Exhibit 99.1

TELUS CORPORATION

CONSOLIDATED FINANCIAL STATEMENTS

DECEMBER 31, 2016

report of management on internal control over financial reporting

Management of TELUS Corporation (TELUS, or the Company) is responsible for establishing and maintaining adequate internal control over financial reporting and for its assessment of the effectiveness of internal control over financial reporting.

TELUS’ President and Chief Executive Officer and Executive Vice-President and Chief Financial Officer have assessed the effectiveness of the Company’s internal control over financial reporting as of December 31, 2016, in accordance with the criteria established in Internal Control — Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission. Internal control over financial reporting is a process designed by, or under the supervision of, the President and Chief Executive Officer and the Executive Vice-President and Chief Financial Officer and effected by the Board of Directors, management and other personnel to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles.

Due to its inherent limitations, internal control over financial reporting may not prevent or detect misstatements on a timely basis. Also, projections of any evaluation of the effectiveness of internal control over financial reporting to future periods are subject to the risk that the controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate. Based on the assessment referenced in the preceding paragraph, management has determined that the Company’s internal control over financial reporting is effective as of December 31, 2016. In connection with this assessment, no material weaknesses in the Company’s internal control over financial reporting were identified by management as of December 31, 2016.

Deloitte LLP, an Independent Registered Public Accounting Firm, audited the Company’s Consolidated financial statements for the year ended December 31, 2016, and as stated in the Report of Independent Registered Public Accounting Firm, they have expressed an unqualified opinion on the effectiveness of the Company’s internal control over financial reporting as of December 31, 2016.

|

/s/ “Doug French” |

|

/s/ “Darren Entwistle” |

|

|

|

|

|

Doug French |

|

Darren Entwistle |

|

Executive Vice-President |

|

President |

|

and Chief Financial Officer |

|

and Chief Executive Officer |

|

February 9, 2017 |

|

February 9, 2017 |

![]()

report of independent registered public accounting firm

To the Board of Directors and Shareholders of TELUS Corporation

We have audited the accompanying consolidated financial statements of TELUS Corporation and subsidiaries (the Company), which comprise the consolidated statements of financial position as at December 31, 2016 and 2015, and the consolidated statements of income and other comprehensive income, consolidated statements of changes in owners’ equity and consolidated statements of cash flows for the years then ended, and a summary of significant accounting policies and other explanatory information.

Management’s Responsibility for the Consolidated Financial Statements

Management is responsible for the preparation and fair presentation of these consolidated financial statements in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board, and for such internal control as management determines is necessary to enable the preparation of consolidated financial statements that are free from material misstatement, whether due to fraud or error.

Auditors’ Responsibility

Our responsibility is to express an opinion on these consolidated financial statements based on our audits. We conducted our audits in accordance with Canadian generally accepted auditing standards and the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we comply with ethical requirements and plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free from material misstatement.

An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the consolidated financial statements. The procedures selected depend on the auditor’s judgment, including the assessment of the risks of material misstatement of the consolidated financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the entity’s preparation and fair presentation of the consolidated financial statements in order to design audit procedures that are appropriate in the circumstances. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of accounting estimates made by management, as well as evaluating the overall presentation of the consolidated financial statements.

We believe that the audit evidence we have obtained in our audits is sufficient and appropriate to provide a basis for our audit opinion.

Opinion

In our opinion, the consolidated financial statements present fairly, in all material respects, the financial position of TELUS Corporation and subsidiaries as at December 31, 2016 and 2015, and their financial performance and their cash flows for the years then ended, in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board.

Other Matter

We have also audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the Company’s internal control over financial reporting as at December 31, 2016, based on the criteria established in Internal Control — Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission and our report dated February 9, 2017, expressed an unqualified opinion on the Company’s internal control over financial reporting.

|

|

/s/ “Deloitte LLP” |

|

|

|

|

|

Deloitte LLP |

|

|

Chartered Professional Accountants |

|

|

Vancouver, Canada |

|

|

February 9, 2017 |

![]()

report of independent registered public accounting firm

To the Board of Directors and Shareholders of TELUS Corporation

We have audited the internal control over financial reporting of TELUS Corporation and subsidiaries (the Company) as of December 31, 2016, based on the criteria established in Internal Control — Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission. The Company’s management is responsible for maintaining effective internal control over financial reporting and for its assessment of the effectiveness of internal control over financial reporting, included in the accompanying Report of Management on Internal Control over Financial Reporting. Our responsibility is to express an opinion on the Company’s internal control over financial reporting based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether effective internal control over financial reporting was maintained in all material respects. Our audit included obtaining an understanding of internal control over financial reporting, assessing the risk that a material weakness exists, testing and evaluating the design and operating effectiveness of internal control based on the assessed risk, and performing such other procedures as we considered necessary in the circumstances. We believe that our audit provides a reasonable basis for our opinion.

A company’s internal control over financial reporting is a process designed by, or under the supervision of, the company’s principal executive and principal financial officers, or persons performing similar functions, and effected by the company’s board of directors, management, and other personnel to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board. A company’s internal control over financial reporting includes those policies and procedures that (1) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the company; (2) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board, and that receipts and expenditures of the company are being made only in accordance with authorizations of management and directors of the company; and (3) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the company’s assets that could have a material effect on the financial statements.

Because of the inherent limitations of internal control over financial reporting, including the possibility of collusion or improper management override of controls, material misstatements due to error or fraud may not be prevented or detected on a timely basis. Also, projections of any evaluation of the effectiveness of the internal control over financial reporting to future periods are subject to the risk that the controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

In our opinion, the Company maintained, in all material respects, effective internal control over financial reporting as of December 31, 2016, based on the criteria established in Internal Control — Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission.

We have also audited, in accordance with Canadian generally accepted auditing standards and the standards of the Public Company Accounting Oversight Board (United States), the consolidated financial statements as at and for the year ended December 31, 2016, of the Company and our report dated February 9, 2017, expressed an unmodified/unqualified opinion on those financial statements.

|

|

/s/ “Deloitte LLP” |

|

|

|

|

|

Deloitte LLP |

|

|

Chartered Professional Accountants |

|

|

Vancouver, Canada |

|

|

February 9, 2017 |

![]()

consolidated statements of income and other comprehensive income

|

Years ended December 31 (millions except per share amounts) |

|

Note |

|

2016 |

|

2015 |

| ||

|

OPERATING REVENUES |

|

|

|

|

|

|

| ||

|

Service |

|

|

|

$ |

12,000 |

|

$ |

11,590 |

|

|

Equipment |

|

|

|

725 |

|

840 |

| ||

|

Revenues arising from contracts with customers |

|

|

|

12,725 |

|

12,430 |

| ||

|

Other operating income |

|

6 |

|

74 |

|

72 |

| ||

|

|

|

|

|

12,799 |

|

12,502 |

| ||

|

OPERATING EXPENSES |

|

|

|

|

|

|

| ||

|

Goods and services purchased |

|

|

|

5,631 |

|

5,532 |

| ||

|

Employee benefits expense |

|

7 |

|

2,939 |

|

2,708 |

| ||

|

Depreciation |

|

17 |

|

1,564 |

|

1,475 |

| ||

|

Amortization of intangible assets |

|

18 |

|

483 |

|

434 |

| ||

|

|

|

|

|

10,617 |

|

10,149 |

| ||

|

OPERATING INCOME |

|

|

|

2,182 |

|

2,353 |

| ||

|

Financing costs |

|

8 |

|

520 |

|

447 |

| ||

|

INCOME BEFORE INCOME TAXES |

|

|

|

1,662 |

|

1,906 |

| ||

|

Income taxes |

|

9 |

|

426 |

|

524 |

| ||

|

NET INCOME |

|

|

|

1,236 |

|

1,382 |

| ||

|

OTHER COMPREHENSIVE INCOME |

|

10 |

|

|

|

|

| ||

|

Items that may subsequently be reclassified to income |

|

|

|

|

|

|

| ||

|

Change in unrealized fair value of derivatives designated as cash flow hedges |

|

|

|

(20 |

) |

(4 |

) | ||

|

Foreign currency translation adjustment arising from translating financial statements of foreign operations |

|

|

|

5 |

|

25 |

| ||

|

|

|

|

|

(15 |

) |

21 |

| ||

|

Item never subsequently reclassified to income |

|

|

|

|

|

|

| ||

|

Employee defined benefit plan re-measurements |

|

|

|

— |

|

445 |

| ||

|

|

|

|

|

(15 |

) |

466 |

| ||

|

COMPREHENSIVE INCOME |

|

|

|

$ |

1,221 |

|

$ |

1,848 |

|

|

NET INCOME ATTRIBUTABLE TO: |

|

|

|

|

|

|

| ||

|

Common Shares |

|

|

|

$ |

1,223 |

|

$ |

1,382 |

|

|

Non-controlling interest |

|

|

|

13 |

|

— |

| ||

|

|

|

|

|

$ |

1,236 |

|

$ |

1,382 |

|

|

COMPREHENSIVE INCOME ATTRIBUTABLE TO: |

|

|

|

|

|

|

| ||

|

Common Shares |

|

|

|

$ |

1,206 |

|

$ |

1,848 |

|

|

Non-controlling interest |

|

|

|

15 |

|

— |

| ||

|

|

|

|

|

$ |

1,221 |

|

$ |

1,848 |

|

|

NET INCOME PER COMMON SHARE |

|

11 |

|

|

|

|

| ||

|

Basic |

|

|

|

$ |

2.06 |

|

$ |

2.29 |

|

|

Diluted |

|

|

|

$ |

2.06 |

|

$ |

2.29 |

|

|

|

|

|

|

|

|

|

| ||

|

TOTAL WEIGHTED AVERAGE COMMON SHARES OUTSTANDING |

|

|

|

|

|

|

| ||

|

Basic |

|

|

|

592 |

|

603 |

| ||

|

Diluted |

|

|

|

593 |

|

604 |

| ||

The accompanying notes are an integral part of these consolidated financial statements.

![]()

consolidated statements of financial position

|

As at December 31 (millions) |

|

Note |

|

2016 |

|

2015 |

| ||

|

ASSETS |

|

|

|

|

|

|

| ||

|

Current assets |

|

|

|

|

|

|

| ||

|

Cash and temporary investments, net |

|

|

|

$ |

432 |

|

$ |

223 |

|

|

Accounts receivable |

|

16 |

|

1,471 |

|

1,428 |

| ||

|

Income and other taxes receivable |

|

|

|

9 |

|

1 |

| ||

|

Inventories |

|

1(p) |

|

318 |

|

360 |

| ||

|

Prepaid expenses |

|

|

|

233 |

|

213 |

| ||

|

Real estate joint venture advances |

|

21(c) |

|

— |

|

66 |

| ||

|

Current derivative assets |

|

4(h) |

|

11 |

|

40 |

| ||

|

|

|

|

|

2,474 |

|

2,331 |

| ||

|

Non-current assets |

|

|

|

|

|

|

| ||

|

Property, plant and equipment, net |

|

17 |

|

10,464 |

|

9,736 |

| ||

|

Intangible assets, net |

|

18 |

|

10,364 |

|

9,985 |

| ||

|

Goodwill, net |

|

18 |

|

3,787 |

|

3,761 |

| ||

|

Other long-term assets |

|

20 |

|

640 |

|

593 |

| ||

|

|

|

|

|

25,255 |

|

24,075 |

| ||

|

|

|

|

|

$ |

27,729 |

|

$ |

26,406 |

|

|

|

|

|

|

|

|

|

| ||

|

LIABILITIES AND OWNERS’ EQUITY |

|

|

|

|

|

|

| ||

|

Current liabilities |

|

|

|

|

|

|

| ||

|

Short-term borrowings |

|

22 |

|

$ |

100 |

|

$ |

100 |

|

|

Accounts payable and accrued liabilities |

|

23 |

|

2,330 |

|

1,990 |

| ||

|

Income and other taxes payable |

|

|

|

37 |

|

108 |

| ||

|

Dividends payable |

|

12 |

|

284 |

|

263 |

| ||

|

Advance billings and customer deposits |

|

24 |

|

737 |

|

760 |

| ||

|

Provisions |

|

25 |

|

124 |

|

197 |

| ||

|

Current maturities of long-term debt |

|

26 |

|

1,327 |

|

856 |

| ||

|

Current derivative liabilities |

|

4(h) |

|

12 |

|

2 |

| ||

|

|

|

|

|

4,951 |

|

4,276 |

| ||

|

Non-current liabilities |

|

|

|

|

|

|

| ||

|

Provisions |

|

25 |

|

395 |

|

433 |

| ||

|

Long-term debt |

|

26 |

|

11,604 |

|

11,182 |

| ||

|

Other long-term liabilities |

|

27 |

|

736 |

|

688 |

| ||

|

Deferred income taxes |

|

9(b) |

|

2,107 |

|

2,155 |

| ||

|

|

|

|

|

14,842 |

|

14,458 |

| ||

|

Liabilities |

|

|

|

19,793 |

|

18,734 |

| ||

|

Owners’ equity |

|

|

|

|

|

|

| ||

|

Common equity |

|

28 |

|

7,917 |

|

7,672 |

| ||

|

Non-controlling interest |

|

|

|

19 |

|

— |

| ||

|

|

|

|

|

7,936 |

|

7,672 |

| ||

|

|

|

|

|

$ |

27,729 |

|

$ |

26,406 |

|

|

|

|

|

|

|

|

|

| ||

|

Contingent Liabilities |

|

29 |

|

|

|

|

| ||

The accompanying notes are an integral part of these consolidated financial statements.

|

Approved by the Directors: |

|

|

|

|

|

|

|

/s/ “William A. MacKinnon” |

|

/s/ “R.H. Auchinleck” |

|

|

|

|

|

William A. MacKinnon |

|

R.H. Auchinleck |

|

Director |

|

Director |

![]()

consolidated statements of changes in owners’ equity

|

|

|

|

|

Common equity |

|

|

|

|

| |||||||||||||||||

|

|

|

|

|

Equity contributed |

|

|

|

Accumulated |

|

|

|

|

|

|

| |||||||||||

|

|

|

|

|

Common Shares (Note 28) |

|

|

|

|

|

other |

|

|

|

Non- |

|

|

| |||||||||

|

|

|

|

|

Number |

|

Share |

|

Contributed |

|

Retained |

|

comprehensive |

|

|

|

controlling |

|

|

| |||||||

|

(millions) |

|

Note |

|

of shares |

|

capital |

|

surplus |

|

earnings |

|

income |

|

Total |

|

interest |

|

Total |

| |||||||

|

Balance as at January 1, 2015 |

|

|

|

609 |

|

$ |

5,175 |

|

$ |

141 |

|

$ |

2,100 |

|

$ |

38 |

|

$ |

7,454 |

|

|

|

|

| ||

|

Net income |

|

|

|

— |

|

— |

|

— |

|

1,382 |

|

— |

|

1,382 |

|

|

|

|

| |||||||

|

Other comprehensive income |

|

10 |

|

— |

|

— |

|

— |

|

445 |

|

21 |

|

466 |

|

|

|

|

| |||||||

|

Dividends |

|

12 |

|

— |

|

— |

|

— |

|

(1,011 |

) |

— |

|

(1,011 |

) |

|

|

|

| |||||||

|

Share option award expense |

|

13(a) |

|

— |

|

— |

|

1 |

|

— |

|

— |

|

1 |

|

|

|

|

| |||||||

|

Share option award net-equity settlement feature |

|

13(d) |

|

1 |

|

7 |

|

(7 |

) |

— |

|

— |

|

— |

|

|

|

|

| |||||||

|

Normal course issuer bid purchase of Common Shares |

|

|

|

(16 |

) |

(133 |

) |

— |

|

(502 |

) |

— |

|

(635 |

) |

|

|

|

| |||||||

|

Liability for automatic share purchase plan commitment pursuant to normal course issuer bids for Common Shares |

|

28(b) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

|

Reversal of opening liability |

|

|

|

— |

|

15 |

|

— |

|

60 |

|

— |

|

75 |

|

|

|

|

| |||||||

|

Recognition of closing liability |

|

|

|

— |

|

(14 |

) |

— |

|

(46 |

) |

— |

|

(60 |

) |

|

|

|

| |||||||

|

Balance as at December 31, 2015 |

|

|

|

594 |

|

$ |

5,050 |

|

$ |

135 |

|

$ |

2,428 |

|

$ |

59 |

|

$ |

7,672 |

|

|

|

|

| ||

|

Balance as at January 1, 2016 |

|

|

|

594 |

|

$ |

5,050 |

|

$ |

135 |

|

$ |

2,428 |

|

$ |

59 |

|

$ |

7,672 |

|

$ |

— |

|

$ |

7,672 |

|

|

Net income |

|

|

|

— |

|

— |

|

— |

|

1,223 |

|

— |

|

1,223 |

|

13 |

|

1,236 |

| |||||||

|

Other comprehensive income |

|

10 |

|

— |

|

— |

|

— |

|

— |

|

(17 |

) |

(17 |

) |

2 |

|

(15 |

) | |||||||

|

Dividends |

|

12 |

|

— |

|

— |

|

— |

|

(1,091 |

) |

— |

|

(1,091 |

) |

— |

|

(1,091 |

) | |||||||

|

Treasury shares acquired |

|

13(a), 28(b) |

|

(1 |

) |

(45 |

) |

— |

|

— |

|

— |

|

(45 |

) |

— |

|

(45 |

) | |||||||

|

Shares settled from Treasury |

|

13(a), 28(b) |

|

1 |

|

44 |

|

— |

|

(3 |

) |

— |

|

41 |

|

— |

|

41 |

| |||||||

|

Share option award net-equity settlement feature |

|

13(d) |

|

— |

|

2 |

|

(2 |

) |

— |

|

— |

|

— |

|

— |

|

— |

| |||||||

|

Normal course issuer bid purchase of Common Shares |

|

|

|

(4 |

) |

(36 |

) |

— |

|

(129 |

) |

— |

|

(165 |

) |

— |

|

(165 |

) | |||||||

|

Reversal of opening liability for automatic share purchase plan commitment pursuant to normal course issuer bids for Common Shares |

|

28(b) |

|

— |

|

14 |

|

— |

|

46 |

|

— |

|

60 |

|

— |

|

60 |

| |||||||

|

Change in ownership interests of subsidiary |

|

1(a), 31(b) |

|

— |

|

— |

|

239 |

|

— |

|

— |

|

239 |

|

4 |

|

243 |

| |||||||

|

Balance as at December 31, 2016 |

|

|

|

590 |

|

$ |

5,029 |

|

$ |

372 |

|

$ |

2,474 |

|

$ |

42 |

|

$ |

7,917 |

|

$ |

19 |

|

$ |

7,936 |

|

The accompanying notes are an integral part of these consolidated financial statements.

![]()

consolidated statements of cash flows

|

Years ended December 31 (millions) |

|

Note |

|

2016 |

|

2015 |

| ||

|

OPERATING ACTIVITIES |

|

|

|

|

|

|

| ||

|

Net income |

|

|

|

$ |

1,236 |

|

$ |

1,382 |

|

|

Adjustments to reconcile net income to cash provided by operating activities: |

|

|

|

|

|

|

| ||

|

Depreciation and amortization |

|

|

|

2,047 |

|

1,909 |

| ||

|

Deferred income taxes |

|

9 |

|

(42 |

) |

68 |

| ||

|

Share-based compensation expense, net |

|

13(a) |

|

(2 |

) |

(38 |

) | ||

|

Net employee defined benefit plans expense |

|

14(b),(g) |

|

93 |

|

118 |

| ||

|

Employer contributions to employee defined benefit plans |

|

|

|

(71 |

) |

(94 |

) | ||

|

Other |

|

|

|

29 |

|

(3 |

) | ||

|

Net change in non-cash operating working capital |

|

31(a) |

|

(71 |

) |

214 |

| ||

|

Cash provided by operating activities |

|

|

|

3,219 |

|

3,556 |

| ||

|

INVESTING ACTIVITIES |

|

|

|

|

|

|

| ||

|

Cash payments for capital assets, excluding spectrum licences |

|

31(a) |

|

(2,752 |

) |

(2,522 |

) | ||

|

Cash payments for spectrum licences |

|

|

|

(145 |

) |

(2,048 |

) | ||

|

Cash payments for acquisitions |

|

|

|

(90 |

) |

(10 |

) | ||

|

Real estate joint ventures advances and contributions |

|

21(c) |

|

(33 |

) |

(50 |

) | ||

|

Real estate joint venture receipts |

|

21(c) |

|

103 |

|

98 |

| ||

|

Proceeds on dispositions |

|

|

|

3 |

|

52 |

| ||

|

Other |

|

|

|

(9 |

) |

3 |

| ||

|

Cash used by investing activities |

|

|

|

(2,923 |

) |

(4,477 |

) | ||

|

FINANCING ACTIVITIES |

|

31(b) |

|

|

|

|

| ||

|

Dividends paid to holders of Common Shares |

|

12(a) |

|

(1,070 |

) |

(992 |

) | ||

|

Purchase of Common Shares for cancellation |

|

28(b) |

|

(179 |

) |

(628 |

) | ||

|

Long-term debt issued |

|

26 |

|

5,726 |

|

8,973 |

| ||

|

Redemptions and repayment of long-term debt |

|

26 |

|

(4,843 |

) |

(6,254 |

) | ||

|

Issue of shares by subsidiary to non-controlling interest |

|

1(a) |

|

294 |

|

— |

| ||

|

Other |

|

|

|

(15 |

) |

(15 |

) | ||

|

Cash provided (used) by financing activities |

|

|

|

(87 |

) |

1,084 |

| ||

|

CASH POSITION |

|

|

|

|

|

|

| ||

|

Increase in cash and temporary investments, net |

|

|

|

209 |

|

163 |

| ||

|

Cash and temporary investments, net, beginning of period |

|

|

|

223 |

|

60 |

| ||

|

Cash and temporary investments, net, end of period |

|

|

|

$ |

432 |

|

$ |

223 |

|

|

SUPPLEMENTAL DISCLOSURE OF OPERATING CASH FLOWS |

|

|

|

|

|

|

| ||

|

Interest paid |

|

|

|

$ |

(510 |

) |

$ |

(458 |

) |

|

Interest received |

|

|

|

$ |

4 |

|

$ |

24 |

|

|

Income taxes paid, net |

|

|

|

$ |

(600 |

) |

$ |

(256 |

) |

The accompanying notes are an integral part of these consolidated financial statements.

![]()

notes to consolidated financial statements

DECEMBER 31, 2016

TELUS Corporation is one of Canada’s largest telecommunications companies, providing a wide range of telecommunications services and products, including wireless and wireline voice and data. Data services include: Internet protocol; television; hosting, managed information technology and cloud-based services; healthcare solutions; and business process outsourcing.

TELUS Corporation was incorporated under the Company Act (British Columbia) on October 26, 1998, under the name BCT.TELUS Communications Inc. (BCT). On January 31, 1999, pursuant to a court-approved plan of arrangement under the Canada Business Corporations Act among BCT, BC TELECOM Inc. and the former Alberta-based TELUS Corporation (TC), BCT acquired all of the shares of BC TELECOM Inc. and TC in exchange for Common Shares and Non-Voting Shares of BCT, and BC TELECOM Inc. was dissolved. On May 3, 2000, BCT changed its name to TELUS Corporation and in February 2005, TELUS Corporation transitioned under the Business Corporations Act (British Columbia), successor to the Company Act (British Columbia). TELUS Corporation maintains its registered office at Floor 7, 510 West Georgia Street, Vancouver, British Columbia, V6B 0M3.

The terms “TELUS”, “we”, “us”, “our” or “ourselves” are used to refer to TELUS Corporation and, where the context of the narrative permits or requires, its subsidiaries.

|

Notes to consolidated financial statements |

|

Page |

|

General application |

|

|

|

1. Summary of significant accounting policies |

|

10 |

|

2. Accounting policy developments |

|

19 |

|

3. Capital structure financial policies |

|

22 |

|

4. Financial instruments |

|

24 |

|

Consolidated results of operations focused |

|

|

|

5. Segment information |

|

30 |

|

6. Other operating income |

|

31 |

|

7. Employee benefits expense |

|

32 |

|

8. Financing costs |

|

32 |

|

9. Income taxes |

|

33 |

|

10. Other comprehensive income |

|

34 |

|

11. Per share amounts |

|

34 |

|

12. Dividends per share |

|

35 |

|

13. Share-based compensation |

|

35 |

|

14. Employee future benefits |

|

39 |

|

15. Restructuring and other costs |

|

45 |

|

Consolidated financial position focused |

|

|

|

16. Accounts receivable |

|

46 |

|

17. Property, plant and equipment |

|

46 |

|

18. Intangible assets and goodwill |

|

47 |

|

19. Leases |

|

50 |

|

20. Other long-term assets |

|

51 |

|

21. Real estate joint ventures |

|

51 |

|

22. Short-term borrowings |

|

54 |

|

23. Accounts payable and accrued liabilities |

|

54 |

|

24. Advance billings and customer deposits |

|

54 |

|

25. Provisions |

|

54 |

|

26. Long-term debt |

|

55 |

|

27. Other long-term liabilities |

|

58 |

|

28. Common Share capital |

|

58 |

|

29. Contingent liabilities |

|

59 |

|

Other |

|

|

|

30. Related party transactions |

|

62 |

|

31. Additional statement of cash flow information |

|

63 |

![]()

notes to consolidated financial statements

1 summary of significant accounting policies

Our consolidated financial statements are expressed in Canadian dollars. The generally accepted accounting principles that we use are International Financial Reporting Standards as issued by the International Accounting Standards Board (IFRS-IASB) and Canadian generally accepted accounting principles. The date of our transition to IFRS-IASB was January 1, 2010, and the date of our adoption was January 1, 2011.

Generally accepted accounting principles require that we disclose the accounting policies we have selected in those instances where we have been obligated to choose from among various accounting policies that comply with generally accepted accounting principles. In certain other instances, including those in which no selection among policies is allowed, we are also required to disclose how we have applied certain accounting policies. In the selection and application of accounting policies we consider, among other factors, the fundamental qualitative characteristics of useful financial information, namely relevance and faithful representation. In our assessment, our required accounting policy disclosures are not all equally significant for us, as set out in the accompanying table; their relative significance to us will evolve over time as we do.

These consolidated financial statements for each of the years ended December 31, 2016 and 2015, were authorized by our Board of Directors for issue on February 9, 2017.

|

|

|

Accounting policy requiring a more | ||

|

Accounting policy |

|

Yes |

|

No |

|

General application |

|

|

|

|

|

(a) Consolidation |

|

|

|

X |

|

(b) Use of estimates and judgments |

|

X |

|

|

|

(c) Financial instruments — recognition and measurement |

|

|

|

X |

|

(d) Hedge accounting |

|

|

|

X |

|

Results of operations focused |

|

|

|

|

|

(e) Revenue recognition |

|

X |

|

|

|

(f) Government assistance |

|

|

|

X |

|

(g) Cost of acquisition and advertising costs |

|

|

|

X |

|

(h) Research and development |

|

|

|

X |

|

(i) Depreciation, amortization and impairment |

|

X |

|

|

|

(j) Translation of foreign currencies |

|

|

|

X |

|

(k) Income and other taxes |

|

X |

|

|

|

(l) Share-based compensation |

|

|

|

X |

|

(m) Employee future benefit plans |

|

X |

|

|

|

Financial position focused |

|

|

|

|

|

(n) Cash and temporary investments, net |

|

|

|

X |

|

(o) Sales of trade receivables |

|

|

|

X |

|

(p) Inventories |

|

|

|

X |

|

(q) Property, plant and equipment; intangible assets |

|

X |

|

|

|

(r) Leases |

|

|

|

X |

|

(s) Investments |

|

|

|

X |

(a) Consolidation

Our consolidated financial statements include our accounts and the accounts of all of our subsidiaries, the principal one of which is TELUS Communications Inc., in which we have a 100% equity interest. Currently, through a 100% interest in both the TELUS Communications Company partnership and the TELE-MOBILE COMPANY partnership, TELUS Communications Inc. includes substantially all of our wireless and wireline operations.

Our financing arrangements and those of our wholly-owned subsidiaries do not impose restrictions on inter-corporate dividends.

On a continuing basis, we review our corporate organization and effect changes as appropriate so as to enhance the value of TELUS Corporation. This process can, and does, affect which of our subsidiaries are considered principal subsidiaries at any particular point in time.

During the three-month period ended June 30, 2016, there was a change in our ownership interests in our TELUS International (Cda) Inc. subsidiary, which encompasses our TELUS International operations, from the issuing of shares to Baring Private Equity Asia for approximately $302 million, exclusive of net transaction costs. We continue to control and consolidate this subsidiary, and the shares it issued to Baring Private Equity Asia are accounted for as a 35% non-controlling interest. Associated with this transaction, an amount equal to 35% of the net book value of the subsidiary has been credited to non-controlling interest in our Consolidated statement of changes in owners’ equity, and the net balance of the proceeds has been credited to contributed surplus. In connection with the issuance of shares to Baring Private Equity Asia, we have also arranged bank financing in the subsidiary company, as set out in Note 26(f).

(b) Use of estimates and judgments

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates, assumptions and judgments that affect: the reported amounts of assets and liabilities at the date of the

![]()

notes to consolidated financial statements

financial statements; the disclosure of contingent assets and liabilities at the date of the financial statements; and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Estimates

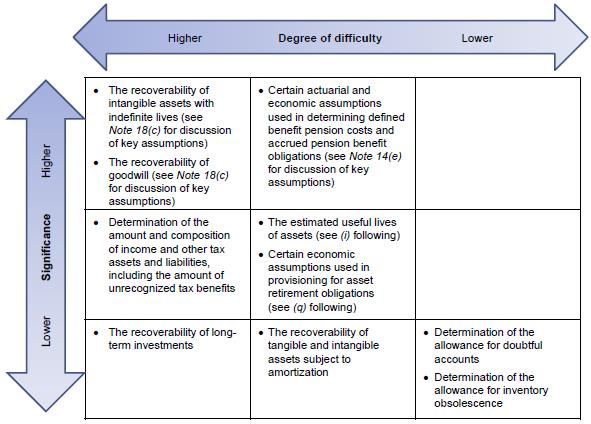

Examples of the significant estimates and assumptions that we make, and their relative significance and degree of difficulty, are as set out in the graphic at right.

Judgments

Examples of our significant judgments, apart from those involving estimation, include the following:

· Assessments about whether line items are sufficiently material to warrant separate presentation in the primary financial statements and, if not, whether they are sufficiently material to warrant separate presentation in the notes to the financial statements. In the normal course, we make changes to our assessments regarding materiality for presentation so that they reflect current economic conditions. Due consideration is given to the view that it is reasonable to expect differing opinions of what is, and is not, material.

· In respect of revenue-generating transactions, we must make judgments that affect the timing of the recognition of revenue. See Note 2(b) for significant changes to IFRS-IASB which are not yet effective and have not yet been applied, but which will significantly affect the timing of the recognition of revenue and the classification of our revenues presented as either service or equipment revenues.

· We must make judgments about when we have satisfied our performance obligations to our customers, satisfied either over a period of time or at a point in time. Service revenues are recognized based upon customers’ access to, or usage of, our telecommunications infrastructure; we believe this method faithfully depicts the transfer of the services, and thus the revenues are recognized as the services are made available and/or rendered. We consider our performance obligations arising from the sale of equipment to have been satisfied when the equipment has been delivered to, and accepted by, the end-user customers (see (e) following).

· Principally in the context of revenue-generating transactions involving wireless handsets, we must make judgments about whether third-party re-sellers that deliver equipment to our customers are acting in the transaction as principals or as our agents. Upon due consideration of the relevant indicators, we believe the decision to consider the re-sellers to be acting, solely for accounting purposes, as our agents is more representative of the economic substance of the transactions, as we are the primary obligor to the end-user customers. The effect of this judgment is that no equipment revenue is recognized upon the transfer of inventory to third-party re-sellers.

· The decision to depreciate and amortize any property, plant, equipment and intangible assets that are subject to amortization on a straight-line basis, as we believe that this method reflects the consumption of resources related to the economic lifespan of those assets better than an accelerated method and is more representative of the economic substance of the underlying use of those assets.

· The preparation of financial statements in accordance with generally accepted accounting principles requires management to make judgments that affect the financial statement disclosure of information regularly reviewed by our chief operating decision-maker used to make resource allocation decisions and to assess performance (segment information, Note 5). A significant judgment we make is in respect of distinguishing between our wireless and

![]()

notes to consolidated financial statements

wireline operations and cash flows, such distinction having been significantly affected by the convergence and integration of our wireless and wireline telecommunications infrastructure technology and operations.

Through December 31, 2015, our judgment was that our wireless and wireline telecommunications infrastructure technology and operations had not experienced sufficient convergence to objectively make their respective operations and cash flows practically indistinguishable. The continued build-out of our technology-agnostic fibre-optic infrastructure, in combination with converged edge network technology, has significantly affected this judgment, as has the commercialization of fixed-wireless solutions.

It has become increasingly impractical to objectively distinguish between our wireless and wireline operations and cash flows, and the assets from which those cash flows arise. Our judgment as to whether these operations can continue to be judged to be individual components of the business and discrete operating segments may change in the future.

The increasing impracticality of objectively distinguishing between our wireless and wireline cash flows, and the assets from which those cash flows arise, is evidence of their increasing interdependence; this may result in the unification of the wireless cash-generating unit and the wireline cash-generating unit as a single cash-generating unit for impairment testing purposes in the future.

· The view that our spectrum licences granted by Innovation, Science and Economic Development Canada will likely be renewed by Innovation, Science and Economic Development Canada; that we intend to renew them; that we believe we have the financial and operational ability to renew them; and thus, they have an indefinite life, as discussed further in Note 18(b).

· In connection with the annual impairment testing of intangible assets with indefinite lives and goodwill, there are instances in which we must exercise judgment in allocating our net assets, including shared corporate and administrative assets, to our cash-generating units when determining their carrying amounts. These judgments are necessary because of the convergence our wireless and wireline telecommunications infrastructure technology and operations have experienced to date, and because of our continuous development. There are instances in which similar judgments must also be made in respect of future capital expenditures in support of both wireless and wireline operations, which are a component of the determination of recoverable amounts used in the annual impairment testing, as discussed further in Note 18(c).

· In respect of claims and lawsuits, as discussed further in Note 29(a), the determination of whether an item is a contingent liability or whether an outflow of resources is probable and thus needs to be accounted for as a provision.

(c) Financial instruments — recognition and measurement

In respect of the recognition and measurement of financial instruments, we have adopted the following policies:

|

|

|

Accounting classification | ||||||||

|

Financial instrument |

|

Fair value |

|

Loans and |

|

Available- |

|

Other liabilities |

|

Part of a cash |

|

Measured at amortized cost |

|

|

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

|

X |

|

|

|

|

|

|

|

Construction credit facilities advances to real estate joint ventures |

|

|

|

X |

|

|

|

|

|

|

|

Short-term obligations |

|

|

|

|

|

|

|

X |

|

|

|

Accounts payable |

|

|

|

|

|

|

|

X |

|

|

|

Provisions |

|

|

|

|

|

|

|

X |

|

|

|

Long-term debt |

|

|

|

|

|

|

|

X |

|

|

|

Measured at fair value |

|

|

|

|

|

|

|

|

|

|

|

Cash and temporary investments |

|

X |

|

|

|

|

|

|

|

|

|

Long-term investments (not subject to significant influence) 4 |

|

|

|

|

|

X |

|

|

|

|

|

Foreign exchange derivatives |

|

X |

|

|

|

|

|

|

|

X |

|

Share-based compensation derivatives |

|

X |

|

|

|

|

|

|

|

X |

(1) Classification includes financial instruments held for trading. Certain qualifying financial instruments that are not required to be classified as held for trading may be classified as held for trading if we so choose.

(2) Unrealized changes in the fair values of financial instruments are included in net income.

(3) Unrealized changes in the fair values of financial instruments classified as available-for-sale, or the effective portion of unrealized changes in the fair values of financial instruments held for hedging, are included in other comprehensive income.

(4) Long-term investments over which we do not have significant influence are classified as available-for-sale. In respect of investments in securities for which the fair values can be reliably measured, we determine the classification on an instrument-by-instrument basis at the time of initial recognition.

![]()

notes to consolidated financial statements

· Trade receivables that may be sold to an arm’s-length securitization trust are accounted for as loans and receivables. We have selected this classification as the benefits of selecting the available-for-sale classification were not expected to exceed the costs of selecting and implementing that classification.

· Long-term investments over which we do not have significant influence are accounted for as available-for-sale. We have selected this classification as we believe that it better reflects management’s investment intentions.

· Derivatives that are part of an established and documented cash flow hedging relationship are accounted for as held for hedging. We believe that classification as held for hedging results in a better matching of the change in the fair value of the derivative financial instrument with the risk exposure being hedged.

In respect of hedges of anticipated transactions, which for us may include those related to inventory purchase commitments, hedge gains/losses are included in the cost of the inventory and are expensed when the inventory is sold. We have selected this method as we believe that it results in a better matching of the hedge gains/losses with the risk exposure being hedged.

Derivatives that are not part of a documented cash flow hedging relationship are accounted for as held for trading and thus are measured at fair value through net income.

· Regular-way purchases or sales of financial assets or financial liabilities (purchases or sales that require actual delivery of financial assets or financial liabilities) are recognized on the settlement date. We have selected this method as the benefits of using the trade date method were not expected to exceed the costs of selecting and implementing that method.

· Transaction costs, other than in respect of items held for trading, are added to the initial fair value of the acquired financial asset or financial liability. We have selected this method as we believe that it results in a better matching of the transaction costs with the periods in which we benefit from the transaction costs.

(d) Hedge accounting

General

We apply hedge accounting to the financial instruments used to: establish designated currency hedging relationships for certain U.S. dollar-denominated future purchase commitments and debt repayments, as set out in Note 4(d); and fix the compensation cost arising from specific grants of restricted stock units, as set out in Note 4(f) and further discussed in Note 13(b).

Hedge accounting

The purpose of hedge accounting, in respect of our designated hedging relationships, is to ensure that counterbalancing gains and losses are recognized in the same periods. We have chosen to apply hedge accounting as we believe this is more representative of the economic substance of the underlying transactions.

In order to apply hedge accounting, a high correlation (which indicates effectiveness) is required in the offsetting changes in the values of the financial instruments (the hedging items) used to establish the designated hedging relationships and all, or a part, of the asset, liability or transaction having an identified risk exposure that we have taken steps to modify (the hedged items). We assess the anticipated effectiveness of designated hedging relationships at inception and their actual effectiveness for each reporting period thereafter. We consider a designated hedging relationship to be effective if the following critical terms match between the hedging item and the hedged item: the notional amount of the hedging item and the principal amount of the hedged item; maturity dates; payment dates; and interest rate index (if, and as, applicable). As set out in Note 4(i), any ineffectiveness, such as would result from a difference between the notional amount of the hedging item and the principal amount of the hedged item, or from a previously effective designated hedging relationship becoming ineffective, is reflected in the Consolidated statements of income and other comprehensive income as Financing costs if in respect of long-term debt, as Goods and services purchased if in respect of U.S. dollar-denominated future purchase commitments or as Employee benefits expense if in respect of share-based compensation.

Hedging assets and liabilities

In the application of hedge accounting, an amount (the hedge value) is recorded in the Consolidated statements of financial position in respect of the fair value of the hedging items. The net difference, if any, between the amounts recognized in the determination of net income and the amounts necessary to reflect the fair value of the designated cash flow hedging items recorded in the Consolidated statements of financial position is recognized as a component of Other comprehensive income, as set out in Note 10.

In the application of hedge accounting to the compensation cost arising from share-based compensation, the amount recognized in the determination of net income is the amount that counterbalances the difference between the quoted market price of our Common Shares at the statement of financial position date and the price of our Common Shares in the hedging items.

![]()

notes to consolidated financial statements

(e) Revenue recognition

General

We earn the majority of our revenues (wireless: network revenues (voice and data); wireline: data revenues (which include: Internet protocol; television; hosting, managed information technology and cloud-based services; business process outsourcing; and certain healthcare solutions) and voice revenues) from access to, and usage of, our telecommunications infrastructure. The majority of the balance of our revenues (wireless equipment and other) arises from providing services and products facilitating access to, and usage of, our telecommunications infrastructure.

We offer complete and integrated solutions to meet our customers’ needs. These solutions may involve deliveries of multiple services and products that occur at different points in time and/or over different periods of time; as referred to in (b), this is a significant judgment for us. As appropriate, these multiple element arrangements are separated into their component accounting units, consideration is measured and allocated among the accounting units based upon their relative fair values (derived using Company-specific objective evidence) and then our relevant revenue recognition policies are applied to the accounting units. (We estimate that more than two-thirds of our revenues arise from multiple element arrangements.) A limitation cap restricts the consideration allocated to services or products currently transferred in multiple element arrangements to an amount that is not contingent upon either delivering additional items or meeting other specified performance conditions. Our view is that the limitation cap results in a faithful depiction of the transfer of services and products, as it reflects the telecommunications industry’s generally accepted understanding of the transfer of services and products, while also reflecting the related cash flows; however, a new revenue accounting standard, which has not yet been applied and must be adopted by January 1, 2018, prohibits the use of a limitation cap, as discussed further in Note 2.

When we receive no identifiable, separable benefit for consideration given to a customer (e.g. discounts and rebates), the consideration is recorded as a reduction of revenue rather than as an expense.

Multiple contracts with a single customer are normally accounted for as separate arrangements. In instances where multiple contracts are entered into with a customer in a short period of time, the contracts are reviewed as a group to ensure that, as with multiple element arrangements, their relative fair values are appropriate.

Lease accounting is applied to an accounting unit if it conveys to a customer the right to use a specific asset but does not convey the risks and/or benefits of ownership.

Our revenues are recorded net of any value-added and/or sales taxes billed to the customer concurrent with a revenue-generating transaction.

Voice and data

We recognize revenues on an accrual basis and include an estimate of revenues earned but unbilled. Wireless and wireline service revenues are recognized based upon access to, and usage of, our telecommunications infrastructure and upon contract fees.

Advance billings are recorded when billing occurs prior to provision of the associated services; such advance billings are recognized as revenue in the period in which the services are provided. Similarly, and as appropriate, upfront customer activation and connection fees are deferred and recognized over the average expected term of the customer relationship.

We use the liability method of accounting for the amounts of our quality of service rate rebates that arise from the jurisdiction of the Canadian Radio-television and Telecommunications Commission (CRTC).

The CRTC has established a mechanism to subsidize local exchange carriers, such as ourselves, that provide residential basic telephone service to high cost serving areas. The CRTC has determined the per network access line/per band subsidy rate for all local exchange carriers. We recognize the subsidy on an accrual basis by applying the subsidy rate to the number of residential network access lines we provide in high cost serving areas, as further discussed in Note 6. Differences, if any, between interim and final subsidy rates set by the CRTC are accounted for as a change in estimate in the period in which the CRTC finalizes the subsidy rate.

Other and wireless equipment

We recognize product revenues, including amounts related to wireless handsets sold to re-sellers and customer premises equipment, when the products are both delivered to and accepted by the end-user customers irrespective of which supply channel delivers the product. With respect to wireless handsets sold to re-sellers, we consider ourselves to be the principal and primary obligor to the end-user customers. Revenues from operating leases of equipment are recognized on a systematic and rational basis (normally a straight-line basis) over the term of the lease.

Non-high cost serving area deferral account

In an effort to foster competition for residential basic service in non-high cost serving areas, the concept of a deferral account mechanism was introduced by the CRTC in 2002 as an alternative to mandating price reductions. We use the

![]()

notes to consolidated financial statements

liability method of accounting for the deferral account. We discharge the deferral account liability by undertaking qualifying actions. We recognize the amortization (over a period no longer than three years) of a proportionate share of the deferral account as qualifying actions are completed. Such amortization is included as a component of government assistance in Other operating income, as set out in Note 6.

(f) Government assistance

We recognize government assistance amounts on an accrual basis as the subsidized services are provided or as the subsidized costs are incurred. As set out in Note 6, government assistance amounts are included in the Consolidated statements of income and other comprehensive income as Other operating income.

(g) Cost of acquisition and advertising costs

The total cost of wireless equipment sold to customers and any commissions and advertising and promotion costs related to initial customer acquisition are expensed as incurred; the cost of equipment we own that is situated at customers’ premises and associated installation costs are capitalized as incurred. Costs of acquiring customers that are expensed are included in the Consolidated statements of income and other comprehensive income as a component of Goods and services purchased, with the exception of amounts paid to our employees, which are included as Employee benefits expense. Costs of advertising production, advertising airtime and advertising space are expensed as incurred.

See Note 2(b) for significant changes to IFRS-IASB that are not yet effective and have not yet been applied, but will significantly affect the timing of recognition of costs of acquiring customers.

(h) Research and development

Research and development costs are expensed except for cases in which development costs meet certain identifiable criteria for capitalization. Capitalized development costs are amortized over the life of the related commercial production, or in the case of serviceable property, plant and equipment, are included in the appropriate property group and are depreciated over its estimated useful life.

(i) Depreciation, amortization and impairment

Depreciation and amortization

Assets are depreciated on a straight-line basis over their estimated useful lives as determined by a continuing program of asset life studies. Depreciation includes amortization of assets under finance leases and amortization of leasehold improvements. Leasehold improvements are normally amortized over the lesser of their expected average service life or the term of the lease. Intangible assets with finite lives (intangible assets subject to amortization) are amortized on a straight-line basis over their estimated useful lives, which are reviewed at least annually and adjusted as appropriate. As referred to in (b), the use of a straight-line basis of depreciation and amortization is a significant judgment for us.

Estimated useful lives for the majority of our property, plant and equipment subject to depreciation are as follows:

|

|

|

Estimated useful lives 1 |

|

|

Network assets |

|

|

|

|

Outside plant |

|

17 to 40 years |

|

|

Inside plant |

|

4 to 17 years |

|

|

Wireless site equipment |

|

5 to 10 years |

|

|

Balance of depreciable property, plant and equipment |

|

3 to 40 years |

|

(1) The composite depreciation rate for the year ended December 31, 2016, was 5.0% (2015 — 4.8%). The rate is calculated by dividing depreciation expense by an average of the gross book value of depreciable assets over the reporting period.

Estimated useful lives for the majority of our intangible assets subject to amortization are as follows:

|

|

|

Estimated useful lives |

|

|

Wireline subscriber base |

|

25 years |

|

|

Customer contracts, related customer relationships and leasehold interests |

|

6 to 10 years |

|

|

Software |

|

2 to 7 years |

|

|

Access to rights-of-way and other |

|

5 to 30 years |

|

Impairment — general

Impairment testing compares the carrying values of the assets or cash-generating units being tested with their recoverable amounts (the recoverable amount being the greater of an asset’s or a cash-generating unit’s value in use or its fair value less costs to sell); as referred to in (b), this is a significant estimate for us. Impairment losses are immediately recognized to the extent that the carrying value of an asset or cash-generating unit exceeds its recoverable amount. Should the recoverable amounts for impaired assets or cash-generating units subsequently increase, the impairment losses previously recognized (other than in respect of goodwill) may be reversed to the extent that the reversal is not a

![]()

notes to consolidated financial statements

result of “unwinding of the discount” and that the resulting carrying values do not exceed the carrying values that would have been the result if no impairment losses had been previously recognized.

Impairment — property, plant and equipment; intangible assets subject to amortization

The continuing program of asset life studies considers such items as the timing of technological obsolescence, competitive pressures and future infrastructure utilization plans; these considerations could also indicate that the carrying value of an asset may not be recoverable. If the carrying value of an asset were not considered recoverable, an impairment loss would be recorded.

Impairment — intangible assets with indefinite lives; goodwill

The carrying values of intangible assets with indefinite lives and goodwill are periodically tested for impairment. The frequency of the impairment testing is generally the reciprocal of the stability of the relevant events and circumstances, but intangible assets with indefinite lives and goodwill must, at a minimum, be tested annually; we have selected December as our annual test date.

We assess our intangible assets with indefinite lives by comparing the recoverable amounts of our cash-generating units to the carrying values of our cash-generating units (including the intangible assets with indefinite lives allocated to a cash-generating unit, but excluding any goodwill allocated to a cash-generating unit). To the extent that the carrying value of a cash-generating unit (including the intangible assets with indefinite lives allocated to the cash-generating unit, but excluding any goodwill allocated to the cash-generating unit) exceeds its recoverable amount, the excess amount would be recorded as a reduction in the carrying value of intangible assets with indefinite lives.

Subsequent to assessing intangible assets with indefinite lives, we assess goodwill by comparing the recoverable amounts of cash-generating units to their carrying values (including the intangible assets with indefinite lives and the goodwill allocated to a cash-generating unit). To the extent that the carrying value of the cash-generating unit (including the intangible assets with indefinite lives and the goodwill allocated to the cash-generating unit) exceeds its recoverable amount, the excess amount would first be recorded as a reduction in the carrying value of goodwill and any remainder would be recorded as a reduction in the carrying values of the assets of the cash-generating unit on a pro-rated basis.

(j) Translation of foreign currencies

Trade transactions completed in foreign currencies are translated into Canadian dollars at the rates of exchange prevailing at the time of the transactions. Monetary assets and liabilities denominated in foreign currencies are translated into Canadian dollars at the rate of exchange in effect at the statement of financial position date, with any resulting gain or loss recorded in the Consolidated statements of income and other comprehensive income as a component of Financing costs, as set out in Note 8. Hedge accounting is applied in specific instances, as further discussed in (d) preceding.

We have foreign subsidiaries that do not have the Canadian dollar as their functional currency. Foreign exchange gains and losses arising from the translation of these foreign subsidiaries’ accounts into Canadian dollars subsequent to January 1, 2010, are reported as a component of other comprehensive income, as set out in Note 10.

(k) Income and other taxes

We follow the liability method of accounting for income taxes; as referred to in (b), this is a significant estimate for us. Under this method, current income taxes are recognized for the estimated income taxes payable for the current year. Deferred income tax assets and liabilities are recognized for temporary differences between the tax and accounting bases of assets and liabilities, and also for any benefits of losses and Investment Tax Credits available to be carried forward to future years for tax purposes that are more likely than not to be realized. The amounts recognized in respect of deferred income tax assets and liabilities are based upon the expected timing of the reversal of temporary differences or usage of tax losses and the application of the substantively enacted tax rates at the time of reversal or usage.

We account for any changes in substantively enacted income tax rates affecting deferred income tax assets and liabilities in full in the period in which the changes are substantively enacted. We account for changes in the estimates of prior year(s) tax balances as estimate revisions in the period in which the changes in estimates arise; we have selected this approach as its emphasis on the statement of financial position is more consistent with the liability method of accounting for income taxes.

Our operations are complex and the related tax interpretations, regulations, legislation and jurisprudence are continually changing. As a result, there are usually some tax matters in question that result in uncertain tax positions. We only recognize the income tax benefit of an uncertain tax position when it is more likely than not that the ultimate determination of the tax treatment of the position will result in that benefit being realized. We accrue an amount for interest charges on current tax liabilities that have not been funded, which would include interest and penalties arising from uncertain tax positions. We include such charges in the Consolidated statements of income and other comprehensive income as a component of Financing costs.

![]()

notes to consolidated financial statements

Our research and development activities may be eligible to earn Investment Tax Credits, for which the determination of eligibility is a complex matter. We only recognize Investment Tax Credits when there is reasonable assurance that the ultimate determination of the eligibility of our research and development activities will result in the Investment Tax Credits being received, at which time they are accounted for using the cost reduction method, whereby such credits are deducted from the expenditures or assets to which they relate, as set out in Note 9(c).

(l) Share-based compensation

General

When share-based compensation vests in its entirety at one future point in time (cliff vesting), we recognize the expense on a straight-line basis over the vesting period. When share-based compensation vests in tranches (graded vesting), we recognize the expense using the accelerated expense attribution method. An estimate of forfeitures during the vesting period is made at the date of grant of such share-based compensation; this estimate is adjusted to reflect actual experience.

Share option awards

A fair value for share option awards is determined at the date of grant and that fair value is recognized in the financial statements. Proceeds arising from the exercise of share option awards are credited to share capital, as are the recognized grant-date fair values of the exercised share option awards.

Share option awards that have a net-equity settlement feature, as set out in Note 13(d), are accounted for as equity instruments. We have selected the equity instrument fair value method of accounting for the net-equity settlement feature as it is consistent with the accounting treatment afforded to the associated share option awards.

Restricted stock units

In respect of restricted stock units without market performance conditions, as set out in Note 13(b), we accrue a liability equal to the product of the number of vesting restricted stock units multiplied by the fair market value of the corresponding Common Shares at the end of the reporting period (unless hedge accounting is applied, as set out in (d) preceding). Similarly, we accrue a liability for the notional subset of our restricted stock units with market performance conditions using a fair value determined using a Monte Carlo simulation. The expense for restricted stock units that do not ultimately vest is reversed against the expense that was previously recorded in their respect.

(m) Employee future benefit plans

Defined benefit plans

We accrue amounts for our obligations under employee defined benefit plans and the related costs, net of plan assets. The cost of pensions and other retirement benefits earned by employees is actuarially determined using the accrued benefit method pro-rated on service and management’s best estimates of salary escalation and the retirement ages of employees. In the determination of net income, net interest for each plan, which is the product of the plan’s surplus (deficit) multiplied by the discount rate, is included as a component of Financing costs, as set out in Note 8.

An amount reflecting the effect of differences between the discount rate and the actual rate of return on plan assets is included as a component of employee defined benefit plan re-measurements within Other comprehensive income, as set out in Note 10 and Note 14. We determine the maximum economic benefit available from the plans’ assets on the basis of reductions in future contributions to the plans.

On an annual basis, at a minimum, the defined benefit plan key assumptions are assessed and revised as appropriate; as referred to in (b), these are significant estimates for us. When the defined benefit plan key assumptions fluctuate significantly relative to their immediately preceding year-end values, actuarial gains (losses) arising from such significant fluctuations are recognized on an interim basis.

Defined contribution plans

We use defined contribution accounting for the Telecommunication Workers Pension Plan and the British Columbia Public Service Pension Plan, which cover certain of our employees and provide defined benefits to their members. In the absence of any regulations governing the calculation of the share of the underlying financial position and plan performance attributable to each employer-participant, and in the absence of contractual agreements between the plans and the employer-participants related to the financing of any shortfall (or distribution of any surplus), we account for these plans as defined contribution plans in accordance with International Accounting Standard 19, Employee Benefits.

(n) Cash and temporary investments, net

Cash and temporary investments, which may include investments in money market instruments that are purchased three months or less from maturity, are presented net of outstanding items, including cheques written but not cleared by the

![]()

notes to consolidated financial statements