Exhibit 99.2

TELUS CORPORATION |

| |

| Management’s

discussion and analysis |

| |

2022

|

TELUS Corporation – Management’s

discussion and analysis – 2022

Caution regarding forward-looking

statements

The terms

TELUS, the Company, we, us and our refer to TELUS Corporation and, where the context of the narrative permits or requires,

its subsidiaries.

This

document contains forward-looking statements about expected events and our financial and operating performance. Forward-looking statements

include any statements that do not refer to historical facts. They include, but are not limited to, statements relating to our objectives

and our strategies to achieve those objectives, our plans and expectations regarding the impact of the COVID-19 pandemic and responses

to it, our expectations regarding trends in the telecommunications industry (including demand for data and ongoing subscriber base growth),

and our financing plans (including our multi-year dividend growth program). Forward-looking statements are typically identified by the

words assumption, goal, guidance, objective, outlook, strategy, target and other similar

expressions, or future or conditional verbs such as aim, anticipate, believe, could, expect, intend,

may, plan, predict, seek, should, strive and will. These statements are made pursuant

to the “safe harbour” provisions of applicable securities laws in Canada and the United States Private Securities Litigation

Reform Act of 1995.

By

their nature, forward-looking statements are subject to inherent risks and uncertainties and are based on assumptions, including assumptions

about future economic conditions and courses of action. These assumptions may ultimately prove to have been inaccurate and, as a result,

our actual results or other events may differ materially from expectations expressed in or implied by the forward-looking statements.

Our general outlook and assumptions for 2023 are presented in Section 9 General trends, outlook and assumptions, and regulatory

developments and proceedings in this Management’s discussion and analysis (MD&A).

Risks

and uncertainties that could cause actual performance or other events to differ materially from the forward-looking statements made herein

and in other TELUS filings include, but are not limited to, the following:

| · | The

COVID-19 pandemic including its impacts on our customers, suppliers and vendors, our

team members and our communities, as well as changes resulting from the pandemic to our business

and operations. |

| · | Regulatory

matters including: changes to our regulatory regime (the timing of announcement or implementation

of which are uncertain) or the outcomes of proceedings, cases or inquiries relating to its

application, including but not limited to those set out in Section 9.4 Communications

industry regulatory developments and proceedings in this MD&A, such as the potential

for government to allow consolidation of competitors in our industry or conversely for government

to intervene with the intent of further increasing competition, for example, through mandated

wholesale access; the potential for additional government intervention on pricing; federal

and provincial consumer protection legislation; a new policy direction to the CRTC; the introduction

in Parliament of new federal privacy legislation that could materially expand or alter the

scope of consumer privacy rights, include significant administrative monetary penalties and

a privacy right of action, and implement a new regulatory regime for the use of artificial

intelligence (AI) in the private sector, with significant enforcement powers; amendments

to existing federal legislation; potential threats to unitary federal regulatory authority

over communications in Canada; potential threats to the CRTC’s ability to enforce competitive

safeguards such as the Standstill Rule and the Wholesale Code, which aims to

ensure the fair treatment by vertically integrated firms of rival competitors operating as

both broadcasting distributors and programming services; regulatory action by the Competition

Bureau or other regulatory agencies; spectrum allocation and compliance with licences, including

our compliance with licence conditions, changes to spectrum licence fees, spectrum policy

determinations such as restrictions on the purchase, sale, subordination, use and transfer

of spectrum licences, the cost and availability of spectrum and timing of spectrum allocation,

and ongoing and future consultations and decisions on spectrum licensing and policy frameworks,

auctions and allocation; draft legislation permitting the government to restrict the use

in telecommunications networks of equipment made by specified companies, potentially including

Huawei and ZTE; draft legislation imposing new cybersecurity reporting requirements; the

request by the Minister of Innovation, Science and Industry to telecommunications

service providers, including TELUS, to improve network resiliency; restrictions on non-Canadian

ownership and control of the common shares of TELUS Corporation (Common Shares) and the ongoing

monitoring of, and compliance with, such restrictions; unanticipated changes to the current

copyright regime, which could impact obligations for internet service providers or broadcasting

undertakings; and our ability to comply with complex and changing regulation of the healthcare

and medical devices industry in the jurisdictions in which we operate, including as an operator

of health clinics. The jurisdictions in which we operate, as well as the contracts that we

enter into (particularly contracts entered into by TELUS International (Cda) Inc. (TELUS

International or TI)), require us to comply with, or facilitate our clients’ compliance

with, numerous, complex and sometimes conflicting legal regimes, both domestically and internationally.

See TELUS International’s financial performance which impacts our financial performance

below. |

| |  | Page 2 of 127 |

TELUS Corporation – Management’s

discussion and analysis – 2022

| · | Competitive

environment including: our ability to continue to retain customers through an enhanced

customer service experience that is differentiated from our competitors, including through

the deployment and operation of evolving network infrastructure; intense competition, including

the ability of industry competitors to successfully combine a mix of new service offerings,

in some cases under one bundled and/or discounted monthly rate, along with their existing

services; the success of new products, services and supporting systems, such as home automation,

security and Internet of Things (IoT) services for internet-connected devices; continued

intense competition across all services among telecommunications companies, cable companies,

other communications companies and over-the-top (OTT) services, which, among other things,

places pressures on current and future average revenue per subscriber per month (ARPU), cost

of acquisition, cost of retention and churn rates for all services, as do market conditions,

government actions, customer usage patterns, increased data bucket sizes or flat-rate pricing

trends for voice and data, inclusive rate plans for voice and data, and availability of Wi-Fi

networks for data; consolidation, mergers and acquisitions of industry competitors; subscriber

additions, losses and retention volumes; our ability to obtain and offer content on a timely

basis across multiple devices on mobile and TV platforms at a reasonable cost as content

costs per unit continue to grow; vertical integration in the broadcasting industry resulting

in competitors owning broadcast content services, and timely and effective enforcement of

related regulatory safeguards; TI’s ability to compete with professional services companies

that offer consulting services, information technology companies with digital capabilities,

and traditional contact centre and business process outsourcing companies that are expanding

their capabilities to offer higher-margin and higher-growth digital services; in our TELUS

Health business, our ability to compete with other providers of employee and family assistance

programs, benefits administration, electronic medical records and pharmacy management products,

claims adjudicators, systems integrators and health service providers, including competitors

with a vertically integrated mix of health services delivery, IT solutions and related

services, global providers that could achieve expanded Canadian footprints, and providers

of virtual healthcare services, preventative health services and personal emergency response

services; and in our TELUS Agriculture & Consumer Goods business, our ability to

compete with focused software and IoT competitors. |

| · | Technology including: reduced utilization and increased commoditization of traditional fixed voice

services (local and long distance) resulting from impacts of OTT applications and mobile

substitution; a declining overall market for TV services, resulting in part from content

piracy and signal theft, a rise in OTT direct-to-consumer video offerings and virtual multichannel

video programming distribution platforms; the increasing number of households with only mobile

and/or internet-based telephone services; potential decline in ARPU as a result of, among

other factors, substitution by messaging and OTT applications; substitution by increasingly

available Wi-Fi services; and disruptive technologies, such as OTT IP services, including

software-defined networks in the business market that may displace or cause us to reprice

our existing data services, and self-installed technology solutions. |

Challenges

to our ability to deploy technology including: high subscriber demand for data that challenges wireless networks and spectrum capacity

levels and may be accompanied by increases in delivery cost; our reliance on information technology and our ability to continually streamline

our legacy systems; the roll-out, anticipated benefits and efficiencies, and ongoing evolution of wireless broadband technologies and

systems, including video distribution platforms and telecommunications network technologies, broadband initiatives (such as fibre-to-the-premises

(FTTP), wireless small-cell deployment and 5G wireless); availability of resources and our ability to build out adequate broadband capacity;

our reliance on wireless network access agreements, which have facilitated our deployment of mobile technologies; our choice of suppliers

and those suppliers’ ability to maintain and service their product lines, which could affect the success of upgrades to, and evolution

of, technology that we offer; supplier limitations and concentration and market power for products such as network equipment, TELUS TV®

and mobile handsets; our expected long-term need to acquire additional spectrum capacity through future spectrum auctions and from

third parties to address increasing demand for data, and our ability to utilize spectrum we acquire; deployment and operation of new

fixed broadband network technologies at a reasonable cost and the availability and success of new products and services to be rolled

out using such network technologies; network reliability and change management; and our deployment of self-learning tools and automation,

which may change the way we interact with customers.

Capital

expenditure levels and potential outlays for spectrum licences in auctions or purchases from third parties affect and are affected

by: our broadband initiatives, including connecting more homes and businesses directly to fibre; our ongoing deployment of newer mobile

technologies, including wireless small cells that can improve coverage and capacity; investments in network technology required to comply

with laws and regulations relating to the security of cyber systems, including bans on the products and services of certain vendors;

investments in network resiliency and reliability, including measures to address changes in usage resulting from restrictions imposed

in response to the COVID-19 pandemic; the allocation of resources to acquisitions and future spectrum auctions held by Innovation, Science

and Economic Development Canada (ISED), including the announcement of a second consultation on the auctioning of the 3800 MHz spectrum,

which the Minister of Innovation, Science and Industry stated is expected to take place in 2023, and the millimetre wave spectrum auction,

which is expected to commence in 2024. Our capital expenditure levels could be impacted if we do not achieve our targeted operational

and financial results or if there are changes to our regulatory environment.

| · | Operational

performance and business combination risks including: our reliance on legacy systems

and our ability to implement and support new products and services and business operations

in a timely manner; our ability to manage the requirements of large enterprise deals; our

ability to implement effective change management for system replacements and upgrades, process

redesigns and business integrations (such as our ability in a timely manner to successfully

complete and integrate acquisitions into our operations and culture, complete divestitures

or establish partnerships and realize expected strategic benefits, including those following

compliance with any regulatory orders); our ability to identify and manage new risks inherent

in new service offerings that we may provide, including as a result of acquisitions, which

could result in damage to our brand, our business in the relevant area or as a whole, and

additional exposure to litigation or regulatory proceedings; our ability to effectively manage

the growth of our infrastructure and integrate new team members; and our reliance on third-party

cloud-based computing services to deliver our IT services. |

| · | Security

and data protection including risks that malfunctions or unlawful acts could result in

unauthorized access or change to, or loss or distribution of, data that may compromise

the privacy of individuals and could result in financial loss and harm to our reputation

and brand. |

Security

threats including intentional damage, unauthorized access or attempted access to our physical assets or our IT systems and network,

or those of our customers or vendors, which could prevent us from providing reliable service or result in unauthorized access to our

information or that of our customers.

Business

continuity events including: our ability to maintain customer service and operate our network in the event of human error or human-caused

threats, such as cyberattacks and equipment failures that could cause various degrees of network outages; technical disruptions and infrastructure

breakdowns; supply chain disruptions, delays and rising costs, including as a result of government restrictions or trade actions; natural

disaster threats; extreme weather events; epidemics; pandemics (including the COVID-19 pandemic); political instability in certain international

locations, including war and other geopolitical developments; information security and privacy breaches, including loss or theft of data;

and the completeness and effectiveness of business continuity and disaster recovery plans and responses.

| |  | Page 3 of 127 |

TELUS Corporation – Management’s

discussion and analysis – 2022

| · | Our

team including: recruitment, retention and appropriate training in a highly competitive

industry (including retention of team members leading recent acquisitions in emerging areas

of our business), the level of our employee engagement and impact on engagement or other

aspects of our business or any unresolved collective agreements including the future outcome

of collective bargaining for an agreement with the Telecommunications Workers Union, United

Steelworkers Local 1944, which expired at the end of 2021, our ability to maintain our unique

culture as we grow, the risk that certain independent contractors in our business could be

classified as employees, and the physical and mental health of our team, which are critical

to engagement and productivity. |

| · | Environment,

health and safety including: loss of employee work time as a result of illness or injury;

public concerns related to radio frequency emissions; environmental issues including climate-related

risks (such as extreme weather events and other natural hazards), waste and waste recycling,

risks relating to fuel systems on our properties, changing government and public expectations

regarding environmental matters and our responses; and challenges associated with epidemics

or pandemics, including the COVID-19 pandemic and our response to it, which may add to or

accentuate these factors. |

Energy

use including: our ability to identify, procure and implement solutions to reduce energy consumption and adopt cleaner sources of

energy; our ability to identify and make suitable investments in renewable energy, including in the form of virtual power purchase agreements;

our ability to continue to realize significant absolute reductions in energy use and the resulting greenhouse gas (GHG) emissions in

our operations (in part as a result of programs and initiatives focused on our buildings and network); and other risks associated with

achieving our goals to achieve carbon neutrality and reduce our GHG emissions by 2030.

| · | Real

estate matters including risks associated with our real estate investments, such as financing

risks and uncertain future demand, occupancy and rental rates, especially during the COVID-19

pandemic. |

| · | Financing,

debt and dividend requirements including: our ability to carry out financing activities,

refinance our maturing debt, lower our net debt to EBITDA ratio to our objective range given

the cash demands of spectrum auctions, and/or our ability to maintain investment-grade credit

ratings. Our business plans and growth could be negatively affected if existing financing

is not sufficient to cover our funding requirements. |

Lower

than planned free cash flow could constrain our ability to invest in operations, reduce leverage or return capital to shareholders, and

could affect our ability to sustain our dividend growth program through 2025 and any further dividend growth programs. This program

may be affected by factors such as the competitive environment, fluctuations in the Canadian economy or the global economy, our earnings

and free cash flow, our levels of capital expenditures and spectrum licence purchases, acquisitions, the management of our capital structure,

regulatory decisions and developments, and business continuity events. Quarterly dividend decisions are subject to assessment and determination

by our Board of Directors based on our financial position and outlook. Common Shares may be purchased under our normal course issuer

bid (NCIB) when and if we consider it opportunistic, based on our financial position and outlook, and the market price of our Common

Shares. There can be no assurance that our dividend growth program or our NCIB will be maintained, unchanged and/or completed.

| · | Tax

matters including: interpretation of complex domestic and foreign tax laws by the relevant

tax authorities that may differ from our interpretations; the timing and character of income

and deductions, such as depreciation and operating expenses; tax credits or other attributes;

changes in tax laws, including tax rates; tax expenses that are materially different than

anticipated, including the taxability of income and deductibility of tax attributes or retroactive

application of new legislation; elimination of income tax deferrals through the use of different

tax year-ends for operating partnerships and corporate partners; and changes to the interpretation

of tax laws, including those resulting from changes to applicable accounting standards or

the adoption of more aggressive auditing practices by tax authorities, tax reassessments

or adverse court decisions impacting the tax payable by us. |

| · | The

economy including: the state of the economy in Canada, which may be influenced by economic

and other developments outside of Canada, including potential outcomes of future policies

and actions of foreign governments and the COVID-19 pandemic, as well as public and private

sector responses to the pandemic; expectations regarding future interest rates; inflation;

unemployment levels; effects of volatility in oil prices; effects of low business spending

(such as reducing investments and cost structure); pension investment returns and factors

affecting pension benefit obligations, funding and solvency discount rates; fluctuations

in exchange rates of the currencies of various countries in which we operate; sovereign credit

ratings and effects on the cost of borrowing; the impact of tariffs on trade between Canada

and the United States; and global implications of the dynamics of trade relationships among

major world economies. |

Ability

to successfully implement cost reduction initiatives and realize planned savings, net of restructuring and other costs, without losing

customer service focus or negatively affecting business operations. Examples of these initiatives are: our operating efficiency and

effectiveness program to drive improvements in financial results; business integrations; business product simplification; business process

automation and outsourcing; offshoring and reorganizations; procurement initiatives; and real estate rationalization.

| |  | Page 4 of 127 |

TELUS Corporation – Management’s

discussion and analysis – 2022

| · | Litigation

and legal matters including: our ability to successfully respond to investigations and

regulatory proceedings; our ability to defend against existing and potential claims and lawsuits

(including intellectual property infringement claims and class actions based on consumer

claims, data, privacy or security breaches and secondary market liability), or to negotiate

and exercise indemnity rights or other protections in respect of such claims and lawsuits;

and the complexity of legal compliance in domestic and foreign jurisdictions, including compliance

with competition, anti-bribery and foreign corrupt practices laws. |

| · | Foreign

operations and our ability to successfully manage operations in foreign jurisdictions,

including managing risks such as currency fluctuations and exposure to various economic,

international trade, political and other risks of doing business globally. See also Section

10.3 Regulatory matters and TELUS International’s financial performance which

impacts our financial performance. |

| · | TELUS

International’s financial performance which impacts our financial performance.

Factors that may affect TI’s financial performance are described in TI’s public

filings available on SEDAR and EDGAR and may include: intense competition from companies

offering similar services; attracting and retaining qualified team members to support its

operations; TI’s ability to grow and maintain profitability if changes in technology

or client expectations outpace service offerings and internal tools and processes; TI maintaining

its culture as it grows; effects of economic and geopolitical conditions on its clients’

businesses and demand for its services; the significant portion of TI’s revenue that

is dependent on a limited number of large clients; continued consolidation in many of the

verticals in which TI offers services resulting in potential client loss; adverse impacts

of the COVID-19 pandemic on TI’s business and financial results; the adverse impact

on TI’s business if certain independent contractors were classified as employees, and

the costs associated with defending, settling or resolving any future lawsuits (including

demands for arbitration) relating to the independent contractor classification; TI’s

ability to successfully identify, complete, integrate and realize the benefits of acquisitions

and manage associated risks; cyberattacks or unauthorized disclosure resulting in access

to sensitive or confidential information and data of its clients or their end customers,

which could have a negative impact on its reputation and client confidence; TI’s business

not developing in ways it currently anticipates due to negative public reaction to offshore

outsourcing, proposed legislation or otherwise; ability to meet client expectations regarding

its content moderation services being adversely impacted due to factors beyond its control

and its content moderation team members suffering adverse emotional or cognitive effects

in the course of performing their work; and TI’s short history operating as a separate,

publicly traded company. TELUS International’s primary functional and reporting currency

is the U.S. dollar and the contribution to our consolidated results of positive results in

our digitally-led customer experiences – TELUS International (DLCX) segment may be

offset by any strengthening of the Canadian dollar (our reporting currency) compared to the

U.S. dollar, the European euro, the Philippine peso and the currencies of other countries

in which TI operates. The trading price of the subordinate voting shares of TI (TI Subordinate

Voting Shares) may be volatile and is likely to fluctuate due to a number of factors beyond

its control, including actual or anticipated changes in profitability; general economic,

social or political developments; changes in industry conditions; changes in governance regulation;

inflation; low trading volume; the general state of the securities markets; and other material

events. TI may choose to publicize targets or provide other guidance regarding its business

and it may not achieve such targets. Failure to do so could also result in a decline in the

trading price of the TI Subordinate Voting Shares. A decline in the trading price of the

TI Subordinate Voting Shares due to these or other factors could result in a decrease in

the fair value of TI multiple voting shares held by TELUS. |

These

risks are described in additional detail in Section 9 General trends, outlook and assumptions, and regulatory developments and

proceedings and Section 10 Risks and risk management in this MD&A. Those descriptions are incorporated by reference

in this cautionary statement but are not intended to be a complete list of the risks that could affect the Company.

Many

of these factors are beyond our control or outside of our current expectations or knowledge. Additional risks and uncertainties that

are not currently known to us or that we currently deem to be immaterial may also have a material adverse effect on our financial position,

financial performance, cash flows, business or reputation. Except as otherwise indicated in this document, the forward-looking statements

made herein do not reflect the potential impact of any non-recurring or special items or any mergers, acquisitions, dispositions or other

business combinations or transactions that may be announced or that may occur after the date of this document.

Readers

are cautioned not to place undue reliance on forward-looking statements. Forward-looking statements in this document describe our expectations,

and are based on our assumptions, as at the date of this document and are subject to change after this date. Except as required by law,

we disclaim any intention or obligation to update or revise any forward-looking statements.

This

cautionary statement qualifies all of the forward-looking statements in this MD&A.

| |  | Page 5 of 127 |

TELUS Corporation – Management’s

discussion and analysis – 2022

Management’s discussion and

analysis (MD&A)

February 9, 2023

Contents

| Section |

|

Page |

|

Subsection |

| 1. |

Introduction |

|

7

7

9

13 |

|

1.1 Preparation of the MD&A

1.2 The environment in which we operate

1.3 Highlights of 2022

1.4 Performance targets (key performance measures) |

| 2. |

Core business and strategy |

|

16

16 |

|

2.1 Core business

2.2 Strategic imperatives |

| 3. |

Corporate priorities |

|

17 |

|

|

| 4. |

Capabilities |

|

23

28

33

35 |

|

4.1 Principal markets addressed and competition

4.2 Operational resources

4.3 Liquidity and capital resources

4.4 Disclosure controls and procedures, changes in internal control over financial reporting and limitations on scope of design |

| 5. |

Discussion of operations |

|

36

38

42

46

53 |

|

5.1 General

5.2 Summary of consolidated quarterly results, trends and fourth quarter recap

5.3 Consolidated operations

5.4 TELUS technology solutions segment

5.5 Digitally-led customer experiences – TELUS International segment |

| 6. |

Changes in financial position |

|

56 |

|

|

| 7. |

Liquidity and capital resources |

|

57

58

58

60

61

63

65

65

65

68

68 |

|

7.1 Overview

7.2 Cash provided by operating activities

7.3 Cash used by investing activities

7.4 Cash provided by financing activities

7.5 Liquidity and capital resource measures

7.6 Credit facilities

7.7 Sale of trade receivables

7.8 Credit ratings

7.9 Financial instruments, commitments and contingent liabilities

7.10 Outstanding share information

7.11 Transactions between related parties |

| 8. |

Accounting matters |

|

68

73 |

|

8.1 Critical accounting estimates and judgments

8.2 Accounting policy developments |

| 9. |

General trends, outlook and assumptions, and regulatory developments and proceedings |

|

73

76

80

81 |

|

9.1 Telecommunications industry in 2022

9.2 Telecommunications industry general outlook and trends

9.3 TELUS assumptions for 2023

9.4 Communications industry regulatory developments and proceedings |

| 10. |

Risks and risk management |

|

87

88

92

95

99

101

103

105

107

109

110

113

114

115

117

118

119 |

|

10.1 Overview

10.2 Principal risks and uncertainties

10.3 Regulatory matters

10.4 Competitive environment

10.5 Technology

10.6 Security and data protection

10.7 Our environment

10.8 Operational performance and business combination

10.9 Customer service

10.10 Our systems and processes

10.11 Our team

10.12 Suppliers

10.13 Real estate matters

10.14 Financing, debt and dividends

10.15 Tax matters

10.16 The economy

10.17 Litigation and legal matters |

| 11. |

Definitions and reconciliations |

|

121

127 |

|

11.1 Non-GAAP and other specified financial measures

11.2 Operating indicators |

© 2023 TELUS Corporation. All rights reserved. The symbols TM

and ® indicate trademarks owned by TELUS Corporation or its subsidiaries used under license. All other trademarks are the property

of their respective owners.

| |  | Page 6 of 127 |

TELUS Corporation – Management’s

discussion and analysis – 2022

The forward-looking statements in this

section, including, for example, statements relating to the expected impact of the COVID-19 pandemic on our operations and financial

condition, are qualified by the Caution regarding forward-looking statements at the beginning of this Management’s discussion

and analysis (MD&A).

1.1 Preparation of the MD&A

The following sections are a discussion

of our consolidated financial position and financial performance for the year ended December 31, 2022, and should be read together

with our December 31, 2022 audited consolidated statements of income and other comprehensive income, statements of financial position,

statements of changes in owners’ equity and statements of cash flows, and the related notes (collectively referred to as the Consolidated

financial statements). The generally accepted accounting principles (GAAP) that we use are International Financial Reporting Standards

(IFRS) as issued by the International Accounting Standards Board (IASB) and Canadian GAAP. In this MD&A, the term IFRS refers to

these standards. In our discussion, we also use certain non-GAAP and other specified financial measures to evaluate our performance,

monitor compliance with debt covenants and manage our capital structure. These measures are defined, qualified and reconciled with their

nearest GAAP measures, as required by National Instrument 52-112, Non-GAAP and Other Financial Measures Disclosure, in Section 11.1.

All currency amounts are in Canadian dollars, unless otherwise specified.

Additional

information relating to the Company, including our Annual Information Form and other filings with securities commissions or similar

regulatory authorities in Canada, is available on SEDAR (sedar.com). Our information filed with or furnished to the

Securities and Exchange Commission in the United States, including Form 40-F, is available on EDGAR (sec.gov).

Additional information about our TELUS International (Cda) Inc. (TELUS International or TI) subsidiary, including discussion of its

business and results, can be found in its public filings available on SEDAR and EDGAR.

Our disclosure

controls and procedures are designed to provide reasonable assurance that all relevant information is gathered and reported to senior

management on a timely basis, so that appropriate decisions can be made regarding public disclosure. This MD&A and the Consolidated

financial statements were reviewed by our Audit Committee and authorized by our Board of Directors (Board) for issuance on February 9,

2023.

In this MD&A,

unless otherwise indicated, results for the year ended December 31, 2022 are compared with results for the year ended December 31,

2021.

1.2 The environment in which we operate

The success of our business and the

challenges we face can best be understood with reference to the environment in which we operate, including broader economic factors that

affect our customers and us, and the competitive nature of our business operations.

2022 Canadian telecom

industry

growth

Est. 4% |

TELUS 2022 operating

revenues

and other income

$18.4 billion |

TELUS telecom subscriber

connections

18.0 million |

TELUS Corporation Common

Share

2022 dividends declared

and growth per share

$1.9 billion / 6.7% |

COVID-19

The COVID-19 pandemic, which emerged

in the first quarter of 2020, continued to have a global impact throughout 2022. We expect the pandemic to continue to affect our operations

for at least the first quarter of 2023 and possibly thereafter. This will depend on both domestic and international factors, such as

rates of vaccination and booster doses, as well as the potential proliferation of COVID-19 variants of concern. We are committed to prioritizing

the health and safety of team members and customers.

With respect to

TELUS International, we currently expect that a majority of team members will return to traditional work environments in offices and

delivery locations over time when it has been deemed safe to do so by local governments and healthcare officials. However, the extent

and timing of such return is expected to vary significantly by geography and practices within each office and delivery location.

| |  | Page 7 of 127 |

TELUS Corporation – Management’s

discussion and analysis – 2022

Canadian

telecommunications industry

As

the pandemic lingered, Canadians continued to adjust to new norms, such as changes in business models and consumer behaviour, while economic

growth carried on into 2022. Throughout the year, the connectivity provided by the telecommunications industry was important in maintaining

economic and social activity, providing positive outcomes for Canada. We estimate that Canadian telecommunications industry revenues

(including TV revenue and excluding equipment and media revenue) grew by approximately 4% in 2022, with industry mobile network revenue

growth of approximately 6.8%. Mobile revenues continued to account for the largest portion of telecommunications sector revenues, as

Canadians consumed more mobile data than ever, enabled by the speed and reach of mobile networks. We estimate that the Canadian mobile

phone industry added approximately 1.7 million net new subscribers in 2022, compared to an estimate of approximately 1.2 million in 2021.

With respect to fixed products and services, we estimate the Canadian consumer high-speed internet penetration rate grew by approximately

one percentage point to 91% in 2022, and subscriber growth is expected to remain steady. Industry internet revenue growth continued,

as many Canadians relied on high-speed internet for work and entertainment at home and increased the speed of their service packages.

Conversely, the shift from the traditional television landscape to alternative forms of media also continued. Competitive pressures continued

in both the consumer and business markets for fixed products and services, while declines in higher-margin fixed legacy voice and data

services were ongoing, mainly attributable to technological substitution. (See Section 9 General trends, outlook and assumptions,

and regulatory developments and proceedings, Section 10.4 Competitive environment and Section 10.16 The economy.)

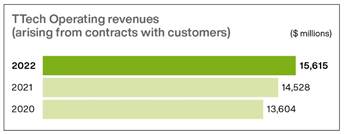

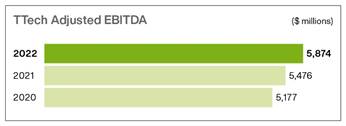

TELUS technology

solutions (TTech)

Across TTech, we are leveraging our

leading technology and compassion to enable remarkable human outcomes. Our long-standing commitment to putting our customers first across

the full range of our solutions spanning mobile, data, IP, voice, television, entertainment, video and security, delivered over

our award-winning networks, has made us a distinct leader in customer service excellence and loyalty. The accolades we have earned over

the years from independent, industry-leading network insight firms highlight the speed, reliability and expansiveness of our leading

networks, reinforcing our commitment to provide Canadians with access to superior technology that connects us to the people, resources

and information that matter most. The healthcare industry continues to move toward digitization of everyday functions within the healthcare

ecosystem. We are helping Canadians and others live healthier lives by leveraging technology that enables access to health information

and delivers improved health outcomes with solutions such as employer-focused healthcare. We are also developing innovative technology

solutions to help feed the world, putting data to work for customers in the agriculture, food and consumer goods sectors. This efficient

and effective collaboration helps ensure the quality and safety of food and consumer goods.

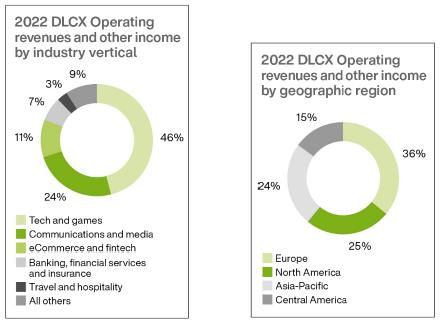

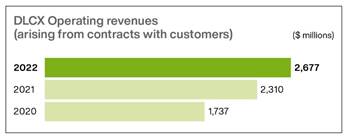

Digitally-led

customer experiences – TELUS International (DLCX)

Technology is transforming the way businesses

interact with their customers at an accelerating pace and scale and, across industries, customer experience has become a critically important

competitive differentiator. DLCX clients and their customers have more information and more choices than ever before, and their expectations

surrounding brand experiences and the speed at which companies must process and respond to customer interactions are changing rapidly.

The proliferation of mobile devices, social media platforms and other methods of digital interaction has enabled customers to access

information 24/7 and engage with companies through multiple digital channels. The COVID-19 pandemic has further accelerated the use of

digital channels as the first, and sometimes only, point of customer interaction. Customers value a consistent and personalized experience

across every channel when interacting with the companies that serve them. Businesses face pressure to engage with their customers across

digital and human channels, and seek to do so by combining technology with an authentic human experience that demonstrates a genuine

commitment to customer satisfaction.

| |  | Page 8 of 127 |

TELUS Corporation – Management’s

discussion and analysis – 2022

Economic estimates

Our estimates regarding our economic

and operational environment, including economic growth, unemployment and housing starts, serve as important inputs for the assumptions

on which our targets are based. The extent of the impact these estimates will have on us, and the timing of that impact, will depend

upon the actual outcomes in specific sectors of the Canadian economy.

| |

|

|

Economic growth |

|

|

Unemployment |

|

|

Housing starts |

|

| |

|

|

(percentage points) |

|

|

(percentage points) |

|

|

(thousands of units) |

|

| |

|

|

Estimated gross

domestic product

(GDP) growth rates |

|

|

Our

estimated

GDP

growth

rates1 |

|

|

Unemployment rates |

|

|

Our

estimated

annual

unemployment

rates1 |

|

|

Seasonally adjusted

annual rate of housing

starts2 |

|

|

Our estimated

annual rate of

housing starts

on an

unadjusted

basis1 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

For the month of |

|

|

|

|

|

For the month of |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

December |

|

|

December |

|

|

|

|

|

December |

|

|

December |

|

|

|

|

| |

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

20223 |

|

|

20213 |

|

|

2023 |

|

|

2022 |

|

|

2021 |

|

|

2023 |

|

| Canada |

|

|

|

1.0 |

4 |

|

|

3.6 |

4 |

|

|

0.6 |

|

|

|

5.0 |

|

|

|

5.9 |

|

|

|

6.1 |

|

|

|

249 |

|

|

|

236 |

|

|

212 |

|

| B.C. |

|

|

|

1.5 |

5 |

|

|

3.2 |

5 |

|

|

0.4 |

|

|

|

4.2 |

|

|

|

5.3 |

|

|

|

5.6 |

|

|

|

59 |

|

|

|

55 |

|

|

34 |

|

| Alberta |

|

|

|

2.7 |

5 |

|

|

4.8 |

5 |

|

|

1.5 |

|

|

|

5.8 |

|

|

|

7.3 |

|

|

|

5.9 |

|

|

|

27 |

|

|

|

31 |

|

|

31 |

|

| Ontario |

|

|

|

0.5 |

5 |

|

|

2.6 |

5 |

|

|

0.3 |

|

|

|

5.3 |

|

|

|

6.0 |

|

|

|

6.6 |

|

|

|

109 |

|

|

|

70 |

|

|

71 |

|

| Quebec |

|

|

|

0.7 |

5 |

|

|

3.1 |

5 |

|

|

0.5 |

|

|

|

4.0 |

|

|

|

4.6 |

|

|

|

5.5 |

|

|

|

33 |

|

|

|

52 |

|

|

50 |

|

| 1 |

Assumptions are as of October 31, 2022 and are based on a composite of estimates from Canadian banks

and other sources. |

| |

|

| 2 |

Source: Statistics Canada. Table 34-10-0158-01 Canada Mortgage and Housing Corporation, housing starts,

all areas, Canada and provinces, seasonally adjusted at annual rates, monthly (x 1,000). |

| |

|

| 3 |

Source: Statistics Canada Labour Force Survey, December 2022 and December 2021, respectively. |

| |

|

| 4 |

Source: Bank of Canada Monetary Policy Report, January 2023. |

| |

|

| 5 |

Source: British Columbia Ministry of Finance, First Quarterly Report, September 2022; Alberta Ministry

of Treasury Board and Finance, 2022 – 23 Mid-year Fiscal Update and Economic Statement, November 2022; Ontario Ministry

of Finance, 2022 Ontario Economic Outlook and Fiscal Review – Ontario’s Plan to Build: A Progress Update, November 2022;

and Ministère des Finances du Québec, Update on Quebec’s Economic and Financial Situation – Fall 2022, December 2022,

respectively. |

1.3 Highlights of

2022

Fully Managed

Inc. acquisition

On January 1, 2022, we acquired

100% ownership of Fully Managed Inc. for cash and contingent consideration of $124 million. Fully Managed Inc. provides managed information

technology support, technology strategy and network management. The acquisition was made with a view to growing our end-to-end capabilities

to support small and medium-sized business customers.

Vivint Smart

Home, Inc. acquisition

On June 8, 2022, we acquired the

Canadian customers, assets and operations of Vivint Smart Home, Inc. (Vivint) for $104 million. Vivint is a security business

that is complementary to our existing lines of business. The investment was made with a view to leveraging our telecommunications infrastructure

and expertise to continue to enhance connected home, business, security and health services for our customers.

LifeWorks Inc. acquisition

On September 1, 2022, we announced

the completion of our $2.2 billion acquisition of all of the issued and outstanding common shares of LifeWorks Inc. (LifeWorks), a world

leader in providing digital and in-person solutions that support the total well-being of individuals – mental, physical, financial

and social – solidifying TELUS Health as one of the largest providers of digital-first health and wellness services and

solutions that empower individuals to live their healthiest lives. The acquisition immediately enabled the opportunity for health services

to operate and grow internationally through long-standing corporate relationships globally, with notable areas of focus in employee health

and wellness programs, mental and physical health solutions, pensions and benefits management, and retirement solutions.

This transaction establishes a

compelling offering for employers that will allow them to provide the best wellness experience for their employees in order to

enhance talent acquisition and retention, while improving business performance. It will also provide complementary end-to-end

solutions supported by our robust infrastructure of leading networks and best-in-class customer experience. With LifeWorks

integrating within TELUS Health, our newly expanded organization will also be a global digital health and wellness leader, providing

access to high-quality, proactive healthcare and mental wellness for employees. We are unifying digital-first solutions across the

care continuum, so that we are well-positioned to improve the lives and healthcare outcomes for people around the world.

Additionally, this acquisition enables continued innovation and market share growth through our solid financial backing, along with

significant cross-selling synergies between our respective organizations, including TELUS International.

| |  | Page 9 of 127 |

TELUS Corporation – Management’s

discussion and analysis – 2022

Business acquisition –

subsequent to 2022

On October 27, 2022, we announced

a definitive agreement to acquire WillowTree, a full-service digital product provider focused on end-user experiences, such as native

mobile applications and unified web interfaces. On January 3, 2023, subsequent to the satisfaction of the closing conditions, WillowTree

was acquired through TELUS International and it will be consolidated in our DLCX segment. Under the agreement, WillowTree was acquired

for purchase consideration of approximately US$1.1 billion (approximately $1.5 billion at foreign exchange rates at the financial position

date), net of assumed debt; purchase consideration is comprised of cash, US$125 million of TELUS International Subordinate Voting Shares

and provisions for written put options.

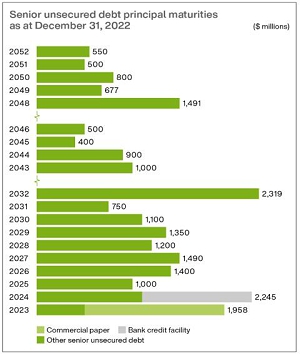

Long-term debt

issues

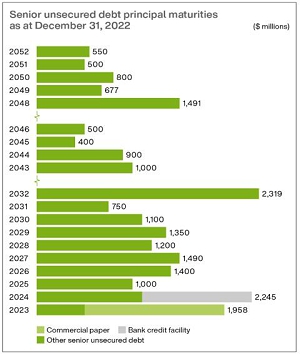

On February 28, 2022, we announced

the successful closing of our second sustainability-linked bond (SLB) offering to date (which is also our inaugural U.S. SLB) issued

pursuant to the SLB framework we announced on June 14, 2021. The US$900 million of senior unsecured 3.40% U.S. Dollar Sustainability-Linked

Notes will mature on May 13, 2032. This bond offering supports our commitment to environmental sustainability by linking our

cost of financing to the achievement of ambitious environmental, social and governance (ESG) targets. The net proceeds from this offering

were used for the repayment of outstanding indebtedness, including the repayment of commercial paper, and for other general corporate

purposes.

On September 8,

2022, we announced a three-tranche note offering of: $1.1 billion of senior unsecured 5.25% Sustainability-Linked Notes, Series CAG,

maturing on November 15, 2032; $550 million of senior unsecured 5.65% Notes, Series CAH, maturing on September 13, 2052;

and $350 million of senior unsecured 5.00% Notes, Series CAI, maturing on September 13, 2029. The net proceeds from the three-tranche

offering were used for the repayment of outstanding indebtedness, including the repayment of commercial paper and the reduction of cash

amounts outstanding under an arm’s-length securitization trust, and for other general corporate purposes.

The Series CAG

notes were issued pursuant to the SLB framework announced on June 14, 2021, linking our cost of financing to our environmental

performance, and the issuance was our third bond offering under the framework. Our second SLB in Canada, and third globally, solidifies

us as one of the largest SLB issuers in Canada, affirming our position as a leader in social capitalism.

Multi-year dividend growth

program

On May 6, 2022, we announced our

intention to target ongoing semi-annual dividend increases, with the annual increase in the range of 7 to 10%, from 2023 through to the

end of 2025. This announcement further extends our dividend program, which was originally announced in May 2011 and extended for

three additional years in each of May 2013, May 2016 and May 2019. Dividend decisions will continue to be subject to our

Board’s assessment and the determination of our financial situation and outlook on a quarterly basis. There can be no assurance

that we will maintain a dividend growth program through 2025. See Section 4.3 Liquidity and capital resources.

Our Board of

Directors

At our 2022 annual general meeting held

on May 6, 2022, the nominees listed in the TELUS 2022 information circular were elected as directors of TELUS, including a new nominee,

Victor Dodig.

Victor has been

the President and Chief Executive Officer of the CIBC group of companies since September 2014. He brings more than 25 years of extensive

business and banking experience, including leading CIBC’s Wealth Management, Asset Management and Retail Banking businesses. Over

his career, Victor also led several businesses with UBS and Merrill Lynch in Canada and internationally, and was a management consultant

with McKinsey & Company. He serves on the board of the C.D. Howe Institute and the Business Council of Canada. Victor is a vocal

advocate for inclusion in the workplace and is chair of the Inclusion and Diversity Leadership Council at CIBC and a co-chair of the

BlackNorth Initiative. He is past chair of the Catalyst Canada Advisory Board and past chair of the 30% Club Canada. In 2017, Victor

was recognized as a Catalyst Canada Honours Champion for his leadership in advancing gender diversity.

| |  | Page 10 of 127 |

TELUS Corporation – Management’s

discussion and analysis – 2022

Consolidated highlights

| Years

ended December 31 ($ millions, except footnotes and unless noted otherwise) | |

2022 | | |

2021 | | |

Change | |

| | |

| | |

| | |

| |

| Consolidated

statements of income |

| Operating

revenues and other income | |

| 18,412 | | |

| 17,258 | | |

| 6.7 | % |

| Operating

income | |

| 2,954 | | |

| 3,074 | | |

| (3.9 | )% |

| Income

before income taxes | |

| 2,322 | | |

| 2,278 | | |

| 1.9 | % |

| Net

income | |

| 1,718 | | |

| 1,698 | | |

| 1.2 | % |

| Net

income attributable to Common Shares | |

| 1,615 | | |

| 1,655 | | |

| (2.4 | )% |

| Adjusted

Net income1 | |

| 1,640 | | |

| 1,430 | | |

| 14.7 | % |

| | |

| | | |

| | | |

| | |

| Earnings

per share (EPS) ($) | |

| | | |

| | | |

| | |

| Basic

EPS | |

| 1.16 | | |

| 1.23 | | |

| (5.7 | )% |

| Adjusted

basic EPS1 | |

| 1.17 | | |

| 1.07 | | |

| 9.3 | % |

| Diluted

EPS | |

| 1.15 | | |

| 1.22 | | |

| (5.7 | )% |

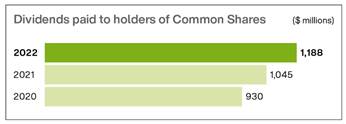

| Dividends

declared per Common Share ($) | |

| 1.3557 | | |

| 1.2710 | | |

| 6.7 | % |

| | |

| | | |

| | | |

| | |

| Basic

weighted-average Common Shares outstanding (millions) | |

| 1,396 | | |

| 1,346 | | |

| 3.7 | % |

| Consolidated

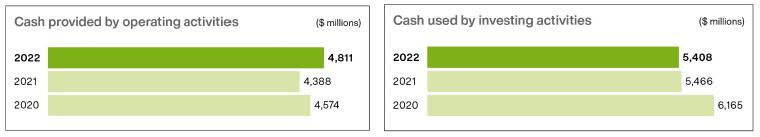

statements of cash flows |

| Cash

provided by operating activities | |

| 4,811 | | |

| 4,388 | | |

| 9.6 | % |

| Cash

used by investing activities | |

| (5,408 | ) | |

| (5,466 | ) | |

| (1.1 | )% |

| Acquisitions | |

| (1,547 | ) | |

| (468 | ) | |

| n/m | |

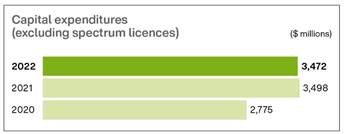

| Capital

expenditures2 | |

| (3,472 | ) | |

| (3,498 | ) | |

| (0.7 | )% |

| | |

| | | |

| | | |

| | |

| Cash

provided by financing activities | |

| 848 | | |

| 953 | | |

| (11.0 | )% |

| Other

highlights |

| Telecom

subscriber connections3 (thousands) | |

| 17,971 | | |

| 16,887 | | |

| 6.4 | % |

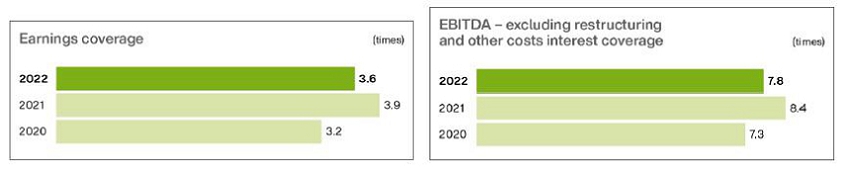

| Earnings

before interest, income taxes, depreciation and amortization1 (EBITDA) | |

| 6,406 | | |

| 6,290 | | |

| 1.9 | % |

| EBITDA

margin1 (%) | |

| 34.8 | | |

| 36.4 | | |

| (1.6 | )

pts. |

| Restructuring

and other costs | |

| 240 | | |

| 186 | | |

| 29.0 | % |

| Adjusted

EBITDA1 | |

| 6,643 | | |

| 6,069 | | |

| 9.5 | % |

| Adjusted

EBITDA margin1 (%) | |

| 36.1 | | |

| 36.0 | | |

| 0.1 | pt. |

| Free

cash flow1 | |

| 1,274 | | |

| 777 | | |

| 64.0 | % |

| Net

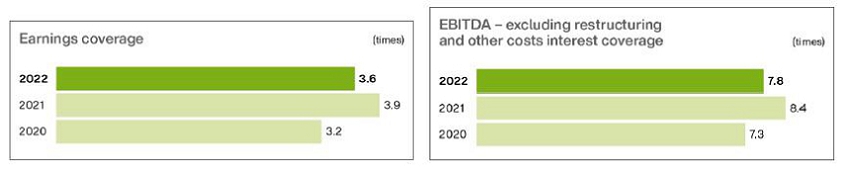

debt to EBITDA – excluding restructuring and other costs1 (times) | |

| 3.63 | | |

| 3.17 | | |

| 0.46 | |

Notations used in MD&A: n/m – not meaningful; pts. – percentage points.

| 1 |

These are non-GAAP and other specified financial measures. See Section 11.1 Non-GAAP and other specified financial measures. |

| |

|

| 2 |

Capital expenditures include assets purchased, excluding right-of-use lease assets, but not yet paid for, and consequently differ from

Cash payments for capital assets, excluding spectrum licences, as reported in the Consolidated financial statements. Refer to Note

31 of the Consolidated financial statements for further information. |

| |

|

| 3 |

The sum of active mobile phone subscribers, connected device subscribers, internet subscribers, residential voice subscribers, TV subscribers

and security subscribers, measured at the end of the respective periods based on information in billing and other source systems. Effective

January 1, 2022, on a prospective basis, following an in-depth review of our definition of a subscriber, we adjusted our connected

devices subscriber base to remove 34,000 subscribers within a legacy reporting system. During the second quarter of 2022, we adjusted

our cumulative security subscriber connections to add approximately 75,000 subscribers as a result of a business acquisition. |

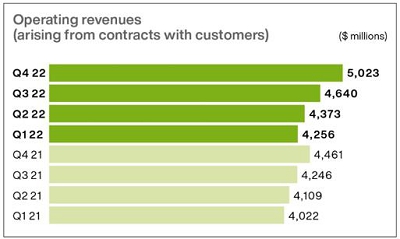

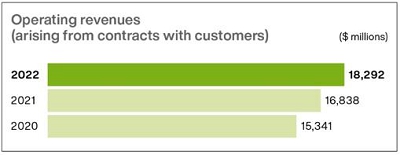

Operating highlights

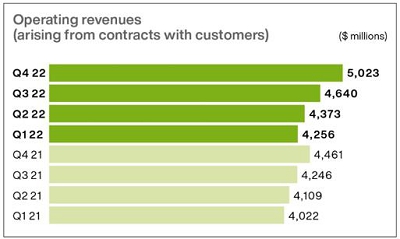

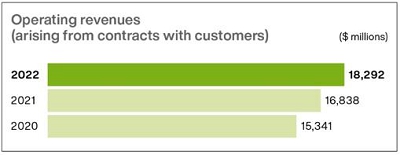

| · | Consolidated Operating revenues and other income increased by $1.2

billion in 2022. |

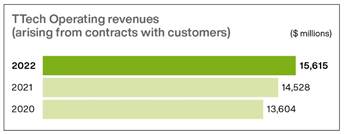

Service

revenues increased by $1.4 billion in 2022. TTech service revenue growth was driven by growth in health services revenues,

higher mobile network revenues, an increase in data service revenues and growth in agriculture and consumer goods service revenues.

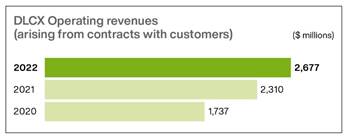

Increased DLCX revenues resulted from growth from both expanded services for existing clients and growth from new clients.

Equipment

revenues increased by $33 million in 2022, driven by growth in fixed equipment revenues, partly offset by lower mobile

equipment revenues.

Other

income decreased by $300 million in 2022, largely reflecting the non-recurrence of the $410 million gain on the

disposition of our financial solutions business in the fourth quarter of 2021. Excluding the effect of this disposition, Other

income increased by $110 million in 2022, reflecting the reversal of provisions for contingent consideration related to business

acquisitions, decreases in provisions arising from business acquisition-related written put options, a gain on acquisition of

control of LifeWorks, and higher gains on investments.

For additional details on Operating

revenues and other income, see Section 5.4 TELUS technology solutions segment and Section 5.5 Digitally-led customer

experiences – TELUS International segment.

| |  | Page 11 of 127 |

TELUS Corporation – Management’s

discussion and analysis – 2022

| · | Operating income decreased by $120 million in 2022. (See Section 5.3

Consolidated operations for additional details.) |

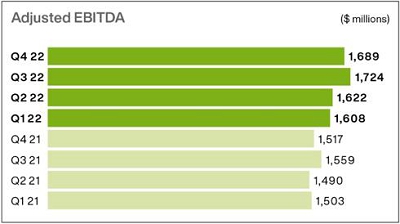

EBITDA,

which includes restructuring and other costs, other equity (income) losses related to real estate joint ventures and the gain on disposition

of our financial solutions business, increased by $116 million in 2022.

Adjusted

EBITDA, which excludes restructuring and other costs, other equity (income) losses related to real estate joint ventures and

the gain on disposition of our financial solutions business, increased by $574 million in 2022. This reflected: (i) higher

mobile network revenues; (ii) increased fixed data service revenues; (iii) an increase in our DLCX segment contribution;

(iv) higher other income, excluding our prior year gain on the sale of our financial solutions business; and

(v) contribution from our acquisition of LifeWorks on September 1, 2022. These factors were partly offset by:

(i) higher employee benefits expense; (ii) higher costs related to the scaling of our digital capabilities;

(iii) continued declines in fixed legacy voice and data services revenues; (iv) lower TV margins; and (v) bad debt

expense returning to pre-pandemic levels, driven by macroeconomic pressures compared to the prior period, which saw historically low

bad debt expense. (See Section 5.3 Consolidated operations for additional details.)

| · | Income before income taxes increased by $44 million in 2022 as a result

of lower Financing costs, which more than offset lower Operating income. The decrease in Financing costs largely resulted from the virtual

power purchase agreements unrealized change in forward element and capitalized long-term debt interest costs for 3500 MHz spectrum licences.

(See Financing costs in Section 5.3.) |

| · | Income tax expense increased by $24 million in 2022. The effective

income tax rate increased from 25.5% to 26.0% in 2022, largely due to adjustments recognized in the current period for income taxes of

prior periods. |

| · | Net income attributable to Common Shares decreased by $40 million

in 2022, reflecting the after-tax impacts of lower Operating income and lower Financing costs. |

Adjusted

Net income excludes the effects of restructuring and other costs, income tax-related adjustments, other equity (income) losses related

to real estate joint ventures, virtual power purchase agreements unrealized change in forward element, long-term debt prepayment premium,

and the gain on disposition of our financial solutions business. Adjusted Net income increased by $210 million or 14.7% in 2022.

| · | Basic EPS decreased by $0.07 or 5.7% in 2022, reflecting the

after-tax impacts of lower Operating income and lower Financing costs, as well as the effect of a higher number of Common Shares

outstanding. |

Adjusted

basic EPS excludes the effects of restructuring and other costs, income tax-related adjustments, other equity (income) losses related

to real estate joint ventures, virtual power purchase agreements unrealized change in forward element, long-term debt prepayment premium,

and the gain on disposition of our financial solutions business. Adjusted basic EPS increased by $0.10 or 9.3% in 2022.

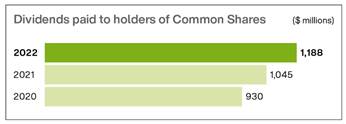

| · | Dividends declared per Common Share were $1.3557 in 2022, an increase

of 6.7% from 2021. On February 8, 2023, the Board declared a first quarter dividend of $0.3511 per share on our issued and outstanding

Common Shares, payable on April 3, 2023, to shareholders of record at the close of business on March 10, 2023. The

first quarter dividend increased by $0.0237 per share or 7.2% from the $0.3274 per share dividend declared one year earlier, consistent

with our multi-year dividend growth program described in Section 4.3 Liquidity and capital resources. |

| · | During 2022, our total telecom subscriber connections increased by

1,084,000 or 6.4%. This reflected an increase of 4.3% in mobile phone subscribers, 15.7% in connected device subscribers, 6.3% in internet

subscribers, 4.7% in TV subscribers and 21.6% in security subscribers, partly offset by a decline of 2.4% in residential voice subscribers.

(See Section 5.4 TELUS technology solutions segment for additional details.) |

Liquidity and capital resource highlights

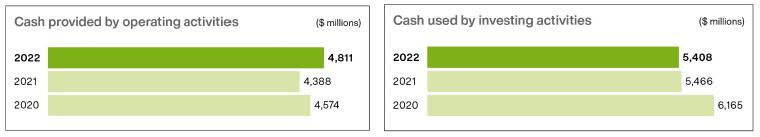

| · | Cash provided by operating activities increased by $423 million

in 2022, primarily driven by growth in EBITDA, lower income taxes paid and other working capital changes, partly offset by an

increase in interest paid. (See Section 7.2 Cash provided by operating activities.) |

| · | Cash used by investing activities decreased by $58 million in

2022, largely attributable to the effect of the fourth quarter 2021 payments for the 3500 MHz spectrum licences acquired in the 2021

spectrum auction, partly offset by: (i) an increase in cash payments for business acquisitions; (ii) an increase in cash

payments for capital assets, excluding spectrum licences; and (iii) the effect of the proceeds on the 2021 disposition of our

financial solutions business. Acquisitions increased by $1,079 million in 2022, primarily reflecting the acquisition of

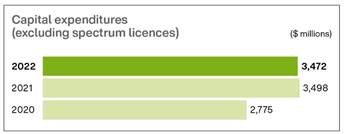

LifeWorks. Capital expenditures decreased by $26 million in 2022, primarily due to a planned slowdown of fibre build consistent with

our annual build target. (See Section 7.3 Cash used by investing activities.) |

| |  | Page 12 of 127 |

TELUS Corporation – Management’s

discussion and analysis – 2022

| · | Cash provided by financing activities decreased by $105 million in

2022, primarily reflecting the effects of the first quarter 2021 equity issuance and the first quarter 2021 proceeds from the TI initial

public offering, partly offset by an increase in our issuances of long-term debt, net of redemptions and repayment. (See Section 7.4 Cash

provided by financing activities.) |

| · | Net debt to EBITDA – excluding restructuring and other costs

ratio was 3.63 times at December 31, 2022, up from 3.17 times at December 31, 2021, as the effect of the increase in net debt

exceeded the effect of the increase in EBITDA – excluding restructuring and other costs, notwithstanding the COVID-19 pandemic impacts

that have reduced EBITDA. As at December 31, 2022, the acquisition of spectrum licences increased the ratio by approximately 0.47

and business acquisitions over the past 12 months increased the ratio by approximately 0.20, while business dispositions over the same

period decreased the ratio by approximately 0.28. (See Section 4.3 Liquidity and capital resources and Section 7.5

Liquidity and capital resource measures.) |

| · | Free cash flow increased by $497 million in 2022, primarily reflecting higher EBITDA and lower income taxes paid, partly offset by an increase in cash interest paid and the timing related to device subsidy repayments

and associated revenue recognition and our TELUS Easy Payment® device financing program. Our definition of free cash flow,

for which there is no industry alignment, is unaffected by accounting changes that do not impact cash, such as IFRS 15 and IFRS 16. |

1.4 Performance targets (key performance measures)

In 2022, we achieved all four

of our consolidated financial targets. Our original targets were announced on February 10, 2022. On November 4, 2022,

we updated our financial targets for the acquisition of LifeWorks, which closed on September 1, 2022, and for lower mobile equipment

revenue, as well as to account for TELUS International’s updated outlook.

We met our consolidated operating revenues target.

Growth in our mobile phones and connected devices subscriber bases and improved ARPU were contributing factors. We also experienced growth

in fixed data service revenues resulting from increased internet and data services, in addition to internet, security and TV subscriber

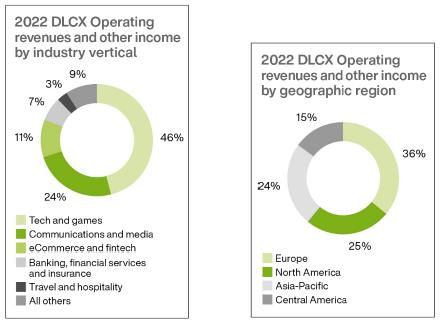

growth, and business acquisitions. DLCX operating revenues increased, due to expanded services for existing clients and growth from new

clients. Although mobile equipment revenue decreased, fixed equipment revenue improved, attributable to higher sales volumes. Health services

revenues also increased, driven by business acquisitions, including LifeWorks, as well as organic growth.

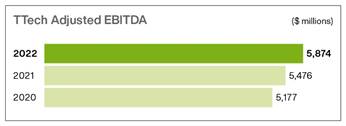

We achieved our Adjusted EBITDA target as a result

of higher mobile network revenue, reflecting growth in our mobile phones and connected devices subscriber bases and improved ARPU. Higher

fixed data services revenues also contributed to the achievement of this target, driven by growth in our internet, security and TV subscriber

bases and business acquisitions. Additionally, increased DLCX contribution as well as the contribution from our LifeWorks acquisition

supported target achievement.

Our free cash flow target was met, attributable

to EBITDA growth and strong cash flow management, including our disciplined focus on profitable loading and effective inventory management

to drive strong growth in customer net additions.

Our capital expenditures in 2022 met our consolidated

target, as we continued our investments in our broadband build to connect more homes and businesses directly to our fibre-optic infrastructure,

enabling us to further expand our broadband footprint including in many rural and Indigenous communities. In addition, we accelerated

investments in our 5G network build, allowing us to expand coverage to approximately 83% of the Canadian population at December 31, 2022. Other capital investments enabled us to support continuing subscriber growth, deliver on our digitization strategy, diversify our

product offerings, and enhance our systems reliability and operational efficiency.

Our capital structure financial policies and report

on financing and capital structure management plans are included in Section 4.3.

The following scorecard compares TELUS’ performance to our consolidated

2022 targets.

| |  | Page 13 of 127 |

TELUS Corporation – Management’s

discussion and analysis – 2022

Scorecard

| | |

2022 performance |

| | |

Consolidated

targets1 and

growth | |

Actual results

and growth | |

Result |

| Operating revenues | |

Approximately

8%1a | |

$18.3 billion

8.6% | |

ü |

| Net

income2 | |

n/a | |

$1.7

billion 1.2% | |

n/a |

| Adjusted EBITDA | |

Growth

of 9 to 10%1b | |

$6.6 billion

9.5% | |

ü |

| Cash

provided by operating activities2 | |

n/a | |

$4.8 billion

9.6% | |

n/a |

| Free cash flow | |

Approximately

$1.3 billion1c | |

$1.3 billion | |

ü |

| Capital expenditures

(excluding spectrum licences) | |

Approximately

$3.475 billion1d | |

$3.472 billion | |

ü |

| ü –

met target |

| |

| n/a – not applicable |

| |

| 1 |

Represents the 2022 revised targets that were announced on

November 4, 2022 to reflect the inclusion of our acquisition of LifeWorks, lower mobile equipment revenue and TELUS International’s

updated outlook. |

| |

| |

a. The original target

for Operating revenues was growth of 8 to 10%. |

| |

|

| |

b. The original target

for Adjusted EBITDA was growth of 8 to 10%. |

| |

|

| |

c. The original target

for free cash flow was $1.0 billion to $1.2 billion. |

| |

|

| |

d. The original target

for capital expenditures was approximately $3.4 billion. |

| |

|

| 2. |

As a result of applying National Instrument 52-112, these measures

are presented as the most directly comparable and similar financial measures to Adjusted EBITDA and free cash flow, respectively, and

were not part of our targets for 2022. |

We made the following key assumptions when we announced the 2022 targets

in February 2022.

Assumptions for 2022 targets and results

| · | Our economic assumptions are based on a composite of estimates from Canadian banks and other sources. Our original assumptions for

2022 economic growth in Canada, B.C., Alberta, Ontario and Quebec were 4.3%, 4.2%, 4.4%, 4.5% and 3.7%, respectively. |

In our first quarter 2022

MD&A, we revised our 2022 assumptions for economic growth in Canada, B.C., Alberta, Ontario and Quebec to 3.9%, 4.1%, 5.1%, 3.8%

and 3.1%, respectively. In our third quarter 2022 MD&A, we further revised our 2022 assumptions for economic growth assumptions

in Canada, B.C., Alberta, Ontario and Quebec to 3.2%, 2.9%, 4.7%, 3.1% and 3.4%, respectively.

| · | With respect to annual unemployment rates, our original assumptions for 2022 in Canada, B.C., Alberta, Ontario and Quebec were 6.1%,

5.2%, 7.1%, 6.1% and 5.3%, respectively. |

In our first quarter 2022

MD&A, we revised our 2022 assumptions for the annual unemployment rate in Canada, B.C., Alberta, Ontario and Quebec to 5.4%,

4.8%, 6.4%, 5.8% and 4.4%, respectively. In our third quarter 2022 MD&A, we further revised our 2022 assumptions for the annual

unemployment rate in Canada, B.C., Alberta, Ontario and Quebec to 5.4%, 4.9%, 5.8%, 5.7% and 4.5%, respectively.

| · | With respect to the pace of housing starts, our original assumptions for 2022 on an unadjusted basis in Canada, B.C., Alberta, Ontario

and Quebec were 224,000 units, 39,000 units, 30,000 units, 83,000 units and 55,000 units, respectively. |

In our first quarter 2022 MD&A,

we revised our 2022 assumptions for the pace of housing starts on an unadjusted basis in Canada, B.C., Alberta, Ontario and Quebec to

240,000 units, 40,000 units, 32,000 units, 87,000 units and 59,000 units, respectively. In our third quarter 2022 MD&A, we further

revised our 2022 assumptions for the pace of housing starts on an unadjusted basis in Canada, B.C., Alberta, Ontario and Quebec to 258,000

units, 39,000 units, 37,000 units, 87,000 units and 61,000 units, respectively.

| · | Our original assumption for 2022 restructuring and other costs was approximately $150 million. In our third quarter 2022

MD&A, we revised our 2022 assumption for restructuring and other costs to approximately $200 million to reflect the

inclusion of our LifeWorks acquisition and other integration costs associated with business acquisitions. Actual 2022 restructuring

and other costs were $240 million, as we incurred higher than expected costs for continuing operational effectiveness initiatives,

with margin enhancement initiatives to mitigate pressures related to intense competition, technological substitution, repricing of

our services, increasing subscriber growth and retention costs, and integration costs associated with business acquisitions. |

Confirmed:

| · | No material adverse regulatory rulings or government actions against TELUS. See Section 9.4 for further information. |

| · | Continued intense mobile products and services competition and fixed products and services competition in both consumer and business

markets. |

| |  | Page 14 of 127 |

TELUS Corporation – Management’s

discussion and analysis – 2022

Assumptions for 2022 targets and results

| · | Continued increase in mobile phone penetration in the Canadian market. |

| · | Ongoing subscriber adoption of, and upgrades to, data-intensive smartphones, as customers seek more mobile connectivity to the internet

at faster speeds. |

| · | Mobile products and services revenue growth resulting from improvements in subscriber loading, with continued competitive pressure

on blended average revenue per subscriber per month (ARPU). Roaming revenues from business and consumer travel returned to pre-pandemic

levels. |

| · | Continued pressure on mobile products and services acquisition and retention expenses, dependent on gross loading and customer renewal

volumes, competitive intensity and customer preferences, as well as continued connected devices growth. |

| · | Continued growth in fixed products and services data revenue, reflecting an increase in internet, TV and security subscribers,

speed upgrades, rate plans with larger data buckets or endless data usage, and expansion of our broadband infrastructure, healthcare solutions,

agriculture and consumer goods solutions and home and business security offerings. |

| · | Continued erosion of residential voice revenues, resulting from technological substitution and greater use of inclusive long distance. |

| · | Continued growth of DLCX revenue and EBITDA, generated by expanded services for existing and new clients and strategic business acquisitions. |

| · | Continued focus on our customers first initiatives and maintaining our customers’ likelihood-to-recommend. |

| · | Our original assumption for 2022 net Cash interest paid was approximately $700 million to $750 million. In our third quarter