f10k2013_deepwell.htm

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

(Mark One)

|

|

|

þ

|

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

| For the fiscal year ended September 30, 2013 |

| |

| or |

| |

|

o

|

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the transition period from ______ to ______

|

| |

|

Commission File Number: 0-24012

|

DEEP WELL OIL & GAS, INC.

(Exact name of registrant as specified in its charter)

|

Nevada

|

|

98-0501168

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(I.R.S. Employer Identification No.)

|

| |

|

Suite 700, 10150 – 100 Street, Edmonton, Alberta, Canada

|

|

T5J 0P6

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (780) 409-8144

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Name of each exchange on which registered

|

|

None

|

|

None

|

Securities registered pursuant to Section 12(g) of the Act:

|

Common Stock, $0.001 par value per share

|

|

(Title of class)

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes o No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes o No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Sections 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.Yes þNo o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þNo o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| |

Large accelerated filer o

|

|

Accelerated filer o

|

| |

Non-accelerated filer o (Do not check if a smaller reporting company)

|

|

Smaller reporting company þ

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No þ

The aggregate market value of the registrant’s common stock held by non-affiliates computed by reference to the price at which the common equity was sold on or about March 31, 2013 was approximately $4.5 million.

As of December 31, 2013, the Issuer had outstanding approximately 229,326,287 shares of common stock, $0.001 par value per share.

|

TABLE OF CONTENTS

|

| |

|

|

|

|

|

| |

|

|

Page Number

|

| |

|

|

|

|

|

|

GLOSSARY AND ABBREVIATIONS

|

|

4

|

|

| |

|

|

|

|

|

|

CURRENCY EXCHANGE RATES

|

|

6

|

|

|

PART I

|

| |

|

|

|

|

|

|

ITEM 1.

|

|

BUSINESS

|

|

7

|

|

| |

|

|

Formation of Organization

|

|

7

|

|

| |

|

|

Business Development

|

|

8

|

|

| |

|

|

Principal Product

|

|

9

|

|

| |

|

|

Market and Distribution of Product

|

|

9

|

|

| |

|

|

Competitive Business Conditions

|

|

10

|

|

| |

|

|

Customers

|

|

10

|

|

| |

|

|

Royalty Agreements

|

|

10

|

|

| |

|

|

Government Approval and Crown Royalties

|

|

11

|

|

| |

|

|

Research and Development

|

|

11

|

|

| |

|

|

Environmental Laws and Regulations

|

|

11

|

|

| |

|

|

Employees

|

|

12

|

|

| |

|

|

|

|

|

|

|

ITEM 1A.

|

|

RISK FACTORS

|

|

12

|

|

| |

|

|

|

|

|

|

|

ITEM 1B

|

|

UNRESOLVED STAFF COMMENTS

|

|

15

|

|

| |

|

|

|

|

|

|

|

ITEM 2.

|

|

PROPERTIES

|

|

15

|

|

| |

|

|

Office Leases

|

|

15

|

|

| |

|

|

Oil and Gas Properties

|

|

16

|

|

| |

|

|

|

Acreage

|

|

16

|

|

| |

|

|

|

Reserves, Production and Delivery Commitments

|

|

17

|

|

| |

|

|

|

Drilling Activity

|

|

17

|

|

| |

|

|

|

Present Activities

|

|

17

|

|

| |

|

|

|

Past Activities

|

|

18

|

|

| |

|

|

|

|

|

|

|

|

ITEM 3.

|

|

LEGAL PROCEEDINGS

|

|

20

|

|

| |

|

|

|

|

|

|

|

|

ITEM 4.

|

|

MINE SAFETY DISCLOSURES

|

|

21

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

PART II

|

| |

|

|

|

|

|

|

|

|

ITEM 5.

|

|

MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

|

|

22

|

|

| |

|

|

Market Information

|

|

22

|

|

| |

|

|

Holders of Record

|

|

22

|

|

| |

|

|

Dividends

|

|

22

|

|

| |

|

|

Return of Capital Distribution

|

|

22

|

|

| |

|

|

Securities Authorized for Issuance Under Equity Compensation Plans

|

|

23

|

|

| |

|

|

Performance Graph

|

|

24

|

|

| |

|

|

Recent Sales of Unregistered Securities

|

|

24

|

|

| |

|

|

|

|

|

|

|

ITEM 6.

|

|

SELECTED FINANCIAL DATA

|

|

24

|

|

| |

|

|

|

|

|

|

|

ITEM 7.

|

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

|

25

|

|

|

ITEM 7A.

|

|

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

|

|

29

|

|

| |

|

|

|

|

|

|

|

REPORT OF INDEPENDENT CERTIFIED PUBLIC ACCOUNTANTS

|

|

30

|

|

| |

|

|

|

|

|

|

|

ITEM 8.

|

|

FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

|

|

30

|

|

| |

|

|

Consolidated Balance Sheets

|

|

31

|

|

| |

|

|

Consolidated Statements of Operations and Comprehensive Loss

|

|

32

|

|

| |

|

|

Consolidated Statements of Shareholders’ Equity

|

|

33

|

|

| |

|

|

Consolidated Statements of Cash Flows

|

|

38

|

|

| |

|

|

Notes to the Consolidated Financial Statements

|

|

39

|

|

| |

|

|

|

|

|

|

|

ITEM 9.

|

|

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

|

|

53

|

|

| |

|

|

|

|

|

|

|

ITEM 9A.

|

|

CONTROLS AND PROCEDURES

|

|

53

|

|

| |

|

|

|

|

|

|

|

ITEM 9B.

|

|

OTHER INFORMATION

|

|

54

|

|

| |

|

|

|

|

|

|

|

PART III

|

| |

|

|

|

|

|

|

|

ITEM 10.

|

|

DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

|

|

55

|

|

| |

|

|

|

|

|

|

|

ITEM 11.

|

|

EXECUTIVE COMPENSATION

|

|

59

|

|

| |

|

|

|

|

|

|

|

ITEM 12.

|

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

|

|

61

|

|

| |

|

|

|

|

|

|

|

ITEM 13.

|

|

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE

|

|

63

|

|

| |

|

|

|

|

|

|

|

ITEM 14.

|

|

PRINCIPAL ACCOUNTING FEES AND SERVICES

|

|

64

|

|

| |

|

|

|

|

|

|

|

PART IV

|

| |

|

|

|

|

|

|

|

ITEM 15.

|

|

EXHIBITS, FINANCIAL STATEMENT SCHEDULES

|

|

65

|

|

| |

|

|

|

|

|

|

|

SIGNATURES

|

|

67

|

|

GLOSSARY AND ABBREVIATIONS

The following are defined terms and abbreviations used herein:

API Gravity – a specific gravity scale developed by the American Petroleum Institute for measuring the density or specific gravity (heaviness) of petroleum liquids, expressed in degrees. The higher the number, the lighter the oil.

Alberta Energy Regulator (“AER” formerly ERCB) – The AER is responsible for the development of Alberta’s oil (including oil sands) and gas resources. The AER succeeded the ERCB and will take on regulatory functions from the Ministry of Environment and Sustainable Resource Development that relate to public lands, water, and the environment. The AER will provide full-lifecycle regulatory oversight of energy resource development in Alberta from application and construction to abandonment and reclamation, and everything in between.

Barrel – the common unit for measuring petroleum, including heavy oil. One barrel contains approximately 159 L.

Battery – equipment to process or store crude oil from one or more wells.

Bbl or Bbls – means barrel or barrels.

Bitumen – a heavy, viscous form of crude oil that generally has an API gravity of less than 10 degrees.

Cdn – means Canadian dollars.

Celsius – a temperature scale that registers the freezing point of water as 0 degrees and the boiling point as 100 degrees under normal atmospheric pressure. Room temperature is between 20 degrees and 25 degrees Celsius.

Cold Flow – a production technique where the oil is simply pumped out of the sands not using a Thermal Recovery Technique.

Conventional Crude Oil – crude oil that flows naturally or that can be pumped without being heated or diluted.

Core – a cylindrical rock sample taken from a formation for geological analysis.

Crude Oil – oil that has not undergone any refining. Crude oil is a mixture of hydrocarbons with small quantities of other chemicals such as sulphur, nitrogen and oxygen. Crude oil varies radically in its properties, namely specific gravity and viscosity.

Cyclic Steam Stimulation (“CSS”) or Horizontal Cyclic Steam Stimulation (“HCSS”) – a thermal in situ recovery method, which consists of a three-stage process involving high-pressure steam injected into the formation for several weeks through vertical or horizontal wells. The heat softens the oil while the water vapor helps to dilute and separate the oil from the sand grains. The pressure also creates channels through which the oil can flow more easily to the well. When a portion of the reservoir is thoroughly saturated, the steam is turned off and the reservoir maybe left to “soak” a short period of time. This is followed by the production phase, when the oil flows, or is pumped, up the same wells to the surface. When production rates decline, another cycle of steam injection begins. This process is sometimes called “huff-and-puff” recovery and can be done utilizing vertical or horizontal wells.

Darcy (Darcies) – a measure of rock permeability (the degree to which natural gas or crude oil can move through the rocks).

Density – the heaviness of crude oil, indicating the proportion of large, carbon-rich molecules, generally measured in kilograms per cubic metre (kg/m3) or degrees on the American Petroleum Institute (API) scale.

Development Well – a well drilled within an area of a natural gas or oil reservoir to the depth of a stratigraphic horizon to which proven reserves have been assigned.

Diluents – light petroleum liquids used to dilute bitumen and heavy oil so they can flow through pipelines.

Drill Stem Test (“DST”) – a method of formation testing. The basic drill stem test tool consists of a packer or packers, valves or ports that may be opened and closed from the surface, and two or more pressure-recording devices. The tool is lowered on the drill string to the zone to be tested. The packer or packers are set to isolate and test the zone from the drilling fluid column.

Drill String – the column, or string, of drill pipe with attached tool joints that transmits fluid and rotational power from the drilling rig on the surface to the drill collars and the bit. Often, the term is loosely applied to include both drill pipe and drill collars.

Enhanced Oil Recovery – any method that increases oil production by using techniques or materials that are not part of normal pressure maintenance or water flooding operations. For example, natural gas can be injected into a reservoir to “enhance” or increase oil production.

Exploratory Well – a well drilled to find and produce natural gas or oil in an unproven area, to find a new reservoir in a field previously found to be productive of natural gas or oil in another reservoir, or to extend a known reservoir.

Farmout – an arrangement whereby the owner (the “Farmor”) of a lease assigns some ownership portion (or all) of the lease(s) to another company (the “Farmee”) in return for the Farmee paying for the drilling on at least some portion of the lease(s) under the Farmout.

Gross Acre/Hectare – a gross acre is an acre in which any portion of a working interest is owned. 1 acre = 0.404685 hectares. 1 hectare = 2.471054 acres.

Heavy Oil – oil having an API gravity less than 22.3 degrees.

Horizontal Well – the drilling of a well that deviates from the vertical and travels horizontally through a producing layer of a reservoir.

In situ – In the oil sands context (In situ means “in place” in Latin), In situ methods such as SAGD or CSS through horizontal or vertical wells maybe required to produce the oil if the oil sands deposits are too deep to mine from the surface.

Lease – a legal document giving an operator the right to drill for or produce oil or gas; also, the land on which a lease has been obtained.

License of Occupation (“LOC”) – a surface crown agreement issued by the Alberta Department of Sustainable Resources Development granting the mineral producer the right to occupy public lands for an approved purpose, usually issued primarily for access roads or to construct access roads, but may also be issued for other purposes.

Light Crude Oil – liquid petroleum which has a low density and flows freely at room temperature. Also called conventional oil, it has an API gravity of at least 22 degrees and a viscosity less than 100 centipoise (cP).

Mbbl or Mbbls – means one thousand barrels or thousands of barrels.

MMbbl or MMbbls – means one million barrels or millions of barrels.

Mineral Surface Lease (MSL) – a surface crown agreement issued by the Alberta Department of Sustainable Resources Development granting the mineral producer the right to construct a well site on publicly owned land.

Net Acre/Hectare – a net acre is the result that is obtained when the fractional ownership working interest of a lease is multiplied by gross acres of that lease.

Oil Sands – naturally occurring mixtures of bitumen, water, sand and clay that are found mainly in three areas of Alberta - Athabasca, Peace River and Cold Lake. A typical sample of oil sand might contain about 12% bitumen by weight.

Pay Zone (Net Oil Pay) – the producing part of a formation.

Permeability – the capacity of a reservoir rock to transmit fluids; or how easily fluids can pass through a rock. The unit of measurement is the darcy or millidarcy.

Porosity – the capacity of a reservoir to store fluids, the volume of the pore space within a reservoir, measured as a percentage.

Primary Recovery – the production of oil and gas from reservoirs using the natural energy available in the reservoirs and pumping techniques.

Saturation – the relative amount of water, oil, and gas in the pores of a rock, usually as a percentage of volume.

SEC – means United States Securities and Exchange Commission.

Section – in reference to a parcel of land, meaning an area of land comprising approximately 640 acres.

Solution Gas – natural gas that is found “in solution” within crude oil in underground reservoirs. When the oil comes to the surface, the gas expands and comes out of the solution.

Specific Gravity – The ratio of the heaviness of a substance compared to that of the same volume of water.

Steam-Assisted Gravity Drainage (“SAGD”) – pairs of horizontal wells (an upper well and a lower well) are drilled into an oil sands formation and steam is injected continuously into the upper well. As the steam heats the oil sands formation, the bitumen softens and drains into the lower well, from which it is brought to the surface.

Thermal Recovery – a type of improved recovery in which heat is introduced into a reservoir to lower the viscosity of heavy oils and to facilitate their flow into producing wells. The pay zone may be heated by injecting steam (steam drive) or by injecting air and burning a portion of the oil in place (in situ combustion).

Upgrading – the process that converts bitumen and heavy oil into a product with a density and viscosity similar to conventional light crude oil.

Viscosity – a measure of a fluid’s resistance to flow. To simplify, the oil’s viscosity represents the measure for which the oil wants to stay put when pushed by moving mechanical components. It varies greatly with temperature. The more viscous the oil the greater the resistance and the less easy it is for it to flow. Centipoise (cp) is the common unit for expressing absolute viscosity. Viscosity matters to producers because the oil’s viscosity at reservoir temperature determines how easily oil flows to the well for extraction.

CURRENCY EXCHANGE RATES

Our functional currency is the US dollar. Therefore, our accounts are reported in United States dollars. However, our Canadian subsidiaries maintain their accounts and records in Canadian dollars. As a result the Canadian dollar amounts are converted according to our stated foreign currency translation accounting policy, except where otherwise indicated, all dollar amounts herein are stated in United States dollars.

The following table sets forth the rates of exchange for the Canadian dollar, expressed in US dollars, in effect at the end of the following periods and the average rates of exchange during such periods, based on the noon rates of exchange for such periods as reported by the Bank of Canada.

|

Year ending September 30

|

|

2013

|

|

|

2012

|

|

|

2011

|

|

|

2010

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Rate at end of year

|

|

$ |

0.9723 |

|

|

$ |

1.0166 |

|

|

$ |

0.9626 |

|

|

$ |

0.9711 |

|

|

Average rate for the year

|

|

$ |

0.9847 |

|

|

$ |

0.9927 |

|

|

$ |

1.0140 |

|

|

$ |

0.9609 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unless the context indicates another meaning, the terms “Company,” “Deep Well,” “we,” “us” and “our” refer to Deep Well Oil & Gas, Inc. and its subsidiaries through which it conducts business. For definitions of some terms used throughout this report, see “Glossary and Abbreviations”.

PART I

ITEM 1. BUSINESS

We are an emerging independent junior oil and gas exploration and development company headquartered in Edmonton, Alberta, Canada. Our immediate corporate focus is to develop the existing oil sands land base that we presently own in the Peace River oil sands area in North Central Alberta. Our principal office is located at Suite 700, 10150 – 100 Street NW, Edmonton, Alberta T5J 0P6, our telephone number is (780) 409-8144 and our fax number is (780) 409-8146. Deep Well Oil & Gas, Inc. is a Nevada corporation and our common stock trades on the OTCQB marketplace under the symbol DWOG. We maintain a web site at www.deepwelloil.com. The contents of our website are not part of this annual report on Form 10-K.

Formation of Organization

Deep Well Oil & Gas, Inc. was originally incorporated on July 18, 1988 under the laws of the state of Nevada as Worldwide Stock Transfer, Inc. On October 25, 1990, Worldwide Stock Transfer, Inc. changed its name to Illustrious Mergers, Inc. On June 18, 1991, a company known as Allied Devices Corporation was merged with and into Illustrious Mergers, Inc. and its name was at that time changed to Allied Devices Corporation. On August 19, 1996, a company called Absolute Precision, Inc. was merged with and into Allied Devices Corporation and it retained its name as Allied Devices Corporation.

On February 19, 2003, Allied Devices Corporation filed a Petition for Relief under Chapter 11 of the U.S. Bankruptcy Code in the United States Bankruptcy Court in and for the Eastern District of New York titled In re: Allied Devices Corporation, et al., Chapter 11, Case No. 03-80962-511 (hereinafter referred to as the “Bankruptcy Action”).

On September 10, 2003, after notice to all creditors and a formal hearing, U.S. Bankruptcy Judge Melanie L. Cyganowski issued an “Order Confirming Liquidating Plan of Reorganization” in the Bankruptcy Action (hereinafter referred to as “Bankruptcy Order”). In conjunction with that Bankruptcy Order, Allied Devices Corporation’s (hereinafter referred to as the “Predecessor Company”) liabilities, among other things, were paid off and extinguished. The Bankruptcy Order, among other things, implemented a change of control and a group of new investors took control of the Predecessor Company and changed its name to Deep Well Oil & Gas, Inc.

Upon emergence from Chapter 11 proceedings, Deep Well adopted fresh-start reporting in accordance with the American Institute of Certified Public Accountants Statement of Position 90-7, Financial Reporting by Entities in Reorganization under the Bankruptcy Code (SOP 90-7). For financial reporting purposes, Deep Well adopted the provisions of fresh-start reporting effective September 10, 2003. All periods presented prior to September 10, 2003, have been designated Predecessor Company.

Deep Well has two wholly owned subsidiaries under which it conducts its operations: (1) Northern Alberta Oil Ltd. (hereinafter referred to as “Northern”) from the date of acquisition, being June 7, 2005, incorporated under the Business Corporations Act (Alberta), Canada; and (2) Deep Well Oil & Gas (Alberta) Ltd. (hereinafter referred to as “Deep Well Alberta”), incorporated under the Business Corporations Act (Alberta), Canada on September 15, 2005.

Business Development

On April 26, 2004, Northern (formerly known as Mikwec Energy Canada, Ltd. and later acquired by Deep Well) signed a Joint Operating Agreement with Pan Orient Energy Ltd. (formerly known as Maxen Petroleum Inc. hereinafter referred to as “Pan Orient”) to provide for the manner of conducting operations on three Peace River oil sands leases for a total of 32 sections covering 20,243 gross acres (8,192 gross hectares). The 32 sections were acquired jointly on April 23, 2004, with Northern having an 80% working interest and Pan Orient having a 20% working interest in the joint lands.

On August 18, 2004, Deep Well and Pan Orient jointly participated in a public offering of Crown Oil Sands Rights held by the Alberta Department of Energy, in which the joint parties successfully bid on three Peace River oil sands leases for a total of 31 sections covering 19,610 gross acres (7,936 gross hectares). Deep Well acquired an undivided 80% working interest and Pan Orient acquired an undivided 20% working interest in the joint property.

On February 25, 2005, Deep Well and Northern entered into a farmout agreement (hereinafter referred to as the “Farmout Agreement dated February 25, 2005”) with Surge Global Energy, Inc. (hereinafter referred to as “Surge US”) and Signet Energy Inc. (formerly known as Surge Global Energy Canada Ltd., and hereinafter referred to as “Signet” or our “Former Farmout Partner”) (collectively, “Surge”). Signet subsequently merged with 1350826 Alberta Ltd. a wholly owned subsidiary of Andora Energy Corporation, and subsequently 1350826 Alberta Ltd. amalgamated with Andora Energy Corporation (hereinafter referred to as “Andora”, a company 71.8% owned by Pan Orient as of November 26, 2012). This agreement allowed Surge to earn up to a 40% working interest in the farmout lands (50% of our share). And on November 26, 2007, pursuant to the Minutes of Settlement between us, Andora and Signet, Signet acquired 40% of Northern’s working interest in 12 sections on two oil sands leases. As part of the transfer to Signet of the 40% working interest, two of the original oil sands leases were split into four oil sands leases.

On June 7, 2005, Deep Well acquired 100% of the common shares of Northern in exchange for 18,208,875 shares of Deep Well’s common stock. Under the terms of the agreement, Deep Well acquired one hundred percent (100%) of Northern’s issued and outstanding common stock and obtained exclusive options to acquire one hundred percent (100%) of Northern’s preferred stock. The agreement provided that one hundred percent (100%) of Northern’s common and preferred shareholders would exchange their Northern shares for newly issued shares of Deep Well’s restricted common stock. Deep Well, through its acquisition of Northern, acquired an 80% working interest in three Peace River oil sands leases, one oil sands permit and one petroleum and natural gas license for a total of 38.5 sections covering 24,355 gross acres (9,856 gross hectares). Through this acquisition our Company more than doubled its acreage position in the Peace River oil sands to 43,965 gross acres (17,792 gross hectares).

On September 15, 2005, Deep Well Alberta was incorporated in order to hold Deep Well’s Canadian oil sands leases, which it acquired on August 18, 2004, other than the oil sands leases already held by Northern.

On April 4, 2007, Deep Well acquired the remaining preferred shares of Northern not already owned by it, resulting in Northern becoming a 100% wholly owned subsidiary of Deep Well.

On November 19, 2008, we entered into an arrangement whereby Deep Well Alberta and Northern exchanged their 755,000 and 6,795,000 common shares of Signet, respectively, into 224,156 and 2,017,402 common shares of Andora, respectively. Andora is our joint venture partner in some of our Sawn Lake oil sands project.

On April 30, 2009, the Alberta Department of Energy approved our application to convert 5 sections of our oil sands permit to a 15-year primary lease. By drilling on these lands where the permits were set to expire, we have preserved title to 5 sections and now have a primary lease, which is valid for an additional 15 years.

Effective December 3, 2012, we entered into and closed upon a Purchase and Sale agreement with our former joint venture partner, 1132559 Alberta Ltd. (hereinafter referred to as “113”), pursuant to which we acquired 113’s 10% working interest in most of the Sawn Lake oil sands properties where we already owned working interests. As of December 3, 2012, after this acquisition, our Company increased our net acres in the Sawn Lake oil sands properties from 31,376 to 35,361 net acres (12,698 to 14,310 net hectares).

On July 30, 2013, we entered into a Steam Assisted Gravity Drainage Demonstration Project Joint Operating Agreement (hereinafter referred to as the “SAGD Project”) to jointly participate in a recently AER approved SAGD Project on our 25% (after the Farmout Agreement dated July 31, 2013 as disclosed below) owned oil sands properties located in North Central Alberta, Canada (also known as the Sawn Lake heavy oil reservoir). On August 15, 2013, and in accordance with the SAGD Project agreement and the amendments, we served notice (hereinafter referred to as the “Notice of Election”) to Andora of our election to participate in the SAGD Project. Upon signing the Notice of Election we were required to pay in full the cash calls for our initial share of the costs of the SAGD Project and we have since paid all the cash calls in full as per the Farmout Agreement dated July 31, 2013.

On July 31, 2013, we entered into farmout agreement (hereinafter referred to as the “Farmout Agreement dated July 31, 2013”) with an additional joint venture partner (hereinafter referred to as the “Farmee”) to fund our share of the recently AER approved SAGD Project at our Sawn Lake heavy oil reservoir in North Central Alberta, Canada. In accordance with the agreement the Farmee has agreed to provide up to $40,000,000 in funding for our portion of the costs for the SAGD Project, in return for a net 25% working interest in 12 sections where we have a working interest of 50% (before the Farmout Agreement dated July 31, 2013). As required by the agreement, the Farmee has since paid in full the cash calls in the amount of $11,014,946 Cdn to the operator of the SAGD Project for the Farmee’s share and our share of the initial costs of the SAGD Project. The Farmee will also provide funding to cover monthly operating expenses of our Company, of which the first such payment shall be in respect of the month of August 2013 and not to exceed $30,000 per month. In addition, by December 31, 2014, the Farmee has the option to elect to obtain an additional working interest of 40% to 45% in the remaining 56 sections of land where we have working interests ranging from 80% to 90%, by committing $110,000,000 of financing to our Company’s Sawn Lake oil sands project.

On October 9, 2013, and in connection to the SAGD Project Agreement dated July 30, 2013, we entered into a Water Rights Conveyance Agreement whereby we acquired a 25% working interest in one water source well and one water disposal well for a cost of $425,000 Cdn, which in turn was reimbursed to our Company by the Farmee. In conjunction with this acquisition our Company was issued a cash call from the operator in the amount of $1,058,568 Cdn for the expenditures relating to the water source well, water disposal well and pipelines to connect them to the SAGD Project surface facility. The Farmee has since paid us this cash call in the amount of $1,058,568 Cdn pursuant to the Farmout Agreement dated July 31, 2013 and we have in turn paid the joint venture operator.

Principal Product

At this time, our primary interest is the exploration for and production of oil in the Peace River oil sands area located in North Central Alberta, Canada. We are engaged in the identification, acquisition, exploration and development of oil and gas prospects. Our immediate focus is the oil sands leases we hold in the Peace River oil sands area. Our main objective is to develop our existing oil sands lease holdings as well as identify and develop other commercially viable oil and gas properties. Exploration and development for commercially viable production of any oil and gas company includes a high degree of risk which careful evaluation, experience and factual knowledge may not eliminate. Currently we have no production from our properties.

Sawn Lake Project – Peace River Oil Sands, Alberta, Canada

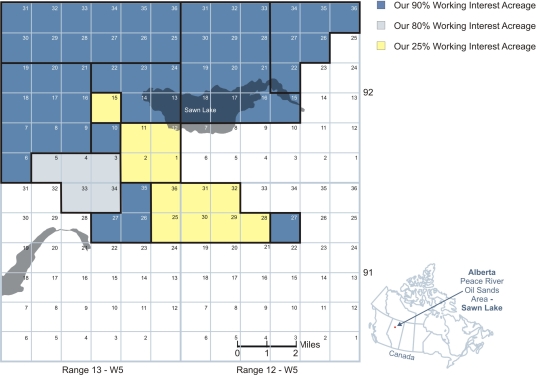

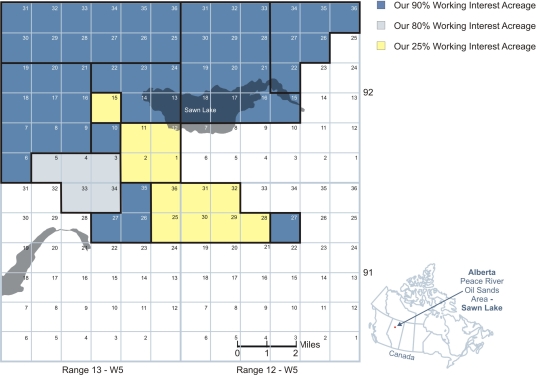

Currently, we have a 90% working interest in 51 sections on six oil sands leases where we are the operator, an 80% working interest in 5 sections on one oil sands lease where we are the operator, and a 25% working interest (after the Farmout Agreement dated July 31, 2013) in an additional 12 sections on two oil sands leases in the Peace River oil sands area of Alberta, Canada. These nine oil sands leases are all contiguous and cover 43,015 gross acres (17,408 gross hectares) with our Company having 33,463 net acres after the Farmout Agreement dated July 31, 2013 (13,542 net hectares). The focus of our Company’s operations is to exploit the heavy oil reservoir to establish proven reserves and to determine the best technology under which oil can be produced from our Sawn Lake project in order to initiate production and generate positive cash flow.

Our Company’s participation in the joint venture SAGD Project, as described above, is well underway and the operator has successfully completed the drilling of the first SAGD well pair for the joint venture project. As reported by the operator, final site preparation and construction of the steam generation facility is underway and equipment for the facility is ready for installation. Steam injection is scheduled to commence near the end of January 2014, with production anticipated in the first half of 2014.

Previously, we successfully completed a drilling program and drilled six vertical wells. In addition, we have a working interest in three horizontal wells, which were previously drilled under the Farmout Agreement dated February 25, 2005, and an interest in an additional two wells that we acquired from an unrelated third party. Since then we have been evaluating the options for production available to us to determine the preferable course of action. Drilling on 80% and now 90% owned lands have opened new avenues for testing and further development of our Sawn Lake project. In the fourth quarter of 2013, we received approval from the AER for our horizontal cyclic steam stimulation (hereinafter referred to as the “HCSS Project”) thermal recovery project application. It is anticipated that we will develop a thermal demonstration project on our properties followed by a commercial expansion project on one half section of land located on section 10-92-13W5 of our Sawn Lake oil sands properties.

Market and Distribution of Product

We anticipate our principal target market to be refiners, remarketers and other companies, some of which have pipeline facilities near our properties. In the event pipeline facilities are not conveniently available, we intend to truck our oil to alternative storage, refining or pipeline facilities. In such a case, if our production were enough to justify our own pipeline facilities we would consider building the necessary additional pipeline facilities.

We intend to sell our oil and gas production under both short-term (less than one year) and long-term (one year or more) agreements at prices negotiated with third parties. Under both short-term and long-term contracts, typically either the entire contract (in the case of short-term contracts) or the price provisions of the contract (in the case of long-term contracts) are renegotiated in intervals ranging in frequency from daily to annual. At this time we have no production and therefore no short-term or long-term contracts. We will adopt specific sales and marketing plans once production is achieved.

Market pricing for bitumen is seasonal, with lower prices in and around the calendar year-end being the norm due to lower demand for asphalt and other bitumen-derived products. By necessity, bitumen is regularly blended with diluent in order to facilitate its transportation through pipelines to North American markets. As such, the effective field price for bitumen is also directly impacted by the input cost of the diluent required, the demand and price of which is also seasonal in nature (higher in winter as colder temperatures necessitate more diluent for transportation). Consequently, bitumen pricing is usually weakest in and around December and not reflective of the annual average realized price or the economics of the “business” overall. We have been advised that, to price bitumen, marketers apply formulas that take as a reference point the prices published for crude oil of particular qualities such as “Western Canadian Select”, “Brent Crude Oil”, “Crude Bitumen 9 API Plant Gate”, “Edmonton light”, “Lloydminster blend”, or the more internationally known “West Texas Intermediate” (hereinafter referred to as “WTI”).

The price of oil and natural gas sold is determined by negotiation between buyers and sellers. An order from the National Energy Board (hereinafter referred to as “NEB”) is required for oil and gas exports from Canada. The NEB is a federal agency which was formed in 1959 by the Parliament of Canada to regulate oil, gas and electric utility industries. The NEB monitors the supply and demand of oil, as it does with natural gas, to ensure quantities exported do not exceed the surplus remaining after Canadian requirements have been met. Any oil export to be made pursuant to an export contract that exceeds a certain duration or quantity requires an exporter to obtain authorization from the NEB. Natural gas exported from Canada is also subject to similar regulation by the NEB. Exporters are free to negotiate prices and other terms with purchasers provided that the export contracts meet certain criteria prescribed by the NEB. The government of Alberta also regulates the volume of natural gas, which may be removed from the province for consumption elsewhere based on such factors as reserve availability, transportation arrangements and market considerations.

Competitive Business Conditions

We operate in a highly competitive environment, competing with major integrated and independent energy companies for desirable oil and natural gas properties as well as for the equipment, labour and materials required to develop and operate those properties. Many of our competitors have longer operating histories and substantially greater financial and other resources greater than ours. Many of these companies not only explore for and produce crude oil and natural gas, but also carry on refining operations and market petroleum and other products on a worldwide basis. Our larger competitors, by reason of their size and relative financial strength, can more easily access capital markets than we can and may enjoy a competitive advantage, whereas we may incur higher costs or be unable to acquire and develop desirable properties at costs we consider reasonable because of this competition. Larger competitors may be able to absorb the burden of any changes in laws and regulation in the jurisdictions in which we do business and handle longer periods of reduced prices of gas and oil more easily than we can. Our competitors may be able to pay more for productive oil and natural gas properties and may be able to define, evaluate, bid for and purchase a greater number of properties and prospects than we can. Our ability to acquire additional properties in the future will depend upon our ability to conduct efficient operations, evaluate and select suitable properties, implement advanced technologies and consummate transactions in a highly competitive environment.

Competitive conditions may be substantially affected by various forms of energy legislation and/or regulation considered from time to time by the government of Canada and other countries as well as factors that we cannot control, including international political conditions, overall levels of supply and demand for oil and gas, and the markets for synthetic fuels and alternative energy sources.

Customers

As we remain in the exploration stage, we have not yet generated any revenues from production, nor do we have any customers at this time. We anticipate our principal target customers to be refiners, remarketers and other companies.

Royalty Agreements

Through the acquisition of Northern, we potentially became a party to the following:

On December 12, 2003, Nearshore Petroleum Corporation (hereinafter referred to as “Nearshore”) entered into a royalty agreement with Mikwec Energy Canada, Ltd. (now known as Northern) that potentially encumbers six oil sands leases covering 23,405 gross acres (9,472 gross hectares) located within our Sawn Lake properties (hereinafter the “Royalty Agreement”). Nearshore claimed a 6.5% gross overriding royalty from Northern on the leased substances on the land interests which Northern holds in the above six oil sands leases. Nearshore was a private corporation incorporated in Alberta, Canada, and was owned and controlled by Mr. Steven P. Gawne and his wife, Mrs. Rebekah J. Gawne, who each owned 50% of Nearshore. Mr. Steven P. Gawne was formerly the President, Chief Executive Officer and Director of Deep Well from February 6, 2004 to June 29, 2005. Nearshore has purportedly transferred part or all of this Royalty Agreement to other parties.

On February 28, 2005, Deep Well and Northern and our Former Farmout Partner agreed that our Company would be responsible for the portion of the claimed 6.5% royalty payable by our Former Farmout Partner, if any, on lands earned under the Farmout Agreement dated February 25, 2005. This liability could arise by virtue of a Royalty Agreement between Northern and Nearshore dated December 12, 2003. This potential obligation of our Company was further modified on November 26, 2007, when it was agreed between our Company and our Former Farmout Partner that our Company would not be liable or obligated to pay any of this claimed portion of the royalty due, if any, on the 3% portion of the royalty acquired by our Former Farmout Partner.

Government Approval and Crown Royalties

Exploration and Production. Our operations are subject to Canadian federal and provincial governmental regulations. Such regulations include: requiring approval and licenses for the drilling of wells, regulating the location of wells and the method and ability to produce wells, surface usage and the restoration of land upon which wells have been drilled, the plugging and abandoning of wells and the transportation of production from our wells. Our operations are also subject to various conservation regulations, including the regulation of in-situ recovery processes, the size of spacing units, the number of wells which may be drilled in a unit, the unitization or pooling of oil and gas properties, the rate of production allowable from oil and gas wells, and the ability to produce oil and gas.

The North American Free Trade Agreement. The North American Free Trade Agreement (hereinafter referred to as “NAFTA”) grants Canada the freedom to determine whether exports to the United States or Mexico will be allowed. In making this determination, Canada must ensure that any export restrictions do not (i) reduce the proportion of energy exported relative to the supply of the energy resource; (ii) impose an export price higher than the domestic price; or (iii) disrupt normal channels of supply. All parties to NAFTA are also prohibited from imposing minimum export or import price requirements.

Investment Canada Act. The Investment Canada Act requires notification and/or review by the Government of Canada in certain cases, including but not limited to, the acquisition of control of a Canadian Business by a non-Canadian. In certain circumstances, the acquisition of a working interest in a property that contains recoverable reserves will be treated as the acquisition of an interest in a “business” and may be subject to either notification or review, depending on the size of the interest being acquired and the asset size of the business.

Crown Royalties and Incentives. Each province and the federal government of Canada have legislation and regulations governing land tenure, royalties, production rates and taxes, environmental protection and other matters under their respective jurisdictions. The royalty regime is a significant factor in the profitability of oil and natural gas production. Royalties payable on production from lands other than Crown lands are determined by negotiations between the parties. Crown royalties are determined by government regulation and are generally calculated as a percentage of the value of the gross production with the royalty rate dependent in part upon prescribed reference prices, well productivity, geographical location, field discovery date and the type and quality of the petroleum product produced. From time to time, the governments of Canada and Alberta have established incentive programs such as royalty rate reductions, royalty holidays, tax credits and drilling royalty credits. These incentives are for the purpose of encouraging oil and natural gas exploration or enhanced recovery projects. These incentives generally increase cash flow.

Effective January 1, 2009, oil sands royalties in Alberta are calculated using a sliding scale for royalty rates ranging from 1% to 9% pre-payout and 25% to 40% post-payout depending on the world oil price. Project “payout” refers to the point in which we earn sufficient revenues to recover all of the allowed costs for the project plus a return allowance. The base royalty starts at 1% and increases for every dollar the world oil price, as reflected by the WTI, is priced above $55 per barrel, to a maximum of 9% when oil is priced at $120 per barrel or greater. The net royalty starts at 25% and increases for every dollar oil is priced above $55 per barrel to 40% when oil is priced at $120 or higher.

Research and Development

We had no material scientific research and development costs for the fiscal years ended September 30, 2013, 2012 and 2011.

Environmental Laws and Regulations

The oil and natural gas industry is subject to environmental laws and regulations pursuant to Canadian local, provincial and federal legislation. Environmental legislation provides for restrictions and prohibitions on releases or emissions of various substances produced or utilized in association with certain oil and gas industry operations. In addition, legislation requires that well and facility sites be monitored, abandoned and reclaimed to the satisfaction of provincial authorities. A breach of such legislation may result in the imposition of fines and penalties. Under these laws and regulations, we could be liable for personal injury, clean-up costs and other environmental and property damages as well as administrative, civil and criminal penalties. Accordingly, we could be liable or could be required to cease production on properties if environmental damage occurs. Although we maintain insurance coverage, the costs of complying with environmental laws and regulations in the future may harm our business. Furthermore, future changes in environmental laws and regulations could occur that result in stricter standards and enforcement, larger fines and liability, and increased capital expenditures and operating costs, any of which could have a material adverse effect on our financial condition or results of operations. We maintain commercial property and general liability insurance coverage on the properties we operate. We also maintain operators extra expense insurance which provides coverage for well control incidents specifically relating to regaining control of a well, seepage, pollution, clean-up and containment. No coverage is maintained with respect to any fine or penalty required to be paid due to a violation of the regulations set out by the federal and provincial regulatory authorities. We are committed to meeting our responsibilities to protect the environment and anticipate making increased expenditures of both a capital and expense nature as a result of the increasingly stringent laws relating to the protection of the environment.

Alberta’s new climate change regulation, effective July 1, 2007, requires Alberta facilities that emit more than 100,000 tonnes of greenhouse gases a year to reduce emissions intensity by 12 per cent. Companies have four choices to meet their reductions: 1.) they can make operating improvements to their operations that will result in greenhouse gas emission reductions; 2.) purchase Alberta based offset credits; 3.) contribute to the Climate Change and Emissions Management Fund; and 4.) purchase or use emission performance credits, also called EPCs, these credits are generated by facilities that have gone beyond the 12% mandatory intensity reduction. EPCs can be banked for future use or sold to other facilities that need to meet the reduction target.

On June 18, 2009, the Canadian government passed the new Environmental Enforcement Act (“EEA”). The EEA was created to strengthen and amend nine existing Statutes that relate to the environment and to enact provisions respecting the enforcement of certain Statutes that relate to the environment. The EEA amends various enforcement, offence, penalty and sentencing provisions to deter offenders from committing offences under the EEA by setting minimum and maximum fines for serious offences. The EEA also gives enforcement officers new powers to investigate cases and grants courts new sentencing authorities that ensure penalties reflect the seriousness of the pollution and wildlife offences. The EEA also expands the authority to deal with environmental offenders by: 1.) specifying aggravating factors such as causing damage to wildlife or wildlife habitat, or causing damage that is extensive, persistent or irreparable; 2.) providing fine ranges that are higher for corporate offenders than for individuals; 3.) doubling fine ranges for repeat offenders; 4.) authorizing the suspension and cancellation of licenses, permits or other authorizations upon conviction; 5.) requiring corporate offenders to report convictions to shareholders; and 6.) mandating the reporting of corporate offences on a public registry.

Employees

Our Company currently has two prime subcontractors and three full-time employees. For further information on our subcontractors see “Compensation Arrangements for Executive Officers” under Item 11 “Executive Compensation”. We expect to hire from time to time more employees, independent consultants, and contractors during the stages of implementing our plans.

ITEM 1A. RISK FACTORS

An investment in our common stock is speculative and involves a high degree of risk and uncertainty. You should carefully consider the risks described below, together with the other information contained in our reports filed with the SEC, including the consolidated financial statements and notes thereto of our Company before deciding to invest in our common stock. The risks described below are not the only ones facing our Company. Additional risks not presently known to us, or that we presently consider immaterial may also adversely affect our Company. If any of the following risks occur, our business, financial condition and results of operations and the value of our common stock could be materially and adversely affected.

Any Development Of Our Resources Will Be Subject To Crown Royalties. The royalty regime of Alberta is a significant factor in the profitability of oil and natural gas production in Alberta, Canada. Crown royalties are determined by government regulation and are generally calculated as a percentage of the value of the gross production with the royalty rate dependent in part upon prescribed reference prices, well productivity, geographical location, field discovery date and the type and quality of the petroleum product produced. From time to time, the governments of Canada and Alberta have established incentive programs such as royalty rate reductions, royalty holidays, tax credits, drilling royalty credits and well incentive programs. These incentives are for the purpose of encouraging oil and natural gas exploration or enhanced recovery projects. These incentives generally increase cash flow. Penalties and interest may be charged to us if we fail to remit royalties on our production to the Crown as prescribed in the regulation.

We Are An Exploration Stage Company Implementing A New Business Plan. We are an exploration stage Company with only a limited operating history upon which to base an evaluation of our current business and future prospects, and we have just begun to implement our business plan. Since our inception, we have suffered recurring losses from operations and have been dependent on new investment to sustain our operations. During the years ended September 30, 2013 and 2012 we reported net losses of $2,463,403 and $1,095,050 respectively.

The Successful Implementation Of Our Business Plan Is Subject To Risks Inherent In The Heavy Oil Business. Our heavy oil operations are subject to the economic risks typically associated with exploration, development and production activities, including the necessity of significant expenditures to locate and acquire properties and to drill exploratory wells. In addition, the cost and timing of drilling, completing, operating and acquiring regulatory approval for thermal recovery operations on our wells is often uncertain. In conducting exploration and development activities, the presence of unanticipated pressure or irregularities in formations, miscalculations or accidents may cause our exploration, development and production activities to be unsuccessful. This could result in a total loss of our investment in a particular property. If exploration efforts are unsuccessful in establishing proven reserves and exploration activities cease, the amounts accumulated as unproven costs will be charged against earnings as impairments. Our exploitation and development of oil and gas reserves depends upon access to the areas where our operations are to be conducted. We conduct a portion of our operations in regions where we are only able to do so on a seasonal basis. Unless the surface is sufficiently frozen, we are unable to access our properties, drill or otherwise conduct our operations as planned. In addition, if the surface thaws earlier than expected, we must cease our operations for the season earlier than planned. Our operations are affected by road bans imposed from time to time during the break-up and thaw period in the spring. Road bans are also imposed due to spring-break up, heavy rain, mud, rock slides and periods of high water, which can restrict access to our well sites and potential production facility sites. Our inability to access our properties or to conduct our operations as planned will result in a shutdown or slowdown of our operations, which will adversely affect our business.

We Rely On Independent Experts And Technical Or Operational Service Providers Over Whom We May Have Limited Control. The success of our business is dependent upon the efforts of various third parties that we do not control. We rely upon various companies to assist us in identifying desirable oil prospects to acquire and to provide us with technical assistance and services. We also rely upon the services of geologists, geophysicists, chemists, engineers and other scientists to explore and analyze oil prospects to determine a method in which the oil prospects may be developed in a cost-effective manner. In addition, we rely upon the owners and operators of oil drilling equipment to drill and develop our prospects to production. Although we have developed relationships with a number of third-party service providers, we cannot assure that we will be able to continue to rely on such persons. If any of these relationships with third-party service providers are terminated or are unavailable on commercially acceptable terms, we may not be able to execute our business plan. Our limited control over the activities and business practices of these third parties, any inability on our part to maintain satisfactory commercial relationships with them or their failure to provide quality services could materially and adversely affect our business, results of operations and financial condition.

Our Interests Are Held In The Form Of Leases That We May Be Unable To Retain. Our Sawn Lake property is held under leases and working interests in leases. These leases we are a party to are for a fixed term of 15 years, but contain a provision that allows us to extend the term of the lease so long as we meet the minimum level of evaluation as set out by the Government of Alberta tenure guidelines. If we or the holder of a lease fails to meet the specific requirements of the lease regarding delay or non-payment of rental payments or we or the holder of the lease fail to meet the minimum level of evaluation, some or all of our leases may terminate or expire. There can be no assurance that any of the obligations required to maintain each lease will be met. The termination or expiration of our leases or the working interests relating to leases may reduce our opportunity to exploit a given prospect for oil production and thus have a material adverse effect on our business, results of operations and financial condition.

We Expect Our Operating Expenses To Increase Substantially In The Future And We May Need To Raise Additional Funds. We have a history of net losses and expect that our operating expenses will increase substantially over the next 12 months as we continue to implement our business plan. In addition, we may experience a material decrease in liquidity due to unforeseen capital calls or other events and uncertainties. As a result, we may need to raise additional funds, and such funds may not be available on favourable terms, if at all. If we cannot raise funds on acceptable terms, we may not be able to execute our business plan, take advantage of future opportunities or respond to competitive pressures or unanticipated requirements. This may seriously harm our business, results of operations and financial condition.

Our Ability To Produce Sufficient Quantities Of Oil From Our Properties May Be Adversely Affected By A Number Of Factors Outside Of Our Control. The business of exploring for and producing oil and gas involves a substantial risk of investment loss. Drilling oil wells involves the risk that the wells may be unproductive or that, although productive, the wells may not produce oil in economic quantities. Other hazards such as unusual or unexpected geological formations, pressures, fires, blowouts, loss of circulation of drilling fluids or other conditions may substantially delay or prevent completion of any well. Adverse weather conditions can also hinder drilling operations. A productive well may become uneconomic due to pressure depletion, water encroachment, mechanical difficulties, etc., which impair or prevent the production of oil and/or gas from the well. There can be no assurance that oil will be produced from the properties in which we have interests. Marketability of any oil that we acquire or discover may be influenced by numerous factors beyond our control. The marketability of our production will depend on the proximity of our reserves to and the capacity of, third party facilities and services, including oil and natural gas gathering systems, pipelines, trucking or terminal facilities, and processing facilities. The unavailability or insufficient capacity of these facilities and services could force us to shut-in producing wells, delay the commencement of production, or discontinue development plans for some of our properties, which would adversely affect our financial condition and performance. There may be periods of time when pipeline capacity is inadequate to meet our oil transportation needs. During periods when pipeline capacity is inadequate, we may be forced to reduce production or incur additional expense as existing production is compressed to fit into existing pipelines. Other risk factors include availability of drilling and related equipment, market fluctuations of prices, taxes, royalties, land tenure, allowable production and environmental protection. We cannot predict how these factors may affect our business.

We Do Not Control All Of Our Operations. We do not operate all of our properties and we therefore have limited influence over the testing, drilling and production operations of those properties. Currently, we have a 90% working interest in 51 sections on six oil sands leases, an 80% working interest in 5 sections on one oil sands lease, where we are the operator of the 80% and 90% leases. We also have a 25% working interest (after the Farmout Agreement dated July 31, 2013) in an additional 12 sections on two oil sands leases where one of our joint venture partners is the operator. These nine oil sands leases, which are all contiguous, cover 43,015 gross acres (17,408 gross hectares) where we currently have 33,463 net acres (13,542 net hectares). All nine oil sands leases are located in the Peace River oil sands area of Alberta, Canada. Our lack of operational control of the 12 sections, currently not operated by us, could result in the following:

|

·

|

The Operator might initiate exploration or development on a faster or slower pace than we prefer;

|

|

·

|

The Operator might propose to drill more wells or build more facilities on a project than we have funds for or that we deem appropriate, which could mean that we are unable or decline to participate in the project or share in the revenues generated by the project;

|

|

·

|

If the Operator refuses to initiate a project on these 12 sections, we might be unable to pursue a project on those sections unless we directly pay the entire cost thereof. In such a scenario, the Joint Operating Agreements governing the relationship of the joint interest owners in Sawn Lake allow a party to recoup the costs which are paid on behalf of other non-participating joint owners in addition to penalties because of their non-participation.

|

Any of these events could materially reduce the value of those properties affected.

We Are Party To a Lawsuit And Will Be Adversely Affected If We Are Found To Be Liable In Connection With Any Legal Proceedings. We are party to a lawsuit described in this annual report on Form 10-K under the heading “Legal Proceedings”. We intend to vigorously defend ourselves against the claims made in the lawsuit, and while we believe that the likelihood of an adverse outcome is remote we cannot predict the outcome of these proceedings, the commencement or outcome of any future proceedings against us, or whether any such proceeding would lead to monetary damages that would have a material adverse effect on our financial position.

Aboriginal Peoples May Make Claims Regarding The Lands On Which Our Operations Are Conducted. Aboriginal peoples have claimed aboriginal title and rights to a substantial portion of western Canada. Since aboriginal peoples have filed a claim claiming aboriginal title or rights to the lands on which some of our properties are located, and if such a claim is successful, it could have a material adverse effect on our operations.

The AER governs our operations in Alberta, Canada and they have implemented a new directive (Directive 056) that the Alberta Government issued its First Nations Consultation Policy on Land Management and Resource Development on May 16, 2005. The AER expects that all industry applicants must adhere to this policy and the consultation guidelines. These requirements and expectations apply to the licensing of all new energy developments and all modifications to existing energy developments, as covered in Directive 056. In the policy, the Alberta Government has developed consultation guidelines to address specific questions about how consultation for land management and resource development should occur in relation to specific activities. Prior to filing an application, the applicant must address all questions, objections, and concerns regarding the proposed development project and attempt to resolve them. This includes concerns and objections raised by members of the public, industry, government representatives, First Nations, Métis, and other interested parties. This process can cause significant delays in obtaining a drilling permit for exploration and/or a production well license for both oil and gas.

Our Operations Are Subject To A Wide Range of Environmental Legislation and Regulation From All Levels Of Government Of Which We Have No Control. Environmental legislation imposes, among other things, restrictions, liabilities and obligations in connection with the generation, handling, storage, transportation, treatment and disposal of hazardous substances and waste and in connection with spills, releases and emissions of various substances into the environment. As well, environmental regulations are imposed on the qualities and compositions of the products sold and imported. Environmental legislation also requires that wells, facility sites and other properties associated with our operations be operated, maintained, abandoned and reclaimed to the satisfaction of applicable regulatory authorities. In addition, certain types of operations, including exploration and development projects and significant changes to certain existing projects, may require the submission and approval of environmental impact assessments. Compliance with environmental legislation can require significant expenditures, and failure to comply with environmental legislation may result in the imposition of fines and penalties and liability for cleanup costs and damages. We cannot assure that the costs of complying with environmental legislation in the future will not have a material adverse effect on our financial condition or results of operations. We anticipate that changes in environmental legislation may require, among other things, reductions in emissions to the air from its operations and result in increased capital expenditures. Future changes in environmental legislation could occur and result in stricter standards and enforcement, larger fines and liability, and increased capital expenditures and operating costs, which could have a material adverse effect on our results of operations and financial condition.

Market Fluctuations In The Prices Of Oil Could Adversely Affect Our Business. Prices for oil tend to fluctuate significantly in response to factors beyond our control. These factors include, but are not limited to, the continued threat of war in the Middle East and actions of the Organization of Petroleum Exporting Countries and its maintenance of production constraints, the U.S. economic environment, weather conditions, the availability of alternate fuel sources, transportation interruption, the impact of drilling levels on crude oil and natural gas supply, and the environmental and access issues that could limit future drilling activities for the industry.

Changes in commodity prices may significantly affect our capital resources, liquidity and expected operating results. Price changes directly affect revenues and can indirectly impact expected production by changing the amount of funds available to reinvest in exploration and development activities. Reductions in oil and gas prices not only reduce revenues and profits, but could also reduce the quantities of reserves that are commercially recoverable. Significant declines in prices could result in non-cash charges to earnings due to impairment.

Changes in commodity prices may also significantly affect our ability to estimate the value of producing properties for acquisition and divestiture and often cause disruption in the market for oil producing properties, as buyers and sellers have difficulty agreeing on the value of the properties. Price volatility also makes it difficult to budget for and project the return on acquisitions and development and exploitation of projects. We expect that commodity prices will continue to fluctuate significantly in the future.

Our Stock Price Could Decline. Our common stock is traded on the OTCQB marketplace. There can be no assurance that an active public market will continue for our common stock or that the market price for our common stock will not decline below its current price. Such price may be influenced by many factors, including but not limited to, investor perception of us and our industry and general economic and market conditions. The trading price of our common stock could be subject to wide fluctuations in response to announcements of our business developments or our competitors, quarterly variations in operating results, and other events or factors. In addition, stock markets have experienced extreme price volatility in recent years. This volatility has had a substantial effect on the market prices of companies, at times for reasons unrelated to their operating performance. Such broad market fluctuations may adversely affect the price of our common stock. Our stock price may decline as a result of future sales of our shares or the perception that such sales may occur.

We Could Be Subject To SEC Penalties If We Do Not File All Of Our SEC Reports. Although we are presently up to date in our filings, in the past we have not timely filed all of our annual and quarterly reports required to be filed by us with the U.S. Securities and Exchange Commission (“SEC”), in a timely manner. It is possible that the SEC could take enforcement action against us, including potentially the de-registration of our securities, if we fail to file our annual and quarterly reports in a timely manner as required by the SEC. If the SEC were to take any such actions, it could adversely affect the liquidity of trading in our common stock and the amount of information about our Company that is publicly available.

Broker-Dealers Are Not Permitted To Solicit Trades In Our Common Stock. Our common stock is considered to be a “penny stock” because it meets one or more of the definitions of “penny stock” in the Exchange Act Rule 3a51-1. The principal result or effect of being designated a “penny stock” is that securities broker-dealers cannot recommend the stock and may only trade in it on an unsolicited basis.

Risks Related To Broker-Dealer Requirements Involving Penny Stocks / Risks Affecting Trading and Liquidity. Section 15(g) of the Securities Exchange Act of 1934, as amended, and Rule 15g-2 promulgated thereunder by the SEC require broker-dealers dealing in penny stocks to provide potential investors with a document disclosing the risks of penny stocks and to obtain a manually signed and dated written receipt of the document before effecting any transaction in a penny stock for the investor’s account. These rules may have the effect of reducing the level of trading activity in the secondary market, if and when one develops.

Potential investors in our common stock are urged to obtain and read such disclosure carefully before purchasing any shares that are deemed to be “penny stock.” Moreover, SEC Rule 15g-9 requires broker-dealers in penny stocks to approve the account of any investor for transactions in such stocks before selling any penny stock to that investor. This procedure requires the broker-dealer to (i) obtain from the investor information concerning his or her financial situation, investment experience and investment objectives; (ii) reasonably determine, based on that information, that transactions in penny stocks are suitable for the investor and that the investor has sufficient knowledge and experience as to be reasonably capable of evaluating the risks of penny stock transactions; (iii) provide the investor with a written statement setting forth the basis on which the broker-dealer made the determination in (ii) above; and (iv) receive a signed and dated copy of such statement from the investor, confirming that it accurately reflects the investor’s financial situation, investment experience and investment objectives. Pursuant to the Penny Stock Reform Act of 1990, broker-dealers are further obligated to provide customers with monthly account statements. Compliance with the foregoing requirements may make it more difficult for investors in our stock to resell their shares to third parties or to alternatively dispose of them in the market or otherwise.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. PROPERTIES

Office Leases

We lease and maintain office space in Edmonton, Alberta for corporate and administrative operations; this lease expired on December 31, 2013. We are currently negotiating the terms of entering into a new lease for our Edmonton office space. We previously leased and maintained an office space in Calgary, Alberta; this lease expired on November 30, 2012 and was not renewed.

Oil and Gas Properties

Acreage

Currently, we have a 90% working interest in 51 sections on six oil sands leases, an 80% working interest in 5 sections on one oil sands lease, and a 25% working interest (after the Farmout Agreement dated July 31, 2013) in an additional 12 sections on two oil sands leases in the Peace River oil sands area of Alberta, all of these sections are contiguous. These nine oil sands leases cover 43,015 gross acres (17,408 gross hectares). Of the 68 contiguous sections on nine oil sands leases, one of our joint venture partners is the operator of 12 sections on two oil sands leases where we have a 25% working interest (after the Farmout Agreement dated July 31, 2013), and we are the operator on 56 sections on seven oil sands leases where we have working interests of either 80% or 90%. For further information, see Oil and Gas Properties on our Balance Sheet and Note 3 and 4 of the notes to the consolidated financial statements included in this annual report on Form 10-K.

The following table summarizes our gross and net developed and undeveloped oil and natural gas rights under lease as of December 31, 2013.

|

OIL SANDS RIGHTS as of December 31, 2013

|

|

| |

|

Gross Hectares

|

|

|

Net

Hectares

|

|

|

Gross Acres

|

|

|

Net

Acres

|

|

|

Oil Sands Developed Acreage

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sawn Lake – Peace River oil sands area, Alberta, Canada

|

|

None

|

|

|

None

|

|

|

None

|

|

|

None

|

|

|

Total

|

|

None

|

|

|

None

|

|

|

None

|

|

|

None

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Oil Sands Undeveloped Acreage

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sawn Lake – Peace River oil sands area, Alberta, Canada

|

|

|

|

|

|

|

|

|

|

|

|

|

|

51 sections (1)

|

|

|

13,056 |

|

|

|

11,750 |

|

|

|

32,261 |

|

|

|

29,035 |

|

|

5 sections (2)

|

|

|

1,280 |

|

|

|

1,024 |

|

|

|

3,163 |

|

|

|

2,530 |

|

|

12 sections (3)

|

|

|

3,072 |

|

|

|

768 |

|

|

|

7,591 |

|

|

|

1,898 |

|

|

Total

|

|

|

17,408 |

|

|

|

13,542 |

|

|

|

43,015 |

|

|

|

33,463 |

|

| |

|

|