UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

þ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended June 30, 2019

Or

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ________to________

Commission file number 0-24012

DEEP WELL OIL & GAS, INC.

(Exact name of registrant as specified in its charter)

| Nevada | 98-0501168 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| Suite 700, 10150 - 100 Street, Edmonton, Alberta, Canada | T5J 0P6 | |

| (Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code: (780) 409-8144

Former name, former address and former fiscal year, if changed since last report: not applicable.

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| None | None | None | ||

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit files). Yes þ No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer o | |

| Non-accelerated filer o | Smaller reporting company þ | |

| Emerging growth company þ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No þ

As of the date of filing this quarterly report on Form 10-Q with the U.S. Securities and Exchange Commission (the “SEC”), Deep Well Oil & Gas, Inc. had outstanding 230,574,603 shares of common stock.

TABLE OF CONTENTS

| Page Number | ||

| PART I – FINANCIAL INFORMATION | ||

| ITEM 1. | CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited) | 1 |

| ITEM 2. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 11 |

| ITEM 3. | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | 18 |

| ITEM 4. | CONTROLS AND PROCEDURES | 18 |

| PART II – OTHER INFORMATION | ||

| ITEM 1. | LEGAL PROCEEDINGS | 19 |

| ITEM 1A. | RISK FACTORS | 19 |

| ITEM 2. | UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS | 19 |

| ITEM 3. | DEFAULTS UPON SENIOR SECURITIES | 19 |

| ITEM 4. | MINE SAFETY DISCLOSURES | 19 |

| ITEM 5. | OTHER INFORMATION | 19 |

| ITEM 6. | EXHIBITS | 20 |

| SIGNATURES | 21 | |

i

DEEP WELL OIL & GAS, INC. (AND SUBSIDIARIES)

Condensed Consolidated Balance Sheets

June 30, 2019 and September 30, 2018

| June 30, | September 30, | |||||||

| 2019 | 2018 | |||||||

| (Unaudited) | ||||||||

| ASSETS | ||||||||

| Current Assets | ||||||||

| Cash and cash equivalents | $ | 34,364 | $ | 298,241 | ||||

| Accounts receivable | 88,415 | 40,920 | ||||||

| Prepaid expenses | 40,615 | 24,730 | ||||||

| Total Current Assets | 163,394 | 363,891 | ||||||

| Long term investments | 399,498 | 398,055 | ||||||

| Oil and gas properties, net, based on full cost method of accounting | 22,036,030 | 21,975,868 | ||||||

| Property and equipment, net | 77,651 | 89,518 | ||||||

| TOTAL ASSETS | $ | 22,676,573 | $ | 22,827,332 | ||||

| LIABILITIES | ||||||||

| Current Liabilities | ||||||||

| Accounts payable and accrued liabilities | $ | 24,379 | $ | 45,137 | ||||

| Accounts payable and accrued liabilities – related parties | 1,210 | – | ||||||

| Total Current Liabilities | 25,589 | 45,137 | ||||||

| Asset retirement obligations (Note 7) | 501,793 | 493,467 | ||||||

| TOTAL LIABILITIES | 527,382 | 538,604 | ||||||

| Commitments and contingencies (Note 11) | ||||||||

| SHAREHOLDERS’ EQUITY | ||||||||

| Common Stock: (Note 8) | ||||||||

| Authorized: 600,000,000 shares at $0.001 par value Issued and outstanding: 230,574,603 shares (September 30, 2018 – 230,574,603 shares) | 230,574 | 230,574 | ||||||

| Additional paid in capital | 43,104,276 | 43,104,276 | ||||||

| Subscriptions receivable – related party | (15,000 | ) | ||||||

| Accumulated deficit | (21,185,659 | ) | (21,031,122 | ) | ||||

| Total Shareholders’ Equity | 22,149,191 | 22,288,728 | ||||||

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | $ | 22,676,573 | $ | 22,827,332 | ||||

See accompanying notes to the condensed consolidated financial statements

1

DEEP WELL OIL & GAS, INC. (AND SUBSIDIARIES)

(Unaudited)

Condensed Consolidated Statements of Operations and Comprehensive Loss

For the Three and Nine Months Ended June 30, 2019 and 2018

| Three Months Ended | Three Months Ended | Nine Months Ended | Nine Months Ended | |||||||||||||

| June 30, | June 30, | June 30, | June 30, | |||||||||||||

| 2019 | 2018 | 2019 | 2018 | |||||||||||||

| Revenue | $ | – | $ | – | $ | – | $ | – | ||||||||

| Royalty refunds (expenses) | – | – | – | – | ||||||||||||

| Revenue, net of royalty | – | – | – | – | ||||||||||||

| Expenses | ||||||||||||||||

| Operating expenses | 16,256 | 65,367 | 59,736 | 130,924 | ||||||||||||

| Operating expenses covered by Farmout | (16,256 | ) | (65,367 | ) | (59,736 | ) | (130,924 | ) | ||||||||

| General and administrative | 35,852 | 61,657 | 129,273 | 236,522 | ||||||||||||

| Depreciation, accretion and depletion | 11,384 | 12,956 | 34,237 | 39,031 | ||||||||||||

| Net loss from operations | (47,236 | ) | (74,613 | ) | (163,510 | ) | (275,553 | ) | ||||||||

| Other income and expenses | ||||||||||||||||

| Rental and other income | 1,210 | (39 | ) | 3,276 | 8,825 | |||||||||||

| Interest income | 1,964 | 1,526 | 5,697 | 4,427 | ||||||||||||

| Net loss and comprehensive loss | $ | (44,062 | ) | $ | (73,126 | ) | $ | (154,537 | ) | $ | (262,301 | ) | ||||

| Net loss per common share | ||||||||||||||||

| Basic and Diluted | $ | (0.00 | ) | $ | (0.00 | ) | $ | (0.00 | ) | $ | (0.00 | ) | ||||

| Weighted Average Outstanding Shares (in thousands) | ||||||||||||||||

| Basic and Diluted | 230,574 | 229,608 | 230,574 | 229,452 | ||||||||||||

See accompanying notes to the condensed consolidated financial statements

2

DEEP WELL OIL & GAS, INC. (AND SUBSIDIARIES)

(Unaudited)

Condensed Consolidated Statements of Changes in Shareholders’ Equity

For the Three and Nine Months Ended June 30, 2019 and 2018

| Common Shares | Additional Paid in | Subscription | Accumulated | |||||||||||||||||||||

| Shares | Amount | Capital | Receivable | Deficit | Total | |||||||||||||||||||

| FOR THE NINE MONTHS ENDED JUNE 30, 2018 | ||||||||||||||||||||||||

| Balance at September 30, 2017 | 229,374,605 | $ | 229,374 | $ | 42,845,292 | $ | – | $ | (20,700,991 | ) | $ | 22,373,675 | ||||||||||||

| Net operating loss for the quarter ended December 31, 2017 | – | – | – | – | (129,135 | ) | (129,135 | ) | ||||||||||||||||

| Balance at December 31, 2017 | 229,374,605 | $ | 229,374 | $ | 42,845,292 | $ | – | $ | (20,830,126 | ) | $ | 22,244,540 | ||||||||||||

| Net operating loss for the quarter ended March 31, 2018 | – | – | – | – | (60,040 | ) | (60,040 | ) | ||||||||||||||||

| Balance at March 31, 2018 | 229,374,605 | $ | 229,374 | $ | 42,845,292 | $ | – | $ | (20,890,166 | ) | $ | 22,184,500 | ||||||||||||

| Options exercised, June 2018 | 1,199,998 | 1,200 | 13,800 | – | – | 15,000 | ||||||||||||||||||

| Subscription receivable | – | – | – | (15,000 | ) | – | (15,000 | ) | ||||||||||||||||

| Distribution refund | – | – | 243,574 | – | – | 243,574 | ||||||||||||||||||

| Net operating loss for the quarter ended June 30, 2018 | – | – | – | – | (73,126 | ) | (73,126 | ) | ||||||||||||||||

| Balance at June 30, 2018 | 230,574,603 | $ | 230,574 | $ | 43,102,666 | $ | (15,000 | ) | $ | (20,963,292 | ) | $ | 22,354,948 | |||||||||||

| FOR THE NINE MONTHS ENDED JUNE 30, 2019 | ||||||||||||||||||||||||

| Balance at September 30, 2018 | 230,574,603 | $ | 230,574 | $ | 43,104,276 | $ | (15,000 | ) | $ | (21,031,122 | ) | $ | 22,288,728 | |||||||||||

| Subscription receivable collected | – | – | – | 15,000 | – | 15,000 | ||||||||||||||||||

| Net operating loss for the quarter ended December 31, 2018 | – | – | – | – | (61,441 | ) | (61,441 | ) | ||||||||||||||||

| Balance at December 31, 2018 | 230,574,603 | $ | 230,574 | $ | 43,104,276 | $ | – | $ | (21,092,563 | ) | $ | 22,242,287 | ||||||||||||

| Net operating loss for the quarter ended March 31, 2019 | – | – | – | – | (49,034 | ) | (49,034 | ) | ||||||||||||||||

| Balance at March 31, 2019 | 230,574,603 | $ | 230,574 | $ | 43,104,276 | $ | – | $ | (21,141,597 | ) | $ | 22,193,253 | ||||||||||||

| Net operating loss for the quarter ended June 30, 2019 | – | – | – | – | (44,062 | ) | (44,062 | ) | ||||||||||||||||

| Balance at June 30, 2019 | 230,574,603 | $ | 230,574 | $ | 43,104,276 | $ | – | $ | (21,185,659 | ) | $ | 22,149,191 | ||||||||||||

See accompanying notes to the condensed consolidated financial statements

3

DEEP WELL OIL & GAS, INC. (AND SUBSIDIARIES)

(Unaudited)

Condensed Consolidated Statements of Cash Flows

For the Nine months ended June 30, 2019 and 2018

| June 30, | June 30, | |||||||

| 2019 | 2018 | |||||||

| CASH PROVIDED BY (USED IN): | ||||||||

| Operating Activities | ||||||||

| Net loss | $ | (154,537 | ) | $ | (262,301 | ) | ||

| Items not affecting cash: | ||||||||

| Depreciation, accretion and depletion | 34,237 | 39,031 | ||||||

| Net changes in non-cash working capital (Note 10) | (82,928 | ) | (86,126 | ) | ||||

| Net Cash Used in Operating Activities | (203,228 | ) | (309,396 | ) | ||||

| Investing Activities | ||||||||

| Purchase of equipment | (534 | ) | – | |||||

| Investment in oil and gas properties | (80,886 | ) | (596,930 | ) | ||||

| Long term investments | 5,771 | 3,955 | ||||||

| Net Cash Used in Investing Activities | (75,649 | ) | (592,975 | ) | ||||

| Financing Activities | ||||||||

| Subscription receivable collected | 15,000 | – | ||||||

| Distribution refund | – | 243,574 | ||||||

| Net Cash Provided by Financing Activities | 15,000 | 243,574 | ||||||

| Decrease in cash and cash equivalents | (263,877 | ) | (658,797 | ) | ||||

| Cash and cash equivalents, beginning of period | 298,241 | 1,097,651 | ||||||

| Cash and cash equivalents, end of period | $ | 34,364 | $ | 438,854 | ||||

| Supplemental Cash Flow Information: | ||||||||

| Cash paid for interest | $ | – | $ | – | ||||

| Cash paid for income taxes | $ | – | $ | – | ||||

See accompanying notes to the condensed consolidated financial statements

4

DEEP WELL OIL & GAS, INC. (AND SUBSIDIARIES)

(Unaudited)

Notes to the Condensed Consolidated Financial Statements

June 30, 2019

| 1. | NATURE OF BUSINESS AND BASIS OF PRESENTATION |

Nature of Business

Deep Well Oil & Gas, Inc. was originally incorporated on July 18, 1988 under the laws of the state of Nevada as Worldwide Stock Transfer, Inc. (Worldwide Stock Transfer, Inc. later changed its name to Allied Devices Corporation) and in connection with a plan of reorganization, effective on September 10, 2003, the company was reorganized and changed its name to Deep Well Oil & Gas, Inc. (“Deep Well”).

These condensed consolidated financial statements have been prepared showing the name “Deep Well Oil & Gas, Inc. (and Subsidiaries)” (“the Company”) and the post-split common stock, with $0.001 par value.

Basis of Presentation

The interim condensed consolidated financial statements included herein have been prepared by the Company, without audit, pursuant to the rules and regulations of the Securities and Exchange Commission. Certain information and footnote disclosures normally included in financial statements prepared in accordance with accounting principles generally accepted in the United States of America (“US GAAP”) have been condensed or omitted pursuant to such rules and regulations, although the Company believes that the disclosures are adequate so as to make the information presented not misleading.

These interim condensed consolidated financial statements follow the same significant accounting policies and methods of application as the Company’s annual consolidated financial statements for the year ended September 30, 2018.

These statements reflect all adjustments, consisting solely of normal recurring adjustments (unless otherwise disclosed) which, in the opinion of management, are necessary for a fair presentation of the information contained therein. However, the results of operations for the interim periods may not be indicative of results to be expected for the full fiscal year. It is suggested that these condensed consolidated financial statements be read in conjunction with the audited consolidated financial statements and notes thereto included in the Company’s Annual Report on Form 10-K for the year ended September 30, 2018.

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES |

Basis of Consolidation

These interim condensed consolidated financial statements include the accounts of two wholly owned subsidiaries: (1) Northern Alberta Oil Ltd. (“Northern”) from the date of acquisition, being June 7, 2005, incorporated under the Business Corporations Act (Alberta), Canada; and (2) Deep Well Oil & Gas (Alberta) Ltd., incorporated under the Business Corporations Act (Alberta), Canada on September 15, 2005. All inter-company balances and transactions have been eliminated.

Crude oil and natural gas properties

The Company follows the full cost method of accounting for oil sands properties pursuant to SEC Regulation S-X Rule 4-10. The full cost method of accounting for oil and gas operations requires that all costs associated with the exploration for and development of oil and gas reserves be capitalized on a country by country basis. Such costs include lease acquisition costs, geological and geophysical expenses, carrying charges on non-producing properties, costs of drilling both productive and non-productive wells, production equipment and overhead charges directly related to acquisition, exploration and development activities.

Under the full cost method, oil and gas properties are subject to the ceiling test performed quarterly. A ceiling test write-down is recognized in net earnings if the carrying amount of a cost centre exceeds the “cost centre ceiling”. The carrying amount of the cost centre includes the capitalized costs of proved oil and natural gas properties, net of accumulated depletion and deferred income taxes. The cost centre ceiling is the sum of (A) present value of the estimated future net cash flows from proved oil and natural gas reserves using a 10 percent per year discount factor, (B) the costs of unproved properties not being amortized, and (C) the lower of cost or fair value of unproved properties included in the costs being amortized; less (D) related income tax effects. As of June 30, 2019, no ceiling test write-downs were recorded for the Company’s oil and gas properties.

5

Costs associated with unproved properties are excluded from the depletion calculation until it is determined that proved reserves are attributable or impairment has occurred. Unproved properties are assessed annually for impairment. Costs that have been impaired are included in the costs subject to depletion within the full cost pool.

Asset Retirement Obligations

The Company accounts for asset retirement obligations by recording the fair value of the estimated future cost of the Company’s plugging and abandonment obligations. The asset retirement obligation is recorded when there is a legal obligation associated with the retirement of a tangible long-lived asset and the fair value of the liability can reasonably be estimated. Upon initial recognition of an asset retirement obligation, the Company increases the carrying amount of the long-lived asset by the same amount as the liability. Over time, the liabilities are accreted for the change in their present value through charges to oil and gas production and well operations costs. The initial capitalized costs are depleted over the useful lives of the related assets through charges to depreciation, depletion, and amortization. If the fair value of the estimated asset retirement obligation changes, an adjustment is recorded to both the asset retirement obligation and the asset retirement cost.

Revisions in estimated liabilities can result from revisions of estimated inflation rates, escalating retirement costs, and changes in the estimated timing of settling asset retirement obligations. As of June 30, 2019, and September 30, 2018, asset retirement obligations amount to $501,793 and $493,467, respectively. The Company has posted bonds, where required, with the Government of Alberta based on the amount the government estimates the cost of abandonment and reclamation to be.

Foreign Currency Translation

The functional currency of the Company is the US dollar, but the functional currency of the Company’s Canadian subsidiaries is the Canadian dollar. Consequently, monetary assets and liabilities are remeasured into United States dollars at the exchange rate on the balance sheet date and non-monetary items are remeasured at the rate of exchange in effect when the assets are acquired, or obligations incurred. Revenues and expenses are remeasured at the average exchange rate prevailing during the period. Foreign currency transaction gains and losses are included in results of operations.

Financial, Concentration and Credit Risk

The Company’s consideration or related financial credit risk related to cash and cash equivalents depends on if funds are fully insured by either The Canada Deposit Insurance Corporation (“CDIC”), or The Credit Union Deposit Guarantee Corporation (“CUDGC”) deposit insurance limit. As of June 30, 2019, the Company has approximately $7,385 funds that are in excess of deposit insurance limits, which may have financial credit risk. For the Company funds that are maintained in a financial institution which has its deposits fully guaranteed by CUDGC, there is no financial credit risk.

The Company is not directly subject to credit risk resulting from the concentration of its crude oil sales. For the period ending June 30, 2019 the Company recorded no oil sales.

Basic and Diluted Net Loss Per Share

Basic net loss per share amounts are computed based on the weighted average number of shares actually outstanding. Diluted net loss per share amounts are computed using the weighted average number of common shares and common equivalent shares outstanding as if shares had been issued on the exercise of the common share rights, unless the exercise becomes antidilutive and then the basic and diluted per share amounts are the same. There were 7,380,000 potentially dilutive securities excluded from the the diluted earnings per share calculation because their effect would be antidilutive.

Recently Adopted Accounting Standards

In February 2016, the FASB issued ASU 2016-02, “Leases (Topic 842),” requiring lessees to recognize lease assets and lease liabilities for most leases classified as operating leases under previous U.S. GAAP. The guidance is effective for fiscal years beginning after December 15, 2018, with early adoption permitted. The Company will be required to use a modified retrospective approach for leases that exist or are entered into after the beginning of the earliest comparative period in the financial statements. This ASU does not apply to the Company’s oil sand leases. It may affect the equipment leases. The adoption of this standard is not expected to have a material impact on the Company’s consolidated financial statements.

Accounting Standard Update No. 2014-09, (“ASU 2014-09”) Revenue from Customers (Topic 606), became effective for us in the period ending September 30, 2018. No significant adjustment was required as a result of adopting the new revenue standard. The comparative information has not been restated and continues to be reported under the historic accounting standards in effect for those periods. The impact of the adoption of the new revenue standard is expected to be immaterial to the Company’s net income on an ongoing basis.

6

| 3. | OIL AND GAS PROPERTIES |

The Company’s oil sands acreage as of June 30, 2019, covers 37,322 gross acres (29,383 net acres) of land under nine oil sands leases. Until the Company extends its oil sands leases “into perpetuity”, based on the Alberta governmental regulations, the lease expiration dates of the Company’s nine oil sands leases are as follows:

| 1. | 14,549 gross acres (8,571 net acres) under five oil sands leases were set to expiry on July 10, 2018 and were subsequently granted continuation under the Alberta Oil Sands Tenure regulations and have no set expiry date. In November 2017, the Company’s joint venture partner and operator of two of the five oil sands leases, submitted two continuation applications to the Alberta Oil Sands Tenure division to apply to continue 7,591 gross acres (1,898 net acres) and in January 2018, approval was received from Alberta Energy to continue 6,958 gross acres (1,740 net acres). In June 2018, the Company as operator of three of these five oil sands leases, submitted three continuation applications to the Alberta Oil Sands Tenure division to apply to continue another 7,591 gross acres (6,832 net acres) where resources were identified and in July 2018 and April 2019, approval was received from Alberta Energy to continue 7,591 gross acres (6,832 net acres). Of these five oil sands leases that were set to expiry on July 10, 2018, a total of 5,693 gross acres (4,713 net acres) expired without being continued. These expired lands were primarily areas where the Company determined that there was no or limited exploitable resources. These continued leases have no future expiry dates but are subject to yearly escalating rental payments until they are deemed to be producing leases; |

| 2. | 19,610 gross acres (17,649 net acres) under three northern oil sands leases are set to expire on August 19, 2019. The Company applied for a term extension on these three northern oil sands leases, however it is not certain if an extension will be granted by Alberta Energy; and |

| 3. | 3,163 gross acres (3,163 net acres) under one oil sands lease are set to expire on April 9, 2024. It is the Company’s opinion that they have already met the governmental requirements for this lease and they will be applying to continue this lease into perpetuity. |

Lease Rental Commitments

The Company has acquired interests in certain oil sands properties located in North Central Alberta, Canada. The lease terms include certain commitments related to oil sands properties that require the payments of yearly rents. As required by the Oil Sands Tenure Regulation of the Mines and Minerals Act of Alberta continued oil sands leases past their expiry dates are subject to escalating rental payments in respect of each term year of a continued lease that is designated as non-producing less any eligible research costs, exploration costs and development costs that are incurred in the term year of a continued lease. Escalating rent is payable at the end of each term year, while annual rent for leases are due at the beginning of each term year. Lessees of continued oil sands leases may reduce or eliminate their escalating rent obligations by conducting exploration or development work, or research, on the non-producing lease. As of June 30, 2019, excluding any eligible research, exploration and or development costs that may be used to reduce the Company’s yearly escalating future rents, the following table sets out the estimated net payments due under this commitment, which could be as high:

| (USD $) | (Cdn $) | |||||||

| 2019 | $ | 11,125 | 14,559 | |||||

| 2020 | $ | 20,648 | 27,022 | |||||

| 2021 | $ | 19,621 | 25,678 | |||||

| 2022 | $ | 26,543 | 34,738 | |||||

| 2023 | $ | 23,376 | 30,592 | |||||

| Subsequent | $ | 126,122 | 165,058 | |||||

The Company follows the full cost method of accounting for costs of oil properties. Under this method, oil and gas properties, for which no proved reserves have been assigned, must be assessed at least annually to ascertain whether or not a write down should occur. Unproven properties are assessed annually, or more frequently as economic events indicate, for potential write down.

This consists of comparing the carrying value of the asset with the asset’s expected future undiscounted cash flows without interest costs. Estimates of expected future cash flows represent management’s best estimate based on reasonable and supportable assumptions. Proven oil properties are reviewed for any write down on a field-by-field basis. No write downs were recognized for the period ended June 30, 2019.

7

Capitalized costs of proven oil properties will be depleted using the unit-of-production method when the property is placed in production.

Substantially all of the Company’s oil activities are conducted jointly with others. The accounts reflect only the Company’s proportionate interest in such activities.

| 4. | CAPITALIZATION OF COSTS INCURRED IN OIL AND GAS ACTIVITIES |

The following table illustrates capitalized costs relating to oil producing activities for the nine months ended June 30, 2019 and the fiscal year ended September 30, 2018:

| June 30, 2019 | September 30, 2018 | |||||||

| Unproved Oil and Gas Properties | $ | 22,140,305 | $ | 22,071,787 | ||||

| Accumulated Depreciation and Depletion | (104,275 | ) | (95,919 | ) | ||||

| Net Capitalized Cost | $ | 22,036,030 | $ | 21,975,868 | ||||

Depreciation and depletion expense for the nine months ended June 30, 2019 and 2018 were $8,356 and $8,356 respectively.

| 5. | EXPLORATION ACTIVITIES |

The following table presents information regarding the Company’s costs incurred in the oil property acquisition, exploration and development activities for the nine months ended June 30, 2019 and the fiscal year ended September 30, 2018:

| June 30, 2019 | September 30, 2018 | |||||||

| Acquisition of Properties: | ||||||||

| Proved | $ | – | $ | – | ||||

| Unproved | $ | – | $ | 38,185 | ||||

| Exploration costs | $ | 68,518 | $ | 710,012 | ||||

| Development costs | $ | – | $ | – | ||||

| 6. | SIGNIFICANT TRANSACTIONS WITH RELATED PARTIES |

Accounts payable – related parties were $1,210 as of June 30, 2019 (September 30, 2018 - $Nil) for expenses to be reimbursed to directors. This amount is unsecured, non-interest bearing, and has no fixed terms of repayment.

Subscriptions receivable – related parties was $Nil as of June 30, 2019 (September 30, 2018 - $15,000) for the amount owed to the Company from one director for the exercise of his stock options.

As of June 30, 2019, officers, directors, their families, and their controlled entities have acquired 53.96% of the Company’s outstanding common capital stock. This percentage does not include unexercised warrants or stock options.

The Company incurred expenses $101,574 to one related party, Concorde Consulting, and entity controlled by a director, for professional fees and consulting services provided to the Company during the period ended June 30, 2019 (June 30, 2018 - $105,840). These amounts were fully paid as of June 30, 2019.

| 7. | ASSET RETIREMENT OBLIGATIONS |

The total future asset retirement obligation is estimated by management based on the Company’s net working interests in all wells and facilities, estimated costs as determined by the Alberta Energy Regulator to reclaim and abandon wells and facilities and the estimated timing of the costs to be incurred in future periods. At June 30, 2019, the Company estimates the undiscounted cash flows related to asset retirement obligation to total approximately $617,565 (September 30, 2018 - $624,354). The fair value of the liability at June 30, 2019 is estimated to be $501,793 (September 30, 2018 - $493,467) using a risk-free rate of 3.74% and an inflation rate of 2%. The actual costs to settle the obligation are expected to occur in approximately 24 years.

8

Changes to the asset retirement obligation were as follows:

| June 30, 2019 | September 30, 2018 | |||||||

| Balance, beginning of period | $ | 493,467 | $ | 493,411 | ||||

| Liabilities incurred | – | |||||||

| Effect of foreign exchange | (5,156 | ) | (17,893 | ) | ||||

| Disposal | – | – | ||||||

| Accretion expense | 13,482 | 17,949 | ||||||

| Balance, end of period | $ | 501,793 | $ | 493,467 | ||||

| 8. | COMMON STOCK |

Common Stock Issued and Outstanding

As of June 30, 2019, the Company had outstanding 230,574,603 shares of common stock.

| 9. | STOCK OPTIONS |

Between June 8 to 10, 2018, five directors, two contractors and one employee of the Company, exercised a total of 3,150,000 option shares at an exercise price of $0.05 by way of a cashless exercise to acquire a total of 899,998 common shares of the Company, based upon the market value of the Company’s common stock of $0.07 per share on June 8, 2018, whereby 2,250,002 common shares were withheld by the Company to pay for the exercise price of the options. The stock certificates from the latest exercise of stock options are currently held in escrow upon final approval and release by Management of the Company.

On June 19, 2018, one director of the Company acquired 300,000 common shares of the Company upon exercising stock options, at an exercise price of $0.05 per common share for total gross proceeds to the Company of $15,000.

On October 28, 2018, 250,000 stock options previously granted on October 28, 2013 to a contractor for services in connection with the Farmout Agreement, expired unexercised.

On December 4, 2018, 450,000 stock options previously granted on December 4, 2013 to one director, expired unexercised.

For the period ended June 30, 2019, the Company recorded no share-based compensation expense related to stock options (September 30, 2018 – $Nil). As of June 30, 2019, there was no unrecognized compensation cost related to option awards. Compensation expense is based upon straight-line depreciation of the grant-date fair value over the vesting period of the underlying unit option.

| Shares Underlying Options Outstanding | Shares Underlying Options Exercisable | |||||||||||||||||||

| Range of Exercise Price | Shares Underlying Options Outstanding | Weighted Average Remaining Contractual Life | Weighted Average Exercise Price | Shares Underlying Options Exercisable | Weighted Average Exercise Price | |||||||||||||||

| $0.38 at June 30, 2019 | 6,780,000 | 0.22 | $ | 0.38 | 6,780,000 | $ | 0.38 | |||||||||||||

| $0.23 at June 30, 2019 | 600,000 | 0.38 | $ | 0.23 | 600,000 | $ | 0.23 | |||||||||||||

| 7,380,000 | 0.24 | $ | 0.37 | 7,380,000 | $ | 0.37 | ||||||||||||||

The aggregate intrinsic value of exercisable options as of June 30, 2019, was $Nil (September 30, 2018 - $Nil).

9

The following is a summary of stock option activity as at June 30, 2019:

| Number of Underlying Shares | Weighted Average Exercise Price | Weighted Average Fair Market Value | ||||||||||

| Balance, September 30, 2018 | 8,080,000 | $ | 0.36 | $ | 0.29 | |||||||

| Expired, October 28, 2018 | (250,000 | ) | 0.30 | 0.30 | ||||||||

| Expired, December 4, 2018 | (450,000 | ) | 0.34 | 0.36 | ||||||||

| Balance, June 30, 2019 | 7,380,000 | $ | 0.37 | $ | 0.29 | |||||||

| Exercisable, June 30, 2019 | 7,380,000 | $ | 0.37 | $ | 0.29 | |||||||

There were no remaining unvested stock options outstanding as of June 30, 2019 (September 30, 2018 – Nil).

| 10. | CHANGES IN NON-CASH WORKING CAPITAL |

| Nine months ended | Nine months ended | |||||||

| June 30, 2019 | June 30, 2018 | |||||||

| Accounts receivable | $ | (47,495 | ) | (13,728 | ) | |||

| Prepaid expenses | (15,885 | ) | 6,243 | |||||

| Accounts payable | (19,548 | ) | (78,641 | ) | ||||

| $ | (82,928 | ) | (86,126 | ) | ||||

| 11. | COMMITMENTS |

Compensation to Executive Officers

Concorde Consulting, a company owned 100% by Mr. Curtis J. Sparrow, for providing services as Chief Financial Officer to the Company for $11,286 per month (Cdn $15,000 per month). As of June 30, 2019, the Company did not owe Concorde Consulting any of this amount.

10

| ITEM 2. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

The following discussion and analysis should be read in conjunction with our consolidated financial statements and related notes. For the purpose of this discussion, unless the context indicates another meaning, the terms: “Deep Well,” “Company,” “we,” “us,” and “our” refer to Deep Well Oil & Gas, Inc. and its subsidiaries. This discussion includes forward-looking statements that reflect our current views with respect to future events and financial performance that involve risks and uncertainties. Our actual results, performance or achievements could differ materially from those anticipated in the forward-looking statements as a result of certain factors including risks discussed in “Cautionary Note Regarding – Forward-Looking Statements” below and elsewhere in this report, and under the heading “Risk Factors” and “Environmental Laws and Regulations” disclosed in our Annual Report on Form 10-K for the fiscal year ended September 30, 2018, filed with the Alberta Securities Commission (“ASC”) on SEDAR on April 12, 2019 and the U.S. Securities and Exchange Commission (“SEC”) on December 21, 2018. Our Annual Report on Form 10-K can be downloaded from our website at www.deepwelloil.com.

Our consolidated financial statements and the supplemental information thereto are reported in United States dollars and are prepared based upon United States generally accepted accounting principles (“US GAAP”). References in this Form 10-Q to “$” are to United States dollars and references to “Cdn$” are to Canadian dollars. The following table sets forth the rates of exchange for the Cdn$, expressed in US dollars, in effect at the end of the following periods and the average rates of exchange during such periods, based on the rates of exchange for such periods as reported by the Bank of Canada.

| Period Ending June 30 | 2019 | 2018 | ||||||

| Rate at end of period | $ | 0.7641 | $ | 0.7594 | ||||

| Average rate for the three month period | $ | 0.7476 | $ | 0.7747 | ||||

General Overview

Deep Well Oil & Gas, Inc., along with its subsidiaries through which it conducts business, is an independent junior oil sands exploration and development company headquartered in Edmonton, Alberta, Canada. Our immediate corporate focus is to develop the existing oil sands land base where we have working interests ranging from 25% to 100% in the Peace River oil sands area of Alberta, Canada. Our principal office is located at Suite 700, 10150 - 100 Street, Edmonton, Alberta, Canada T5J 0P6, our telephone number is (780) 409-8144, and our fax number is (780) 409-8146. Deep Well Oil & Gas, Inc. is a Nevada corporation and trades on the OTC Marketplace under the symbol DWOG. We maintain a website at www.deepwelloil.com. Our financial statements are available for download on our website or you may download our financial statements from the U.S. Securities and Exchange Commission’s website at www.sec.gov. The contents of our website are not part of this quarterly report on Form 10-Q.

Results of Operations

Since the inception of our current business plan, our operations have consisted of various exploration and start-up activities relating to our properties, including the acquisition of lease holdings, raising capital, locating joint venture partners, acquiring and analyzing seismic data, complying with environmental regulations, drilling, testing and analyzing of wells to define our oil sands reservoir, and development planning of our Alberta Energy Regulatory (“AER”) approved thermal recovery projects, which includes our steam assisted gravity drainage project where we have a 25% working interest.

The following table sets forth summarized financial information:

| Three Months Ended | Three Months Ended | Nine Months Ended | Nine Months Ended | |||||||||||||

| June 30, 2019 | June 30, 2018 | June 30, 2019 | June 30, 2018 | |||||||||||||

| Revenue | $ | – | $ | – | $ | – | $ | – | ||||||||

| Royalty refunds (expenses) | – | – | – | – | ||||||||||||

| Revenue, net of royalty | – | – | – | – | ||||||||||||

| Expenses | ||||||||||||||||

| Operating expenses | 16,256 | 65,367 | 59,736 | 130,924 | ||||||||||||

| Operating expense covered by Farmout | (16,256 | ) | (65,367 | ) | (59,736 | ) | (130,924 | ) | ||||||||

| General and administrative | 35,852 | 61,657 | 129,273 | 236,522 | ||||||||||||

| Depreciation, accretion and depletion | 11,384 | 12,956 | 34,237 | 39,031 | ||||||||||||

| Net loss from operations | (47,236 | ) | (74,613 | ) | (163,510 | ) | (275,553 | ) | ||||||||

| Other income and expenses | ||||||||||||||||

| Rental and other income | 1,210 | (39 | ) | 3,276 | 8,825 | |||||||||||

| Interest income | 1,964 | 1,526 | 5,697 | 4,427 | ||||||||||||

| Net loss and comprehensive loss | $ | (44,062 | ) | $ | (73,126 | ) | $ | (154,537 | ) | $ | (262,301 | ) | ||||

11

First production from our present joint Steam Assisted Gravity Drainage Demonstration Project (the “SAGD Project”) began on September 16, 2014. A majority of our Joint Venture partners voted to temporarily suspend operations of the SAGD Project at the end of February 2016. In accordance with the Farmout Agreement we entered into on July 31, 2013, the Farmee has agreed to provide up to $40,000,000 in funding for our working interest portion of the costs of the SAGD Project before the execution of the Farmout Agreement in return for a net 25% working interest in two oil sands leases where we had a working interest of 50%. The Farmee is also required to provide funding to cover monthly operating expenses of our Company provided that such funding shall not exceed $30,000 per month. The Farmee shall continue to cover our administrative costs up to $30,000 per month, under the Farmout Agreement, until completion in all substantial respects of the SAGD Project agreement entered into between us and the operator of the SAGD Project. Our net operating margin after operating expenses is zero, under the Farmout Agreement, any negative operating cash flows are reimbursed to us to fund our share of the SAGD Project. Therefore, the total share of the capital costs and operating expenses of our joint SAGD Project, has been funded in accordance with the Farmout Agreement, at a net cost to our Company of $Nil. As required by the Farmout Agreement, as of June 30, 2019, the Farmee has since reimbursed our Company and/or paid the operator in total approximately $20.8 million ($27.2 million Cdn) for the Farmee’s share and our share of the capital costs and operating expenses of the SAGD Project. These costs included the drilling and completion of one SAGD well pair; the purchase and transportation of equipment of which included the once through steam generator, production tanks, water treatment plant, and power generators; installation and construction of the steam plant facility; testing and commissioning; the purchase of the water source and disposal wells; construction of pipelines and expenditures to connect and tie-in the source and disposal water wells to the steam plant facility along with a fuel source tie-in pipeline; equipment for processing and treating the bitumen production at the SAGD facility site; replacement of the electrical submersible pump; front end costs for the expansion; the operating expenses associated with the steaming and production of the one SAGD well pair; and the expenses associated with the monthly shut-in operations of the SAGD Project facility.

For the three months ended June 30, 2019, our general and administrative expenses decreased by $25,805 compared to the three months ended June 30, 2018, which was primarily due to decreases of engineering fees and audit fees. We also received $90,000 during this quarter from the Farmee in accordance with a Farmout Agreement to offset our monthly expenses. After adjusting out the non-cash item foreign exchange loss, and the funds we received from the Farmee, our general and administrative expenses were $124,258 for the three months ended June 30, 2019 compared to $154,414 for the three months ended June 30, 2018.

For the nine months ended June 30, 2019, our general and administrative expenses decreased by $107,249 compared to the nine months ended June 30, 2018, which was primarily due to a decrease of engineering fees of $57,206 and a decrease of audit fees of $31,000. We also received $270,000 during the last nine months from the Farmee in accordance with the Farmout Agreement, to offset our monthly expenses. After adjusting out the non-cash items for foreign exchange loss, and the funds we received from the Farmee, our general and administrative expenses were $395,741 for the nine months ended June 30, 2019 compared to $498,017 for the nine months ended June 30, 2018.

For the three months ended June 30, 2019, our depreciation, depletion, and accretion expense decreased by $1,572 compared to the three months ended June 30, 2018, which was primarily due to the depreciating value of our assets. Depreciation expense is computed using the declining balance method over the estimated useful life of the asset. In compliance with our accounting policy, only half of the depreciation is taken in the year of acquisition. No significant asset purchases were made in the quarter ended June 30, 2019.

For the nine months ended June 30, 2019, our depreciation and accretion expense decreased by $4,794 compared to the nine months ended June 30, 2018, which was primarily due to the depreciating value of our assets. Depreciation expense is computed using the declining balance method over the estimated useful life of the asset. In compliance with our accounting policy, only half of the depreciation is taken in the year of acquisition. No significant depreciable asset purchases were made in the quarter ended June 30, 2019.

For the three months ended June 30, 2019, rental and other income increased by $1,249 compared to the three months ended June 30, 2018.

For the nine months ended June 30, 2019, rental and other income decreased by $5,549 compared to the nine months ended June 30, 2018.

For the three months ended June 30, 2019, there were no significant increases or decreases for interest income compared to the three months ended June 30, 2018.

For the nine months ended June 30, 2019, there were no significant increases or decreases for interest income compared to the nine months ended June 30, 2018.

As a result of the above transactions, we recorded a decrease of $29,064 in our net loss and loss from operations for the three months ended June 30, 2019 compared to the three months ended June 30, 2018.

As a result of the above transactions, we recorded a decrease of $107,764 in our net loss and loss from operations for the nine months ended June 30, 2019 compared to the nine months ended June 30, 2018. As discussed above, this decrease was primarily due to decreases in engineering and audit fees.

12

Operations

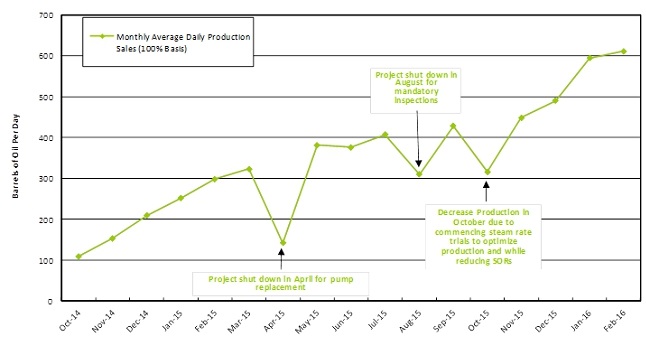

The first SAGD well pair, for the SAGD Project, was drilled to a vertical depth of approximately 650 meters with a horizontal length of 780 meters each. Steam injection commenced in May 2014 and production started in September of 2014. Production from this one SAGD well pair increased significantly over the 18-month period it produced. Over January and February of 2016 production from the SAGD Project averaged 615 bopd, on a 100% basis (154 bopd net to us), with an average SOR of 2.1 from one SAGD well pair. The SOR is reflective of the amount of steam needed to produce one barrel of oil. This SAGD Project was temporarily suspended at the end of February 2016. The capital costs of the existing SAGD Project steam plant facility, with pipelines and one SAGD well was approximately $26.5 million (Cdn $34.8 million) on a 100% working interest basis, of which our share is covered under the Farmout Agreement. These capital costs do not include the start-up operating expenses to initiate oil production from the SAGD well pair.

The current SAGD Project has:

| ● | confirmed that the SAGD process works in the Bluesky formation at Sawn Lake; |

| ● | established characteristics of ramp up through stabilization of SAGD performance; |

| ● | indicated the productive capability and SOR of the reservoir; and |

| ● | provided critical information required for well and facility design associated with future commercial development. |

The following graph sets out the production levels that the SAGD Project achieved. These production numbers along with the corresponding SORs compare favorably to analogous reservoirs in thermal recovery projects that we are monitoring and using as a basis of comparison.

Our Sawn Lake properties are in a pre-commercial stage of development and engineering work has, and is, continuing towards the commercial expansion of our joint SAGD Project, for the expansion of the existing battery. In early May of 2016, an amended application was submitted to the AER for an expansion of the existing SAGD Project facility site and received regulatory approval in December 2017. This expansion application sought approval to expand the current SAGD Project facility site to 3,200 bopd (100% basis). It is anticipated that only five SAGD well pairs will need to be operating to achieve this production level. We and our joint venture partners continue to work towards the anticipated reactivation and expansion of the existing SAGD Project facility site. The SAGD Project development plan will be done in stages to reduce initial financial costs. The first stage anticipates the reactivation of the existing SAGD battery and existing SAGD well pair, along with the drilling of one additional SAGD well pair, initially producing from 2 well pairs. The second stage anticipates drilling an additional three SAGD well pairs to produce up to 3,200 bopd and the expansion of the existing SAGD facility to generate the additional steam required. We anticipate our near- and long-term funding of our operations to be financed through the existing Farmout Agreement, future earn-in agreements, and cash flow from the reactivation of the existing SAGD Project. We anticipate drilling future wells on our properties to further expand the boundary of the Sawn Lake Bluesky reservoir. We also intend to negotiate with the Petroleum and Natural Gas holders in the area of our leases, to enter into further downhole contribution agreements to acquire logs and cores of the Bluesky formation, in order to expand the boundaries of the oil sands reservoir and save on drilling costs and reduce our environmental footprint.

13

In August of 2017, we jointly participated in drilling one well on our Sawn Lake properties. This well was drilled to a total depth of 681 meters.

On February 15, 2018, we entered into a contribution agreement with a third-party, whereby we paid a cash contribution to drill and acquire cores and logs through the Bluesky formation from a well drilled by a third-party on one of our oil sands leases.

In August 2013, we received approval from the AER for our horizontal cyclic steam stimulation project (“HCSS Project”) application. It is anticipated that we will develop a thermal demonstration project on our properties followed by a commercial expansion project on one half section of land located on section 10-92-13W5 of our Sawn Lake oil sands properties where we currently have a 90% working interest. The final performance results and revised reservoir modeling studies from our SAGD Project are being used to fine-tune our HCSS Project facility design before we initiate start-up operations on the half of a section of land where we plan to drill two horizontal wells to test the use of HCSS technology. We performed an environmental field study and surveyed the proposed location of our planned HCSS Project site and received AER approval for the surface wellsite and access road for our HCSS Project.

Our Company to date has, but not limited to, drilled or participated in 13 wells over our Sawn Lake leases to expand the boundaries of the Bluesky oil sands reservoir; commissioned various independent reservoir simulation studies of our properties; successfully produced bitumen from the SAGD Project, which outperformed independent reservoir production type curves; acquired AER approvals for two thermal recovery projects, which includes our joint SAGD Project facility expansion to produce up to 3200 bopd; successfully entered into Farmout Agreements; and successfully applied to continue 5 leases, where resources were assigned, past their initial expiry dates.

Our oil sands acreage as of June 30, 2019, covers 37,322 gross acres (29,383 net acres) of land under nine oil sands leases. Until our Company extends its oil sands leases “into perpetuity”, based on the Alberta governmental regulations, the lease expiration dates of our nine oil sands leases are as follows:

| 1. | 14,549 gross acres (8,571 net acres) under five oil sands leases were set to expiry on July 10, 2018 and were subsequently granted continuation under the Alberta Oil Sands Tenure regulations and now have no set expiry date. In November 2017, our joint venture partner and operator of two of the five oil sands leases, submitted two continuation applications to the Alberta Oil Sands Tenure division to apply to continue 7,591 gross acres (1,898 net acres) and in January 2018, approval was received from Alberta Energy to continue 6,958 gross acres (1,740 net acres). In June 2018, our Company as operator of three of these five oil sands leases, submitted three continuation applications to the Alberta Oil Sands Tenure division to apply to continue another 7,591 gross acres (6,832 net acres) where resources were identified and in July 2018 and April 2019, approval was received from Alberta Energy to continue 7,591 gross acres (6,832 net acres). Of these five oil sands leases that were set to expiry on July 10, 2018, a total of 5,693 gross acres (4,713 net acres) expired without being continued. These expired lands were primarily areas where our Company determined that there was no or limited exploitable resources. The vast majority of the resources that the Company has identified to date are within these five leases which have been continued to perpetuity and the lease referred to in #3 below. These continued leases have no future expiry dates but are subject to yearly escalating rental payments until they are deemed to be producing leases; |

| 2. | 19,610 gross acres (17,649 net acres) under three northern oil sands leases are set to expire on August 19, 2019. We applied for a term extension on these three northern oil sands leases, however it is not certain if an extension will be granted by Alberta Energy; and |

| 3. | 3,163 gross acres (3,163 net acres) under one oil sands lease are set to expire on April 9, 2024. We believe that we have already met the governmental requirements for this lease and we currently intend to apply to continue this lease into perpetuity. |

The development progress of our properties is governed by several factors such as federal and provincial governmental regulations. Long lead times in getting regulatory approval for thermal recovery projects are commonplace in our industry. Road bans, winter access only roads and environmental regulations can, and often, do delay development of similar projects. Because of these and other factors, our oil sands project could take significantly longer to complete than regular conventional drilling programs for lighter oil.

Liquidity and Capital Resources

As of June 30, 2019, our total assets were $22,676,573 compared to $22,827,332 as of September 30, 2018.

Our total liabilities as of June 30, 2019 were $527,382 compared to $538,604 as of September 30, 2018. There was no significant change in our total liabilities from the September 30, 2018 year end.

14

Our working capital (current liabilities subtracted from current assets) is as follows:

| Nine months Ended | Year Ended | |||||||

| June 30, 2019 | September 30, 2018 | |||||||

| Current Assets | $ | 163,394 | 363,891 | |||||

| Current Liabilities | 25,589 | 45,137 | ||||||

| Working Capital | $ | 137,805 | 318,754 | |||||

As of June 30, 2019, we had working capital of $137,805 compared to a working capital of $318,754 as of September 30, 2018. This decrease of $180,949 is primarily due to general and administrative expenses.

As reported on our condensed Consolidated Statement of Cash Flows under “Operating Activities”, for the nine months ended June 30, 2019, our net cash used in operating activities was $203,228 compared to $309,396 for the nine months ended June 30, 2018. This decrease of $106,168 in our operating activities was due to a decrease in general and administrative expenses.

As reported on our condensed Consolidated Statement of Cash Flows under “Investing Activities”, cash flows used on investment in our oil and gas properties for the nine months ended June 30, 2019 decreased by $516,044 compared to the nine months ended June 30, 2018. This decrease was a result of less expenditures used in our oil and gas properties in comparison to the nine months ended June 30, 2018. In the nine months ended June 30, 2018, we paid a cash contribution of $395,500 ($500,000 Cdn) to a third-party operator who was drilling into a deeper formation below our properties, to drill and acquire cores and logs for us through the Bluesky formation on one of our oil sands leases.

As reported on our condensed Consolidated Statement of Cash Flows under “Financing Activities”, for the nine months ended June 30, 2019 we received $15,000 from one of our directors for the exercise of his stock options. For the nine months ended June 30, 2018 we received a distribution refund of $243,574 which was related to a return of capital distribution our Company issued in September of 2013.

Our cash and cash equivalents as of June 30, 2019 was $34,364 compared to $438,854 as of June 30, 2018. This decrease of $404,490 in cash was primarily due to the decrease in general and administrative expenses and the $243,574 distribution refund described above.

As of June 30, 2019, we had no long-term debt other than our estimated future asset retirement obligations on oil and gas properties.

Our current SAGD Project capital and operating costs are covered under the terms of the Farmout Agreement. As described above the Farmee shall continue to cover our administrative costs up to $30,000 per month, under the Farmout Agreement, until completion in all substantial respects of the SAGD Demonstration Project agreement entered into between us and the operator of the SAGD Project. For our long-term operations, we anticipate that, among other alternatives, we may raise funds during the next twenty-four months through sales of our equity securities, debt, or entering into another form of joint venture. We also note that if we issue more shares of our common stock, our stockholders will experience dilution in the percentage of their ownership of common stock. We may not be able to raise sufficient funding from stock sales for long-term operations and if so, we may be forced to delay our business plans until adequate funding is obtained.

Off-Balance Sheet Arrangements

We do not have any off-balance sheet arrangements.

Cautionary Note Regarding Forward-Looking Statements

This quarterly report on Form 10-Q, including all referenced Exhibits, contains “forward-looking statements” within the meaning of the United States federal securities laws. All statements other than statements of historical facts included or incorporated by reference in this report, including, without limitation, statements regarding our future financial position, business strategy, projected costs and plans and objectives of management for future operations, are forward-looking statements. The words “may,” “believe,” “intend,” “will,” “anticipate,” “expect,” “estimate,” “project,” “future,” “plan,” “strategy,” “probable,” “possible,” or “continue,” and other expressions that are predictions of or indicate future events and trends and that do not relate to historical matters, often identify forward-looking statements. For these statements, Deep Well claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. The forward-looking statements in this quarterly report include, among others, statements with respect to:

| ● | our current business strategy; |

| ● | our future financial position and projected costs; |

| ● | our projected sources and uses of cash; |

| ● | our plan for future development and operations, including the building of all-weather roads; |

| ● | our drilling and testing plans; |

| ● | our proposed plans for further thermal in-situ development or demonstration project or projects; |

15

| ● | the sufficiency of our capital in order to execute our business plan; |

| ● | our reserves and resources estimates; |

| ● | the timing and sources of our future funding; |

| ● | the quantity and value of our reserves; |

| ● | the intent to issue a distribution to our shareholders; |

| ● | our or our operator’s objectives and plans for our current SAGD Project; |

| ● | our plans for development of our Sawn Lake properties; |

| ● | production levels from our current SAGD Project; |

| ● | costs of our current SAGD Project; |

| ● | funding from the Farmee to pay our costs for the current SAGD project in connection with the Farmout Agreement; |

| ● | additional sources of funding from the Farmout Agreement; |

| ● | funding from the Farmee to cover our monthly operating expenses; |

| ● | our access and availability to third-party infrastructure; |

| ● | present and future production of our properties; |

| ● | our ability to extend our leases past their primary expiration dates; and |

| ● | expectations regarding the ability of our Company and its subsidiaries to raise capital and to continually add to reserves through acquisitions and development. |

These forward-looking statements are based on the beliefs and expectations of our management and are subject to significant risks and uncertainties. If underlying assumptions prove inaccurate or unknown risks or uncertainties materialize, actual results may differ materially from current expectations and projections. Factors that could cause actual results to differ materially from those set forward in the forward-looking statements include, but are not limited to:

| ● | changes in general business or economic conditions; |

| ● | changes in governmental legislation or regulation that affect our business; |

| ● | our ability to obtain necessary regulatory approvals and permits for the development of our properties, including obtaining the required water licences from Alberta Environment to withdraw water for our thermal operations; |

| ● | changes to the greenhouse gas reduction program and other environmental and climate change regulations which are adopted by provincial or federal governments of Canada or which are being considered, which may also include cap and trade regimes, carbon taxes, increased efficiency standards, each of which could increase compliance costs and impose significant penalties for non-compliance; |

| ● | increase in taxes and changes to existing legislation affecting governmental royalties or other governmental initiatives; |

| ● | future marketing and transportation of our produced bitumen; |

| ● | our ability to receive approvals from the AER for additional tests to further evaluate the wells on our lands; |

| ● | our Farmout Agreement and joint operating agreements; |

| ● | opposition to our regulatory requests by various third parties; |

| ● | actions of aboriginals, environmental activists and other industrial disturbances; |

| ● | the costs of environmental reclamation of our lands; |

| ● | availability of labor or materials or increases in their costs; |

| ● | the availability of sufficient capital to finance our business or development plans on terms satisfactory to us; |

| ● | adverse weather conditions and natural disasters affecting access to our properties and well sites; |

| ● | risks associated with increased insurance costs or unavailability of adequate coverage; |

| ● | volatility in market prices for oil, bitumen, natural gas, diluent and natural gas liquids. A decline in oil prices could result in a downward revision of our future reserves and a ceiling test write-down of the carrying value of our oil sands properties, which could be substantial and could negatively impact our future net income and stockholders’ equity; |

| ● | competition; |

| ● | changes in labor, equipment and capital costs; |

| ● | future acquisitions or strategic partnerships; |

| ● | the risks and costs inherent in litigation; |

| ● | imprecision in estimates of reserves, resources and recoverable quantities of oil, bitumen and natural gas; |

| ● | product supply and demand; |

| ● | changes and amendments in the Canadian Oil and Gas Evaluation Handbook and or the Petroleum Resources Management System to general disclosure of reserves and resources standards and specific annual reserves and resources disclosure requirements for reporting issuers with oil and gas activities; |

| ● | future appraisal of potential bitumen, oil and gas properties may involve unprofitable efforts; |

| ● | the ability to meet minimum level of requirements and obtain approval from Alberta Energy to continue our oil sands leases beyond their expiry dates; |

| ● | the ability to pay future escalating lease rents on continued leases; |

| ● | changes in general business or economic conditions; |

| ● | risks associated with the finding, determination, evaluation, assessment and measurement of bitumen, oil and gas deposits or reserves; |

16

| ● | geological, technical, drilling and processing problems; |

| ● | third party performance of obligations under contractual arrangements; |

| ● | failure to obtain industry partner and other third-party consents and approvals, when required; |

| ● | treatment under governmental regulatory regimes and tax laws; |

| ● | royalties payable in respect of bitumen, oil and gas production; |

| ● | unanticipated operating events which can reduce production or cause production to be shut-in or delayed; |

| ● | incorrect assessments of the value of acquisitions, and exploration and development programs; |

| ● | stock market volatility and market valuation of the common shares of our Company; |

| ● | fluctuations in currency and interest rates; and |

| ● | the additional risks and uncertainties, many of which are beyond our control, referred to elsewhere in this quarterly report and in our other SEC filings. |

The preceding bullets outline some of the risks and uncertainties that may affect our forward-looking statements. For a full description of risks and uncertainties, see the sections entitled “Risk Factors” and “Environmental Laws and Regulations” of our annual report on Form 10-K for the fiscal year ended September 30, 2018 filed with the United States Securities and Exchange Commission (“SEC”) on December 21, 2018 and the Alberta Securities Commission (“ASC”) on SEDAR on April 12, 2019.. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those anticipated, believed, estimated or expected. Any forward-looking statement speaks only as of the date on which it was made and, except as required by law, we disclaim any obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise. However, any further disclosures made on related subjects in subsequent reports on Forms 10-K, 10-Q, 8-K and any other SEC filing or amendments thereto should be consulted.

17

| ITEM 3. | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK |

We are a smaller reporting company as defined by Rule 12b-2 under the Exchange Act and therefore we are not required to provide the information required under this item.

| ITEM 4. | CONTROLS AND PROCEDURES |

Disclosure Controls and Procedures

As of the end of our fiscal quarter ended June 30, 2019, an evaluation of the effectiveness of our “disclosure controls and procedures” (as such term is defined in Rules 13a-15(e) and 15d-15(e) under the Securities Exchange Act of 1934) was carried out under the supervision and with the participation of our principal executive officer and principal financial officer. Based upon that evaluation, our principal executive officer and principal financial officer have concluded that as of the end of that quarter, our disclosure controls and procedures were effective to ensure that information required to be disclosed by us in reports that we file or submit under the Exchange Act is (i) recorded, processed, summarized and reported within the time periods specified in Securities and Exchange Commission rules and forms and (ii) accumulated and communicated to our management, including our principal executive officer and principal financial officer, to allow timely decisions regarding required disclosure.

It should be noted that while our principal executive officer and principal financial officer believe that our disclosure controls and procedures provide a reasonable level of assurance that they are effective, they do not expect that our disclosure controls and procedures or internal control over financial reporting will prevent all errors and fraud. A control system, no matter how well conceived or operated, can provide only reasonable, not absolute, assurance that the objectives of the control system are met.

Changes In Internal Control Over Financial Reporting

During the fiscal quarter ended June 30, 2019, there were no changes in our internal control over financial reporting that materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

18

PART II. OTHER INFORMATION

| ITEM 1. | LEGAL PROCEEDINGS |

None.

| ITEM 1A. | RISK FACTORS |

Although we are a smaller reporting company as defined by Rule 12b-2 under the Exchange Act and are therefore not required to provide the information required under this item, there have been no material changes in our risk factors from those disclosed in our annual report on Form 10-K for the fiscal year ended September 30, 2018, filed with the Alberta Securities Commission on SEDAR on April 12, 2019 and the U.S. Securities and Exchange Commission on December 21, 2018.

| ITEM 2. | UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS |

None.

| ITEM 3. | DEFAULTS UPON SENIOR SECURITIES |

None.

| ITEM 4. | MINE SAFETY DISCLOSURES |

Not applicable.

| ITEM 5. | OTHER INFORMATION |

Information to be Reported on Form 8-K

Deep Well reported all information that was required to be disclosed on Form 8-K during the period covered by this quarterly report on Form 10-Q for the period ended June 30, 2019.

Shareholder Nominations

There have been no changes to the procedures by which shareholders may recommend nominees to our Board of Directors during the time period covered by this quarterly report on Form 10-Q for the period ended June 30, 2019.

19

| ITEM 6. | EXHIBITS |

20

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| DEEP WELL OIL & GAS, INC. | ||

| By | /s/ Horst A. Schmid | |

| Dr. Horst A. Schmid | ||

| Chief Executive Officer and President | ||

| (Principal Executive Officer) | ||

| Date | August 14, 2019 | |

| By | /s/ Curtis Sparrow | |

| Mr. Curtis James Sparrow | ||

| Chief Financial Officer | ||

| (Principal Financial and Accounting Officer) | ||

| Date | August 14, 2019 | |

21