Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 28, 2013

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 0-18914

DORMAN PRODUCTS, INC.

(Exact name of registrant as specified in its charter)

| Pennsylvania | 23-2078856 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S Employer Identification No.) |

3400 East Walnut Street, Colmar, Pennsylvania 18915

(Address of principal executive offices) (Zip Code)

(215) 997-1800

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class: | Name of each exchange on which registered: | |

| Common Stock, $0.01 Par Value | The NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Securities Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act:

| Large accelerated filer | x | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of February 18, 2014 the registrant had 36,502,600 shares of common stock, $0.01 par value, outstanding. The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant as of June 29, 2013 was $1,005,064,313.

DOCUMENTS INCORPORATED BY REFERENCE

Certain portions of the registrant’s definitive proxy statement, in connection with its Annual Meeting of Shareholders, to be filed with the Securities and Exchange Commission within 120 days after December 28, 2013, are incorporated by reference into Part III of this annual report on Form 10-K.

Table of Contents

DORMAN PRODUCTS, INC.

INDEX TO ANNUAL REPORT ON FORM 10-K

DECEMBER 28, 2013

The Company’s fiscal year ends on the last Saturday of the calendar year.

| References to |

Refers to the year ended | |

| Fiscal 2009 | December 26, 2009 | |

| Fiscal 2010 | December 25, 2010 | |

| Fiscal 2011 | December 31, 2011 | |

| Fiscal 2012 | December 29, 2012 | |

| Fiscal 2013 | December 28, 2013 |

2

Table of Contents

Dorman Products, Inc. was incorporated in Pennsylvania in October 1978. As used herein, unless the context otherwise requires, “Dorman”, the “Company”, “we”, “us”, or “our” refers to Dorman Products, Inc. and its subsidiaries.

We are a leading supplier of replacement parts and fasteners for passenger cars, light trucks, and heavy duty trucks in the automotive aftermarket. We distribute and market approximately 150,000 different stock keeping units (“SKU’s”) of automotive replacement parts, many of which we design and engineer. We believe we are the dominant aftermarket supplier of original equipment “dealer exclusive” items. Original equipment dealer exclusive parts are those which were traditionally available to consumers only from original equipment manufacturers or used parts from salvage yards and include, among other parts, intake manifolds, exhaust manifolds, window regulators, radiator fan assemblies, tire pressure monitor sensors, complex electronics devices, and exhaust gas recirculation (EGR) coolers. Fasteners include such items as oil drain plugs, wheel bolts, and wheel lug nuts. Approximately 85% of our products are sold under brands that we own and the remainder is sold for resale under customers’ private labels, other brands or in bulk. Our products are sold primarily in the United States through automotive aftermarket retailers (such as AutoZone, Advance Auto Parts, and O’Reilly Auto Parts), national, regional and local warehouse distributors (such as Carquest and NAPA) and specialty markets and salvage yards. We distribute automotive replacement parts internationally, with sales primarily into Europe, Mexico, the Middle East, Asia and Canada.

The automotive replacement parts market is made up of two components: parts for passenger cars and light trucks, which accounted for projected industry sales of approximately $239.1 billion in 20131, and parts for medium and heavy duty trucks, which accounted for projected industry sales of approximately $79.1 billion in 20131. We market products primarily for passenger cars and light trucks, including those with diesel engines and, more recently, for medium and heavy duty trucks. Two distinct groups of end-users buy replacement vehicle (automotive and truck) parts: (i) individual consumers, who purchase parts to perform “do-it-yourself” repairs on their own vehicles; and (ii) professional installers, which include vehicle repair shops and the dealership service departments. The individual consumer market is typically supplied through retailers and through the retail arms of warehouse distributors. Vehicle repair shops generally purchase parts through local independent parts wholesalers and through national parts distributors. Automobile dealership service departments generally obtain parts through the distribution systems of vehicle manufacturers and specialized national and regional parts distributors.

Spending in the light vehicle aftermarket can be generally grouped into three categories: discretionary, maintenance and repair. Discretionary, such as accessories and performance, tends to move in-line with consumer discretionary spending. Maintenance is composed of products and services, such as oil and oil changes, and tends to be less correlated with discretionary spending. The repair segment consists mainly of replacement parts which fail over time and tends to be less cyclical as it is largely comprised of parts necessary for a vehicle to function properly or safely. We believe the majority of our products fall into the repair segment. The increasing complexity of automobiles and the number of different makes and models of automobiles have resulted in a significant increase in the number of products required to service the domestic and foreign automotive fleet. Accordingly, the number of parts required to be carried by retailers and wholesale distributors has increased substantially. The requirement to include more products in inventory and the significant consolidation among distributors of automotive replacement parts have in turn resulted in larger distributors.

Retailers and others who purchase aftermarket automotive repair and replacement parts for resale are constrained to a finite amount of space in which to display and stock products. Thus, the reputation for quality, customer service, and line profitability which a supplier enjoys are significant factors in a purchaser’s decision as to which product lines to carry in the limited space available. Further, because of the efficiencies achieved through the ability to order all or part of a complete line of products from one supplier (with possible volume discounts), as opposed to satisfying the same requirements through a variety of different sources, retailers and other purchasers of automotive parts seek to purchase products from fewer but stronger suppliers.

| 1 | Source: AAIA Fact Book 2014 |

3

Table of Contents

We sell approximately 150,000 different SKU’s of automotive replacement parts and fasteners to meet a variety of needs. Our DORMAN® NEW SINCE 1918™ marketing campaign positions our brands under a single corporate umbrella—DORMAN®. Our products are now sold under one of the eight DORMAN® sub-brands as follows:

| DORMAN® OE Solutions ™ |

- Automotive replacement parts, such as intake manifolds, exhaust manifolds, oil cooler lines, window regulators, harmonic balancers and radiator fan assemblies. | |

| DORMAN® HELP! ® |

- Automotive replacement parts, including window handles, switches, door hardware, interior trim parts, headlamp aiming screws and retainer rings, radiator parts, battery hold-down bolts and repair kits, valve train parts and power steering filler caps. | |

| DORMAN® TECHoice™ |

- A value line of automotive replacement parts, including mass air flow sensors, belt tensioners, and idler pulleys. | |

| DORMAN® AutoGrade™ |

- A line of application specific and general automotive hardware that is a necessary element to a complete repair. Product categories include body hardware, general automotive fasteners, oil drain plugs, and wheel hardware. | |

| DORMAN® Conduct-Tite!® |

- A selection of electrical connectors, wire, tools, testers, and accessories. | |

| DORMAN® FirstStop™ |

- Value priced technician quality brake and clutch program. | |

| DORMAN® HD Solutions™ |

- A line of heavy duty aftermarket parts for class 4-8 heavy vehicles. Coverage includes coolant tubes, door handles and other body parts, fluid reservoirs, headlights and lighting, hood components, window regulators, and wiper transmissions. | |

| DORMAN® Hybrid Drive Batteries |

- A broad selection of remanufactured “plug & play” hybrid drive batteries including batteries for the Toyota Prius and Camry hybrid vehicles (Gen 1 and Gen 2) and Honda Civic, Insight, and Accord hybrid vehicles (Gen 1 and Gen 2). | |

We also generate revenues from the sale of parts that we package for ourselves, or others, for sale in bulk or under the private labels of parts manufacturers and national warehouse distributors (such as Carquest and NAPA).

We group our products into four major classes: power-train, automotive body, chassis, and hardware. The following table represents each of the four classes as a percentage of net sales for each of the last three fiscal years.

| Percentage of Net Sales | ||||||||||||

| Year Ended | ||||||||||||

| December 28, 2013 | December 29, 2012 | December 31, 2011 | ||||||||||

| Power-train |

36 | % | 33 | % | 33 | % | ||||||

| Automotive Body |

30 | % | 30 | % | 28 | % | ||||||

| Chassis |

25 | % | 26 | % | 27 | % | ||||||

| Hardware |

9 | % | 11 | % | 12 | % | ||||||

|

|

|

|

|

|

|

|||||||

| Total |

100 | % | 100 | % | 100 | % | ||||||

Our power-train product line includes intake and exhaust manifolds, cooling products, harmonic balancers, fluid lines, fluid reservoirs, connectors, 4 wheel drive components and axles, drain plugs, and other engine, transmission and axle components. Our line of automotive body products include door handles and hinges, window lift motors, window regulators, switches and handles, wiper components, lighting, electrical, and other interior and exterior automotive body components. Chassis products include brake hardware and hydraulics, wheel and axle hardware, suspension arms, knuckles, links, bushings, and other suspension, steering and brake components. Hardware products include threaded bolts, auto body and home fasteners, automotive and home electrical wiring components, and other hardware assortments and merchandise.

Our HD Solutions™ brand of New to the Heavy Duty Aftermarket parts provides coverage for medium and heavy duty vehicles in a variety of product lines including coolant tubes, door handles and other body parts, fluid reservoirs, headlights and lighting, hood components, window regulators, wiper transmissions, and many other parts. Our Heavy Duty Aftermarket parts feature re-engineered replacement parts aimed at increasing durability, complete kits that yield time and cost savings, and products that enable technicians to replace just the failed component part rather than an entire assembly.

4

Table of Contents

In May 2013, we purchased Re-Involt Technologies, LLC., a leader in hybrid battery remanufacturing, and subsequently launched our Hybrid Drive Battery program. The program provides broad coverage for the most popular hybrid vehicles in service. Our hybrid drive battery packs are completely remanufactured and are extensively tested to ensure performance. Our hybrid drive batteries are “plug and play” direct replacements, ready to install and requiring no programming time or expense thus saving the service technicians’ time and the hybrid vehicle owner’s money.

In September 2011, our Board of Directors approved the exit from the international portion of our ScanTech business, which was headquartered outside of Stockholm, Sweden. ScanTech marketed and distributed a line of Volvo and Saab replacement parts throughout the world. As part of the exit, ScanTech’s North American business, which was serviced from Sweden, was transferred to our U.S. distribution centers, while ScanTech’s international business was liquidated.

We warrant our products against certain defects in material and workmanship when used as designed on the vehicle on which it was originally installed. We offer a limited lifetime warranty on all of our products. Our warranty limits the customer’s remedy to the repair or replacement of the part that is defective.

Product development is central to our business. The development of a broad range of products, many of which are not conveniently or economically available elsewhere, has in part, enabled us to grow to our present size and is important to our future growth. In developing our products, our strategy has been to design and package parts so as to make them better and easier to install and/or use than the original parts they replace and to sell automotive parts for the broadest possible range of uses. Each new product idea is reviewed by our product management staff, as well as by members of the production, sales, finance, marketing, legal, and administrative staffs.

Through careful evaluation, exacting design and precise tooling, we are frequently able to offer products which fit a broader range of makes and models, as well as a wider range of application years than the original equipment parts they replace. One such innovation is our replacement spare tire hoist, which through several mechanical design changes we are able to offer a part that replaces three original equipment parts, and now fits common domestic models over a thirteen year range. By selecting an appropriate micro controller and making other customizations, our Xenon headlight control module fits a range of domestic models from GM and Chrysler, as well as models from BMW, Mercedes Benz, Volkswagen and Volvo. This flexibility assists retailers and other purchasers in maximizing the productivity of the limited space available for each class of part sold. Further, where possible, we improve our parts so that they are better than the parts they replace. Our replacement sway bar kits are solid bars that ensure they are will not exhibit the same failure modes as the hollow bars they replace. Finally, we make every attempt to look at the repair through the eyes of the end user, and redesign many of our items to make installation easier. Our “split” brake dust shields allow for a replacement that does not require removal of the vehicle’s rear axle, and several of our replacement key fobs come with a disposable programmer that easily pairs the key fob to the car and eliminates the need for expensive programming tools. In addition, we often package different items in complete kits to further aid installation.

Ideas for expansion of our product lines arise through a variety of sources. We maintain an in-house product management staff that routinely generates ideas for new parts and the expansion of existing lines. Further, we maintain an “800” telephone number and an Internet site for “New Product Suggestions” and receive, either through our sales force or product development team, many ideas from our customers and end-users as to which types of presently unavailable parts the ultimate consumers are seeking.

We market our products to three groups of purchasers who in turn supply individual consumers and professional installers. As of December 28, 2013:

(i) approximately 43% of our revenues were generated from sales to automotive aftermarket retailers (such as AutoZone, Advance Auto Parts, and O’Reilly Auto Parts), local independent parts wholesalers and national general merchandise chain retailers. We sell many of our products to virtually all major chains of automotive aftermarket retailers;

(ii) approximately 49% of our revenues were generated from sales to automotive parts distributors (such as Carquest and NAPA), which may be local, regional or national in scope, and which may also engage in retail sales; and

5

Table of Contents

(iii) the balance of our revenues (approximately 8%) are generated from international sales and sales to special markets, which include, among others, mass merchants (such as Wal-Mart), salvage yards and the parts distribution systems of parts manufacturers.

We use a number of different methods to sell our products. Our more than 50 person direct sales force and sales support staff solicits purchases of our products directly from customers, as well as manages the activities of approximately 20 independent manufacturers’ representative agencies worldwide. We use independent manufacturers’ representative agencies to help service existing automotive retail, automotive and heavy duty parts distribution customers, providing frequent on-site contact. We increase sales by securing new customers, by adding new product lines and expanding product selection within existing customers. For certain of our major customers, and our private label purchasers, we rely primarily upon the direct efforts of our sales force who, together with our marketing department and our executive officers, coordinate the more complex pricing and ordering requirements of these accounts.

Our sales efforts are not directed merely at selling individual products, but rather more broadly towards selling groups of related products that can be displayed on attractive Dorman-designed display systems, thereby maximizing each customer’s ability to present our product line within the confines of the available area.

We prepare a number of on-line catalogs, application guides and training materials designed to describe our products and other applications as well as to train our customers’ sales teams in the promotion and sale of our products. A catalog of all our parts is available on our website.

We currently service more than 3,100 active accounts. During fiscal 2013, fiscal 2012 and fiscal 2011, four customers (AutoZone, Advance Auto Parts, O’Reilly Auto Parts and Genuine Parts Co.) each accounted for more than 10% and in the aggregate accounted for 57% of net sales in each period.

Substantially all of our products are manufactured by third parties. Because numerous manufacturers are available to manufacture our products, we are not dependent upon the services of any one manufacturer or any small group of them. No one manufacturer supplies more than 10% of our products. In fiscal 2013, as a percentage of our total dollar volume of purchases, approximately 25% of our products were purchased from various suppliers throughout the United States and the balance of our products were purchased directly from vendors in a variety of foreign countries.

Once a new product has been identified, our engineering department produces detailed proprietary engineering drawings and prototypes which are used to solicit bids for manufacture from a variety of vendors in the United States and abroad. After a vendor is selected, the vendor produces tooling which we then own. A pilot run of the product is produced and subjected to rigorous testing by our engineering department and, on occasion, by outside testing laboratories and facilities in order to evaluate the precision of manufacture and the resiliency and structural integrity of the materials used. If acceptable, the product then moves into full production.

Packaging, Inventory and Shipping

Finished products are received at one or more of our facilities, depending on the type of part. It is our practice to inspect samples of shipments based upon vendor performance. If cleared, these shipments of finished parts are logged into our computerized production tracking systems and staged for packaging, if necessary.

We employ a variety of custom-designed packaging machines which include blister sealing, skin film sealing, clamshell sealing, bagging and boxing lines. Packaged product contains our label (or a private label), a part number, a universal packaging bar code suitable for electronic scanning, a description of the part and, if appropriate, installation instructions. Products are also sold in bulk to automotive parts manufacturers and packagers. Computerized tracking systems, mechanical counting devices and experienced workers combine to assure that the proper variety and numbers of parts meet the correct packaging materials at the appropriate places and times to produce the required quantities of finished products.

Completed inventory is stocked in the warehouse portions of our facilities and is organized to facilitate the most efficient methods of retrieving product to fill customer orders. We strive to maintain a level of inventory to adequately meet current customer order demand with additional inventory to satisfy new customer orders and special programs. We maintain a “safety stock” of inventory to compensate for fluctuations in demand and delivery.

We ship our products from all of our locations by contract carrier, common carrier or parcel service. Products are generally shipped to the customer’s main warehouses for redistribution within their network. In certain circumstances, at the request of the customer, we ship directly to the customer’s stores either via smaller direct ship orders or consolidated store orders that are cross docked.

6

Table of Contents

The replacement automotive parts industry is highly competitive. Various competitive factors affecting the automotive aftermarket are price, product quality, breadth of product line, range of applications and customer service. Substantially all of our products are subject to competition with similar products manufactured by other manufacturers of aftermarket automotive repair and replacement parts. Some of these competitors are divisions and subsidiaries of companies much larger than us, and possess a longer history of operations and greater financial and other resources than we do. We also face competition from automobile manufacturers who sell through their dealerships many of the same replacement parts that we sell, although these manufacturers generally sell parts only for cars they produce. Further, some of our private label customers also compete with us.

While we take steps to register our trademarks when possible, we believe that our business is not heavily dependent on such trademark registration. Similarly, while we actively seek patent protection for the products and improvements which we develop, we do not believe that patent protection is critical to the success of our business. Rather, the quality, price and availability of our product is critical to our success.

At December 28, 2013, we had 1,452 employees worldwide, essentially all of which were employed full-time. Of these employees, 894 were engaged in production, inventory, and quality control, 294 were involved in engineering, product development and purchasing, 113 were employed in sales and customer service, and the remaining 151 were devoted to administration.

No domestic employees are covered by any collective bargaining agreement. We consider our relations with our employees to be generally good.

Our Internet address is www.dormanproducts.com. The information on this website is not and should not be considered part of this Form 10-K and is not incorporated by reference in this Form 10-K. This website is, and is only intended to be, for reference purposes only. We make available free of charge on our web site our annual report on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as soon as reasonably practicable after we electronically file such material with, or furnish it to, the Securities and Exchange Commission (the “SEC”). In addition, we will provide, at no cost, paper or electronic copies of our reports and other filings made with the SEC. Requests should be directed to: Dorman Products, Inc.—Office of General Counsel, 3400 East Walnut Street, Colmar, Pennsylvania 18915.

In addition to the other information set forth in this report, you should carefully consider the following factors, which could materially affect our business, financial condition or future results. The risks described below are not the only risks we face. Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial also may materially affect our business, financial conditions or results of operations.

We May Lose Business to Competitors.

Competition within the automotive aftermarket parts business is intense. We compete in North America with both original equipment parts manufacturers and with companies that, like us, supply parts only to the automotive aftermarket. We expect such competition to continue. If we are unable to compete successfully in our industry we could lose customers.

Unfavorable Economic Conditions May Adversely Affect Our Business.

Adverse changes in economic conditions, including inflation, recession, or instability in the financial markets or credit markets may either lower demand for our products or increase our operational costs, or both. Such conditions may also materially

7

Table of Contents

impact our customers, suppliers and other parties with whom we do business. Our revenue will be adversely affected if demand for our products declines. The impact of unfavorable economic conditions may also impair the ability of our customers to pay for products they have purchased. As a result, reserves for doubtful accounts and write-offs of accounts receivables may increase and failure to collect a significant portion of amounts due on those receivables could have a material adverse effect on our results of operations and financial condition.

The Loss or Decrease in Sales Among One of Our Top Customers Could Have a Substantial Negative Impact on Our Sales and Operating Results.

A significant percentage of our sales has been, and will continue to be, concentrated among a relatively small number of customers. During fiscal 2013, fiscal 2012 and fiscal 2011, four customers (AutoZone, Advance Auto Parts, O’Reilly Auto Parts and Genuine Parts Co.) each accounted for more than 10% and in the aggregate accounted for 57% of net sales in each period. We anticipate that this concentration of sales among customers will continue in the future. The loss of a significant customer or a substantial decrease in sales to such a customer could have a material adverse effect on our sales and operating results.

Customer Consolidation in the Automotive Aftermarket May Lead to Customer Contract Terms Less Favorable to Us Which May Negatively Impact Our Financial Results.

The automotive aftermarket has been consolidating over the past several years. By way of example, in October 2013, Advance Auto Parts agreed to acquire General Parts International, Inc. (Carquest), one of the largest automotive parts distributors. As a result of such consolidations, many of our customers have grown larger and therefore have more leverage in the arms-length negotiations of agreements with us for the sale of our products. Customers may require us to provide extended payment terms and returns of slow moving product in order to obtain new or retain existing business. While we attempt to avoid or minimize such concessions, in some cases payment terms to customers have been extended and returns of product have exceeded historical levels. The product returns primarily affect our profit levels while payment terms extensions generally reduce operating cash flow and require additional capital to finance the business. We expect both of these trends to continue for the foreseeable future.

The Cancellation or Rescheduling of Orders May Cause Our Operating Results to Fluctuate.

The cancellation or rescheduling of orders may cause our operating results to fluctuate. Although we make every reasonable effort to maintain ongoing relationships with our customers, there is an ongoing risk that orders may be cancelled or rescheduled due to fluctuations in our customers’ business needs or overall market demand for our products. Additionally, although we serve more than 3,100 individual accounts, the cancellation or rescheduling of orders by larger customers may still have a material adverse effect on our operating results from time to time.

Our Business May be Negatively Impacted By Foreign Currency Fluctuations and Our Dependence on Foreign Suppliers.

In fiscal 2013, approximately 75% of our products were purchased from vendors in a variety of foreign countries. The products generally are purchased through purchase orders with the purchase price specified in U.S. dollars. Accordingly, we generally do not have exposure to fluctuations in the relationship between the dollar and various foreign currencies between the time of execution of the purchase order and payment for the product. To the extent that the dollar decreases in value relative to foreign currencies in the future, the price of the product in dollars for new purchase orders may increase.

The largest portion of our overseas purchases is from China. Since January 2011, the Chinese Yuan has increased approximately 7.9% relative to the U.S. Dollar. A continued increase in the value of the Yuan relative to the U.S. Dollar will likely result in an increase in the cost of products that we purchase from China.

As a result of the magnitude of our foreign sourcing, our business may be subject to risks, including the following:

| • | uncertainty caused by the elimination of import quotas and the possible imposition of additional quotas or antidumping or countervailing duties or other retaliatory or punitive trade measures; |

| • | imposition of duties, taxes and other charges on imports; |

| • | significant devaluation of the dollar against foreign currencies; |

| • | restrictions on the transfer of funds to or from foreign countries; |

8

Table of Contents

| • | political instability, military conflict or terrorism involving the United States or any of the countries where our products are manufactured, which could cause a delay in transportation or an increase in costs of transportation, raw materials or finished product or otherwise disrupt our business operations; and |

| • | disease, epidemics and health-related concerns could result in closed factories, reduced workforces, scarcity of raw materials and scrutiny and embargoing of goods produced in infected areas. |

If these risks limit or prevent us from acquiring products from foreign suppliers or significantly increase the cost of our products, our operations could be seriously disrupted until alternative suppliers are found, which could negatively impact our business.

We Extend Credit to Our Customers Who May Be Unable to Pay In the Future.

We regularly extend credit to our customers. A significant percentage of our accounts receivable have been, and will continue to be concentrated among a relatively small number of automotive retailers and automotive parts distributors in the United States. Our five largest customers accounted for 81% and 86% of total accounts receivable as of December 28, 2013 and December 29, 2012, respectively. Management continually monitors the credit terms and credit limits of these and other customers. If any of these customers were unable to pay, our business and financial condition would be adversely affected.

The Loss of a Key Vendor Could Lead to Increased Costs and Lower Profit Margins.

The majority of the products we sell are purchased from a number of foreign vendors. If any of our existing vendors fail to meet our needs, we believe that sufficient capacity exists in the open market to supply any shortfall that may result. Nevertheless, it is not always possible to replace a vendor without a disruption in our operations and replacement of a significant vendor is often at higher prices.

Limited Shelf Space May Adversely Affect Our Ability to Expand Our Product Offerings.

Since the amount of space available to a retailer and other purchasers of our products is limited, our products compete with other automotive aftermarket products, some of which are entirely dissimilar and otherwise non-competitive (such as car waxes and engine oil), for shelf and floor space. No assurance can be given that additional space will be available in our customers’ stores to support the expansion of the number of products that we offer.

If We Do Not Continue to Develop New Products and Bring Them to Market, Our Business, Financial Condition and Results of Operations Could Be Materially Impacted.

The development and production of new products is often accompanied by design and production delays and related costs typically associated with the development and production of new products. While we expect and plan for such delays and related costs, we cannot predict with precision the time and expense required to overcome these initial problems so that the products comply with specifications. There is a risk that we may not be able to introduce or bring to full-scale production new products as quickly as we expected in our product introduction plans, which could have a material adverse effect on our business, financial condition, and results of operations.

An Increase in Patent Filings by Original Equipment Manufacturers Could Negatively Impact Our Ability to Develop New Products.

We have seen an increase in patent requests for new designs made by original equipment manufacturers. If original equipment manufacturers are able to obtain patents on new designs at a rate higher than historical levels, we could be restricted or prohibited from selling aftermarket products covered by such items until such patents expire, which could have an adverse impact on our business.

Quality Problems with Our Products Could Damage Our Reputation and Adversely Affect Our Business.

We have experienced, and in the future may experience, reliability, quality, or compatibility problems in products after their production and sale to customers. Product quality problems could result in damage to our reputation, loss of customers, a decrease in revenue, litigation, unexpected expenses, and a loss of market share. We have invested and will continue to invest in our engineering, design, and quality infrastructure in an effort to reduce and potentially eliminate these problems; however, there can be no assurance that we can successfully remedy all of these issues. To the extent we experience significant quality problems in the future our business and results of operations may be negatively impacted.

9

Table of Contents

Loss of Third-Party Transportation Providers Upon Whom We Depend or Increases in Fuel Prices Could Increase Our Costs or Cause a Disruption in Our Operations.

We depend upon third-party transportation providers for delivery of our products to us and to our customers. Strikes, slowdowns, transportation disruptions or other conditions in the transportation industry, including, but not limited to, shortages of truck drivers, disruptions in rail service, decreases in ship building or increases in fuel prices, could increase our costs and disrupt our operations and our ability to service our customers on a timely basis.

We May Not Properly Execute, or Realize Anticipated Cost Savings or Benefits from, Our Ongoing Information Technology Initiatives.

Our success is partly dependent on properly executing, and realizing cost savings or other benefits from, our ongoing information technology initiatives. These initiatives are primarily designed to make us more efficient in the development, acquisition and distributions of our products, which is necessary in our highly competitive industry. These initiatives are often complex, and a failure to implement them properly may, in addition to not meeting projected cost savings or benefits, result in an interruption to our business functions.

Unfavorable Results of Legal Proceedings Could Materially Adversely Affect Us.

We are subject to various legal proceedings and claims that have arisen out of the ordinary course of our business which are not yet resolved and additional claims may arise in the future. Although we currently believe that resolving all of these matters, individually or in the aggregate, will not have a material adverse impact on our financial position, legal claims and proceedings are subject to inherent uncertainty and our view on these matters may change in the future. Regardless of merit, litigation may be both time-consuming and disruptive to our operations and cause significant expense and diversion of management attention. Should we fail to prevail in certain matters, we may be faced with significant monetary damages or injunctive relief that would materially adversely affect our business and financial condition and operating results.

We Have No History of Paying Regular Dividends And Do Not Intend to Pay Regular Dividends.

On December 5, 2012, we announced a special cash dividend of $1.50 per share payable on December 28, 2012 to shareholders of record at the close of business on December 17, 2012. This special cash dividend notwithstanding, we do not intend to pay regular cash dividends. Rather, for the foreseeable future, we intend to retain our earnings, if any, for the operation and continued expansion of our business.

Dorman’s Chairman of the Board and Chief Executive Officer and His Family Members Have a Controlling Influence on the Company.

As of February 18, 2014, Steven L. Berman, our Chairman and Chief Executive Officer and director of Dorman Products, Inc., and his family members beneficially own approximately 26% of the outstanding Common Stock and have a controlling influence over the election of the Board of Directors and the outcome of most corporate actions requiring shareholder approval (including certain fundamental transactions) and the affairs of the Company. Such concentration of ownership may have the effect of delaying, preventing or deterring a change in control of the Company, could deprive shareholders of an opportunity to receive a premium for their common stock as part of a sale of the Company and might ultimately affect the market price of our common stock.

Our Success Depends on the Efforts of Our Management Team.

The success of our business will continue to be dependent upon Steven L. Berman, Chairman of the Board and Chief Executive Officer, Secretary and Treasurer, other executive officers and key employees and our ability to attract and retain other skilled managers. The loss of the services of any of these individuals for an extended period of time could have a material adverse effect on our business.

Our Operations, Revenues and Operating Results, and the Operations of Our Third Party Manufacturers, Suppliers and Customers, may be Subject to Quarter to Quarter Fluctuations and Disruptions from Events Beyond Our or Their Control.

Our operations, revenues and operating results, as well as the operations of our third party manufacturers, suppliers and customers, may be subject to quarter to quarter fluctuations and disruptions from a variety of causes outside of our or their control, including work stoppages, market volatility, acts of war, terrorism, cyber incidents, pandemics, fire, earthquake, flooding, changes in weather patterns, weather or seasonal fluctuations or other climate-based changes, including hurricanes or tornadoes, or other natural disasters. If a major disruption were to occur at our operations or the operations of our third party manufacturers, suppliers or customers, it could result in harm to people or the natural environment, delays in shipments of products to customers or suspension of operations, any of which could have a material adverse effect on our business, revenues and operating results.

10

Table of Contents

New Regulations Related to Conflict Minerals Could Adversely Impact Our Business.

The Dodd-Frank Wall Street Reform and Consumer Protection Act (“Dodd-Frank”) contains provisions to improve transparency and accountability concerning the supply of certain minerals, known as “conflict minerals”, originating from the Democratic Republic of Congo (DRC) and adjoining countries. In August, 2012, as required by Dodd-Frank, the SEC adopted rules requiring disclosure regarding the use of conflict minerals. The new rules required us to begin due diligence efforts during 2013 to determine the sources of conflict minerals used in our products. The implementation of these rules could adversely affect the sourcing, supply, and pricing of materials used in our products.as the number of suppliers who provide conflict-free minerals may be limited. We may also suffer reputational harm if we determine that certain of our products contain minerals not determined to be conflict-free or if we are unable to modify our products to avoid the use of such materials. We may also face challenges in satisfying customers who may require that our products be certified as containing conflict-free minerals.

Item 1B. Unresolved Staff Comments.

None

Facilities

We currently have 15 warehouse and office facilities located throughout the United States, Canada, China and India. Two of these facilities are owned and the remainder are leased. Our headquarters and principal warehouse facilities are as follows:

| Location | Description | |

| Colmar, PA | Corporate Headquarters Warehouse and office - 339,500 sq. ft. (leased) (1) | |

| Warsaw, KY | Warehouse and office - 710,500 sq. ft. (owned) | |

| Portland, TN | Warehouse and office - 475,000 sq. ft. (leased) | |

| Louisiana, MO | Warehouse and office - 90,000 sq. ft. (owned) | |

| Sanford, NC | Warehouse and office - 8,000 sq. ft. (leased) | |

| (1) | We lease the Colmar facility from a partnership of which Steven L. Berman, Chairman of the Board and Chief Executive Officer of the Company, and his family members are partners. Under our lease agreement we paid rent of $4.51 per square foot ($1.5 million per year) in fiscal 2013. The rents payable will be adjusted on January 1 of each year to reflect annual changes in the Consumer Price Index for All Urban Consumers—U.S. City Average, All Items. On November 15, 2012, we entered into a new lease with the partnership that expires on December 31, 2017. In the opinion of the Audit Committee, the terms of this lease are no less favorable than those which could have been obtained from an unaffiliated party. |

We are a party to or otherwise involved in legal proceedings that arise in the ordinary course of business, such as various claims and legal actions involving contracts, competitive practices, trademark and patent rights, product liability claims and other matters arising out of the conduct of our business. In the opinion of management, none of the actions, individually or in the aggregate, would likely have a material financial impact on the Company and we believe the range of reasonably possible losses from current matters is immaterial.

Item 4. Mine Safety Disclosures.

Not applicable

11

Table of Contents

Item 4.1. Executive Officers of the Registrant.

Executive Officers of the Registrant.

The following table sets forth certain information with respect to our executive officers:

| Name | Age | Position with the Company | ||||

| Steven L. Berman |

54 | Chairman of the Board, Chief Executive Officer, Secretary and Treasurer | ||||

| Mathias J. Barton |

54 | President and Director | ||||

| Jeffrey L. Darby |

46 | Senior Vice President, Sales and Marketing | ||||

| Michael B. Kealey |

39 | Senior Vice President, Product | ||||

| Thomas J. Knoblauch |

57 | Vice President, General Counsel and Assistant Secretary | ||||

| Matthew S. Kohnke |

42 | Chief Financial Officer | ||||

Steven L. Berman is Chairman of the Board, Chief Executive Officer, Secretary and Treasurer of the Company. Mr. Berman became Chairman, Chief Executive Officer, Secretary and Treasurer in January 2011. He previously held the positions of President, Secretary and Treasurer and a director of the Company from October 24, 2007 to January 30, 2011. Prior to October 24, 2007, he served as Executive Vice President, Secretary and Treasurer and a director of the Company since its inception in 1978. He attended Temple University.

Mathias J. Barton joined the Company in November 1999 as Senior Vice President, Chief Financial Officer. He became co-President of the Company in February 2011 and President in August 2013. Mr. Barton was appointed as a member of our Board of Directors in January 2014. Prior to joining the Company, Mr. Barton was Senior Vice President and Chief Financial Officer of Central Sprinkler Corporation, a manufacturer and distributor of automatic fire sprinklers, valves and component parts. From May 1989 to September 1998, Mr. Barton was employed by Rapidforms, Inc., a manufacturer of business forms and other products, most recently as Executive Vice President and Chief Financial Officer. He is a graduate of Temple University.

Jeffrey L. Darby joined the Company in November 1998 as a National Account Manager. He became Senior Vice President, Sales and Marketing in February 2011. Prior to joining the Company, Mr. Darby worked for Federal Mogul Corporation/Moog Automotive, an automotive parts supplier, beginning in 1990. He holds an MBA Degree from Fairleigh Dickenson University and a B.A. Degree from William Paterson University.

Michael B. Kealey joined Dorman Products in November of 2002, as a Product Manager. He became Senior Vice President, Product in February 2011. He previously held the positions of Vice President – Product from January 2007 through January 2011, and Director – Product Management from April 2003 through December 2006. Prior to joining the company, Mr. Kealey was employed by Eastern Warehouse Distributors, Inc., a distributor of automotive replacement parts, most recently as Vice President – Purchasing. He attended Temple University.

Thomas J. Knoblauch joined the Company in April 2005 as Vice President and General Counsel. In May 2005, Mr. Knoblauch was appointed Assistant Secretary. Prior to joining the Company he was Corporate Counsel at SunGard Data Systems, Inc. a software and technology services company, from 1996 to 2000 and General Counsel at Rosenbluth International, Inc., a corporate travel company, from 2000 to May 2005. He is a graduate of Widener University, St. Joseph’s University, the Widener University School of Law, and the Temple University Beasley School of Law Graduate Tax Program. Mr. Knoblauch is a member of both the Pennsylvania and New York Bar.

Matthew S. Kohnke joined Dorman Products in May 2002 as Vice President—Corporate Controller. He became Vice President and Chief Financial Officer of the Company in February 2011. Prior to joining the Company, Mr. Kohnke worked for Arthur Andersen LLP, beginning as an intern in January 1992 and advancing to manager in the Audit and Business Advisory practice. He is a graduate of Villanova University.

12

Table of Contents

Item 5. Market for Registrant’s Common Equity, Related Shareholder Matters and Issuer Purchases of Equity Securities.

Our shares of common stock are traded publicly on the NASDAQ Global Select Market under the ticker symbol “DORM”. At February 18, 2014 there were 166 holders of record of common stock, representing more than 5,900 beneficial owners. The last price for our common stock on February 18, 2014, as reported by the NASDAQ Global Select Market, was $51.83 per share. On December 28, 2012, we paid a special cash dividend to all common stockholders of record on December 17, 2012 of $1.50 for each share of common stock outstanding. We do not presently contemplate paying regular or special dividends in the foreseeable future. The range of high and low sales prices for our common stock for each quarterly period of fiscal 2013 and fiscal 2012 are as follows:

| Fiscal 2013 | Fiscal 2012(1) | |||||||||||||||

| High | Low | High | Low | |||||||||||||

| First Quarter |

$ | 38.45 | $ | 32.70 | $ | 25.67 | $ | 18.05 | ||||||||

| Second Quarter |

47.21 | 33.63 | 26.06 | 21.94 | ||||||||||||

| Third Quarter |

52.43 | 44.94 | 31.95 | 24.11 | ||||||||||||

| Fourth Quarter |

56.42 | 46.49 | 34.97 | 28.90 | ||||||||||||

| (1) | On June 15, 2012, we paid a stock dividend to all shareholders of our common stock of record on June 1, 2012 of one share of common stock for each share of common stock outstanding. All share price information has been adjusted to reflect the stock dividend paid on June 15, 2012. |

For the information regarding our equity compensation plans, see Item 12, Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters.

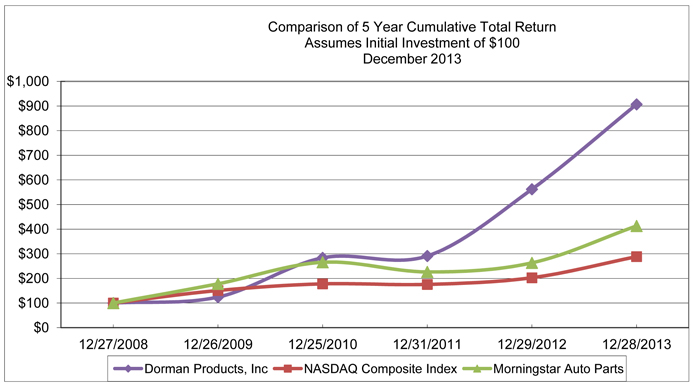

Stock Performance Graph. Below is a line graph comparing the cumulative total shareholder return for our common stock with the cumulative total shareholder return for the Automotive Parts & Accessories Peer Group of the Morningstar Group Index (formerly Hemscott Group Index) and the NASDAQ Composite Market Index for the period from December 27, 2008 to December 28, 2013. The Automotive Parts & Accessories Peer Group is comprised of 130 public companies and the information was furnished by Morningstar, Inc. through Zacks Investment Research, Inc. The graph assumes $100 invested on December 27, 2008 in our common stock and each of the indices, and that the dividends were reinvested when and as paid. In calculating the cumulative total shareholder returns, the companies included are weighted according to the stock market capitalization of such companies.

13

Table of Contents

Stock Repurchases

During the last three months of the fiscal year ended December 28, 2013, we purchased shares of our Common Stock as follows:

| Period |

Total Number of Shares Purchased (1) |

Average Price Paid per Share |

Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs |

Maximum Number (or Approximate Dollar Value) of Shares that May Yet Be Purchased Under the Plans or Programs (2) |

||||||||||||

| September 29, 2013 through October 26, 2013 |

4,030 | $ | 48.29 | — | — | |||||||||||

| October 27, 2013 through November 23, 2013 |

3,140 | $ | 47.30 | — | — | |||||||||||

| November 24, 2013 through December 28, 2013 |

11,196 | $ | 51.69 | — | $ | 10,000,000 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total |

18,366 | $ | 50.19 | — | $ | 10,000,000 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (1) | Includes 1,956 shares of our common stock withheld from participants for income tax withholding purposes in connection with the vesting of restricted stock grants during the period. The restricted stock was issued to participants pursuant to our 2008 Stock Option and Incentive Plan. Also includes 16,410 shares purchased from the Dorman Products, Inc, 401(k) Plan and Trust (as described in Note 12 to the Notes to Consolidated Financial statements in this annual report on Form 10-K). |

| (2) | On December 12, 2013 we announced that our Board of Directors authorized the purchase of up to $10 million of our outstanding common stock. This stock repurchase authorization expires at the end of 2014. Under this program, share repurchases may be made from time to time depending on market conditions, share price and availability and other factors at our discretion. We did not purchase any shares under this program during the quarter ended December 28, 2013. |

Item 6. Selected Financial Data.

| Fiscal year ended (1) | ||||||||||||||||||||

| (in thousands, except per share data) | December 28, 2013 |

December 29, 2012 (c) |

December 31, 2011 (d) |

December 25, 2010 |

December 26, 2009 |

|||||||||||||||

| Statement of Operations Data: |

||||||||||||||||||||

| Net sales |

$ | 664,466 | $ | 570,420 | $ | 513,432 | $ | 438,205 | $ | 358,519 | ||||||||||

| Income from operations |

127,939 | $ | 104,231 | 87,637 | 76,807 | 44,098 | ||||||||||||||

| Income from continuing operations |

81,920 | 66,405 | 56,202 | 48,101 | 26,968 | |||||||||||||||

| Income (loss) from discontinued operations (a) |

— | 4,557 | (2,925 | ) | (1,963 | ) | (473 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income |

$ | 81,920 | $ | 70,962 | $ | 53,277 | $ | 46,138 | $ | 26,495 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Earnings per share |

||||||||||||||||||||

| Basic |

||||||||||||||||||||

| Income from continuing operations |

$ | 2.25 | $ | 1.84 | $ | 1.57 | $ | 1.35 | $ | 0.76 | ||||||||||

| Income (loss) from discontinued operations |

— | 0.12 | (0.08 | ) | (0.06 | ) | (0.01 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income |

$ | 2.25 | $ | 1.96 | $ | 1.49 | $ | 1.29 | $ | 0.75 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Diluted |

||||||||||||||||||||

| Income from continuing operations |

$ | 2.24 | $ | 1.82 | $ | 1.55 | $ | 1.33 | $ | 0.75 | ||||||||||

| Income (loss) from discontinued operations |

— | 0.12 | (0.08 | ) | (0.06 | ) | (0.01 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income |

$ | 2.24 | $ | 1.94 | $ | 1.47 | $ | 1.27 | $ | 0.74 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Balance Sheet Data: |

||||||||||||||||||||

| Total assets |

$ | 529,169 | $ | 412,683 | $ | 382,116 | $ | 326,960 | $ | 260,203 | ||||||||||

| Working capital |

$ | 340,702 | $ | 272,364 | $ | 265,600 | $ | 218,935 | $ | 173,153 | ||||||||||

| Long-term debt |

$ | — | $ | — | $ | — | $ | — | $ | 266 | ||||||||||

| Dividends paid (b) |

$ | — | $ | 54,716 | $ | — | $ | — | $ | — | ||||||||||

| Shareholders’ equity |

$ | 413,641 | $ | 332,872 | $ | 317,103 | $ | 263,153 | $ | 215,335 | ||||||||||

| (1) | We operate on a fifty-two, fifty-three week period ending on the last Saturday of the calendar year. |

| (a) | On September 21, 2011, we announced our plan to exit the international portion of our ScanTech business due to continued operating losses and to focus on growing our North American business. The results of ScanTech have been presented as a discontinued operation in the Statement of Operations data presented above. |

| (b) | On December 5, 2012, we announced a special cash dividend of $1.50 per share of common stock payable on December 28, 2012 to shareholders of record at the close of business on December 17, 2012. |

14

Table of Contents

| (c) | Net income from discontinued operations includes a reclassification of approximately $3.0 million of a previously recognized currency translation adjustments from accumulated other comprehensive income to net income ($0.08 per share) and $1.4 million of benefits related to foreign tax credits we expect to utilize in the future ($0.04 per share). |

| (d) | Net income from discontinued operations includes charges of $2.2 million to write down inventory and tooling ($0.06 per share) and $0.4 million to write down other assets and to accrue employee-related costs ($0.01 per share). |

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Cautionary Statement Regarding Forward Looking Statements

Certain statements in this document constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. While forward-looking statements sometimes are presented with numerical specificity, they are based on various assumptions made by management regarding future circumstances over many of which the Company has little or no control. Forward-looking statements may be identified by words including “anticipate,” “believe,” “estimate,” “expect,” and similar expressions. The Company cautions readers that forward-looking statements, including, without limitation, those relating to future business prospects, revenues, working capital, liquidity, and income, are subject to certain risks and uncertainties that would cause actual results to differ materially from those indicated in the forward-looking statements. Factors that could cause actual results to differ from forward-looking statements include but are not limited to competition in the automotive aftermarket industry, unfavorable economic conditions, loss of suppliers, loss of third-party transportation providers, an increase in patent filings by original equipment manufacturers, quality problems, delay in the development and design of new products, space limitations on our customers’ shelves, concentration of the Company’s sales and accounts receivable among a small number of customers, the impact of consolidation in the automotive aftermarket industry, foreign currency fluctuations, timing and amount of customers’ orders of Company’s products, dependence on senior management, disruption from events beyond the Company’s control, and other risks and factors identified from time to time in the reports the Company files with the SEC. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those anticipated, estimated or projected. For additional information concerning factors that could cause actual results to differ materially from the information contained in this report, reference is made to the information in “Part I, Item 1A Risk Factors.”

Overview

We are a leading supplier of replacement parts and fasteners for passenger cars, light trucks, and heavy duty trucks in the automotive aftermarket. We distribute and market approximately 150,000 different SKU’s of automotive replacement parts, many of which we design and engineer. These SKU’s are sold under our various brand names, under our customers’ private label brands or in bulk. We believe we are the dominant aftermarket supplier of original equipment dealer “exclusive” items. Original equipment dealer “exclusive” parts are those parts which were traditionally available to consumers only from original equipment manufacturers or salvage yards. These parts include, among other parts, intake manifolds, exhaust manifolds, window regulators, radiator fan assemblies, tire pressure monitor sensors, complex electronics devices, and exhaust gas recirculation (EGR) coolers.

We generate virtually all of our revenues from customers in the North American automotive aftermarket, primarily in the United States and Canada. Our products are sold through automotive aftermarket retailers; national, regional and local warehouse distributors and specialty markets; and salvage yards. We distribute automotive replacement parts outside the United States, with sales into Europe, Mexico, the Middle East, Asia and Canada.

Executive Overview

We achieved record net sales and net income in 2013. Net sales from continuing operations increased 16% over fiscal 2012 levels to $664.5 million, while net income from continuing operations increased 23% to $81.9 million. We believe our strong financial results have been driven by favorable industry dynamics, sales growth resulting from new product sales, continued investments in new product development and a commitment to process improvements.

The automotive aftermarket has benefited from some of the factors affecting the general economy, including the impact of the recent recession, continued high unemployment, and high gas prices. We believe vehicle owners have become more likely to keep their current vehicles longer and perform necessary repairs and maintenance in order to keep those vehicles well maintained as a result of these factors. According to data published by Polk, a division of IHS Automotive, the average age of vehicles increased to 11.4 years as of August 2013. The number of miles driven is another important statistic that impacts our business. Generally, as vehicles are driven more miles, the more likely it is that parts will fail. The combination of the vehicle age increase and number of miles driven has accounted for a portion of our sales growth.

15

Table of Contents

The overall automotive aftermarket in which we compete has benefited from the conditions mentioned above. However, our customer base has consolidated in recent years. As a result, our customers regularly seek more favorable pricing, product returns and extended payment terms when negotiating with us. We attempt to avoid or minimize these concessions as much as possible, but we have granted pricing concessions, increased customer payment terms and allowed higher level of product returns in certain cases. These concessions impact our profit levels and may require additional capital to finance the business. We expect our customers to continue to exert pressure on our margins as the customer base continues to consolidate.

New product development is a critical success factor for us and is our primary vehicle for growth. We have made incremental investments to increase our new product development efforts each year since 2003 in an effort to grow our business and strengthen our relationships with our customers. The investments are primarily in the form of increased product development resources, increased customer and end-user awareness programs and customer service improvements. These investments have enabled us to provide an expanding array of new product offerings and grow revenues at levels that exceed market growth rates.

In 2012, we introduced a new line of products to be marketed for the medium and heavy duty truck aftermarket. We believe that this market provides many of the same opportunities for growth that the automotive aftermarket has provided us over the past several years. Our focus here is on Formerly Dealer Only parts as it is on the automotive side of the business. We launched the initial program with a limited offering, but have made additional investments in new product development efforts to expand our product offering. We currently have approximately 300 SKU’s in our medium and heavy duty product line. Revenues from this product line were approximately 1% of our net sales in 2013.

In September 2013, we launched our Hybrid Drive Battery program which provides broad coverage for the most popular hybrid vehicles in service. Our hybrid drive battery packs are completely remanufactured and are extensively tested to ensure performance. Our hybrid drive batteries are “plug and play” direct replacements, ready to install and requiring no programming time or expense thus saving the service technicians time and the hybrid vehicle owner’s money.

We may experience significant fluctuations from quarter to quarter in our results of operations due to the timing of orders placed by our customers. Generally, the second and third quarters have the highest level of customer orders. The introduction of new products and product lines to customers may cause significant fluctuations from quarter to quarter.

We operate on a fifty-two, fifty-three week period ended on the last Saturday of the calendar year. The fiscal years ended December 28, 2013 and December 29, 2012 were fifty-two week periods. The fiscal year ended December 31, 2011 was a fifty-three week period.

Discontinued Operations

On September 21, 2011, we announced our plan to exit the international portion of our ScanTech business due to continued operating losses and to focus on growing our North American business. ScanTech was headquartered outside Stockholm, Sweden and distributed a line of Volvo and Saab replacement parts throughout the world. ScanTech’s results of operations have been presented as a discontinued operation in the Consolidated Statement of Operations.

Results of Operations

The following table sets forth, for the periods indicated, the percentage of net sales represented by certain items in our Consolidated Statements of Operations:

| Percentage of Net Sales | ||||||||||||

| For the Year Ended | ||||||||||||

| December 28, 2013 | December 29, 2012 | December 31, 2011 | ||||||||||

| Net sales |

100.0 | % | 100.0 | % | 100.0 | % | ||||||

| Cost of goods sold |

60.7 | 62.3 | 63.1 | |||||||||

|

|

|

|

|

|

|

|||||||

| Gross profit |

39.3 | 37.7 | 36.9 | |||||||||

| Selling, general and administrative expenses |

20.0 | 19.4 | 19.8 | |||||||||

|

|

|

|

|

|

|

|||||||

| Income from operations |

19.3 | 18.3 | 17.1 | |||||||||

| Interest expense, net |

0.1 | 0.0 | 0.1 | |||||||||

|

|

|

|

|

|

|

|||||||

| Income from continuing operations before income taxes |

19.2 | 18.3 | 17.0 | |||||||||

| Provision for income taxes |

6.9 | 6.7 | 6.1 | |||||||||

|

|

|

|

|

|

|

|||||||

| Net income from continuing operations |

12.3 | % | 11.6 | % | 10.9 | % | ||||||

|

|

|

|

|

|

|

|||||||

16

Table of Contents

Fiscal Year Ended December 28, 2013 Compared to Fiscal Year Ended December 29, 2012

Net sales increased 16% to $664.5 million from $570.4 million last year. Our revenue growth was primarily driven by strong overall demand for our new products, especially those new products introduced in the preceding 24 months.

Cost of goods sold, as a percentage of net sales, decreased to 60.7% in fiscal 2013 from 62.3% in fiscal 2012. A favorable change in sales mix towards higher margin new products and the positive effects of price increases in select customer groups contributed to the improved gross margin during fiscal 2013. In addition, lower transportation costs were partially offset by $0.8 million of higher excess and obsolete inventory charges in the 2013 period compared to the same period in 2012.

Selling, general and administrative expenses in fiscal 2013 increased approximately 20% to $133.0 compared to $111.0 million in fiscal 2012. The spending increase was primarily due to higher variable costs associated with our 16% sales growth, $3.7 million in additional investments in product management and other resources to support our new product growth efforts and $3.2 million of depreciation and other related support costs associated with our enterprise resource planning system implementation. In addition, in January 2013 one large customer changed the way it distributes our product through its network. As a result, our selling, general and administrative costs increased by approximately $4.6 million in fiscal 2013. Also, financing costs associated with the accounts receivable sales program increased $0.8 million in fiscal 2013 compared to fiscal 2012.

Interest expense, net, was $0.2 million in fiscal 2013 compared to $0.1 million in fiscal 2012.

Our effective tax rate was 35.9% in fiscal 2013 compared to 36.2% in fiscal 2012. The effective tax rate in fiscal 2013 benefited from increased research and development tax credits and from lower state income taxes.

Fiscal Year Ended December 29, 2012 Compared to Fiscal Year Ended December 31, 2011

Net sales increased 11% over the prior year to $570.4 million from $513.4 million last year. Excluding the impact of an additional $4.8 million in sales due to a fifty-third week in fiscal 2011, revenues increased 12% over fiscal 2011 levels. Our revenue growth was driven by overall strong demand for our products and higher new product sales.

Cost of goods sold, as a percentage of net sales decreased to 62.3% in fiscal 2012 from 63.1% in the same period last year. Lower transportation costs contributed approximately one-half of the difference. The remaining variance was primarily the result of a favorable sales mix towards higher margin products, and provisions for excess and obsolete inventory were $1.0 million lower in fiscal 2012 than in fiscal 2011.

Selling, general and administrative expenses in fiscal 2012 increased 9% to $111.0 million from $101.6 million in fiscal 2011. The spending increase in fiscal 2012 was primarily the result of approximately $3.2 million of increased payroll expenses due to investments in additional product management and other resources to support our product development and growth efforts, $1.7 million of higher incentive compensation expenses and $0.9 million of increased financing costs associated with our accounts receivable sales programs. However, selling, general and administrative expenses decreased to 19.4% of net sales from 19.8% of net sales as we were able to leverage our expenses over growing net sales.

Interest expense, net, was $0.1 million in fiscal 2012 and fiscal 2011.

Our effective tax rate increased to 36.2% in fiscal 2012 from 35.8% in the prior year. The effective tax rate in fiscal 2011 was favorably impacted by the 2011 receipt of tax exempt life insurance proceeds to fund an officer’s death benefit.

Liquidity and Capital Resources

Historically, we have financed our growth through a combination of cash flow from operations, accounts receivable sales programs provided by certain customers and through the issuance of senior indebtedness through our bank credit facility and senior note agreements. Cash and cash equivalents as of December 28, 2013 increased to $60.6 million from $27.7 million as of December 29, 2012 primarily due to increased operating cash flow which was not fully offset by capital expenditures. Working capital was $340.7 million at December 28, 2013 compared to $272.4 million at December 29, 2012. We had no long-term debt or borrowings under our Revolving Credit Facility at December 28, 2013 or December 29, 2012. Shareholders’ equity was $413.6 million at December 28, 2013 and $332.9 million at December 29, 2012.

Over the past several years we have continued to extend payment terms to certain customers as a result of customer requests and market demands. These extended terms have resulted in increased accounts receivable levels and significant uses of cash flow. We participate in accounts receivable sales programs with several customers which allow us to sell our accounts receivable to financial institutions to offset the negative cash flow impact of these payment terms extensions. During fiscal 2013 and fiscal 2012,

17

Table of Contents

we sold approximately $406.4 million and $312.7 million, respectively, under these programs. We had the ability to sell significantly more accounts receivable under these programs if the needs of the business warranted. We expect continued pressure to extend our payment terms for the foreseeable future. Further extensions of customer payment terms will result in additional uses of cash flow or increased costs associated with the sale of accounts receivable.

We have a $30.0 million Revolving Credit Facility which expires in June 2015. Borrowings under the facility are on an unsecured basis with interest rates ranging from LIBOR plus 75 basis points to LIBOR plus 250 basis points based upon the achievement of certain benchmarks related to the ratio of funded debt to earnings before interest, taxes, depreciation and amortization (“EBITDA”). The interest rate at December 28, 2013 was LIBOR plus 75 basis points (0.92%). There were no borrowings under the Revolving Credit Facility as of December 28, 2013. As of December 28, 2013, we had three letters of credit outstanding for approximately $0.9 million in the aggregate which were issued to secure ordinary course of business transactions. We had approximately $29.1 million available under the facility at December 28, 2013, net of these letters of credit. The loan agreement also contains covenants, the most restrictive of which pertain to net worth and the ratio of debt to EBITDA. As of December 28, 2013, we were in compliance with all financial covenants contained in the Revolving Credit Facility.

Off-Balance Sheet Arrangements

Our business activities do not include the use of unconsolidated special purpose entities, and there are no significant business transactions that have not been reflected in the accompanying financial statements.

Contractual Obligations and Commercial Commitments

We have obligations for future minimum rental and similar commitments under non-cancellable operating leases as well as contingent obligations related to outstanding letters of credit. These obligations as of December 28, 2013 are summarized in the tables below (in thousands):

| Payments Due by Period | ||||||||||||||||||||

| Contractual Obligations |

Total | Less than 1 year | 1-3 years | 3-5 years | Thereafter | |||||||||||||||

| Operating leases |

$ | 12,548 | $ | 3,115 | $ | 5,686 | $ | 3,747 | $ | — | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| $ | 12,548 | $ | 3,115 | $ | 5,686 | $ | 3,747 | $ | — | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Amount of Commitment Expiration Per Period | ||||||||||||||||||||

| Other Commercial Commitments |

Total Amount Committed |

Less than 1 year | 1-3 years | 3-5 years | Thereafter | |||||||||||||||

| Letters of Credit |

$ | 850 | $ | — | $ | 850 | $ | — | $ | — | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| $ | 850 | $ | — | $ | 850 | $ | — | $ | — | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

We have excluded from the table above unrecognized tax benefits due to the uncertainty of the amount and period of payment. As of December 28, 2013, the Company has gross unrecognized tax benefits of $1.2 million (see Note 10, Income Taxes, to the Consolidated Financial Statements).

Cash Flows

Below is a table setting forth the key lines of our Consolidated Statements of Cash Flows:

| (in thousands) |

December 28, 2013 |

December 29, 2012 |

December 31, 2011 |

|||||||||

| Cash provided by operating activities |

$ | 61,559 | $ | 48,911 | $ | 38,063 | ||||||

| Cash used in investing activities |

(26,563 | ) | (18,078 | ) | (18,102 | ) | ||||||

| Cash used in financing activities |

(2,111 | ) | (53,390 | ) | (4 | ) | ||||||

| Effect of exchange rate changes on cash and cash equivalents |

— | 69 | (224 | ) | ||||||||

|

|

|

|

|

|

|

|||||||

| Net increase (decrease) in cash and cash equivalents |

$ | 32,885 | $ | (22,488 | ) | $ | 19,733 | |||||

|

|

|

|

|

|

|

|||||||

Cash provided by operating activities in fiscal 2013 increased by $12.6 million compared to fiscal 2012 primarily due to a $11.0 million increase in net income in fiscal 2013 compared to fiscal 2012. The sales growth in fiscal 2013 and fiscal 2012 resulted in additional accounts receivable, inventory and accounts payable. In addition, the timing of Chinese New Year and purchases to support anticipated future growth resulted in increased inventory and accounts payable in fiscal 2013 compared to fiscal 2012.

18

Table of Contents