Pay vs Performance Disclosure - USD ($)

|

12 Months Ended |

Dec. 31, 2022 |

Dec. 31, 2021 |

Dec. 31, 2020 |

| Pay vs Performance Disclosure [Table] |

|

|

|

| Pay vs Performance [Table Text Block] |

Pay Versus Performance As discussed in the Compensation Discussion and Analysis above, our Compensation Committee has implemented an executive compensation program based on the philosophy that our executive

management team should be aligned with our shareholders, and that our executives should be incentivized and rewarded for performance that advances business goals and the creation of sustainable value in all business cycles, leading to shareholder

value creation. The following table sets forth additional compensation information for our NEOs, calculated in accordance with SEC regulations, for fiscal years ended December 31, 2022, 2021 and 2020.

| |

Year |

|

Summary

Compensation

Table Total for

PEO |

|

Compensation

Actually Paid

to PEO(1)(3) |

|

Average

Summary

Compensation

Table Total

for Non-PEO

Named

Executive

Officers(2) |

|

Average

Compensation

Actually Paid

to Non-PEO

Named

Executive

Officers(1)(2)(3) |

|

Value of Initial Fixed $100

Investment Based On:(4) |

|

Net Income (loss)

(in thousands) |

|

Adjusted

EBITDA

(Company-

Selected

Measure)

(in thousands)(5)

|

|

| |

|

|

|

|

|

Company

Total

Shareholder

Return |

|

Peer Group

Total

Shareholder

Return |

|

|

|

| |

2022 |

|

$6,356,663 |

|

$ 16,491,636 |

|

$2,214,710 |

|

$5,694,654 |

|

$76.4 |

|

$112.9 |

|

$ |

(87,784)

|

|

$ |

121,022

|

|

| |

2021 |

|

$ 2,876,989 |

|

$ 829,802 |

|

$1,871,043 |

|

$1,248,042 |

|

$32.3 |

|

$ 69.9 |

|

$ |

(61,684)

|

|

$ |

96,276

|

|

| |

2020 |

|

$5,335,487 |

|

$(3,579,907) |

|

$1,805,011 |

|

$(238,275) |

|

$43.5 |

|

$ 57.9 |

|

$ |

20,084

|

|

$ |

155,260

|

|

|

| (1) |

The amounts shown for Compensation Actually Paid (“CAP”) have been calculated in accordance with Item 402(v) of Regulation S-K and do not reflect compensation actually earned, realized, or received by the Company’s NEOs. To calculate the CAP,

the following amounts were deducted from and added to the Summary Compensation Table (“SCT”) total compensation: |

PEO SCT Total to CAP Reconciliation:

| |

Year |

|

Salary |

|

Bonus and

Non-Equity Incentive

Compensation |

|

Other

Compensation(i) |

|

SCT Total |

|

Deductions

from SCT

Total(ii) |

|

Additions to

SCT Total(iii) |

|

CAP |

|

| |

2022 |

|

$ |

700,000 |

|

$ |

1,400,000 |

|

$ |

7,625 |

|

$6,356,663 |

|

$4,249,038 |

|

$ |

14,384,011 |

|

$ |

16,491,636 |

|

| |

2021 |

|

$ |

700,000 |

|

$ |

929,670 |

|

$ |

0 |

|

$2,876,989 |

|

$1,247,319 |

|

$ |

(799,868) |

|

$ |

829,802 |

|

| |

2020 |

|

$ |

597,917 |

|

$ |

472,500 |

|

$ |

7,125 |

|

$5,335,487 |

|

$4,257,945 |

|

$ |

(4,657,449) |

|

$ |

(3,579,907) |

|

Average Non-PEO NEOs SCT Total to CAP Reconciliation:

| |

Year |

|

Salary |

|

Bonus and

Non-Equity Incentive

Compensation |

|

Other

Compensation(i) |

|

SCT Total |

|

Deductions

from SCT

Total(ii) |

|

Additions to

SCT Total(iii) |

|

CAP |

|

| |

2022 |

|

$433,333 |

|

$ |

576,333 |

|

$ |

5,083 |

|

$2,214,710 |

|

$ |

1,199,960 |

|

$ |

4,679,904 |

|

$ |

5,694,654 |

|

| |

2021 |

|

$433,333 |

|

$ |

417,173 |

|

$ |

0 |

|

$1,871,043 |

|

$ |

1,020,536 |

|

$ |

397,535 |

|

$ |

1,248,042 |

|

| |

2020 |

|

$395,500 |

|

$ |

222,000 |

|

$ |

4,750 |

|

$1,805,011 |

|

$ |

1,182,761 |

|

$ |

(860,525) |

|

$ |

(238,275) |

|

|

| (i) |

Reflects “all other compensation” reported in the SCT for each year shown. |

|

| (ii) |

Represents the grant date fair value of equity-based awards granted each year. |

|

| (iii) |

Reflects the value of equity calculated in accordance with the SEC methodology for determining CAP for each year shown. The equity component of CAP for fiscal years ended December 31, 2022, 2021 and 2020 is further detailed in the

supplemental tables below. |

PEO Equity Component of CAP for Fiscal Year ended December 31, 2022:

| |

Equity Type |

|

Fair Value of Current

Year Equity Awards at

12/31/2022

(a)

|

|

Change in Value of

Prior Years’ Awards

Unvested at

12/31/2022

(b)

|

|

Change in Value of

Prior Years’ Awards

That Vested in

FY2022

(c)

|

|

Equity Value

Included in CAP

(d) = (a) + (b) + (c)

|

|

| |

PSUs |

|

$ |

7,823,076 |

|

$ |

1,665,913 |

|

— |

|

$ |

9,488,989 |

|

| |

RSUs |

|

$ |

4,257,692 |

|

$ |

371,906 |

|

— |

|

$ |

4,629,598 |

|

| |

RSAs |

|

|

— |

|

$ |

265,424 |

|

— |

|

$ |

265,424 |

|

| |

Total |

|

$ |

12,080,768 |

|

$ |

2,303,243 |

|

— |

|

$ |

14,384,011 |

|

Average Non-PEO NEOs Equity Component of CAP for Fiscal Year ended December 31, 2022:

| |

Equity Type |

|

Fair Value of Current

Year Equity Awards at

12/31/2022

(a)

|

|

Change in Value of

Prior Years’ Awards

Unvested at

12/31/2022

(b)

|

|

Change in Value of

Prior Years’ Awards

That Vested in

FY2022

(c)

|

|

Equity Value

Included in CAP

(d) = (a) + (b) + (c)

|

|

| |

PSUs |

|

$ |

2,209,295 |

|

$ |

890,189 |

|

— |

|

$ |

3,099,484 |

|

| |

RSUs |

|

$ |

1,202,404 |

|

$ |

304,287 |

|

— |

|

$ |

1,506,691 |

|

| |

RSAs |

|

|

— |

|

$ |

73,729 |

|

— |

|

$ |

73,729 |

|

| |

Total |

|

$ |

3,411,698 |

|

$ |

1,268,205 |

|

— |

|

$ |

4,679,904 |

|

PEO Equity Component of CAP for Fiscal Year ended December 31, 2021:

| |

Equity Type |

|

Fair Value of Current

Year Equity Awards at

12/31/2021

(a)

|

|

Change in Value of

Prior Years’ Awards

Unvested at

12/31/2021

(b)

|

|

Change in Value of

Prior Years’ Awards

That Vested in

FY2021

(c)

|

|

Equity Value

Included in CAP

(d) = (a) + (b) + (c)

|

|

| |

PSUs |

|

$ |

652,796 |

|

$ |

(1,620,184) |

|

— |

|

$ |

(967,389) |

|

| |

RSUs |

|

$ |

408,570 |

|

|

— |

|

— |

|

$ |

408,570 |

|

| |

RSAs |

|

|

— |

|

$ |

(241,050) |

|

— |

|

$ |

(241,050) |

|

| |

Total |

|

$ |

1,061,366 |

|

$ |

(1,861,234) |

|

— |

|

$ |

(799,868) |

|

Average Non-PEO NEOs Equity Component of CAP for Fiscal Year ended December 31, 2021:

| |

Equity Type |

|

Fair Value of Current

Year Equity Awards at

12/31/2021

(a)

|

|

Change in Value of

Prior Years’ Awards

Unvested at

12/31/2021

(b)

|

|

Change in Value of

Prior Years’ Awards

That Vested in

FY2021

(c)

|

|

Equity Value

Included in CAP

(d) = (a) + (b) + (c)

|

|

| |

PSUs |

|

$ |

534,108 |

|

$ |

(409,631) |

|

— |

|

$ |

124,477 |

|

| |

RSUs |

|

$ |

334,286 |

|

|

— |

|

— |

|

$ |

334,286 |

|

| |

RSAs |

|

|

— |

|

$ |

(61,228) |

|

— |

|

$ |

(61,228) |

|

| |

Total |

|

$ |

868,394 |

|

$ |

(470,859) |

|

— |

|

$ |

397,535 |

|

PEO Equity Component of CAP for Fiscal Year ended December 31, 2020:

| |

Equity Type |

|

Fair Value of Current

Year Equity Awards at

12/31/2020

(a) |

|

Change in Value of

Prior Years’ Awards

Unvested at

12/31/2020

(b) |

|

Change in Value of

Prior Years’ Awards

That Vested in

FY2020

(c) |

|

Equity Value

Included in CAP

(d) = (a) + (b) + (c) |

|

| |

PSUs |

|

$ |

1,059,814 |

|

$ |

(5,047,613) |

|

— |

|

$ |

(3,987,799) |

|

| |

RSUs |

|

|

— |

|

|

— |

|

— |

|

|

— |

|

| |

RSAs |

|

$ |

785,047 |

|

$ |

(1,454,697) |

|

— |

|

$ |

(669,650) |

|

| |

Total |

|

$ |

1,844,861 |

|

$ |

(6,502,310) |

|

— |

|

$ |

(4,657,449) |

|

Average Non-PEO NEOs Equity Component of CAP for Fiscal Year ended December 31, 2020:

| |

Equity Type |

|

Fair Value of Current

Year Equity Awards at

12/31/2020

(a) |

|

Change in Value

of Prior Years’

Awards Unvested at

12/31/2020

(b) |

|

Change in Value of

Prior Years’ Awards

That Vested in

FY2020

(c) |

|

Equity Value

Included in CAP

(d) = (a) + (b) + (c) |

|

| |

PSUs |

|

$ |

294,392 |

|

$ |

(1,060,193) |

|

— |

|

$ |

(765,801) |

|

| |

RSUs |

|

|

— |

|

|

— |

|

— |

|

|

— |

|

| |

RSAs |

|

$ |

218,068 |

|

$ |

(312,792) |

|

— |

|

$ |

(94,724) |

|

| |

Total |

|

$ |

512,460 |

|

$ |

(1,372,985) |

|

— |

|

$ |

(860,525) |

|

|

| (2) |

The non-principal executive officer (“PEO”) named executive officers (“NEOs”) reflected in the Non-PEO named executive officer columns represent the following individuals for each of the years shown: Scotty Sparks, Executive Vice President

and Chief Operating Officer; Erik Staffeldt, Executive Vice President and Chief Financial Officer; and Ken Neikirk, Executive Vice President, General Counsel and Corporate Secretary. |

|

| (3) |

We do not have pensions; therefore an adjustment to the SCT totals related to pension values for any of the years reflected is not needed. |

|

| (4) |

The Peer Group TSR in this table utilizes the Philadelphia Oil Service Sector index (the “OSX”), which we also utilize in the stock performance graph required by Item 201(e) of Regulation S-K included in our 2022 Annual Report. The comparison

assumes $100 was invested for the period starting December 31, 2019 through the end of the listed year in the Company and the OSX, respectively. These results are not necessarily indicative of future performance. |

|

| (5) |

Adjusted EBITDA is a non-GAAP financial measure. For a reconciliation of Adjusted EBITDA to reported net income (loss), see

“Non-GAAP Financial Measures” on pages 38-39 of our 2022 Annual Report. |

|

|

|

| Company Selected Measure Name |

Adjusted EBITDA

|

|

|

| Named Executive Officers, Footnote [Text Block] |

|

| (2) |

The non-principal executive officer (“PEO”) named executive officers (“NEOs”) reflected in the Non-PEO named executive officer columns represent the following individuals for each of the years shown: Scotty Sparks, Executive Vice President

and Chief Operating Officer; Erik Staffeldt, Executive Vice President and Chief Financial Officer; and Ken Neikirk, Executive Vice President, General Counsel and Corporate Secretary. |

|

|

|

| Peer Group Issuers, Footnote [Text Block] |

|

| (4) |

The Peer Group TSR in this table utilizes the Philadelphia Oil Service Sector index (the “OSX”), which we also utilize in the stock performance graph required by Item 201(e) of Regulation S-K included in our 2022 Annual Report. The comparison

assumes $100 was invested for the period starting December 31, 2019 through the end of the listed year in the Company and the OSX, respectively. These results are not necessarily indicative of future performance. |

|

|

|

| PEO Total Compensation Amount |

$ 6,356,663

|

$ 2,876,989

|

$ 5,335,487

|

| PEO Actually Paid Compensation Amount |

$ 16,491,636

|

829,802

|

(3,579,907)

|

| Adjustment To PEO Compensation, Footnote [Text Block] |

|

| (1) |

The amounts shown for Compensation Actually Paid (“CAP”) have been calculated in accordance with Item 402(v) of Regulation S-K and do not reflect compensation actually earned, realized, or received by the Company’s NEOs. To calculate the CAP,

the following amounts were deducted from and added to the Summary Compensation Table (“SCT”) total compensation: |

PEO SCT Total to CAP Reconciliation:

| |

Year |

|

Salary |

|

Bonus and

Non-Equity Incentive

Compensation |

|

Other

Compensation(i) |

|

SCT Total |

|

Deductions

from SCT

Total(ii) |

|

Additions to

SCT Total(iii) |

|

CAP |

|

| |

2022 |

|

$ |

700,000 |

|

$ |

1,400,000 |

|

$ |

7,625 |

|

$6,356,663 |

|

$4,249,038 |

|

$ |

14,384,011 |

|

$ |

16,491,636 |

|

| |

2021 |

|

$ |

700,000 |

|

$ |

929,670 |

|

$ |

0 |

|

$2,876,989 |

|

$1,247,319 |

|

$ |

(799,868) |

|

$ |

829,802 |

|

| |

2020 |

|

$ |

597,917 |

|

$ |

472,500 |

|

$ |

7,125 |

|

$5,335,487 |

|

$4,257,945 |

|

$ |

(4,657,449) |

|

$ |

(3,579,907) |

|

|

| (i) |

Reflects “all other compensation” reported in the SCT for each year shown. |

|

| (ii) |

Represents the grant date fair value of equity-based awards granted each year. |

|

| (iii) |

Reflects the value of equity calculated in accordance with the SEC methodology for determining CAP for each year shown. The equity component of CAP for fiscal years ended December 31, 2022, 2021 and 2020 is further detailed in the

supplemental tables below. |

PEO Equity Component of CAP for Fiscal Year ended December 31, 2022:

| |

Equity Type |

|

Fair Value of Current

Year Equity Awards at

12/31/2022

(a)

|

|

Change in Value of

Prior Years’ Awards

Unvested at

12/31/2022

(b)

|

|

Change in Value of

Prior Years’ Awards

That Vested in

FY2022

(c)

|

|

Equity Value

Included in CAP

(d) = (a) + (b) + (c)

|

|

| |

PSUs |

|

$ |

7,823,076 |

|

$ |

1,665,913 |

|

— |

|

$ |

9,488,989 |

|

| |

RSUs |

|

$ |

4,257,692 |

|

$ |

371,906 |

|

— |

|

$ |

4,629,598 |

|

| |

RSAs |

|

|

— |

|

$ |

265,424 |

|

— |

|

$ |

265,424 |

|

| |

Total |

|

$ |

12,080,768 |

|

$ |

2,303,243 |

|

— |

|

$ |

14,384,011 |

|

PEO Equity Component of CAP for Fiscal Year ended December 31, 2021:

| |

Equity Type |

|

Fair Value of Current

Year Equity Awards at

12/31/2021

(a)

|

|

Change in Value of

Prior Years’ Awards

Unvested at

12/31/2021

(b)

|

|

Change in Value of

Prior Years’ Awards

That Vested in

FY2021

(c)

|

|

Equity Value

Included in CAP

(d) = (a) + (b) + (c)

|

|

| |

PSUs |

|

$ |

652,796 |

|

$ |

(1,620,184) |

|

— |

|

$ |

(967,389) |

|

| |

RSUs |

|

$ |

408,570 |

|

|

— |

|

— |

|

$ |

408,570 |

|

| |

RSAs |

|

|

— |

|

$ |

(241,050) |

|

— |

|

$ |

(241,050) |

|

| |

Total |

|

$ |

1,061,366 |

|

$ |

(1,861,234) |

|

— |

|

$ |

(799,868) |

|

PEO Equity Component of CAP for Fiscal Year ended December 31, 2020:

| |

Equity Type |

|

Fair Value of Current

Year Equity Awards at

12/31/2020

(a) |

|

Change in Value of

Prior Years’ Awards

Unvested at

12/31/2020

(b) |

|

Change in Value of

Prior Years’ Awards

That Vested in

FY2020

(c) |

|

Equity Value

Included in CAP

(d) = (a) + (b) + (c) |

|

| |

PSUs |

|

$ |

1,059,814 |

|

$ |

(5,047,613) |

|

— |

|

$ |

(3,987,799) |

|

| |

RSUs |

|

|

— |

|

|

— |

|

— |

|

|

— |

|

| |

RSAs |

|

$ |

785,047 |

|

$ |

(1,454,697) |

|

— |

|

$ |

(669,650) |

|

| |

Total |

|

$ |

1,844,861 |

|

$ |

(6,502,310) |

|

— |

|

$ |

(4,657,449) |

|

|

|

|

| Non-PEO NEO Average Total Compensation Amount |

$ 2,214,710

|

1,871,043

|

1,805,011

|

| Non-PEO NEO Average Compensation Actually Paid Amount |

$ 5,694,654

|

1,248,042

|

(238,275)

|

| Adjustment to Non-PEO NEO Compensation Footnote [Text Block] |

|

| (1) |

The amounts shown for Compensation Actually Paid (“CAP”) have been calculated in accordance with Item 402(v) of Regulation S-K and do not reflect compensation actually earned, realized, or received by the Company’s NEOs. To calculate the CAP,

the following amounts were deducted from and added to the Summary Compensation Table (“SCT”) total compensation: |

Average Non-PEO NEOs SCT Total to CAP Reconciliation:

| |

Year |

|

Salary |

|

Bonus and

Non-Equity Incentive

Compensation |

|

Other

Compensation(i) |

|

SCT Total |

|

Deductions

from SCT

Total(ii) |

|

Additions to

SCT Total(iii) |

|

CAP |

|

| |

2022 |

|

$433,333 |

|

$ |

576,333 |

|

$ |

5,083 |

|

$2,214,710 |

|

$ |

1,199,960 |

|

$ |

4,679,904 |

|

$ |

5,694,654 |

|

| |

2021 |

|

$433,333 |

|

$ |

417,173 |

|

$ |

0 |

|

$1,871,043 |

|

$ |

1,020,536 |

|

$ |

397,535 |

|

$ |

1,248,042 |

|

| |

2020 |

|

$395,500 |

|

$ |

222,000 |

|

$ |

4,750 |

|

$1,805,011 |

|

$ |

1,182,761 |

|

$ |

(860,525) |

|

$ |

(238,275) |

|

|

| (i) |

Reflects “all other compensation” reported in the SCT for each year shown. |

|

| (ii) |

Represents the grant date fair value of equity-based awards granted each year. |

|

| (iii) |

Reflects the value of equity calculated in accordance with the SEC methodology for determining CAP for each year shown. The equity component of CAP for fiscal years ended December 31, 2022, 2021 and 2020 is further detailed in the

supplemental tables below. |

Average Non-PEO NEOs Equity Component of CAP for Fiscal Year ended December 31, 2022:

| |

Equity Type |

|

Fair Value of Current

Year Equity Awards at

12/31/2022

(a)

|

|

Change in Value of

Prior Years’ Awards

Unvested at

12/31/2022

(b)

|

|

Change in Value of

Prior Years’ Awards

That Vested in

FY2022

(c)

|

|

Equity Value

Included in CAP

(d) = (a) + (b) + (c)

|

|

| |

PSUs |

|

$ |

2,209,295 |

|

$ |

890,189 |

|

— |

|

$ |

3,099,484 |

|

| |

RSUs |

|

$ |

1,202,404 |

|

$ |

304,287 |

|

— |

|

$ |

1,506,691 |

|

| |

RSAs |

|

|

— |

|

$ |

73,729 |

|

— |

|

$ |

73,729 |

|

| |

Total |

|

$ |

3,411,698 |

|

$ |

1,268,205 |

|

— |

|

$ |

4,679,904 |

|

Average Non-PEO NEOs Equity Component of CAP for Fiscal Year ended December 31, 2021:

| |

Equity Type |

|

Fair Value of Current

Year Equity Awards at

12/31/2021

(a)

|

|

Change in Value of

Prior Years’ Awards

Unvested at

12/31/2021

(b)

|

|

Change in Value of

Prior Years’ Awards

That Vested in

FY2021

(c)

|

|

Equity Value

Included in CAP

(d) = (a) + (b) + (c)

|

|

| |

PSUs |

|

$ |

534,108 |

|

$ |

(409,631) |

|

— |

|

$ |

124,477 |

|

| |

RSUs |

|

$ |

334,286 |

|

|

— |

|

— |

|

$ |

334,286 |

|

| |

RSAs |

|

|

— |

|

$ |

(61,228) |

|

— |

|

$ |

(61,228) |

|

| |

Total |

|

$ |

868,394 |

|

$ |

(470,859) |

|

— |

|

$ |

397,535 |

|

Average Non-PEO NEOs Equity Component of CAP for Fiscal Year ended December 31, 2020:

| |

Equity Type |

|

Fair Value of Current

Year Equity Awards at

12/31/2020

(a) |

|

Change in Value

of Prior Years’

Awards Unvested at

12/31/2020

(b) |

|

Change in Value of

Prior Years’ Awards

That Vested in

FY2020

(c) |

|

Equity Value

Included in CAP

(d) = (a) + (b) + (c) |

|

| |

PSUs |

|

$ |

294,392 |

|

$ |

(1,060,193) |

|

— |

|

$ |

(765,801) |

|

| |

RSUs |

|

|

— |

|

|

— |

|

— |

|

|

— |

|

| |

RSAs |

|

$ |

218,068 |

|

$ |

(312,792) |

|

— |

|

$ |

(94,724) |

|

| |

Total |

|

$ |

512,460 |

|

$ |

(1,372,985) |

|

— |

|

$ |

(860,525) |

|

|

|

|

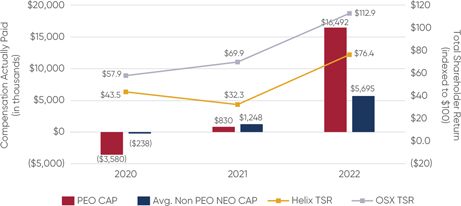

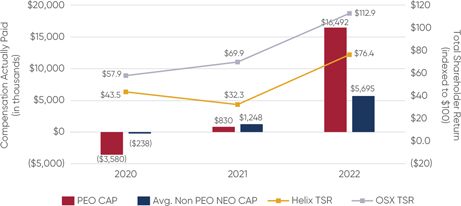

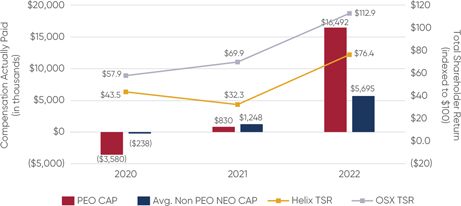

| Compensation Actually Paid vs. Total Shareholder Return [Text Block] |

The following chart sets forth the relationship between Compensation Actually Paid to our PEO, the average of Compensation Actually Paid to our Non-PEO NEOs, and the Company and Peer

Group’s cumulative TSR over the three most recently completed fiscal years. CAP vs. Total Shareholder Return

|

|

|

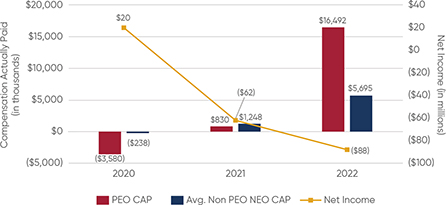

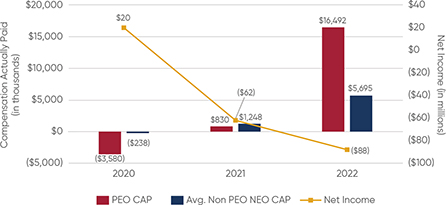

| Compensation Actually Paid vs. Net Income [Text Block] |

The

following chart sets forth the relationship between Compensation Actually Paid to our PEO, the average of Compensation Actually Paid to our other NEOs, and our net income (loss) during the three most recently completed fiscal years. CAP vs. Net Income (loss)

|

|

|

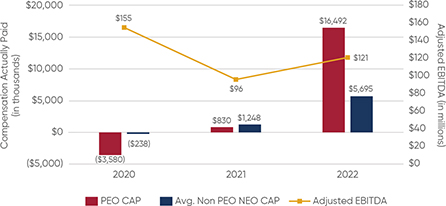

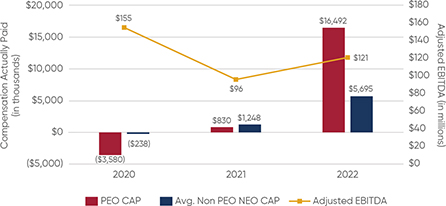

| Compensation Actually Paid vs. Company Selected Measure [Text Block] |

The following chart sets forth the relationship between Compensation Actually Paid to our PEO, the average of Compensation Actually Paid to our other Non-PEO NEOs, and our Adjusted EBITDA during the

three most recently completed fiscal years. CAP vs. Adjusted EBITDA(1)

| (1) |

Adjusted EBITDA is a non-GAAP financial measure. For a reconciliation of Adjusted EBITDA to reported net income (loss), see “Non-GAAP Financial Measures” on pages 38-39 of our 2022 Annual Report. |

|

|

|

| Total Shareholder Return Vs Peer Group [Text Block] |

The following chart sets forth the relationship between Compensation Actually Paid to our PEO, the average of Compensation Actually Paid to our Non-PEO NEOs, and the Company and Peer

Group’s cumulative TSR over the three most recently completed fiscal years. CAP vs. Total Shareholder Return

|

|

|

| Tabular List [Table Text Block] |

The three items listed in the following table represent the most important metrics we used to determine CAP to our CEO and other NEOs for the fiscal year ended December 31, 2022 as

further described in our CD&A within the sections titled “2022 Executive Compensation Program” and “Long-Term Incentive Program”. The role of each of these performance measures is discussed in the CD&A. The measures in this table are not

ranked.

| |

Most Important Performance Measures |

|

| |

• Adjusted EBITDA |

|

| |

• Total Shareholder Return |

|

| |

• Free Cash Flow |

|

|

|

|

| Total Shareholder Return Amount |

$ 76.4

|

32.3

|

43.5

|

| Peer Group Total Shareholder Return Amount |

112.9

|

69.9

|

57.9

|

| Net Income (Loss) |

$ (87,784,000)

|

$ (61,684,000)

|

$ 20,084,000

|

| Company Selected Measure Amount |

121,022,000

|

96,276,000

|

155,260,000

|

| Measure [Axis]: 1 |

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

| Measure Name |

Adjusted EBITDA

|

|

|

| Non-GAAP Measure Description [Text Block] |

|

| (5) |

Adjusted EBITDA is a non-GAAP financial measure. For a reconciliation of Adjusted EBITDA to reported net income (loss), see

“Non-GAAP Financial Measures” on pages 38-39 of our 2022 Annual Report. |

|

|

|

| Measure [Axis]: 2 |

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

| Measure Name |

Total Shareholder Return

|

|

|

| Measure [Axis]: 3 |

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

| Measure Name |

Free Cash Flow

|

|

|

| PEO [Member] |

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

| Salary |

$ 700,000

|

$ 700,000

|

$ 597,917

|

| Bonus and Non-Equity Incentive Compensation |

1,400,000

|

929,670

|

472,500

|

| All Other Compensation |

7,625

|

0

|

7,125

|

| PEO [Member] | Deductions from SCT Total [Member] |

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

| Adjustment to Compensation Amount |

(4,249,038)

|

(1,247,319)

|

(4,257,945)

|

| PEO [Member] | Additions to SCT Total [Member] |

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

| Adjustment to Compensation Amount |

14,384,011

|

(799,868)

|

(4,657,449)

|

| PEO [Member] | Fair Value of Current Year Equity Awards [Member] |

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

| Adjustment to Compensation Amount |

12,080,768

|

1,061,366

|

1,844,861

|

| PEO [Member] | Fair Value of Current Year Equity Awards, Performance Share Units (PSUs) [Member] |

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

| Adjustment to Compensation Amount |

7,823,076

|

652,796

|

1,059,814

|

| PEO [Member] | Fair Value of Current Year Equity Awards, Restricted Stock Units (RSUs) [Member] |

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

| Adjustment to Compensation Amount |

4,257,692

|

408,570

|

0

|

| PEO [Member] | Fair Value of Current Year Equity Awards, Restricted Stock Awards (RSAs). [Member] |

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

| Adjustment to Compensation Amount |

0

|

0

|

785,047

|

| PEO [Member] | Change in Value of Prior Years Awards Unvested [Member] |

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

| Adjustment to Compensation Amount |

2,303,243

|

(1,861,234)

|

(6,502,310)

|

| PEO [Member] | Change in Value of Prior Years Awards Unvested, Performance Share Units (PSUs) [Member] |

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

| Adjustment to Compensation Amount |

1,665,913

|

(1,620,184)

|

(5,047,613)

|

| PEO [Member] | Change in Value of Prior Years Awards Unvested, Restricted Stock Units (RSUs) [Member] |

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

| Adjustment to Compensation Amount |

371,906

|

0

|

0

|

| PEO [Member] | Change in Value of Prior Years Awards, Unvested Restricted stock awards (RSAs) [Member] |

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

| Adjustment to Compensation Amount |

265,424

|

(241,050)

|

(1,454,697)

|

| PEO [Member] | Change in Value of Prior Years Awards that Vested [Member] |

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

| Adjustment to Compensation Amount |

0

|

0

|

0

|

| PEO [Member] | Change in Value of Prior Years Awards that Vested, Performance Share Units (PSUs) [Member] |

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

| Adjustment to Compensation Amount |

0

|

0

|

0

|

| PEO [Member] | Change in Value of Prior Years Awards that Vested, Restricted Stock Units (RSUs) [Member] |

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

| Adjustment to Compensation Amount |

0

|

0

|

0

|

| PEO [Member] | Change in Value of Prior Years Awards that Vested, Restricted stock awards (RSAs) [Member] |

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

| Adjustment to Compensation Amount |

0

|

0

|

0

|

| PEO [Member] | Equity Value Included in CAP [Member] |

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

| Adjustment to Compensation Amount |

14,384,011

|

(799,868)

|

(4,657,449)

|

| PEO [Member] | Equity Value Included in CAP, Performance Share Units (PSUs) [Member] |

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

| Adjustment to Compensation Amount |

9,488,989

|

(967,389)

|

(3,987,799)

|

| PEO [Member] | Equity Value Included in CAP, Restricted Stock Units (RSUs) [Member] |

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

| Adjustment to Compensation Amount |

4,629,598

|

408,570

|

0

|

| PEO [Member] | Equity Value Included in CAP, Restricted Stock Awards (RSAs) [Member] |

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

| Adjustment to Compensation Amount |

265,424

|

(241,050)

|

(669,650)

|

| Non-PEO NEO [Member] |

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

| Salary |

433,333

|

433,333

|

395,500

|

| Bonus and Non-Equity Incentive Compensation |

576,333

|

417,173

|

222,000

|

| All Other Compensation |

5,083

|

0

|

4,750

|

| Non-PEO NEO [Member] | Deductions from SCT Total [Member] |

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

| Adjustment to Compensation Amount |

(1,199,960)

|

(1,020,536)

|

(1,182,761)

|

| Non-PEO NEO [Member] | Additions to SCT Total [Member] |

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

| Adjustment to Compensation Amount |

4,679,904

|

397,535

|

(860,525)

|

| Non-PEO NEO [Member] | Fair Value of Current Year Equity Awards [Member] |

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

| Adjustment to Compensation Amount |

3,411,698

|

868,394

|

512,460

|

| Non-PEO NEO [Member] | Fair Value of Current Year Equity Awards, Performance Share Units (PSUs) [Member] |

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

| Adjustment to Compensation Amount |

2,209,295

|

534,108

|

294,392

|

| Non-PEO NEO [Member] | Fair Value of Current Year Equity Awards, Restricted Stock Units (RSUs) [Member] |

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

| Adjustment to Compensation Amount |

1,202,404

|

334,286

|

0

|

| Non-PEO NEO [Member] | Fair Value of Current Year Equity Awards, Restricted Stock Awards (RSAs). [Member] |

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

| Adjustment to Compensation Amount |

0

|

0

|

218,068

|

| Non-PEO NEO [Member] | Change in Value of Prior Years Awards Unvested [Member] |

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

| Adjustment to Compensation Amount |

1,268,205

|

(470,859)

|

(1,372,985)

|

| Non-PEO NEO [Member] | Change in Value of Prior Years Awards Unvested, Performance Share Units (PSUs) [Member] |

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

| Adjustment to Compensation Amount |

890,189

|

(409,631)

|

(1,060,193)

|

| Non-PEO NEO [Member] | Change in Value of Prior Years Awards Unvested, Restricted Stock Units (RSUs) [Member] |

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

| Adjustment to Compensation Amount |

304,287

|

0

|

0

|

| Non-PEO NEO [Member] | Change in Value of Prior Years Awards, Unvested Restricted stock awards (RSAs) [Member] |

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

| Adjustment to Compensation Amount |

73,729

|

(61,228)

|

(312,792)

|

| Non-PEO NEO [Member] | Change in Value of Prior Years Awards that Vested [Member] |

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

| Adjustment to Compensation Amount |

0

|

0

|

0

|

| Non-PEO NEO [Member] | Change in Value of Prior Years Awards that Vested, Performance Share Units (PSUs) [Member] |

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

| Adjustment to Compensation Amount |

0

|

0

|

0

|

| Non-PEO NEO [Member] | Change in Value of Prior Years Awards that Vested, Restricted Stock Units (RSUs) [Member] |

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

| Adjustment to Compensation Amount |

0

|

0

|

0

|

| Non-PEO NEO [Member] | Change in Value of Prior Years Awards that Vested, Restricted stock awards (RSAs) [Member] |

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

| Adjustment to Compensation Amount |

0

|

0

|

0

|

| Non-PEO NEO [Member] | Equity Value Included in CAP [Member] |

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

| Adjustment to Compensation Amount |

4,679,904

|

397,535

|

(860,525)

|

| Non-PEO NEO [Member] | Equity Value Included in CAP, Performance Share Units (PSUs) [Member] |

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

| Adjustment to Compensation Amount |

3,099,484

|

124,477

|

(765,801)

|

| Non-PEO NEO [Member] | Equity Value Included in CAP, Restricted Stock Units (RSUs) [Member] |

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

| Adjustment to Compensation Amount |

1,506,691

|

334,286

|

0

|

| Non-PEO NEO [Member] | Equity Value Included in CAP, Restricted Stock Awards (RSAs) [Member] |

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

| Adjustment to Compensation Amount |

$ 73,729

|

$ (61,228)

|

$ (94,724)

|