UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended September 30, 2016

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _____ to_____

Commission file number: 1-10596

ESCO Technologies Inc.

(Exact name of registrant as specified in its charter)

| Missouri | 43-1554045 | |

| (State or other jurisdiction | (I.R.S. Employer | |

| of incorporation or organization) | Identification No.) | |

| 9900A Clayton Road | ||

| St. Louis, Missouri | 63124-1186 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code:

(314) 213-7200

Securities registered pursuant to section 12(b) of the Act:

| Name of each exchange | ||

| Title of each class | on which registered | |

| Common Stock, par value $0.01 per share | New York Stock Exchange |

Securities registered pursuant to section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. x Yes ¨ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ¨

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). x Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form l0-K or any amendment to this Form l0-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer x | Accelerated filer ¨ |

| Non-accelerated filer ¨ (Do not check if a smaller reporting company) | Smaller reporting company ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). ¨ Yes x No

Aggregate market value of the Common Stock held by non-affiliates of the registrant as of the close of trading on March 31, 2016, the last business day of the registrant’s most recently completed second fiscal quarter: approximately $979,784,000.*

* Based on the New York Stock Exchange closing price. For purpose of this calculation only, without determining whether the following are affiliates of the registrant, the registrant has assumed that (i) its directors and executive officers are affiliates, and (ii) no party who has filed a Schedule 13D or 13G is an affiliate.

Number of shares of Common Stock outstanding at November 3, 2016: 25,720,461

DOCUMENTS INCORPORATED BY REFERENCE:

Part III of this Report incorporates by reference certain portions of the registrant’s definitive Proxy Statement for its 2017 Annual Meeting of Shareholders, which the registrant currently anticipates first sending to shareholders on or about December 14, 2016 (hereinafter, the “2016 Proxy Statement”).

INDEX TO ANNUAL REPORT ON FORM 10-K

| i |

Statements contained in this Form 10-K regarding future events and the Company’s future results that are based on current expectations, estimates, forecasts and projections about the Company’s performance and the industries in which the Company operates are considered “forward-looking statements” within the meaning of the safe harbor provisions of the Federal securities laws. These include, without limitation, statements about: the adequacy of the Company’s buildings, machinery and equipment; the adequacy of the Company’s credit facilities and future cash flows; the outcome of litigation, claims and charges; future costs relating to environmental matters; continued reinvestment of foreign earnings and the resulting U.S. tax liability in the event such earnings are repatriated; repayment of debt within the next twelve months; the outlook for 2017 and beyond, including amounts, timing and sources of 2017 sales, revenues, sales growth, EBIT, EBITDA, EBIT margins and EPS; interest on Company debt obligations; the ability of expected hedging gains or losses to be offset by losses or gains on related underlying exposures; the Company’s ability to increase shareholder value; acquisitions; the Company’s expected effective tax rate; minimum cash funding required by, expected benefits payable from, and Management’s assumptions about future events which could affect liability under, the Company’s defined benefit plans and other postretirement benefit plans; the recognition of unrecognized compensation costs related to share-based compensation arrangements; the Company’s exposure to market risk related to interest rates and to foreign currency exchange risk; the likelihood of future variations in the Company’s assumptions or estimates used in recording contracts and expected costs at completion under the percentage of completion method; the Company’s estimates and assumptions used in the preparation of its financial statements; cost and estimated earnings on long-term contracts; valuation of inventories; estimates of uncollectible accounts receivable; the risk of goodwill impairment; the Company’s estimates utilized in software revenue recognition and the amortization of intangible assets; the valuation of deferred tax assets; amounts of NOL not realizable and the timing and amount of the reduction of unrecognized tax benefits; the effects of implementing recently issued accounting pronouncements; and any other statements contained herein which are not strictly historical. Words such as expects, anticipates, targets, goals, projects, intends, plans, believes, estimates, variations of such words, and similar expressions are intended to identify such forward-looking statements.

Investors are cautioned that such statements are only predictions and speak only as of the date of this Form 10-K, and the Company undertakes no duty to update the information in this Form 10-K except as may be required by applicable laws or regulations. The Company’s actual results in the future may differ materially from those projected in the forward-looking statements due to risks and uncertainties that exist in the Company’s operations and business environment, including but not limited to those described herein under “Item 1A, Risk Factors,” and the following: Aclara’s continuing ability to perform contracts guaranteed by the Company; the impacts of labor disputes, civil disorder, wars, elections, political changes, terrorist activities or natural disasters on the Company’s operations and those of the Company’s customers and suppliers; the timing and content of future customer orders; the appropriation and allocation of government funds; the termination for convenience of government and other customer contracts; the timing and magnitude of future contract awards; weakening of economic conditions in served markets; the success of the Company’s competitors; changes in customer demands or customer insolvencies; competition; intellectual property rights; technical difficulties; the availability of selected acquisitions; delivery delays or defaults by customers; performance issues with key customers, suppliers and subcontractors; material changes in the costs of certain raw materials; material changes in the cost of credit; changes in laws and regulations including but not limited to changes in accounting standards and taxation requirements; costs relating to environmental matters; litigation uncertainty; and the Company’s successful execution of internal restructuring and other plans.

| ii |

The Registrant, ESCO Technologies Inc. (ESCO), is a producer of engineered products and systems sold to customers worldwide, primarily for utility, industrial, aerospace and commercial applications. ESCO conducts its business through a number of wholly-owned direct and indirect subsidiaries. ESCO and its subsidiaries are referred to in this Report as “the Company.”

ESCO was incorporated in Missouri in August 1990 as a wholly owned subsidiary of Emerson Electric Co. (Emerson) to be the indirect holding company for several Emerson subsidiaries, which were primarily in the defense business. Ownership of the Company was spun off by Emerson to its shareholders on October 19, 1990, through a special distribution. Since that time, through a series of acquisitions and divestitures, the Company has shifted its primary focus from defense contracting to the production and supply of engineered products and systems marketed to utility, industrial, aerospace and commercial users.

The Company’s fiscal year ends September 30. Throughout this document, unless the context indicates otherwise, references to a year (for example 2016) refer to the Company’s fiscal year ending on September 30 of that year.

The Company is organized based on the products and services it offers, and classifies its business operations in segments for financial reporting purposes. Beginning in the second quarter of 2016 Management expanded the presentation of its reporting segments to include a fourth segment, Technical Packaging. This segment was created to separately disclose Thermoform Engineered Quality LLC along with the recently acquired Plastique and Fremont businesses discussed below, as they no longer met the criteria for aggregation with the Filtration/Fluid Flow reporting segment. Prior period segment amounts have been reclassified to conform to the current period presentation.

The Company’s four segments, together with the significant domestic and foreign operating subsidiaries within each segment during 2016, are as follows:

Filtration/Fluid Flow (Filtration):

Crissair, Inc. (Crissair)

PTI Technologies Inc. (PTI)

VACCO Industries (VACCO)

Westland Technologies Inc. (Westland)

RF Shielding and Test (Test):

Beijing Lindgren ElectronMagnetic Technology Co., Ltd.

ETS-Lindgren Inc.

ETS-Lindgren OY

ETS-Lindgren Inc. and the Company’s other Test subsidiaries are collectively referred to herein as “ETS-Lindgren.”

Utility Solutions Group (USG):

Doble Engineering Company

Doble PowerTest Ltd.

Doble TransiNor AS

Doble Engineering Company and the Company’s other USG subsidiaries are collectively referred to herein as “Doble.”

Aclara Technologies LLC, formerly a part of this segment, was characterized as discontinued operations beginning in the third quarter of 2013 and was divested in the second quarter of 2014. See the next section, “Discontinued Operations,” and Note 3 to the Consolidated Financial Statements included herein.

Technical Packaging:

Thermoform Engineered Quality LLC (TEQ)

Plastique Limited

Plastique Sp. z o.o.

Plastique Limited and Plastique Sp. z o.o. are together referred to herein as “Plastique.”

The Company’s operating subsidiaries are engaged primarily in the research, development, manufacture, sale and support of the products and systems described below. Their respective businesses are subject to a number of risks and uncertainties, including without limitation those discussed in Item 1A, “Risk Factors.” See also Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and “Forward-Looking Information.”

| 1 |

ESCO is continually seeking ways to save costs, streamline its business processes and enhance the branding of its products and services. During 2014 the Company merged Canyon Engineering Products, Inc. (Canyon) into Crissair and consolidated Crissair’s operations into Canyon’s facility in Valencia, California. In October 2015 the Company announced several restructuring and realignment actions involving the Test and USG segments which were completed during 2016, including: closing ETS-Lindgren’s operating subsidiaries in Germany and the United Kingdom and consolidating their operations into other existing Test facilities; eliminating certain underperforming product line offerings in Test primarily related to lower margin international shielding end markets; reducing headcount in Test’s U.S. business; and closing Doble’s Brazil operating office and consolidating Doble’s South American sales and support activities.

ESCO is also continually seeking opportunities to supplement its growth by making strategic acquisitions. During 2016, the Company acquired Westland, a market leader in the design, development and manufacture of elastomeric-based signature reduction solutions for U.S. Naval maritime platforms; Plastique, a market leader in the development and manufacture of highly-technical thermoformed plastic and precision molded pulp fiber packaging primarily for the pharmaceutical, personal care, and other specialty end markets; and Fremont Plastics, Inc. (Fremont), an Indiana-based manufacturer of high quality sterile-ready and non-sterile thin gauge thermoformed medical plastic packaging products which has been merged into TEQ. More information about these 2016 acquisitions as well as the Company’s acquisition activity during 2015 is provided in Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations, and in Note 2 to the Consolidated Financial Statements included herein. The Company did not make any acquisitions during 2014.

During the third quarter of 2013, the Company’s Board of Directors approved the initiation of a process to sell that portion of the Company’s USG segment represented by Aclara Technologies LLC and two related entities (together, Aclara). Aclara is a leading supplier of data communications systems and related software used by electric, gas and water utilities in support of their advanced metering infrastructure (AMI) deployments, typically encompassing the utility’s entire service area. Aclara’s largest contracts, such as those with Pacific Gas & Electric Company and Southern California Gas Co., each involve several million end points. The sale of Aclara was completed during the second quarter of 2014.

Prior to the sale Aclara constituted a component of the Company with operations and cash flows that were clearly distinguishable, operationally and for financial reporting purposes, from the rest of the entity. Accordingly, for financial reporting purposes Aclara is reflected for 2014 and 2015 as discontinued operations. Unless otherwise specifically stated, all operating results presented in this report are exclusive of discontinued operations.

The Company’s principal products are described below. See Note 15 to the Consolidated Financial Statements included herein for financial information regarding business segments and 10% customers.

Filtration

The Filtration segment accounted for approximately 36%, 37% and 37% of the Company’s total revenue in 2016, 2015 and 2014, respectively.

PTI is a leading supplier of filtration and fluid control products serving the commercial aerospace, military aerospace and various industrial markets. Products include filter elements, manifolds, assemblies, modules, indicators and other related components. All products must meet stringent qualification requirements and withstand severe operating conditions. Product applications include: hydraulic, fuel, cooling and air filtration systems for fixed wing and rotary aircraft, mobile transportation and construction equipment, aircraft engines and stationary plant equipment. PTI supplies products worldwide to original equipment manufacturers and the U.S. government under long term contracts, and to the commercial and military aftermarket through distribution channels.

VACCO supplies filtration and fluid control products including valves, manifolds, filters, regulators and various other components for use in the space, military aerospace, defense missile systems, U.S. Navy and commercial industries. Applications include aircraft fuel and de-icing systems, missiles, satellite propulsion systems, satellite launch vehicles and other space transportation systems such as the Space Launch System. VACCO also utilizes its multi-fab technology and capabilities to produce products for use in space and U.S. Navy applications.

| 2 |

Crissair supplies a wide variety of custom and standard valves, actuators, manifolds and other various components to the aerospace, defense, automotive and commercial industries. Product applications include hydraulic, fuel and air filtration systems for commercial and military fixed wing and rotary aircraft, defense missile systems and commercial engines. Crissair supplies products worldwide to original equipment manufacturers and to the U.S. Government under long term contracts and to the commercial aftermarket through distribution channels.

Westland is a leading designer and manufacturer of elastomeric-based signature reduction solutions to enhance U.S. Navy maritime survivability. Westland’s products include complex tiles and other shock and vibration dampening systems that reduce passive acoustic signatures and/or modify signal (radar, infrared, acoustical, sonar) emission and reflection to reduce or obscure a vessel’s signature. Westland’s products are used on the majority of the U.S. Naval fleet including submarines, surface ships and aircraft carriers.

Test

The Test segment accounted for approximately 28%, 33% and 34% of the Company’s total revenue in 2016, 2015 and 2014, respectively.

ETS-Lindgren designs and manufactures products to measure and contain magnetic, electromagnetic and acoustic energy. It supplies customers with a broad range of isolated environments and turnkey systems, including RF test facilities, acoustic test enclosures, RF and magnetically shielded rooms, secure communication facilities, RF measurement systems and broadcast and recording studios. Many of these facilities include proprietary features such as shielded doors and windows. ETS-Lindgren also provides the design, program management, installation and integration services required to successfully complete these types of facilities.

ETS-Lindgren also supplies customers with a broad range of components including RF absorptive materials, RF filters, active compensation systems, antennas, antenna masts, turntables and electric and magnetic probes, RF test cells, proprietary measurement software and other test accessories required to perform a variety of tests. ETS-Lindgren offers a variety of services including calibration for antennas and field probes, chamber certification, field surveys, customer training and a variety of product tests. ETS-Lindgren’s test labs are accredited by the following organizations: American Association for Laboratory Accreditation, National Voluntary Laboratory Accreditation Program and CTIA-The Wireless Association Accredited Test Lab. ETS-Lindgren serves the acoustics, medical, health and safety, electronics, wireless communications, automotive and defense markets.

USG

Revenue from Doble’s various products and services accounted for approximately 22%, 23% and 22% of the Company’s total revenue in 2016, 2015 and 2014, respectively.

Doble develops, manufactures, and delivers diagnostic testing solutions for electrical equipment comprising the electric power grid, and enterprise management systems, that are designed to optimize electrical power assets and system performance, minimize risk and improve operations. It combines three core elements for customers – diagnostic test and monitoring instruments, expert consulting, and testing services – and provides access to its large reserve of related empirical knowledge. Doble flagship solutions include protection diagnostics with the Doble Protection Suite and F6000 series, the M4100 and new transformational patent-pending technology of the M7100 Doble Tester, the dobleARMS® asset risk management system, and Doble’s Enoserv PowerBase® and DUCe compliance tools for the North American Electric Reliability Corporation Critical Infrastructure Protection plan (NERC CIP), a set of requirements designed to secure the assets required for operating North America’s bulk electric system.

Doble has been operating for over 90 years, and serves over 5,500 companies in over 110 countries. It has seven offices in the United States and nine international offices.

Technical Packaging

The Technical Packaging segment accounted for approximately 13%, 7% and 7% of the Company’s total revenue of the Company’s total revenue in 2016, 2015 and 2014, respectively. Prior to 2016 the Technical Packaging business was included in the Filtration segment.

TEQ produces highly engineered thermoformed products and packaging materials for medical, pharmaceutical, retail, food and electronic applications. Through its alliance partner program, TEQ also provides its clients with a total packaging solution including engineering services and testing, sealing equipment and tooling, contract manufacturing, and packing. In October 2015, TEQ’s business was significantly expanded through the Company’s acquisition of Fremont, a developer and manufacturer of high quality sterile-ready and non-sterile thin gauge thermoformed medical plastic packaging products.

| 3 |

Plastique, with locations in the UK and Poland, designs and manufactures plastic and pulp fibre packaging for customers in the personal care, household products, pharmaceutical, food and broader retail markets. Through its Fibrepak brand, Plastique became the first European manufacturer of smooth-surfaced press-to-dry pulp packaging, a sustainable alternative to plastic packaging.

The Company’s products generally are distributed to customers through a domestic and foreign network of distributors, sales representatives, direct sales teams and in-house sales personnel.

The Company’s sales to international customers accounted for approximately $168 million (29%), $152 million (28%) and $157 million (30%) of the Company’s total revenue in 2016, 2015 and 2014, respectively. See Note 15 to the Consolidated Financial Statements included herein for financial information regarding geographic areas. See also Item 1A, “Risk Factors,” for a discussion of risks of the Company’s international operations.

Some of the Company’s products are sold directly or indirectly to the U.S. Government under contracts with the Army, Navy and Air Force and subcontracts with prime contractors of such entities. Direct and indirect sales to the U.S. Government, primarily related to the Filtration segment, accounted for approximately 14%, 15% and 19% of the Company’s total revenue in 2016, 2015 and 2014, respectively.

The Company owns or has other rights in various forms of intellectual property (i.e., patents, trademarks, service marks, copyrights, mask works, trade secrets and other items). As a major supplier of engineered products to industrial and commercial markets, the Company emphasizes developing intellectual property and protecting its rights therein. However, the scope of protection afforded by intellectual property rights, including those of the Company, is often uncertain and involves complex legal and factual issues. Some intellectual property rights, such as patents, have only a limited term. Also, there can be no assurance that third parties will not infringe or design around the Company’s intellectual property. Policing unauthorized use of intellectual property is difficult, and infringement and misappropriation are persistent problems for many companies, particularly in some international markets. In addition, the Company may not elect to pursue an unauthorized user due to the high costs and uncertainties associated with litigation. Further, there can be no assurance that courts will ultimately hold issued patents or other intellectual property valid and enforceable. See Item 1A, “Risk Factors.”

A number of products in the Filtration segment are based on patented or otherwise proprietary technology that sets them apart from the competition, such as VACCO’s proprietary quieting technology and Westland’s signature reduction solutions.

In the Test segment, patent protection has been sought for significant inventions. Examples of such inventions include novel designs for window and door assemblies used in shielded enclosures and anechoic chambers, improved acoustic techniques for sound isolation and a variety of unique antennas. In addition, the Test segment holds a number of patents, and has patents pending, on products used to perform wireless device testing.

In the USG segment, the segment policy is to seek patent and/or other forms of intellectual property protection on new and improved products, components of products and methods of operation for its businesses, as such developments are made. Doble is pursuing patent protection on improvements to its line of diagnostic equipment and NERC CIP compliance tools. Doble also holds an extensive library of apparatus performance information useful to Doble employees and to entities that generate, distribute or consume electric energy. Doble makes part of this library available to registered users via an Internet portal.

The Technical Packaging segment emphasizes advanced manufacturing technology and methods. For example, the TEQ 3-in-1 tooling system, with an added staking tool, provides a competitive edge over traditional thermoform tooling; and Plastique’s “Cure-In-The-Mold” technology produces high-quality, smooth-surface, thin-wall packaging products which may be made from sustainable virgin crop fibers or virgin pulp. The segment’s intellectual property consists chiefly of trade secrets and proprietary technology embodied in products for which the Company is the only approved source, such as the TEQconnexTM and TEQethelyeneTM single polymer sterile barrier medical packaging systems for which TEQ owns the validation studies required to register the package with the FDA.

| 4 |

The Company considers its patents and other intellectual property to be of significant value in each of its segments.

Total Company backlog of firm orders at September 30, 2016 was $332.4 million, representing an increase of $4.9 million (2%) from the backlog of $327.5 million on September 30, 2015. The backlog at September 30, 2016 and September 30, 2015, respectively, by segment, was: $195.8 million and $178.8 million for Filtration; $83.1 million and $95.1 million for Test; $33.8 million and $36.3 million for USG; and $19.7 million and $17.3 million for Technical Packaging. The Company estimates that as of September 30, 2016 domestic customers accounted for approximately 73% of the Company’s total firm orders and international customers accounted for approximately 27%. Of the total Company backlog at September 30, 2016, approximately 76% is expected to be completed in the fiscal year ending September 30, 2017.

Purchased Components and Raw Materials

The Company’s products require a wide variety of components and materials. Although the Company has multiple sources of supply for most of its materials requirements, certain components and raw materials are supplied by sole source vendors, and the Company’s ability to perform certain contracts depends on their performance. In the past, these required raw materials and various purchased components generally have been available in sufficient quantities. However, the Company does have some risk of shortages of materials or components due to reliance on sole or limited sources of supply. See Item 1A, “Risk Factors.”

The Filtration segment purchases supplies from a wide array of vendors. In most instances, multiple vendors of raw materials are screened during a qualification process to ensure that there will not be an interruption of supply should one of them discontinue operations. Nonetheless, in some situations, there is a risk of shortages due to reliance on a limited number of suppliers or because of price fluctuations due to the nature of the raw materials. For example, aerospace-grade titanium and gaseous helium, important raw materials for our Filtration segment subsidiaries, may at times be in short supply.

The Test segment is a vertically integrated supplier of electro-magnetic (EM) shielding and RF absorbing products, producing most of its critical RF components. This segment purchases significant quantities of raw materials such as polyurethane foam, polystyrene beads, steel, aluminum, copper, nickel and wood. Accordingly, it is subject to price fluctuations in the worldwide raw materials markets, although ETS-Lindgren has long-term contracts with a number of its suppliers of certain raw materials.

The USG segment manufactures electronic instrumentation through a network of regional contract manufacturers under long term contracts. In general, Doble purchases the same kinds of component parts as do other electronic products manufacturers, and purchases only a limited amount of raw materials.

The Technical Packaging segment selects suppliers initially on the basis of their ability to meet requirements, and then conducts ongoing evaluations and ratings of the supplier’s performance based on a documented evaluation process. The segment purchases raw materials according to a documented and controlled process assuring that purchased materials meet defined specifications. Thermoplastics represent the largest percentage of raw material spend, with purchase prices subject to fluctuation depending on petrochemical industry pricing and capacity in the plastic resin market.

Competition in the Company’s major markets is broadly based and global in scope. Competition can be particularly intense during periods of economic slowdown, and this has been experienced in some of our markets. Although the Company is a leading supplier in several of the markets it serves, it maintains a relatively small share of the business in many of the other markets it serves. Individual competitors range in size from annual revenues of less than $1 million to billion-dollar enterprises. Because of the specialized nature of the Company’s products, its competitive position with respect to its products cannot be precisely stated. In the Company’s major served markets, competition is driven primarily by quality, technology, price and delivery performance. See also Item 1A, “Risk Factors.”

Primary competitors of the Filtration segment include Pall Corporation, Moog, Inc., Sofrance, CLARCOR Inc. and PneuDraulics.

| 5 |

The Test segment is a global leader in EM shielding. Significant competitors in this market include Rohde & Schwarz GMBH, Microwave Vision SA (MVG), TDK RF Solutions Inc., Albatross GmbH, IMEDCO AG and Cuming Microwave Corporation.

Doble’s significant competitors in diagnostic test equipment include OMICRON electronics Corp., Megger Group Limited and Qualitrol Company LLC (a subsidiary of Danaher Corporation).

Primary Competitors of the Technical Packaging segment include Nelipak Corporation, Prent Corporation, Placon Corporation and Sonoco /Alloyd.

Research and development and the Company’s technological expertise are important factors in the Company’s business. Research and development programs are designed to develop technology for new products or to extend or upgrade the capability of existing products, and to enhance their commercial potential. The Company performs research and development at its own expense, and also engages in research and development funded by customers.

Total Company-sponsored research and development expenses were approximately $12.9 million, $16.7 million and $16.9 million for 2016, 2015 and 2014, respectively. Total customer-sponsored research and development expenses were approximately $7.0 million, $6.8 million and $3.6 million for 2016, 2015 and 2014, respectively. All of the foregoing expense amounts exclude certain engineering costs primarily associated with product line extensions, modifications and maintenance, which amounted to approximately $11.5 million, $13.9 million and $20.5 million for 2016, 2015 and 2014, respectively.

The Company is involved in various stages of investigation and cleanup relating to environmental matters. It is very difficult to estimate the potential costs of such matters and the possible impact of these costs on the Company at this time due in part to: the uncertainty regarding the extent of pollution; the complexity and changing nature of Government laws and regulations and their interpretations; the varying costs and effectiveness of alternative cleanup technologies and methods; the uncertain level of insurance or other types of cost recovery; the uncertain level of the Company’s responsibility for any contamination; the possibility of joint and several liability with other contributors under applicable law; and the ability of other contributors to make required contributions toward cleanup costs. Based on information currently available, the Company does not believe that the aggregate costs involved in the resolution of any of its environmental matters will have a material adverse effect on the Company’s financial condition or results of operations.

The Company contracts with the U.S. Government and subcontracts with prime contractors of the U.S. Government. Although VACCO and Westland have a number of “cost-plus” Government contracts, the Company’s Government contracts also include firm fixed-price contracts under which work is performed and paid for at a fixed amount without adjustment for the actual costs experienced in connection with the contracts. All Government prime contracts and virtually all of the Company’s Government subcontracts provide that they may be terminated at the convenience of the Government or the customer. Upon such termination, the Company is normally entitled to receive equitable compensation from the customer. See “Marketing and Sales” in this Item 1, and Item 1A, “Risk Factors,” for additional information regarding Government contracts and related risks.

As of September 30, 2016, the Company employed 2,643 persons, including 2,419 full time employees. Of the Company’s full-time employees, 1,840 were located in the United States and 579 were located in 22 foreign countries.

For information about the Company’s credit facility, see Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Bank Credit Facility,” and Note 9 to the Consolidated Financial Statements included herein, which are incorporated into this Item by reference.

| 6 |

The Company makes available free of charge on or through its Internet website, www.escotechnologies.com, its annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, as soon as reasonably practicable after such material is electronically filed with or furnished to the Securities and Exchange Commission. Information contained on the Company’s website is not incorporated into this Report.

Executive Officers of the Registrant

The following sets forth certain information as of November 1, 2016 with respect to the Company’s executive officers. These officers are elected annually to terms which expire at the first meeting of the Board of Directors after the next Annual Meeting of Stockholders.

| Name | Age | Position(s) | ||

| Victor L. Richey | 59 | Chairman of the Board of Directors and Chief Executive Officer since April 2003; President since October 2006 * | ||

| Gary E. Muenster | 56 | Executive Vice President and Chief Financial Officer since February 2008; Director since February 2011 | ||

| Alyson S. Barclay | 57 | Senior Vice President, Secretary and General Counsel since November 2008 |

* Mr. Richey also serves as Chairman of the Executive Committee of the Board of Directors.

There are no family relationships among any of the executive officers and directors.

This Form 10-K, including Item 1, “Business,” Item 2, “Properties,” Item 3, “Legal Proceedings,” Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and Item 7A, “Quantitative and Qualitative Disclosures About Market Risk,” contains “forward-looking statements” within the meaning of the safe harbor provisions of the federal securities laws, as described under “Forward-Looking Statements” above.

In addition to the risks and uncertainties discussed in that section and elsewhere in this Form 10-K, the following important risk factors could cause actual results and events to differ materially from those contained in any forward-looking statements, or could otherwise adversely affect the Company’s business, operating results or financial condition:

Our sales of products to the Government depend upon continued Government funding.

Sales to the U.S. Government and its prime contractors and subcontractors represent a significant portion of our business. Over the past three fiscal years, from 14% to 19% of our revenues from continuing operations have been generated from sales to the U.S. Government or its contractors, primarily within our Filtration segment. These sales are dependent on government funding of the underlying programs, which is generally subject to annual Congressional appropriations. There could be reductions or terminations of, or delays in, the government funding on programs which apply to us or our customers. These funding effects could adversely affect our sales and profit, and could bring about a restructuring of our operations, which could result in an adverse effect on our financial condition or results of operations. A significant part of VACCO’s and Westland’s sales involve major U.S. Government programs such as NASA’s Space Launch System (SLS) and the U.S. Navy’s submarine program. A reduction or delay in Government spending on these programs could have a significant adverse impact on our financial results which could extend for more than a single year. For example, VACCO’s immediate customer for SLS parts informed it late in 2014 that 2015 orders would be lower than in 2014 because NASA had decided to smooth its SLS spending over the following three years.

| 7 |

Negative worldwide economic conditions and related credit shortages could result in a decrease in our sales and an increase in our operating costs, which could adversely affect our business and operating results.

If there is a worsening of global and U.S. economic and financial market conditions and additional tightening of global credit markets, as has been experienced recently in certain Asian and European countries, many of our customers may further delay or reduce their purchases of our products. Uncertainties in the global economy may cause the utility industry and commercial market customers to experience shortages in available credit, which could limit capital spending. To the extent this problem affects customers of our USG and Test segments, the sales and profits of these segments could be adversely affected. Likewise, if our suppliers face challenges in obtaining credit, they may have to increase their prices or become unable to continue to offer the products and services we use to manufacture our products, which could have an adverse effect on our business, results of operations and financial condition.

Our quarterly results may fluctuate substantially.

We have experienced variability in quarterly results and believe our quarterly results will continue to fluctuate as a result of many factors, including the size and timing of customer orders, governmental approvals and funding levels, changes in existing taxation rules or practices, the gain or loss of significant customers, timing and levels of new product developments, shifts in product or sales channel mix, increased competition and pricing pressure, and general economic conditions.

A significant part of our manufacturing operations depends on a small number of third-party suppliers.

A significant part of our manufacturing operations relies on a small number of third-party manufacturers to supply component parts or products. For example, Doble has arrangements with four manufacturers which produce and supply substantially all of its end-products. One of these suppliers produces more than 50% of Doble’s products from a single location within the United States. A significant disruption in the supply of those products could negatively affect the timely delivery of products to customers as well as future sales, which could increase costs and reduce margins.

Certain of our other businesses are dependent upon sole source or a limited number of third-party manufacturers of parts and components. Many of these suppliers are small businesses. Since alternative supply sources are limited, there is an increased risk of adverse impacts on our production schedules and profits if our suppliers were to default in fulfilling their price, quality or delivery obligations. In addition, some of our customers or potential customers may prefer to purchase from a supplier which does not have such a limited number of sources of supply.

Increases in prices of raw material and components, and decreased availability of such items, could adversely affect our business.

The cost of raw materials and product components is a major element of the total cost of many of our products. For example, our Test segment’s critical components rely on purchases of raw materials from third parties. Increases in the prices of raw materials (such as steel, copper, nickel, zinc, wood and petrochemical products) could have an adverse impact on our business by, among other things, increasing costs and reducing margins. Aerospace-grade titanium and gaseous helium, important raw materials for our Filtration segment, may at times be in short supply. Further, many of Doble’s items of equipment which are provided to its customers for their use are in the maturity of their life cycles, which creates the risk that replacement components may be unavailable or available only at increased costs.

In addition, our reliance on sole or limited sources of supply of raw materials and components in each of our segments could adversely affect our business, as described in the preceding Risk Factor. Weather-created disruptions in supply, in addition to affecting costs, could impact our ability to procure an adequate supply of these raw materials and components, and delay or prevent deliveries of products to our customers.

Our international operations expose us to fluctuations in currency exchange rates that could adversely affect our results of operations and cash flows.

We have significant manufacturing and sales activities in foreign countries, and our domestic operations have sales to foreign customers. Our financial results may be affected by fluctuations in foreign currencies and by the translation of the financial statements of our foreign subsidiaries from local currencies into U.S. dollars. In addition, a rise in the dollar against foreign currencies could make our products more expensive for foreign customers and cause them to reduce the volume of their purchases.

| 8 |

Failure or delay in new product development could reduce our future sales.

Much of our business is dependent on the continuous development of new products and technologies to meet the changing needs of our markets on a cost-effective basis. Many of these markets are highly technical from an engineering standpoint, and the relevant technologies are subject to rapid change. If we fail to timely enhance existing products or develop new products as needed to meet market or competitive demands, we could lose sales opportunities, which would adversely affect our business. In addition, in some existing contracts with customers, we have made commitments to develop and deliver new products. If we fail to meet these commitments, the default could result in the imposition on us of contractual penalties including termination. Our inability to enhance existing products in a timely manner could make our products less competitive, while our inability to successfully develop new products may limit our growth opportunities. Development of new products and product enhancements may also require us to make greater investments in research and development than we now do, and the increased costs associated with new product development and product enhancements could adversely affect our operating results. In addition, our costs of new product development may not be recoverable if demand for our products is not as great as we anticipate it to be.

Changes in testing standards could adversely impact our Test and USG segments’ sales.

A significant portion of the business of our Test and USG segments involves sales to technology customers who need to have a third party verify that their products meet specific international and domestic test standards. If regulatory agencies were to eliminate or reduce certain domestic or international test standards, or if demand for product testing from these customers were to decrease for some other reason, our sales could be adversely affected. For example, if Wi-Fi technology in mobile phones were to be superseded by a new communications technology, then there might be no need for certain testing on mobile phones; or if a regulatory authority were to relax the test standards for certain electronic devices because they were determined not to interfere with the broadcast spectrum, our sales of certain testing products could be significantly reduced.

The end of customer product life cycles could negatively affect our Filtration segment’s results.

Many of our Filtration segment products are sold to be components in our customers’ end-products. If a customer discontinues a certain end-product line, our ability to continue to sell those components will be reduced or eliminated. The result could be a significant decrease in our sales. For example, a substantial portion of PTI’s revenue is generated from commercial aviation aftermarket sales. As certain aircraft are retired and replaced by newer aircraft, there could be a corresponding decrease in sales associated with our current products. Such a decrease could adversely affect our operating results.

Product defects could result in costly fixes, litigation and damages.

Our business exposes us to potential product liability risks that are inherent in the design, manufacture and sale of our products and the products of third-party vendors which we use or resell. If there are claims related to defective products (under warranty or otherwise), particularly in a product recall situation, we could be faced with significant expenses in replacing or repairing the product. For example, the Filtration segment obtains raw materials, machined parts and other product components from suppliers who provide certifications of quality which we rely on. Should these product components be defective and pass undetected into finished products, or should a finished product contain a defect, we could incur significant costs for repairs, re-work and/or removal and replacement of the defective product. In addition, if a dispute over product claims cannot be settled, arbitration or litigation may result, requiring us to incur attorneys’ fees and exposing us to the potential of damage awards against us.

We may not be able to identify suitable acquisition candidates or complete acquisitions successfully, which may inhibit our rate of growth.

As part of our growth strategy, we plan to continue to pursue acquisitions of other companies, assets and product lines that either complement or expand our existing business. However, we may be unable to implement this strategy if we are unable to identify suitable acquisition candidates or consummate future acquisitions at acceptable prices and terms. We expect to face competition for acquisitions candidates which may limit the number of acquisition opportunities available to us and may result in higher acquisition prices. As a result, we may be limited in the number of acquisitions which we are able to complete and we may face difficulties in achieving the profitability or cash flows needed to justify our investment in them.

| 9 |

Our acquisitions of other companies carry risk.

Acquisitions of other companies involve numerous risks, including difficulties in the integration of the operations, technologies and products of the acquired companies, the potential exposure to unanticipated and undisclosed liabilities, the potential that expected benefits or synergies are not realized and that operating costs increase, the potential loss of key personnel, suppliers or customers of acquired businesses and the diversion of Management’s time and attention from other business concerns. Although we attempt to identify and evaluate the risks inherent in any acquisition, we may not properly ascertain or mitigate all such risks, and our failure to do so could have a material adverse effect on our business.

We may incur significant costs, experience short term inefficiencies, or be unable to realize expected long term savings from facility consolidations and other business reorganizations.

We periodically assess the cost and operational structure of our facilities in order to manufacture and sell our products in the most efficient manner, and based on these assessments, we may from time to time reorganize, relocate or consolidate certain of our facilities. These actions may require us to incur significant costs and may result in short term business inefficiencies as we consolidate and close facilities and transition our employees; and in addition, we may not achieve the expected long term benefits. Any or all of these factors could result in an adverse impact on our operating results, cash flows and financial condition.

The trading price of our common stock continues to be volatile and may result in investors selling shares of our common stock at a loss.

The trading price of our common stock is volatile and subject to wide fluctuations in price in response to various factors, many of which are beyond our control, including those described in this section and including but not limited to: actual or anticipated variations in our quarterly operating results; changes in financial estimates by securities analysts that cover our stock or our failure to meet those estimates; substantial sales of our common stock by our existing shareholders; and general stock market conditions. In recent years the stock markets in general have experienced dramatic price and volume fluctuations, which may continue indefinitely, and changes in industry, general economic or market conditions could harm the price of our stock regardless of our operating performance.

The Company has guaranteed certain Aclara contracts.

In the normal course of business during the time that Aclara was our subsidiary, we agreed to provide guarantees of Aclara’s performance under certain real property leases, certain vendor contacts, and certain large, long-term customer contracts for the delivery, deployment and performance of AMI systems such as those described under “Discontinued Operations” in Item 1. In connection with the sale of Aclara, we agreed to remain a guarantor of Aclara’s performance of these contracts. If Aclara were to fail to perform any of these guaranteed contracts, the other party to the contract could seek damages from us resulting from the non-performance, and such damages could have a material adverse effect on our business, operating results or financial condition. If we were determined to be liable for these damages, we would be entitled to seek indemnification from Aclara, although our ability to recover would be subject to Aclara’s financial position at that time.

We may not realize as revenue the full amounts reflected in our backlog.

As of September 30, 2016 our twelve-month backlog was approximately $254.1 million, which represents confirmed orders we believe will be recognized as revenue within the next twelve months. There can be no assurance that our customers will purchase all the orders represented in our backlog, particularly as to contracts which are subject to the U.S. Government’s ability to modify or terminate major programs or contracts, and if and to the extent that this occurs, our future revenues could be materially reduced.

Economic, political and other risks of our international operations, including terrorist activities, could adversely affect our business.

In 2016, approximately 29% of our net sales were to customers outside the United States. An economic downturn or an adverse change in the political situation in certain foreign countries in which we do business could cause a decline in revenues and adversely affect our financial condition. For example, our Test segment does significant business in Asia, and changes in the Asian political climate or political changes in specific Asian countries could negatively affect our business; several Doble and ETS-Lindgren companies are based in Europe and could be negatively impacted by weakness in the European economy; Doble’s and Plastique’s UK-based businesses could be adversely affected by Brexit; and Doble’s current multi-year project involving the national power grid in Saudi Arabia could be adversely affected by the continuing political unrest, wars and terrorism in the Middle East.

| 10 |

Our international sales are also subject to other risks inherent in foreign commerce, including currency fluctuations and devaluations, differences in foreign laws, uncertainties as to enforcement of contract rights, and difficulties in negotiating and resolving disputes with our foreign customers.

Our governmental sales and our international and export operations are subject to special U.S. and foreign government laws and regulations which may impose significant compliance costs, create reputational and legal risk, and impair our ability to compete in international markets.

The international scope of our operations subjects us to a complex system of commercial and trade regulations around the world, and our foreign operations are governed by laws and business practices that often differ from those of the U.S. In addition, laws such as the U.S. Foreign Corrupt Practices Act and similar laws in other countries increase the need for us to manage the risks of improper conduct not only by our own employees but by distributors and contractors who may not be within our direct control. Many of our exports are of products which are subject to U.S. Government regulations and controls such as the U.S. International Traffic in Arms Regulations (ITAR), which impose certain restrictions on the U.S. export of defense articles and services, and these restrictions are subject to change from time to time, including changes in the countries into which our products may lawfully be sold.

Our failure to comply with these laws and regulations could subject us to significant fines, penalties and other sanctions including the inability to continue to export our products or to sell our products to the U.S. Government or to certain other customers. In addition, some of these regulations may be viewed as too restrictive by our international customers, who may elect to develop their own domestic products or procure products from other international suppliers which are not subject to comparable export restrictions; and the laws, regulations or policies of certain other countries may also favor their own domestic suppliers over foreign suppliers such as the Company.

Despite our efforts, we may be unable to adequately protect our intellectual property.

Much of our business success depends on our ability to protect and freely utilize our various intellectual properties, including both patents and trade secrets. Despite our efforts to protect our intellectual property, unauthorized parties or competitors may copy or otherwise obtain and use our products and technology, particularly in foreign countries where the laws may not protect our proprietary rights as fully as in the United States. Our current and future actions to enforce our proprietary rights may ultimately not be successful; or in some cases we may not elect to pursue an unauthorized user due to the high costs and uncertainties associated with litigation. We may also face exposure to claims by others challenging our intellectual property rights. Any or all of these actions may divert our resources and cause us to incur substantial costs.

Disputes with contractors could adversely affect our Test segment’s costs.

A major portion of our Test segment’s business involves working in conjunction with general contractors to produce complex building components constructed on-site, such as electronic test chambers, secure communication rooms and MRI facilities. If there are performance problems caused by either us or a contractor, they could result in cost overruns and may lead to a dispute as to which party is responsible. The resolution of such disputes can involve arbitration or litigation, and can cause us to incur significant expense including attorneys’ fees. In addition, these disputes could result in a reduction in revenue, a loss on a particular project, or even a significant damages award against us.

Environmental or regulatory requirements could increase our expenses and adversely affect our profitability.

Our operations and properties are subject to U.S. and foreign environmental laws and regulations governing, among other things, the generation, storage, emission, discharge, transportation, treatment and disposal of hazardous materials and the clean-up of contaminated properties. These regulations, and changes to them, could increase our cost of compliance, and our failure to comply could result in the imposition of significant fines, suspension of production, alteration of product processes, cessation of operations or other actions which could materially and adversely affect our business, financial condition and results of operations.

We are currently involved as a responsible party in several ongoing investigations and remediations of contaminated third-party owned properties. In addition, environmental contamination may be discovered in the future on properties which we formerly owned or operated and for which we could be legally responsible. Future costs associated with these situations, including ones which may be currently unknown to us, are difficult to quantify but could have a significant effect on our financial condition. See Item 1, “Business – Environmental Matters” for a discussion of these factors.

| 11 |

We are or may become subject to legal proceedings that could adversely impact our operating results.

We are, and will likely be in the future, a party to a number of legal proceedings and claims involving a variety of matters, including environmental matters such as those described in the preceding risk factor and disputes over the ownership or use of intellectual property. Given the uncertainties inherent in litigation, including but not limited to the possible discovery of facts adverse to our position, adverse rulings by a court or adverse decisions by a jury, it is possible that such proceedings could result in a liability that we may have not adequately reserved for, that may not be adequately covered by insurance, or that may otherwise have a material adverse effect on our financial condition or results of operations.

The loss of specialized key employees could affect our performance and revenues.

There is a risk of our losing key employees having engineering and technical expertise to other employers. For example, our USG segment relies heavily on engineers with significant experience and reputation in the utility industry to furnish expert consulting services and support to customers. There is a current trend of a shortage of these qualified engineers because of hiring competition from other companies in the industry. Loss of these employees to other employers could reduce the segment’s ability to provide services and negatively affect our revenues.

Our decentralized organizational structure presents certain risks.

We are a relatively decentralized company in comparison with some of our peers. This decentralization necessarily places significant control and decision-making powers in the hands of local management, which present various risks, including the risk that we may be slower or less able to identify or react to problems affecting a key business than we would in a more centralized management environment. We may also be slower to detect or react to compliance related problems (such as an employee undertaking activities prohibited by applicable law or by our internal policies), and Company-wide business initiatives may be more challenging and costly to implement, and the risks of noncompliance or failures higher, than they would be under a more centralized management structure. Depending on the nature of the problem or initiative in question, such noncompliance or failure could materially adversely affect our business, financial condition or result of operations.

Provisions in our articles of incorporation, bylaws and Missouri law could make it more difficult for a third party to acquire us and could discourage acquisition bids or a change of control, and could adversely affect the market price of our common stock.

Our articles of incorporation and bylaws contain certain provisions which could discourage potential hostile takeover attempts, including: a limitation on the shareholders’ ability to call special meetings of shareholders; advance notice requirements to nominate candidates for election as directors or to propose matters for action at a meeting of shareholders; a classified board of directors, which means that approximately one-third of our directors are elected each year; and the authority of our board of directors to issue, without shareholder approval, preferred stock with such terms as the board may determine. In addition, the laws of Missouri, in which we are incorporated, require a two-thirds vote of outstanding shares to approve mergers or certain other major corporate transactions, rather than a simple majority as in some other states such as Delaware. These provisions could impede a merger or other change of control not approved by our board of directors, which could discourage takeover attempts and in some circumstances reduce the market price of our common stock.

Item 1B. Unresolved Staff Comments

None

| 12 |

The Company believes its buildings, machinery and equipment have been generally well maintained, are in good operating condition and are adequate for the Company’s current production requirements and other needs.

The Company’s principal manufacturing facilities and other

materially important properties, including those described in the table below, comprise approximately 1,435,000 square feet of

floor space, of which approximately 841,000 square feet are owned and approximately 594,000 square feet are leased. Leased facilities

of less than 5,000 square feet are not included in the table. See also Note 16 to the Consolidated Financial Statements included

herein.

| 13 |

| Location | Approximate Size (Sq. Ft.) |

Owned/ Leased |

If Leased, Expiration Date |

Principal Use(s) and (Operating Segment) | ||||

| Modesto, CA | 135,000 | Leased | 5/31/2021 | Office, Engineering & Manufacturing (Filtration) | ||||

| Denton, TX(1) | 130,000 | Leased | 9/30/2029 (plus options) | Office, Engineering & Manufacturing (Filtration) | ||||

| Oxnard, CA | 127,400 | Owned | Office, Engineering & Manufacturing (Filtration) | |||||

| Cedar Park, TX | 118,000 | Owned | Office, Engineering & Manufacturing (Test) | |||||

| South El Monte, CA | 100,100 | Owned | Office, Engineering & Manufacturing (Filtration) | |||||

| Durant, OK | 100,000 | Owned | Manufacturing (Test) | |||||

| Huntley, IL | 86,000 | Owned | Office, Engineering & Manufacturing (Technical Packaging) | |||||

| Watertown, MA | 82,100 | Owned | Office, Engineering & Manufacturing (USG) | |||||

| Valencia, CA | 79,300 | Owned | Office, Engineering & Manufacturing (Filtration) | |||||

| South El Monte, CA | 64,100 | Leased | 6/30/2017 | Office, Engineering & Manufacturing (Filtration) | ||||

| Eura, Finland | 41,500 | Owned | Office, Engineering & Manufacturing (Test) | |||||

| Fremont, Indiana | 39,800 | Owned | Office, Engineering & Manufacturing (Technical Packaging) | |||||

| Beijing, China | 39,100 | Leased | 12/31/2017 & 12/21/2019 | Manufacturing (Test) | ||||

| Minocqua, WI | 35,400 | Owned | Engineering & Manufacturing (Test) | |||||

| Poznan, Poland | 32,000 | Owned | Office, Engineering & Manufacturing (Technical Packaging) | |||||

| Nottingham, England | 23,900 | Leased | 7/31/2019 | Office, Engineering & Manufacturing (Technical Packaging) | ||||

| Hutto, TX | 22,600 | Leased | 9/30/2017 | Warehouse (Test) | ||||

| St. Louis, MO | 21,500 | Leased | 8/31/2020 (plus options) | ESCO Corporate Headquarters | ||||

| Tunbridge Wells, England | 14,400 | Leased | 7/31/2019 | Office, Engineering & Manufacturing (Technical Packaging) | ||||

| Stevenage, England | 12,200 | Leased | 6/1/2017 | (Former Test facility; closed in 2016) | ||||

| Morrisville, NC | 11,600 | Leased | 8/31/2019 | Office (USG) | ||||

| Huntley, IL | 11,500 | Leased | 12/31/2018 | Manufacturing (Filtration) | ||||

| Marlborough, MA | 11,200 | Leased | 6/30/2020 | Office & Engineering (USG) | ||||

| Wood Dale, IL | 10,700 | Leased | 3/31/2019 | Office & Engineering (Test) | ||||

| Tulsa, OK | 9,900 | Leased | 12/31/2018 | Office (USG) | ||||

| Bangalore, India | 8,400 | Leased | Various, month-to-month to 8/2/2017 | Office, Engineering & Warehouse (Test) | ||||

| Trondheim, Norway | 6,100 | Leased | 6/30/2018 | Office (USG) | ||||

| Houston, TX | 5,200 | Leased | 6/14/2021 | Office (USG) |

| (1) | The Company acquired this facility in November 2016 in connection with its acquisition of Mayday Manufacturing Co. and Hi-Tech Metals, Inc. |

| 14 |

As a normal incident of the businesses in which the Company is engaged, various claims, charges and litigation are asserted or commenced from time to time against the Company. With respect to claims and litigation asserted or commenced against the Company, it is the opinion of Management that final judgments, if any, which might be rendered against the Company are adequately reserved for, are covered by insurance, or are not likely to have a material adverse effect on the Company’s financial condition or results of operations. Nevertheless, given the uncertainties of litigation, it is possible that such claims, charges and litigation could have a material adverse impact on the Company; see Item 1A, “Risk Factors.”

Item 4. Mine Safety Disclosures

Not applicable.

| 15 |

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Price Range Of Common Stock. The Company’s common stock is listed on the New York Stock Exchange under the symbol “ESE.” The following table summarizes the high and low prices of the common stock for each quarter in the last two fiscal years.

| 2016 | 2015 | |||||||||||||||

| Quarter | High | Low | High | Low | ||||||||||||

| First | $ | 39.98 | 33.62 | $ | 38.44 | 33.01 | ||||||||||

| Second | 39.59 | 31.50 | 39.73 | 34.47 | ||||||||||||

| Third | 41.68 | 37.19 | 39.26 | 36.20 | ||||||||||||

| Fourth | 47.39 | 39.14 | 39.37 | 34.03 | ||||||||||||

Holders of Record. As of October 31, 2016 there were approximately 1,878 holders of record of the Company’s common stock.

Dividends. For information about dividends paid on the common stock in the last two fiscal years, please refer to Note 18 to the Company’s Consolidated Financial Statements included herein.

Company Purchases of Equity Securities. The Company did not repurchase any shares of its common stock during the fourth quarter of fiscal 2016.

Securities Authorized for Issuance Under Equity Compensation Plans. For information about securities authorized for issuance under the Company’s equity compensation plans, please refer to Item 12 of this Form 10-K and to Note 11 to the Company’s Consolidated Financial Statements included herein.

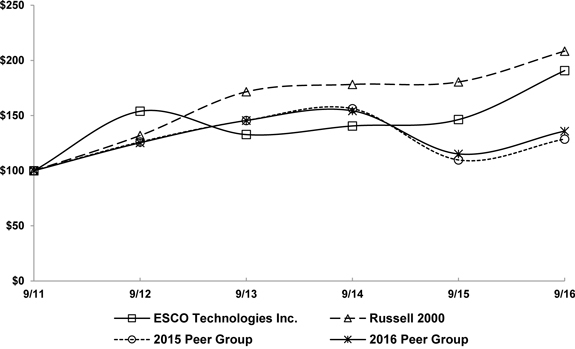

Performance Graph. The graph and table below present a comparison of the cumulative total shareholder return on the Company’s common stock as measured against the Russell 2000 index and two customized peer groups whose individual component companies are listed below. Because the Company changed the composition of the peer group for 2016, as described below, the peer group used for the corresponding disclosures in 2015 is also shown for comparison. The Company is not a component of either the 2016 peer group or the 2015 peer group, but it is a component of the Russell 2000 Index. The measurement period begins on September 30, 2011 and measures at each September 30 thereafter. These figures assume that all dividends, if any, paid over the measurement period were reinvested, and that the starting values of each index and the investments in the Company’s common stock were $100 at the close of trading on September 30, 2011.

| 16 |

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN

Among ESCO Technologies Inc., the Russell 2000

Index,

2015 Peer Group and 2016 Peer Group

Copyright© 2016 Russell Investment Group. All rights reserved.

| 9/30/11 | 9/30/12 | 9/30/13 | 9/30/14 | 9/30/15 | 9/30/16 | |||||||||||||||||||

| ESCO Technologies Inc. | $ | 100.00 | 153.91 | 132.78 | 140.60 | 146.37 | 190.78 | |||||||||||||||||

| Russell 2000 | 100.00 | 131.91 | 171.55 | 178.30 | 180.52 | 208.44 | ||||||||||||||||||

| 2016 Peer Group | 100.00 | 125.33 | 145.48 | 154.30 | 115.26 | 135.88 | ||||||||||||||||||

| 2015 Peer Group | 100.00 | 126.06 | 145.51 | 156.24 | 109.78 | 128.70 | ||||||||||||||||||

The 2016 peer group is composed of eleven companies that correspond to the Company’s four industry segments used for financial reporting purposes during 2016, as follows: Filtration/Fluid Flow segment (36% of the Company’s 2016 total revenue) – CIRCOR International, Inc., CLARCOR Inc., Donaldson Company, Inc. and Moog Inc.; Test segment (28% of the Company’s 2016 total revenue) – EXFO Inc. and FARO Technologies, Inc.; USG segment (23% of the Company’s 2016 total revenue) – Aegion Corporation, Ameresco, Inc. and EnerNOC, Inc.; and Technical Packaging Segment (13% of the Company’s 2016 total revenue) – AptarGroup, Inc. and Bemis Company, Inc.

The 2015 peer group was composed of nine companies that corresponded to the Company’s three industry segments used for financial reporting purposes during 2015, as follows: Filtration/Fluid Flow segment (44% of the Company’s 2015 total revenue) – CIRCOR International, Inc., CLARCOR Inc., Donaldson Company, Inc. and Moog Inc.; Test segment (33% of the Company’s 2015 total revenue) – EXFO Inc. and FARO Technologies, Inc.; and USG segment (23% of the Company’s 2015 total revenue) – Aegion Corporation, Ameresco, Inc. and EnerNOC, Inc.

In calculating the composite return of the 2015 and 2016 peer groups, the return of each company comprising the peer group was weighted by (a) its market capitalization in relation to the other companies in its corresponding Company industry segment, and (b) the percentage of the Company’s total revenue represented by its corresponding Company industry segment.

| 17 |

Item 6. Selected Financial Data

The following selected consolidated financial data of the Company and its subsidiaries should be read in conjunction with the Company’s Consolidated Financial Statements, the Notes thereto, and Management’s Discussion and Analysis of Financial Condition and Results of Operations, as of the respective dates indicated and for the respective periods ended thereon.

| (Dollars in millions, except per share amounts) | 2016 | 2015 | 2014 | 2013 | 2012 | |||||||||||||||

| For years ended September 30: | ||||||||||||||||||||

| Net sales | $ | 571.5 | 537.3 | 531.1 | 490.1 | 478.7 | ||||||||||||||

| Net earnings from continuing operations | 45.9 | 41.7 | 42.6 | 31.3 | 34.8 | |||||||||||||||

| Net earnings (loss) from discontinued operations | - | 0.8 | (42.2 | ) | (56.9 | ) | 12.1 | |||||||||||||

| Net earnings (loss) | 45.9 | 42.5 | 0.4 | (25.6 | ) | 46.9 | ||||||||||||||

| Earnings (loss) per share: | ||||||||||||||||||||

| Basic: | ||||||||||||||||||||

| Continuing operations | $ | 1.78 | 1.60 | 1.61 | 1.18 | 1.30 | ||||||||||||||

| Discontinued operations | - | 0.03 | (1.60 | ) | (2.15 | ) | 0.46 | |||||||||||||

| Net earnings (loss) | $ | 1.78 | 1.63 | 0.01 | (0.97 | ) | 1.76 | |||||||||||||

| Diluted: | ||||||||||||||||||||

| Continuing operations | $ | 1.77 | 1.59 | 1.60 | 1.17 | 1.29 | ||||||||||||||

| Discontinued operations | - | 0.03 | (1.58 | ) | (2.13 | ) | 0.44 | |||||||||||||

| Net earnings (loss) | $ | 1.77 | 1.62 | 0.02 | (0.96 | ) | 1.73 | |||||||||||||

| As of September 30: | ||||||||||||||||||||

| Working capital | $ | 165.4 | 155.0 | 148.9 | 163.6 | 139.2 | ||||||||||||||

| Total assets | 978.4 | 864.2 | 845.9 | 1,092.3 | 1,033.8 | |||||||||||||||

| Total debt | 110.0 | 50.0 | 40.0 | 172.0 | 115.0 | |||||||||||||||

| Shareholders’ equity | 615.1 | 584.2 | 580.2 | 601.7 | 631.3 | |||||||||||||||

| Cash dividends declared per common share | $ | 0.32 | 0.32 | 0.32 | 0.32 | 0.32 | ||||||||||||||

See also Notes 2 and 3 to the Consolidated Financial Statements included herein for discussion of acquisition and divestiture activity.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion should be read in conjunction with the Consolidated Financial Statements included herein and Notes thereto and refers to the Company’s results from continuing operations, except where noted.

Introduction

ESCO Technologies Inc. and its wholly owned subsidiaries (the Company) are organized into four operating segments for financial reporting purposes: Filtration/Fluid Flow (Filtration), RF Shielding and Test (Test), Utility Solutions Group (USG), and Technical Packaging. The Technical Packaging segment was created in the second quarter of 2016 to disclose TEQ, Plastique and Fremont separately as they no longer met the criteria for aggregation with the Filtration segment. Prior period amounts have been reclassified to conform to the current period presentation. The Company’s business segments are comprised of the following primary operating entities:

| · | Filtration: PTI Technologies Inc. (PTI); VACCO Industries (VACCO); Crissair, Inc. (Crissair); and Westland Technologies, Inc. (Westland). |

| · | Test: ETS-Lindgren Inc. (ETS-Lindgren). |

| · | USG: Doble Engineering Company (Doble). |

| · | Technical Packaging: Thermoform Engineered Quality LLC (TEQ); Plastique Limited and Plastique Sp. z o.o. (together, Plastique). |

| 18 |

Filtration. Most of the companies within this segment primarily design and manufacture specialty filtration products including hydraulic filter elements and fluid control devices used in commercial aerospace applications, unique filter mechanisms used in micro-propulsion devices for satellites and custom designed filters for manned aircraft and submarines; Westland designs, develops and manufactures elastomeric-based signature reduction solutions for U.S. naval vessels.

Test. ETS-Lindgren is an industry leader in providing its customers with the ability to identify, measure and contain magnetic, electromagnetic and acoustic energy.

USG. Doble provides high-end, intelligent diagnostic test solutions for the electric power delivery industry and is a leading supplier of power factor and partial discharge testing instruments used to assess the integrity of high-voltage power delivery equipment.

Technical Packaging. The companies within this segment provide innovative solutions to the medical and commercial markets for thermoformed and precision molded pulp fiber packages and specialty products using a wide variety of thin gauge plastics and pulp.

The Company continues to operate with meaningful growth prospects in its primary served markets and with considerable financial flexibility. The Company continues to focus on new products that incorporate proprietary design and process technologies. Management is committed to delivering shareholder value through internal growth, ongoing performance improvement initiatives, and acquisitions.

Highlights of 2016 Operations

| · | Sales, net earnings and diluted earnings per share in 2016 were $571.5 million, $45.9 million and $1.77 per share, respectively, compared to sales, net earnings from continuing operations and diluted earnings per share from continuing operations of $537.3 million, $41.7 million and $1.59 per share, respectively, in 2015. |

| · | Diluted EPS for 2016 was $1.77. Diluted EPS – As Adjusted for 2016 was $2.03 which excludes $6.9 million, net after tax, or $0.26 per share, related to the previously announced exit of Test’s operating facilities in Germany and England and the impact of the domestic headcount reductions, plus Doble’s closure of its Brazil operating office. |

| · | Net cash provided by operating activities from continuing operations was approximately $73.9 million in 2016, compared to $65.0 million in 2015. |