Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant [X] | ||||

| Filed by a Party other than the Registrant [ ] | ||||

| Check the appropriate box: | ||||

| [ ] | Preliminary Proxy Statement | [ ] | Soliciting Material Under Rule 14a-12 | |

| [ ] | Confidential, For Use of

the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|||

| [X] | Definitive Proxy Statement | |||

| [ ] | Definitive Additional Materials | |||

| Automatic Data Processing, Inc. | ||

| (Name of Registrant as Specified In Its Charter) | ||

|

(Name

of Person(s) Filing Proxy Statement, if Other Than the

Registrant) |

| Payment of Filing Fee (Check the appropriate box): | ||||

| [X] | No fee required. | |||

|

[

] |

Fee computed on

table below per Exchange Act Rules 14a-6(i)(4) and

0-11. | |||

| 1) | Title of each class of securities to which transaction applies: | |||

| 2) | Aggregate number of securities to which transaction applies: | |||

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| 4) | Proposed maximum aggregate value of transaction: | |||

| 5) | Total fee paid: | |||

|

[

] |

Fee paid previously

with preliminary materials: | |||

|

[

] |

Check box if any part of the fee is offset as provided by Exchange

Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee

was paid previously. Identify the previous filing by registration

statement number, or the form or schedule and the date of its

filing. | |||

| 1) | Amount previously paid: | |||

| 2) | Form, Schedule or Registration Statement No.: | |||

| 3) | Filing Party: | |||

| 4) | Date Filed: | |||

AUTOMATIC DATA PROCESSING, INC.

One

ADP Boulevard

Roseland, New Jersey 07068

Notice of 2014 Annual Meeting of

Stockholders

________________________________

The 2014 Annual Meeting of Stockholders of Automatic Data Processing, Inc. will take place at 10:00 a.m., Eastern Standard Time, Tuesday, November 11, 2014 at our corporate headquarters, One ADP Boulevard, Roseland, New Jersey.

A Notice of Internet Availability of Proxy Materials or the proxy statement for the 2014 Annual Meeting of Stockholders is first being mailed to stockholders on or about September 25, 2014.

The purposes of the meeting are to:

| 1. | Elect a board of directors; | ||

| 2. | Hold an advisory vote on executive compensation; | ||

| 3. | Ratify the appointment of Deloitte & Touche LLP, an independent registered public accounting firm, to serve as our independent certified public accountants for fiscal year 2015; and | ||

| 4. | Transact any other business that may properly come before the meeting or any adjournment(s) thereof. | ||

Only stockholders of record at the close of business on September 12, 2014 are entitled to receive notice of, to attend, and to vote at the meeting. If you plan to attend the meeting in person, please note the admission procedures described under “How Can I Attend the Meeting?” on page 1 of the proxy statement.

Your vote is important, and we urge you to vote whether or not you plan to attend the meeting. The Notice of Internet Availability of Proxy Materials instructs you on how to access your proxy card to vote via the Internet or by telephone. If you receive a paper copy of the proxy materials, you may also vote by completing, signing, dating and returning the accompanying printed proxy in the enclosed envelope, which requires no postage if mailed in the United States.

| By order of the Board of Directors | |

| MICHAEL A. BONARTI | |

| Secretary | |

| September 25, 2014 | |

| Roseland, New Jersey | |

|

This summary highlights certain information contained elsewhere in the proxy statement. This summary does not contain all of the information that you should consider. You should read the entire proxy statement carefully before voting. |

2014 Annual Meeting of Stockholders

|

10:00 a.m. Eastern Standard Time, Tuesday, November 11, 2014 | |

|

One ADP Boulevard, Roseland, New Jersey, 07068 | |

|

Stockholders of record at the close of business on September 12, 2014 are entitled to vote at the meeting in person or by proxy. | |

|

Admission to the meeting is restricted to stockholders and/or their designated representatives. All stockholders will be required to show valid picture identification in order to be admitted to the meeting. | |

|

Under rules adopted by the Securities and Exchange Commission, we are furnishing proxy materials to our stockholders primarily via the Internet, instead of mailing printed copies of those materials to each stockholder. On September 25, 2014, we commenced the mailing to our stockholders (other than those who previously requested electronic or paper delivery) of a Notice of Internet Availability of Proxy Materials containing instructions on how to access our proxy materials. If you would prefer to receive printed proxy materials, please follow the instructions included in the Notice of Internet Availability of Proxy Materials. | |

|

The Notice of Internet Availability of Proxy Materials instructs you on how to access your proxy card to vote through the Internet or by telephone. If you receive a paper copy of the proxy materials, you may also vote your shares by completing, signing, dating and returning the accompanying printed proxy in the enclosed envelope, which requires no postage if mailed in the United States. |

Voting Matters and Board Voting Recommendations

| Proposal | Board Recommendation |

Page Reference For More Detail | ||||

| Proposal 1: | Election of directors | For Each Nominee | 5 | |||

| Proposal 2: | Advisory resolution to approve compensation of named executive officers | For | 21 | |||

| Proposal 3: | Ratification of Deloitte & Touche LLP as our independent registered public accounting firm for fiscal year 2015 | For | 67 |

| i | | | Automatic Data Processing, Inc. – Proxy Statement |

|

2014 Proxy Statement Summary |

Election of Directors (Proposal 1)

The board of directors has nominated the following current directors for re-election as directors. Please refer to page 6 in the proxy statement for important information about the qualifications and experience of each of the following director nominees.

| Director Since |

Committee Memberships | |||||||||||||||

| Name | Age | Principal Occupation | Independent | AC | CC | NCGC | CDAC | |||||||||

| Ellen R. Alemany | 58 | 2011 | Retired Chairman and Chief Executive Officer of Citizens Financial Group, Inc. and Head of RBS Americas | X | X | X | ||||||||||

| Leslie A. Brun | 62 | 2003 | Chairman and Chief Executive Officer of Sarr Group, LLC | X | ||||||||||||

| Richard T. Clark | 68 | 2011 | Retired Chairman and Chief Executive Officer of Merck & Co., Inc. | X | X | X | ||||||||||

| Eric C. Fast | 65 | 2007 | Retired Chief Executive Officer of Crane Co. | X | C, F | X | ||||||||||

| Linda R. Gooden | 61 | 2009 | Retired Executive Vice President of Lockheed Martin Corporation Information Systems & Global Solutions | X | X | C | ||||||||||

| Michael P. Gregoire | 48 | 2014 | Chief Executive Officer and Director of CA Technologies | X | X | X | ||||||||||

| R. Glenn Hubbard | 56 | 2004 | Dean of Columbia University’s Graduate School of Business | X | F | X | ||||||||||

| John P. Jones | 63 | 2005 | Retired Chairman and Chief Executive Officer of Air Products and Chemicals, Inc. | X | X | C | ||||||||||

| Carlos A. Rodriguez | 50 | 2011 | President and Chief Executive Officer of Automatic Data Processing, Inc. | |||||||||||||

CC Compensation Committee

C Committee Chair

F Financial Expert

NCGC Nominating / Corporate Governance Committee

CDAC Corporate Development Advisory Committee

Advisory Resolution to Approve Executive Compensation (Proposal 2)

Consistent with the stockholders’ advisory vote at our 2011 Annual Meeting of Stockholders, we determined to hold the advisory say-on-pay vote to approve our named executive officer compensation on an annual basis. Therefore, we are asking our stockholders to approve, on an advisory basis, our named executive officer compensation for fiscal year 2014. Our stockholders will

have the opportunity to approve, on an advisory basis, our named executive officer compensation for fiscal year 2015 at the 2015 Annual Meeting of Stockholders.

The board of directors recommends a vote FOR this resolution because it believes that the policies and practices described in the “Compensation Discussion and Analysis” section on page 22 of the proxy statement are effective in achieving the company’s goals of linking pay to performance and levels of responsibility, encouraging our

| Automatic Data Processing, Inc. – Proxy Statement | | | ii |

|

2014 Proxy Statement Summary |

executive officers to remain focused on both short-term and long-term operational and financial goals of the company and linking executive performance to stockholder value.

At our 2013 Annual Meeting of Stockholders, our stockholders approved the compensation of our fiscal year 2013 named executive officers by a vote of approximately 97% in favor.

Ratification of the Appointment of Auditors (Proposal 3)

We are asking our shareholders to ratify the selection of Deloitte & Touche LLP (“Deloitte”) as our independent certified public accountants for fiscal year 2015. A summary of fees paid to Deloitte for services provided in fiscal years 2013 and 2014 is provided on page 66 of the proxy statement.

Fiscal Year 2014 Business Highlights

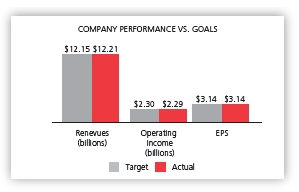

In fiscal year 2014, we demonstrated our focus and commitment to sustaining our position as a global leader of Human Capital Management solutions through our product innovations and our decision to spin off our Dealer Services business into its own independent, publicly traded company. Our fiscal year 2014 results continue to reflect the strength of our underlying business model, including the diversity of our client base and products. Fiscal year 2014 revenue growth was 8.1% compared to a target of 7.6%, and adjusted operating income growth was 8.1% compared to a target of 8.6%. Fiscal year 2014 adjusted earnings per share growth was 9.0% compared to a target of 9.0%.

Compensation Principles

We believe that compensation should be designed to create a direct link between performance and stockholder value. Five principles that guide our decisions involving executive compensation are that compensation should be:

- based on (i) the overall performance of the

company, (ii) the performance of each

executive’s business unit, and (iii) each

executive’s individual performance;

- closely aligned with the short-term and long-term financial and strategic objectives that build sustainable long-term stockholder value;

- competitive, in order to attract and retain

executives critical to our long-term

success;

- consistent with high standards of corporate

governance and best practices; and

- designed to discourage the incentive for executives to take excessive risks or to behave in ways that are inconsistent with the company’s strategic planning processes and high ethical standards.

Good Governance and Best Practices

We are committed to ensuring that our compensation programs reflect principles of good governance, including the following:

| ü | Pay for performance: We design our compensation programs to link pay to performance and levels of responsibility, to encourage our executive officers to remain focused on both the short-term and long-term operational and financial goals of the company, and to link executive performance to stockholder value. | |

| ü | Annual say-on-pay vote: We hold an advisory say-on-pay vote to approve our named executive officer compensation on an annual basis. | |

| ü | Clawback policy: We maintain a compensation recovery, or “clawback,” provision in our 2008 Omnibus Award Plan. | |

| ü | Stock ownership guidelines: We maintain stock ownership guidelines to encourage equity ownership by our executive officers. | |

| ü | Double trigger change in control payments: Our Change in Control Severance Plan for Corporate Officers is based on a “double trigger,” such that payments of cash and vesting of equity awards occur only if termination of employment without cause or with good reason occurs during the two-year period after a change in control. | |

| ü | Limited perquisites: We provide limited, reasonable perquisites that we believe are consistent with our overall compensation philosophy. | |

| ü | No IRC Section 280G or 409A tax gross-ups: We do not provide tax gross-ups under our change in control provisions or deferred compensation programs. |

| iii | | | Automatic Data Processing, Inc. – Proxy Statement |

|

2014 Proxy Statement Summary |

| ü | No stock option repricing or discount stock options: We do not lower the exercise price of any outstanding stock options, and the exercise price of our stock options is not less than 100% of the fair market value of our common stock on the date of grant. | |

| ü | Anti-hedging or pledging policy: We prohibit our directors and executive officers from engaging in any hedging or similar transactions involving ADP securities, holding ADP securities in a margin account, or pledging ADP securities as collateral for a loan. | |

| ü | Independence of our compensation committee and advisor: The compensation committee of our board of directors, which is comprised solely of independent directors, utilizes the services of Frederic W. Cook & Co., Inc. (“Cook & Co.”) as an independent compensation consultant. Cook & Co. reports to the compensation committee, does not perform any other services for the company other than in connection with an annual review of competitive director compensation for the |

| nominating/corporate governance committee of our board of directors, and has no economic or other ties to the company or the management team that could compromise their independence or objectivity. |

2014 Compensation Highlights

Please refer to the “Compensation Discussion and Analysis” section on page 22 of the proxy statement, and the tables and narratives that follow on page 37 of the proxy statement, for more detail concerning the compensation of our named executive officers.

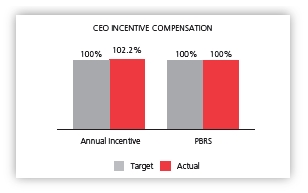

Consistent with our pay for performance philosophy, the compensation of our named executive officers is structured with a significant portion of their total compensation at risk and paid based on the performance of the company and the applicable business unit. Our financial performance in fiscal year 2014 impacted the compensation for all of our executive officers, not just our named executive officers, in several ways, most notably through our annual cash bonus plan and performance-based restricted stock program.

|

For fiscal year 2014, we increased the base salary of each named executive officer by an average of 3.8%. | |

|

For fiscal year 2014, we maintained annual cash bonus targets for the named executive officers at fiscal year 2013 levels. In fiscal year 2014, our named executive officers received cash bonuses that averaged approximately 106.1% of target. | |

|

As part of our equity compensation program in fiscal year 2014, in addition to stock option grants, we introduced a performance stock unit (PSU) program based on financial objectives that are measured over a three-year performance cycle comprised of three one-year performance periods. This new three-year program replaces our current PBRS program. The shift from the two-year vesting schedule of the PBRS program to a three-year vesting schedule of the PSU program results in a gap in our annual vesting schedule with no vesting opportunity in fiscal year 2016. We addressed this gap with a one-time transition grant award opportunity under our PBRS program in fiscal year 2014, which will vest in September of fiscal year 2016 in accordance with the current program. |

| Automatic Data Processing, Inc. – Proxy Statement | | | iv |

|

2014 Proxy Statement Summary |

A summary of fiscal year 2014 total direct compensation for our named executive officers is set forth in the following table:

| Base | Annual | Stock | ||||||||||

| Name | Salary | Bonus | PBRS | PSUs | Options | Total | ||||||

| Carlos A. Rodriguez | ||||||||||||

| President and Chief Executive Officer | $900,000 | $1,471,680 | $2,341,875 | $800,006 | $1,599,998 | $7,113,559 | ||||||

| Jan Siegmund | ||||||||||||

| Chief Financial Officer | $550,001 | $449,680 | $836,160 | $285,640 | $434,240 | $2,555,721 | ||||||

| Regina R. Lee | ||||||||||||

| President, Major Account Services and | ||||||||||||

| ADP Canada | $530,503 | $450,713 | $766,480 | $261,837 | $434,240 | $2,443,773 | ||||||

| Steven J. Anenen | ||||||||||||

| President, Dealer Services | $475,004 | $391,020 | $592,280 | $202,328 | $284,970 | $1,945,602 | ||||||

| Dermot J. O’Brien | ||||||||||||

| Chief Human Resources Officer | $488,001 | $349,115 | $557,440 | $190,427 | $284,970 | $1,869,953 |

The mix of total direct compensation (base salary, cash bonus, and long-term incentive awards) for fiscal year 2014 was designed to deliver the following approximate proportions of total compensation to Mr. Rodriguez, our chief executive officer, and the other named executive officers (on average) if company and individual target levels of performance are achieved:

Important Dates for the 2015 Annual Meeting of Stockholders

Please refer to the “Stockholder Proposals” section on page 68 of the proxy statement for more information regarding the applicable requirements for submission of stockholder proposals.

If a stockholder intends to submit any proposal for inclusion in the company’s proxy statement for the company’s 2015 Annual Meeting of Stockholders in accordance with Rule 14a-8 under the Securities Exchange Act of 1934, as amended, the proposal must be received by the corporate secretary of the company no later than May 28, 2015.

Separate from the requirements of Rule 14a-8 relating to the inclusion of a stockholder proposal in the company’s proxy statement, the company’s amended and restated by-laws require that notice of a stockholder nomination for candidates for our board of directors or any other business to be considered at the company’s 2015 Annual Meeting of Stockholders must be received by the company no earlier than July 14, 2015, and no later than the close of business (5:30 p.m. Eastern Daylight Time) on August 13, 2015.

| v | | | Automatic Data Processing, Inc. – Proxy Statement |

Proxy Statement

The board of directors of Automatic Data Processing, Inc. is soliciting your proxy to vote at the 2014 Annual Meeting of Stockholders to be held on November 11, 2014 at 10:00 a.m. Eastern Standard Time, and at any postponement(s) or adjournment(s) thereof. The meeting will be held at our corporate headquarters, One ADP Boulevard, Roseland, New Jersey.

Under rules adopted by the Securities and Exchange Commission, we are furnishing proxy materials to our stockholders primarily via the Internet, instead of mailing printed copies of those materials to each stockholder. On September 25, 2014, we commenced the mailing to our stockholders (other than those who previously requested electronic or paper delivery of printed proxy materials) of a Notice of Internet Availability of Proxy Materials containing instructions on how to access our proxy materials, including our proxy statement and our annual report on Form 10-K (which is not a part of the proxy soliciting material). This process is designed to expedite stockholders’ receipt of proxy materials, lower the cost of the Annual Meeting, and help conserve natural resources.

However, if you would prefer to receive printed proxy materials, please follow the instructions included in the Notice of Internet Availability of Proxy Materials. If you have previously elected to receive our proxy materials electronically, you will continue to receive these materials via e-mail unless you elect otherwise.

The only outstanding class of securities entitled to vote at the meeting is our common stock, par value $0.10 per share. At the close of business on September 12, 2014, the record date for determining stockholders entitled to notice of, to attend, and to vote at the meeting, we had 482,065,865 issued and outstanding shares of common stock (excluding 156,646,577 treasury shares not entitled to vote). Each outstanding share of common stock is entitled to one vote with respect to each matter to be voted on at the meeting.

This proxy statement and our annual report on Form 10-K are also available on our corporate website at www.adp. com under “Financials” in the “Investor Relations” section.

Questions and Answers About the Annual Meeting and Voting

|

WHY AM I

|

We are providing these proxy materials to holders of shares of the company’s common stock, par value $0.10 per share, in connection with the solicitation of proxies by our board of directors for the forthcoming 2014 Annual Meeting of Stockholders to be held on November 11, 2014 at 10:00 a.m. Eastern Standard Time, and at any postponement(s) or adjournment(s) thereof. The company will bear all expenses in connection with this solicitation. | |

|

HOW CAN I

ATTEND |

Admission to the meeting is restricted to stockholders and/or their designated representatives. If your shares are registered in your name and you plan to attend the meeting, your admission ticket will be the top portion of the proxy card. If your shares are in the name of your broker or bank or you received your proxy materials electronically, you will need to bring evidence of your stock ownership, such as your most recent brokerage account statement. All stockholders will be required to show valid picture identification. If you do not have valid picture identification and either an admission ticket or proof of your stock ownership, you will not be admitted to the meeting. For security purposes, packages and bags will be inspected and you may be required to check these items. Please arrive early enough to allow yourself adequate time to clear security. |

| 1 | | | Automatic Data Processing, Inc. – Proxy Statement |

|

Questions and Answers About the Annual Meeting and Voting |

|

HOW MANY |

The representation in person or by proxy of a majority of the issued and outstanding shares of stock entitled to vote at the meeting constitutes a quorum. Under our amended and restated certificate of incorporation and our amended and restated bylaws and under Delaware law, abstentions and “non-votes” are counted as present in determining whether the quorum requirement is satisfied. A non-vote occurs when a nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting power for that particular item and has not received instructions from the beneficial owner. | |||||

| HOW CAN I VOTE MY SHARES? |

The Notice of Internet Availability of Proxy Materials instructs you on how to access your proxy card to vote through the Internet or by telephone. If you receive a paper copy of the proxy materials, you may also vote your shares by completing, signing, dating and returning the accompanying printed proxy in the enclosed envelope, which requires no postage if mailed in the United States. Unless contrary instructions are indicated on the proxy, all shares represented by valid proxies received pursuant to this solicitation (and not revoked before they are voted) will be voted in accordance with the recommendations of our board of directors as indicated below. If you are a registered stockholder and attend the meeting, you may deliver your completed proxy card in person. | |||||

|

IF I HOLD

SHARES |

If your shares are held in “street name” (i.e., your shares are held by a bank, brokerage firm or other nominee), you must provide voting instructions to your bank or broker by the deadline provided in the materials you receive from your bank or broker. If you hold your shares in street name and you do not instruct your bank or broker as to how to vote your shares, your bank or broker may only vote your shares in its discretion on the ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for fiscal year 2015 (Proposal 3), but will not be allowed to vote your shares on any of the other proposals described in this proxy statement, including the election of directors. Under applicable Delaware law, a broker non-vote will have no effect on the outcome of any of the other proposals described in this proxy statement because the non-votes are not considered in determining the number of votes necessary for approval. | |||||

|

WHAT MATTERS

|

Proposal |

Voting Choices |

Board Recommendation | |||

|

Proposal 1: Election of the 9 nominees named in this proxy statement to serve on the company’s board of directors |

|

FOR election of all 9 | ||||

|

Proposal 2: Advisory resolution approving the compensation of the company’s named executive officers as disclosed in the “COMPENSATION DISCUSSION AND ANALYSIS” section on page 22 of this proxy statement |

|

FOR | ||||

|

Proposal 3: Ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for fiscal year 2015 |

|

FOR | ||||

|

So far as the board of directors is aware, only the above matters will be acted upon at the meeting. If any other matters properly come before the meeting, the accompanying proxy may be voted on such other matters in accordance with the best judgment of the person or persons voting the proxy. | ||||||

| Automatic Data Processing, Inc. – Proxy Statement | | | 2 |

|

Questions and Answers About the Annual Meeting and Voting |

|

HOW MANY

VOTES |

Proposal 1: The affirmative vote of the holders of a majority of the shares represented in person or by proxy and entitled to vote thereon is required to elect a director, provided that if the number of nominees exceeds the number of directors to be elected (a situation that the company does not anticipate), the directors shall be elected by the vote of a plurality of the shares represented in person or by proxy. Votes may be cast in favor of all nominees, withheld from all nominees or withheld from specifically identified nominees. Votes that are withheld will have the effect of a negative vote, provided that if the number of nominees exceeds the number of directors to be elected, withheld votes will be excluded entirely and will have no effect on the vote. A broker non-vote will have no effect on the outcome of this proposal because the non-votes are not considered in determining the number of votes necessary for approval. Proposal 2: The affirmative vote of the holders of a majority of the shares represented in person or by proxy and entitled to vote thereon is required to approve the advisory resolution on executive compensation. Votes may be cast in favor of or against this proposal or a stockholder may abstain from voting. Abstentions will have the effect of a negative vote. Because the vote on this proposal is advisory in nature, it will not affect any compensation already paid or awarded to any named executive officer and will not be binding on or overrule any decisions by the compensation committee or the board of directors. Because we value our stockholders’ views, however, the compensation committee and the board of directors will consider the results of this advisory vote when formulating future executive compensation policy. A broker non-vote will have no effect on the outcome of the advisory resolution because the non-votes are not considered in determining the number of votes necessary for approval. Proposal 3: The affirmative vote of the holders of a majority of the shares represented in person or by proxy and entitled to vote thereon is required to ratify the appointment of Deloitte & Touche LLP, an independent registered public accounting firm, as the company’s independent certified public accountants for fiscal year 2015. Votes may be cast in favor of or against this proposal or a stockholder may abstain from voting. Abstentions will have the effect of a negative vote. Brokers have the authority to vote shares for which their customers did not provide voting instructions on the ratification of the appointment of Deloitte & Touche LLP. | |

|

MAY I REVOKE

MY |

If your shares are registered in your name, you may revoke your proxy and change your vote prior to the completion of voting at the Annual Meeting by:

If your shares are held in “street name,” you should contact your bank or broker and follow its procedures for changing your voting instructions. You also may vote in person at the Annual Meeting if you obtain a legal proxy from your bank or broker. |

| 3 | | | Automatic Data Processing, Inc. – Proxy Statement |

|

Questions and Answers About the Annual Meeting and Voting |

|

IS MY VOTE |

Proxies and ballots identifying the vote of individual stockholders will be kept confidential from our management and directors, except as necessary to meet legal requirements in cases where stockholders request disclosure or in a contested election. | |

|

WHERE CAN I FIND |

The preliminary voting results will be announced at the Annual Meeting. The final voting results, which are tallied by independent tabulators and certified by independent inspectors, will be published in the company’s current report on Form 8-K, which we are required to file with the Securities and Exchange Commission within four business days following the Annual Meeting. | |

|

WHAT IS |

To reduce the expense of delivering duplicate proxy materials to stockholders who may have more than one account holding our stock but share the same address, we have adopted a procedure known as “householding.” Under this procedure, certain stockholders of record who have the same address and last name, and who do not participate in electronic delivery of proxy materials, will receive only one copy of our Notice of Internet Availability of Proxy Materials and, as applicable, any additional proxy materials that are delivered until such time as one or more of these stockholders notifies us that they want to receive separate copies. Stockholders who participate in householding will continue to have access to and utilize separate proxy voting instructions. If you are a registered stockholder and choose to have separate copies of our Notice of Internet Availability of Proxy Materials, proxy statement and annual report on Form 10-K mailed to you, you must “opt-out” by writing to Broadridge Financial Solutions, Inc., Householding Department, 51 Mercedes Way, Edgewood, New York, 11717 or by calling 1-800-542-1061 and we will cease householding all such disclosure documents within 30 days. If we do not receive instructions to remove your accounts from this service, your accounts will continue to be “householded” until we notify you otherwise. If you own our common stock in nominee name (such as through a broker), information regarding householding of disclosure documents should have been forwarded to you by your broker. You can also contact Broadridge Financial Solutions, Inc. at 1-800-542-1061 if you received multiple copies of the Annual Meeting materials and would prefer to receive a single copy in the future. |

| Automatic Data Processing, Inc. – Proxy Statement | | | 4 |

| Proposal

1 Election of Directors |

The board of directors has nominated the following current directors for re-election as directors. Properly executed proxies will be voted as marked. Unmarked proxies will be voted in favor of electing the persons named below (each of whom is now a director) as directors to serve until the next Annual Meeting of Stockholders and until their successors are duly elected and qualified. If any nominee is no longer a candidate at the time of the meeting (a situation that we do not anticipate), proxies will be voted in favor of remaining nominees and may be voted for substitute nominees designated by the board of directors.

| Served as a | ||||||

| Director | ||||||

| Continuously | ||||||

| Name | Age | Since | Principal Occupation | |||

| Ellen R. Alemany | 58 | 2011 | Retired Chairman and Chief Executive Officer of Citizens Financial Group, Inc. and Head of RBS Americas | |||

| Leslie A. Brun | 62 | 2003 | Chairman and Chief Executive Officer of Sarr Group, LLC, an investment holding company | |||

| Richard T. Clark | 68 | 2011 | Retired Chairman and Chief Executive Officer of Merck & Co., Inc. | |||

| Eric C. Fast | 65 | 2007 | Retired Chief Executive Officer of Crane Co., a manufacturer of industrial products | |||

| Linda R. Gooden | 61 | 2009 | Retired Executive Vice President of Lockheed Martin Corporation Information Systems & Global Solutions | |||

| Michael P. Gregoire | 48 | 2014 | Chief Executive Officer and Director of CA Technologies | |||

| R. Glenn Hubbard | 56 | 2004 | Dean of Columbia University’s Graduate School of Business | |||

| John P. Jones | 63 | 2005 | Retired Chairman and Chief Executive Officer of Air Products and Chemicals, Inc., an industrial gas and related industrial process equipment business | |||

| Carlos A. Rodriguez | 50 | 2011 | President and Chief Executive Officer of Automatic Data Processing, Inc. |

Messrs. Gregory D. Brenneman and Gregory L. Summe have notified the board of directors that they will not stand for re-election at the conclusion of their current term ending at the 2014 Annual Meeting of Stockholders.

| 5 | | | Automatic Data Processing, Inc. – Proxy Statement |

|

Proposal 1 |

Below are summaries of the principal occupations, business experience, and background of the nominees.

|

Ellen R. Alemany | ||

Director since: 2011 Independent |

Retired Chairman and Chief Executive Officer of Citizens Financial Group, Inc. and Head of RBS Americas Ms. Alemany is the retired Head of RBS Americas, the management structure that oversees The Royal Bank of Scotland’s businesses in the Americas, and chief executive officer of RBS Citizens Financial Group, Inc., an RBS subsidiary. Ms. Alemany retired from RBS in September 2013. She joined RBS as the Head of RBS Americas in June 2007, and was named to the additional role of chief executive officer of RBS Citizens Financial Group, Inc. in March 2008. She was also appointed the chairman of RBS Citizens Financial Group, Inc. in March 2009. Ms. Alemany joined RBS from Citigroup, where she served as the chief executive officer for global transaction services from February 2006 until April 2007. Ms. Alemany joined Citigroup in 1987, and held a number of senior positions during her tenure, including executive vice president for the commercial business group from March 2003 until January 2006, and also CitiCapital, where she served as president and chief executive officer from September 2001 until January 2006. Prior to being appointed executive vice president for the commercial business group in 2003, Ms. Alemany also held a number of executive positions in Citigroup’s Global Corporate Bank. Ms. Alemany is a director of Fidelity National Information Services, Inc. and a director of CIT Group Inc. With over 30 years of management experience in financial services and a proven track record of achievement and leadership, Ms. Alemany brings a wealth of managerial and operational expertise to our board of directors, as well as extensive experience in the issues facing multinational businesses. | |

|

Leslie A. Brun | ||

Director since: 2003 Independent |

Chairman and Chief Executive Officer of Sarr Group, LLC Mr. Brun is chairman and chief executive officer of Sarr Group, LLC, an investment holding company that manages Mr. Brun’s personal and family investments. He is the founder and was chairman emeritus of Hamilton Lane, a private equity advisory and management firm where he served as chief executive officer and chairman from 1991 until 2005. Mr. Brun also serves as the chairman of the board of directors of Broadridge Financial Solutions, Inc., a director and chairman of the audit committee of Merck & Co., Inc., and a director of NXT Capital. In addition, Mr. Brun is a former managing director and head of investor relations at CCMP Capital Advisors, LLC, a global private equity firm. Mr. Brun has extensive financial expertise coupled with a track record of achievement demonstrated by his career at Hamilton Lane, his experience as a managing director and co-founder of the investment banking group of Fidelity Bank, and as a vice president in the corporate finance division of E.F. Hutton & Co. Mr. Brun also brings to our board of directors management expertise and board leadership experience essential to a large public company. In addition, his directorships at other public companies provide him with broad experience on governance issues facing public companies. | |

| Automatic Data Processing, Inc. – Proxy Statement | | | 6 |

|

Proposal 1 |

|

Richard T. Clark | ||

Director since: 2011 Independent |

Retired Chairman and Chief Executive Officer of Merck & Co., Inc. Mr. Clark is the retired chairman of the board, chief executive officer, and president of Merck & Co., Inc. Mr. Clark served as chairman of Merck & Co., Inc. from April 2007 until December 2011, as chief executive officer from May 2005 until December 2010, and as president from May 2005 until April 2010. He held a variety of other positions during his 39-year tenure at Merck, including president of the Merck manufacturing division from June 2003 to May 2005, and chairman and chief executive officer of Medco Health Solutions, Inc. from March 2002 to June 2003. Mr. Clark is a director of Corning Incorporated, a global manufacturing company, and serves on the advisory board of American Securities, a private equity firm. With a proven track record of leadership and achievement, Mr. Clark offers our board of directors broad managerial and operational expertise, as well as extensive experience in the issues facing public companies and multinational businesses. | |

|

Eric C. Fast | ||

Director since: 2007 Independent |

Retired Chief Executive Officer of Crane Co. Mr. Fast is the retired chief executive officer, president, and director of Crane Co., a manufacturer of industrial products. Mr. Fast served as the chief executive officer of Crane Co. from April 2001 until January 2014, as president from 1999 through January 2013, and as a director from 1999 to January 2014. Mr. Fast is also a director of National Integrity Life Insurance Company and Regions Financial Corporation. He was a director of Convergys Corporation from 2000 to 2007. Mr. Fast also served as a managing director, co-head of global investment banking, and a member of the management committee of Salomon Smith Barney from 1997 to 1998. Mr. Fast held those same positions at Salomon Brothers Inc. from 1995 until the merger of Salomon Brothers Inc. and Travelers/Smith Barney, and prior to that he was co-head of U.S. corporate finance at Salomon Brothers Inc. from 1991 to 1995. Mr. Fast has extensive financial and transactional experience, demonstrated by his career in investment banking prior to his tenure at Crane Co. With years of demonstrated leadership ability, Mr. Fast contributes significant organizational skills to our board of directors, including expertise in financial, accounting, and transactional matters. | |

|

Linda R. Gooden | ||

Director since: 2009 Independent |

Retired Executive Vice President of Lockheed Martin Corporation Information Systems & Global Solutions Ms. Gooden is the retired executive vice president – information systems & global solutions of Lockheed Martin Corporation, a position that she held from January 2007 to March 2013. She previously served as deputy executive vice president – information & technology services of Lockheed Martin Corporation from October 2006 to December 2006, and president, Lockheed Martin Information Technology from September 1997 to December 2006. Ms. Gooden is a director of WGL Holdings, Inc., a public utility holding company, and director of Washington Gas Light Company, a subsidiary of WGL Holdings, Inc. Ms. Gooden brings to our board of directors broad managerial and operational expertise, a strong background in information technology, as well as a proven track record of achievement and sound business judgment demonstrated throughout her career with Lockheed Martin Corporation. | |

| 7 | | | Automatic Data Processing, Inc. – Proxy Statement |

|

Proposal 1 |

|

Michael P. Gregoire | ||

Director since: 2014 Independent |

Chief Executive Officer and Director of CA Technologies Mr. Gregoire is chief executive officer and a director of CA Technologies. He served as president and chief executive officer of Taleo Corporation, a provider of on-demand talent management software solutions, from March 2005 until its acquisition by Oracle Corporation in April 2012, as chairman of the board from May 2008 to April 2012, and as a director from April 2005 to April 2012. Mr. Gregoire served as executive vice president, global services and held various other senior management positions at PeopleSoft, Inc. from May 2000 to January 2005. Mr. Gregoire was managing director for global financial markets at Electronic Data Systems, Inc. from 1996 to April 2000, and in various other roles from 1988 to 1996. He has also served as a director of ShoreTel, Inc. from November 2008 to January 2014 and the chair of its compensation committee from July 2010 to January 2014. Mr. Gregoire is also a director of NPower, a nonprofit information technology services network, since September 2013. Mr. Gregoire brings to our board of directors extensive executive leadership experience with public companies in the software and services business and extensive experience in the technology industry. In addition, his directorships at other public companies provide him with broad experience on governance issues facing public companies. | |

|

R. Glenn Hubbard | ||

Director since: 2004 Independent |

Dean of Columbia University’s Graduate School of Business Mr. Hubbard has been the dean of Columbia University’s Graduate School of Business since 2004 and has been the Russell L. Carson professor of finance and economics since 1994. He is also a director of BlackRock Closed-End Funds and MetLife, Inc. and a member of the Panel of Economic Advisors for the Federal Reserve Bank of New York. Mr. Hubbard served as a director of KKR Financial Holdings, LLC from 2004 until 2014, Information Services Group, Inc. from 2006 to 2008, Duke Realty Corporation from 2004 to 2008, Capmark Financial Corporation from 2006 to 2008, Dex Media, Inc. from 2004 to 2006, and R.H. Donnelley Corporation in 2006. Mr. Hubbard was chairman of the President’s Council of Economic Advisers from 2001 to 2003. Mr. Hubbard provides our board of directors with substantial knowledge of and expertise in global macroeconomic conditions and economic, tax and regulatory policies, as well as perspective on financial markets. In addition, his directorships at other public companies provide him with broad experience on governance issues facing public companies. | |

|

John P. Jones | ||

Director since: 2005 Independent |

Retired Chairman and Chief Executive Officer of Air Products and Chemicals, Inc. Mr. Jones is the retired chairman of the board, chief executive officer, and president of Air Products and Chemicals, Inc., an industrial gas and related industrial process equipment business. Mr. Jones served as chairman of Air Products and Chemicals, Inc. from October 2007 until April 2008, as chairman and chief executive officer from September 2006 until October 2007, and as chairman, president, and chief executive officer from December 2000 through September 2006. He also served as a director of Sunoco, Inc. from 2010 to 2012. With a track record of achievement and sound business judgment demonstrated during his thirty-six year tenure at Air Products and Chemicals, Inc., Mr. Jones brings to the board of directors extensive experience in issues facing public companies and multinational businesses, including organizational management, strategic planning, and corporate governance matters, combined with proven business and financial acumen. | |

| Automatic Data Processing, Inc. – Proxy Statement | | | 8 |

|

Proposal 1 |

|

Carlos A. Rodriguez | ||

Director since: 2011 Management |

President and Chief Executive Officer of Automatic Data Processing, Inc. Mr. Rodriguez is president and chief executive officer of the company. He served as president and chief operating officer of the company before he was appointed to his current position in November 2011. Having started his career at the company in 1999, Mr. Rodriguez previously served as president of several key businesses, including National Accounts Services, Employer Services International, Small Business Services, and Professional Employer Organization, giving him deep institutional knowledge across the company’s business. Mr. Rodriguez is also a director of Hubbell Inc., a manufacturer of electrical and electronic products. Mr. Rodriguez brings a wealth of business acumen and leadership experience to our board of directors, coupled with a proven track record of integrity, achievement, and strategic vision. | |

| Stockholder Approval Required |

At the 2014 Annual Meeting of Stockholders, directors will be elected by the affirmative vote of the holders of a majority of the shares represented in person or by proxy and entitled to vote thereon, provided that if the number of nominees exceeds the number of directors to be elected (a situation we do not anticipate), the directors shall be elected by the vote of a plurality of the shares represented in person or by proxy.

|

THE BOARD OF DIRECTORS RECOMMENDS THAT THE STOCKHOLDERS VOTE FOR THE ELECTION OF THE NOMINEES TO THE BOARD OF DIRECTORS. |

| 9 | | | Automatic Data Processing, Inc. – Proxy Statement |

The board of directors’ categorical standards of director independence are consistent with NASDAQ Stock Market (“NASDAQ”) listing standards and are available online at: http://www.adp.com/who-we-are/corporate-social-responsibility/working-with-adp/governance/standards-of-director-independence.aspx. Directors meeting these standards are considered to be “independent.” Ms. Alemany, Ms. Gooden, and Messrs. Brenneman, Brun, Clark, Fast, Gregoire, Hubbard, Jones, and Summe meet these standards and are, therefore, considered to be independent directors. Mr. Rodriguez does not meet these standards and is, therefore, not considered to be an independent director. Based on the foregoing categorical standards, all current members of the audit, compensation and nominating/corporate governance committees are independent. Mr. Brun, our independent non-executive chairman of the board, is not a member of any of these board committees.

It is our policy that our directors attend the Annual Meetings of Stockholders. All of our directors attended our 2013 Annual Meeting of Stockholders.

During fiscal year 2014, our board of directors held 5 meetings. All of our incumbent directors attended at least 75%, in the aggregate, of the meetings of the board of directors and the committees of which they were members during the periods that they served on our board of directors during fiscal year 2014, with the exception of Mr. Gregoire, who was appointed to serve on the board of directors in January 2014 and, due to a commitment made prior to his appointment to the board of directors, was unable to attend one meeting of the Corporate Development Advisory Committee, which was one of three total meetings of the board of directors and the committees of which he was a member during the period in which he served as a director.

Executive sessions of the non-management directors are held during each board of directors and committee meeting. Mr. Brun, our independent non-executive chairman of the board, presides at each executive session of the board of directors.

| Board Leadership Structure |

Our Corporate Governance Principles do not require the separation of the roles of chairman of the board and chief executive officer because the board believes that effective board leadership can depend on the skills and experience of, and personal interaction between, people in leadership roles. Our board of directors is currently led by Mr. Brun, our independent non-executive chairman of the board. Mr. Rodriguez, our chief executive officer, serves as a member of the board of directors. The board of directors

believes this leadership structure is in the best interests of the company’s stockholders at this time. Separating these positions allows our chief executive officer to focus on developing and implementing the company’s business plans and supervising the company’s day-to-day business operations, and allows our chairman of the board to lead the board of directors in its oversight, advisory, and risk management roles.

| Director Nomination Process |

When the board of directors decides to recruit a new member, or when the board of directors considers any director candidates submitted for consideration by our stockholders, it seeks strong candidates who, ideally, meet all of its categorical standards of director independence, and who are, preferably, senior executives of large companies who have backgrounds directly related to our technologies, markets and/or clients. Additionally, candidates should possess the following personal characteristics: (i) business community respect for his or her integrity, ethics, principles, insights and

analytical ability; and (ii) ability and initiative to frame insightful questions, speak out and challenge questionable assumptions and disagree without being disagreeable. The nominating/corporate governance committee will not consider candidates who lack the foregoing personal characteristics. In addition, the nominating/corporate governance committee considers a wide range of other factors in determining the composition of our board of directors, including age, diversity of background, diversity of thought, and other individual qualities such as professional experience, skills, education, and training.

| Automatic Data Processing, Inc. – Proxy Statement | | | 10 |

|

Corporate Governance |

Nominations of candidates for our board of directors by our stockholders for consideration at our 2015 Annual Stockholder Meeting are subject to the deadlines and

other requirements described under “Stockholder Proposals” on page 68 of this proxy statement.

| Retirement Policy |

Each director will automatically retire from the board of directors at the company’s Annual Meeting of Stockholders following the date he or she turns 72. Management

directors who are no longer officers of the company are required to offer to resign from the board of directors.

| Committees of the Board of Directors |

The table below provides membership and meeting information for each of the committees of the board of directors.

| Committee Memberships | ||||||||

| Name | AC | CC | NCGC | CDAC | ||||

| Ellen R. Alemany | X | X | ||||||

| Gregory D. Brenneman(1) | F | C | ||||||

| Richard T. Clark | X | X | ||||||

| Eric C. Fast | C, F | X | ||||||

| Linda R. Gooden | X | C | ||||||

| Michael P. Gregoire | X | X | ||||||

| R. Glenn Hubbard | F | X | ||||||

| John P. Jones | X | C | ||||||

| Gregory L. Summe(1) | X | X | ||||||

| Number of meetings held in fiscal 2014 | 8 | 5 | 3 | 1 | ||||

| AC Audit Committee | CDAC Corporate Development Advisory Committee | |||||||

| CC Compensation Committee | F Financial Expert | |||||||

| NCGC Nominating / Corporate Governance Committee | C Committee Chair | |||||||

| (1) | Messrs. Brenneman and Summe have notified the board of directors that they will not stand for re-election at the conclusion of their current term ending at the 2014 Annual Meeting of Stockholders. |

| 11 | | | Automatic Data Processing, Inc. – Proxy Statement |

|

Corporate Governance |

Eric C. Fast Other |

The audit committee’s principal functions are to assist the board of directors in fulfilling its oversight responsibilities with respect to:

The audit committee acts under a written charter, which is available online at http://www.adp. com/who-we-are/corporate-social-responsibility/working-with-adp/governance/audit-committee-charter.aspx. The members of the audit committee satisfy the independence requirements of NASDAQ listing standards. | |

John P. Jones Other |

The principal functions of the nominating/corporate governance committee are to:

The nominating/corporate governance committee acts under a written charter, which is available online at http://www.adp.com/who-we-are/corporate-social-responsibility/working-with-adp/governance/nominating-corporate-governance-committee-charter.aspx. The members of the nominating/corporate governance committee satisfy the independence requirements of NASDAQ listing standards. | |

| Automatic Data Processing, Inc. – Proxy Statement | | | 12 |

|

Corporate Governance |

Gregory D.

Brenneman Other |

The compensation committee sets and administers our executive compensation program. See “Compensation Discussion and Analysis” on page 22 of this proxy statement. The compensation committee is authorized to engage the services of outside advisors, experts and others to assist the committee. For fiscal year 2014, the compensation committee sought advice from Frederic W. Cook & Co., Inc., an independent compensation consulting firm specializing in executive and director compensation. For further information about Frederic W. Cook & Co., Inc.’s services to the compensation committee, see “Compensation Discussion and Analysis” under “Compensation Consultant” on page 26 of this proxy statement. The compensation committee acts under a written charter, which is available online at http://www.adp.com/who-we-are/corporate-social-responsibility/working-with-adp/governance/ compensation-committee-charter.aspx. The members of the compensation committee satisfy the independence requirements of NASDAQ listing standards. In addition, each member of the compensation committee is a “Non-Employee Director” as defined in Rule 16b-3 under the Securities Exchange Act of 1934, as amended, and an “outside director” as defined in the regulations under Section 162(m) of the Internal Revenue Code of 1986, as amended. The compensation committee may form and delegate authority to subcommittees when appropriate, provided that the subcommittees are composed entirely of directors who satisfy the applicable independence requirements of NASDAQ. | |

Linda R. Gooden Other |

The corporate development advisory committee’s principal functions are to assist the board of directors and management in reviewing and assessing potential acquisitions, strategic investments and divestitures. The corporate development advisory committee acts under a written charter, which is available online at http://www.adp.com/who-we-are/corporate-social-responsibility/working-with-adp/ governance/corporate-development-advisory-committee-charter.aspx. The members of the corporate development advisory committee satisfy the independence requirements of NASDAQ listing standards. | |

| 13 | | | Automatic Data Processing, Inc. – Proxy Statement |

|

Corporate Governance |

The Board’s Role in Risk Oversight

Our board of directors provides oversight with respect to the company’s enterprise risk assessment and risk management activities, which are designed to identify, prioritize, assess, monitor and mitigate the various risks confronting the company, including risks that are related to the achievement of the company’s operational and financial strategy. The board of directors performs this oversight function periodically as part of its meetings and also through its committees, each of which examines various components of enterprise risk as part of its assigned responsibilities. Management is responsible for implementing and supervising day-to-day risk management processes and reporting to the board of directors and its committees as necessary.

Our audit committee focuses on financial risks, including reviewing with management, the company’s internal auditors, and the company’s independent auditors the company’s major financial risk exposures, the adequacy and effectiveness of accounting and financial controls, and the steps management has taken to monitor and control financial risk exposures. In addition, our audit committee reviews risks related to compliance with applicable laws, regulations, and ethical standards, and also operational risks related to information security and system disruption. Our audit committee regularly receives, reviews and discusses with management presentations and analyses on various risks confronting the company.

Our nominating/corporate governance committee oversees risks associated with board structure and other corporate governance policies and practices, including review and approval of any related-party transactions under our Related Persons Transaction Policy. Our compensation

committee oversees risks related to compensation matters. Our committees report on risk oversight matters directly to the board of directors on a regular basis.

Our compensation committee considered the risks presented by the company’s compensation policies and practices at its meetings in August 2013 and 2014 and believes that our policies and practices of compensating employees do not encourage excessive or unnecessary risk-taking for the following reasons:

| ü | Our incentive plans have diverse performance measures, including company and business unit financial measures, operational measures, and individual goals; | |

| ü | Our compensation programs balance annual and long-term incentive opportunities; | |

| ü | We cap incentive plan payouts within a reasonable range; | |

| ü | The mix of performance-based restricted stock and stock options in our long-term incentive programs serves the best interests of stockholders and the company; | |

| ü | Our stock ownership guidelines link the interests of our executive officers to those of our stockholders; and | |

| ü | Our compensation recovery policy for equity awards provides for the clawback of the value of awards in the event an employee engages in conduct contributing to a financial restatement. |

| Communications with All Interested Parties |

All interested parties who wish to communicate with the board of directors, the audit committee, or the non-management directors, individually or as a group, may do so by sending a detailed letter to P.O. Box 34, Roseland, New Jersey 07068, leaving a message for a return call at 973-974-5770 or sending an email to adp_audit_committee@adp.com. We will relay any such communication to the non-management director to which such communication is addressed, if applicable, or to the most appropriate committee chairperson, the chairman of the board, or the full board of directors,

unless, in any case, it is outside the scope of matters considered by the board of directors or duplicative of other communications previously forwarded to the board of directors. Communications to the board of directors, the non-management directors, or to any individual director that relate to the company’s accounting, internal accounting controls, or auditing matters are referred to the chairperson of the audit committee.

| Automatic Data Processing, Inc. – Proxy Statement | | | 14 |

|

Corporate Governance |

Transactions with Related Persons

We have a written “Related Persons Transaction Policy” pursuant to which any transaction between the company and a “related person” in which such related person has a direct or indirect material interest, and where the amount involved exceeds $120,000, must be submitted to our nominating/corporate governance committee for review, approval, or ratification.

A “related person” means a director, executive officer or beneficial holder of more than 5% of the company’s outstanding common stock, or any immediate family member of the foregoing, as well as any entity at which any such person is employed, is a partner or principal (or holds a similar position), or is a beneficial owner of a 10% or greater direct or indirect equity interest. Our directors and executive officers must inform our general counsel at the earliest practicable time of any plan to engage in a potential related person transaction.

This policy requires our nominating/corporate governance committee to be provided with full information concerning the proposed transaction, including the benefits to the company and the related person, any alternative means by which to obtain like benefits, and terms that would prevail in a similar transaction with an unaffiliated third party. In considering whether to approve any such transaction, the nominating/corporate governance committee will consider all relevant factors, including the nature of the interest of the related person in the transaction and whether the transaction may involve a conflict of interest.

Specific types of transactions are excluded from the policy, such as, for example, transactions in which the related person’s interest derives solely from his or her service as a director of another entity that is a party to the transaction.

The wife of Michael L. Capone, our vice president and chief information officer, is employed as an executive of the company and received total cash compensation for fiscal year 2014 in excess of $120,000.

| Availability of Corporate Governance Documents |

Our Corporate Governance Principles and Related Persons Transaction Policy may be viewed online on the company’s website at www.adp.com under ”Investor Relations” in the “Corporate Governance” section. Our Code of Business Conduct & Ethics and Code of Ethics for Principal Executive

Officer and Senior Financial Officers may be found at www.adp.com in the “Who We Are” section, under “Working with ADP”. In addition, these documents are available in print to any stockholder who requests them by writing to Investor Relations at the company’s headquarters.

| Compensation Committee Interlocks and Insider Participation |

Messrs. Brenneman, Clark, Hubbard, Jones and Summe are the five independent directors who sit on the compensation committee. No compensation committee member has ever been an officer of the company. During fiscal year 2014 and as of the date of this proxy statement, no compensation committee member has been an employee of the company or eligible to participate in our employee compensation programs or plans, other than the company’s

2008 Omnibus Award Plan under which non-employee directors have received stock option grants and deferred stock units. None of the executive officers of the company have served on the compensation committee or on the board of directors of any entity that employed any of the compensation committee members or directors of the company.

| 15 | | | Automatic Data Processing, Inc. – Proxy Statement |

Compensation of Non-Employee Directors

The annual retainer for non-employee directors, other than Mr. Brun, the chairman of our board of directors, is $220,000, $130,000 of which is paid in the form of deferred stock units and $90,000 of which may, at the election of each director, be paid in cash or in deferred stock units. The chairman of our board of directors receives an annual retainer of $385,000, $230,000 of which is paid in the form of deferred stock units and $155,000 of which may, at the election of the chairman of our board of directors, be paid in cash or in deferred stock units. The chairperson of the audit committee was paid an additional annual retainer of $15,000 and the chairperson of each of the compensation committee and the nominating/corporate governance committee was paid an additional annual retainer of $10,000. Meeting fees are not paid in respect of the first seven meetings of the board of directors or of any individual committee. Non-employee directors receive $2,000 for each board of directors meeting attended and $1,500 for each committee meeting attended beginning with the eighth meeting of the board of directors or any individual committee, as applicable. Meeting fees and the additional annual retainer may, at the election of each director, be paid in cash, deferred, or paid in deferred stock units.

Effective at the time of the 2014 Annual Meeting of Stockholders, an additional annual retainer of $10,000 will be established for the chairperson of the corporate development advisory committee, and the additional annual retainer for the chairperson of the compensation committee will be increased to $15,000. In addition, the annual retainer for each non-employee director (including the chairman of our board of directors) will be increased by $10,000, payable as to $5,000 in the form of deferred stock units and as to $5,000 in cash or deferred stock units at the election of each director.

All of our non-employee directors chose to receive the entire elective portion of their annual retainers in the form of deferred stock units except for Mr. Brenneman, who elected to receive the amount of his additional annual retainer in cash. Under our 2008 Omnibus Award Plan a director may specify whether, upon separation from the board, he or she would like to receive the deferred cash amounts in such director’s deferred account in a lump sum payment or in a series of substantially equal annual payments over a period ranging from two to ten years.

Pursuant to our 2008 Omnibus Award Plan, each non-employee director is credited with an annual grant of deferred stock units on the date established by the board for the payment of the annual retainer equal in number to the quotient of $130,000, or $230,000 in the case of the chairman of the board of directors, divided by the closing price of a share of our common stock on the date this amount is credited. Deferred stock units are fully vested when credited to a director’s account. When a dividend is paid on our common stock, each director’s account is credited with an amount equal to the cash dividend. When a director ceases to serve on our board, such director will receive a number of shares of common stock equal to the number of deferred stock units in such director’s account and a cash payment equal to the dividend payments accrued, plus interest on the dividend equivalents from the date such dividend equivalents were credited. The interest will be paid with respect to each twelve-month period beginning on November 1 of such period to the date of payment and will be equal to the rate for five-year U.S. Treasury Notes published in The Wall Street Journal® on the first business day of November of each such twelve-month period plus 0.50%. Non-employee directors do not have any voting rights with respect to their deferred stock units.

Non-employee directors no longer receive annual stock option grants. Prior to our 2010 Annual Meeting of Stockholders, upon initial election to the board of directors, a non-employee director received a grant of options to purchase 5,000 shares of common stock if such director attended a regularly scheduled board of directors meeting prior to the next Annual Meeting of Stockholders. Thereafter, a non-employee director received an annual grant of options to purchase 5,000 shares of common stock. All such options were granted under the 2008 Omnibus Award Plan, have a term of ten years, and were granted at the fair market value of the common stock as determined by the closing price of our common stock on the NASDAQ Global Select Market on the date of the grant.

Options granted to our non-employee directors under the 2008 Omnibus Award Plan are exercisable in four equal installments, with the first twenty-five percent becoming exercisable on the first anniversary of the option’s grant date, and the remaining three installments becoming exercisable on each successive anniversary date thereafter. The options vest only while a director is serving in such

| Automatic Data Processing, Inc. – Proxy Statement | | | 16 |

|

Compensation of Non-Employee Directors |

capacity, unless certain specified events occur, such as death or permanent disability, in which case the options immediately vest and become fully exercisable. In addition, non-employee directors who have been non-employee directors for at least ten years will have all of their options vested upon retirement from the board of directors and will have 36 months to exercise their options. Non-employee

directors who have served as non-employee directors for fewer than ten years at the time they retire or otherwise leave the board will not qualify for accelerated vesting, but will have 60 days to exercise their then-vested options. Notwithstanding the foregoing, all options will expire no more than ten years from their date of grant.

|

Our share ownership guidelines are intended to promote ownership in the company’s stock by our non-employee directors and to align their financial interests more closely with those of other stockholders of the company. Each non-employee director has a minimum shareholding requirement of our common stock equal to five times his or her annual cash retainer. |

The following table shows compensation for our non-employee directors for fiscal year 2014.

DIRECTOR COMPENSATION TABLE FOR FISCAL YEAR 2014

| Name | Fees Earned or Paid in Cash(7) ($) |

Stock Awards(8) ($) |

All

Other Compensation(9) ($) |

Total ($) | ||||||||||

| (a) | (b) | (c) | (g) | (h) | ||||||||||

| Ellen Alemany | $90,000 | $130,000 | $2,500 | $222,500 | ||||||||||

| Gregory D. Brenneman(1) | $100,000 | $130,000 | $0 | $230,000 | ||||||||||

| Leslie A. Brun(2) | $155,000 | $230,000 | $15,000 | $400,000 | ||||||||||

| Richard T. Clark | $90,000 | $130,000 | $20,000 | $240,000 | ||||||||||

| Eric C. Fast(3) | $105,000 | $130,000 | $15,000 | $250,000 | ||||||||||

| Linda R. Gooden | $90,000 | $130,000 | $10,000 | $230,000 | ||||||||||

| Michael P. Gregoire(4) | $75,000 | $108,333 | $0 | $183,333 | ||||||||||

| R. Glenn Hubbard | $90,000 | $130,000 | $35,000 | $255,000 | ||||||||||

| John P. Jones(5) | $100,000 | $130,000 | $0 | $230,000 | ||||||||||

| Enrique T. Salem(6) | $0 | $0 | $0 | $0 | ||||||||||

| Gregory L. Summe | $90,000 | $130,000 | $20,000 | $240,000 | ||||||||||

| Footnotes: | |

| (1) | As chairman of the compensation committee, Mr. Brenneman received a $10,000 annual retainer, which is included in fees earned. |

| (2) | Mr. Brun is the non-executive chairman of the board of directors. |

| (3) | As chairman of the audit committee, Mr. Fast received a $15,000 annual retainer, which is included in fees earned. |

| (4) | Mr. Gregoire became a director on January 23, 2014. |

| (5) | As chairman of the nominating/corporate governance committee, Mr. Jones received a $10,000 annual retainer, which is included in fees earned. |

| (6) | Mr. Salem resigned from the board of directors at the conclusion of his term ending at the 2013 Annual Meeting of Stockholders. |

| 17 | | | Automatic Data Processing, Inc. – Proxy Statement |

|

Compensation of Non-Employee Directors |

| (7) | Represents the following, whether received as cash, deferred or received as deferred stock units: (i) the elective portion of directors’ annual retainer, (ii) annual retainers for committee chairpersons and (iii) board and committee attendance fees. See footnote 8 below for additional information about deferred stock units held by directors. |

| (8) | Represents the portion of the annual retainer required to be credited in deferred stock units to a director’s annual retainer account. Amounts set forth in the Stock Awards column represent the aggregate grant date fair value for fiscal year 2014 as computed in accordance with FASB Accounting Standards Codification Topic 718 (“FASB ASC Topic 718”), disregarding estimates of forfeitures related to service-based vesting conditions. For additional information about the assumptions used in these calculations, see Note 11 to our audited consolidated financial statements for the fiscal year ended June 30, 2014 included in our annual report on Form 10-K for the fiscal year ended June 30, 2014. |

| The grant date fair value for each deferred stock unit award granted to directors in fiscal year 2014 (including in respect of elective deferrals of amounts otherwise payable in cash), calculated in accordance with FASB ASC Topic 718, is as follows: | |

| Director | Grant Date | Grant Date Fair Value | ||

| Ellen Alemany | 11/12/2013 | $220,000 | ||

| Gregory D. Brenneman | 11/12/2013 | $220,000 | ||

| Leslie A. Brun | 11/12/2013 | $370,000 | ||

| Richard T. Clark | 11/12/2013 | $220,000 | ||

| Eric C. Fast | 11/12/2013 | $235,000 | ||

| Linda R. Gooden | 11/12/2013 | $220,000 | ||

| Michael P. Gregoire | 1/23/2014 | $183,333 | ||

| R. Glenn Hubbard | 11/12/2013 | $220,000 | ||

| John P. Jones | 11/12/2013 | $230,000 | ||

| Gregory L. Summe | 11/12/2013 | $220,000 |

| The aggregate number of outstanding deferred stock units held by each director at June 30, 2014 is as follows: Ms. Alemany, 9,759; Mr. Brenneman, 27,534; Mr. Brun, 44,310; Mr. Clark, 11,117; Mr. Fast, 23,255; Ms. Gooden, 18,446; Mr. Gregoire, 2,311; Mr. Hubbard, 27,936; Mr. Jones, 27,402; Mr. Summe, 22,366. | |

| In fiscal year 2014, no stock option awards were granted. The aggregate number of outstanding stock options held by each director at June 30, 2014 is as follows: Mr. Brenneman, 4,750; Mr. Brun, 1,250; Ms. Gooden, 3,750; Mr. Jones, 31,461. | |

| (9) | Reflects contributions by the ADP Foundation that match the charitable gifts made by our directors. The ADP foundation makes matching charitable contributions in an amount not to exceed $20,000 in a calendar year in respect of any given director’s charitable contributions for that calendar year. Amounts in the Director Compensation Table may exceed $20,000 because, while matching charitable contributions are limited to the $20,000 in a calendar year, the Director Compensation Table reflects matching charitable contributions for the fiscal year ended June 30, 2014. |

| Automatic Data Processing, Inc. – Proxy Statement | | | 18 |

Security Ownership of Certain Beneficial Owners and Management

The following table contains information regarding the beneficial ownership of the company’s common stock by (i) each director and nominee for director of the company, (ii) each of our named executive officers included in the Summary Compensation Table below (we refer to such executive officers as “named executive officers”), (iii) all company directors and executive officers as a group (including the named executive officers) and (iv) all stockholders that are known to the company to be the

beneficial owners of more than 5% of the outstanding shares of the company’s common stock. Unless otherwise noted in the footnotes following the table, each person listed below has sole voting and investment power over the shares of common stock reflected in the table. Unless otherwise noted in the footnotes following the table, the information in the table is as of August 31, 2014 and the address of each person named is P.O. Box 34, Roseland, New Jersey, 07068.

| Name of Beneficial Owner | Amount and Nature

of Beneficial Ownership(1) |

Percent | |||

| Ellen Alemany | 9,759 | * | |||

| Steven J. Anenen(2) | 144,140 | * | |||

| Gregory D. Brenneman | 27,534 | * | |||

| Leslie A. Brun | 46,494 | * | |||

| Richard T. Clark | 11,117 | * | |||

| Eric C. Fast | 23,255 | * | |||

| Linda R. Gooden | 22,196 | * | |||

| Michael P. Gregoire | 2,311 | * | |||

| R. Glenn Hubbard | 28,936 | * | |||

| John P. Jones | 53,376 | * | |||

| Regina R. Lee | 182,784 | * | |||

| Dermot J. O’Brien | 20,124 | * | |||

| Carlos A. Rodriguez | 179,764 | * | |||

| Jan Siegmund | 102,613 | * | |||

| Gregory L. Summe | 22,366 | * | |||

| The Vanguard Group, Inc.(3) | 28,571,068 | 5.9% | |||

| Directors and executive officers as a group (27 persons, | |||||

| including those directors and executive officers named above) | 1,557,370 | * | |||

| Footnotes: | |

| * | Indicates less than one percent. |

| (1) | Includes: (i) 285,974 shares that may be acquired upon the exercise of stock options that are exercisable on or prior to October 31, 2014 held by the following directors and executive officers: 57,250 (Mr. Anenen), 3,750 (Ms. Gooden), 25,974 (Mr. Jones), 82,250 (Ms. Lee), 59,500 (Mr. Rodriguez), and 57,250 (Mr. Siegmund); and (ii) 689,922 shares subject to stock options held by the directors and executive officers as a group. Includes shares issuable upon settlement of deferred stock units held by non-employee directors as follows: 9,759 (Ms. Alemany), 27,534 (Mr. Brenneman), 44,494 (Mr. Brun), 11,117 (Mr. Clark), 23,255 (Mr. Fast), 18,446 (Ms. Gooden), 2,311 (Mr. Gregoire), 27,936 (Mr. Hubbard), 27,402 (Mr. Jones), and 22,366 (Mr. Summe). |

| (2) | Includes 16,946 shares that Mr. Anenen deferred upon exercise of stock options prior to 2002. |