that are trading at a significant discount to the Adviser's estimate of the company's intrinsic value. At the time the Adviser buys a company, the Adviser wants the company's stock to be inexpensive relative to what it believes the entire business is worth. 2. Invest with companies expected to grow shareholder value over time. Value investors can sometimes fall into the trap of buying a stock that is inexpensive for a reason-because the company just does not grow. The Adviser looks for good quality, growing businesses with positive free cash flow and intelligent investment of cash. 3. Invest with management teams that think and act as owners. The Adviser seeks out companies with management teams that understand the dynamics of per share value growth and are focused on achieving such growth. Stock ownership and incentives that align managements' interests with those of shareholders are key components of this analysis. In making its investment decisions, the Adviser uses a "bottom-up" approach focused on individual companies, rather than focusing on specific economic factors or specific industries. In order to select investments that meet the criteria described above, the Adviser uses independent, in-house research to analyze each company. As part of this selection process, the Adviser's analysts typically visit companies and conduct other research on the companies and their industries. Once the Adviser determines that a stock is selling at a significant discount and that the company has the additional qualities mentioned above, the Adviser may consider buying that stock for the Fund. The Adviser usually sells a stock when the price approaches its estimated worth. This means the Adviser sets specific "buy" and "sell" targets for each stock held by the Fund. The Adviser also monitors each holding and adjusts those price targets as warranted to reflect changes in a company's fundamentals. The Adviser believes that holding a relatively small number of stocks allows its "best ideas" to have a meaningful impact on the Fund's performance. Therefore, the Fund's portfolio typically holds thirty to sixty stocks rather than hundreds. |

||||||||||||||||||||||||||||||

| PRINCIPAL INVESTMENT RISKS | ||||||||||||||||||||||||||||||

| As an investor in the Fund, you should have a long-term perspective and be able to tolerate potentially wide fluctuations in the value of your Fund shares. Your investment in the Fund is subject to risks, including the possibility that the value of the Fund's portfolio holdings may fluctuate in response to events specific to the companies in which the Fund invests, as well as economic, political or social events in the U.S. or abroad. As a result, when you redeem your Fund shares, they may be worth more or less than you paid for them. Although the Fund makes every effort to achieve its objective, it cannot guarantee it will attain that objective. The principal risks of investing in the Fund are: Market Risk. The Fund is subject to market risk-the risk that securities markets and individual securities will increase or decrease in value. Market risk applies to every market and every security. Security prices may fluctuate widely over short or extended periods in response to market or economic news and conditions, and securities markets also tend to move in cycles. If there is a general decline in the securities markets, it is possible your investment may lose value regardless of the individual results of the companies in which the Fund invests. The magnitude of up and down price or market fluctuations over time is sometimes referred to as "volatility," which, at times, can be significant. In addition, different asset classes and geographic markets may experience periods of significant correlation with each other. As a result of this correlation, the securities and markets in which the Fund invests may experience volatility due to market, economic, political or social events and conditions that may not readily appear to directly relate to such securities, the securities' issuer or the markets in which they trade. Common Stock Risk. Common stocks are subject to greater fluctuations in market value than other asset classes as a result of such factors as a company's business performance, investor perceptions, stock market trends and general economic conditions. The rights of common stockholders are subordinate to all other claims on a company's assets including debt holders and preferred stockholders; therefore, the Fund could lose money if a company in which it invests becomes financially distressed. Focused Portfolio Risk. The Fund's portfolio tends to be invested in a relatively small number of stocks. As a result, the appreciation or depreciation of any one security held by the Fund will have a greater impact on the Fund's net asset value than it would if the Fund invested in a larger number of securities. Although that strategy has the potential to generate attractive returns over time, it also increases the Fund's volatility. Small and Mid Cap Securities Risk. Investments in small and mid cap companies may be riskier than investments in larger, more established companies. The securities of smaller companies may trade less frequently and in smaller volumes, and as a result, may be less liquid than securities of larger companies. In addition, smaller companies may be more vulnerable to economic, market and industry changes. As a result, share price changes may be more sudden or erratic than the prices of other equity securities, especially over the short term. Because smaller companies may have limited product lines, markets or financial resources or may depend on a few key employees, they may be more susceptible to particular economic events or competitive factors than large capitalization companies. Value Style Risk. Investing in "value" stocks presents the risk that the stocks may never reach what the Adviser believes are their full market values, either because the market fails to recognize what the Adviser considers to be the companies' true business values or because the Adviser misjudged those values. In addition, value stocks may fall out of favor with investors and underperform growth stocks during given periods. Non-U.S. Securities Risk. Investments in securities issued by entities based outside the United States involve risks relating to political, social and economic developments abroad, as well as risks resulting from the differences between the regulations to which U.S. and non-U.S. issuers and markets are subject. These risks may result in the Fund experiencing rapid and extreme value changes due to currency controls; different accounting, auditing, financial reporting, and legal standards and practices; political and diplomatic changes and developments; expropriation; changes in tax policy; a lack of available public information regarding non-U.S. issuers; greater market volatility; a lack of sufficient market liquidity; differing securities market structures; higher transaction costs; and various administrative difficulties, such as delays in clearing and settling portfolio transactions or in receiving payment of dividends. These risks may be heightened in connection with investments in issuers located in developing and emerging countries, and in issuers in more developed countries that conduct substantial business in such developing and emerging countries. Fluctuations in the exchange rates between currencies may negatively affect an investment in non-U.S. securities. The Fund may hedge its exposure to foreign currencies. Although hedging may be used to protect the Fund from adverse currency movements, the use of such hedges may reduce or eliminate the potentially positive effect of currency revaluations on the Fund's total return, and there is no guarantee that the Fund's hedging strategy will be successful. Your investment in the Fund is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. You may lose money by investing in the Fund. The likelihood of loss may be greater if you invest for a shorter period of time. |

||||||||||||||||||||||||||||||

| PERFORMANCE INFORMATION | ||||||||||||||||||||||||||||||

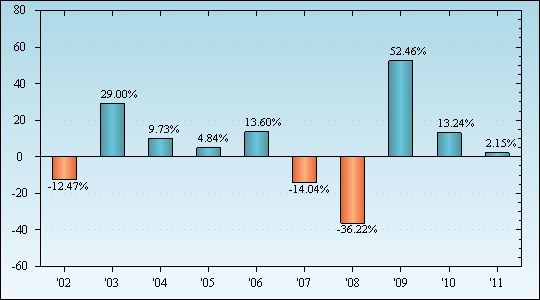

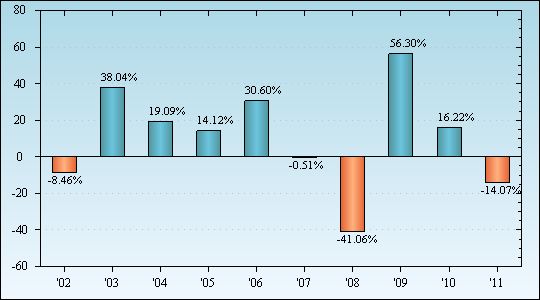

| The Fund's past performance (before and after taxes), as provided by the bar chart and performance table that follow, is not an indication of how the Fund will perform in the future. This information can help you evaluate the potential risk and reward of investing in the Fund by showing changes in the performance of the Fund's Class I Shares from year to year. The information illustrates the volatility of the Fund's historical returns and shows how the Fund's annual average returns compare with those of a broad measure of market performance. Updated performance information is available at oakmark.com or by calling 1-800-OAKMARK. |

||||||||||||||||||||||||||||||

| Since 2002, the highest and lowest quarterly returns for the Fund's Class I Shares were: • Highest quarterly return: 33.2%, during the quarter ended June 30, 2009 • Lowest quarterly return: -22.9%, during the quarter ended September 30, 2002 |

||||||||||||||||||||||||||||||

| Class I Shares Total Returns for Years Ended December 31 (%) | ||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||

| Average Annual Total Returns for Periods Ended December 31, 2011 | ||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||

| The Morgan Stanley Capital International (MSCI) World ex U.S. Index is an unmanaged index that includes countries throughout the world, in proportion to world stock market capitalization, but excludes U.S. companies. All returns reflect reinvested dividends. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor's tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their shares through tax-deferred arrangements, such as 401(k) plans, qualified plans, education savings accounts or individual retirement accounts. In some cases, the after-tax returns may exceed the return before taxes due to an assumed tax benefit from any losses on a sale of Fund shares at the end of the measurement period. After-tax returns are shown only for Class I shares. After-tax returns for Class II shares will vary from returns shown for Class I. |