adp_10k.htm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 10-K

| [X] |

|

ANNUAL REPORT PURSUANT TO

SECTION 13 OR 15(d) OF THE |

| |

|

SECURITIES EXCHANGE ACT OF

1934 |

| For the fiscal year ended June

30, 2010 |

| |

| |

|

OR |

| |

| [

] |

|

TRANSITION REPORT PURSUANT TO

SECTION 13 OR 15(d) OF THE |

| |

|

SECURITIES EXCHANGE ACT OF

1934 |

| Commission file number

1-5397 |

AUTOMATIC DATA PROCESSING,

INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

22-1467904 |

| (State or other jurisdiction

of incorporation or organization) |

(I.R.S. Employer

Identification No.) |

| |

| One ADP Boulevard, Roseland,

New Jersey |

07068 |

| (Address of principal

executive offices) |

(Zip

Code) |

Registrant’s

telephone number, including area code: 973-974-5000

| Securities registered pursuant

to Section 12(b) of the Act: |

|

| |

Name of each exchange

on |

| Title of each class |

which registered |

| |

| Common Stock, $.10 Par

Value |

NASDAQ Global Select

Market |

| (voting) |

Chicago Stock

Exchange |

Securities

registered pursuant to Section 12(g) of the Act: None

Indicate by

check mark if the Registrant is a well-known seasoned issuer, as defined in Rule

405 of the Securities Act. Yes [x] No [ ]

Indicate by

check mark if the Registrant is not required to file reports pursuant to Section

13 or 15(d) of the Act. Yes [ ] No [x]

Indicate by

check mark whether the Registrant (1) has filed all reports required to be filed

by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for such shorter period that the Registrant was required

to file such reports), and (2) has been subject to the filing requirements for

the past 90 days. Yes [x] No [ ]

Indicate by

check mark whether the registrant has submitted electronically and posted on its

corporate Web site, if any, every Interactive Data File required to be submitted

and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter)

during the preceding 12 months (or for such shorter period that the registrant

was required to submit and post such files). Yes [x] No [ ]

Indicate by

check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation

S-K (§229.405) is not contained herein and will not be contained, to the best of

Registrant’s knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this Form 10-K or any amendment to this

Form 10-K. [ ]

Indicate by

check mark whether the Registrant is a large accelerated filer, an accelerated

filer, a non-accelerated filer or a smaller reporting company. See the

definitions of “large accelerated filer,” “accelerated filer” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer

[x] |

Accelerated filer

[ ] |

Non-accelerated filer

[ ] |

Smaller reporting

company [ ] |

Indicate by

check mark whether the Registrant is a shell company (as defined in Rule 12b-2

of the Act). [ ] Yes [x] No

The

aggregate market value of the voting and non-voting common equity held by

non-affiliates of the Registrant as of the last business day of the Registrant’s

most recently completed second fiscal quarter was approximately $21,535,777,370.

On August 20, 2010 there

were 492,022,525 shares

of Common Stock outstanding.

DOCUMENTS

INCORPORATED BY REFERENCE

|

Portions

of the Registrant’s Proxy Statement for its 2010 Annual Meeting of

Stockholders.

|

Part III |

| |

| Table of

Contents |

| |

|

|

|

|

|

Page |

| Part I |

|

|

|

| Item 1. |

|

Business |

|

2 |

| Item

1A. |

|

Risk

Factors |

|

7 |

| Item 1B. |

|

Unresolved Staff

Comments |

|

9 |

| Item

2. |

|

Properties |

|

9 |

| Item

3. |

|

Legal

Proceedings |

|

9 |

| Part

II |

|

|

|

| Item

5. |

|

Market for

the Registrant’s Common Equity, Related Stockholder Matters and Issuer

Purchases of Equity Securities |

|

10 |

| Item

6. |

|

Selected

Financial Data |

|

13 |

| Item

7. |

|

Management’s

Discussion and Analysis of Financial Condition and Results of

Operations |

|

14 |

| Item

7A. |

|

Quantitative

and Qualitative Disclosures About Market Risk |

|

35 |

| Item

8. |

|

Financial

Statements and Supplementary Data |

|

35 |

| Item

9. |

|

Changes in

and Disagreements with Accountants on Accounting and Financial

Disclosure |

|

69 |

| Item

9A. |

|

Controls and

Procedures |

|

69 |

| Item

9B. |

|

Other

Information |

|

71 |

| Part

III |

|

|

|

| Item

10. |

|

Directors,

Executive Officers and Corporate Governance |

|

72 |

| Item

11. |

|

Executive

Compensation |

|

74 |

| Item

12. |

|

Security

Ownership of Certain Beneficial Owners and Management and

Related |

|

|

|

|

|

Stockholder

Matters |

|

74 |

| Item

13. |

|

Certain

Relationships and Related Transactions, and Director

Independence |

|

74 |

| Item

14. |

|

Principal

Accounting Fees and Services |

|

74 |

| Part

IV |

|

|

|

| Item

15. |

|

Exhibits,

Financial Statement Schedules |

|

75 |

| Signatures |

|

|

81 |

Part I

Item 1. Business

Automatic Data Processing, Inc.,

incorporated in Delaware in 1961 (together with its subsidiaries, “ADP” or the

“Company”), is one of the world’s largest providers of business outsourcing

solutions. Leveraging 60 years of experience, ADP® offers a wide range of

human resource (HR), payroll, tax and benefits administration solutions from a

single source. ADP is also a leading provider of integrated computing solutions

to automotive, truck, motorcycle, marine, recreational vehicle and heavy

machinery dealers throughout the world. For financial information by segment and

by geographic area, see Note 18 of the “Notes to Consolidated Financial

Statements” contained in this Annual Report on Form 10-K. The Company’s Annual Reports on Form

10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, all

amendments to those reports, and the Proxy Statement for its Annual Meeting of

Stockholders are made available, free of charge, on its website at www.adp.com

as soon as reasonably practicable after such reports have been filed with or

furnished to the Securities and Exchange Commission. The following summary describes

ADP’s activities.

Employer

Services

Employer Services offers a

comprehensive range of HR information, payroll processing, tax and benefits

administration solutions and services, including traditional and Web-based

outsourcing solutions, that assist employers in the United States, Canada,

Europe, South America (primarily Brazil), Australia and Asia to staff, manage,

pay and retain their employees. As of June 30, 2010, Employer Services assisted

approximately 520,000 employers with approximately 614,000 payrolls. Employer

Services markets these solutions and services through its direct marketing

salesforce and, on a limited basis, through indirect sales channels, such as

marketing relationships with banks and accountants, among others. In fiscal

2010, 80% of Employer Services’ revenues were from the United States, 13% were

from Europe, 5% were from Canada and 2% were from South America (primarily

Brazil), Australia and Asia.

United States

Employer Services’ approach to the

market is to match clients’ needs to the solutions and services that will best

meet their expectations. To facilitate this approach, in the United States,

Employer Services is comprised of the following market-facing groups: Small

Business Services (SBS) (serving primarily organizations with fewer than 50

employees); Major Account Services (serving primarily organizations with between

50 and 999 employees); and National Account Services (serving primarily

organizations with 1,000 or more employees). In addition, Employer Services’

Added Value Services division provides services to clients across all three of

these groups.

ADP provides payroll services that

include the preparation of client employee paychecks, electronic direct deposits

and stored value payroll cards, along with employee pay statements, supporting

journals, summaries and management reports. ADP also supplies the quarterly and

annual social security, medicare and federal, state and local income tax

withholding reports required to be filed by employers. ADP enables its largest

clients to interface their major enterprise resource planning (ERP) applications

with ADP’s outsourced payroll services. For those companies that choose to

process payroll in-house, ADP delivers stand-alone services such as payroll tax

filing, check printing and distribution, year-end tax statements (i.e., Form W-2), wage garnishment

services, health and welfare administration and flexible spending account (FSA)

administration.

In order to address the growing

business process outsourcing (BPO) market for clients seeking human resource

information systems and benefit outsourcing solutions, ADP offers its integrated

comprehensive outsourcing services (COS) solution that allows larger clients to

outsource to ADP HR, payroll, payroll administration, employee service center,

benefits administration, and time and labor management functions. For mid-sized

clients, ADP Workforce Now™ Comprehensive Services provides integrated tools and

technology to support payroll, a full-featured benefits administration solution,

HR guidance and HR administration needs from recruitment to retirement. ADP also

offers ADP Resource®, an integrated,

flexible HR and payroll service offering for smaller clients that provides a

menu of optional services, such as 401(k), FSA and a comprehensive

Pay-by-Pay®

workers’ compensation payment program.

2

ADP’s Added Value Services division

includes the following businesses: Tax and Financial Services, Insurance

Services and Tax Credit Services. These businesses primarily support SBS, Major

Account Services and/or National Account Services, and their services are sold

through those businesses, as well as by dedicated sales teams and via marketing

arrangements with alliance partners.

- Tax and Financial

Services processes and collects federal, state and local payroll taxes on

behalf of, and from, ADP clients and remits these taxes to the appropriate

taxing authorities. This business provides an electronic interface between ADP

clients and over 7,600 federal, state and local tax agencies in the United

States, from the Internal Revenue Service to local governments. In fiscal

2010, Tax and Financial Services in the United States processed and delivered

approximately 47 million employee year-end tax statements and over 38 million

employer payroll tax returns and deposits, and moved $1.1 trillion in client

funds to taxing authorities and its clients’ employees via electronic

transfer, direct deposit and ADPCheck™. Tax and Financial Services is also

responsible for the efficient movement of information and funds from clients

to third parties through service offerings such as new hire reporting,

TotalPay®

payroll check (ADPCheck™), full service direct deposit (FSDD), stored value

payroll card (TotalPay® Card), wage

verification services, unemployment claims processing, wage garnishment

processing, sales and use tax services and its new ADP Procure-to-Pay

SolutionsSM,

which automates the P2P supply chain and streamlines order, receipt, invoice

and payment processes.

- Insurance Services

provides a comprehensive Pay-by-Pay workers’ compensation payment program and,

through Automatic Data Processing Insurance Agency, Inc., offers workers

compensation and group health insurance to small and mid-sized

clients.

- Tax Credit Services

provides job tax credit services that assist employers in the identification

of, and filing for, federal, state and local tax credits and other incentives

based on geography, demographics and other criteria, and includes negotiation

of incentive packages with applicable governmental agencies.

Employer Services also provides the

following solutions and services:

- Retirement Services

provides recordkeeping and/or related administrative services with respect to

various types of retirement (primarily 401(k) and SIMPLE IRA) plans, deferred

compensation plans and “premium only” cafeteria plans.

- Pre-Employment Services

includes Screening and Selection Services and Applicant Management Services.

Screening and Selection Services provides background checks, reference

verifications and an HR help desk. Applicant Management Services provides

employers with a web-based solution to manage their talent throughout their

lifecycle.

- ADP’s Benefit Services

provides benefits administration across all market segments, including

management of open enrollment and ongoing enrollment of benefits, and leave of

absence, COBRA and FSA administration.

- ADP’s Time and Labor

Management Services provides solutions for employers to capture, calculate and

report employee time and attendance.

- ADP’s Talent Management

solutions include Performance Management, Compensation Management and Learning

Management.

3

In fiscal 2010, ADP made several

acquisitions to help expand its client base and reach into adjacent markets,

including: DO2 Technologies Inc., a leading provider of electronic-invoicing

solutions; OneClick HR plc, a UK provider of human resources solutions offering

HR software, training services and outsourced HR solutions; and HRinterax, Inc.,

an HR content and support services company focused on the small business market.

In August 2010, ADP acquired Workscape, Inc., a leading provider of integrated

benefits and compensation solutions and services.

International

Employer Services has a growing

presence outside of the United States, where it offers solutions on the basis of

both geographic and specific client business needs. ADP offers in-country “best

of breed” payroll and human resource outsourcing solutions to both small and

large clients in over a dozen foreign countries. In each of Canada and Europe,

ADP is the leading provider of payroll processing (including full departmental

outsourcing) and human resource administration services. Within Europe, Employer

Services has business operations supporting its in-country solutions in eight

countries: France, Germany, Italy, the Netherlands, Poland, Spain, Switzerland

and the United Kingdom. It also offers services in Ireland (from the United

Kingdom) and in Portugal (from Spain). In South America (primarily Brazil),

Australia and Asia (primarily China), ADP provides traditional service bureau

payroll and also offers full departmental outsourcing of payroll services. ADP

also offers wage and tax collection and remittance services in Canada, the

United Kingdom and the Netherlands.

In fiscal 2010, ADP continued to

expand its GlobalView® offering, making it

available in 41 countries. GlobalView is built on the SAP® ERP Human Capital

Management and the SAP NetWeaver® platform and offers

multinational and global companies an end-to-end outsourcing solution enabling

standardized payroll processing and human resource administration. As of the end

of fiscal 2010, 96 clients had contracted for GlobalView services, with

approximately 714,000 employees being processed. Upon completing the

implementation for all these clients, ADP expects to be providing GlobalView

services to nearly 1.3 million employees in 41 countries. Further, through its

ADP Streamline®

offering, ADP also provides a single point of contact for payroll processing and

human resource administration services for multinational companies with small

and mid-sized operations in 63 countries. At the end of fiscal 2010, ADP

Streamline was used by 330 multinational companies with

approximately 52,000 employees being processed.

Professional Employer Organization

Services

In the United States, ADP’s

TotalSource®, the

Company’s professional employer organization (PEO) business, provides

approximately 5,600 clients with comprehensive

employment administration outsourcing solutions through a co-employment

relationship, including payroll, payroll tax filing, HR guidance, 401(k) plan

administration, benefits administration, compliance services, health and

workers’ compensation coverage and other supplemental benefits for employees.

ADP’s TotalSource is the largest PEO in the United States based on the number of

paid worksite employees. ADP’s TotalSource has 47 offices located in 22 states

and serves approximately 211,000 worksite employees in all 50

states.

4

Dealer Services

Dealer Services provides integrated

dealer management systems (such a system is also known in the industry as a

“DMS”) and other business management solutions to automotive, truck, motorcycle,

marine, recreational vehicle (RV) and heavy machinery retailers in North

America, Europe, Africa and the Asia Pacific region. Approximately 25,000

automotive, truck, motorcycle, marine, RV and heavy machinery retailers in over

90 countries use ADP’s DMS products, other software applications, networking

solutions, data integration, consulting and/or digital marketing services.

Clients use ADP’s DMS solutions to

manage core business activities such as accounting, inventory management,

factory communications, appointment scheduling, vehicle financing and insurance,

sales and service. In addition to its DMS solutions, Dealer Services offers its

clients a full suite of additional integrated applications to address each

department and functional area of the dealership, including Customer

Relationship Management (CRM) applications, front-end sales and

marketing/advertising solutions, and an IP Telephony phone system

fully-integrated into the DMS to help dealerships drive sales processes and

business development initiatives. Dealer Services also provides its dealership

clients computer hardware, hardware maintenance services, software support,

system design and network consulting services.

Dealer Services also designs,

establishes and maintains communications networks for its dealership clients

that allow interactive communications among multiple site locations as well as

links between franchised dealers and their vehicle manufacturer franchisors.

These networks are used for activities such as new vehicle ordering and status

inquiry, warranty submission and validation, parts and vehicle locating,

dealership customer credit application submission and decision-making, vehicle

repair estimation and acquisition of vehicle registration and lien holder

information.

All of Dealer Services’ solutions

are supported by comprehensive training offerings and business process

consulting services. ADP’s DMS and other software solutions are available as

“on-site” applications installed at the dealership or as application service

provider (ASP) managed services solutions (in which clients outsource their

information technology management activities to Dealer Services).

In August 2010, ADP acquired Cobalt,

a leading provider of digital marketing solutions for the automotive industry,

for approximately $400 million.

Markets and Marketing Methods

Employer Services offers services in

the United States, Canada, Europe, South America (primarily Brazil), Australia

and Asia. PEO Services are offered exclusively in the United States. Dealer

Services has offerings in North America, Europe, Africa and the Asia Pacific

region. In select emerging markets, Dealer Services uses distributors to sell,

implement and support ADP’s solutions.

None of ADP’s major business groups

has a single homogenous client base or market. Employer Services and PEO

Services have clients from a large variety of industries and markets. Within

this client base are concentrations of clients in specific industries. Dealer

Services primarily serves automobile dealers, which in turn may be dependent on

a relatively small number of automobile manufacturers, but also serves truck,

powersports (i.e., motorcycle, marine and

recreational) and heavy machinery dealers, auto repair shops, used car lots,

state departments of motor vehicles and manufacturers of automobiles and trucks.

Employer Services also sells to automobile dealers. While concentrations of

clients exist, no one client or industry group is material to ADP’s overall

revenues.

5

Historically ADP’s businesses have

not been overly sensitive to price changes, although in the current economic

conditions we have observed, among some clients and groups of clients, an impact

on sensitivity to pricing and demand for ADP’s services. Employer Services’

revenues were flat in fiscal 2010. In the United States, revenues from our

traditional payroll and payroll tax filing business declined 4% for the full

year and beyond payroll revenues grew 6% for the full year. Dealer Services’

revenues decreased 3% in fiscal 2010 due to dealership consolidations and

closings, lower transactional revenue and dealerships reducing services in order

to cut their discretionary expenses. PEO Services’ revenues grew 11% in fiscal

2010 due to a 5% increase in the average number of worksite employees, as well

as an increase in benefits costs and state uninsurance rates.

ADP enjoys a leadership position in

each of its major service offerings and does not believe any major service or

business unit in ADP is subject to unique market risk.

Competition

The industries in which ADP operates

are highly competitive. ADP knows of no reliable statistics by which it can

determine the number of its competitors, but it believes that it is one of the

largest providers of business outsourcing solutions in the world. Employer

Services and PEO Services compete with other independent business outsourcing

companies, companies providing enterprise resource planning services, software

companies and financial institutions. Captive in-house functions, whereby a

company installs and operates its own business processing systems, are another

competitive factor in the industries in which Employer Services and PEO Services

operate. Dealer Services’ competitors include full service DMS providers such as

The Reynolds & Reynolds Company, Dealer Services’ largest DMS competitor in

the United States and Canada, and companies providing applications and services

that compete with Dealer Services’ non-DMS applications and services.

Competition in ADP’s industries is

primarily based on service responsiveness, product quality and price. ADP

believes that it is very competitive in each of these areas and that there are

no material negative factors impacting ADP’s competitive position.

Clients and Client

Contracts

ADP provides its services to about

550,000 clients. In fiscal 2010, no single client or group of affiliated clients

accounted for revenues in excess of 2% of annual consolidated revenues.

Our business is typically

characterized by long-term client relationships that result in recurring

revenue. ADP is continuously in the process of performing implementation

services for new clients. Depending on the service agreement and/or the size of

the client, the installation or conversion period for new clients could vary

from a short period of time (as little as 24 hours) for an SBS client to a

longer period (generally six to twelve months) for a National Account Services

or Dealer Services client with multiple deliverables, and in some cases may

exceed two years for a large GlobalView client or other large, complicated

implementation. Although we monitor sales that have not yet been billed or

installed, we do not view this metric as material in light of the recurring

nature of our business. This is not a reported number, but it is used by

management as a planning tool relating to resources needed to install services,

and a means of assessing our performance against the installation timing

expectations of our clients.

ADP’s average client retention is

estimated at just under 10 years in Employer Services, approximately 5 years in

PEO Services and 10 or more years in Dealer Services, and has not varied

significantly from period to period.

6

ADP’s services are provided under

written price quotations or service agreements having varying terms and

conditions. No one price quotation or service agreement is material to ADP.

Systems Development and Programming

During the fiscal years ended June

30, 2010, 2009 and 2008, ADP invested $614 million, $588 million and $611

million, respectively, from continuing operations, in systems development and

programming, migration to new computing technologies and the development of new

products and maintenance of our existing technologies, including purchases of

new software and software licenses.

Product Development

ADP continually upgrades, enhances

and expands its existing solutions and services. Generally, no new solution or

service has a significant effect on ADP’s revenues or negatively impacts its

existing solutions and services, and ADP’s solutions and services have

significant remaining life cycles.

Licenses

ADP is the licensee under a number

of agreements for computer programs and databases. ADP’s business is not

dependent upon a single license or group of licenses. Third-party licenses,

patents, trademarks and franchises are not material to ADP’s business as a

whole.

Number of Employees

ADP employed approximately

47,000 persons as of June 30, 2010.

Item 1A. Risk Factors

Our businesses routinely encounter

and address risks, some of which may cause our future results to be different

than we currently anticipate. Risk factors described below represent our current

view of some of the most important risks facing our businesses and are important

to understanding our business. The following information should be read in

conjunction with Management’s Discussion and Analysis of Financial Condition and

Results of Operations, Quantitative and Qualitative Disclosures About Market

Risk and the consolidated financial statements and related notes included in

this Annual Report on Form 10-K. This discussion includes a number of

forward-looking statements. You should refer to the description of the

qualifications and limitations on forward-looking statements in the first

paragraph under Management’s Discussion and Analysis of Financial Condition and

Results of Operations included in this Annual Report on Form 10-K. Unless

otherwise indicated or the context otherwise requires, reference in this section

to “we,” “ours,” “us” or similar terms means ADP, together with its

subsidiaries. The level of importance of each of the following risks may vary

from time to time, and any of these risks may have a material effect on our

business.

Changes in laws and regulations may

decrease our revenues and earnings

Portions of ADP’s business are

subject to governmental regulations. Changes in governmental regulations may

decrease our revenues and earnings and may require us to change the manner in

which we conduct some aspects of our business. For example, a change in

regulations either decreasing the amount of taxes to be withheld or allowing

less time to remit taxes to government authorities would adversely impact

interest income from investing client funds before such funds are remitted to

the applicable taxing authorities or client employees. In addition, changes in

taxation requirements in the United States or in other countries could adversely

affect our effective tax rate and our net income.

7

Security and privacy breaches may

hurt our business

We store electronically personal

information about our clients and employees of our clients. In addition, our

retirement services systems maintain investor account information for retirement

plans. There is no guarantee that the systems and procedures that we maintain to

protect against unauthorized access to such information are adequate to protect

against all security breaches. Any significant violations of data privacy could

result in the loss of business, litigation and regulatory investigations and

penalties that could damage our reputation, and the growth of our business could

be adversely affected.

Our systems may be subject to

disruptions that could adversely affect our business and

reputation

Many of our businesses are highly

dependent on our ability to process, on a daily basis, a large number of

complicated transactions. We rely heavily on our payroll, financial, accounting

and other data processing systems. If any of these systems fail to operate

properly or become disabled even for a brief period of time, we could suffer

financial loss, a disruption of our businesses, liability to clients, regulatory

intervention or damage to our reputation. We have disaster recovery plans in

place to protect our businesses against natural disasters, security breaches,

military or terrorist actions, power or communication failures or similar

events. Despite our preparations, our disaster recovery plans may not be

successful in preventing the loss of client data, service interruptions,

disruptions to our operations, or damage to our important facilities.

If we fail to adapt our technology

to meet client needs and preferences, the demand for our services may

diminish

Our businesses operate in industries

that are subject to rapid technological advances and changing client needs and

preferences. In order to remain competitive and responsive to client demands, we

continually upgrade, enhance and expand our existing solutions and services. If

we fail to respond successfully to technology challenges, the demand for our

services may diminish.

Political and economic factors may

adversely affect our business and financial results

Trade, monetary and fiscal policies,

and political and economic conditions may substantially change, and credit

markets may experience periods of constriction and volatility. When there is a

slowdown in the economy, employment levels and interest rates may decrease with

a corresponding impact on our businesses. Clients may react to worsening

conditions by reducing their spending on payroll and other outsourcing services

or renegotiating their contracts with us. In addition, the availability of

financing, even to borrowers with the highest credit ratings, may limit our

access to short-term debt markets to meet liquidity needs required by our

Employer Services business.

We invest our client funds in

liquid, investment-grade marketable securities, money market securities and

other cash equivalents. Nevertheless, our client fund assets are subject to

general market, interest rate, credit and liquidity risks, which individually or

in unison may be exacerbated during periods of unusual financial market

volatility.

We are dependent upon various large

banks to execute Automated Clearing House and wire transfers as part of our

client payroll and tax services. While we have contingency plans in place for

bank failures, a systemic shut-down of the banking industry would impede our

ability to process funds on behalf of our payroll and tax services clients and

could have an adverse impact on our financial results and liquidity.

We derive a significant portion of

our revenues and operating income from affiliates operating in non-U.S. dollar

currency environments and, as a result, we are exposed to market risk from

changes in foreign currency exchange rates that could impact our consolidated

results of operations, financial position or cash flows.

8

Change in our credit ratings could

adversely impact our operations and lower our profitability

The major credit rating agencies

periodically evaluate our creditworthiness and have consistently given us their

highest long-term debt and commercial paper ratings. Failure to maintain high

credit ratings on long-term and short-term debt could increase our cost of

borrowing, reduce our ability to obtain intra-day borrowing required by our

Employer Services business, and ultimately reduce our client interest revenue.

We may be unable to attract and

retain qualified personnel

Our ability to grow and provide our

clients with competitive services is partially dependent on our ability to

attract and retain highly motivated people with the skills to serve our clients.

Competition for skilled employees in the outsourcing and other markets in which

we operate is intense and if we are unable to attract and retain highly skilled

and motivated personnel, results from our operations may suffer.

Item 1B. Unresolved Staff

Comments

None.

Item 2.

Properties

ADP owns 41 of its processing/print

centers, other operational offices, sales offices and its corporate headquarters

complex in Roseland, New Jersey, which aggregate approximately 3,913,066 square

feet. None of ADP’s owned facilities is subject to any material encumbrances.

ADP leases space for some of its processing centers, other operational offices

and sales offices. All of these leases, which aggregate approximately 5,657,832

square feet in North America, Europe, South America (primarily Brazil), Asia,

Australia and South Africa, expire at various times up to the year 2036. ADP

believes its facilities are currently adequate for their intended purposes and

are adequately maintained.

Item 3. Legal

Proceedings

In the normal course of business,

the Company is subject to various claims and litigation. While the outcome of

any litigation is inherently unpredictable, the Company believes it has valid

defenses with respect to the legal matters pending against it and the Company

believes that the ultimate resolution of these matters will not have a material

adverse impact on its financial condition, results of operations or cash flows.

9

Part II

Item 5. Market for the Registrant’s

Common Equity, Related Stockholder Matters and Issuer Purchases of Equity

Securities

Market for the Registrant’s Common

Equity

The principal market for the

Company’s common stock (symbol: ADP) is the NASDAQ Global Select Market. The

following table sets forth the reported high and low sales prices of the

Company’s common stock reported on the NASDAQ Global Select Market and the cash

dividends per share of common stock declared, during the past two fiscal years.

As of June 30, 2010, there were 43,305 holders of record of the Company’s common

stock. As of such date, 365,199 additional holders held their common

stock in “street name.”

|

|

|

Price Per Share |

|

Dividends |

|

|

|

High |

|

Low |

|

Per

Share |

| Fiscal 2010 quarter

ended: |

|

|

|

|

|

|

|

|

|

|

| |

| June 30 |

|

$ |

45.74 |

|

$ |

39.27 |

* |

|

$ |

0.340 |

| March 31 |

|

$ |

45.22 |

|

$ |

39.72 |

|

|

$ |

0.340 |

| December 31 |

|

$ |

44.50 |

|

$ |

38.51 |

|

|

$ |

0.340 |

| September 30 |

|

$ |

40.44 |

|

$ |

33.26 |

|

|

$ |

0.330 |

| |

| Fiscal 2009 quarter

ended: |

|

|

|

|

|

|

|

|

|

|

| |

| June 30 |

|

$ |

39.08 |

|

$ |

34.08 |

|

|

$ |

0.330 |

| March 31 |

|

$ |

40.99 |

|

$ |

32.03 |

|

|

$ |

0.330 |

| December 31 |

|

$ |

42.93 |

|

$ |

30.83 |

|

|

$ |

0.330 |

| September 30 |

|

$ |

45.97 |

|

$ |

40.26 |

|

|

$ |

0.290 |

* Excludes

trading on May 6, 2010, during which a low sales price of $26.46 was

reported.

10

Issuer Purchases of Equity

Securities

| |

(a) |

(b) |

(c) |

(d) |

| |

|

|

Total

Number |

Maximum |

| |

|

|

of

Shares |

Number of

Shares |

| |

|

|

Purchased as

Part |

that may yet

be |

| |

|

|

of the

Publicly |

Purchased

under |

| |

|

|

Announced |

the

Common |

| |

Total Number

of |

Average

Price |

Common

Stock |

Stock

Repurchase |

| Period |

Shares Purchased (1) |

Paid

per Share |

Repurchase Plan (2) |

Plan

(2) |

| April

1, 2010 to |

|

|

|

|

| April

30, 2010 |

500,190 |

$44.00 |

500,000 |

39,981,759 |

| May

1, 2010 to |

|

|

|

|

| May

31, 2010 |

7,681,344 |

$41.70 |

7,681,344 |

32,300,415 |

| June

1, 2010 to |

|

|

|

|

| June

30, 2010 |

3,516,364 |

$41.20 |

3,516,364 |

28,784,051 |

| Total |

11,697,898 |

|

11,697,708 |

|

| (1) |

|

Pursuant to the terms of the Company’s restricted stock program,

the Company purchased 190 shares during April 2010 at the then market

value of the shares in connection with the exercise by employees of their

option under such program to satisfy certain tax withholding requirements

through the delivery of shares to the Company instead of

cash. |

|

|

|

|

| (2) |

|

The Company received the Board of Directors’ approval to repurchase

shares of the Company’s common stock as

follows: |

| Date of

Approval |

|

Shares |

| March 2001 |

50 million |

| November 2002 |

35 million |

| November 2005 |

50 million |

| August 2006 |

50 million |

| August 2008 |

50

million |

There is no expiration date for the

common stock repurchase plan.

11

Performance

Graph

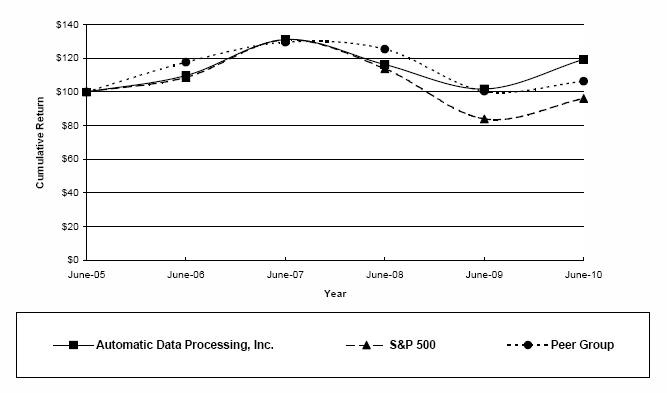

The following graph compares the

cumulative return on the Company’s common stock(a) for the most recent five years with

the cumulative return on the S&P 500 Index and a Peer Group Index(b), assuming an initial investment of

$100 on June 30, 2005, with all dividends reinvested.

|

(a)

|

|

On March 30, 2007, the Company completed the spin-off of

its former Brokerage Services Group business, comprised of Brokerage

Services and Securities Clearing and Outsourcing Services, into an

independent publicly traded company called Broadridge Financial Solutions,

Inc. The cumulative returns of the Company’s common stock have been

adjusted to reflect the spin-off.

|

| |

|

|

|

(b)

|

|

The Peer Group Index is comprised

of the following companies: |

| |

Administaff, Inc. |

Paychex, Inc. |

|

|

Computer Sciences

Corporation |

The Ultimate Software Group,

Inc. |

|

|

Global Payments Inc. |

Total System Services,

Inc. |

|

|

Hewitt Associates,

Inc. |

The Western Union

Company |

|

|

Intuit Inc. |

|

12

Item 6. Selected Financial

Data

The following

selected financial data is derived from our consolidated financial statements

and should be read in conjunction with the consolidated financial statements and

related notes, Management’s Discussion and Analysis of Financial Condition and

Results of Operations, and Quantitative and Qualitative Disclosures About Market

Risk included in this Annual Report on Form 10-K.

| (Dollars and shares in

millions, except per share amounts) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Years ended

June 30, |

|

2010 |

|

2009 |

|

2008 |

|

2007 |

|

2006 |

| Total revenues |

|

$ |

8,927.7 |

|

|

$ |

8,838.4 |

|

|

$ |

8,733.7 |

|

|

$ |

7,769.8 |

|

|

$ |

6,821.3 |

|

| Total costs of

revenues |

|

$ |

5,029.7 |

|

|

$ |

4,822.7 |

|

|

$ |

4,657.2 |

|

|

$ |

4,067.6 |

|

|

$ |

3,594.1 |

|

| Gross profit |

|

$ |

3,898.0 |

|

|

$ |

4,015.7 |

|

|

$ |

4,076.5 |

|

|

$ |

3,702.2 |

|

|

$ |

3,227.2 |

|

| Earnings from continuing

operations before income taxes |

|

$ |

1,863.2 |

|

|

$ |

1,900.1 |

|

|

$ |

1,803.4 |

|

|

$ |

1,622.7 |

|

|

$ |

1,361.6 |

|

| Net

earnings from continuing operations |

|

$ |

1,207.3 |

|

|

$ |

1,325.1 |

|

|

$ |

1,155.7 |

|

|

$ |

1,020.7 |

|

|

$ |

842.2 |

|

| Basic earnings per share from

continuing operations |

|

$ |

2.41 |

|

|

$ |

2.63 |

|

|

$ |

2.22 |

|

|

$ |

1.86 |

|

|

$ |

1.47 |

|

| Diluted earnings per share

from continuing operations |

|

$ |

2.40 |

|

|

$ |

2.62 |

|

|

$ |

2.19 |

|

|

$ |

1.83 |

|

|

$ |

1.45 |

|

| Basic weighted average shares

outstanding |

|

|

500.5 |

|

|

|

503.2 |

|

|

|

521.5 |

|

|

|

549.7 |

|

|

|

574.8 |

|

| Diluted weighted average

shares outstanding |

|

|

503.7 |

|

|

|

505.8 |

|

|

|

527.2 |

|

|

|

557.9 |

|

|

|

580.3 |

|

| Cash dividends declared per

share |

|

$ |

1.3500 |

|

|

$ |

1.2800 |

|

|

$ |

1.1000 |

|

|

$ |

0.8750 |

|

|

$ |

0.7100 |

|

| Return

on equity from continuing operations (Note 1) |

|

|

22.4 |

% |

|

|

25.5 |

% |

|

|

22.6 |

% |

|

|

18.3 |

% |

|

|

14.3 |

% |

| At year end: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash, cash equivalents and

marketable securities |

|

$ |

1,775.5 |

|

|

$ |

2,388.5 |

|

|

$ |

1,660.3 |

|

|

$ |

1,884.6 |

|

|

$ |

2,461.3 |

|

| Total assets |

|

$ |

26,862.2 |

|

|

$ |

25,351.7 |

|

|

$ |

23,734.4 |

|

|

$ |

26,648.9 |

|

|

$ |

27,490.1 |

|

| Obligation under commercial

paper borrowing |

|

$ |

- |

|

|

$ |

730.0 |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

| Long-term debt |

|

$ |

39.8 |

|

|

$ |

42.7 |

|

|

$ |

52.1 |

|

|

$ |

43.5 |

|

|

$ |

74.3 |

|

| Stockholders’ equity |

|

$ |

5,478.9 |

|

|

$ |

5,322.6 |

|

|

$ |

5,087.2 |

|

|

$ |

5,147.9 |

|

|

$ |

6,011.6 |

|

Note 1. Return

on equity from continuing operations has been calculated as net earnings from

continuing operations divided by average total stockholders’

equity.

13

Item 7. Management’s

Discussion and Analysis of Financial Condition and Results of

Operations

FORWARD-LOOKING

STATEMENTS

This report and other written or oral statements made from time to time

by ADP may contain “forward-looking statements” within the meaning of the

Private Securities Litigation Reform Act of 1995. Statements that are not

historical in nature, and which may be identified by the use of words like

“expects,” “assumes,” “projects,” “anticipates,” “estimates,” “we believe,”

“could be” and other words of similar meaning, are forward-looking statements.

These statements are based on management’s expectations and assumptions and are

subject to risks and uncertainties that may cause actual results to differ

materially from those expressed. Factors that could cause actual results to

differ materially from those contemplated by the forward-looking statements

include: ADP’s success in obtaining, retaining and selling additional services

to clients; the pricing of services and products; changes in laws regulating

payroll taxes, professional employer organizations and employee benefits;

overall market and economic conditions, including interest rate and foreign

currency trends; competitive conditions; auto sales and related industry

changes; employment and wage levels; changes in technology; availability of

skilled technical associates and the impact of new acquisitions and

divestitures. ADP disclaims any obligation to update any forward-looking

statements, whether as a result of new information, future events or otherwise.

These risks and uncertainties, along with the risk factors discussed above under

“Item 1A. Risk Factors,” should be considered in evaluating any forward-looking

statements contained herein.

DESCRIPTION OF THE COMPANY AND

BUSINESS SEGMENTS

ADP is one of the world’s largest providers of business outsourcing

solutions. Leveraging over 60 years of experience, ADP offers a wide range of

human resource (“HR”), payroll, tax and benefits administration solutions from a

single source. ADP is also a leading provider of integrated computing solutions

to automotive, truck, motorcycle, marine, recreational vehicle (“RV”) and heavy

machinery dealers in North America, Europe, South Africa and the Asia Pacific

region. The Company’s reportable segments are: Employer Services, PEO Services

and Dealer Services. A brief description of each segment’s operations is

provided below.

Employer

Services

Employer Services offers a comprehensive range of HR information, payroll

processing, tax and benefits administration solutions and services, including

traditional and Web-based outsourcing solutions, that assist employers in the

United States, Canada, Europe, South America (primarily Brazil), Australia and

Asia to staff, manage, pay and retain their employees. As of June 30, 2010,

Employer Services assisted approximately 520,000 employers with approximately

614,000 payrolls. From time to time, we reevaluate our employer count based upon

updated information that helps us associate individual employer accounts with

one another. As such, on a comparable basis, as of June 30, 2009, Employer

Services assisted approximately 520,000 employers with approximately 619,000

payrolls. Employer Services categorizes its services as payroll and payroll tax,

and “beyond payroll.” The payroll and payroll tax business represents the

Company’s core payroll processing and payroll tax filing business. The “beyond

payroll” business represents services such as time and labor management,

benefits administration, retirement recordkeeping and administration, and HR

administration services. Within Employer Services, the Company collects client

funds and remits such funds to tax authorities for payroll tax filing and

payment services, and to employees of payroll services clients.

PEO Services

PEO Services provides approximately

5,600 small and medium sized businesses with comprehensive employment

administration outsourcing solutions through a co-employment relationship,

including payroll, payroll tax filing, HR guidance, 401(k) plan administration,

benefits administration, compliance services, health and workers’ compensation

coverage and other supplemental benefits for employees.

Dealer

Services

Dealer Services provides integrated dealer management systems (such a

system is also known in the industry as a “DMS”) and other business management

solutions to automotive, truck, motorcycle, marine, RV and heavy machinery

retailers in North America, Europe, South Africa and the Asia Pacific region.

Approximately 25,000 automotive, truck, motorcycle, marine, RV and heavy

machinery retailers in over 90 countries use our DMS products, other software

applications, networking solutions, data integration, consulting and/or digital

marketing services. From time to time, we reevaluate our client count based upon

updated information that helps us associate individual client accounts with one

another. As such, on a comparable basis, as of June 30, 2009, Dealer Services

provided DMS products to 26,000 retailers in over 90 countries.

14

EXECUTIVE

OVERVIEW

During the

fiscal year ended June 30, 2010 (“fiscal 2010”), we maintained focus on the

execution of our five-point strategic growth program, which consists of:

- Strengthening the core

business;

- Growing our

differentiated HR Business Process Outsourcing (“BPO”)

offerings;

- Focusing on

international expansion;

- Entering adjacent

markets that leverage the core; and

- Expanding pretax

margins.

ADP’s fiscal

2010 was a challenging year and our results continued to be impacted by the

economic downturn, including high unemployment levels, record-low interest rates

and volatile financial markets. However, as we look back over fiscal 2010, we

were pleased that ADP’s financial results were better than we initially

anticipated. The economy showed signs of stabilization early on in the fiscal

year. Demand for ADP’s solutions increased and key business metrics, including

Employer Services’ sales, retention and pays per control, began to improve

during the second half of the year.

Consolidated

revenues grew 1%, to $8,927.7 million in fiscal 2010, from $8,838.4 million in

fiscal 2009, aided by fluctuations in foreign currency rates, which increased

revenues $68.2 million. In fiscal 2010, pretax earnings from continuing

operations declined 2%, to $1,863.2 million, net earnings from continuing

operations declined 9%, to $1,207.3 million, and diluted earnings per share from

continuing operations decreased 8%, to $2.40, from $2.62 in fiscal 2009. Fiscal

2010 and fiscal 2009 included favorable tax items that reduced the provision for

income taxes by $12.2 million and $120.0 million, respectively. Excluding the

favorable tax items from both years, net earnings from continuing operations

declined 1% and diluted earnings per share from continuing operations declined

slightly from $2.38 to $2.37.

Employer

Services’ revenues were flat in fiscal 2010. In the United States, revenues from

our traditional payroll and payroll tax filing business declined 4% for the full

year and beyond payroll revenues grew 6% for the full year. “Pays per control,”

which represents the number of employees on our clients’ payrolls as measured on

a same-store-sales basis utilizing a subset of approximately 130,000 payrolls of

small to large businesses that are reflective of a broad range of U.S.

geographic regions, decreased 3.4% in fiscal 2010, but were slightly positive in

the fourth quarter of fiscal 2010 compared to the fourth quarter of fiscal 2009.

Worldwide client retention increased 0.4 percentage points as compared to the

prior year. PEO Services’ revenues grew 11% in fiscal 2010 due to a 5% increase

in the average number of worksite employees, as well as an increase in benefits

costs and state unemployment insurance rates. Employer Services’ and PEO

Services’ worldwide new business sales, which represent annualized recurring

revenues anticipated from sales orders to new and existing clients, increased

4%, to just over $1 billion in fiscal 2010. Dealer Services’ revenues decreased

3% in fiscal 2010 due to continued dealership consolidations and closings, lower

transactional revenue and dealerships reducing services in order to cut their

discretionary expenses. Consolidated interest on funds held for clients declined 11%, or $67.0

million, to $542.8 million. The decrease in the consolidated interest on funds

held for clients resulted from the decrease in the average interest rate earned

to 3.6% in fiscal 2010 as compared to 4.0% in fiscal 2009. Average client funds

balances increased slightly as a result of wage growth and an increase in state

unemployment insurance withholdings offset by the decline in pays per

control.

We have a

strong business model, which has approximately 90% recurring revenues, excellent

margins from the ability to generate consistent, healthy cash flows, strong

client retention and low capital expenditure requirements. Additionally, ADP has

continued to return excess cash to our shareholders. In the last five fiscal

years, we have reduced the Company’s common stock outstanding by approximately

15% through share buybacks, partially offset by common stock issued under

employee stock-based compensation programs. We have also raised the dividend

payout per share for 35 consecutive years.

15

We are

especially pleased with the performance of our investment portfolio and the

investment choices we made. Our investment portfolio does not contain any

asset-backed securities with underlying collateral of sub-prime mortgages,

alternative-A mortgages, sub-prime auto loans or home equity loans,

collateralized debt obligations, collateralized loan obligations, credit default

swaps, asset-backed commercial paper, derivatives, auction rate securities,

structured investment vehicles or non-investment-grade fixed-income securities.

We own senior tranches of fixed rate credit card, rate reduction, and auto loan

asset-backed securities, secured predominately by prime collateral. All

collateral on asset-backed securities is performing as expected. In addition, we

own senior debt directly issued by Federal Home Loan Banks, Federal National

Mortgage Association (“Fannie Mae”) and Federal Home Loan Mortgage Corporation

(“Freddie Mac”). We do not own subordinated debt, preferred stock or common

stock of any of these agencies. We do own AAA rated mortgage-backed securities,

which represent an undivided beneficial ownership interest in a group or pool of

one or more residential mortgages. These securities are collateralized by the

cash flows of 15-year and 30-year residential mortgages and are guaranteed by

Fannie Mae and Freddie Mac as to the timely payment of principal and interest.

Our client funds investment strategy is structured to allow us to average our

way through an interest rate cycle by laddering investments out to five years

(in the case of the extended portfolio) and out to ten years (in the case of the

long portfolio). This investment strategy is supported by our short-term

financing arrangements necessary to satisfy short-term funding requirements

relating to client funds obligations. In addition, our AAA credit rating has

helped us maintain uninterrupted access to the commercial paper

market.

Our financial

condition and balance sheet remain solid at June 30, 2010, with cash and cash

equivalents and marketable securities of $1,775.5 million. Our net cash flows

provided by operating activities were $1,682.1 million in fiscal 2010, as

compared to $1,562.6 million in fiscal 2009. This increase in cash flows from

fiscal 2009 to fiscal 2010 was due to tax refunds received and a reduction in

cash bonuses paid, partially offset by an increase in pension plan contributions

as compared to the prior year.

In August

2010, we completed the acquisition of two businesses, Cobalt and Workscape, Inc.

Cobalt is a leading provider of digital marketing solutions for the automotive

industry. It aligns with ADP Dealer Services’ global layered applications

strategy and strongly supports Dealer Services’ long-term growth strategy.

Workscape, Inc. is a leading provider of integrated benefits and compensation

solutions and services.

16

RESULTS OF

OPERATIONS

ANALYSIS OF CONSOLIDATED

OPERATIONS

Fiscal 2010 Compared to Fiscal

2009

(Dollars in

millions, except per share amounts)

|

|

|

Years ended June 30, |

|

|

|

|

|

|

|

|

|

|

|

|

2010 |

|

2009 |

|

$

Change |

|

%

Change |

| Total revenues |

|

$ |

8,927.7 |

|

|

$ |

8,838.4 |

|

|

$ |

89.3 |

|

|

1 |

% |

| |

| Costs of revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating expenses |

|

|

4,277.2 |

|

|

|

4,087.0 |

|

|

|

190.2 |

|

|

5 |

% |

| Systems development

and |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

programming costs |

|

|

513.9 |

|

|

|

498.3 |

|

|

|

15.6 |

|

|

3 |

% |

| Depreciation and

amortization |

|

|

238.6 |

|

|

|

237.4 |

|

|

|

1.2 |

|

|

1 |

% |

| Total costs of

revenues |

|

|

5,029.7 |

|

|

|

4,822.7 |

|

|

|

207.0 |

|

|

4 |

% |

| |

| Selling, general and |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| administrative

expenses |

|

|

2,127.4 |

|

|

|

2,190.3 |

|

|

|

(62.9 |

) |

|

(3 |

)% |

| Interest expense |

|

|

8.6 |

|

|

|

33.3 |

|

|

|

(24.7 |

) |

|

(74 |

)% |

| Total expenses |

|

|

7,165.7 |

|

|

|

7,046.3 |

|

|

|

119.4 |

|

|

2 |

% |

| |

| Other income, net |

|

|

(101.2 |

) |

|

|

(108.0 |

) |

|

|

(6.8 |

) |

|

(6 |

)% |

| |

| Earnings from

continuing |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| operations before income

taxes |

|

$ |

1,863.2 |

|

|

$ |

1,900.1 |

|

|

$ |

(36.9 |

) |

|

(2 |

)% |

| Margin |

|

|

20.9 |

% |

|

|

21.5 |

% |

|

|

|

|

|

|

|

| |

| Provision for income

taxes |

|

$ |

655.9 |

|

|

$ |

575.0 |

|

|

$ |

80.9 |

|

|

14 |

% |

| Effective tax rate |

|

|

35.2 |

% |

|

|

30.3 |

% |

|

|

|

|

|

|

|

| |

| Net earnings from |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| continuing

operations |

|

$ |

1,207.3 |

|

|

$ |

1,325.1 |

|

|

$ |

(117.8 |

) |

|

(9 |

)% |

| |

| Diluted earnings per

share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| from continuing

operations |

|

$ |

2.40 |

|

|

$ |

2.62 |

|

|

$ |

(0.22 |

) |

|

(8 |

)% |

Total

Revenues

Our consolidated revenues grew 1% to $8,927.7 million in fiscal 2010,

from $8,838.4 million in fiscal 2009, due to an increase in revenues in PEO

Services of 11%, or $131.0 million, to $1,316.8 million, and fluctuations in

foreign currency rates, which increased revenues $68.2 million. Such increases

were partially offset by a decrease in Dealer Services revenues of 3%, or $38.5

million, to $1,229.4 million, and a decrease in the consolidated interest on

funds held for clients of $67.0 million. The decrease in the consolidated

interest on funds held for clients resulted from the decrease in the average

interest rate earned to 3.6% in fiscal 2010 as compared to 4.0% in fiscal 2009.

Employer Services’ revenues were flat in fiscal 2010 as compared to fiscal

2009.

Total

Expenses

Our total expenses in fiscal 2010 increased $119.4 million, to $7,165.7

million, from $7,046.3 million in fiscal 2009. The increase in our consolidated

expenses for fiscal 2010 was due to our increase in revenues, higher

pass-through costs associated with our PEO Services business of $113.7 million,

an increase of $48.6 million related to fluctuations in foreign currency

exchange rates, an increase of $14.7 million related to additional domestic

service personnel and incremental investments in our products. These increases

were partially offset by a decrease in severance expenses of $76.8 million, a

decrease in stock-based compensation expense of $28.4 million and our costs

savings initiatives, which included lower compensation from reduced headcount

and a reduction in travel and entertainment expenses.

17

Our total

costs of revenues increased $207.0 million to $5,029.7 million in fiscal 2010,

as compared to fiscal 2009 due to the increase in operating expenses discussed

below.

Operating

expenses increased $190.2 million, or 5%, in fiscal 2010 as compared to fiscal

2009, due to an increase in PEO Services pass-through costs that are

re-billable, including costs for benefits coverage, workers’ compensation

coverage and state unemployment taxes for worksite employees. These pass-through

costs were $988.5 million in fiscal 2010, which included costs for benefits

coverage of $811.5 million and costs for workers’ compensation and payment of

state unemployment taxes of $176.9 million. These costs were $874.8 million in

fiscal 2009, which included costs for benefits coverage of $724.3 million and

costs for workers compensation and payment of state unemployment taxes of $150.5

million. In addition, operating expenses increased $30.1 million due to changes

in foreign currency exchange rates and $14.7 million due to additional service

personnel. These increases were partially offset by a decrease of $8.9 million

in stock-based compensation expense and our costs savings initiatives, which

included lower compensation from reduced headcount and a reduction in travel and

entertainment expenses.

Systems

development and programming expenses increased $15.6 million, or 3%, in fiscal

2010 as compared to fiscal 2009, due to incremental investments in our products

during fiscal 2010. Additionally, systems development and programming expenses

increased by $2.1 million due to expenses of acquired businesses and by $3.6

million due to the impact from changes in foreign currency exchange rates. These

increases were partially offset by a $5.0 million decline in stock-based

compensation expense.

Selling,

general and administrative expenses decreased $62.9 million, or 3%, in fiscal

2010 as compared to fiscal 2009. The decrease in expenses was due to a decrease

in severance expenses of $76.8 million, a reduction in expenses of $31.1 million

related to cost saving initiatives, which included lower compensation from

reduced headcount and a reduction in travel and entertainment expenses and a

decline of $14.5 million in stock-based compensation expense. In addition,

selling, general and administrative expenses decreased due to the $15.5 million

charge we recorded during fiscal 2009 to increase our allowance for doubtful

accounts as a result of an increase in estimated credit losses related to our

notes receivable from automotive, truck and powersports dealers. These decreases

in expenses were partially offset by an asset impairment charge of $6.8 million,

recorded during fiscal 2010 as a result of the announcement by General Motors

Corporation (“GM”) that it will shut down its Saturn division. In addition,

there was an increase of $13.7 million due to the impact of changes in foreign

currency exchange rates and an increase of $9.5 million in expenses of acquired

businesses.

Interest

expense decreased $24.7 million in fiscal 2010 as compared to fiscal 2009. In

fiscal 2010 and 2009, the Company’s average borrowings under the commercial

paper program were $1.6 billion and $1.9 billion, respectively, at weighted

average interest rates of 0.2% and 1.0%, respectively, which resulted in a

decrease of $15.8 million in interest expense. In fiscal 2010 and 2009, the

Company’s average borrowings under the reverse repurchase program were

approximately $425.0 million and $425.9 million, respectively, at weighted

average interest rates of 0.2% and 1.3%, respectively, which resulted in a

decrease of $4.6 million in interest expense.

Other Income,

net

| Years ended June 30, |

|

2010 |

|

2009 |

|

$

Change |

| (Dollars in

millions) |

|

|

|

|

|

|

|

|

|

|

|

|

| Interest income on corporate

funds |

|

$ |

(98.8 |

) |

|

$ |

(134.2 |

) |

|

$ |

(35.4 |

) |

| Realized gains on

available-for-sale securities |

|

|

(15.0 |

) |

|

|

(11.4 |

) |

|

|

3.6 |

|

| Realized losses on

available-for-sale securities |

|

|

13.4 |

|

|

|

23.8 |

|

|

|

10.4 |

|

| Realized (gain) loss on

investment in Reserve Fund |

|

|

(15.2 |

) |

|

|

18.3 |

|

|

|

33.5 |

|

| Impairment losses on

available-for-sale securities |

|

|

14.4 |

|

|

|

- |

|

|

|

(14.4 |

) |

| Net loss (gain) on sales of

buildings |

|

|

2.3 |

|

|

|

(2.2 |

) |

|

|

(4.5 |

) |

| Other, net |

|

|

(2.3 |

) |

|

|

(2.3 |

) |

|

|

- |

|

| |

| Other income, net |

|

$ |

(101.2 |

) |

|

$ |

(108.0 |

) |

|

$ |

(6.8 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

18

Other income,

net, decreased $6.8 million in fiscal 2010 as compared to fiscal 2009 due to a

$35.4 million decrease in interest income on corporate funds, a $14.4 million

impairment loss on available-for-sale securities recorded during fiscal 2010 and

a $2.3 million net loss on sales of buildings in fiscal 2010 as compared to a

$2.2 million net gain on sales of buildings in fiscal 2009. Interest income on

corporate funds decreased as a result of lower average interest rates, partially

offset by higher average daily balances. Average interest rates decreased from

3.6% in fiscal 2009 to 2.6% in fiscal 2010. Average daily balances increased

from $3.7 billion in fiscal 2009 to $3.8 billion in fiscal 2010. These decreases

in other income were partially offset by a gain on the investment in Reserve

Fund of $15.2 million in fiscal 2010 as compared to a loss on the investment in

the Reserve Fund of $18.3 million in fiscal 2009, as well as a $14.0 million

increase in net realized gains on available-for-sale securities.

Earnings from Continuing Operations

before Income Taxes

Earnings from continuing operations

before income taxes decreased $36.9 million, or 2%, from $1,900.1 million in

fiscal 2009 to $1,863.2 million in fiscal 2010 because the increase in revenues

was more than offset by the increase in expenses and decrease in other income,

net discussed above. Overall margin decreased 60 basis points in fiscal 2010.

Provision for Income

Taxes

The effective tax rate in fiscal 2010 and 2009 was 35.2% and 30.3%,

respectively. For fiscal 2010, the effective tax rate includes a reduction in

the provision for income taxes of $12.2 million related to the resolution of

certain tax matters, which decreased the effective tax rate by 0.7 percentage

points. For fiscal 2009, the effective tax rate includes a reduction in the

provision for income taxes of $120.0 million related to an Internal Revenue

Service (“IRS”) audit settlement and the settlement of a state tax matter, which

decreased the effective tax rate by 6.3 percentage points.

Net Earnings from Continuing

Operations and Diluted Earnings per Share from Continuing

Operations

Net earnings from continuing operations decreased $117.8 million to

$1,207.3 million in fiscal 2010, from $1,325.1 million in fiscal 2009, and

diluted earnings per share from continuing operations decreased 8%, to $2.40.

The decrease in net earnings from continuing operations in fiscal 2010 reflects

the decrease in earnings from continuing operations before income taxes and the

impact of the tax matters discussed above. The decrease in diluted earnings per

share from continuing operations in fiscal 2010 reflects the decrease in

earnings from continuing operations and the impact of the tax matters discussed

above partially offset by the impact of fewer shares outstanding due to the

repurchase of 18.2 million shares in fiscal 2010 and 13.8 million shares in

fiscal 2009.

The following

table reconciles the Company’s results for fiscal 2010 and fiscal 2009 to

adjusted results that exclude the impact of favorable tax items. The Company

uses certain adjusted results, among other measures, to evaluate the Company’s

operating performance in the absence of certain items and for planning and

forecasting of future periods. The Company believes that the adjusted results

provide relevant and useful information for investors because it allows

investors to view performance in a manner similar to the method used by the

Company’s management and improves their ability to understand the Company’s

operating performance. Since adjusted earnings from continuing operations and

adjusted diluted EPS are not measures of performance calculated in accordance

with accounting principles generally accepted in the United States of America

(“U.S. GAAP”), they should not be considered in isolation from, or as a

substitute for, earnings from continuing operations and diluted EPS from

continuing operations, respectively, and they may not be comparable to similarly

titled measures employed by other companies.

|

|

|

Year ended June 30, 2010 |

|

|

|

Earnings from |

|

|

|

|

|

Diluted EPS |

|

|

|

continuing

operations |

|

Provision for |

|

Net earnings from |