UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the registrant ☒ Filed by a party other than the registrant ☐

| Check the appropriate box: |

| ☐ | Preliminary Proxy Statement |

| ☐ | CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14A-6(E)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to Section 240.14a-12 |

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of filing fee (check the appropriate box): |

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

April 5, 2023

Dear Shareholder:

You are cordially invited to join us for our 2023 Annual Meeting of Shareholders to be held on Wednesday, May 17, 2023, at 8:30 a.m. at Helix Energy Solutions Group, Inc.’s corporate office, 3505 West Sam Houston Parkway North, Suite 400, Houston, Texas 77043.

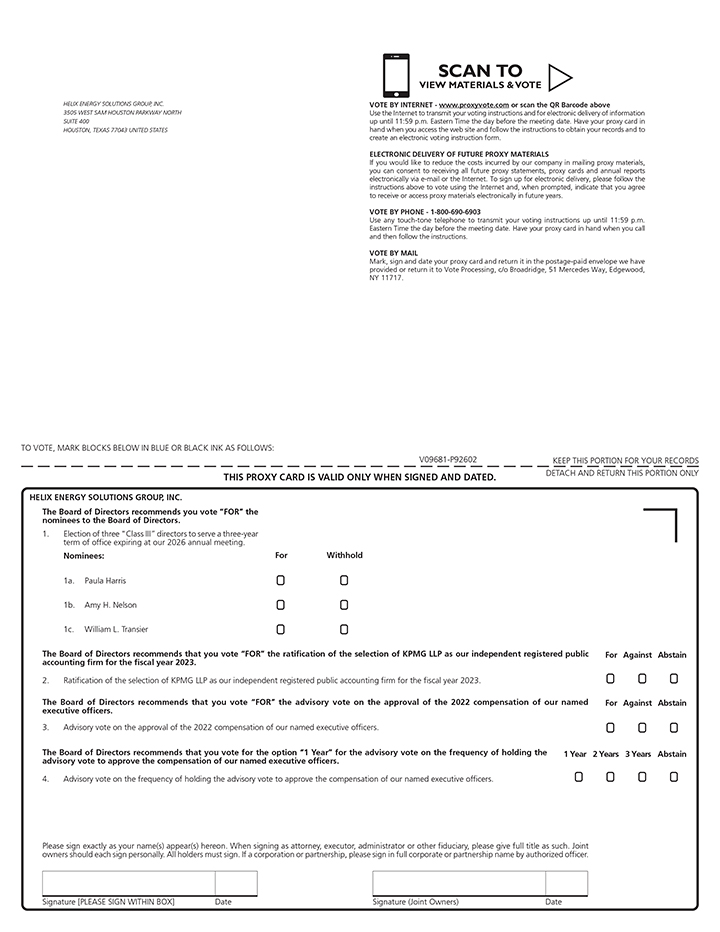

The materials following this letter include the formal Notice of Annual Meeting of Shareholders and the proxy statement. The proxy statement describes the business to be conducted at the Annual Meeting, including the election of three Class III directors, the ratification of the selection of KPMG LLP as our independent registered public accounting firm for the 2023 fiscal year, an advisory vote on the approval of the 2022 compensation of our named executive officers, and an advisory vote on the frequency of holding the advisory vote to approve the compensation of our named executive officers.

We have elected to furnish proxy materials to our shareholders on the Internet pursuant to rules adopted by the Securities and Exchange Commission. We believe that this election enables us to provide you with the information you need, while making delivery more efficient, more cost effective and friendlier to the environment. In accordance with these rules, we have sent a Notice of Availability of Proxy Materials to each of our shareholders.

Whether you own a few or many shares of our stock, we want your shares to be represented. Regardless of whether you plan to attend the Annual Meeting, please take a moment to vote your proxy over the Internet, by telephone, or if this proxy statement was mailed to you, by completing and signing the enclosed proxy card and promptly returning it in the envelope provided. The Notice of Annual Meeting of Shareholders of this proxy statement includes instructions on how to vote your shares.

Helix’s officers and directors appreciate and encourage shareholder participation. We look forward to your participation in the Annual Meeting.

|

Sincerely, |

|

|

|

|

|

Owen

Kratz |

|

Important notice regarding the availability of proxy materials for the Annual Meeting of Shareholders to be held on May 17, 2023 The Helix Energy Solutions Group, Inc. 2023 Proxy Statement and Annual Report to Shareholders (including our Annual Report on Form 10-K) for the fiscal year ended December 31, 2022 are available electronically at www.helixesg.com/annualmeeting |

Table of Contents

|

Helix Energy Solutions Group, Inc. | 2023 Proxy Statement | i |

|

HELIX ENERGY SOLUTIONS GROUP, INC. 3505 West Sam Houston Parkway North, Suite 400 Houston, Texas 77043 |

Notice

of 2023 Annual

Meeting of Shareholders

| Items of Business | |||

| 1 | To elect three Class III directors to serve a three-year term expiring at the Annual Meeting of Shareholders in 2026 or, if at a later date, until their successors are duly elected and qualified. | ||

| 2 | To ratify the selection of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023. | ||

| 3 | Advisory vote on the approval of the 2022 compensation of our named executive officers. | ||

| 4 | Advisory vote on the frequency of holding the advisory vote to approve the compensation of our named executive officers. | ||

| 5 | To consider any other business that may properly be considered at the Annual Meeting or any adjournment thereof. | ||

By Order of the Board of Directors,

Kenneth E. Neikirk

Executive Vice President,

General Counsel and Corporate Secretary

Houston, Texas

April 5, 2023

|

Date Wednesday, May 17, 2023 |

|

Time 8:30 a.m., Central Daylight Time |

|

Place Helix Energy Solutions Group, Inc.’s corporate office, 3505 West Sam Houston Parkway North, Suite 400, Houston, TX 77043 |

|

Record Date You may vote at the Annual Meeting if you were a holder of record of our common stock at the close of business on March 21, 2023. |

|

Voting By Proxy Please vote your proxy as soon as possible, even if you plan to attend the Annual Meeting. Shareholders of record can vote by one of the following methods: 1. CALL 800.690.6903 to vote by telephone; OR 2. GO TO THE WEBSITE 3. IF PRINTED PROXY MATERIALS WERE MAILED TO YOU, MARK, SIGN, DATE AND RETURN your proxy card in the enclosed postage-paid envelope. If you are voting by telephone or the Internet, please do not mail your proxy card. |

|

Important notice regarding the availability of proxy materials for the annual meeting of shareholders to be held on May 17, 2023: The proxy statement and Annual Report to Shareholders (including our Annual Report on Form 10-K) for the fiscal year ended December 31, 2022 are also available at www.helixesg.com/annualmeeting. |

Your Vote is Important |

| ii | 2023 Proxy Statement | Helix Energy Solutions Group, Inc. |  |

Proxy Summary

|

Date Wednesday, |

|

Time 8:30 a.m., Central |

|

Place Helix Energy Solutions |

Company Statement

The Board of Directors of Helix Energy Solutions Group, Inc., a Minnesota corporation (referred to herein as “Helix,” the “Company,” “we,” “us” or “our”), is soliciting your proxy to vote at our 2023 Annual Meeting of Shareholders (the “Annual Meeting”) on Wednesday, May 17, 2023. This proxy statement contains information about the items being voted on at the Annual Meeting and information about Helix. Please read it carefully.

Voting Matters

| Voting Item | Recommendation | Page Reference | |||||

| 1 | Election of Three Class III Directors | “FOR” each nominee | 11 | ||||

| 2 | Ratification of Public Accounting Firm | “FOR” | 35 | ||||

| 3 | Advisory Vote on the Approval of the 2022 Compensation of Our Named Executive Officers | “FOR” | 73 | ||||

| 4 | Advisory Vote on the Frequency of Holding the Advisory Vote to Approve the Compensation of Our Named Executive Officers | “1 YEAR” | 75 | ||||

Ways to Vote

Shareholders of record can vote by one of the following methods:

|

Phone Call 800.690.6903 to vote by telephone; OR |

|

Internet Go to the website vote over the Internet; OR |

|

Mark, sign, date and return your proxy card in the enclosed postage-paid envelope. |

|

Helix Energy Solutions Group, Inc. | 2023 Proxy Statement | 1 |

Proxy Summary

Board of Directors

|

|

|

||

|

Nominee Paula Harris |

Nominee Amy H. Nelson |

Nominee William L. Transier |

|

|

|

|

|

||||

|

Diana Glassman Hermes |

Amerino Gatti Energy Executive |

Owen Kratz Helix Energy Solutions Group, Inc. |

T. Mitch Little Energy Executive |

John V. Lovoi JVL Partners |

Board Independence

87.5% of our Board is Independent as defined under NYSE Rule 303A and applicable rules promulgated under the Securities Exchange Act of 1934.

| 87.5% Independent |

The Chairman of the Board is Indpendent and all members of our committees are Independent:

|

Audit Committee |

|

Compensation Committee |

|

Corporate Governance and Nominating Committee |

| 2 | 2023 Proxy Statement | Helix Energy Solutions Group, Inc. |  |

Proxy Summary

Summary Board Matrix

| Gatti | Glassman | Harris | Kratz | Little | Lovoi | Nelson | Transier | |

| Knowledge, Skills and Experience | ||||||||

| Accounting/Financial |  |

|

|

|||||

| Corporate Governance/Ethics |  |

|

|

|

|

|

|

|

| Energy Industry |  |

|

|

|

|

|

|

|

| Energy Transition/Sustainability |  |

|

|

|||||

| Executive Experience |  |

|

|

|

|

|||

| Health, Safety & Environmental |  |

|

|

|||||

| HR/Compensation |  |

|

|

|||||

| International Business |  |

|

|

|

|

|

||

| Mergers and Acquisitions |  |

|

|

|

|

|

|

|

| Operations |  |

|

|

|

||||

| Other Public Company Board Experience |  |

|

|

|

|

|

||

| Risk Management |  |

|

|

|

|

|||

| Science, Technology and Engineering |  |

|

|

|

||||

| Strategic Planning/Oversight |  |

|

|

|

|

|

|

|

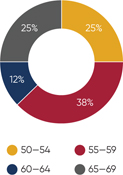

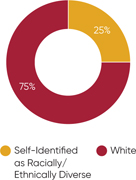

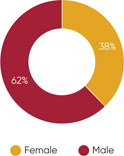

Diversity of the Board

| Age | Racial/Ethnic Diversity | Gender Diversity |

|

|

|

| 11 Years |

| Average Tenure of our Directors |

| 8 Years |

| Average Tenure of our Independent Directors |

|

Helix Energy Solutions Group, Inc. | 2023 Proxy Statement | 3 |

Proxy Statement

Annual Meeting of Shareholders to be Held on May 17, 2023

The Board of Directors of Helix Energy Solutions Group, Inc., a Minnesota corporation (referred to herein as “Helix,” the “Company,” “we,” “us” or “our”), is soliciting your proxy to vote at our 2023 Annual Meeting of Shareholders (the “Annual Meeting”) on Wednesday, May 17, 2023. This proxy statement contains information about the items being voted on at the Annual Meeting and information about Helix. Please read it carefully.

The Annual Meeting will be held at Helix’s corporate office, 3505 West Sam Houston Parkway North, Suite 400, Houston, Texas 77043. Helix’s Board of Directors (the “Board”) has set March 21, 2023 as the record date for the Annual Meeting. There were 151,493,912 shares of Helix common stock outstanding on the record date.

As permitted by Securities and Exchange Commission (“SEC”) rules, we are making this proxy statement and our 2022 Annual Report to Shareholders available to our shareholders electronically via the Internet. On or about April 5, 2023, we intend to mail to our shareholders a Notice of Availability of Proxy Materials (the “Notice”). The Notice contains instructions on how to vote online, by telephone or, in the alternative, how to request a paper copy of the proxy materials and proxy card. By providing the Notice and access to our proxy materials via the Internet, we are lowering the costs and reducing the environmental impact of the Annual Meeting.

| 4 | 2023 Proxy Statement | Helix Energy Solutions Group, Inc. |  |

General Information

| 1. | Why am I receiving these materials? |

We are providing these proxy materials to you in connection with the Annual Meeting, to be held on Wednesday, May 17, 2023 at 8:30 a.m. Central Daylight Time (Houston Time) at Helix’s corporate office, 3505 West Sam Houston Parkway North, Suite 400, Houston, Texas 77043, and all reconvened meetings after adjournments thereof. As a shareholder of Helix, you are invited to attend the Annual Meeting and are entitled and requested to vote on the proposals described in this proxy statement.

| 2. | What proposals will be voted on at the Annual Meeting? |

Four matters are currently scheduled to be voted on at the Annual Meeting:

| ● | First is the election of three Class III directors to the Board, to serve a three-year term expiring at the Annual Meeting of Shareholders in 2026 or, if at a later date, until their successors are duly elected and qualified. |

| ● | Second is the ratification of the selection by the Board’s Audit Committee of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023 (subject to the ongoing discretionary authority of the Audit Committee to direct the appointment of a new independent registered public accounting firm should the Audit Committee believe such is in the best interest of Helix and its shareholders). |

| ● | Third is the advisory vote on the approval of the 2022 compensation of our named executive officers. |

| ● | Fourth is the advisory vote on the frequency of holding the advisory vote to approve the compensation of our named executive officers. |

Although we do not expect any other items of business, we also will consider other business that properly comes before the Annual Meeting or any adjournment thereof in accordance with Minnesota law and our By-laws. The moderator of the Annual Meeting may refuse to allow the presentation of a proposal or a nomination for the Board from the floor of the Annual Meeting if the proposal or nomination was not properly submitted.

| 3. | Who may vote at the Annual Meeting? |

The Board has set March 21, 2023 as the record date for the Annual Meeting. Owners of Helix common stock whose shares are recorded directly in their name in our stock register (“shareholders of record”) at the close of business on March 21, 2023 may vote their shares on the matters to be acted upon at the Annual Meeting. Shareholders who, as of March 21, 2023, hold shares of our common stock in “street name,” that is, through an account with a broker, bank or other nominee, may direct the shareholder of record how to vote their shares at the Annual Meeting by following the instructions they will receive from the shareholder of record for this purpose. You are entitled to one vote for each share of common stock you held on the record date on each of the matters presented at the Annual Meeting.

|

Helix Energy Solutions Group, Inc. | 2023 Proxy Statement | 5 |

General Information

| 4. | How does the Board recommend that I vote, and what are the voting standards? |

| Voting Item | Voting Recommendation |

Voting Standard to Approve Proposal (assuming a quorum is present) |

Treatment of: |

||||||||

| Abstentions | Broker Non-Votes | ||||||||||

| 1 | Election of Directors | “FOR” each nominee |

Plurality Voting Standard: The three nominees receiving the greatest number of votes cast | “Withhold authority” or abstentions not counted as votes cast and as such have no effect(a) | Not counted as votes cast and as such have no effect; brokers may not vote on this proposal absent instructions | ||||||

| 2 | Ratification of Public Accounting Firm | “FOR” | Majority of Votes Cast: Votes that shareholders cast “for” must exceed the votes that shareholders cast “against” | Counted as votes “against” | Not counted as votes cast and as such have no effect; brokers may vote without restriction on this proposal | ||||||

| 3 | Advisory Vote on the Approval of the 2022 Compensation of Named Executive Officers(b) | “FOR” | Majority of Votes Cast: Votes that shareholders cast “for” must exceed the votes that shareholders cast “against” | Counted as votes “against” | Not counted as votes cast and as such have no effect; brokers may not vote on this proposal absent instructions | ||||||

| 4 | Advisory Vote on the Frequency of Holding the Advisory Vote to Approve the Compensation of Named Executive Officers(c) |

“1 YEAR” | The choice of frequency that receives the highest number of votes will be considered the advisory vote of the shareholders | Not counted as votes cast and as such have no effect | Not counted as votes cast and as such have no effect; brokers may not vote on this proposal absent instructions | ||||||

| (a) | In accordance with the Corporate Governance Guidelines for the Board, any nominee receives a greater number of “withhold authority” than votes “for” his or her election, then that nominee is to promptly tender his or her resignation, which the Board, upon the recommendation of the Corporate Governance and Nominating Committee, will decide to accept or decline. |

| (b) | Because this shareholder vote is advisory, the vote will not be binding on the Board or Helix. The Compensation Committee, however, will review the voting results and take them into consideration when making future compensation decisions for our named executive officers. |

| (c) | Because this shareholder vote is advisory, the vote will not be binding on the Board or Helix. The Board, however, will review the voting results and take them into consideration when determining the frequency of holding the advisory vote to approve the compensation of our named executive officers. |

5. If I received a notice in the mail regarding Internet availability of the proxy materials instead of a paper copy of the proxy materials, why was that the case?

We are using the “notice and access” process permitted by the SEC to distribute proxy materials to certain shareholders. This process allows us to post proxy materials on a designated website and notify our shareholders of the availability of the proxy materials on that website. As such, we are furnishing proxy materials, including this proxy statement and our 2022 Annual Report to Shareholders, to most of our shareholders by providing access to those documents on the Internet instead of mailing paper copies. The Notice, which is being mailed to most of our shareholders, describes how to access and review all of the proxy materials on the Internet. The Notice also describes how to vote via the Internet. If you would like to receive a paper copy by mail or an electronic copy by e-mail of the proxy materials, you should follow the instructions in the Notice. Accessing your proxy materials on the Internet and receiving future proxy materials by e-mail saves us the cost of printing and mailing documents to you and reduces the impact on the environment.

6. Can I vote my shares by filling out and returning the Notice of Availability of Proxy Materials?

No. The Notice identifies the matters to be voted on at the Annual Meeting, but you cannot vote by marking the Notice and returning it.

| 6 | 2023 Proxy Statement | Helix Energy Solutions Group, Inc. |  |

General Information

7. How do I vote my shares?

If you are a shareholder of record, you may either vote your shares in person at the Annual Meeting or designate another person to vote your shares. That other person is called a “proxy,” and you may vote your shares through your proxy using one of the following methods of voting:

| • | by telephone, |

| • | electronically using the Internet, or |

| • | if this proxy statement was mailed to you, by marking, signing and dating the enclosed proxy card and returning it in the enclosed postage-paid envelope. |

The instructions for these three methods of voting your shares are set forth on the Notice and also on the proxy card. If you return your signed proxy card but do not mark the boxes showing how you wish to vote, your shares will be voted as recommended by the Board. The giving of a proxy does not affect your right to vote during the Annual Meeting (until the polls are closed).

8. Am I a shareholder of record?

Shareholder of Record. If your shares are registered directly in your name with our transfer agent, EQ Shareowner Services, you are considered a “shareholder of record” with respect to those shares and the Notice is being sent directly to you by EQ Shareowner Services. As a shareholder of record, you may vote at the Annual Meeting or vote by proxy. Whether or not you plan to attend the Annual Meeting, we urge you to vote by telephone, via the Internet, or by marking, signing, dating and returning the proxy card.

Beneficial Owner. If like most Helix shareholders you hold your shares in “street name” through a broker, bank or other nominee (your “Nominee”) rather than directly in your own name, you are considered the “beneficial owner” of those shares, and the Notice is being forwarded to you by your Nominee as the shareholder of record. If you are a beneficial owner, you may appoint proxies and vote as provided by your Nominee. The availability of telephone or Internet voting will depend upon the voting process of your Nominee. You should follow the voting directions provided by your Nominee. If you provide specific voting instructions in accordance with the directions provided by your Nominee, your Nominee will vote your shares as you have directed.

Your Nominee is considered to be the shareholder of record for purposes of voting at the Annual Meeting. Accordingly, you may vote shares held in “street name” at the Annual Meeting only if you (a) obtain a signed “legal proxy” from your Nominee giving you the right to vote the shares and (b) provide an account statement or letter from your Nominee showing that you were the beneficial owner of the shares on the record date. If your shares are not registered in your name and you plan to attend the Annual Meeting and vote your shares, you should contact your Nominee to obtain a proxy executed in your favor and bring it to the Annual Meeting.

9. May I change my vote?

Yes. If you are a shareholder of record, you may change your vote and revoke your proxy prior to the vote at the Annual Meeting by sending a written statement to that effect to the Corporate Secretary of Helix, submitting a properly signed proxy card with a later date, or attending the meeting and voting in person at the Annual Meeting.

If you hold shares in “street name,” you must follow the procedures required by your Nominee to revoke or change a proxy. You should contact your Nominee directly for more information on these procedures.

|

Helix Energy Solutions Group, Inc. | 2023 Proxy Statement | 7 |

General Information

10. What is a quorum?

A majority of Helix’s outstanding shares of common stock as of the record date must be present at the Annual Meeting in order to hold the meeting and conduct business. This is called a quorum. Shares are counted as present at the Annual Meeting if a shareholder:

| • | is present at the Annual Meeting, or |

| • | has properly submitted a proxy (by telephone, electronically using the Internet or written proxy card). |

Proxies received but marked as abstentions or withholding authority and broker non-votes will be included in the calculation of the number of shares considered to be present at the meeting for quorum purposes.

11. What are broker non-votes and abstentions?

If you are the beneficial owner of shares held in street name, then your Nominee, as shareholder of record, is required to vote those shares in accordance with your instructions. However, if you do not give instructions to your Nominee, then it will have discretion to vote the shares with respect to “routine” matters, such as the ratification of the selection of an independent registered public accounting firm, but will not be permitted to vote with respect to “non-routine” matters, such as (i) the election of directors, (ii) the vote, on a non-binding advisory basis, on the approval of the 2022 compensation of our named executive officers and (iii) the vote, on a non-binding advisory basis, on the frequency of holding the advisory vote to approve the compensation of our named executive officers. Accordingly, if you do not instruct your Nominee on how to vote your shares with respect to non-routine matters, your shares will be broker non-votes with respect to those proposals.

An abstention is a decision by a shareholder to take a neutral position on a proposal being submitted to shareholders at a meeting. Taking a neutral position through an abstention is considered a vote cast on a proposal being submitted at a meeting, as described in the response to Question 4 above.

12. How many shares can vote?

On the record date, there were 151,493,912 shares of Helix common stock outstanding and entitled to vote at the Annual Meeting, held by approximately 76,460 beneficial owners.

These shares are the only securities entitled to vote at the Annual Meeting. Each holder of a share of common stock is entitled to one vote on each of the matters presented at the Annual Meeting for each share held on the record date.

13. What happens if additional matters are presented at the Annual Meeting?

Other than the four matters noted in response to Question 2 above, we are not aware of any other business to be acted upon at the Annual Meeting.

If you grant a proxy (other than the proxy held by the shareholder of record if you are the beneficial owner and hold your shares in street name) the persons named as proxy holders will have the discretion to vote your shares on any additional matters properly presented for a vote at the Annual Meeting or any adjournment thereof in accordance with Minnesota law and our By-laws.

14. What if I don’t provide specific voting instructions?

Shareholders of Record. If you are the shareholder of record and you return a signed proxy card but do not indicate how you wish to vote, then your shares will be voted in accordance with the recommendations of the Board on all matters presented in this proxy statement and as the proxy holders may determine in their discretion regarding any other matters properly presented for a vote at the Annual Meeting or any adjournment thereof. If you provide voting instructions on your proxy card with respect to any matter to be acted upon, the shares will be voted in accordance with your instructions.

Beneficial Owners. If you are a beneficial owner and hold your shares in street name and do not provide your Nominee with voting instructions, your Nominee will determine whether it has the discretionary authority to vote on the particular matter.

Under applicable rules, brokers, banks and other nominees have the discretion to vote on “routine” matters, such as the ratification of the selection of an independent registered public accounting firm, but do not have discretion to vote on

| 8 | 2023 Proxy Statement | Helix Energy Solutions Group, Inc. |  |

General Information

“non-routine” matters, such as (i) the election of directors, (ii) the vote, on a non-binding advisory basis, on the approval of the 2022 compensation of our named executive officers and (iii) the vote, on a non-binding advisory basis, on the frequency of holding the advisory vote to approve the compensation of our named executive officers.

Accordingly, if you do not instruct your Nominee on how to vote your shares with respect to non-routine matters, your shares will be broker non-votes with respect to those proposals.

| Your vote is especially important. If your shares are held in street name (by your Nominee), your Nominee cannot independently vote your shares for (i) the election of directors, (ii) the advisory vote on the approval of the 2022 compensation of our named executive officers or (iii) the advisory vote on the frequency of holding the advisory vote to approve the compensation of our named executive officers. Therefore, please promptly instruct your Nominee regarding how to vote your shares regarding these matters. |

15. Is my vote confidential?

Proxy cards, proxies delivered by the Internet or telephone, ballots and voting tabulations that identify individual shareholders are mailed or returned directly to Broadridge Financial Solutions as the independent inspector of election and handled in a manner that protects your voting privacy. As the independent inspector of election, Broadridge Financial Solutions will count the votes.

16. What does it mean if I receive more than one proxy card?

It means you hold shares registered in more than one account. To ensure that all your shares are voted, please follow the instructions and vote the shares represented by each proxy card that you receive. To avoid this situation in the future, we encourage you to have all accounts registered in the same name and address whenever possible. For shares you hold directly, you can do this by contacting our transfer agent, EQ Shareowner Services, at 800.468.9716.

17. Who will count the votes?

We have hired a third party, Broadridge Financial Solutions, to judge the voting, be responsible for determining whether a quorum is present, and tabulate votes cast by proxy or in person at the Annual Meeting.

18. Who will bear the cost for soliciting votes for the Annual Meeting?

We will bear all expenses in conjunction with the solicitation of proxies, including the charges of brokerage houses and other custodians, nominees or fiduciaries for forwarding documents to beneficial owners. However, we will not bear any costs related to an individual shareholder’s use of the Internet or telephone to cast their vote. Proxies may be solicited by mail, in person, by telephone or by facsimile, by certain of our directors, officers and other employees, without extra compensation.

19. How can I obtain directions to attend the Annual Meeting?

Directions to the Annual Meeting can be obtained at www.helixesg.com/annualmeeting.

20. May shareholders ask questions at the Annual Meeting?

Yes. During the Annual Meeting shareholders may ask questions directly related to the matters being voted on. To ensure an orderly meeting, we ask that shareholders direct questions to the moderator of the Annual Meeting.

In addition, certain directors, officers and other employees will be available at the meeting to provide information about 2022 developments and to answer questions of more general interest regarding Helix.

21. How do I find out the results of the Annual Meeting?

Preliminary voting results will be announced at the Annual Meeting. The final voting results will be reported in a Current Report on Form 8-K.

|

Helix Energy Solutions Group, Inc. | 2023 Proxy Statement | 9 |

General Information

22. Whom should I contact with other questions?

If you have additional questions about this proxy statement or the Annual Meeting, or would like additional copies of this proxy statement or our 2022 Annual Report to Shareholders (including our Annual Report on Form 10-K), please contact the Corporate Secretary, Helix Energy Solutions Group, Inc., 3505 West Sam Houston Parkway North, Suite 400, Houston, Texas 77043.

23. How may I communicate with Helix’s Board of Directors?

Shareholders may send communications in care of the Corporate Secretary, Helix Energy Solutions Group, Inc., 3505 West Sam Houston Parkway North, Suite 400, Houston, Texas 77043.

Please provide your name, address, and class and number of voting securities you hold, and indicate whether your message is for the Board as a whole, a particular group or committee of directors, our Chairman or another individual director.

24. When are shareholder proposals for the 2024 Annual Meeting of Shareholders due?

| Proposal Type | Deadline | Compliance | Submission | |||||

| To be included in the proxy statement for the 2024 Annual Meeting(1) |

December 7, 2023(2) | Must comply with Regulation 14A of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), regarding the inclusion of shareholder proposals in company-sponsored proxy materials |

All submissions to, or requests of, the Corporate Secretary should be addressed to our corporate office at: |

|||||

| Not to be included in the proxy statement | February 16, 2024(3) | Must comply with our By-laws and Regulation 14A of the Exchange Act(4)(5) |

3505 West Sam Houston Parkway North, Suite 400, Houston, Texas 77043 |

| (1) | The persons designated in the proxy card will be granted discretionary authority with respect to any shareholder proposal not submitted to us timely. |

| (2) | 120 days prior to the anniversary of this year’s mailing date. |

| (3) | Not less than 90 days prior to the anniversary of this year’s Annual Meeting. |

| (4) | A copy of our By-laws is available from our Corporate Secretary. |

| (5) | The shareholder providing the proposal must provide their name, address, and class and number of voting securities held by them. The shareholder must also be a shareholder of record on the day the notice is delivered to us, be eligible to vote at the 2024 Annual Meeting of Shareholders and represent that they intend to appear in person or by proxy at the meeting. |

| 10 | 2023 Proxy Statement | Helix Energy Solutions Group, Inc. |  |

Proposal

1:

Election of Directors

Three directors are to be elected at the Annual Meeting. The Board has proposed three nominees, Paula Harris, Amy H. Nelson and William L. Transier, to stand for election as Class III directors to serve a three-year term expiring at the Annual Meeting of Shareholders in 2026 or, if at a later date, until their respective successor is duly elected and qualified. Mmes. Harris and Nelson and Mr. Transier are currently serving as Class III directors.

The nominees have agreed to be named in this proxy statement and have indicated a willingness to continue to serve if elected. The Corporate Governance and Nominating Committee of the Board has determined that each of the nominees qualifies for election under its criteria for the evaluation of directors and has nominated the candidates for election. If a nominee becomes unable to serve before the election, the shares represented by proxies may be voted for a substitute designated by the Board, unless a contrary instruction is indicated on the proxy card. The Board has no reason to believe that any of the nominees will become unable to serve. The Board has affirmatively determined that each of Mmes. Harris and Nelson and Mr. Transier qualifies as “independent” as that term is defined under New York Stock Exchange (“NYSE”) Rule 303A and applicable rules promulgated under the Exchange Act.

Unless otherwise instructed, the persons named as proxies will vote all proxies received FOR the election of each person nominated below as a Class III director for a term of three years, until the Annual Meeting of Shareholders in 2026 or, if at a later date, until their respective successor is duly elected and qualified. There is no cumulative voting for the election of directors and the Class III directors will be elected by a plurality of the votes cast at the Annual Meeting.

In the section below, we provide the name and biographical information about each of the Class III director nominees and each other member of the Board. Information in each director’s biographical information is as of March 21, 2023. Information about the number of shares of our common stock beneficially owned by each director as of March 21, 2023 appears below under the heading “Share Ownership Information–Management Shareholdings” on page 77.

Vote Required

Election of each director requires the affirmative vote of holders of a plurality of the shares present or represented and voting on the proposal at the Annual Meeting. This means that the three nominees receiving the greatest number of votes cast by the holders entitled to vote on the matter will be elected as directors.

Under the Corporate Governance Guidelines for the Board, any nominee for director who receives a greater number of “withhold authority” than votes “for” his or her election is required to promptly tender his or her resignation. The Corporate Governance and Nominating Committee is to consider whether to accept or decline the resignation and make its recommendation to the full Board. The Board is to act upon the committee’s recommendation within 90 days of the shareholder vote, and the Board’s decision (and if the Board should decline the resignation, the reasons therefor) will be disclosed in a Current Report on Form 8-K.

|

Board of Directors Recommendation The Board recommends that you vote “FOR” the nominees to the Board of Directors set forth in this Proposal 1. |

|

Helix Energy Solutions Group, Inc. | 2023 Proxy Statement | 11 |

Proposal 1

| Information about Nominees for Class III Directors: | ||

Primary Occupation: Director Since:

Age: |

Paula Harris | |

|

Professional Experience: Ms. Harris was appointed as a director in September 2022. Ms. Harris is on the executive leadership team at the Houston Astros serving as Senior Vice President of Community and overseeing the Astros Foundation. Ms. Harris has over 34 years of experience in international oilfield services with Schlumberger Limited (NYSE: SLB), most recently serving as Director of Global Stewardship from 2015 until her retirement in 2020. Prior to such role at Schlumberger Ms. Harris served in a variety of roles of progressing leadership responsibility, initially having worked in field operations offshore before roles in training, sales and environmental-social sustainability, including leading the development and implementation of metrics-based, cost-efficient environmental programs tailored to meet the needs of stakeholders, communities and customers and aiding the delivery of long-term sustainable development goals in carbon reduction, energy efficiency, increased green technology sales and increased female and minority employees. Ms. Harris currently serves on the boards of directors of Hunting PLC (LSE: HTG), a manufacturer and provider of downhole metal tools and components to the oil and gas industry, and Chart Industries, Inc. (NYSE: GTLS), a global manufacturer of engineered equipment servicing multiple applications in the clean energy and industrial gas markets, as well as other privately held and non-profit boards. Ms. Harris holds a Bachelor of Science degree in petroleum engineering from Texas A&M University and a Master of Education degree in technical instruction and learning from Abilene Christian University. Director Qualifications: As a result of her professional experiences, Ms. Harris possesses particular knowledge and experience in the oilfield services sector, Environmental, Social and Governance (“ESG”) and sustainability matters, human capital resource management and training, corporate governance and community engagement that strengthen the Board’s collective qualifications, skills and experience. |

||

| 12 | 2023 Proxy Statement | Helix Energy Solutions Group, Inc. |  |

Proposal 1

Primary Occupation: Director

Since: Age: |

Amy H. Nelson | |

|

Professional Experience: Ms. Nelson was appointed as a director in August 2019. Ms. Nelson founded Greenridge Advisors, LLC in 2007, an energy services and equipment consulting firm focused on the development, execution and financing of corporate and business line strategies. Prior to founding Greenridge, Ms. Nelson served as Vice President of SCF Partners, an oilfield service and equipment-focused private equity firm, and worked for Amoco Production Company in planning, project management and engineering roles. In addition to serving on several private company boards during her tenure at SCF Partners and Greenridge, Ms. Nelson currently serves on the board of directors of APA Corporation (NYSE:APA), an independent energy company that explores for, develops and produces oil and natural gas. Since July 2019, Ms. Nelson has been a director of NexTier Oilfield Solutions Inc. (NYSE:NEX), which is a U.S. land oilfield service company providing well completion and production services. Ms. Nelson holds economics and mechanical engineering degrees from Rice University, and an M.B.A. with distinction from Harvard Business School. Director Qualifications: Ms. Nelson also has professional experience and direct engagement regarding ESG matters, and for each of the public company boards on which she serves she sits on the committees responsible for ESG oversight. As a result of her professional experiences, Ms. Nelson possesses particular knowledge and experience in corporate strategy, capital allocation, ESG matters, and the assessment and management of risks in the oil and gas industry including managing regulatory and compliance environmental issues, that strengthen the Board’s collective qualifications, skills and experience. |

|

Helix Energy Solutions Group, Inc. | 2023 Proxy Statement | 13 |

Proposal 1

Primary Occupation: Director

Since: Age: |

William L. Transier | |

|

Professional Experience: Mr. Transier has served as a director since October 2000, and served as Lead Independent Director from March 2016 through July 2017 when he was appointed Chairman of the Board. He is the founder and Chief Executive Officer of Transier Advisors, LLC, an independent advisory firm providing services to companies facing financial distress, suboptimal operational situations, turnaround, restructuring or in need of interim executive or board leadership. Mr. Transier was co-founder of Endeavour International Corporation, an international oil and gas exploration and production company. He served as non-executive Chairman of Endeavour’s board of directors from December 2014 until November 2015. He served from September 2006 until December 2014 as Chairman, Chief Executive Officer and President of Endeavour and as its Chairman and Co-Chief Executive Officer from its formation in February 2004 through September 2006. Prior to Endeavour, Mr. Transier served as Executive Vice President and Chief Financial Officer of Ocean Energy, Inc. and its predecessor, Seagull Energy Corporation from May 1996 to April 2003. Before his tenure with Ocean, Mr. Transier served in various roles including partner in the audit department and head of the Global Energy practice of KPMG LLP from June 1986 to April 1996. Mr. Transier served as the Chairman of the board of directors of Battalion Oil Corporation (which changed its name from Halcón Resources Corporation) and as Chairman of its audit committee from October 2019 until May 2021. In April 2020, Mr. Transier was elected to the board of Exela Technologies, Inc. where he serves as Chairman of its audit committee and a member of the strategic planning committee. In November 2022, Mr. Transier was elected to the board of M3-Brigade Acquisition III Corp. Mr. Transier was previously a member of the boards of Sears Holding Corporation (2018 – 2020), Teekay Offshore Partners L.P. (2019 – 2020), Gastar Exploration, Inc. (2018 – 2019), CHC Group Ltd. (2016 -2017) and Paragon Offshore plc (2014 – 2017). Mr. Transier has been recognized by the Dallas Business Journal as an Outstanding Director for excellence in corporate governance. Mr. Transier graduated from the University of Texas with a B.B.A. in accounting, has an M.B.A. from Regis University and earned an M.A. in Theological Studies from Dallas Baptist University. Director Qualifications: Mr. Transier also has extensive knowledge of international operations, the energy industry, leadership of complex organizations, financial restructuring, merger and acquisitions, and other aspects of operating a major corporation that strengthen the Board’s collective qualifications, skills and experience. As a result of his professional experiences, Mr. Transier possesses particular knowledge and experience in audit, accounting and disclosure compliance including accounting rules and regulations. |

| 14 | 2023 Proxy Statement | Helix Energy Solutions Group, Inc. |  |

Proposal 1

Information about Continuing Directors

Class II Directors with Term Expiring in 2024:

Primary Occupation: Director

Since: Age: |

Amerino Gatti | |

|

Professional Experience: Mr. Gatti was appointed as a director in August 2018. Mr. Gatti is an Energy Executive having most recently served as Chief Executive Officer and a member of the board of directors from January 2018 to March 2022, and as Chairman of the board from February 2020 to March 2022, of Team, Inc. (NYSE:TISI), a provider of integrated specialty industrial services with operations in over 20 countries, including inspection and assessment of critical assets utilized in the refining, petrochemical, power, pipeline, renewables and various other industries. Prior to joining Team, he served as an Executive Officer and President of the Production Group for Schlumberger Limited (NYSE:SLB), an oilfield services and products provider with operations in over 85 countries. Over his 25-year career at Schlumberger, Mr. Gatti served in a variety of roles of progressing leadership responsibility, including President Well Services, Vice President of the Production Group for North America, Vice President and General Manager for Qatar and Yemen, Global Vice President for Sand Management Services and Vice President Marketing for North America. Earlier in his Schlumberger career, he held field operations, engineering and human resources positions around the world, including North America, South Asia and the Middle East. Mr. Gatti holds a mechanical engineering degree from the University of Alberta, Canada. Director Qualifications: Mr. Gatti brings extensive knowledge of international business and executive leadership experience in operations, technology, talent management, and integrating and transforming complex organizations. In addition, his 30-year career in energy businesses provides him with global expertise in key customer segments that strengthen the Board’s collective qualifications, skills and experience. |

|

Helix Energy Solutions Group, Inc. | 2023 Proxy Statement | 15 |

Proposal 1

Primary Occupation: Director

Since: Age: |

Diana Glassman | |

|

Professional Experience: Ms. Glassman was appointed as a director in September 2022. Ms. Glassman since December 2019 has been Director-Engagement at EOS at Federated Hermes, a leader in the evolving field of responsible investing. She leads their Oil & Gas and co-leads their Technology sector engagements, as well as engagement on Human Capital including diversity, equity and inclusion with a focus on business strategy, capital allocation and ESG considerations. Ms. Glassman sits on Federated Hermes Limited’s Inclusion Committee and is Chair of its employee networks. Between July 2014 and December 2019 Ms. Glassman was Chief Executive Officer of Integration Strategy, Inc., a strategy consulting firm advising leaders of companies, private equity firms and government entities primarily in energy and infrastructure, and previously held positions of increasing responsibility at TD Bank Group, Credit Suisse and PricewaterhouseCoopers. Ms. Glassman holds a Bachelor of Science degree in Biology, magna cum laude from Yale University, an M.P.A. in International Development from Harvard Kennedy School, and an M.B.A. from Harvard Business School. Director Qualifications: Ms. Glassman brings experience as a senior strategy consultant and public and private company executive. She has extensive experience in investment analysis, corporate governance, strategy planning and change management. Ms. Glassman also has professional experience in energy transition, sustainability, merger integration and employee engagement. As a result of her professional experiences, Ms. Glassman possesses particular knowledge and leadership experiences in business strategy, change management and ESG matters that strengthen the Board's collective qualifications, skills and experience. |

Primary Occupation: Director

Since: Age: |

Owen Kratz | |

|

Professional Experience: Mr. Kratz is President and Chief Executive Officer of Helix. He was named Executive Chairman in October 2006 and served in that capacity until February 2008 when he resumed the position of President and Chief Executive Officer. He served as Helix’s Chief Executive Officer from April 1997 until October 2006. Mr. Kratz served as Helix’s President from 1993 until February 1999, and has served as a Director since 1990 (including as Chairman of the Board from May 1998 to July 2017). He served as Chief Operating Officer from 1990 through 1997. Mr. Kratz joined Cal Dive International, Inc. (now known as Helix) in 1984 and held various offshore positions, including saturation diving supervisor, and management responsibility for client relations, marketing and estimating. From 1982 to 1983, Mr. Kratz was the owner of an independent marine construction company operating in the Bay of Campeche. Prior to 1982, he was a superintendent for Santa Fe and various international diving companies, and a diver in the North Sea. From February 2006 to December 2011, Mr. Kratz was a member of the Board of Directors of Cal Dive International, Inc., a once publicly traded company, which was formerly a subsidiary of Helix. Mr. Kratz has a Bachelor of Science degree from State University of New York. Director Qualifications: As a result of these experiences, Mr. Kratz possesses extensive knowledge of the energy industry and significant executive leadership and international operational experience that strengthen the Board’s collective qualifications, skills and experience. |

| 16 | 2023 Proxy Statement | Helix Energy Solutions Group, Inc. |  |

Proposal 1

Class I Directors with Term Expiring in 2025:

Primary Occupation: Director

Since: Age: |

T. Mitch Little | |

|

Professional Experience: Mr. Little was appointed as a director in July 2021. He served as Executive Vice President – Operations for Marathon Oil Corporation (NYSE: MRO) from August 2016 until his retirement in December 2020, where he held full responsibility for all operations and development activities. Prior to such role Mr. Little served in a variety of roles of progressing leadership responsibility at Marathon, including Vice President – Conventional & Oil Sands Mining Assets, Vice President – International & Offshore Exploration & Production Operations, Managing Director – Norway, and General Manager – Worldwide Drilling & Completions. Mr. Little joined Marathon in 1986 and has over 30 years’ experience in the petroleum industry in various technical, supervisory and senior management positions. Mr. Little previously served as the Chairman of the Oilfield Energy Center, a non-profit venture dedicated to expanding awareness of subsurface hydrocarbon energy resources and supporting global stewardship in the communities that develop those resources in a safe and environmentally responsible manner. Director Qualifications: Mr. Little has a wide range of experience and knowledge in the oil and gas exploration and production industry. His over 30-year career of leadership experience and expertise in both domestic and international business in key customer segments strengthens the Board’s collective qualifications, skills and experience. |

Primary Occupation: Director

Since: Age: |

John V. Lovoi | |

|

Professional Experience: Mr. Lovoi was appointed as a director in February 2003. Mr. Lovoi is a founder and Managing Partner of JVL Partners, a private oil and gas investment partnership. Mr. Lovoi served as head of Morgan Stanley’s global oil and gas investment banking practice from 2000 to 2002 and was a leading oilfield services and equipment research analyst for Morgan Stanley from 1995 to 2000. Prior to joining Morgan Stanley in 1995, he spent two years as a senior financial executive at Baker Hughes and four years as an energy investment banker with Credit Suisse First Boston. Mr. Lovoi also serves as Chairman of the board of directors of Dril-Quip, Inc. (NYSE: DRQ), a provider of offshore drilling and production equipment to the global oil and gas business, and as Chairman of Epsilon Energy Ltd. (NASDAQ: EPSN), an exploration and production company focused in the Marcellus shale play in the northeast United States. Mr. Lovoi served as a director of Roan Resources, Inc., an independent oil and natural gas company focused on the Anadarko Basin, from September 2018 to December 2019. Mr. Lovoi graduated from Texas A&M University with a Bachelor of Science degree in chemical engineering and received an M.B.A. from the University of Texas. Director Qualifications: As a result of these professional experiences, Mr. Lovoi possesses particular financial knowledge and experience in financial matters including capital market transactions, strategic financial planning (including risk assessment), and analysis that strengthen the Board’s collective qualifications, skills and experience. |

|

Helix Energy Solutions Group, Inc. | 2023 Proxy Statement | 17 |

Corporate Governance

Composition of the Board

The Board currently consists of eight members and, in accordance with our By-laws, is divided into three classes of similar size. The members of each class are elected to serve a three-year term with the term of office of each class ending in successive years. The Class I, II and III directors are currently serving until the later of the Annual Meeting in 2025, 2024 and 2023 respectively, and their respective successors being duly elected and qualified. There are currently two directors in Class I and three directors each in Class II and Class III.

Role of the Board

The Board has established guidelines that it follows in matters of corporate governance. A complete copy of the Corporate Governance Guidelines for the Board of Directors, which were most recently amended in February 2023, is available on our website at www.helixesg.com/about-helix/our-company/corporate-governance. In accordance with the Corporate Governance Guidelines, the Board is vested with all powers necessary for the management and administration of Helix’s business operations. Although not responsible for our day-to-day operations, the Board has the responsibility to oversee management, provide strategic direction, provide counsel to management regarding the business of Helix, and to be informed, investigate and act as necessary to promote our business objectives.

Board of Directors Independence and Determinations

The Board has affirmatively determined that each of Mr. Gatti, Ms. Glassman, Ms. Harris, Mr. Little, Mr. Lovoi, Ms. Nelson and Mr. Transier qualifies as “independent” as that term is defined under NYSE Rule 303A and applicable rules promulgated under the Exchange Act. In making this determination, the Board has concluded that none of these directors has a relationship with Helix that, in the opinion of the Board, is material and would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. Our only current non-independent director is Mr. Kratz, our President and Chief Executive Officer. Accordingly, a majority of the members of the Board are independent, as required by NYSE Rule 303A. This independence determination is analyzed annually to promote arms-length oversight. In making its determination regarding independence the Board reviewed the NYSE Rule 303A criteria for independence in advance of the first meeting of the Board in 2023. In connection with its determination, the Board gathered information with respect to each Board member individually regarding transactions and relationships between Helix and its directors, including the existence of ongoing transactions, if any, entered into between Helix and other entities of which our directors serve as officers or directors. Each director also completed a questionnaire, which included questions about his or her relationship with Helix. None of these transactions or relationships were deemed to affect the independence of the applicable director, nor did they exceed the thresholds established by NYSE rules.

Selection of Director Candidates

The Board is responsible for selecting candidates for Board membership and establishing the criteria to be used in identifying potential candidates. The Board delegates the screening and nomination process to the Corporate Governance and Nominating Committee. For more information on the director nomination process, including selection criteria, see “Corporate Governance and Nominating Committee” on page 26 and “Director Nomination Process” starting on page 28.

| 18 | 2023 Proxy Statement | Helix Energy Solutions Group, Inc. |  |

Corporate Governance

Board of Directors Qualifications, Skills and Experience

We are an international offshore energy services company that provides specialty services to the offshore energy industry, with a focus on well intervention, robotics and full-field decommissioning operations. Our services are centered on a threelegged business model well positioned to facilitate global energy transition by maximizing production of remaining oil and gas reserves, supporting renewable energy developments and decommissioning end-of-life oil and gas fields. We believe the Board should be composed of individuals with sophistication and experience in the substantive areas that impact our business. We believe qualifications, skills or experience in one or more of the following areas to be most important: offshore oilfield services, oil and gas exploration and production, renewable energy, international operations, accounting and finance, strategic planning, investor relations, leadership and administration of complex organizations, management of risk, human capital management, corporate governance and other areas related to the operation of a major international corporation (whether social, cultural, industrial, financial or operational). In addition, we focus on qualifications, skills and experience related to the importance of our ESG initiatives. We believe that each of our current Board members possesses the professional and personal qualifications necessary for Board service, with the director qualifications described in their biographies under “Election of Directors” on pages 11-17 and in the Matrix below.

Board of Directors Matrix

The following Matrix provides information regarding the members of our Board, including certain types of knowledge, skills, experiences and attributes possessed by one or more of our directors which our Board believes are relevant to our business and industry. The Matrix does not encompass all of the knowledge, skills, experiences or attributes of our directors, and the fact that a particular knowledge, skill, experience or attribute is not listed does not mean that a director does not possess it. In addition, the absence of a particular knowledge, skill, experience or attribute with respect to any of our directors does not mean the director in question is unable to contribute to the decision-making process in that area. The type and degree of knowledge, skill and experience listed below may vary among the members of our Board.

|

Helix Energy Solutions Group, Inc. | 2023 Proxy Statement | 19 |

Corporate Governance

| Gatti | Glassman | Harris | Kratz | Little | Lovoi | Nelson | Transier | ||||||||

| Knowledge, Skills and Experience | |||||||||||||||

| Accounting/Financial |  |

|

|

||||||||||||

| Corporate Governance/Ethics |  |

|

|

|

|

|

|

|

|||||||

| Energy Industry |  |

|

|

|

|

|

|

|

|||||||

| Energy Transition/Sustainability |  |

|

|

||||||||||||

| Executive Experience |  |

|

|

|

|

||||||||||

| Health, Safety & Environmental |  |

|

|

||||||||||||

| HR/Compensation |  |

|

|

||||||||||||

| International Business |  |

|

|

|

|

|

|||||||||

| Mergers and Acquisitions |  |

|

|

|

|

|

|

||||||||

| Operations |  |

|

|

|

|||||||||||

| Other Public Company Board Experience |  |

|

|

|

|

|

|||||||||

| Risk Management |  |

|

|

|

|

||||||||||

| Science, Technology and Engineering |  |

|

|

|

|||||||||||

| Strategic Planning/Oversight |  |

|

|

|

|

|

|

||||||||

| Demographics | |||||||||||||||

| Self-Identified Race/Ethnicity | |||||||||||||||

| Asian |  |

||||||||||||||

| Black/African American |  |

||||||||||||||

| Caucasian/White |  |

|

|

|

|

|

|

||||||||

| Hispanic/Latinx | |||||||||||||||

| Native American/Alaska Native | |||||||||||||||

| Native Hawaiian/Pacific Islander | |||||||||||||||

| Country of Birth | Canada | USA | USA | Zimbabwe | USA | USA | USA | USA | |||||||

| Self-Identified Gender/Sexual Orientation | |||||||||||||||

| Female |  |

|

|

||||||||||||

| Male |  |

|

|

|

|

||||||||||

| Non-Binary | |||||||||||||||

| LGBTQ+ | |||||||||||||||

| Other Attributes | |||||||||||||||

| Tenure (Years) | 5 | 1 | 1 | 33 | 2 | 20 | 4 | 23 | |||||||

| Independence |  |

|

|

|

|

|

|

||||||||

| Age | 52 | 56 | 59 | 68 | 59 | 62 | 54 | 68 | |||||||

| Committee Membership | Gov. (Chair) Comp. |

Gov. | Comp. | — | Comp. Gov. | Comp. (Chair) Audit |

Audit (Chair) Gov. | Audit |

| 20 | 2023 Proxy Statement | Helix Energy Solutions Group, Inc. |  |

Corporate Governance

Board Leadership Structure

In July 2017, the Board appointed its former Lead Director, Mr. Transier, to serve as its independent Chairman. The Corporate Governance and Nominating Committee periodically reviews and recommends to the Board appropriate Board leadership structure.

Communications with the Board

Pursuant to the terms of the Corporate Governance Guidelines, any shareholder or other interested party wishing to send written communications to any one or more of Helix’s directors may do so by sending them in care of our Corporate Secretary at Helix’s corporate office. All such communications will be forwarded to the intended recipient(s). All such communications should provide the shareholder's name, address, and class and number of voting securities held, and indicate whether they contain a message for the Board as a whole, a particular group or committee of directors, our Chairman or another individual director.

Code of Business Conduct and Ethics

In addition to the Corporate Governance Guidelines, our written Code of Business Conduct and Ethics applies to all of our directors, officers and employees. We have also established a Code of Ethics for Chief Executive Officer and Senior Financial Officers applicable to our Chief Executive Officer, Chief Financial Officer, Principal Accounting Officer or Corporate Controller (or person performing a similar function, if any), and Vice President – Internal Audit. We have posted a current copy of both codes on our website at www.helixesg.com/about-helix/our-company/corporate-governance. In addition, we intend to post on our website all disclosures that are required by law or NYSE listing standards concerning any amendments to, or waivers of, any provision of the Code of Business Conduct and Ethics. The Code of Business Conduct and Ethics, the Code of Ethics for Chief Executive and Senior Financial Officers and the Corporate Governance Guidelines are available free of charge to any shareholder in print upon request sent to the Corporate Secretary at Helix Energy Solutions Group, Inc., 3505 West Sam Houston Parkway North, Suite 400, Houston, Texas 77043.

Attendance at the Annual Meeting

The Board holds a regular meeting immediately preceding and/or immediately after each year’s Annual Meeting of Shareholders. Therefore, members of the Board generally attend Helix’s Annual Meetings of Shareholders. The Board encourages its members to attend the Annual Meeting, but does not have a written policy regarding attendance at the meeting. All members of the then-current Board attended the 2022 Annual Meeting of Shareholders.

Mandatory Retirement Policy

The Board has a mandatory retirement policy for directors such that no person may be a director nominee to serve for a term of service on the Board if during the applicable term he or she would reach the age of 75, and as written such policy does not contemplate waivers or exceptions.

Directors’ Continuing Education

The Board encourages all directors to attend director education programs if they believe attendance will enable them to perform better and to recognize and effectively deal with issues as they arise. To assist directors’ continuing education, Helix is a member of the National Association of Corporate Directors and from time to time Helix presents or hosts programs regarding topical matters to the Board.

|

Helix Energy Solutions Group, Inc. | 2023 Proxy Statement | 21 |

Corporate Governance

Risk Oversight

The Board and its committees are actively involved in overseeing risk management for Helix. In order to advance our business strategy, maintain our financial strength and create long-term value for our shareholders, the Board routinely assesses the major, “mission critical” risks facing Helix and various options for mitigation of those risks. Specifically, the Audit Committee is responsible for oversight with respect to processes, guidelines and policies with respect to risk assessment and risk management, including Helix’s major financial and cybersecurity risk exposures and the risk of fraud, and the steps taken to monitor and control such exposures and review of the assessment process and methodology with respect to the identification of risk assessment and risk management. Management is responsible for the day-to-day operation and oversight of Helix, and identifies and prioritizes risks associated with our business, which are discussed at Board and/or committee meetings as appropriate. We believe that our risk management responsibilities, processes and procedures serve as an effective approach for addressing the risks facing Helix, and that our Board and management structures support this approach.

Among its duties beyond its enumerated responsibilities related to risk oversight, the Audit Committee regularly reviews with the Board and management:

| • | Our policies and processes with respect to risk assessment, mitigation and management; |

| • | Our systems of disclosure controls and internal controls over financial reporting; |

| • | Key credit risks; |

| • | Our hedging policies and transactions; |

| • | Cybersecurity risk and control procedures; and |

| • | Our compliance with legal and regulatory requirements. |

Among its duties, the Compensation Committee regularly reviews with the Board and management:

| • | Our compensation philosophy, policies and programs; |

| • | Retention risk; and |

| • | Alignment with shareholder interests. |

Among its duties, the Corporate Governance and Nominating Committee regularly reviews with the Board and management:

| • | The disclosure and reporting of any ESG matters, and specifically including with respect to climate change, regarding our business and industry; |

| • | Shareholder concerns and matters regarding corporate governance; and |

| • | Succession planning. |

The Board’s risk oversight process builds upon management’s risk assessment and mitigation efforts, and the Board works directly with management in establishing strategic planning and enterprise risk management processes for risk oversight identification, reporting and monitoring. Our finance, legal (which includes compliance, human resources, contracts and insurance functions) and internal audit departments serve as the primary monitoring and testing functions for company policies and procedures, and manage the day-to-day oversight of our risk management strategy. This oversight includes identifying, evaluating and addressing potential risks that may exist at the enterprise, strategic, financial, operational, compliance and reporting levels. Management regularly reports on these risks to the Board and its relevant committees, and additional review and reporting of risks are conducted as appropriate. All committees report to the Board, including when a matter rises to the level of a material risk.

| 22 | 2023 Proxy Statement | Helix Energy Solutions Group, Inc. |  |

Corporate Governance

In addition to reports from its committees, the Board receives presentations throughout the year from various members of management that include discussion of risks as necessary and appropriate, including risks associated with proposed transactions. At each Board meeting, our Chief Executive Officer addresses matters of particular importance or concern, including any significant areas of risk that may call for Board attention, whether commercial, operational, legal, regulatory or other type of risk. Additionally, the Board reviews our short-term and long-term strategies, including consideration of significant risks facing Helix and the impact of such risks.

Corporate Sustainability

Helix understands the important role we play as a steward of the people, communities and environments we serve, and we regularly look for ways to emphasize and improve our own ESG record. Our core business values and priorities of Safety, Sustainability and Value Creation incorporate ESG initiatives and support our vision as a preeminent offshore energy transition company with a top-down approach led by the Board and management.

In line with these values, the Board, and more specifically the Corporate Governance and Nominating Committee, and management are committed to implementing and improving ESG initiatives throughout our business. This commitment is further disclosed in our annual Corporate Sustainability Report, the most recent version of which was published in November 2022, which builds upon our disclosures and transparency related to Helix’s operational, environmental, safety performance and human capital metrics. In the Report, we detail our climate change risks and opportunities, the management and strategy we employ with respect to such risks and opportunities, the composition of our workforce and our 2021 Scope 1, Scope 2 and Scope 3 greenhouse gas (“GHG”) emission metrics, including target GHG emission reductions. Sustainability at Helix is not viewed as a static goal, but rather a process embedded within our organization that we refine to improve the health and safety of our employees and lessen the environmental impact of our operations amongst other goals.

Our Corporate Sustainability Report reflects our commitment to transition to a more sustainable future and continue the discussion regarding ESG in current and future disclosures, all of which we believe further creates value for our investors, customers and employees.

To read the current Report on Helix’s homepage (located at www.helixesg.com), select Corporate Sustainability under the About Helix heading and scroll down to the link for the 2022 Corporate Sustainability Report.

The Board and ESG

The Board is focused on not only Helix governance practices, but is actively engaged on environmental, health, safety and social issues. The Board provides meaningful insight into management’s efforts through an open dialogue. At every regular Board meeting our Chief Operating Officer or his designee reports to the Board on Helix’s performance compared to Health, Safety and Environment (“HSE”) targets set for ourselves against industry statistics, and various initiatives being implemented by HSE management. The Board also receives a report on Helix’s safety record (including total reportable incident rate, or TRIR), lost time incidents, any significant accident or illness incidents, information security matters and risks, and has the opportunity to question management.

The Corporate Governance and Nominating Committee is specifically tasked with overseeing, assessing and reviewing risks associated with corporate sustainability, including climate change. At every committee meeting, our Sustainability Officer provides an update with respect to the disclosure and reporting of our ESG strategy, including the expansion of sustainability and climate strategy throughout our organization.

Our services are centered on a three-legged business model well positioned for a global energy transition by maximizing production of remaining oil and gas reserves, supporting renewable energy developments and decommissioning end-of-life oil and gas fields. Our core operations have long included evaluating and mitigating risks and opportunities associated with climate change and our Climate Change Action Committee, comprised of key leaders from HSE, legal, our business units and executive management, helps guide and improve our sustainability strategy with respect to climate change targets and related policies and programs.

|

Helix Energy Solutions Group, Inc. | 2023 Proxy Statement | 23 |

Corporate Governance

Throughout the year the Committee convenes to evaluate Helix's impact on climate change and our go-forward strategies and disclosures of emissions.

From a social perspective, the Board and management recognize their leadership responsibility in embracing our vision and core values. The Board is focused on maintaining an ethical culture at all levels within our organization. The Audit Committee receives an update from management at every regular committee meeting outlining the Company’s compliance initiatives, including adherence to the Company’s Code of Business Conduct and Ethics. The Board also receives regular educational updates on matters such as anti-corruption, legal and regulatory developments and specific risks in the geographic areas in which we operate or seek to operate. As part of this process, Helix has adopted a Statement on Human Rights and Supplier and Vendor Expectations, both of which can be found on our website at www.helixesg.com/about-helix/our-company/corporate-governance.

The Board is also invested in maintaining Helix’s employee culture, including embracing diversity and inclusion. As of December 31, 2022 Helix employed 2,280 employees worldwide, representing 34 nationalities. The Board believes that employing people with different backgrounds, experience and perspectives makes Helix a stronger company.

Meetings of the Board and Committees

The Board currently has, and appoints members to, three standing committees: the Audit Committee, the Compensation Committee, and the Corporate Governance and Nominating Committee. Each committee acts under the terms of a written charter, copies of which are available on our website at www.helixesg.com/about-helix/our-company/corporate-governance. A copy of each charter is available free of charge to any shareholder upon request sent to the Corporate Secretary at Helix Energy Solutions Group, Inc., 3505 West Sam Houston Parkway North, Suite 400, Houston, Texas 77043.

The following table summarizes the current membership of the Board and each of its committees as well as the number of times each met during 2022. Members were elected to each committee based upon the recommendation of the Corporate Governance and Nominating Committee followed by a vote of the Board. Each member of each committee is “independent” as defined by applicable NYSE and SEC rules.

| Name | Board | Audit | Compensation | Corporate Governance and Nominating |

||||||||

| Mr. Gatti |  |

|

|

|||||||||

| Ms. Glassman |  |

|

||||||||||

| Ms. Harris |  |

|

||||||||||

| Mr. Kratz |  |

|||||||||||

| Mr. Little |  |

|

|

|||||||||

| Mr. Lovoi |  |

|

|

|||||||||

| Ms. Nelson |  |

|

|

|||||||||

| Mr. Transier |  |

|

||||||||||

| Number of Meetings in 2022 | ||||||||||||

| Regular | 5 | 6 | 4 | 4 | ||||||||

| Special | 12 | 1 | 3 | 3 | ||||||||

|

Chair |  |

Member | |||||||||

| 24 | 2023 Proxy Statement | Helix Energy Solutions Group, Inc. |  |

Corporate Governance

Board Attendance

During 2022, the Board held a total of seventeen meetings. Each director attended 75% or more of the total meetings of the Board held during the time such director was a member, and each director attended 75% or more of the total meetings of the committees on which such director served.

Executive Sessions of Directors

Non-management directors meet in regular executive sessions following Board and committee meetings without any members of management being present and at which only those directors who meet the independence standards of the NYSE are present, provided, however, that committees do occasionally meet with individual members of management, including the Chief Executive Officer, by invitation during executive sessions. The independent Chairman presides at executive sessions of the independent directors. In the case of an executive session of independent directors held in connection with a committee meeting, the Chair of the applicable committee presides.

Audit Committee

The Audit Committee currently is composed of three independent directors: Ms. Nelson, Chair, and Messrs. Lovoi and Transier. The Audit Committee is appointed by the Board to assist the Board in fulfilling its oversight responsibility to our shareholders, potential shareholders, the investment community and others relating to: (i) the integrity of our financial statements, (ii) the effectiveness of our internal control over financial reporting, (iii) our compliance with legal and regulatory requirements, (iv) the performance of our internal audit function and independent registered public accounting firm and (v) the independent registered public accounting firm’s qualifications and independence. Among its duties, all of which are more specifically described in the Audit Committee charter, which was most recently amended in May 2022, the Audit Committee:

| • | Appoints and oversees our independent registered public accounting firm; | |

| • | Reviews the adequacy of our accounting and audit principles and practices, and the adequacy of compliance assurance procedures and internal controls; | |