| Kansas Municipal Fund | ||||||||||||||||||||||||||||||

| KANSAS MUNICIPAL FUND—FUND SUMMARY | ||||||||||||||||||||||||||||||

| Investment Objectives | ||||||||||||||||||||||||||||||

| The Fund seeks to provide its shareholders with as high a level of current income that is exempt from both federal income tax and Kansas income tax as is consistent with preservation of capital. | ||||||||||||||||||||||||||||||

| Fees and Expenses of the Fund | ||||||||||||||||||||||||||||||

| This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. You may qualify for sales charge discounts with respect to purchases of shares of the Fund if you and your family invest, or agree to invest in the future, at least $100,000 in the Fund or in other funds in the Integrity/Viking family of funds. More information about these and other discounts is available from your financial professional and in “Distribution Arrangements—Sales Loads and Rule 12b-1 Fees” on page 47 of the Fund’s prospectus and “Purchase, Redemption, and Pricing of Shares” on page B-36 of the Fund’s statement of additional information. | ||||||||||||||||||||||||||||||

| Shareholder Fees (fees paid directly from your investment) | ||||||||||||||||||||||||||||||

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | ||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||

| Example | ||||||||||||||||||||||||||||||

| This Example is intended to help you compare the cost of investing in the Fund with the costs of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year, that the Fund’s operating expenses remain the same, and that the contractual expense limitation agreement currently in place is not renewed beyond November 29, 2017. Although your actual costs may be higher or lower, based on these assumptions your costs would be: | ||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||

| Portfolio Turnover | ||||||||||||||||||||||||||||||

| The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the Example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 12.10% of the average value of its portfolio. | ||||||||||||||||||||||||||||||

| Principal Investment Strategies | ||||||||||||||||||||||||||||||

| The Fund purchases Kansas municipal bonds that, at the time of purchase, are either rated investment grade (BBB- or higher) by at least one independent ratings agency, or, if non-rated, have been judged by the Fund’s investment adviser to be of comparable quality. The Fund is non-diversified and may invest more of its assets in a single issuer than a diversified mutual fund. The expected average dollar weighted maturity of the Fund’s portfolio is between 5 and 25 years. To pursue its objective, the Fund normally invests at least 80% of its assets (including any borrowings for investment purposes) in municipal securities that pay interest free from federal income taxes and Kansas personal income taxes (excluding alternative minimum tax (“AMT”)). The Fund may invest up to 100% of its assets in municipal securities that pay interest subject to the AMT. Municipal securities generally include debt obligations issued by the state of Kansas and its political subdivisions, municipalities, agencies and authorities, and debt obligations issued by U.S. territories and possessions. State and local governments, their agencies and authorities issue municipal securities to borrow money for various public and private projects. Municipal securities pay a fixed, floating, or variable rate of interest and require the amount borrowed (principal) to be repaid at maturity. The Fund may invest up to 15% of its total assets in U.S. territorial obligations (including qualifying obligations of Puerto Rico, the U.S. Virgin Islands, and Guam), the interest on which is exempt from federal income taxes. The Fund’s investment adviser uses a value-oriented strategy and looks for higher-yielding municipal bonds that offer the potential for above-average return. To assess a bond’s investment potential, the Fund’s investment adviser considers the bond’s yield, price, credit quality, and future prospects. The Fund’s investment adviser will consider selling a municipal bond with deteriorating credit or limited upside potential compared to other available bonds. | ||||||||||||||||||||||||||||||

| Principal Risks | ||||||||||||||||||||||||||||||

| As with all mutual funds, there is the risk that you could lose money through your investment in the Fund. Many factors affect the Fund's net asset value and performance. General risk. There is no assurance that the Fund will meet its investment objective. The Fund's share price, and the value of your investment, may change. When the value of the Fund's investments goes down, so does its share price. Since the value of the Fund's shares can go up or down, it is possible to lose money by investing in the Fund. Non-diversification risk. Because the Fund is non-diversified, it may invest a relatively high percentage of its assets in a limited number of issuers; therefore its investment return is more likely to be impacted by changes in the market value and returns of any one issuer. Municipal volatility risk. The municipal market can be significantly affected by a number of factors, including adverse tax, legislative or political changes, changes in interest rates, general economic and market conditions, and the financial condition of the issuers of municipal securities. Municipal securities and single state risks. The values of municipal securities held by the Fund may be adversely affected by local political and economic conditions and developments. Adverse conditions in an industry significant to a local economy could have a correspondingly adverse effect on the financial condition of local issuers. Because the Fund invests primarily in the municipal securities of Kansas, it is particularly susceptible to any economic, political, or regulatory developments affecting a particular issuer or issuers of the Kansas municipal securities in which it invests. Investing primarily in a single state makes the Fund more sensitive to risks specific to the state. To the extent it invests a significant portion of its assets in the municipal securities of U.S. territories and possessions, the Fund will also be more sensitive to risks specific to such U.S. territories and possessions. In recent years, certain municipal bond issuers in Puerto Rico have been experiencing financial difficulties and rating agency downgrades. Interest rate risk. Interest rate risk is the risk that the value of the Fund’s portfolio will decline because of rising interest rates. Risks associated with rising rates are heightened given that interest rates in the U.S. are at, or near, historic lows. Interest rate changes are influenced by a number of factors, including government policy, monetary policy, inflation expectations, perceptions of risk, and supply of and demand for securities. When interest rates change, the values of longer-duration debt securities usually change more than the values of shorter-duration debt securities. Income risk. The income from the Fund's portfolio may decline because of falling market interest rates. This can result when the Fund invests the proceeds from new share sales, or from matured or called bonds, at market rates that are below the portfolio's current earnings rate. Liquidity risk. Liquidity risk is the risk that the Fund may not be able to sell a holding in a timely manner at a desired price. Liquidity risk may result from the lack of an active market, the reduced number of traditional market participants, or the reduced capacity of traditional market participants to make a market in securities. The secondary market for certain municipal securities tends to be less developed and liquid than many other securities markets, which may adversely affect the Fund's ability to sell such municipal securities at attractive prices. Moreover, inventories of municipal securities held by brokers and dealers have decreased in recent years, lessening their ability to make a market in these securities. This reduction in market making capacity has the potential to decrease the Fund's ability to buy or sell bonds, and increase bond price volatility and trading costs, particularly during periods of economic or market stress. As a result, the Fund may be forced to accept a lower price to sell a security, to sell other securities to raise cash, or to give up an investment opportunity, any of which could have a negative effect on performance. If the Fund needed to sell large blocks of securities to raise cash (such as to meet heavy shareholder redemptions), those sales could further reduce the securities' prices and hurt performance. Maturity risk. Generally, longer-term securities are more susceptible to changes in value as a result of interest-rate changes than are shorter-term securities. Credit risk. Credit risk is the possibility that an issuer will be unable to make interest payments or repay principal. Changes in an issuer's financial strength or in a security's credit rating may affect its value. Securities supported by insurance or other credit enhancements also have the credit risk of the entity providing the insurance or other credit support. Changes in the credit quality of the insurer or other credit provider could affect the value of the security and the Fund's share price. Not all securities are rated. In the event that rating agencies assign different ratings to the same security, the Fund's investment adviser may rely on the higher rating. Credit risks associated with certain particular classifications of municipal securities include: General Obligation Bonds—Timely payments depend on the issuer's credit quality, ability to raise tax revenues, and ability to maintain an adequate tax base.Municipal insurance risk. The Fund's investments may include investments in insured municipal securities. Municipal security insurance does not guarantee the value of either individual municipal securities or of shares of the Fund. In addition, a municipal security insurance policy generally will not cover: (i) repayment of a municipal security before maturity (redemption), (ii) prepayment or payment of an acceleration premium (except for a mandatory sinking fund redemption) or any other provision of a bond indenture that advances the maturity of the bond or (iii) nonpayment of principal or interest caused by negligence or bankruptcy of the paying agent. A mandatory sinking fund redemption may be a provision of a municipal security issue whereby part of the municipal security issue may be retired before maturity. Downgrades and withdrawal of ratings from insurers of municipal securities have substantially limited the availability of insurance sought by issuers of municipal securities thereby reducing the supply of insured municipal securities. Because of the consolidation among insurers of municipal securities, to the extent that the Fund invests in insured municipal securities, it is subject to the risk that credit risk may be concentrated among fewer insurers and the risk that events involving one or more insurers could have a significant adverse effect on the value of the securities insured by an insurer and on the municipal markets as a whole. Call risk. Call risk is the likelihood that a security will be prepaid (or "called") before maturity. An issuer is more likely to call its bonds when interest rates are falling, because the issuer can issue new bonds with lower interest payments. If a bond is called, the Fund may have to replace it with a lower-yielding security. Extension risk. Extension risk is the risk that an issuer will exercise its right to pay principal on an obligation held by the Fund later than expected. This may happen during a period of rising interest rates. Under these circumstances, the value of the obligation will decrease and the Fund will suffer from the inability to invest in higher yielding securities. Portfolio strategy risk. The investment adviser's skill in choosing appropriate investments for the Fund will determine in part the Fund's ability to achieve its investment objective. Inflation risk. There is a possibility that the rising prices of goods and services may have the effect of offsetting the Fund's real return. This is likely to have a greater impact on the returns of bond funds and money market funds, which historically have had more modest returns in comparison to equity funds. As inflation increases, the value of the Fund's assets can decline as can the value of the Fund's distributions. Tax risk. Income from municipal securities held by the Fund could be declared taxable because of unfavorable changes in tax laws, adverse interpretations by the Internal Revenue Service or state tax authorities, or noncompliant conduct of a bond issuer. Moreover, a portion of the Fund's otherwise exempt-interest dividends may be taxable to those shareholders subject to the AMT. In addition, proposals have been made to restrict or eliminate the federal income tax exemption for interest on municipal securities, and similar proposals may be introduced in the future. Proposed "flat tax" and "value added tax" proposals would also have the effect of eliminating the tax preference for municipal securities. Some of these proposals would apply to interest on municipal securities issued before the date of enactment, which would adversely affect their value to a material degree. If such a proposal were enacted, the availability of municipal securities for investment by the Fund and the value of the Fund's portfolio would be adversely affected. Municipal sector risk. The Fund may invest more than 25% of its total assets in municipal securities that finance, or pay interest from the revenues of, similar projects that tend to be impacted the same or similar ways by economic, business or political developments, which would increase credit risk. For example, legislation on the financing of a project or a declining economic need for the project would likely affect all similar projects. Risks of health care revenue bonds. The Fund may invest in health care revenue bonds. The health care sector is subject to regulatory action by a number of private and governmental agencies, including federal, state, and local governmental agencies. A major source of revenues for the health care sector is payments from the Medicare and Medicaid programs. As a result, the sector is sensitive to legislative changes and reductions in governmental spending for such programs. Numerous other factors may affect the sector, such as general economic conditions; demand for services; expenses (including malpractice insurance premiums); and competition among health care providers. In addition, various factors may adversely affect health care facility operations, including adoption of national, state and/or local health care reform measures; medical and technological advances which dramatically alter the need for health services or the way in which such services are delivered; changes in medical coverage which alter the traditional fee-for-service revenue stream; and efforts by employers, insurers and governmental agencies to reduce the costs of health care insurance and health care services. Risks of electric utility revenue bonds. The Fund may invest in electric utility revenue bonds. The electric utilities industry has been experiencing increased competitive pressures. Additional risks associated with electric utility revenue bonds include: (a) the availability and costs of fuel; (b) the availability and costs of capital; (c) the effects of conservation on energy demand; (d) the effects of rapidly changing environmental, safety, and licensing requirements, and other federal, state and local regulations; (e) timely and sufficient rate increases; and (f) opposition to nuclear power. Risks of gas utility revenue bonds. The Fund may invest in gas utility revenue bonds. Gas utilities are subject to the risks of supply conditions and increased competition from other providers of utility services. In addition, gas utilities are affected by gas prices, which may be magnified to the extent that a gas company enters into long-term contracts for the purchase or sale of gas at fixed prices, since such prices may change significantly and to the disadvantage of the gas utility in the open market. Gas utilities are particularly susceptible to supply and demand imbalances due to unpredictable climate conditions and other factors and are subject to regulatory risks as well. Risks of water and sewer revenue bonds. The Fund may invest in water and sewer revenue bonds. Issuers of water and sewer bonds face public resistance to rate increases, costly environmental litigation and Federal environmental mandates. In addition, the lack of water supply due to insufficient rain, run-off, or snow pack may be a concern. Cybersecurity risk. Cybersecurity breaches may allow an unauthorized party to gain access to Fund assets, customer data, or proprietary information, or cause the Fund and/or its service providers to suffer data corruption or lose operational functionality. Valuation risk. The sales price the Fund could receive for any particular portfolio investment may differ from the Fund's valuation of the investment, particularly for securities that trade in thin or volatile markets or that are valued using a fair value methodology. | ||||||||||||||||||||||||||||||

| Fund Performance | ||||||||||||||||||||||||||||||

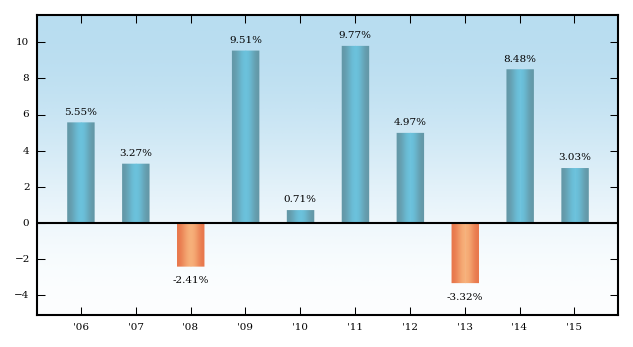

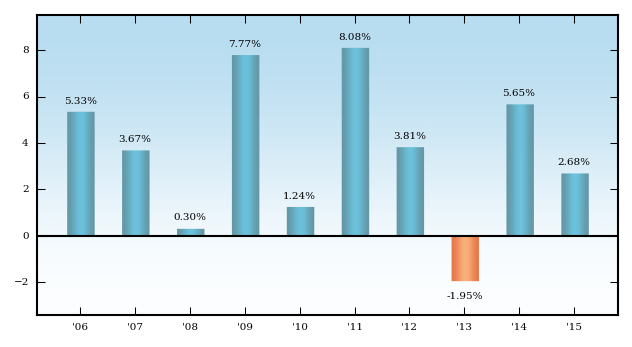

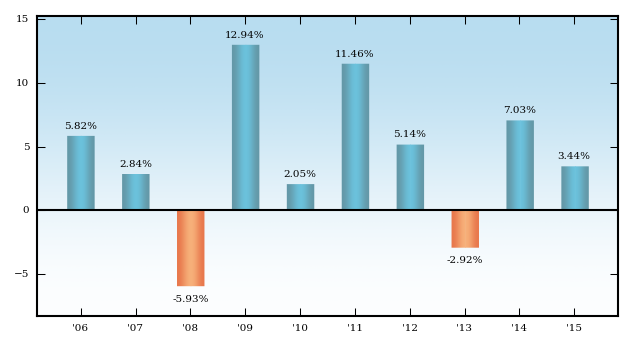

| The following bar chart and table provide some indication of the potential risks of investing in the Fund. The bar chart below shows the variability of the Fund’s performance from year to year. The table below shows the Fund’s average annual returns for 1, 5 and 10 years, and since inception, and how they compare over the time periods indicated with those of a broad measure of market performance. The Fund’s past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. Updated performance information is available at www.integrityvikingfunds.com or by calling 800-276-1262. The bar chart and highest/lowest quarterly returns below do not reflect the Fund's sales charges, and if these charges were reflected, the returns would be less than those shown. | ||||||||||||||||||||||||||||||

| Annual Total Returns (as of 12/31 each year) | ||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||

| During the ten-year period shown in the bar chart, the highest return for a quarter was 5.10% (quarter ended September 30, 2009), and the lowest return for a quarter was -3.97% (quarter ended December 31, 2010). | ||||||||||||||||||||||||||||||

| After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts. | ||||||||||||||||||||||||||||||

| Average Annual Total Returns (for the periods ended December 31, 2015) | ||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||