Exhibit 10.2

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form

(Mark One)

For

the Quarterly Period Ended

OR

For the transition period from ______________ to ______________

Commission

File No.

(Exact name of small business issuer as specified in its charter)

| 5511 | ||||

(State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

(Address of principal executive offices)

(

(Registrant’s telephone number, including area code)

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading symbol(s) | Name of each exchange on which registered | ||

| OTC PINK |

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days.

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted and posted pursuant

to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit and post such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer” and “large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ☐ | Accelerated filer ☐ | |

Smaller

reporting company Emerging

growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐

The number of shares of Common Stock (no par value) of the registrant outstanding was at August 13, 2021. The number of shares of Series A Preferred Stock ($0.0001 par value and that each convert into one share of common stock) of the registrant outstanding was 5,750,000 at August 13, 2021. The number of shares of Series B Preferred Stock ($0.0001 par value and that each convert into 1,000 shares of common stock) of the registrant outstanding was 5,143,115 at August 13, 2021. The number of shares of Series C Preferred Stock ($0.0001 par value and that each convert into one share of common stock) of the registrant outstanding was 1,000,000 at August 16, 2021. The market value of common shares outstanding as of August 13, 2021 was $8,661,567.

FOMO CORP.

QUARTERLY REPORT ON FORM 10-Q FOR THE PERIOD ENDED SEPTEMBER 30, 2019

TABLE OF CONTENTS

| 2 |

PART I

ITEM 1. FINANCIAL STATEMENTS

FOMO CORP. and Subsidiaries

INDEX TO FINANCIAL STATEMENTS

| 3 |

FOMO CORP. and Subsidiaries

(Formerly 2050 Motors, Inc.)

Condensed Balance Sheets

As of June 30, 2021 | As of December 31, 2020 | |||||||

| (unaudited) | (audited) | |||||||

| Assets | ||||||||

| Current assets | ||||||||

| Cash | $ | $ | ||||||

| Accounts receivable, net | ||||||||

| Deposit on option to purchase business | - | |||||||

| Inventory | - | |||||||

| Loan receivable | - | |||||||

| Prepaid expense | ||||||||

| Total current assets | ||||||||

| Other assets: | ||||||||

| Investments | ||||||||

| Intangible assets | ||||||||

| Goodwill | ||||||||

| Total other assets | ||||||||

| Total assets | $ | $ | ||||||

| Liabilities and stockholders’ deficit | ||||||||

| Liabilities | ||||||||

| Current liabilities | ||||||||

| Accounts payable | $ | $ | ||||||

| Accrued intertest on loans payable | ||||||||

| Customer deposit | ||||||||

| Loan payable related party | ||||||||

| Loans payable due to non-related parties, net | ||||||||

| Loan Cares PPP | - | |||||||

| Derivative liability | ||||||||

| Total current liabilities | ||||||||

| Total liabilities | ||||||||

| Stockholders’ deficit | ||||||||

| Common stock; | ||||||||

| Preferred stock Class A; $ par value authorized: issued and outstanding and at June 30, 2021 and December 31, 2020, respectively: discretionary | ||||||||

| Preferred stock Class B; $ par value authorized: issued and outstanding and at June 30, 2021 and December 31, 2020, respectively: discretionary | ||||||||

| Preferred stock Class C; $ par value authorized: and issued and outstanding at June 30, 2021 and December 31, 2020, respectively: discretionary | ||||||||

| Additional paid-in-capital | ||||||||

| Accumulated deficit | ( | ) | ( | ) | ||||

| Common stock issuable | ||||||||

| Total stockholders’ deficit | ( | ) | ||||||

| Total liabilities and stockholders’ deficit | $ | $ | ||||||

The accompanying notes are an integral part of these financial statements

| 4 |

FOMO CORP. and Subsidiaries

(Formerly 2050 Motors, Inc.)

Condensed Statement of Operations

(Unaudited)

| Three Months Ended | Six Months Ended | |||||||||||||||

| June 30, 2021 | June 30, 2020 | June 30, 2021 | June 30, 2020 | |||||||||||||

| Operating revenue | $ | $ | $ | $ | ||||||||||||

| Cost of revenues | ||||||||||||||||

| Gross profit | ||||||||||||||||

| Operating expenses: | ||||||||||||||||

| General and administrative | ||||||||||||||||

| Net loss from operations | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| Other income (expenses): | ||||||||||||||||

| Interest expense | ( | ) | ( | ) | ||||||||||||

| Loan forgiveness | ||||||||||||||||

| Loss on investment | ( | ) | ( | ) | ||||||||||||

| Impairment loss | ( | ) | ||||||||||||||

| Derivative liability gain (loss) | ||||||||||||||||

| Debt conversion gain (loss) | ||||||||||||||||

| Debt settlement gain (loss) | ( | ) | ||||||||||||||

| Other income, net | ||||||||||||||||

| Total other income (expenses) | ||||||||||||||||

| Income (loss) before income taxes | ( | ) | ||||||||||||||

| Provision for income taxes | ||||||||||||||||

| Net income (loss) | $ | $ | $ | ( | ) | $ | ||||||||||

| Net income (loss) per share, basic and diluted | $ | $ | $ | ( | ) | $ | ||||||||||

| Weighted average common equivalent share outstanding, basic and diluted | ||||||||||||||||

The accompanying notes are an integral part of these financial statements

| 5 |

FOMO CORP. and Subsidiaries

(Formerly 2050 Motors, Inc.)

Condensed Statement of Stockholders’ Deficit

(Unaudited)

| Common Stock | Preferred Stock | |||||||||||||||||||||||||||||||||||||||||||||||

| Class A | Class B | Class C | Common | Additional | Total | |||||||||||||||||||||||||||||||||||||||||||

| Number | No | Number | $0.0001 | Number | $0.0001 | Number | $0.0001 | Stock | paid-in | Accumulated | stockholders’ | |||||||||||||||||||||||||||||||||||||

| of Shares | par value | of Shares | par value | of Shares | par value | of Shares | par value | Issuable | capital | deficit | deficit | |||||||||||||||||||||||||||||||||||||

| Balance, December 31, 2019 | $ | $ | $ | $ | $ | $ | $ | ( | ) | $ | ( | ) | ||||||||||||||||||||||||||||||||||||

| Conversion of convertible debt | ||||||||||||||||||||||||||||||||||||||||||||||||

| Warrants | - | - | - | - | ||||||||||||||||||||||||||||||||||||||||||||

| Net income | - | - | - | - | ||||||||||||||||||||||||||||||||||||||||||||

| Balance, March 31, 2020 | ( | ) | ( | ) | ||||||||||||||||||||||||||||||||||||||||||||

| Warrants | - | - | - | - | ||||||||||||||||||||||||||||||||||||||||||||

| Net income | - | - | - | - | ||||||||||||||||||||||||||||||||||||||||||||

| Balance, June 30, 2020 | $ | $ | $ | $ | $ | $ | $ | ( | ) | $ | ( | ) | ||||||||||||||||||||||||||||||||||||

| Balance December 31, 2020 | $ | $ | $ | $ | $ | $ | $ | ( | ) | $ | ( | ) | ||||||||||||||||||||||||||||||||||||

| Conversion of convertible debt | ||||||||||||||||||||||||||||||||||||||||||||||||

| Stock issued for compensation | ||||||||||||||||||||||||||||||||||||||||||||||||

| Stock issued for loan cost | ||||||||||||||||||||||||||||||||||||||||||||||||

| Purchase common share | ||||||||||||||||||||||||||||||||||||||||||||||||

| Purchase Preferred A shares | ||||||||||||||||||||||||||||||||||||||||||||||||

| Stock issued for compensation | ||||||||||||||||||||||||||||||||||||||||||||||||

| Options to purchase business | ||||||||||||||||||||||||||||||||||||||||||||||||

| Purchase assets | ||||||||||||||||||||||||||||||||||||||||||||||||

| Warrents | - | - | - | - | ||||||||||||||||||||||||||||||||||||||||||||

| Net income | - | - | - | - | ( | ) | ( | ) | ||||||||||||||||||||||||||||||||||||||||

| Balance, March 31, 2021 | ( | ) | ( | ) | ||||||||||||||||||||||||||||||||||||||||||||

| Purchase common shares | ||||||||||||||||||||||||||||||||||||||||||||||||

| Net income | - | - | - | - | ||||||||||||||||||||||||||||||||||||||||||||

| Balance June 30, 2021 | ( | ) | ||||||||||||||||||||||||||||||||||||||||||||||

The accompanying notes are an integral part of these financial statements

| 6 |

FOMO CORP. and Subsidiaries

(Formerly 2050 Motors, Inc.)

Condensed Statement of Cash Flows

(Unaudited)

| Six Months Ended | ||||||||

| June 30, 2021 | June 30, 2020 | |||||||

| Cash flows provided by (used for) operating activities: | ||||||||

| Net income (loss) | $ | ( | ) | $ | ||||

| Adjustments to reconcile net loss to net cash provided by (used for) operating activities: | ||||||||

| Amortization of debt discount | ||||||||

| Debt settlement (income) loss | ||||||||

| Issuance of common stock for services | ||||||||

| Derivative liability adjustment | ( | ) | ||||||

| Loan forgiveness | ( | ) | ||||||

| Loss on investment | ||||||||

| Increase (decrease) in assets and liabilities: | ||||||||

| Accounts receivable | ( | ) | ||||||

| Accounts payable | ( | ) | ||||||

| Inventory | ( | ) | ||||||

| Prepaid expenses | ( | ) | ||||||

| Customer deposits | ||||||||

| Accrued expenses | ||||||||

| Tax payable | ||||||||

| Net cash used for operating activities | ( | ) | ( | ) | ||||

| Cash flows provided by (used for) Investing activities | ||||||||

| Cash flows provided by (used for) Financing activities | ||||||||

| Proceeds from non-related loans | ||||||||

| Payment of loan receivable | ( | ) | ||||||

| Proceeds from sale of common stock | ||||||||

| Proceeds from sale Preferred A shares | ||||||||

| Proceeds from CARES Act loan | ||||||||

| Net cash provided by (used for) financing activities | ||||||||

| Net (decrease increase in cash | ( | ) | ||||||

| Cash, beginning of period | ||||||||

| Cash, end of period | $ | $ | ||||||

| Supplemental disclosure of cash flow information | ||||||||

| Amortization of deferred finance cost from non-cash transaction | $ | $ | ||||||

| Common stock issued for debt | $ | $ | ||||||

| Debt discount from convertible loan | $ | $ | ||||||

| Reclassification of derivative liability | $ | $ | ||||||

| Interest paid | $ | $ | ||||||

The accompanying notes are an integral part of these financial statements

| 7 |

FOMO CORP. and subsidiaries

(formerly 2050 MOTORS, INC.)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Note 1 – BASIS OF PRESENTATION AND ORGANIZATION

FOMO CORP. previously known as “2050 Motors, Inc.” (“the Company”) is the successor to an entity incorporated on February 27, 1990 in the state of California as a blank check company named “K7 Capital Corporation”. On or around the year 2000, the Company restructured to seek acquisition candidates. 2050 Motors, Inc., the Company’s sole operating subsidiary from 2014 - 2019, was incorporated on October 9, 2012 in the state of Nevada to import, market, and sell electric cars manufactured in China. In 2019, new management dissolved the Company’s Nevada subsidiary as the electric vehicle strategy had failed. Meanwhile, the Company incubated an internet business targeting the Cannabis market and pursued various ventures in the internet, communications, and technology markets. The Company purchased Purge Virus, LLC to enter the viral disinfection technology market on October 19, 2020, closed lighting and energy management asset purchases of Independence LED Lighting, LLC and Energy Intelligence Center, LLC during the first three months of 2021, and has since announced letters of intent and definitive agreements to acquire additional technology and services businesses. The Company also owns an equity interest in Himalaya Technologies, owner and operator of an early-stage social media business called “Kanab Club” targeting the cannabis sector.

Corporate Actions and Related

On March 6, 2019, William Fowler resigned as our President, Chief Executive Officer, Chief Financial Officer and Director. His resignation was not due to any matter relating to our operations, policies, or practices. On March 6, 2019, pursuant to a Special Board of Directors Meeting, our Board of Directors accepted his resignation.

On March 6, 2019, Bernd Schaefers resigned as our Secretary and Director. His resignation was not due to any matter relating to our operations, policies, or practices. On March 6, 2019, pursuant to a Special Board of Directors Meeting, our Board of Directors accepted his resignation.

On

March 6, 2019, Vikram Grover was appointed our President, Chief Executive Officer, Chief Financial Officer, Secretary and Director. Mr.

Grover’s compensation consists of $

On April 4, 2019, we removed all Officers and/or Directors of our wholly owned subsidiary, 2050 Motors, Inc., a Nevada corporation (“2050 Private”); thereafter, 2050 Private appointed our Chief Executive Officer, Vikram Grover, as 2050 Private’s President and Sole Director. 2050 Motors, Inc. Nevada was subsequently dissolved.

On May 14, 2019, we dissolved our 2050 Motors, Inc. Nevada subsidiary and terminated all discussions and contractual relationships with Chinese manufacturers.

On December 16, 2019, we changed our company name to “FOMO CORP.” with the Secretary of State of California on the SEC’s EDGAR system. On November 17, 2020, we applied for a name change with FINRA and have responded to comments several times.

| 8 |

On October 19, 2020, FOMO CORP. purchased Purge Virus, LLC and consequently entered the viral disinfection market.

On November 17, 2020, an application was submitted to FINRA to change the name and ticker symbol from 2050 Motors and ETFM to FOMO CORP. and FOMO, respectively. Subsequently, on May 7, 2021, FINRA issued a name change and ticker change to “FOMO CORP.” and applied the ticker “FOMC”.

On February 12, 2021, we purchased the assets of Independence LED Lighting, LLC (a Pennsylvania LLC). The assets were subsequently placed into a newly formed subsidiary, Energy Intelligence Center LLC (a Wyoming LLC).

On March 6, 2021, we purchased the assets of Energy Intelligence Center, LLC (a Pennsylvania LLC). The assets were subsequently placed into a newly formed subsidiary, Energy Intelligence Center LLC (a Wyoming LLC).

As of June 30, 2021, the Company was current with its financials.

Note 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

The accompanying financial statements were prepared in conformity with generally accepted accounting principles in the United States of America (“US GAAP”).

Use of Estimates

The preparation of financial statements in conformity with US GAAP requires management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. Significant estimates include accounts payable, the recoverability of long-term assets, and the valuation of derivative liabilities.

Consolidation

The consolidated financial statements of the Company include the Company and its wholly owned subsidiaries, 2050 Motors, Inc., Purge Virus, LLC and Energy Intelligence Center LLC. All material intercompany balances and transactions have been eliminated in consolidation.

Cash

Cash

consists of deposits in one large national bank. On June 30, 2021 and December 31, 2020, respectively, the Company had $

Fair Value of Financial Instruments

For certain of the Company’s financial instruments, including cash accounts payable, accrued liabilities, short-term debt, and derivative liability, the carrying amounts approximate their fair values due to their short maturities. We adopted ASC Topic 820, “Fair Value Measurements and Disclosures,”, which requires disclosure of the fair value of financial instruments held by the Company. ASC Topic 825, “Financial Instruments,” defines fair value, and establishes a three-level valuation hierarchy for disclosures of fair value measurement that enhances disclosure requirements for fair value measures. The carrying amounts reported in the balance sheets for receivables and current liabilities each qualify as financial instruments and are a reasonable estimate of their fair values because of the short period of time between the origination of such instruments and their expected realization and their current market rate of interest. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (level 1 measurement) and the lowest priority to unobservable inputs (level 3 measurements). The three levels of valuation hierarchy are defined as follows:

Level 1 input to the valuation methodology are quoted prices for identical assets or liabilities in active markets. The Company’s investment in Mobicard Inc., see Note 4, is actively traded on the pink sheets.

| 9 |

Level 2 inputs to the valuation methodology include quoted prices for similar assets and liabilities in active markets, and inputs that are observable for the asset or liability, either directly or indirectly, for substantially the full term of the financial instrument.

Level 3 inputs to the valuation methodology are unobservable in which little or no market data exists, therefore requiring an entity to develop its own assumptions, such as valuations derived from valuation techniques in which one or more significant inputs or significant value drivers are unobservable.

The Company’s analyses of all financial instruments with features of both liabilities and equity under ASC 480, “Distinguishing Liabilities from Equity,” and ASC 815.

We have recorded the conversion option on notes as a derivative liability because of the variable conversion price, which in accordance with U.S. GAAP, prevents them from being considered as indexed to our stock and qualified for an exception to derivative accounting.

We recognize derivative instruments as either assets or liabilities on the accompanying balance sheets at fair value. We record changes in the fair value of the derivatives in the accompanying statement of operations.

Assets and liabilities measured at fair value are as follows as of June 30, 2021:

| Total | Level 1 | Level 2 | Level 4 | |||||||||||||

| Assets | ||||||||||||||||

| Investments | ||||||||||||||||

| Total assets measured at fair value | ||||||||||||||||

| Liabilities | ||||||||||||||||

| Derivative liability | ||||||||||||||||

| Total liabilities measured at fair value | ||||||||||||||||

Assets and liabilities measured at fair value are as follows as of December 31, 2020:

| Total | Level 1 | Level 2 | Level 4 | |||||||||||||

| Assets | ||||||||||||||||

| Investments | ||||||||||||||||

| Total assets measured at fair value | ||||||||||||||||

| Liabilities | ||||||||||||||||

| Derivative liability | ||||||||||||||||

| Total liabilities measured at fair value | ||||||||||||||||

The following is a reconciliation of the derivative liability for which Level 3 inputs were used in determining the approximate fair value:

| Balance as of December 31, 2019 | $ | |||

| Fair value of derivative liabilities | ||||

| Loss on conversion | ( | ) | ||

| Gain on change in derivative liabilities | ||||

| Balance as of December 31, 2020 | $ | |||

| Balance as of December 31, 2020 | $ | |||

| Fair value of derivative liabilities | ||||

| Loss on conversion | ( | ) | ||

| Gain on change in derivative liabilities | ||||

| Balance as of June 20, 2021 | $ |

| 10 |

Basic EPS is computed by dividing income available to common shareholders by the weighted average number of common shares outstanding for the period. Diluted EPS is computed similar to basic net income per share except that the denominator is increased to include the number of additional common shares that would have been outstanding if all the potential common shares, warrants and stock options had been issued and if the additional common shares were dilutive. Diluted EPS assumes that all dilutive convertible shares and stock options were converted or exercised. Dilution is computed by applying the treasury stock method for the outstanding options and the if-converted method for the outstanding convertible preferred shares. Under the treasury stock method, options and warrants are assumed to be exercised at the beginning of the period (or at the time of issuance, if later), and as if funds obtained thereby were used to purchase common stock at the average market price during the period. Under the if-converted method, convertible outstanding instruments are assumed to be converted into common stock at the beginning of the period (or at the time of issuance, if later). During the year ended December 31, 2020 and 2019, the Company generated no revenues and incurred substantial losses, of which the vast majority were due to mostly non-cash charges for accrued interest, penalties and derivative charges related to convertible debt instruments. Therefore, the effect of any common stock equivalents on EPS is anti-dilutive during those periods.

Concentration of Credit Risk

Cash is mainly maintained by one highly qualified institution in the United States. At no time were such amounts more than federally insured limits. Management does not believe that the Company is subject to any unusual financial risk beyond the normal risk associated with commercial banking relationships. The Company has not experienced any losses on our deposits of cash.

Income Taxes

The Company utilizes FASB Accounting Standards Codification (ASC) Topic 740, Income Taxes, which requires recognition of deferred tax assets and liabilities for the expected future tax consequences of events that were included in the financial statements or tax returns. Under this method, deferred income taxes are recognized for the tax consequences in future years of differences between the tax bases of assets and liabilities and their financial reporting amounts at each period end based on enacted tax laws and statutory tax rates applicable to the periods in which the differences are expected to affect taxable income. Valuation allowances are established, when necessary, to reduce deferred tax assets to the amount expected to be realized.

ASC 740 provides accounting and disclosure guidance about positions taken by an organization in its tax returns that might be uncertain. When tax returns are filed, it is likely that some positions taken would be sustained upon examination by the taxing authorities, while others are subject to uncertainty about the merits of the position taken or the amount of the position that would be ultimately sustained. The benefit of a tax position is recognized in the financial statements in the period during which, based on all available evidence, management believes it is more likely than not that the position will be sustained upon examination, including the resolution of appeals or litigation processes, if any. Tax positions taken are not offset or aggregated with other positions. Tax positions that meet the more-likely-than-not recognition threshold are measured as the largest amount of tax benefit that is more than 50 percent likely of being realized upon settlement with the applicable taxing authority. The portion of the benefits associated with tax positions taken that exceeds the amount measured as described above is reflected as a liability for unrecognized tax benefits in the accompanying balance sheets along with any associated interest and penalties that would be payable to the taxing authorities upon examination. Interest associated with unrecognized tax benefits is classified as interest expense and penalties are classified in selling, general and administrative expenses in the statements of income.

| 11 |

On June 30, 2021 and December 31, 2020, the Company had not taken any significant uncertain tax positions on its tax returns for the period ended December 31, 2020 and prior years or in computing its tax provisions for any years. Prior management considered its tax positions, and believed that all of the positions taken by the Company in its Federal and State tax returns were more likely than not to be sustained upon examination. The Company is subject to examination by U.S. Federal and State tax authorities from inception to present, generally for three years after they are filed. New management, which took control of the Company on March 5, 2019, filed federal and state taxes in California, Illinois and Pennsylvania as required and brought the Company current in all regards in 2021.

Concentration of Credit Risk

Cash is mainly maintained by one highly qualified institution in the United States. At various times, such amounts are more than federally insured limits. Management does not believe that the Company is subject to any unusual financial risk beyond the normal risk associated with commercial banking relationships. The Company has not experienced any losses on our deposits of cash.

Risks and Uncertainties

The Company is subject to risks from, among other things, competition associated with the industry in general, other risks associated with financing, liquidity requirements, rapidly changing customer requirements, limited operating history and the volatility of public markets.

Accounts Receivable

Accounts

receivable are stated at the amount management expects to collect from outstanding balances. The Company provides for probable uncollectible

amounts based upon its assessment of the current status of the individual receivables and after using reasonable collection efforts.

The allowance for doubtful accounts as of June 30, 2021 and December 31, 2020 was $

Revenue Recognition

The Company recognizes revenues in accordance with Accounting Standards Codification (“ASC”) 606 – Contracts with Customers. Revenue from sales of products is recognized when the related performance obligation is satisfied. The Company’s performance obligation is satisfied upon the shipment or delivery of products to customers.

Stock-Based Compensation

The Company accounts for all stock-based compensation using a fair value-based method. The fair value of equity-classified awards granted to employees is estimated on the date of the grant using the Black-Scholes option-pricing model and the related stock-based compensation expense is recognized over the vesting period during which an employee is required to provide service in exchange for the award.

| 12 |

Goodwill and Other Acquired Intangible Assets

The Company initially records goodwill and other intangible assets at their estimated fair values and reviews these assets periodically for impairment. Goodwill represents the excess of the purchase price over the fair value of identifiable tangible and intangible assets acquired and liabilities assumed in a business combination and is tested at least annually for impairment, historically during our fourth quarter.

Recently Issued Accounting Pronouncements

In February 2016, FASB issued ASU No. 2016-02, Leases (Topic 842) (“ASU 2016-02”). ASU 2016-02 requires an entity to recognize right-of-use assets and lease liabilities on its balance sheet and disclose key information about leasing arrangements. For public companies, ASU 2016-02 is effective for annual reporting periods beginning after December 15, 2018, including interim periods within that reporting period, and requires a modified retrospective adoption, with early adoption permitted. We are evaluating the impact this guidance will have on our financial position and statement of operations.

Note 3 – GOING CONCERN

The

accompanying financial statements have been prepared in conformity with accounting principles generally accepted in the United States

of America, which contemplate the continuation of the Company as a going concern. The Company reported an accumulated deficit of ($

In view of the matters described, there is substantial doubt as to the Company’s ability to continue as a going concern without a significant infusion of capital. We anticipate that we will have to raise additional capital to fund operations over the next 12 months. To the extent that we are required to raise additional funds to acquire properties, and to cover costs of operations, we intend to do so through additional offerings of debt or equity securities. There are no commitments or arrangements for other offerings in place, no guaranties that any such financings would be forthcoming, or as to the terms of any such financings. Any future financing may involve substantial dilution to existing investors.

Note 4 - INVESTMENTS

During

the year ended December 31, 2019, the Company issued share of preferred class B stock in exchange for shares of Mobicard

Inc. The shares were valued at the market price of $ per share, or $

During the year ended December 31, 2019, the Company received shares of KANAB CORP. for consulting services provided by the Company’s CEO, Vikram Grover. The shares were valued at $ per share.

On

October 19, 2020, the Company acquired

On

February 12, 2021, we purchased

| 13 |

On

March 6, 2021, we purchased

On May 18 2021, FOMO CORP. (“FOMO”) incorporated FOMO ADVISORS LLC, a Wyoming limited liability company, as a wholly owned public/private merchant banking subsidiary. FOMO ADVISORS LLC intends to assist private companies in accessing the capital markets through “pass through” investments that allow investors to gain liquidity from FOMO stock while benefiting from direct exposure to private company growth through derivative instruments or other rights. The subsidiary is engaging with strategic targets to introduce them to its network of financial and strategic contacts, provide them management consulting, and create a portfolio of technology investments for future incubation, capital formation, and wealth creation. An outline of FOMO’s plans is attached herein as Exhibit 10.1. The Company is currently evaluating its corporate development pipeline and has identified a number of candidates for this capital formation model, though there can be no assurances.

On

July 31, 2021, we sold our

Note 5 – LOANS PAYABLE DUE TO RELATED PARTIES

As

of June 30, 2021, the Company subsidiary’s chief executive officer had an outstanding balance of $

Note 6 - CONVERTIBLE NOTE PAYABLES

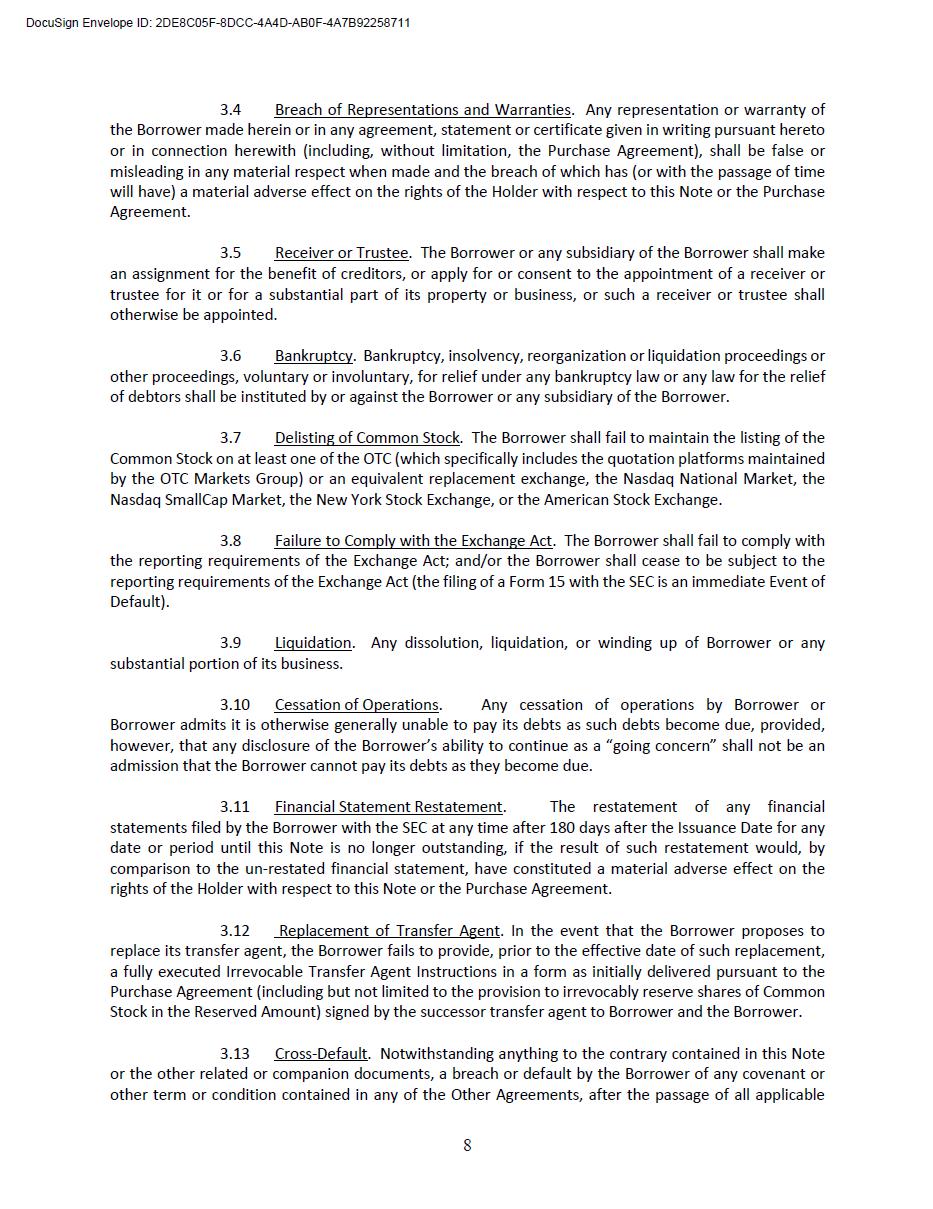

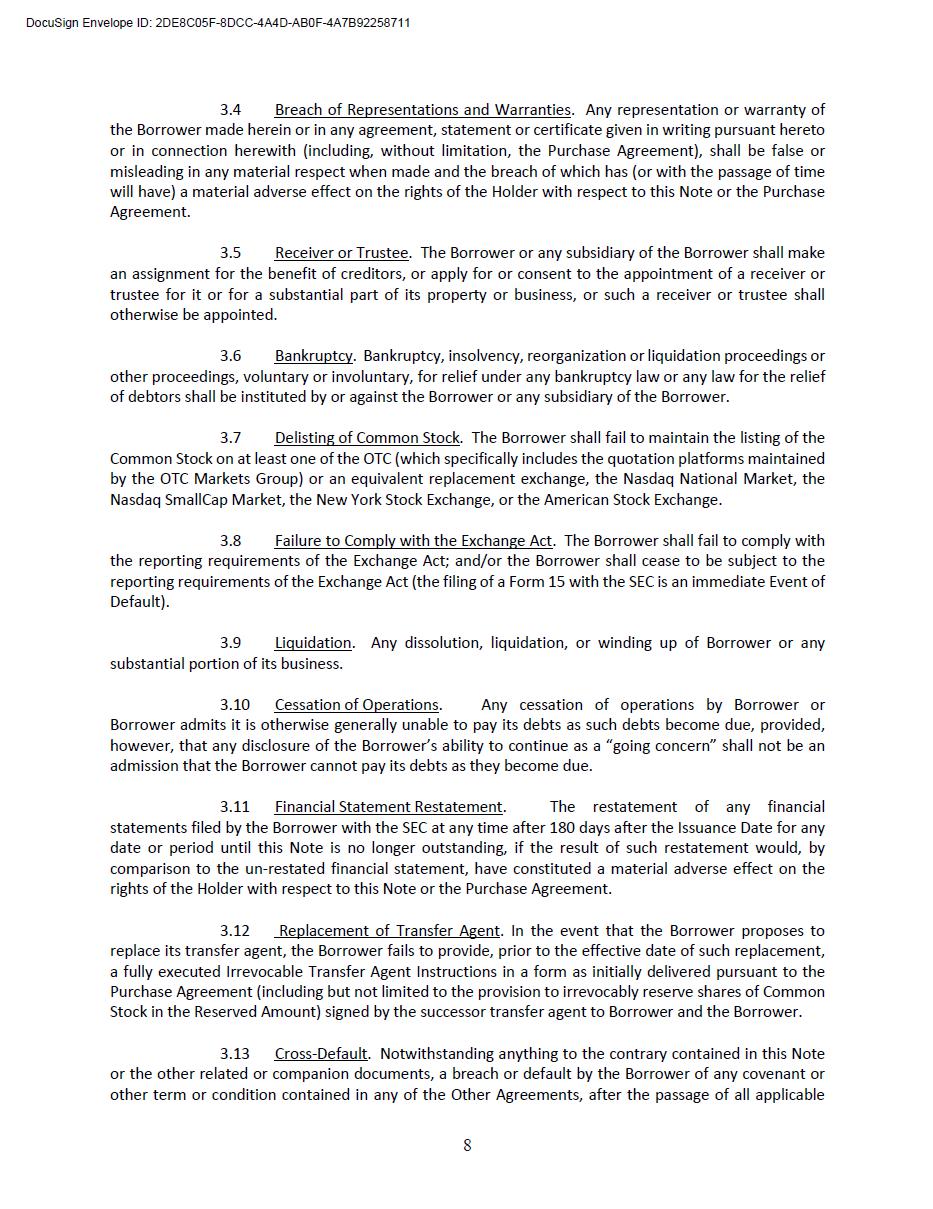

The

Company had convertible note payables with three third parties with stated interest rates ranging between

| Lender | Origination | Maturity | Amount | Interest | ||||||||||||||

| Note | % | |||||||||||||||||

| Note | % | |||||||||||||||||

| Note | % | |||||||||||||||||

| Note | % | |||||||||||||||||

| Total | $ | |||||||||||||||||

| less discount | ||||||||||||||||||

| Net | $ | |||||||||||||||||

During

the year ended December 31, 2020, third-party lenders converted $

| 14 |

During

the six months ended June 30, 2021, third-party lenders converted $

The variables used for the Black-Scholes model are as listed below:

| June 30, 2021 | December 31, 2020 | |||

| ● | Volatility:

|

Volatility:

| ||

| ● | Risk

free rate of return: |

Risk

free rate of return: | ||

| ● | Expected

term: |

Expected

term: |

The

Company amortized a debt discount of $

On

October 28, 2020, a third-party lender funded the Company $

On

January 20, 2021, a third-party lender funded the Company $

On

April 8, 2021, a third-party lender funded the Company $

On

May 10, 2021, a third-party lender funded the Company $

On

June 25, 2021, a third-party lender funded the Company $

During

the three months ended March 31, 2021 third-party lenders converted $

Note 7 – COMMITMENTS AND CONTINGENCIES

Legal Proceedings

The Company may from time to time, become a party to various legal proceedings, arising in the ordinary course of business. The Company investigates these claims as they arise. There is no litigation outstanding as of June 30, 2021.

Note 8 – INCOME TAXES

The Company did not file its federal tax returns for fiscal years from 2012 through 2020. Management at year-end 2020 believed that it should not have any material impact on the Company’s financials because the Company did not have any tax liabilities due to net loss incurred during these years.

Based on the available information and other factors, management believes it is more likely than not that any potential net deferred tax assets on March 31, 2021 and December 31, 2020 will not be fully realizable. The Company is current with franchise tax board fees due to the State of California and in 2021 filed tax statements for the federal and state requirements (California, Illinois, Pennsylvania) for 2018 – 2019 - 2020. Today, the Company is current with its federal and state tax filings.

| 15 |

Note 9 – WARRANTS AND OPTIONS

As

of December 31, 2019, the Company had

On

March 4, 2021, we issued Dilip Limaye

On March 20, 2021 the Company issued warrants with a strike price of $ and a expiration to Online Energy Manager as consideration for a software license.

On

March 31, 2021 The Company issued

On May 12, 2021, we issued John Conklin warrants with a strike price of $ and a expiration as compensation for joining our Advisory Board.

Note 10 – EQUITY

Between

January 1, 2020 and December 31, 2020, the Company issued to third-party lenders a total of shares of common stock pursuant

to conversions of $

On

January 8, 2020, a third-party lender converted $

On

February 3, 2020, a third-party lender converted $

On

February 5, 2020, a third-party lender converted $

On

February 18, 2020, a third-party lender converted $

On

August 26, 2020, the Company issued its CEO, Vikram Grover, Series B Preferred Shares for accrued compensation of $

On

August 27, 2020, a third-party lender converted $

On

August 31, 2020, a third-party lender converted $

On September 3, 2020, the Company issued its CEO, Vikram Grover, Restricted Series B Preferred shares for accrued compensation of $.

| 16 |

On

September 4, 2020, a third-party lender converted $

From

September 10, 2020 through October 8, 2020, a third-party lender converted $

On

September 15, 2020, a third-party lender converted $

On

September 30, 2020, a third-party lender converted $

On

October 8, 2020, a third-party lender converted $

On

October 9, 2020, the Company issued its CEO, Vikram Grover, Restricted Series B Preferred shares for accrued compensation of $

On

October 13, 2020, we amended the terms of our Series A Preferred Shares to include an annual dividend of $

On

October 20, 2020, a third-party lender converted $0 principal, $

From January 1, 2020 through October 23, 2020, the Company issued Restricted Series B Preferred shares to consultants for professional services, including due diligence on the Purge Virus transaction, corporate development, sales and marketing, and other.

Effective

October 25, 2020, the Company and a third party lender amended a prior settlement agreement effected in 2019 to require the issuance

of seven hundred ninety four million, forty one thousand, one hundred thirty three () Settlement Shares of common stock, as

follows: a) publicly tradeable shares of common stock (the “Settlement Shares” or the “Shares”) to be converted,

transferred and delivered to the third party lender, in whole or in part pursuant to the third party lender’s notice: 1) on or

before November 1, 2020 – Settlement Shares, in whole or in part as determined by the third party lender, in its discretion;

plus 2) on or before December 1, 2020 – Settlement Shares, in whole or in part as determined by the third party lender,

in its discretion; plus 3) on or before January 1, 2021 – Settlement Shares, in whole or in part, as determined by

the third party lender, in its discretion. Remaining shares, which were reserved and subsequently sold, settled the balance of the November

2019 $

On

November 2, 2020, a third-party lender converted $

On

October 28, 2020, a third-party lender funded the Company $

On

December 2, 2020, a third-party lender converted $

| 17 |

On

December 30, 2020, a third-party lender converted $

On December 31, 2020, we issued a consultant Series B Preferred shares for cannabis legal analysis.

On January 1, 2021, the Company issued a consultant Series B Preferred shares for services.

On January 6, 2021, the Company issued Series B Preferred shares as a non-refundable deposit to purchase SmartGuard.

On

January 6, 2021, the Company issued

On January 21, 2021 the Company issued a third-party lender shares of no-par common stock for loan cost.

On February 11, 2021, the Company issued Series B Preferred shares as a non-refundable deposit to purchase PVBJ.

On February 24, 2021, the Company issued Series B Preferred shares to purchase assets of Independence LED Lighting LLC.

On February 27, 2021, the Company issued a consultant shares of no-par common stock for investor relations services.

During

February 2021 the Company sold Series A Preferred shares for $

On March 1, 2021, the Company issued a consultant shares of no-par common stock for consulting services.

On March 20, 2021, the Company issued Series B Preferred shares to purchase the assets of Energy Intelligence Center LLC.

On

March 31, 2021, the Company sold commitment and initial shares of common stock for $

During

the three months ended March 31, 2021 third-party lenders converted $

On April 9, 2021, the Company issued a consultant shares of no-par common stock for consulting services.

Business Development and Related

On October 2, 2020, The option was subsequently canceled.

The joint venture partnership with PPESI was subsequently canceled.

| 18 |

COVID-19 Pandemic Update

In March 2020, the World Health Organization declared a global health pandemic related to the outbreak of a novel coronavirus. The COVID-19 pandemic adversely affected the company’s financial performance in the third and fourth quarters of fiscal year 2020 and could have an impact throughout fiscal year 2021. In response to the COVID-19 pandemic, government health officials have recommended and mandated precautions to mitigate the spread of the virus, including shelter-in-place orders, prohibitions on public gatherings and other similar measures. There is uncertainty around the duration and breadth of the COVID-19 pandemic, as well as the impact it will have on the company’s operations, supply chain and demand for its products. As a result, the ultimate impact on the company’s business, financial condition or operating results cannot be reasonably estimated at this time.

On

June 4, 2020, the Company entered a $

On

June 22, 2021, Himalaya Technologies, Inc. a/k/a Homeland Resources Ltd. (OTC: HMLA) retained our merchant banking subsidiary FOMO ADVISORS

LLC to advise on its restructuring and merger and acquisition activities. As part of the program, Himalaya Technologies issued us

On

June 28, 2021, Himalaya Technologies, Inc. issued us

During

June 2021, we entered into a Master Note with Himalaya Technologies, Inc. for up to $

Warrants

On

October 28, 2020, the Company issued

On

November 3, 2020, the Company issued

On

December 2, 2020, the Company reduced the exercise price on

On

December 7, 2020, we issued Paul Benis, an Advisory Board member,

On

December 31, 2020, we issued a consultant

On

December 31, 2020, as compensation for bring the Company SEC current and for retention purposes, we issued our CEO Vikram Grover

On

December 31, 2020, we issued Roderick Martin, CEO of AGILE Technologies Group, LLC,

On

December 31, 2020, we issued AGILE Technologies Group, LLC,

| 19 |

On March 20, 2021 the Company issued warrants with a strike price of $ and a expiration to Online Energy Manager for a software license.

On

March 31, 2021 The Company issued

On

April 9, 2021, the Company issued a consultant

On April 24, 2021, the Company issued Series B Preferred shares for consulting services.

On April 20, 2021, the Company issued Series B Preferred shares for consulting services relating to Kanab Corp.

On

April 8, 2021, a third-party lender funded the Company $

On April 16, 2021, the Company extended the LOI’s to purchase Ecolite and PPE Source International LLC until July 1, 2021

On

or around April 14, 2021, the Company signed an agreement to purchase

On

or around April 14, 2021, the Company signed an agreement to purchase

On

May 10, 2021, a third-party lender funded the Company $

On

June 25, 2021, a third-party lender funded the Company $

Note 11--SUBSEQUENT EVENTS

.

On July 15, 2021, we appointed Shamira Jaffer, a businesswoman with substantial technology experience in automated retail, advertising and technology, to our Advisory Board. We issued Ms. Jaffer common stock purchase warrants with an exercise price of $ and a expiration.

On July 22, 2021, we appointed Senator Gerald Dial, former Alabama State Senator, former Chair of the Senate Health Committee and current Advisory Board member to our partner Safely Opening Schools, to our Advisory Board. We issued Senator Dial common stock purchase warrants with an exercise price of $ and a expiration.

On July 2021, we issued common shares to a public relations consultant for services rendered.

| 20 |

Item 2. Management’s Discussion and Analysis or Plan of Operation

Plan of Operations

This 10−Q contains forward-looking statements. Our actual results could differ materially from those set forth as a result of general economic conditions and changes in the assumptions used in making such forward-looking statements. The following discussion and analysis of our financial condition and results of operations should be read together with the audited consolidated financial statements and accompanying notes and the other financial information appearing elsewhere in this report. The analysis set forth below is provided pursuant to applicable Securities and Exchange Commission regulations and is not intended to serve as a basis for projections of future events.

Plan of Operations

On May 2, 2014, the Company had nominal assets whose sole business was to identify, evaluate, and investigate various companies to acquire or with which to merge. Upon consummation of a merger with 2050 Motors, Inc., a Nevada corporation, the Company’s business became the business of 2050 Motors, which at the time was the Company’s sole operating subsidiary focused on the importation of electric vehicles (“EV’s”) from China. That business was dissolved in May 2019. Today, our principal business objective for the next 12 months will be to achieve long-term growth through the launch of new business units, subsidiaries and ventures, initially, with a business concentration in the areas of communications, power over ethernet (PoE) and LED lighting, energy management software, and social media.

FOMO CORP. is a development stage company with no operating history and may never be able to carry out its business plan or achieve any revenues or profitability. The Company was incorporated February 27, 1990 and has not generated any revenues, nor has it realized a profit from its operations to date, and there is little likelihood that it will generate any revenues or realize any profits in the short term. Any profitability in the future from its business will be dependent upon the successful marketing and sales of future business activities. The Company may not be able to successfully carry out its business plan. There can be no assurance that it will ever achieve any revenues or profitability. Accordingly, its prospects must be considered in light of the risks, expenses, and difficulties frequently encountered in establishing a new business, especially one in the automobile industry, and therefore it is a highly speculative venture involving significant financial risk. Since new management was appointed in March 2019, we expanded our mission statement to invest in, incubate and accelerate businesses in the communications, energy, electric vehicle, and Internet industries.

| 21 |

Costs and Resources

FOMO CORP. is currently pursuing additional funding resources that will potentially enable it to maintain its current and planned operations through the next 12 months. The Company anticipates that it will need to raise additional capital in order to sustain and grow its operations over the next few years. To the extent that the Company’s capital resources are insufficient to meet current or planned operating requirements, the Company will seek additional funds through equity or debt financing, collaborative or other arrangements with corporate partners, licensees or others, and from other sources, which may have the effect of diluting the holdings of existing shareholders. The Company has no current arrangements with respect to, or sources of, such additional financing and the Company does not anticipate that existing shareholders or creditors will provide any portion of the Company’s future financing requirements. No assurance can be given that additional financing will be available when needed or that such financing will be available on terms acceptable to the Company. If adequate funds are not available, the Company may be required to delay or terminate expenditures for certain of its programs that it would otherwise seek to develop and commercialize. This would have a material adverse effect on the Company.

Results of Operation for the Three Months Ended June 30, 2021 and 2020

During the three months ended June 30, 2021 and 2020, the Company had $84,661 and $0 in operating revenues. During the three months ended June 30, 2021 the Company incurred $65,286 in cost of revenues. During the three months ended June 30, 2021, the Company incurred operating expenses of $359,853 consisting primarily of G&A expenses, consulting fees and travel expenses and other general and administrative costs. For the three months ended June 30, 2021, these operating losses combined with non-operating income (expenses) of $1,523,187 resulted in net income of $1,182,709. For the three months ended June 30, 2020, the Company had operating losses of $48,742 and non-operating income (expenses) of $175,116 leading to net income of $126,374.

Results of Operation for the Six Months Ended June 30, 2021 and 2020

During the six months ended June 30, 2021 and 2020, the Company had $256,863 and $0 in operating revenues. During the six months ended June 30, 2021 the Company incurred $197,506 in cost of revenues. During the six months ended June 30, 2021, the Company incurred operating expenses of $1,613,577, consisting primarily of G&A expenses, consulting fees and travel expenses and other general and administrative costs. For the six months ended June 30, 2021, these operating losses combined with non-operating income (expenses) of $150,193 resulted in net loss of $1,206,521. For the six months ended June 30, 2020, the Company had operating losses of $99,274 and non-operating income (expenses) of $585,358 leading to net income of $486,084.

Equity and Capital Resources

We have incurred losses since the inception of our business and as of June 30, 2021 we had an accumulated deficit of $8,869,166. As of June 30, 2021, the Company had cash balance of $32,076 and a negative working capital of $732,426.

To date, we have funded our operations through short-term debt and equity financing. During the six months ended June 30, 2021, the Company received $288,834 of borrowed funds from non-related parties. In addition, during this period the Company issued no of common stock to lenders for conversions of no of principal and interest related to third-party debt and issued 10,000,000 shares of common no-par shares for loan costs. The Company issued 6,550,000 shares of common no-par shares and 300,000 Preferred B shares for compensation. The Company sold 140,000,000 shares of no-par common stock for $525,000. The Company also issued 175,000 Preferred B shares to purchase the assets of a business.

We expect our expenses will continue to increase during the foreseeable future as a result of increased operational expenses and the development of our automobile business. However, we do not expect to start generating revenues from our operations for another 12 months. Consequently, we are dependent on the proceeds from future debt or equity investments to sustain our operations and implement our business plan. If we are unable to raise sufficient capital, we will be required to delay or forego some portion of our business plan, which would have a material adverse effect on our anticipated results from operations and financial condition. There is no assurance that we will be able to obtain necessary amounts of additional capital or that our estimates of our capital requirements will prove to be accurate. As of the date of this Report we did not have any commitments from any source to provide such additional capital. Even if we are able to secure outside financing, it may be unavailable in the amounts or the times when we require. Furthermore, such financing would likely take the form of bank loans, private placement of debt or equity securities or some combination of these. The issuance of additional equity securities would dilute the stock ownership of current investors while incurring loans, leases or debt would increase our capital requirements and possible loss of valuable assets if such obligations were not repaid in accordance with their terms.

| 22 |

Delinquent Loans

As of June 30, 2021, the Company is no longer delinquent in its payments on any loans owing to third-party lenders.

Off-balance Sheet Arrangements

Since our inception through June 30, 2021, we have not engaged in any off-balance sheet arrangements.

Item 3. Quantitative and Qualitative Disclosures about Market Risk

As a “small reporting company” we are not required to provide this information under this item pursuant to Regulation S-K.

Item 4. Controls and Procedures

Evaluation of Disclosure Controls and Procedures

As of the end of the period covered by this report on Form 10-Q, our President and Chief Financial Officer performed an evaluation of the effectiveness of and the operation of our disclosure controls and procedures as defined in Rule 13a-15(e) or Rule 15d-15(e) under the Exchange Act. Based on that evaluation, our President and Chief Financial Officer concluded that as of the end of the period covered by this report on Form 10-Q, our disclosure controls and procedures are not effective in timely alerting them to material information relating to 2050 Motors, Inc. required to be included in our Exchange Act filings.

Changes in Internal Control over Financial Reporting

There have been no changes in our internal control over financial reporting identified in connection with the evaluation required by paragraph (d) of Rule 13a-15 or Rule 15d-15 under the Exchange Act that occurred during the quarter ended September 30, 2018 that has materially affected, or is reasonably likely to materially affect, our internal control over financial reporting.

PART II — OTHER INFORMATION

Item 1. Legal Proceedings.

The Company has settled all lawsuits with third-party lenders regarding delinquent loans as of June 30, 2021.

Item 1A. Risk Factors.

As a “smaller reporting company”, we are not required to provide this information under this item pursuant to Regulation S-K.

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds.

During the six months ended June 30, 2021, the Company received $205,000 of borrowed funds from non-related parties. In addition, during this period the Company issued 905,435,038 of common stock to lenders for conversions of $563,643 of principal and interest related to third-party debt and issued 10,000,000 shares of common no-par shares for 20,000 of loan costs. The company also sold 2,750,000 shares of Preferred A shares for $275,000. The Company issued 6,550,000 shares of common no-par shares and Preferred B shares for compensation. The Company sold 65,000,000 shares of no-par common stock for $250,000. The Company also issued 175,000 Preferred B shares as a deposit for a future business purchase and 350,000 Preferred B shares to purchase the assets of a business, of which half is refundable.

| 23 |

During the three months ended June 30, 2021, the Company received $250,000 initial investment from the sale of 65,000,000 common shares to Tysadco Partners, LLC under an equity line of credit (“ELOC”) facility, which was subsequently canceled and repapered in the format of a Form S-1 equity sale of up to two million (2,000,000) registered common shares and warrants. The Company also received $222,250 of borrowed funds from third-parties.

Item 3. Defaults Upon Senior Securities.

As of June 30, 2020, the Company is no longer delinquent in its payments on any loans owing to third-party lenders.

Item 4. Mine Safety Disclosures.

Not applicable.

Item 5. Other Information.

None.

Item 6. Exhibits.

(a) Exhibits.

*Filed by reference to Form 10-Q for the three months ended March 31, 2021 filed on EDGAR on May 24, 2021.

**Filed herewith.

| 24 |

SIGNATURES

In accordance with the requirements of the Exchange Act, the registrant caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| FOMO CORP. | |

| Date: August 16, 2021 | /s/ Vikram Grover |

| Vikram Grover, President | |

| (Principal Executive Officer) | |

| Date: August 16, 2021 | /s/ Vikram Grover |

| Vikram Grover, Chief Financial Officer | |

| (Principal Financial and Accounting Officer) |

EXHIBIT INDEX

*Filed by reference to Form 10-Q for the three months ended March 31, 2021 filed on EDGAR on May 24, 2021.

**Filed herewith.

| 25 |

Exhibit 10.2

Exhibit 10.3

Exhibit 10.4

EXHIBIT 31.1

CERTIFICATION

I, Vikram Grover, certify that:

| 1. | I have reviewed this report on Form 10-Q of FOMO Corp (Formerly 2050 Motors, Inc.); |

| 2. | Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report; |

| 3. | Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this report; |

| 4. | The registrant’s other certifying officer and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) for the registrant and have: |

| a. | designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared; | |

| b. | evaluated the effectiveness of the registrant’s disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and | |

| c. | disclosed in this report any change in the registrant’s internal control over financial reporting that occurred during the registrant’s most recent fiscal quarter (the registrant’s fourth fiscal quarter in the case of an annual report) that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting. |

| 5. | The registrant’s other certifying officer and I have disclosed, based on our most recent evaluation of internal control over financial reporting, to the registrant’s auditors and the audit committee of registrant’s board of directors (or persons performing the equivalent functions): |

| a. | all significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant’s ability to record, process, summarize and report financial information; and | |

| b. | any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant’s internal control over financial reporting. |

| /s/ Vikram Grover | |

| Vikram Grover | |

| President (Principal Executive Officer) | |

| August 16, 2021 |

EXHIBIT 31.2

CERTIFICATION

I, Vikram Grover, certify that:

| 1. | I have reviewed this report on Form 10-Q of FOMO Corp (Formerly 2050 Motors, Inc.).; |

| 2. | Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report; |

| 3. | Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this report; |

| 4. | The registrant’s other certifying officer and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) for the registrant and have: |

| a. | designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared; | |

| b. | evaluated the effectiveness of the registrant’s disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and | |

| c. | disclosed in this report any change in the registrant’s internal control over financial reporting that occurred during the registrant’s most recent fiscal quarter (the registrant’s fourth fiscal quarter in the case of an annual report) that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting. |

| 5. | The registrant’s other certifying officer and I have disclosed, based on our most recent evaluation of internal control over financial reporting, to the registrant’s auditors and the audit committee of registrant’s board of directors (or persons performing the equivalent functions): |

| a. | all significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant’s ability to record, process, summarize and report financial information; and | |

| b. | any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant’s internal control over financial reporting. |

| /s/ Vikram Grover | |

| Vikram, Grover | |

| Chief Financial Officer | |

| August 16, 2021 |

EXHIBIT 32.1

CERTIFICATION PURSUANT TO 18 U.S.C. SECTION 1350, AS ADOPTED

PURSUANT TO SECTION 906 OF THE SARBANES-OXLEY ACT OF 2002

In connection with the report of FOMO Corp (Formerly 2050 Motors, Inc.) (the “Company”) on Form 10-Q for the period ending June 30, 2021 as filed with the Securities and Exchange Commission on the date hereof (the “Report”), the undersigned, in the capacities and on the dates indicated below, hereby certifies, pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002, that to his knowledge:

| (1) | The Report fully complies with the requirements of Section 13(a) or 15(d) of the Securities Exchange Act of 1934; and |

| (2) | The information contained in the Report fairly presents, in all material respects, the financial condition and results of operations of the Company. |

| /s/ Vikram Grover | |

| Vikram Grover | |

| President (Principal Executive Officer) | |

| August 16, 2021 | |

| /s/ Vikram Grover | |

| Vikram Grover | |

| Chief Financial Officer | |

| August 16, 2021 |