UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION

REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

| Filed by the Registrant | [X] |

| Filed by a Party other than the Registrant | [ ] |

Check the appropriate box:

| [X] | Preliminary Proxy Statement | |

| [ ] | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| [ ] | Definitive Proxy Statement | |

| [ ] | Definitive Additional Materials | |

| [ ] | Soliciting Material Pursuant to §240.14a-12 |

PROPHASE LABS, INC.

(Name of Registrant as Specified in Its Charter)

Payment of Filing Fee (Check the appropriate box):

| [X] | No fee required. | |

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: | |

| (2) | Aggregate number of securities to which transaction applies: | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| (4) | Proposed maximum aggregate value of transaction: | |

| (5) | Total fee paid: |

| [ ] | Fee paid previously with preliminary materials: |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: | |

| (2) | Form, Schedule or Registration Statement No.: | |

| (3) | Filing Party: | |

| (4) | Date Filed: |

[●], 2018

Dear Stockholder:

You are cordially invited to attend a special meeting of stockholders (the “Special Meeting”) of ProPhase Labs, Inc. (the “Company”), to be held on Thursday, April 12, 2018, beginning at 4:00 p.m., local time, at the offices of Reed Smith LLP, 599 Lexington Avenue, New York, New York 10022 for the following purposes:

| 1. | To approve the Company’s 2018 Stock Incentive Plan; and | |

| 2. | To approve the Amended and Restated 2015 Executive Employment Agreement with Ted Karkus, the Company’s Chairman and Chief Executive Officer. |

The two proposals to be voted on at the Special Meeting are more fully described in the proxy statement. In addition, stockholders may be asked to consider and vote upon such other business as may properly come before the meeting or any adjournment or postponement thereof.

It is important that your shares be represented at the Special Meeting, regardless of the size of your holdings. Accordingly, whether or not you expect to attend the Special Meeting, we urge you to vote promptly by returning the enclosed proxy card. You may revoke your proxy at any time before it has been voted. Voting by proxy will not prevent you from voting your shares in person if you subsequently choose to attend the Special Meeting.

Thank you for your cooperation and continued support.

| Very truly yours, | |

| /s/ Ted Karkus | |

| Ted Karkus | |

| Chairman of the Board of Directors | |

| and Chief Executive Officer |

ProPhase Labs, Inc.

621 N. Shady Retreat Road

Doylestown, PA 18901

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

to be held on Thursday, April 12, 2018

Dear Stockholder:

You are hereby given notice of and invited to attend in person or by proxy a special meeting of stockholders (the “Special Meeting”) of ProPhase Labs, Inc. (the “Company”), to be held at the offices of Reed Smith LLP, 599 Lexington Avenue, New York, New York 10022, on Thursday, April 12, 2018, at 4:00 p.m., local time, for the following purposes:

| 1. | To approve the Company’s 2018 Stock Incentive Plan; and | |

| 2. | To approve the Amended and Restated 2015 Executive Employment Agreement with Ted Karkus, the Company’s Chairman and Chief Executive Officer. |

The two proposals to be voted on at the Special Meeting are more fully described in the proxy statement. In addition, stockholders may be asked to consider and vote upon such other business as may properly come before the meeting or any adjournment or postponement thereof.

YOUR BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE FOR THE PROPOSALS DESCRIBED ABOVE AND IN THE ACCOMPANYING PROXY STATEMENT.

The board of directors has fixed the close of business on March 14, 2018, as the record date for the determination of stockholders entitled to notice of and to vote at the special meeting and any adjournments thereof. Only stockholders of record at the close of business on that date may vote at the Special Meeting or any adjournment or postponement thereof.

| By Order of the Board of Directors | |

| /s/ Ted Karkus | |

| Ted Karkus | |

| Chairman of the Board of Directors | |

| and Chief Executive Officer |

Doylestown, PA

[●], 2018

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SPECIAL MEETING OF STOCKHOLDERS TO BE HELD ON April 12, 2018

The Notice of Special Meeting of Stockholders and Proxy Statement are available at:

http://www.astproxyportal.com/ast/07814 |

ProPhase Labs, Inc.

621 N. Shady Retreat Road

Doylestown, PA 18901

PROXY STATEMENT

SPECIAL

MEETING OF STOCKHOLDERS

to be held

on Thursday, April 12, 2018

TABLE OF CONTENTS

ProPhase Labs, Inc.

621 N. Shady Retreat Road

Doylestown, PA 18901

PROXY STATEMENT

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND THE SPECIAL MEETING OF STOCKHOLDERS

| Q: | Why am I receiving these materials? |

| A: | The Board of Directors (the “Board”) of ProPhase Labs, Inc. (the “Company,” “we,” “our,” or “us,” as the context requires) is providing this proxy statement (this “Proxy Statement”) to solicit your proxy in connection with a special meeting of stockholders (the “Special Meeting”), which will take place at the offices of Reed Smith LLP, 599 Lexington Avenue, New York, New York 10022, on Thursday, April 12, 2018, at 4:00 p.m., local time. The Board is requesting your vote on the proposals described in this Proxy Statement. This Proxy Statement and the accompanying proxy card, or voting instruction form, as applicable, are being distributed on or about [●], 2018. |

| Q: | Who is soliciting the proxies? |

| A: | We are soliciting proxies in the form enclosed on behalf of the Board. Our Board has selected Ted Karkus and Monica Brady (the “Named Proxies”) to vote all shares for which the Company has been appointed to act as proxy at the Special Meeting. The Named Proxies will vote any properly executed proxy, if received in time and not revoked, at the Special Meeting in accordance with your directions. The Named Proxies will vote any signed proxy that fails to specify a choice on the proposals to be acted upon at the Special Meeting in accordance with the Board’s voting recommendations (as described below in “What are the Board’s voting recommendations?”, and, in the Named Proxies’ discretion, FOR or AGAINST such other business as may properly come before the Special Meeting or any adjournment or adjournments thereof. |

| Q: | What information is contained in these materials? |

| A: | This Proxy Statement contains information related to the proposals to be voted on at the Special Meeting, the voting process, the compensation of the Company’s executive officers and directors, and other required information. |

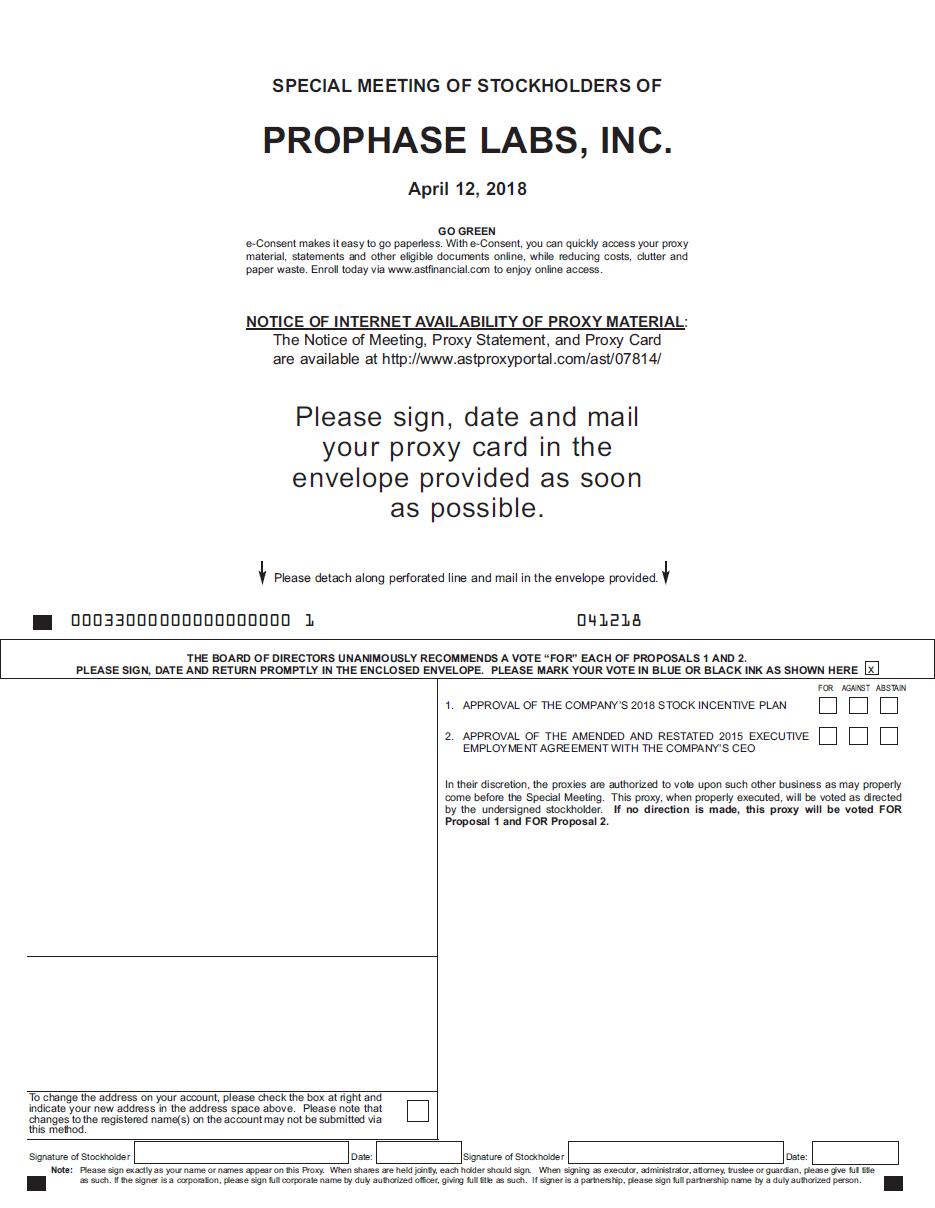

| Q: | What proposal will be voted on at the Special Meeting? |

| A: | There are two matters on which a vote is scheduled at the Special Meeting: |

| 1. | to approve the Company’s 2018 Stock Incentive Plan (the “2018 Stock Plan Proposal”); and | |

| 2. | to approve the Amended and Restated 2015 Executive Employment Agreement with Ted Karkus, the Company’s Chairman and Chief Executive Officer (the “New CEO Employment Agreement Proposal”) |

We will also consider and vote upon any other business properly brought before the Special Meeting, or any adjournment or postponement thereof. However, our Secretary has not received timely and proper notice from any stockholder of any other matter to be presented at the meeting.

| Q: | What are the Board’s voting recommendations? |

| A: | The Board recommends that you vote your shares : |

| ● | FOR the 2018 Stock Plan Proposal (Proposal 1); and | |

| ● | FOR the New CEO Employment Agreement Proposal (Proposal 2). |

For a more detailed discussion of why you should vote “FOR” Proposals 1 and 2, see “Proposal 1 – Approval of the 2018 Stock Incentive Plan” and “Proposal 2 – Approval of the New CEO Employment Agreement.”

| 1 |

| Q: | What shares may I vote? |

| A: | You may vote all shares of the Company’s Common Stock, par value $0.0005 per share (“Common Stock”), that you owned as of the close of business on March 14, 2018 (the “Record Date”). These shares include: |

| 1. | those held directly in your name as the stockholder of record; and | |

| 2. | those held for you as the beneficial owner through a bank, broker, or similar institution at the close of business on the Record Date. |

Each share of Common Stock is entitled to one vote. On the Record Date, there were [●] shares of Common Stock issued and outstanding. There was no other class of voting securities of the Company outstanding on the Record Date.

| Q: | What is the difference between holding shares as a stockholder of record and as a beneficial owner? |

| A: | Most Company stockholders hold their shares through a bank, broker or similar institution rather than directly in their own name. As summarized below, there are some distinctions between shares held of record and those owned beneficially. |

Stockholder of Record

If your shares are registered directly in your name with the Company’s transfer agent, American Stock Transfer & Trust Company LLC (the “Transfer Agent”), you are considered, with respect to those shares, the stockholder of record and we are sending these proxy materials directly to you. As the stockholder of record, you have the right to vote your shares in person at the Special Meeting or grant a proxy to vote your shares to the Company or any other person who will appear in person at the Special Meeting, and any adjournment and postponement thereof, and vote your shares on your behalf. Stockholders of record are requested to complete, date, sign and return (in the prepaid envelope provided for this purpose) the enclosed form of proxy for your shares, giving the Company the right to vote your shares for you at the Special Meeting, as you direct.

Beneficial Owner

If you hold shares in a stock brokerage account or through a bank or similar institution, you are considered the beneficial owner of shares held in street name, and your bank, broker or nominee is forwarding these proxy materials to you. Your bank, broker, or nominee is considered, with respect to those shares, the stockholder of record. As the beneficial owner, you have the right to direct your bank, broker, or other nominee on how to vote your shares, but because you are not the stockholder of record, you may not vote these shares in person at the Special Meeting unless you obtain a signed proxy from the record holder giving you the right to vote the shares. As a beneficial owner, you are, however, welcome to attend the Special Meeting. Your bank, broker, or nominee has enclosed a voting instruction form for you to use.

| Q: | May I attend the Special Meeting in person? |

| A: | You are invited to attend the Special Meeting and we encourage all stockholders of the Company to attend the Special Meeting. |

All stockholders attending the Special Meeting will be asked to present a form of photo identification, such as a driver’s license, in order to be admitted to the meeting. All bags or packages permitted in the meeting room will be subject to inspection. No cameras, computers, recording equipment, other similar electronic devices, signs, placards, briefcases, backpacks, large bags, or packages will be permitted in the Special Meeting. The use of mobile phones, tablets, laptops and similar electronic devices during the Special Meeting is prohibited, and such devices must be turned off and put away before entering the meeting room. By attending the Special Meeting, stockholders agree to abide by the agenda and procedures for the Special Meeting, copies of which will be distributed to attendees at the meeting.

| 2 |

| Q: | How can I vote my shares in person at the Special Meeting? |

| A: | You may vote shares you hold directly in your name as the stockholder of record in person at the Special Meeting. If you choose to do so, please bring the enclosed proxy card. Voting in person at the Special Meeting will revoke any proxy you submitted earlier. |

| If you are the beneficial owner of shares held in street name and your bank, broker, or nominee is forwarding these proxy materials to you, you may vote the shares in person at the Special Meeting only if you have obtained a signed proxy from your bank, broker, or nominee (i.e., the record holder) giving you the right to vote the shares. | |

| Even if you plan to attend the Special Meeting, we recommend that you also submit your proxy as described below so that your vote will be counted if you later decide not to attend the Special Meeting. Submitting your proxy now will not prevent you from voting your shares in person at the Special Meeting if you desire to do so, as your proxy is revocable at your option. |

| Q: | How can I vote my shares without attending the Special Meeting? |

| A: | Whether you hold shares directly as the stockholder of record or beneficially in street name, you may direct your vote without attending the Special Meeting. If you hold your shares directly, you may vote by granting a proxy. If you hold your shares in street name, you may submit voting instructions to your bank, broker, or other nominee. Please refer to the summary instructions below and those included on your proxy card or, for shares held in street name, the voting instruction form included by your broker or nominee. |

| By Mail—You may vote by mail by signing your proxy card or, for shares held in street name, the voting instruction card provided by your bank, broker or nominee, and mailing it in the enclosed, postage prepaid and addressed envelope. If you provide specific voting instructions, your shares will be voted as you instruct at the Special Meeting. If you sign but do not provide instructions, your shares will be voted as described below in “How are votes counted?” | |

| On the Internet—If you hold your shares in street name and the firm that holds your shares offers online voting, your broker voting instruction form will contain instructions on how to vote online. If you vote online, you do not need to mail in your proxy card. If you hold your shares directly in your name as the stockholder of record you may not vote online. | |

| By Telephone—If you hold your shares in street name and the firm that holds your shares offers voting by telephone, your broker voting instruction form will contain instructions on how to vote by telephone. If you vote by telephone, you do not need to mail in your proxy card. If you hold your shares directly in your name as the stockholder of record you may not vote by telephone. |

| Q: | May I change or revoke my vote? |

| A: | Yes, you may change or revoke your proxy instructions at any time prior to the vote at the Special Meeting. |

If you hold your shares directly and returned your proxy by mail, you must (a) provide written notice of revocation to the Secretary of the Company, (b) timely deliver a valid, later-dated proxy, or (c) vote in person at the Special Meeting. Your attendance at the Special Meeting will not by itself revoke your previously granted proxy unless you give written notice of revocation to the Secretary of the Company before the Special Meeting or you vote at the Special Meeting. Any proxy submitted by a stockholder of record may be revoked at any time prior to its exercise at the Special Meeting.

For shares you own beneficially, you may change your vote by submitting new voting instructions to your bank, broker or nominee. If you voted on the Internet or by telephone, you may change your vote by following the instructions for voting by either method until the cut-off time stated in the proxy instructions.

| Q: | How are votes counted? |

| A: | You may vote you may vote “FOR”, “AGAINST” or “ABSTAIN.” For abstentions, see “What happens if I abstain from voting?” below. |

| 3 |

If you specify a voting choice, the shares will be voted in accordance with that choice. If you vote your shares, but do not indicate your voting preferences, the Named Proxies will vote your shares in accordance with the recommendations of the board of directors.

If you are a beneficial owner and you have not provided voting instructions to your broker, your broker will not be entitled to vote your shares because it does not have discretionary authority to vote on the 2018 Stock Plan Proposal or the New CEO Employment Agreement Proposal, resulting in a “broker-non-vote” with respect to each of these proposals. See “What is a broker non-vote?” for more information.

| Q: | What is the quorum requirement for the Special Meeting? |

| A: | The quorum requirement for holding the Special Meeting and transacting business is a majority of the outstanding shares of Common Stock entitled to vote, represented in person or by proxy (the “Shares”). Abstentions will be counted as present and entitled to vote for purposes of determining a quorum at the Special Meeting. Broker non-votes (described below) will not be counted for this purpose. |

| Q: | What is the voting requirement to approve each of the proposals? |

| A: | Each of the proposals must be approved by a majority of the votes cast by the stockholders entitled to vote on such matters who are present in person or represented by proxy at the Special Meeting. A quorum must be present at the Special Meeting for a valid vote.

The Board and Mr. Karkus have agreed that Mr. Karkus will abstain from voting on the two proposals due to his personal interest in these matters. |

| Q: | What happens if I abstain from voting? |

| A: | If an executed proxy card is returned and the stockholder has explicitly abstained from voting, the Shares represented by the proxy will be considered present at the Special Meeting for the purpose of determining a quorum. Abstentions will not be counted as votes cast and therefore they will have no effect on the outcome of either of the proposals. |

| Q: | What is a “broker non-vote”? |

| A: | A “broker non-vote” occurs when a broker submits a proxy that does not indicate a vote for one or more proposals because the broker has not received instructions from the beneficial owner on how to vote on such proposal(s) and does not have discretionary authority to vote in the absence of instructions. Brokers have discretionary authority to vote on matters that are deemed “routine.” Brokers do not have discretionary authority to vote on matters that are deemed “non-routine,” such as the 2018 Stock Plan Proposal or the New CEO Employment Agreement Proposal. As such, broker non-votes will have no effect on the outcome of either of the proposals. |

| Q: | Will I have dissenters’ rights? |

| A: | No dissenters’ rights are available under the General Corporation Law of the State of Delaware, our certificate of incorporation, or our bylaws to any stockholder with respect to either of the proposals. |

| Q: | What does it mean if I receive more than one proxy card or voting instruction form? |

| A: | It means your Shares are registered differently or are held in more than one account. Please provide voting instructions for all proxy cards and voting instruction forms you receive. |

| Q: | Where can I find the voting results of the Special Meeting? |

| A: | We will announce preliminary voting results at the Special Meeting and publish final results in a Current Report on Form 8-K following the Special Meeting. |

| 4 |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information regarding ownership of our Common Stock as of February 26, 2018 by (a) each person known to the Company to own more than 5% of the outstanding shares of our Common Stock, (b) each director and nominee for director of the Company, (c) the named executive officers and (d) all directors and executive officers as a group. Unless otherwise indicated, the address of each person or entity listed below is the Company’s principal executive office.

| Name of Beneficial Owners | Common Stock Beneficially Owned(1) | Percent of Class | ||||||

| Officers and Directors | ||||||||

| Ted Karkus(2) | 2,734,849 | 24.0 | % | |||||

| Monica Brady(3) | 13,678 | * | ||||||

| Jason Barr | 7,721 | * | ||||||

| Mark Burnett | 310,808 | 2.8 | % | |||||

| Louis Gleckel, MD | 79,235 | * | ||||||

| Robert V. Cuddihy, Jr.(4) | 7,959 | * | ||||||

| ALL DIRECTORS AND EXECUTIVE OFFICERS | 3,154,250 | 27.7 | % | |||||

| (Five Persons) | ||||||||

* Less than 1%

| (1) | Beneficial ownership has been determined in accordance with Rule 13d-3 (“Rule 13d-3”) under the Exchange Act, and unless otherwise indicated, represents shares for which the beneficial owner has sole voting and investment power. The percentage of class is calculated in accordance with Rule 13d-3 based on 11,129,892 shares outstanding on February 26, 2018 and includes options or other rights to subscribe for shares of Common Stock which are exercisable within sixty (60) days of February 26, 2018. |

| (2) | Includes 2,484,849 shares and options to purchase 250,000 shares that are vested and exercisable. This number does not include 127,776 shares of common stock that will vest and become exercisable under the stock option granted to Mr. Karkus on February 23, 2018. As noted elsewhere in this Proxy Statement, under the terms of this stock option agreement, Mr. Karkus may not exercise these options unless and until stockholder approval of the New CEO Employment Agreement Proposal and the 2018 Stock Plan Proposal has been attained. |

| (3) | Includes 7,428 shares and options to purchase 6,250 shares that are vested and exercisable. |

| (4) | Mr. Cuddihy resigned from the Company effective September 29, 2017. |

| 5 |

EXECUTIVE AND DIRECTOR COMPENSATION

The following summary compensation table sets forth the total compensation paid or accrued for the years ended December 31, 2017 and 2016 to our Chief Executive Officer, our Chief Accounting Officer and our former Chief Financial Officer and Chief Accounting Officer. We refer to these officers as our “named executive officers.”

Summary Compensation Table (2017 and 2016)

| Name

and Principal Position | Year | Salary($) | Bonus(1) ($) | Option Awards(2) ($) | All Other Compensation (3)($) | Total($) | ||||||||||||||||||

| Ted Karkus | ||||||||||||||||||||||||

| Chairman of the Board and | 2017 | 675,000 | 725,000 | 458,062 | 25,800 | 1,883,862 | ||||||||||||||||||

| Chief Executive Officer | 2016 | 675,000 | 150,000 | — | 25,600 | 850,600 | ||||||||||||||||||

| Monica Brady | ||||||||||||||||||||||||

| Chief Accounting Officer | 2017 | 113,250 | 60,000 | 18,428 | 11,872 | 203,550 | ||||||||||||||||||

| Robert V. Cuddihy, Jr | ||||||||||||||||||||||||

| Former Chief Financial Officer and | 2017 | 247,115 | — | — | 677,338 | 924,453 | ||||||||||||||||||

| Chief Operating Officer | 2016 | 350,000 | 75,000 | — | 25,600 | 450,600 | ||||||||||||||||||

| (1) | For Mr. Karkus, the amount reported for 2017 includes a $650,000 discretionary bonus paid to Mr. Karkus in May 2017 in recognition of his efforts related to the sale of substantially all of the Company’s assets, comprised of the intellectual property and other assets related to the Company’s Cold-EEZE® brand and product line, to Mylan N.V. It also includes a $75,000 discretionary year-end bonus paid to Mr. Karkus in recognition of services rendered in 2017.

Ms. Brady received a $40,000 discretionary bonus in May 2017 in connection with the closing of the sale of the Company’s Cold-EEZE® brand and product line, to Mylan N.V. and a $20,000 discretionary year-end bonus in recognition of services rendered in 2017. | |

| (2) | Represents the aggregate grant date fair value of the option awards granted to Mr. Karkus and Ms. Brady in 2017, determined in accordance with FASB ASC Topic 718. We used the Black-Scholes option pricing model during the fiscal year ended December 31, 2017 to determine the fair value of the stock options at the date of grant. Based upon our limited historical experience, we determined the expected term of the stock option grants to be a range between 2.5 to 6.5 years, calculated using the “simplified” method in accordance with the SEC Staff Accounting Bulletin 110. We use the “simplified” method since our historical data does not provide a reasonable basis upon which to estimate expected term. Below is a summary of the assumptions used in determining the fair value of the stock options at the date of grant. |

| ● | Expected option life: 4.5 – 4.75 years | |

| ● | Weighted average risk free rate: 1.62% - 1.81% | |

| ● | Dividend yield: 0% | |

| ● | Expected volatility: 38.59% - 44.51% |

| (3) | For Mr. Karkus, the amount reported for 2017 includes a $15,000 vehicle allowance and a $10,800 matching contribution in the Company’s 401(k) defined contribution plan.

For Ms. Brady, the amount reported for 2017 includes a $5,000 vehicle allowance and a $6,872 matching contribution in the Company’s 401(k) defined contribution plan.

For Mr. Cuddihy, the amount reported for 2017 includes a $600,000 termination payment received pursuant to his April 2017 Employment Agreement Termination and Release Agreement and a $55,000 termination payment received pursuant to his September 2017 Employment Agreement Termination and Release Agreement. The amount also includes a $11,538 vehicle allowance and a $10,800 matching contribution in the Company’s 401(k) defined contribution plan. |

| 6 |

Our Compensation Committee believes that the most effective compensation program should:

| ● | attract and retain talented executives who will lead us through the challenges that we may face and put us in a position to grow and succeed; | |

| ● | motivate our executives to achieve short-term, medium-term and long-term financial and strategic goals; | |

| ● | reward our executives for the achievement of individual and corporate objectives; and | |

| ● | align the interests of management with those of our stockholders by providing incentives for superior performance that improves shareholder value. |

There is no pre-established policy or target for the allocation between either cash and non-cash or short-term, medium-term and long-term incentive compensation. This approach provides our Compensation Committee the ability to evaluate the compensation package from year to year with the flexibility to configure allocations and amounts in a manner that aligns closely with stockholder interests. The Compensation Committee considers our corporate performance, individual performance, and the economic environment in general and in our industry when it makes compensation decisions. The Compensation Committee uses these factors, in conjunction with its overall compensation philosophy, when it determines compensation to be awarded to our executive officers during a fiscal year.

While we do not have any policy for the proportion of compensation that should be allocated as cash or non-cash, or short or long-term, we have historically paid our executive officers a greater percentage of their total compensation as base salary. This is due to market factors in our industry and the specific situations facing our Company. It is important for us to retain the services of our talented and experienced executive team through market fluctuations. To do so, we believe that it is important to provide a certain amount of fixed compensation that will give our executive officers some assurance as to the level of compensation they will earn.

We have utilized annual bonus awards to reward results or extraordinary efforts, which motivates our executive officers to produce positive short-term results. We grant stock options and other stock-based awards which align the long-term interests of our executive officers to the interests of our stockholders by making our executive officers stakeholders in the Company and tying their long-term interests to our success.

Our Compensation Committee does not specifically benchmark the compensation of our executives to the pay of other executives in companies of similar size in our industry, given the unique challenges that are faced by other companies of our size in our industry. However, we have historically compared the level of our executives’ compensation against the compensation of other companies in our industry in general, and believe that the level of compensation our executives receive is within the range of compensation paid to other executives in our industry. We use these compensation checks to ensure that our executives are being appropriately rewarded and to discourage their departure to any competitor. In April 2017, the Compensation Committee retained the services of Bond & Pecaro, Inc. to advise the committee on a going forward basis on all executive compensation matters.

Regarding most compensation matters, the Chief Executive Officer’s responsibility is to provide recommendations to the Compensation Committee based on an analysis of market standards and trends and an evaluation of the contribution of each executive officer to the Company’s performance. Our Compensation Committee considers, but retains the right to accept, reject or modify such recommendations. Neither the Chief Executive Officer nor any other member of management is present during executive sessions of the Compensation Committee. Moreover, the Chief Executive Officer is not present when decisions with respect to his compensation are made.

Consideration of 2016 Advisory Stockholder Vote on Executive Compensation

On May 24, 2016, at our annual meeting of stockholders, our stockholders overwhelmingly approved, on a non-binding advisory basis, the compensation of the Company’s named executive officers, including the Company’s compensation practices and principles and their implementation, as discussed and disclosed in the compensation tables and related narrative disclosure contained in our 2016 Proxy Statement (the “Say on Pay Vote”). The Compensation Committee appreciates and values the views of our stockholders. In light of the strong level of support of the overall pay practices, and of the general effectiveness of our long standing compensation policies, the Board and the Compensation Committee did not make any specific changes to our executive compensation program for 2017.

| 7 |

At the annual meeting on May 6, 2013, our stockholders expressed a preference that our Say on Pay Vote occur every three years. In accordance with the results of this vote, the Board of Directors determined to implement a Say on Pay Vote every three years. Therefore, the next Say on Pay Vote will be held at our 2019 annual meeting of stockholders. The next required vote on the frequency of Say on Pay Votes will also be held at our 2019 annual meeting of stockholders.

Subject to variation where appropriate, the elements of compensation to our named executive officers include:

| ● | base salary, which is determined on an annual basis and is generally set forth in employment agreements with our executives; | |

| ● | annual cash incentive compensation, which is awarded by our Compensation Committee on a discretionary basis, determined based on the Company and individual performance in the applicable fiscal year; and | |

| ● | long-term incentive compensation in the form of options and other stock-based awards. |

Base Salary and Annual Bonus

Base salaries are an integral component of our total compensation program, and setting base salaries at competitive levels helps us to attract and retain senior executives. Base salary is the only fixed component of compensation for our executives. The base salaries for our named executive officers were determined based on the Compensation Committee’s evaluation of the competitive marketplace, the salaries of our other executives, and the scope of each named executive officer’s responsibilities. The base salaries of our named executive officers were set at the level deemed necessary to secure their employment for an extended period and to appropriately reward them for the multiple roles they played for our Company.

Our annual bonus opportunity is intended to incentivize the achievement of our short-term goals. On an annual basis, generally in mid-December, our Compensation Committee assesses the individual performance of each of our executive officers and the performance of the Company and determines the appropriate annual bonus award, if any, for our executive officers. We do not use pre-established targets for the annual bonus award because market factors that affect our Company’s performance are unpredictable, and thus it would be difficult to set goals at the beginning of the fiscal year that would appropriately motivate our executive officers throughout the year. By basing the annual incentive on assessments made at the end of the year of the performance of the individual executives and the Company, and occasionally making mid-year determinations where the circumstances warrant an immediate reward, we can take all market factors into account and reward our executive officers appropriately for their performance.

Equity-Based Awards

Our Compensation Committee believes that equity-based participation provides our executive officers a strong economic interest in maximizing stock price appreciation over the long term and aligns their interests with the interests of our stockholders. Equity-based awards are made pursuant to the Company’s equity incentive plans. The ProPhase Labs, Inc. Amended and Restated 2010 Equity Compensation Plan (the “2010 Plan”) authorizes us to issue up to 3,200,000 shares of Common Stock (subject to adjustments described in the 2010 Plan) to eligible employees, directors, consultants, advisors and other service providers of the Company or any of our affiliates.

The 2010 Plan has served as a key retention tool. Retention serves as a very important factor in our determination of the type of award to grant and the number of underlying shares that are granted in connection with that award. In addition, our Compensation Committee considers cost to the Company in determining the form of award, as well as our desire to have equity awards drive and reward performance over an extended period of time in order to promote long-term value for our stockholders, and to be an integral part of a competitive compensation program. Our Compensation Committee believes that stock options, restricted shares and stock grants are the best forms of award to achieve these goals, as stock options are designed to deliver value to executives only if our stock price increases over the value at the time of grant, and restricted shares and stock grants provide compensation that fluctuates with our stock price.

| 8 |

In determining the size of an option, restricted stock or stock grant to a named executive officer, both upon initial hire and on an ongoing basis, our Compensation Committee considers competitive market factors, the size of the equity incentive plan pool, cost to the Company, the level of equity held by the executive and by other officers, and individual contribution to corporate performance.

Although there is no set target level for holding options or stock ownership, our Compensation Committee recognizes that the equity-based component ensures additional focus by our executive officers on stock price performance, enhances executive retention, and aligns the interests of our executive officers with the interests of our stockholders. Accordingly, the exercise price of stock options is tied to the fair market value of our Common Stock on the date of grant. A grant of stock options typically will vest over a two to three year period, although the Compensation Committee may at times determine that a fully vested award is appropriate.

There is no set formula for the granting of awards to individual executives or employees. The number of options awarded may vary up or down from prior year awards, based on the Compensation Committee’s review and consideration of the above-listed goals and factors.

In keeping with our executive compensation program and philosophy for incentivizing the performance of our executive officers, as noted above, our Compensation Committee has used grants of stock, including restricted stock. Such grants are intended to reinforce the alignment of interests of our named executive officers with those of our stockholders, as the value of the awards granted thereunder is linked to the value of our Common Stock, which, in turn, is indirectly attributable to the individual performance of our executive officers.

Defined Contribution Plan

In 1999, we implemented a 401(k) defined contribution plan for its employees. The 401(k) plan is the Company’s primary retirement benefit for its employees, including its executives. For executive officers, as well as all other employees, the Company makes a contribution to the plan annually based on the amount of the employee’s 401(k) plan contributions and compensation. The contribution to the plan by the Company consists of a 50% match of the employee’s contribution, up to $10,800 per person, per annum. The Company’s total contribution to the 401(k) plan in 2017 for its named executive officers, in the aggregate, was approximately $28,500. Company contributions to the Company’s 401(k) plan are included in the Summary Compensation Table as “Other Compensation.”

The Company does not provide its executive officers with any type of defined benefit retirement benefit or the opportunity to defer compensation pursuant to a non-qualified deferred compensation plan.

Perquisites and Other Personal Benefits

The Company provides executives with limited personal benefits. The Compensation Committee reviews annually the levels of personal benefits provided to the executives. Medical and dental insurance is provided to each executive, along with all other eligible employees, subject to the same terms and conditions, including premium payments, that apply to all other eligible employees. Life and disability insurance is provided to each executive at no cost to the executive. All such welfare benefits terminate at the time each executive is no longer employed with the Company or as otherwise provided in the applicable employment agreement (except as otherwise required by continuation coverage laws).

On May 29, 2015, the Company entered into employment agreements (the “2015 Employment Agreements”) with each of Ted Karkus, Chairman and Chief Executive Officer of the Company, and Robert V. Cuddihy, Jr., former Chief Financial Officer and Chief Operating Officer of the Company. Each employment agreement was approved by our Board of Directors.

On February 16, 2018, the Board of Directors approved the Amended and Restated 2015 Executive Employment Agreement with Mr. Karkus (the “New CEO Employment Agreement”), which became effective February 23, 2018. See Proposals 1 and 2 for a description of the New CEO Employment Agreement. As described in Proposals 1 and 2, the New CEO Employment Agreement will be null and void if it is not approved by the requisite vote of stockholders at the Special Meeting. In the event the requisite vote of stockholders is not attained at the Special Meeting, Mr. Karkus’ 2015 Employment Agreement (described below) will be reinstated in its entirety, and the initial annual base salary provided for under his 2015 Employment Agreement will be reinstated, retroactive to the effective date of the New CEO Employment Agreement.

| 9 |

2015 Employment Agreement with Ted Karkus

Under his 2015 Employment Agreement with the Company (the “2015 CEO Employment Agreement”), Mr. Karkus agreed to an initial annual base salary of $675,000 as Chief Executive Officer. He was eligible to receive an annual increase in base salary and bonus in the sole discretion of the Compensation Committee, and was also eligible to receive regular benefits routinely provided to other senior executives of the Company.

Clawback Provision

The 2015 CEO Employment Agreement included a clawback provision. Specifically, in the event certain conditions were satisfied, namely, if:

| ● | a mandatory restatement of the Company’s financial results occured while the Company remained publicly traded and was attributable to misconduct or wrongdoing by Mr. Karkus; | |

| ● | Mr. Karkus had received payment of a cash bonus or had been issued any Company shares as a bonus within three (3) years preceding the mandatory restatement; and | |

| ● | the amount of such cash bonus or share grant was calculated and awarded pursuant to a specific financial formula, and the cash bonus or share grant would have been diminished based on the restated financial results had the financial formula been applied using the restated financial results; |

then Mr. Karkus would have been required to remit to the Company the amount by which the original cash bonus or share grant would have been diminished, net of taxes originally paid. However, if the net effect of the restatement was effectively neutral to the Company over the applicable time periods, then no clawback amount would have been due from Mr. Karkus.

Payments upon Termination or Change in Control

The 2015 CEO Employment Agreement also provided for payments upon certain terminations and change in control benefits.

The Compensation Committee provides our executive officers with termination benefits in order to attract and retain talented executives in a marketplace where such benefits are commonly provided as a part of a competitive compensation package. Change in control termination benefits also ensure that our executive officers make decisions based on the good of the stockholders, and will retain their drive and focus in the event of a change in control of the Company, even if it means that they would lose their jobs as a result.

The level of severance benefits provided for in the 2015 CEO Employment Agreement were based on a multiple of base salary only, rather than base and bonus as is typical in the market. The Compensation Committee determined that a multiple of bonus would not be appropriate since our bonus is generally discretionary and payable only on an ad hoc basis upon short-term achievements. The Compensation Committee determined that the base salary multiple included in the 2015 CEO Employment Agreement was set at an appropriate level given the lack of bonus inclusion, as well as in light of our compensation program goals of retention and the provision of a competitive compensation package.

Under the 2015 CEO Employment Agreement, in the event of termination by the Company of Mr. Karkus’ employment for “Cause” or due to his voluntary resignation without a Good Reason (as such terms are defined in the 2015 CEO Employment Agreement), no severance benefits would be payable to Mr. Karkus. If Mr. Karkus’ employment was terminated by the Company for any reason other than termination for Cause or due to his voluntary resignation without Good Reason (as defined in the 2015 CEO Employment Agreement), then Mr. Karkus would be paid a severance payment 1.5 times his base salary (decreased from 2.5 times his base salary in his prior employment agreement) (“Karkus Severance”). One-half of the Karkus Severance payment would be paid as a lump sum payment in cash and the remaining one-half would be paid in 12 equal consecutive, monthly installments commencing on the first business day of the month following the effective date of the termination. In addition, Mr. Karkus, and his eligible dependents, would be entitled to Company-paid COBRA continuation coverage premiums under the Company’s welfare plans, for a period of up to 18 months. Notwithstanding the above, if a termination of employment occured as a result of death or disability, then any cash severance payment would only be made to the extent that the proceeds were payable to the Company through a “key man” life, disability or similar insurance policy.

| 10 |

Additionally, if Mr. Karkus’ employment was terminated within twenty four (24) months after or within 180 days prior to, or otherwise in contemplation of, a Change in Control (as defined in the 2015 CEO Employment Agreement) of the Company, without Cause (other than due to death or disability) or due to his voluntary resignation with Good Reason, then in lieu of the cash severance described above, Mr. Karkus would have instead been entitled to receive a one-time severance payment in cash equal to the greater of (x) One Million Five Hundred Thousand Dollars ($1,500,000) (voluntarily decreased by Mr. Karkus from $2,500,000 in his prior employment agreement), and (y) 199 percent (decreased from 299 percent in his prior employment agreement) of his average annual total Form W-2 compensation for the three calendar years immediately preceding the date of termination.

In the event Mr. Karkus’ employment was terminated without Cause or due to his voluntary resignation with Good Reason, stock options and/or restricted stock held by Mr. Karkus would automatically vest concurrently with such termination of employment.

As a condition to Mr. Karkus receiving any termination or severance benefit contemplated by his 2015 CEO Employment Agreement, Mr. Karkus agreed to execute and deliver to the Company, in connection with any termination of his employment, a separation agreement and general release to, among other things, release and discharge the Company from claims arising out of his employment relationship with the Company or the termination of that relationship. In addition, both the Company and Mr. Karkus would agree not to disparage to any third party the professional or personal reputation or character of the other.

No Excise Tax Gross-Up

The 2015 CEO Employment Agreement did not provide for tax reimbursement payments or gross-ups related to any change in control. Under the terms of his 2015 CEO Employment Agreement, if any payments payable or benefits provided to Mr. Karkus would become subject to the excise tax imposed by Section 4999 of the Internal Revenue Code or to any similar tax imposed by state or local law, then the aggregate amount of payments payable to Mr. Karkus would be reduced to the aggregate amount of payments that could be made without incurring such excise tax, provided that such reduction would only be imposed if the aggregate after-tax value of the payments retained by Mr. Karkus (after giving effect to such reduction) was equal to or greater than the aggregate after-tax value (after giving effect to the excise tax) of the payments without any such reduction.

2015 Employment Agreement with Robert V. Cuddihy, Jr.

Under his 2015 Employment Agreement with the Company, Mr. Cuddihy agreed to an annual base salary of $350,000 as Chief Financial Officer and Chief Operating Officer. Mr. Cuddihy was eligible to receive annual increases in base salary and was eligible to receive bonuses in the sole discretion of the Compensation Committee. He also received regular benefits routinely provided to other senior executives of the Company.

April 2017 Employment Agreement Termination and Release Agreements with Robert V. Cuddihy, Jr.

On April 17, 2017, the Company entered into an Employment Agreement Termination and Release Agreement with Mr. Cuddihy (the “April 2017 Termination Agreement”) in light of the Company’s recent successful sale of its Cold-EEZE® brand. The April 2017 Termination Agreement terminated Mr. Cuddihy’s 2015 Employment Agreement and set forth the new terms of Mr. Cuddihy’s employment with the Company.

Under the terms of the April 2017 Termination Agreement, Mr. Cuddihy remained employed by the Company on an at-will basis as the Company’s Chief Financial Officer/Chief Accounting Officer; he ceased serving as the Company’s Chief Operating Officer, but became Chief Operating Officer/Contract Manufacturing, focusing on operational responsibility for the Company’s manufacturing business; he relinquished his rights under the 2015 Employment Agreement, including his rights to separation payments, in consideration for the Company remitting to him a $675,000 termination payment (inclusive of the $75,000 bonus paid to him in recognition of the Cold-EEZE® brand sale), subject to his execution of a general release. Under the terms of the April 2017 Termination Agreement he received an annual base salary of $350,000 until July 1, 2017, at which time his annual base salary was reduced to $250,000. He also remained eligible to participate in the Company’s equity incentive compensation plans, annual bonus plans, and employee benefit plans, and was entitled to receive four weeks paid vacation and a $1,250 monthly auto allowance.

September 2017 Employment Agreement Termination and Release Agreement with Robert V. Cuddihy, Jr.

On August 22, 2017, Mr. Cuddihy notified the Company of his intention to resign in order to pursue other career opportunities that had been offered to him. To facilitate an orderly transition, Mr. Cuddihy agreed to continue in his employment with the Company and his role as Chief Financial Officer and Chief Accounting Officer until September 29, 2017.

| 11 |

On September 27, 2017, the Company entered into another Employment Agreement Termination and Release Agreement with Mr. Cuddihy (the “September 2017 Termination Agreement”). The September 2017 Termination Agreement provided that Mr. Cuddihy’s employment would terminate effective as of 5:00 p.m. on September 30, 2017. Mr. Cuddihy received a one-time lump sum termination payment of $55,000. The September 2017 Termination Agreement contained a general release of claims in favor of the Company and other customary provisions.

Compensation Arrangement with Monica Brady

On September 26, 2017, the board of directors appointed Monica Brady as the Company’s Chief Accounting Officer, effective October 2, 2017. In connection with Ms. Brady’s appointment as Chief Accounting Officer, Ms. Brady’s annual base salary was increased to $132,000. In addition, on September 26, 2017, Ms. Brady was granted a stock option to purchase 25,000 shares of the Company’s common stock.

Outstanding Equity Awards at 2017 Fiscal Year End(1)

| Option Awards | ||||||||||||||||

| Name | Number of Securities Underlying Unexercised Options Exercisable | Equity Incentive Plan Awards Number of Securities Underlying Unexercised Unearned Options | Option Exercise Price ($) | Option Expiration Date | ||||||||||||

| Ted Karkus | 100,000 | — | 1.65 | 12/18/2019 | ||||||||||||

| — | 600,000 | (2) | 2.00 | 4/27/2024 | ||||||||||||

| Monica Brady | 6,250 | (3) | 18,750 | (3) | 2.15 | 9/26/2024 | ||||||||||

| (1) | Mr. Cuddihy did not have any outstanding option or stock awards as of December 31, 2017. |

| (2) | Award of 600,000 options was granted on April 27, 2017 and will vest in four equal annual installments beginning April 26, 2018. |

| (3) | Award of 25,000 options was granted on September 26, 2017, with 6,250 shares vested as of the grant date and the remaining 18,750 shares vesting in three equal annual installments beginning September 26, 2018. |

Director Compensation for 2017

| Name (1) | Fees Earned or Paid in Cash ($) | All Other Compensation ($) | Total ($) | |||||||||

| Jason Barr | $ | 39,000 | — | $ | 39,000 | |||||||

| Mark Burnett | $ | 39,000 | — | $ | 39,000 | |||||||

| Louis Gleckel, MD | $ | 39,000 | — | $ | 39,000 | |||||||

| Mark Leventhal(2) | $ | 15,425 | — | $ | 15,425 | |||||||

| James McCubbin(3) | $ | 13,650 | $ | 18,000 | $ | 31,650 | ||||||

| (1) | Our employee directors do not receive director fees. Accordingly, Mr. Ted Karkus, a director and the Chairman of the Board and the Chief Executive Officer of the Company, is not entitled to, and did not receive, any compensation for his service on the Board. | |

| (2) | Mr. Leventhal resigned from the Board on June 5, 2017. | |

| (3) | Mr. McCubbin resigned from the Board effective May 18, 2017, the date of our 2017 annual meeting of stockholders. The Company paid Mr. McCubbin $18,000 for consulting services provided to the Company from June to November 2017. |

In setting director compensation, the Company considers the significant amount of time that directors expend in fulfilling their duties to the Company. Each non-employee director received a quarterly Board fee of $9,000 for the first and second quarters of fiscal year 2017, $9,750 for the third quarter of fiscal year 2017, and $11,250 for the fourth quarter of 2017, paid following the close of each quarter, pro-rated for partial service. Non-employee directors do not receive additional fees for attendance at Board or committee meetings.

We reimburse each non-employee member of our Board for out-of-pocket expenses incurred in connection with attending Board and Committee meetings. Non-employee directors do not participate in any Company nonqualified deferred compensation plan and we do not pay any life insurance policies for the directors. Any director who is an employee of the Company is not entitled to compensation for service as a Board member.

| 12 |

PROPOSAL 1 – APPROVAL OF THE 2018 STOCK INCENTIVE PLAN

On February 16, 2018, the Board adopted the ProPhase Labs, Inc. 2018 Stock Incentive Plan (the “2018 Stock Plan”), subject to stockholder approval. The 2018 Stock Plan provides for the grant of incentive stock options qualifying under Section 422 of the Code (“ISOs”) to our eligible employees, and for the grant of nonstatutory stock options to eligible employees, directors and consultants. The 2018 Stock Plan is attached to this Proxy Statement as Appendix A.

Purpose

The purpose of the 2018 Stock Plan is to advance the interests of the Company and its stockholders by providing an incentive to attract, retain and reward persons performing services for the Company and by motivating such persons to contribute to the growth and profitability of the Company. The Company intends that the stock options granted pursuant to the 2018 Stock Plan will be exempt from or comply with Section 409A of the Code (including any amendments or replacements of such section), and the 2018 Stock Plan will be so construed.

Term of 2018 Stock Plan

The 2018 Stock Plan will continue in effect until it is terminated by the Board, however, all stock options will be granted, if at all, within ten years from the date the 2018 Stock Plan was adopted by the Board.

Authorized Shares

Subject to certain adjustments, as described below, the aggregate number of shares of Common Stock that may be issued pursuant to stock options awarded under the 2018 Stock Plan may not exceed 2,300,000 shares of Common Stock. The Common Stock issuable under the 2018 Stock Plan may consist, in whole or in part, of unissued shares or treasury share. All shares of Common Stock authorized under the 2018 Stock Plan have been reserved for the stock option granted to the Company’s Chief Executive Officer on February 23, 2018, subject to stockholder approval of the 2018 Stock Plan and the New CEO Employment Agreement.

If a stock option granted under the 2018 Stock Plan expires without having been exercised in full, the shares that were subject to the stock option will become available for future grant or sale under the 2018 Stock Plan (unless the 2018 Stock Plan has terminated).

The maximum aggregate number of shares that may be issued under the 2018 Stock Plan for the exercise of ISOs will not exceed 2,300,000 shares.

Plan Administration

The Board or one or more committees appointed by the Board (the “Administrator”) will administer the 2018 Stock Plan. If we determine it is desirable to qualify transactions under the 2018 Stock Plan as exempt under Rule 16b-3, such transactions will be structured to satisfy the requirements for exemption under Rule 16b-3. Subject to the provisions of the 2018 Stock Plan, the Administrator has the power to administer the 2018 Stock Plan, including but not limited to, the power to interpret the terms of the 2018 Stock Plan and stock options granted under it, to create, amend and revoke rules relating to the 2018 Stock Plan, including creating sub-plans, and to determine the terms of any stock options granted under the 2018 Stock Plan, including the exercise price, the number of shares subject to each such stock option, the exercisability of the stock options and the form of consideration, if any, payable upon exercise.

Options

The exercise price of stock options granted under the 2018 Stock Plan must at least be equal to the fair market value of the Common Stock on the grant date. The term of an ISO may not exceed ten years, except that with respect to any participant who owns more than 10% of the voting power of all classes of our outstanding stock, the term must not exceed five years and the exercise price must equal at least 110% of the fair market value on the grant date. For nonstatutory stock options the exercise price must equal at least 100% of the fair market value. The Administrator will determine the methods of payment of the exercise price of an option, which may include cash, shares or other property acceptable to the Administrator, as well as other types of consideration permitted by applicable law. After the termination of service of an employee, director or consultant, he or she may exercise the vested portion of his or her stock option for the period of time stated in his or her award agreement, except in the case of an employee terminated for cause (as defined in the 2018 Stock Plan), in which case the stock option will terminate upon his or her termination from service. Generally, if termination is due to death or disability, the vested portion of the stock option will remain exercisable for 12 months. In all other cases, the vested portion of the stock option generally will remain exercisable for three months following the termination of service. A stock option may not be exercised after expiration of its term. However, if the exercise of a stock option is prevented by applicable law the exercise period may be extended under certain circumstances. Subject to the provisions of the 2018 Stock Plan, the Administrator determines the other terms of stock options.

| 13 |

Non-Transferability of Stock Options

Unless the Administrator provides otherwise, stock options issued under the 2018 Stock Plan are not transferrable other than by will or the laws of descent and distribution, and only the recipient of a stock option may exercise an award during his or her lifetime, although a recipient may designate a beneficiary to exercise a stock option after death.

Certain Adjustments to Stock Options and Stock Reserves

Subject to any required action of our stockholders, the number of shares of Common Stock covered by each outstanding stock option, and the exercise price per share for a stock option, shall be proportionately adjusted for any increase or decrease in the number of issued shares of Common Stock of the Company resulting from a dividend (other than regular, ongoing dividends) or other distribution (whether in the form of cash, shares, other securities, or other property), recapitalization, stock split, reverse stock split, reorganization, merger, consolidation, split-up, spin-off, combination, repurchase, or exchange of shares or other securities of the Company, or other change in the corporate structure of the Company effecting the shares affected without receipt of consideration by the Company.

Merger or Change in Control

The 2018 Stock Plan provides that in the event of a merger or Change in Control (as defined under the 2018 Stock Plan), each outstanding stock option will be treated as the Administrator determines, including (i) the assumption, continuation or substitution of the stock options by the successor corporation or its parent or subsidiary, (ii) the acceleration of vesting for any unvested portion of the stock options, or (iii) the cash-out of the stock option.

Amendment or Termination of the 2018 Stock Plan

The Administrator has the authority to amend, suspend or terminate the 2018 Stock Plan provided such action does not impair the existing rights of any participant.

Summary of Federal Income Tax Consequences of Awards

ISOs. A participant who is granted an ISO does not recognize taxable income at the time the ISO is granted or upon its exercise, but the excess of the aggregate fair market value of the shares acquired on the exercise date (the “ISO shares”) over the aggregate exercise price paid by the participant is included in the participant’s income for alternative minimum tax purposes. Upon a disposition of the ISO shares more than two years after grant of the ISOs and one year after exercise of the ISOs, any gain or loss is treated as long-term capital gain or loss. In such case, the Company would not be entitled to a deduction. If the participant sells the ISO shares prior to the expiration of these holding periods, the participant recognizes ordinary income at the time of disposition equal to the excess if any, of the lesser of (1) the aggregate fair market value of the ISO shares at the date of exercise and (2) the amount received for the ISO shares, over the aggregate exercise price previously paid by the participant. Any gain or loss recognized on such a premature disposition of the ISO shares in excess of the amount treated as ordinary income is treated as long-term or short-term capital gain or loss, depending on how long the ISO shares were held by the participant prior to the sale. The amount of ordinary income recognized by the participant is subject to payroll taxes. The Company would be entitled to a deduction at the same time and in the same amount as the participant recognizes ordinary income.

Nonstatutory Stock Options. A participant who is granted a stock option that is not an ISO (a nonstatutory stock option) does not recognize any taxable income at the time of grant. Upon exercise, the participant recognizes taxable income in an amount equal to the aggregate fair market value of the shares subject to the nonstatutory stock options over the aggregate exercise price of such shares. Any taxable income recognized in connection with the exercise of nonstatutory stock options by an employee is subject to payroll taxes. The Company is entitled to a deduction at the same time and in the same amount as the participant recognizes ordinary income. The participant’s basis in the Stock will be increased by the amount of ordinary income recognized. Upon the sale of the Stock issued upon exercise of the nonstatutory stock options, any further gain or loss recognized will be treated as long-term or short-term capital gain or loss, depending on how long the shares were held by the participant prior to the sale.

| 14 |

New Plan Benefits

The stock options detailed in the table below were granted subject to stockholder approval of the 2018 Stock Plan and the New CEO Employment Agreement.

| NEW PLAN BENEFITS 2018 Stock Incentive Plan | ||||||||

| Name and Position | Dollar Value ($) | Number of Units | ||||||

| Ted Karkus Chief Executive Officer | — | 2,300,000 | ||||||

| Monica Brady Chief Accounting Officer | — | — | ||||||

| Robert V. Cuddihy Former Chief Financial Officer and Chief Operating Officer | — | — | ||||||

| Executive Group | — | 2,300,000 | ||||||

| Non-Executive Director Group | — | — | ||||||

| Non-Executive Officer Employee Group | — | — | ||||||

On February 16, 2018, the Board approved the New CEO Employment Agreement, which became effective February 23, 2018 (the “Effective Date”), subject to stockholder approval of the New CEO Employment Agreement Proposal and this 2018 Stock Plan Proposal.

Pursuant to the terms of the New CEO Employment Agreement, Mr. Karkus has agreed to reduce his base salary from a rate of not less than $675,000 per annum to a base salary of not less than $125,000 per annum. As consideration for his agreement to accept the reduced base salary, under the terms of the New CEO Employment Agreement, Mr. Karkus was granted a stock option under the 2018 Stock Plan, on the Effective Date, to purchase 2,300,000 shares of Common Stock of the Company at an exercise price of $3.00 per share (the “CEO Option”), which will vest and be exercisable in 35 equal monthly installments of 63,888 shares on the 1st day of each month beginning on March 1, 2018 (the “Initial Vesting Date”), and one monthly installment of 63,920 shares on the 1st day of the 36th month following the Initial Vesting Date, subject to Mr. Karkus’ continued employment with the Company. The CEO Option is subject to accelerated vesting in the event Mr. Karkus’ employment is terminated for any reason other than by the Company for Cause or by Mr. Karkus without Good Reason (as such terms are defined in the New CEO Employment Agreement).

In the event our stockholders do not approve both the New CEO Employment Agreement Proposal and the 2018 Stock Plan Proposal, the New CEO Employment Agreement will become null and void and the CEO Option will terminate and be cancelled. The CEO Option may not be exercised unless and until stockholder approval has been attained. See “Proposal 2—Approval of New CEO Employment Agreement” for additional information regarding the terms and conditions of the New CEO Employment Agreement.

Required Vote

The 2018 Stock Plan Proposal must be approved by the affirmative vote of the majority of the votes cast by the shares of Common Stock of the Company present in person or represented by proxy at the Special Meeting and entitled to vote on this matter. A quorum must be present at the Special Meeting for a valid vote.

The Board and Mr. Karkus have agreed that Mr. Karkus will abstain from voting on the 2018 Stock Plan Proposal, due to his personal interest in this matter.

Recommendation of the Board of Directors

THE BOARD OF DIRECTORS OF THE COMPANY RECOMMENDS THAT STOCKHOLDERS VOTE TO APPROVE THE 2018 STOCK PLAN PROPOSAL. PROXIES SOLICITED BY THE BOARD WILL BE VOTED “FOR” THE 2018 STOCK PLAN PROPOSAL UNLESS STOCKHOLDERS SPECIFY A CONTRARY VOTE.

| 15 |

EQUITY COMPENSATION PLAN INFORMATION

The table below sets forth information with respect to shares of common stock that may be issued under our equity compensation plans issued as of December 31, 2017:

| Plan Category | Number

of Securities to be Issued Upon Exercise of Outstanding Options, Warrants and Rights | Weighted-Average Exercise Price of Outstanding Options, Warrants and Rights | Number

of Securities Remaining Available for Future Issuance Under Equity Compensation Plans (Excluding Securities Reflected in Column (a)) | |||||||||

| (a) | (b) | (c) | ||||||||||

| Equity compensation plans approved by security holders(1)(2) | 979,500 | $ | 1.8156 | 268,967 | ||||||||

| Equity compensation plans not approved by security holders | — | — | — | |||||||||

| Total | 979,500 | $ | 1.8156 | 268,967 | ||||||||

| (1) | On May 5, 2010, our stockholders approved the 2010 Plan which, was subsequently amended and restated and approved by stockholders on April 24, 2011, further amended and approved by stockholders on May 6, 2013, and further amended and restated and approved by stockholders on May 24, 2016. The 2010 Plan provides that the total number of shares of Common Stock that may be issued under the 2010 Plan is equal to 3,200,000 shares. At December 31, 2017, we had outstanding 979,500 stock options, subject to vesting, under the 2010 Plan. At December 31, 2017, there were 121,159 shares of Common Stock that were available for issuance pursuant to the 2010 Plan. |

| (2) | On May 5, 2010, our stockholders approved the 2010 Directors’ Equity Compensation Plan, which was subsequently amended and approved by our stockholders on May 6, 2013. The 2010 Directors’ Equity Compensation Plan provides that the total number of shares of Common Stock that may be issued under the 2010 Directors’ Equity Compensation Plan is equal to 425,000. At December 31, 2017, there were no shares of our Common Stock outstanding pursuant to awards under the 2010 Directors’ Equity Compensation Plan. At December 31, 2017, there were 147,808 shares of Common Stock that were available for issuance pursuant to the 2010 Directors Equity Compensation Plan. |

| 16 |

PROPOSAL 2 – APPROVAL OF THE NEW CEO EMPLOYMENT AGREEMENT

On February 16, 2018, the Board approved a new employment agreement with Ted Karkus, our Chief Executive Officer, which became effective February 23, 2018, subject to stockholder approval. The New CEO Employment Agreement is attached to this Proxy Statement as Appendix B.

Background

In March 2017, the Company sold its Cold-EEZE® business to a wholly-owned subsidiary of Mylan N.V. (“Mylan”). The Company continues to own and operate its manufacturing facility and manufacturing business in Lebanon, Pennsylvania, and its headquarters in Doylestown, Pennsylvania. Prior to the sale to Mylan, our flagship OTC drug brand was Cold-EEZE® and our principal product was Cold-EEZE® cold remedy zinc gluconate lozenges, proven in clinical studies to reduce the duration and severity of symptoms of the common cold

As part of the sale of the Cold-EEZE® business, the Company entered into a manufacturing and supply agreement, pursuant to which it supplies various Cold-EEZE® lozenge products to Mylan. The Company also produces over-the-counter drug and dietary supplement lozenges and other products for other third party customers in addition to performing operational tasks such as warehousing, customer order processing and shipping.

The Company is also engaged in the research and development of additional over-the-counter dietary supplements, including Legendz XL, which are marketed under the Company’s TK Supplements brand.

The Company is also developing ProPhase Digital Media as a service that leverages and applies technology to the direct-to-consumer marketing of consumer products and is actively exploring additional opportunities outside of the consumer products industry.

Given the current transitional state of the Company, the Board of Directors and Mr. Karkus have determined that it is in the best interests of the Company and its stockholders to reduce the cash compensation payable to Mr. Karkus in order to further align Mr. Karkus’ interests with the interests of the Company and its stockholders and to provide more liquidity to the Company so that the Company may continue to expand its research and development efforts for its over-the-counter dietary supplement initiatives, continue to develop ProPhase Digital Media, and pursue potential business opportunities outside of the consumer products industry.

Terms of the New CEO Employment Agreement

The New CEO Employment Agreement is substantially similar to the 2015 CEO Employment Agreement, except that the New CEO Employment Agreement (1) amends the salary and benefits payable to Mr. Karkus and (2) amends the benefits payable to Mr. Karkus upon termination of his employment. See “Executive and Director Compensation—Employment Agreements—2015 Employment Agreement with Ted Karkus.”

Adjustments to Salary and Benefits

Under the New CEO Employment Agreement, Mr. Karkus has agreed to reduce his base salary from a rate of not less than $675,000 per annum to a base salary of not less than $125,000 per annum. As consideration for his agreement to accept a reduced base salary, Mr. Karkus was granted a stock option under the 2018 Stock Plan on February 23, 2018 to purchase 2,300,000 shares of Common Stock of the Company at an exercise price of $3.00 per share, which will vest and be exercisable in 35 equal monthly installments of 63,888 shares on the 1st day of each month beginning on March 1, 2018, and one monthly installment of 63,920 shares on the 1st day of the 36th month following the Initial Vesting Date, subject to Mr. Karkus’ continued employment with the Company. The CEO Option is subject to accelerated vesting in the event Mr. Karkus’ employment is terminated for any reason other than by the Company for Cause or by Mr. Karkus without Good Reason (as such terms are defined in the New CEO Employment Agreement). The CEO Option may not be exercised unless and until stockholder approval of the New CEO Employment Agreement Proposal and the 2018 Stock Plan Proposal has been attained.

Changes to Benefits Payable to Mr. Karkus Upon Termination

Under the terms of the New CEO Employment Agreement, in the event of a termination of Mr. Karkus’ employment by the Company for “Cause” or due to his voluntary resignation without a “Good Reason” (as such terms are defined in the New CEO Employment Agreement) (each an “Ineligible Termination”), no severance benefits will become payable to Mr. Karkus. If, however, Mr. Karkus’ employment is terminated by the Company for any reason other than termination for Cause or due to his voluntary resignation without Good Reason (as defined in the agreements), then Mr. Karkus will be entitled to receive the benefits and payments set forth below.

| 17 |

Termination of Employment Prior to February 22, 2021

For the time period from the Effective Date until February 22, 2021, Mr. Karkus will be eligible to receive a combination of accelerated vesting of the CEO Option and a cash severance payment upon a termination of his employment other than an Ineligible Termination as set forth in the chart below.

| Month

in which Mr. Karkus’ employment is terminated other than an Ineligible Termination | Ratio

of CEO Option subject to acceleration of vesting | Cash

severance payment (based upon a total potential cash severance payment of $1,687,500) | ||||||

| January 2018 | 1 | $ | 0 | |||||

| February 2018 | 35/36 | $ | 46,875 | |||||

| March 2018 | 34/36 | $ | 93,750 | |||||

| April 2018 | 33/36 | $ | 140,625 | |||||

| May 2018 | 32/36 | $ | 187,500 | |||||

| June 2018 | 31/36 | $ | 234,375 | |||||

| July 2018 | 30/36 | $ | 281,250 | |||||

| August 2018 | 29/36 | $ | 328,125 | |||||

| September 2018 | 28/36 | $ | 375,000 | |||||

| October 2018 | 27/36 | $ | 421,875 | |||||

| November 2018 | 26/36 | $ | 468,750 | |||||

| December 2018 | 25/36 | $ | 515,625 | |||||

| January 2019 | 24/36 | $ | 562,500 | |||||

| February 2019 | 23/36 | $ | 609,375 | |||||

| March 2019 | 22/36 | $ | 656,250 | |||||

| April 2019 | 21/36 | $ | 703,125 | |||||

| May 2019 | 20/36 | $ | 750,000 | |||||

| June 2019 | 19/36 | $ | 796,875 | |||||

| July 2019 | 18/36 | $ | 843,750 | |||||

| August 2019 | 17/36 | $ | 890,625 | |||||

| September 2019 | 16/36 | $ | 937,500 | |||||

| October 2019 | 15/36 | $ | 984,375 | |||||

| November 2019 | 14/36 | $ | 1,031,250 | |||||

| December 2019 | 13/36 | $ | 1,078,125 | |||||

| January 2020 | 12/36 | $ | 1,125,000 | |||||

| February 2020 | 11/36 | $ | 1,171,875 | |||||

| March 2020 | 10/36 | $ | 1,218,750 | |||||

| April 2020 | 9/36 | $ | 1,265,625 | |||||

| May 2020 | 8/36 | $ | 1,312,500 | |||||

| June 2020 | 7/36 | $ | 1,359,375 | |||||

| July 2020 | 6/36 | $ | 1,406,250 | |||||

| August 2020 | 5/36 | $ | 1,453,125 | |||||

| September 2020 | 4/36 | $ | 1,500,000 | |||||

| October 2020 | 3/36 | $ | 1,546,875 | |||||

| November 2020 | 2/36 | $ | 1,593,750 | |||||

| December 2020 | 1/36 | $ | 1,640,625 | |||||

| 18 |

Termination of Employment On or After February 23, 2021

On or after February 23, 2021, Mr. Karkus will be eligible to receive the following benefits and cash payments upon a Termination of Employment other than an Ineligible Termination:

| ● | A cash severance payment equal to two and one-half (2.5) times his then current base salary (i.e., two hundred fifty percent (250%) of his then current base salary). Such cash severance payment will be paid as follows: (x) one-half of the cash severance payment will be paid in a lump sum within five (5) business days following the effective date of the termination; and (y) the remaining one-half of the cash severance payment will be paid in twelve (12) equal, consecutive, monthly installments commencing on the first business day of the month following the effective date of the termination; and | |

| ● | All of his outstanding and unvested stock options and/or restricted stock will automatically vest concurrently upon such termination of employment, regardless of any prior existing vesting schedules. |

If Mr. Karkus’s employment terminates by reason of his death or disability, then the cash payments described above under will be paid only to the extent of the proceeds payable to the Company through a “key man” life, disability or similar insurance relating to the death or disability of Mr. Karkus.

In the event that Mr. Karkus has received a cash payment described above in connection with his termination of employment and it is determined that his employment termination was in connection with a Change in Control, then Mr. Karkus will be entitled to receive an additional payment as described below, less the amount of payments previously received in connection with the termination of employment.