Document

P5YP5YP3YP1Yfalse--06-30Q120200000008670549000005930000040000060000000000.690.790.10.1100000000010000000006387000006387000004342000004334000000.022500.033752020-09-152025-09-152024-06-302023-06-302020-06-30113000003000000020450000020530000016000001900000

0000008670

2019-07-01

2019-09-30

0000008670

2019-10-30

0000008670

2018-07-01

2018-09-30

0000008670

2019-09-30

0000008670

2019-06-30

0000008670

2018-09-30

0000008670

2018-06-30

0000008670

2018-07-01

2019-06-30

0000008670

srt:RestatementAdjustmentMember

2018-07-01

2019-06-30

0000008670

srt:ScenarioPreviouslyReportedMember

2018-07-01

2019-06-30

0000008670

srt:RestatementAdjustmentMember

2018-07-01

2018-09-30

0000008670

srt:ScenarioPreviouslyReportedMember

2018-07-01

2018-09-30

0000008670

2019-07-01

0000008670

adp:GlobalMember

2019-07-01

2019-09-30

0000008670

adp:PEOMember

adp:ProfessionalEmployeeOrganizationServicesSegmentMember

2019-07-01

2019-09-30

0000008670

us-gaap:AllOtherSegmentsMember

2019-07-01

2019-09-30

0000008670

adp:GlobalMember

us-gaap:AllOtherSegmentsMember

2019-07-01

2019-09-30

0000008670

adp:GlobalMember

adp:EmployerServicesSegmentMember

2019-07-01

2019-09-30

0000008670

adp:ProfessionalEmployeeOrganizationServicesSegmentMember

2019-07-01

2019-09-30

0000008670

adp:HROMember

adp:ProfessionalEmployeeOrganizationServicesSegmentMember

2019-07-01

2019-09-30

0000008670

adp:ClientfundinterestMember

adp:EmployerServicesSegmentMember

2019-07-01

2019-09-30

0000008670

adp:ClientfundinterestMember

adp:ProfessionalEmployeeOrganizationServicesSegmentMember

2019-07-01

2019-09-30

0000008670

adp:EmployerServicesSegmentMember

2019-07-01

2019-09-30

0000008670

adp:HCMMember

us-gaap:AllOtherSegmentsMember

2019-07-01

2019-09-30

0000008670

adp:HCMMember

adp:EmployerServicesSegmentMember

2019-07-01

2019-09-30

0000008670

adp:HROMember

adp:EmployerServicesSegmentMember

2019-07-01

2019-09-30

0000008670

adp:HCMMember

2019-07-01

2019-09-30

0000008670

adp:PEOMember

us-gaap:AllOtherSegmentsMember

2019-07-01

2019-09-30

0000008670

adp:ClientfundinterestMember

us-gaap:AllOtherSegmentsMember

2019-07-01

2019-09-30

0000008670

adp:PEOMember

adp:EmployerServicesSegmentMember

2019-07-01

2019-09-30

0000008670

adp:HROMember

us-gaap:AllOtherSegmentsMember

2019-07-01

2019-09-30

0000008670

adp:HROMember

2019-07-01

2019-09-30

0000008670

adp:ClientfundinterestMember

2019-07-01

2019-09-30

0000008670

adp:GlobalMember

adp:ProfessionalEmployeeOrganizationServicesSegmentMember

2019-07-01

2019-09-30

0000008670

adp:PEOMember

2019-07-01

2019-09-30

0000008670

adp:HCMMember

adp:ProfessionalEmployeeOrganizationServicesSegmentMember

2019-07-01

2019-09-30

0000008670

adp:ClientfundinterestMember

adp:ProfessionalEmployeeOrganizationServicesSegmentMember

2018-07-01

2018-09-30

0000008670

adp:ProfessionalEmployeeOrganizationServicesSegmentMember

2018-07-01

2018-09-30

0000008670

us-gaap:AllOtherSegmentsMember

2018-07-01

2018-09-30

0000008670

adp:GlobalMember

2018-07-01

2018-09-30

0000008670

adp:GlobalMember

us-gaap:AllOtherSegmentsMember

2018-07-01

2018-09-30

0000008670

adp:PEOMember

adp:EmployerServicesSegmentMember

2018-07-01

2018-09-30

0000008670

adp:HROMember

us-gaap:AllOtherSegmentsMember

2018-07-01

2018-09-30

0000008670

adp:GlobalMember

adp:ProfessionalEmployeeOrganizationServicesSegmentMember

2018-07-01

2018-09-30

0000008670

adp:GlobalMember

adp:EmployerServicesSegmentMember

2018-07-01

2018-09-30

0000008670

adp:ClientfundinterestMember

adp:EmployerServicesSegmentMember

2018-07-01

2018-09-30

0000008670

adp:EmployerServicesSegmentMember

2018-07-01

2018-09-30

0000008670

adp:HROMember

2018-07-01

2018-09-30

0000008670

adp:ClientfundinterestMember

2018-07-01

2018-09-30

0000008670

adp:ClientfundinterestMember

us-gaap:AllOtherSegmentsMember

2018-07-01

2018-09-30

0000008670

adp:PEOMember

us-gaap:AllOtherSegmentsMember

2018-07-01

2018-09-30

0000008670

adp:HCMMember

2018-07-01

2018-09-30

0000008670

adp:PEOMember

2018-07-01

2018-09-30

0000008670

adp:HCMMember

adp:EmployerServicesSegmentMember

2018-07-01

2018-09-30

0000008670

adp:HROMember

adp:EmployerServicesSegmentMember

2018-07-01

2018-09-30

0000008670

adp:HCMMember

adp:ProfessionalEmployeeOrganizationServicesSegmentMember

2018-07-01

2018-09-30

0000008670

adp:PEOMember

adp:ProfessionalEmployeeOrganizationServicesSegmentMember

2018-07-01

2018-09-30

0000008670

adp:HCMMember

us-gaap:AllOtherSegmentsMember

2018-07-01

2018-09-30

0000008670

adp:HROMember

adp:ProfessionalEmployeeOrganizationServicesSegmentMember

2018-07-01

2018-09-30

0000008670

us-gaap:ForeignGovernmentDebtSecuritiesMember

2019-09-30

0000008670

us-gaap:USGovernmentAgenciesDebtSecuritiesMember

2019-09-30

0000008670

adp:CanadianProvincialBondsMember

2019-09-30

0000008670

us-gaap:CorporateDebtSecuritiesMember

2019-09-30

0000008670

us-gaap:OtherDebtSecuritiesMember

2019-09-30

0000008670

us-gaap:USTreasurySecuritiesMember

2019-09-30

0000008670

us-gaap:AssetBackedSecuritiesMember

2019-09-30

0000008670

us-gaap:MunicipalBondsMember

2019-09-30

0000008670

adp:NoncurrentMember

2019-06-30

0000008670

adp:NoncurrentMember

2019-09-30

0000008670

adp:CurrentMember

2019-06-30

0000008670

adp:CurrentMember

2019-09-30

0000008670

adp:CorporateInvestmentsMember

2019-06-30

0000008670

us-gaap:FederalHomeLoanBankCertificatesAndObligationsFHLBMember

2019-09-30

0000008670

adp:FundsHeldForClientsMember

2019-06-30

0000008670

us-gaap:ForeignCorporateDebtSecuritiesMember

2019-09-30

0000008670

adp:CorporateInvestmentsMember

2019-09-30

0000008670

adp:AssetBackedAutoLoanReceivablesMember

2019-09-30

0000008670

adp:FundsHeldForClientsMember

2019-09-30

0000008670

adp:FixedRateCreditCardMember

2019-09-30

0000008670

adp:FederalFarmCreditBanksMember

2019-09-30

0000008670

adp:SovereignBondsMember

2019-09-30

0000008670

us-gaap:CommercialMortgageBackedSecuritiesMember

2019-09-30

0000008670

adp:RateReductionReceivableMember

2019-09-30

0000008670

adp:SupranationalBondsMember

2019-09-30

0000008670

adp:AssetBackedEquipmentLeaseReceivableMember

2019-09-30

0000008670

us-gaap:USGovernmentAgenciesDebtSecuritiesMember

2019-06-30

0000008670

us-gaap:CorporateDebtSecuritiesMember

2019-06-30

0000008670

us-gaap:OtherDebtSecuritiesMember

2019-06-30

0000008670

us-gaap:ForeignGovernmentDebtSecuritiesMember

2019-06-30

0000008670

us-gaap:MunicipalBondsMember

2019-06-30

0000008670

us-gaap:AssetBackedSecuritiesMember

2019-06-30

0000008670

us-gaap:USTreasurySecuritiesMember

2019-06-30

0000008670

adp:CanadianProvincialBondsMember

2019-06-30

0000008670

us-gaap:FairValueInputsLevel1Member

2019-06-30

0000008670

us-gaap:FairValueInputsLevel3Member

2019-06-30

0000008670

us-gaap:FairValueInputsLevel1Member

2019-09-30

0000008670

us-gaap:FairValueInputsLevel3Member

2019-09-30

0000008670

us-gaap:ComputerSoftwareIntangibleAssetMember

2019-06-30

0000008670

us-gaap:CustomerListsMember

2019-06-30

0000008670

us-gaap:OtherIntangibleAssetsMember

2019-06-30

0000008670

us-gaap:CustomerListsMember

2019-09-30

0000008670

us-gaap:OtherIntangibleAssetsMember

2019-09-30

0000008670

us-gaap:ComputerSoftwareIntangibleAssetMember

2019-09-30

0000008670

us-gaap:CustomerListsMember

2019-07-01

2019-09-30

0000008670

us-gaap:ComputerSoftwareIntangibleAssetMember

2019-07-01

2019-09-30

0000008670

us-gaap:OtherIntangibleAssetsMember

2019-07-01

2019-09-30

0000008670

adp:PeoServicesSegmentMember

2019-07-01

2019-09-30

0000008670

adp:EmployerServicesSegmentMember

2019-06-30

0000008670

adp:EmployerServicesSegmentMember

2019-09-30

0000008670

adp:PeoServicesSegmentMember

2019-06-30

0000008670

adp:PeoServicesSegmentMember

2019-09-30

0000008670

us-gaap:CommercialPaperMember

2018-07-01

2018-09-30

0000008670

us-gaap:CommercialPaperMember

2019-07-01

2019-09-30

0000008670

adp:ShortTermCommercialPaperProgramMember

2018-07-01

2018-09-30

0000008670

adp:ShortTermCommercialPaperProgramMember

2019-07-01

2019-09-30

0000008670

adp:ThreeHundredAndSixtyFourDayCreditFacilityMember

2019-09-30

0000008670

adp:CreditFacilityExpiringInJuneTwoThousandTwentyFourMember

2019-07-01

2019-09-30

0000008670

adp:CreditFacilityExpiringInJuneTwoThousandTwentyThreeMember

2019-07-01

2019-09-30

0000008670

adp:ThreeHundredAndSixtyFourDayCreditFacilityMember

2019-07-01

2019-09-30

0000008670

adp:CreditFacilityExpiringInJuneTwoThousandTwentyThreeMember

2019-09-30

0000008670

adp:CreditFacilityExpiringInJuneTwoThousandTwentyFourMember

2019-09-30

0000008670

us-gaap:CommercialPaperMember

2019-09-30

0000008670

adp:ReverseRepurchaseAgreementsMember

2018-07-01

2018-09-30

0000008670

adp:ReverseRepurchaseAgreementsMember

2019-07-01

2019-09-30

0000008670

adp:Notesdueon2025Member

2019-07-01

2019-09-30

0000008670

adp:Notesdueon2020Member

2019-07-01

2019-09-30

0000008670

adp:Notesdueon2025Member

2019-09-30

0000008670

adp:Notesdueon2020Member

2019-09-30

0000008670

us-gaap:OtherDebtSecuritiesMember

2019-06-30

0000008670

adp:Notesdueon2025Member

2019-06-30

0000008670

adp:Notesdueon2020Member

2019-06-30

0000008670

us-gaap:OtherDebtSecuritiesMember

2019-09-30

0000008670

adp:TimeBasedRestrictedStockUnitsMember

2019-07-01

2019-09-30

0000008670

adp:TimeBasedRestrictedStockUnitsMember

2019-09-30

0000008670

adp:TimeBasedRestrictedStockMember

2019-07-01

2019-09-30

0000008670

adp:TimeBasedRestrictedStockMember

2019-09-30

0000008670

adp:TimeBasedRestrictedStockUnitsMember

2019-06-30

0000008670

adp:TimeBasedRestrictedStockMember

2019-06-30

0000008670

adp:TimeBasedRestricedStockgrantedduringorafterFiscal2019Domain

2019-07-01

2019-09-30

0000008670

srt:MaximumMember

adp:PerformanceBasedRestrictedStockandUnitsDomain

2019-07-01

2019-09-30

0000008670

us-gaap:RestrictedStockUnitsRSUMember

2019-07-01

2019-09-30

0000008670

adp:PerformanceBasedRestrictedStockandUnitsDomain

2019-07-01

2019-09-30

0000008670

us-gaap:EmployeeStockMember

2019-07-01

2019-09-30

0000008670

adp:NonvestedStockOptionsMember

2019-09-30

0000008670

adp:NonvestedStockOptionsMember

2019-07-01

2019-09-30

0000008670

us-gaap:RestrictedStockUnitsRSUMember

2019-09-30

0000008670

adp:NonvestedRestrictedStockMember

2019-07-01

2019-09-30

0000008670

adp:NonvestedRestrictedStockMember

2019-09-30

0000008670

adp:TimeBasedRestrictedStockgrantedduringFiscal2013Domain

2019-07-01

2019-09-30

0000008670

adp:PerformanceBasedRestrictedStockMember

2019-07-01

2019-09-30

0000008670

adp:PerformanceBasedRestrictedStockUnitDomain

2019-06-30

0000008670

adp:PerformanceBasedRestrictedStockUnitDomain

2019-09-30

0000008670

adp:PerformanceBasedRestrictedStockMember

2019-09-30

0000008670

adp:PerformanceBasedRestrictedStockMember

2019-06-30

0000008670

adp:PerformanceBasedRestrictedStockUnitDomain

2019-07-01

2019-09-30

0000008670

adp:SystemDevelopmentAndProgrammingCostsMember

2018-07-01

2018-09-30

0000008670

adp:OperatingExpensesMember

2019-07-01

2019-09-30

0000008670

adp:SystemDevelopmentAndProgrammingCostsMember

2019-07-01

2019-09-30

0000008670

us-gaap:SellingGeneralAndAdministrativeExpensesMember

2019-07-01

2019-09-30

0000008670

adp:OperatingExpensesMember

2018-07-01

2018-09-30

0000008670

us-gaap:SellingGeneralAndAdministrativeExpensesMember

2018-07-01

2018-09-30

0000008670

srt:MinimumMember

adp:PerformanceBasedRestrictedStockandUnitsDomain

2019-07-01

2019-09-30

0000008670

us-gaap:TreasuryStockMember

2018-06-30

0000008670

us-gaap:CommonStockMember

2018-07-01

2018-09-30

0000008670

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2018-07-01

2018-09-30

0000008670

us-gaap:AdditionalPaidInCapitalMember

2018-07-01

2018-09-30

0000008670

us-gaap:TreasuryStockMember

2018-07-01

2018-09-30

0000008670

us-gaap:RetainedEarningsMember

2018-07-01

2018-09-30

0000008670

us-gaap:RetainedEarningsMember

2018-06-30

0000008670

us-gaap:AdditionalPaidInCapitalMember

2018-09-30

0000008670

us-gaap:CommonStockMember

2018-06-30

0000008670

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2018-06-30

0000008670

us-gaap:TreasuryStockMember

2018-09-30

0000008670

us-gaap:CommonStockMember

2018-09-30

0000008670

us-gaap:RetainedEarningsMember

2018-09-30

0000008670

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2018-09-30

0000008670

us-gaap:AdditionalPaidInCapitalMember

2018-06-30

0000008670

us-gaap:AdditionalPaidInCapitalMember

2019-07-01

2019-09-30

0000008670

us-gaap:RetainedEarningsMember

2019-07-01

2019-09-30

0000008670

us-gaap:RetainedEarningsMember

2019-06-30

0000008670

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2019-07-01

2019-09-30

0000008670

us-gaap:CommonStockMember

2019-09-30

0000008670

us-gaap:TreasuryStockMember

2019-07-01

2019-09-30

0000008670

us-gaap:CommonStockMember

2019-07-01

2019-09-30

0000008670

us-gaap:TreasuryStockMember

2019-06-30

0000008670

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2019-09-30

0000008670

us-gaap:CommonStockMember

2019-06-30

0000008670

us-gaap:RetainedEarningsMember

2019-09-30

0000008670

us-gaap:AdditionalPaidInCapitalMember

2019-09-30

0000008670

us-gaap:AdditionalPaidInCapitalMember

2019-06-30

0000008670

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2019-06-30

0000008670

us-gaap:TreasuryStockMember

2019-09-30

0000008670

us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember

2018-07-01

2018-09-30

0000008670

us-gaap:AccumulatedTranslationAdjustmentMember

2018-07-01

2018-09-30

0000008670

us-gaap:AccumulatedTranslationAdjustmentMember

2018-06-30

0000008670

us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember

2018-09-30

0000008670

us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember

2018-06-30

0000008670

us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember

2018-07-01

2018-09-30

0000008670

us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember

2018-09-30

0000008670

us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember

2018-06-30

0000008670

us-gaap:AccumulatedTranslationAdjustmentMember

2018-09-30

0000008670

us-gaap:AccumulatedTranslationAdjustmentMember

2019-07-01

2019-09-30

0000008670

us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember

2019-07-01

2019-09-30

0000008670

us-gaap:AccumulatedTranslationAdjustmentMember

2019-06-30

0000008670

us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember

2019-07-01

2019-09-30

0000008670

us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember

2019-09-30

0000008670

us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember

2019-06-30

0000008670

us-gaap:AccumulatedTranslationAdjustmentMember

2019-09-30

0000008670

us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember

2019-06-30

0000008670

us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember

2019-09-30

xbrli:shares

xbrli:pure

iso4217:USD

iso4217:USD

xbrli:shares

adp:segment

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________

FORM 10-Q

______________

|

| | | | |

☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the Quarterly Period Ended September 30, 2019

OR

|

| | | | |

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the Transition Period From to

Commission File Number 1-5397

__________________________

AUTOMATIC DATA PROCESSING, INC.

(Exact name of registrant as specified in its charter)

__________________________

|

| | |

Delaware | 22-1467904 |

(State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) |

One ADP Boulevard | |

Roseland, | NJ | 07068 |

(Address of principal executive offices) | (Zip Code) |

| |

Registrant's telephone number, including area code: (973) 974-5000

__________________________

|

| | |

Securities registered pursuant to Section 12(b) of the Act: |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Common Stock, $0.10 Par Value

(voting) | ADP | NASDAQ Global Select Market |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ý No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

| | | |

Large Accelerated Filer | ☒ | Accelerated filer | ☐ |

Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

|

| | | | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). | Yes | ☐ | No | ☒ |

The number of shares outstanding of the registrant’s common stock as of October 30, 2019 was 432,698,089.

Table of Contents

Part I. FINANCIAL INFORMATION

Item 1. Financial Statements

Automatic Data Processing, Inc. and Subsidiaries

Statements of Consolidated Earnings

(In millions, except per share amounts)

(Unaudited)

|

| | | | | | | |

| Three Months Ended |

| September 30, |

| 2019 | | 2018 |

| |

REVENUES: | | | |

Revenues, other than interest on funds held for clients and PEO revenues | $ | 2,306.2 |

| | $ | 2,218.6 |

|

Interest on funds held for clients | 133.9 |

| | 118.5 |

|

PEO revenues (A) | 1,055.6 |

| | 973.2 |

|

TOTAL REVENUES | 3,495.7 |

| | 3,310.3 |

|

| | | |

EXPENSES: | |

| | |

|

Costs of revenues: | |

| | |

|

Operating expenses | 1,787.7 |

| | 1,697.0 |

|

Systems development and programming costs | 168.2 |

| | 158.0 |

|

Depreciation and amortization | 88.9 |

| | 72.6 |

|

TOTAL COSTS OF REVENUES | 2,044.8 |

| | 1,927.6 |

|

| | | |

Selling, general, and administrative expenses | 726.5 |

| | 713.9 |

|

Interest expense | 39.9 |

| | 35.9 |

|

TOTAL EXPENSES | 2,811.2 |

| | 2,677.4 |

|

| | | |

Other income, net | (54.6 | ) | | (13.9 | ) |

| | | |

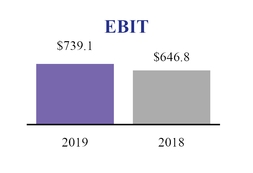

EARNINGS BEFORE INCOME TAXES | 739.1 |

| | 646.8 |

|

| | | |

Provision for income taxes | 156.7 |

| | 141.4 |

|

| | | |

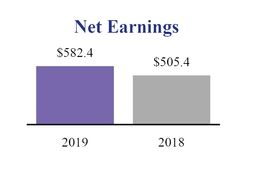

NET EARNINGS | $ | 582.4 |

| | $ | 505.4 |

|

| | | |

BASIC EARNINGS PER SHARE | $ | 1.35 |

| | $ | 1.16 |

|

| | | |

DILUTED EARNINGS PER SHARE | $ | 1.34 |

| | $ | 1.15 |

|

| | | |

Basic weighted average shares outstanding | 432.7 |

| | 436.8 |

|

Diluted weighted average shares outstanding | 435.4 |

| | 439.9 |

|

(A)$10,510.6 million and $9,629.4 million for the three months ended September 30, 2019 and 2018, respectively.

See notes to the Consolidated Financial Statements.

Automatic Data Processing, Inc. and Subsidiaries

Statements of Consolidated Comprehensive Income

(In millions)

(Unaudited)

|

| | | | | | | |

| Three Months Ended |

| September 30, |

| 2019 | | 2018 |

| |

Net earnings | $ | 582.4 |

| | $ | 505.4 |

|

| | | |

Other comprehensive income/(loss): | | | |

Currency translation adjustments | (48.9 | ) | | (22.9 | ) |

| | | |

Unrealized net gains/(losses) on available-for-sale securities | 96.1 |

| | (50.4 | ) |

Tax effect | (20.8 | ) | | 12.3 |

|

Reclassification of net (gain)/losses on available-for-sale securities to net earnings | (2.3 | ) | | 0.9 |

|

Tax effect | 0.5 |

| | (0.2 | ) |

| | | |

Reclassification of pension liability adjustment to net earnings | (1.7 | ) | | 0.2 |

|

Tax effect | 0.5 |

| | (0.2 | ) |

| | | |

Other comprehensive income/(loss), net of tax | 23.4 |

| | (60.3 | ) |

Comprehensive income | $ | 605.8 |

| | $ | 445.1 |

|

See notes to the Consolidated Financial Statements.

Automatic Data Processing, Inc. and Subsidiaries

Consolidated Balance Sheets

(In millions, except per share amounts)

(Unaudited) |

| | | | | | | | |

| | September 30, | | June 30, |

| | 2019 | | 2019 |

Assets | | | | |

Current assets: | | | | |

Cash and cash equivalents | | $ | 1,403.9 |

| | $ | 1,949.2 |

|

Short-term marketable securities (B) | | 3,545.1 |

| | 10.5 |

|

Accounts receivable, net of allowance for doubtful accounts of $59.3 and $54.9, respectively | | 2,490.4 |

| | 2,439.3 |

|

Other current assets | | 675.9 |

| | 509.1 |

|

Total current assets before funds held for clients | | 8,115.3 |

| | 4,908.1 |

|

Funds held for clients | | 21,393.2 |

| | 29,434.2 |

|

Total current assets | | 29,508.5 |

| | 34,342.3 |

|

Long-term receivables, net of allowance for doubtful accounts of $0.6 and $0.4, respectively | | 22.1 |

| | 23.8 |

|

Property, plant and equipment, net | | 767.1 |

| | 764.2 |

|

Operating lease right-of-use asset | | 504.0 |

| | — |

|

Deferred contract costs | | 2,401.4 |

| | 2,428.5 |

|

Other assets | | 1,129.4 |

| | 934.4 |

|

Goodwill | | 2,303.3 |

| | 2,323.0 |

|

Intangible assets, net | | 1,078.9 |

| | 1,071.5 |

|

Total assets | | $ | 37,714.7 |

| | $ | 41,887.7 |

|

Liabilities and Stockholders' Equity | | |

| | |

|

Current liabilities: | | |

| | |

|

Accounts payable | | $ | 108.8 |

| | $ | 125.5 |

|

Accrued expenses and other current liabilities | | 1,994.6 |

| | 1,759.0 |

|

Accrued payroll and payroll-related expenses | | 443.6 |

| | 721.1 |

|

Dividends payable | | 339.1 |

| | 340.1 |

|

Short-term deferred revenues | | 213.1 |

| | 220.7 |

|

Obligations under reverse repurchase agreements (A) | | 428.6 |

| | 262.0 |

|

Obligation under commercial paper borrowing (B) | | 3,536.7 |

| | — |

|

Short-term debt | | 1,001.3 |

| | — |

|

Income taxes payable | | 123.7 |

| | 54.8 |

|

Total current liabilities before client funds obligations | | 8,189.5 |

| | 3,483.2 |

|

Client funds obligations | | 21,011.4 |

| | 29,144.5 |

|

Total current liabilities | | 29,200.9 |

| | 32,627.7 |

|

Long-term debt | | 1,003.4 |

| | 2,002.2 |

|

Operating lease liabilities | | 355.4 |

| | — |

|

Other liabilities | | 707.9 |

| | 798.7 |

|

Deferred income taxes | | 708.2 |

| | 659.9 |

|

Long-term deferred revenues | | 378.2 |

| | 399.3 |

|

Total liabilities | | 32,354.0 |

| | 36,487.8 |

|

| | | | |

Commitments and contingencies (Note 13) | |

|

| |

|

|

| | | | |

Stockholders' equity: | | |

| | |

|

Preferred stock, $1.00 par value: authorized, 0.3 shares; issued, none | | — |

| | — |

|

Common stock, $0.10 par value: authorized, 1,000.0 shares; issued, 638.7 shares at September 30, 2019 and June 30, 2019;

outstanding, 433.4 and 434.2 shares at September 30, 2019 and June 30, 2019, respectively | | 63.9 |

| | 63.9 |

|

Capital in excess of par value | | 1,213.7 |

| | 1,183.2 |

|

Retained earnings | | 17,729.6 |

| | 17,500.6 |

|

Treasury stock - at cost: 205.3 and 204.5 shares at September 30, 2019 and June 30, 2019, respectively | | (13,412.6 | ) | | (13,090.5 | ) |

Accumulated other comprehensive loss | | (233.9 | ) | | (257.3 | ) |

Total stockholders’ equity | | 5,360.7 |

| | 5,399.9 |

|

Total liabilities and stockholders’ equity | | $ | 37,714.7 |

| | $ | 41,887.7 |

|

of cash and cash equivalents have been pledged as collateral under the Company's reverse repurchase agreements. Refer to Note 9.

of funds held for clients to short-term marketable securities as a result of proceeds from commercial paper borrowings as of September 30, 2019 which were utilized to pay our client obligations. Refer to Note 9.

See notes to the Consolidated Financial Statements.

Automatic Data Processing, Inc. and Subsidiaries

Statements of Consolidated Cash Flows

(In millions)

(Unaudited)

|

| | | | | | | | |

| | Three Months Ended |

| | September 30, |

| | 2019 | | 2018 |

| | |

Cash Flows from Operating Activities: | | | | |

Net earnings | | $ | 582.4 |

| | $ | 505.4 |

|

Adjustments to reconcile net earnings to cash flows provided by operating activities: | | |

| | |

|

Depreciation and amortization | | 117.3 |

| | 99.0 |

|

Amortization of deferred contract costs | | 227.3 |

| | 216.9 |

|

Deferred income taxes | | 44.4 |

| | 26.4 |

|

Stock-based compensation expense | | 37.1 |

| | 38.4 |

|

Net pension expense | | (2.7 | ) | | 17.1 |

|

Net amortization of premiums and accretion of discounts on available-for-sale securities | | 12.2 |

| | 14.3 |

|

Impairment of intangible assets | | — |

| | 12.1 |

|

Gain on sale of assets | | (1.9 | ) | | — |

|

Other | | 11.9 |

| | 10.1 |

|

Changes in operating assets and liabilities, net of effects from acquisitions: | | |

| | |

|

Increase in accounts receivable | | (96.8 | ) | | (239.2 | ) |

Increase in other assets | | (391.7 | ) | | (471.2 | ) |

Decrease in accounts payable | | (15.1 | ) | | (2.3 | ) |

Decrease in accrued expenses and other liabilities | | (91.6 | ) | | (77.8 | ) |

Net cash flows provided by operating activities | | 432.8 |

| | 149.2 |

|

| | | | |

Cash Flows from Investing Activities: | | |

| | |

|

Purchases of corporate and client funds marketable securities | | (1,409.9 | ) | | (755.8 | ) |

Proceeds from the sales and maturities of corporate and client funds marketable securities | | 1,653.7 |

| | 539.8 |

|

Capital expenditures | | (56.8 | ) | | (43.2 | ) |

Additions to intangibles | | (88.2 | ) | | (73.8 | ) |

Acquisitions of businesses, net of cash acquired | | — |

| | (119.7 | ) |

Proceeds from the sale of property, plant, and equipment and other assets | | 23.4 |

| | — |

|

Net cash flows provided by / (used in) investing activities | | 122.2 |

| | (452.7 | ) |

| | | | |

Cash Flows from Financing Activities: | | |

| | |

|

Net decrease in client funds obligations | | (8,063.3 | ) | | (1,711.5 | ) |

Payments of debt | | (0.5 | ) | | (0.5 | ) |

Repurchases of common stock | | (309.7 | ) | | (227.1 | ) |

Net proceeds from stock purchase plan and stock-based compensation plans | | (32.1 | ) | | (24.4 | ) |

Dividends paid | | (343.3 | ) | | (302.6 | ) |

Net proceeds from reverse repurchase agreements | | 166.3 |

| | 448.4 |

|

Net proceeds from commercial paper borrowings | | 3,536.7 |

| | — |

|

Net cash flows used in financing activities | | (5,045.9 | ) | | (1,817.7 | ) |

| | | | |

Effect of exchange rate changes on cash, cash equivalents, restricted cash, and restricted cash equivalents | | (33.1 | ) | | (12.6 | ) |

| | | | |

Net change in cash, cash equivalents, restricted cash, and restricted cash equivalents | | (4,524.0 | ) | | (2,133.8 | ) |

| | | | |

Cash, cash equivalents, restricted cash, and restricted cash equivalents, beginning of period | | 6,796.2 |

| | 6,542.1 |

|

Cash, cash equivalents, restricted cash, and restricted cash equivalents, end of period | | $ | 2,272.2 |

| | $ | 4,408.3 |

|

| | | | |

Reconciliation of cash, cash equivalents, restricted cash, and restricted cash equivalents to the Consolidated Balance Sheets | | | | |

Cash and cash equivalents | | $ | 1,403.9 |

| | $ | 1,490.3 |

|

Restricted cash and restricted cash equivalents included in funds held for clients (A) | | 868.3 |

| | 2,918.0 |

|

Total cash, cash equivalents, restricted cash, and restricted cash equivalents | | $ | 2,272.2 |

| | $ | 4,408.3 |

|

| | | | |

Supplemental disclosures of cash flow information: | | | | |

Cash paid for interest | | $ | 53.6 |

| | $ | 49.4 |

|

Cash paid for income taxes, net of income tax refunds | | $ | 45.6 |

| | $ | 39.3 |

|

(A) Note 6 for a reconciliation of restricted cash and restricted cash equivalents in funds held for clients on the Consolidated Balance Sheets.

See notes to the Consolidated Financial Statements.

Automatic Data Processing, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements

(Tabular dollars in millions, except per share amounts or where otherwise stated)

(Unaudited)

Note 1. Basis of Presentation

The accompanying Consolidated Financial Statements and footnotes thereto of Automatic Data Processing, Inc., its subsidiaries and variable interest entity (“ADP” or the “Company”) have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”). The Consolidated Financial Statements and footnotes thereto are unaudited. In the opinion of the Company’s management, the Consolidated Financial Statements reflect all adjustments, which are of a normal recurring nature, that are necessary for a fair presentation of the Company’s interim financial results.

The Company has a grantor trust, which holds the majority of the funds provided by its clients pending remittance to employees of those clients, tax authorities, and other payees. The Company is the sole beneficial owner of the trust. The trust meets the criteria in Accounting Standards Codification (“ASC”) 810, “Consolidation” to be characterized as a variable interest entity (“VIE”). The Company has determined that it has a controlling financial interest in the trust because it has both (1) the power to direct the activities that most significantly impact the economic performance of the trust (including the power to make all investment decisions for the trust) and (2) the right to receive benefits that could potentially be significant to the trust (in the form of investment returns) and, therefore, consolidates the trust. Further information on these funds and the Company’s obligations to remit to its clients’ employees, tax authorities, and other payees is provided in Note 6, “Corporate Investments and Funds Held for Clients.”

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the assets, liabilities, revenue, expenses, and accumulated other comprehensive income that are reported in the Consolidated Financial Statements and footnotes thereto. Actual results may differ from those estimates. Interim financial results are not necessarily indicative of financial results for a full year. The information included in this Quarterly Report on Form 10-Q should be read in conjunction with the Company’s Annual Report on Form 10-K for the fiscal year ended June 30, 2019 (“fiscal 2019”).

Revision of Previously Reported Financial Information

The Company has historically classified certain fees collected from worksite employers for certain benefits within PEO revenues, and the associated costs of these benefits have historically been classified within operating expenses as PEO zero-margin benefits pass-through costs in the Company's Statements of Consolidated Earnings. During the quarter ended September 30, 2019, management determined that the Company does not retain risk and is acting as the agent, rather than as the primary obligor, for a portion of the fees collected for worksite employee benefits and the worksite employer is primarily responsible for fulfilling certain aspects of the service and has discretion in establishing price. Accordingly, the accompanying Statements of Consolidated Earnings for the three months ended September 30, 2018 has been revised to correct the amounts previously reported on a gross basis to a net basis by reducing PEO revenues and operating expenses for associated costs of an equal amount, as follows:

|

| | | | | | | | | | |

| Three Months Ended |

| September 30, 2018 |

| As reported | | Revision | | As revised |

PEO revenues | $ | 986.1 |

| | (12.9 | ) | | $ | 973.2 |

|

TOTAL REVENUES | 3,323.2 |

| | (12.9 | ) | | 3,310.3 |

|

Operating expenses | 1,709.9 |

| | (12.9 | ) | | 1,697.0 |

|

Total Expenses | 2,690.3 |

| | (12.9 | ) | | 2,677.4 |

|

EARNINGS BEFORE INCOME TAXES | 646.8 |

| | — |

| | 646.8 |

|

Provision for income taxes | 141.4 |

| | — |

| | 141.4 |

|

NET EARNINGS | $ | 505.4 |

| | — |

| | $ | 505.4 |

|

In addition, the revised amounts for the fiscal year ended June 30, 2019 are as follows:

|

| | | | | | | | | | |

| Twelve Months Ended |

| June 30, 2019 |

| As reported | | Revision | | As revised |

PEO revenues | $ | 4,237.5 |

| | (65.0 | ) | | $ | 4,172.5 |

|

TOTAL REVENUES | 14,175.2 |

| | (65.0 | ) | | 14,110.2 |

|

Operating expenses | 7,145.9 |

| | (65.0 | ) | | 7,080.9 |

|

Total Expenses | 11,280.7 |

| | (65.0 | ) | | 11,215.7 |

|

EARNINGS BEFORE INCOME TAXES | 3,005.6 |

| | — |

| | 3,005.6 |

|

Provision for income taxes | 712.8 |

| | — |

| | 712.8 |

|

NET EARNINGS | $ | 2,292.8 |

| | — |

| | $ | 2,292.8 |

|

The correction of these previously reported amounts had no impact on the Company's earnings before income taxes, net earnings, consolidated financial condition or cash flows. In addition, corresponding revisions have been made elsewhere in the Company's consolidated footnote disclosures, where applicable, including its Interim Financial Data by Segment disclosure.

Note 2. New Accounting Pronouncements

Recently Adopted Accounting Pronouncements

Effective July 1, 2019, the Company adopted accounting standard update (“ASU”) 2016-02, “Leases (ASC 842)” under the optional transition method. As a result, the Company recorded on the Consolidated Balance Sheets total operating lease right-of-use (“ROU”) assets of $573.3 million and total operating lease liabilities of $522.6 million, as of the adoption date. The adoption did not have an impact on our Statements of Consolidated Earnings or Statements of Consolidated Cash Flows. Refer to Note 7 for further details.

Recently Issued Accounting Pronouncements

The following table summarizes recent ASU's issued by the Financial Accounting Standards Board (“FASB”) which have been assessed: |

| | | |

Standard | Description | Effective Date | Effect on Financial Statements or Other Significant Matters |

ASU 2018-14 Compensation-Retirement Benefits-Defined Benefit Plans | This update modifies the disclosure requirements for employers that sponsor defined benefit pension or other post-retirement plans by removing and adding certain disclosures for these plans. The eliminated disclosures include (a) the amounts in accumulated other comprehensive income expected to be recognized in net periodic benefit costs over the next fiscal year, and (b) the effects of a one percentage point change in assumed health care cost trend rates on the net periodic benefit costs and the benefit obligation for post-retirement health care benefits. Additional disclosures include descriptions of significant gains and losses affecting the benefit obligation for the period. The amendments in ASU 2018-14 would need to be applied on a retrospective basis. | July 1, 2021 (Fiscal 2022) | The adoption of this guidance will modify disclosures but will not have an impact on the Company's consolidated results of operations, financial condition, or cash flows.

|

|

| | | |

Standard | Description | Effective Date | Effect on Financial Statements or Other Significant Matters |

ASU 2018-13 Fair Value Measurement | This update modifies the disclosure requirements on fair value measurements. Certain disclosures in ASU 2018-13 would need to be applied on a retrospective basis and others on a prospective basis. | July 1, 2020 (Fiscal 2021) | The adoption of this guidance will modify disclosures but will not have an impact on the Company's consolidated results of operations, financial condition, or cash flows.

|

ASU 2016-13 Financial Instruments - Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments | This update introduces the current expected credit loss (CECL) model, which will require an entity to measure credit losses for certain financial instruments and financial assets, including trade receivables. Under this update, on initial recognition and at each reporting period, an entity will be required to recognize an allowance that reflects the entity’s current estimate of credit losses expected to be incurred over the life of the financial instrument. In addition, this update modifies the impairment model for available-for-sale debt securities and provides for a simplified accounting model for purchased financial assets with credit deterioration since their origination. | July 1, 2020 (Fiscal 2021) | The adoption of this guidance will not have a material impact on its consolidated results of operations, financial condition, or cash flows.

|

Note 3. Revenue

Based upon similar operational and economic characteristics, the Company’s revenues are disaggregated by its three strategic pillars: HCM (“HCM”), HR Outsourcing (“HRO”), and Global (“Global”) Solutions with separate disaggregation for PEO zero-margin benefits pass-through revenues and client fund interest revenues. The Company believes these revenue categories depict how the nature, amount, timing, and uncertainty of its revenue and cash flows are affected by economic factors.

HCM provides a suite of product offerings that assist employers of all types and sizes in all stages of the employment cycle, from recruitment to retirement. Global is generally consistent with the types of services provided within HCM but represents geographies outside of the United States and includes our multinational offerings. HCM and Global revenues are primarily attributable to fees for providing solutions for payroll, benefits, talent, retirement services and HR processing and fees charged to implement the Company's solutions for clients.

HRO provides a comprehensive human resources outsourcing solution, including offering benefits, providing workers’ compensation insurance, and administering state unemployment insurance, among other human resources functions. This revenue is primarily driven by the PEO. Amounts collected from PEO worksite employers include payroll, fees for benefits, and an administrative fee that also includes payroll taxes, fees for workers’ compensation and state unemployment taxes. The payroll and payroll taxes collected from the worksite employers are presented in revenue net, as the Company does not retain risk and acts as an agent with respect to this aspect of the PEO arrangement. With respect to the payroll and payroll taxes, the worksite employer is primarily responsible for providing the service and has discretion in establishing wages. The fees collected from the worksite employers for benefits (i.e., PEO benefits pass-throughs), workers’ compensation and state unemployment taxes are presented in revenues and the associated costs of benefits, workers’ compensation and state unemployment taxes are included in operating expenses, as the Company acts as a principal with respect to this aspect of the arrangement. With respect to these fees, the Company is primarily responsible for fulfilling the service and has discretion in establishing price. The Company has further disaggregated HRO to separate out its PEO zero-margin benefits pass-through revenues.

The Company recognizes client fund interest revenues on collected but not yet remitted funds held for clients in revenues as earned, as the collection, holding and remittance of these funds are critical components of providing these services.

The following tables provide details of revenue by our strategic pillars with disaggregation for PEO zero-margin benefits pass-throughs and client fund interest, and includes a reconciliation to the Company’s reportable segments:

|

| | | | | | | |

| Three Months Ended |

| September 30, |

Types of Revenues | 2019 | | 2018 |

HCM | $ | 1,568.5 |

| | $ | 1,520.3 |

|

HRO, excluding PEO zero-margin benefits pass-throughs | 591.1 |

| | 557.5 |

|

PEO zero-margin benefits pass-throughs | 699.1 |

| | 640.5 |

|

Global | 503.1 |

| | 473.5 |

|

Interest on funds held for clients | 133.9 |

| | 118.5 |

|

Total Revenues | $ | 3,495.7 |

| | $ | 3,310.3 |

|

Reconciliation of disaggregated revenue to our reportable segments for the three months ended September 30, 2019:

|

| | | | | | | | | | | | | | | |

Types of Revenues | Employer Services | | PEO | | Other | | Total |

HCM | $ | 1,570.0 |

| | $ | — |

| | $ | (1.5 | ) | | $ | 1,568.5 |

|

HRO, excluding PEO zero-margin benefits pass-throughs | 235.7 |

| | 356.5 |

| | (1.1 | ) | | 591.1 |

|

PEO zero-margin benefits pass-throughs | — |

| | 699.1 |

| | — |

| | 699.1 |

|

Global | 503.1 |

| | — |

| | — |

| | 503.1 |

|

Interest on funds held for clients | 132.6 |

| | 1.3 |

| | — |

| | 133.9 |

|

Total Segment Revenues | $ | 2,441.4 |

| | $ | 1,056.9 |

| | $ | (2.6 | ) | | $ | 3,495.7 |

|

Reconciliation of disaggregated revenue to our reportable segments for the three months ended September 30, 2018:

|

| | | | | | | | | | | | | | | |

Types of Revenues | Employer Services | | PEO | | Other | | Total |

HCM | $ | 1,521.8 |

| | $ | — |

| | $ | (1.5 | ) | | $ | 1,520.3 |

|

HRO, excluding PEO zero-margin benefits pass-throughs | 226.1 |

| | 332.7 |

| | (1.3 | ) | | 557.5 |

|

PEO zero-margin benefits pass-throughs | — |

| | 640.5 |

| |

|

| | 640.5 |

|

Global | 473.5 |

| | — |

| |

|

| | 473.5 |

|

Interest on funds held for clients | 116.8 |

| | 1.7 |

| |

|

| | 118.5 |

|

Total Segment Revenues | $ | 2,338.2 |

| | $ | 974.9 |

| | $ | (2.8 | ) | | $ | 3,310.3 |

|

Contract Balances

The timing of revenue recognition for our HCM, HRO and Global Solutions is consistent with the invoicing of clients, as invoicing occurs in the period the services are provided. Therefore, the Company does not recognize a contract asset or liability resulting from the timing of revenue recognition and invoicing.

Changes in deferred revenue related to set up fees for the three months ended September 30, 2019 were as follows:

|

| | | |

Contract Liability | |

Contract liability, July 1, 2019 | $ | 563.4 |

|

Recognition of revenue included in beginning of year contract liability | (45.4 | ) |

Contract liability, net of revenue recognized on contracts during the period | 31.2 |

|

Currency adjustments | (4.5 | ) |

Contract liability, September 30, 2019 | $ | 544.7 |

|

Note 4. Earnings per Share (“EPS”)

|

| | | | | | | | | | | | | | |

| | Basic | | Effect of Employee Stock Option Shares | | Effect of Employee Restricted Stock Shares | | Diluted |

Three Months Ended September 30, 2019 | | |

| | |

| | |

| | |

|

Net earnings | | $ | 582.4 |

| | |

| | |

| | $ | 582.4 |

|

Weighted average shares (in millions) | | 432.7 |

| | 1.3 |

| | 1.4 |

| | 435.4 |

|

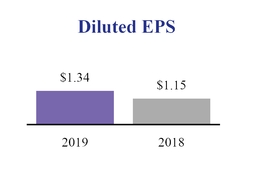

EPS | | $ | 1.35 |

| | |

| | |

| | $ | 1.34 |

|

Three Months Ended September 30, 2018 | | |

| | |

| | |

| | |

|

Net earnings | | $ | 505.4 |

| | |

| | |

| | $ | 505.4 |

|

Weighted average shares (in millions) | | 436.8 |

| | 1.4 |

| | 1.7 |

| | 439.9 |

|

EPS | | $ | 1.16 |

| | |

| | |

| | $ | 1.15 |

|

Options to purchase 0.7 million and 0.3 million shares of common stock for the three months ended September 30, 2019 and 2018, respectively, were excluded from the calculation of diluted earnings per share because their inclusion would have been anti-dilutive.

Note 5. Other Income, Net

|

| | | | | | | |

| Three Months Ended |

| September 30, |

| 2019 | | 2018 |

Interest income on corporate funds | $ | (32.3 | ) | | $ | (28.5 | ) |

Realized gains on available-for-sale securities | (2.6 | ) | | (0.4 | ) |

Realized losses on available-for-sale securities | 0.3 |

| | 1.3 |

|

Impairment of intangible assets | — |

| | 12.1 |

|

Gain on sale of assets | (1.9 | ) | | — |

|

Non-service components of pension expense, net (see Note 11) | (18.1 | ) | | 1.6 |

|

Other income, net | $ | (54.6 | ) | | $ | (13.9 | ) |

In fiscal 2019, the Company wrote down $12.1 million of internally developed software which was determined to have no future use due to redundant software identified as part of an acquisition.

Note 6. Corporate Investments and Funds Held for Clients

Corporate investments and funds held for clients at September 30, 2019 and June 30, 2019 were as follows:

|

| | | | | | | | | | | | | | | |

| September 30, 2019 |

| Amortized Cost | | Gross Unrealized Gains | | Gross Unrealized Losses | | Fair Market Value (A) |

Type of issue: | | | | | | | |

Money market securities, cash and other cash equivalents | $ | 2,272.2 |

| | $ | — |

| | $ | — |

| | $ | 2,272.2 |

|

Available-for-sale securities: | | | | | | | |

Corporate bonds | 10,716.8 |

| | 232.7 |

| | (2.2 | ) | | 10,947.3 |

|

Asset-backed securities | 4,325.9 |

| | 45.0 |

| | (2.8 | ) | | 4,368.1 |

|

U.S. Treasury securities | 3,474.5 |

| | 30.9 |

| | (5.9 | ) | | 3,499.5 |

|

U.S. government agency securities | 2,106.7 |

| | 25.1 |

| | (2.2 | ) | | 2,129.6 |

|

Canadian government obligations and Canadian government agency obligations | 1,155.3 |

| | 6.2 |

| | (5.7 | ) | | 1,155.8 |

|

Canadian provincial bonds | 793.7 |

| | 16.0 |

| | (0.3 | ) | | 809.4 |

|

Municipal bonds | 561.3 |

| | 17.5 |

| | (0.1 | ) | | 578.7 |

|

Other securities | 1,130.5 |

| | 27.6 |

| | (0.5 | ) | | 1,157.6 |

|

| | | | | | | |

Total available-for-sale securities | 24,264.7 |

| | 401.0 |

| | (19.7 | ) | | 24,646.0 |

|

| | | | | | | |

Total corporate investments and funds held for clients | $ | 26,536.9 |

| | $ | 401.0 |

| | $ | (19.7 | ) | | $ | 26,918.2 |

|

(A) $4,121.1 million and funds held for clients with fair values of $20,524.9 million. All available-for-sale securities were included in Level 2 of the fair value hierarchy. |

| | | | | | | | | | | | | | | |

| June 30, 2019 |

| Amortized Cost | | Gross Unrealized Gains | | Gross Unrealized Losses | | Fair Market Value (B) |

Type of issue: | |

| | |

| | |

| | |

|

Money market securities, cash and other cash equivalents | $ | 6,796.2 |

| | $ | — |

| | $ | — |

| | $ | 6,796.2 |

|

Available-for-sale securities: | | | | | | | |

|

Corporate bonds | 10,691.8 |

| | 182.8 |

| | (6.7 | ) | | 10,867.9 |

|

Asset-backed securities | 4,658.3 |

| | 37.8 |

| | (5.4 | ) | | 4,690.7 |

|

U.S. Treasury securities | 2,933.0 |

| | 23.8 |

| | (8.0 | ) | | 2,948.8 |

|

US government agency securities | 2,612.0 |

| | 17.7 |

| | (5.8 | ) | | 2,623.9 |

|

Canadian government obligations and Canadian government agency obligations | 1,164.1 |

| | 7.0 |

| | (6.0 | ) | | 1,165.1 |

|

Canadian provincial bonds | 800.2 |

| | 14.5 |

| | (0.5 | ) | | 814.2 |

|

Municipal bonds | 596.1 |

| | 16.4 |

| | (0.1 | ) | | 612.4 |

|

Other securities | 1,116.1 |

| | 20.6 |

| | (0.6 | ) | | 1,136.1 |

|

| | | | | | | |

Total available-for-sale securities | 24,571.6 |

| | 320.6 |

| | (33.1 | ) | | 24,859.1 |

|

| | | | | | | |

Total corporate investments and funds held for clients | $ | 31,367.8 |

| | $ | 320.6 |

| | $ | (33.1 | ) | | $ | 31,655.3 |

|

(B) $271.9 million and funds held for clients with fair values of $24,587.2 million. All available-for-sale securities were included in Level 2 of the fair value hierarchy.

For a description of the fair value hierarchy and the Company's fair value methodologies, including the use of an independent third-party pricing service, see Note 1 “Summary of Significant Accounting Policies” in the Company's Annual Report on Form 10-K for fiscal 2019. The Company did not transfer any assets between Levels during the three months ended September 30, 2019 or fiscal 2019. In addition, the Company concurred with and did not adjust the prices obtained from the independent pricing service. The Company had no available-for-sale securities included in Level 1 or Level 3 at September 30, 2019.

The unrealized losses and fair values of available-for-sale securities that have been in an unrealized loss position for a period of less than and greater than 12 months as of September 30, 2019, are as follows:

|

| | | | | | | | | | | | | | | | | | | | | | | |

| September 30, 2019 |

| Securities in Unrealized Loss Position Less Than 12 Months | | Securities in Unrealized Loss Position Greater Than 12 Months | | Total |

| Gross

Unrealized

Losses | | Fair Market Value | | Gross

Unrealized

Losses | | Fair Market Value | | Gross Unrealized Losses | | Fair Market Value |

Corporate bonds | $ | (1.0 | ) | | $ | 438.5 |

| | $ | (1.2 | ) | | $ | 615.8 |

| | $ | (2.2 | ) | | $ | 1,054.3 |

|

Asset-backed securities | (0.9 | ) | | 327.2 |

| | (1.9 | ) | | 1,142.8 |

| | (2.8 | ) | | 1,470.0 |

|

U.S. Treasury securities | (0.2 | ) | | 90.8 |

| | (5.7 | ) | | 979.7 |

| | (5.9 | ) | | 1,070.5 |

|

U.S. government agency securities | (0.1 | ) | | 61.3 |

| | (2.1 | ) | | 945.3 |

| | (2.2 | ) | | 1,006.6 |

|

Canadian government obligations and Canadian government agency obligations | (5.7 | ) | | 794.4 |

| | — |

| | 1.1 |

| | (5.7 | ) | | 795.5 |

|

Canadian provincial bonds | (0.2 | ) | | 83.9 |

| | (0.1 | ) | | 29.8 |

| | (0.3 | ) | | 113.7 |

|

Municipal bonds | (0.1 | ) | | 20.0 |

| | — |

| | 5.0 |

| | (0.1 | ) | | 25.0 |

|

Other securities | (0.2 | ) | | 22.4 |

| | (0.3 | ) | | 67.6 |

| | (0.5 | ) | | 90.0 |

|

| $ | (8.4 | ) | | $ | 1,838.5 |

| | $ | (11.3 | ) | | $ | 3,787.1 |

| | $ | (19.7 | ) | | $ | 5,625.6 |

|

The unrealized losses and fair values of available-for-sale securities that have been in an unrealized loss position for a period of less than and greater than 12 months as of June 30, 2019, are as follows:

|

| | | | | | | | | | | | | | | | | | | | | | | |

| June 30, 2019 |

| Securities in Unrealized Loss Position Less Than 12 Months | | Securities in Unrealized Loss Position Greater Than 12 Months | | Total |

| Gross

Unrealized

Losses | | Fair Market Value | | Gross

Unrealized

Losses | | Fair Market Value | | Gross Unrealized Losses | | Fair Market Value |

Corporate bonds | $ | (0.6 | ) | | $ | 151.9 |

| | $ | (6.1 | ) | | $ | 2,055.6 |

| | $ | (6.7 | ) | | $ | 2,207.5 |

|

Asset-backed securities | (0.2 | ) | | 171.9 |

| | (5.2 | ) | | 2,083.5 |

| | (5.4 | ) | | 2,255.4 |

|

U.S. Treasury securities | — |

| | 1.8 |

| | (8.0 | ) | | 1,159.4 |

| | (8.0 | ) | | 1,161.2 |

|

U.S. government agency securities | — |

| | — |

| | (5.8 | ) | | 1,671.4 |

| | (5.8 | ) | | 1,671.4 |

|

Canadian government obligations and Canadian government agency obligations | (6.0 | ) | | 662.7 |

| | — |

| | 1.1 |

| | (6.0 | ) | | 663.8 |

|

Canadian provincial bonds | (0.3 | ) | | 81.5 |

| | (0.2 | ) | | 50.1 |

| | (0.5 | ) | | 131.6 |

|

Municipal bonds | — |

| | 1.5 |

| | (0.1 | ) | | 23.3 |

| | (0.1 | ) | | 24.8 |

|

Other securities | (0.1 | ) | | 36.4 |

| | (0.5 | ) | | 148.1 |

| | (0.6 | ) | | 184.5 |

|

| $ | (7.2 | ) | | $ | 1,107.7 |

| | $ | (25.9 | ) | | $ | 7,192.5 |

| | $ | (33.1 | ) | | $ | 8,300.2 |

|

At September 30, 2019, Corporate bonds include investment-grade debt securities with a wide variety of issuers, industries, and sectors, primarily carry credit ratings of A and above, and have maturities ranging from October 2019 through September 2029.

At September 30, 2019, asset-backed securities include AAA rated senior tranches of securities with predominantly prime collateral of fixed-rate auto loan, credit card, equipment lease, and rate reduction receivables with fair values of $2,157.9 million, $1,578.7 million, $481.8 million, and $149.7 million, respectively. These securities are collateralized by the cash flows of the underlying pools of receivables. The primary risk associated with these securities is the collection risk of the underlying receivables. All collateral on such asset-backed securities has performed as expected through September 30, 2019.

At September 30, 2019, U.S. government agency securities primarily include debt directly issued by Federal Home Loan Banks and Federal Farm Credit Banks with fair values of $1,266.5 million and $661.2 million, respectively. U.S. government agency securities represent senior, unsecured, non-callable debt that primarily carry ratings of Aaa by Moody's, and AA+ by Standard & Poor's, with maturities ranging from November 2019 through January 2029.

At September 30, 2019, other securities and their fair value primarily include U.S. government agency commercial mortgage-backed securities of $640.3 million issued by Federal Home Loan Mortgage Corporation and Federal National Mortgage Association, Aa2 rated United Kingdom Gilt securities of $188.1 million, AAA and AA rated supranational bonds of $108.5 million, and AAA and AA rated sovereign bonds of $89.5 million.

Classification of corporate investments on the Consolidated Balance Sheets is as follows:

|

| | | | | | | | |

| | September 30, | | June 30, |

| | 2019 | | 2019 |

Corporate investments: | | | | |

Cash and cash equivalents | | $ | 1,403.9 |

| | $ | 1,949.2 |

|

Short-term marketable securities | | 3,545.1 |

| | 10.5 |

|

Long-term marketable securities (a) | | 576.0 |

| | 261.4 |

|

Total corporate investments | | $ | 5,525.0 |

| | $ | 2,221.1 |

|

Funds held for clients represent assets that, based upon the Company's intent, are restricted for use solely for the purposes of satisfying the obligations to remit funds relating to the Company’s payroll and payroll tax filing services, which are classified as client funds obligations on our Consolidated Balance Sheets.

Funds held for clients have been invested in the following categories:

|

| | | | | | | | |

| | September 30, | | June 30, |

| | 2019 | | 2019 |

Funds held for clients: | | | | |

Restricted cash and cash equivalents held to satisfy client funds obligations | | $ | 868.3 |

| | $ | 4,847.0 |

|

Restricted short-term marketable securities held to satisfy client funds obligations | | 1,168.6 |

| | 5,013.9 |

|

Restricted long-term marketable securities held to satisfy client funds obligations | | 19,356.3 |

| | 19,573.3 |

|

Total funds held for clients | | $ | 21,393.2 |

| | $ | 29,434.2 |

|

Client funds obligations represent the Company's contractual obligations to remit funds to satisfy clients' payroll, tax, and other payee payment obligations and are recorded on the Consolidated Balance Sheets at the time that the Company impounds funds from clients. The client funds obligations represent liabilities that will be repaid within one year of the balance sheet date. The Company has reported client funds obligations as a current liability on the Consolidated Balance Sheets totaling $21,011.4 million and $29,144.5 million at September 30, 2019 and June 30, 2019, respectively. The Company has classified funds held for clients as a current asset since these funds are held solely for the purpose of satisfying the client funds obligations. Of the Company’s funds held for clients at September 30, 2019 and June 30, 2019, $18,898.2 million and $26,648.0 million, respectively, are held in the grantor trust. The liabilities held within the trust are intercompany liabilities to other Company subsidiaries and are eliminated in consolidation.

The Company has reported the cash flows related to the purchases of corporate and client funds marketable securities and related to the proceeds from the sales and maturities of corporate and client funds marketable securities on a gross basis in the investing section of the Statements of Consolidated Cash Flows. The Company has reported the cash and cash equivalents related to client funds investments with original maturities of ninety days or less, within the beginning and ending balances of

cash, cash equivalents, restricted cash, and restricted cash equivalents. These amounts have been reconciled to the Consolidated Balance Sheets on the Statements of Consolidated Cash Flows. The Company has reported the cash flows related to the cash received from and paid on behalf of clients on a net basis within net increase in client funds obligations in the financing activities section of the Statements of Consolidated Cash Flows.

Approximately 79% of the available-for-sale securities held a AAA or AA rating at September 30, 2019, as rated by Moody's, Standard & Poor's, DBRS for Canadian dollar-denominated securities, and Fitch for asset-backed and commercial mortgage-backed securities. All available-for-sale securities were rated as investment grade at September 30, 2019.

Expected maturities of available-for-sale securities at September 30, 2019 are as follows:

|

| | | |

One year or less | $ | 4,713.6 |

|

One year to two years | 6,040.5 |

|

Two years to three years | 4,743.3 |

|

Three years to four years | 3,726.7 |

|

After four years | 5,421.9 |

|

Total available-for-sale securities | $ | 24,646.0 |

|

Note 7. Leases

During the first quarter of the fiscal year ending June 30, 2020 ("fiscal 2020"), the Company adopted ASC 842 using the optional transition method under which financial results reported in periods prior were not adjusted and continue to be reported in accordance with historic accounting under ASC 840 - Leases.

The Company elected the following practical expedients permitted under the lease standard:

| |

• | The Company did not reassess prior conclusions about lease identification, lease classification or initial direct costs, and did not use hindsight for leases existing at adoption date. |

| |

• | The Company did not record leases with an initial term of 12 months or less on the consolidated balance sheet but continues to expense them on a straight-line basis over the lease term. |

| |

• | The Company elected to combine lease and non-lease components for our facilities leases only. Non-lease components consist primarily of maintenance services. |

The Company records leases on the consolidated balance sheets as operating lease ROU assets, records the current portion of operating lease liabilities within accrued expenses and other current liabilities and, separately, records long-term operating lease liabilities.

The Company has entered into operating lease agreements for facilities and equipment. The Company's leases have remaining lease terms of up to approximately ten years. Operating lease ROU assets and operating lease liabilities are recognized at the lease commencement date based on the present value of the lease payments over the lease term. The lease liabilities are measured by discounting future lease payments at the Company’s collateralized incremental borrowing rate for financing instruments of a similar term, unless the implicit rate is readily determinable. ROU assets also include adjustments related to prepaid or deferred lease payments and lease incentives. As of September 30, 2019, total operating lease ROU assets were $504.0 million, current and long-term operating lease liabilities were approximately $103.3 million and $355.4 million, respectively. The difference between total ROU assets and total lease liabilities are primarily attributable to pre-payments of our obligations and the recognition of various lease incentives.

The components of operating lease expense were as follows for the three months ended September 30, 2019:

|

| | | |

Operating lease cost | $ | 44.2 |

|

Short-term lease cost | 2.7 |

|

Variable lease cost | 1.3 |

|

Total operating lease cost | $ | 48.2 |

|

Information related to our operating lease ROU assets and operating lease liabilities was as follows:

|

| | | |

| September 30, 2019 |

Cash paid for operating lease liabilities | $ | 40.2 |

|

Operating lease ROU assets obtained in exchange for new operating lease liabilities | $ | 6.7 |

|

Weighted-average remaining lease term (in years) | 6 |

|

Weighted-average discount rate | 2.4 | % |

As of September 30, 2019, maturities of operating lease liabilities are as follows:

|

| | | |

Nine months ending June 30, 2020 | $ | 87.0 |

|

Twelve months ending June 30, 2021 | 97.1 |

|

Twelve months ending June 30, 2022 | 80.8 |

|

Twelve months ending June 30, 2023 | 68.2 |

|

Twelve months ending June 30, 2024 | 47.6 |

|

Thereafter | 116.0 |

|

Total undiscounted lease obligations | 496.7 |

|

Less: Imputed interest | (38.0 | ) |

Net lease obligations | $ | 458.7 |

|

Note 8. Goodwill and Intangible Assets, net

Changes in goodwill for the three months ended September 30, 2019 are as follows:

|

| | | | | | | | | | | |

| Employer Services | | PEO Services | | Total |

Balance at June 30, 2019 | $ | 2,318.2 |

| | $ | 4.8 |

| | $ | 2,323.0 |

|

Additions and other adjustments | (3.3 | ) | | — |

| | (3.3 | ) |

Currency translation adjustments | (16.4 | ) | | — |

| | (16.4 | ) |

Balance at September 30, 2019 | $ | 2,298.5 |

| | $ | 4.8 |

| | $ | 2,303.3 |

|

Components of intangible assets, net, are as follows:

|

| | | | | | | | |

| | September 30, | | June 30, |

| | 2019 | | 2019 |

Intangible assets: | | | | |

Software and software licenses | | $ | 2,556.5 |

| | $ | 2,519.3 |

|

Customer contracts and lists | | 867.8 |

| | 860.7 |

|

Other intangibles | | 238.5 |

| | 237.9 |

|

| | 3,662.8 |

| | 3,617.9 |

|

Less accumulated amortization: | | |

| | |

|

Software and software licenses | | (1,788.0 | ) | | (1,762.3 | ) |

Customer contracts and lists | | (576.9 | ) | | (566.4 | ) |

Other intangibles | | (219.0 | ) | | (217.7 | ) |

| | (2,583.9 | ) | | (2,546.4 | ) |

Intangible assets, net | | $ | 1,078.9 |

| | $ | 1,071.5 |

|

Other intangibles consist primarily of purchased rights, trademarks and trade names (acquired directly or through acquisitions). All intangible assets have finite lives and, as such, are subject to amortization. The weighted average remaining useful life of the intangible assets is 6 years (6 years for software and software licenses, 6 years for customer contracts and lists, and 5 years for other intangibles). Amortization of intangible assets was $69.4 million and $53.4 million for the three months ended September 30, 2019 and 2018, respectively.

Estimated future amortization expenses of the Company's existing intangible assets are as follows:

|

| | | |

| Amount |

Nine months ending June 30, 2020 | $ | 209.7 |

|

Twelve months ending June 30, 2021 | $ | 223.0 |

|

Twelve months ending June 30, 2022 | $ | 176.6 |

|

Twelve months ending June 30, 2023 | $ | 139.4 |

|

Twelve months ending June 30, 2024 | $ | 108.8 |

|

Twelve months ending June 30, 2025 | $ | 61.4 |

|

Note 9. Short-term Financing

The Company has a $3.8 billion, 364-day credit agreement that matures in June 2020 with a one year term-out option. The Company also has a $2.75 billion five year credit facility that matures in June 2024 that contains an accordion feature under which the aggregate commitment can be increased by $500 million, subject to the availability of additional commitments. In addition, the Company has a five year $3.75 billion credit facility maturing in June 2023 that also contains an accordion feature under which the aggregate commitment can be increased by $500 million, subject to the availability of additional commitments. The interest rate applicable to committed borrowings is tied to LIBOR, the effective federal funds rate, or the prime rate, depending on the notification provided by the Company to the syndicated financial institutions prior to borrowing. The Company is also required to pay facility fees on the credit agreements. The primary uses of the credit facilities are to provide liquidity to the commercial paper program and funding for general corporate purposes, if necessary. The Company had no borrowings through September 30, 2019 under the credit agreements.

The Company's U.S. short-term funding requirements related to client funds are sometimes obtained on an unsecured basis through the issuance of commercial paper, rather than liquidating previously-collected client funds that have already been invested in available-for-sale securities. This commercial paper program provides for the issuance of up to $10.3 billion in aggregate maturity value. The Company’s commercial paper program is rated A-1+ by Standard & Poor’s and Prime-1 by Moody’s. These ratings denote the highest quality commercial paper securities. Maturities of commercial paper can range from overnight to up to 364 days. At September 30, 2019, the Company had $3,536.7 million of commercial paper outstanding, which was repaid in early October 2019. At June 30, 2019, the Company had no commercial paper borrowing outstanding. Details of the borrowings under the commercial paper program are as follows:

|

| | | | | | | |

| Three Months Ended |

| September 30, |

| 2019 | | 2018 |

Average daily borrowings (in billions) | $ | 4.0 |

| | $ | 3.7 |

|

Weighted average interest rates | 2.3 | % | | 2.0 | % |

Weighted average maturity (approximately in days) | 2 days |

| | 2 days |

|

The Company’s U.S., Canadian and United Kingdom short-term funding requirements related to client funds obligations are sometimes obtained on a secured basis through the use of reverse repurchase agreements, which are collateralized principally by government and government agency securities, rather than liquidating previously-collected client funds that have already been invested in available-for-sale securities. These agreements generally have terms ranging from overnight to up to five business days. At September 30, 2019 and June 30, 2019, the Company had $428.6 million and $262.0 million, respectively, of outstanding obligations related to the reverse repurchase agreements. All outstanding reverse repurchase obligations matured and were fully paid in early October 2019 and early July 2019, respectively. Details of the reverse repurchase agreements are as follows:

|

| | | | | | | |

| Three Months Ended |

| September 30, |

| 2019 | | 2018 |

Average outstanding balances | $ | 426.6 |

| | $ | 495.1 |

|

Weighted average interest rates | 2.0 | % | | 1.7 | % |

Note 10. Debt

The Company has fixed-rate notes with 5-year and 10-year maturities for an aggregate principal amount of $2.0 billion (collectively the “Notes”). The Notes are senior unsecured obligations, and interest is payable in arrears, semi-annually.

The principal amounts and associated effective interest rates of the Notes and other debt as of September 30, 2019 and June 30, 2019, are as follows: |

| | | | | | | | | | |

Debt instrument | | Effective Interest Rate | | September 30, 2019 | | June 30, 2019 |

Fixed-rate 2.25% notes due September 15, 2020 | | 2.37% | | $ | 1,000.0 |

| | $ | 1,000.0 |

|

Fixed-rate 3.375% notes due September 15, 2025 | | 3.47% | | 1,000.0 |

| | 1,000.0 |

|

Other | | | | 9.2 |

| | 10.9 |

|

| | | | 2,009.2 |

| | 2,010.9 |

|

Less: current portion | | | | (1,001.3 | ) | | (2.5 | ) |

Less: unamortized discount and debt issuance costs | | | | (4.5 | ) | | (6.2 | ) |

Total long-term debt | | | | $ | 1,003.4 |

| | $ | 2,002.2 |

|

The effective interest rates for the Notes include the interest on the Notes and amortization of the discount and debt issuance costs.

As of September 30, 2019, the fair value of the Notes, based on Level 2 inputs, was $2,074.1 million. For a description of the fair value hierarchy and the Company's fair value methodologies, including the use of an independent third-party service, see Note 1 “Summary of Significant Accounting Policies” in the Company's Annual Report on Form 10-K for fiscal 2019.

Note 11. Employee Benefit Plans

A. Stock-based Compensation Plans. Stock-based compensation consists of the following:

| |

• | Stock Options. Stock options are granted to employees at exercise prices equal to the fair market value of the Company's common stock on the dates of grant. Stock options generally vest ratably over 4 years and have a term of 10 years. Compensation expense is measured based on the fair value of the stock option on the grant date and recognized on a straight-line basis over the vesting period. Stock options are forfeited if the employee ceases to be employed by the Company prior to vesting. |

| |

• | Time-Based Restricted Stock and Time-Based Restricted Stock Units. Time-based restricted stock and time-based restricted stock units granted September 1, 2018 and after generally vest ratably over 3 years. Time-based restricted stock and time-based restricted stock units granted prior to September 1, 2018 are generally subject to a vesting period of 2 years. Awards are forfeited if the employee ceases to be employed by the Company prior to vesting. |

Time-based restricted stock cannot be transferred during the vesting period. Compensation expense relating to the issuance of time-based restricted stock is measured based on the fair value of the award on the grant date and recognized on a straight-line basis over the vesting period. Dividends are paid on shares awarded under the time-based restricted stock program.