Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

INFORMATION REQUIRED IN PROXY STATEMENT

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

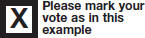

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| x | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

ValueVision Media, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) Title of each class of securities to which transaction applies: | ||

|

| ||

| (2) Aggregate number of securities to which transaction applies: | ||

|

| ||

| (3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | ||

|

| ||

| (4) Proposed maximum aggregate value of transaction: | ||

|

| ||

| (5) Total fee paid: | ||

|

| ||

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) Amount Previously Paid: | ||

|

| ||

| (2) Form, Schedule or Registration Statement No.: | ||

|

| ||

| (3) Filing Party: | ||

|

| ||

| (4) Date Filed: | ||

|

|

Table of Contents

PRELIMINARY COPY

VALUEVISION MEDIA, INC.

Dear Shareholders:

A special meeting of shareholders of ValueVision Inc. (the “Company”) is to be held at [ ] on Friday, March 14, 2014 at [ ], central time, or at any postponements or adjournments thereof. The items to be considered and voted on at the special meeting are described in the notice of the special meeting of shareholders and are more fully addressed in our proxy materials accompanying this letter. We encourage you to read all of these materials carefully and then vote the enclosed WHITE proxy card.

Your participation at this meeting is extremely important. As you may already be aware, we are calling the meeting to give our shareholders the opportunity to vote and express their views on a series of proposals put forth by a group of shareholders, including Clinton Relational Opportunity Master Fund, L.P., Cannell Capital LLC and certain related persons and entities (the “Shareholder Group”), who have sought to demand a special meeting of the Company’s shareholders. The Clinton Group is a hedge fund, which we believe is focused on short term profits. The purpose of the special meeting is to consider the proposals put forth by the Shareholder Group and opposed by the existing Board of Directors and management of the Company. The proposals seek to, among other things, remove five members of our Board of Directors and replace them with nominees of the Shareholder Group, thus allowing the Shareholder Group’s nominees to take control of the Board and your Company by replacing all but one of the members of our Board of Directors, each of whom was carefully selected by our Nominating and Corporate Governance Committee, with the Shareholder Group’s own nominees.

Your Board of Directors is deeply committed to the Company, its shareholders and enhancing shareholder value. In the Board’s opinion, the Shareholder Group’s proposals are not in the best interests of ALL shareholders of the Company, but rather were made in furtherance of the Shareholder Group’s own interests. If the Shareholder Group, a minority group of shareholders beneficially owning approximately 9.8% of the Company’s shares, were to succeed in this proxy contest, then the Shareholder Group’s nominees would control over 80% of the seats on your board. The Shareholder Group has not offered to purchase a controlling interest in the Company nor offered to pay the Company’s shareholders any control premium for the privilege of having the Shareholder Group’s nominees control your board. For these reasons, among others, the Board is soliciting proxies against the Shareholder Group’s proposals. We urge you to join the Board of Directors in opposing the Shareholder Group’s proposals by voting “AGAINST” their proposal to remove five of the current members of the Company’s Board of Directors without cause, as well as their related proposals, by signing and returning the WHITE proxy card.

THE FUTURE OF VALUEVISION IS IN YOUR HANDS. YOUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE “AGAINST” PROPOSALS NO. 1 THROUGH 5 AND “WITHHOLD” WITH RESPECT TO THE ELECTION OF THE SHAREHOLDER GROUP’S NOMINEES PURSUANT TO PROPOSAL NO. 6 ON THE ENCLOSED WHITE PROXY CARD TODAY.

Your vote is extremely important regardless of the number of shares you own. Please promptly use the enclosed WHITE proxy card to vote by telephone, by Internet, or by signing, dating and returning the WHITE proxy card in the postage-paid envelope provided.

If you have any questions or need assistance in voting your shares, please contact our proxy solicitor, Innisfree M&A Incorporated, toll-free at (888) 750-5834; banks and brokers may call collect at (212) 750-5833.

I can assure you that the Company’s Board of Directors and management will continue to act in the best interests of ALL of the Company’s shareholders. We appreciate your continued support.

Sincerely,

[ ]

Keith R. Stewart

Chief Executive Officer

and Member of the Board of Directors

Table of Contents

PRELIMINARY COPY

VALUEVISION MEDIA, INC.

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON MARCH 14, 2014

To the Shareholders of ValueVision Media, Inc.:

A Special Meeting of shareholders (the “Special Meeting”) of ValueVision Media, Inc., a Minnesota corporation (the “Company”), will be held at [ ] on Friday, March 14, 2014 at [ ], central time, or at any adjournments or postponements thereof. We have called this special meeting to allow our shareholders the opportunity to vote and express their views on a series of proposals put forth by a group of the Company’s shareholders, including Clinton Relational Opportunity Master Fund, L.P., Cannell Capital LLC and certain related persons and entities (the “Shareholder Group”), who together beneficially own approximately 9.8% of our outstanding shares. We believe that turning control of the Company over to the Shareholder Group’s nominees, particularly at this time, would be contrary to the best interests of the Company and its other shareholders, and accordingly we are opposing the Shareholder Group’s proposals.

The Special Meeting is being held for the purpose of considering only the following proposals:

| 1. | to repeal any provision of the Company’s by-laws (the “By-laws”) that was not included in the By-laws publicly filed with the Securities and Exchange Commission (the “SEC”) on September 27, 2010, and that is inconsistent with or disadvantageous to the election of the nominees or other proposals presented at the Special Meeting, described below; |

| 2. | to delete in its entirety Section 4.12 of Article 4 of the By-laws; |

| 3. | to amend and restate in its entirety Section 4.13 of Article 4 of the By-laws as follows: |

“4.13 Vacancies. Vacancies in the Board of Directors resulting from death, resignation, retirement, disqualification, removal from office, or other cause and newly-created directorships resulting from any increase in the authorized number of directors may be filled by the shareholders or by the Board of Directors by no less than a majority vote of the remaining directors then in office, though less than a quorum, and each director so chosen shall hold office until the first meeting of shareholders held after his or her appointment for the purpose of electing directors and until his or her successor is elected and qualified or until his or her earlier death, resignation, or removal from office.”;

| 4. | to remove from the Company’s Board of Directors (the “Board”), without cause, (i) each of Jill R. Botway, John D. Buck, William F. Evans, Randy S. Ronning and Keith R. Stewart and (ii) any person appointed by the Board to fill any vacancy on the Board or any newly-created directorships at any time after November 4, 2013 and prior to the conclusion of the Special Meeting or any adjournments or postponements thereof pursuant to Section 302A.223 (Subd. 3) of the Minnesota Business Corporation Act; |

| 5. | to adopt a shareholder resolution pursuant to Section 4.2 of our By-Laws to fix the size of the Board at nine (9) directors; and |

| 6. | conditioned on and subject to the approval of the removal of incumbent directors pursuant to Proposal No. 4 above, to elect Thomas D. Beers, Dorrit M. Bern, Mark Bozek, Melissa B. Fisher, Thomas D. Mottola, Robert Rosenblatt and Fred Siegel to fill any vacancies on the Board resulting from the removal of any incumbent directors pursuant to Proposal No. 4 above and from any increase in the size of the Board pursuant to Proposal No. 5 above. The Shareholder Group stated that this Proposal is conditioned on and subject to the approval of the removal of incumbent directors. |

Table of Contents

The six proposals above are the only proposals to be acted upon at the Special Meeting. Therefore, in accordance with our By-laws and the Minnesota Business Corporations Act, no other business will be conducted at the Special Meeting. Any proposals other than those set forth above will be disregarded in their entirety. Only Company shareholders of record as of the close of business on February 13, 2014 will be entitled to receive notice of and to vote at the Special Meeting or any adjournments or postponements thereof. The mailing of the accompanying proxy statement and the Board’s form of proxy to shareholders whose shares are registered directly in their names with our transfer agent will commence on or about [ ], 2014.

The Board does not believe the Shareholder Group’s proposals are in the best interests of all of our shareholders. As the Company has previously stated, the Board continues to be receptive to listening to and considering the views of shareholders and is open to adding to the Board at an appropriate time qualified independent directors with appropriate expertise in areas that would complement the strengths of its current directors and management’s focus on executing the Company’s strategy to deliver value for all shareholders. In that spirit, the Company has twice made proposals to the Shareholder Group to add directors to the Board in order to avoid the costs and expenses of calling a special meeting and allow us to work cooperatively to enhance shareholder value together. In each instance, the Shareholder Group responded that it was not interested.

However, despite this and despite the fact that the Shareholder Group’s attempt to demand a special meeting was deficient under our By-laws and Minnesota law, the Board has determined to hold the Special Meeting to permit our shareholders the opportunity to vote and express their views on the Shareholder Group’s proposals.

Under the Shareholder Group’s proposals, five of our six directors, including our Chief Executive Officer and four independent directors, would be removed. The Shareholder Group has not put forward any concrete strategic recommendations or provided any specific insight into what value their nominees would bring to the Board or how they would alter or improve the Company’s business plan or strategy if given the opportunity. We therefore believe that if the Shareholder Group’s proposals are successful, only following the removal of substantially all of our independent directors and our Chief Executive Officer would the new Board seek to establish a strategy for the Company. Under these conditions we believe that turning control of the Company over to the Shareholder Group’s nominees creates too great a risk of missteps and lost opportunities that could substantially diminish, rather than enhance, shareholder value.

The Board believes that the Company’s shareholders will be better served by the current Board and management continuing to pursue the Company’s business plan, which has been thoughtfully developed and refined with the primary objective of enhancing shareholder value. Accordingly, the Board does not believe that approval of the Shareholder Group’s proposals will achieve this objective.

The Board is soliciting proxies AGAINST Proposals No. 1, No. 2, No. 3, No. 4 and No. 5 and unanimously recommends that you vote AGAINST Proposals No. 1, No. 2, No. 3, No. 4 and No. 5. The Board is also soliciting proxies with respect to Proposal No. 6 and unanimously recommends that you WITHHOLD your vote with respect to the election of the Shareholder Group’s nominees pursuant to Proposal No. 6.

Your vote is extremely important. You may attend the Special Meeting and vote in person, or you may vote by submitting a WHITE proxy card for the Special Meeting. If you choose to attend or to submit a proxy card, we request that you submit a proxy voting AGAINST Proposals No. 1, No. 2, No. 3, No. 4 and No. 5 and that you WITHHOLD your vote with respect to the election of the Shareholder Group’s nominees pursuant to Proposal No. 6 by signing, dating and returning the enclosed WHITE proxy card in the postage-paid envelope provided. Shareholders or their proxies attending the Special Meeting should be prepared to provide proper identification.

We urge you NOT to sign or return any [color] proxy card that may be sent to you by the Shareholder Group.

If you attend the Special Meeting and wish to change your proxy, you may do so automatically by voting in person at the Special Meeting. You may also revoke any previously returned proxy by sending another later-dated proxy for the Special Meeting. If you have previously returned a [color] proxy card sent to you by the Shareholder Group, we urge you to sign, date and return the enclosed WHITE proxy card marked AGAINST Proposals No. 1, No. 2, No. 3, No. 4 and No. 5 and WITHHOLD with respect to the election of the Shareholder Group’s nominees pursuant to Proposal No. 6. Only your latest-dated proxy counts.

By Order of the Board of Directors

[ ]

Teresa Dery

SVP General Counsel

Corporate Secretary

[ ], 2014

6740 Shady Oak Road

Eden Prairie, Minnesota 55344-3433

Table of Contents

If you have any questions about these proxy materials or require assistance in voting your shares on the

WHITE proxy card, or need additional copies of ValueVision’s proxy materials, please contact:

Innisfree M&A Incorporated

501 Madison Avenue, 20th Floor

New York, NY 10022

Shareholders May Call Toll Free: (888) 750-5834

Banks and Brokers May Call Collect: (212) 750-5833

Table of Contents

| 1 | ||||

| 5 | ||||

| 8 | ||||

| 9 | ||||

| 14 | ||||

| 14 | ||||

| PROPOSAL NO. 3: AMENDMENT AND RESTATEMENT OF SECTION 4.13 OF THE BY-LAWS |

15 | |||

| 16 | ||||

| PROPOSAL NO. 5: FIXING THE SIZE OF THE BOARD AT NINE DIRECTORS |

17 | |||

| 18 | ||||

| BOARD OF DIRECTORS, CORPORATE GOVERNANCE AND EXECUTIVE OFFICERS |

19 | |||

| 28 | ||||

| INFORMATION ABOUT OUR SOLICITATION OF PROXIES AND RELATED EXPENSES |

30 | |||

| 30 | ||||

| 31 | ||||

| 45 | ||||

| 47 | ||||

| 48 | ||||

| 52 | ||||

| 53 | ||||

| 55 | ||||

| 55 | ||||

| 56 | ||||

| 56 | ||||

| A-1 | ||||

Table of Contents

ABOUT THE SPECIAL MEETING

The following questions and answers are intended to address briefly some commonly asked questions regarding the matters to be considered at the special meeting of shareholders (the “Special Meeting”) of ValueVision Media, Inc., a Minnesota corporation (the “Company”), to be held at [ ] on Friday, March 14, 2014 at [ ], central time, or at any adjournments or postponements thereof. We urge you to read the remainder of this proxy statement carefully because the information in this section does not provide all information that might be important to you. Please refer to the more detailed information contained elsewhere in this proxy statement, the appendix to this proxy statement and the documents referred to in this proxy statement, which you should read carefully.

We expect that this proxy statement and the enclosed proxy card will be first mailed to shareholders on or about [ ], 2014.

| Q: | Why am I receiving this proxy statement? |

| A: | The Special Meeting was called by the Company’s Board of Directors (the “Board”) in order to allow our shareholders the opportunity to vote and express their views on a series of proposals put forth by a group of the Company’s shareholders, including Clinton Relational Opportunity Master Fund, L.P., Cannell Capital LLC and certain related persons and entities (the “Shareholder Group”), designed to give the Shareholder Group’s nominees control of our Company and our Board. |

| Q: | What business will be conducted at the Special Meeting? |

| A: | At the Special Meeting, ValueVision shareholders will be asked to vote on the following proposals, all of which are opposed by our Board: |

| 1. | to repeal any provision of the Company’s by-laws (the “By-laws”) that was not included in the By-laws publicly filed with the Securities and Exchange Commission (the “SEC”) on September 27, 2010, and that is inconsistent with or disadvantageous to the election of the nominees or other proposals presented at the Special Meeting, described below; |

| 2. | to delete in its entirety Section 4.12 of Article 4 of the By-laws; |

| 3. | to amend and restate in its entirety Section 4.13 of Article 4 of the By-laws as follows: |

“4.13 Vacancies. Vacancies in the Board of Directors resulting from death, resignation, retirement, disqualification, removal from office, or other cause and newly-created directorships resulting from any increase in the authorized number of directors may be filled by the shareholders or by the Board of Directors by no less than a majority vote of the remaining directors then in office, though less than a quorum, and each director so chosen shall hold office until the first meeting of shareholders held after his or her appointment for the purpose of electing directors and until his or her successor is elected and qualified or until his or her earlier death, resignation, or removal from office.”;

| 4. | to remove from the Company’s Board of Directors, without cause, (i) each of Jill R. Botway, John D. Buck, William F. Evans, Randy S. Ronning and Keith R. Stewart and (ii) any person appointed by the Board to fill any vacancy on the Board or any newly-created directorships at any time after November 4, 2013 and prior to the conclusion of the Special Meeting or any adjournments or postponements thereof pursuant to Section 302A.223 (Subd. 3) of the Minnesota Business Corporation Act; |

| 5. | to adopt a shareholder resolution pursuant to Section 4.2 of our By-Laws to fix the size of the Board at nine (9) directors; and |

| 6. | conditioned on and subject to the approval of the removal of incumbent directors pursuant to Proposal No. 4 above, to elect Thomas D. Beers, Dorrit M. Bern, Mark Bozek, Melissa B. Fisher, Thomas D. Mottola, Robert Rosenblatt and Fred Siegel to fill any vacancies on the Board resulting from the removal of any incumbent directors pursuant to Proposal No. 4 above and from any increase in the size of the Board pursuant to Proposal No. 5 above. The Shareholder Group stated that this Proposal is conditioned on and subject to the approval of the removal of incumbent directors. |

1

Table of Contents

| Q: | Who is making this solicitation? |

| A: | The Board of Directors of ValueVision Media, Inc. |

| Q: | How does the Board of Directors recommend that I vote? |

| A: | The Board is soliciting proxies AGAINST Proposals No.1, No. 2, No. 3, No. 4 and No. 5 and unanimously recommends that you vote AGAINST Proposals No. 1, No. 2, No. 3, No. 4 and No. 5. The Board is also soliciting proxies with respect to Proposal No. 6 and unanimously recommends that you WITHHOLD your vote with respect to the election of the Shareholder Group’s nominees pursuant to Proposal No. 6. |

| Q: | Who is entitled to vote at the Special Meeting? |

| A: | Only Company shareholders of record as of the close of business on February 13, 2014 will be entitled to notice of, and to vote at, the Special Meeting. Our common stock is our only authorized and issued voting security. Every share is entitled to one vote on each matter that comes before the Special Meeting. At the close of business on the record date, we had [ ] shares of our common stock outstanding and entitled to vote. |

| Q: | Who is entitled to attend the Special Meeting? |

| A: | All ValueVision shareholders of record as of the record date, or their duly appointed proxies, may attend the Special Meeting in person. Registration will begin at [ ], central time. Cameras, recording devices and other electronic devices will not be permitted at the Special Meeting. |

Please also note that if you hold your shares in “street name” (that is, through a broker or other nominee), and you wish to vote your shares at the Special Meeting, instead of by proxy, you will need to bring a legal proxy issued to you by your broker or other nominee entitling you to vote in person.

| Q: | What constitutes a quorum for the Special Meeting? |

| A: | The presence at the Special Meeting, in person or represented by proxy, of a majority of the outstanding shares of our common stock as of the record date will constitute a quorum for the transaction of business at the Special Meeting. Abstentions and “broker non-votes” are counted in determining whether a quorum is present for the transaction of business at the Special Meeting. |

| Q: | What vote is required to approve each proposal? |

| A: | Proposals No.1, No. 2, No. 3 and No. 5 require the affirmative vote of the holders of a majority of the number of shares of common stock present in person or by proxy at the Special Meeting and entitled to vote (provided that the number of shares voted in favor of such proposals constitutes more than 25% of the outstanding shares of our common stock). |

Proposal No. 4 requires, with respect to the proposed removal of each director, the affirmative vote of the holders of a majority of the voting power of all shares entitled to vote at an election of directors.

With respect to Proposal No. 6, the affirmative vote of a plurality of the shares of common stock present in person or by proxy at the Special Meeting and entitled to vote is required for the election to the Board. Shareholders do not have the right to cumulate their votes in the election of directors or with respect to any other proposal or matter.

| Q: | Can I vote my shares in person at the Special Meeting? |

| A: | Shares held directly in your name as the shareholder of record may be voted in person at the Special Meeting. If you choose to do so, please bring the enclosed WHITE proxy and proof of identification to the Special Meeting. If you hold your shares in a brokerage account in your broker’s name (this is called “street name”), you must request a legal proxy from your broker in order to vote in person at the Special Meeting. |

2

Table of Contents

| Q: | Can I vote my shares without attending the Special Meeting? |

| A: | Yes. Whether you hold shares directly as a shareholder of record or beneficially in street name, you may vote without attending the Special Meeting. If you are a shareholder of record, you may vote without attending the Special Meeting only by submitting a proxy by telephone, by Internet or by signing and returning a proxy card. If you hold your shares in street name you may vote by submitting voting instructions to your broker or other nominee, following the directions provided by such nominee. |

Shares will be voted in accordance with the specific voting instructions on the WHITE proxy. Any WHITE proxies received by the Company which are signed by shareholders but which lack specific instruction will be voted AGAINST Proposals No. 1, No. 2, No. 3, No. 4 and No. 5 and WITHHOLD with respect to the election of the Shareholder Group’s nominees pursuant to Proposal No. 6.

| Q: | Can I change my vote after I return my proxy? |

| A: | You may revoke any proxy and change your vote at any time before the vote at the Special Meeting. You may do this by: |

| • | delivering written notice to ValueVision prior to the time of voting, c/o Innisfree M&A Incorporated, 501 Madison Avenue, 20th Floor, New York, NY 10022, stating that your proxy is being revoked; |

| • | signing a new proxy and presenting it at the Special Meeting prior to the time of voting; or |

| • | attending the Special Meeting and voting in person. |

Attending the Special Meeting alone will not revoke your proxy unless you specifically request it.

| Q: | How will abstentions and “broker non-votes” be treated at the Special Meeting? |

| A: | Shares of our common stock represented at the Special Meeting for which proxies have been received but with respect to which shareholders have abstained will be treated as present at the Special Meeting for purposes of determining whether a quorum exists. |

Abstentions will have the effect of a vote AGAINST Proposals No. 1, No. 2, No. 3, No. 4 and No. 5 and will have no effect on the election of directors (if any) pursuant to Proposal No. 6.

Your broker does not have discretionary authority to vote on any of the proposals to be considered by shareholders at the Special Meeting. Thus, if your shares are held in street name and you do not provide instructions as to how your shares are to be voted, your broker or other nominee will not be able to vote your shares on these matters. Accordingly, we urge you to direct your broker or nominee to vote your shares by following the instructions provided on the voting instruction card that you receive from your broker. Any “broker non-votes” will be counted for purposes of determining the presence of a quorum at the Special Meeting. Broker non-votes will have no effect on the outcome of Proposals No. 1, No. 2, No. 3 or No. 5, except to the extent such broker non-votes could cause the affirmative vote total to be 25% or less of the number of our outstanding shares. Broker non-votes will have the effect of a vote AGAINST Proposal No. 4 and will have no effect on the election of directors (if any) pursuant to Proposal No. 6.

| Q: | What should I do if I receive more than one set of voting and proxy materials? |

| A: | If your shares are registered differently and are held in more than one account, then you will receive more than one proxy statement and proxy card. Please be sure to vote all of your accounts so that all of your shares are represented at the Special Meeting. |

| Q: | What should I do with any [color] proxy card I may receive from the Shareholder Group? |

| A: | The Board recommends that you discard any [color] proxy card sent to you by the Shareholder Group. Instead, the Board recommends that you use the WHITE proxy card to vote by telephone, by Internet or by signing, dating and returning the WHITE proxy card in the envelope provided TODAY. If you have already returned a [color] proxy card, you can effectively revoke it by voting the enclosed WHITE proxy card. Only your latest-dated proxy will be counted at the Special Meeting. |

3

Table of Contents

If you need additional proxy materials or have any questions, please call Innisfree M&A Incorporated. Stockholders call toll-free at (888) 750-5834. Banks and brokers call collect at (212) 750-5833.

4

Table of Contents

PRELIMINARY COPY

VALUEVISION MEDIA, INC.

PROXY STATEMENT FOR THE

SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON MARCH 14, 2014

These proxy materials are being furnished to holders of shares of common stock of ValueVision Media, Inc., a Minnesota corporation (the “Company” or “ValueVision”), in connection with the solicitation of proxies by our Board of Directors (the “Board”) for the special meeting of shareholders (the “Special Meeting”) to be held on March 14, 2014, at [ ], central time, and at any adjournments or postponements thereof, for the purposes set forth herein. The Special Meeting will be held at [ ].

This proxy statement and the accompanying WHITE proxy card are first being sent or given to ValueVision shareholders on or about [ ], 2014.

This proxy statement contains important information to consider when deciding how to vote on the matters set forth in the Notice of Special Meeting of Shareholders. In this proxy statement, the terms “ValueVision,” the “Company,” “we,” “our,” “ours,” and “us” refer to ValueVision Media, Inc. Our principal executive offices are located at 6740 Shady Oak Road, Eden Prairie, Minnesota 55344-3433 and our main telephone number is (952) 943-6000.

BACKGROUND ON THE CALLING OF THE SPECIAL MEETING

In August 2013, Greg Taxin, President of the Clinton Group Inc. (the “Clinton Group”), contacted representatives of the Company and notified them that the Clinton Group was a shareholder of the Company and requested to meet with members of our senior management team.

On September 4, 2013, at the request of the Clinton Group, Keith Stewart, our Chief Executive Officer, and Bill McGrath, our Chief Financial Officer, had a telephonic meeting with Mr. Taxin and other members of the Clinton Group in order to provide the Clinton Group an opportunity to discuss the Company’s business and performance, as well as its views of the Company and anything else it may want to bring to the Company’s attention. At the meeting, Mr. Taxin said that the Clinton Group had acquired at least 4% of the Company’s outstanding shares.

On September 19, 2013, at the request of the Clinton Group, Messrs. Stewart and McGrath had a telephonic meeting with Messrs. Taxin and Hall of the Clinton Group in order to provide the Clinton Group an opportunity to further discuss the Company’s business and performance. At this meeting, Mr. Taxin advised Messrs. Stewart and McGrath that, among other things, he did not believe that the CEO was the right fit for the Company’s business going forward and that fresh thinking was needed on the Board. In this conversation Mr. Taxin also advised that he expected that the Clinton Group would hold 5% of the Company’s outstanding shares by September 24, 2013.

On September 24, 2013, Mr. McGrath and a member of our senior management team attended a consumer conference, at which Mr. Taxin approached them and again expressed the Clinton Group’s views of the Company.

On September 25, 2013, the Finance Committee of the Board met. Among other things, the committee discussed recent communications from the Clinton Group and considered further comments and criticism made by Mr. Taxin.

On September 27, 2013, at the request of representatives of the Clinton Group and at the direction of the Finance Committee of the Board, our general counsel and our outside counsel spoke with representatives of the Clinton Group, who requested the opportunity to meet with members of our Board. In this conversation representatives of the Clinton Group advised that the Clinton Group owned 4.9% of the Company’s outstanding shares.

5

Table of Contents

On October 2, 2013, the Board discussed the Clinton Group’s stated views about the Company’s performance, management team and Board members and resolved to give a special committee (the “Special Committee”) comprised of independent Board members Randy Ronning (Chairman of the Board) and Sean Orr the authority to consider and respond to shareholder inquiries and requests including, but not limited to, the authority to negotiate with such shareholders, to consider and evaluate strategic decisions in response to shareholder inquiries and requests, and to take such other actions in connection therewith as the Special Committee may deem necessary or appropriate, including to recommend to the Board the approval or rejection of particular actions or transactions.

On October 21, 2013, at the request of the Clinton Group, the members of the Special Committee and representatives of management hosted representatives of the Clinton Group, including Mr. Taxin, at a meeting in Minneapolis. Representatives of the Clinton Group made a number of comments about the Company, its performance, its strategy and its management and said that both Mr. Stewart and the Board must be replaced, but did not provide any concrete suggestions or recommendations to improve the Company’s business and strategy. Mr. Taxin also said that the Clinton Group had acquired over 5% of the Company’s outstanding shares and would be filing a Schedule 13D with the SEC within 10 days.

On October 28, 2013, Mr. Orr and our general counsel spoke with Mr. Taxin and other members of the Clinton Group to follow-up on the meeting of October 21, 2013.

On October 30, 2013, the Clinton Group sent a letter to Mr. Ronning calling for the removal of Mr. Stewart and stating that it would be interested in an investment of “at least $25 million at a substantial premium to the stock price” if the Company replaced Mr. Stewart and “updated the Board significantly.” This proposal was conditioned on the completion of due diligence; however, the Clinton Group had refused to enter into a confidentiality agreement with the Company that could permit a diligence process to be conducted. On the same day, the Clinton Group filed a Schedule 13D with the SEC disclosing that it beneficially owned 2,887,847 shares of our common stock, which represented approximately 5.8% of our outstanding shares. In the letter, Clinton explicitly noted “To be clear: We are not seeking a Board seat for ourselves or any other measure of power or control.”

On the same day, the Company responded to the Schedule 13D filing with a press release noting that the Company had engaged in numerous discussions with the Clinton Group since early September, when Clinton first met with senior representatives of management but that the Clinton Group had failed to provide any concrete suggestions or recommendations to improve the Company’s business and strategy. The press release also called attention to the outperformance of the Company’s stock relative to the Russell 2000 index and strong performance relative to peers resulting from the Board and management team’s execution of the Company’s turnaround strategy. In particular, the release noted that since Keith Stewart’s appointment as CEO in January 2009 through the Clinton Group’s Schedule 13D filing on October 30, 2013, the Company’s stock outperformed the Russell 2000 by almost 800%, and outperformed it by more than 70% and 115% in the three years and one year prior to the Clinton Group’s Schedule 13D filing, respectively. Furthermore, the release noted that over the three years and one year prior to the Clinton Group’s Schedule 13D filing, the Company’s stock outperformed its closest publicly-listed peer by 50% and 140%, respectively.

On November 4, 2013, an amended Schedule 13D was filed stating that the Clinton Group and Cannell Capital LLC and its affiliates had formed a group. The amended Schedule 13D stated that the Shareholder Group beneficially owned 5,445,679 shares, or approximately 11.0%, of the Company’s outstanding common stock, including 3,194,346 shares, representing 6.5% of the Company’s outstanding common stock, held by the Clinton Group.

On the same day, the Clinton Group delivered a letter to the Company on behalf of the Shareholder Group requesting that we call a special meeting of shareholders to be held on December 19, 2013, which letter was reviewed by the Board’s and the Company’s advisors, discussed with the Board and found to be deficient; however, the Board determined that the Company should continue to engage in discussions with the Shareholder Group.

On November 5, 2013, Mr. Ronning sent a letter to the Clinton Group stating that the Board was receptive to listening to and considering the views of our shareholders, including the suggestion of adding qualified independent directors to our Board with appropriate expertise in areas that would complement the strengths of our current Board members. The letter also requested that the Shareholder Group withdraw its request for a special meeting until after the end of the holiday season so that our management could devote its full energy to running the Company and executing its strategy over that critical period.

On November 6, 2013, the Clinton Group sent a letter to Mr. Ronning again demanding that a special meeting be held in late January 2014. The Shareholder Group also filed an amendment to its Schedule 13D on November 6, 2013, which included as exhibits the Shareholder Group’s letters seeking to demand a special meeting of shareholders.

6

Table of Contents

On November 14, 2013, although we and our Minnesota counsel had determined that the Shareholder Group’s letters requesting that a special meeting be held were deficient under our By-laws and Minnesota law, our Board determined that it would be in the best interests of all shareholders to provide shareholders with an opportunity to vote and express their views on the Clinton Group’s proposals, in part to avoid the distraction and expenses associated with a prolonged public dispute with the Shareholder Group regarding the calling and scheduling of a special meeting. Accordingly, the Company announced in a press release on November 15, 2013 that a special meeting would be held on March 14, 2014.

On November 18, 2013, the Clinton Group sent a letter to the Company criticizing the Company for calling a special meeting of the shareholders for March 14, 2014 and threatening to bring legal action to force the Company to convene a special shareholder meeting at the end of January 2014.

On November 21, 2013, the Company received a new letter from the Clinton Group seeking to demand a special meeting of the shareholders to vote on the Shareholder Group’s proposals, even though the Company had already publicly announced its intention to hold such a special meeting on March 14, 2014.

On December 6, 2013, a member of the Special Committee spoke with Mr. Taxin to discuss the Shareholder Group’s proposals. The member of the Special Committee noted that the Company would be willing to consider expanding our Board of Directors to include one nominee of the Shareholder Group that would qualify as an independent director as well as one additional mutually acceptable independent candidate. The Clinton Group rejected this offer.

On December 20, 2013, the Company sent a letter to the Shareholder Group notifying them that their second demand letter, dated November 21, 2013, was deficient under our By-laws and Minnesota law.

On December 24, 2013, the Clinton Group filed an amendment to its Schedule 13D, indicating that it had sold 545,685 Company shares since October 30, 2013 and that the Shareholder Group owned 4,899,994 shares, or approximately 9.8%, of our outstanding shares (fewer than the 10% required to demand a special meeting), including 2,698,661 shares, representing 5.4% of the Company’s outstanding common stock, held by the Clinton Group.

On January 10, 2014, a representative of the Company’s outside counsel called a representative of outside counsel to the Shareholder Group, to discuss the special meeting and suggested that, in order to save the costs and expenses of calling a special meeting (among other reasons), the Shareholder Group consider a settlement in which two mutually acceptable individuals would be added to the Board. Later that day, the Clinton Group responded that it was not interested in discussing this proposal.

On January 16, 2014, a representative of outside counsel to the Shareholder Group called a representative of the Company’s outside counsel to suggest a possible settlement in which the Company would agree to explore strategic alternatives, as well as add an unspecified number of directors to the Board. On January 17, 2014, the Company publicly announced that it had set February 13, 2014 as the record date for the Special Meeting to be held on March 14, 2014. On January 24, 2014, a representative of the Company’s outside counsel formally advised a representative of the Shareholder Group’s outside counsel that the Company was not interested in discussing the settlement proposal with them.

7

Table of Contents

DESCRIPTION OF THE SHAREHOLDER GROUP PROPOSALS

On November 4, 2013 and November 21, 2013, the Shareholder Group sent letters to our Chief Executive Officer and our General Counsel purporting to make a demand for a special meeting of shareholders to consider and vote on Proposals 1 through 6 set forth below (collectively, the “Shareholder Group Proposals”). Although the demand letters submitted by the Shareholder Group did not comply with the requirements of our By-laws and applicable Minnesota law, our Board decided to call a special meeting of shareholders to allow our shareholders an opportunity to vote and express their views on the Shareholder Group Proposals.

We expect that the Shareholder Group will file with the Securities and Exchange Commission (the “SEC”) a proxy statement and related materials for the purpose of soliciting your proxy to vote in favor of the Shareholder Group Proposals. Our Board recommends that you vote AGAINST the Shareholder Group Proposals.

| Proposal No. 1: | A proposal to repeal any provision of the Company’s by-laws (the “By-laws”) that was not included in the By-laws publicly filed with the SEC on September 27, 2010, and that is inconsistent with or disadvantageous to the election of the nominees or other proposals presented at the Special Meeting, described below.

| |

| Proposal No. 2: | A proposal to delete in its entirety Section 4.12 of Article 4 of the By-laws.

| |

| Proposal No. 3: | A proposal to amend and restate in its entirety Section 4.13 of Article 4 of the By-laws as follows: |

“4.13 Vacancies. Vacancies in the Board of Directors resulting from death, resignation, retirement, disqualification, removal from office, or other cause and newly-created directorships resulting from any increase in the authorized number of directors may be filled by the shareholders or by the Board of Directors by no less than a majority vote of the remaining directors then in office, though less than a quorum, and each director so chosen shall hold office until the first meeting of shareholders held after his or her appointment for the purpose of electing directors and until his or her successor is elected and qualified or until his or her earlier death, resignation, or removal from office.”

| Proposal No. 4: | A proposal to remove from the Company’s Board of Directors, without cause, (i) each of Jill R. Botway, John D. Buck, William F. Evans, Randy S. Ronning and Keith R. Stewart and (ii) any person appointed by the Board to fill any vacancy on the Board or any newly-created directorships at any time after November 4, 2013 and prior to the conclusion of the Special Meeting or any adjournments or postponements thereof pursuant to Section 302A.223 (Subd. 3) of the Minnesota Business Corporation Act. | |

| Proposal No. 5: | A proposal to adopt a shareholder resolution pursuant to Section 4.2 of our By-Laws to fix the size of the Board at nine (9) directors. | |

| Proposal No. 6: | Conditioned on and subject to the approval of the removal of incumbent directors pursuant to Proposal No. 4 above, a proposal to elect Thomas D. Beers, Dorrit M. Bern, Mark Bozek, Melissa B. Fisher, Thomas D. Mottola, Robert Rosenblatt and Fred Siegel (collectively, the “Shareholder Group Nominees”) to fill any vacancies on the Board resulting from the removal of any incumbent directors pursuant to Proposal No. 4 above and from any increase in the size of the Board pursuant to Proposal No. 5 above. The Shareholder Group stated that this Proposal is conditioned on and subject to the approval of the removal of incumbent directors. | |

Each of these six proposals is described in additional detail below.

8

Table of Contents

REASONS TO REJECT THE SHAREHOLDER GROUP PROPOSALS

The Shareholder Group Proposals would effect a change in control of the Company by removing all but one of the members of your duly elected Board and replacing them with the Shareholder Group Nominees. There are several compelling reasons to reject the Shareholder Group Proposals, including:

| • | The Shareholder Group is asking you to consent to turning over control of the Company, without payment of any control premium to the Company’s shareholders, to the nominees of a Shareholder Group that beneficially owns approximately 9.8% of the Company’s shares. Moreover, having acquired the Company’s shares commencing substantially in August 2013, the Clinton Group has already sold a significant number of Company shares at a substantial gain as the Company’s stock price performance has improved. |

| • | Under the Shareholder Group’s proposal, five of our six directors, including four independent directors and our Chief Executive Officer, would be removed. We believe that the introduction of a substantially reconstituted board would disrupt the Company’s execution of its plan to bring value to all shareholders. |

| • | The Shareholder Group has not put forward any concrete strategic recommendations or provided any specific insight into what value their nominees would bring to the Board or how they would alter or improve the Company’s business plan or strategy if given the opportunity. We therefore believe that if the Shareholder Group’s proposals are successful, only following the removal of substantially all of our independent directors and our Chief Executive Officer would the new Board seek to establish a strategy for the Company. Under these conditions we believe that turning control of the Company over to the Shareholder Group’s nominees creates too great a risk of missteps and lost opportunities that could substantially diminish, rather than enhance, shareholder value. Accordingly, the Board believes that the Shareholder Group Proposals would destroy shareholder value. |

| • | In considering the Shareholder Group Proposals, your Board believes that the Shareholder Group Nominees are not in a position to best serve the interests of all the Company’s shareholders. The Shareholder Group Nominees have been chosen solely by the Shareholder Group and as shareholders, the Shareholder Group has no duty to act in the best interests of all of the Company’s shareholders in determining the Company’s strategic direction or when nominating the Shareholder Group Nominees to serve on your Board. Several of the Shareholder Group Nominees have longstanding relationships with and/or economic ties to the Clinton Group and have been nominated by the Clinton Group for election to the boards of directors of other companies in which the Clinton Group has been a shareholder. |

| • | We believe our Board and management team have taken meaningful steps to drive performance and position the Company to deliver shareholder value. We have focused on four key growth drivers: (1) broading and diversifying our product mix with a compelling assortment of national brands and proprietary products; (2) increasing our visibility to customers by expanding and optimizing our TV distribution platform; (3) growing our customer base through new customer acquisition, and increased purchase frequency and retaining existing customers reflecting improvements to overall customer experience; and (4) being a Watch & Shop Anytime, Anywhere experience through continued enhancements to our internet and mobile platforms. |

| • | We believe that the current Board and management team have been effective stewards of the Company and our business, as demonstrated by their ability to streamline operations, improve the quality and cost effectiveness of the Company’s TV distribution footprint, and significantly enhance the stability and flexibility of the Company’s balance sheet, resulting in stronger financial performance. We believe we have already begun to see results, as evidenced by our strong financial and operating performance through the first three quarters of fiscal 2013. |

| • | We believe we have strengthened the Board over the past three years to add independent directors that ensure we have the best team to oversee the execution of our strategy. The average tenure of our board is three years, with three of our directors having been appointed in the last three years. The members of the Board were carefully selected by our Nominating and Corporate Governance Committee following a thorough review of their qualifications and were overwhelmingly re-elected at the June 2013 annual meeting of shareholders with strong support from our shareholders. |

| • | Your Board is made up of engaged and dedicated directors with a broad range of relevant experience: |

| • | Jill Botway has served as a director since 2013. She is Executive Vice President and Director of Sales and Marketing for Specific Media/MySpace, a multi-platform, digital media company, and brings broad expertise in media and consumer marketing, as well as brand development, which gives the board insight into customer focusing initiatives, marketing methods and brand positioning. |

| • | John D. Buck has served as a director since 2004. He served as our interim chief executive officer from October 2007 to March 2008, and again from August 2008 through January 2009. Mr. Buck provides the Board with his experience in the consumer retail industry and brings to us the knowledge and judgment he gains from serving on other public and private company boards, which allows us to benefit from his insight into board governance matters and appropriate board processes. |

9

Table of Contents

| • | William F. Evans has served as a director since 2011. He was executive vice president and chief financial officer of Witness Systems, Inc., a public, global provider of workforce optimization software and services until he retired when the company was sold in June 2007. Mr. Evans offers senior financial management and accounting expertise gained through his long career in public accounting, as well as in senior management and board positions with corporate governance duties at a number of companies. We believe his broad experience and service in senior management and on boards of directors provides our Board with valuable expertise, particularly with respect to financial reporting. |

| • | Randy S. Ronning has served as a director and Chairman of our Board since 2009. He was executive vice president and chief merchandising officer of QVC, a major electronic retailer, and prior to joining QVC, he spent 30 years with J.C. Penney Co., where he held executive positions including president of its catalog and internet divisions. Mr. Ronning’s extensive senior executive level experience at two major retailing companies provides the Board and the Company with invaluable expertise and industry knowledge as we execute our new strategy for growth and profitability. In particular, Mr. Ronning’s record of success in leading the development and success of the e-commerce operations at his prior companies is of substantial importance to the Board and the Company in addressing similar growth opportunities in our Company’s business. |

| • | Keith R. Stewart has served as a director since 2008. He is our Chief Executive Officer. He was named our president and Chief Executive Officer in January 2009 after having joined our Company as President and Chief Operating Officer in August 2008. Mr. Stewart retired from QVC in July 2007 where he had served a significant part of his retail career. Mr. Stewart brings to our Board and our Company extensive executive retail, operations, product sourcing and e-commerce experience both domestically and internationally with more than 20 years of leadership experience in the electronic retailing industry. His strong understanding of multichannel retailing strategy and operations and his proven track record of delivering growth and profitability in our industry gives the Board essential perspectives and insights in their oversight of Company strategy and development. |

| • | Sean F. Orr is currently the Chief Financial Officer and Treasurer of Accretive Health, Inc., a New York Stock Exchange listed company. Before that, Mr. Orr served as Senior Vice President and Chief Financial Officer for Maxum Petroleum, Inc. a national marketer and logistics company for petroleum products, during 2012 until the company was sold. Prior to that he served as president and chief financial officer of Dale and Thomas Popcorn, LLC, a snack food business, from February 2007 until March 2009. Mr. Orr also was a member of the Board of Directors and Chairman of the Board’s Finance Committee for The Interpublic Group of Companies from 1999-2003, and has served on the Boards of Directors for several non-profit organizations. Mr. Orr is a certified public accountant. Mr. Orr offers senior financial management and accounting expertise gained through his long career both in public accounting and in private industry. We believe his broad experience and service in senior management provides our Board with valuable expertise, particularly with respect to financial reporting and capital markets. |

| • | The removal and replacement of a majority of the Board as a result of the Shareholder Group Proposals would constitute a “change of control” under certain of the Company’s material agreements, potentially requiring the Company, among other things, to offer to repay amounts owed under its revolving line of credit, which are approximately $38 million as of January 24, 2014 and which could be materially harmful to the Company. |

| • | The removal and replacement of all but one of our Board members as a result of the Shareholder Group Proposals would result in the accelerated vesting of a substantial number of options and shares of restricted stock held by directors and employees. This accelerated vesting would reduce the important desired effects of using unvested option and restricted stock awards, to retain employees or achieve the specified vesting criteria. We believe the potential loss of key employees with expertise in the Company’s key operating areas as a result of any accelerated vesting could result in a destruction of value for shareholders. |

10

Table of Contents

FOR THE FOREGOING REASONS, YOUR BOARD STRONGLY BELIEVES THAT THE SHAREHOLDER GROUP PROPOSALS ARE NOT IN THE BEST INTERESTS OF THE COMPANY AND ALL OF ITS SHAREHOLDERS AND THAT YOU SHOULD VOTE AGAINST THEM BY RETURNING THE WHITE PROXY CARD.

In addition to the reasons indicated above, your Board believes you should reject each proposal for the following reasons.

Proposal No. 1: We recommend that you VOTE AGAINST Proposal No. 1 because there have not been any amendments to date to our By-laws since September 27, 2010 and because this proposal is designed to nullify unspecified provisions of the By-laws that may be adopted by the Board in its efforts to act in, and protect the best interests of, the Company and its shareholders.

Furthermore, the Board’s fiduciary duties require that it retain flexibility to adopt, at any time, any amendment to the By-laws that it believes is proper and in the best interests of the Company’s shareholders and other stakeholders. The automatic repeal of any duly adopted By-law amendment made after the date hereof, irrespective of its content, could have the unfortunate effect of repealing one or more properly adopted By-law amendments determined by the Board to be in the best interests of the Company and its shareholders.

Proposal No. 2: We recommend that you VOTE AGAINST Proposal No. 2 because it is designed to further the Shareholder Group’s plan to remove and replace a majority of the Board and take control of the Company, which we believe is not in the best interests of the Company and ALL of its shareholders.

We believe the Board should retain the right to remove directors that are not well suited for the Company as may be required by the Board’s fiduciary duties to the Company’s shareholders and other stakeholders.

Proposal No. 3: We recommend that you VOTE AGAINST Proposal No. 3 because it is designed to further the Shareholder Group’s plan to remove and replace a majority of the Board and take control of the Company, which we believe is not in the best interests of the Company and ALL of its shareholders. Under our By-laws, shareholders already have a right to nominate directors at our annual meeting or at any special meeting that such shareholder has the right to demand that the Company call.

Proposal No. 4: We recommend that you VOTE AGAINST each removal set forth in Proposal No. 4 because we believe that the current Board is comprised of members that understand the Company’s business and who are committed to maximizing the Company’s value for the benefit of ALL of its shareholders and other stakeholders, and not just the Shareholder Group. Our Board is already comprised of six individuals with outstanding and varying business experience as described below who effectively serve in the role that their board membership requires. As we have previously announced, we have a committee of independent directors seeking to identify, and evaluating adding, additional independent directors to our Board that would complement our current directors. Your independent engaged Board includes:

| • | Jill R. Botway, who has served as Executive Vice President and Director of Sales and Marketing for Specific Media/MySpace, a multi-platform, digital media company in New York since 2012. In addition, from 2009 to 2010 Ms. Botway was Chief Executive Officer of WMI, Inc., a multi-platform media services company, and since 2010, she has been a Managing Member at private equity firm Cavu Holdings LLC. From 2005-2009, Ms. Botway was President of Omnicom Media Group’s U.S. Strategic Business Units. Before joining Omnicom, Ms. Botway held various executive positions with media companies and as an attorney has prior law firm experience. Ms. Botway brings broad expertise in media and consumer marketing, as well as brand development, which gives the Board insight into customer focusing initiatives, marketing methods and brand positioning. As an attorney, Ms. Botway also brings a sound understanding of legal issues and concerns that may face the Company. |

| • | John D. Buck, who currently serves as non-executive chairman of the board of Medica (Minnesota’s second largest health insurer) and previously served as chief executive officer of Medica from July 2001 until his retirement in January 2003. From October 2007 to March 2008, and again from August 2008 through January 2009, Mr. Buck served as our interim Chief Executive Officer. Previously, Mr. Buck worked for Fingerhut Companies where he held several senior executive positions, including president and chief operating officer. He left Fingerhut in October 2000. |

11

Table of Contents

| Mr. Buck also previously held executive positions at Graco Inc., Honeywell Inc., and Alliant Techsystems Inc. Mr. Buck currently serves on the board of directors of Patterson Companies, Inc. Mr. Buck provides the Board with his experience in the consumer retail industry, including his past service as an interim Chief Executive Officer of our Company and his senior leadership positions at Fingerhut Companies. He additionally brings to us the knowledge and judgment he gains from serving on other public and private company boards, which allows us to benefit from his insight into board governance matters and appropriate board processes. |

| • | William F. Evans, who most recently served as the executive vice president and chief financial officer of Witness Systems, Inc., a public, global provider of workforce optimization software and services based in Roswell, Georgia from May 2002 until he retired when the company was sold in June 2007. Previously, Mr. Evans had served in a number of operational and financial management roles for a variety of companies, including Superior Essex, ProSource, Inc., H&R Block, Inc., Management Sciences of America and Electromagnetic Sciences, Inc. He began his professional career at Peat Marwick, Mitchell, and Co. (now KPMG), where he was elected a partner in 1980 and was named partner-in-charge of the Atlanta audit practice in 1985. Mr. Evans has served on the Board of Directors of several other private and public companies, including SFN Group, Inc. and Wolverine Tube, Inc. Mr. Evans also currently serves on the board of directors of SAIA, Inc., where he serves on the audit committee. Mr. Evans offers senior financial management and accounting expertise gained through his long career both in public accounting as well as in senior management and board positions with corporate governance duties at a number of companies. We believe his broad experience and service in senior management and boards of directors provides our Board with valuable expertise, particularly with respect to financial reporting. |

| • | Randy S. Ronning, who currently serves as Chairman of our Board. Mr. Ronning served as executive vice president and chief merchandising officer of QVC, a major electronic retailer, where he oversaw all merchandising, brand management, and merchandise analysis efforts of QVC and QVC.com, from June 2005 until his retirement in January 2007. He also was responsible for QVC.com operations during this period. Previously, Mr. Ronning was executive vice president with responsibility over affiliate sales and marketing, information services, marketing, research and sales analysis, direct marketing, corporate marketing, public relations, and charitable giving at QVC, from 2001 to May 2005. Prior to joining QVC, Mr. Ronning spent 30 years with J.C. Penney Co., where he held executive positions including president of its catalog and internet divisions. Mr. Ronning currently serves on the board of directors of another private company, and has served on the boards of several non-profit and organizations, including the Electronic Retailing Association, the Dallas Symphony Association, the University of Dallas, the Fashion Institute of Technology, the Mail Order Association, Chairman of the Board, Forrester Research, Knot, Philadelphia Orchestra, The Franklin Institute, and another private company, Commerce Hub, where he was Chairman of the Board. Mr. Ronning’s extensive senior executive level experience at two major retailing companies provides the board and the company with invaluable expertise and industry knowledge as we execute our new strategy for growth and profitability. In particular, Mr. Ronning’s record of success in leading the development and success of the e-commerce operations at his prior companies is of substantial importance to the Board and the Company in addressing similar growth opportunities in our Company’s business. Mr. Ronning’s depth of experience in managing, leading and motivating employees provides the Board with great insights in his role as chairman of the human resources and compensation committee. |

| • | Keith R. Stewart, who is our Chief Executive Officer. He was named our President and Chief Executive Officer in January 2009 after having joined the Company as President and Chief Operating Officer in August 2008. Mr. Stewart voluntarily relinquished the title of president in February 2010 in conjunction with the appointment of a new president of our Company. Mr. Stewart retired from QVC in July 2007 where he had served a significant part of his retail career, most recently as vice president — global sourcing of QVC (USA) and vice president — merchandising of QVC (USA) from April 2004 to June 2007. Previously he was general manager of QVC’s German business unit and was overseas from 1998 to March 2004. Mr. Stewart first joined QVC as a consumer electronics buyer in 1992 and was promoted through a series of progressively responsible positions in key operational areas of tv home shopping. Mr. Stewart brings to our Board and our Company extensive executive retail, operations, product sourcing and |

12

Table of Contents

| e-commerce experience both domestically and internationally with more than 20 years of leadership experience in the electronic retailing industry. His strong understanding of multichannel retailing strategy and operations and his proven track record of delivering growth and profitability in our industry gives the board essential perspectives and insights in their oversight of Company strategy and development. |

| • | Sean F. Orr, who is currently the Chief Financial Officer and Treasurer of Accretive Health, Inc., a New York Stock Exchange listed company. Before that, Mr. Orr served as Senior Vice President and Chief Financial Officer for Maxum Petroleum, Inc. a national marketer and logistics company for petroleum products, during 2012 until the company was sold. Prior to that he served as president and chief financial officer of Dale and Thomas Popcorn, LLC, a snack food business, from February 2007 until March 2009. Prior to that, he was a partner in Tatum Partners, LLC, an executive services firm, in 2006, and the executive vice president and chief financial officer of The Interpublic Group of Companies, a parent of global advertising and public relations firms, from 1999 to 2003. He also worked at Pepsico Inc. from 1994 to1999 in the roles of Senior Vice President and Controller at Pepsico Corporate Headquarters and Executive Vice President and Chief Financial Officer of its Frito-Lay division; Reader’s Digest as Vice President and Controller from 1990 to 1994; and Peat Marwick, Mitchell, and Co. (now KPMG), from 1976 to 1990 (serving as a partner from 1986 to 1990). Mr. Orr also was a member of the Board of Directors and Chairman of the Board’s Finance Committee for The Interpublic Group of Companies from 1999-2003, and has served on the Boards of Directors for several non-profit organizations. Mr. Orr is a certified public accountant. Mr. Orr offers senior financial management and accounting expertise gained through his long career both in public accounting and in private industry. We believe his broad experience and service in senior management provides our Board with valuable expertise, particularly with respect to financial reporting and capital markets. |

Proposal No. 5: We recommend rejection of Proposal No. 5 because it is designed to further the Shareholder Group’s plan to remove and replace a majority of the Board and take control of the Company which we believe is not in the best interest of the Company and ALL of its shareholders.

As previously announced, our Board has formed a special nominating committee of independent directors in connection with the Shareholder Group Proposals to oversee a Board candidate evaluation process designed to identify potential new candidates with skills and experience that would enhance the overall composition of the Board. We believe that this process should be undertaken in a manner consistent with the Company’s longstanding process that is traditionally overseen by its corporate governance and nominating committee. As publicly stated, this committee is also evaluating the qualifications of Shareholder Group Nominees.

Given this evaluation process that is currently underway, we believe that the Board, not the Shareholder Group, is in the best position to set the size of the Board as it may determine is appropriate, taking into account the availability of qualified candidates, as well as GE and Comcast’s right to appoint up to three directors in the aggregate to our Board pursuant to the Amended and Restated Shareholders Agreement that is publicly filed and described in additional detail below under the caption “CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS – Relationship with NBCU and GE Equity.”

Proposal No. 6: We recommend rejection of each of the directors nominated pursuant to Proposal No. 6 because they are nominated solely as part of a plan by the Shareholder Group, which beneficially owns approximately 9.8% of our shares, to remove and replace a majority of the Board and take control of the Company, which we believe is not in the best interests of the Company and ALL of its shareholders.

WE URGE SHAREHOLDERS TO REJECT THE SHAREHOLDER GROUP PROPOSALS AND REVOKE ANY PROXY CARD FROM THE SHAREHOLDER GROUP PREVIOUSLY SUBMITTED. IF YOU HAVE SUBMITTED A PROXY CARD FROM THE SHAREHOLDER GROUP, YOU MAY SUBMIT A WHITE PROXY CARD FROM THE COMPANY TO REVOKE THE SHAREHOLDER GROUP PROXY.

DO NOT DELAY. IN ORDER TO HELP ENSURE THAT THE CURRENT BOARD IS ABLE TO ACT IN YOUR BEST INTERESTS, PLEASE SIGN, DATE AND DELIVER THE ENCLOSED WHITE PROXY CARD USING THE ENCLOSED PRE-PAID ENVELOPE AS PROMPTLY AS POSSIBLE WHETHER OR NOT YOU HAVE SIGNED THE [COLOR] PROXY CARD FROM THE SHAREHOLDER GROUP.

13

Table of Contents

REPEAL OF CERTAIN BY-LAW AMENDMENTS

Proposal No. 1 is a proposal to repeal any provision of our By-laws that was not included in the By-laws publicly filed with the SEC on September 27, 2010, and that is inconsistent with or disadvantageous to the election of the nominees or other proposals presented at the Special Meeting. The text of the proposed resolution is below:

“RESOLVED, that any provision of the By-laws of ValueVision, Media, Inc. (the “Corporation”) as of the date of effectiveness of this resolution that was not included in the By-laws publicly filed with the Securities and Exchange Commission on September 27, 2010, and is inconsistent with or disadvantageous to the election of the nominees nominated or other proposals presented at the Corporation’s Special Meeting of shareholders held on March 14, 2014 (or any adjournments or postponements thereof), be and hereby is repealed.”

Proposal No. 1 requires the affirmative vote of the holders of a majority of the number of shares of common stock present in person or by proxy at the Special Meeting and entitled to vote (provided that the number of shares voted in favor of such proposal constitutes more than 25% of the outstanding shares of our common stock). Shareholders may vote “FOR” or “AGAINST,” or may “ABSTAIN” with respect to, Proposal No. 1.

For the reasons stated above under the caption “REASONS TO REJECT THE SHAREHOLDER GROUP PROPOSALS,” the Board is soliciting proxies AGAINST Proposal No. 1 and unanimously recommends that you vote AGAINST Proposal No. 1.

DELETION OF SECTION 4.12 OF THE BY-LAWS

Proposal No. 2 is a proposal to delete in its entirety Section 4.12 of Article 4 of the By-laws. The text of the proposed resolution is below:

“RESOLVED, that Section 4.12 of Article 4 of the By-laws of ValueVision Media, Inc. shall be, and hereby is, deleted in its entirety.”

Proposal No. 2 requires the affirmative vote of the holders of a majority of the number of shares of common stock present in person or by proxy at the Special Meeting and entitled to vote (provided that the number of shares voted in favor of such proposal constitutes more than 25% of the outstanding shares of our common stock). Shareholders may vote “FOR” or “AGAINST,” or may “ABSTAIN” with respect to, Proposal No. 2.

Section 4.12 of Article 4 of the By-laws currently reads as follows: “Any director may be removed by a majority vote of all directors constituting the Board, exclusive of the director whose removal is proposed, with or without cause.” This provision of the By-laws currently allows a majority of the directors constituting the entire Board (excluding the director whose removal is proposed) to remove any other director at any time, with or without cause.

For the reasons stated above under the caption “REASONS TO REJECT THE SHAREHOLDER GROUP PROPOSALS,” the Board is soliciting proxies AGAINST Proposal No. 2 and unanimously recommends that you vote AGAINST Proposal No. 2.

14

Table of Contents

AMENDMENT AND RESTATEMENT OF SECTION 4.13 OF THE BY-LAWS

Proposal No. 3 is a proposal to amend and restate in its entirety Section 4.13 of Article 4 of the By-laws. The text of the proposed resolution is below:

“RESOLVED, that Section 4.13 of Article 4 of the By-laws of ValueVision Media, Inc. shall be, and hereby is, amended and restated in its entirety as follows:

“4.13 Vacancies. Vacancies in the Board of Directors resulting from death, resignation, retirement, disqualification, removal from office, or other cause and newly-created directorships resulting from any increase in the authorized number of directors may be filled by the shareholders or by the Board of Directors by no less than a majority vote of the remaining directors then in office, though less than a quorum, and each director so chosen shall hold office until the first meeting of shareholders held after his or her appointment for the purpose of electing directors and until his or her successor is elected and qualified or until his or her earlier death, resignation, or removal from office.”

Proposal No. 3 requires the affirmative vote of the holders of a majority of the number of shares of common stock present in person or by proxy at the Special Meeting and entitled to vote (provided that the number of shares voted in favor of such proposal constitutes more than 25% of the outstanding shares of our common stock). Shareholders may vote “FOR” or “AGAINST,” or may “ABSTAIN” with respect to, Proposal No. 3.

Section 4.13 of Article 4 of the By-laws currently reads as follows: “Any vacancy on the Board of Directors may be filled by vote of the remaining directors, even though less than a quorum.” This provision of the By-laws currently allows any vacancies on the Board to be filled by a majority vote of the remaining directors, even if less than a quorum.

For the reasons stated above under the caption “REASONS TO REJECT THE SHAREHOLDER GROUP PROPOSALS,” the Board is soliciting proxies AGAINST Proposal No. 3 and unanimously recommends that you vote AGAINST Proposal No. 3.

15

Table of Contents

REMOVAL OF CERTAIN DIRECTORS

Proposal No. 4 is a proposal to remove from the Board, without cause, (i) each of Jill R. Botway, John D. Buck, William F. Evans, Randy S. Ronning and Keith R. Stewart and (ii) any person appointed by the Board to fill any vacancy on the Board or any newly-created directorships at any time after November 4, 2013 and prior to the conclusion of the Special Meeting or any adjournments or postponements thereof pursuant to Section 302A.223 (Subd. 3) of the Minnesota Business Corporation Act. The text of each proposed resolution is below:

“RESOLVED, that Jill R. Botway be, and hereby is, removed from the Board of Directors of ValueVision Media, Inc., effective immediately upon the adoption of this resolution.”

“RESOLVED, that John D. Buck be, and hereby is, removed from the Board of Directors of ValueVision Media, Inc., effective immediately upon the adoption of this resolution.”

“RESOLVED, that William F. Evans be, and hereby is, removed from the Board of Directors of ValueVision Media, Inc., effective immediately upon the adoption of this resolution.”

“RESOLVED, that Randy S. Ronning be, and hereby is, removed from the Board of Directors of ValueVision Media, Inc., effective immediately upon the adoption of this resolution.”

“RESOLVED, that Keith R. Stewart be, and hereby is, removed from the Board of Directors of ValueVision Media, Inc., effective immediately upon the adoption of this resolution.”

“RESOLVED, that any individual(s) (other than the individual(s) elected pursuant to a nomination by Clinton Relational Opportunity Fund, L.P.) that may be elected or appointed to the Board of Directors of ValueVision Media, Inc. to fill any existing or newly created directorship or vacancy on the Board of Directors (whether the result of any expansion of the Board of Directors or removal or resignation of a director) at any time after November 4, 2013 and prior to the conclusion of the Special Meeting or at any adjournment or postponement of such meeting, be, and hereby is, removed from the Board of Directors.”

Proposal No. 4 requires, with respect to the proposed removal of each director, the affirmative vote of the holders of a majority of the voting power of all shares entitled to vote at an election of directors. Shareholders may vote “FOR” or “AGAINST,” or may “ABSTAIN” with respect to, the removal of each director pursuant to Proposal No. 4.

For the reasons stated above under the caption “REASONS TO REJECT THE SHAREHOLDER GROUP PROPOSALS,” the Board is soliciting proxies AGAINST Proposal No. 4 and unanimously recommends that you vote AGAINST the removal of each director pursuant to Proposal No. 4.

16

Table of Contents

FIXING THE SIZE OF THE BOARD AT NINE DIRECTORS

Proposal No. 5 is a proposal to adopt a shareholder resolution pursuant to Section 4.2 of our By-Laws to fix the size of the Board at nine (9) directors. The text of the proposed resolution is below:

“RESOLVED, that the size of the Board of Directors of ValueVision Media, Inc. shall be nine directors.”

Proposal No. 5 requires the affirmative vote of the holders of a majority of the number of shares of common stock present in person or by proxy at the Special Meeting and entitled to vote (provided that the number of shares voted in favor of such proposal constitutes more than 25% of the outstanding shares of our common stock). Shareholders may vote “FOR” or “AGAINST,” or may “ABSTAIN” with respect to, Proposal No. 5.

For the reasons stated above under the caption “REASONS TO REJECT THE SHAREHOLDER GROUP PROPOSALS,” the Board is soliciting proxies AGAINST Proposal No. 5 and unanimously recommends that you vote AGAINST Proposal No. 5.

17

Table of Contents