|

Share Class | T

|

|

|

|

|

Federated Hermes Municipal High Yield Advantage Fund

A Portfolio of Federated Hermes Municipal Securities Income Trust

(formerly, Federated Municipal Securities Income Trust)

IMPORTANT NOTICE TO SHAREHOLDERS

(Additional information contained on the inside cover.)

|

Shareholder Fees (fees paid directly from your investment)

|

T

|

|

Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price)

|

2.50%

|

|

Maximum Deferred Sales Charge (Load) (as a percentage of original purchase price or

redemption proceeds, as applicable)

|

None

|

|

Maximum Sales Charge (Load) Imposed on Reinvested Dividends (and other Distributions)

(as a percentage of offering price)

|

None

|

|

Redemption Fee (as a percentage of amount redeemed, if applicable)

|

None

|

|

Exchange Fee

|

None

|

|

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of

the value of your investment)

|

|

|

Management Fee

|

0.60%

|

|

Distribution (12b-1) Fee

|

None

|

|

Other Expenses1

|

0.44%

|

|

Total Annual Fund Operating Expenses

|

1.04%

|

|

Fee Waivers and/or Expense Reimbursements2

|

(0.15)%

|

|

Total Annual Fund Operating Expenses After Fee Waivers and/or Expense Reimbursements

|

0.89%

|

|

1 Year

|

$353

|

|

3 Years

|

$573

|

|

5 Years

|

$810

|

|

10 Years

|

$1,489

|

|

Share Class

|

1 Year

|

5 Years

|

10 Years

|

|

T:

|

|

|

|

|

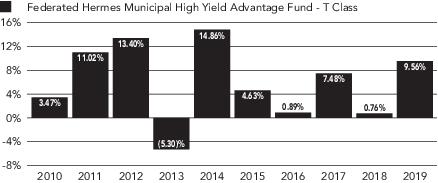

Return Before Taxes

|

4.64%

|

3.65%

|

5.42%

|

|

Return After Taxes on Distributions

|

4.64%

|

3.65%

|

5.42%

|

|

Return After Taxes on Distributions and Sale of Fund Shares

|

4.25%

|

3.70%

|

5.25%

|

|

S&P Municipal Bond Index1

(reflects no deduction for fees, expenses or taxes)

|

7.26%

|

3.50%

|

4.41%

|

|

S&P 25% A and Higher/25% BBB/50% High Yield, All 3-Year

Plus Sub-Index2

(reflects no deduction for fees, expenses or taxes)

|

5.31%

|

7.81%

|

6.69%

|

|

Morningstar High Yield Muni Funds Average3

|

9.12%

|

4.67%

|

5.78%

|

Federated Hermes Municipal High Yield Advantage Fund

Federated Hermes Municipal High Yield Advantage Fund

Federated Hermes Funds

4000 Ericsson Drive

Warrendale, PA 15086-7561 Contact us at FederatedInvestors.com

or call 1-800-341-7400. Federated Securities Corp., Distributor Investment Company Act File No. 811-6165 CUSIP 313923781 Q453475 (10/20) © 2020 Federated Hermes, Inc.