UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| þ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

| For the fiscal year ended December 31, 2014 | |

| or | |

| o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

| For the transition period from ________ to _________ | |

Commission File No. 1-35526

NEONODE INC.

(Exact name of Registrant as specified in its charter)

| Delaware | 94-1517641 | |

| (State or Other Jurisdiction of | (I.R.S. Employer | |

| Incorporation or Organization) | Identification Number) |

Storgatan 23C, 114 55 Stockholm, Sweden

(Address of Principal Executive Office and Zip Code)

+46 (0) 8 667 17 17

(Registrant’s Telephone Number, including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Name of Each Exchange on Which Registered | |

| Common Stock, par value $0.001 per share | The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☒ | |

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act. Yes ¨ No ☒

The approximate aggregate market value of voting and non-voting common equity held by non-affiliates of the registrant, based on the closing price for the registrant’s common stock on June 30, 2014 (the last business day of the registrant’s most recently completed second fiscal quarter) as reported on the NASDAQ Stock Market, was $106,591,762.

The number of shares of the registrant’s common stock outstanding as of March 9, 2015 was 40,455,352.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement for the registrant’s 2015 Annual Meeting of Stockholders are incorporated by reference as set forth in Part III of this Annual Report. The registrant intends to file such definitive proxy statement with the Securities and Exchange Commission within 120 days of the registrant’s fiscal year ended December 31, 2014.

NEONODE INC.

2014 ANNUAL REPORT ON FORM 10-K

TABLE OF CONTENTS

| 2 |

SPECIAL NOTE ON FORWARD-LOOKING STATEMENTS

This Annual Report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, adopted pursuant to the Private Securities Litigation Reform Act of 1995. Statements that are not purely historical may be forward-looking. You can identify some forward-looking statements by the use of words such as “believes,” “anticipates,” “expects,” “intends” and similar expressions. Forward-looking statements involve inherent risks and uncertainties regarding events, conditions and financial trends that may affect our future plans of operation, business strategy, results of operations and financial position. A number of important factors could cause actual results to differ materially from those included within or contemplated by such forward-looking statements, including, but not limited to risks relating to the uncertainty of growth in market acceptance for our technology, our history of losses since inception, our ability to remain competitive in response to new technologies, the costs to defend, as well as risks of losing, patents and intellectual property rights, our customer concentration and dependence on a limited number of customers, a reliance on our future customers’ ability to develop and sell products that incorporate our technology, the uncertainty of demand for our technology in certain markets, the length of a product development and release cycle, our ability to manage growth effectively, our dependence on key members of our management and development team, our remediation and detection of material weaknesses in our internal control over financial reporting, and our ability to obtain adequate capital to fund future operations, For a discussion of these and other factors that could cause actual results to differ from those contemplated in the forward-looking statements, please see ‘‘Item 1A. Risk Factors’’ and elsewhere in this Annual Report, and in our publicly available filings with the Securities and Exchange Commission. Forward-looking statements reflect our analysis only as of the date of this Annual Report. Because actual events or results may differ materially from those discussed in or implied by forward-looking statements made by us or on our behalf, you should not place undue reliance on any forward-looking statement. We do not undertake responsibility to update or revise any of these factors or to announce publicly any revision to forward-looking statements, whether as a result of new information, future events or otherwise.

| 3 |

| ITEM 1. | BUSINESS |

Neonode Inc. (collectively with its subsidiaries, is referred to in this Annual Report as “Neonode”, “we”, “us”, “our”, “registrant”, or “Company”) develops and licenses user interfaces and optical infrared touch technology. Our patented technology offers multiple features including the ability to sense an object’s size, depth, velocity, pressure, and proximity to any type of surface. We license our multi-touch technology to Original Equipment Manufacturers (“OEMs”) and Original Design Manufacturers (“ODMs”) who incorporate it into devices that they produce and sell. OEMs and ODMs use our touch technology in controller designed specifically for our touch technology. Our technology licensing model allows us to focus on the development of solutions for touchscreens and touch-enabled surfaces. We do not manufacture products or components.

As of December 31, 2014, we had thirty-five technology license agreements with global OEMs and ODMs. Sixteen of our customers are currently shipping products and we anticipate other customers will initiate product shipments as they complete their final product development and release cycle throughout 2015 and onwards. In addition, we are currently developing prototype products and are engaged in product engineering design discussions with numerous global OEMs and ODMs who are in the process of qualifying our touch technology for incorporation in various products. The development and release cycle for these products typically takes six to thirty-six months.

Our Company

Neonode Inc., formerly known as SBE, Inc., was incorporated in the State of Delaware on September 4, 1997. SBE’s name was changed to Neonode Inc. upon the completion of a merger on August 10, 2007 between SBE and the parent company of Neonode AB, a company founded in February 2004 and incorporated in Sweden. As a result of the merger, the business and operations of Neonode AB became the primary business and operations of Neonode Inc. Our principal executive office is located in Stockholm, Sweden. Our office in the United States is located in Santa Clara, California.

| 4 |

In 2008, we established a subsidiary Neonode Technologies AB to develop and license touchscreen technology. In 2013, we established additional subsidiaries: Neonode Japan Inc., (Japan); Neno User Interface Solutions AB (Sweden); NEON Technology Inc. (U.S.); and Neonode Americas Inc. (U.S.). In 2014, we established one additional subsidiary: Neonode Korea Ltd. (South Korea). In 2015, we have established one additional subsidiary as of the filing date of this Annual Report: Neonode Taiwan Ltd.

Our Touch Solution

We develop and license user interface and touch solutions. We offer our patented family of touch solutions under the registered trademarks MultiSensing® and zForce®. Our optical touch technology is capable of projecting a full plane of light beams in free air or over any flat touch surface. Our technology can also send light into a fluid or a glass to achieve a flush design without a bezel. An object touching the touch surface obstructs a portion of the projected light beams. This small variance of signal is detected with sensitive light sensors connected to our touch controllers that process the analog signals and produce touch object coordinates.

For users, our solution provides “sense enablement” through touch and proximity sensing. Consumers experience our technology in products such as laptop computers, all-in-one computers and stand-alone monitors running on Microsoft Windows and Google Chrome operating systems, printer products, GPS devices, e-Readers, tablets, touch panels for automobiles, household appliances, mobile phones, wearable electronics, games and toys. In addition to traditional screens, our technology can make any surface – including water and air – touch functional.

For OEMs and ODMs, our solution offers industrial design flexibility, low power consumption, and cost-effective manufacturing. OEMS and ODMs can incorporate our touch technology into a wide range of devices such as tablets and e-Readers, printers, computers, mobile phones, wearables, toys and gaming consoles, and advanced automotive infotainment systems. We also offer engineering consulting services to our OEM and ODM customers on a flat rate or hourly rate basis.

Touch Technologies

There are various technologies for touchscreen and touch-enabled surfaces available in the market with differing profiles, power consumption, level of maturity, and cost:

| · | Optical touch technology uses light beams that are broken, reflected by a finger or other non-conductive object to detect a touch. |

| · | Capacitive touchscreens typically use one or several layers of transparent conductive material typically indium tin oxide applied to the inner structure of the LCD or on a glass or plastic layer in front on the LCD to sense touch activation. |

| · | Resistive touchscreens use conductive and resistive layers separated by thin space. |

| · | Acoustic pulse recognition touch technology uses piezoelectric transducers at positions of the screen to turn the mechanical energy of a touch vibration into an electronic signal. |

| · | Surface acoustic wave touchscreens use ultrasonic waves that pass over the screen. | |

| · | In-cell optical touch technology embeds photo sensors or conductive sensors directly into a Liquid Crystal Display (“LCD”) glass to act like a low-resolution camera to “see” the shadow of the finger. | |

| · | Dispersive signal touch technology uses sensors to detect the mechanical energy in the glass occurring due to a touch. |

The two dominant types of touchscreen technologies available are capacitive and resistive. A capacitive touchscreen reacts to a conductive object by sensing the difference in capacitance between two areas on the sensor surface or between the finger and the ground. Capacitive touchscreens are suitable if the user has unimpeded contact between the finger and the screen. A resistive touchscreen is pressure-sensitive. Resistive touchscreens are suitable for detailed work and for selection of particular spot on a screen. Resistive technology is not useful for sweeping gestures or motion, such as zooming in and out.

Optical Touch Advantages

Our optical technology projects light across the touch surface or detection area without any need for an extra physical layer to be added. It can be used with thick gloves or any other object. Our optical touch technology also can be fully waterproofed and will provide touch functionality even when fully submerged. In addition to traditional touch interaction on the screen, our optional touch technology can be used in the free space around the screen or product using proximity sensing.

| 5 |

We believe our optical touch technology has a number of key advantages over other touch screen technologies:

| ● | Our optical technology does not require additional layers that may dilute the image quality of the display or cause unwanted reflections and glare making reading the display difficult; | |

| ● | Our optical technology is more responsive than capacitive sensor technology and, as a result, is quicker and less prone to misread; | |

| ● | Our optical technology requires no downward pressure on the touch surface in order to select or move items on the touch surface in stark contrast to resistive touch screens; | |

| ● | Our optical technology is cost-efficient due to the lower cost of materials and simple and high yield manufacturing process; | |

| ● | Our optical technology enables multiple methods of input, such as continuous tracking of multiple fingers, taps to hit keys, sweeps to zoom in or out, and gestures to write text or symbols directly on the touch surface; | |

| ● | Our optical technology works in all climates and environments and does not require any special properties from the object used; and | |

| ● | Our optical technology does not require any black space or borders on the sides of the display and can therefore enable a slimmer design around a display leading to smaller and better looking devices. |

Unlike competing technologies, our optical touch screen technology does not require glass. The removal of the glass reduces glare, enhances image clarity, optimizes power consumption, lightens weight, and lowers cost. In contrast, other touch technologies such as capacitive and resistive require a physical touch sensor layer, typically covering the display, in order to detect touches. Layering technology required to activate the capacitive and resistive sensors can be very costly. Glass or plastic layers used in capacitive touch may also increase the friction of the touch surface giving a less enjoyable feel.

Controller Chips

We develop, but do not produce controller chips or other components. Under our licensing model, our OEM and ODM customers use customized single optical controller chips developed in collaboration with Texas Instruments designed specifically for our optical touch technology. These controller chips can only be sold to customers who have a technology license agreement with Neonode.

The NN1001, the first generation optical controller chip, was developed pursuant to an Analog Device Development Agreement between Neonode and Texas Instruments entered into on February 4, 2011 and effective as of January 24, 2010. The NN1001 began shipping to customers in May 2012.

The NN1002, the second generation optical controller chip, was developed pursuant to an Analog Device Development Agreement between Neonode and Texas Instruments entered into on April 25, 2013 effective December 6, 2012. The NN1002 is currently in development and has not been released to mass production. Through December 31, 2014, we had made no payments under the NN1002 agreement.

The NN1003 is the third generation controller chip and is currently in development with a major global chip component supplier. The NN1003 is designed for large screen applications.

The NN1001, NN1002, and NN1003 controller chips are designed to simplify integration, reduce cost, and increase performance.

| · | The NN1001 and NN1002 have scanning speeds of 1000 Hz (latency down to 1ms). |

| · | The NN1002 is designed to support advanced power management and enables touch detection even when the device is in sleep or off mode. |

| · | The NN1002 is designed to consume less than 1mW at 100Hz. |

| 6 |

| · | The NN1002 and NN1003 are designed to be synchronized to touch enabled larger areas by using multiple chips. |

| · | The NN1002 and NN1003 are designed to support simultaneous scanning leading to significantly higher scanning speeds and reduced power consumption. |

Our Market

E-Readers and Tablets

Our touch technology is widely used in e-Readers and tablets. Since 2011, nearly 18 million e-Reader and tablet units have been shipped containing our touch technology by customers such as Amazon, Kobo, Barnes & Noble, Sony and Deutsche Telekom. Sony discontinued its e-Reader products in 2014 and is no longer manufacturing or shipping any e-Readers. However, Sony is currently shipping a 13.3 inch writing tablet named “Digital Paper” that integrates our technology. Customers such as LeapFrog Enterprises, Oregon Scientific and LG are shipping tablets with our technology integrated to enhance the process of children’s learnings.

Printers and Office Equipment

Photo printers and printers combining printer/scanner/fax functions typically require feature-rich menus and settings to deliver the best user experience, and OEMs increasingly are replacing mechanical buttons with touchscreen displays. We have signed agreements with the top three global leading printers and office equipment OEMs including Hewlett Packard (“HP”). HP started shipping the first consumer printer with our touch technology integrated in early 2014 and today they have more than twenty printer models on the market using our technology. Other customers currently in development phase are expected to have printers and office equipment ready for retail rollouts throughout 2016.

Computers and Monitors

Our touch technology is suitable for laptops, all-in-one computers and stand-alone monitors. Our technology provides for a state of the art modern looking industrial design with no bezels and a flush edge to edge design optimized for the new generation of LCD panels with only a few millimeters of black frame. Because it does not require any expensive and brittle glass in front of the LCD to carry the touch sensors, our touch solution can result in a 50% or more reduction in the cost to implement touch functionality and in a glare free product with up to two kilograms less weight. In addition, our technology scales over different display sizes and can handle curved displays. We have technology license agreements and are in product design phase with tier one computer and monitor OEMs that we expect will begin shipping products in the second half of 2015. We are also in the process of attaining Microsoft Windows 10 certification on top of our already received Windows 8.1 certification.

Automotive

Touch interface displays are becoming standard equipment in vehicles. Our touch technology is able to fulfill stringent requirements to operate in an automotive environment, including electrical, temperature, moisture and vibration standards. Unlike competing technologies such as resistive and projected capacitive, our optical touch solutions does not require an additional layer to be placed in front of the screen which otherwise would reduce the readability of the screen and causes glare and reflections. In the second quarter of 2013, Volvo began offering a touch-enabled Human Machine Interfaces (“HMI”) infotainment system as a dealer installed aftermarket retrofit product that uses our touch technology. In the fourth quarter of 2013, a leading Brazilian bus manufacturer, Marcopolo S.A., launched its Torino Series incorporating our touch technology. In the fourth quarter 2014, Volvo launched their new XC-90 incorporating a 9.7 inch display using our touch technology. In the fourth quarter 2014, the new MG GT was launched also using our technology. We believe that our optical touch solutions are positioned to make inroads in the automotive market by providing brighter, more readable displays, with a full operating temperature range that are easily usable while wearing gloves. We are currently engaged with several global automotive OEMs and their tier one suppliers developing automotive HMI, infotainment and innovative entry systems. These projects typically have long development cycles that can take as long as four to five years before any meaningful production and license fee generation will occur.

| 7 |

Mobile Phones, Wearables and Accessories, Games

Our touch and proximity sensor technology platform for mobile phones can be integrated in the phone or in a phone mobile phone protective case that enables an interaction with applications not only on the screen but also in the space around and above the mobile phone. We also believe our touch technology is suitable for smart watches, fitness devices, activity trackers, medical monitors, multifunction keyboards and GPS tracking devices, gaming and toy products. These market segments benefit from our touch solutions low power consumption and bill of material, geometrical design freedom (circular touch) and independence from a brittle, glossy, heavy and costly glass.

Home Electronics

Mechanical buttons, dials and membrane switches still mostly control machines in the kitchen and laundry room. New designs can make use of our touch technology with or without an underlying display. For example, touch sensitive buttons can now be a pre-printed array on metal, glass or any other material providing for easy cleaning and extremely long life without the failures and wear-out mechanisms found in mechanical buttons, switches and dials. A touch panel can include illumination without a display. A feature-rich device, like a high-end dryer design, can be streamlined and user friendly with a touch-enabled display or interaction surface. We are in discussions with OEMs in the home electronics market who are designing touch enabled products such as kitchen fans and stovetops, ovens and laundry room washers and dryers.

Distribution, Sales and Marketing

We consider OEMs and ODMs to be our primary customers. OEMs and ODMs determine the design requirements and make the overall decision regarding the use of our user interface and touch technology in their products. The use and pricing of our user interface and touch technology are governed by a technology licensing agreement.

Our sales staff solicits prospective customers and receives substantial technical assistance and support from our internal engineering resources because of the highly technical nature of our product solutions. We expect that sales will frequently result from our sales efforts that involve executive/senior management, design engineers, and our sales personnel interacting with our potential customers’ decision-makers throughout the product development and order process.

Our sales are normally negotiated and executed in U.S. Dollars.

Our sales force and marketing operations are managed out of our office in Stockholm, Sweden. Our current sales force is comprised of sales offices located in the U.S., Sweden, South Korea, Taiwan and Japan.

Technology Agreements

As of December 31, 2014, we have entered into thirty-five technology license agreements compared to thirty-three and twenty-four license agreements as of December 31, 2013 and 2012, respectively. The products related to these license agreements include e-Readers, tablets, mobile phones, commercial and consumer printers, automotive consoles, home appliances, toys and games and GPS devices.

We are dependent on a limited number of OEM and ODM customers and the loss of any one of these customers could have a material adverse effect on our future revenue stream. In the short term, we anticipate that we remain dependent on a limited number of customers for substantially all of our future revenues. Failure to anticipate or respond adequately to technological developments in our industry, changes in customer or supplier requirements or changes in regulatory requirements or industry standards, or any significant delays in the development or introduction of products or services could have a material adverse effect on our business, operating results and cash flows.

Our customers are located in the United States of America (“U.S.”), Europe and Asia.

As of December 31, 2014 three customers represented approximately 87% of the Company’s consolidated accounts receivable.

| 8 |

As of December 31, 2013 two customers represented approximately 56% of the Company’s consolidated accounts receivable.

Our net revenues for the year ended December 31, 2014 were earned from thirty-two customers. Customers who accounted for 10% or more of our net revenues during the year ended December 31, 2014 are as follows.

· Hewlett-Packard Company – 24%

· KOBO Inc. – 10%

· Leap Frog Enterprises Inc. – 11%

· Sony Corporation – 10%

Our revenues for the year ended December 31, 2013 were earned from twenty-nine customers. Customers who accounted for 10% or more of our net revenues during the year ended December 31, 2013 are as follows.

· KOBO Inc. – 28%

· Netronix Inc. – 18%

· Leap Frog Enterprises Inc. – 12%

· Sony Corporation – 11%

Our revenues for the year ended December 31, 2012 were earned from twenty customers. Customers who accounted for 10% or more of our net revenues during the year ended December 31, 2012 are as follows:

· Amazon.com Inc. – 32%

· KOBO Inc. – 26%

· Sony Corporation – 17%

Geographical Data

The following table presents our net revenues by geographic region as a percentage of total revenues for the years ended December 31:

| 2014 | 2013 | 2012 | ||||||||||

| U.S. | 60 | % | 51 | % | 73 | % | ||||||

| Japan | 11 | % | 12 | % | 19 | % | ||||||

| China | 11 | % | 9 | % | 5 | % | ||||||

| Taiwan | 8 | % | 18 | % | 1 | % | ||||||

| South-Korea | 4 | % | -- | -- | ||||||||

| Italy | 3 | % | -- | -- | ||||||||

| Sweden | 1 | % | 9 | % | 1 | % | ||||||

| Other | 2 | % | 1 | % | 1 | % | ||||||

| Total | 100 | % | 100 | % | 100 | % | ||||||

The following table presents our total assets by geographic region for the years ended December 31 (in thousands):

| 2014 | 2013 | 2012 | ||||||||||

| U.S. | $ | 7,314 | $ | 10,280 | $ | 10,990 | ||||||

| Sweden | 1,231 | 1,161 | 1,178 | |||||||||

| Asia | 57 | 30 | -- | |||||||||

| Total | $ | 8,602 | $ | 11,471 | $ | 12,168 | ||||||

Competition

The touch technologies market is intensely competitive and characterized by rapidly changing technology, evolving standards and new product releases by our competitors. Implementation of resistive touch technologies in consumer devices is exponentially declining due to limitations regarding sweep gestures, limitations on industrial design, and the negative impact on screen clarity due to film overlays.

| 9 |

Neonode is one of few companies that offer optical touch technology. Our major competition are companies offering projected capacitive (“PCAP”) technologies. PCAP is a prevalent standard in mobiles and tablets offering finger based touch and industrial design flexibility. PCAP has many suppliers competing to offer the same solution with price being a major differentiation point. OEMs regularly change PCAP suppliers in order to maintain the best pricing.

Our competitors, and the interface technology we believe they offer, include the following:

| Company | Technology | ||

| Synaptics | Capacitive; In-cell | ||

| ATMEL | Capacitive; In-cell | ||

| Cypress | Capacitive; In-cell | ||

| Maxim | Capacitive; In-cell | ||

| Tyco Electronics | Capacitive; Resistive; Surface acoustic wave | ||

| Touch International | Resistive; Capacitive |

Intellectual Property

We rely on a combination of intellectual property laws and contractual provisions to establish and protect the proprietary rights in our technology. The number of our issued and pending patents and patents filed in each jurisdiction as of December 31, 2014 is set forth in the following table:

| Jurisdiction | No. of Issued Patents | No. of Patents Pending | ||

| United States | 28 | 32 | ||

| Europe | 2 | 13 | ||

| Japan | 6 | 10 | ||

| China | 4 | 12 | ||

| South Korea | 3 | 8 | ||

| Canada | 5 | 11 | ||

| Australia | 7 | 12 | ||

| Singapore | 4 | 13 | ||

| Patent Convention Treaty | Not Applicable | 6 | ||

| Total: | 59 | 117 |

Our patents cover six main categories: user interfaces, optics, controller integrated circuits, drivers, mechanics and applications. The following table groups our patents into these six categories:

| Patents | UI | Optics | ASICs | Drivers | Mechanical | Applications | Total | |||||||

| Issued | 11 | 16 | 2 | 9 | 2 | 19 | 59 | |||||||

| Pending | 22 | 60 | 2 | 6 | 8 | 19 | 117 | |||||||

| Total | 33 | 76 | 4 | 15 | 10 | 38 | 176 |

Our user interface software may also be protected by copyright laws in most countries, including Sweden and the European Union, which do not grant patent protection for the software itself, if the software is deemed new and original. Protection can be claimed from the date of creation.

Research and Development

In fiscal years 2014, 2013 and 2012, we spent $7.4 million, $7.2 million and $5.7 million, respectively, on research and development activities. Our research and development is predominantly in-house, but is also done in collaboration with external partners and specialists.

| 10 |

Employees

On December 31, 2014, we had fifty-two employees and eleven part-time or full-time consultants. There were a total of seven employees in our general and administrative group, seven in our sales and marketing group and thirty-eight in our engineering group. We have employees located in the U.S., Sweden, Israel and Japan. None of our employees are represented by a labor union. We have experienced no work stoppages. We believe our employee relations are positive.

Additional Information

We are subject to the informational requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and we file or furnish reports, proxy statements, and other information with the Securities and Exchange Commission (“SEC”). The SEC maintains an Internet site that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC at www.sec.gov. The reports and other information filed by us with the SEC are available free of charge on the SEC’s website. The public may read and copy any materials we file with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330.

Our website is www.neonode.com. Through our website, we make available free of charge all of our filings with the SEC, including our annual reports on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form 8-K as well as Form 3, Form 4, and Form 5 reports for the Company’s directors, officers, and principal stockholders, together with amendments to those reports filed or furnished pursuant to Sections 13(a), 15(d), or 16 under the Exchange Act. These reports are available as soon as reasonably practicable after their electronic filing or furnishing with the SEC. Our website also includes corporate governance information, such as our Code of Business Conduct (including Code of Ethics for the Chief Executive Officer and Senior Financial Officers) and Board Committee Charters. We are not including the information contained on our website as part of, nor incorporating it by reference into, this Annual Report.

| ITEM 1A. | RISK FACTORS |

An investment in our common stock involves a high degree of risk. Before deciding to purchase, hold, or sell our common stock, you should consider carefully the risks described below in addition to the cautionary statements and risks described elsewhere and the other information contained in this Annual Report and in our other filings with the SEC, including subsequent reports on Forms 10-Q and 8-K. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also impair our business operations. If any of these known or unknown risks or uncertainties actually occurs, our business, financial condition, results of operations or cash flows could be seriously harmed. This could cause the trading price of our common stock to decline, resulting in a loss of all or part of your investment.

Risks Related To Our Business

We are dependent on a limited number of customers.

Our net revenues for the year ended December 31, 2014 were earned from thirty-two customers. During the year ended December 31, 2014, four customers represented approximately 55% of our consolidated net revenues.

Our customer concentration may change significantly from period-to-period depending on a customer’s product cycle and changes in our industry. The loss of a major customer, a reduction in net revenues of a major customer for any reason, or a failure of a major customer to fulfill its financial or other obligations due to us could have a material adverse effect on our business, financial condition, and future revenue stream.

We are dependent on the ability of our customers to design, manufacture and sell their products that incorporate our touch technology, particularly in markets other than e-Readers and tablets.

We generate revenue through technology licensing agreements with companies which must be successful in designing, manufacturing and selling their products that incorporate our touch technology. The majority of our license fees earned in 2014, 2013 and 2012 were from customer shipments of e-Reader and tablet products. We expect that customer shipments of e-Readers and tablet products will decline in the future. If we are unable to expand our licenses beyond e-Readers and tablets or if our customers are not able to design, manufacture or sell their products, or are delayed in producing their products, our revenues, profitability, and liquidity, as well as our brand image, may be adversely affected.

| 11 |

The length of a customer’s product development and release cycle depends on many factors outside of our control and could cause us to incur significant expenses without offsetting revenues, or revenues that vary significantly from quarter to quarter.

The development and release cycle for customer products is lengthy and unpredictable. Our customers often undertake significant evaluation and design in the qualification of our products, which contributes to a lengthy product release cycle. A customer’s decision to purchase our technology often requires a lengthy approval process undertaken by several decision makers at the customer. The typical product development and release cycle is six to thirty-six months with new customers while existing customer lead times are typically six to nine months. The development and release cycle may be longer in some cases, particularly for automotive vehicle products. There is no assurance that a customer will adopt our technology after the evaluation or design phase. The lengthy and variable development and release cycle for products may also have a negative impact on the timing of our revenues, causing our revenues and results of operations to vary significantly from quarter to quarter.

If we fail to develop and introduce new touch technology successfully and in a cost effective and timely manner, we will not be able to compete effectively and our ability to generate revenues will suffer.

We operate in a highly competitive, rapidly evolving environment, and our success depends on our ability to develop and introduce new touch technology that our customers and end users choose to buy. If we are unsuccessful at developing new touch technology that are appealing to our customers and end users with acceptable functionality, quality, prices and terms, we will not be able to compete effectively and our ability to generate revenues will suffer. The development of new touch technology is very difficult and requires high levels of innovation and competence. The development process is also lengthy and costly. If we fail to anticipate our end users’ needs or technological trends accurately or if we are unable to complete development in a cost effective and timely fashion, we will be unable to introduce new touch technology into the market or successfully compete with other providers. As we introduce new or enhanced touch technology or integrate new touch technology into new or existing customer products, we face risks including, among other things, disruption in customers’ ordering patterns, inability to deliver new touch technology to meet customers’ demand, possible product and technology defects, and potentially unfamiliar sales and support environments. Premature announcements or leaks of new products, features, or technologies may exacerbate some of these risks. Our failure to manage the transition to newer touch technology or the integration of newer technology into new or existing customer products could adversely affect our business, results of operations, and financial condition.

We are dependent on Texas Instruments as a component supplier for our technology.

Our business operates upon a technology licensing model. We do not manufacture products or components. Under our licensing model, OEMs and ODMs manufacture or contract to manufacture controller chips containing our touch technology. As an alternative to sourcing controller chips, our customers may opt to use customized NN1001 and NN1002 optical controller chips developed in collaboration with Texas Instruments designed specifically for our optical touch technology. These controller chips can only be sold to customers who have a technology license agreement with us. As part of their product development process, our customers must qualify the chip components used in our products. If the controller chips provided by Texas Instruments experience quality control problems, our technology may be disqualified by one or more of our customers. Our dependence on Texas Instruments to supply controller chips with our touch technology exposes us to a number of risks including their inability to obtain an adequate supply of components, the failure to meet our customer requirements, or their failure to remain in business or adjust to market conditions. If our customers are unable to obtain controller chips with our touch technology, we may not be able to meet demand, which could have a material adverse effect on our business, financial condition, results of operations and cash flows.

Our operating results may fluctuate significantly as a result of a variety of factors, many of which are outside of our control.

As a result of our limited operating history and the nature of the markets in which we compete, it is extremely difficult for us to forecast accurately. We base our current and future expense levels largely on our investment plans and estimates of future events, although certain of our expense levels are, to a large extent, fixed. We may be unable to adjust spending in a timely manner to compensate for any unexpected revenue shortfall. Accordingly, any significant shortfall in revenues relative to our planned expenditures would have an immediate adverse effect on our business, results of operations and financial condition.

| 12 |

In addition, we are subject to the following factors, among others, that may negatively affect and cause fluctuations in our operating results:

| · | the announcement or introduction of new products or technologies by our competitors; | |

| · | our ability to upgrade and develop our infrastructure to accommodate growth; | |

| · | our ability to attract and retain key personnel in a timely and cost effective manner; | |

| · | technical difficulties; | |

| · | the amount and timing of operating costs and capital expenditures relating to the expansion of our business, operations, and infrastructure; and | |

| · | general economic conditions as well as economic conditions specific to the touchscreen industry. |

Further, as a strategic response to changes in the competitive environment, we may from time to time make certain pricing, service, or marketing decisions that could have a material and adverse effect on our business, results of operations, and financial condition. Due to the foregoing factors, our revenues and operating results are and will remain difficult to forecast.

We have had a history of losses and may require additional capital to fund our operations, which capital may not be available on commercially attractive terms or at all.

We have experienced substantial net losses in each fiscal period since our inception. These net losses resulted from a lack of substantial revenues and the significant costs incurred in the development and acceptance of our technology. We may in the future require sources of capital in addition to cash on hand to continue operations and to implement our business plan. We project that we have sufficient liquid assets to continue operating for at least the next twelve months. However, if our operations do not become cash flow positive, we may be forced to seek credit line facilities from financial institutions, equity investments, or debt arrangements. No assurances can be given that we will be successful in obtaining such additional financing on reasonable terms, or at all. If adequate funds are not available when needed on acceptable terms, or at all, we may be unable to adequately fund our business plan, which could have a negative effect on our business, results of operations, and financial condition.

We must significantly enhance our sales and technology development organizations.

We will need to improve the effectiveness and breadth of our sales efforts in order to increase market awareness and sales of our technology, especially as we expand into new market segments. Competition for qualified sales personnel is intense, and we may not be able to hire the kind and number of sales personnel we are targeting. Likewise, our efforts to improve and refine our technology require skilled engineers and programmers. Competition for professionals capable of expanding our research and development efforts is intense due to the limited number of people available with the necessary technical skills. If we are unable to identify, hire, or retain qualified sales, marketing, and technical personnel, our ability to achieve future revenue may be adversely affected.

We will need to increase the size of our organization, and we may be unable to manage our growth effectively.

Our failure to manage growth effectively could have a material and adverse effect on our business, results of operations and financial condition. We anticipate that expansion of our organization will be required to address internal growth to handle licensing and research activities. This expansion may place a significant strain on management, operational, and financial resources. To manage the expected growth of our operations and personnel, we must both improve our existing operational and financial systems, procedures, and controls, and implement new systems, procedures, and controls. We must also expand our finance, administrative, and operations staff. Our current personnel, systems, procedures, and controls may not adequately support future operations. Management may be unable to hire, train, retain, motivate, and manage the necessary personnel, or to identify, manage and exploit existing and potential strategic relationships and market opportunities.

| 13 |

We may make acquisitions and strategic investments that are dilutive to existing shareholders, resulting in unanticipated accounting charges or otherwise adversely affect our results of operations.

We may decide to grow our business through business combinations or other acquisitions of businesses, products or technologies that allow us to complement our existing touch technology offerings, expand our market coverage, increase our workforce or enhance our technological capabilities. If we make any future acquisitions, we could issue stock that would dilute our shareholders’ percentage ownership or we may incur substantial debt, reduce our cash reserves and/or assume contingent liabilities. Further, acquisitions and strategic investments may result in material charges, adverse tax consequences, substantial depreciation, deferred compensation charges, in-process research and development charges, and the amortization of amounts related to deferred compensation and identifiable purchased intangible assets or impairment of goodwill. Any of these could negatively impact our results of operations.

We are dependent on the services of our key personnel.

Our senior management team consists of two executive officers. Our Chief Executive Officer is one of the founders of our Company. The unplanned loss of the services of any member of management could have a materially adverse effect on our operations and future prospects.

Our revenues and growth are dependent on licensing fees from our intellectual property.

Our success depends in large part on our proprietary technology and other intellectual property rights. We rely on a combination of patents, copyrights, trademarks and trade secrets, confidentiality provisions, and licensing arrangements to establish and protect our proprietary rights. Our intellectual property, particularly our patents, may not provide us with a significant competitive advantage. If we fail to protect or to enforce our intellectual property rights successfully, our competitive position could suffer, which could harm our results of operations. Our pending patent applications for registration may not be allowed, or others may challenge the validity or scope of our patents. Even if our patents registrations are issued and maintained, these patents may not be of adequate scope or benefit to us or may be held invalid and unenforceable against third parties. We may need to expend significant resources to secure and protect our intellectual property. The loss of intellectual property rights may adversely impact our ability to generate revenues and expand our business.

If third parties infringe upon our intellectual property, we may expend significant resources enforcing our rights or suffer competitive injury.

Existing laws, contractual provisions and remedies afford only limited protection for our intellectual property. We may be required to spend significant resources to monitor and police our intellectual property rights. Effective policing of the unauthorized use of our technology or intellectual property is difficult and litigation may be necessary in the future to enforce our intellectual property rights. Intellectual property litigation is not only expensive, but time-consuming, regardless of the merits of any claim, and could divert attention of our management from operating the business. Intellectual property lawsuits are subject to inherent uncertainties due to, among other things, the complexity of the technical issues involved, and we cannot assure you that we will be successful in asserting our intellectual property rights. Attempts may be made to copy or reverse engineer aspects of our technology or to obtain and use information that we regard as proprietary. We may not be able to detect infringement and may lose competitive position in the market before they do so. In addition, competitors may design around our technology or develop competing technologies. We cannot assure you that we will be able to protect our proprietary rights against unauthorized third party copying or use. The unauthorized use of our technology or of our proprietary information by competitors could have an adverse effect on our ability to sell our technology.

The laws of foreign countries may not provide protection of our intellectual property rights to the same extent as the laws of the United States, which may make it more difficult for us to protect our intellectual property.

As part of our business strategy, we target customers and relationships with suppliers and original equipment manufacturers in countries with large populations and propensities for adopting new technologies. However, many of these countries do not address misappropriation of intellectual property nor deter others from developing similar, competing technologies or intellectual property. Effective protection of patents, copyrights, trademarks, trade secrets and other intellectual property may be unavailable or limited in some foreign countries. In particular, the laws of some foreign countries in which we do business may not protect our intellectual property rights to the same extent as the laws of the United States. As a result, we may not be able to effectively prevent competitors in these regions from infringing our intellectual property rights, which could reduce our competitive advantage and ability to compete in those regions and negatively impact our business.

| 14 |

We have an international presence in countries and must manage currency risks.

A significant portion of our business is conducted in currencies other than the U.S. dollar (the currency in which our consolidated financial statements are reported), primarily the Swedish Krona and, to a lesser extent, the Euro, Japanese Yen and Korean Won. For the year ended December 31, 2014, our revenues from the U.S., Asia, and Europe were 60%, 35%, and 5% respectively. We incur a significant portion of our expenses in Swedish Krona, including a significant portion of our research and development expenses and a substantial portion of our general and administrative expenses. As a result, appreciation of the value of the Swedish Krona relative to the other currencies, particularly the U.S. dollar, could adversely affect operating results. We do not currently undertake hedging transactions to cover our currency exposure, but we may choose to hedge a portion of our currency exposure in the future as it deems appropriate.

If we are unable to remediate and detect material weaknesses in our internal control, our financial report and our Company may be adversely affected.

As discussed in “Part II—Item 9A—Controls and Procedures,” our management has concluded that we did not have adequate controls designed and in place for our quarterly and annual financial close processes relating to intercompany adjustments and accounting for complex transactions. Although this control deficiency did not result in a material misstatement in the consolidated financial statements, we have concluded that material weaknesses exist in our internal control over financial reporting. We are currently working to remediate the material weaknesses. We cannot be sure when we will successfully remediate the material weaknesses or whether compensating controls will be effective before then in preventing or detecting material errors. The remediation may require substantial time and resources to successfully implement. Moreover, these material weaknesses and the financial statement errors we have had in the past or may have in the future could cause investors, creditors, distributors, customers, rating agencies, regulators and others to lose confidence in the effectiveness of our internal controls and the accuracy of our financial statements and other information, all of which could have a material adverse impact on our business, results of operations and financial condition.

Risks Related to Owning Our Stock

Our certificate of incorporation and bylaws and the Delaware General Corporation Law contain provisions that could delay or prevent a change in control.

Our Board of Directors has the authority to issue up to 1,000,000 shares of preferred stock and to determine the price, rights, preferences and privileges of those shares without any further vote or action by the stockholders. The rights of the holders of common stock will be subject to, and may be materially adversely affected by, the rights of the holders of any preferred stock that may be issued in the future. The issuance of preferred stock could have the effect of making it more difficult for a third party to acquire a majority of our outstanding voting stock. Furthermore, certain other provisions of our certificate of incorporation and bylaws may have the effect of delaying or preventing changes in control or management, which could adversely affect the market price of our common stock. In addition, we are subject to the provisions of Section 203 of the Delaware General Corporation Law, an anti-takeover law.

Our stock price has been volatile, and your investment in our common stock could suffer a decline in value.

There has been significant volatility in the market price and trading volume of equity securities, which is unrelated to the financial performance of the companies issuing the securities. These broad market fluctuations may negatively affect the market price of our common stock. You may not be able to resell your shares at or above the price you pay for those shares due to fluctuations in the market price of our common stock caused by changes in our operating performance or prospects, and other factors.

Some factors that may have a significant effect on our common stock market price include:

| · | actual or anticipated fluctuations in our operating results or future prospects; |

| · | our announcements or our competitors’ announcements of new technology; |

| 15 |

| · | the public’s reaction to our press releases, our other public announcements, and our filings with the SEC; |

| · | strategic actions by us or our competitors, such as acquisitions or restructurings; |

| · | new laws or regulations or new interpretations of existing laws or regulations applicable to our business; |

| · | changes in accounting standards, policies, guidance, interpretations or principles; |

| · | changes in our growth rates or our competitors’ growth rates; |

| · | developments regarding our patents or proprietary rights or those of our competitors; |

| · | our inability to raise additional capital as needed; |

| · | concern as to the efficacy of our technology; |

| · | changes in financial markets or general economic conditions; |

| · | sales of common stock by us or members of our management team; and |

| · | changes in stock market analyst recommendations or earnings estimates regarding our common stock, other comparable companies, or our industry generally. |

Future sales of our common stock by our stockholders could negatively affect our stock price.

During 2011 and 2013, officers and directors of Neonode sold shares of our common stock in public offerings. In May 2014, Neonode sold to an institutional investor 2,500,000 shares of common stock and a warrant that may be exercised by November 15, 2015 to purchase an additional 2,500,000 shares of our common stock at an exercise price of $5.09 per share. The common stock and shares issuable upon exercise of the warrant from the May 2014 offering can be resold pursuant to a registration statement that we filed which became effective in June 2014. Sales of a substantial number of shares of our common stock in the public market by insiders or large stockholders, or the perception that these sales might occur, could depress the market price of our common stock and could impair our ability to raise capital through the sale of additional equity securities.

Future sales of our common stock by us could adversely affect its price, and our future capital-raising activities could involve the issuance of equity securities, which would dilute your investment and could result in a decline in the trading price of our common stock.

Our long-term success is dependent on us obtaining sufficient capital to fund our operations and to develop our touch technology, and bringing our technology to the worldwide market to obtain sufficient sales volume to be profitable. We may sell securities in the public or private equity markets if and when conditions are favorable, even if we do not have an immediate need for additional capital at that time. Sales of substantial amounts of common stock, or the perception that such sales could occur, could adversely affect the prevailing market price of our common stock and our ability to raise capital. We may issue additional common stock in future financing transactions or as incentive compensation for our executive management and other key personnel, consultants and advisors. Issuing any equity securities would be dilutive to the equity interests represented by our then-outstanding shares of common stock. The market price for our common stock could decrease as the market takes into account the dilutive effect of any of these issuances. Furthermore, we may enter into financing transactions at prices that represent a substantial discount to the market price of our common stock. A negative reaction by investors and securities analysts to any discounted sale of our equity securities could result in a decline in the trading price of our common stock.

If securities analysts do not publish research or if securities analysts or other third parties publish inaccurate or unfavorable research about us, the price of our common stock could decline.

The trading market for our common stock will rely in part on the research and reports that securities analysts and other third parties choose to publish about us. We do not control these analysts or other third parties. The price of our common stock could decline if one or more securities analysts downgrade our common stock or if one or more securities analysts or other third parties publish inaccurate or unfavorable research about us or cease publishing reports about us.

| ITEM 1B. | UNRESOLVED STAFF COMMENTS |

None.

| 16 |

| ITEM 2. | PROPERTIES |

We lease 3,185 square feet of office space located at 2350 Mission College Blvd, Suite 190, Santa Clara, CA 95054 USA. The annual payment for this space equates to approximately $86,000 per year. This lease is valid through July 31, 2015. We are currently reviewing alternative office space location nearby our current location.

Our subsidiary Neonode Technologies AB leases 6,520 square feet of office space located at Storgatan 23C, Stockholm, Sweden. The annual payment for this space is approximately $443,000 per year including property tax (excluding VAT). This lease is valid through November 30, 2017. The lease can be extended on a yearly basis.

Our subsidiary Neonode Japan K.K. leases 430 square feet of office space located at 608 Bureau Shinagawa, 4-1-6 Konan, Minato-ku, 108-0075 Tokyo, Japan. This lease is valid through October 31, 2016. The annual payment for this space equates to approximately $28,000 per year.

Our subsidiary Neonode Korea Ltd. entered into a lease agreement located at B-1807, Daesung D-Polis. 543-1, Seoul, South Korea in January, 2015. This lease is valid through February 13, 2017. The annual payment for this space equates to approximately $24,000 per year.

We believe our existing facilities are in good condition and suitable for the conduct of our business.

| ITEM 3. | LEGAL PROCEEDINGS |

We are not currently involved in any material legal proceedings. However, from time to time, we may become subject to legal proceedings, claims, and litigation arising in the ordinary course of business, including, but not limited to, employee, customer and vendor disputes.

| ITEM 4. | MINE SAFETY DISCLOSURES |

Not applicable.

| ITEM 5. | MARKET FOR THE REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Market Information

Our common stock is quoted on the NASDAQ Stock Market under the symbol NEON. Shares of our common stock commenced trading on the NASDAQ Stock Market on May 1, 2012. Set forth below are the high and low sales prices for our common stock for the quarterly periods indicated.

| Fiscal Quarter Ended | ||||||||||||||||

| March 31 | June 30 | September 30 | December 31 | |||||||||||||

| Fiscal 2014 | ||||||||||||||||

| High | $ | 7.80 | $ | 6.20 | $ | 3.50 | $ | 3.48 | ||||||||

| Low | $ | 5.50 | $ | 2.44 | $ | 1.94 | $ | 1.72 | ||||||||

| Fiscal 2013 | ||||||||||||||||

| High | $ | 6.39 | $ | 6.21 | $ | 8.84 | $ | 6.82 | ||||||||

| Low | $ | 4.48 | $ | 5.02 | $ | 5.75 | $ | 4.96 | ||||||||

Holders

As of March 9, 2015, there were approximately 114 stockholders of record of our common stock. We estimate that there were approximately 5,400 stockholders as of February 23, 2015 whose shares were held in “street name” by brokers and other institutions on behalf of stockholders of record.

| 17 |

Dividends

There are no restrictions on our ability to pay dividends. It is currently the intention of the Board of Directors to retain all earnings, if any, for use in our business and we do not anticipate paying cash dividends in the foreseeable future. Any future determination as to the payment of dividends will depend, among other factors, upon our earnings, capital requirements, operating results and financial condition.

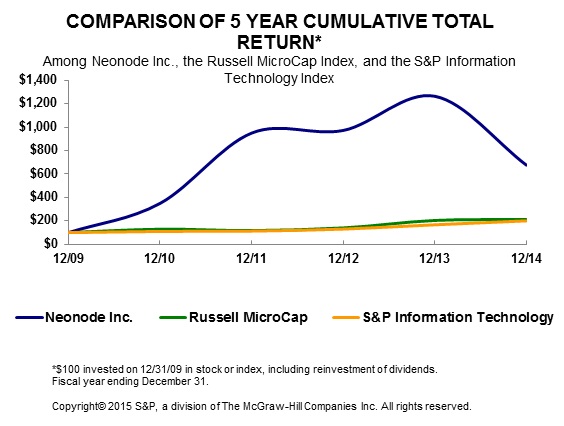

Stock Performance Graph

The graph below compares the cumulative total shareholder return on our common stock with the cumulative total returns of the Russell MicroCap index and the S&P Information Technology index. The graph tracks the performance of a $100 investment in our common stock and in each index (with the reinvestment of all dividends) from December 31, 2009 to December 31, 2014. The stock price performance included in this graph is not necessarily indicative of future stock price performance.

| 12/09 | 12/10 | 12/11 | 12/12 | 12/13 | 12/14 | |||||||||||||||||||

| Neonode Inc. | 100.00 | 349.50 | 950.00 | 972.00 | 1264.00 | 676.00 | ||||||||||||||||||

| Russell MicroCap | 100.00 | 128.89 | 116.93 | 140.02 | 203.90 | 211.34 | ||||||||||||||||||

| S&P Information Technology | 100.00 | 110.19 | 112.84 | 129.57 | 166.41 | 199.89 |

The stock performance graph above shall not be deemed incorporated by reference into any filing by us under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except to the extent that we specifically incorporate such information by reference, and shall not otherwise be deemed filed under such Acts.

| ITEM 6. | SELECTED FINANCIAL DATA |

The following table of selected financial information should be read in conjunction with our consolidated financial statements and related notes thereto included elsewhere in this Annual Report.

| 18 |

| As of or for the Year Ended December 31, | ||||||||||||||||||||

| 2014 | 2013 | 2012 | 2011 | 2010 | ||||||||||||||||

| (In thousands, except per share data) | ||||||||||||||||||||

| Financial Results: | ||||||||||||||||||||

| Total net revenues | $ | 4,740 | $ | 3,717 | $ | 7,137 | $ | 6,067 | $ | 440 | ||||||||||

| Net loss | (14,234 | ) | (13,080 | ) | (9,287 | ) | (17,145 | ) | (31,626 | ) | ||||||||||

| Per Share: | ||||||||||||||||||||

| Basic and diluted loss per share | $ | (0.36 | ) | $ | (0.37 | ) | $ | (0.28 | ) | $ | (0.64 | ) | $ | (1.73 | ) | |||||

| Weighted average number of shares outstanding | 39,532 | 35,266 | 33,003 | 26,784 | 18,293 | |||||||||||||||

| Financial Position: | ||||||||||||||||||||

| Total assets | $ | 8,602 | $ | 11,471 | $ | 12,168 | $ | 16,627 | $ | 1,251 | ||||||||||

| Total liabilities | 5,332 | 5,123 | 4,068 | 2,954 | 11,115 | |||||||||||||||

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

The following discussion and analysis should be read in conjunction with our consolidated financial statements and the related notes thereto included elsewhere in this Annual Report.

Overview

Neonode develops and licenses user interfaces and optical infrared touch technology. Our patented technology offers multiple features including the ability to sense an object’s size, depth, velocity, pressure, and proximity to any type of surface. We offer our family of touch solutions under the name MultiSensing. Our MultiSensing offerings are based upon our patented technology we call zForce. We license our multi-touch technology to OEMs and ODMs who incorporate it into devices that they produce and sell. Our technology licensing model allows us to focus on the development of solutions for touchscreens and touch-enabled surfaces. We do not manufacture products or components.

As of December 31, 2014, we had thirty-five technology license agreements with global OEMs and ODMs. This compares with thirty-three and twenty-four technology license agreements as of December 31, 2013 and 2012, respectively. During the year ended December 31, 2014, we had sixteen customers using our touch technology in products that were being shipped to customers. In 2014, we received license fees from customers such as HP (printers), Leap Frog and Oregon Scientific (children’s tablets) and Volvo (after-market installed touch for their automobile infotainment systems).

The majority of our license fees earned in 2014, 2013 and 2012 were from customer shipments of e-Reader and tablets and printer products. We expect license fees earned from customer shipments of e-Readers and tablets to decrease as a percentage of total revenue as other customer products are introduced to the market. In the fourth quarter of 2012, Amazon discontinued shipping a Kindle e-Reader product that incorporated our touch technology. Amazon reintroduce it latest e-Reader product using our touch technology in the fourth quarter 2014. Revenue related to this product will be recorded in Q1 2015. We anticipate other customers will initiate product shipments as they complete their final product development and manufacturing cycle throughout 2015 and onwards.

Current and future drivers of the touch technology market include laptop computers, all-in-one and computer monitors running Microsoft Windows 8.1 and 10 and Google Chrome operating systems, printers, mobile phone cases, automotive, household appliances, tablets, e-Readers, navigation and wearables. The proliferation and mass market acceptance of touch technology have prompted new applications and uses for existing and new offerings, thus making the production and utilization of these modules one of the fastest growing tech segments.

| 19 |

The typical product development and release cycle is six to thirty-six months with new customers while existing customer lead times are typically six to nine months. During the initial cycle, there are three phases: evaluation, design, and commercialization. In the evaluation phase, prospects validate our technology and may produce short runs of prototype products. During the design phase, product development and solution definition begins. This design phase tends to be the longest and delays typically occur which may extend the term of the overall cycle. In the final phase, commercialization, the customer enters into full production mode, ships products to the market and we earn license revenue.

Critical Accounting Policies and Estimates

The consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) and include the accounts of Neonode Inc. and its wholly owned subsidiaries. All inter-company accounts and transactions have been eliminated in consolidation.

The consolidated statements of operations, comprehensive loss and cash flows for the year ended December 31, 2012 include our accounts and those of our wholly owned subsidiary, Neonode Technologies AB (Sweden).

The consolidated balance sheet at December 31, 2013 and the consolidated statements of operations, comprehensive loss and cash flows for the year ended December 31, 2013 include our accounts and those of our wholly owned subsidiaries, Neonode Technologies AB (Sweden), Neonode Americas Inc. (U.S.), Neonode Japan Inc. (Japan), NEON Technology Inc. (U.S.) and Neno User Interface Solutions AB (Sweden).

The consolidated balance sheet at December 31, 2014 and the consolidated statements of operations, comprehensive loss and cash flows for the year ended December 31, 2014 include our accounts and those of our wholly owned subsidiaries, Neonode Technologies AB (Sweden), Neonode Americas Inc. (U.S.), Neonode Japan Inc. (Japan), NEON Technology Inc. (U.S.), Neno User Interface Solutions AB (Sweden) and Neonode Korea Ltd. (South Korea).

The accounting policies affecting our financial condition and results of operations are more fully described in Note 2 to our consolidated financial statements. Certain of our accounting policies require the application of judgment by management in selecting appropriate assumptions for calculating financial estimates, which inherently contain some degree of uncertainty. Management bases its estimates on historical experience and various other assumptions that are believed to be reasonable under the circumstances. The historical experience and assumptions form the basis for making judgments about the reported carrying values of assets and liabilities and the reported amounts of revenue and expenses that may not be readily apparent from other sources. Actual results may differ from these estimates under different assumptions or conditions. We believe the following are critical accounting policies and related judgments and estimates used in the preparation of our consolidated financial statements.

Estimates

The preparation of financial statements in conformity with U.S. GAAP requires making estimates and assumptions that affect, at the date of the consolidated financial statements, the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities and the reported amounts of revenue and expenses. Actual results could differ from these estimates. Significant estimates include, but are not limited to, collectability of accounts receivable, recoverability of capitalized project costs and long-lived assets, the valuation allowance related to our deferred tax assets and the fair value of options and warrants issued for stock-based compensation.

| 20 |

Revenue Recognition

Licensing Revenues:

We derive revenue from the licensing of internally developed intellectual property (“IP”). We enter into IP licensing agreements that generally provide licensees the right to incorporate our IP components in their products with terms and conditions that vary by licensee. Fees under these agreements may include license fees relating to our IP and royalties payable following the distribution by our licensees of products incorporating the licensed technology. The license for our IP has standalone value and can be used by the licensee without maintenance and support. We follow U.S. GAAP for revenue recognition as per unit royalty products are distributed or licensed by our customers. For technology license arrangements that do not require significant modification or customization of the underlying technology, we recognize technology license revenue when: (1) we enter into a legally binding arrangement with a customer for the license of technology; (2) the customer distributes or licenses the products; (3) the customer payment is deemed fixed or determinable and free of contingencies or significant uncertainties; and (4) collection is reasonably assured. Our customers report to us the quantities of products distributed or licensed by them after the end of the reporting period stipulated in the contract, generally 30 to 45 days after the end of the month or quarter. Effective October 16, 2013, we determined it was appropriate to recognize licensing revenue in the period in which royalty reports are received, rather than the period in which the products are distributed or to which the license relates.

Explicit return rights are not offered to customers. There were no returns through December 31, 2014.

Engineering Services:

We may sell engineering consulting services to our customers on a flat rate or hourly rate basis. We recognize revenue from these services when all of the following conditions are met: (1) evidence existed of an arrangement with the customer, typically consisting of a purchase order or contract; (2) our services were performed and risk of loss passed to the customer; (3) we completed all of the necessary terms of the contract; (4) the amount of revenue to which we were entitled was fixed or determinable; and (5) we believed it was probable that we would be able to collect the amount due from the customer. To the extent that one or more of these conditions has not been satisfied, we defer recognition of revenue. Generally, we recognize revenue as the engineering services stipulated under the contract are completed and accepted by our customers. Engineering services performed under a signed statement of work (“SOW”) with a customer are accounted for under the completed contract method, as these SOW’s are short-term in nature and our total contract costs are difficult to estimate. Estimated losses on SOW projects are recognized in full as soon as they become evident.

Accounts Receivable and Allowance for Doubtful Accounts

Our accounts receivable are stated at net realizable value. Our policy is to maintain allowances for estimated losses resulting from the inability of our customers to make required payments. Credit limits are established through a process of reviewing the financial history and stability of each customer. Where appropriate, we obtain credit rating reports and financial statements of the customer when determining or modifying its credit limits. We regularly evaluate the collectability of our trade receivable balances based on a combination of factors. When a customer’s account balance becomes past due, we initiate dialogue with the customer to determine the cause. If it is determined that the customer will be unable to meet its financial obligation, such as in the case of a bankruptcy filing, deterioration in the customer’s operating results or financial position or other material events impacting its business, we record a specific allowance to reduce the related receivable to the amount we expect to recover. Should all efforts fail to recover the related receivable, we will write-off the account. We also record an allowance for all customers based on certain other factors including the length of time the receivables are past due and historical collection experience with customers.

Projects in Process

Projects in process consist of costs incurred toward the completion of various projects for certain customers. These costs are primarily comprised of direct engineering labor costs and project-specific equipment costs. These costs are capitalized on our balance sheet as an asset and deferred until revenue for each project is recognized in accordance with our revenue recognition policy.

Property and Equipment

Property and equipment are stated at cost, net of accumulated depreciation and amortization. Depreciation and amortization are computed using the straight-line method based upon estimated useful lives of the assets as follows:

Estimated useful lives

| Computer equipment | 3 years | |||

| Furniture and fixtures | 5 years |

| 21 |

Equipment purchased under capital leases is amortized on a straight-line basis over the estimated useful life of the asset or the term of the lease, whichever is shorter. Upon retirement or sale of property and equipment, cost and accumulated depreciation and amortization are removed from the accounts and any gains or losses are reflected in the consolidated statement of operations. Maintenance and repairs are charged to expense as incurred.

Long-lived Assets

We assess any impairment by estimating the future cash flow from the associated asset in accordance with relevant accounting guidance. If the estimated undiscounted future cash flow related to these assets decreases or the useful life is shorter than originally estimated, we may incur charges for impairment of these assets. As of December 31, 2014, we believe there was no impairment of our long-lived assets. There can be no assurance, however, that market conditions will not change or sufficient demand for our products and services will continue, which could result in impairment of long-lived assets in the future.

Research and Development

Research and development (“R&D”) costs are expensed as incurred. R&D costs consist mainly of personnel related costs in addition to some external consultancy costs such as testing, certifying and measurements.

Stock-Based Compensation Expense

We measure the cost of employee services received in exchange for an award of equity instruments, including share options, based on the estimated fair value of the award on the grant date, and recognize the value as compensation expense over the period the employee is required to provide services in exchange for the award, usually the vesting period, net of estimated forfeitures.