United States

Securities and Exchange Commission

Washington, D.C. 20549

Form N-CSR

Certified Shareholder Report of Registered Management Investment Companies

811-6165

(Investment Company Act File Number)

Federated Hermes Municipal Securities Income Trust

_______________________________________________________________

(Exact Name of Registrant as Specified in Charter)

Federated Hermes Funds

4000 Ericsson Drive

Warrendale, Pennsylvania 15086-7561

(Address of Principal Executive Offices)

(412) 288-1900

(Registrant's Telephone Number)

Peter J. Germain, Esquire

1001 Liberty Avenue

Pittsburgh, Pennsylvania 15222-3779

(Name and Address of Agent for Service)

(Notices should be sent to the Agent for Service)

Date of Fiscal Year End: 08/31/23

Date of Reporting Period: 08/31/23

| Item 1. | Reports to Stockholders |

|

Share Class | Ticker

|

A | MMIFX

|

Institutional | MMFIX

|

|

|

Federated Hermes Michigan Intermediate Municipal Fund

A Portfolio of Federated Hermes Municipal Securities Income Trust

|

|

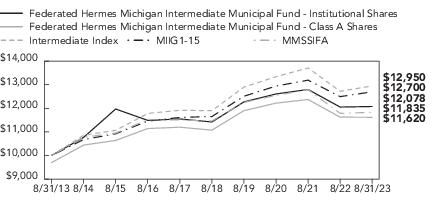

1 Year

|

5 Years

|

10 Years

|

|

Class A Shares

|

-3.02%

|

0.35%

|

1.51%

|

|

Institutional Shares5

|

0.20%

|

1.12%

|

1.91%

|

|

Intermediate Index

|

1.80%

|

1.71%

|

2.62%

|

|

MIIG1-15

|

1.64%

|

1.74%

|

2.42%

|

|

MMSSIFA

|

0.51%

|

0.71%

|

1.92%

|

|

Sector Composition

|

Percentage of

Total Net Assets

|

|

General Obligation—Local

|

35.7%

|

|

Water & Sewer

|

14.1%

|

|

Higher Education

|

11.7%

|

|

Hospital

|

9.9%

|

|

Pre-refunded

|

5.4%

|

|

General Obligation—State Appropriation

|

5.2%

|

|

Dedicated Tax

|

4.8%

|

|

Airport

|

2.4%

|

|

Electric & Gas

|

2.3%

|

|

Public Power

|

2.3%

|

|

Other2

|

5.6%

|

|

Other Assets and Liabilities—Net3

|

0.6%

|

|

TOTAL

|

100%

|

|

Principal

Amount

|

|

|

Value

|

|

|

|

MUNICIPAL BONDS—97.8%

|

|

|

|

|

Michigan—97.8%

|

|

|

$1,200,000

|

|

Ann Arbor, MI Public School District, UT GO 2022 School

Building and Site Bonds, 5.000%, 5/1/2040

|

$1,304,828

|

|

500,000

|

|

Ann Arbor, MI Public School District, UT GO School Building and

Site Bonds (Series 2023), 4.000%, 5/1/2034

|

530,204

|

|

1,255,000

|

|

Ann Arbor, MI, LT GO Capital Improvement Bonds

(Series 2019A), 4.000%, 5/1/2033

|

1,298,864

|

|

1,690,000

|

|

Bishop, MI International Airport Authority, Refunding LT GO

(Series 2010A), (Assured Guaranty Municipal Corp. INS),

4.500%, 12/1/2023

|

1,691,427

|

|

400,000

|

|

Bloomfield Hills Schools, MI, UT GO Bonds (Series 2023),

5.000%, 5/1/2031

|

453,244

|

|

1,425,000

|

|

Calhoun County, MI Transportation Fund, Revenue Bonds,

4.000%, 11/1/2030

|

1,438,045

|

|

775,000

|

|

Crawford AuSable, MI School District, UT GO School Building

and Site Bonds (Series 2022-1), (Assured Guaranty Municipal

Corp. INS), 4.000%, 5/1/2030

|

807,011

|

|

830,000

|

|

Dearborn Heights, MI, LT GO Capital Improvement Bonds

(Series 2021), (Build America Mutual Assurance INS),

3.000%, 5/1/2026

|

818,339

|

|

2,000,000

|

|

Dearborn, MI School District, UT GO School Building & Site

Bonds (Series 2014A), (United States Treasury PRF

11/1/2023@100), 5.000%, 5/1/2025

|

2,004,720

|

|

500,000

|

|

Detroit, MI Downtown Development Authority, Tax Increment

Revenue Refunding Bonds (Catalyst Development Series 2018A),

(Assured Guaranty Municipal Corp. INS), 5.000%, 7/1/2035

|

501,296

|

|

375,000

|

|

Downriver Utility Wastewater Authority, Sewer System Revenue

Bonds (Series 2018), (Assured Guaranty Municipal Corp. INS),

5.000%, 4/1/2031

|

402,394

|

|

450,000

|

|

Forest Hills, MI Public Schools, UT GO School Building and Site

Bonds (Series 2023-III), 5.000%, 5/1/2031

|

507,605

|

|

200,000

|

|

Gerald R. Ford International Airport, LT Revenue Bonds

(Series 2021), (Kent County, MI GTD), 5.000%, 1/1/2026

|

206,489

|

|

125,000

|

|

Gerald R. Ford International Airport, LT Revenue Bonds

(Series 2021), (Kent County, MI GTD), 5.000%, 1/1/2028

|

132,457

|

|

1,000,000

|

|

Grand Rapids, MI Sanitary Sewer System, Revenue Refunding

Bonds (Series 2016), 5.000%, 1/1/2034

|

1,032,895

|

|

500,000

|

|

Great Lakes, MI Water Authority (Great Lakes, MI Water

Authority Water Supply System), Water Supply System Revenue

Senior Lien Bonds (Series 2022A), 5.000%, 7/1/2035

|

558,870

|

|

500,000

|

|

Huron Valley, MI School District, UT GO School Building and Site

Bonds (Series 2023), (Michigan School Bond Qualification and

Loan Program GTD), 4.000%, 5/1/2034

|

535,772

|

|

Principal

Amount

|

|

|

Value

|

|

|

|

MUNICIPAL BONDS—continued

|

|

|

|

|

Michigan—continued

|

|

|

$420,000

|

|

L’Anse Creuse, MI Public Schools, UT GO Refunding Bonds

(Series 2023), (Michigan School Bond Qualification and Loan

Program GTD), 5.000%, 5/1/2032

|

$480,318

|

|

500,000

|

|

Lansing, MI Board of Water & Light, Utility System Revenue

Bonds (Series 2021B), 2.000%, Mandatory Tender 7/1/2026

|

467,637

|

|

400,000

|

|

Livonia, MI Public School District, UT GO School Building and

Site Bonds (Series 2023-II), (Assured Guaranty Municipal Corp.

INS), 5.000%, 5/1/2031

|

451,205

|

|

1,000,000

|

|

Michigan State Building Authority, Revenue Refunding Bonds

(Series 2015I), 5.000%, 4/15/2027

|

1,032,379

|

|

500,000

|

|

Michigan State Building Authority, Revenue Refunding Bonds

Facilities Program (Series 2023-II), 5.000%, 10/15/2029

|

554,522

|

|

1,000,000

|

|

Michigan State Comprehensive Transportation Fund, Refunding

Revenue Bonds (Series 2015), 5.000%, 11/15/2026

|

1,018,831

|

|

750,000

|

|

Michigan State Finance Authority (Beaumont Health Spectrum

Health System), Hospital Revenue Refunding Bonds

(Series 2022A), 5.000%, 4/15/2030

|

824,046

|

|

500,000

|

|

Michigan State Finance Authority (Charter County of Wayne

Criminal Justice Center Project), Senior Lien State Aid Revenue

Bonds (Series 2018), 5.000%, 11/1/2033

|

533,385

|

|

250,000

|

|

Michigan State Finance Authority (Clean Water Revolving Fund),

Drinking Water Revolving Fund Revenue Bonds (Series 2021B),

5.000%, 10/1/2027

|

268,553

|

|

1,000,000

|

|

Michigan State Finance Authority (Clean Water Revolving Fund),

Revenue Refunding Bonds (Series 2018B), 5.000%, 10/1/2032

|

1,088,450

|

|

2,000,000

|

|

Michigan State Finance Authority (Great Lakes, MI Water

Authority Water Supply System), Senior Lien Revenue Bonds

(Series 2014 D-2), (Assured Guaranty Municipal Corp. INS),

5.000%, 7/1/2025

|

2,020,255

|

|

1,000,000

|

|

Michigan State Finance Authority (Trinity Healthcare Credit

Group), Hospital Revenue & Refunding Bonds (Series 2015MI),

5.500%, 12/1/2026

|

1,030,702

|

|

500,000

|

|

Michigan State Finance Authority, Drinking Water Revolving Fund

Revenue Bonds (Series 2023A), 5.000%, 10/1/2031

|

575,305

|

|

2,000,000

|

|

Michigan State Hospital Finance Authority (Ascension Health

Alliance Senior Credit Group), Revenue Bonds (Series 1999B-3),

4.000%, 11/15/2032

|

2,031,633

|

|

250,000

|

|

Michigan State Hospital Finance Authority (Trinity Healthcare

Credit Group), Revenue Refunding Bonds (Series 2017C),

5.000%, 12/1/2031

|

265,554

|

|

150,000

|

|

Michigan State Trunk Line, State Trunk Line Fund Bonds

(Series 2023), 5.000%, 11/15/2033

|

173,872

|

|

455,000

|

|

Michigan State Trunk Line, State Trunk Line Fund Refunding

Bonds (Series 2020B), 5.000%, 11/15/2028

|

499,377

|

|

Principal

Amount

|

|

|

Value

|

|

|

|

MUNICIPAL BONDS—continued

|

|

|

|

|

Michigan—continued

|

|

|

$585,000

|

|

Michigan State Trunk Line, State Trunk Line Fund Revenue Bonds

(Series 2020B), 5.000%, 11/15/2033

|

$662,283

|

|

1,250,000

|

|

Michigan State University Board of Trustees, General Revenue

Bonds (Series 2019B), 5.000%, 2/15/2034

|

1,356,476

|

|

400,000

|

|

Michigan State University Board of Trustees, General Revenue

Bonds (Series 2023A), 5.000%, 2/15/2031

|

451,568

|

|

1,000,000

|

|

Michigan Strategic Fund (Consumers Energy), Variable Rate

Limited Obligation Revenue Bonds (Series 2019), 1.800%,

Mandatory Tender 10/1/2024

|

973,104

|

|

500,000

|

|

Michigan Strategic Fund (DTE Electric Co.), Limited Obligation

Revenue Bonds (Series 2023DT), 3.875%, Mandatory

Tender 6/3/2030

|

489,733

|

|

500,000

|

|

Michigan Strategic Fund (United Methodist Retirement

Community, Inc.), Limited Obligation Revenue Refunding Bonds

(Series 2019), 5.000%, 11/15/2034

|

484,546

|

|

250,000

|

|

Michigan Tobacco Settlement Finance Authority, Tobacco

Settlement Asset-Backed Senior Current Interest Bonds

(Series 2020A Class 1), 5.000%, 6/1/2025

|

254,945

|

|

595,000

|

|

Oxford, MI Area Community Schools, UT GO Bonds

(Series 2018I), (Michigan School Bond Qualification and Loan

Program GTD), 4.000%, 11/1/2032

|

614,689

|

|

1,000,000

|

|

Royal Oak, MI Hospital Finance Authority (Beaumont Health

Credit Group), Hospital Revenue Refunding Bonds

(Series 2014D), (United States Treasury PRF 9/1/2023@100),

5.000%, 9/1/2023

|

1,000,000

|

|

500,000

|

|

Saginaw, MI City School District, UT GO School Building and Site

Bonds (Series 2021), (Michigan School Bond Qualification and

Loan Program GTD), 4.000%, 5/1/2027

|

512,464

|

|

500,000

|

|

Saline, MI Area Schools, School Building and Site Bonds

(Series 2023-I), (Michigan School Bond Qualification and Loan

Program GTD), 5.000%, 5/1/2031

|

564,733

|

|

1,085,000

|

|

Southfield, MI Library Building Authority, Refunding LT GO

Bonds, 5.000%, 5/1/2026

|

1,110,736

|

|

1,000,000

|

|

Southfield, MI, UT GO 2018 Street Improvement Bonds,

4.000%, 5/1/2029

|

1,034,020

|

|

250,000

|

|

Troy, MI School District, UT GO School Building & Site Bonds

(Series 2023), (Q-SBLF GTD), 5.000%, 5/1/2031

|

285,294

|

|

1,000,000

|

|

University of Michigan (The Regents of), General Revenue Bonds

(Series 2017A), 5.000%, 4/1/2027

|

1,066,936

|

|

2,000,000

|

|

University of Michigan (The Regents of), Revenue Bonds

(Series 2018A), 4.000%, 4/1/2033

|

2,049,943

|

|

675,000

|

|

Warren, MI, LT GO Bonds (Series 2021), 4.000%, 6/1/2032

|

708,446

|

|

Principal

Amount

|

|

|

Value

|

|

|

|

MUNICIPAL BONDS—continued

|

|

|

|

|

Michigan—continued

|

|

|

$1,000,000

|

|

Wayne County, MI Airport Authority, Airport Revenue Refunding

Bonds (Series 2015F), 5.000%, 12/1/2027

|

$1,018,668

|

|

|

|

TOTAL MUNICIPAL BONDS

(IDENTIFIED COST $43,114,629)

|

42,179,068

|

|

|

1

|

SHORT-TERM MUNICIPALS—1.6%

|

|

|

|

|

Michigan—1.6%

|

|

|

350,000

|

|

Green Lake Township, MI (Interlochen Center), (Series 2004) Daily

VRDNs, (PNC Bank, N.A. LOC), 3.950%, 9/1/2023

|

350,000

|

|

350,000

|

|

Michigan Strategic Fund (Air Products & Chemicals, Inc.),

(Series 2007) Daily VRDNs, 3.890%, 9/1/2023

|

350,000

|

|

|

|

TOTAL SHORT-TERM MUNICIPALS

(IDENTIFIED COST $700,000)

|

700,000

|

|

|

|

TOTAL INVESTMENT IN SECURITIES—99.4%

(IDENTIFIED COST $43,814,629)2

|

42,879,068

|

|

|

|

OTHER ASSETS AND LIABILITIES - NET—0.6%3

|

240,862

|

|

|

|

TOTAL NET ASSETS—100%

|

$43,119,930

|

|

GO

|

—General Obligation

|

|

GTD

|

—Guaranteed

|

|

INS

|

—Insured

|

|

LOC

|

—Letter of Credit

|

|

LT

|

—Limited Tax

|

|

PRF

|

—Pre-refunded

|

|

UT

|

—Unlimited Tax

|

|

VRDNs

|

—Variable Rate Demand Notes

|

|

Year Ended August 31

|

2023

|

2022

|

2021

|

2020

|

2019

|

|

Net Asset Value, Beginning of Period

|

$10.46

|

$11.34

|

$11.46

|

$11.42

|

$10.92

|

|

Income From Investment Operations:

|

|

|

|

|

|

|

Net investment income

|

0.19

|

0.15

|

0.20

|

0.25

|

0.27

|

|

Net realized and unrealized gain (loss)

|

(0.19)

|

(0.83)

|

(0.05)

|

0.05

|

0.53

|

|

TOTAL FROM INVESTMENT OPERATIONS

|

(0.00)1

|

(0.68)

|

0.15

|

0.30

|

0.80

|

|

Less Distributions:

|

|

|

|

|

|

|

Distributions from net investment income

|

(0.19)

|

(0.15)

|

(0.21)

|

(0.25)

|

(0.27)

|

|

Distributions from net realized gain

|

(0.08)

|

(0.05)

|

(0.06)

|

(0.01)

|

(0.03)

|

|

TOTAL DISTRIBUTIONS

|

(0.27)

|

(0.20)

|

(0.27)

|

(0.26)

|

(0.30)

|

|

Net Asset Value, End of Period

|

$10.19

|

$10.46

|

$11.34

|

$11.46

|

$11.42

|

|

Total Return2

|

(0.05)%

|

(6.05)%

|

1.26%

|

2.67%

|

7.46%

|

|

Ratios to Average Net Assets:

|

|

|

|

|

|

|

Net expenses3

|

0.78%4

|

0.77%

|

0.77%

|

0.77%4

|

0.77%4

|

|

Net investment income

|

1.78%

|

1.42%

|

1.80%

|

2.20%

|

2.42%

|

|

Expense waiver/reimbursement5

|

0.49%

|

0.36%

|

0.32%

|

0.32%

|

0.29%

|

|

Supplemental Data:

|

|

|

|

|

|

|

Net assets, end of period (000 omitted)

|

$34,408

|

$50,484

|

$66,554

|

$72,959

|

$78,276

|

|

Portfolio turnover6

|

15%

|

17%

|

20%

|

11%

|

21%

|

|

|

Year Ended August 31,

|

Period

Ended

8/31/20201,2

|

||

|

2023

|

2022

|

2021

|

||

|

Net Asset Value, Beginning of Period

|

$10.46

|

$11.34

|

$11.46

|

$11.15

|

|

Income From Investment Operations:

|

|

|

|

|

|

Net investment income

|

0.21

|

0.18

|

0.23

|

0.09

|

|

Net realized and unrealized gain (loss)

|

(0.19)

|

(0.83)

|

(0.06)

|

0.31

|

|

TOTAL FROM INVESTMENT OPERATIONS

|

0.02

|

(0.65)

|

0.17

|

0.40

|

|

Less Distributions:

|

|

|

|

|

|

Distributions from net investment income

|

(0.21)

|

(0.18)

|

(0.23)

|

(0.09)

|

|

Distributions from net realized gain

|

(0.08)

|

(0.05)

|

(0.06)

|

—

|

|

TOTAL DISTRIBUTIONS

|

(0.29)

|

(0.23)

|

(0.29)

|

(0.09)

|

|

Net Asset Value, End of Period

|

$10.19

|

$10.46

|

$11.34

|

$11.46

|

|

Total Return3

|

0.20%

|

(5.81)%

|

1.50%

|

3.56%

|

|

Ratios to Average Net Assets:

|

|

|

|

|

|

Net expenses4

|

0.53%5

|

0.52%

|

0.52%

|

0.52%5,6

|

|

Net investment income

|

2.03%

|

1.66%

|

2.03%

|

2.23%6

|

|

Expense waiver/reimbursement7

|

0.49%

|

0.36%

|

0.32%

|

0.40%6

|

|

Supplemental Data:

|

|

|

|

|

|

Net assets, end of period (000 omitted)

|

$8,712

|

$14,465

|

$10,675

|

$3,273

|

|

Portfolio turnover8

|

15%

|

17%

|

20%

|

11%9

|

August 31, 2023

|

Assets:

|

|

|

|

Investment in securities, at value (identified cost $43,814,629)

|

|

$42,879,068

|

|

Cash

|

|

38,761

|

|

Income receivable

|

|

556,855

|

|

Receivable for shares sold

|

|

2,215

|

|

TOTAL ASSETS

|

|

43,476,899

|

|

Liabilities:

|

|

|

|

Payable for investments purchased

|

$172,434

|

|

|

Payable for shares redeemed

|

96,145

|

|

|

Income distribution payable

|

13,316

|

|

|

Payable for portfolio accounting fees

|

48,201

|

|

|

Payable for share registration costs

|

12,167

|

|

|

Payable for other service fees (Notes 2 and 5)

|

7,583

|

|

|

Payable for administrative fee (Note 5)

|

328

|

|

|

Accrued expenses (Note 5)

|

6,795

|

|

|

TOTAL LIABILITIES

|

|

356,969

|

|

Net assets for 4,230,650 shares outstanding

|

|

$43,119,930

|

|

Net Assets Consists of:

|

|

|

|

Paid-in capital

|

|

$45,222,501

|

|

Total distributable earnings (loss)

|

|

(2,102,571)

|

|

TOTAL NET ASSETS

|

|

$43,119,930

|

|

Net Asset Value, Offering Price and Redemption Proceeds Per Share:

|

|

|

|

Class A Shares:

|

|

|

|

Net asset value per share ($34,408,325 ÷ 3,376,075 shares outstanding),

no par value, unlimited shares authorized

|

|

$10.19

|

|

Offering price per share (100/97.00 of $10.19)

|

|

$10.51

|

|

Redemption proceeds per share

|

|

$10.19

|

|

Institutional Shares:

|

|

|

|

Net asset value per share ($8,711,605 ÷ 854,575 shares outstanding), no

par value, unlimited shares authorized

|

|

$10.19

|

|

Offering price per share

|

|

$10.19

|

|

Redemption proceeds per share

|

|

$10.19

|

Year Ended August 31, 2023

|

Investment Income:

|

|

|

|

|

Interest

|

|

|

$1,329,429

|

|

Expenses:

|

|

|

|

|

Investment adviser fee (Note 5)

|

|

$208,109

|

|

|

Administrative fee (Note 5)

|

|

41,617

|

|

|

Transfer agent fees

|

|

31,662

|

|

|

Directors’/Trustees’ fees (Note 5)

|

|

2,059

|

|

|

Auditing fees

|

|

31,930

|

|

|

Legal fees

|

|

11,637

|

|

|

Other service fees (Notes 2 and 5)

|

|

102,260

|

|

|

Portfolio accounting fees

|

|

119,655

|

|

|

Share registration costs

|

|

40,161

|

|

|

Printing and postage

|

|

21,944

|

|

|

Miscellaneous (Note 5)

|

|

22,789

|

|

|

TOTAL EXPENSES

|

|

633,823

|

|

|

Waiver, Reimbursement and Reduction:

|

|

|

|

|

Waiver of investment adviser fee (Note 5)

|

$(189,161)

|

|

|

|

Reimbursement of other operating expenses (Note 5)

|

(68,296)

|

|

|

|

Reduction of custodian fees (Note 6)

|

(735)

|

|

|

|

TOTAL WAIVER, REIMBURSEMENT AND REDUCTION

|

|

(258,192)

|

|

|

Net expenses

|

|

|

375,631

|

|

Net investment income

|

|

|

953,798

|

|

Realized and Unrealized Gain (Loss) on Investments:

|

|

|

|

|

Net realized loss on investments

|

|

|

(1,168,051)

|

|

Net change in unrealized depreciation of investments

|

|

|

182,743

|

|

Net realized and unrealized gain (loss) on investments

|

|

|

(985,308)

|

|

Change in net assets resulting from operations

|

|

|

$(31,510)

|

|

Year Ended August 31

|

2023

|

2022

|

|

Increase (Decrease) in Net Assets

|

|

|

|

Operations:

|

|

|

|

Net investment income

|

$953,798

|

$999,326

|

|

Net realized gain (loss)

|

(1,168,051)

|

630,946

|

|

Net change in unrealized appreciation/depreciation

|

182,743

|

(5,806,022)

|

|

CHANGE IN NET ASSETS RESULTING FROM OPERATIONS

|

(31,510)

|

(4,175,750)

|

|

Distributions to Shareholders:

|

|

|

|

Class A Shares

|

(1,063,689)

|

(939,304)

|

|

Institutional Shares

|

(313,537)

|

(361,203)

|

|

CHANGE IN NET ASSETS RESULTING FROM DISTRIBUTIONS

TO SHAREHOLDERS

|

(1,377,226)

|

(1,300,507)

|

|

Share Transactions:

|

|

|

|

Proceeds from sale of shares

|

6,889,023

|

23,250,144

|

|

Net asset value of shares issued to shareholders in payment of

distributions declared

|

1,126,820

|

983,180

|

|

Cost of shares redeemed

|

(28,436,178)

|

(31,037,061)

|

|

CHANGE IN NET ASSETS RESULTING FROM

SHARE TRANSACTIONS

|

(20,420,335)

|

(6,803,737)

|

|

Change in net assets

|

(21,829,071)

|

(12,279,994)

|

|

Net Assets:

|

|

|

|

Beginning of period

|

64,949,001

|

77,228,995

|

|

End of period

|

$43,119,930

|

$64,949,001

|

|

Year Ended August 31

|

2023

|

2022

|

||

|

Class A Shares:

|

Shares

|

Amount

|

Shares

|

Amount

|

|

Shares sold

|

568,223

|

$5,846,046

|

1,147,335

|

$12,135,149

|

|

Shares issued to shareholders in payment of

distributions declared

|

99,003

|

1,021,617

|

79,867

|

871,641

|

|

Shares redeemed

|

(2,118,766)

|

(21,844,947)

|

(2,268,964)

|

(24,995,448)

|

|

NET CHANGE RESULTING FROM

CLASS A SHARE TRANSACTIONS

|

(1,451,540)

|

$(14,977,284)

|

(1,041,762)

|

$(11,988,658)

|

|

Year Ended August 31

|

2023

|

2022

|

||

|

Institutional Shares:

|

Shares

|

Amount

|

Shares

|

Amount

|

|

Shares sold

|

100,568

|

$1,042,977

|

989,321

|

$11,114,995

|

|

Shares issued to shareholders in payment of

distributions declared

|

10,194

|

105,203

|

10,208

|

111,539

|

|

Shares redeemed

|

(639,132)

|

(6,591,231)

|

(557,955)

|

(6,041,613)

|

|

NET CHANGE RESULTING FROM

INSTITUTIONAL SHARE TRANSACTIONS

|

(528,370)

|

$(5,443,051)

|

441,574

|

$5,184,921

|

|

NET CHANGE RESULTING FROM

TOTAL FUND SHARE TRANSACTIONS

|

(1,979,910)

|

$(20,420,335)

|

(600,188)

|

$(6,803,737)

|

|

|

2023

|

2022

|

|

Tax-exempt income

|

$952,848

|

$1,000,305

|

|

Ordinary income1

|

$2,368

|

$17,219

|

|

Long-term capital gains

|

$422,010

|

$282,983

|

|

Undistributed tax-exempt income

|

$1,041

|

|

Net unrealized depreciation

|

$(935,561)

|

|

Capital loss carryforwards

|

$(1,168,051)

|

|

TOTAL

|

$(2,102,571)

|

|

Short-Term

|

Long-Term

|

Total

|

|

$240,300

|

$927,751

|

$1,168,051

|

|

Administrative Fee

|

Average Daily Net Assets

of the Investment Complex

|

|

0.100%

|

on assets up to $50 billion

|

|

0.075%

|

on assets over $50 billion

|

|

Purchases

|

$7,608,211

|

|

Sales

|

$26,648,314

|

October 24, 2023

|

|

Beginning

Account Value

3/1/2023

|

Ending

Account Value

8/31/2023

|

Expenses Paid

During Period1

|

|

Actual:

|

|

|

|

|

Class A Shares

|

$1,000

|

$1,001.50

|

$3.88

|

|

Institutional Shares

|

$1,000

|

$1,002.70

|

$2.62

|

|

Hypothetical (assuming a 5% return

before expenses):

|

|

|

|

|

Class A Shares

|

$1,000

|

$1,021.32

|

$3.92

|

|

Institutional Shares

|

$1,000

|

$1,022.58

|

$2.65

|

|

Class A Shares

|

0.77%

|

|

Institutional Shares

|

0.52%

|

|

Name

Birth Date

Positions Held with Trust

Date Service Began

|

Principal Occupation(s) for Past Five Years,

Other Directorships Held and Previous Position(s)

|

|

J. Christopher Donahue*

Birth Date: April 11, 1949

President and Trustee

Indefinite Term

Began serving: August 1990

|

Principal Occupations: Principal Executive Officer and President of

certain of the Funds in the Federated Hermes Fund Family; Director or

Trustee of the Funds in the Federated Hermes Fund Family; President,

Chief Executive Officer and Director, Federated Hermes, Inc.;

Chairman and Trustee, Federated Investment Management Company;

Trustee, Federated Investment Counseling; Chairman and Director,

Federated Global Investment Management Corp.; Chairman and

Trustee, Federated Equity Management Company of Pennsylvania;

Trustee, Federated Shareholder Services Company; Director,

Federated Services Company.

Previous Positions: President, Federated Investment Counseling;

President and Chief Executive Officer, Federated Investment

Management Company, Federated Global Investment Management

Corp. and Passport Research, Ltd; Chairman, Passport Research, Ltd.

|

|

Name

Birth Date

Positions Held with Trust

Date Service Began

|

Principal Occupation(s) for Past Five Years,

Other Directorships Held and Previous Position(s)

|

|

John B. Fisher*

Birth Date: May 16, 1956

Trustee

Indefinite Term

Began serving: May 2016

|

Principal Occupations: Principal Executive Officer and President of

certain of the Funds in the Federated Hermes Fund Family; Director or

Trustee of certain of the Funds in the Federated Hermes Fund Family;

Director and Vice President, Federated Hermes, Inc.; President,

Director/Trustee and CEO, Federated Advisory Services Company,

Federated Equity Management Company of Pennsylvania, Federated

Global Investment Management Corp., Federated Investment

Counseling, Federated Investment Management Company, and

Federated MDTA LLC; Director, Federated Investors Trust Company.

Previous Positions: President and Director of the Institutional Sales

Division of Federated Securities Corp.; President and CEO of Passport

Research, Ltd.; Director and President, Technology, Federated

Services Company.

|

|

Name

Birth Date

Positions Held with Trust

Date Service Began

|

Principal Occupation(s) for Past Five Years,

Other Directorships Held, Previous Position(s) and Qualifications

|

|

John T. Collins

Birth Date: January 24, 1947

Trustee

Indefinite Term

Began serving: October 2013

|

Principal Occupations: Director or Trustee, and Chair of the Board

of Directors or Trustees, of the Federated Hermes Fund Family;

formerly, Chairman and CEO, The Collins Group, Inc. (a private equity

firm) (Retired).

Other Directorships Held: Director, KLX Energy Services Holdings,

Inc. (oilfield services); former Director of KLX Corp. (aerospace).

Qualifications: Mr. Collins has served in several business and financial

management roles and directorship positions throughout his career.

Mr. Collins previously served as Chairman and CEO of The Collins

Group, Inc. (a private equity firm) and as a Director of KLX Corp.

Mr. Collins serves as Chairman Emeriti, Bentley University. Mr. Collins

previously served as Director and Audit Committee Member, Bank of

America Corp.; Director, FleetBoston Financial Corp.; and Director,

Beth Israel Deaconess Medical Center (Harvard University

Affiliate Hospital).

|

|

Name

Birth Date

Positions Held with Trust

Date Service Began

|

Principal Occupation(s) for Past Five Years,

Other Directorships Held, Previous Position(s) and Qualifications

|

|

G. Thomas Hough

Birth Date: February 28, 1955

Trustee

Indefinite Term

Began serving: August 2015

|

Principal Occupations: Director or Trustee, Chair of the Audit

Committee of the Federated Hermes Fund Family; formerly, Vice

Chair, Ernst & Young LLP (public accounting firm) (Retired).

Other Directorships Held: Director, Chair of the Audit Committee,

Equifax, Inc.; Lead Director, Member of the Audit and Nominating and

Corporate Governance Committees, Haverty Furniture Companies,

Inc.; formerly, Director, Member of Governance and Compensation

Committees, Publix Super Markets, Inc.

Qualifications: Mr. Hough has served in accounting, business

management and directorship positions throughout his career.

Mr. Hough most recently held the position of Americas Vice Chair of

Assurance with Ernst & Young LLP (public accounting firm). Mr. Hough

serves on the President’s Cabinet and Business School Board of

Visitors for the University of Alabama. Mr. Hough previously served on

the Business School Board of Visitors for Wake Forest University, and

he previously served as an Executive Committee member of the

United States Golf Association.

|

|

Maureen Lally-Green

Birth Date: July 5, 1949

Trustee

Indefinite Term

Began serving: August 2009

|

Principal Occupations: Director or Trustee of the Federated Hermes

Fund Family; Adjunct Professor Emerita of Law, Duquesne University

School of Law; formerly, Dean of the Duquesne University School of

Law and Professor of Law and Interim Dean of the Duquesne

University School of Law; formerly, Associate General Secretary and

Director, Office of Church Relations, Diocese of Pittsburgh.

Other Directorships Held: Director, CNX Resources Corporation

(natural gas).

Qualifications: Judge Lally-Green has served in various legal and

business roles and directorship positions throughout her career. Judge

Lally-Green previously held the position of Dean of the School of Law

of Duquesne University (as well as Interim Dean). Judge Lally-Green

previously served as Associate General Secretary of the Diocese of

Pittsburgh, a member of the Superior Court of Pennsylvania and as a

Professor of Law, Duquesne University School of Law. Judge

Lally-Green was appointed by the Supreme Court of Pennsylvania to

serve on the Supreme Court’s Board of Continuing Judicial Education

and the Supreme Court’s Appellate Court Procedural Rules

Committee. Judge Lally-Green also currently holds the positions on

not for profit or for profit boards of directors as follows: Director

and Chair, UPMC Mercy Hospital; Regent, Saint Vincent Seminary;

Member, Pennsylvania State Board of Education (public); Director,

Catholic Charities, Pittsburgh; and Director CNX Resources

Corporation (natural gas). Judge Lally-Green has held the positions of:

Director, Auberle; Director, Epilepsy Foundation of Western and

Central Pennsylvania; Director, Ireland Institute of Pittsburgh; Director,

Saint Thomas More Society; Director and Chair, Catholic High Schools

of the Diocese of Pittsburgh, Inc.; Director, Pennsylvania Bar Institute;

Director, St. Vincent College; Director and Chair, North Catholic High

School, Inc.; Director and Vice Chair, Our Campaign for the Church

Alive!, Inc.; and Director and Vice Chair, Saint Francis University.

|

|

Name

Birth Date

Positions Held with Trust

Date Service Began

|

Principal Occupation(s) for Past Five Years,

Other Directorships Held, Previous Position(s) and Qualifications

|

|

Thomas M. O’Neill

Birth Date: June 14, 1951

Trustee

Indefinite Term

Began serving: August 2006

|

Principal Occupations: Director or Trustee of the Federated Hermes

Fund Family; Sole Proprietor, Navigator Management Company

(investment and strategic consulting).

Other Directorships Held: None.

Qualifications: Mr. O’Neill has served in several business, mutual fund

and financial management roles and directorship positions throughout

his career. Mr. O’Neill serves as Director, Medicines for Humanity.

Mr. O’Neill previously served as Chief Executive Officer and President,

Managing Director and Chief Investment Officer, Fleet Investment

Advisors; President and Chief Executive Officer, Aeltus Investment

Management, Inc.; General Partner, Hellman, Jordan Management

Co., Boston, MA; Chief Investment Officer, The Putnam Companies,

Boston, MA; Credit Analyst and Lending Officer, Fleet Bank; Director

and Consultant, EZE Castle Software (investment order management

software); Director, Midway Pacific (lumber); and Director, The

Golisano Children’s Museum of Naples, Florida.

|

|

Madelyn A. Reilly

Birth Date: February 2, 1956

Trustee

Indefinite Term

Began serving:

November 2020

|

Principal Occupations: Director or Trustee of the Federated Hermes

Fund Family; formerly, Senior Vice President for Legal Affairs,

General Counsel and Secretary of Board of Directors, Duquesne

University (Retired).

Other Directorships Held: None.

Qualifications: Ms. Reilly has served in various business and legal

management roles throughout her career. Ms. Reilly previously served

as Senior Vice President for Legal Affairs, General Counsel and

Secretary of Board of Directors and Director of Risk Management and

Associate General Counsel, Duquesne University. Prior to her work at

Duquesne University, Ms. Reilly served as Assistant General Counsel

of Compliance and Enterprise Risk as well as Senior Counsel of

Environment, Health and Safety, PPG Industries. Ms. Reilly currently

serves as a member of the Board of Directors of UPMC

Mercy Hospital.

|

|

Name

Birth Date

Positions Held with Trust

Date Service Began

|

Principal Occupation(s) for Past Five Years,

Other Directorships Held, Previous Position(s) and Qualifications

|

|

P. Jerome Richey

Birth Date: February 23, 1949

Trustee

Indefinite Term

Began serving: October 2013

|

Principal Occupations: Director or Trustee of the Federated Hermes

Fund Family; Retired; formerly, Senior Vice Chancellor and Chief Legal

Officer, University of Pittsburgh and Executive Vice President and

Chief Legal Officer, CONSOL Energy Inc. (now split into two separate

publicly traded companies known as CONSOL Energy Inc. and CNX

Resources Corp.).

Other Directorships Held: None.

Qualifications: Mr. Richey has served in several business and legal

management roles and directorship positions throughout his career.

Mr. Richey most recently held the positions of Senior Vice Chancellor

and Chief Legal Officer, University of Pittsburgh. Mr. Richey previously

served as Chairman of the Board, Epilepsy Foundation of Western

Pennsylvania and Chairman of the Board, World Affairs Council of

Pittsburgh. Mr. Richey previously served as Chief Legal Officer and

Executive Vice President, CONSOL Energy Inc. and CNX Gas

Company; and Board Member, Ethics Counsel and Shareholder,

Buchanan Ingersoll & Rooney PC (a law firm).

|

|

John S. Walsh

Birth Date:

November 28, 1957

Trustee

Indefinite Term

Began serving: June 1999

|

Principal Occupations: Director or Trustee of the Federated Hermes

Fund Family; President and Director, Heat Wagon, Inc. (manufacturer

of construction temporary heaters); President and Director,

Manufacturers Products, Inc. (distributor of portable construction

heaters); President, Portable Heater Parts, a division of Manufacturers

Products, Inc.

Other Directorships Held: None.

Qualifications: Mr. Walsh has served in several business management

roles and directorship positions throughout his career. Mr. Walsh

previously served as Vice President, Walsh & Kelly, Inc.

(paving contractors).

|

|

Name

Birth Date

Positions Held with Trust

Date Service Began

|

Principal Occupation(s) for Past Five Years

and Previous Position(s)

|

|

Lori A. Hensler

Birth Date: January 6, 1967

TREASURER

Officer since: April 2013

|

Principal Occupations: Principal Financial Officer and Treasurer of the

Federated Hermes Fund Family; Senior Vice President, Federated

Administrative Services; Financial and Operations Principal for

Federated Securities Corp.; and Assistant Treasurer, Federated

Investors Trust Company. Ms. Hensler has received the Certified

Public Accountant designation.

Previous Positions: Controller of Federated Hermes, Inc.; Senior Vice

President and Assistant Treasurer, Federated Investors Management

Company; Treasurer, Federated Investors Trust Company; Assistant

Treasurer, Federated Administrative Services, Federated

Administrative Services, Inc., Federated Securities Corp., Edgewood

Services, Inc., Federated Advisory Services Company, Federated

Equity Management Company of Pennsylvania, Federated Global

Investment Management Corp., Federated Investment Counseling,

Federated Investment Management Company, Passport Research,

Ltd., and Federated MDTA, LLC; Financial and Operations Principal for

Federated Securities Corp., Edgewood Services, Inc. and Southpointe

Distribution Services, Inc.

|

|

Peter J. Germain

Birth Date:

September 3, 1959

CHIEF LEGAL OFFICER,

SECRETARY and EXECUTIVE

VICE PRESIDENT

Officer since: January 2005

|

Principal Occupations: Mr. Germain is Chief Legal Officer, Secretary

and Executive Vice President of the Federated Hermes Fund Family.

He is General Counsel, Chief Legal Officer, Secretary and Executive

Vice President, Federated Hermes, Inc.; Trustee and Senior Vice

President, Federated Investors Management Company; Trustee and

President, Federated Administrative Services; Director and President,

Federated Administrative Services, Inc.; Director and Vice President,

Federated Securities Corp.; Director and Secretary, Federated Private

Asset Management, Inc.; Secretary, Federated Shareholder Services

Company; and Secretary, Retirement Plan Service Company of

America. Mr. Germain joined Federated Hermes, Inc. in 1984 and is a

member of the Pennsylvania Bar Association.

Previous Positions: Deputy General Counsel, Special Counsel,

Managing Director of Mutual Fund Services, Federated Hermes, Inc.;

Senior Vice President, Federated Services Company; and Senior

Corporate Counsel, Federated Hermes, Inc.

|

|

Stephen Van Meter

Birth Date: June 5, 1975

CHIEF COMPLIANCE

OFFICER AND SENIOR

VICE PRESIDENT

Officer since: July 2015

|

Principal Occupations: Senior Vice President and Chief Compliance

Officer of the Federated Hermes Fund Family; Vice President and

Chief Compliance Officer of Federated Hermes, Inc. and Chief

Compliance Officer of certain of its subsidiaries. Mr. Van Meter joined

Federated Hermes, Inc. in October 2011. He holds FINRA licenses

under Series 3, 7, 24 and 66.

Previous Positions: Mr. Van Meter previously held the position of

Compliance Operating Officer, Federated Hermes, Inc. Prior to joining

Federated Hermes, Inc., Mr. Van Meter served at the United States

Securities and Exchange Commission in the positions of Senior

Counsel, Office of Chief Counsel, Division of Investment Management

and Senior Counsel, Division of Enforcement.

|

|

Name

Birth Date

Positions Held with Trust

Date Service Began

|

Principal Occupation(s) for Past Five Years

and Previous Position(s)

|

|

Robert J. Ostrowski

Birth Date: April 26, 1963

CHIEF INVESTMENT OFFICER

Officer since: February 2010

|

Principal Occupations: Robert J. Ostrowski joined Federated Hermes,

Inc. in 1987 as an Investment Analyst and became a Portfolio Manager

in 1990. He was named Chief Investment Officer of Federated

Hermes, Inc. taxable fixed-income products in 2004 and also serves as

a Senior Portfolio Manager. Mr. Ostrowski became an Executive Vice

President of the Fund’s Adviser in 2009 and served as a Senior Vice

President of the Fund’s Adviser from 1997 to 2009. Mr. Ostrowski has

received the Chartered Financial Analyst designation. He received his

M.S. in Industrial Administration from Carnegie Mellon University.

|

Annual Evaluation of Adequacy and Effectiveness

Federated Hermes Funds

4000 Ericsson Drive

Warrendale, PA 15086-7561

or call 1-800-341-7400.

CUSIP 313923773

|

Share Class | Ticker

|

A | FMOAX

|

C | FMNCX

|

F | FHTFX

|

|

|

Institutional | FMYIX

|

|

|

Federated Hermes Municipal High Yield Advantage Fund

A Portfolio of Federated Hermes Municipal Securities Income Trust

|

|

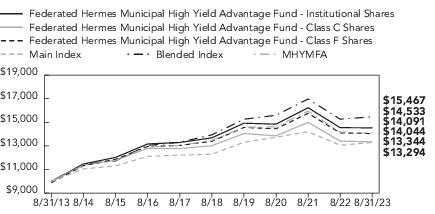

1 Year

|

5 Years

|

10 Years

|

|

Class A Shares

|

-4.94%

|

0.02%

|

3.08%

|

|

Class C Shares

|

-2.19%

|

0.20%

|

2.93%

|

|

Class F Shares

|

-2.40%

|

0.75%

|

3.45%

|

|

Institutional Shares

|

-0.11%

|

1.21%

|

3.81%

|

|

Main Index

|

1.79%

|

1.57%

|

2.89%

|

|

Blended Index

|

1.29%

|

2.10%

|

4.46%

|

|

MHYMFA

|

-0.67%

|

0.93%

|

3.54%

|

|

Sector Composition

|

Percentage of

Total Net Assets

|

|

Dedicated Tax

|

18.1%

|

|

Primary/Secondary Education

|

13.2%

|

|

Industrial Development Bond/Pollution Control Revenue Bond

|

10.4%

|

|

Senior Care

|

9.8%

|

|

Hospital

|

8.7%

|

|

Tobacco

|

6.4%

|

|

General Obligation—State

|

4.6%

|

|

Incremental Tax

|

4.4%

|

|

Public Power

|

4.1%

|

|

General Obligation—Local

|

3.9%

|

|

Other2

|

15.8%

|

|

Other Assets and Liabilities—Net3

|

0.6%

|

|

TOTAL

|

100%

|

|

Principal

Amount

|

|

|

Value

|

|

|

|

MUNICIPAL BONDS—99.0%

|

|

|

|

|

Alabama—1.2%

|

|

|

$500,000

|

1,2

|

Huntsville, AL Special Care Facilities Financing Authority

(Redstone Village), Retirement Facilities Revenue Bonds

(Series 2011A), (Original Issue Yield: 7.625%), 7.500%, 1/1/2047

|

$300,000

|

|

1,500,000

|

1,2

|

Huntsville, AL Special Care Facilities Financing Authority

(Redstone Village), Retirement Facility Revenue Bonds

(Series 2007), (Original Issue Yield: 5.600%), 5.500%, 1/1/2043

|

900,000

|

|

2,000,000

|

|

Jefferson County, AL Sewer System, Senior Lien Sewer Revenue

Current Interest Warrants (Series 2013-A), (Original Issue Yield:

5.650%), (Assured Guaranty Municipal Corp. INS),

5.500%, 10/1/2053

|

2,025,242

|

|

2,000,000

|

|

Jefferson County, AL Sewer System, Senior Lien Sewer Revenue

Current Interest Warrants (Series 2013A), (Original Issue Yield:

5.450%), (Assured Guaranty Municipal Corp. INS),

5.250%, 10/1/2048

|

2,018,268

|

|

|

|

TOTAL

|

5,243,510

|

|

|

|

Alaska—0.0%

|

|

|

1,000,000

|

1,2

|

Alaska Industrial Development and Export Authority (Boys & Girls

Home & Family Services, Inc.), Community Provider Revenue

Bonds (Series 2007C), 6.000%, 12/1/2036

|

2,600

|

|

|

|

Arizona—3.2%

|

|

|

650,000

|

3

|

Arizona State IDA (Basis Schools, Inc. Obligated Group),

Education Revenue Bonds (Series 2017D), 5.000%, 7/1/2051

|

568,859

|

|

500,000

|

3

|

Arizona State IDA (Basis Schools, Inc. Obligated Group),

Education Revenue Bonds (Series 2017G), 5.000%, 7/1/2051

|

437,584

|

|

1,000,000

|

3

|

Arizona State IDA (Doral Academy of Nevada FMMR), Education

Revenue Bonds (Series 2019A), 5.000%, 7/15/2049

|

907,484

|

|

1,750,000

|

3

|

Arizona State IDA (Pinecrest Academy of Nevada), Horizon,

Inspirada and St. Rose Campus Education Revenue Bonds

(Series 2018A), 5.750%, 7/15/2048

|

1,706,938

|

|

1,000,000

|

|

Chandler, AZ IDA (Intel Corp.), Industrial Development Revenue

Bonds (Series 2022-2), 5.000%, Mandatory Tender 9/1/2027

|

1,029,160

|

|

1,000,000

|

|

Maricopa County, AZ, IDA (Commercial Metals Corp.), Exempt

Facilities Revenue Bonds (Series 2022), 4.000%, 10/15/2047

|

832,517

|

|

1,000,000

|

3

|

Maricopa County, AZ, IDA (Paradise Schools), Revenue Refunding

Bonds, 5.000%, 7/1/2047

|

915,385

|

|

1,500,000

|

|

Phoenix, AZ IDA (GreatHearts Academies), Education Facility

Revenue Bonds (Series 2014A), 5.000%, 7/1/2044

|

1,421,318

|

|

1,000,000

|

|

Phoenix, AZ IDA (GreatHearts Academies), Education Facility

Revenue Bonds (Series 2016A), 5.000%, 7/1/2046

|

937,468

|

|

1,000,000

|

3

|

Pima County, AZ IDA (La Posada at Pusch Ridge), Senior Living

Revenue Bonds (Series 2022A), 6.250%, 11/15/2035

|

998,198

|

|

Principal

Amount

|

|

|

Value

|

|

|

|

MUNICIPAL BONDS—continued

|

|

|

|

|

Arizona—continued

|

|

|

$1,000,000

|

3

|

Pima County, AZ IDA (La Posada at Pusch Ridge), Senior Living

Revenue Bonds (Series 2022A), 7.000%, 11/15/2057

|

$997,277

|

|

3,000,000

|

|

Salt Verde Financial Corp., AZ, Senior Gas Revenue Bonds

(Series 2007), (Original Issue Yield: 5.100%), (Citigroup, Inc.

GTD), 5.000%, 12/1/2037

|

3,071,612

|

|

430,000

|

3

|

Verrado Community Facilities District No. 1, AZ, District GO

Refunding Bonds (Series 2013A), 6.000%, 7/15/2027

|

431,236

|

|

|

|

TOTAL

|

14,255,036

|

|

|

|

Arkansas—0.3%

|

|

|

1,250,000

|

|

Arkansas Development Finance Authority (United States Steel

Corp.), Environmental Improvement Revenue Bonds

(Series 2022), 5.450%, 9/1/2052

|

1,214,541

|

|

|

|

California—6.1%

|

|

|

4,445,000

|

|

California Health Facilities Financing Authority (Cedars-Sinai

Medical Center), Revenue Refunding Bonds (Series 2021A),

5.000%, 8/15/2051

|

4,721,573

|

|

500,000

|

3

|

California Public Finance Authority (Kendal at Sonoma), Enso

Village Senior Living Revenue Refunding Bonds (Series 2021A),

5.000%, 11/15/2046

|

445,799

|

|

750,000

|

3

|

California School Finance Authority (KIPP LA), School Facility

Revenue Bonds (Series 2014A), 5.125%, 7/1/2044

|

752,113

|

|

565,000

|

3

|

California School Finance Authority (KIPP LA), School Facility

Revenue Bonds (Series 2015A), 5.000%, 7/1/2045

|

565,978

|

|

500,000

|

3

|

California School Finance Authority (KIPP LA), School Facility

Revenue Bonds (Series 2017A), 5.000%, 7/1/2047

|

500,874

|

|

2,000,000

|

|

California State Municipal Finance Authority (LINXS APM Project),

Senior Lien Revenue Bonds (Series 2018A), 5.000%, 12/31/2043

|

2,000,248

|

|

1,000,000

|

3

|

California State School Finance Authority Charter School

Revenue (Bright Star Schools-Obligated Group), Charter School

Revenue Bonds (Series 2017), 5.000%, 6/1/2037

|

966,170

|

|

500,000

|

3

|

California State School Finance Authority Charter School

Revenue (Rocketship Public Schools), Revenue Bonds

(Series 2017G), 5.000%, 6/1/2047

|

454,121

|

|

1,100,000

|

3

|

California State School Finance Authority Charter School

Revenue (Summit Public Schools Obligated Group), (Series 2017),

5.000%, 6/1/2053

|

941,425

|

|

900,000

|

|

California State, Various Purpose UT GO Bonds,

5.250%, 9/1/2047

|

997,338

|

|

2,250,000

|

3

|

California Statewide Communities Development Authority (Loma

Linda University Medical Center), Revenue Bonds (Series 2016A),

5.000%, 12/1/2046

|

2,162,263

|

|

1,000,000

|

|

Community Facilities District No. 2017 of the County of Orange

(CFD 2017-1 (Village of Esencia)), Improvement Area No. 1

Special Tax Revenue Bonds (Series 2018A), 5.000%, 8/15/2042

|

1,016,603

|

|

Principal

Amount

|

|

|

Value

|

|

|

|

MUNICIPAL BONDS—continued

|

|

|

|

|

California—continued

|

|

|

$5,000,000

|

4

|

Golden State Tobacco Securitization Corp., CA, Subordinate

Tobacco Settlement Asset-Backed Bonds (Series 2021B-2),

0.000%, 6/1/2066

|

$495,153

|

|

1,590,000

|

|

Golden State Tobacco Securitization Corp., CA, Tobacco

Settlement Asset-Backed Bonds (Series 2022), 5.000%, 6/1/2051

|

1,650,771

|

|

95,000

|

|

Irvine, CA (Irvine, CA Reassessment District No. 13-1), Limited

Obligation Improvement Bonds, 5.000%, 9/2/2028

|

95,864

|

|

365,000

|

|

Irvine, CA (Irvine, CA Reassessment District No. 13-1), Limited

Obligation Improvement Bonds, 5.000%, 9/2/2029

|

368,333

|

|

180,000

|

|

Irvine, CA (Irvine, CA Reassessment District No. 13-1), Limited

Obligation Improvement Bonds, 5.000%, 9/2/2030

|

181,631

|

|

850,000

|

|

Los Angeles, CA Department of Airports (Los Angeles

International Airport), Subordinate Revenue Bonds

(Series 2017A), 5.000%, 5/15/2047

|

862,031

|

|

2,500,000

|

|

M-S-R Energy Authority, CA, Gas Revenue Bonds (Series 2009A),

(Citigroup, Inc. GTD), 7.000%, 11/1/2034

|

3,048,898

|

|

1,250,000

|

|

Orange County, CA Community Facilities District No. 2016-1

(CFD 2016-1 (Village of Esencia)), Special Tax Revenue Bonds

(Series 2016A), 5.000%, 8/15/2041

|

1,265,364

|

|

1,000,000

|

|

Palomar Health, CA Revenue, (Series 2016), 5.000%, 11/1/2039

|

1,006,311

|

|

1,000,000

|

|

Roseville, CA Special Tax (Fiddyment Ranch CFD No. 1), Special

Tax Refunding Revenue Bonds (Series 2017), 5.000%, 9/1/2034

|

1,038,271

|

|

1,255,000

|

|

Roseville, CA Special Tax (Fiddyment Ranch CFD No. 5), Special

Tax Revenue Bonds (Series 2021), 4.000%, 9/1/2050

|

1,048,749

|

|

340,000

|

3

|

San Francisco Special Tax District No. 2020-1 (Mission Rock

Facilities and Services), Development Special Tax Bonds

(Series 2021A), 4.000%, 9/1/2051

|

264,536

|

|

|

|

TOTAL

|

26,850,417

|

|

|

|

Colorado—6.6%

|

|

|

1,000,000

|

|

Banning Lewis Ranch Metropolitan District No. 4, LT GO Bonds

(Series 2018A), 5.750%, 12/1/2048

|

988,090

|

|

1,000,000

|

|

Banning Lewis Ranch Regional Metropolitan District, LT GO

Bonds (Series 2018A), 5.375%, 12/1/2048

|

946,305

|

|

1,500,000

|

|

Base Village Metropolitan District No. 2, LT GO Refunding Bonds

(Series 2016A), 5.750%, 12/1/2046

|

1,500,325

|

|

500,000

|

|

Colorado Educational & Cultural Facilities Authority (Aspen View

Academy), Charter School Revenue Bonds (Series 2021),

4.000%, 5/1/2061

|

367,577

|

|

2,000,000

|

|

Colorado Educational & Cultural Facilities Authority (James Irwin

Educational Foundation), Charter School Revenue Bonds

(Series 2022), 5.000%, 9/1/2062

|

1,813,381

|

|

1,000,000

|

3

|

Colorado Educational & Cultural Facilities Authority (Loveland

Classical School), School Improvement Revenue Bonds

(Series 2016), 5.000%, 7/1/2036

|

975,450

|

|

Principal

Amount

|

|

|

Value

|

|

|

|

MUNICIPAL BONDS—continued

|

|

|

|

|

Colorado—continued

|

|

|

$1,625,000

|

|

Colorado Educational & Cultural Facilities Authority (Skyview

Academy), Charter School Refunding & Improvement Revenue

Bonds (Series 2014), 5.500%, 7/1/2049

|

$1,579,058

|

|

1,000,000

|

|

Colorado Educational & Cultural Facilities Authority (University

Lab School), Charter School Refunding & Improvement Revenue

Bonds (Series 2015), (Original Issue Yield: 5.020%),

5.000%, 12/15/2045

|

1,001,724

|

|

5,000,000

|

|

Colorado Health Facilities Authority (Advent Health

System/Sunbelt Obligated Group), Hospital Revenue Bonds

(Series 2021A), 4.000%, 11/15/2050

|

4,577,151

|

|

1,500,000

|

|

Colorado Health Facilities Authority (Christian Living

Communities), Revenue Refunding Bonds (Series 2016),

5.000%, 1/1/2031

|

1,445,551

|

|

2,500,000

|

|

Colorado State Health Facilities Authority (Intermountain

Healthcare Obligated Group), Revenue Bonds (Series 2022A),

5.000%, 5/15/2052

|

2,591,861

|

|

500,000

|

|

Denver, CO Convention Center Hotel Authority, Senior Revenue

Refunding Bonds (Series 2016), 5.000%, 12/1/2040

|

483,824

|

|

1,000,000

|

3

|

Denver, CO Health & Hospital Authority, Revenue Refunding

Bonds (Series 2017A), 5.000%, 12/1/2034

|

1,032,704

|

|

615,000

|

|

Eagle County, CO Air Terminal Corp., Revenue Refunding Bonds

(Series 2011A), 6.000%, 5/1/2027

|

615,518

|

|

1,170,000

|

|

Hogback Metropolitan District, CO, LT GO Bonds (Series 2021A),

5.000%, 12/1/2051

|

993,349

|

|

1,500,000

|

|

Lakes at Centerra Metropolitan District No. 2, LT GO Refunding

and Improvement Bonds (Series 2018A), 5.125%, 12/1/2037

|

1,427,759

|

|

2,500,000

|

|

North Range, CO Metropolitan District No. 2, LT GO and Special

Revenue Refunding and Improvement Bonds (Series 2017A),

5.750%, 12/1/2047

|

2,507,802

|

|

2,000,000

|

|

Public Authority for Colorado Energy, Natural Gas Purchase

Revenue Bonds (Series 2008), (Original Issue Yield: 6.630%),

(Bank of America Corp. GTD), 6.250%, 11/15/2028

|

2,123,053

|

|

2,510,000

|

|

St. Vrain Lakes, CO Metropolitan District No. 2, LT GO Senior

Bonds (Series 2017A), 5.000%, 12/1/2037

|

2,422,943

|

|

|

|

TOTAL

|

29,393,425

|

|

|

|

Connecticut—0.9%

|

|

|

1,000,000

|

|

Connecticut Development Authority (Bombardier, Inc.), Airport

Facility Revenue Bonds, 7.950%, 4/1/2026

|

996,021

|

|

1,835,000

|

3

|

Mohegan Tribe of Indians of Connecticut Gaming Authority,

Priority Distribution Payment Refunding Bonds (Series 2015C),

(Original Issue Yield: 6.375%), 6.250%, 2/1/2030

|

1,869,171

|

|

1,500,000

|

|

Steel Point Infrastructure Improvement District, Steelpoint

Harbor Special Obligation Revenue Bonds (Series 2021),

4.000%, 4/1/2051

|

1,195,097

|

|

|

|

TOTAL

|

4,060,289

|

|

Principal

Amount

|

|

|

Value

|

|

|

|

MUNICIPAL BONDS—continued

|

|

|

|

|

Delaware—1.6%

|

|

|

$1,600,000

|

|

Delaware EDA (Newark Charter School, Inc.), Charter School

Revenue Bonds (Series 2021), 4.000%, 9/1/2041

|

$1,398,098

|

|

3,000,000

|

|

Delaware Health Facilities Authority (Christiana Care Health

Services), Revenue and Refunding Bonds (Series 2020A),

4.000%, 10/1/2049

|

2,739,497

|

|

3,000,000

|

3

|

Millsboro, DE Special Obligations (Plantation Lakes Special

Development District), Special Tax Revenue Refunding Bonds

(Series 2018), (Original Issue Yield: 5.140%), 5.125%, 7/1/2038

|

2,911,286

|

|

|

|

TOTAL

|

7,048,881

|

|

|

|

District of Columbia—1.5%

|

|

|

1,000,000

|

|

District of Columbia (Friendship Public Charter School, Inc.),

Revenue Bonds (Series 2016A), 5.000%, 6/1/2046

|

960,164

|

|

1,000,000

|

|

District of Columbia (Ingleside at Rock Creek), Project Revenue

Bonds (Series 2017A), (Original Issue Yield: 5.250%),

5.000%, 7/1/2052

|

812,287

|

|

1,000,000

|

|

District of Columbia (KIPP DC), Revenue Bonds (Series 2019),

4.000%, 7/1/2039

|

902,687

|

|

1,000,000

|

|

Metropolitan Washington, DC Airports Authority, Revenue

Refunding Bonds (Series 2017A), 5.000%, 10/1/2047

|

1,012,178

|

|

1,700,000

|

|

Washington Metropolitan Area Transit Authority, Dedicated

Revenue Bonds (Series 2020A), 4.000%, 7/15/2045

|

1,623,119

|

|

1,180,000

|

|

Washington Metropolitan Area Transit Authority, Dedicated

Revenue Bonds (Series 2020A), 5.000%, 7/15/2045

|

1,250,751

|

|

|

|

TOTAL

|

6,561,186

|

|

|

|

Florida—8.6%

|

|

|

1,245,000

|

|

Alta Lakes, FL CDD, Special Assessment Bonds (Series 2019),

4.625%, 5/1/2049

|

1,082,330

|

|

125,000

|

|

Arborwood, FL CDD, Special Assessment Revenue Bonds

(Series 2014A-1), (Original Issue Yield: 6.900%), 6.900%, 5/1/2036

|

125,087

|

|

450,000

|

|

Artisan Lakes East CDD, Capital Improvement Revenue Bonds

(Series 2021-1), 4.000%, 5/1/2051

|

345,412

|

|

550,000

|

|

Artisan Lakes East CDD, Capital Improvement Revenue Bonds

(Series 2021-2), 4.000%, 5/1/2052

|

418,793

|

|

1,365,000

|

|

Boggy Branch CDD, FL, Special Assessment Bonds (Series 2021),

4.000%, 5/1/2051

|

1,057,097

|

|

3,000,000

|

|

Broward County, FL (Broward County, FL Convention Center

Hotel), First Tier Revenue Bonds (Series 2022), (Broward County,

FL GTD), 5.500%, 1/1/2055

|

3,280,073

|

|

2,237,081

|

1,2,3

|

Collier County, FL IDA (Arlington of Naples), Continuing Care

Community Revenue Bonds (Series 2013A), (Original Issue Yield:

8.375%), 8.250%, 5/15/2049

|

123,039

|

|

1,000,000

|

3

|

Florida Development Finance Corp. (Glenridge on Palmer Ranch),

Senior Living Revenue and Refunding Bonds (Series 2021),

5.000%, 6/1/2051

|

808,268

|

|

Principal

Amount

|

|

|

Value

|

|

|

|

MUNICIPAL BONDS—continued

|

|

|

|

|

Florida—continued

|

|

|

$1,000,000

|

|

Florida Development Finance Corp. (Mayflower Retirement

Community), Senior Living Revenue Bonds (Series 2021A),

4.000%, 6/1/2055

|

$610,981

|

|

1,000,000

|

|

Florida Development Finance Corp. (Shands Jacksonville Medical

Center, Inc.), UFHealth Revenue Refunding Bonds (Series 2022A),

5.000%, 2/1/2052

|

878,193

|

|

1,000,000

|

|

Harbor Bay, FL CDD, Special Assessment District Area One

(Series 2019A-1), (Original Issue Yield: 4.140%), 4.100%, 5/1/2048

|

799,184

|

|

265,000

|

|

Lakes of Sarasota CDD, Improvement Revenue Bonds Phase 1

Project (Series 2021A-1), 4.100%, 5/1/2051

|

211,337

|

|

450,000

|

|

Lakes of Sarasota CDD, Improvement Revenue Bonds Phase 1

Project (Series 2021A-2), (Original Issue Yield: 3.960%),

3.875%, 5/1/2031

|

426,672

|

|

555,000

|

|

Lakewood Ranch Stewardship District, FL (Indigo Expansion Area

Project), Special Assessment Revenue Bonds (Series 2019),

4.000%, 5/1/2049

|

434,774

|

|

1,000,000

|

|

Lakewood Ranch Stewardship District, FL (Lakewood Centre

North), Special Assessment Revenue Bonds (Series 2015),

(Original Issue Yield: 4.960%), 4.875%, 5/1/2045

|

923,480

|

|

1,000,000

|

|

Lakewood Ranch Stewardship District, FL (Lakewood National &

Polo Run), Special Assessment Bonds, (Original Issue Yield:

5.400%), 5.375%, 5/1/2047

|

1,005,948

|

|

750,000

|

|

Lakewood Ranch Stewardship District, FL (Northeast Sector

Phase-2B), Special Assessment Revenue Bonds (Series 2020),

4.000%, 5/1/2050

|

580,770

|

|

1,000,000

|

|

Lakewood Ranch Stewardship District, FL (Northeast Sector

Project—Phase 1B), Special Assessment Revenue Bonds

(Series 2018), 5.450%, 5/1/2048

|

989,731

|

|

1,075,000

|

|

Lakewood Ranch Stewardship District, FL (Villages of Lakewood

Ranch South), Special Assessment Revenue Bonds (Series 2016),

(Original Issue Yield: 5.160%), 5.125%, 5/1/2046

|

1,028,340

|

|

1,000,000

|

|

Lee County, FL IDA (Cypress Cove at Healthpark), Healthcare

Facilities Revenue Bonds (Series 2022A), 5.250%, 10/1/2057

|

824,717

|

|

1,000,000

|

|

LT Ranch, FL CDD (LT Ranch, FL CDD Phase IIA Assessment

Area), Capital Improvement Revenue Bonds Phase IIA

(Series 2022-2), (Original Issue Yield: 5.740%), 5.700%, 5/1/2053

|

1,003,301

|

|

1,840,000

|

|

LT Ranch, FL CDD, Capital Improvement Revenue Bonds

(Series 2019), 4.000%, 5/1/2050

|

1,424,706

|

|

745,000

|

|

Midtown Miami, FL CDD, Special Assessment & Revenue

Refunding Bonds (Series 2014A), (Original Issue Yield: 5.250%),

5.000%, 5/1/2037

|

722,557

|

|

1,000,000

|

|

North River Ranch Improvement Stewardship District, Special

Assessment Revenue Bonds (Series 2023A-1), 5.800%, 5/1/2043

|

981,526

|

|

1,000,000

|

|

North River Ranch Improvement Stewardship District, Special

Assessment Revenue Bonds (Series 2023A-1), 6.000%, 5/1/2054

|

977,972

|

|

Principal

Amount

|

|

|

Value

|

|

|

|

MUNICIPAL BONDS—continued

|

|

|

|

|

Florida—continued

|

|

|

$2,000,000

|

3

|

Polk County, FL IDA (Mineral Development, LLC), Secondary

Phosphate Tailings Recovery Project Revenue Bonds

(Series 2020), 5.875%, 1/1/2033

|

$1,994,842

|

|

145,000

|

1,2

|

Reunion East CDD, FL, Special Assessment Bonds

(Series 2002A-1), 7.375%, 5/1/2033

|

1

|

|

1,125,000

|

|

River Landing CDD, Capital Improvement Revenue Bonds

(Series 2020A), (Original Issue Yield: 4.360%), 4.350%, 5/1/2051

|

921,508

|

|

900,000

|

|

Rivers Edge III CDD, Capital Improvement Revenue Bonds

(Series 2021), 4.000%, 5/1/2051

|

692,315

|

|

1,250,000

|

|

Seminole County, FL IDA (Legacy Pointe at UCF), Retirement

Facilities Revenue Bonds (Series 2019A), 5.750%, 11/15/2054

|

972,843

|

|

745,000

|

|

Southern Grove, FL CDD #5, Special Assessment Bonds

(Series 2021), 4.000%, 5/1/2048

|

585,314

|

|

585,000

|

|

Southern Grove, FL CDD #5, Special Assessment District Revenue

Refunding Bonds (Series 2019), 4.000%, 5/1/2043

|

482,382

|

|

500,000

|

|

St. Johns County, FL IDA (Vicar’s Landing), Senior Living Revenue

Bonds (Series 2021A), 4.000%, 12/15/2050

|

355,581

|

|

495,000

|

|

Talavera, FL CDD, Capital Improvement Revenue Bonds

(Series 2019), 4.350%, 5/1/2040

|

441,416

|

|

770,000

|

|

Talavera, FL CDD, Capital Improvement Revenue Bonds

(Series 2019), 4.500%, 5/1/2050

|

649,420

|

|

1,000,000

|

|

Three Rivers CDD, Special Assessment Refunding Bonds

(Series 2023), (Original Issue Yield: 5.600%), 5.550%, 5/1/2043

|

978,856

|

|

1,000,000

|

|

Three Rivers CDD, Special Assessment Refunding Bonds

(Series 2023), (Original Issue Yield: 5.800%), 5.750%, 5/1/2053

|

972,195

|

|