UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material under §240.14a-12 |

MANPOWER INC

(Name of registrant as specified in its

charter)

(Name of person(s) filing proxy statement, if other than the registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which the transaction applies: |

| (2) | Aggregate number of securities to which the transaction applies: |

| (3) | Per unit price or other underlying value of the transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of the transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

MANPOWER INC.

100 MANPOWER PLACE

MILWAUKEE, WISCONSIN 53212

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

May 3, 2011

To the Shareholders of Manpower Inc.:

The 2011 Annual Meeting of Shareholders of Manpower Inc. will be held at the International Headquarters of Manpower Inc., 100 Manpower Place, Milwaukee, Wisconsin, on May 3, 2011, at 10:00 a.m., local time, for the following purposes:

| (1) | To elect four individuals nominated by the Board of Directors of Manpower Inc. to serve until 2014 as Class III directors; |

| (2) | To ratify the appointment of William Downe to serve until 2013 as a Class II director; |

| (3) | To ratify the appointment of Patricia A. Hemingway Hall to serve until 2013 as a Class II director; |

| (4) | To ratify the appointment of Deloitte & Touche LLP as our independent auditors for 2011; |

| (5) | To approve the Manpower Inc. Corporate Senior Management Annual Incentive Pool Plan; |

| (6) | To approve the 2011 Equity Incentive Plan of Manpower Inc.; |

| (7) | To consider an advisory vote on compensation of our named executive officers; |

| (8) | To consider an advisory vote on the frequency of the vote on compensation of our named executive officers; and |

| (9) | To transact such other business as may properly come before the meeting. |

Shareholders of record at the close of business on February 22, 2011 are entitled to notice of and to vote at the annual meeting and at all adjournments of the annual meeting.

Holders of a majority of the outstanding shares must be present in person or by proxy in order for the annual meeting to be held. Therefore, whether or not you expect to attend the annual meeting in person, you are urged to vote by a telephone vote, by voting electronically via the Internet or by completing and returning the accompanying proxy in the enclosed envelope. Instructions for telephonic voting and electronic voting via the Internet are contained on the accompanying proxy card. If you attend the meeting and wish to vote your shares personally, you may do so by revoking your proxy at any time prior to the voting thereof. In addition, you may revoke your proxy at any time before it is voted by advising the Secretary of Manpower in writing (including executing a later-dated proxy or voting via the Internet) or by telephone of such revocation.

Important Notice Regarding the Availability of Proxy Materials for the annual meeting of Shareholders to be held on May 3, 2011: The annual report and proxy statement of Manpower Inc. are available at www.manpower.com/annualmeeting.

Kenneth C. Hunt, Secretary

March 23, 2011

MANPOWER INC.

100 Manpower Place

Milwaukee, Wisconsin 53212

March 23, 2011

PROXY STATEMENT

The enclosed proxy is solicited by the board of directors of Manpower Inc. for use at the annual meeting of shareholders to be held at 10:00 a.m., local time, on May 3, 2011, or at any postponement or adjournment of the annual meeting, for the purposes set forth in this proxy statement and in the accompanying notice of annual meeting of shareholders. The annual meeting will be held at Manpower’s International Headquarters, 100 Manpower Place, Milwaukee, Wisconsin.

The expenses of printing and mailing proxy material, including expenses involved in forwarding materials to beneficial owners of stock, will be paid by us. No solicitation other than by mail is contemplated, except that our officers or employees may solicit the return of proxies from certain shareholders by telephone. In addition, we have retained Georgeson Shareholder Communications Inc. to assist in the solicitation of proxies for a fee of approximately $9,500 plus expenses.

Only shareholders of record at the close of business on February 22, 2011 are entitled to notice of and to vote the shares of our common stock, $.01 par value, registered in their name at the annual meeting. As of the record date, we had outstanding 81,885,463 shares of common stock. The presence, in person or by proxy, of a majority of the shares of the common stock outstanding on the record date will constitute a quorum at the annual meeting. Abstentions and broker non-votes, which are proxies from brokers or nominees indicating that such persons have not received instructions from the beneficial owners or other persons entitled to vote shares, will be treated as present for purposes of determining the quorum. Each share of common stock entitles its holder to cast one vote on each matter to be voted upon at the annual meeting. With respect to the proposals to elect the individuals nominated by our Board of Directors to serve as Class III directors, to ratify the appointment of William Downe to serve until 2013 as a Class II director, to ratify the appointment of Patricia A. Hemingway Hall to serve until 2013 as a Class II director, to ratify the appointment of Deloitte & Touche LLP as our independent auditors for 2011, to approve the Manpower Inc. Corporate Senior Management Annual Incentive Pool Plan, and to approve the 2011 Equity Incentive Plan of Manpower Inc., as well as the advisory vote on compensation of our named executive officers and the advisory vote on the frequency of an advisory vote on compensation of our named executive officers, abstentions and broker non-votes will not be counted as voting on the proposals.

This proxy statement, notice of annual meeting of shareholders and the accompanying proxy card, together with our annual report to shareholders, including financial statements for our fiscal year ended December 31, 2010, are being mailed to shareholders commencing on or about March 30, 2011.

If the accompanying proxy card is properly signed and returned to us and not revoked, it will be voted in accordance with the instructions contained in the proxy card. Each shareholder may revoke a previously granted proxy at any time before it is exercised by advising the secretary of Manpower in writing (either by submitting a duly executed proxy bearing a later date or voting via the Internet) or by telephone of such revocation. Attendance at the annual meeting will not, in itself, constitute revocation of a proxy. Unless otherwise directed, all proxies will be voted for the election of each of the individuals nominated by our board of directors to serve as Class III directors, will be voted for ratification of the appointment of William Downe to serve until 2013 as a Class II director, will be voted for the ratification of the appointment of Patricia A. Hemingway Hall to serve until 2013 as a Class II director, will be voted for the appointment of Deloitte & Touche LLP as our independent auditors for 2011, will be voted for approval of the Manpower Inc. Corporate Senior Management Annual Incentive Pool Plan, will be voted for approval of the 2011 Equity Incentive Plan of Manpower Inc., will be voted for approval of the compensation of our named executive officers, and will be voted in favor of one year as the frequency of an advisory vote on the compensation of our named executive officers.

CORPORATE GOVERNANCE DOCUMENTS

Certain documents relating to corporate governance matters are available in print by writing to Mr. Kenneth C. Hunt, Secretary, Manpower Inc., 100 Manpower Place, Milwaukee, Wisconsin 53212 and on Manpower’s web site at www.investor.manpower.com. These documents include the following:

| • | Amended and Restated Articles of Incorporation; |

| • | Amended and Restated By-Laws; |

| • | Corporate governance guidelines; |

| • | Code of business conduct and ethics; |

| • | Charter of the nominating and governance committee, including the guidelines for selecting board candidates; |

| • | Categorical standards for relationships deemed not to impair independence of non-employee directors; |

| • | Charter of the audit committee; |

| • | Policy on services provided by independent auditors; |

| • | Charter of the executive compensation and human resources committee; |

| • | Executive officer stock ownership guidelines; |

| • | Outside director stock ownership guidelines; and |

| • | Foreign Corrupt Practices Act Compliance Policy. |

Information contained on Manpower’s web site is not deemed to be a part of this proxy statement.

2

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

The following table lists as of the record date information as to the persons believed by us to be beneficial owners of more than 5% of our outstanding common stock:

| Name and Address of Beneficial Owners |

Amount and Nature of Beneficial Ownership |

Percent of Class(1) |

||||||

| BlackRock, Inc. 40 East 52nd Street New York, New York 10022 |

11,622,148 | (2) | 14.2 | % | ||||

| T. Rowe Price Associates, Inc. 100 East Pratt Street Baltimore, Maryland 21202 |

5,114,875 | (3) | 6.2 | % | ||||

| (1) | Based on 81,885,463 shares of common stock outstanding as of the record date. |

| (2) | This information is based on a Schedule 13G filed on January 10, 2011, filed by BlackRock, Inc. on its behalf and on behalf of its following affiliates: BlackRock Advisors LLC, BlackRock Advisors (UK) Limited, BlackRock Asset Management Australia Limited, BlackRock Asset Management Canada Limited, BlackRock Asset Management Japan Limited, BlackRock Capital Management, Inc. BlackRock Financial Management, Inc., BlackRock Fund Advisors, BlackRock Institutional Trust Company, N.A., BlackRock Investment Management, LLC, BlackRock Investment Management (Australia) Limited, BlackRock Asset Management Ireland Limited, BlackRock (Luxembourg) S.A., BlackRock (Netherlands) B.V., BlackRock International Ltd, BlackRock Investment Management UK Ltd and State Street Research & Management Co. According to this Schedule 13G, these securities are owned of record by BlackRock, Inc. BlackRock, Inc. has sole voting power with respect to 11,622,148 shares held and sole dispositive power with respect to 11,622,148 shares held. |

| (3) | This information is based on a Schedule 13G filed on February 11, 2011. According to this Schedule 13G, these securities are owned by various individual and institutional investors for which T.Rowe Price Associates, Inc. (“Price Associates”) serves as investment adviser. Price Associates has sole voting power with respect to 1,082,033 shares held and sole dispositive power with respect to 5,114,875 shares held. |

3

1. ELECTION OF DIRECTORS

Manpower’s directors are divided into three classes, designated as Class I, Class II and Class III, with staggered terms of three years each. The term of office of directors in Class III expires at the annual meeting. The board of directors proposes that the nominees described below, all of whom are currently serving as Class III directors, be elected as Class III directors for a new term of three years ending at the 2014 annual meeting of shareholders and until their successors are duly elected, except as otherwise provided in the Wisconsin Business Corporation Law. Ms. Dominguez and Mr. Zore are standing for re-election. Ms. Sartain was appointed to the board of directors in August 2010 after being recommended for appointment to the board of directors by an independent director search firm, and subsequently by the nominating and governance committee. Mr. Mendoza was appointed to the board of directors in April 2009 following the ratification of his appointment by Manpower’s shareholders at the 2009 annual meeting of shareholders, after being recommended for appointment to the board of directors by an independent director search firm and subsequently by the nominating and governance committee.

In accordance with our articles of incorporation and by-laws, a nominee will be elected as a director if the number of votes cast in favor of the election exceeds the number of votes against the election of that nominee. Abstentions and broker non-votes will not be counted as votes cast. If the number of votes cast in favor of the election of an incumbent director is less than the number of votes cast against the election of the director, the director is required to tender his or her resignation from the board of directors to the nominating and governance committee. Any such resignation will be effective only upon its acceptance by the board of directors. The nominating and governance committee will recommend to the board of directors whether to accept or reject the tendered resignation or whether other action should be taken. The board of directors will act on the recommendation of the nominating and governance committee and publicly disclose its decision, and the rationale behind its decision, within 90 days from the date of the announcement of the final results of balloting for the election.

| Name |

Age | Principal Occupation and Directorships | ||||

| NOMINEES FOR DIRECTORS — CLASS III | ||||||

| Cari M. Dominguez |

61 | Chair of the U.S. Equal Employment Opportunity Commission from 2001 to 2006. President, Dominguez & Associates, a consulting firm, from 1999 to 2001. Partner, Heidrick & Struggles, a consulting firm, from 1995 to 1998. Director, Spencer Stuart, a consulting firm, from 1993 to 1995. Assistant Secretary for Employment Standards Administration and Director of the Office of Federal Contract Compliance Programs, U.S. Department of Labor, from 1989 to 1993. Prior thereto, held senior management positions with Bank of America. A trustee of Calvert SAGE Funds since September 2008. A director of Manpower since May 2007. No other directorships in the past five years. | ||||

| Roberto Mendoza |

65 | Senior Managing Director of Atlas Advisors LLC, an independent global investment banking firm, since March 2010. Partner of Deming Mendoza & Co. LLC, a corporate finance advisory firm, from January 2009 to March 2010. Non-executive Chairman of Trinsum Group, Inc., an international strategic and financial advisory firm, from February 2007 to November 2008. Chairman of Integrated Finance Limited, a financial advisory firm, from June 2001 to January 2007. Managing Director of Goldman Sachs & Co. from September 2000 to March 2001. Director and Vice Chairman of J.P. Morgan & Co. Inc., from January 1990 to June 2000. A | ||||

4

| director of Manpower since April 2009. A director of The Western Union Company and PartnerRe Limited, a reinsurance company. Also a member of the Council on Foreign Relations. Previously a director of Egg plc. from 2000 to 2006, Prudential plc. from 2000 to 2007 and Paris Re Holdings Limited from 2007 to 2009. | ||||||

| Elizabeth P. Sartain |

56 | Independent Human Resource Advisor and Consultant since April 2008. Executive Vice President and Chief People Yahoo at Yahoo! Inc. from August 2001 to April 2008. Prior thereto, an executive with Southwest Airlines serving in various positions from 1988 to 2001. Director of Peets Tea and Coffee, Inc. A director of Manpower since August 2010. | ||||

| Edward J. Zore |

65 | Retired Chairman and Chief Executive Officer of The Northwestern Mutual Life Insurance Company (“Northwestern Mutual”) from March 2009 to July 2010. President and Chief Executive Officer of Northwestern Mutual from June 2001 to March 2009. President of Northwestern Mutual from March 2000 to June 2001. Executive Vice President, Life and Disability Income Insurance, of Northwestern Mutual from 1998 to 2000. Executive Vice President, Chief Financial Officer and Chief Investment Officer of Northwestern Mutual from 1995 to 1998. Prior thereto, Chief Investment Officer and Senior Vice President of Northwestern Mutual. Also a trustee of Northwestern Mutual. A director of Manpower for more than five years. A director of RenaissanceRe Holdings Ltd. since August 2010. Previously, a director of Mason Street Funds from 2000 to 2007 and a director of the Northwestern Mutual Series Fund, Inc. from 2000 to May 2010. | ||||

| Class I Directors (term expiring in 2012) | ||||||

| Jeffrey A. Joerres |

51 | Chairman of Manpower since May 2001, and President and Chief Executive Officer of Manpower since April 1999. Senior Vice President European Operations and Marketing and Major Account Development of Manpower from July 1998 to April 1999. A director of Artisan Funds, Inc., Johnson Controls, Inc. and the Federal Reserve Bank of Chicago. A director of Manpower for more than five years. An employee of Manpower since July 1993. | ||||

| John R. Walter |

64 | Retired President and Chief Operating Officer of AT&T Corp. from November 1996 to July 1997. Chairman, President and Chief Executive Officer of R.R. Donnelley & Sons Company, a print and digital information management, reproduction and distribution company, from 1989 through 1996. Currently a director of InnerWorkings, Inc. Served as Non-Executive Chairman of the Board of InnerWorkings, Inc. from May 2004 to June 2010. Also a director of Vasco Data Securities, Inc. and Echo Global Logistics. A director of Manpower for more than five years. Previously, a director of Abbott Laboratories from 1990 to 2007, Deere & Company from 1991 to 2007 and SNP Corporation of Singapore from 2002 to 2009. | ||||

| Marc J. Bolland |

51 | Chief Executive Officer of Marks and Spencer Group plc. since May 2010. Chief Executive Officer of Wm Morrisons Supermarket Plc from September 2006 to April 2010. Executive Board Member of Heineken N.V., a Dutch beer brewing and bottling company, from 2001 to August 2006. Previously, a Managing Director of Heineken | ||||

5

| Export Group Worldwide, a subsidiary of Heineken N.V., from 1999 to 2001, and Heineken Slovensko, Slovakia, a subsidiary of Heineken N.V., from 1995 to 1998. A director of Manpower for more than five years. No other directorships in the past five years. | ||||||

| Ulice Payne, Jr. |

55 | President of Addison-Clifton, LLC, a provider of global trade compliance advisory services, from May 2004 to present. President and Chief Executive Officer of the Milwaukee Brewers Baseball Club from 2002 to 2003. Partner with Foley & Lardner LLP, a national law firm, from 1998 to 2002. A director of Northwestern Mutual and Wisconsin Energy Corporation. A director of Manpower since October 2007. Previously, a director of Midwest Air Group, Inc. from 1998 to 2006 and Badger Meter, Inc. from 2000 to 2010. | ||||

| Class II Directors (term expiring in 2013) | ||||||

| Gina R. Boswell |

48 | President, Global Brands, of Alberto-Culver Company since January 2008. Senior Vice President and Chief Operating Officer — North America of Avon Products, Inc. from February 2005 to May 2007. Senior Vice President — Corporate Strategy and Business Development of Avon Products, Inc. from 2003 to February 2005. Prior thereto, an executive with Ford Motor Company, serving in various positions from 1999 to 2003. A director of Manpower since February 2007. Previously, a director of Applebee’s International, Inc. (now DineEquity) from 2005 to 2007. | ||||

| Jack M. Greenberg |

68 | Non-Executive Chairman of The Western Union Company since 2006. Also Non-Executive Chairman of InnerWorkings, Inc. since June 2010. Retired Chairman and Chief Executive Officer of McDonald’s Corporation from May 1999 to December 2002 and Chief Executive Officer and President from August 1998 to May 1999. Director of The Allstate Corporation, InnerWorkings, Inc., Hasbro, Inc. and The Western Union Company. A director of Manpower for more than five years. Previously, a director of Abbott Laboratories from 2000 to 2007 and First Data Corporation from 2003 to 2006. | ||||

| Terry A. Hueneke |

68 | Retired Executive Vice President of Manpower from 1996 until February 2002. Senior Vice President — Group Executive of Manpower’s former principal operating subsidiary from 1987 until 1996. A director of Manpower for more than five years. No other directorships in the past five years. | ||||

Each director attended at least 75% of the board meetings and meetings of committees on which he or she served in 2010. The board of directors held seven meetings during 2010. The board of directors did not take action by written consent during 2010.

Under Manpower’s by-laws, nominations, other than those made by the board of directors or the nominating and governance committee, must be made pursuant to timely notice in proper written form to the secretary of Manpower. To be timely, a shareholder’s request to nominate a person for election to the board of directors at an annual meeting of shareholders, together with the written consent of such person to serve as a director, must be received by the secretary of Manpower not less than 90 days nor more than 150 days prior to the anniversary of the annual meeting of shareholders held in the prior year. To be in proper written form, the notice must contain certain information concerning the nominee and the shareholder submitting the nomination, including the disclosure of any hedging, derivative or other complex transactions involving the Company’s common stock to which a shareholder proposing a director nomination is a party.

6

The board of directors has adopted categorical standards for relationships deemed not to impair independence of non-employee directors to assist it in making determinations of independence. The categorical standards are attached to this proxy statement as Appendix A. The board of directors has determined that ten of eleven of the current directors of Manpower are independent under the listing standards of the New York Stock Exchange after taking into account the categorical standards and the following:

| • | Mr. Walter is a director and shareholder of Echo Global Logistics, a public company that entered into an agreement to provide logistics support to Manpower. |

| • | Mr. Walter and Mr. Greenberg are directors of InnerWorkings, Inc., a public company, which provides print management services to Manpower. |

| • | Mr. Zore was the President and Chief Executive Officer of Northwestern Mutual until July 2010. Also, Mr. Payne is a director of Northwestern Mutual. Northwestern Mutual and certain of its affiliates have engaged Manpower, Manpower Professional, Jefferson Wells and Right Management to provide contingent staffing, accounting and other services. In addition, Manpower and certain of its affiliates have from time to time leased space from joint venture and limited liability companies in which Northwestern Mutual has an equity interest. |

The independent directors are Mr. Bolland, Ms. Boswell, Ms. Dominguez, Mr. Greenberg, Mr. Hueneke, Mr. Mendoza, Mr. Payne, Ms. Sartain, Mr. Walter and Mr. Zore.

The nominating and governance committee will evaluate eligible shareholder-nominated candidates for election to the board of directors in accordance with the procedures described in Manpower’s Amended and Restated By-Laws and in accordance with the guidelines and considerations relating to the selection of candidates for membership on the board of directors described under “Board Composition and Qualifications of Board Members” below.

Manpower does not have a policy regarding board members’ attendance at the annual meeting of shareholders. Ten of the eleven directors attended the 2010 annual meeting of shareholders.

Any interested party who wishes to communicate directly with the lead director or with the non-management directors as a group may do so by calling 1-800-210-3458. The third-party service provider that monitors this telephone number will forward a summary of all communications directed to the non-management directors to the lead director.

Committees of the Board

The board of directors has standing audit, executive compensation and human resources, and nominating and governance committees. The board of directors has adopted written charters for the audit, executive compensation and human resources and nominating and governance committees. These charters are available on Manpower’s web site at www.investor.manpower.com.

Due to a question whether an executive committee continued to be necessary, the board of directors did not act to reappoint an executive committee when it considered reappointment of its standing committees at the February 2011 meeting. The executive committee had consisted of Messrs. Joerres and Walter and did not meet or take action by written consent during 2010.

The audit committee consists of Mr. Zore (Chairman), Ms. Boswell, Mr. Hueneke, Mr. Payne and Mr. Mendoza. Each member of the audit committee is “independent” within the meaning of the applicable listing standards of the New York Stock Exchange. The board of directors has determined that Mr. Zore is an “audit committee financial expert” and “independent” as defined under the applicable rules of the Securities and Exchange Commission.

7

The functions of the audit committee include: (i) appointing the independent auditors for the annual audit and approving the fee arrangements with the independent auditors; (ii) monitoring the independence, qualifications and performance of the independent auditors; (iii) reviewing the planned scope of the annual audit; (iv) reviewing the financial statements to be included in our quarterly reports on Form 10-Q and our annual report on Form 10-K, and our disclosures under “Management’s Discussion and Analysis of Financial Condition and Results of Operations”; (v) reviewing compliance with and reporting under Section 404 of the Sarbanes-Oxley Act of 2002; (vi) reviewing our accounting management and controls and any significant audit adjustments proposed by the independent auditors; (vii) making a recommendation to the board of directors regarding inclusion of the audited financial statements in our annual report on Form 10-K; (viii) reviewing recommendations, if any, by the independent auditors resulting from the audit to ensure that appropriate actions are taken by management; (ix) reviewing matters of disagreement, if any, between management and the independent auditors; (x) periodically reviewing our Policy Regarding the Retention of Former Employees of Independent Auditors; (xi) overseeing compliance with our Policy on Services Provided by Independent Auditors; (xii) meeting privately on a periodic basis with the independent auditors, internal audit staff and management to review the adequacy of our internal controls; (xiii) monitoring our internal audit department, including our internal audit plan; (xiv) monitoring our policies and procedures regarding compliance with the Foreign Corrupt Practices Act and compliance by our employees with our code of business conduct and ethics; (xv) assisting the board of directors with its oversight of the performance of the Company’s risk management function; (xvi) reviewing current tax matters affecting us; (xvii) periodically discussing with management our risk management framework; (xviii) serving as our qualified legal compliance committee; and (xix) monitoring any litigation involving Manpower, which may have a material financial impact on Manpower or relate to matters entrusted to the audit committee. In addition, the charter of the audit committee provides that the audit committee shall review and approve all related party transactions that are material to Manpower’s financial statements or that otherwise require disclosure to Manpower’s shareholders, provided that the audit committee shall not be responsible for reviewing and approving related party transactions that are reviewed and approved by the board of directors or another committee of the board of directors. The audit committee held five meetings during 2010. The audit committee did not take action by written consent during 2010.

The executive compensation and human resources committee consists of Mr. Greenberg (Chairman), Mr. Bolland, Ms. Dominguez, Ms. Sartain and Mr. Walter. Ms. Sartain was appointed to the committee on February 16, 2011. Each member of the executive compensation and human resources committee is “independent” within the meaning of the applicable listing standards of the New York Stock Exchange and qualifies as an “outside director” under Section 162(m) of the Internal Revenue Code. The functions of this committee are to: (i) establish the compensation of the president and chief executive officer and the chief financial officer of Manpower, subject to ratification by the board of directors; (ii) approve the compensation, based on the recommendations of the president and chief executive officer of Manpower, of certain other senior executives of Manpower and its subsidiaries; (iii) determine the terms of any agreements concerning employment, compensation or employment termination, as well as monitor the application of Manpower’s retirement and other fringe benefit plans, with respect to the individuals listed in (i) and (ii); (iv) monitor the development of Manpower’s key executive officers; (v) administer Manpower’s equity incentive plans and employee stock purchase plans and oversee Manpower’s employee retirement and welfare plans; (vi) administer Manpower’s corporate senior management annual incentive plan; and (vii) act as the compensation committee of outside directors under Section 162(m) of the Internal Revenue Code. The executive compensation and human resources committee held six meetings during 2010. The executive compensation and human resources committee did not take action by written consent during 2010.

The nominating and governance committee consists of Mr. Walter (Chairman), Ms. Boswell, Mr. Greenberg, Mr. Payne, and Mr. Zore. Ms. Boswell and Mr. Payne were appointed to the committee on August 3, 2010. Each member of the nominating and governance committee is “independent” within the meaning of the applicable listing standards of the New York Stock Exchange. The functions of this committee are to: (i) recommend nominees to stand for election at annual meetings of shareholders, to fill vacancies on the board of directors and to serve on committees of the board of directors; (ii) establish procedures and assist in

8

identifying candidates for board membership; (iii) review the qualifications of candidates for board membership; (iv) periodically review the compensation arrangements in effect for the non-management members of the board of directors and recommend any changes deemed appropriate; (v) coordinate the annual self- evaluation of the performance of the board of directors and each of its committees; (vi) establish and review, for recommendation to the board of directors, guidelines and policies on the size and composition of the board, the structure, composition and functions of the board committees, and other significant corporate governance principles and procedures; (vii) oversee the content and format of our code of business conduct and ethics; (vii) monitor compliance by the non-management directors with our code of business conduct and ethics; and (viii) develop and periodically review succession plans for the directors. The nominating and governance committee has from time to time engaged director search firms to assist it in identifying and evaluating potential board candidates. The nominating and governance committee met five times during 2010. The nominating and governance committee did not take action by written consent during 2010.

Board Composition and Qualifications of Board Members

The nominating and governance committee has adopted, and the board of directors has approved, guidelines for selecting board candidates that the committee considers when evaluating candidates for nomination as directors. The guidelines call for the following with respect to the composition of the board:

| • | a variety of experience and backgrounds |

| • | a core of business executives having substantial senior management and financial experience |

| • | individuals who will represent the best interests of the shareholders as a whole rather than special interest constituencies |

| • | the independence of at least a majority of the directors |

| • | individuals who represent a diversity of gender, race and age |

In connection with its consideration of possible candidates for board membership, the committee also has identified areas of experience that members of the board should as a goal collectively possess. These areas include:

| • | previous board experience |

| • | active or former CEO/COO/Chairperson |

| • | human resources experience |

| • | accounting or financial oversight experience |

| • | international business experience |

| • | sales experience |

| • | marketing and branding experience |

| • | operations experience |

| • | corporate governance experience |

| • | government relations experience |

| • | technology experience |

The Company believes that the present composition of the board of directors satisfies the guidelines for selecting board candidates set out above; specifically, the board is composed of individuals who have a variety of experience and backgrounds, the board has a core of business executives having substantial experience in management as well as one member having government experience, board members represent the best interests

9

of all of the shareholders rather than special interests, and ten of eleven directors are independent under the rules of the New York Stock Exchange. The composition of the board also reflects diversity of country of origin, gender, race and age, an objective that the nominating and governance committee continually strives to enhance when searching for and considering new directors.

In addition, the particular areas of desired experience identified above that are possessed by each director with significant or some experience is as follows:

M. Bolland — Active CEO/COO/Chairman, Human Resources, Financial Oversight/Accounting, International Business, Sales, Marketing/Branding, Operations and Government Relations

G. Boswell — Previous Board Experience, Active CEO/COO/Chairman, Human Resources, Financial Oversight/Accounting, International Business, Sales, Marketing/Branding, Operations, Governance and Technology

C. Dominguez — Human Resources, International Business, Operations, Governance and Government Relations

J. Greenberg — Previous Board Experience, Active CEO/COO/Chairman, Former CEO, Human Resources, Financial Oversight/Accounting, International Business, Marketing/Branding, Operations, Governance, Government Relations and Technology

T. Hueneke — Human Resources, Financial Oversight/Accounting, International Business, Sales, Marketing/Branding and Operations

R. Mendoza — Previous Board Experience, Human Resources, Financial Oversight/Accounting, International Business, Sales, Operations and Governance

U. Payne — Previous Board Experience, Active CEO/COO/Chairman, Former CEO, Human Resources, Financial Oversight/Accounting, International Business, Sales, Marketing/Branding, Operations, Governance and Government Relations

E. Sartain — Previous Board Experience, Human Resources, International Business, Marketing/Branding and Operations

J. Walter — Previous Board Experience, Active CEO/COO/Chairman, Former CEO, Human Resources, Financial Oversight/Accounting, International Business, Sales, Marketing/Branding, Operations, Governance, Government Relations and Technology

E. Zore — Previous Board Experience, Active CEO/COO/Chairman, Human Resources, Financial Oversight/Accounting, Sales, Marketing/Branding, Operations, Governance, Government Relations and Technology

Mr. Joerres has experience in many of these areas as well, however his position on the board is due to his position as CEO of the Company, as the board of directors has determined the CEO should also be chairman of the board of directors. For more information on how each of the board of directors meets these objectives, see their occupations and directorships disclosed previously under “Election of Directors”.

Manpower’s corporate governance guidelines state that it is the policy of the board of directors that no individual who would be age 70 or older at the time of his or her election will be eligible to stand for election to the board of directors.

10

Board Leadership Structure

The board of directors has appointed the chief executive officer of the Company to the position of chairman of the board. Combining the roles of chairman of the board and chief executive officer (1) enhances alignment between the board of directors and management in strategic planning and execution as well as operational matters, (2) avoids the confusion over roles, responsibilities and authority that can result from separating the positions, and (3) streamlines board process in order to conserve time for the consideration of the important matters the board needs to address. At the same time, the combination of a completely independent board (except for the chairman of the board) and the lead director arrangement maintained by the board facilitate effective oversight of the performance of senior management.

The board of directors has established an arrangement under which the chairman of one of the principal board committees serves as lead director on a rotating basis for each calendar year in the following order: executive compensation and human resources committee, audit committee, and nominating and governance committee. The lead director’s duties as specified in the Company’s corporate governance guidelines are as follows:

| • | Preside at executive sessions of the non-employee directors and all other meetings of directors where the chairman of the board is not present; |

| • | Serve as liaison between the chairman of the board and the non-employee directors; |

| • | Approve what information is sent to the board; |

| • | Approve the meeting agendas for the board; |

| • | Approve meeting schedules to assure that there is sufficient time for discussion on all agenda items; |

| • | Have the authority to call meetings of the non-employee directors; and |

| • | If requested by major shareholders, ensure that he or she is available for consultation and direct communication. |

Mr. Walter, the chairman of the nominating and governance committee, will serve as lead director in 2011.

Board Oversight of Risk

The audit committee is responsible for assisting the board of directors with its oversight of the performance of the Company’s risk management functions including:

| • | Periodically reviewing and discussing with management the Company’s policies, practices and procedures regarding risk assessment and management; |

| • | Periodically receiving, reviewing and discussing with management reports on selected risk topics as the committee or management deems appropriate from time to time; and |

| • | Periodically reporting to the board of directors on its activities in this oversight role. |

In this oversight capacity, the committee’s role is one of informed oversight rather than direct management of risk. In addition, it is not intended that the committee be involved in the day-to-day risk management activities. Instead, the committee is expected to engage in reviews and discussions with management (and others if considered appropriate) as necessary to be reasonably assured that the Company’s risk management processes (1) are adequate to identify the material risks that we face in a timely manner, (2) include strategies for the management of risk that are responsive to our risk profile and specific material risk exposure, (3) serve to integrate risk management considerations into business decision-making throughout the Company, and (4) include policies and procedures that are reasonably effective in facilitating the transmission of information with respect to material risks to the senior executives of the Company and the committee.

11

Compensation Consultant

The executive compensation and human resources committee directly retains Mercer (US) Inc. to advise it on executive compensation matters. Mercer reports to the chairman of the committee. On an annual basis, the Company and Mercer enter into an engagement letter, which sets out the services to be performed by Mercer for the committee during the ensuing year. Mercer’s primary role is to provide objective analysis, advice and information and otherwise to support the committee in the performance of its duties. Mercer’s fees for executive compensation consulting to the committee in 2010 were $202,987.

The committee requests information and recommendations from Mercer as it deems appropriate in order to assist it in structuring and evaluating Manpower’s executive compensation programs and practices. The committee’s decisions about executive compensation, including the specific amounts paid to executive officers, are its own and may reflect factors and considerations other than the information and recommendations provided by Mercer.

Mercer was engaged by the committee to perform the following services for the period from June 1, 2010 through May 31, 2011:

| • | Evaluate the competitiveness of our total executive compensation and benefits program for the CEO, CFO and senior management team, including base salary, annual incentive, total cash compensation, long-term incentive awards, total direct compensation, retirement benefits and total remuneration against the market; |

| • | Assess how well the compensation and benefits programs are aligned with the committee’s stated philosophy to align pay with performance, including analyzing our performance against comparator companies; |

| • | Review the companies included in our industry peer group; |

| • | Provide advice and assistance to the committee on the levels of total compensation and the principal elements of compensation for our senior executives; |

| • | Brief the executive compensation and human resources committee on executive compensation trends in executive compensation and benefits among large public companies and on regulatory, legislative and other developments; |

| • | Advise the executive compensation and human resources committee on salary, target incentive opportunities and equity grants; and |

| • | Assist with the preparation of the Compensation Discussion and Analysis and other executive compensation disclosures to be included in this proxy statement. |

In connection with the engagement, Manpower and Mercer have agreed on written guidelines for minimizing potential conflicts of interest. These guidelines are as follows:

| • | The committee has the authority to retain and dismiss Mercer at any time; |

| • | Mercer reports directly to the committee and has direct access to the committee through the chairman; |

| • | Mercer does not consult with or otherwise interact with our executives except to discuss our business and compensation strategies and culture, obtain compensation and benefits data along with financial projections and operational data, consult about the nature and scope of the various executive jobs for benchmarking purposes, confirm factual and data analyses to ensure accuracy, and consult with the CEO about the compensation of the other executives of Manpower; |

| • | Mercer’s main contacts with management are the CFO and executive vice president, global strategy and talent; |

12

| • | Mercer’s written reports may be distributed to committee members as part of the committee meeting mailings, except any findings and recommendation regarding the CEO are sent in a separate document directly to committee members; |

| • | Each engagement of Mercer by the committee is documented in an engagement letter that includes a description of the agreed upon services, fees and other matters considered appropriate; and |

| • | Prior to the Mercer consultant performing any services, whether related to compensation or other consulting services, for Manpower in addition to those performed for the committee, the consultant must inform the committee chairman and obtain approval. |

Ultimately, the consultant provides recommendations and advice to the committee in an executive session where management is not present, which is when critical pay decisions are made. This approach protects the committee’s ability to receive objective advice from the consultant so that the committee may make independent decisions about executive pay at our company.

Besides Mercer’s involvement with the committee, it and its affiliates also provide other non-executive compensation services to us. The total amount paid for these other services provided in 2010 was $553,063.

The committee believes the advice it receives from the individual executive compensation consultant is objective and not influenced by Mercer’s or its affiliates’ relationships with us because of the procedures Mercer and the committee have in place, including the following:

| • | The consultant receives no incentive or other compensation based on the fees charged to us for other services provided by Mercer or any of its affiliates; |

| • | The consultant is not responsible for selling other Mercer or affiliate services to us; |

| • | Mercer’s professional standards prohibit the individual consultant from considering any other relationships Mercer or any of its affiliates may have with us in rendering his or her advice and recommendations; and |

| • | The committee evaluates the quality and objectivity of the services provided by the consultant each year and determines whether to continue to retain the consultant. |

13

2. RATIFACTION OF THE APPOINTMENT OF WILLIAM DOWNE TO BOARD OF DIRECTORS

The nominating and governance committee has recommended and the board of directors has appointed, William Downe to the board of directors to serve as a Class II director effective at the close of the annual meeting. Mr. Downe was recommended for appointment to the board of directors by an independent director search firm. The appointment of Mr. Downe to the board of directors is subject to ratification by the shareholders.

Our board of directors believes that it is good practice to provide shareholders an opportunity to vote on the election of a newly appointed board member at the earliest possible time. However, our by-laws provide that if the number of directors is changed, any increase or decrease must be apportioned among the classes so as to maintain the number of directors in each class as equal as possible. Given the current make-up of the classes and taking into account the age limitation in the retirement policy for board members, the board of directors believes Mr. Downe’s appointment to Class II is most appropriate.

Class II directors do not stand for election until 2013. In order to provide shareholders an opportunity to vote on Mr. Downe’s appointment to the board of directors consistent with the practice above, our board of directors has decided to submit Mr. Downe’s appointment to the board of directors for ratification by the shareholders at the annual meeting. If the shareholders do not ratify the appointment, the appointment will not take effect. If the appointment is approved by shareholders, the appointment will take effect at the close of the annual meeting and Mr. Downe will serve as a Class II director. Mr. Downe will be appointed to any committees of the board of directors at a later date. The board of directors has determined that Mr. Downe is independent under the listing standards of the New York Stock Exchange.

| Name |

Age | Principal Occupation and Directorships | ||||

| William Downe |

58 | President and Chief Executive Officer of BMO Financial Group since March 2007. Chief Operating Officer of BMO Financial Group from 2006 to March 2007. Deputy Chair of BMO Financial Group and Chief Executive Officer, BMO Nesbitt Burns and Head of Investment Banking Group from 2001 to 2006. Vice Chair of Bank of Montreal, 1999 to 2001. Prior thereto, held various senior management positions at Bank of Montreal in Canada and the U.S. A Director of BMO Financial Group. | ||||

The nominating and governance committee believes Mr. Downe’s qualifications to serve on our board of directors include his experience as a current CEO, as a director of other companies, as well as his experience in international business and operations.

The affirmative vote of a majority of votes cast on the proposal shall constitute the ratification of the appointment of Mr. Downe to the board of directors.

The board of directors recommends that you vote FOR the ratification of the appointment of William Downe to the board of directors and your proxy will be so voted unless you specify otherwise.

14

3. RATIFACTION OF THE APPOINTMENT OF PATRICIA A. HEMINGWAY HALL TO BOARD OF DIRECTORS

The nominating and governance committee has recommended and the board of directors has appointed, Patricia Hemingway Hall to the board of directors to serve as a Class II director. The appointment of Ms. Hemingway Hall will be effective at the close of the board of directors meeting being held on May 3, 2011. Ms. Hemingway Hall was recommended for appointment to the board of directors by an independent director search firm. The appointment of Ms. Hemingway Hall to the board of directors is subject to ratification by the shareholders.

Our board of directors believes that it is good practice to provide shareholders an opportunity to vote on the election of a newly appointed board member at the earliest possible time. However, our by-laws provide that if the number of directors is changed, any increase or decrease must be apportioned among the classes so as to maintain the number of directors in each class as equal as possible. Given the current make-up of the classes and taking into account the age limitation in the retirement policy for board members, the board of directors believes Ms. Hemingway Hall’s appointment to Class II is most appropriate.

Class II directors do not stand for election until 2013. In order to provide shareholders an opportunity to vote on Ms. Hemingway Hall’s appointment to the board of directors consistent with the practice above, our board of directors has decided to submit Ms. Hemingway Hall’s appointment to the board of directors for ratification by the shareholders at the annual meeting. If the shareholders do not ratify the appointment, the appointment will not take effect. If the appointment is approved by shareholders, the appointment will take effect at the close of the board of directors meeting being held on May 3, 2011 and Ms. Hemingway Hall will serve as a Class II director. Ms. Hemingway Hall will be appointed to any committees of the board of directors at a later date. The board of directors has determined that Ms. Hemingway Hall is independent under the listing standards of the New York Stock Exchange.

| Name |

Age | Principal Occupation and Directorships | ||||

| Patricia A. Hemingway Hall |

58 | President and Chief Executive Officer of Health Care Service Corporation since November 2008. President and Chief Operating Officer of Health Care Service Corporation from November 2007 to November 2008. Executive Vice President of Internal Operations of Health Care Service Corporation from 2006 to 2007. Prior thereto held other senior management positions within Health Care Service Corporation since 1998. No other public directorships in the past five years. | ||||

The nominating and governance committee believes Ms. Hemingway Hall’s qualifications to serve on our board of directors include her experience as a current CEO as well as her experience in human resources, sales, marketing and branding, operations and government relations.

The affirmative vote of a majority of votes cast on the proposal shall constitute the ratification of the appointment of Ms. Hemingway Hall to the board of directors.

The board of directors recommends that you vote FOR the ratification of the appointment of Patricia A. Hemingway Hall to the board of directors and your proxy will be so voted unless you specific otherwise.

15

SECURITY OWNERSHIP OF MANAGEMENT

Set forth in the table below, as of February 22, 2011, are the shares of Manpower common stock beneficially owned by each director and nominee, each of the executive officers named in the table under the heading “Executive and Director Compensation — Summary Compensation Table,” who we refer to as the named executive officers, and all directors and executive officers of Manpower as a group and the shares of Manpower common stock that could be acquired within 60 days of February 22, 2011 by such persons.

| Name of Beneficial Owner |

Common Stock Beneficially Owned(1) |

Right to Acquire Common Stock(1)(2) |

Percent of Class(3) |

|||||||||

| Jeffrey A. Joerres |

1,297,938 | (4)(5) | 1,029,500 | 1.6 | % | |||||||

| Michael J. Van Handel |

322,961 | (5) | 240,000 | * | ||||||||

| Barbara J. Beck |

159,137 | 157,419 | * | |||||||||

| Marc J. Bolland |

16,832 | (5) | 6,250 | * | ||||||||

| Gina R. Boswell |

9,361 | (5) | 0 | * | ||||||||

| Cari M. Dominguez |

6,194 | (5) | 0 | * | ||||||||

| Darryl Green |

65,438 | 59,750 | * | |||||||||

| Jack M. Greenberg |

22,189 | (5) | 10,000 | * | ||||||||

| Françoise Gri |

75,341 | 67,500 | * | |||||||||

| Terry A. Hueneke |

21,727 | (5) | 8,750 | * | ||||||||

| Roberto Mendoza |

0 | 0 | * | |||||||||

| Ulice Payne, Jr |

3,944 | 0 | * | |||||||||

| Jonas Prising |

101,331 | (5) | 80,750 | * | ||||||||

| Elizabeth P. Sartain |

2,517 | 0 | * | |||||||||

| Owen J. Sullivan |

137,501 | (5) | 133,020 | * | ||||||||

| John R. Walter |

46,569 | 28,028 | * | |||||||||

| Edward J. Zore |

76,288 | (5) | 45,000 | * | ||||||||

| All directors and executive officers as a group (20 persons) |

2,551,598 | 2,041,263 | 3.1 | % | ||||||||

| (1) | Except as indicated below, all shares shown in this column are owned with sole voting and dispositive power. Amounts shown in the Right to Acquire Common Stock column are also included in the Common Stock Beneficially Owned column. |

| The table does not include vested shares of deferred stock, which will be settled in shares of Manpower common stock on a one-for-one basis, held by the following directors that were issued under the 2003 Equity Incentive Plan and the Terms and Conditions Regarding the Grant of Awards to Non-Employee Directors under the 2003 Equity Incentive Plan: |

| Director | Vested Deferred Stock | |||

| Marc J. Bolland |

2,024 | |||

| Cari M. Dominguez |

3,030 | |||

| Jack M. Greenberg |

1,559 | |||

| Terry A. Hueneke |

4,478 | |||

| Roberto Mendoza |

4,404 | |||

| Ulice Payne, Jr. |

3,030 | |||

| Elizabeth P. Sartain |

328 | |||

| John R. Walter |

10,817 | |||

| Edward J. Zore |

4,864 | |||

| The table does not include 1,663 unvested shares of deferred stock, which will be settled in shares of Manpower common stock on a one-for-one basis, held by each of Mr. Mendoza, Mr. Payne, Ms. Sartain and Mr. Walter that were issued under the 2003 Plan and the Terms and Conditions on January 1, 2011. These shares of deferred stock vest in equal quarterly installments during 2011. |

16

| Finally, the table does not include unvested restricted stock units, which will be settled in shares of Manpower common stock on a one-for-one basis, held by the following executive officers that were issued under the 2003 Plan: |

| Officer | Unvested Restricted Stock Units |

|||

| Jeffrey A. Joerres |

38,029 | |||

| Michael J. Van Handel |

14,318 | |||

| Darryl Green |

25,322 | |||

| Francoise Gri |

12,080 | |||

| Jonas Prising |

23.031 | |||

| Owen J. Sullivan |

20,971 | |||

| Of these amounts, (i) 10,560 restricted stock units held by Mr. Green vest on May 28, 2011, (ii) the following restricted stock units vest on February 17, 2012: Mr. Joerres — 17,170; Mr. Van Handel — 6,868; Mr. Green — 3,950; Ms. Gri — 3,950; Mr. Prising — 3,092; and Mr. Sullivan — 3,092, (iii) the following restricted stock units vest on February 17, 2013: Mr. Green — 5,150, Ms. Gri — 5,150 and Mr. Prising — 2,060, (iv) the following restricted stock units vest on February 16, 2014: Mr. Joerres — 20,859; Mr. Van Handel — 7,450; Mr. Green — 5,662; Ms. Gri — 2,980; Mr. Prising — 2,980; and Mr. Sullivan – 2,980, and (v) 14,899 shares of restricted stock held by each of Mr. Prising and Mr. Sullivan will vest on February 16, 2016 , except as otherwise provided in the 2003 Plan. |

| (2) | Common stock that may be acquired within 60 days of the record date through the exercise of stock options and the settlement of restricted stock units. |

| (3) | No person named in the table, other than Mr. Joerres, beneficially owns more than 1% of the outstanding shares of common stock. The percentage is based on the column entitled Common Stock Beneficially Owned. |

| (4) | Includes 300 shares held by Mr. Joerres’ spouse. |

| (5) | Includes the following number of shares of unvested restricted stock as of the record date: |

| Officer or Director | Unvested Restricted Stock |

|||

| Jeffrey A. Joerres |

75,000 | |||

| Michael J. Van Handel |

6,000 | |||

| Jonas Prising |

2,500 | |||

| Owen J. Sullivan |

2,500 | |||

| Marc J. Bolland |

1,663 | |||

| Gina R. Boswell |

1,663 | |||

| Cari M. Dominguez |

1,663 | |||

| Jack M. Greenberg |

1,663 | |||

| Terry A. Hueneke |

1,663 | |||

| Edward J. Zore |

1,663 | |||

| The holders of the restricted stock have sole voting power with respect to all shares held and no dispositive power with respect to all shares held. |

17

EXECUTIVE AND DIRECTOR COMPENSATION

Compensation Discussion and Analysis

Background

This compensation discussion and analysis provides information about Manpower’s compensation policies and decisions regarding the company’s CEO, CFO and the five executive officers who are the leaders of the company’s business operating units. In the discussion below, we refer to this group of executives as the named executive officers (“NEOs”). This group includes the executive officers for whom disclosure is required under the rules of the Securities and Exchange Commission.

The executive compensation and human resources committee of the board of directors oversees the design and administration of Manpower’s compensation programs for executive officers and certain other officers who, together with the Company’s executive officers, comprise Manpower’s executive management team. A discussion of the committee’s structure, roles and responsibilities and related matters can be found under the heading “Meetings and Committees of the Board.”

Summary

Manpower is the world leader in innovative workforce solutions and services with over 84% percent of its revenues coming from outside the United States. The company does business in 82 countries, has nearly 3,900 offices and over 30,000 staff employees globally, and placed 3.5 million people in jobs in 2010. The variations in laws around the world, the variety of services offered, and the increasing multiregional solutions that clients are requesting make the business increasingly complex. None of the company’s competitors can match its global reach or breadth of service offerings.

To be successful, Manpower needs senior executives who have the capability and experience to operate effectively in this environment. A guiding principle of the company’s compensation program is to provide pay opportunities to the NEOs that are competitive in attracting and retaining executives of this caliber. Other key objectives of the program are to align compensation to shareholder interests and, as an element of that objective, to pay for results and not pay for failure.

Components of Compensation and Award Targets

Compensation packages for NEOs generally include, as short-term arrangements, a base salary and an annual incentive bonus, and for long-term focus and value accumulation, stock options, performance share units (PSUs), and in more recent years, restricted stock units. The annual incentive is earned based on achievement of goals established at the beginning of each year. Likewise, performance share units represent a right to receive shares of Company common stock based on achievement of goals established at the time the PSUs are granted. For both, award opportunities are established for achievement at threshold, target and outstanding levels.

The Company structures the compensation packages of the NEOs so that the overall outcomes fall generally between the median of the competitive market and the 75th percentile of that market. For the annual incentive and the PSU components of the package, award levels for achievement of the applicable goals generally are set at the median of the competitive market for target results and the 75th percentile for outstanding results. However, actual outcomes may vary among NEOs due to experience and other individual factors. In addition, because of the cyclical nature of the Company’s business and the resulting impact on our stock price, actual outcomes may significantly exceed or fall short of this range after taking into account performance factors.

18

Alignment with Shareholder Interests and Pay for Performance

As noted above, a key objective of the compensation program is to align compensation to shareholder interests. The company’s compensation program addresses this objective on both a short-term basis and a long-term basis. Annual incentive awards are based on achievement of goals that are drivers of shareholder value and PSUs are earned based on operating profit margin percentage goals, an incentive closely correlated with growth in shareholder value. A substantial portion of the annual incentive awards paid to the CEO and CFO, for example, are based on achievement of earnings per share and economic profit goals for the year, two metrics that are aligned with shareholder interests.

Both the short-term and long-term components of the compensation program reflect the objective that senior executives should be paid for results and not paid for failure. NEO base salaries generally are at or below market median with a significant component of the annual cash opportunity based on the level of attainment of financial goals for the year. If the actual results fall short of the goals, the award level is correspondingly reduced or eliminated. For 2009, for example, when financial results were down significantly, the CEO had a target incentive opportunity that was 150 percent of his base salary, but he actually received an award that was only 20 percent of base salary.

As for the long-term components of the compensation program, the ultimate value received by an executive, through stock appreciation, will of course depend directly on the performance of the company. This point is vividly illustrated by the substantial decline in value experienced by the CEO of the stock and options he has accumulated from compensatory grants in connection with the recent recessionary period. For example, for the stock options exercisable as of January 1, 2008 for the CEO, the net value of these awards declined from $14.8 million on January 1, 2008, to $1.5 million on January 1, 2009, as a result of the decline in the company’s stock value. In addition, a significant component of the long-term compensation package consists of performance share units which are earned only to the extent the company achieves a pre-established level of performance tied to a designated financial metric, in this instance operating profit margin. To illustrate, the performance share units issued to NEOs in 2008 for the 2008 to 2010 period, which accounted for approximately 28% percent of the target value of the long-term compensation awarded that year, turned out to be worth nothing because of the weak financial performance of the company during that period.

The Competitive Market

Identifying the competitive market for the company has been a challenge over the past few years. Most recently the company has turned to certain index and survey data which are described below. The size, global reach, breadth, international scope, and complexity of Manpower’s business make it difficult to put together a comparable peer group. Besides Manpower, there are two other large companies in the staffing industry, Adecco and Ranstad, which ordinarily would be considered as good comparables. However, both are headquartered in Europe and as a result, the relevant compensation data for their executives is not readily available due to differences in disclosure laws, and pay practices in Europe are somewhat different than in the United States. The other companies in the industry are significantly smaller and far less complex than Manpower.

Identification of a comparable peer group for the company for purposes of assessing the company’s compensation program also has been a problem in the context of the evaluations of our executive compensation program by shareholder advisory groups, including ISS and Glass, Lewis &Co. We believe that, generally speaking, the peer groups used by these firms to evaluate our program are not really comparable, leading to results which we believe are flawed. Representatives of the company have spoken to both ISS and Glass Lewis about the issue. Both use GICs codes as a primary basis for the selection of the peer group, along with various other criteria. However, the companies that fall within the same GICs Code as the Company, generally, are far smaller and lack the global reach and complexity of the Company. The GICs group companies range from about 5 percent to about 25 percent of our size based on revenue and, while the Company does business in 82 countries, the next largest company in terms of global reach does business in 35 countries with a majority of the GICs group companies operating in less than 10 countries.

19

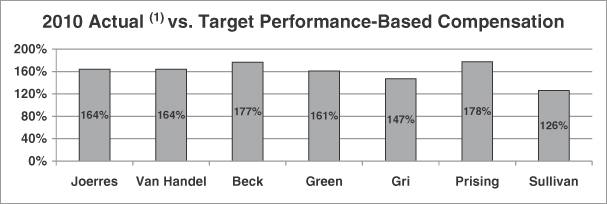

2010 Overview

During 2010, Manpower saw improvement in most of its markets, which allowed the company to utilize its operating leverage and significantly improve its operating results during the year compared to the prior year. These strong financial results were a significant factor in the amounts earned by NEOs for the year.

The 2010 compensation of the CEO and the CFO can be found in the Summary Compensation Table on page 39. These amounts reflect substantial increases over prior years but are driven by the strong financial results for the year. The compensation of the other NEO’s for 2010 also increased significantly over 2009 levels, again reflecting the improvement in results for the segments of the business for which they were responsible during 2010.

During 2010, only Mr. Prising received an increase in base salary. This was due to Mr. Prising’s increased responsibilities as President of the Americas. None of the CEO, the CFO, or any of the other NEOs received an increase in base salary, in part due to the economic conditions at the time. However, again as a result of Manpower’s strong financial performance in 2010 within the context of its pay for performance objective, all of the NEO’s received bonuses for 2010 based on achievement of a portion of his or her financial objectives. Similarly, in regard to the performance share units granted in 2010 as a component of Manpower’s long-term incentive program, which, as explained further below, are earned based on achievement of a pre-established goal for improving operating margin in 2010, and maintaining at least the threshold operating margin level in 2011, the NEO’s are currently expected to receive an award level between the target and outstanding level, as long as the threshold level operating margin can be maintained in 2011. However, as noted above, none of the NEO’s will receive anything from the performance share units granted in 2008, which were based on achievement of average operating profit margin over a three-year period, due to the weak financial performance in 2008 and 2009.

Manpower Inc. and Barbara Beck, Executive Vice President, President — EMEA, mutually agreed that her employment with the Company would end on March 1, 2011. She and the Company entered into an agreement containing the terms of her departure based on her existing severance agreement with the Company. For further details regarding this agreement, see the Company’s Current Report on Form 8-K filed December 29, 2010.

Changes for 2011

The committee is continually looking to enhance and refine the Company’s executive compensation program to align the program with best governance practices within the committee’s philosophy. As a result, when conducting the review of the severance agreements entered into between the Company and each of the CEO and CFO in February 2011, the committee eliminated any tax gross up payments for any amounts considered excess parachute payments under Section 280G of the Internal Revenue Code and subject to the 20% excise tax imposed on such payments under Section 4999 of the Internal Revenue Code. None of the other NEO’s severance agreements contained this feature.

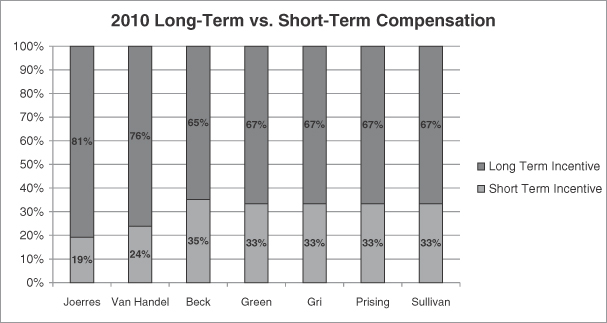

The committee has also changed the structure of the executive compensation program for 2011 to include restricted stock units in addition to stock options and performance share units. In 2010, performance share units and stock options were weighted approximately 40% and 60%, respectively. Beginning in 2011, performance share units will comprise approximately 50% of the long-term compensation grant for the NEOs, while stock options will comprise approximately 30% and restricted stock units will comprise approximately 20% of the long-term compensation grant for each of the NEOs. The committee believes performance shares should represent a significant portion of the NEOs equity compensation in view of the Company’s pay-for-performance objective. The committee has chosen to include restricted stock units to add balance to the package in view of the impact of economic cycles on the Company’s financial results and the resulting impact on our stock price. The committee believes restricted stock units directly align NEOs with the shareholders and add balance to the compensation program as they provide both upside potential and downside risk in our stock price and add an additional retention incentive. In addition, restricted stock units allow us to maintain a lower dilution rate than if the same value was granted as stock options. The grant date fair value of each restricted stock unit that we grant is greater than the grant date fair value of each stock option that we grant. Therefore, for the same value, employees would receive fewer restricted stock units than stock options.

20

Objectives of Compensation Program

In making decisions regarding compensation elements, program features and compensation award levels, Manpower is guided by a series of principles, listed below. Within the framework of these principles, Manpower considers the competitive market, corporate, business unit and individual results, and various individual factors. Although certain elements of compensation are tied to objective, predetermined goals, compensation decisions are not strictly formulaic but reflect subjective judgments as well.

Manpower’s executive compensation guiding principles are to:

| • | pay for results, |

| • | not pay for failure, |

| • | align compensation with shareholder interests, |

| • | pay competitively, |

| • | balance cash and equity, |

| • | use internal and external performance reference points, |

| • | recognize the global and cyclical nature of our business, |

| • | retain executives, |

| • | assure total compensation is affordable, and |

| • | clearly communicate plans so that they are understood. |

Compensation Elements

Manpower’s guiding principles for the compensation of the Company’s executive management team are implemented using various elements. The range of elements used is intended to provide a compensation and benefits package that addresses the competitive market for executive talent with the broad competencies and skills described earlier, creates a strong incentive to maximize shareholder value, produces outcomes that increase and decrease commensurate with Manpower’s results, and is aligned with Manpower’s business strategies.

The following are the main elements used by Manpower in its compensation program:

| • | Base salary |

| • | Annual incentive award paid in cash for achieving pre-determined objective and subjective goals |

| • | Long-term incentive awards |

| – | Stock options, |

| – | Performance share units, which give the holder the right to receive a certain number shares of stock at the end of a specified period based on achievement of a pre-established performance metric for that period, and |

| – | Restricted stock or restricted stock units, which give the holder the right to receive shares of stock at the end of a specified vesting period. |

Other elements of Manpower’s compensation program for the NEO’s include:

| • | Career shares in very few select circumstances, which in contrast to restricted stock or restricted stock units generally vest completely on a single date several years into the future |

21

| • | Availability of a nonqualified savings plan |

| • | Other benefits |

| – | Financial planning reimbursement and broad-based automobile benefits, |

| – | Selected benefits for expatriate executives, |

| – | Participation in broad-based employee benefit plans, and |

| – | Other benefits required by local law or driven by local market practice. |

Manpower does not offer a pension plan benefit to its senior executives in the United States, having frozen the company’s qualified, noncontributory defined benefit pension plan, as well as it’s nonqualified, noncontributory, defined benefit deferred compensation plan as of February 29, 2000. It also does not offer a qualified defined contribution plan (a “401(k) plan”) to its senior executives because of the limitations on participation applicable to highly compensated employees under the rules governing such plans. Although, as indicated above, the Company does offer the nonqualified savings plan which provides a benefit somewhat similar to that provided in a 401(k) plan, the nonqualified savings plan is a poor substitute because of the inflexibility as to the timing of payouts of the retirement benefits for nonqualified plans.

Positioning compensation against the market. The Company’s practice is to manage compensation generally to the median of compensation paid in the competitive market for target results and to provide maximum remuneration opportunities that approximate the 75th percentile of the competitive market for outstanding results. The Company’s approach to market positioning is not strictly formulaic; some compensation levels or award opportunities may be above or below these reference points. This approach is embodied in the design of the annual incentive plan and the program of equity-based awards, as described below. In setting each component of compensation, the Company takes into consideration the allocation of awards in the competitive market between current cash compensation and non-cash compensation including stock options, performance share units and restricted stock or restricted stock units.

Determining the competitive market. In determining the competitive market, Manpower employs three main sources: (1) an index of companies developed by Mercer for its compensation research, (2) an industry-specific peer group, and (3) position-specific published surveys.

Manpower’s size and global reach relative to other companies in its industry make it difficult to find relevant comparative data on performance and compensation. Because the size and scope of their operations are smaller, the public companies in the industry are not comparable to Manpower.

This industry-specific peer group is as follows:

| Insperity (f/k/a Administaff, Inc.) |

Robert Half International Inc. | |

| CDI Corp. |

SFN Group, Inc. (f/k/a Spherion Corporation) | |

| Kelly Services, Inc. |

TrueBlue, Inc. | |

| Kforce Inc. |