Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

SunPower Corporation

(Name of Registrant as Specified In Its Charter)

n/a

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount previously paid with preliminary materials: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Table of Contents

NOTICE OF THE 2012 ANNUAL MEETING OF STOCKHOLDERS

TO ALL SUNPOWER STOCKHOLDERS:

NOTICE IS HEREBY GIVEN that the 2012 Annual Meeting of Stockholders (the “Annual Meeting”) of SunPower Corporation, a Delaware corporation (“SunPower”), will be held on:

| Date: |

Wednesday, May 9, 2012 | |

| Time: |

Noon Pacific Time | |

| Place: |

SunPower Corporation, 77 Rio Robles, San Jose, California 95134 | |

| Items of Business: | 1. The re-election of three directors to serve as Class I directors on our board of directors (the “Board”); | |

| 2. The proposal to approve, in an advisory vote, our named executive officer compensation; and | ||

| 3. To transact such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof. | ||

The foregoing items of business are more fully described in the proxy statement accompanying this Notice. On March 23, 2012 we began mailing to stockholders either a Notice of Internet Availability of Proxy Materials or this notice of the Annual Meeting, the proxy statement and the form of proxy.

All stockholders are cordially invited to attend the Annual Meeting in person. Only stockholders of record at the close of business on March 12, 2012 (the “Record Date”) are entitled to receive notice of, and to vote at, the Annual Meeting or any adjournment or postponement of the Annual Meeting. Any registered stockholder in attendance at the Annual Meeting and entitled to vote may do so in person even if such stockholder returned a proxy.

| San Jose, California | FOR THE BOARD OF DIRECTORS | |||||

| March 23, 2012 |

| |||||

| Christopher Jaap | ||||||

| Assistant Secretary | ||||||

IMPORTANT: WHETHER OR NOT YOU EXPECT TO ATTEND THE ANNUAL MEETING, PLEASE COMPLETE, DATE AND SIGN THE PROXY CARD AND MAIL IT PROMPTLY, OR YOU MAY VOTE BY TELEPHONE OR VIA THE INTERNET BY FOLLOWING THE DIRECTIONS ON THE PROXY CARD. ANY ONE OF THESE METHODS WILL ENSURE REPRESENTATION OF YOUR SHARES AT THE ANNUAL MEETING. NO POSTAGE NEED BE AFFIXED TO THE COMPANY-PROVIDED PROXY CARD ENVELOPE IF MAILED IN THE UNITED STATES.

Table of Contents

PROXY STATEMENT FOR

2012 ANNUAL MEETING OF STOCKHOLDERS

| Page | ||

| INFORMATION CONCERNING SOLICITATION AND VOTING | 1 | |

| 1 | ||

| Important Notice Regarding the Availability of Proxy Materials |

1 | |

| 1 | ||

| 2 | ||

| 2 | ||

| 2 | ||

| 3 | ||

| 3 | ||

| 3 | ||

| 3 | ||

| 4 | ||

| 5 | ||

| 10 | ||

| 10 | ||

| 10 | ||

| 10 | ||

| 10 | ||

| 11 | ||

| 11 | ||

| 12 | ||

| 12 | ||

| 12 | ||

| 13 | ||

| 15 | ||

| 15 | ||

| 15 | ||

| Submission of Stockholder Proposal for the 2013 Annual Meeting |

15 | |

| 16 | ||

| Code of Business Conduct and Ethics; Related Persons Transactions Policy and Procedures |

17 | |

| 17 | ||

| 31 | ||

| 33 | ||

| 33 | ||

| 34 | ||

| PROPOSAL TWO — ADVISORY VOTE TO APPROVE NAMED EXECUTIVE OFFICER COMPENSATION |

35 | |

| 37 |

Table of Contents

| Page | ||

| 39 | ||

| 39 | ||

| 40 | ||

| 41 | ||

| 41 | ||

| 42 | ||

| 43 | ||

| 44 | ||

| 48 | ||

| Section 162(m) Treatment Regarding Performance-Based Equity Awards |

48 | |

| 49 | ||

| 50 | ||

| 50 | ||

| 50 | ||

| 52 | ||

| 52 | ||

| 53 | ||

| Estimated Possible Payouts Under Non-Equity Incentive Plan Awards Table |

53 | |

| 55 | ||

| 56 | ||

| 56 | ||

| 60 | ||

| 60 | ||

| 61 | ||

| 62 | ||

| 63 | ||

| 65 | ||

| SECURITY OWNERSHIP OF MANAGEMENT AND CERTAIN BENEFICIAL OWNERS |

66 | |

| 67 | ||

| 68 | ||

| 69 | ||

| 70 |

ii

Table of Contents

SUNPOWER CORPORATION

77 Rio Robles

San Jose, California 95134

PROXY STATEMENT FOR

2012 ANNUAL MEETING OF STOCKHOLDERS

INFORMATION CONCERNING SOLICITATION AND VOTING

The Board of Directors (the “Board”) of SunPower Corporation, a Delaware corporation, is furnishing this proxy statement and proxy card to you in connection with its solicitation of proxies to be used at SunPower Corporation’s Annual Meeting of Stockholders to be held on May 9, 2012 at noon Pacific Time at SunPower Corporation, 77 Rio Robles, San Jose, California, or at any adjournment(s), continuation(s) or postponement(s) of the meeting (the “Annual Meeting”).

We use a number of abbreviations in this proxy statement. We refer to SunPower Corporation as “SunPower,” “the Company,” or “we,” “us” or “our.” The term “proxy solicitation materials” includes this proxy statement, the notice of the Annual Meeting, and the proxy card. References to “fiscal 2011” mean our 2011 fiscal year, which began on January 3, 2011 and ended on January 1, 2012.

Our principal executive offices are located at 77 Rio Robles, San Jose, California 95134, and our telephone number is (408) 240-5500.

Important Notice Regarding the Availability of Proxy Materials

We have elected to comply with the Securities and Exchange Commission (the “SEC”) “Notice and Access” rules, which allow us to make our proxy solicitation materials available to our stockholders over the Internet. Under these rules, on or about March 23, 2012, we started mailing to certain of our stockholders a Notice of Internet Availability of Proxy Materials (the “Notice of Internet Availability”). The Notice of Internet Availability contains instructions on how our stockholders can both access the proxy solicitation materials and our 2011 Annual Report for the fiscal year ended January 1, 2012 (“2011 Annual Report”) online and vote online. By sending the Notice of Internet Availability instead of paper copies of the proxy materials, we expect to lower the costs and reduce the environmental impact of our Annual Meeting.

Our proxy solicitation materials and our 2011 Annual Report are available at www.proxyvote.com.

Stockholders receiving the Notice of Internet Availability may request a paper or electronic copy of our proxy solicitation materials by following the instructions set forth on the Notice of Internet Availability. Stockholders who did not receive the Notice of Internet Availability will continue to receive a paper or electronic copy of our proxy solicitation materials, which were first mailed to stockholders and made public on or about March 23, 2012.

If you would like to further reduce our costs in mailing proxy materials, you can consent to receiving all future proxy statements, proxy cards and annual reports electronically via e-mail or the Internet. To sign up for electronic delivery, please follow the instructions provided for voting via www.proxyvote.com and, when prompted, indicate that you agree to receive or access proxy materials electronically in future years.

To reduce the expenses of delivering duplicate materials to our stockholders, we are taking advantage of householding rules that permit us to deliver only one set of proxy solicitation materials, proxy card, and our 2011 Annual Report, or one copy of the Notice of Internet Availability, to stockholders who share the same address, unless otherwise requested. Each stockholder retains a separate right to vote on all matters presented at the Annual Meeting.

If you share an address with another stockholder and have received only one set of materials, you may write or call us to request a separate copy of these materials at no cost to you. For future annual meetings, you may request separate materials or request that we only send one set of materials to you if you are receiving multiple copies by writing to us at SunPower Corporation, 77 Rio Robles, San Jose, California 95134, Attention: Corporate Secretary, or calling us at (408) 240-5500.

A copy of our Annual Report on Form 10-K has been furnished with this proxy statement to each stockholder. A stockholder may also request a copy of our Annual Report on Form 10-K by writing to our Corporate Secretary at 77 Rio

1

Table of Contents

Robles, San Jose, California 95134. Upon receipt of such request, we will provide a copy of our Annual Report on Form 10-K without charge, including the financial statements required to be filed with the SEC pursuant to Rule 13a-1 of the Securities Exchange Act of 1934 (“Exchange Act”) for our fiscal year 2011. Our Annual Report on Form 10-K is also available on our website at http://investors.sunpowercorp.com/sec.cfm.

Record Date and Shares Outstanding

Stockholders who owned shares of our common stock, par value $0.001 per share, at the close of business on March 12, 2012, which we refer to as the Record Date, are entitled to notice of, and to vote at, the Annual Meeting. On the Record Date, we had 118,284,623 shares of common stock outstanding. For more information about beneficial ownership of our issued and outstanding common stock, please see “Security Ownership of Management and Certain Beneficial Owners.”

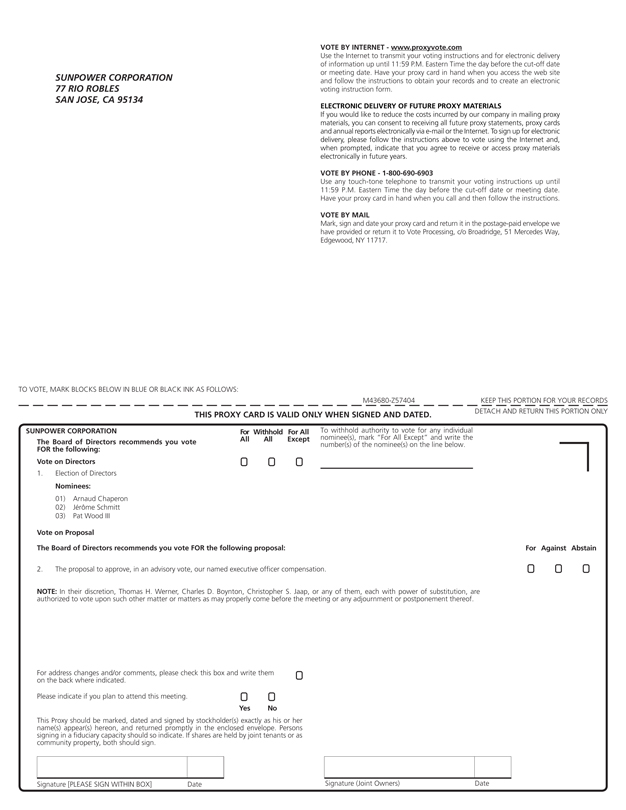

Our Board recommends that you vote:

| — | “FOR” Proposal One: re-election of each of the nominated Class I directors; and |

| — | “FOR” Proposal Two: the approval, on an advisory basis, of the compensation of our named executive officers. |

Each holder of shares of common stock is entitled to one vote for each share of common stock held as of the Record Date. Cumulating votes is not permitted under our By-laws.

Many of our stockholders hold their shares through a stockbroker, bank or other nominee, rather than directly in their own name. As summarized below, there are distinctions between shares held of record and those beneficially owned.

Stockholder of Record. If your shares are registered directly in your name with our transfer agent, Computershare Trust Company N.A., you are considered, with respect to those shares, the stockholder of record and these proxy solicitation materials are being furnished to you directly by us.

Beneficial Owner. If your shares are held in a stock brokerage account, or by a bank or other nominee (also known as shares registered in “street name”), you are considered the beneficial owner of such shares held in street name, and these proxy solicitation materials are being furnished to you by your broker, bank or other nominee, who is considered, with respect to those shares, the stockholder of record. As the beneficial owner, you have the right to direct your broker, bank or other nominee as to how to vote your shares. You are also invited to attend the Annual Meeting. However, since you are not the stockholder of record, you may not automatically vote your shares in person at the Annual Meeting.

How To Vote. If you hold shares directly as a stockholder of record, you can vote in one of the following three ways, in addition to attending the Annual Meeting:

(1) Vote via the Internet at www.proxyvote.com. Use the Internet to transmit your voting instructions and for electronic delivery of information up until 11:59 p.m. Eastern Time on May 8, 2012. Have your Notice of Internet Availability or proxy card in hand when you access the website and then follow the instructions.

(2) Vote by Telephone at 1-800-690-6903. Use a touch-tone telephone to transmit your voting instructions up until 11:59 p.m. Eastern Time on May 8, 2012. Have your Notice of Internet Availability or proxy card in hand when you call and then follow the instructions. This number is toll free in the U.S. and Canada.

(3) Vote by Mail. Mark, sign and date your proxy card and return it in the postage-paid envelope we have provided with any paper copy of the proxy statement, or return the proxy card to SunPower Corporation, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717.

If you hold shares beneficially in street name, you may submit your voting instructions in the manner prescribed by your broker, bank or other nominee by following the instructions provided by your broker, bank or other nominee. Shares registered in street name may be voted in person by you at the Annual Meeting only if you obtain a signed proxy from the broker, bank or other nominee who holds your shares, giving you the right to vote the shares.

Even if you plan to attend the Annual Meeting, we recommend that you vote your shares in advance as described above so that your vote will be counted if you later decide not to attend the Annual Meeting.

Quorum. A quorum, which is the holders of at least a majority of shares of our stock issued and outstanding and entitled to vote as of the Record Date, is required to be present in person or by proxy at the Annual Meeting in order to hold the Annual Meeting and to conduct business. Your shares will be counted as being present at the Annual Meeting if you

2

Table of Contents

appear in person at the Annual Meeting (and are the stockholder of record for your shares), if you vote your shares by telephone or over the Internet, or if you submit a properly executed proxy card. Abstentions and “broker non-votes” are counted as present and entitled to vote for purposes of determining a quorum. Votes against a particular proposal will also be counted both to determine the presence or absence of a quorum and to determine whether the requisite number of voting shares has been obtained.

Explanation of Broker Non-Votes and Abstentions. A “broker non-vote” occurs when a nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting power with respect to that item and has not received instructions from the beneficial owner. NYSE rules (which also apply to companies listed on The Nasdaq Stock Exchange) prohibit brokers from voting in their discretion on any of our proposals without instructions from the beneficial owners. If you do not instruct your broker how to vote on the proposals, your broker will not vote for you. Abstentions are deemed to be entitled to vote for purposes of determining whether stockholder approval of that matter has been obtained, and they would be included in the tabulation of voting results as votes against the proposal.

Votes Required/Treatment of Broker Non-Votes and Abstentions.

Proposal One — Re-election of Class I Directors. Election of a director requires the affirmative vote of the holders of a plurality of votes represented by the shares present in person or represented by proxy at a meeting at which a quorum is present. The three persons receiving the greatest number of votes at the Annual Meeting shall be elected as Class I directors. Since only affirmative votes will be counted, neither “broker non-votes” nor abstentions will affect the outcome of the voting on Proposal One.

Proposal Two — Advisory Vote on Named Executive Officer Compensation. The advisory vote on named executive compensation requires the affirmative vote of the holders of a majority of our stock having voting power and present in person or represented by proxy at the Annual Meeting. “Broker non-votes” and abstentions will not count as votes in favor of the advisory vote on named executive officer compensation and abstentions, but not “broker non-votes,” will have the effect of votes against Proposal Two.

If you complete and submit your proxy card or vote via the Internet or by telephone, the shares represented by your proxy will be voted at the Annual Meeting in accordance with your instructions. If you submit your proxy card by mail, but do not fill out the voting instructions on the proxy card, the shares represented by your proxy will be voted in favor of Proposals One and Two. In addition, if any other matters properly come before the Annual Meeting, it is the intention of the persons named in the enclosed proxy card to vote the shares they represent as directed by the Board. We have not received notice of any other matters that may properly be presented at the Annual Meeting.

You may revoke your proxy at any time prior to the date of the Annual Meeting by: (1) submitting a later-dated vote in person at the Annual Meeting, via the Internet, by telephone or by mail; or (2) delivering instructions to us at 77 Rio Robles, San Jose, California 95134 to the attention of our Corporate Secretary. Any notice of revocation sent to us must include the stockholder’s name and must be actually received by us prior to the Annual Meeting to be effective. Your attendance at the Annual Meeting after having executed and delivered a valid proxy card or vote via the Internet or by telephone will not in and of itself constitute a revocation of your proxy. If you intend to revoke your proxy by voting in person at the Annual Meeting, you will be required to give oral notice of your intention to do so to the Inspector of Elections at the Annual Meeting. If your shares are held in “street name,” you should follow the directions provided by your broker, bank or other nominee regarding how to revoke your proxy.

We will pay for the cost of this proxy solicitation. We may reimburse brokerage firms and other persons representing beneficial owners of shares for their expenses in forwarding or furnishing proxy solicitation materials to such beneficial owners. Proxies may also be solicited personally or by telephone, telegram, or facsimile by certain of our directors, officers, and regular employees, without additional compensation.

We will announce preliminary voting results at the Annual Meeting and publish final results pursuant to a Current Report on Form 8-K which we intend to file with the SEC within four business days following the Annual Meeting.

3

Table of Contents

Note Concerning Forward-Looking Statements

Certain of the statements contained in this proxy statement are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are statements that do not represent historical facts and the assumptions underlying such statements. We use words such as “anticipate,” “believe,” “continue” “could,” “estimate,” “expect,” “intend,” “may,” “potential,” “should,” “will,” “would” and similar expressions to identify forward-looking statements. These statements include, but are not limited to, operating results, business strategies, management’s plans and objectives for future operations, expectations and intentions, actions to be taken by us and other statements that are not historical facts. These forward-looking statements are based on information available to us as of the date of this proxy statement and our current expectations, forecasts and assumptions and involve a number of risks and uncertainties that could cause actual results to differ materially from those anticipated by these forward-looking statements. Such risks and uncertainties include a variety of factors, some of which are beyond our control. All of the forward-looking statements are qualified in their entirety by reference to the factors discussed in Part I, Item 1A, “Risk Factors” and elsewhere in our Annual Report on Form 10-K for the year ended January 1, 2012, which accompanies this proxy statement. There may be other factors of which we are not currently aware that may affect matters discussed in the forward-looking statements and may also cause actual results to differ materially from those discussed. These forward-looking statements should not be relied upon as representing our views as of any subsequent date, and we are under no obligation to, and expressly disclaim any responsibility to, update or alter our forward-looking statements, whether as a result of new information, future events or otherwise.

WHETHER OR NOT YOU EXPECT TO ATTEND THE ANNUAL MEETING IN PERSON, YOU ARE REQUESTED TO COMPLETE, DATE, AND SIGN THE PROXY CARD AND RETURN IT PROMPTLY, OR VOTE BY TELEPHONE OR VIA THE INTERNET BY FOLLOWING THE DIRECTIONS ON THE PROXY CARD. BY RETURNING YOUR PROXY CARD OR VOTING BY PHONE OR INTERNET PROMPTLY, YOU CAN HELP US AVOID THE EXPENSE OF FOLLOW-UP MAILINGS TO ENSURE A QUORUM IS PRESENT AT THE ANNUAL MEETING. STOCKHOLDERS WHO ATTEND THE ANNUAL MEETING MAY REVOKE A PRIOR PROXY VOTE AND VOTE THEIR SHARES IN PERSON AS SET FORTH IN THIS PROXY STATEMENT.

4

Table of Contents

RE-ELECTION OF CLASS I DIRECTORS

Our Board is currently comprised of eleven members and divided into three classes, in accordance with Article IV, Section B of our Certificate of Incorporation. Only the terms of the three directors serving as Class I directors are scheduled to expire in 2012. The terms of other directors expire in subsequent years.

On April 28, 2011, we and Total Gas & Power USA, SAS (“Total”), a subsidiary of Total S.A. (“Total S.A.”), entered into a Tender Offer Agreement (the “Tender Offer Agreement”). Pursuant to the Tender Offer Agreement, on June 21, 2011, Total purchased in a cash tender offer approximately 60% of the outstanding shares of our former class A common stock and 60% of the outstanding shares of our former class B common stock (the “Tender Offer”) at a price of $23.25 per share for each class. In connection with the Tender Offer, we and Total entered into an Affiliation Agreement that governs the relationship between Total and us following the close of the Tender Offer (the “Affiliation Agreement”). In accordance with the terms of the Affiliation Agreement, our Board has eleven members, composed of our Chief Executive Officer, four non-Total designated members of the Board, and six directors designated by Total. On the first anniversary of the consummation of the Tender Offer, the size of the Board will be reduced to nine members and one non-Total designated director and one director designated by Total will resign from the Board. If the Total Group’s (as defined in the Affiliation Agreement) ownership percentage declines, the number of members of the Board that Total is entitled to nominate will be reduced as set forth in the Affiliation Agreement.

The Board has considered and approved the nomination of Arnaud Chaperon, Jérôme Schmitt and Pat Wood III, our current Class I directors, for re-election as directors at the Annual Meeting. Messrs. Chaperon and Schmitt are Total designated directors. Each nominee has consented to being named in this proxy statement and to serve if re-elected. Unless otherwise directed, the proxy holders will vote the proxies received by them for the three nominees named below. If any nominee is unable or declines to serve as a director at the time of the Annual Meeting, the proxies will be voted for any nominee who is designated by the present Board to fill the vacancy. It is not expected that any nominee will be unable or will decline to serve as a director. The Class I directors elected will hold office until the annual meeting of stockholders in 2015 or until their successors are elected.

The Class II group of directors consists of W. Steve Albrecht, Betsy S. Atkins, Bernard Clement and Denis Giorno, and they will hold office until the annual meeting of stockholders in 2013 or until their successors are elected. Messrs. Clement and Giorno are Total designated directors. The Class III group of directors consists of Thomas R. McDaniel, Jean-Marc Otero del Val, Humbert de Wendel and Thomas H. Werner, and they will hold office until the annual meeting of stockholders in 2014 or until their successors are elected. Messrs. Otero del Val and de Wendel are Total designated directors.

Additional information, as of March 23, 2012, about the Class I director nominees for re-election and the Class II and Class III directors is set forth below.

Class I Directors Nominated for Re-Election at the Annual Meeting

| Name | Class | Age | Position(s) with SunPower |

Director Since | ||||||||||||

| Arnaud Chaperon |

I | 56 | Director | 2011 | ||||||||||||

| Jérôme Schmitt |

I | 46 | Director | 2012 | ||||||||||||

| Pat Wood III |

I | 49 | Director | 2005 |

Mr. Arnaud Chaperon currently serves as the Senior Vice President of New Energies for the Gas & Power division of Total S.A. Before taking this position in 2007, Mr. Chaperon was the Managing Director for five years of Total E&P Qatar and country representative of the Total group, which has oil, gas, and petrochemical assets and operations in the State of Qatar. Previous to that, he held other positions within the Total group, where he has been employed since 1980. Mr. Chaperon holds a master’s degree in engineering from École Nationale Supérieure de Techniques Avancées.

Mr. Chaperon brings significant international strategic, operational and development experience to the Board. His experience developing renewable energy projects and investments throughout the value chain for the Total group, as well as managing traditional oil and gas operations, gives him a unique perspective on the Company’s strategic outlook and worldwide opportunities. Based on the Board’s identification of these qualifications, skills and experiences, the Board has concluded that Mr. Chaperon should serve as a director of the Company.

5

Table of Contents

Mr. Jérôme Schmitt has served as the Senior Vice President, Corporate Affairs of the Supply & Marketing Division of Total S.A since the beginning of 2012. Previously, Mr. Schmitt was Total’s Group Treasurer from 2009 through the end of 2011. Before taking this position, Mr. Schmitt was Vice President, Investor Relations at Total for five years. Previous to that, he held other positions within the Total group, where he has been employed since 1992. Mr. Schmitt graduated as a Civil Mining Engineer from the Ecole Nationale Superieure des Mines de Sainte-Etienne.

Mr. Schmitt brings significant international finance and communications experience to the Board. Mr. Schmitt’s extensive experience and relationships both with financial institutions and investors in the energy sector uniquely qualifies him to provide the insight necessary for developing the Company’s financial base and business opportunities. Based on the Board’s identification of these qualifications, skills and experiences, the Board has concluded that Mr. Schmitt should serve as a director of the Company.

Mr. Pat Wood III has served as a Principal of Wood3 Resources, an energy infrastructure developer, since July 2005. He is active in the development of electric power and natural gas infrastructure assets in North America. From 2001 to 2005 Mr. Wood served as the Chairman of the Federal Energy Regulatory Commission. From 1995 to 2001, he chaired the Public Utility Commission of Texas. Mr. Wood has also been an attorney with Baker & Botts, a global law firm, and an associate project engineer with Arco Indonesia, an oil and gas company, in Jakarta. He currently serves as a director of Quanta Services, Inc. and is on the board of privately-held Xtreme Power and First Wind. He is a strategic advisor to Natural Gas Partners, an energy private equity fund. Mr. Wood is a past director of the American Council on Renewable Energy and is a member of the National Petroleum Council.

Mr. Wood brings significant strategic and operational management experience to the Board. Mr. Wood has demonstrated strong leadership skills through nearly ten years of regulatory leadership in the energy sector. Mr. Wood brings a unique perspective and extensive knowledge of energy project development, public policy development, governance and the regulatory process. His legal background also provides the Board with a perspective on the legal implications of matters affecting our business. Based on the Board’s identification of these qualifications, skills and experiences, the Board has concluded that Mr. Wood should serve as a director of the Company and Chairman of the Nominating and Corporate Governance Committee.

Class II Directors with Terms Expiring in 2013

| Name | Class | Age | Position(s) with SunPower |

Director Since | ||||||||||||

| W. Steve Albrecht |

II | 65 | Director | 2005 | ||||||||||||

| Betsy S. Atkins |

II | 58 | Director | 2005 | ||||||||||||

| Bernard Clement |

II | 53 | Director | 2011 | ||||||||||||

| Denis Giorno |

II | 61 | Director | 2011 |

Mr. W. Steve Albrecht has served as Andersen Alumni Professor of Accounting at the Marriott School of Management at Brigham Young University, or BYU, since 1977, and as Associate Dean from 1997 through 2008. Mr. Albrecht, a certified public accountant, certified internal auditor, and certified fraud examiner, joined BYU in 1977 after teaching at Stanford University and the University of Illinois. Prior to becoming a professor, he worked as an accountant for Deloitte & Touche. Mr. Albrecht is the past president of the American Accounting Association and the Association of Certified Fraud Examiners. Mr. Albrecht currently serves on the board of directors of Cypress Semiconductor Corporation and Red Hat, Inc. He served as a trustee of the Financial Accounting Foundation that oversees the Financial Accounting Standards Board (FASB) and the Governmental Accounting Standards Board (GASB) until June 2009. He served on the board of directors of SkyWest, Inc. and Red Hat, Inc. from 2003 to 2009. He was a prior member of the Committee of Sponsoring Organizations (COSO) and has done extensive expert witnessing in major financial cases and consulting for major organizations.

Mr. Albrecht brings significant financial management and financial disclosure experience, as well as significant knowledge of the Company’s recent history and experiences to the Board. Mr. Albrecht’s experience is quite different from that of the Company’s other directors in that he does not have lengthy work experience in the industry served by the Company. Mr. Albrecht instead brings to the Board his extensive knowledge in the areas of accounting, strategy, financial reporting, and controls and experience as a leader of a large, well-respected academic institution. This background and experience qualifies him as a financial expert, which is relevant to his duties as an audit committee member. Based on the Board’s identification of these qualifications, skills and experiences, the Board has concluded that Mr. Albrecht should serve as a director of the Company and Chairman of the Audit Committee.

6

Table of Contents

Ms. Betsy S. Atkins has served as Chief Executive Officer of Baja Ventures, a technology, life sciences and renewable energy early stage venture capital fund, since 1994. She served as the Chairman and Chief Executive Officer of Clear Standards, Inc., which developed enterprise level emission measurement software, from 2008 to 2009 until its sale to SAP. She previously served as Chairperson and Chief Executive Officer of NCI, Inc., a neutraceutical functional food company, from 1991 through 1993. Ms. Atkins co-founded Ascend Communications, a manufacturer of communications equipment, in 1989, where she was also a member of the board of directors until its acquisition by Lucent Technologies, a telecommunications systems, software and products company, in 1999. Ms. Atkins currently serves on the board of directors of Polycom, Inc., Chico’s FAS, Inc., and Schneider Electric, Inc. She is a member of the Council on Foreign Relations. Ms. Atkins served on the boards of directors of Vonage Holdings Corp. from 2005 to 2007; Reynolds American, Inc. from 2004 to 2010; and Towers Watson & Co. in 2010. She served as a presidential appointee to the Pension Benefit Guaranty Corp. board of directors from 2001 to 2003. Ms. Atkins is also a member of Florida International University’s College of Medicine Health Care Network Faculty Group Practice, Inc.

Ms. Atkins brings significant global, sales, marketing and corporate governance experience to the Board. Ms. Atkins’ experience, through nearly 25 years of executive officer service with companies in a high growth phase, gives her a unique perspective on the Company’s business. Ms. Atkins also brings to the Board extensive knowledge in the areas of executive compensation and corporate governance. Based on the Board’s identification of these qualifications, skills and experiences, the Board has concluded that Ms. Atkins should serve as a director of the Company, Chairperson of the Compensation Committee and Lead Independent Director.

Mr. Bernard Clement has served as the Senior Vice President of Gas Assets, Technology, and Research & Development for the Gas & Power division of Total S.A. since January 1, 2010. From 2003 through 2009, Mr. Clement served as Vice President of the Exploration & Production division of Total S.A. relative to its interests in the Middle East. Previous to that, he held other positions within the Total group, where he has been employed since 1983. Mr. Clement has engineering degrees from Ecole Nationale Supérieure du Pétrole et des Moteurs, where he focused on geophysics, and from École Polytechnique.

Mr. Clement brings significant international operational and development experience to the Board. His extensive experience managing international energy projects and assets, as well as managing the development of technology allows him to provide valuable insight into the strategic development of the Company and its ability to meet its manufacturing roadmap. Based on the Board’s identification of these qualifications, skills and experiences, the Board has concluded that Mr. Clement should serve as a director of the Company.

Mr. Denis Giorno has served as President and General Manager of Total Gas & Power New Energies USA since November 2011. From October 2007 until October 2011, he served as the Vice President of New Ventures for the Gas & Power division of Total S.A. From 2005 to 2007, Mr. Giorno was Vice President, Business Development, of the Gas & Power division relative to Total’s interests in Asia, South America, and Africa. Previous to that, he held other positions within the Total group, where he has been employed since 1975. Mr. Giorno received a degree in civil engineering from École Nationale des Ponts et Chaussées, a Master of Science degree in managerial science and engineering at Stanford University and a degree in Petroleum Engineering from École Nationale du Pétrole et des Moteurs. Mr. Giorno also completed the Stanford Graduate School of Business’ Executive Education program.

Mr. Giorno’s extensive, worldwide business development and international negotiation experience covers a broad spectrum of traditional power projects and renewable energy projects, including throughout the value chain in the solar sector. This experience allows him to make significant contributions to the Company’s strategic outlook and international development perspectives. Based on the Board’s identification of these qualifications, skills and experiences, the Board has concluded that Mr. Giorno should serve as a director of the Company.

Class III Directors with Terms Expiring in 2014

| Name | Class | Age | Position(s) with SunPower |

Director Since | ||||||||||||

| Thomas R. McDaniel |

III | 63 | Director | 2009 | ||||||||||||

| Jean-Marc Otero del Val |

III | 45 | Director | 2011 | ||||||||||||

| Humbert de Wendel |

III | 55 | Director | 2011 | ||||||||||||

| Thomas H. Werner |

III | 52 | President and CEO, Director

and |

2003 |

7

Table of Contents

Mr. Thomas R. McDaniel was Executive Vice President, Chief Financial Officer and Treasurer of Edison International, a generator and distributor of electric power and investor in infrastructure and energy assets, before retiring in July 2008 after 37 years of service. Prior to January 2005, Mr. McDaniel was Chairman, Chief Executive Officer and President of Edison Mission Energy, a power generation business specializing in the development, acquisition, construction, management and operation of power production facilities. Mr. McDaniel was also Chief Executive Officer and a director of Edison Capital, a provider of capital and financial services supporting the growth of energy and infrastructure projects, products and services, both domestically and internationally. He is Chairman of the Board of Tendril, a smart grid software as a service company. Mr. McDaniel is a director of SemGroup, L.P., a midstream energy service company. He is also a director of Cypress Envirosystems, a subsidiary of Cypress Semiconductor Corporation, which develops and markets energy efficiency products. Mr. McDaniel also serves on the Advisory Board of Coda Automotive, which is a manufacturer and distributor of all-electric cars and transportation battery systems, and On Ramp Wireless, a communications company serving electrical, gas and water utilities. Mr. McDaniel currently serves on the board of directors of the Senior Care Action Network (SCAN). Through the McDaniel Family Foundation, he is also actively involved in a variety of charitable activities such as the Boys and Girls Club of Huntington Beach, the Adult Day Care Center and the Free Wheelchair Mission.

Mr. McDaniel brings significant operational and development experience to the Board. Mr. McDaniel’s extensive experience growing and operating global electric power businesses is directly aligned with the Company’s efforts to expand the utility and power plant segment of the business. In addition, Mr. McDaniel’s prior experience as a Chief Financial Officer qualifies him as a financial expert, which is relevant to his duties as an audit committee member. Based on the Board’s identification of these qualifications, skills and experiences, the Board has concluded that Mr. McDaniel should serve as a director of the Company and Chairman of the Finance Committee.

Mr. Jean-Marc Otero del Val has served as the Vice President, Electricity, for the Gas & Power Division of Total S.A. since September 2011. Mr. Otero del Val previously served as General Manager of the Grandpuits Refinery for Total France S.A. from 2007 to August 2011. From 2003 to 2007, Mr. Otero del Val served as the Managing Director for Total Coal South Africa (Pty) Ltd., a subsidiary of Total S.A. that focuses on the mining of export quality coal in South Africa. Previous to that, he held other positions within the Total group, where he has been employed since 1998. Mr. Otero del Val received a degree in chemical engineering from École Polytechnique, a Bachelor of Arts in finance from Strasbourg University, and a Master of Arts in finance from Paris-Dauphine University.

Mr. Otero del Val brings significant international managerial and operational experience to the Board. His extensive experience managing complex industrial assets gives him a unique perspective on the Company’s efforts to manage its manufacturing and project development activities. Based on the Board’s identification of these qualifications, skills and experiences, the Board has concluded that Mr. Otero del Val should serve as a director of the Company.

Mr. Humbert de Wendel has served as the Total Group Treasurer since the beginning of 2012. Previously, Mr. de Wendel served as the Senior Vice President of Corporate Business Development for Total from 2006 to 2011. From 2000 to 2006, Mr. de Wendel served as a Vice President for Total overseeing finance operations of its exploration and production subsidiaries. Previous to that, he held other positions within the Total group, where he has been employed since 1982. Mr. de Wendel holds a degree in law and economics from the Institut d’études Politiques de Paris, and a degree in business administration from École Supérieure des Sciences Économiques et Commerciales.

Mr. de Wendel brings extensive international experience in finance and business development to the Board. This experience allows him to bring valuable perspective on the Company’s relationships with its key financial and industrial partners. Based on the Board’s identification of these qualifications, skills and experiences, the Board has concluded that Mr. de Wendel should serve as a director of the Company.

Mr. Thomas H. Werner has served as our President and Chief Executive Officer since May 2010, as a member of our Board since June 2003, and Chairman of the Board of Directors since May 2011. From June 2003 to April 2010, Mr. Werner served as our Chief Executive Officer. Prior to joining SunPower, from 2001 to 2003, he held the position of Chief Executive Officer of Silicon Light Machines, Inc., an optical solutions subsidiary of Cypress Semiconductor Corporation. From 1998 to 2001, Mr. Werner was Vice President and General Manager of the Business Connectivity Group of 3Com Corp., a network solutions company. He has also held a number of executive management positions at Oak Industries, Inc. and General Electric Co., and currently serves as a board member of Cree, Inc., Silver Spring Networks, and the Silicon Valley Leadership Group. Mr. Werner is on the Board of Trustees of Marquette University. Mr. Werner holds a bachelors degree in industrial engineering from the University of Wisconsin Madison, a bachelor’s degree in electrical engineering from Marquette University and a master’s degree in business administration from George Washington University.

8

Table of Contents

Mr. Werner brings significant leadership and operational management experience to the Board. Mr. Werner provides the Board with valuable insight into management’s perspective with respect to the Company’s operations. Mr. Werner brings significant technical, operational and financial management experience to the Board. Mr. Werner has demonstrated strong executive leadership skills through nearly 20 years of executive officer service with various companies and brings the most comprehensive view of the Company’s operational history over the past few years. Mr. Werner also brings to the Board leadership experience through his service on the board of directors for two other organizations, which gives him the ability to compare the way in which management and the boards operate within the companies he serves. Based on the Board’s identification of these qualifications, skills and experiences, the Board has concluded that Mr. Werner should serve as a director of the Company.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ELECTION TO THE BOARD OF EACH OF THE CLASS I PROPOSED NOMINEES.

9

Table of Contents

Our Board has determined that four of our eleven directors, namely Mr. Albrecht, Ms. Atkins, and Messrs. McDaniel and Wood, each meet the standards for independence as defined by applicable listing standards of the Nasdaq Global Select Market and rules and regulations of the SEC. Our Board has also determined that Mr. Werner, our President and Chief Executive Officer, and Messrs. Chaperon, Clement, Giorno, Otero del Val, Schmitt and de Wendel, as directors designated by our controlling stockholder Total Gas & Power USA, SAS (“Total”), pursuant to our Affiliation Agreement with Total, are not “independent” as defined by applicable listing standards of the Nasdaq Global Select Market. There are no family relationships among any of our directors or executive officers.

Leadership Structure and Risk Oversight

The Board has determined that having a lead independent director assist Mr. Werner, the Chairman of the Board and Chief Executive Officer, is in the best interest of stockholders at this time. In early 2010, Betsy S. Atkins was appointed to serve as the lead independent director for the Board. This structure ensures a greater role for the independent directors in the oversight of the Company and active participation of the independent directors in setting agendas and establishing priorities and procedures for the work of the Board. We believe that this leadership structure also is preferred by a significant number of our stockholders.

The Board is actively involved in oversight of risks that could affect the Company. This oversight is conducted primarily through committees of the Board, in particular our Audit Committee, as disclosed in the descriptions of each of the committees below and in the charters of each of the committees. The full Board, however, has retained responsibility for general oversight of risks. The Board satisfies this responsibility through full reports by each committee chair regarding the committee’s considerations and actions, as well as through regular reports directly from officers responsible for oversight of particular risks within the Company. The Board believes its administration of its risk oversight function has not affected the Board’s leadership structure.

Our Board held four regular, quarterly meetings, one annual meeting and 11 special meetings during fiscal year 2011. During fiscal year 2011, each director attended at least 75% of the aggregate number of meetings of the Board and its committees on which such director served, except for T.J. Rodgers and Reinhard Schneider, who have both resigned from the Board. Our independent directors held six executive sessions during regular, quarterly meetings without management present during fiscal year 2011.

Total presently owns 66% of our outstanding voting securities and we are therefore considered a “controlled company” within the meaning of the Nasdaq Stock Market rules. As a “controlled company,” we are presently exempt from the rules that would otherwise require that our Board be comprised of a majority of independent directors and that our Compensation Committee and Nominating and Corporate Governance Committee be composed entirely of independent directors. This “controlled company” exception does not modify the independence requirements for the Audit Committee, and we comply with the requirements of the Sarbanes-Oxley Act and the Nasdaq Stock Market rules, requiring that our Audit Committee be comprised exclusively of independent directors.

10

Table of Contents

We believe that good corporate governance is important to ensure that we are managed for the long-term benefit of our stockholders. Our Board has established committees to ensure that we maintain strong corporate governance standards. Our Board has standing Audit, Compensation, Nominating and Corporate Governance, and Finance Committees. The charters of our Audit, Compensation, Nominating and Corporate Governance, and Finance Committees are available on our website at http://investors.sunpowercorp.com/documents.cfm. You may also request copies of our committee charters free of charge by writing to SunPower Corporation, 77 Rio Robles, San Jose, California 95134, Attention: Corporate Secretary. Below is a summary of our committee structure and membership information.

| Director | Audit Committee | Compensation Committee |

Nominating and Corporate Governance Committee |

Finance Committee | ||||

| W. Steve Albrecht(I) |

Chair | -- | -- | -- | ||||

| Betsy S. Atkins(I) |

-- | Chair | Member | -- | ||||

| Arnaud Chaperon |

-- | -- | -- | Member | ||||

| Bernard Clement |

-- | -- | Member | -- | ||||

| Denis Giorno |

-- | -- | Member | -- | ||||

| Thomas R. McDaniel(I) |

Member | Member | -- | Chair | ||||

| Jérôme Schmitt |

-- | Member | -- | -- | ||||

| Humbert de Wendel |

-- | Member | -- | Member | ||||

| Pat Wood III(I) |

Member | -- | Chair | Member |

| (I) | Indicates an independent director. |

Our Audit Committee is a separately-designated standing committee established in accordance with Section 3(a)(58)(A) of the Exchange Act. Each of the members of our Audit Committee is “independent” as that term is defined in Section 10A of the Exchange Act and as defined by applicable listing standards of the Nasdaq Global Select Market. Each member of the Audit Committee is financially literate and has the requisite financial sophistication as required by the applicable listing standards of the Nasdaq Global Select Market. In addition, the Board has determined that each of Messrs. Albrecht and McDaniel meet the criteria of an “audit committee financial expert” within the meaning of applicable SEC regulations due to his professional experience described above under “Proposal One — Re-election of Class I Directors.” The Audit Committee held eight meetings during fiscal 2011.

The purpose of the Audit Committee, pursuant to its charter, is to:

| — | provide oversight of our accounting and financial reporting processes and the audit of our financial statements and internal controls by our independent registered public accounting firm; |

| — | assist the Board in the oversight of: (1) the integrity of our financial statements; (2) our compliance with legal and regulatory requirements; (3) the independent registered public accounting firm’s performance, qualifications and independence; and (4) the performance of our internal audit function; |

| — | oversee management’s identification, evaluation, and mitigation of major risks to the Company; |

| — | prepare an audit committee report as required by the SEC to be included in our annual proxy statement; |

| — | provide to the Board such information and materials as it may deem necessary to make the Board aware of financial matters requiring the attention of the Board; and |

| — | consider questions of actual and potential conflicts of interest (including corporate opportunities) of Board members and corporate officers and review and approve proposed related party transactions (as defined in Item 404 of Regulation S-K); any waiver of the Code of Business Conduct and Ethics for directors and executive officers and any approval of related party transactions may be made only by the disinterested members of the Audit Committee. |

The Audit Committee also serves as the representative of the Board with respect to its oversight of the matters described below in the “Audit Committee Report.” The Audit Committee has also established procedures for (1) the receipt, retention

11

Table of Contents

and treatment of complaints received by us regarding accounting, internal accounting controls or auditing matters, and (2) the confidential, anonymous submission by our employees of concerns regarding accounting or auditing matters. The Audit Committee promptly reviews such complaints and concerns.

In 2011, the Compensation Committee had three members: Ms. Atkins and Messrs. McDaniel and de Wendel. On March 7, 2012, the Board appointed Mr. Schmitt as an additional member of the Compensation Committee. Messrs. Schmitt and de Wendel were designated by Total to be on the Compensation Committee pursuant to our Affiliation Agreement with Total. Two of the four members of the Compensation Committee, Ms. Atkins and Mr. McDaniel, are “independent” as defined by applicable listing standards of the Nasdaq Global Select Market. The Compensation Committee held seven meetings during fiscal 2011.

The Compensation Committee, pursuant to its charter, assists the Board in discharging its duties with respect to:

| — | the formulation, implementation, review, and modification of the compensation of our directors and executive officers; |

| — | the preparation of an annual report of the Compensation Committee for inclusion in our annual proxy statement or Annual Report on Form 10-K, in accordance with applicable rules of the SEC and applicable listing standards of the Nasdaq Global Select Market; |

| — | reviewing and discussing the Compensation Discussion and Analysis, set forth in our annual proxy statement, with management; and |

| — | the administration of our stock plans, including the Third Amended and Restated SunPower Corporation 2005 Stock Incentive Plan. |

In certain instances, the Compensation Committee has delegated limited authority to Mr. Werner, in his capacity as a Board member, with respect to compensation and equity awards for employees other than our executive officers. For more information on our processes and procedures for the consideration and determination of executive compensation, see “Compensation Discussion and Analysis” below.

Compensation Committee Interlocks and Insider Participation

No member of our Compensation Committee was at any time during fiscal 2011 one of our officers or employees, or is one of our former officers or employees. No member of our Compensation Committee had any relationship requiring disclosure under Item 404 and Item 407(e)(4) of Regulation S-K. Additionally, during fiscal 2011, none of our executive officers or directors was a member of the board of directors, or any committee of the board of directors, or of any other entity such that the relationship would be construed to constitute a compensation committee interlock within the meaning of the rules and regulations of the SEC.

Nominating and Corporate Governance Committee

In 2011, the Nominating and Corporate Governance Committee had three members: Ms. Atkins and Messrs. Giorno and Wood. On March 7, 2012, the Board appointed Mr. Clement as an additional member of the Nominating and Corporate Governance Committee. Messrs. Clement and Giorno were designated by Total to be on the Nominating and Corporate Governance Committee pursuant to our Affiliation Agreement with Total. Two of the four members of the Nominating and Corporate Governance Committee, Ms. Atkins and Mr. Wood, are “independent” as defined by applicable listing standards of the Nasdaq Global Select Market. The Nominating and Corporate Governance Committee held four meetings during fiscal 2011.

The Nominating and Corporate Governance Committee, pursuant to its charter, assists the Board in discharging its responsibilities with respect to:

| — | the identification of individuals qualified to become directors and the selection or recommendation of candidates for all directorships to be filled by the Board or by the stockholders; |

| — | the evaluation of whether an incumbent director should be nominated for re-election to the Board upon expiration of such director’s term, based upon factors established for new director candidates as well as the incumbent director’s qualifications, performance as a Board member, and such other factors as the Committee deems appropriate; and |

12

Table of Contents

| — | the development, maintenance and recommendation of a set of corporate governance principles applicable to us, and for periodically reviewing such principles. |

The Nominating and Governance Committee also considers diversity in identifying nominees for directors. In particular, the Nominating and Governance Committee believes that the members of the Board should encompass a diverse range of talent, skill and expertise sufficient to provide sound and prudent guidance with respect to the Company’s operations and interests. In addition, the Nominating and Governance Committee has determined that the Board as a whole must have the right diversity, mix of characteristics and skills for the optimal functioning of the Board in its oversight of the Company.

The Nominating and Governance Committee believes the Board should be comprised of persons with skills in areas such as:

| — | relevant industries, especially solar products and services; |

| — | technology manufacturing; |

| — | sales and marketing; |

| — | leadership of large, complex organizations; |

| — | finance and accounting; |

| — | corporate governance and compliance; |

| — | strategic planning; |

| — | international business activities; and |

| — | human capital and compensation. |

Under our Corporate Governance Principles, during the director nominee evaluation process, the Nominating and Corporate Governance Committee and the Board will take the following into account:

| — | A significant number of directors on the Board should be independent directors, unless otherwise required by applicable law or the Nasdaq Stock Market rules; |

| — | Candidates should be capable of working in a collegial manner with persons of different educational, business and cultural backgrounds and should possess skills and expertise that complement the attributes of the existing directors; |

| — | Candidates should represent a diversity of viewpoints, backgrounds, experiences and other demographics; |

| — | Candidates should demonstrate notable or significant achievement and possess senior-level business, management or regulatory experience that would benefit the Company; |

| — | Candidates shall be individuals of the highest character and integrity; |

| — | Candidates shall be free from any conflict of interest that would interfere with their ability to properly discharge their duties as a director or would violate any applicable law or regulation; |

| — | Candidates shall be capable of devoting the necessary time to discharge their duties, taking into account memberships on other boards and other responsibilities; and |

| — | Candidates shall have the desire to represent the interests of all stockholders. |

In 2011, the Finance Committee (formerly known as the Strategy and Finance Committee) had three members: Messrs. Chaperon, McDaniel and Wood. On March 7, 2012, the Board appointed Mr. de Wendel as an additional member of the Finance Committee. Messrs. Chaperon and de Wendel were designated by Total to be on the Finance Committee pursuant to our Affiliation Agreement with Total. Two of the four members of the Finance Committee, Messrs. McDaniel and Wood, are “independent” as defined by applicable listing standards of the Nasdaq Global Select Market. The Finance Committee held six meetings during fiscal 2011.

The Finance Committee, pursuant to its charter, assists the Board in discharging its duties with respect to:

| — | The review, evaluation and approval of financing transactions, including credit facilities, structured finance, issuance of debt and equity securities in private and public transactions, and the repurchase of debt and equity securities (other than financing activity exceeding $50 million which requires the review and approval of the Board); |

13

Table of Contents

| — | The review of the Company’s annual operating plan for recommendation to the Board, and the monitoring of capital spend as compared to the annual operating plan; |

| — | The review and recommendation to the Board of investments, acquisitions, divestitures and other corporate transactions; and |

| — | General oversight of the Company’s treasury activities, and the review, at least annually, of the Company’s counterparty credit risk and insurance programs. |

14

Table of Contents

Stockholder Communications with Board of Directors

We provide a process by which stockholders may send communications to our Board, any committee of the Board, our non-management directors or any particular director. Stockholders can contact our non-management directors by sending such communications to the chairman of the Nominating and Corporate Governance Committee, c/o Corporate Secretary, SunPower Corporation, 77 Rio Robles, San Jose, California 95134. Stockholders wishing to communicate with a particular Board member, a particular Board committee or the Board as a whole, may send a written communication to our Corporate Secretary, SunPower Corporation, 77 Rio Robles, San Jose, California 95134. The Corporate Secretary will forward such communication to the full Board, to the appropriate committee or to any individual director or directors to whom the communication is addressed, unless the communication is unduly hostile, threatening, illegal, or harassing, in which case the Corporate Secretary has the authority to discard the communication or take appropriate legal action regarding the communication.

Directors’ Attendance at Our Annual Meetings

Although we do not have a formal policy that mandates the attendance of our directors at our annual stockholder meetings, our directors are encouraged to attend. Ten of our eleven directors are expected to attend the 2012 Annual Meeting, and six of our seven directors attended our annual meeting of stockholders held on May 3, 2011 (the “2011 Annual Meeting”).

Submission of Stockholder Proposal for the 2013 Annual Meeting

As a SunPower stockholder, you may submit a proposal, including director nominations, for consideration at future annual meetings of stockholders.

Stockholder Proposals. Only stockholders meeting certain criteria outlined in our By-laws are eligible to submit nominations for election to the Board or to propose other proper business for consideration by stockholders at an annual meeting. Under the By-laws, stockholders who wish to nominate persons for election to the Board or propose other proper business for consideration by stockholders at an annual meeting must give proper written notice to us not earlier than the 120th day and not later than the 90th day prior to the first anniversary of the preceding year’s annual meeting, provided that in the event that our 2013 annual meeting is called for a date that is not within 25 days before or after such anniversary date, notice by the stockholder in order to be timely must be received not later than the close of business on the 10th day following the day on which we mail or publicly announce our notice of the date of the annual meeting, whichever occurs first. Therefore, notices regarding nominations of persons for election to the Board and proposals of other proper business for consideration at the 2012 annual meeting of stockholders must be submitted to the Company no earlier than January 9, 2013 and no later than February 8, 2013. If the date of the 2013 annual meeting is moved more than 25 days before or after the anniversary date of the 2012 Annual Meeting, the deadline will instead be the close of business on the 10th day following notice of the date of the 2013 annual meeting of stockholders or public disclosure of such date, whichever occurs first. We have discretionary power, but are not obligated, to consider stockholder proposals submitted after February 8, 2013.

Stockholder proposals will also need to comply with SEC regulations, such as Rule 14a-8 of the Exchange Act regarding the inclusion of stockholder proposals in any Company-sponsored proxy material. The submission deadline for stockholder proposals to be included in our proxy materials for the 2013 annual meeting of stockholders pursuant to Rule 14a-8 of the Exchange Act is November 23, 2012. All written proposals must be received by our Corporate Secretary, at our corporate offices at 77 Rio Robles, San Jose, California 95134 by the close of business on the required deadline in order to be considered for inclusion in our proxy materials for the 2013 annual meeting of stockholders.

Nomination of Director Candidates. Our Nominating and Corporate Governance Committee will consider director candidates recommended by our stockholders. Such nominations should be directed to the Nominating and Corporate Governance Committee, c/o Corporate Secretary, SunPower Corporation, 77 Rio Robles, San Jose, California 95134. In addition, the stockholder must give notice of a nomination to our Corporate Secretary, and such notice must be received within the time period described above under “Stockholder Proposals.” Any such proposal must include the following:

| — | the name, age, business address, residence address and record address of such nominee; |

| — | the principal occupation or employment of such nominee; |

| — | the class or series and number of shares of our stock owned beneficially or of record by such nominee; |

| — | any information relating to the nominee that would be required to be disclosed in our proxy statement; |

15

Table of Contents

| — | the nominee holder for, and number of, shares owned beneficially but not of record by such person; |

| — | whether and the extent to which any hedging or other transaction or series of transactions has been entered into by or on behalf of, or any other agreement, arrangement or understanding (including any derivative or short positions, profit interests, options or borrowed or loaned shares) has been made, the effect or intent of which is to mitigate loss to or manage risk or benefit of share price changes for, or to increase or decrease the voting power of, such person with respect to any share of our stock; |

| — | to the extent known by the stockholder giving the notice, the name and address of any other stockholder supporting the nominee for election or reelection as a director on the date of such stockholder’s notice; |

| — | a description of all arrangements or understandings between or among such persons pursuant to which the nomination(s) are to be made by the stockholder and any relationship between or among the stockholder giving notice and any person acting in concert, directly or indirectly, with such stockholder and any person controlling, controlled by or under common control with such stockholder, on the one hand, and each proposed nominee, on the other hand; and |

| — | a representation that the stockholder intends to appear in person or by proxy at the meeting to nominate the persons named in its notice. |

If a director nomination is made pursuant to the process set forth above, the Nominating and Corporate Governance Committee will apply the same criteria in evaluating the nominee as it would any other board nominee candidate, and will recommend to the Board whether or not the stockholder nominee should be included as a candidate for election in our proxy statement. The nominee and nominating stockholder should be willing to provide any information reasonably requested by the Nominating and Corporate Governance Committee in connection with its evaluation. The Board shall make the final determination whether or not a nominee will be included in the proxy statement and on the proxy card for election.

Once either a search firm selected by the Nominating and Corporate Governance Committee or a stockholder has provided our Nominating and Corporate Governance Committee with the identity of a prospective candidate, the Nominating and Corporate Governance Committee communicates the identity and known background and experience of the candidate to the Board. If warranted by a polling of the Board, members of our Nominating and Corporate Governance Committee and/or other members of our senior management may interview the candidate. If the Nominating and Governance Committee reacts favorably to a candidate, the candidate is next invited to interview with the members of the Board who are not on the Nominating and Governance Committee. The Nominating and Governance Committee then makes a final determination whether to recommend the candidate to the Board for directorship. The Nominating and Governance Committee currently has not set specific, minimum qualifications or criteria for nominees that it proposes for Board membership, but evaluates the entirety of each candidate’s credentials. The Nominating and Governance Committee believes, however, that we will be best served if our directors bring to the Board a variety of diverse experience and backgrounds and, among other things, demonstrated integrity, executive leadership and financial, marketing or business knowledge and experience. See “Board Structure — Nominating and Corporate Governance Committee” for factors considered by the Nominating and Corporate Governance Committee and the Board in considering director nominees.

Corporate Governance Principles

We believe that strong corporate governance practices are the foundation of a successful, well-run company. The Board has adopted Corporate Governance Principles that set forth our core corporate governance principles, including:

| — | oversight responsibilities of the Board; |

| — | election and responsibilities of the lead independent director; |

| — | role of Board committees and assignment and rotation of members; |

| — | review of the Code of Business Conduct and Ethics and consideration of related party transactions; |

| — | independent directors meetings without management and with outside auditors; |

| — | Board’s access to employees; |

| — | annual review of Board member compensation; |

| — | membership criteria and selection of the Board; |

| — | annual review of Board performance; |

16

Table of Contents

| — | director orientation and continuing education; |

| — | annual review of performance and compensation of executive officers; and |

| — | succession planning for key executive officers. |

The Corporate Governance Principles are available on our website at http://investors.sunpowercorp.com.

Code of Business Conduct and Ethics; Related Persons Transactions Policy and Procedures

It is our general policy to conduct our business activities and transactions with the highest level of integrity and ethical standards and in accordance with all applicable laws. In addition, it is our policy to avoid situations that create an actual or potential conflict between our interests and the personal interests of our officers and directors. Such principles are described in our Code of Business Conduct and Ethics. Our Code of Business Conduct and Ethics is applicable to our directors, officers, and employees (including our principal executive officer, principal financial officer and principal accounting officer) and is designed to promote compliance with the laws applicable to our business, accounting standards, and proper and ethical business methods and practices. Our Code of Business Conduct and Ethics is available on our website at http://investors.sunpowercorp.com under the link for “Code of Conduct.” You may also request a copy by writing to us at SunPower Corporation, 77 Rio Robles, San Jose, California 95134, Attention: Corporate Secretary. If we amend or grant a waiver applicable to our principal executive officer, principal financial officer or principal accounting officer, we will post a copy of such amendment or waiver on our website. Under the Corporate Governance Principles, the Nominating and Corporate Governance Committee is responsible for reviewing and recommending changes to our Code of Business Conduct and Ethics.

Pursuant to our Corporate Governance Principles and our Audit Committee Charter, our Audit Committee will consider questions of actual and potential conflicts of interest (including corporate opportunities) of directors and officers, and approve or prohibit such transactions. The Audit Committee will review and approve in advance all proposed related party transactions (as defined in Item 404 of Regulation S-K), in compliance with the applicable Nasdaq Stock Market rules. A related party transaction will only be approved if the Audit Committee determines that it is in the best interests of SunPower. If a director is involved in the transaction, he or she will be recused from all voting and approval processes in connection with the transaction.

Certain Relationships and Related Persons Transactions

Other than the compensation agreements and other arrangements described herein, and the transactions described below, since the start of our last fiscal year on January 3, 2011, there has not been, nor is there currently proposed, any transaction or series of similar transactions to which SunPower has been or will be a party:

| — | in which the amount involved exceeded or will exceed $120,000; and |

| — | in which any director, director nominee, executive officer, beneficial owner of more than 5% of any class of our common stock, or any immediate family member of such persons had or will have a direct or indirect material interest. |

Arrangements with Cypress Semiconductor Corporation

Until September 29, 2008, Cypress Semiconductor Corporation (“Cypress”) held all of the outstanding shares of our former class B common stock, which represented a controlling interest in our combined former class A and class B common stock. However, after the close of trading on September 29, 2008, Cypress distributed all of its shares of our former class B common stock to its stockholders of record as of September 17, 2008. Mr. T.J. Rodgers, Chairman of our Board of Directors until May 3, 2011, is also the co-founder, board member, President and Chief Executive Officer of Cypress. In addition, Mr. Albrecht currently serves on our Board and the board of directors of Cypress. In 2005, we entered into a series of related agreements with Cypress, then our parent company, in connection with our initial public offering and separation from Cypress. Many of the agreements have since expired. The principal agreements, under which we paid more than $120,000 to Cypress during fiscal 2011, include the former lease agreement for our headquarters facility and the tax sharing agreement. These principal agreements are summarized below.

Leased Headquarters Facility in San Jose, California; Other Payments. In May 2006, we entered into a lease agreement for our approximately 44,000 square foot headquarters, which is located in a building owned by Cypress in San Jose, California, for $6.0 million over the five-year term of the lease expiring in April 2011. In October 2008, we amended the lease agreement, increasing the rentable square footage and the total lease obligations to approximately 60,000

17

Table of Contents

and $7.6 million, respectively, over the five-year term of the lease. We paid Cypress $1.6 million in fiscal 2011 to rent the building as well as other related services on the premises under a transition services agreement entered into at the time of Cypress’s distribution of our former class B common stock. We moved to new offices leased from an unaffiliated third party in May 2011. In addition, we paid Cypress $0.3 million in fiscal 2011 for certain electronic equipment located at our manufacturing facilities.

Tax Sharing Agreement. On October 6, 2005, while a wholly-owned subsidiary of Cypress, we entered into a tax sharing agreement with Cypress providing for each party’s obligations concerning various tax liabilities. The tax sharing agreement is structured such that Cypress would pay all federal, state, local and foreign taxes that are calculated on a consolidated or combined basis while we were a member of Cypress’s consolidated or combined group for federal, state, local and foreign tax purposes. Our portion of tax liabilities or benefits was determined based upon our separate return tax liability as defined under the tax sharing agreement. These tax liabilities or benefits were based on a pro forma calculation as if we were filing a separate income tax return in each jurisdiction, rather than on a combined or consolidated basis, subject to adjustments as set forth in the tax sharing agreement.

On June 6, 2006, we ceased to be a member of Cypress’s consolidated group for federal income tax purposes and certain state income tax purposes. On September 29, 2008, we ceased to be a member of Cypress’s combined group for all state income tax purposes. To the extent that we become entitled to utilize on our separate tax returns portions of any tax credit or loss carryforwards existing as of such date, we will distribute to Cypress the tax effect, estimated to be 40% for federal and state income tax purposes, of the amount of such tax loss carryforwards so utilized, and the amount of any credit carryforwards so utilized. We will distribute these amounts to Cypress in cash or in our shares, at Cypress’s option. As of January 1, 2012, we have a potential liability of approximately $2.2 million that may be due under this arrangement.

We will continue to be jointly and severally liable for any tax liability during all periods in which we are deemed to be a member of the Cypress consolidated or combined group. Accordingly, although the tax sharing agreement allocates tax liabilities between Cypress and all its consolidated subsidiaries, for any period in which we were included in Cypress’s consolidated or combined group, we could be liable in the event that any federal or state tax liability was incurred, but not discharged, by any other member of the group.