| UNITED STATES SECURITIES AND EXCHANGE COMMISSION | ||

| Washington, D.C. 20549 | ||

FORM N-CSR | ||

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES | ||

| Investment Company Act file number: | (811-05989) |

| Exact name of registrant as specified in charter: | Putnam Global Utilities Fund |

| Address of principal executive offices: | One Post Office Square, Boston, Massachusetts 02109 |

| Name and address of agent for service: | Robert T. Burns, Vice President One Post Office Square Boston, Massachusetts 02109 |

| Copy to: | John W. Gerstmayr, Esq. Ropes & Gray LLP 800 Boylston Street Boston, Massachusetts 02199-3600 |

| Registrant’s telephone number, including area code: | (617) 292-1000 |

| Date of fiscal year end: | August 31, 2012 |

| Date of reporting period: | September 1, 2011 — August 31, 2012 |

Item 1. Report to Stockholders: |

| The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940: | |||

Putnam

Global Utilities

Fund

Annual report

8 | 31 | 12

| Message from the Trustees | 1 | ||

|

|

|||

| About the fund | 2 | ||

|

|

|||

| Performance snapshot | 4 | ||

|

|

|||

| Interview with your fund’s portfolio manager | 5 | ||

|

|

|||

| Your fund’s performance | 10 | ||

|

|

|||

| Your fund’s expenses | 13 | ||

|

|

|||

| Terms and definitions | 15 | ||

|

|

|||

| Other information for shareholders | 16 | ||

|

|

|||

| Trustee approval of management contract | 17 | ||

|

|

|||

| Financial statements | 22 | ||

|

|

|||

| Federal tax information | 46 | ||

|

|

|||

| About the Trustees | 47 | ||

|

|

|||

| Officers | 49 | ||

|

|

|||

Consider these risks before investing: International investing involves certain risks, such as currency fluctuations, economic instability, and political developments. Additional risks may be associated with emerging-market securities, including illiquidity and volatility. The fund’s policy of concentrating on a limited group of industries and the fund’s non-diversified status, which means the fund may invest in fewer issuers, can increase the fund’s vulnerability to common economic forces and may result in greater losses and volatility. The use of derivatives involves additional risks, such as the potential inability to terminate or sell derivatives positions and the potential failure of the other party to the instrument to meet its obligations. Growth stocks may be more susceptible to earnings disappointments, and value stocks may fail to rebound. These risks are generally greater for small and midsize companies. The use of short selling may result in losses if the securities appreciate in value. The prices of stocks in the fund’s portfolio may fall or fail to rise over extended periods of time for a variety of reasons, including both general financial market conditions and factors related to a specific issuer or industry.

Message from the Trustees

Dear Fellow Shareholder:

Markets worldwide have exhibited resiliency in recent months, despite the challenges of a global economic slowdown and tepid growth here in the United States. Since early summer, stock and bond investors have increasingly moved into riskier assets. Still, the market rebound has been punctuated by periods of volatility.

Persistently high U.S. unemployment, Europe’s tenacious credit troubles, and a manufacturing slowdown in China all have created a climate of uncertainty — an environment that, we believe, will remain for some time. The hope is that, after election day, Washington lawmakers will act swiftly to resolve pressing challenges, such as the impending “fiscal cliff” set to occur on January 1, 2013, that will trigger automatic tax increases and government spending cuts.

A long-term view and balanced investment approach become ever more important in this type of market environment, as does reliance on a financial advisor, who can help you navigate your way toward your financial goals.

We would like to take this opportunity to announce the arrival of two new Trustees, Liaquat Ahamed and Katinka Domotorffy, CFA, to your fund’s Board of Trustees. Mr. Ahamed, who in 2010 won the Pulitzer Prize for History with his book, Lords of Finance: The Bankers Who Broke the World, also serves on the Board of Aspen Insurance and the Board of the Rohatyn Group, an emerging-market fund complex that manages money for institutional investors. Ms. Domotorffy, who until year-end 2011 was a Partner, Chief Investment Officer, and Global Head of Quantitative Investment Strategies at Goldman Sachs Asset Management, currently serves as a member of the Anne Ray Charitable Trust’s Investment Committee, Margaret A. Cargill Philanthropies, and director for Reach Out and Read of Greater New York, an organization dedicated to promoting early childhood literacy.

We would also like to extend a welcome to new shareholders of the fund and to thank all of our investors for your continued confidence in Putnam.

About the fund

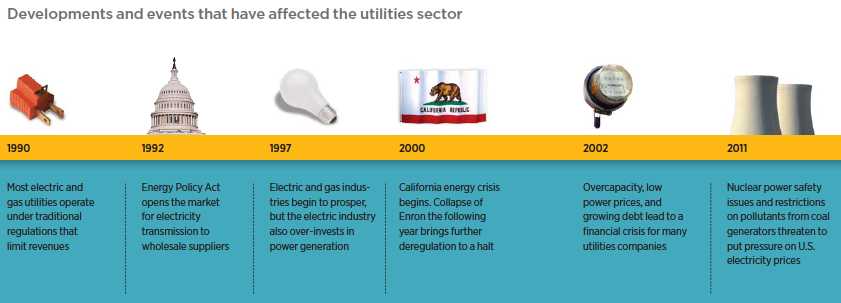

Investing in the utilities sector for over 20 years

Many stock funds offer the potential for growth but produce little or no income for investors. Putnam Global Utilities Fund pursues both capital growth and current income through investments in the utilities sector. The fund targets industries that can profit from the global demand for utilities. It can invest in bonds as well as stocks, in both domestic and international markets, and across several industries with varying degrees of regulation.

The fund, which is part of Putnam’s suite of global sector funds, invests in utilities and their related industries in markets around the world.

Although the fund’s portfolio can include businesses of all sizes and at different stages of growth, established corporations are the norm in the utilities sector. Utilities have a history of consistent dividend payouts to investors. Their securities are valued as an alternative to bonds, especially during periods of low interest rates, when investors look outside the bond market for income.

The fund’s strategy, particularly during periods of uncertainty, is to maintain a solid foundation of securities in stable-demand industries, such as electric power and natural gas. Guided by this approach, the fund’s manager is committed to finding rewarding opportunities for income and growth by anticipating developments that affect the utilities sector worldwide. The manager conducts intensive research with support from analysts on Putnam’s Global Equity Research team.

Sector investing at Putnam

In recent decades, innovation and business growth have propelled stocks in different industries to market-leading performance. Finding these stocks, many of which are in international markets, requires rigorous research and in-depth knowledge of global markets.

Putnam’s sector funds invest in nine sectors worldwide and offer active management, risk controls, and the expertise of dedicated sector analysts. The funds’ managers invest with flexibility and precision, using fundamental research to hand select stocks for the portfolios.

All sectors in one fund:

Putnam Global Sector Fund

A portfolio of individual Putnam Global Sector Funds that provides exposure to all sectors of the MSCI World Index.

Individual sector funds:

Global Consumer Fund

Retail, hotels, restaurants, media, food and beverages

Global Energy Fund

Oil and gas, energy equipment and services

Global Financials Fund

Commercial banks, insurance, diversified financial services, mortgage finance

Global Health Care Fund

Pharmaceuticals, biotechnology, health-care services

Global Industrials Fund

Airlines, railroads, trucking, aerospace and defense, construction, commercial services

Global Natural Resources Fund

Metals, chemicals, oil and gas, forest products

Global Technology Fund

Software, computers, Internet services

Global Telecommunications Fund

Diversified and wireless telecommunications services

Global Utilities Fund

Electric, gas, and water utilities

| 2 | 3 |

Current performance may be lower or higher than the quoted past performance, which cannot guarantee future results. Share price, principal value, and return will fluctuate, and you may have a gain or a loss when you sell your shares. Performance of class A shares assumes reinvestment of distributions and does not account for taxes. Fund returns in the bar chart do not reflect a sales charge of 5.75%; had they, returns would have been lower. See pages 5 and 10–12 for additional performance information. For a portion of the periods, the fund had expense limitations, without which returns would have been lower. A short-term trading fee of 1% may apply to redemptions or exchanges from certain funds within the time period specified in the fund’s prospectus. To obtain the most recent month-end performance, visit putnam.com.

* The fund’s benchmark, the MSCI World Utilities Index (ND), was introduced on 1/1/01, which post-dates the inception of the fund’s class A shares.

4

Interview with your fund’s portfolio manager

Volatility continued to roil global equity markets over the past year. How did Putnam Global Utilities Fund perform in this uncertain environment?

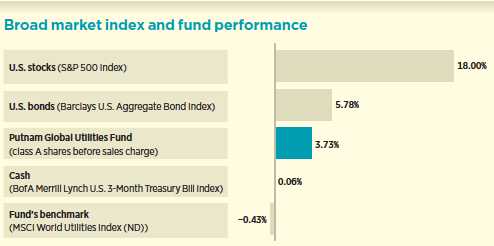

Just as the world’s economies had their ups and downs over the past year, Putnam Global Utilities Fund, too, had its share of encouraging and discouraging performance. On balance for the 12 months ending August 31, 2012, however, the fund did remarkably well, outperforming its benchmark, the MSCI World Utilities Index (ND), by a significant margin, thanks to opportune security selection.

The utilities sector is a relatively defensive sector and tends to be counter-cyclical in nature, meaning that when the broad market is in a cyclical uptrend, utilities shares typically lag the market, and vice versa. During late 2011 and into the early months of 2012, as the broad market was rallying on signs of improving economic data in the United States and some level of optimism about a potential resolution to the eurozone sovereign debt crisis, utilities stocks showed generally anemic returns. That performance slowdown notwithstanding, utilities stocks were buoyed by their high dividend yields.

The rally tide began to recede by early spring, however, as concerns about European sovereign debt resurfaced, chinks were revealed in the U.S. growth story, and economic activity in the emerging markets

This comparison shows your fund’s performance in the context of broad market indexes for the 12 months ended 8/31/12. See pages 4 and 10–12 for additional fund performance information. Index descriptions can be found on page 15.

5

continued to decelerate. As the global equity markets pivoted and began to retreat, utilities stocks came back into favor for their more defensive characteristics, and then gave back some of those gains in the late summer as global markets again rallied.

From a regional perspective during the 12-month period, utilities stocks in Germany, the United States, and the United Kingdom were the best performers in the benchmark index, in U.S. dollar terms, while peripheral European markets such as Greece and Spain were among the worst.

What helped the fund outperform the sector benchmark?

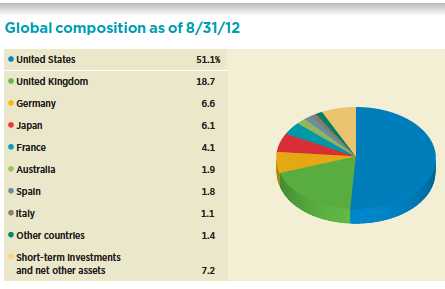

Strong security selection was the overall key. And, more gratifying, solid stock picking was demonstrated broadly, across virtually all subsectors and all geographies represented in the group, including both regulated and unregulated utilities. Stock selection in Japan, for example — a geographic market where utilities did not perform well during the period — provided the biggest performance boost, even though our slight overweight to the Japanese market marginally dampened our stock-picking success. Stock selection in the United States also helped, as did our overweight position in the largest of the countries represented in the index.

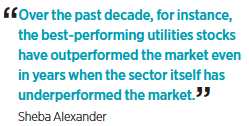

Our research has shown that there are ways to make money in the utilities market regardless of whether the sector is outperforming or underperforming the broad market. Over the past decade, for instance, the best-performing utilities stocks have outperformed the market even in years when the sector itself has underperformed the market, making a strong case for bottom-up research-driven stock picking within this sector.

You began managing the portfolio in June 2012. Have you made any significant changes in the fund’s positioning since then?

I’ve done a few things since taking over three months ago. First, in the Japanese market, I made some stock-specific trades that had the effect of reducing the fund’s overweight position there.

Country allocations are shown as a percentage of the fund’s net assets. Summary information may differ from the portfolio schedule included in the financial statements due to the inclusion of derivative securities and the exclusion of as-of trades, if any. Weightings will vary over time.

6

In the U.S. market, I also made a number of stock-specific changes. Among regulated utilities, whose stocks have tended to be quite expensive of late, I opted to shift the focus more toward companies whose growth prospects I consider to be better than the sector average and whose dividend payouts have been at the lower end of the typical range for such stocks, believing that there may be room for their dividends to grow faster than their earnings. I’ve tended to favor companies whose earnings prospects are not too closely tied to natural gas prices.

Additionally in the U.S. market, which currently has an oversupply of power capacity, I am tending to favor competitive-generation companies that have some exposure to Texas, California, and Mid-Atlantic region markets, each of which for various reasons is likely to see upward pressure on power prices.

Which individual holdings made the biggest contributions to relative performance?

The top contributor was an overweight position in Tokyo Gas, the largest natural gas distributor in Japan. This conservatively managed company has consistently met or exceeded its earnings projections, and its stock price has followed suit.

The fund’s overweight position in Ameren, which provides electricity and gas to customers in Illinois and Missouri, also helped bolster the fund’s outperformance of its benchmark, as the regulatory environment in those states improved, and Ameren’s share price increased in value.

An underweight in Iberdrola, a Spanish multinational electric utility, also contributed, as the valuation of this stock depreciated due to eurozone worries.

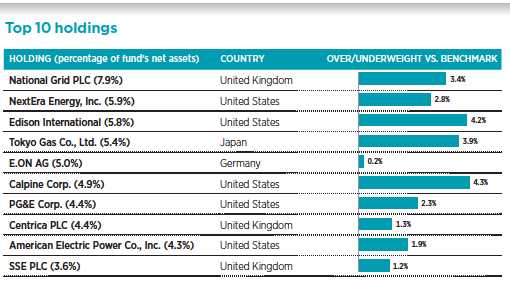

This table shows the fund’s top 10 holdings by percentage of the fund’s net assets as of 8/31/12. Short-term holdings are excluded. Holdings will vary over time.

7

Choosing not to hold shares of Tokyo Electric Power, the owner and operator of the Fukushima Daiichi power plant crippled by the 2011 earthquake, also proved beneficial, as the company’s stock price has not recovered since plummeting in the wake of the disaster.

Which stocks detracted from the fund’s relative performance?

Among the fund’s biggest detractors were strong-performing index constituents that we chose not to hold. Principal among them was RWE, a German-based utility whose stock outperformed on the back of that country’s relative economic strength versus the rest of the eurozone. The fund also held no stake in The Southern Company, a large regulated U.S. utility whose stock performed well during the period.

Although I have since added to the fund’s position in NextEra Energy, a Florida-based electric utility, the fund’s net underweight position to this strong-performing index component during the period detracted from our relative performance.

Our overweight position in Japan’s largest electric utility, Electric Power Development, also hurt our relative results.

How did the fund use derivatives during the period?

We used currency forward contracts to hedge portions of the fund’s foreign currency exposures relative to the benchmark. We use currency forwards in an effort to protect the fund from adverse exchange-rate movements.

What is your outlook for global utilities?

I don’t see much changing in the near term. In the United States, from the point of view of regulated utilities, I don’t expect to see much of a change from the somewhat benign regulatory environment that exists today. From a power market perspective, I expect U.S. markets to remain in oversupply and, with natural gas prices expected to remain soft, I expect a soft power market to persist. All that said, I am comfortable with the fund’s current positioning and will continue to seek

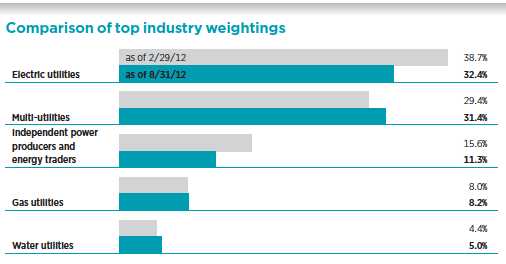

This chart shows how the fund’s top weightings have changed over the past six months. Weightings are shown as a percentage of net assets. Summary information may differ from the portfolio schedule included in the financial statements due to the inclusion of derivative securities and the exclusion of as-of trades, if any. Holdings will vary over time.

8

out what I consider to be the best-performing stories I can find, wherever they exist in the global utilities market. In Europe, I think power markets will continue to remain in oversupply and, on the regulated side, I believe that the United Kingdom will remain the most favorable market on a relative basis.

Thank you, Sheba, for your time and insights today.

The views expressed in this report are exclusively those of Putnam Management and are subject to change. They are not meant as investment advice.

Please note that the holdings discussed in this report may not have been held by the fund for the entire period. Portfolio composition is subject to review in accordance with the fund’s investment strategy and may vary in the future. Current and future portfolio holdings are subject to risk.

Of special interest

In June 2012, the fund reduced its class A share quarterly dividend by 11.84%, from $0.076 to $0.067 per share, due to a decrease in dividend income earned in the fund. Similar reductions were made to all of the fund’s other share classes.

Portfolio Manager Sheba M. Alexander has an M.B.A. from the Tuck School of Business at Dartmouth College, a Master of Finance and Control from the University of Delhi in New Delhi, India, and a B.A. from the University of Delhi. A CFA charterholder, she joined Putnam in 1999 and has been in the investment industry since 1995.

IN THE NEWS

In a bid to protect Spain and Italy from financial collapse, the European Central Bank (ECB) made a bold move in early September to buy unlimited amounts of short-term bonds from those eurozone countries that need the most assistance. The program is designed to effectively spread the risk for the responsibility of sharing repayment of the nations’ debt. The move is meant to provide countries like Spain and Italy with sufficient time to reduce their debt and restore their economies. Financial markets worldwide reacted positively to the news because it may reduce the likelihood that the 17-nation euro currency union will dismantle, which could have significant economic ramifications.

9

Your fund’s performance

This section shows your fund’s performance, price, and distribution information for periods ended August 31, 2012, the end of its most recent fiscal year. In accordance with regulatory requirements for mutual funds, we also include performance as of the most recent calendar quarter-end and expense information taken from the fund’s current prospectus. Performance should always be considered in light of a fund’s investment strategy. Data represent past performance. Past performance does not guarantee future results. More recent returns may be less or more than those shown. Investment return and principal value will fluctuate, and you may have a gain or a loss when you sell your shares. Performance information does not reflect any deduction for taxes a shareholder may owe on fund distributions or on the redemption of fund shares. For the most recent month-end performance, please visit the Individual Investors section at putnam.com or call Putnam at 1-800-225-1581. Class R and class Y shares are not available to all investors. See the Terms and Definitions section in this report for definitions of the share classes offered by your fund.

Fund performance Total return for periods ended 8/31/12

| Class A | Class B | Class C | Class M | Class R | Class Y | |||||

| (inception dates) | (11/19/90) | (4/27/92) | (7/26/99) | (3/1/95) | (12/1/03) | (10/4/05) | ||||

|

| ||||||||||

| Before | After | Before | After | Net | Net | |||||

| sales | sales | Before | After | Before | After | sales | sales | asset | asset | |

| charge | charge | CDSC | CDSC | CDSC | CDSC | charge | charge | value | value | |

|

| ||||||||||

| Annual average | ||||||||||

| (life of fund) | 6.23% | 5.94% | 5.44% | 5.44% | 5.44% | 5.44% | 5.71% | 5.53% | 5.97% | 6.32% |

|

| ||||||||||

| 10 years | 83.28 | 72.79 | 69.87 | 69.87 | 70.00 | 70.00 | 74.34 | 68.30 | 78.96 | 86.60 |

| Annual average | 6.25 | 5.62 | 5.44 | 5.44 | 5.45 | 5.45 | 5.72 | 5.34 | 5.99 | 6.44 |

|

| ||||||||||

| 5 years | –17.49 | –22.25 | –20.55 | –21.98 | –20.54 | –20.54 | –19.48 | –22.32 | –18.48 | –16.41 |

| Annual average | –3.77 | –4.91 | –4.50 | –4.84 | –4.49 | –4.49 | –4.24 | –4.93 | –4.00 | –3.52 |

|

| ||||||||||

| 3 years | 3.52 | –2.40 | 1.21 | –1.60 | 1.25 | 1.25 | 2.05 | –1.52 | 2.78 | 4.41 |

| Annual average | 1.16 | –0.81 | 0.40 | –0.54 | 0.41 | 0.41 | 0.68 | –0.51 | 0.92 | 1.45 |

|

| ||||||||||

| 1 year | 3.73 | –2.25 | 2.97 | –2.04 | 2.89 | 1.88 | 3.20 | –0.38 | 3.48 | 4.08 |

|

| ||||||||||

Current performance may be lower or higher than the quoted past performance, which cannot guarantee future results. After-sales-charge returns for class A and M shares reflect the deduction of the maximum 5.75% and 3.50% sales charge, respectively, levied at the time of purchase. Class B share returns after contingent deferred sales charge (CDSC) reflect the applicable CDSC, which is 5% in the first year, declining over time to 1% in the sixth year, and is eliminated thereafter. Class C share returns after CDSC reflect a 1% CDSC for the first year that is eliminated thereafter. Class R and Y shares have no initial sales charge or CDSC. Performance for class B, C, M, R, and Y shares before their inception is derived from the historical performance of class A shares, adjusted for the applicable sales charge (or CDSC) and the higher operating expenses for such shares, except for class Y shares, for which 12b-1 fees are not applicable.

For a portion of the periods, the fund had expense limitations, without which returns would have been lower.

Class B share performance does not reflect conversion to class A shares.

A short-term trading fee of 1% may apply to redemptions or exchanges from certain funds within the time period specified in the fund’s prospectus.

10

Comparative index returns For periods ended 8/31/12

| MSCI World Utilities Index (ND) | |

|

| |

| Annual average (life of fund) | —* |

|

| |

| 10 years | 106.52% |

| Annual average | 7.52 |

|

| |

| 5 years | –18.65 |

| Annual average | –4.04 |

|

| |

| 3 years | 0.93 |

| Annual average | 0.31 |

|

| |

| 1 year | –0.43 |

|

| |

Index results should be compared with fund performance before sales charge, before CDSC, or at net asset value.

* The fund’s benchmark, the MSCI World Utilities Index (ND), was introduced on 1/1/01, which post-dates the inception of the fund’s class A shares.

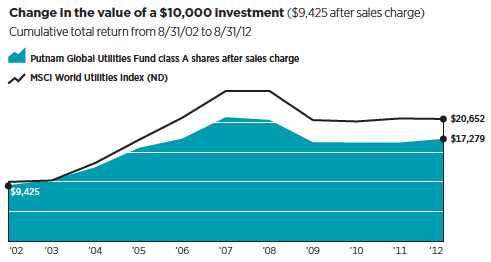

Past performance does not indicate future results. At the end of the same time period, a $10,000 investment in the fund’s class B and class C shares would have been valued at $16,987 and $17,000, respectively, and no contingent deferred sales charges would apply. A $10,000 investment in the fund’s class M shares ($9,650 after sales charge) would have been valued at $16,830. A $10,000 investment in the fund’s class R and class Y shares would have been valued at $17,896 and $18,660, respectively.

11

Fund price and distribution information For the 12-month period ended 8/31/12

| Distributions | Class A | Class B | Class C | Class M | Class R | Class Y | ||

|

| ||||||||

| Number | 4 | 4 | 4 | 4 | 4 | 4 | ||

|

| ||||||||

| Income | $0.322 | $0.246 | $0.247 | $0.270 | $0.297 | $0.347 | ||

|

| ||||||||

| Capital gains | — | — | — | — | — | — | ||

|

| ||||||||

| Total | $0.322 | $0.246 | $0.247 | $0.270 | $0.297 | $0.347 | ||

|

| ||||||||

| Before | After | Net | Net | Before | After | Net | Net | |

| sales | sales | asset | asset | sales | sales | asset | asset | |

| Share value | charge | charge | value | value | charge | charge | value | value |

|

| ||||||||

| 8/31/11 | $10.30 | $10.93 | $10.26 | $10.23 | $10.29 | $10.66 | $10.27 | $10.30 |

|

| ||||||||

| 8/31/12 | 10.35 | 10.98 | 10.31 | 10.27 | 10.34 | 10.72 | 10.32 | 10.36 |

|

| ||||||||

The classification of distributions, if any, is an estimate. Before-sales-charge share value and current dividend rate for class A and M shares, if applicable, do not take into account any sales charge levied at the time of purchase. After-sales-charge share value, current dividend rate, and current 30-day SEC yield, if applicable, are calculated assuming that the maximum sales charge (5.75% for class A shares and 3.50% for class M shares) was levied at the time of purchase. Final distribution information will appear on your year-end tax forms.

Fund performance as of most recent calendar quarter

Total return for periods ended 9/30/12

| Class A | Class B | Class C | Class M | Class R | Class Y | |||||

| (inception dates) | (11/19/90) | (4/27/92) | (7/26/99) | (3/1/95) | (12/1/03) | (10/4/05) | ||||

|

| ||||||||||

| Before | After | Before | After | Net | Net | |||||

| sales | sales | Before | After | Before | After | sales | sales | asset | asset | |

| charge | charge | CDSC | CDSC | CDSC | CDSC | charge | charge | value | value | |

|

| ||||||||||

| Annual average | ||||||||||

| (life of fund) | 6.29% | 6.01% | 5.50% | 5.50% | 5.50% | 5.50% | 5.77% | 5.60% | 6.03% | 6.38% |

|

| ||||||||||

| 10 years | 107.35 | 95.56 | 92.56 | 92.56 | 92.45 | 92.45 | 97.47 | 90.68 | 102.30 | 111.05 |

| Annual average | 7.56 | 6.94 | 6.77 | 6.77 | 6.77 | 6.77 | 7.04 | 6.67 | 7.30 | 7.76 |

|

| ||||||||||

| 5 years | –20.03 | –24.63 | –22.98 | –24.36 | –22.98 | –22.98 | –21.95 | –24.67 | –21.00 | –19.00 |

| Annual average | –4.37 | –5.50 | –5.09 | –5.43 | –5.09 | –5.09 | –4.84 | –5.51 | –4.61 | –4.13 |

|

| ||||||||||

| 3 years | 3.61 | –2.34 | 1.32 | –1.49 | 1.23 | 1.23 | 2.13 | –1.41 | 2.87 | 4.41 |

| Annual average | 1.19 | –0.79 | 0.44 | –0.50 | 0.41 | 0.41 | 0.71 | –0.47 | 0.95 | 1.45 |

|

| ||||||||||

| 1 year | 8.70 | 2.41 | 7.93 | 2.93 | 7.86 | 6.86 | 8.26 | 4.47 | 8.47 | 9.08 |

|

| ||||||||||

12

Your fund’s expenses

As a mutual fund investor, you pay ongoing expenses, such as management fees, distribution fees (12b-1 fees), and other expenses. Using the following information, you can estimate how these expenses affect your investment and compare them with the expenses of other funds. You may also pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial representative.

Expense ratios

| Class A | Class B | Class C | Class M | Class R | Class Y | |

|

| ||||||

| Total annual operating expenses | ||||||

| for the fiscal year ended 8/31/11 | 1.28% | 2.03% | 2.03% | 1.78% | 1.53% | 1.03% |

|

| ||||||

| Annualized expense ratio | ||||||

| for the six-month period | ||||||

| ended 8/31/12* | 1.29% | 2.04% | 2.04% | 1.79% | 1.54% | 1.04% |

|

| ||||||

Fiscal-year expense information in this table is taken from the most recent prospectus, is subject to change, and may differ from that shown for the annualized expense ratio and in the financial highlights of this report. Expenses are shown as a percentage of average net assets.

* For the fund’s most recent fiscal half year; may differ from expense ratios based on one-year data in the financial highlights.

Expenses per $1,000

The following table shows the expenses you would have paid on a $1,000 investment in the fund from March 1, 2012, to August 31, 2012. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| Class A | Class B | Class C | Class M | Class R | Class Y | |

|

| ||||||

| Expenses paid per $1,000*† | $6.58 | $10.39 | $10.39 | $9.12 | $7.85 | $5.31 |

|

| ||||||

| Ending value (after expenses) | $1,029.90 | $1,026.20 | $1,026.30 | $1,027.30 | $1,028.70 | $1,032.10 |

|

| ||||||

* Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of average net assets for the six months ended 8/31/12. The expense ratio may differ for each share class.

† Expenses are calculated by multiplying the expense ratio by the average account value for the period; then multiplying the result by the number of days in the period; and then dividing that result by the number of days in the year.

13

Estimate the expenses you paid

To estimate the ongoing expenses you paid for the six months ended August 31, 2012, use the following calculation method. To find the value of your investment on March 1, 2012, call Putnam at 1-800-225-1581.

Compare expenses using the SEC’s method

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the following table shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total costs) of investing in the fund with those of other funds. All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| Class A | Class B | Class C | Class M | Class R | Class Y | |

|

| ||||||

| Expenses paid per $1,000*† | $6.55 | $10.33 | $10.33 | $9.07 | $7.81 | $5.28 |

|

| ||||||

| Ending value (after expenses) | $1,018.65 | $1,014.88 | $1,014.88 | $1,016.14 | $1,017.39 | $1,019.91 |

|

| ||||||

* Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of average net assets for the six months ended 8/31/12. The expense ratio may differ for each share class.

† Expenses are calculated by multiplying the expense ratio by the average account value for the period; then multiplying the result by the number of days in the period; and then dividing that result by the number of days in the year.

14

Terms and definitions

Important terms

Total return shows how the value of the fund’s shares changed over time, assuming you held the shares through the entire period and reinvested all distributions in the fund.

Before sales charge, or net asset value, is the price, or value, of one share of a mutual fund, without a sales charge. Before-sales-charge figures fluctuate with market conditions, and are calculated by dividing the net assets of each class of shares by the number of outstanding shares in the class.

After sales charge is the price of a mutual fund share plus the maximum sales charge levied at the time of purchase. After-sales-charge performance figures shown here assume the 5.75% maximum sales charge for class A shares and 3.50% for class M shares.

Contingent deferred sales charge (CDSC) is generally a charge applied at the time of the redemption of class B or C shares and assumes redemption at the end of the period. Your fund’s class B CDSC declines over time from a 5% maximum during the first year to 1% during the sixth year. After the sixth year, the CDSC no longer applies. The CDSC for class C shares is 1% for one year after purchase.

Share classes

Class A shares are generally subject to an initial sales charge and no CDSC (except on certain redemptions of shares bought without an initial sales charge).

Class B shares are not subject to an initial sales charge. They may be subject to a CDSC.

Class C shares are not subject to an initial sales charge and are subject to a CDSC only if the shares are redeemed during the first year.

Class M shares have a lower initial sales charge and a higher 12b-1 fee than class A shares and no CDSC (except on certain redemptions of shares bought without an initial sales charge).

Class R shares are not subject to an initial sales charge or CDSC and are available only to certain defined contribution plans.

Class Y shares are not subject to an initial sales charge or CDSC, and carry no 12b-1 fee. They are generally only available to corporate and institutional clients and clients in other approved programs.

Comparative indexes

Barclays U.S. Aggregate Bond Index is an unmanaged index of U.S. investment-grade fixed-income securities.

BofA (Bank of America) Merrill Lynch U.S. 3-Month Treasury Bill Index is an unmanaged index that seeks to measure the performance of U.S. Treasury bills available in the marketplace.

MSCI World Utilities Index (ND) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets in the utilities sector.

S&P 500 Index is an unmanaged index of common stock performance.

Indexes assume reinvestment of all distributions and do not account for fees. Securities and performance of a fund and an index will differ. You cannot invest directly in an index.

15

Other information for shareholders

Important notice regarding Putnam’s privacy policy

In order to conduct business with our shareholders, we must obtain certain personal information such as account holders’ names, addresses, Social Security numbers, and dates of birth. Using this information, we are able to maintain accurate records of accounts and transactions.

It is our policy to protect the confidentiality of our shareholder information, whether or not a shareholder currently owns shares of our funds. In particular, it is our policy not to sell information about you or your accounts to outside marketing firms. We have safeguards in place designed to prevent unauthorized access to our computer systems and procedures to protect personal information from unauthorized use.

Under certain circumstances, we must share account information with outside vendors who provide services to us, such as mailings and proxy solicitations. In these cases, the service providers enter into confidentiality agreements with us, and we provide only the information necessary to process transactions and perform other services related to your account. Finally, it is our policy to share account information with your financial representative, if you’ve listed one on your Putnam account.

Proxy voting

Putnam is committed to managing our mutual funds in the best interests of our shareholders. The Putnam funds’ proxy voting guidelines and procedures, as well as information regarding how your fund voted proxies relating to portfolio securities during the 12-month period ended June 30, 2012, are available in the Individual Investors section at putnam.com, and on the Securities and Exchange Commission (SEC) website, www.sec.gov. If you have questions about finding forms on the SEC’s website, you may call the SEC at 1-800-SEC-0330. You may also obtain the Putnam funds’ proxy voting guidelines and procedures at no charge by calling Putnam’s Shareholder Services at 1-800-225-1581.

Fund portfolio holdings

The fund will file a complete schedule of its portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Shareholders may obtain the fund’s Forms N-Q on the SEC’s website at www.sec.gov. In addition, the fund’s Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. You may call the SEC at 1-800-SEC-0330 for information about the SEC’s website or the operation of the Public Reference Room.

Trustee and employee fund ownership

Putnam employees and members of the Board of Trustees place their faith, confidence, and, most importantly, investment dollars in Putnam mutual funds. As of August 31, 2012, Putnam employees had approximately $339,000,000 and the Trustees had approximately $80,000,000 invested in Putnam mutual funds. These amounts include investments by the Trustees’ and employees’ immediate family members as well as investments through retirement and deferred compensation plans.

16

Trustee approval of management contract

General conclusions

The Board of Trustees of the Putnam funds oversees the management of each fund and, as required by law, determines annually whether to approve the continuance of your fund’s management contract with Putnam Investment Management (“Putnam Management”), the sub-management contract with respect to your fund between Putnam Management and its affiliate, Putnam Investments Limited (“PIL”), and the sub-advisory contract among Putnam Management, PIL, and anotheraffiliate, The Putnam Advisory Company (“PAC”).

The Board of Trustees, with the assistance of its Contract Committee, requests and evaluates all information it deems reasonably necessary under the circumstances in connection with its annual contract review. The Contract Committee consists solely of Trustees who are not “interested persons” (as this term is defined in the Investment Company Act of 1940, as amended (the “1940 Act”)) of the Putnam funds (“Independent Trustees”).

At the outset of the review process, members of the Board’s independent staff and independent legal counsel met with representatives of Putnam Management to review the annual contract review materials furnished to the Contract Committee during the course of the previous year’s review and to discuss possible changes in these materials that might be necessary or desirable for the coming year. Following these discussions and in consultation with the Contract Committee, the Independent Trustees’ independent legal counsel requested that Putnam Management furnish specified information, together with any additional information that Putnam Management considered relevant, to the Contract Committee. Over the course of several months ending in June 2012, the Contract Committee met on a number of occasions with representatives of Putnam Management, and separately in executive session, to consider the information that Putnam Management provided. Throughout this process, the Contract Committee was assisted by the members of the Board’s independent staff and by independent legal counsel for the Putnam funds and the Independent Trustees.

In May 2012, the Contract Committee met in executive session with the other Independent Trustees to discuss the Contract Committee’s preliminary recommendations with respect to the continuance of the contracts. At the Trustees’ June 22, 2012 meeting, the Contract Committee met in executive session with the other Independent Trustees to review a summary of the key financial data that the Contract Committee considered in the course of its review. The Contract Committee then presented its written report, which summarized the key factors that the Committee had considered and set forth its final recommendations. The Contract Committee then recommended, and the Independent Trustees approved, the continuance of your fund’s management, sub-management and sub-advisory contracts, effective July 1, 2012. (Because PIL and PAC are affiliates of Putnam Management and Putnam Management remains fully responsible for all services provided by PIL and PAC, the Trustees have not evaluated PIL or PAC as separate entities, and all subsequent references to Putnam Management below should be deemed to include reference to PIL and PAC as necessary or appropriate in the context.)

The Independent Trustees’ approval was based on the following conclusions:

• That the fee schedule in effect for your fund represented reasonable compensation in light of the nature and quality of the services being provided to the fund, the fees paid by competitive funds, and the costs incurred by Putnam Management in providing services, and

17

• That the fee schedule represented an appropriate sharing between fund shareholders and Putnam Management of such economies of scale as may exist in the management of the fund at current asset levels.

These conclusions were based on a comprehensive consideration of all information provided to the Trustees and were not the result of any single factor. Some of the factors that figured particularly in the Trustees’ deliberations and how the Trustees considered these factors are described below, although individual Trustees may have evaluated the information presented differently, giving different weights to various factors. It is also important to recognize that the management arrangements for your fund and the other Putnam funds are the result of many years of review and discussion between the Independent Trustees and Putnam Management, that some aspects of the arrangements may receive greater scrutiny in some years than others, and that the Trustees’ conclusions may be based, in part, on their consideration of fee arrangements in previous years.

Management fee schedules and total expenses

The Trustees reviewed the management fee schedules in effect for all Putnam funds, including fee levels and breakpoints. In reviewing management fees, the Trustees generally focus their attention on material changes in circumstances — for example, changes in assets under management, changes in a fund’s investment style, changes in Putnam Management’s operating costs, or changes in competitive practices in the mutual fund industry — that suggest that consideration of fee changes might be warranted. The Trustees concluded that the circumstances did not warrant changes to the management fee structure of your fund.

Most of the open-end Putnam funds, including your fund, have relatively new management contracts, which introduced fee schedules that reflect more competitive fee levels for many funds, complex-wide breakpoints for the open-end funds, and performance fees for some funds. These new management contracts have been in effect for two years — since January or, for a few funds, February 2010. The Trustees approved the new management contracts on July 10, 2009, and fund shareholders subsequently approved the contracts by overwhelming majorities of the shares voted.

Under its management contract, your fund has the benefit of breakpoints in its management fee that provide shareholders with significant economies of scale in the form of reduced fee levels as assets under management in the Putnam family of funds increase. The Contract Committee observed that the complex-wide breakpoints of the open-end funds had only been in place for two years, and the Trustees will continue to examine the operation of this new breakpoint structure in future years in light of further experience.

As in the past, the Trustees also focused on the competitiveness of each fund’s total expense ratio. In order to ensure that expenses of the Putnam funds continue to meet evolving competitive standards, the Trustees and Putnam Management agreed in 2009 to implement certain expense limitations. These expense limitations serve in particular to maintain competitive expense levels for funds with large numbers of small shareholder accounts and funds with relatively small net assets. Most funds had sufficiently low expenses that these expense limitations did not apply. However, in the case of your fund, the first of the expense limitations applied during its fiscal year ending in 2011. The expense limitations were: (i) a contractual expense limitation applicable to all retail open-end funds of 37.5 basis points (effective March 1, 2012, this expense limitation was reduced to 32 basis points) on investor servicing fees and expenses and (ii) a contractual expense limitation applicable to all open-end funds of 20 basis points on so-called “other expenses” (i.e., all expenses exclusive of management fees, investor servicing fees, distribution fees, investment-related

18

expenses, interest, taxes, brokerage commissions, extraordinary expenses, and acquired fund fees and expenses). Putnam Management’s support for these expense limitations, including its agreement to reduce the expense limitation applicable to the open-end funds’ investor servicing fees and expenses as noted above, was an important factor in the Trustees’ decision to approve the continuance of your fund’s management, sub-management and sub-advisory contracts.

The Trustees reviewed comparative fee and expense information for a custom group of competitive funds selected by Lipper Inc. This comparative information included your fund’s percentile ranking for effective management fees and total expenses (excluding any applicable 12b-1 fee), which provides a general indication of your fund’s relative standing. In the custom peer group, your fund ranked in the 3rd quintile in effective management fees (determined for your fund and the other funds in the custom peer group based on fund asset size and the applicable contractual management fee schedule) and in the 3rd quintile in total expenses (excluding any applicable 12b-1 fees) as of December 31, 2011 (the first quintile representing the least expensive funds and the fifth quintile the most expensive funds). The fee and expense data reported by Lipper as of December 31, 2011 reflected the most recent fiscal year-end data available in Lipper’s database at that time.

In connection with their review of the management fees and total expenses of the Putnam funds, the Trustees also reviewed the costs of the services provided and the profits realized by Putnam Management and its affiliates from their contractual relationships with the funds. This information included trends in revenues, expenses and profitability of Putnam Management and its affiliates relating to the investment management, investor servicing and distribution services provided to the funds. In this regard, the Trustees also reviewed an analysis of Putnam Management’s revenues, expenses and profitability, allocated on a fund-by-fund basis, with respect to the funds’ management, distribution, and investor servicing contracts. For each fund, the analysis presented information about revenues, expenses and profitability for each of the agreements separately and for the agreements taken together on a combined basis. The Trustees concluded that, at current asset levels, the fee schedules in place represented reasonable compensation for the services being provided and represented an appropriate sharing of such economies of scale as may exist in the management of the funds at that time.

The information examined by the Trustees as part of their annual contract review for the Putnam funds has included for many years information regarding fees charged by Putnam Management and its affiliates to institutional clients such as defined benefit pension plans, college endowments, and the like. This information included comparisons of those fees with fees charged to the funds, as well as an assessment of the differences in the services provided to these different types of clients. The Trustees observed that the differences in fee rates between institutional clients and mutual funds are by no means uniform when examined by individual asset sectors, suggesting that differences in the pricing of investment management services to these types of clients may reflect historical competitive forces operating in separate markets. The Trustees considered the fact that in many cases fee rates across different asset classes are higher on average for mutual funds than for institutional clients, as well as the differences between the services that Putnam Management provides to the Putnam funds and those that it provides to its institutional clients. The Trustees did not rely on these comparisons to any significant extent in concluding that the management fees paid by your fund are reasonable.

19

Investment performance

The quality of the investment process provided by Putnam Management represented a major factor in the Trustees’ evaluation of the quality of services provided by Putnam Management under your fund’s management contract. The Trustees were assisted in their review of the Putnam funds’ investment process and performance by the work of the investment oversight committees of the Trustees, which meet on a regular basis with the funds’ portfolio teams and with the Chief Investment Officer and other members of Putnam Management’s Investment Division throughout the year. The Trustees concluded that Putnam Management generally provides a high-quality investment process — based on the experience and skills of the individuals assigned to the management of fund portfolios, the resources made available to them, and in general Putnam Management’s ability to attract and retain high-quality personnel — but also recognized that this does not guarantee favorable investment results for every fund in every time period.

The Trustees considered the investment performance of each fund over multiple time periods and considered information comparing each fund’s performance with various benchmarks and, where applicable, with the performance of competitive funds or targeted annualized return. They noted that since 2009, when Putnam Management began implementing major changes to strengthen its investment personnel and processes, there has been a steady improvement in the number of Putnam funds showing above-median three-year performance results. They also noted the disappointing investment performance of some funds for periods ended December 31, 2011 and considered information provided by Putnam Management regarding the factors contributing to the underperformance and actions being taken to improve the performance of these particular funds. The Trustees indicated their intention to continue to monitor performance trends to assess the effectiveness of these efforts and to evaluate whether additional actions to address areas of underperformance are warranted.

In the case of your fund, the Trustees considered information about the total return of your fund, and your fund’s performance relative to its internal benchmark over the one-, three- and five-year periods ended December 31, 2011. Putnam Global Utilities Fund’s class A shares’ return net of fees and expenses was negative over the one- and five-year periods, was positive over the three-year period, trailed the return of its internal benchmark over the one-year period, exceeded the return of its internal benchmark over the three-year period, and approximated the return of its internal benchmark over the five-year period. (When considering performance information, shareholders should be mindful that past performance is not a guarantee of future results.)

The Trustees also considered a number of other changes that Putnam Management had made in recent years in efforts to support and improve fund performance generally. These changes included Putnam Management’s efforts to increase accountability and to reduce complexity in the portfolio management process for the Putnam equity funds by moving generally from a portfolio management team structure to a decision-making process that vests full authority and responsibility with individual portfolio managers and by affirming its commitment to a fundamental-driven approach to investing. The Trustees noted that Putnam Management had also worked to strengthen its fundamental research capabilities by adding new investment personnel to the large-cap equities research team and by bringing U.S. and international research under common leadership. In addition, the Trustees recognized that Putnam Management has adjusted the compensation structure for portfolio managers and research analysts

20

so that only those who achieve top-quartile returns over a rolling three-year basis are eligible for full bonuses.

Brokerage and soft-dollar allocations; investor servicing

The Trustees considered various potential benefits that Putnam Management may receive in connection with the services it provides under the management contract with your fund. These include benefits related to brokerage allocation and the use of soft dollars, whereby a portion of the commissions paid by a fund for brokerage may be used to acquire research services that are expected to be useful to Putnam Management in managing the assets of the fund and of other clients. Subject to policies established by the Trustees, soft-dollar credits acquired through these means are used primarily to acquire research services that supplement Putnam Management’s internal research efforts. However, the Trustees noted that a portion of available soft-dollar credits continues to be allocated to the payment of fund expenses. The Trustees indicated their continued intent to monitor regulatory developments in this area with the assistance of their Brokerage Committee and also indicated their continued intent to monitor the potential benefits associated with fund brokerage and soft-dollar allocations and trends in industry practices to ensure that the principle of seeking best price and execution remains paramount in the portfolio trading process.

Putnam Management may also receive benefits from payments that the funds make to Putnam Management’s affiliates for investor or distribution services. In conjunction with the annual review of your fund’s management, sub-management and sub-advisory contracts, the Trustees reviewed your fund’s investor servicing agreement with Putnam Investor Services, Inc. (“PSERV”) and its distributor’s contracts and distribution plans with Putnam Retail Management Limited Partnership (“PRM”), both of which are affiliates of Putnam Management. The Trustees concluded that the fees payable by the funds to PSERV and PRM, as applicable, for such services are reasonable in relation to the nature and quality of such services.

21

Financial statements

These sections of the report, as well as the accompanying Notes, preceded by the Report of Independent Registered Public Accounting Firm, constitute the fund’s financial statements.

The fund’s portfolio lists all the fund’s investments and their values as of the last day of the reporting period. Holdings are organized by asset type and industry sector, country, or state to show areas of concentration and diversification.

Statement of assets and liabilities shows how the fund’s net assets and share price are determined. All investment and non-investment assets are added together. Any unpaid expenses and other liabilities are subtracted from this total. The result is divided by the number of shares to determine the net asset value per share, which is calculated separately for each class of shares. (For funds with preferred shares, the amount subtracted from total assets includes the liquidation preference of preferred shares.)

Statement of operations shows the fund’s net investment gain or loss. This is done by first adding up all the fund’s earnings — from dividends and interest income — and subtracting its operating expenses to determine net investment income (or loss). Then, any net gain or loss the fund realized on the sales of its holdings — as well as any unrealized gains or losses over the period — is added to or subtracted from the net investment result to determine the fund’s net gain or loss for the fiscal year.

Statement of changes in net assets shows how the fund’s net assets were affected by the fund’s net investment gain or loss, by distributions to shareholders, and by changes in the number of the fund’s shares. It lists distributions and their sources (net investment income or realized capital gains) over the current reporting period and the most recent fiscal year-end. The distributions listed here may not match the sources listed in the Statement of operations because the distributions are determined on a tax basis and may be paid in a different period from the one in which they were earned.

Financial highlights provide an overview of the fund’s investment results, per-share distributions, expense ratios, net investment income ratios, and portfolio turnover in one summary table, reflecting the five most recent reporting periods. In a semiannual report, the highlights table also includes the current reporting period.

22

Report of Independent Registered Public Accounting Firm

To the Trustees and Shareholders of

Putnam Global Utilities Fund:

In our opinion, the accompanying statement of assets and liabilities, including the portfolio, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of Putnam Global Utilities Fund (the “fund”) at August 31, 2012, and the results of its operations, the changes in its net assets and the financial highlights for each of the periods indicated, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the fund’s management. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of investments owned at August 31, 2012 by correspondence with the custodian, brokers, and transfer agent, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

Boston, Massachusetts

October 10, 2012

23

The fund’s portfolio 8/31/12

| COMMON STOCKS (92.9%)* | Shares | Value |

|

| ||

| Air freight and logistics (1.5%) | ||

| Deutsche Post AG (Germany) | 167,384 | $3,245,479 |

|

| ||

| 3,245,479 | ||

| Electric utilities (32.4%) | ||

| American Electric Power Co., Inc. | 214,550 | 9,223,505 |

|

| ||

| Edison International | 282,135 | 12,354,692 |

|

| ||

| Electricite de France SA (EDF) (France) | 136,286 | 2,769,628 |

|

| ||

| Energias de Portugal (EDP) SA (Portugal) | 769,587 | 1,872,967 |

|

| ||

| Entergy Corp. | 27,307 | 1,859,061 |

|

| ||

| Exelon Corp. | 25,300 | 922,691 |

|

| ||

| Iberdrola SA (Spain) | 965,378 | 3,818,615 |

|

| ||

| ITC Holdings Corp. | 31,000 | 2,231,380 |

|

| ||

| NextEra Energy, Inc. | 184,700 | 12,432,157 |

|

| ||

| Northeast Utilities | 25,705 | 968,307 |

|

| ||

| NV Energy, Inc. | 389,025 | 6,823,499 |

|

| ||

| OGE Energy Corp. | 32,900 | 1,778,245 |

|

| ||

| Pinnacle West Capital Corp. | 9,824 | 504,659 |

|

| ||

| PPL Corp. | 118,284 | 3,469,270 |

|

| ||

| SSE PLC (United Kingdom) | 348,852 | 7,579,323 |

|

| ||

| 68,607,999 | ||

| Gas utilities (8.2%) | ||

| China Resources Gas Group, Ltd. (China) | 600,000 | 1,182,185 |

|

| ||

| Questar Corp. | 56,300 | 1,111,925 |

|

| ||

| Snam SpA (Italy) | 551,343 | 2,318,080 |

|

| ||

| Tokyo Gas Co., Ltd. (Japan) | 2,072,000 | 11,447,682 |

|

| ||

| UGI Corp. | 45,200 | 1,377,696 |

|

| ||

| 17,437,568 | ||

| Independent power producers and energy traders (11.3%) | ||

| AES Corp. (The) † | 474,748 | 5,407,380 |

|

| ||

| Calpine Corp. † | 595,100 | 10,444,005 |

|

| ||

| Electric Power Development Co. (Japan) | 65,500 | 1,567,411 |

|

| ||

| NRG Energy, Inc. | 306,100 | 6,532,174 |

|

| ||

| 23,950,970 | ||

| Multi-utilities (31.4%) | ||

| Alliant Energy Corp. | 44,534 | 1,963,059 |

|

| ||

| Ameren Corp. | 65,859 | 2,154,906 |

|

| ||

| Centrica PLC (United Kingdom) | 1,813,027 | 9,407,887 |

|

| ||

| Dominion Resources, Inc. | 67,300 | 3,531,904 |

|

| ||

| E.ON AG (Germany) | 465,394 | 10,684,271 |

|

| ||

| GDF Suez (France) | 240,845 | 5,917,484 |

|

| ||

| National Grid PLC (United Kingdom) | 837,073 | 9,077,563 |

|

| ||

| National Grid PLC ADR (United Kingdom) | 142,300 | 7,751,081 |

|

| ||

| PG&E Corp. | 217,356 | 9,435,424 |

|

| ||

| Sempra Energy | 84,843 | 5,616,607 |

|

| ||

| Wisconsin Energy Corp. | 27,256 | 1,034,638 |

|

| ||

| 66,574,824 | ||

24

| COMMON STOCKS (92.9%)* cont. | Shares | Value |

|

| ||

| Oil, gas, and consumable fuels (3.1%) | ||

| EQT Corp. | 47,600 | $2,568,496 |

|

| ||

| Origin Energy, Ltd. (Australia) | 320,963 | 3,964,561 |

|

| ||

| 6,533,057 | ||

| Water utilities (5.0%) | ||

| American Water Works Co., Inc. | 126,968 | 4,681,310 |

|

| ||

| Severn Trent PLC (United Kingdom) | 93,961 | 2,582,899 |

|

| ||

| United Utilities Group PLC (United Kingdom) | 294,599 | 3,317,239 |

|

| ||

| 10,581,448 | ||

| Total common stocks (cost $186,633,771) | $196,931,345 | |

| U.S. TREASURY OBLIGATIONS (0.1%)* | Principal amount | Value |

|

| ||

| U.S. Treasury Notes 1/8s, December 31, 2013 i | $111,000 | $110,903 |

|

| ||

| Total U.S. Treasury obligations (cost $110,903) | $110,903 | |

| SHORT-TERM INVESTMENTS (5.9%)* | Principal amount/shares | Value |

|

| ||

| Putnam Money Market Liquidity Fund 0.13% e | 10,739,224 | $10,739,224 |

|

| ||

| SSgA Prime Money Market Fund 0.12% P | 288,230 | 288,230 |

|

| ||

| U.S. Treasury Bills with an effective yield of 0.090%, | ||

| November 15, 2012 | $107,000 | 106,983 |

|

| ||

| U.S. Treasury Bills with effective yields ranging from | ||

| 0.175% to 0.187%, May 2, 2013 | 478,000 | 477,546 |

|

| ||

| U.S. Treasury Bills with effective yields ranging from | ||

| 0.170% to 0.172%, May 30, 2013 ## | 375,000 | 374,589 |

|

| ||

| U.S. Treasury Bills with effective yields ranging from | ||

| 0.085% to 0.104%, October 18, 2012 | 129,000 | 128,983 |

|

| ||

| U.S. Treasury Bills with effective yields ranging from | ||

| 0.094% to 0.095%, December 13, 2012 | 371,000 | 370,899 |

|

| ||

| Total short-term investments (cost $12,486,241) | $12,486,454 | |

| TOTAL INVESTMENTS | ||

|

| ||

| Total investments (cost $199,230,915) | $209,528,702 | |

Key to holding’s abbreviations

| ADR | American Depository Receipts: represents ownership of foreign securities on deposit with a custodian bank |

Notes to the fund’s portfolio

Unless noted otherwise, the notes to the fund’s portfolio are for the close of the fund’s reporting period, which ran from September 1, 2011 through August 31, 2012 (the reporting period). Within the following notes to the portfolio, references to “ASC 820” represent Accounting Standards Codification ASC 820 Fair Value Measurements and Disclosures.

* Percentages indicated are based on net assets of $212,060,338.

† Non-income-producing security.

## This security, in part or in entirety, was pledged and segregated with the custodian for collateral on certain derivative contracts at the close of the reporting period.

e See Note 6 to the financial statements regarding investments in Putnam Money Market Liquidity Fund. The rate quoted in the security description is the annualized 7-day yield of the fund at the close of the reporting period.

i Security purchased with cash, or security received, that was pledged to the fund for collateral on certain derivative contracts (Note 1).

25

P Security purchased with cash, or security received, that was pledged to the fund for collateral on certain derivatives contracts. The rate quoted in the security description is the annualized 7-day yield of the fund at the close of the reporting period (Note 1).

At the close of the reporting period, the fund maintained liquid assets totaling $465,574 to cover certain derivatives contracts.

Debt obligations are considered secured unless otherwise indicated.

The dates shown on debt obligations are the original maturity dates.

| DIVERSIFICATION BY COUNTRY* |

|

|

Distribution of investments by country of risk at the close of the reporting period, excluding collateral received, if any (as a percentage of Portfolio Value):

| United States | 57.7% | Spain | 1.8% | |

|

|

| |||

| United Kingdom | 19.0 | Italy | 1.1 | |

|

|

| |||

| Germany | 6.7 | Portugal | 0.9 | |

|

|

| |||

| Japan | 6.2 | China | 0.6 | |

|

|

| |||

| France | 4.1 | Total | 100.0% | |

|

|

||||

| Australia | 1.9 | |||

|

|

||||

* Methodology differs from that used for purposes of complying with the fund’s policy regarding investments in securities of foreign issuers, as discussed further in the fund’s prospectus.

FORWARD CURRENCY CONTRACTS at 8/31/12 (aggregate face value $92,032,592)

| Unrealized | ||||||

| Contract | Delivery | Aggregate | appreciation/ | |||

| Counterparty | Currency | type | date | Value | face value | (depreciation) |

|

| ||||||

| Bank of America, N.A. | ||||||

|

| ||||||

| Australian Dollar | Sell | 9/20/12 | $868,702 | $882,963 | $14,261 | |

|

| ||||||

| British Pound | Sell | 9/20/12 | 2,493,420 | 2,451,080 | (42,340) | |

|

| ||||||

| Euro | Buy | 9/20/12 | 3,122,583 | 3,059,361 | 63,222 | |

|

| ||||||

| Barclays Bank PLC | ||||||

|

| ||||||

| British Pound | Buy | 9/20/12 | 838,338 | 824,694 | 13,644 | |

|

| ||||||

| Euro | Buy | 9/20/12 | 4,457,184 | 4,363,895 | 93,289 | |

|

| ||||||

| Hong Kong Dollar | Buy | 9/20/12 | 4,318,501 | 4,319,838 | (1,337) | |

|

| ||||||

| Japanese Yen | Buy | 9/20/12 | 3,192,504 | 3,179,481 | 13,023 | |

|

| ||||||

| Citibank, N.A. | ||||||

|

| ||||||

| Australian Dollar | Buy | 9/20/12 | 688,359 | 698,654 | (10,295) | |

|

| ||||||

| British Pound | Sell | 9/20/12 | 4,168,508 | 4,096,910 | (71,598) | |

|

| ||||||

| Euro | Sell | 9/20/12 | 2,704,427 | 2,648,306 | (56,121) | |

|

| ||||||

| Credit Suisse AG | ||||||

|

| ||||||

| British Pound | Buy | 9/20/12 | 2,419,430 | 2,381,059 | 38,371 | |

|

| ||||||

| Euro | Buy | 9/20/12 | 5,397,154 | 5,281,359 | 115,795 | |

|

| ||||||

| Japanese Yen | Sell | 9/20/12 | 3,414,410 | 3,419,746 | 5,336 | |

|

| ||||||

| Deutsche Bank AG | ||||||

|

| ||||||

| Euro | Sell | 9/20/12 | 1,823,456 | 1,786,632 | (36,824) | |

|

| ||||||

26

FORWARD CURRENCY CONTRACTS at 8/31/12 (aggregate face value $92,032,592) cont.

| Unrealized | ||||||

| Contract | Delivery | Aggregate | appreciation/ | |||

| Counterparty | Currency | type | date | Value | face value | (depreciation) |

|

| ||||||

| Goldman Sachs International | ||||||

|

| ||||||

| Australian Dollar | Sell | 9/20/12 | $889,646 | $903,449 | $13,803 | |

|

| ||||||

| British Pound | Sell | 9/20/12 | 114,160 | 117,873 | 3,713 | |

|

| ||||||

| Euro | Buy | 9/20/12 | 1,036,836 | 1,008,347 | 28,489 | |

|

| ||||||

| Japanese Yen | Buy | 9/20/12 | 2,965,632 | 2,969,089 | (3,457) | |

|

| ||||||

| HSBC Bank USA, National Association | ||||||

|

| ||||||

| Australian Dollar | Buy | 9/20/12 | 791,427 | 803,384 | (11,957) | |

|

| ||||||

| British Pound | Buy | 9/20/12 | 1,100,160 | 1,082,705 | 17,455 | |

|

| ||||||

| Euro | Buy | 9/20/12 | 365,823 | 358,405 | 7,418 | |

|

| ||||||

| Hong Kong Dollar | Buy | 9/20/12 | 3,483,193 | 3,483,957 | (764) | |

|

| ||||||

| JPMorgan Chase Bank, N.A. | ||||||

|

| ||||||

| British Pound | Sell | 9/20/12 | 2,546,927 | 2,503,270 | (43,657) | |

|

| ||||||

| Canadian Dollar | Buy | 9/20/12 | 3,919,984 | 3,857,300 | 62,684 | |

|

| ||||||

| Euro | Buy | 9/20/12 | 752,152 | 736,610 | 15,542 | |

|

| ||||||

| Hong Kong Dollar | Buy | 9/20/12 | 1,043,903 | 1,044,224 | (321) | |

|

| ||||||

| Japanese Yen | Sell | 9/20/12 | 1,837,284 | 1,839,967 | 2,683 | |

|

| ||||||

| Royal Bank of Scotland PLC (The) | ||||||

|

| ||||||

| British Pound | Sell | 9/20/12 | 9,000,700 | 8,847,863 | (152,837) | |

|

| ||||||

| Euro | Sell | 9/20/12 | 3,041,820 | 2,980,185 | (61,635) | |

|

| ||||||

| Japanese Yen | Sell | 9/20/12 | 767,366 | 769,370 | 2,004 | |

|

| ||||||

| State Street Bank and Trust Co. | ||||||

|

| ||||||

| Australian Dollar | Buy | 9/20/12 | 1,021,396 | 1,035,936 | (14,540) | |

|

| ||||||

| Canadian Dollar | Sell | 9/20/12 | 600,867 | 590,863 | (10,004) | |

|

| ||||||

| Euro | Sell | 9/20/12 | 1,535,251 | 1,503,752 | (31,499) | |

|

| ||||||

| UBS AG | ||||||

|

| ||||||

| Australian Dollar | Sell | 9/20/12 | 886,654 | 899,360 | 12,706 | |

|

| ||||||

| British Pound | Sell | 9/20/12 | 3,123,920 | 3,070,583 | (53,337) | |

|

| ||||||

| Euro | Buy | 9/20/12 | 7,230,171 | 7,080,969 | 149,202 | |

|

| ||||||

| Westpac Banking Corp. | ||||||

|

| ||||||

| Australian Dollar | Sell | 9/20/12 | 496,976 | 504,723 | 7,747 | |

|

| ||||||

| British Pound | Buy | 9/20/12 | 1,565,215 | 1,538,242 | 26,973 | |

|

| ||||||

| Euro | Buy | 9/20/12 | 921,981 | 902,947 | 19,034 | |

|

| ||||||

| Japanese Yen | Buy | 9/20/12 | 2,201,871 | 2,205,241 | (3,370) | |

|

| ||||||

| Total | $120,501 | |||||

27

ASC 820 establishes a three-level hierarchy for disclosure of fair value measurements. The valuation hierarchy is based upon the transparency of inputs to the valuation of the fund’s investments. The three levels are defined as follows:

Level 1: Valuations based on quoted prices for identical securities in active markets.

Level 2: Valuations based on quoted prices in markets that are not active or for which all significant inputs are observable, either directly or indirectly.

Level 3: Valuations based on inputs that are unobservable and significant to the fair value measurement.

The following is a summary of the inputs used to value the fund’s net assets as of the close of the reporting period:

| Valuation inputs | ||||

|

| ||||

| Investments in securities: | Level 1 | Level 2 | Level 3 | |

|

| ||||

| Common stocks: | ||||

|

| ||||

| Energy | $2,568,496 | $3,964,561 | $— | |

|

| ||||

| Industrials | — | 3,245,479 | — | |

|

| ||||

| Utilities | 113,609,575 | 73,543,234 | — | |

|

| ||||

| Total common stocks | 116,178,071 | 80,753,274 | — | |

| U.S. Treasury obligations | — | 110,903 | — | |

|

| ||||

| Short-term investments | 11,027,454 | 1,459,000 | — | |

|

| ||||

| Totals by level | $127,205,525 | $82,323,177 | $— | |

| Valuation inputs | ||||

|

| ||||

| Other financial instruments: | Level 1 | Level 2 | Level 3 | |

|

| ||||

| Forward currency contracts | $— | $120,501 | $— | |

|

| ||||

| Totals by level | $— | $120,501 | $— | |

The accompanying notes are an integral part of these financial statements.

28

Statement of assets and liabilities 8/31/12

| ASSETS | |

|

| |

| Investment in securities, at value (Note 1): | |

| Unaffiliated issuers (identified cost $188,491,691) | $198,789,478 |

| Affiliated issuers (identified cost $10,739,224) (Note 6) | 10,739,224 |

|

| |

| Dividends, interest and other receivables | 1,024,997 |

|

| |

| Receivable for shares of the fund sold | 63,469 |

|

| |

| Receivable for investments sold | 10,972,743 |

|

| |

| Unrealized appreciation on forward currency contracts (Note 1) | 726,394 |

|

| |

| Total assets | 222,316,305 |

| LIABILITIES | |

|

| |

| Payable for investments purchased | 8,486,659 |

|

| |

| Payable for shares of the fund repurchased | 177,730 |

|

| |

| Payable for compensation of Manager (Note 2) | 114,826 |

|

| |

| Payable for investor servicing fees (Note 2) | 111,761 |

|

| |

| Payable for custodian fees (Note 2) | 8,892 |

|

| |

| Payable for Trustee compensation and expenses (Note 2) | 161,412 |

|

| |

| Payable for administrative services (Note 2) | 479 |

|

| |

| Payable for distribution fees (Note 2) | 94,276 |

|

| |

| Unrealized depreciation on forward currency contracts (Note 1) | 605,893 |

|

| |

| Collateral on certain derivative contracts, at value (Note 1) | 399,133 |

|

| |

| Other accrued expenses | 94,906 |

|

| |

| Total liabilities | 10,255,967 |

| Net assets | $212,060,338 |

|

| |

| REPRESENTED BY | |

|

| |

| Paid-in capital (Unlimited shares authorized) (Notes 1 and 4) | $223,867,157 |

|

| |

| Undistributed net investment income (Note 1) | 99,716 |

|

| |

| Accumulated net realized loss on investments and foreign currency transactions (Note 1) | (22,331,321) |

|

| |

| Net unrealized appreciation of investments and assets and liabilities in foreign currencies | 10,424,786 |

|

| |

| Total — Representing net assets applicable to capital shares outstanding | $212,060,338 |

(Continued on next page)

29

Statement of assets and liabilities (Continued)

| COMPUTATION OF NET ASSET VALUE AND OFFERING PRICE | |

|

| |

| Net asset value and redemption price per class A share | |

| ($197,503,493 divided by 19,074,243 shares) | $10.35 |

|

| |

| Offering price per class A share (100/94.25 of $10.35)* | $10.98 |

|

| |

| Net asset value and offering price per class B share ($5,752,609 divided by 557,859 shares)** | $10.31 |

|

| |

| Net asset value and offering price per class C share ($3,451,618 divided by 335,956 shares)** | $10.27 |

|

| |

| Net asset value and redemption price per class M share ($1,284,443 divided by 124,231 shares) | $10.34 |

|

| |

| Offering price per class M share (100/96.50 of $10.34)* | $10.72 |

|

| |

| Net asset value, offering price and redemption price per class R share | |

| ($1,269,426 divided by 123,002 shares) | $10.32 |

|

| |

| Net asset value, offering price and redemption price per class Y share | |

| ($2,798,749 divided by 270,259 shares) | $10.36 |

|

| |

* On single retail sales of less than $50,000. On sales of $50,000 or more the offering price is reduced.

** Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge.

The accompanying notes are an integral part of these financial statements.

30

Statement of operations Year ended 8/31/12

| INVESTMENT INCOME | |

|

| |

| Dividends (net of foreign tax of $368,483) | $9,150,622 |

|

| |

| Interest (including interest income of $3,259 from investments in affiliated issuers) (Note 6) | 4,541 |

|

| |

| Securities lending (Note 1) | 116,242 |

|

| |

| Total investment income | 9,271,405 |

| EXPENSES | |

|

| |

| Compensation of Manager (Note 2) | 1,403,928 |

|

| |

| Investor servicing fees (Note 2) | 738,990 |

|

| |

| Custodian fees (Note 2) | 25,349 |