Putnam Global Utilities

Fund

Before

you invest, you may wish to review the fund’s prospectus, which contains more information about the fund and its risks. You

may obtain the prospectus and other information about the fund, including the statement of additional information (SAI) and most

recent reports to shareholders, at no cost by visiting putnam.com/funddocuments, calling 1-800-225-1581, or e-mailing Putnam at

funddocuments@putnam.com.

The fund’s

prospectus and SAI, both dated 12/30/14, are incorporated by reference into this summary prospectus.

Goal

Putnam

Global Utilities Fund seeks capital growth and current income.

Fees and expenses

The

following table describes the fees and expenses you may pay if you buy and hold shares of the fund. You may qualify for sales charge

discounts if you and your family invest, or agree to invest in the future, at least $50,000 in Putnam funds. More information about

these and other discounts is available from your financial advisor and in How do I buy fund shares? beginning on page 57

of the fund’s prospectus and in How to buy shares beginning on page II-1 of the fund’s statement of additional

information (SAI).

Shareholder

fees (fees paid directly from your investment)

| Share class |

Maximum sales charge (load) imposed on purchases (as a percentage of offering price) |

Maximum deferred sales charge (load) (as a percentage of original purchase price or redemption proceeds, whichever is lower) |

| Class A |

5.75% |

1.00%* |

| Class B |

NONE |

5.00%** |

| Class C |

NONE |

1.00%*** |

| Class M |

3.50% |

0.65%* |

| Class R |

NONE |

NONE |

| Class Y |

NONE |

NONE |

2

Annual

fund operating expenses

(expenses you pay each year as a percentage of the value of your investment)

| Share class |

Management fees |

Distribution and service (12b-1) fees |

Other expenses |

Total annual fund operating expenses |

| Class A |

0.62% |

0.25% |

0.34% |

1.21% |

| Class B |

0.62% |

1.00% |

0.34% |

1.96% |

| Class C |

0.62% |

1.00% |

0.34% |

1.96% |

| Class M |

0.62% |

0.75% |

0.34% |

1.71% |

| Class R |

0.62% |

0.50% |

0.34% |

1.46% |

| Class Y |

0.62% |

0.00% |

0.34% |

0.96% |

* Applies

only to certain redemptions of shares bought with no initial sales charge.

** This

charge is phased out over six years.

*** This

charge is eliminated after one year.

Example

The

following hypothetical example is intended to help you compare the cost of investing in the fund with the cost of investing in

other funds. It assumes that you invest $10,000 in the fund for the time periods indicated and then, except as indicated, redeem

all your shares at the end of those periods. It assumes a 5% return on your investment each year and that the fund’s operating

expenses remain the same. Your actual costs may be higher or lower.

| Share class |

1 year |

3 years |

5 years |

10 years |

| Class A |

$691 |

$937 |

$1,202 |

$1,957 |

| Class B |

$699 |

$915 |

$1,257 |

$2,091 |

| Class B (no redemption) |

$199 |

$615 |

$1,057 |

$2,091 |

| Class C |

$299 |

$615 |

$1,057 |

$2,285 |

| Class C (no redemption) |

$199 |

$615 |

$1,057 |

$2,285 |

| Class M |

$518 |

$870 |

$1,246 |

$2,299 |

| Class R |

$149 |

$462 |

$797 |

$1,746 |

| Class Y |

$98 |

$306 |

$531 |

$1,178 |

Portfolio turnover

The

fund pays transaction-related costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio).

A higher turnover rate may indicate higher transaction costs and may result in higher taxes when the fund’s shares are held

in a taxable account. These costs, which are not reflected in annual fund operating expenses or the above example, affect fund

performance. The fund’s turnover rate in the most recent fiscal year was 27%.

3

Investments, risks,

and performance

Investments

For

this non-diversified fund concentrating in the utilities industries, we invest mainly in common stocks (growth or value stocks

or both) of large and midsize companies worldwide that we believe have favorable investment potential. Potential investments include

electric, gas or water utilities and companies that operate as independent producers and/or distributors of power. We may purchase

stocks of companies with stock prices that reflect a value lower than that which we place on the company. We may also consider

other factors that we believe will cause the stock price to rise. We may consider, among other factors, a company’s valuation,

financial strength, growth potential, competitive position in its industry, projected future earnings, cash flows and dividends

when deciding whether to buy or sell investments. We may also use derivatives, such as futures, options, certain foreign currency

transactions, warrants and swap contracts, for both hedging and non-hedging purposes, and may engage in short sales of securities.

Risks

It

is important to understand that you can lose money by investing in the fund.

The

value of stocks in the fund’s portfolio may fall or fail to rise over extended periods of time for a variety of reasons,

including both general financial market conditions and factors related to a specific company or industry. Growth stocks may be

more susceptible to earnings disappointments, and value stocks may fail to rebound. These risks are generally greater for small

and midsize companies. The utilities industries may be affected by increases in fuel costs, technological obsolescence, changes

in regulatory policies and deregulation. Our policy of concentrating on a limited group of industries and the fund’s “non-diversified”

status, which means the fund may invest a greater percentage of its assets in fewer issuers than a “diversified fund,”

can increase the fund’s vulnerability to adverse developments affecting a single industry or issuer, which may result in

greater losses and volatility for the fund. The value of international investments traded in foreign currencies may be adversely

impacted by fluctuations in exchange rates. International investments, particularly investments in emerging markets, may carry

risks associated with potentially less stable economies or governments (such as the risk of seizure by a foreign government, the

imposition of currency or other restrictions, or high levels of inflation or deflation), and may be illiquid.

4

Our

use of derivatives may increase these risks by increasing investment exposure (which may be considered leverage) or, in the case

of many over-the-counter instruments, because of the potential inability to terminate or sell derivatives positions and the potential

failure of the other party to the instrument to meet its obligations. Our use of short selling may result in losses if the securities

appreciate in value.

The

fund may not achieve its goal, and it is not intended to be a complete investment program. An investment in the fund is not insured

or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

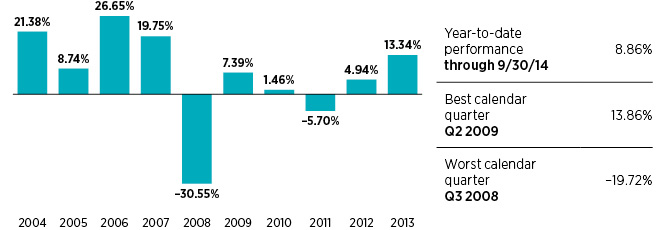

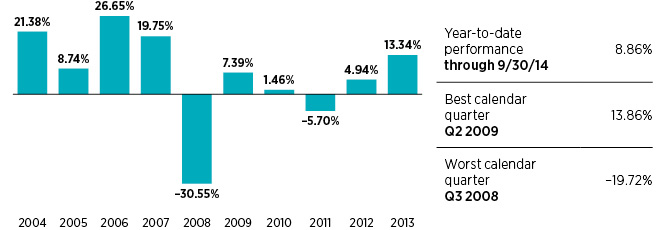

Performance

The

performance information below gives some indication of the risks associated with an investment in the fund by showing the fund’s

performance year to year and over time. The bar chart does not reflect the impact of sales charges. If it did, performance would

be lower. Please remember that past performance is not necessarily an indication of future results. Monthly performance figures

for the fund are available at putnam.com.

Annual

total returns for class A shares before sales charges

5

Average

annual total returns after sales charges

(for periods ending 12/31/13)

| Share class |

1 year |

5 years |

10 years |

| Class A before taxes |

6.82% |

2.87% |

4.82% |

| Class A after taxes on distributions |

6.21% |

2.36% |

4.41% |

| Class A after taxes on distributions and sale of fund shares |

4.33% |

2.36% |

3.98% |

| Class B before taxes |

7.62% |

2.96% |

4.80% |

| Class C before taxes |

11.50% |

3.31% |

4.65% |

| Class M before taxes |

8.84% |

2.83% |

4.54% |

| Class R before taxes |

13.18% |

3.83% |

5.19% |

| Class Y before taxes |

13.73% |

4.36% |

5.66% |

| MSCI World Utilities Index (ND) (no deduction for fees, expenses or taxes other than withholding taxes on reinvested dividends) |

12.61% |

3.13% |

7.03% |

After-tax

returns reflect the historical highest individual federal marginal income tax rates and do not reflect state and local taxes. Actual

after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns are shown for

class A shares only and will vary for other classes. These after-tax returns do not apply if you hold your fund shares through

a 401(k) plan, an IRA, or another tax-advantaged arrangement.

Class

B share performance reflects conversion to class A shares after eight years.

Your fund’s management

Investment

advisor

Putnam

Investment Management, LLC

Portfolio

manager

Sheba

Alexander, Analyst, portfolio manager of the fund since 2012

Purchase and sale of

fund shares

You

can open an account, purchase and/or sell fund shares, or exchange them for shares of another Putnam fund by contacting your financial

advisor or by calling Putnam Investor Services at 1-800-225-1581.

When

opening an account, you must complete and mail a Putnam account application, along with a check made payable to the fund, to: Putnam

Investor Services, P.O. Box 8383, Boston, MA 02266-8383. The minimum initial investment of $500 is currently waived, although Putnam

reserves the right to reject initial investments under $500 at its discretion. There is no minimum for subsequent investments.

6

You

can sell your shares back to the fund or exchange them for shares of another Putnam fund any day the New York Stock Exchange (NYSE)

is open. Shares may be sold or exchanged by mail, by phone, or online at putnam.com. Some restrictions may apply.

Tax information

The

fund’s distributions will be taxed as ordinary income or capital gains unless you hold the shares through a tax-advantaged

arrangement, in which case you will generally be taxed only upon withdrawal of monies from the arrangement.

Financial intermediary

compensation

If

you purchase the fund through a broker/dealer or other financial intermediary (such as a bank or financial advisor), the fund and

its related companies may pay that intermediary for the sale of fund shares and related services. Please bear in mind that these

payments may create a conflict of interest by influencing the broker/dealer or other intermediary to recommend the fund over another

investment. Ask your advisor or visit your advisor’s website for more information.

Additional

information, including current performance, is available at putnam.com/funddocuments, by calling 1-800-225-1581, or by e-mailing

Putnam at funddocuments@putnam.com.

7

%`\5!@@'#_V@`,`P$``A`#$````.-_5?QX```J]TBDB)II

M<6QW=L=RQ75\<[$\P]H=%4.@`"J``````"`$@"L0T0%8@D):3((`!````"@`

M````!4```````D`4F0I*D"(I"DS0`2MI`"``',]+TH``JUDDU=$BL]J7$X[J

MV.X8[B^.=C=5Y5M60(`2```!#UK4)`5``!5%4$J3(4F:Q%8`\5J!0`*`````

M````````5`"H`4%F:))+,@%8BL"(`30HD```YGJ>D`!%9/:)%7)6.>U)YIDJDBM4265FK5$`J`2``:(J@*H``"A4`"0-%60``````````0)`````

M`````````!29HE4D```"A4``YGJ>C`&))JTQ4>:S32>U)YI<3CG4GO252I(J

M(DL%20`0J!6`5*P`&15%$*!48J``50Z!```$``"``0````)```2```D```!1

M-$JD``*%"A0!BH)HDBCE4.K4J!4K(0

M`$A!`A4J5*@@!!`B0:8:8``9#1`D@1(J(`````````````!(D2!,$A"R58``

M*"UFD2))@F"8$B1(!SK4]!4$234DPTUD5FM2::W%J2J3*26I+,55K"MH!T5FKF6KDZ7J]G7-CF9NN;)TRZ7M<7>]?K83-H9&N

M;*X]C7LVA>5O@,NG>1EU;/S0``#IFEW]2V.7CT_8Y=Q&78DZW4Z]H^@X3U/(XG)J7,3M&'H=8T/08#-I\LW_`#O1

M]/N<>Z/EL;?#PWJ>/J5*@;!AWNS\[U&?L9P<1Z?C:E

M3T%R?<;-@W["^+==7K$.3=#R_ICB?1/GKZ[X6#VKL.'>[-S?5YO!O]&T^[AL

MND')]_S&@[G!T_9Y`!W[D>ZV7#T;"V+<];JLGDW0\MZQ\_\`4OG![3\\JD,]

MAW^Q;G!PN75X?U/'$@[]Q_=;)AZ%A;%N>MU63R/H>

M8V'#O>;NUX`D`!00"A1-$Z-@[985/-:S$A(J]JRS656::5FLJ'5:T-,`Y5`J

M```5J"LJE1JPR!``R*HJ,ED)4Q4`0Z*H`A6(=4`!I-(*0I"@%0*R"L@(1P`"

M1`")CFQ(D`*LJ0`*%)-(*"IHB@JU``T?#VR#3#35AQYK+-'FLJLTUK-9"10&

MM#3`,,"!`""!5OVKVNP:'I>>[7&W37ZDD1B;X>6;_F]D>/[J2,N@

M[7#V?!O=:T?2\@W_`#7+=[S>O9.?)-26]:G:[%SO4\_VN-TW3[W.=SS^NY=#

MH&GZ#@76\&2(!Z0X_P!!DC+H&WP-HP=':<'4Q]L/.]S@U0D'5:8EFKS6566:U5DDZM4!6336L@8:`$BL$1F\

M>WB[ZW1-3NX?)J9C'LZ_FT8)K@,NBRM1:SLF'U@ZUU6]E?$0S^+?P.70

MUW-SP#-8]S&6P=$U.]:VPVEL<28)KJ.QR@I966P8=\KDN*VL[8UL4JG7LV@+

M`2(4(TUM`42J=*P=F2U1#$B&0TQDHML^/9D1):&BKS#(JBH!)I5F*55DT0Q6

M`5*`@0##`500(-$R36L02`BH-!H5F*Q-%6`>(:8`*Q),"7K80%`DJ"8`B0JE

M9J`4(XM604%`:;)`%DL@$DR!"SOCUK+HQI1:LP2HD-.P]:LQ4:B&DZ&15``!(@``%2J*HJ.5*55!$BH$"JJ'F*Q`.K4>H`$5@ZH%3V5!6J'

M@0```D"R5("1(1P`D"I6TB"+$B!)9*`BU95E#6S(2;$B0`BU$ZO3I!(J`--9

MD%JNB16I):"*DF&`9%4(LR*HJ@```"HRK%*G*HD5`"HA(J("H]:O"H`.K5!`

ME6#S0J"0````!"@!(E19(DD0`E0182`!'(E291(!1*+`2+`!%J)U>G29#(`'

MFLJ"U')%:CRK,"H``,,`%1E:@@"!`D0:8:(!H-6'F*H`A5#Q4D#UBL1(`#*M

M6"1`'5J@&&````$*``"+42!(`)1K"0!10E':P`"+42!8`42B29UBG1=``2E4

M>8K-6'0R`DL%1`"0$!48J`%450R`($`J.BL0]0.K5`!6(>M2R2!$,$14:(=4

M"!!D-:H5&@L*0K*I6591@`!$QQ8"1(`HE+6H`")$$S':2!!9LLR``%$HD2MF

MNUZ``#3$DU9#35BHZH5D\A4!8!`"!%1BM1(D5K68:2U,5'*Q#UBH(=6@U18U

M(960(""(J..I6!4`27H0($`J4``"1("2ULL2`$BP$6HE"@3),@"R6%$I>P!0

MJ42BP!0UQT``))HPUH95@)%0!I-(````!`@B'A4`0($`XU3@AXBH(%7JK`'5

M9#U"H`XZ&BI4`.K5``\16!*@LS0``"-<``"PE&N$8`"1)*.01KD@)1R85<`H

M)+7XZ`"&)%6"]>E:?<^D7DOLX6-L7GSJ^.\8^@^8Q6K)8"E#)TV/;GF_J7A+

MT_R6H`""(K$`X`@5!JG@X*N5B!4)*@*GM5ZPP14*CCUI08"J'5(/"L```I))

M$@$QK``4*E)E+6I!)$"0D2LEDL65)($LI(!<*"!:VOUW@94)45D6KW;F>L^S

M_P`]_2OS&]G\,OZ9O?'F/K?C3T'S/PYZ3Y5:7QZ_FTL_BW;RN3:,/1^\_P`P

M_6?P+^I?D72MCE[EJ]/3]GF=FYWI^6[W`UG/H/2>NZ'H<]BVN+]'R^.O@VK!

MOQ*;GK].WG'S;Y?-?5/7G!^BZ/MM;J_#?Z1^4/I3Y#[IZ5Y'MM6S<_N?-]9YB['A-PP=#M7.]7\F_%1H50*U'```H(`)HFJ4E20(4D)%@",)DM-!!4JL%+$

M``2+)M^T'SW]*_,;V?PS(TS^_/+_6_#OI/EG9>?Z;

MC>_YSY_>J^.?0'ROV+LFAZ3Y@^R^&_H6^5_L'\W_`-;_`!8'Z(_E'[*^*_T3

M\P<(Z?DONC\T_5WS@]=\5\N=KP/H'E^P>'U&\7]Z^8?L?@_J_B?0V1\N?9_`

MOI[XW[QO.MU_D;[O\V_27R'W3<=?H_+'VGYW%9*@!T2TJ2(JPR"B14&%&0RM

M1X$``DLE`!%J)8!0"4:Q(F5%!):2"61KT`!)4D)%@CLCFP!AVVX%!@M!->Z\

MSUOVR^=_IOR)WOG>*OA\V=?P_D#O_.?K/X;]"<>WO/?/CU?QSZ$>5^Q=@T?1

M?,'V7PW]"WRK]@_F_P#KGXL#]$?R?]E?"3Z7^4.<;G$^V'SO]/>#/3?)O>OE

M_K7$NEY;CF_YKZ#^6^Q_,'V7PCU'Q?>ZMGYGSE]9\3^C7D_MFVZ_2^7GLOS]

M[]\Q]E['S_1_*3VGYUJAQU0(2Q0@#UK($'5J@`"2*$)```%%"1*-<```"-<"

MQ19*M4!;(IN``J5M%%A-2&UED`8AMN*5*A:":]UYGK?L/X+]&?`?ZA^1@`/I

M5X_[?Z5X_M?FYZ_XI]*_'_;N/]'SGRV]I\)_1%\H_8OQ7^A_F;B/2\Q]^?EW

MZW^$/TO\H\%>F^3_`%B\/^@?BS]"_,6JYN?]L/G?ZA^5OMO@

M/J+B^]U?/S?G-ZSXE]&O)_;-LU^E\O?8_G[W[YC[+V'1])\I?9_G1AAE604.

MK5#1#5AAAE6B"!85.K5#E0`!10`C7)$@*BR@BX`A02UJ2"DRD6+"01KT0J:%

M916L`$,7?;!1@"]1'2M/N^]/,_5_F+[+X6`!M>#H_3CQOW/(4S>;NOXM)IX<

M])\L^C_DOM7>N7ZSY;>T^$_0?ROU_P":OL/BFI9^=]$/*?8?-'8\/O6KU/1.]\Z[)SO387+J>4>W\Z]8\+Z'G:;?C?O?+O3_']_ONMUO$

MWH/E#Q#@/%*U50ZK5AHBI4:$D4``9#*L-4($DEDH%$HL```*E;6H5$*%))-B

M2I58D6*E5@0H+:52`4F<9;:```O0`D`4H!0`!(D2``%"H%5&JJ!6#*U`>%:T

M8D014)(AD,-56*U0T))H42*@$E3*L@`JAXK6#Q4`!5ED2I,HL```(M1*64`"

M@DV+%65($H[7`(P([6``2UL=.R``3!:H!(!00```2+```HI4:%8@15#0J`R&

M16#U@5:M6'15`-4\0\U($B$E:5'5$@(H(L%)E)L2`@2

M"-<([``%2J2Y(M1*2J+:Y!;%`19;`"BV-OL@`$P6K4H.5`C`$B!(D2"E"@%"

MH%8/4($50PQ6L!(AHAHJP15D,25K6#H(J$M8=6L'@*O"2*A6(I*L)%1$@0`E

M02!((UP)4A4)42DRLRL@(LEE`LCK:DRE@"1:.P*39","LS2;8^^<0)$%A,-4

MMF8Q[7OOS'UKT5R?9X.^KY&[WSSQOW_F_L?@?2?5G#^@?(SW?YW25``#Z?>,

M^Z:IGT/G1ZSXXZ*UAAH`($,C[G?./U5\G?:?G_B_0\I(CZ&>6^Q^;.KX?AG2

M\C53UEQ?HN%_0_'BL?:_P7ZO^9_JOS_["XGU/ENWYW6,

MW+]3\?Z+\M/6_G+VCP_K7AOO_&7/M%X7]*>58`2H)`D2)*LJ

M:%`%69"S9)4D+(4D2C762R`FRI4)):U!"@38FU

M#/S_``?Z;Y/MV'H>L^%]#^2?N?SU[%X/TCUYP/HOQI]]^;([.NZ'HLG7/Q/H

M^9AFOU0\5]YU//SO#'I/E^VX.AQ;H>8(C+8\W8]#T=C;'QS?\TDT^_GS+]?KC

MX.?1?Q[IV7E=SY_K>0;GE_IIY7[[R3<\WY$[?RW=-;JXFVK]Q/!_L#X6^_\`

MQIJ&;E]RY_L>0;GE-=R3Q=M6AUG2]9,MR'=\K',$Q22)!

M"@)%DLI(6H(4DDWH($BUZ"%)E+2"BI%@Q^7*PJ1!82>KUMPOHGTX\?\`=^G>N^!]&^-_O?S=]?O"_HGKFCZ#$WPJCXI_0_S5]+O(?:

M_1G)]?J^;2WG6Z?)=_S_`,;???G/ZN^)^\[[J]7J.EW>+='S'R"]S^=_O[\S

M_6WQZ]Q^<^&=+R3J_:[Y_P#J#P;Z+Y-Y*[GS5JOHUY;[9MF#I6%L7OWSGU_A

MV_Y3Y?\`KOSW];/%_I/Y(>R_-?N?@?6^2[?F]5S.[OE.MZ?IOCA[;\F>T>']?\`

M1W,]_K^32XYN^5^=/I?@=0%D22+4F"8%TE29$A')5E261A,EK!&*LMA*,%A-

M"PRY9",),+8]7T4\G]G[%I>A^0WN_P`[]_Y7K_K[X3]%!\U_7?%I(GUYPOHW

MA_T7R[Z+^4^Q?#/Z/^8(+4^Q'@?T3PWH^8WO6ZNWX.A\?O=_GC*8\_WU^:?J

M[X]^Z_/')M[S_>^;ZFVG']JOGWZ8_.5]4_&WWQ^;?K'X]>X_.?#>EY(A]L?`

M?I[P9Z+Y-Y'[GS:5'T;\I]LVS!TOG/ZCXE^@;YM^Q_SK_3?Q$17[Q_//V'\D

M/9?FOW/P/KG)=OS6JYN5ZRXWTWY8^L_.'WM^?_M#\]'T7\,NK]TO!_LOY-^M

M_,WU0\G^DOG;Z/X/P;H^&^C7F?O_`#[9X/8M/UFIY>9X.]!\4YIM^=A```C7

M`D61@D32261KA222%B9H)*.;`DVH$R2C+?+E",+)*DLK#V#P?H_TJ\C]M^#?

MTS\GO%L_CW?J?XK[QYWZGD,-DU/7?#^C>7^SX7T-RO7_`!]]Y^>2KZ0>2^S;

MOK]*&8T[9Y_S;];\:*ON5\Z_3OAGT7R_Z4^2^S_/OU'R.UG%]0O'?=/SO?4_

MQ[]Y_FWZL^._N/SKP_I>1K$?9#PGZ3\J]GY]X=]#\KEBGTX\E]WMU?`'I/C?

MZ!OFW['_`#J?3?Q$T5^\GSS]A_)#V7YK]S\#ZYR3;\UJV;E>LN-]-^5_K/SA

M][_G_P"T/SS_`$7\-2*?=+P?[+^3?K?S-]@?&?JCS[T?"8'+SZG`.AX?S=TO

MG_NW@?;/5G)^F^1^S\O^;WIOS^``$:X`22R@+4$NC7!1;"))LH@E[!&N!8LE

M+?+E",+)*EE4OZ9OM_\`.OU)SG;X_A?TORG/XMSZ3^1^U?/3U'R&*:>N^']&

M^6OL_A7W,^;_`*B^5_M/A.L9=+ZN^*^\_)#V_P``]>OA+](_+/<.=Z?[6_/OTM^=/ZG^.OO/\W_5GQU]

MQ^=>'=+R;J^X/._4?HGY;[+\P_7_``C,XMGZA^0^\_'GW/YJY'N^:_0A\T_9

M?QI]Q^7^+;_E/MUX']7_`".]E^:_=/`^NF^7]%\D=CY7ZAY7T

MKB&_X[=M?M?0?SWW7XE^X_'Y(D`1K@`+8LJ)$I8BU)E10*6NHB5M-)E%@+$D

MJ8,N0(Y-)J@I*L,_BW?>_FOK?H+E>PU[-I^2.W\]\?=[YUZ"Y?K^Z\WUGS]]

M3\E[_P`KUOT'\M]T?/?2\M7/WGF>KV[#T/GOZCY)YVZ

MGC_HIY;Z[Z/Y/M/+':\%W;F^J^4?L_@?TO\`(_:_!7I/E/-]OAN25I[B\]]3

M]9\7Z#CK8?%?>^6^6>Q\^EK7Z,^7^W]UY_K/F)ZOX#[CX'UCPUWODGI+F>WT

M?-R,)DTNY<_U_A3O?&/HAYO[OV[1]9\T/3_GSVSQ/KGB+M?(-4S\KZ"^=^Y=

MGTO6\.W?&>!/0?#/3'-^C>N>/]4N8R>#>_\`%?/O1\.`%@1K@`!'M:@AAZU=#JUH=%59*Q)%0DK6H\)*TJAZU:(=#0K"J'5"I,I6(*P`

M4M-9FA"M1(`2CBY(DH%)),JDDEK4B5F5DHMK!&L6$D65-1)F*UC*"*;5@```

M1V$B)*V6Q9+$JL5`"+4`".XJ(`PP1!6&&&&5*Q(,JZ'BM:G5:L2Q6J&K#((>*O$,K6J16I+6M8AXAJU=6I)4ZM4$)*U$!(J)$4$6``2UJ3(

M`BU$K*DJ"I69)1S<`CM9)FA02U@"->.X*+H&P"-8"PD4=(T^[]'_`"OV<`(G

MQOWOG/ESL^#CD0C7`(U@"@@`L)^]OS7]3_(/W/Y^X?T?+5&@5J`2CQ!%9"L5

MEK6J'J:*R(%9*PR&B)*P*R$E*,-%9(.K5!4\5J@)``$1I``5*S8L`$6HE)4D

MJ522CM<*"6LDS05*S-)"462RDRJU"FP"B:HCO8"'<^7ZW[/?/_TK\Q/9_#"!

M%N#]+RV&R:G.=KD6\UWK6[&JYM#8<6YA9;?%#-X]OL>AZ/C.

M_P"=^^/S;]3?&SW?YYX1T?*50Y6H0(J3555=%8AZU8:M98AU:H:M6)8K6#5I

M(/6LB*UB2(94B&@R&5!RM0%D8`!1*+$EDTEB5FRBS),Q@1WN@%%TLI)4JE;!

M*K4DB5FRR-@``DS2TD.Y\KUOV%\+^C/@']0_(P%+A^D3Y/\`M#\\7U'\@ZEG

MYWWC^;?JWY6^S^#_`$(\O]>W[6ZN&OK=YYOJOC)[W\Z3YM^K/E;[/X/\`0CR_U[S?UO&_.WU'R+ZH^-^YQF6IGUW+J?+GV'Q/;\'1

M_0;\Q_5WPZ^A_FGA'2\L55B'5D`"M4JM4.JT0U:M"2M70\5:*LB6IHJZ&I5B

M6*/"L5>H488DB!%:PZH"R%)$V(4M"+!&`)%EDM@LMB)1:@DR6LEE))%J2C"U

MA*%%DF4M+;4%0`"6M27<^7ZW["^#_1GP#^H?D8@5D6_2)\G_`&A^>?Z?^0]+

MV>;]Z?FOZM^5/M/@WT(\O]>\?=WYYX>]#\S^E/D_LVV8.COFMT_+?9\1X.]'

M\OH?H/\`F/ZP^,OO/SUPKI>4($&B&5D`(-$.AZ4,I)]M6"`!292T]TYGK?L)X+]&?`7Z?\`D98$!?\`0-\P_77AST7R

M[E6[P_K-XC[]\5OH/YJ^A'E_KWC[N_//#_H?FGTH\G]FVS!T.-;_`)SWUYGZ

MK\E_:_!_1O+]?]//(?:?A']&_,G".EY9ZU`A(H$D`(.J]:O$.AJPT1(K)6'5

MJH]30EK5HHXU8F5K6KPJ@5DJK`1*JU:@!,K,HE%JE`L25`2+4$L%EDB4M919

M%KT$*+1W(":+)::+(!)M@0H`$=K=(T^[[R\S]7^8GL?A:!`6],\?W/OWS/UO

M@'3\GDJ;'BKT'S/U)QO=\$Z7EO.75\AZZXGT#-X=OQ=Z#YQ]"/,?6?3/(]IY

M([?A.J:?:\`>D^7

ME75:#Q#Q62M61-6M4/%6B):UK$2(>M98J\14%6K#0JB:M:H$``L$5I18`6Q9

M"18$*2I:T2566Q032;16E4TDE@FBR3*K+*A<;=4644``CO8H!"@+H4*)18(U

MD*`O2"2`$6HF.HA63E4/%0*F&F&BK0DBKQ6J'HD5>*M$35JT1(J5B2*O$2Q6

ML1)6LL58(B14H::R1#!%20"P1E)E(L2))91(L2H(4O:)94K8H)6UHIFB02RD

MV$QK"8[*)N=O'1,:R``"3-(D$*`NHB42)H(M01(M'42)*E5@CJ(`$@ZM8@@%

M1U:Q$U:U)%*U2Q$D4:(>*RUBJ'K5HB2(EBE825I+%6JJB14J9#JN%8(DM4FP

M(4$6HDD22;4B201V)-DFRS)*-*S-)E)E9D$F:3(F*;"5E'-KO;Q`DS$L0`*"

M38@I25(LJ8TJL%!%J")6++46$HUP".H@)$!(/6M4`##*R5B2*O%:Q$D1)6KH

M>M9(JQ)6E8/%9HJT0]:R15JPX\4K"J'5D@55*%)5L0H*LJ0!;2JU"@MD;>(*$%KE0`")HD*"+(E$JL%!%J")6++`L

M1:B06"P%B`"H2#15H@`D16M98AHK)6*HFK5U6K$D5=$E:UB)(K)"2*-6'BCU

MB0:*M$!(I6IH5`4I*LEDJRI`%F5FU!`E':U$I-BQ4QS99(FDR61KA24-K430

M2UKS;Q`%O:X%0!018*"+*E$HL%!%E%2E;4D"+4F0CH$DS'96IX$5;>(`BFR6DH#"X.GJ&IV.

MC=+RU"@BRI4C7`(UE%2E;4D0696;)52`LMBR**CA$/$5!%2M8DB,1AW<[FYS

M1$U8:*M%9JU:(D0]:RQ2M8DB'K61$E:21%:PY(H5,JT14FBH+,Q)`*3*18L)

M42DVI)`*3*3,6Q:W@Z&1MCZ

M+TO)Z5J=[K?4\GY5\W]0W#9YEY;!E\NOHFGVMRV^+C*9]TV>5RWF^K@K'=NQ

MX3B7']SV_L>&X?R/;]`VN#Y6X'T_T9VOGG9.GXCFW,]AJ6MT_2?;^99.^B]:

MN/2DRK5B2*O6&BLE8FBA$2#JTI#H=5H/%:0:R-99!1*+4"PF46H(%I$H17O0

M696;+*.;4"4=KK)4HFEIH)-KS?P%;!05:B8SF?*]KYPX?T.YOK^D^WX'@'(]

MM'$JL3%4=GZWC]>KDYCR/:M;%@L/1R5]?UKZSXWX;\3][](>C^8=`VN+YX=KPFGZO8YYH>BWGHWWH^6YKR?8]-Z'F<7BW,KL\?N

M/5\3YF\]]1=7L_3\3S'F>QQ^/8]%]SY=N&QP9(J]8DBLJK5K*AZ0T4DK$RM:

MU<:M2(L5BH`+4DEI$1KT$&DLVI,H`6L@DV2THD6CNHE$EB39+2J431-)

M):UYT-<_T^@:7?[;U_#\AY7M=IV^*HJRE$[+L-_)?:/;'M/A>+U.IXZ\S]9]%=WY]=VP;[O^WMM5ZU>*RUB16M:2DM:M%):Q+%7K5X@"M9"1#TK54`$B4

MF:6E$T(P"U@694)E9F-9)E+!=+*2C6+*)BFRVM&D*22UKSH:X%;$2"+*E``"

M-:,%E2B46!4QI4CKUTL`K8B:)1:,``P^/=R.34HFBT8BX8

MG'MY&^LDHZW(+:8HM2`L"%!5E2`%0.K5`/5)%:C*LB6E71)6LBDE(>*R5B56

M2*M6CU3*-6LE8FK62M:JUB'JJB15PBH$A911%B9H4DDBUB)I8D%FRVF-:.X2

MDV6;))"DRLV6;1I65)FDSD-_762V$25L"+>1O*_:.T=GP?(>-[WI74\=LVWQ

M-TV^+PWC>]\_\3Z'Z]]-\EX'Q/H71.CY7;-W@[GMIO1_*:`D3&`JRI!%G5*@D5$$'J=#(>M7BLT5:(D4EK#5K)6)E7K5XH]8EBL

MD4>J:*24JR*Q5Z@D4DJJK44%EL4594@$=A(7)1BVM'-EF8["919)LMBBS:DR

MBR)22VD3D.AK@EE)%;$2J?/'`^G=)ZGCM=U>UA\.]O'0\QNNWQ=:UNQY`\I]

MGVO9Y?JSU/QWRAY;[#WOT'S7T^VU\'L'UGQF@+**`B]"

MB46$25J%4.J55'@RKQ#UK+%7B)%9JTK5+6DBLM:NI)2&B)JTDB'BLU:/`BLE

M8!U9*PZK"BK4$DLRJP`EE)"PF,6]HUEM*%+2DVB6+%DLVI,HNI'8LS1.4Z6N

ME01V$6(D.$<3Z+CD>F^0;%LXW?

M>X&_]+RFY;7'QNOU/./&]UM^UQN+\CW/LGUGQ/:R%]=".+4B46C31(E11%J1($([72IBJ!#HDB

MM0J9#(EK5XJ\1)%9:5D4>J:*/6LD4DA)%)*Q+7&]$S')$-56(>*UB)%9(/6H

M)::3*"I18D2594EH)F,69CM95J2296;0VL"R6UE2MKH1K4DMF6Z6N2"@D(XL

M1-$HM&`$:P1BKJ1K42D642)2+*F-94B5%(UR`43'-DJ!RJ!5ZI4$!62%8K-%

M7B'BDU:R15JQ+%9:T:(FBLE:M%9JUEI62*3*M0$E:!(H]4L5!4I,K90C7`%M

M*K`6))2.UTFU!+2JT5[4%DMI59)LLS$L229R_4U!8`H0Q-*V!%HTT`1-$H*N

M@BU$QUE4J1Q=4HLB1*B)18@02;*E(`#E8@B)(.BJ!$E(D4D5DK$D5EK1XK+5

M)6CJRTI+$/6LL5EK1ZUGK1X")*U!U9*1(K4H(LDJ6(M1(4$M<`+(Y1K)-Z2C

MN5:*UZ259;%F8TTM:-:DEBV7ZNG20L`1"5L1*I19`%2J5%6C2J56CJ591(LB

MRK1I$QBK+$DB$GII<)$@L(4E;!&NA0H(LHJT::)19*E6225LBRK1@M&42

MBP42BQ5&"U`16(>5:B(D5J/6KQ#J35J\1+6KUI+%9*Q-6C1$JLU*2166*O2L

ML4EK62L.J$E*U1(AZ022UE$`2UJ3(`BU)FDJ$-[*LLRMK(F.\I$TF4M9;(TK

M-EF5F46ZMH_1Z2I(2%(1I("52J:`(D%2B01:D*)0I%E%64$J4%6!4T204$T*

M%8ABH0J,K5#5AD21#1#Q5D25AHAXAXJR)*U9#Q#5K)$-%7@RM1JP#H:L`LR3

M*`"%FQ(*)5*R!9FDRB:6FB5DB:3-)E19FB:2695;W/Y3]!``````````````

M``````````````````````````````````````````````````>SP```````

M````````````````````````````````````````````````````````#HX`

M```````````````````````````````````````&@;FAR?H\W>M+?Z[S^D``

M``````````````````%0```````````````````````````````````````#

MQG[#POFWU/D=.WN3Y&Z&AZ>\?]'^SWSGZ)9Q;PP!Z/.X``'-RW.H````````

M`````````````````````````````````````````````<&[/!\8>\^=^HO+

M^NY'U?/Z+;)X"[W.^C/B?=>P/)^G_#&>R#RL?JQ-Q/8AX7/G`>5#]'QR8A.D

MG>CP.;@?0@^

M/SU'T>/I*````````````````````````````````````````````````0%B

M6XYFC5C9#1#>33C=3#&<,(5,B:0;Z84D`RQJ1LA>````````````````````

M````````````````````````````````````````````````````````````

M`````````````````````````````````````````````````````?&3Z)^5

MZHD14$"`<``=4``$6198(LI&LJT<31,2U$QI2)C66)59$HF-98F-98F-:--$

MK$JE9LE0*ED`PT0T0R)*UDBLM:S122M9:TFK2>M):UFI26M)ZTEI26MLKK="

MYKEFKD:++-$F([41%M?%99=.WR8A*)6UEF8IFEK16LMI29CFRK):8YFDDFT<

MVI:4F53Q_P!-\T965%015#@`#JU0``%$Q++%H8LLS%6R6O'68UD6B3'%HYF*

MMT6CB46B61:*)B72+1IA75*+)64FR5D$6H.JPXU:O$2166M)Z4GKCGBDU,=Q

M6EQ3'<4I<8\=Q3'<4QW&/'/6F66MTM6.:QVQQ36WOBQV;4L,^B

MEH19+629AM9+6CM:*UX[VCM,:T=KQS*VF.;16M',K-EM.[=3C.K*@!6HX`,J

MR````$6B62LQ+JF%=4Q1:B85XXF*92MH9NE95:%=$Q19)M#6ZD#(B56CK*+)

M$A&L`.K(5A)6C1$D4N*UGICFK2:N.XI2YICGICN*8[BE+C'CNJ8I\=*UH[7CM*6F*;

MQVE;3'-HK6CF5FR+;OUN+(I(`*L,"'15`````!"NL6ABRS,5;I:T=9C61:&)

MC6C3$O'6RK0I5:)>.)BBZ)A7B6HF.MDFR5E4HD`!XJXU8D5DK6>*34I/7'-2

MMQ3%.MQ95&`%6&)%`

M```*HJ*D%6B2E;1+HF)=8F%95H5HHM'*.MXUXXE$Q+HM%$QK1Q>):%=4QULB

M5BT2U```'K%8B95XK-6D]:S5QSTI<5QW./'/3'<4I<4QW%,=UBQ7-,>4U]_.

MZ?5NL>:>MY*W6U(9A+4BFMODPV&76QVQH6>36CNAFZS:.\Q6O%>8YO':ZW0+

MQVLLS#:RS:*UEM*+;QUN),K4`58=#J@```.K5"+42$:T:T5;(M$NDVBK*+1+

M11:.9CB8F2.LJM$M&M'%HEHXM&M`NJ8ZWC31:&+4```"2E:DU:R*3UI-6D]<

M=Q2ESCQ7%*3TI/'=8L63P;N:F19K%:LT^UDL&U<4R3TR!%:D=Z0S6*U+3)AM,NMC<^A99=.&UHK72TQ6O%>8K6

MCO=%HK3':Z6F&UEFT=K),I-M[ZW"D`$")!U:H``"J'5`)"-,:P(M$M%6Z)CB

M\\5K):T5KQ3:.TI:Z6F&UDFT=Y2

M;)-M\ZW"<`5"0D4``"J'5`&&`B2BP0KHM!6Z+1Q,:\2RIC6ABT:8JWA65,47

MCFT46C6CBRVDF:6$J6"4FU9A`32)$5H(FE12*T-BA\43TQ7-:7-,5Q2EQ3'<

M8\=UCQW>/#>X9V#3[.7U>A&)1,,7ABR)C7)DR0UU;1&M$M%6RK1I19%J)C

M!8`%9*JHDBCUK.K+2KX8KAA\$28*W%,5Q2EUCQ7>+%>X8S^GU\SJ]&\Q9[BN

M2>F1+8XI1VI%-8+X[7)AL\NMCL^CB]CGPV)DM%-H+7CO*6R1S,5K1VM':T*ME6C3&MM.KV:1;=]#T/->EYC9]7KX'/S[#)K8C

M/SY:6OL>:2D+;$3J7-<DQ%-4M$=JPVQVF3!9Y=?'YM3&9^=9Y<$=[Q6M#>\=K16LDVBO:.UH[6CFT

M=ICFT5KI-N@=C@B!`2#*L@`D4`&&!`@``*+0KJF%:&MT6CBTT=K0VM%D

MO'-HK6CM9+3%:\=K1VE)M#:Z3;H'8X(J%1QU:H"J'5J.`*@````J\*R)AB\-

M;I-HXLEK->'RUCF8UHXM!6ZIZGR_97M-GCO5\AVOC>ZX%V_![)J]CNW#]]HN

MYQH"\ILI%NL/J^SR_37E_JMO"SFN-O@LII#%L=;%BLFCBL

M_)Q^;E5R<:YMP[+'L<8P^Q[[7PVZ<_IW.AL7&G.3UMR[QY;FMW2B(58K52T6

M]\=EEUK/+KX_/J8S/S[/+B2UH+6CR7CM,-K1S=+3'>T,W292UHK7CM;H'8X`

M@&&)%`!D,JY54```!P$!,:T:T*T5;Q+MDALL4E&O$M$M&MLVGV-9SZ/HC@?2

MNWE^6^HO-_48D^?NUX7=]+O><>[X'UQY;ZUF\&_LNOU/'/J?D

MV/M@ZQR_73TS;1I]K7;8LG3/9HP5L..RZ4%\6.G!8VPXW+S;3/PZY_)VN/+R

MO#ZCID>;Z%JUY'E]1W3BVVWETAP8[BMYJV6T0JQS$-J17K9Y,%IEU[#/JXW-

MHX_/JPW0VF.]XK6BO:.;QS,=[16O',I:T5KQVMT#L>?`'&0ZH`ZM42*@```,

M,`HH)B6B72TY%MV.;3@9$$7B6]'^=^I=;Y7L>`]OP.D;7'TG:X^Z:?>O:;/-

MM[@>P?+?7?.?5\EZT\_]'>,G%.KY+5<_.YUN\3FN_P"?C62'7N5Z[9];K=6Y

M7KM_0.QY\`D&59`!(I4=4```88"J*HB6H46W+

M3]7T?F^WXYW_`)I@L_+C7A6C6]P>+^^8O)@Z)H^A\X][YUPSK>*[KQ?>:SGT

M;FN>ZKL<"Z/F,-K]''=/R^6T^UF(S;/@Z&(R:W,=_P`]&O:4R6FGU]PC/GL.

MUZ#X?T"WKDUZ^N]L>$V.9$BWBUG./$1>WMK667G:]F\]7)Y^VIDXM3V4#)=U

M=:T\'6M'%L>GGUYCZCRM.VM1%8;Q'-+:^.SRZ]EFP6.73Q.SH6>7##:T&]DFT5K1VM%:T=[QS,=K1VOT#L^?!AAU:H"J'59#(``J,5`!U*B+3QF]`^;

M^W]4V-(W.+KN?0T[:Y&3P[_J+SGU/TQY_P"E\$['

MAN(=;QUI+UMYGZKY"]!\ZZ_QO<_/_O\`SCT9I=[5]3K=6KGX'WO`=@TN]YI[

MG@\9CV='T.UBL.UF<^G;5R[?K=+TAH^CV3%NY*+Z_;#C;X;*^#$Y-/&H2<6/

MM@U>^'D632B3M[D4KFT]U&BT\1ZHX./T'Q;\VW*WFOH7V/!#:J36VOCM,F&R

MRZ]EFU,7L:.,SZD5K1VM%:T-\D=ICM>&TI:T5KI,Q6M':_0.UY\&&'4J`R&5

M=%4`##``#JU0&6ITO2OE?O70]#TV=KFS%,EPKE\>UI.[P-2VN/PKL^%Z!H^A

M[[Q??QS7C/3\EU'G>F^<'M/A&I[7*]2>8^M>E^-[OY9=CPWH+#T/2O.]5Y"Z

M/E>@8]K3#O&KV?EAZ+Y=)-8HM'%B9JB17+US>L^7[+<:;-BK@+X89I86QX*^

MGC9KC,FG%?6T2V#1+875(ODL77Q>?0Q6QHPY)AM:.UH+72TQ6O#>R6M%-TLBM>.;]`[?GP88=2H#*

MLB14`88`*H9%4!MVKZGUCXW]&;'3+E49K'GV'%MPVP3'ECTOR?OW$^@>?^W\

M_P#'7J?D.6P[^T:W8GKDU9/GGF^MR.YP_9VMU,!SO4^+M[SOHG1]!L]-G>L'

M2V[%M;)CV9DZKDU?$_4\AQ[H><@B]((F6:^FN9ZWJVOU;"^+(UO@YQX"^O/,

M6%\.(MK6$UTS-S^7YN7/&.RC-2)O:7C7RF.->RY(YCK/-GIVC'1]*,3;4V#3

MTBV.TMBLLNO:9=;&YM/$[7/M1=+S'GB+^PN3['Q1[#XE]+/"_H37LVEX

MXZ'G?GMV/%=DU.QKF36YWFT4BWO?B>_[KJ=OGF;1^;'HOF1"&+@#(1/M7E>U

MR-,U#&337"UDM,5LD=D2\

M=[]`[?GP88=2H#*LB14`D`D4`*G4^1].]5>3^[YFV"]G%E(9W%M9FF?&Y=/!

MY^=YM]!\P:N7U;YSZOMNMUL!FYZ&-R:UW3/BUCA96IB;8K.V+#7UKE7C^UQ-5R:FSTRXN=?#HAC/?4M

M6)1.2QL7DF(V'!;2]EONK3N?%Q[_`,[E6F37LLNO99=7%;&AB]G2BM>*TPWR

M0WLDVM[W29BMDCNB7CO?H';\^###JU0#(95U:@2`2*`'4>3],]7^2^]9+)HY

MVFQ>3AS>/-M&#I8S/SV4LLFMI^SQNA:7H9D;-AW\)DU<9DUI8R7U,]K-6C);

MS3S!V_!\@Z'G%KGX+H>@O(OY!['BF1M6WR^UU>1[MT6MJ2UR8B<5O:N%OJVU]7&VPX.<7,MCDVK'+%2+7.//C

M[6OJ3<5F"R"9L[*FZ:C6-AL.OB]+^;1Q&;GYW!T.;=#RGC'UGQ?OG&]]G<^G]CT?

M0_/?L>'T#+I]VT?0>=NEYC4+ZU9![+XON]GKLXV<>N7UEDDTQ$TBFNL9-+%9

M-+E>SPR$ZD$9(8O<4R9"EH$D6NJS;V8K(DA%,XZZW6W32P>JO.\-[QS,-KQVM%>\-I2;1VOO__R\9;

M*:8VV'$7PPS6P5Q-\/+<_)U'9XLBM(/$2Q0+[%F6N>VF7B;NEI:K&]HIC'7F

MTLQUYI2^]:6IZ?X'G+/+J8?;YMAEP0WO%>T%LB6F&UXYF&^2*\QS9+6W[N<$

M)*BQU:H`)%*H=`2`7[8[=Q/JW*>[\PQ&QR.G\SV/T#\%^EM@Q;V'V.3(J\UV

M7#NTOK[%K]'/8.AIFWR,;?!@\VE>X]B@Z%,:\:V4

MQ;F+OCL9C6M;I;!S?5?3_P`Y].\5>E^8;-K]/RIWO`V^/):QEL\>6UKEM*9?

M6/#^@9G%NXRV"UOBQRO*-CD)->:;GG75(FL1N6#K8'+SK.<6;C=P$X,UK9($

MQ+.C&77^.V)R+JE]6SD3#%^QM3MYS%N>&_7?#_`"7Z/Y5])?"?I#=M3N*D+JF7-8]OPGZOX[XA

M]3\EC6@6CK>*)B7B6^NG@/T7U30]'HN;1^;_`%_&>,NSXSO^MU=)[GAO6GG/

MIGC?TOS)8F-9(`BWICSOTO'ZO2HI;6IB[8N"='R6N9=2158FJ*1+Q&8IL;+3

M8PEZXZ^I-K9HB:)MYF\QWJC!YJY_7R:!MRB4BUNMZ+XGG-[U^'A=KEPWR0VF

M&^2*UH;7CF8[7@O:.]D6W[O<&L'@6.K5`-$--60R&'1=9\=;5)B2!+J/,]E]

M!?"?I`MAR],^2BNP8MO<-7L:-NL9+%?!YZR"IUR]["U\I2F#G-T%T5

MLL5Y@M>.;):UO>\=K)-M^[W!:#0+'5J@&BK3%4.ABYRXY;U`M62!+OW"^D>T

M_(?=+B:[KK[^[:W7QU]?7<_,:,FK;/(OZ;%$_.#W'YT]U>1^Y=7>]\]A7B6ABT5;P+>M?/\`TCVEYOZAL^#H2QDP5\7PA];\?U7-

MH;EEP9S=X]G,+%HTQQ(*E5NB<[TF\:'?M\.WRS:XO,MS@)$TB2"1:Z8I5+J,

M="6*W.+:2N9$Y#'9"SLOL=ZFN;$6<9->R9,C6MLM:Q?:];3[_P`WP%MEQP6F

M.^6&TP6NEK1VM;WO'-DM;?N]P6J:1)U:H!ZUK:*CJRWK<9<;@%JR0)>I?-?6

MO7OEOLG1]3M9S'MZ3N<'#9-/#YM"XKDN8R9/%N;9J]AC4-GDJG%Y,#I\C^A^

M8>=NSXCG.[Q<5?%#%XHM#%MHP=3H6EW?1?&]KZ*Y'M,I3/\`&+VWPWCU,WTU

M\U]2YIU_)>3N_P#/DBT:4B<%K[^+P[6V;W)#IG,]/NO*]9SC:XW'M_S"UE(F

M&M[VV&=256:*5B(XM/5K9[

MZ*=2T?+])UO,P7M%?)%:T%K1VO':T%KQ6LMK;[WN"U32)2*`$E:%E42(NL^)

MIAP*VJ]59CWEXK]">L_-_6M+WO-6]L&SZ_7UC/S+VN38L'1V3!T[RF35]GF:

M[ET/%_JOC74>=ZOJG.]5<5R;SJ=J_IL5/F_[7X3Y(]#\WBKDABT"WIKB>_[C

MRO5^B.3[2YKDW?5ZV*KGX+T.!S[>TQY(ZW4CBUW;%.I+%)59*U:(C6EQ[$49LU@M-6U8FQR%1<5OA,U)

M,&SIF>]E:8YG:ZZN%MDQ6//Z0YGSN_C7AO:.U[>]H[7BM>"]HYLMK;[WN"]5

M9$I%`K!XH6,BYR8YC;O`FKEMK8_E?]"_+OU#^>_J#/8>ALN#IYK%N6%\$MU,I3/@\FM'7)RK)@BR8^9[G(\)^I^4X[W%+34N1

M:SM&`V*7^.;"UM>IN92VO@K92U)ZQJL[>YZ_'[AH^)AM:*]X+VCM>*UX;6CM

M9+3OO>X3U5L$2*@T0T5+))K>9\0ARH3#Q'J7S/V'1M[S70]+T/L7S'V.RR:&

M>Q;N^:?>K##9=34-GD8S+IXC+J!R/I^1\V]OYY]9/F_ZPR$9.5;_`)K5=CFX

MJ^&YKEW/5[-8GY,_0/SAW[D>T]R^6^N;?@Z.S8-WD^]PN>;7)@F;19*;.J7Q

M>`_6?)>.=#S=C;&JAU6F'1)-)%5B9IK>3ADB*Q")(FT9][>])49+%.*KGQ.QCLZ9=7R9=QQZ^DWVK-D[]SO![!

M3GQ7O!:\=[0VO%:T5KTLWSO<)Z*W50ZH/6M4%EUEQS7Q@Y4)B2(Z7SO5W5;>

MEN#]/]#\7WW7.;ZK$Y=31MS@8;+IR1DL[8,ICVY3+8MS8<&_8VIK.QS<7?!4

MRV+=U38YN&RZN;P;^\:W6^('T_\`)L$7]W^5^P>D^+[K/X=[8<.[SW:Y.JY]

M.M^R89E)9K0BK:ZMCN

M&,B2MDBY7/DZQ>Q@N\FQY;:;VEUGV

M/D72\ED<6[B_P`.^E-GF6SS.5[G&T';Y?*-[S_GGM>%QF#:L\6;.[6E@]3=FM1D4K*U

MO

MS@TZ=C5HV-^:%E,Z97?I,=XT/#YZNA%-HLEX;6CM>&UTF>@=[@/`L=6J&B&K

M4LNLN.;)C`)`'5J>G?.?6?;7D?N6*V.7:Y-2[KEEB;:^ONVGW-XU>W>8]CD_

M3\AB+Z^#S\\B;F,FYZ?X]C-8]S/X-_$Y=3EV]P-3S\Z-;I>CZ#+8]K

MF.[PT-MP='N?-]-IF?G\XVN=RG;Y>`E8Q?PEZCY16O47"MTQRTR-3/=3JSQCDI>3'OM7;K&6^QKS'-Q2.<[N*?%

M32]IO6&\\S)6(IP1VUL9EU^5WW\1&:&)W7%R.SZGC89M%DO#:\=K0VNDVZ%W

M?/L%DB@/6M8BMU]GP5F`88JAT51]#/!?I[)Q&Q8MW8\>QDZ9=JUNOL^MU,=D

MU^4=/R+UNR9JWL\FO97U]DU^IN>GW-YU>W\%/L'X5GIN>@^)]!]D^8^N[OJ=

MKG&YQ,1?%G,>WTK2[>SX.C8S37\VGI&SS?CU[SX'D:;.>P;^>P]#=M/L^0_0

M?.;R,]DQVUL24NTI;8JEGI],P[EI:6\^]C1[MR=[0-UIN35Z5K9\K1Q[=P6]ZX7)CQZ+2+O$V:_H+

M1\%?->.UX;6CM:&UXYMT/N^?8K:'5(25H2FRUNLN$`%RZ>&S:&P:_4D1MNKV.AZ7?):;L\C1]OB8'-

MH\VW?/?/+VGP?T'Q/H7H3B?0.HZ'I>J:'HTB<+EULQBVF3S?;Y'B+T7S;7,N

MMLN'?Y)O<7@73\UC;8T@)]O>3^P&]H[7AFR6MT+N^?:#(=5HAE0

MN]C%+>@`Y495CU'YG[%[!\I]MV_!OXK8Y6+V.5C[ZN$S<_-8>AEL>QEL6YL6

M'?GC):331=WS]Q6^;P]#F&_YK&7PT6^8'O?SC;UR6C-:QD@9/N1\O_6G(M_S

M^NYM/=M7J7],_P`]_4_*<3DQ_2WQ_P!CO\6]\6^L:CF

MT.53IWI+?G3M62,,L3+CZ,U+W6

M/(1GBMG:+34BXK6:E?.74T+JD;Y@S<*WM5(O"E945JI/-'K3ONGX.*UXKVAM

M:*;I:>A=[S[U/%60R&5K*\VL+(J@)`0Z*GTT^:_KVPS\U;ZVS/$

M[[I]_)8]B\IL;FL/1^T/S?]0^%O2_*^FZ7?Z_S_2=,U.SB[X5[W$^

M)WT+\[_3?Q/W3FFWRN3[O!\Q][P?:.3ZXK?%7P\NS\BN;4KFTV5EI5DS4QRQ

M3(+S<:,=K17O#-DFW0^]YZ2AE60RK(ER5GV*,AHJ

M$@*N5/4'F/LG<./[[,TS9_'GZ[H>CR^/.DM2V>1I6UQ,+ETV-BP[^;P=#&Y=

M/:M;L;%K]3/8]SGNYP?EG[W\X6\7^EWA_P!"^._1_,?$GI?EO4-#TGU-\-]_

M^(OTG\P?5;PWWSTIQO;WU?0X)

MU_'@0$3Z77IDUES\^55ZU>(EK2:*Y;G>OFK$],U[CZ-)UI&*?'M7-.A+7?=S

M[G'CFK+UNRSPB7M[Y=8S4YOEY>M9,-[BQXZ\XV^:[,==;L,,TL)ONN'B],Q>

M:CO>&UHIO',]$[OGI*F59%2JMUGQR9:R1414=`B0#U[Y'[MW?B?1.D:7H9;Z

MEEGYF.RZ"(6:6%]>:,F:Q;FYZGZ7D-#V^.JVWZW7\.>I^/[)K

M]7T5Q?>]1TN_\5_I'Y@]U>6^M>VO,_5-@Q[7#.CYCE6]Q=BP[G4=+N?#SZ-^

M;YZY\ECV?H?X[[1\Y/9?%],V>:``*M5?Z/=FP[=GTO)5A-6DT4EK7*Z?H[K%

MM7>/:R>OWWB+#:\$MN9G-/Z)+7:>-"XQY9:Y:QM$YAD6;M6N,G6XGNZ.LWU8

MZ8KJM,;DVK2UJRMYQQ3KM.*X:_8]3Q\5[PVO%:R+=%[?G7&59`.K>;6)K5>*

MA4=4)!CZ??,/V?;WT]>W//K?6O&+.8]C:L'4OZY>O)]'OXC8L6UNNOTNBZG8S--K"9=#2=KB3

MQDDBW-M_S%A;%>4VNU\KVV8Q[>.MAM;4S^'>U+8YW"^GY3'7Q=9T/1:_DUM$

MV>9MV#H]IYWH_AI](_-.F9]&-,:TL97C)96Q(4`J/4%4933ZTM+66UR*S@FK

MCGBC1$E:Y[3]'DL70L[\>RR^:DK22*W%,O0>9]SJK)6STUJQ62JC)'-B(CFT

M638\S[W!UF=2%$ZV7C:[CJV\[;NOAK56=3JMN=AL'.V^O*M[6CM:.;=)[7G:

MDB@,B?)CGSTD4`)`)%0D.^>?^I>G?,?9]IP;VU8.E9Y^3@-KB7",;DTI(OX?GOJ>4^5'MOAD:\:T:8UD6HD(P`DJ`1(K(KFM'N[ARO8S5R6.SQ;;+S-

M=W_'R4KLFEZC+X.QJF]\WEK#Q7,8.WT7F?88;:-O//:N.XQ[4L9'C*-BLYN;

M9]'7,F$II.TQV

MMTKL>=)2*!(K/GQSY*,J%1P)%7A5#S7Z!_._UG%?6BOIY%.=Q[.5K;9<6UO>

MGW[:^OF<.]+&3G>]YWG&YP]=S:76N9ZVTOAT';X^7Q;G>>5["ZB^!R:UE:DI

MQW>\_P"%O2_,_+':\1&LBT:46C6$J*`T&!#JR16J)*6R.'^R^#I<]ZGRAZPT5RN'H]%Y_U&>FS8WY-Q3/>8]N]KU;ENJC&.;Q?:

MY7-=G%A;8I:5M&/V+S_3\VV,&`MK\[S:?H/5CR%O:]9P=#B^/MR=VP^6MYO'

M:R6MTKK^IW

MMWUNI/.#7=GC\YW_`#%C:D,TZMS?7:;L\K'6PYNFYZ2XOO-!VN/J&QSL+DUL

MYCV^(]'S&M9=7INGW.#]/RWC?O\`@.0[W!C65,:561:B8P*CPK,-$5B)%*DM

M(>*R5I-%=JT?3]+Y/T#BGH/B4](JK8^CSY5B$=,_*=C0Z;BV^%[&GV"M/

M.^77[YA\+;S>.UH[6Z7V/.--60\15%WM8I;8R)K$O:M8/6KE9B1C(CLG$^F]

M%YWK=0WO+^J_+?<]?V>%E*;&43DHB.VNT9=AQ;W4N?Z;:M?I:#M\;EN_YW)X

MMNXC)PSI^5L+4]'IXI)6LL1MFEZ/>>?ZSDO8^52UJT1<1C:CK/,^H;EJ^KNHOD:;^O9?/

M6C3EIEFILW#86+Z-FT_/&_HV5JQUB&*=GU=KJNOMQS.KY-6SM?6\FQ;7U^<9

M>?+-.-Y<'<\7A&FL,W2]NE]?SCQ6L0Y65[N:[U`TPUJM6'B'0\TK%:K>A?,_

M:=4W/.;II^BZ9S?97",ICS[?@ZG4-'T>T8MJ:::9M<76,_.WS4[O">KXO74R]%U.UUW0]#\._I/YBX!U/*PQ:-=$HLB8U@"-<&156H

M%8B6*LK)0R&I6=2M6SZO:VS4[_.>C\_>L2162*R5CN/(^M75;SURYK%UM?R^

M?6)R./?R>/JY>O3JMJ>32X%N<6SM;0LFG=UCI>"_8=;?FGHQSEQEM#6[Z/'M

MKG#'KV34YO>_3L?B\C.M!:\=K=,ZOG)%`D*WK?;.&L`>:U1)%7&FCQ1HO<4S

M=*Y'O1;IW-]IUSD^]SV+?RM-B.V#4]SSFVZ_4QF;1T_9Y&,RZ>U8.CTG2]!L

M>#I7=AYWSQU_&^./0?..3;W!C7B62+1)19%E2`*LRH``25K

M(JT0U4L4:L2JM6)*T>(EBC52Q66*/2.\\GZTU66Q[NRX>[9VTKJNQD*;]BU(

MU8BS:UM.'GN7!YCZ&G[BY?H6;4!8VP6-M+#VYGF#=KZ%UXMIZ.J6><=OS^ZU

M\AGG/AM>*UNF]7S;JL,->M]L80$2*NJPR)6*2F6YQ[%S38N*9_7GC/TYYE]3

M\`](>;^V3F&V./;WQ9"FSL^OTMSUNOE:YO+OH/F/COTGR:&+_3OPWZ,\T=KP

MWGOK^)Z9H>D[IRO9\_V^1XZ]#\SBFT2ZICB\:43$N`````/6LBK(:IXB6*O6

MC0>*R5J\5EK5H2Q26*M6/67G_NV9Q]&:L[-A[6A[7DL?;5LFO=X]ZXKGGC8M

MII?QO-%L/=.P\CS\+@^UR;Z-S+-W(UKOV+I9^N?7LO(P&7G\SRX]+OX[;8Y,

M-KQ6MT[J^:9#E1[TO=C$#JNJR&1+&.?'FN<>S_-V;#W,??2P=^:UG]7S520$2WI=[&.JKHD5(35I&_5S*V634U#=\W:7P['K];PI[7\YV\Y(HM`R1K1+PK0LD*O$,AAHB:M6BCUAZI(JT5DK1ZG1+6DB"([I

MR_H&[ZW>O:9]HP]?=]?T5G..QG6I&37[\NW55>Q4U#+J_.CL^)O9_GJ%>%>)>):)>)>%9$]SX_NR,GG_`+/ADM9*VC%65,:P```R&5X\UYBW;BN6YIL7%,\M;R

M1>WMAQ^36L,NIN?.]SR[L?-_5?C?TWE,6ZDXLIBW].W?.^//8?`(5X%T6B7B

M6A7B2BT24FT:R3:.ME2B:$:X`%4.@0PT5K!RJ)J5:*/6K$D0U*R*R1!5/6C1

M5T=%T_0_1GRWZ%^7_K/S#Z!YOT/I.IZ7:,/6QEM;$6U]AP]3/8^LT9=#S8/`

MG6\/C+8;=CQ-M77[ZM9RYBF_D8S6,QCICUAI[WG7'!>

M\-K=0ZOFF*JU1--;S8PLB6(O<>:]Q;MQ3/WP<#L<>TMCP&SR>#=_Y9"R1+1+1KPK1K[5J]OU1Y7[)SGH

M>F>1]#\J=?Y9Z\XGUOKVCZ[H&OZ#<,':(231X232

M]V<3Q6_QY[W'MW&/8N\>Q=4S31=EE1:6PX[+J8G/SK#)@AF;9?:-+UO6N%]7

ML:/3?(WC)U/D>XO*[',^AY?3M[BV

ML%E2;)4%$T2R!`5'01#P=6L)(AXJT5K6)!ZTDK#15AH34QUB'16(DK#Q4J:$

MD5V?#TO?_G/T!YQMJQ65L&)OH8>^E/&2\KN[=CZ.

M,9+&:-,8*^GC9;>UK6OF-L\7^FFB]MDUN9=?P7&^Y\UC6B6S.

MOV,CAZ/4>1[CS[Z3Y=83ABFR)[GYWZCE,/2DQY_,_K/CA:8Z`)DB`!K&J%6J

M9$BI"2M9$%:M"9#5JU:O$5@Z):4(B1!$25B2*E51ZQ(K]8?(?JCY:^J_+_5.

M;]AUEUN99^=`C6,FGC;8,'DY^)M@R]-W)UW,]CZ6KVPY6,F%MCQ63F1K-FX&

MT:_,ST:%O?)#>_3NGYID2Q6M:R(RNS3*8MZYQ;5S7+=X]B>+.LT3%-;.V+'Y

M-/#Y]#'WUH[6MYO&O$M"OVGS7W&TOKX':XVK[G"LKZV$S\[?N7[7:=+TOGWT

MOR%)11=+VCK.:P=:;'L9K4['.>KXZ2P@5J$E335HAZGBC!2LA)

M%7B*UJ\14>(EK0K$B/7O%^E<)WO'\_V>#6@'J[=H^M^F7F/T/\9/9?D>#2^R

M\FSX\?;3U>\0JVZ^5C)A+80R]"^3IW

M3\U)%'K5R:*YW)L9''NW%<]YCS35R25EXLDQ;VI89=7%Y='$Y=.WM2&]H5X5

MXUHE]]X_TF^Q=*_P].]Q;VQ:?H,/GYEA?7TWH>9Y)W?G")C66UHXF.;)6T43

M672N']"NL&[+BVN0^H^4-)I$01!!H/$/-:U/%7B*E:5F*UI)$$5D@#Q$M:$1

M)$?9+Q'Z<\%^@^/^9^IX!J0#0R^/8Z+K=SD^UYCD^#Z]L5-B6NQ*B9C6:XLTU,LL2\6""U;.^#&Y]'$Y=+'Y->%>&]HUHUH5XUH9O',PKHM

M)3;1U+H>:Q.72L,VJB4F\9'6\N/8Z7POH?/^WX>-%_K]'`]

M#SS5R5K"3B`)*Q):I4\*Q22#1#5B0K6CQ`K)4$D5DK4B-OP='[Q_/OUS\*??

M?D?3,W)>L$`DK%LS9'2^AW6'UMS&2J->OI\0WO$])UO43K>311ESN/=Z?B^=Q7O;VO!?)T_H>8=$D1+%)(KFHWMAQ=>>

MF66+R+5+><=CEUK+)K8[+J8S)J06BW9$O,*R+0KQ+13:.;0KHM"OTK@?4E6N

M\/0N\.]"VN0LVC6CK+TR;AS/7ZAU_(0S4`SG(]:4M@^OXX')5"

MJL'0T5:#Q5ZF&K1HK5#U!+%?N5\^_5GR:]A^=N0[OF/5O'^A^5.M\Z:$D5*B

MJIZ[XGV+S=F[.L7P-:&;1+Q39$Q+PKQIC7S6EZ+:^9[.XQ;O+/2?+K3)K*F&+

MT%@]E!5J`-CM6"6QN2*U052#*M2&0R'K6L6DK04>JL`EBOMWSWU+R!VOFN'O

MIU5:#5-6&B"!#ZC>7_0?E?>XGAK>K6<>SX]S$7YO-MK@RJ.B%=U6C)UW3]?A

M;XM:R\S5"]^G;WFI(K-%)8JZ)JY-ZP^JFKD:)"

MUOAQV;4Q^33L,N#'Y=..5NR):8EDFT"\:T*Z6F%=%H5XTQK0KS4V\OI>AV3F

M>NYUZ+YK:Y-=")<*0K(*"+$05BLJP=#JD*PD0T5K5(J$E*U2]:D4DJ#I&KV]

M6R\S$6TQ#5,J1$E15)%0*O:WG/T9RW/AYKFU?.G1\#V#2]IQC=\;@;X+9DN6

M.T96)V/?];TUG&QK6;CXG)S;:1CCQWO#:T-K].WO-RQCEBLT5(

M/$;QA]5>UVGK:"^.QR:^.S:=E?!C\NI9Y-6&;P,B$=KQS:->!:)=+3$M&M"O

M&LBT*R6FM<_1_*_8N;>H^2VV77C3&L$F/9GP;MIM\E:YJ3`Q/):F@RK(*G)%

M:Q#UBJ&B&K%4/6*Q5ZF1]S_GWZL^?OH_C_#M_P`G]=?&?HOX;>]_*#((AXBM

M35AD!Q[%[?TAS/H?ECJ?/[=?LVE[#@V[YF):.+03>D2TPL*1GR<3B+8J)$9)

M7N^OX)YQQS>*]H+7Z?O>9GK2>*5JJ.KL^+O;!B[-)65\%AEU+&^M8Y,./S:$

M%J6]LD*R+):T,VC7A72;13*)@7C7C6C6BF4FU)F-;--:*UX5HUDFT,RJT

M"\:T:T2R3,S7%?7AK:/8Y\N;4FG

M!25S;!)6K@-6&B*H>E0IUS5]!Y]Z'C(UKMA$VS)BVSMN/>CF4M:.UH;6ZIM^8FK6L16((BA<5R[[A]C%>N/R:

M=CEU;.^/'9=.UR:UO>\2R)BF\-*+VZU+2BQ)%H@!=$R<

M;VD>360BP[,&?12V&W6M*VCR:D$1;Q?>]_@.5J!Z5J2*%`2(*UDJ[!H>EY7N

M>=M;8V1)0*$-_P!7L?0#SOV'YO>E^(86^JR&K7&QM<\KZ#`5WO3?-]]YQZ'B

ML9;#$M$O0MV2AE:;V/396P4G'*K*K:1L]HP>*S<:44RMK1VM#-NK;7EY(J5"

MH35RRUMG8[63;^.SZEC?6L\F/'YN?;VK!.2*4:T:\=I2;PKQICM9$Q+Q+1K1

MK0S:EI18$6C*)%HTIR?5Q9,$=;6>/83)K132R8\=69[XYIHL"6\[O%:*M$-6

M`DBA4PT16*O5^A_YC^R?B;[W\N<5Z'EV@]0J(W_4['U6\C^@_E!Z[\\Z;FY0

M50]:\NIZA-7VNAYN?!;'=4VL6`M6U9((OF8U>\X/"4

M$F4M9+6C3U?:\O6L""$E;W%.TK,K%B2+1E$BR1>PX_L+16&<=K$P9=*[SZD]\-

MICRPUO=6Q05OA\6YTKH^<:*R14JJAXJ52!%:Q#U5@ZH9.F?*8\VN9-`1]"?-

M?9?>/G?K]E?!\%O?_D(`>*^D^7[J31^D^`^]\LVW'L^C>7[WR+V/G446EFB+

M8^,]$W\X,#&](]4*WP(+0N19EN29@_-2$^>[R<7L"2TY'3T21AL_RJ\T'Y#IAM1K/D69

M;DF8/ZFT^:'#(),]K9[N1T]$D8;/\K9ATPC\P0K>?(LRW),P?U-I\S,TAS\@

M;\R_!5)W$.D#1J.D"2$IV\NWS4G<$HT!)T'2!(T"4[>11;B'2"DZA2=PZ8V<

MNWS4G<$HT!)T"4[1TP2=#XJ+<0Z0-O4;!L&SEV^:D[@2=`2=!MU/;YI3I\&9

MZ#>-XWC>-XWC>-XWC>-XWC>-XWC>-XWC>-XWC>-XWC>-XWC>-XWC>-XWC>-X

MWC>-XWC>-XWC>-XWC>-XWC>-XWC>-XWC>-XWC>-XWC>-XWC>-XWC>-XWC>-X

MWC>-XWC>-XWC>-XW@E:__(NZO8GURAZY0*@]>7^*R?H0GF6(Z

M=J5?,U*>"HZDA"S0;:]Y34&9)B+,+BJ2&G3;"5;BG?-MTT%Z58^05*,T^F6#

M+017=Y?X!)^A"MI^N2#G$'GC=.$UH)WU0/D)_P`H/U.?+BKYQD;4B0G:J'])

MGH#E((%*08?TW1#_`"3OG!3J8G)\X:=5"D1WND?JT!][JG!^I?F03+280O>2OFS](E_7"^E2=ILNDLEND@.KZAP

M_HG?.!PGB#\Q.$+ZO\`=1O2B&I)\BT$LEPC((A*,.Q-2C1C;,/0]3*&LPRWT

MTG"4$)VD'XIK5';Z9/QNH#AK"()AV&9FPWTRDQS=.,P;7"2R;HC,&V8DLFZ(

M\OA.K/='\T\'I1H4PYU

M"X27C:$=\W#,]!ZTN*W%:QSU3+5H<0]1*5H3"S-1GH/5EQ6X>K!ZI_#I#_5-

MB*;@*(@+A),%#/4BT$[Z8?U\%/I2$R$GQG?.`%.D@)D)5Q,]`$KZX?T\)HA?.4V9F.@H1T[4N_

M5'^F7]4,2_E&^J2V9F.BH,)VI<^;'TOO;`236#C*"%F@T+WE)<#;!K"HRB$4

MC_!9PA?4))Z)ZRAUE"$HU%.^F']U,=OJ*X3&MAP5B=\X;>\P9:AU&PXRM

MR5K)(]6@=="^+OU1OIX2OKA_3PFB%\W/EQ=^J/\`3+^J&)?TQOJ7\N+GS8^E

MU6XV-$EO(2=-8BA)+13,C8$NDK\&F)U2RO8H&6HZ9":6BH/RG?3#^N<7E"/1

M7"<8@EYSOG`/C)/5<<]C9F;AI@D#@D#!!WZHWT\)9:*A'Y<)I^<(@OY<7?JC

M_3+^J&)?TQOJ7\N+GS8^E1:!,=ZIPBT*=],/ZW6^H7F@VYA*"I:2#CAN'&:Z93OFVX;9HE)4

M'9A$"(UFXWHVTO8:5DH/2"1P2'?JC?3PEM;B:<-LTRTF%RTD%*WG';V)7YD$

MR4F$*WD[]4?Z9?U0Q+^F-]2_,@4A(0K<3GS8^F2WH;#^T=9(7*#:]Y+D[32^

MDP\Z6C1:J_!5))07!!PU@H2C#<,D\)#1NDQ%-M0>CDX%0U$$PU&&8I-\),N4/7*$9XW?'=5^:/\`3_AA2&F2:'53Q-U)`CU!N$02HE!3Z4A#I+XFK:/4H!*W!WZH_T_P"%

MR?I9^KE;^0?^J+]$SZD.'IZ58^0BN]0GG>F2UFLTQ%&/S,&M6XX_T_X7)^GD

M3\@W\@_]47Z)GU04>0G)T.#\YJO.$WKP6C>2BVG&^G_"Y/TL_5RM_(/_`%1?

MHF?5!^D3Q!^41$N8D@8B_1,^J#](GB

M#\YK>I,N](TR4F'Y9<(WT_X6\C>E$-23Y'X_5!Q%!J%H'(AJ-E&Q+\4W#CM&

MV0DL&Z(TD6&8>T+AJ4;2-A?_`!(K62`F0E7X"2R/\??_`%.DVX'W

M.D2#U*,\;H1*4H)F&/5*2K2U*'JCW>H4@+=)!==80Z2R]0I8;

M=-0;-6YYXT!:M"0_JGJK,)/7\:6M"CD,I03YFIMMTB3!$$?_`.TX3A)^B+]#

M!Z+9U>""T=46KIEJ"7T1&1L2[\H2RTDGN5)+5;Y:IBK+:H][CC)+-AP]6U$E

MR6LMKR3)!$LR0UHB(LMI+)08/\\P.N%M8(C0:%-$VO>7XRXPEP%#204DE$F(

MD@TR30:9)H=$MSK).AUDG0M&\FT;"0R2#.(DPF,E)]$MRU;2/_["@Y\H[).)

M;CDV%LDHPN(E0;:)L.1DK#;)-AM!+6F(D@9:CT:0E))"XJ5!#1-A<9*S-HC(

MHJ2"62(O2)!%I_Z/[O/F4>G^+//+2.IHCO`OUG?D'/

MIB*VI)1/&TLB<_Q"6DS2I2D(;W(#+AK!_4'=Z35O?#K.]*7'$".R:0[\@OY1

MF_R^E0$1]5_XIISJ3K_[T_7)'KDCUR1ZY(]N2/7)'KDCUR1ZY(]N2/

M7)'KDCUJ1ZY(]N2/7)'K4CUJ1ZU(]:D>M2/6I'K4CUJ1ZU(]:D>M2/6I'

MK4CUJ1ZU(]:D>M2/6I'K4CUJ1ZU(]:D>L2/6)'K$CUB1ZQ(]8D>L2/5I'JTC

MU:1ZLAZHAZHAZHAZHAZDAZDAZDAZDAZ@AZ@AZ@AZ@AZ@AUR'7(=A<#D=3?\`CT6*.J$.:@R$F"2P9:?XW$9Z

MJGE".SU@<1"5/Q>F4=>]-@SM/_&JL3$Z$1=)QX_^9_\`,MC\JK!.J/\`&JU>

MARV%.`HKJC>_6?CN&J/'62K(_P`O^--.=,VW"<)XU:*BNJ./O!GH)3_55_C;

M$@V3:G(6.ND+EH0)$LW?_=)Z1`](@>D0/2('I$#TB!Z1`](@>D0/2('I$#TB

M!Z1`](@>D0/2('I$#TB!Z1`]*@>D0/2H'I4#TJ!Z5`]*@>E0/2H'I4#TJ!Z5

M`]*@>E0/2H'I4#TJ!Z5`]*@>E0/2H'I4#TJ!Z9`]*@>F0/3('ID#TR!Z9`],

M@>F2/3)'IDCTR1Z9(].D>G2/3I'ITCH)'02.@D=%(Z)#I$.D0-HAL(;"&TAM

M&TAL(;"&PAL(=,ATB'2(=(ATB'2(=$AT4CHI'12.@D=!(Z"1T$CH)'ITCTZ1

MZ=(].D>G2/3I_P`#,'X)?XP?^0F#_P`@,'X1?XL8/PB_Q8P?AE_BI@_#+\:T

M&@VC:-!ISZ#:-HVC:-/",'X9`OQ70;1I\+M&T&7,8,'X9?B6@T\0G",^J0)X

MU!:]H]00ZI#>7%*MPW$->4R!H!IXF#!^&0+\/T&GA&XHS"M0K4@V9F#;U-;!

M)X$&VM1T2,.N:!#I$1N!1^82C4%S&6H-(,&#\,@7X;MYW)!("923!GH&U*<,

M.$9D44PLE!QPT!,;RZ)-A:]QD1J#;02TD+3N(RTY]0E05Y`N51`R!@_$+\*T

MYTN$H:AY*$!ITD!U_J!MLD$XXLPE]8<>Z9%+X&A85N&H:;VDZC<7IS'340U,

M::>!N"#Y3!EJ%-@R\0OPC0$9G2$1DI"M=#C*"?^

M)*C5JAS8/5@I9!+Y*/BZ]L!R->&@\QY\GER$?(9#4T@OSAUKPR_"''2;'7Z@

M01$7(\\LS2G833Y-@IB0A>\GG#4#5T$QUJ6#E^;JR23!DK@1I,&TE0.,D-LD

MCB?D-Q&"0E04RD&9'R:&",^&O'R">92=!J6FI)"FR5X!<"_!79.HUU"6]P99

MZ0?D],,R-X;?)P)=)1A2"4)"$(&J0\Z3@C)(BDNF@B>6D-I)E)KZQMJ)!2'M

M2:;VA:E:FYL)ATUF%'H-_!*MH6>H-!!PMH\N7S&HU!&-?`>9TX)61A2=O@%^

M!FHDAR0:AN(P:2!MF"=4@=0./[P;I&49*4B2\K4I"B!O[@44MJ&B<-"";(2G

MC29NJ,)T07J2,>2C4X1DR6@=,P2S(?(>9<#,&8,>0VZA1Z'KRZ@:+42G303"3(*+4C9+13!`V!T3!),$9D"<,@V9J!Z@P9^>H^9N`]1J-

M>70:`N;4>7%YO>"3O"$A7GS$"_`%.[0I6X=74>1CIZCIF.HI(Z@88(@KY*:\

M^D8C-J6FG51A,A1&RZI9[@MXDA"R6/($'S\U*,

M=4R"2\RUU(_/7S(P6@(?^=1KRZ#:-/`(N#JM@^H+:)04G0&6G*7Q[CW#>"VF

M"1N!M&0(S2">,@V\204X@^^2RZ!Z[#T)Y1#K^?52#V:*:+6,E+8E&I:M5)"E

MF$_E(I>@6KJ&G1)%H/(?^"4>I+#3AF9$9`E!)@C!!9>:2!&",:\2T!$"^0,N

M74:^>I`DZ#;J$$:1\PI)*+;KRE\<\L&8ZA@U$8-!`VC'F@R>,AU1^0PU&Z@-

M@R!QU$9.*'J#,=8E&A2`E*=.EHGI&DMBFQ"(]9*R:$5PW03!!#&TU'J#T'3U

M$C\I$M1$R6H5_P`8:7N"3T!'H$GH$@@KYZ^9*!'Q\@6FI$-O*>O#4QO+0M`1

M<"!H)1F@C-;6X&G;Q+XUXS222T#CF@U28Z9&.BH:&D=4QUM1^4-L$\;B>FB)

M&-)S'S(S?7HM_<2EI49DA9DR2U%'-1FPK52E+'J5F#;ZA>KV!7Y0CYF@B&XM

M260E*,C4XK1O4R6WJ-_3"5ZD2M`DPD.%YGJ-1NT,C!&"X::C9S:`B,&8-1`]

M%#0AH/,:\7&]XTT!`@7Q?TAM)K/:%0B,=(>G5P)]1#K$#4@P;1:QDI03SNU)

M.*2:7U)-+^@):2+1&U;1))QC82FE-%!:,N'3+@F$DC,M02=`9:CHJ49ZF;CA

MK-QTU&0V$8V@B,AYC=R.MZ\"^*06X;"UX.

MKZ9*>49]4=1)@D)4"8)9]!6FBFQ7HT+ID'UI2%J1HZE!!QC:;C!H"T*;*"V:

M2YYNNY>Y!$\I*6%FLC3Y,LDDS+4)B>?,^KS-6H4%`]`1^0($0+B?)KH>[S29

M&-"4";T&TQYCJ<=GI%-<,U&M2"3)4E+Z9,RC0&%D2DF3BW5)6K3

M:#4$J(O!=:W!;6T&GR;+R($6H(AISZ@EZF2B,;241HWC;YD2AN,BW>9*(^&G

M%2=P+X8N>4P;A^G5H:#2#,R'J#,^N2E-J09H:1H4;5/IE:);/1LS2&Y"DGZC

M1&39$9-:%L5H:E$74T,GBY//BM/QLLS6I*]#3*4D

M%)\C4G:XVD*8_,I@R4MLTFLS"GE:')/;':);;K+;)--(,FHV\)8-1K;,E.ZI

M$'Z.1R6E!S=%$48]K#1F&D&HU&9FIU0]2K2.X:RXK,(/AO&X*&WR(@7$^8PH

MM0IHC"FP:3UU,C2L]2=(RW$#;(:<=W$RT^$+GDN]-*7U)'6\MS:ST;6:(^I>

MF5HDE)"=4AMY38;D^:7DJ4@DOK(MHDEO6[&-L*;4@D;DAIPTJ-XU&N;[I+#&FWBL(X:`TC:-`0

MU&H,^?34;/+9Y;5::JT-WR-XAO(&@C(T>>T>8U&H,N"R^*EOF@-HZB'FFT#:

MG:J-H2XJD!Q)H"EF%.JT=D;R<>2:5FC:MA*4QF";#Y[D(;-8,S6;CR]5RE:(

M?V(C+0D,H2M3B4J4RUTBFMFLB841-$>IK,S=?4L+?/8T\241EI(T$E2G23N)

M26BUUXK""X;09:<",$8U!@^?0)3H$$9!"CU0YJ:7B,$9.$M)*'3\R;T'F1:^

M:5;N&S3BHM/@BYUL$LW)"6Q++JJ]*K4B-82L]42E)-J1^9I:34RA"S:8)P_3

MFI3D=1&Z1I"C-*6Y"FTQW^F:7B4IUQ*SE$A(6P24-15+)J.;G&:^:0W+4@-/

M:*<=)9R5H4%H02&624F.UN5TCU=;-!QTFE/!9!!`^!F-P(P7`QIX&IZ[]#-W

M0^H1'Y$9)(C4G<-A[5&HAO\`/K%H-!IQ46OQ3K2E*3JD)<-`*4HB.1^5U:22

MZVA).QMA+B*22F30E!F@,N&V:7C-3LCJ')<0%$WM:91M8C]4S:4:GVS;-6J4

M-.FV&Y"DGZU8D2>H.HC9&).C+1.&\WHJ0R;8Z*DH:(PCYK69FI]1@I)D3#IJ

MX*"3&@48,$"+@9<=1J-1KPU!KT"EZ!1D%D1A39`V_/0R,)<,=8M-2'RX>?(H

MO@"\":YM(G322I*C);R7%?D<6ADG%%%-:BC*,R2:C4HU!U]1A6OD8V$8V#S(;C&O%1?$.R-ZDK2M3:$*!1OR^

MD5H;1I(C-)-NFV&92D!EXB-LTN+VH<4\RDE2(_22<924M(,Q]7`RU#ZTL$PI

M!FM25JDI20..1(:BFH%'49NIVFK4B;=4@F'U;E()06T2QZ=.B(J4CT8(&K0$

M>O#70:\5\",;@I0W>1`@8,AIQ,@:=02?).NB%'H1`G2,D*W!2"4.F6I-C3AJ

M->0_&+P%N$@NFG:J.:2<8-`6DT!1F'7C4'9.\G'DF3FQ*5,I)"8OY&F%+"$&

MLW%&HW%JT1)4A,=_:&YQJ4)4?JA,`]$0U&:VE$;R#0$F:4,J-)]=0?D]41M'

M$)92P&YI+-23]47Y!03R*/0)4#,*T&GD1#:#(&-1KP,$$F$K"7""7

M-01$$H(@8>(Q^;7<->97C%X$U)J"FS29ZJ'6/Y#Z34T:'%(;)]1,]5:X

MRB-]OIFLC027%()F6:`U(T4^]U52EH,NB@D18^X^5Y\W0N5JF.ZE"6=AJ?3X93IJ4B4I)HD:!*D$E*4$CTWY?2J))LJ

M(D:D&U[#;D*W/2.JX+B]-$>-U1T%"0C:9I4E,/ZP\^9GZH]([QKX.1]P4QY-,[`I>@2K7G<

M&[R2H;@HP?`N7:-GF:3U/4C-6A[_`#)6HT(R-.H).@V\Q^(7@O[&@K9M=;))

M.QS2;C1H-Q)I"U&%2#V^IT0AQ*4,DWI&9)Q2F^HMZ(:#<9-LD:D$:ZKD*4<9

M>Y,AWIDP:=QSRU^8D(W);C&LQ/\`FG<1,GHI4A2C9/JI2@D\'5)4HV"6EACI

M\JD:A"=.=:AN\D:#R"B!I&@+CH-`849A2M`:]`:N'3()3M&T]-#X%RJ\0O!E

M-FM2F#(]IF:5GN3)41IDF:NH3RW5(<6^TDC>C;`N*I"4MGHWY&I1J-U]2@4L

MR1$<)`)2%*.6EL2]JTQXV\%'49H3M*P,-+-!]0]9#YK!2=$1WDI,U(,TIVA2

MR0$.DL>G40;1L+F=#7,M&HZ82@:!00%`C&O(9Z`U:`P9!2=1H-XW>9'YDL;A

MJ->0R^%WGJATT&W)-`;>21-&@B:929,QNH&XJE&2#,W%;C=4H%)4E+,K83"D

MK4ZM*U26T$"B?DCQC49MF1O(-`29I0TLT&;ZC#\DS#,DD)C[34Z:%*7%):4P

M0F&H^$XA$(]W@.+T#:M?`,:CY\=H,'PUX'YA1`T@R\CUTW:`ST^$+PGMK1?D

MVK:3M=C["=8-LE(-):F1-NFV34I2`V_^=UU+BI.P+92E$:-N)$=2S=;Z9N)4

M@FEF@D+,C=?-PW)&J([R$AK8M4HD[EQ2VLQ36.@H(3M+D(M/!6C<$(V@CUYG

M%:!"]1LY3+0'Q,&#&HW#<-1MU(TZC:-H,AJ"Y#\(O"E-&X'&30'$[35J%N&8

M=DFH.2=Q+6C8A*-C,"$ZCIC

MI`B,B\]-X2O4&H:#7D5X1>'UC-1/GN)XE*(T.+4A*UO-:J>C&@.-F@B(R0TL

MT&A9D;LDUFY*W)9=028Z$N*=0E2GXNP)BGM0T:S=(]R]22RX;83(40D2#-41

M>Y/P)((@;9&%-ZA*-H)6O!T@W\^*CT!*"@HAH-.30(_*-WGN&X$K4:A)A8_\

MH+X:4Z9".LU%*6#-.

MTFT[4Q]2;CFL);-1K^:S,)>4E+,HT#K?FE.I49]/9&:0H$SJI^*:#].I*(Z3

M4HQ%^CX=:-P0UIS.*\R<\D*!GJ:]!IY$0TXD>@-P=0*5H-X6K7E(PHP0+PB\

M1UGJ`E$V)*#,W&M@4DR+S(D.&@,O&1]\9#0M$(U&T++0&7D"&HUXH^:_ES(&@T!<#\`O

M!UY'?FGR)UP]5OFH+=_*2D[&$)#3!+-;!DIYDVQ"09%PD/F:HCF\B;(@N*E1

MRB00B(27X"Z6AF6A(X*5YFL$KR3S&?!):CICIC8#0"/3AN&H+P2\7:0]1YKC

M[C>;+5YC0.,FE/3/1GR/E>B]0VFNF7"4G14-!D7X`M>I]7R0YH$&6J]#-9$-

MGD207'7@:0:07Y3W#<"4%*&HW#R&@('X!>,3)ZA9>:]0ITS+KF267]H9,MW@

MR'S0([YJ/X]3.H=21!+?DA!ZFG0*+0?^"5H"4"4->!?,^97#:-.!&#\`N;7P

M%>1-N'KM(..$HWS286VG:F/JEAHS/P7V.H&&-GX"]\_/1L]#ZAAQSS4O4B,M

M$D02G4(3J:F]0I&H4C4&D&D:>>T;=!M'3'R"2"@0/P"Y3/P=-0B/M,&R>KC>

MPW$Z#4](Q_F_"75;2)PR!IU#RB2&C(((C-:?-Q&@-&A$",-_-1F%*,@:M`:A

MJ-1N&\;QN&H(PH@1`_`+Q2XJ!&%N'JZ\9A3I&F+IX#JMI$Z9!Q\]6E[R^.46

MH3&T,2&S,$R>C9&9A1C>>G4\DK#)^?C'X!>*7)T2U7M,WD%JMC:49O3E,]!Z

M@]4GJ%)W!,8.1]3;1TR_!-I!:R4:FB4%H(B:0#1J9MD8-L;!IP,AH-@VC:-H

MT&@T!_"%S&@R-:=#7\HI\BUD@(<)P>F,$6G))^;:S2"<,OP0FSU(M`MK<;:3

M2>JM=QZFOSW#7@9@E#?Y;QO&\%Y\"!_%N.&9N.[@APDDV]N!.D8-1$)"=0PG

MSY5MDL=(B),?3@9Z#77XIV22#0YOY7CT2V?F$ND8)9&-W/K\67@+8U-<<&P9

M$EH^#GS-9Z1U'X4CYH5H"69?$NM'K'1M+D,M0EHD\$%H$MD0)H@E&A],$GDV

M>1IU&WS)/D?'37Q->8O&T#B]3<41DSH02Z2AN+F,]!UC&A+&PB!,$7`ST&NO

MPJST(U&9H/4N9WY))1$WN(FU*,D+,^"5[N12MHWCJ#>"/7X30:>.M@]5M&0)

MH]&_F8:^7)IJ/3@N1\,_!J>49LJW)'I4\[KNU2WR(*>(B-9:$HM"/7Q=?P-U

M6TFW#U4O4TGJ7A'YC33X,XA&9)V^"^X1F24F%IW!:-Q&T1DELD\^PQL!%IR'

M^!J+4)9T!H+5):?&K=)`)6[PRB@F=%+2HS(.;@7.I6@WA)Z_A.@3\N12MH0Y

MNX&>@U^$?^J']+RMJ2?41^`8;>W\>J1G\0?Q;CID?6\D.[@3I`U$06G<3:/,

M._,M=$^1_!&@C#TK:;2NLE,1)<#61>`1:<2;(CYR;!%I\`?$OB'&MPZ/DAK0

M=,PX7GYZ(/0;C"U@G/)!CJ`U`C!'K\`[%-1LM],N"@R6B?`7YAE!IYS/0:\J

MO'+XQ:QU/)"]!Y!>@VEHE.HVA2=!H"\5;R4;

M0:`O+X(P7QJ_F"X&/,%J""@?R+0%XY@CUXS`@-_5R2"+;'))<%!LBW>&?/\`

M_]H`"`$#``$%`?\`XKDI-9K@.(!1U&90UF;4!QTB:-1JKW$FB,M8*$XI;5ZA+S*F5''424P'5)3`=4EEA3YR(RXY\8

M\5<@+AN-AIHWC1&6M1U[I*D1EQS]`[OY%U[K:7F5,J-A1)3`=4E,!U28\-<@

M/,*9/BQ%7("X:T!IHW31&6M1P'24[%6R?I%D?P456UQ^2WU%J0T<>:WN)!/-

M+E;Y$XD)3)E]1;=J1NPUMFVE:7D-.H$9)QW+!+91A"NBZVC1!:,R7?^-*$.E&

M(I!R]$J_!6G.DHSU!3#(-R#2/5F1J>,TO.]4^0W3VLO&T;C^\ENFLCFZFN0:

MR>=ZI\6G.DI1Z@IID&GS;4R\;0]4/4'R]8]C#YLF[(WDMXUD^\;QG,4%/&I/

M%ISI*4>H*:9!N5M+U`*28]2KEZQ[&7C9-Q_>2WC62732DG32EQTW/@R+4=`Q

MT#'0,=`QT#'0,=`QT#'0,=`QT#'0,=`QT#'0,=`QT#'0,=`QT#'0,=`QT#'0

M,=`QT#'0,=`QT#'IS'IS'IS'IS'IS'IS'IS'IS'IS'IS'IS'IS'IS'IS'IS'

MIS'IS'IS'IC'IS'IC'I5#TQCTQCTQCTQCTQCTYCTYCTQCTQCTQCTYCTYCTYC

MTYCTYCTYCTYCTYCTYCTYCTYCTYCTYCTYCTYCTYCTYCTYCTYCTYA3)I_^1>$P

M3[GV\T/MYH*QYL2:%;8,M.9M&\_MU?\`BM5^M(0_I1OKXM_3:/F\Z*QXWFKTM'DI-9HIGU!=,^D5N[I7:

M='\<^C(7S2D8XZ9IOGC;:&..F99&7_%_@%5^LZYTT_<+05D+8E7CCW#'OTLC

M^8QPO/(?THWU\6_IF_JBF_0O_P!:KA%&1.O>DHLA<$&5ZI%Y^MCOT9)PQL9'

M]`QOYY%^E_@%5^M-_2Y,=>\K*!ZQ)4KXKH7I$Y#^DRK:H.4SR3?8-A3?TS?U

M13?H7WZS+G53/@KCKCPG)!Q(_IT7GZV._1DG#&QD?T#&_GD7Z7^`0GR8OFD")<[5VEHB6@0;PDI7=LI$Z1ZAQ%^T12'.HL0+A$=NSE

ME*776QQ0F\9,I.0)(1+U+:+&44ERJLT1$VU@F9PJ;%,,6MHB6D5,],,[6U1+

M1_[9&VS<./CVH32,D%T+2A+HUL\*%!+:2IK(T$@Z!E+KEQ$;0P

MTCJ*^V5\8T)HT7#9-O\`X:1;A6UY1$V%NF*%7;YAB^=0'+MOIK6:SQ_]6[_1

MX-5[KH#E:\WQ0@UA%6\L.5KS?&%^E:_K<*;]"_P#UN&-#

M(_HAQUK4/0NA;9MFA4K1\U&K'/TLE^<8W".0J1MA1EK6/0.AQLVS;7*T?-9J

M#$1;X.ED$'&U-GP:JWG0Y4OMC33\%HV.H[.D>G;4>[EQ_P#5N_T2+45M2F.4

MBQ:8#%HT\W(%O7

M$\D0OTK7];A3?H7_`.MPQL9']%+,;;;'NK(MG4NO0?TK?]?'/TLE^>.?JWWZ

M%',;;:'NK`N'DO/0/TKC]>GJ_5FZ\W#2B_84D*E!+>]$T/1-"]92VK'_U;O]&C9ZCMG*],V9Z\*66;Z,A9

MT/'OHNY9LH"%FV<1_KHM6NF\TPIXRI7C!5S\W1,1%F+BG'R1"A'EMR!=52=OX(E1I.OG%+385"9(72/I-FB=6(,,HB

M+]PE.8_^K=_HPI/IE_E?3)HW&S9I77#BQDQ4VLSU+F/?1*C)DI>J'6SATBUF

MM9,IBRMTF8SUFW6%-'!JUR##OU0OTK7];A13.DJ9$3*2[1O(-BA=6;+*6$VL

MOU+C"MJP[2O)5(CG'5!_2M_U\<_2R7YXY^K??H1U;5AVC>2J3'..J!^EZMFX2&?P5IY31Q\A";MDPY?-

M)$J[<='S%7,3$78VZ)+8A62XH:O6EAR\92)UNN3PJ[)$1,VWZBF+Y"@Y>,I$

MZS7+X0[W:7O3(FWAN%]P-!9ZG'O&VT37R?,J#E\RD3KA:%K`3$/QH;9=.S+1[_"ZG]:0YTT?<+H^X71]P.B;/5+'HG09:

M<$Q'%!:#0:(RW"6TIL-5SKH?AN,<6VSD_1R!\]1C[IJ3D)?EH&MJ+Z4:>##YL*;7U$VGZW^%U/ZT

MW]+EE?6*_P#2N/UZ3]'(/U1CHR#Z*-6K.0)_Y.$-.QNT_6_PNI_6F_IF1-NS=*/=MMHF/$\Y_\2+$9;YN5;S9?@"V%(+\>KB,XWK)405L4IKCZ

M.FNVKTPQ(IFF0[1I!U#;J*F`F6&:AI8*J;9%E7>D#,2/MG5I-)C5)2&3@,DY

M-C>FW)..WU%RJPDO*@1DFZ@D*_&6(S[

M2:R<\^JO0EN5*B.*>R,9&#_Z..#'!4?KW/Z]@6Z/--$`/JWQ&EFB$E6TU,%.

M.UD=9V)^I?,*-52@V6JI>QBM<)+URRHG6TFQ%C35,MV$5OIRF5.Q:5E74@NI

M5(6IE"GYA+?NF%$XY'6V5BG6-0%H(45?6LU+3)3):FJFQ_3N?C,6R6

M3;RFU.7CKA3;!4P3;!4P>X*Z4*>J((4]401WS85)D'(4_/4\AN[=23MHXZCU

MZNDPUUE(UK61%_4LYZXKLJRW&;_Q#'_U9OZM?6JE''Q(LS)G_%"='V\Z/MYT?;SH^WG1]O.C[>='V^Z/M

M]T?;[H^WW1]ONC[?='L#H]@='L#H]@='L+H]A='L+H]A<'L+@]A<'L+@]A<'

ML3@]B<'L3@]B<'L3@]A<'L3@]B<'L+@]A<'L+@]A='L#H]@='L#H]@='V^Z/

MM]T?;[H^WG1]O.C[>='VZZ/MUT?;KH^W'1]N.C[;='VVZ/MMT?;;H^VG1]M.

MC[:='VT\/MIX?;3P^VG1]M.C[:='VV\/MMT?;;H^VW1]MNC[;='VVZ/MMT?;

MCH^W'1]N.C[<='VZZ/MUT?;KH^W71]NNC[=='V\Z/MYT?;SH^WG1]ON_^P%Q

M]+0]P;#2W

ML>D(-,`O/_&G$=0G630;"$ZHE-))]+82D1V>F7^-O,$Z3D)21Z=01%4H,12;

M_P#=)[W('O<@>]R![W('O<@>]R![W('O<@>]R![W('O<@>^2![Y('OD@>^2!

M[Y('O<@>]R![W('O<@>]OCWI\>]/CWI\>]/CWE\>\OCWE\>\OCWE\>\/CWA\

M>\/CWA\>\/CW=\>[O#W=X>[/#W9X>[/#W9X>[/#W5X>ZO#W5X>ZO#W5X>ZO#

MW5X>ZO#W9X>[/#W9X>[O#W=\>[OCWA\>\/CWE\>\OCWE\>]/CWI\>]R![W(!

M7<@%[OCW=X>[OCW=\>\/CWA\'Y`][D#WN0/>Y`][D#WN0

M/>GQ[T^/>GQ[T^/>7Q[R^/>7Q[R^/>7Q[P^/>'Q[P^/>'Q[P_P#X&0+GT!@R

M_P`83S&7`R!D%%_BI\$`O`,&#_Q9`(%SF#"B_P`60"\$P8,O\3/@@)\(PHO\

M50$@O!,&#_&=1J-1J-1KX&HU&X:C7PDA(+PC"B_%=1J-?A=1J->8@D%X)@P9

M?B6HU\1452$E$687!0V3+!O'[>L'$60-A1<7&S;,VC(S;,N;7E2"\$P8,@K\

M/U&OA)C-H2&MNK1(44A*4!$@TH9L#<,R"O(2)F@]#EH9*]:N2&(_22I26RDR]#=EN&3+G34A1K(R!D1`S(AKMX>84@/,

M$9,)2LI"$EP;0:SV]1*T;#06X=(?(%X1@P9?A6O.Y$6TDTF107I$@Y<-4@H5

M><<29)R#C166R=KV=(T+U)JIS2""7F-&S9UVB9)-U41XF5>XH,'*:69)(@2B

M41D?#S"@>@5H%&1#HDDYB#X(0:@RM1"2?FR8(:#9X)\#"OPE;2DERQ*0UB+6

ME$-FQ)2YLXY9I=4DBLG2-^T<>)DTDI-JT8>5ZMQM#>U^.4@CI_)=0H.05MIX

MPX9/$FM-!ZGKKY'IJ1I'EH9#S'YB!FH*!I2'6O-#AMA"MW!3"3"2,N!#34&G

M3G,&#!@_P:)7+DCVPXA27%K5R0(#*$N.G(7+@*DDJB<(2&#CJ@QD,DALI[MF

MRTP2:8R3#CJ>5/0IHR\PHG$!,MQL%9N$4B<6J

MJB)D*7"9=*2\J:XACT#A@]H)"2!H(PMO4;#T\]#$@MQ1U[BY33J#3I

MRF#!@_P-B.IXXE2ADB94@)=403*0HUPVGR5'$:O..IN(M+EJX\Z=3!;V*JV5

M!-?TR5;J-Z1,5%1(>5)5H*B`AQ*(C2#<-3ZO:E)+\[:68JT+GK-8A(29*80X

M-24?DHR(C-)!):!)&0(STZIH)I.Y!I,:'KYZ&9C4&X-"&B!TTA1:C0QJH:^`

MI'(?`P?X%7P_4J;CI2GH#>MLO4$02M+Q>C0#94%7ZD.1['K)N;!2R#;RF@=@

MZ:*^;Z13\E8U&O.I(,N!@P85\?!K-#(@4)>..$*ZM5'<*P22>NWN7`:6#@$2#B.$$$_N;EKVVSKD

M@JA#;#1-M.AN.@S=T>6=.2@PV<=MTU.K,E&9ZZEJ:EM))*V/RRXJ4)4I)A:"

M,.)U):?)1'I'61)=5H%((R4WJ-OF1'KHK12E:*49&K7<2CU:<(*2E8T(QIYE

MJ-?`,M08,&#"OCJR(2`1`XB0E"TAN0L)FH,_R/I<@(690S(_^=LIEMZ12+%"

M@BT94E<1HS*N0@O0J:2^T\0<==ZA2S4YZQ#BS?:DG?+02:MA4P6T9,0U6*S#

M\\W4MH-(02AZ@TG6_P#*M;+:CGJV&SK+.7')LUI(PM&X+3J%ZZ+UT9T-&Q*D

MK:(R6C4&D]?/4MQ!9JVK<-)&]H:W"09F1&2$D"1H7GX.@4G4&7`PKXVK:0XM

MU6X1HFX&VZD>K6A/KVR!&ETCA-FKT!D6CI'*LE02C.E*D75LAQ-%6H4A%92@WV$*FK8;79(:0B>T2666V2*L9;),HXZ_9SD$UJX;Y:)2^HP3:

MR2I@Q4-I6AN,V:Y9DA<>3L,F3EAYDD+4C4+3J%D8BJ+:@DF1-ITZ)&E:/)2#

M"B4#UUZAI-+^I$HS3U-2-:5$HB,=/0R+0%X2T;@9:`P8/XM#9N',<3%23JB)

MG(EI'K3))6;(\M5UK:PJ"H@EM]*D35DBX=>D*@P^J\Y%;<2]7MNIVMD7HU(/20A/JE*=8M$.DB8VM'20VI%:AI)0#9;<:=C-O+?81.L#C%*M

MFXY+L664K5N/F;:4X#+;P8/0S>-P2&NDTU9N)2JH5H1Z`E&0)PQU3!O`WA#T

M-*&20$-;`TV:";2HB)\TCKZEYZZGJ:]#-PDFVL@I!)4E!),P1^(ZC4&%E\21

M:B2KH))]1)X0XWJ5M0&T(.$6OIG$$N0ZR:[)3"3LFDK-34N"VZY8,H94EW\\VT*61!S0PAI.O2+4:Z#7D

MU\!YO0*^.JHBI#A0MHT?027W$*19H,(LFE(V):-NM0RA['&5)DXR0L#?,K&Y

M]&L[QHU/63;9N&AM+L=F.UX,6"B.F#`1&)-?U`^P32S;(S?01>`S)4R(1K63

M:5$:#5N]1M4^O>I1GJM6T.*T)2RT/11;"61-^6AA.X%Y\NO`N!#7B9:AU&T'

M\;3*>U0X\2DV.U"+!`62'P_%;DA58A;C4-1.P/4;8\MTFV++_CM)WK7,?BI0

MTAEJ0IRI;<JU:!2]"-9&1'N"2+1*"((;VA"32$&K4E<=1\AJ

M->)#4&",:AU&\EEI\;3V*8R2M&MR'VW22A"C35H;2JM4VW)9?0E^8_O7;[7/

M=V^H[*;W2T(=*56,N)*L)II$5<1FN8>92]$D68:KG736@VSY&)"F#]T=WQY\

MB:J;)?;*5/4RC8ZT31'I4G^6Z4DU\C1!TN,%XFQZE)G,604H*7H#40+S"4D$

MH(@E.ADDR,S,E*<-)FK3CJ-PUX:#3D/R&O"6U\;0H1'9<8)Q+U,RZ2JG5;;+

MW5C2GM&K%1-M6*%-L2DO(92@PW!:W)JD$[:S7&),&=)G*F37D+FVIQR>L4,H

MCRD+;AFAP9`9&]R1J9U]-$2FEKLT=6?,0@29"&T-H)"6HC1D56WNLHR6%<6D

MZAQ/#I`D:AOR!K\U*T"OE\PE)!"=`E.AGKJLS(UN;0ITB&NO#4:C7AH#3P(]

M1H-!H-01@RU#B-A_%5,,I;KM:TZ$P/\`DZ%;HDAN2U(>ZK5MU'(]RR^(SR9!-,(U9A

M-$J%5DPN)`=2Y';DFZQ9//.V]BN4*Y),OOR4,!"$QTQ8#!I9IVR7(KCD2+5A

MYPIK[D=N.XXTU-F'+70R4,J58-*5,4DD(92A,.`VP&*]/6EPENO6;+BTOK<9

M:B*7TUM.3%*2:>+82-1N/53F@6YH%GJ7U`FRT0UL!%

MIP,@:0:1IH?TC<-PW`_,$6@/S!$"\^#[73/X$^>/9N1VXE4[**D64-HKEGIK

M<2P'8S9HD4S+J)E89MRX[J&Y\B1'3,L%Q6RM4LMQK-E:(2T/$VAMYR55-2G+

M.O.2EV"XTU#BNQT5#CSI,6*W7Y=LVRN;9(BEPHH"71*IFWCE0=S4:*IE%8R\

MV([SZGI9&-1(;WE\3"G---.['0]%

M0^%4S2G&ZL^M#8>4]!DONJAVQR%,7;+JF[!M]V0E#YSXJ92'H"4M0JPHB*F*

M_HTJ4;TN>]U;&S](E,MM+=?+3*2V:'GYL-$L2*UMQ!43)%6U1Q0<9\W[1;VZ

M=+5&1"D&IFMG%(/UK:WI:D![3:RPE"&H+:356)-=A#2T00060U"2!:@S,*,:

MA*M0DR,S(M7&R,*9(R:;_*RTI`02R5O,E*5M,_+AH-!H-!H-!L&T)&H7Y!"M

M!J-0^WL/QS\#'8I.K<@MNK;J&FU1X#L9LS?B,29SD1E=PF.TY;,H2IU#2&V4

MMB#6LH#-,A#IU[BY-@U)<NW"LD2UNN-N.2D)6A->R0AU#

M3)>SJ-ZRBO.G/==9:B&XENKL52S.X23LNQ:9!NI(HFS8F(T;DFN;>5-A]9*(

MQMH:FN1PW8J2J7-.1P(]`:M>!+"5:@U:!1EH1:AOY=,MSC!&;[6I;%;8^_1E

MQ6OJ-%K>))J,@9`T:C:-H47DD*!#0:`P9#0)(:<)2-Q?#P:LXS3L9YAJ5(?:

M"K4R=*[9-Q$UMYQ:4.JDPT21.IFI`L(*EHEH>BL$X_$:@3WEMU=IZQQ-NRZ[

M-?0@O)L@VX;9UT=RP78M/(0PT[':J77EDFR4;TRV2T%V;24Q'.HAHD+5)BMO

MKGP&S;;?6V&9:V3]P]'H9ZA#9K!IV\"+4&6G%H&1:N)\NB099T!,

MF2GR40>W;6W3-,>01A$I)J6XDE/I+1QLC+I^24^2==$F"4",@KS+4$6H-/'8

M"3H-!M&@<1L/Q3\"-&5)4:G/+?>N")^;9-,')DICIBM):1%C,FI^I9D.V==U"DXZAIL5%EZ(W,C3N

M>O&4ICS6G$0GD/DZE+C\YI+J/;VM*^L**+,U17US7;`Y%(II#-6XZE2=I\:S

M3IVNFH0%\C:-YNM^24*(H^X=11+??VAB>C9

M*T:,PA8)>HVDH$0V#0)!GIRZC4P6HEH\8_`QY]#08E)>0DDM$J`CI/5*>C(K

MG$-34OQFI$I=YJM@JAMTL=]"

MBL)"W[>T-I'+"@(B%'J"0[8Q''G)I/H:BD^RV\V]8*B).&],L$QTHE(6F<\3

MSG&'#(DJ@$M>SS)&ADG0&DP1&04>IU]0]8V

M?I!Z]K2N=)U"7&UN7.G1$*"A*/:4[[&$EDA'L3:)JQ,E3)O6#;.X.-[.>&1;

M5,)-H$>Y9D.O2D]261*0TREE,*L::"J-

M*W[N*N0%MOLM-TKTH4O4CNV=J4ZR^:)IK+3Y7TP4[\S\Q.G71I'62TV

M/UQ$$MGTI25V+3K#4..]':J93[AG=*Z]E;(:0B4A:8,A$@G4IG*5ZCKL3'C=A6OJ7(=FB6MF2EYPT)6Y+A(DJFTK4@I

M5;JQ#A.Q&J?U.D>>\](M[;HJ?LVF$P9126XSS4A4R.A]4B.A:(5@4HU>"P_TQ(D=0*2:>:%')TYD

M,D%Z]>G%2#2&'B>2PM*QTT[WF"4?_DO(

M%Y`E^?5T&[4&>HZ9!,?I"46A^"?A4VEUB(C-.U1$%

M$#;-)^0_*0WD9FT/(*U!N![PC\,X"4LJJTI957N,,K0_$89?>C,5\[8Q!N6W

MRBRFY"E.)7(FQDR4R([;B(=0B.F)2FRY80WW';22Y&:A/N-M5MP<@W;=OJ/S

M$,)AJ2;;/36Y,BHD!RN:<*MKDH;N&>DY\!KH%OJ6$35()F8;9R9)OAQA3?"L

M<(69ELXQFNJN5'5LBH6EN"ZX9G-,G'I24FX^E)'H9$1&1,I2GH:)Z7Y>G^78

M>A^0ZR0ZG<&T;TFC11L*26T*/:$K(P\CR^$3;2)(L[%V,'KYL/VS38EK02%K

M)!,QTM(A5C<80Z1+3LRN>=?N>N2#D.L,U4\WFVKM*W9MBUHH]HA[30<1M;UI

M$2^ANM0VFMJU,"5">6]:.NLM0[Q+:)LLY2_A*[3?)^CECQ%2!TUPW)DKHH9G

M(<*+(2^-R#6^V2S?8)TEQB-+;!DDT*2@:C7RW>37YDK:)8)@DJ4V:"2XH$]T

MP;Z5A/S7&2%%J7PF/K)+V1O%MQ]LE/2(C01&@@24NAYO0*U3P46A_

M!T,)#B;B*EARBC*,TH?ZZYCQ/OVW3EH91'V[(Z$$'(#3ST^F1((X.

MC=-#=:;04GU-I->:(YNQNOMDO)*Q;<>L72;:26A6NG6^'BR>@6MBI-

M#U22)*R>DS";6[+2V1N$1(T,NB1I:C:@HID33.\)CFH-

MJ-M)RB(NH6H4PDR]*1&VTK=^)0<

M+R-.@D%^;G/P2(:`B&@@Z=*09*7!A()N-5(9./7GUEM/G)M'WR5-LU,(CV:5

MM5]@F6602$N*X5=.4CJ6!$I!ENY8-P<9,R6#5P$OE9UZ62^/C7"FDULIQPY-@:79\U"&VI"74QGR?2G0W7XJ7CDU

MZ7"DPRV=!:&V>HAMIU1MD>@UT!#_`,!/D-%`W%DLIQ:)>2L?,+8(2O&)((N)

M%Q,,IZBIT)OI%(6108:V&JIMYLHTMTWG;4VW;.AI/

M4RWF9]7<:'M!ZLQIO#Q)W--'HI2R$OQ4D"(:#0%Q,&8)PT'(NU.H#=B@VXDL

MI*8CR7#-"#\@EE)(MJ6T*+I$LC9U)PMI&O0;B&PATO/H^?1/3HF0)"@RZ1$MTA*

M\`^30$0T&G*84?%E)*4;9&F/";)$&N2@-0%)?NTK\"$T3JW(;:RBUR#3,C]!

M7QS+IM*>OE+2*2T)"9+WJ5F6GX)ZE>D*$MAJ/:KBJK[!;[DF:;BDR3029

M:DD3YZ&O<3R2="F=3;3M6E00_P"9/$0-PM.H04>X;M`X[H)7S\$B!$"($7,9

MA1@^5$E"TQW4NICZ&J[26O&/&4^;T1<4%<("U[SXU1?EE,)=-R*A1?@:[%M+

M;KG4562TL-2'4.ETVC3Z=.A,&8-H]5ZDM+VJV%=4*TV^G_,3!F7IQT#(+/8:

M=%"0DUE(^KP"+4$0(N!

M8)SSW#R!`@38^8U!F8UXK+4/'JKP$D"+@1T+4DA#6BFF#2$,&E)O_`)D/$DC=+:MTMS9;5+;-1]$@2M@,]?!;

M\`P9@_$ZAZ1HQMIBM.)78;UF]#6T1-*,N5"=Q^B0"6IDS?49JFJ40(M0I)I^

M%CM]1:&4H3*02'.5*=P@Q"0XZIM:Y)MJ7(;;2IQA+89<,PIDVB;?U2F3^4Y.

MU+#?6!,'H<4]?3GH^?1'6!+,PM>U/@M`N74&H&H&8,_%CV*=L:2"9"=\O@F:UIM-DP3#H]^>V\U1")UIFO6LVH2U*)D

MS4MM1K6GIA*B,C5J"T21D6BM!KPU-/`_/AJ)/DGP6OGRJ,'P/X""T3BI45)I

M;C=-+J=I^$1Z`SU^#;R!:$.NFZ?@4T-QI"'7TFPZ;1M2.BI$Q:527E/D<$1ZDHS(WG%$''#(U.GN

M)TS4A[<92/RQFNJGTYF3Q]-76U'4,P@S$I6Y7A-GJ7`P8/@9_!)/0R<(R=/5

M7(V@UF[&-O@E)F#+3X2LV]'(#U=KXY2'5UC*D^!#5J4J%T";DDM12$F:H:TI

MZI;NI^;<1F2M01D8W%IIH-`KR&HUT&H)1&%'N\..?$P?`PKX2-%)9'#_`#/Q

M>F#B*(DMFL,.=)4A\C(1/DX1&IXM2^";D+;*OI"?1-8]M=>OG7$A$5Q9I3I%5JGRWOI)1=)(:9(@IC\SQ'IZ<$V9@T

MZ`TZ?`0;Q+3=C-]6O@T1$FR<2X]R-(WFZQ^4V=$](VTPT$T)[I.FA*TI3N0G

M5:$K-9)6M6NY6YC_`)`I)#>H;U$-5C11B4?B$"/7@8/@KXEADM"CD2GVC4#)

M1$R:B+J*W..Z`W`E>HW>:_EXC%J1F3I&;?\`R!/YAN!.$8ZJ1UB"5;@\OW;^1PC!$>Y*3V[3U))C88,B$

MKG__V@`(`0$``04!\`@0()!`@7Q&G+J-?P74:C7DT&@T\4@7(0($"^)U&HUY

M-!IPU&HU^)U&HU&HUX:#3DU&HU&HU^`($"!`@7P&O^&$"!<2\34:C7EUX:\F

MOX9KSZ\^O@%Q3X.HU\/7P=?P[7X`N!`N"?'U&O`N;7\_,PFZKS;H9RWD8K:J?K\+NK6,S`DR)+V&7,:1&H+"4

MEK%;5Z?7X3=6D>LQ^RN'7,8M&7ZZLE6[]M2S:-WFE8?=0HMC72:B2Y43&H3.

M(W$F&QB5Q(AU\"1:R)##D5WC4T4^]7*QNSA%`@2+61&I9TR8YB5NU,M:2=2.

MS\'O*QGDE8?3#J,=L;XK*LE5#_`!J**?>KE8W9PB@0)%K(C4LZ9,W'CV]%*R-N9F&7^V,1L@R5NQLX?

M<9A^\QR94JK&)<.XKX%G7I&/M+QVTS9NJ;5J->2IEH@3LI@QY4C/JYFSM9MS

M03HM?(KK&MKY%;8UN%S:^E:SN3!LYO&C>C6=%5Q(Q5V-^@Q53UK$>O#D5U=9

M9HW5-KR>?3FOC4RD0)N408\J1GM:S9VLVXH9L6OD5UA6U\BNL*W$YL;T=Q7I

MK7.-(]&LJ*KB1BKL<]!BRGK6(]>'(KJZQS-NK;7_`"#'^Y3^?"JEH@377EU\8N.HUXZC7X+3FU\&2

M&*.^M%'5K@?_`)'':AJ_*UDHE2>.+M(D7,V+*)&0Q66KF"^AC)(;J9;+E\;J

M[ZKBT43DI8DTZ"?"AE'ADABCOK11U=U0ULR18-0G+C)(K50?'&&FY%S-BRB1

MD,5EJXR&%&98Q".;K-[_`/BA>UD6CA\E-%G'03H<,H\,D,T=]9J.K9C5]BQ1

MMMY`_D1-L2_@BX%X>O-6SEUDMQ9NJ:RA]M,&[?B$63R&WG;5YV-963EJ]QU"

MK)U<*LM'JIR?;KFMRK)V8P[E?77*NY4QJRL5VCW&NG+K);CAO+:R=]":^U>K

MI-=9O5BU7Q=0KF2:>15DXN%66CU4Y86ZYSJG)]NN:W*L79C#5

MDXQ#9L7&(LZROBE\2?P)_"%X>HUXZ_$E\(?*?Q)^*7/K\47*7@%XI^&?PI@#_8:

MG-.1=D[6K0M"FU_GN559_/%^(W?JX2O

M#ZC$;U

M9>C?Z[/;'*)#=I33Z1P)(UG"P+(IY2NV.3PTRHC\%P0*.QM4SZ>?4BHPF]O4

M7&'W6/I%3@U]=HML+O*-/C%RE^'=L_W/F7^@X=A2<]Y[PFT6+=A_]!W]_P"X

M.P7_`'.^_P#H.T675%53C^3L8',P%5'=3'+AS*<2@9;$LJ]ZJE]A?];D.+P+R7_*.+-K;

M<8GLP.U-17W#W=#%V'8\ABP9[LX@SC5C\$7,?-IXQ_"=L_W/?P'+6L_@>_$7

ML+<*EM*,EC17IKL3M-E$M,KM+E,5.`G..@[NLDSE'87_6]];=Z)`'8>S=

MD0N]%N[740[#VCCC7?5E)TW*7(7+KP+P#YM?`/PCY3YRY.V?[GLI[=5$_GB@

M$KOW4I+).\US=(/S'8?_`$'?Y!E*'8%"CE=^/]!1?[+C5_\`2S+_`'X[1_M/

MO9^Y.VV'QL8J\R[T^T2VN_%V2L-R8LNJ^\G[G["?ZW^P'#^OX[\_ZT=A/^YW

MT_T(+X<_&/E/E/E/D+@?+VS_`'/F7^@Y.P=JDVNX>$)S:`GL]E2G,`PYK"H'

M?C_053Z8\X3^TF2Q9=Y32L>FU?\`TLR_WX[1_M/O9^Y*FP;MH6:X;98[84>(

MV^1NXK0(QBK[R_N?L)_K?[`W:V8P7NU48S2=P\GBY=;X#W2E8BB/WFQAYO(

M.^L1MO%N]4&OK<_R.-E5QVR[B5V&1.Z&>0,UX=K\[@84.Y?<2NS*(.V>:0L,

M?[D]R:S,:PN8N!>"7`N4_"/P3Y#Y3_#"!<"\,N8N4_$/G/\`"M>0O'+E+XP_

MP37X(N)?A!\A_"P(,BS?Q_L.XZF-V:Q=@3.R..2"RKLS:T:!V1AQYU[W?J(,

M/&QKR]B(;$FN[_168WA8E15KM'W%9;CY)PP;M/49-2=P\9BXG;<.V&"P,U'<

MKMY78;$A1CFR/X(L^..8K2OU7./XM2O5?!Y!<)G]MLFK4J2;9ZCL!_K

M/["BIQ6WO2L>W.2U:?EPAPY$]R)VTR>:+#MYDE81D:3&&_Z#N7^Y^':3]I]Z

M_P!R<.P`[\_ZW&*.RFS!]GWPEPI%>[#>S;H6KDYR7V._T7??_MT#ENA^XD99

MZ3&*2QF3!]HWHEPY%>[$D9KT+5R:Y*%50V-V;O;/)F42X4BOUL3'&;_/

MZ+&ETOWU=F+-M52:29V`_P!;E&%10UDW<6HQ9^K[M8]9+[SRJKTHU!^(?PW]?\`I]7OGO\`MT=KH<>P

MR;[-H!]FT`[V54*JLNPW[@[T_MCLO3(M,A[D9*O%J)UQ;RQV:RM_(:OO[3(;

M=[`?ZWO3E#]#5:B',>KW\3N_N.H[I5:*G)JFDGWCC?9S*EDGM]EV-2%))926

MN@]AO[?[E_N?AVD_:?>S]R%P_K^._/\`K:+_`&7'#_\`0]R?W+V-_P!#WW_[

M?8[_`'O>#]M4/^RXXC_HNX_[DPBK13T?Y=>>1YS#@UN&5=KW]G*>@]_;-"XSWJ6K#_`+6&_M_N7^Y^'9>9ZG&.^U]X/VU0_P"RXXC_

M`*+N/^Y*=Y,F!:]VZFFF?S;1C^;:,=Q.X==EM?0Y%.QJ13=[8;Q4^1U>0I[H

M]OHB8?P!\A^,?"-)=AO8)FL;,H.==IX>5.2NSF4QW*OLED,U>&8DQAE?WUFL

M2;CL-_O^]/[8P[(U8K;J*#DU?DW96YK7J?L]D=F[C6.P\0K>Z67HRRX[`?ZW

M*<=B97`NNTF1U#N(=E[2QD3)<2AA8ME7J\XRZG7?TUC16%0]A/;2SR641$DK

M#_M8;^W^YG[HX=E,K;J)V5XM#RZ#9=F,DANTG9.]F.U-5$QV#W*RA&57-2\F

M/.$_M/D<:7=TTG'YN'_Z'N1^YNQO^A[\?]OL=_O>\'[:J'4QYPG]JLAC2KJG

MD4$S$?\`1=Q_W)VARENSK>Y7;=[('OL7(-V-=F7'VLDQZ3C$['NT1W%+:]N,

M@JEX'AU\FYSV:W!Q[P3YSY3YCY2Y:RTETTB@[\FA,;O+B[XF]\,>CED_>>WN

MDJ4:S[9Y;#PVT[@]U:G*Z889W&L\,.L[WX[,3/[UXS$3FO=BQRM`[8=QZW"H

MF:]W4V4RD[[U,ENQ[VXU#3G'OL)%7(H.];"D'W7QG9D/>I&R7+>GO8

MOW7LZ),'O#C\HIG=['(R%H-.!>(?QAY+:6LFYBY2X%RES%\"?@GX)_`=M/W/?SW*JL_GF_'\\

MWX_GF_&7YM.S5W[-OPXVII0CXK=3&YD.17NPL