EXHIBIT 99.1

CANAGOLD RESOURCES LTD.

Third Quarter Report

Condensed Consolidated Interim Financial Statements

(expressed in United States dollars)

Three and Nine Months ended September 30, 2023

(Unaudited – Prepared by Management)

Notice of No Auditor Review of

Unaudited Condensed Consolidated Interim Financial Statements

For the Three and Nine Months Ended September 30, 2023

In accordance with National Instrument 51-102 Part 4, subsection 4.3(3)(a), if an auditor has not performed a review of these unaudited condensed consolidated interim financial statements, they must be accompanied by a notice indicating that the unaudited condensed consolidated interim financial statements have not been reviewed by an auditor.

The accompanying unaudited condensed consolidated interim financial statements of Canagold Resources Ltd. (the “Company”) for the three and nine months ended September 30, 2023 (the “Financial Statements”) have been prepared by and are the responsibility of the Company’s management, and have not been reviewed by the Company’s auditors. The Financial Statements are stated in terms of United States dollars, unless otherwise indicated, and are prepared in accordance with International Accounting Standards 34 (“IAS 34”) and International Financial Reporting Standards (“IFRS”).

| CANAGOLD RESOURCES LTD. Condensed Consolidated Interim Statements of Financial Position (Unaudited – Prepared by Management) (expressed in thousands of United States dollars) |

|

|

|

|

|

| September 30, |

|

| December 31, |

| |||

|

|

| Notes |

|

| 2023 |

|

| 2022 |

| |||

|

|

|

|

|

|

|

|

|

|

| |||

| ASSETS |

|

|

|

|

|

|

|

|

| |||

|

|

|

|

|

|

|

|

|

|

| |||

| CURRENT ASSETS |

|

|

|

|

|

|

|

|

| |||

| Cash and cash equivalents |

|

|

|

| $ | 3,013 |

|

| $ | 3,825 |

| |

| Marketable securities |

|

| 6 |

|

|

| 375 |

|

|

| 855 |

|

| Receivables and prepaids |

|

| 15 |

|

|

| 933 |

|

|

| 1,131 |

|

| Total Current Assets |

|

|

|

|

|

| 4,321 |

|

|

| 5,811 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NON-CURRENT ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

| Mineral property interests |

|

| 7,13 |

|

|

| 29,915 |

|

|

| 26,277 |

|

| Mineral property deposits |

|

| 13 |

|

|

| 152 |

|

|

| 166 |

|

| Equipment |

|

| 8 |

|

|

| 312 |

|

|

| 374 |

|

| Total Non-Current Assets |

|

|

|

|

|

| 30,379 |

|

|

| 26,817 |

|

| Total Assets |

|

|

|

|

| $ | 34,700 |

|

| $ | 32,628 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| LIABILITIES AND SHAREHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| CURRENT LIABILITIES |

|

|

|

|

|

|

|

|

|

|

|

|

| Accounts payable and accrued liabilities |

|

| 12 |

|

| $ | 1,237 |

|

| $ | 1,296 |

|

| Flow through premium liability |

|

| 9(a) |

|

| - |

|

|

| 32 |

| |

| Deferred royalty liability, current |

|

| 9(b) |

|

| 35 |

|

|

| 35 |

| |

| Lease liability, current |

|

| 9(c) |

|

| 62 |

|

|

| 62 |

| |

| Total Current Liabilities |

|

|

|

|

|

| 1,334 |

|

|

| 1,425 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| LONG TERM LIABILITIES |

|

|

|

|

|

|

|

|

|

|

|

|

| Deferred royalty liability, long term |

|

| 9(b) |

|

| 73 |

|

|

| 96 |

| |

| Lease liability, long term |

|

| 9(c) |

|

| 160 |

|

|

| 195 |

| |

| Share based compensation liability |

|

| 10(c(iv)) |

|

| 262 |

|

|

| - |

| |

| Deferred income tax liability |

|

| 15 |

|

|

| 1,347 |

|

|

| 1,399 |

|

| Total Long Term Liabilities |

|

|

|

|

|

| 1,842 |

|

|

| 1,690 |

|

| Total Liabilities |

|

|

|

|

|

| 3,176 |

|

|

| 3,115 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| SHAREHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

| Share capital |

|

| 10(b) |

|

| 88,759 |

|

|

| 85,465 |

| |

| Reserve for share-based payments |

|

|

|

|

|

| 509 |

|

|

| 815 |

|

| Accumulated other comprehensive loss |

|

|

|

|

|

| (3,717 | ) |

|

| (3,990 | ) |

| Deficit |

|

|

|

|

|

| (54,027 | ) |

|

| (52,777 | ) |

| Total Shareholders' Equity |

|

|

|

|

|

| 31,524 |

|

|

| 29,513 |

|

| Total Liabilities and Shareholders' Equity |

|

|

|

|

| $ | 34,700 |

|

| $ | 32,628 |

|

Nature of operations and going concern (Note 1)

Commitments (Note 14)

Subsequent events (Note 16)

Refer to the accompanying notes to the condensed consolidated interim financial statements.

Approved on behalf of the Board:

| /s/ Sofia Bianchi |

| /s/ Andrew Trow |

|

|

|

|

|

|

| Director |

| Director |

|

| CANAGOLD RESOURCES LTD. Condensed Consolidated Interim Statements of Comprehensive Loss (Unaudited – Prepared by Management) (expressed in thousands of United States dollars, except per share amounts) |

|

|

|

|

| Three Months ended September 30, |

|

| Nine Months ended September 30, |

| ||||||||||||

|

|

| Notes |

|

| 2023 |

|

| 2022 |

|

| 2023 |

|

| 2022 |

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

| Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

| Amortization |

|

| 8 |

|

| $ | 27 |

|

| $ | 12 |

|

| $ | 68 |

|

| $ | 38 |

|

| Corporate development |

|

| 12 |

|

|

| 24 |

|

|

| 58 |

|

|

| 158 |

|

|

| 58 |

|

| Employee and/or director remuneration |

|

| 12 |

|

|

| 90 |

|

|

| 292 |

|

|

| 479 |

|

|

| 547 |

|

| General and administrative |

|

| 11,12 |

|

|

| 144 |

|

|

| 274 |

|

|

| 346 |

|

|

| 665 |

|

| Shareholder relations |

|

|

|

|

|

| - |

|

|

| 91 |

|

|

| - |

|

|

| 325 |

|

| Share-based payments |

|

| 10(c),12 |

|

| 263 |

|

|

| (71 | ) |

|

| 263 |

|

|

| 129 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating loss |

|

|

|

|

|

| (547 | ) |

|

| (656 | ) |

|

| (1,313 | ) |

|

| (1,762 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest income |

|

|

|

|

|

| 18 |

|

|

| - |

|

|

| 44 |

|

|

| - |

|

| Foreign exchange (loss) gain |

|

|

|

|

|

| 97 |

|

|

| (49 | ) |

|

| 68 |

|

|

| (58 | ) |

| Change in fair value of marketable securities |

|

| 6 |

|

|

| (325 | ) |

|

| (59 | ) |

|

| (360 | ) |

|

| (531 | ) |

| Write off of mineral property interests |

|

|

|

|

|

| - |

|

|

| (12 | ) |

|

| - |

|

|

| (20 | ) |

| Mineral property option income |

|

| 7(a)and(b) |

|

| - |

|

|

| 530 |

|

|

| - |

|

|

| 540 |

| |

| Interest and finance expense |

|

| 9(b),(c),(d) |

|

| (5 | ) |

|

| (20 | ) |

|

| (27 | ) |

|

| (34 | ) | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss before income tax |

|

|

|

|

|

| (763 | ) |

|

| (266 | ) |

|

| (1,588 | ) |

|

| (1,865 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income tax recovery |

|

| 9(a) |

|

| - |

|

|

| 218 |

|

|

| 32 |

|

|

| 434 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss for the period |

|

|

|

|

|

| (763 | ) |

|

| (48 | ) |

|

| (1,556 | ) |

|

| (1,431 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other comprehensive income (loss): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Items that will not be reclassified into profit or loss: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Foreign currency translation adjustment |

|

|

|

|

|

| (665 | ) |

|

| (1,455 | ) |

|

| 273 |

|

|

| (1,865 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Comprehensive loss for the period |

|

|

|

|

| $ | (1,428 | ) |

| $ | (1,503 | ) |

| $ | (1,283 | ) |

| $ | (3,296 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and diluted loss per share |

|

|

|

|

| $ | (0.01 | ) |

| $ | - |

|

| $ | (0.01 | ) |

| $ | (0.02 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average number of shares outstanding |

|

|

|

|

|

| 151,658,625 |

|

|

| 86,559,596 |

|

|

| 141,830,570 |

|

|

| 86,277,728 |

|

Refer to the accompanying notes to the condensed consolidated interim financial statements.

| CANAGOLD RESOURCES LTD. Condensed Consolidated Interim Statements of Changes in Shareholders’ Equity (Unaudited – Prepared by Management) (expressed in thousands of United States dollars) |

|

|

| Share Capital |

|

| Reserve for |

|

| Accumulated Other |

|

|

|

|

|

|

| |||||||||

|

|

| Number of Shares |

|

| Amount |

|

| Share-Based Payments |

|

| Comprehensive Income (Loss) |

|

| Deficit |

|

| Total |

| ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

| Balance, December 31, 2021 |

|

| 82,509,596 |

|

| $ | 77,753 |

|

| $ | 1,676 |

|

| $ | (2,049 | ) |

| $ | (51,087 | ) |

| $ | 26,293 |

|

| Private placement |

|

| 8,750,000 |

|

|

| 2,151 |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| 2,151 |

|

| Exercise of share appreciation rights |

|

| 45,629,798 |

|

|

| 5,873 |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| 5,873 |

|

| Share issue expenses |

|

| - |

|

|

| (312 | ) |

|

| - |

|

|

| - |

|

|

| - |

|

|

| (312 | ) |

| Share-based payments |

|

| - |

|

|

| - |

|

|

| 154 |

|

|

| - |

|

|

| - |

|

|

| 154 |

|

| Cancellation and expiration of stock options |

|

| - |

|

|

| - |

|

|

| (1,015 | ) |

|

| - |

|

|

| 1,015 |

|

|

| - |

|

| Comprehensive loss for the year |

|

| - |

|

|

| - |

|

|

| - |

|

|

| (1,941 | ) |

|

| (2,705 | ) |

|

| (4,646 | ) |

| Balance, December 31, 2022 |

|

| 136,889,394 |

|

|

| 85,465 |

|

|

| 815 |

|

|

| (3,990 | ) |

|

| (52,777 | ) |

|

| 29,513 |

|

| Private placement |

|

| 21,000,000 |

|

|

| 3,305 |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| 3,305 |

|

| Share issuance expense |

|

| - |

|

|

| (11 | ) |

|

| - |

|

|

| - |

|

|

| - |

|

|

| (11 | ) |

| Cancellation and expiration of stock options |

|

| - |

|

|

| - |

|

|

| (306 | ) |

|

| - |

|

|

| 306 |

|

|

| - |

|

| Comprehensive income (loss) for the period |

|

| - |

|

|

| - |

|

|

| - |

|

|

| 273 |

|

|

| (1,556 | ) |

|

| (1,283 | ) |

| Balance, September 30, 2023 |

|

| 157,889,394 |

|

|

| 88,759 |

|

|

| 509 |

|

|

| (3,717 | ) |

|

| (54,027 | ) |

|

| 31,524 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance, December 31, 2021 |

|

| 82,509,596 |

|

|

| 77,753 |

|

|

| 1,676 |

|

|

| (2,049 | ) |

|

| (51,087 | ) |

|

| 26,293 |

|

| Private placement |

|

| 4,050,000 |

|

|

| 1,264 |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| 1,264 |

|

| Share issue expenses |

|

|

|

|

|

| (31 | ) |

|

|

|

|

|

| - |

|

|

| - |

|

|

| (31 | ) |

| Share-based payments |

|

| - |

|

|

| - |

|

|

| 129 |

|

|

| - |

|

|

| - |

|

|

| 129 |

|

| Cancellation and expiration of stock options |

|

| - |

|

|

| - |

|

|

| (915 | ) |

|

| - |

|

|

| 915 |

|

|

| - |

|

| Comprehensive income (loss) for the period |

|

| - |

|

|

| - |

|

|

| - |

|

|

| (1,865 | ) |

|

| (1,431 | ) |

|

| (3,296 | ) |

| Balance, September 30, 2022 |

|

| 86,559,596 |

|

| $ | 78,986 |

|

| $ | 890 |

|

| $ | (3,914 | ) |

| $ | (51,603 | ) |

| $ | 24,359 |

|

Refer to the accompanying notes to the condensed consolidated interim financial statements.

| CANAGOLD RESOURCES LTD. Condensed Consolidated Interim Statements of Cash Flows (Unaudited – Prepared by Management) (expressed in thousands of United States dollars) |

|

|

| Three Months ended September 30, |

|

| Nine Months ended September 30, |

| ||||||||||

|

|

| 2023 |

|

| 2022 |

|

| 2023 |

|

| 2022 |

| ||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

| Cash provided from (used by): |

|

|

|

|

|

|

|

|

|

|

|

| ||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

| Operations: |

|

|

|

|

|

|

|

|

|

|

|

| ||||

| Net loss |

| $ | (763 | ) |

| $ | (48 | ) |

| $ | (1,556 | ) |

| $ | (1,431 | ) |

| Items not involving cash: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Accrued interest |

|

| 2 |

|

|

| 20 |

|

|

| 24 |

|

|

| 34 |

|

| Amortization |

|

| 27 |

|

|

| 12 |

|

|

| 68 |

|

|

| 38 |

|

| Share-based payments |

|

| 263 |

|

|

| (71 | ) |

|

| 263 |

|

|

| 129 |

|

| Change in fair value of marketable securities |

|

| 341 |

|

|

| 59 |

|

|

| 483 |

|

|

| 531 |

|

| Income tax recovery |

|

| - |

|

|

| (218 | ) |

|

| (32 | ) |

|

| (434 | ) |

| (Recovery) write off of mineral properties |

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

|

|

| (130 | ) |

|

| (246 | ) |

|

| (751 | ) |

|

| (1,133 | ) |

| Changes in non-cash working capital items: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Receivables and prepaids |

|

| 77 |

|

|

| (179 | ) |

|

| 214 |

|

|

| (16 | ) |

| Accounts payable and accrued liabilities |

|

| 613 |

|

|

| 179 |

|

|

| (59 | ) |

|

| (134 | ) |

| Net cash used by operating activities |

|

| 559 |

|

|

| (246 | ) |

|

| (595 | ) |

|

| (1,283 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Financing: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Proceeds from loans |

|

| - |

|

|

| 1,823 |

|

|

| - |

|

|

| 1,842 |

|

| Repayment of loan |

|

| - |

|

|

| (19 | ) |

|

| - |

|

|

| (19 | ) |

| Issuance of common shares, net of share issuance costs |

|

| 3,294 |

|

|

| - |

|

|

| 3,294 |

|

|

| 1,621 |

|

| Exercise of stock options |

|

|

|

|

|

| - |

|

|

|

|

|

|

| - |

|

| Exercise of warrants |

|

|

|

|

|

| - |

|

|

|

|

|

|

| - |

|

| Lease payments |

|

| (16 | ) |

|

| (7 | ) |

|

| (47 | ) |

|

| (26 | ) |

| Cash provided from financing activities |

|

| 3,278 |

|

|

| 1,795 |

|

|

| 3,247 |

|

|

| 3,387 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Investing: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Proceeds from disposition of marketable securities |

|

| - |

|

|

| (2 | ) |

|

| 123 |

|

|

| 306 |

|

| Expenditures for mineral properties, net of recoveries |

|

| (1,607 | ) |

|

| (958 | ) |

|

| (3,355 | ) |

|

| (3,262 | ) |

| Expenditures for leasehold improvements and equipment |

|

| (1 | ) |

|

| (2 | ) |

|

| (4 | ) |

|

| (117 | ) |

| Cash used by investing activities |

|

| (1,608 | ) |

|

| (962 | ) |

|

| (3,236 | ) |

|

| (3,073 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Unrealized foreign exchange gain (loss) on cash |

|

| (280 | ) |

|

| (191 | ) |

|

| (227 | ) |

|

| (231 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Decrease) increase in cash |

|

| 1,949 |

|

|

| 396 |

|

|

| (585 | ) |

|

| (1,200 | ) |

| Cash, beginning of period |

|

| 1,064 |

|

|

| 412 |

|

|

| 3,825 |

|

|

| 2,008 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash, end of period |

| $ | 3,013 |

|

| $ | 808 |

|

| $ | 3,013 |

|

| $ | 808 |

|

Refer to the accompanying notes to the condensed consolidated interim financial statements.

| CANAGOLD RESOURCES LTD. Condensed Consolidated Interim Statements of Cash Flows (Unaudited – Prepared by Management) (expressed in thousands of United States dollars) |

|

|

|

|

| Three Months ended September 30, |

|

| Nine Months ended September 30, |

| ||||||||||||

|

|

| Notes |

|

| 2023 |

|

| 2022 |

|

| 2023 |

|

| 2022 |

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

| Income taxes paid |

|

|

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Interest paid |

|

| 9(b),(c) |

|

| - |

|

|

| 33 |

|

|

| - |

|

|

| 34 |

| |

Refer to the accompanying notes to the condensed consolidated interim financial statements.

| CANAGOLD RESOURCES LTD. Notes to the Condensed Consolidated Interim Financial Statements For the Three and Nine Months ended September 30, 2023 (Unaudited – Prepared by Management) (tabular dollar amounts expressed in thousands of United States dollars, except per share amounts) |

1. Nature of Operations and Going Concern

Canagold Resources Ltd. (the “Company”), a company incorporated under the laws of British Columbia on January 22, 1987, is in the mineral exploration business and has not yet determined whether its mineral property interests contain reserves. The recoverability of amounts capitalized for mineral property interests is dependent upon the existence of reserves in its mineral property interests, the ability of the Company to arrange appropriate financing and receive necessary permitting for the exploration and development of its mineral property interests, and upon future profitable production or proceeds from the disposition thereof. The address of the Company’s registered office is #1500 – 1055 West Georgia Street, Vancouver, BC, Canada, V6E 4N7 and its principal place of business is #1250 – 625 Howe Street, Vancouver, BC, Canada, V6C 2T6.

The Company has no operating revenues, has incurred a significant net loss of $1.6 million for the nine months ended September 30, 2023 (September 30, 2022 - $1.4 million) and has a deficit of $54.1 million as at September 30, 2023 (December 31, 2022 - $52.8 million).In addition, the Company has negative cash flows from operations. These condensed consolidated interim financial statements have been prepared on a going concern basis, which assumes the realization of assets and repayment of liabilities in the normal course of business. The Company’s ability to continue as a going concern is dependent on the ability of the Company to raise debt or equity financings, and the attainment of profitable operations. Management continues to find opportunities to raise the necessary capital to meet its planned business objectives and continues to seek financing opportunities. There can be no assurance that management’s plans will be successful. These matters indicate the existence of material uncertainties that cast substantial doubt about the Company’s ability to continue as a going concern. These condensed consolidated interim financial statements do not include any adjustments to the recoverability and classification of recorded asset amounts and classification of liabilities that might be necessary should the Company be unable to continue as a going concern, and such adjustments could be material.

2. Basis of Presentation

(a) Statement of compliance:

These condensed consolidated interim financial statements have been prepared in accordance with International Accounting Standard 34 Interim Financial Reporting (“IAS 34”) using accounting policies consistent with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board and the interpretations of the International Financial Reporting Standards Interpretations Committee. These unaudited condensed consolidated interim financial statements do not include all of the information and disclosures required for full and complete annual financial statements, and accordingly should be read in conjunction with the Company’s audited consolidated financial statements for the year ended December 31, 2022. The Company has consistently applied the same accounting policies for all periods as presented. Certain of the prior periods’ comparative figures may have been reclassified to conform to the presentation adopted in the current period.

(b) Approval of condensed consolidated interim financial statements:

These condensed consolidated interim financial statements were approved by the Company’s Board of Directors on November 9, 2023.

|

|

|

| Canagold Resources Ltd. | Page 7 |

| CANAGOLD RESOURCES LTD. Notes to the Condensed Consolidated Interim Financial Statements For the Three and Nine Months ended September 30, 2023 (Unaudited – Prepared by Management) (tabular dollar amounts expressed in thousands of United States dollars, except per share amounts) |

2. Basis of Presentation (continued)

(c) Basis of presentation:

These condensed consolidated interim financial statements have been prepared on a historical cost basis except for certain financial instruments which are measured at fair value, as disclosed in Note 5. In addition, these condensed consolidated interim financial statements have been prepared using the accrual basis of accounting, except for cash flow information.

(d) Functional currency and presentation currency:

The functional currency of the Company and its subsidiaries is the Canadian dollar, and accounts denominated in currencies other than the Canadian dollar have been translated as follows:

|

| · | Monetary assets and liabilities at the exchange rate at the condensed consolidated interim statement of financial position date; |

|

| · | Non-monetary assets and liabilities at the historical exchange rates, unless such items are carried at fair value, in which case they are translated at the date when the fair value was determined; |

|

| · | Shareholders’ equity items at historical exchange rates; and |

|

| · | Revenue and expense items at the rate of exchange on the transaction date. |

The Company’s presentation currency is the United States dollar. For presentation purposes, all amounts are translated from the Canadian dollar functional currency to the United States dollar presentation currency for each period. Statement of financial position accounts, with the exception of equity, are translated using the exchange rate at the end of each reporting period, transactions on the statement of comprehensive income (loss) are recorded at the average rate of exchange during the period, and equity accounts are translated using historical actual exchange rates.

Exchange gains and losses arising from translation to the Company’s presentation currency are recorded as cumulative translation adjustment, which is included in accumulated other comprehensive income (loss).

(e) Critical accounting estimates and judgements:

The preparation of the condensed consolidated interim financial statements in accordance with IFRS requires management to make estimates, assumptions and judgements that affect the application of accounting policies and the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the condensed consolidated interim financial statements along with the reported amounts of revenues and expenses during the period. Actual results may differ from these estimates and, as such, estimates and judgements and underlying assumptions are reviewed on an ongoing basis. Revisions are recognized in the period in which the estimates are revised and in any future periods affected.

Significant areas requiring the use of management estimates relate to determining the recoverability of mineral property interests and receivables; valuation of certain marketable securities; accrued site remediation; amount of flow-through obligations; recognition of deferred income tax liability; the variables used in the determination of the fair value of stock options granted and finder’s fees warrants issued or modified; and the recoverability of deferred tax assets. While management believes the estimates are reasonable, actual results could differ from those estimates and could impact future results of operations and cash flows.

|

|

|

| Canagold Resources Ltd. | Page 8 |

| CANAGOLD RESOURCES LTD. Notes to the Condensed Consolidated Interim Financial Statements For the Three and Nine Months ended September 30, 2023 (Unaudited – Prepared by Management) (tabular dollar amounts expressed in thousands of United States dollars, except per share amounts) |

2. Basis of Presentation (continued)

(e) Critical accounting estimates and judgements: (continued)

The Company applies judgement in assessing the functional currency of each entity consolidated in these condensed consolidated interim financial statements. The functional currency of the Company and its subsidiaries is determined using the currency of the primary economic environment in which that entity operates.

For right of use assets and lease liability, the Company applies judgement in determining whether the contract contains an identified asset, whether they have the right to control the asset, and the lease term. The lease term is based on considering facts and circumstances, both qualitative and quantitative, that can create an economic incentive to exercise renewal options. Management considers all facts and circumstances that create an economic incentive to exercise an extension option, or not to exercise a termination option.

The Company applies judgement in assessing whether material uncertainties exist that would cast substantial doubt as to whether the Company could continue as a going concern.

The Company is required to spend proceeds received from the issuance of flow-through shares on qualifying resources expenditures. Differences in judgement between management and regulatory authorities with respect to qualified expenditures may result in disallowed expenditures by the tax authorities. Any amount disallowed may result in the Company’s required expenditures not being fulfilled.

At the end of each reporting period, the Company assesses each of its mineral resource properties to determine whether any indication of impairment exists. Judgement is required in determining whether indicators of impairment exist, including factors such as: the period for which the Company has the right to explore; expected renewals of exploration rights; whether substantive expenditures on further exploration and evaluation of resource properties are budgeted or planned; and results of exploration and evaluation activities on the exploration and evaluation assets.

3. Significant Accounting Policies

The accounting policies set out below have been applied consistently to all periods presented in these condensed consolidated interim financial statements.

Basis of consolidation:

These condensed consolidated interim financial statements include the accounts of the Company and its wholly-owned subsidiaries including New Polaris Gold Mines Ltd. (Canada) and American Innovative Minerals LLC (“AIM”) (USA). The financial statements of subsidiaries are included in the condensed consolidated interim financial statements from the date control commences until the date control ceases. All significant intercompany transactions and balances are eliminated on consolidation.

Control is achieved when the Company is exposed, or has rights, to variable returns from its involvement with the investee and has the ability to affect those returns through its power over the investee.

|

|

|

| Canagold Resources Ltd. | Page 9 |

| CANAGOLD RESOURCES LTD. Notes to the Condensed Consolidated Interim Financial Statements For the Three and Nine Months ended September 30, 2023 (Unaudited – Prepared by Management) (tabular dollar amounts expressed in thousands of United States dollars, except per share amounts) |

4. Management of Capital

The Company is an exploration stage company and this involves a high degree of risk. The Company has not determined whether its mineral property interests contain reserves of ore and currently has not earned any revenues from its mineral property interests and, therefore, does not generate cash flows from operations. The Company’s primary source of funds comes from the issuance of share capital and proceeds from debt. The Company has generated cash inflows from the disposition of marketable securities. The Company is not subject to any externally imposed capital requirements.

The Company defines its capital as debt and share capital. Capital requirements are driven by the Company’s exploration activities on its mineral property interests. To effectively manage the Company’s capital requirements, the Company has a planning and budgeting process in place to ensure that adequate funds are available to meet its strategic goals. The Company monitors actual expenses to budget on all exploration projects and overhead to manage costs, commitments and exploration activities.

The Company has in the past invested its capital in liquid investments to obtain adequate returns. The investment decision is based on cash management to ensure working capital is available to meet the Company’s short-term obligations while maximizing liquidity and returns of unused capital.

Although the Company has been successful at raising funds in the past through the issuance of share capital, it is uncertain whether it will be able to continue this financing in the future. The Company will continue to rely on debt and equity financings to meet its commitments as they become due, to continue exploration work on its mineral property interests, and to meet its administrative overhead costs for the coming periods.

There were no changes in the Company’s approach to capital management during the three and nine months ended September 30, 2023.

5. Management of Financial Risk

The Company is exposed in varying degrees to a variety of financial instrument related risks, including credit risk, liquidity risk and market risk which includes foreign currency risk, interest rate risk and other price risk. The types of risk exposure and the way in which such exposure is managed are provided as follows.

(a) Credit risk:

Credit risk is the risk of potential loss to the Company if the counterparty to a financial instrument fails to meet its contractual obligations.

The Company’s credit risk is primarily attributable to its liquid financial assets including cash. The Company limits exposure to credit risk on liquid financial assets through maintaining its cash with high-credit quality Canadian financial institutions.

To reduce credit risk, the Company regularly reviews the collectability of its amounts receivable, which may include amounts receivable from certain related parties, and records an expected credit loss based on its best estimate of potentially uncollectible amounts. Management believes that the credit risk with respect to these financial instruments is remote.

|

|

|

| Canagold Resources Ltd. | Page 10 |

| CANAGOLD RESOURCES LTD. Notes to the Condensed Consolidated Interim Financial Statements For the Three and Nine Months ended September 30, 2023 (Unaudited – Prepared by Management) (tabular dollar amounts expressed in thousands of United States dollars, except per share amounts) |

5. Management of Financial Risk (continued)

The financial instruments that potentially subject the Company to credit risk comprise investments, cash and cash equivalents and certain amounts receivable, the carrying value of which represents the Company’s maximum exposure to credit risk.

(b) Liquidity risk:

Liquidity risk is the risk that the Company will not be able to meet its financial obligations as they become due.

The Company ensures that there is sufficient capital in order to meet short-term business requirements, after taking into account the Company’s holdings of cash and its ability to raise equity financings. As at September 30, 2023, the Company had a working capital (current assets less current liabilities) of $3.0 million (December 31, 2022 – $4.4 million). The Company will require significant additional funding to meet its short-term liabilities, administrative overhead costs, and to maintain and advance its mineral property interests in the future.

The following schedule provides the contractual obligations related to the deferred royalty and lease liability payments (Notes 9(b) and (c)) as at September 30, 2023:

|

|

| Payments due by Period |

|

| Payments due by Period |

| ||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

| (CAD$000) |

|

|

|

|

|

|

|

|

|

| (US$000) |

|

|

|

|

| ||||||||||||||||||

|

|

|

|

|

| Less than |

|

|

|

|

|

|

|

| After |

|

|

|

|

| Less than |

|

|

|

|

|

|

|

| After |

| ||||||||||

|

|

| Total |

|

| 1 year |

|

| 1-3 years |

|

| 3-5 years |

|

| 5 years |

|

| Total |

|

| 1 year |

|

| 1-3 years |

|

| 3-5 years |

|

| 5 years |

| ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||

| Basic office lease |

| $ | 343 |

|

| $ | 85 |

|

| $ | 173 |

|

| $ | 85 |

|

| $ | - |

|

| $ | - |

|

| $ | - |

|

| $ | - |

|

| $ | - |

|

| $ | - |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Advance royalty payments |

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| 180 |

|

|

| 35 |

|

|

| 105 |

|

|

| 40 |

|

|

| - |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total, September 30, 2023 |

| $ | 343 |

|

| $ | 85 |

|

| $ | 173 |

|

| $ | 85 |

|

| $ | - |

|

| $ | 180 |

|

| $ | 35 |

|

| $ | 105 |

|

| $ | 40 |

|

| $ | - |

|

Accounts payable and accrued liabilities are due in less than 90 days.

(c) Market risk:

The significant market risk exposures to which the Company is exposed are foreign currency risk, interest rate risk and other price risk.

(i) Foreign currency risk:

Certain of the Company’s mineral property interests and operations are in Canada. Most of its operating expenses are incurred in Canadian dollars. Fluctuations in the Canadian dollar would affect the Company’s condensed consolidated interim statements of comprehensive income (loss) as its functional currency is the Canadian dollar, and fluctuations in the U.S. dollar would impact its cumulative translation adjustment as its condensed consolidated interim financial statements are presented in U.S. dollars.

|

|

|

| Canagold Resources Ltd. | Page 11 |

| CANAGOLD RESOURCES LTD. Notes to the Condensed Consolidated Interim Financial Statements For the Three and Nine Months ended September 30, 2023 (Unaudited – Prepared by Management) (tabular dollar amounts expressed in thousands of United States dollars, except per share amounts) |

5. Management of Financial Risk (continued)

(c) Market risk: (continued)

The Company is exposed to currency risk for its U.S. dollar equivalent of assets and liabilities denominated in currencies other than U.S. dollars as follows:

(i) Foreign currency risk: (continued)

|

|

| Stated in U.S. Dollars |

| |||||

|

|

| (Held in Canadian Dollars) |

| |||||

|

|

| September 30, |

|

| December 31, |

| ||

|

|

| 2023 |

|

| 2022 |

| ||

|

|

|

|

|

|

|

| ||

| Cash |

| $ | 1,490 |

|

| $ | 3,825 |

|

| Marketable securities |

|

| 375 |

|

|

| 855 |

|

| Receivables and prepaids |

|

| 933 |

|

|

| 1,131 |

|

| Accounts payable and accrued liabilities |

|

| (1,237 | ) |

|

| (1,296 | ) |

| Lease liability |

|

| (222 | ) |

|

| (257 | ) |

| Share based compensation liability |

|

| (262 | ) |

|

| - |

|

|

|

|

|

|

|

|

|

|

|

| Net financial assets (liabilities) |

| $ | 1,077 |

|

| $ | 4,259 |

|

Based upon the above net exposure as at September 30, 2023 and assuming all other variables remain constant, a 10% (December 31, 2022 – 10%) depreciation or appreciation of the U.S. dollar relative to the Canadian dollar could result in a decrease (increase) of approximately $108,000 (December 31, 2022 - $426,000)) in the cumulative translation adjustment in the Company’s shareholders’ equity.

The Company has not entered into any agreements or purchased any instruments to hedge possible currency risks at this time.

(ii) Interest rate risk:

In respect of financial assets, the Company’s policy is to invest excess cash at floating rates of interest in cash equivalents, in order to maintain liquidity, while achieving a satisfactory return. Fluctuations in interest rates impact on the value of cash equivalents. The Company’s investments in guaranteed investment certificates bear a fixed rate. Interest rate risk is not significant to the Company as it has no interest bearing debt at period-end.

(iii) Other price risk:

Other price risk is the risk that the value of a financial instrument will fluctuate as a result of changes in market prices.

The Company’s other price risk includes equity price risk, whereby investment in marketable securities are held for trading financial assets with fluctuations in quoted market prices recorded at FVTPL. There is no separately quoted market value for the Company’s investments in the shares of certain strategic investments.

|

|

|

| Canagold Resources Ltd. | Page 12 |

| CANAGOLD RESOURCES LTD. Notes to the Condensed Consolidated Interim Financial Statements For the Three and Nine Months ended September 30, 2023 (Unaudited – Prepared by Management) (tabular dollar amounts expressed in thousands of United States dollars, except per share amounts) |

5. Management of Financial Risk (continued)

(c) Market risk: (continued)

(iii) Other price risk (continued):

As certain of the Company’s marketable securities are carried at market value and are directly affected by fluctuations in value of the underlying securities, the Company considers its financial performance and cash flows could be materially affected by such changes in the future value of the Company’s marketable securities. Based upon the net exposure as at September 30, 2023 and assuming all other variables remain constant, a net increase or decrease of 30% (December 31, 2022 - 75%) in the market prices of the underlying securities would increase or decrease respectively net (loss) income by $112,500 (December 31, 2022 - $641,000).

6. Marketable Securities

|

|

| September 30, 2023 |

|

| December 31, 2022 |

| ||

| Balance, begin of period |

| $ | 855 |

|

| $ | 1,300 |

|

|

|

|

|

|

|

|

|

|

|

| Fair value of marketable securities received from options on mineral property interests |

|

| - |

|

|

| 356 |

|

| Disposition of marketable securities at fair value |

|

| - |

|

|

| (325 | ) |

| Change in fair value of marketable securities |

|

| (484 | ) |

|

| (425 | ) |

| Foreign currency translation adjustment |

|

| 4 |

|

|

| (51 | ) |

| Balance, end of period |

| $ | 375 |

|

| $ | 855 |

|

|

|

|

| Canagold Resources Ltd. | Page 13 |

| CANAGOLD RESOURCES LTD. Notes to the Condensed Consolidated Interim Financial Statements For the Three and Nine Months ended September 30, 2023 (Unaudited – Prepared by Management) (tabular dollar amounts expressed in thousands of United States dollars, except per share amounts) |

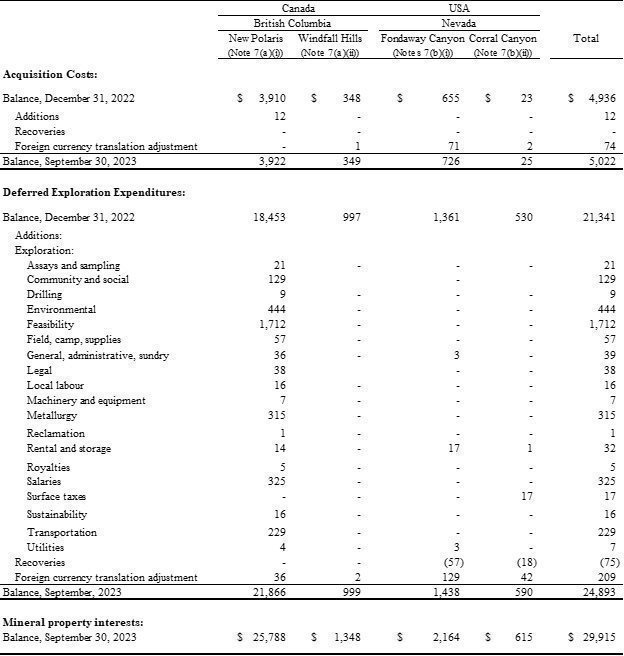

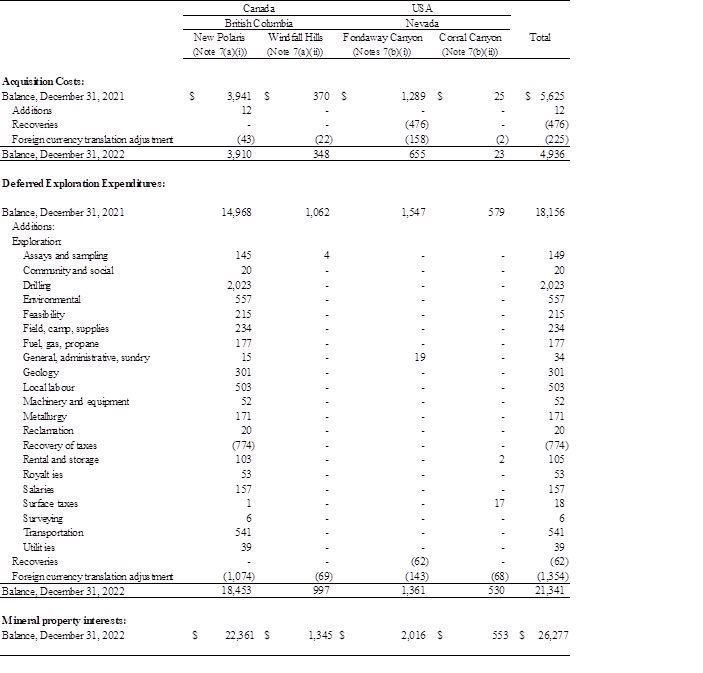

7. Mineral Property Interests

|

|

| Canada |

|

| USA |

|

|

| ||||||||||||

|

|

| British Columbia |

|

| Nevada |

|

|

|

| |||||||||||

|

|

| New Polaris |

|

| Windfall Hills |

|

| Fondaway Canyon |

|

| Corral Canyon |

|

| Total |

| |||||

|

|

| (Note 7(a)(i)) |

|

| (Note 7(a)(ii)) |

|

| (Notes 7(b)(i)) |

|

| (Note 7(b)(ii)) |

|

|

| ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

| Acquisition Costs: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

| Balance, December 31, 2022 |

| $ | 3,910 |

|

| $ | 348 |

|

| $ | 655 |

|

| $ | 23 |

|

| $ | 4,936 |

|

| Additions |

|

| 12 |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| 12 |

|

| Recoveries |

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

| Foreign currency translation adjustment |

|

| - |

|

|

| 1 |

|

|

| 71 |

|

|

| 2 |

|

|

| 74 |

|

| Balance, Sep 30, 2023 |

|

| 3,922 |

|

|

| 349 |

|

|

| 726 |

|

|

| 25 |

|

|

| 5,022 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Deferred Exploration Expenditures: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance, December 31, 2022 |

|

| 18,453 |

|

|

| 997 |

|

|

| 1,361 |

|

|

| 530 |

|

|

| 21,341 |

|

| Additions: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Exploration: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Assays and sampling |

|

| 21 |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| 21 |

|

| Community and social |

|

| 129 |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| 129 |

|

| Drilling |

|

| 9 |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| 9 |

|

| Environmental |

|

| 444 |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| 444 |

|

| Feasibility |

|

| 1,712 |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| 1,712 |

|

| Field, camp, supplies |

|

| 57 |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| 57 |

|

| General, administrative, sundry |

|

| 36 |

|

|

| - |

|

|

| 3 |

|

|

| - |

|

|

| 39 |

|

| Legal |

|

| 38 |

|

|

|

|

|

|

| - |

|

|

| - |

|

|

| 38 |

|

| Local labour |

|

| 16 |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| 16 |

|

| Machinery and equipment |

|

| 7 |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| 7 |

|

| Metallurgy |

|

| 315 |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| 315 |

|

| Rental and storage |

|

| 14 |

|

|

| - |

|

|

| 17 |

|

|

| 1 |

|

|

| 32 |

|

| Royalties |

|

| 5 |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| 5 |

|

| Salaries |

|

| 325 |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| 325 |

|

| Surface taxes |

|

| - |

|

|

| - |

|

|

| - |

|

|

| 17 |

|

|

| 17 |

|

| Sustainability |

|

| 16 |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| 16 |

|

| Transportation |

|

| 229 |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| 229 |

|

| Utilities |

|

| 4 |

|

|

| - |

|

|

| 3 |

|

|

| - |

|

|

| 7 |

|

| Recoveries |

|

| - |

|

|

| - |

|

|

| (57 | ) |

|

| (18 | ) |

|

| (75 | ) |

| Foreign currency translation adjustment |

|

| 36 |

|

|

| 2 |

|

|

| 129 |

|

|

| 42 |

|

|

| 209 |

|

| Balance, Sep 30, 2023 |

|

| 21,866 |

|

|

| 999 |

|

|

| 1,456 |

|

|

| 572 |

|

|

| 24,893 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Mineral property interests: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance, Sep 30, 2023 |

| $ | 25,788 |

|

| $ | 1,348 |

|

| $ | 2,182 |

|

| $ | 597 |

|

| $ | 29,915 |

|

|

|

|

| Canagold Resources Ltd. | Page 14 |

| CANAGOLD RESOURCES LTD. Notes to the Condensed Consolidated Interim Financial Statements For the Three and Nine Months ended September 30, 2023 (Unaudited – Prepared by Management) (tabular dollar amounts expressed in thousands of United States dollars, except per share amounts) |

7. Mineral Property Interests (continued)

|

|

|

| Canagold Resources Ltd. | Page 15 |

| CANAGOLD RESOURCES LTD. Notes to the Condensed Consolidated Interim Financial Statements For the Three and Nine Months ended September 30, 2023 (Unaudited – Prepared by Management) (tabular dollar amounts expressed in thousands of United States dollars, except per share amounts) |

7. Mineral Property Interests (continued)

(a) Canada:

(i) New Polaris (British Columbia):

The New Polaris property, which is located in the Atlin Mining Division, British Columbia, is 100% owned by the Company subject to a 15% net profit interest which may be reduced to a 10% net profit interest within one year of commercial production by issuing 150,000 common shares to Rembrandt Gold Mines Ltd.

(ii) Windfall Hills (British Columbia):

The Company owns 100% undivided interests in two adjacent gold properties (Uduk Lake and Dunn properties) located in British Columbia. The Uduk Lake properties are subject to a 1.5% NSR production royalty that can be purchased for CAD$1 million and another 3% NSR production royalty. The Dunn properties are subject to a 2% NSR royalty which can be reduced to 1% NSR royalty for $500,000.

(iii) Princeton (British Columbia):

In December 2018 and then as amended in June 2019, the Company entered into a property option agreement jointly with Universal Copper Ltd. (formerly, Tasca Resources Ltd.) (“Universal”) and an individual. In October 2020, the Company assigned its interest in the property option agreement for the Princeton property to Damara Gold Corp. (“Damara”). Pursuant to the assignment, Damara issued 9.9% of its outstanding common shares to the Company on closing of the assignment at a fair value of $228,500. After reducing the carrying value of the property to $Nil by recording a $228,000 recovery to the mineral property, the Company recorded mineral property option income of $500 for the year ended December 31, 2020. Subject to the exercise of the option by December 31, 2021, the Company’s aggregate ownership in the capital of Damara shall increase to 19.9% which Damara did exercise by the issuance of 9.8 million Damara shares to the Company at a fair value of $588,800 which was recorded as mineral property option income for the year ended December 31, 2021.

(iv) Hard Cash and Nigel (Nunavut):

In November 2018, the Company entered into a property option agreement with Silver Range Resources Ltd. (“Silver Range”) whereby the Company had an option to earn a 100% undivided interests in the Hard Cash and Nigel properties by paying CAD$150,000 in cash and issuing 1.5 million common shares to Silver Range over a four year period.

In 2020, the Company terminated the property option agreement, and accordingly indicators of impairment existed leading to a test of recoverable amount which resulted in an impairment loss of $1.1 million. A value in use calculation is not applicable as the Company does not have any expected cash flows from the property option agreement at this stage. In estimating the fair value less costs of disposal, management did not have observable or unobservable input to estimate the recoverable amount greater than $nil. As this valuation technique requires management’s judgement and estimates of recoverable amount, it is classified as Level 3 of the fair value hierarchy.

|

|

|

| Canagold Resources Ltd. | Page 16 |

| CANAGOLD RESOURCES LTD. Notes to the Condensed Consolidated Interim Financial Statements For the Three and Nine Months ended September 30, 2023 (Unaudited – Prepared by Management) (tabular dollar amounts expressed in thousands of United States dollars, except per share amounts) |

7. Mineral Property Interests (continued)

(b) United States:

(i) Fondaway Canyon (Nevada):

On March 20, 2017, the Company closed the Membership Interest Purchase Agreement with AIM (the “Membership Agreement”) whereby the Company acquired 100% legal and beneficial interests in mineral properties located in Nevada, Idaho and Utah (USA) for a total cash purchase price of $2 million in cash and honouring pre-existing NSRs. Certain of the mineral properties are subject to royalties. For the Fondaway Canyon project, it bears both a 3% NSR and a 2% NSR. The 3% NSR has a buyout provision for an original amount of $600,000 which is subject to advance royalty payments of $35,000 per year by July 15th of each year until a gross total of $600,000 has been paid at which time the NSR is bought out. A balance of $425,000 with a fair value of $183,000 was outstanding upon the closing of the Membership Agreement; a balance of $180,000 remains payable as at September 30, 2023 (December 31, 2022 - $215,000). The 2% NSR has a buyout provision of either $2 million in cash or 19.99% interest of a public entity which owns AIM if AIM were to close an initial public offering of at least $5 million.

On October 16, 2019, the Company signed a binding Letter Agreement with Getchell Gold Corp. (“Getchell”) which was later superseded by the Option Agreement for the Acquisition of Fondaway Canyon and Dixie Comstock Properties on January 3, 2020, whereby Getchell has an option for 4 years to acquire 100% of the Fondaway Canyon and Dixie Comstock properties located in Churchill County, Nevada (both subject to a 2% NSR) for $4 million in total compensation to the Company, comprised of $2 million in cash and $2 million in shares of Getchell. Payment terms by Getchell are as follows:

|

|

|

|

|

|

|

| US$ equivalent in |

|

|

|

| ||

|

|

|

| Cash |

|

|

|

|

| Getchell Shares |

| |||

|

|

|

|

|

|

|

|

|

|

|

| |||

| At signing of agreement |

| $ | 100 |

|

| (received in 2020) |

| $ | 100 |

|

| (received in 2020 with fair value of $104,600) | |

| 1st anniversary |

|

| 100 |

|

| (received in 2020) |

|

| 200 |

|

| (received in 2020 with fair value of $208,400) | |

| 2nd anniversary |

|

| 100 |

|

| (received in 2021) |

|

| 300 |

|

| (received in 2021 with fair value of $259,000) | |

| 3rd anniversary |

|

| 100 |

|

| (received in 2022) |

|

| 400 |

|

| (received in 2022 with fair value of $376,000) | |

| 4th anniversary |

|

| 1,600 |

|

|

|

|

| 1,000 |

|

|

| |

|

|

| $ | 2,000 |

|

|

|

| $ | 2,000 |

|

|

| |

The option includes minimum annual work commitments of $1.45 million on the properties. Getchell must also honor the pre-existing NSR and advance royalty commitments related to the properties, and grant the Company a 2% NSR on the Fondaway Canyon and Dixie Comstock properties of which half (1%) can be bought for $1 million per property.

(ii) Corral Canyon (Nevada):

In 2018, the Company staked 92 mining claims in Nevada, USA.

|

|

|

| Canagold Resources Ltd. | Page 17 |

| CANAGOLD RESOURCES LTD. Notes to the Condensed Consolidated Interim Financial Statements For the Three and Nine Months ended September 30, 2023 (Unaudited – Prepared by Management) (tabular dollar amounts expressed in thousands of United States dollars, except per share amounts) |

7. Mineral Property Interests (continued)

(b) United States: (continued)

(iii) Silver King (Nevada):

In October 2018, the Company entered into a property option agreement for its Silver King property with Brownstone Ventures (US) Inc. (“Brownstone”) whereby Brownstone has an option to earn a 100% undivided interest by paying $240,000 in cash over a 10 year period with early option exercise payment of $120,000. The Company will retain a 2% NSR of which a 1% NSR can be acquired by Brownstone for $1 million. The Company received $12,000 cash in 2022 (2021 - $12,000) which was recognized as mineral property option income.

(iv) Lightning Tree (Idaho):

On September 10, 2020, the Company entered into an option agreement in the form of a definitive mineral property purchase agreement for its Lightning Tree property located in Lemhi County, Idaho, with Ophir Gold Corp. (“Ophir”), whereby Ophir shall acquire a 100% undivided interest in the property. In order to acquire the property, over a three year period, Ophir shall pay to the Company a total of CAD$137,500 in cash over a three year period and issue 2.5 million common shares and 2.5 million warrants over a two year period, and shall incur aggregate exploration expenditures of at least $4 million over a three year period. The Company will retain a 2.5% NSR of which a 1% NSR can be acquired by Ophir for CAD$1 million. If Ophir fails to file a NI 43-101 compliant resource on the Lightning Tree property within three years, the property will not be conveyed to Ophir. In August 2022, the Company received CAD$50,000 cash (2021 – CAD$25,000 cash). In 2021, the Company received 1.25 million shares with a fair value of $159,600 and 1.25 million warrants with a fair value of $5,000, all of which were recognized as mineral property option income. In Q3 2023, the Company and Ophir mutually agreed to terminate the September 10, 2020 agreement, and the property was returned to the Company.

(v) Hot Springs Point (Nevada):

In July 2022, the Company entered into a Real Estate Purchase and Sale Agreement for the Hot Springs Point property located in Eureka County, Nevada, with a third party (the “Purchaser”), whereby the Purchaser acquired a 100% interest for $480,000 (received). The Purchaser also grants a 3% NSR to the Company. The entire amount received was recognized in mineral property option income as a gain as Hot Springs book value on acquisition day by the Company was $nil, Hot Springs being incidental to the Fondaway Canyon property when they were acquired together.

|

|

|

| Canagold Resources Ltd. | Page 18 |

| CANAGOLD RESOURCES LTD. Notes to the Condensed Consolidated Interim Financial Statements For the Three and Nine Months ended September 30, 2023 (Unaudited – Prepared by Management) (tabular dollar amounts expressed in thousands of United States dollars, except per share amounts) |

7. Mineral Property Interests (continued)

(c) Expenditure options:

As at September 30, 2023, to maintain the Company’s interest and/or to fully exercise the options under various property agreements covering its properties, the Company must make payments as follows:

|

|

| Cash |

|

| Cash |

|

| Annual |

|

| Number of |

| ||||

|

|

| Payments |

|

| Payments |

|

| Payments |

|

| Shares |

| ||||

|

|

| (CADS$000) |

|

| (US$000) |

|

| (US$000) |

|

|

|

| ||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

| New Polaris (Note 7(a)(i)): |

|

|

|

|

|

|

|

|

|

|

|

| ||||

| Net profit interest reduction or buydown |

| $ | - |

|

| $ | - |

|

| $ | - |

|

|

| 150,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Fondaway Canyon (Note 7(b)(i)): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Advance royalty payment for buyout of 3% net smelter return (1) |

|

| - |

|

|

| - |

|

|

| 35 |

|

|

| - |

|

| Buyout provision for net smelter return of 2% (2) |

|

| - |

|

|

| 2,000 |

|

|

| - |

|

|

| - |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Windfall Hills (Note 7(a)(ii)): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Buyout provision for net smelter return of 1.5% |

|

| 1,000 |

|

|

| - |

|

|

| - |

|

|

| - |

|

| Reduction of net smelter return of 2% to 1% |

|

| - |

|

|

| 500 |

|

|

| - |

|

|

| - |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| $ | 1,000 |

|

| $ | 2,500 |

|

| $ | 35 |

|

|

| 150,000 |

|

|

| (1) | Advance royalty payments of $180,000 remain payable as at September 30, 2023 with annual payments of $35,000. Pursuant to the option agreement, Getchell will be obligated to pay the annual advance royalty (Note 7(b)(i)). The advance royalty of $35,000 due in July 2023 was paid by Getchell. |

|

|

|

|

|

| (2) | The 2% NSR has a buyout provision of either $2 million in cash or 19.99% interest of a public entity which owns AIM if AIM were to close an initial public offering of at least $5 million. |

These amounts may be reduced in the future as the Company determines which mineral property interests to continue to explore and which to abandon.

(d) Title to mineral property interests:

The Company has diligently investigated rights of ownership of all of its mineral property interests/concessions and, to the best of its knowledge, all agreements relating to such ownership rights are in good standing. However, all properties and concessions may be subject to prior claims, agreements or transfers, and rights of ownership may be affected by undetected defects.

(e) Realization of assets:

The Company’s investment in and expenditures on its mineral property interests comprise a significant portion of the Company’s assets. Realization of the Company’s investment in these assets is dependent on establishing legal ownership of the mineral properties, on the attainment of successful commercial production or from the proceeds of their disposal. The recoverability of the amounts shown for mineral property interests is dependent upon the existence of reserves, the ability of the Company to obtain necessary financing to complete the development of the properties, and upon future profitable production or proceeds from the disposition thereof.

|

|

|

| Canagold Resources Ltd. | Page 19 |

| CANAGOLD RESOURCES LTD. Notes to the Condensed Consolidated Interim Financial Statements For the Three and Nine Months ended September 30, 2023 (Unaudited – Prepared by Management) (tabular dollar amounts expressed in thousands of United States dollars, except per share amounts) |

7. Mineral Property Interests (continued)

(f) Environmental:

Environmental legislation is becoming increasingly stringent and costs and expenses of regulatory compliance are increasing. The impact of new and future environmental legislation of the Company’s operation may cause additional expenses and restrictions.

If the restrictions adversely affect the scope of exploration and development on the mineral properties, the potential for production on the property may be diminished or negated.

The Company is subject to the laws and regulations relating to environmental matters in all jurisdictions in which it operates, including provisions relating to property reclamation, discharge of hazardous materials and other matters. The Company may also be held liable should environmental problems be discovered that were caused by former owners and operators of its current properties and former properties in which it has previously had an interest. The Company is not aware of any existing environmental problems related to any of its current or former mineral property interests that may result in material liability to the Company.

8. Equipment

|

|

| Leasehold |

|

| Office Furnishings |

|

| Right of Use |

|

|

|

| ||||

|

|

| Improvements |

|

| and Equipment |

|

| Asset |

|

| Total |

| ||||

| Cost: |

|

|

|

|

|

|

|

| ||||||||

| Balance, December 31, 2021 |

| $ | 89 |

|

| $ | 63 |

|

| $ | 121 |

|

| $ | 273 |

|

| Acquisitions |

|

| 117 |

|

|

| 2 |

|

|

| 272 |

|

|

| 391 |

|

| Dispositions |

|

| (84 | ) |

|

| - |

|

|

| (113 | ) |

|

| (197 | ) |

| Foreign currency translation adjustment |

|

| (6 | ) |

|

| (4 | ) |

|

| (9 | ) |

|

| (19 | ) |

| Balance, December 31, 2022 |

|

| 116 |

|

|

| 61 |

|

|

| 271 |

|

|

| 448 |

|