UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

RANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended June 30, 2012

oTRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ______________ to________________

Commission file number 000-33173

Moller International, Inc.

|

California

|

68-0006075

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

1222 Research Park Drive, Davis, CA 95618

(530) 756-5086

Securities registered under Section 12(b) of the Exchange Act: None

Securities registered under Section 12(g) of the Exchange Act:

Common Stock, No Par Value

Check whether the issuer is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. o

Check whether the issuer (1) filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes R No o

Check if there is no disclosure of delinquent filers in response to Item 405 of Regulation S-K contained in this form, and no disclosure will be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer ¨

|

Accelerated filer ¨

|

|

|

Non-accelerated filer ¨

(Do not check if a smaller reporting company)

|

Smaller reporting company þ

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No R

The issuer’s revenues for its most recent fiscal year ended June 30, 2012 are $10,182.

The aggregate market value of the voting and non-voting common equity held by non-affiliates is $3,628,007 with a total of 25,914,337 shares owned by non-affiliates as of October 10, 2012 and the closing price of such common equity of $0.15 per share on the OTC Bulletin Board on such date.

As of October 15, 2012, the Company had 49,063,408 common shares issued and outstanding.

Transitional Small Business Disclosure Format: Yes R No o

TABLE OF CONTENTS

|

PART I

|

||

|

Item 1

|

1

|

|

|

Item 2

|

23

|

|

|

Item 3

|

23

|

|

|

Item 4

|

23

|

|

|

PART II

|

||

|

Item 5

|

24

|

|

|

Item 6

|

25

|

|

|

Item 7

|

25

|

|

|

Item 8

|

All Financials

|

28

|

|

Item 9

|

41

|

|

|

Item 9A

|

41

|

|

|

PART III

|

||

|

Item 10

|

42

|

|

|

Item 11

|

43

|

|

|

Item 12

|

44

|

|

|

Item 13

|

45

|

|

|

Item 14

|

45

|

|

|

PART IV

|

||

|

Item 15

|

46

|

|

|

47

|

||

|

|

||

|

|

||

|

|

||

|

|

PART I

Item 1. BUSINESS

OUR COMPANY

Moller International, Inc. was incorporated April 19, 1983 in California for the purpose of designing, developing, manufacturing and marketing a line of Vertical Take-off and Landing ("VTOL") aircraft. Our flagship model, the M400 Skycar® is currently under development and testing and is projected to be a 4-passenger aircraft that will combine the cruise performance of an airplane with the vertical-flight capabilities of a helicopter. It is designated the "M400 Skycar®." A related product we are developing is the Aerobot® line of unmanned aerial vehicles. While certain engineering problems remain to be solved before we can deliver a production aircraft meeting our design performance specifications, we have been able to conduct flight tests on a production prototype since 2002, including approximately 30 unmanned, tethered tests of the vehicle’s vertical takeoff and landing capabilities.

The M200X, a vehicle that was developed in the 1970s and demonstrated in approximately 150 manned flights up until the early 1990s, is now being readied for market. Funding constraints have forced us to reduce the number of vehicles being worked on this calendar year and reschedule completion into next year’s adjusted goal of 6 to 12 units. In addition the Company continues to move forward with other designs and has two new concepts for aircraft designated as “Light Sport” or “LS” series VTOL aircraft. We now anticipate that the M200-based products, now referred to as the “Neuera” (pronounced “new era”), and these LS series aircraft will be the first vehicles that the company brings to market.

Since our inception, we have not been subject to a receivership, bankruptcy or similar proceeding, nor have we been involved in any material reclassification, merger, acquisition, or purchase or sale of a significant amount of our assets.

OUR PRODUCTS

We currently have no products that are ready to go to market. Last year we anticipated the arrival of sufficient capital to begin production of our M200-based products. This did not occur, but we continue to believe that the required capital will be obtained through the licensing Moller rotary engine technology. While it is not possible to predict the exact timing for the conclusion of talks we have underway, we remain confident that these talks will be fruitful and they will result in the Company obtaining the necessary initial funds to undertake the construction and preliminary testing of its M200-based products, and be sufficient to take us into initial, low rate of production for these products. While the timing of this event is subject to the availability of funds we continue to anticipate that this will occur within the next 12-to-18 months.

We are in the latter stages of development of a number of other innovative aviation products that we hope to launch in the coming years. Our founder, Dr. Paul S. Moller, has for more than thirty-five years been engaged in research and development activities aimed at designing and producing an aircraft that combines the speed and efficiency advantages of the fixed-wing airplane with the vertical take-off and landing and hovering capabilities of the helicopter. We believe that such an innovation will deliver to a wide range of conventional aircraft operators a new level of utility and economy for a variety of aerial applications. By-products of our aircraft development activities, in particular the Moller Rotary Engine and the Aerobot remotely-flown air-borne vehicle, should become important products in their own right and could account for an important segment of our overall sales once production commences. Except as noted above it remains uncertain when, if ever, we will enter commercial production of any of our other products.

The Skycar, Neuera and Aerobot are products we plan to offer in the future. They are based upon fundamental research and on earlier prototypes developed by Moller International. The Skycar concept is through the detail design stage and we have a prototype undergoing testing at this point. There are significant technical issues that remain unproven and may preclude us from meeting the design objectives for the Skycar. The Aerobot is a limited-production vehicle, with twelve prototypes built, tested and delivered to end-users. Neither vehicle is ready for volume production at this time, nor is there any guarantee that they will ever reach a point where they are viable products.

M400 Skycar

Our principal product will be the M400 Skycar vertical take-off and landing (“VTOL”) aircraft. The concept of the Skycar as a personal transportation vehicle is that it would be so practical and affordable that it could become a preferred mode of transport, replacing at once the automobile and the private or commercial airplane for many trips. Should we succeed in achieving a production aircraft design meeting our target specifications, we believe the M400 will support such a degree of usefulness.

Moller M400 “Skycar” prototype

Following are our current target design and performance specifications for the M400 4-passenger (including pilot) aircraft:

|

Passengers

|

4

|

Dimensions (LxWxH) 19.5'x 8.5'x 7.5'

|

||

|

Cruise speed @ 20,000’

|

275 mph

|

Takeoff and landing area

|

35-ft dia

|

|

|

Top speed @ 13,200’

|

375 mph

|

Noise level at 500 ft (goal)

|

65 dba

|

|

|

Maximum rate of climb

|

6,000 fpm

|

Critical failure components

|

none

|

|

|

Maximum range

|

750 mi

|

Complex moving parts

|

few

|

|

|

Payload excluding fuel

|

750 lbs

|

Piloting difficulty

|

low

|

|

|

Fuel consumption

|

20 mpg

|

Vertical takeoff and landing

|

yes

|

|

|

Operational ceiling

|

36,000 ft

|

Garage parking/roadability

|

yes

|

|

|

Gross weight

|

2,400 lbs

|

Uses non-fossil fuel (ethanol)

|

yes

|

|

|

Engine power (2 min rating)

|

1200 hp

|

Emergency parachutes

|

yes

|

Earlier performance numbers vary somewhat from the number shown above. We continuously revise the performance projections to reflect the results of ongoing analysis and changes to the design characteristics of various components. Recent decreases in projected range were the result of a change to ethanol fuel. Installed horsepower has changed due the projected use of a multi-stage, compound rotary engines of our design, and the on-board stabilization electronics have been redesigned to be faster and more reliable.

We believe that if we succeed in achieving the above cruising speeds, altitudes, payloads, and fuel economy per passenger mile in a production model aircraft, the Skycar will compare favorably with today’s light twin-engine and turbo-prop airplanes. But the M400 should offer the additional advantage of needing no runway for take-off and landing, since it will be able to hover and take-off vertically like a helicopter. But because the M400’s VTOL capability will be provided by our proprietary “ducted fan” technology rather than a helicopter-type system of main and anti-torque rotors, maintenance and repair costs should be significantly less and safety should be considerably enhanced.

It is important to recognize that the above design specifications are theoretical, based on research, engineering, and flight- and wind tunnel testing of various components. They have not yet been demonstrated to be achievable in a production model aircraft.

The following table compares certain of the target performance specifications of the M400 to a current production model helicopter and fixed-wing airplane that we believe might be potential competitors for production model M400 customers:

|

Powered-Lift

|

Helicopter

|

Airplane

|

|

|

Moller International

M400 Skycar®

|

McDonnell Douglas

MD 520 N

|

Socata TMB S.A.

TBM 700

|

|

|

Performance

|

|||

|

High Speed Cruise

Maximum Speed

Operational Ceiling (ft)

Maximum range

Rate of Climb

Vertical takeoff

and landing

|

330 mph

375 mph

35,000

750 mi

4,900 fpm

yes

|

155 mph

175 mph

16,300

267 mi

2,069 fpm

yes

|

335 mph

345 mph

30,000

1,796 mi

2,380 fpm

no

|

|

Payload and Capacity

|

|||

|

Passengers

Gross Weight

Maximum Net Payload

|

4

2,400 lbs

750 lbs

|

3 to 4

1,591 lbs

1,106 lbs

|

6

4,685 lbs

805 lbs

|

|

Safety

|

|||

|

Critical failure

components

Complex moving components

|

None

Few

|

Several

Many

|

One

Few

|

|

Other

|

|||

|

Maintenance costs

Piloting difficulty

Garage parking / roadability

|

Low

Low

Yes

|

Very high

Very high

No

|

Moderate

High

No

|

|

Price

|

$995,000

|

$1,010,000

|

$2,697,000

|

The above figures represent the actual manufacturers’ performance specifications for the helicopter and airplane models listed, and our theoretical specifications for the Skycar M400. They are presented here to illustrate the comparative utility of the three types of aircraft. However, it is not yet certain that we will indeed achieve our target specifications, nor will we know the actual values for the Skycar until we have completed further development. Also, the $995,000 selling price for the Skycar is estimated, based on numerous assumptions that may or may not bear out over time. The actual selling price may be more or less than $995,000.

We believe that certain specific design features of the Skycar® will further facilitate its eventual acceptance as an alternative vehicle of mass transportation. These features will include:

|

·

|

Computer-augmented flight stabilization system

|

|

·

|

Fly-by-wire control systems (electrical wires take the place of mechanical cables) and on-board computers which can interface with and be controlled by remote ATC system computer and navigation resources

|

|

·

|

High-speed capability, which maximizes the benefits of personalized air travel.

|

|

·

|

Hover or low speed capability, which provides the ability to cue up for entry to or exit from highly controlled air planes.

|

|

·

|

Ability to climb, descend, accelerate and decelerate rapidly to enter and exit air-lanes quickly

|

|

·

|

Relative insensitivity to gusts and wind shear that makes tightly constrained flight possible

|

|

·

|

VTOL ability to land anywhere which allows emergency exit from air-lanes

|

|

·

|

Small size which reduces required vertiport infrastructure dimensions

|

Notwithstanding these design features, the utility of the Skycar in mass transportation will be limited by existing laws and regulations. For example, Federal Aviation Regulations (“FARs”) prohibit operation of civil aircraft within certain airspace, and require minimum altitudes above, and horizontal separation from, obstacles on the ground and in other airspace. In addition, much of the airspace in and around major metropolitan areas requires that pilots operating in such areas hold special qualifications. And although we intend that the Skycar have the capability to travel from “garage to garage,” in urban and suburban areas existing laws and regulations will preclude most such “off-airport” operations.

Moreover, mass transportation using the Skycar would likely have to rely on some future navigation system such as NASA’s (National Aeronautics and Space Administration, an agency of the federal government) proposed Small Aircraft Transportation System (“SATS”), which is funded with public funds. Demonstrations of a “Highway in the Sky” technologies have been emerging for the past several years and the Company continues to believe it can rely on these technologies for many of the navigational requirements of the Skycar.

Environmental Noise Issues

The theoretically achievable noise level of the M400 Skycar with conventional muffling and noise abatement technologies would allow it to fly with somewhat lower noise levels than present fixed-wing aircraft. It should be considerably quieter than a helicopter because of the enclosed fans instead of the open rotor blades. Use of urban area vertiports is unlikely due to city noise abatement laws unless the Skycar were to employ some degree of mutual noise cancellation. Tests to date by other researchers suggest that a 15-decibel drop in noise is achievable with mutual noise cancellation. If so, it would be possible for the Skycar to operate from most locations except the user’s home, where a 30-decibel drop in noise may be required by noise abatement laws. To achieve this reduction in noise level as needed for such a flight originating from a residence, three-dimensional mutual noise cancellation would be required. There is no assurance that such a reduced level of noise can be achieved for the noise spectrum generated by the Skycar.

Further Skycar Development Stages

The company is currently preparing the M400 Skycar prototype, now designated the M400X, for an anticipated manned, untethered flight test. The current configuration of the M400X is equipped with experimental single-rotor rotary engines. These single-rotor engines are being replaced with more powerful engines of either single or twin-rotor configuration.

Since July 12, 2002, MI has been successfully conducting demonstration hover flights with this Skycar prototype. The aircraft has flown several times and at altitudes up to forty feet above ground level in stable, controlled flight. While an overhead safety line is used during the flights, it has remained slack during the majority of the flight and never used to support or stabilize the vehicle. The aircraft has been flown by remote control from the ground and has flown without an onboard pilot through this stage of the testing. Success at this stage has depended upon demonstration of a controlled hovering flight, which has now been achieved and documented for the four-passenger M400 Skycar model as it was on several occasions for an earlier 2-passenger model. Success at the next stage will be to demonstrate the same level of controlled flight while the aircraft is under the control of an on-board pilot. In addition, payload objectives will be tested with an increasing payload weight, up to the full payload of 750 pounds if possible.

The previous unmanned hover tests are complete, and many of the required components for the engine upgrade are already fabricated. The purpose of the engine change is to allow the M400 Skycar to undertake “maneuvering” tests at low speed with the safety of significantly higher reserve power. (“Maneuvering” in this context, means lateral and vertical movement at a modest speed where lift remains entirely dependent upon the thrust from the engines (non-aerodynamic lift.)) The cost for these extended tests is expected to be between $1.5 and $2 million. The risk at this stage centers almost entirely around the reliability of the various aircraft systems. These flights are to be carried out over water at altitudes up to 50 feet to lessen the damage to the Skycar should a system fail and to reduce the risk of fire to the aircraft and injury to the pilot.

The third phase of the Skycar test program involves flight speeds sufficiently high so that direct lift from the ducts is replaced by aerodynamic lift generated on the wing surfaces, referred to as “transition” testing. This segment of the flight where the aircraft transitions from one mode of flight to the other is considered the most technically challenging, and historically is the most dangerous. Wind-tunnel tests indicate that the Skycar is capable of completing this transition, however a number of factors are present in free flight that cannot be accounted for in a wind tunnel. Therefore there is no assurance that these tests will be successful without incidents that risk both the aircraft and the pilot. Achieving even one successful transitioning flight would establish the overall viability of the Skycar approach to this historically difficult aspect of VTOL aircraft design.

Near-term Objectives

With over 150 manned and unmanned flight demonstrations of the M200X volantor since 1989 we recognize that these successful and extensive test flights of the Neuera may provide the Company with a more easily achieved, nearer term product. We also see an opportunity to offer derivatives of this basic aircraft design for various utilitarian and recreational applications. While the Skycar is designed for much higher speed it is also expected to require a lengthy and expensive FAA certification program. The M200-based products may provide a less expensive and shorter time to market opportunity. Since the Company is experiencing shortfalls in available funding which have slowed production plans for the Skycar, we are now looking to other potential Moller products and their potential ability to generate near-term revenue.

The Company feels that the initial market for M200-based products will be for derivatives that appear exempt from FAA certification requirements. FAA certification is a detailed analysis, documentation and test process that applies to most aircraft that operate in the US National air space. It can require over two years to complete. However there are a number of exceptions to this requirement. For example, if the user completes 50% of the construction, the aircraft falls into a category of a “home built” and other rules apply. The Company estimates there are presently over 35,000 aircraft under construction nationwide in this category.

Building aircraft for the “home built” market has been a milestone on the path to a manufacturer’s FAA certified aircraft production while mitigating some of the legal liabilities to the manufacturer during this startup period. In the case of the M200E Neuera volantor we anticipate that the builder will not be required to participate in the construction of the vehicle’s powerplants or computer controls, and since the airframe is composed of two halves bolted together, the user’s assembly time is estimated at less than 50 hours and will require only rudimentary technical skills. From the Company’s perspective the lower product liability and minimal assembly labor requirements make the M200E Neuera an attractive and achievable product to bring to market.

Another variation to the basic M200 series is the M200G. The M200G Neuera is intended to operate within ground effect, and thereby may also be exempt from FAA certification requirements. This low-level of flight allows the craft to operate below what is commonly considered to be the National Air Space and therefore appears to not to fall under the jurisdiction of the FAA.

The following is a list of potential models that could be derived from the M200-class volantor:

• As demonstrators for marketing purposes and use over one’s own property (M200D)

• For operation within ground effect (up to 10 ft altitude) (M200G)

• As a rescue vehicle from side of skyscrapers (Firefly)

• As a military aircraft (M200M, M200R)

• Under the EAA category (home built) (M200E)

The Company has extensive hard tooling in place to rapidly produce the airframe and engines for M200-class vehicles. We intend to replace the analog artificial stability system used in the original M200X with the latest digital system originally developed for the M400 Skycar. The most significant differences between various models involve engine horsepower and seating arrangement.

The various models will emphasize safety as the number one design criteria. The following design elements will be incorporated in the vehicles to achieve this:

• Fueled by a mixture of 70% ethanol – 30% water. This combination will barely ignite outside the engine. It then burns very slowly for a short time before extinguishing itself as the ethanol reduces and the water remains.

• Air-bags will be used extensively throughout the cockpit.

• The artificial stability system will be highly redundant with at least four identical computers providing stability control.

• Able to tolerate one engine failure during hover. A second failure will lead to a survivable hard landing.

• Racecar impact-resistant fuel tanks will be used.

• Redundant fuel level warning system will be incorporated.

• Vehicle parachutes will be available on all models.

• Damage resistant composite fan blades will be used based on the Company’s proven experience.

Vehicle prices will vary depending on the model and use. The goal is to take orders for a sufficient number that economy of scale can apply. The minimum quantity sought is 1,000 vehicles to be delivered over a three-year period. Beyond the first 40 M200G models sold, the Company believes the prices will vary from approximately $95,000 for a single passenger M200G model to approximately $350,000 for the Firefly 3, a high-performance model intended for missions requiring a payload of three people or less.

Our goal is to complete the construction of a minimum of a up to 6 demonstrators, followed by 40 vehicles in the first year of production, 270 in the second year, and 650 in the third year. The plan requires that sufficient capital be raised and the foregoing projections are dependent on this funding being available, demand for the product develops as expected and that the anticipated production schedule can be kept.

The Company has not sought a legal opinion nor obtained a preliminary ruling from the FAA regarding the feasibility of any exemption from the FAA certification requirements for the M200G. Therefore, the ability to successfully market the M200 and any variants may or may not be achieved due to such uncertainty.

There is a continuing potential market for other products that have been designed, developed and tested by the Company but these are not being immediately pursued due to the focus on the M200 Neuera volantor and variations on that design.

The Company believes the M400 Skycar and their derivative are capable of much higher speed and range and anticipates that they will enter the civilian market following a successful FAA certification effort. As stated earlier, the funding required for this effort is significant and while it remains the long-term objective of the Company, at this point we do not expect to enter into this program before 2013 at the earliest.

Aerobot Remotely-operated Aerial Vehicles

Aerobot® is our design for a line of remotely piloted VTOL vehicles. The principal advantage of these craft is the ability to hover at a fixed point in space, which we believe makes them suitable for payloads such as video cameras and other sensors for data acquisition and inspection. The Aerobot is intended to carry a wide variety of customer supplied mission specific payload packages. Payload requirements are model-specific and there are restrictions on weight, size and location. We have incorporated video camera technology, and believe other technologies such as sensors and transmitters are within the Aerobot’s payload capabilities, although we cannot guarantee that any payload within weight and size limitations will perform as desired or allow the Aerobot to function properly. Moller has developed and demonstrated both electric- and fuel-powered Aerobots® for commercial and military applications, although we have not commenced commercial marketing of them.

The electric-powered Aerobot®, which employs an umbilical cord to transmit power, data and control signals, can stay aloft for extended periods (8-12 hours or to the limitation of ground-supplied electrical power) at heights of up to 250 feet. The fuel-powered Aerobot® utilizes Moller’s rotary engines, which produce greater than 2 horsepower per pound of engine weight. A high power-to-weight ratio, a lightweight airframe, and a patented system for automatic stabilization and control are key design elements of both types of Aerobot®.

The demonstrated performance specifications for the two Aerobot models are set forth in the following table:

|

Electric-Powered

ES20-9

|

Fuel-Powered

FS24-50

|

|||

|

Payload (including fuel)

|

15 lbs

|

65 lbs

|

||

|

Empty weight

|

40 lbs

|

90 lbs

|

||

|

Hover time

|

8-12 hours*

|

1.5 hrs

|

||

|

Hover ceiling

|

250 ft

|

2,500 ft

|

||

|

Forward speed

|

— |

50 mph

|

||

|

Size

|

26”L x 26” W x 14” H

|

30”L x 30”W x 16”H

|

* Flight duration is calculated based on estimated run-time of ground-based electrical generator.

We expect to continue to solicit and execute contracts for government use of our Aerobots. As in the past and for the next 18 months, these contracts are expected to be for one-off demonstration vehicles. The $200,000 to $300,000 price of these one-off Aerobots will remain 200-to-300% higher than the desired target price of approximately $100,000 as long as volume is insufficient to establish quantity discounts for its components. This may restrict initial sales to those clients, if any, to whom price is less important than the functional characteristics of the Aerobot. However, if expressed interest translates into increased sales, the production price could reduce to a point where civilian, paramilitary and military use could be broadened, resulting in increased sales. However at this time there is no assurance that volume sales of the company’s Aerobots can be achieved.

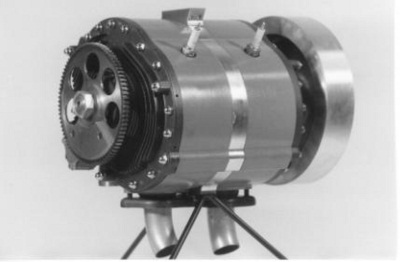

Moller Rotary Engine

Moller has acquired and developed proprietary technology enabling the Company to manufacture a high performance, low-cost rotary engine that produces more than 2 horsepower per pound of engine weight. Key design characteristics and the resulting attributes of Moller’s engines are outlined below and are applied to its intended use as a ducted fan power plant:

|

Design Feature

|

Attributes

|

|

Air-cooled or charge-cooled rotor

Aluminum housings

Simplified Lubrication System

|

Light Weight

|

|

Few moving parts

|

Low cost + Reliability

|

|

Perfect dynamic balance

Low vibration

Solid engine mounts

Small fan tip clearance

|

High propulsive efficiency

|

|

Four-stroke combustion cycle

|

Good fuel economy + Low emissions + Low noise

|

We believe that Moller’s rotary engine, called the Rotapower® engine, will be advantageous for ducted fan VTOL applications such as those required by the Skycar® and Aerobot® product lines. The engine’s round shape and small size will allow it to be hidden in the center of the duct behind the fan hub. Furthermore, the engine’s power-to-weight ratio should enhance performance in VTOL applications, where all of the required lift must be provided by the engine/fan unit without benefit of a wing surface as in a rolling take-off or landing.

Moller International granted Freedom Motors a license to manufacture, market and distribute the Rotapower engine for all applications except for aviation and use in ducted fans. In return for this license, Freedom Motors agreed to pay Moller International a 5% royalty on all sales of the Rotapower engine.

Moller’s unique engine design is based on a rotary engine that was mass-produced by Outboard Marine Corporation (“OMC”) from 1972 to 1976. In 1985, Moller purchased the OMC drawings, production routing sheets and engineering support man-hours. The Company subsequently hired the key OMC engineers who had developed the engine, participated in the production engineering process and contributed to the establishment of the service organization.

Using the OMC single-rotor engine as a starting point, Moller created a high-performance, modular design engine. The Company added electronic fuel injection and thermal barrier coatings, and introduced unique seal, lubrication and cooling systems. In all, Moller has made more than 25 major engine design improvements, of which eight are deemed patentable and two are patented and one is patent pending. Prior to entering production, Moller expects to have applied for patents on all key elements.

Specifications of Moller’s high-performance engines are as follows:

|

High Performance

|

||

|

Single-Rotor

|

Two-Rotor

|

|

|

Specifications

Weight

Dimensions (L, Diameter)

Displacement

|

55 lb

14 in, 11 in

530cc

|

85 lb

19 in, 11 in

1060cc

|

|

Performance

Rated Power

Rated Speed

Maximum Speed

Idle Speed

Porting

|

80 hp

7000 RPM

7500 RPM

1800 RPM

Radial

|

160 hp

7000 RPM

7500 RPM

1800 RPM

Radial

|

|

General

|

All engines can operate on regular grade gasoline

|

|

To demonstrate the significance of Moller’s rotary engine technology for aircraft applications, the following table and graphs compare the high performance two-rotor engine to a standard piston engine of similar horsepower.

|

MOLLER ROTARY(1)

|

STANDARD PISTON(2)

|

|

|

POWER

|

160 hp

|

180 hp

|

|

WEIGHT

|

85 lbs

|

260 lbs

|

|

VOLUME

|

1.0 ft3

|

8.6 ft3

|

|

FRONTAL AREA

|

0.8 ft2

|

3 ft2

|

|

Horsepower per Pound

of Engine Weight

|

Horsepower per Cubic Foot

of Engine Volume

|

Horsepower per Square Foot

of Engine Frontal Area

|

||||||||||||||||

|

200

|

||||||||||||||||||

|

160

|

||||||||||||||||||

|

2.0

|

||||||||||||||||||

|

0.7

|

||||||||||||||||||

|

40

|

||||||||||||||||||

|

15

|

||||||||||||||||||

|

Moller Standard

Rotary(1) Piston(2)

|

Moller Standard

Rotary(1) Piston(2)

|

Moller Standard

Rotary(1) Piston(2)

|

||||||||||||||||

| Moller Advantage: 3:1 | Moller Advantage:11:1 | Moller Advantage: 5:1 | ||||||||||||||||

(1) Two rotor, 530cc/rotor

(2) Avco Lycoming 0-360-A

Comparison of Moller rotary and Standard Piston Engines

Our Rotapower engine is in very limited production. It has been installed in a number of non-aircraft products for field-testing. To date the company has demonstrated the ability to operate its engine on diesel fuel at about 60% of the power it can generate on gasoline.

Because of the military’s interest in lightweight engine running on diesel or jet fuel the company has previously received government support to achieve its present level of success. Presently the company is testing its engine for long-term durability that means establishing a time between overhauls of at least 1000 hours. It has successfully completed an FAA-type engine durability test of running the engine on gasoline for 150 hours at maximum power. If a 1000-hour-plus test can be achieved with diesel fuel the potential for military and civilian sales of an aircraft Rotapower engine is likely to increase. There is no assurance at this time that this endurance test will be successful. The company intends to license the production of the engines to a firm with the resources it believes will be adequate for the task. As part of these negotiations, the company hopes to retain a favorable position for the procurement of these engines for its own incorporation into potential products as well as continued testing and development.

Regulation of Aerobots and Engines

The Aerobot’s use is controlled by the FAA if it is untethered, except for military use. No federal, state or local approval is required at this time regarding the design or construction of either the engine or the Aerobot. However there is no assurance that such regulations will not come into existence in the future.

PATENTS

The current Moller International’s U.S. and Foreign Patents and Trademarks are listed below:

Moller International Intellectual Property

|

Patent No.

|

Description

|

||

| 5,413,877 |

Combination thermal barrier and wear coating for internal combustion engines

|

||

| 6,164,942 |

Rotary engine having enhanced charge cooling and lubrication

|

||

| 6,325,603 |

Charged cooled rotary engine

|

||

| 6,450,445 |

Stabilizing control apparatus for robotic or remotely controlled flying platform

|

||

| D498,201 |

Vertical takeoff and landing aircraft

|

||

OUR MARKETS

Due to the innovative nature of the Moller Skycar, we cannot be certain of any level of market acceptance for the product. The following discussion of potential markets for our Skycar, Neuera and Aerobot products is based upon: 1) our observations and understanding of the ways various owners and operators of conventional fixed-wing and rotary-wing aircraft have used those vehicles; 2) our assumptions as to how the proposed design capabilities of our products may prove more efficient, utilitarian, or cost-effective features in those same or similar applications; and 3) anecdotal data from a small number of potential customers who have visited our facilities and expressed interest in the Skycar. However, until we can manufacture and deliver production model aircraft, we cannot be certain that operators will indeed realize benefits by employing our products in place of conventional aircraft employing significantly dissimilar technologies. Our ability to successfully market our Skycar and Aerobot products will depend in large part on the ability of those products to deliver a realizable benefit to users.

Skycar

Prior to full FAA certification (See “Regulation – Airworthiness Certificate Requirements” below), we hope to be able to sell our products to certain operators who are exempt from the civil aviation certification requirements. These may include:

|

·

|

military and para-military (rescue, drug enforcement, and border patrol)

|

|

·

|

wealthy individuals, for use within their own property in the U.S., Australia, Canada, etc.

|

|

·

|

foreign countries where FAA certification is not mandatory

|

No such customers have made any binding commitments with regard to our products.

Market Segments

Although there is no assurance we will be successful, we will attempt to develop markets for the Skycar® within the following aircraft operator segments:

|

General Aviation

|

Military

|

|

|

Private Individuals

|

Surveillance

|

|

|

Corporations

|

Air utility vehicle

|

|

|

Charter and Rental Services

|

Rescue

|

|

|

Aviation Schools

|

Medical Evacuation

|

|

|

Utilities

|

||

|

News Gathering

|

||

|

Police/Fire/Rescue/Ambulance

|

||

|

Drug Enforcement

|

||

|

Express Delivery

|

||

|

Border Patrol

|

We have relied upon our own research and anecdotal data from a small number of potential customers who have visited our facilities and expressed interest in the Skycar to support our belief that operators in the above categories will be interested in purchasing Skycars. Individual fixed- and winged-aircraft owners, charter and rental service owners, corporate officers, and a variety of other interested parties have given us their input on the suitability and desirability of the aircraft within these fields of use. However, such subjective input does not necessarily indicate that an economically viable market exists for the Skycar. Further, the above listing of potential market segments does not imply that Moller has contacted or received an expression of interest from each such market segment.

Competition

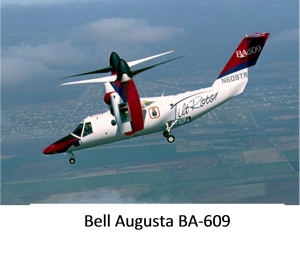

Today, there is no company that we are aware of offering a vehicle that is substantially similar to the Skycar®. Companies periodically emerge with preliminary designs, but to date none has succeeded in demonstrating a working model, owing presumably to the high cost of developing the required technologies. Moller has test-flown an experimental vehicle and is completing the construction of a production prototype. Moreover, we have applied for and obtained patents on many key aspects of the Skycar, which we expect will stave off direct competition to some extent, although there can be no assurance of our ability to successfully defend our patents against infringement. The nearest competition, insofar as we are aware, appears to be the six to nine passenger tilt-rotor BA 609 (Bell-Augusta) which is in development. Its announced price of $10 million, however, will likely constrain it to a different market than the target market for the Skycar®.

If we are able to successfully demonstrate the Skycar’s flight characteristics, we expect that such success will generate renewed competitive interest. Primary competition is expected to come from large aircraft manufacturers because they have the resources necessary to enter the personal VTOL market. Given adequate financing, however, any of a number of existing small and large aircraft manufacturers could develop competitive products. We believe we have one advantage that will prove difficult for potential competitors to overcome, however, and that is our rotary engine and ducted fan propulsion technology. The advantage, however, may depend upon our future ability to successfully defend our intellectual property rights against infringement, of which we cannot be certain.

It is difficult for us to predict the precise sources of competition for our products, or our competitive position in the marketplace, owing to the fundamental dissimilarities between our products and the products that historically have been used in the roles for which our products are intended. Although we may surmise significant benefits to customers in switching to our products, because they represent a unique and innovative technology there is no historical basis for believing that customers will in fact switch.

In marketing the Skycar as a vehicle for personal transportation, we will have to compete against the sundry existing forms of transportation with which people are already familiar and comfortable. These include the automobile, railroads, buses, commercial aviation, and general aviation, among others. Each mode of transportation offers a unique set of advantages and disadvantages, relating to cost, convenience, comfort, safety, and perhaps other considerations. In order for the Skycar to gain acceptance as a mode of personal transportation, prospective users will have to conclude that its particular advantages justify its cost. There is no assurance that sufficient numbers of people will perceive such advantages as to create a viable market for Skycar.

NEUERA™

Based on the M200X, the Neuera is both old and new. Originally conceived as a stepping-stone on the path to the development of the M400 Skycar®, the Neuera™ is now seen as a potential product that can stand on its own merits. Potentially a low cost, easy to operate and uniquely agile aircraft, the Company views the Neuera as a product that it can produce in the near-term that might gain wide acceptance as a recreational and/or utility vehicle. With the anticipated software and computer hardware implementations the Company also believes it can constrain specific versions of the M200-class vehicle to operational speeds and altitudes that would exclude it from the necessity of obtaining FAA approvals and inspections as well as allow it to be operated by persons with little to no formal flight training. The Company feels that under these conditions, the cost to produce and operate a Neuera would be significantly less than other types of aircraft, and make it even more attractive to own.

SKYCAR LS

Skycar LS Series are volantors with a gross weight of 1,320 pounds or less and may be able to operate under a subcategory of the Powered Lift category similar to the FAA's Light Sport Aircraft (LSA) category.

These volantors have the following characteristics:

|

§

|

A traditional pilot's license is not required

|

|

§

|

Limited to operating no higher than 8,500 ft altitude

|

|

§

|

Gross weight restriction limits design to two passengers

|

|

§

|

Maximum speed presently allowed is 138 mph (FAA's appears amenable to higher speed and multiple engines following testing).

|

|

§

|

Low cost (similar to LSA airplane)

|

|

§

|

Limited hover capability (sufficient to take off vertically and transition)

|

The Skycar LS models use technology generated for the M400X Skycar® and Neuera® volantors.

AEROBOTS®

Many of the potential markets for air-borne remotely flown vehicles (Aerobot®) are currently addressed by manned helicopters and airplanes, both of which in our opinion represent significantly less economical solutions. In addition, the unmanned Aerobot® can operate in areas that are prohibitively dangerous for manned aircraft. Furthermore, the Aerobot®’s ducted fan design is well suited for operation in confined quarters where the exposed propeller or rotor blades of alternative solutions (both manned and unmanned) pose significant risks to people nearby and to the aircraft itself.

Market Segments

We believe the Aerobot® is suitable for a variety of commercial and military applications:

|

Commercial

|

Military

|

|

|

Bridge and utility line inspection

|

Battle damage assessment

|

|

|

Building heat loss detection

|

Electronic counter measures

|

|

|

Smoke stack air quality testing

|

Target acquisition

|

|

|

Electronic news gathering

|

Surveillance

|

|

|

Sports event reporting

|

Communications relay

|

|

|

Hazardous waste detection

|

Decoy operations

|

|

|

Natural disaster damage assessment

|

||

|

Law enforcement

|

||

|

Fire surveillance

|

COMPETITION

To date there are three fundamentally different aircraft design approaches to providing this vertical takeoff and landing (VTOL) capability:

|

·

|

Helicopters

|

|

·

|

Tilt-rotor aircraft

|

|

·

|

Ducted fan aircraft

|

Helicopters

Capable of lifting heavy loads with modest horsepower, the helicopter is capable of hovering for extended periods and its top speed is low, but adequate in most paramilitary roles. However, the helicopter is very complicated with over 100 critical drive train moving parts and over 40 engine moving parts even when powered by a single engine. Failure of any one of the critical drive train or engine’s moving parts while hovering below 200 feet of altitude above the ground is likely to be fatal for all aboard. Above 200 feet the failure of any one of these moving components could be fatal. As a result of the helicopter’s complexity and potential consequences of a component failure the operating maintenance and insurance costs are very high.

Tilt-rotor Aircraft

| The tilt-rotor configuration is in reality a helicopter with added capability, which makes it more complicated and expensive to operate. By rotating the helicopter’s rotors into a vertical rotating plane, the tilt-rotor aircraft is able to translate at approximately twice the speed of the high performance light helicopter. The purchase price of the Bell Augusta BA-609 tilt-rotor is approximately $1 million per passenger seat versus $200,000 for a high performance light helicopter like those made by Hughes. |  |

Ducted Fan Aircraft

There are two design directions to duct fan aircraft:

|

·

|

Enclose the twin rotors of a helicopter-like aircraft within protective ducts. The aircraft is often referred to as an “aerial jeep.”

|

|

·

|

Use many ducted fans with each fan driven directly by an engine, generally referred to as a volantor.

|

Aerial Jeep Approach

There have been a number of vehicles developed beginning in the 1950’s that attempted to use two large ducted fans driven by a central powerplant. A few of these are shown below along with the date of their introduction.

Upper left: Piasecki VZ-8 (1958), Upper right: Chrysler VZ-6 (1959), Lower left: Piasecki 59H (1962); Lower right: X-Hawk (2006)

The limitations of this design (and that ultimately led to its termination after one or two prototypes) are as follows:

|

·

|

The design involved a large number of critical components in which the failure of any one and at any altitude was likely to be fatal.

|

|

·

|

Large ducted fans have inherently adverse reactions to airflow over the duct’s leading edge as they begin to translate. The instabilities created greatly limit the forward speed since the airflow can stall at the leading edge of the duct. Once this occurs the aircraft is lost. The Chrysler VZ-6 and Piasecki VZ-8 never attempted to exceed 50 mph in forward speed.

|

|

·

|

The large fans made it difficult to locate a significant and/or bulky payload in a practical location.

|

|

·

|

Their complex drive train with many of the elements of the helicopter meant that the vehicle’s initial cost would be high, and it would have result in maintenance and insurance costs.

|

Clearly if this approach had any merit further development would have occurred. It would seem that the recent X-Hawk, which is very similar to the previous “aerial jeep” concepts is relying on the adage “we repeat what we choose to forget.”

Volantors

The volantor uses enough ducted fans driven directly by individual engines to ensure that it can continue to hover on a hot day at altitude following the failure of an engine. This requires a minimum of five engines with eight chosen to minimize installed power.

Since hover stability and control are achieved only through engine control no added mechanical complexity is needed. This reduces cost and does not compromise the inherent statistical reliability of the volantor. Since the engines directly drive the fans a drive train is also eliminated.

The Company believes the volantor’s simplicity will allow it to achieve the lowest cost per seat for an aircraft with both VTOL-capability and a reasonably fail-safe design.

REGULATION

Airworthiness Certification Requirements

The Federal Aviation Act of 1958, as amended, vests in the Federal Aviation Administration (commonly, the “FAA”) the authority to regulate virtually all aspects of civil (i.e., non-military) aviation within the United States, including pilot certification, airspace usage, and the certification of aircraft. The FAA exercises its authority primarily through the issue and enforcement of regulations, known as the Federal Aviation Regulations (or “FAR”s), which are codified in Title 14 of the Code of Federal Regulations. Among other things, the FARs set forth the type certification requirements (known as “airworthiness standards”) for aircraft designs, the requirements for manufacturers’ production quality control systems, the requirements for airworthiness certification of individual aircraft, and the operations and maintenance rules for air carriers and repair facilities.

The Aircraft Certification Service (designated “AIR” by FAA) is the department within the FAA that develops and administers safety standards for aircraft and related products that are manufactured in the United States or are used by operators of aircraft registered in the United States. Related products include engines, propellers, equipment, and replacement parts. As a regulatory function, AIR’s mission priorities are:

|

1.

|

Continued airworthiness and other activities related to continued operational safety;

|

|

2.

|

Rulemaking and policy development; and

|

|

3.

|

Certification.

|

Continued airworthiness is given the highest priority because these activities have the greatest impact on the safety of operating aircraft and because they promote the continued satisfactory performance of approved systems, such as manufacturers’ approved quality control systems. Rulemaking and policy development are considered to be a higher priority than issuing new certificates because the integrity of the certification program depends on the currency of applicable rules and policies.

One of the key goals of the certification and continued airworthiness standards is that each safety-critical system have a reliability of at least 0.999999999 per flight hour, which is another way of saying that a particular safety-critical component or system should have no more than a one-in-one-billion chance of failure for each flight hour. In pursuit of this goal, the regulations address a combination of requirements for design, analysis, test, inspection, maintenance, and operations. To permit design innovation, the regulations for the most part avoid specifying details such as materials, structural concepts, etc.; instead, designers are given a free hand as long as they accept the responsibility for showing that systems with innovative design features meet the FAA’s stringent reliability standards.

The cornerstone of AIR’s certification process is the “airworthiness certificate,” issued for each individual aircraft. Generally, regulations prohibit operating an aircraft without an airworthiness certificate, or in violation of any limitation or restriction of its airworthiness certificate. Certificates may be issued as either “standard” or “special.” Aircraft certificated in the Standard category are subject only to the same operating restrictions as most other production aircraft, that is, that they be operated within the manufacturers’ approved design limitations for the particular type. “Special” category aircraft might include experimental designs or homebuilt aircraft, for example, and may be subject to various operational restrictions, such as a prohibition against carrying non-crewmember passengers, or operating over densely populated areas.

For a civil aircraft to receive an airworthiness certificate, the FAA must determine that the aircraft conforms in detail to an FAA-approved type design and is in safe operating condition. Similar requirements exist for engines, propellers, and certain materials, parts and equipment installed on certificated aircraft. The first step in the certification of a new design is to establish which body of standards will apply. Because the original aircraft classifications of “airplane,” “airship,” “rotorcraft,” etc. would not accommodate the radical design of the Moller 400 Skycar® (and a couple of other VTOL designs in development by other companies), the FAA in the early 1990s established a new category and class of aircraft: “Powered-lift -- Normal Category,” and set about developing an airworthiness criteria manual that would serve as the basis for certification. As of this filing, the manual has not been finalized, but we expect that the draft will suffice for us to proceed with initial testing toward certification. In fact, the FAA has indicated to us that because of the uniqueness of the Skycar®, they expect to develop the final airworthiness criteria as we progress through the test program.

Once the company has been issued a “Type Certificate” for a particular design, each production aircraft we manufacture to those same specifications will be entitled to a “standard” airworthiness certificate. Even after the Type Certificate is issued, however, AIR has the authority to order us to make design changes if it determines that safety so requires.

Effect of Certification Requirements On Our Operations

An aircraft’s airworthiness certification bears on its usefulness to its owner or operator. In particular, the value to a prospective purchaser of an un-certificated or “special” certificated aircraft may be affected to some extent by the corresponding operational restrictions, which can prevent them from taking full advantage of the aircraft’s design capabilities. Certain operators, however, are exempt from the airworthiness requirements to varying degrees, and we expect that such operators may provide a market for our products prior to final FAA certification. See “Marketing Strategy” below.

Certification testing will be a recurring expense for us as we bring our products to market, and incorporate design improvements into previously certificated models. The initial type certification testing on each aircraft design will encompass design approvals for materials, spare parts, and other equipment to be installed. Therefore, if we or any of our potential strategic partners should choose to make a major modification in a model, such as an airframe re-design or changing a safety-related onboard system, the change may have to undergo additional testing to prove the new system’s reliability.

As a future aircraft manufacturer, we will undertake an ongoing obligation to monitor the serviceability and safety of the aircraft we expect to build and sell. We intend to establish and maintain, at our expense, a system of feedback and reporting whereby maintenance mechanics and inspectors can report back to us any and all failures, excessive or unpredicted wear, malfunctions, and flight safety issues of any kind that arise or are detected during maintenance and repair activities. Where appropriate, we will issue “service bulletins” to owners and operators of the affected model, detailing the problem and our recommendation for correction. Where the problem may potentially affect the safety of flight operations, we may recommend to the FAA that they issue an Airworthiness Directive (commonly called an “AD”) making the correction mandatory for every operator.

It is impossible to predict the future costs to us of ongoing compliance with federal airworthiness regulations; however, we expect that the costs will be manageable and that we will be able to absorb them in our pricing structure.

Pre-production Test Flight Program

Tethered flight tests have been conducted with the M200X aircraft using the same number of rotary engines (eight) and a forerunner of the type of electronic control and stabilization system as is employed on the M400 Skycar®. We have conducted extensive ground tests of all of the M400’s systems and have now completed the initial tethered flight tests and hover demonstration.

We began test flying the pre-production model of the M400 in late 2002. The aircraft was flown tethered so we could test and de-bug the stabilization and control electronics. These flight tests first explored systems functions in the safest portions of the flight envelope then expanded the envelope. We expect the entire test program, involving many hours of powered tests on the ground and in tethered flight, and several hundred hours of free flight tests, to extend until we achieve FAA “Experimental” certification, hopefully within the next 12 months. However, this forecast is based upon the assumptions that (a) the Company will succeed in raising sufficient capital to cover the costs of flight testing, (b) a number of remaining engineering problems will be resolved through further development, and (c) that the FAA will establish certification criteria for the Skycar that are within our technical capabilities. All of these assumptions remain highly uncertain as of the date of filing of this annual report.

Pilot Requirements

Initially, a private pilot’s license will be required to pilot the Skycar®, primarily to ensure adequate flight management and navigational skills. To obtain a license, the prospective pilot must pass a flight test administered by a licensed flight instructor in order to demonstrate familiarity with its simplified controls. The Skycar® is not piloted like a traditional fixed-wing airplane and has only two hand control sticks that the pilot uses to inform the redundant computer control systems of his or her desired flight maneuvers. The Company plans to have its own pilot training program until the Skycar® is FAA certified. Once the Skycar® is certified, it is expected that all training programs will be provided by private and/or military aircraft flight training schools. The FAA has begun awarding “Powered Lift” pilot’s licenses.

MARKETING STRATEGY

In the early stages of sales development, we plan to market primarily through direct selling by Company sales specialists to individual customers within our target markets. Brand exposure may be accomplished through displays at trade shows and industry exhibitions, direct mail, advertisements in aviation publications, and cooperation with the news media. For at least three decades the news media has followed the progress of Paul Moller’s VTOL research and experimentation, underscoring the public’s perennial fascination with the promise of convenient and affordable air travel made as personal and individualized as automobile travel has been. We expect, but cannot be certain, that the Skycar and our other vehicles will continue to receive periodic media coverage as we approach our first delivery schedules.

M400 Skycar®

Although sales of the Skycar® into most civilian markets will require that we be able to deliver an FAA certificated aircraft, the regulations permit certain types of operations by certain defined operators to be conducted without the standard airworthiness certification requirement. These markets include:

Government -- domestic and foreign agencies including:

Police departments

Border Patrol

Forest Service

Drug Enforcement agencies

Medical services

Initially, we anticipate that most sales to this segment will consist of Skycars® for test and evaluation. The craft’s capabilities should make drug enforcement agencies and Border Patrol viable candidates for early purchases. However, we have not received any commitments from those agencies to make any such purchases.

Military -- Initial sales to domestic and foreign military organizations will likely be for test and evaluation purposes. We anticipate that military organizations will utilize the Skycar® in critical applications for which competing aircraft are ill suited. For example, the Skycar® is expected to have superior speed, range and VTOL capability for the rescue of crews of downed aircraft with minimal risks. In addition, military subcontractors may wish to use the Skycar® as a platform for autonomous aircraft programs, one of the fastest growing areas of military spending. Autonomous aircraft applications currently utilize un-manned aircraft piloted by infrequent remote control commands or under the control of a monitoring computer. Such aircraft are currently in use by the military as remote data gathering platforms that feed information via radio or other communication links back to a flight control center. Moller expects that military organizations will wish to use Skycars® in a broader range of applications if volume production reduces manufacturing costs and overall pricing. Eventually, we believe the Skycar® has the potential to become the aerial counterpart of the “HMMWV,” the military’s current ground utility vehicle.

Corporations — Moller intends to sell the M400 Skycar® to corporations for use in the airspace above their property and we plan to specifically target companies in industries such as timber and oil that have survey and exploration needs. The Company also expects that it will be able to address a broader range of commercial applications in some foreign markets due to fewer legal restrictions than in the United States.

Assuming that the Skycar eventually receives full airworthiness certification, we will consider augmenting our sales efforts with retail dealerships, either existing or newly-franchised. Further, we intend to establish a network of regional maintenance and repair facilities, either Company-owned or partnered with existing service facilities, to handle routine maintenance and repair services for non-military Skycars.

Neuera™

The Neuera is a directed-thrust vertical takeoff and landing aircraft in the late stages of production design. The design relies on thrust generated by the eight ducted fans to lift the vehicle, as well as provide for forward movement up to about 100 miles per hour. The eight ducted fans are located in a circular pattern around the vehicle and embedded into the saucer-like fuselage. Four of the ducted fans have moving vanes at the exit of the duct, which are designed to deflect the thrust to provide forward movement and directional control. Each of the individual engines directly drives a fan, with engine speed being the determining factor for the amount of thrust produced. The Company has developed a flight control system that maintains stability through the use of precise throttle commands to each engine. Any un-commanded change in the attitude of the aircraft will be detected and the system will issue multiple commands per second until it is corrected.

The Neuera volantors are intended for use "off-road" somewhat like an ATV or hovercraft would be used. The Neuera is meant as an alternative to a trail bike, boat, jeep, airboat or other off-road vehicle to access remote areas that would otherwise not be open for travel. It is not intended for use above roads, trails, walkways, etc. and especially not within an urban area where there are lots of other alternatives. The exception to this would be for emergency services like fire fighting, search and rescue, and emergency medical evacuation from high-rise buildings and such.

It is the Company’s intent to directly market the Neuera to end-users initially, and then if demand is sufficient, solicit distributors from the among existing high-end recreational product distributors such as boat, snowmobile and ATV dealers.

To date, due to lack of funding, we have not taken any significant steps to implement any of the marketing strategies cited above.

MANUFACTURING

Skycars®

We believe that the long-term success of any aircraft manufacturer is dependent on the quality of the vehicle produced. The quality of both the design and manufacturing processes is important. Moller expects to purchase or contract out the major Skycar® components that require capital intensive equipment, subject to Moller’s rigid specifications and stringent quality assurances and testing requirements. We expect that some components and parts will be finish-machined in Moller' s facilities when they have proprietary technological content, require special finishing, or are small custom parts with little tooling required. Moller plans to perform quality control, assembly and final test work at its own facilities. During 2011 and 2012 any manufacturing work will necessarily be executed using low volume techniques. Special tooling and manufacturing processes are expected to be developed for higher volume production in the future.

Airframe manufacture encompasses the assembly of the major airframe components (fuselage, wing and nacelles) and installation of fuel and oil tanks, parachutes, seats, canopy, landing gear, and the vertical thrust vane system. Moller anticipates that a key strategic partner will be required in order to complete composite airframe construction. Moller will require a complete test of all systems through an extensive flight test program before final release.

Important electronic systems include computer stabilization, pilot controls, display, power regulation and engine controls. Electronics manufacture will include the following activities:

Assembly of electronic sub-systems

Burn-in of electronic components

Mounting of printed circuit boards

Fabrication of electronic enclosures

Interconnection of components and wiring

Installation of equipment in airframe

While no specific firm has been identified at this point, we expect to work with one or two key strategic partners to provide electronics and avionics systems for the Skycar®.

The quality control department will be an autonomous organization carefully integrated into every aspect of the production operation. Every employee will play a part in assuring the highest possible level of quality and performance.

Neuera™

The Neuera is remarkably simple to manufacture. The complete airframe is composed of two halves with tooling in place for their manufacture. This allows the production of approximately one airframe per workday with the existing molds. The Company believes this is sufficient to address the near-term production requirements through our third year of production. With present facilities of only 35,000 square feet, high-volume airframe production would have to occur elsewhere and we have not evaluated the cost associated with expanding production capacity. All electronics will be subcontracted, as will the engines and their support structure. Assembly of the first year’s production is projected to be accomplished within the present facility but lower cost facilities may be available or, if necessary, our operations might be cost-effectively expanded (space available for additional 50,000 square feet). Alternatively assembly could be moved to facilities nearby. Engine components may be subcontracted with assembly and inspection occurring within the present facility, but the simplicity of the Rotapower engine makes its assembly and test operations elsewhere feasible.

In the simplest of terms, the volantor is basically made up of a number of computers coupled through algorithms to a number of engines. Both of these components lend themselves to volume production in which economy of scale can have a dramatic effect on cost.

Aerobots®

Both electric-powered and fuel-powered Aerobots can be produced in the present Moller facility in volumes of up to four per week, which is sufficient for currently projected production. The electric-powered Aerobots consists of off-the-shelf components and high performance motors, electronic control boards, and a composite frame manufactured by Moller. Both individual components and final assembly are inspected to assure product quality. The fuel-powered Aerobots utilizes the Moller rotary engine (single-rotor) and thus requires more extensive facilities. The frame of the fuel-powered Aerobots is of welded construction; the fuel tank, duct and cowling are composites. Some component and subassembly tests will supplement the basic assembly quality control. Costs of manufacture are expected to decrease for both Aerobots as production volumes increase. However, no specific amount or rate of decrease can be projected at this time.

In most cases, customers require a complete operating system, not just a vehicle. Moller plans to supply the radio control system and, in some cases, install the interface for the payload sensor system.

Engines

We expect that our Freedom Motors affiliate or its sub-licensee will supply most of the primary engine components necessary to generate a FAA certified Rotapower® engine. For that reason various elements are already incorporated into the basic engine design to satisfy future requirement for FAA certification. For example, dual spark plugs and an appropriate thrust load carrying bearing are already part of the basic design. Moller will inspect, assemble, and test completed engines prior to their sale or incorporation in Skycars® and Aerobots®.

EMPLOYEES

We currently have 3 full-time management and executive management personnel and 4 part-time employees. We have no specific plans for a significant increase or decrease in the number of our employees. Future staffing needs will depend in large part on any partnering or out-sourcing arrangements we may make for manufacturing of components and sub-systems.

NEED TO RAISE ADDITIONAL CAPITAL TO COMPLETE DEVELOPMENT AND FLIGHT TESTING

We estimate a cost of $26 million to demonstrate a flight worthy pre-production model of the M400 Skycar. Likewise, $24 million is the estimated start up cost for the production of the Neuera volantor. The Company’s current plan assumes that the required funds will be raised through the sale of equity, although no offer has been made nor are talks underway with any potential purchasers.

RISK FACTORS

Business Viability

We are still in the process of developing our products, and have yet to produce any meaningful level of sales or any profits from these products. There is no clear basis for judging our viability as a business enterprise, or our management’s ability to develop the company to profitability.

Limited Experience

Our management has limited experience in aircraft manufacturing. While our management has considerable general business and management experience, and some specialized knowledge and experience in the in the aircraft industry, none of our current management has significant experience managing a business that manufactures and markets aircraft. Accordingly, our success will depend in large part on our ability to recruit or to contract individuals with specialized skills and knowledge relating to aircraft manufacturing and marketing without adversely impacting the overall budget for employee compensation. There is no assurance that we will be successful in retaining such specialists.

Need for Additional Capital

We will have to raise substantial amounts of capital before we can produce meaningful revenues from sales of our products with no assurance as to when or at what level revenues will commence. We estimate that we will need $26 million to demonstrate a fully functional, pre-production prototype Skycar, and an additional $40 - $90 million to complete FAA certification and begin initial production of certified aircraft. Alternatively we believe we would require $24 million to fund the production startup of the Neuera. Should we be unsuccessful in raising the needed capital, we may never develop into a viable business enterprise. At this time, we have no specific arrangements with any underwriters for the placement of our shares, nor any binding commitments from any person to invest in the Company.

Dilution of Share Value

We will likely sell shares of our stock to raise capital needed to fund future operations. Any such sales will have the effect of reducing the proportionate ownership of existing shareholders.

Impact of Emerging Technologies

Evolving technologies may force us to alter or even abandon our product designs, or may render our proprietary technologies obsolete or non-competitive. Although we believe strongly in the existence of a substantial market for our products, new technologies are being developed and deployed at a rapid rate. It is possible that as time goes on, technological advances in such areas as power plants, propulsion systems, airframe materials, manufacturing systems, and perhaps others, will require us to make costly changes in our strategy or additional investments in equipment and in research and development in order to become or remain competitive.

Impact of Potential Product Liability Claims

The Company may expend an inordinate amount of its resources in litigating product liability claims. Historically, manufacturers of aircraft have been held by the courts to be liable for injuries suffered by crewmembers, passengers, and others where some design deficiency or manufacturing defect was found to have contributed to the injury. Although we intend to take all reasonable precautions in the design and manufacture of our products to ensure that they can be operated safely and without undue risk to life, health, or property, and we intend to purchase insurance against potential product liability claims, it is nevertheless possible that our operations could be adversely affected by the costs and disruptions of answering such claims.

Impacts related to Sarbanes-Oxley Act of 2002

We may be exposed to potential risks relating to our disclosure controls including our internal controls over financial reporting. Section 404a of the Sarbanes-Oxley Act of 2002 (“SOX 404”) requires public companies to include a report of management on the company’s internal controls over financial reporting in their annual reports, including Form 10-K.