United States

Securities and Exchange Commission

Washington, D.C. 20549

Form N-CSR

Certified Shareholder Report of Registered Management Investment Companies

811-6165

(Investment Company Act File Number)

Federated Municipal Securities Income Trust

_______________________________________________________________

(Exact Name of Registrant as Specified in Charter)

Federated Investors Funds

4000 Ericsson Drive

Warrendale, Pennsylvania 15086-7561

(Address of Principal Executive Offices)

(412) 288-1900

(Registrant's Telephone Number)

John W. McGonigle, Esquire

Federated Investors Tower

1001 Liberty Avenue

Pittsburgh, Pennsylvania 15222-3779

(Name and Address of Agent for Service)

(Notices should be sent to the Agent for Service)

Date of Fiscal Year End: 08/31/2012

Date of Reporting Period: 08/31/2012

Item 1. Reports to Stockholders

| 1 | Please see the footnotes to the line graphs under “Fund Performance and Growth of a $10,000 Investment” below for information regarding the effect of the reorganization of Federated Municipal High Yield Advantage Fund, Inc., a predecessor fund, into the Fund as of the close of business on November 10, 2006. |

| 2 | The Fund's broad-based securities market index is the S&P Municipal Bond Index (Main Index), which had a total return of 9.34% during the reporting period. Please see the footnotes to the line graphs under “Fund Performance and Growth of a $10,000 Investment” below for the definition of, and more information about, the Main Index and the Blended Index. |

| 3 | Credit ratings pertain only to the securities in the portfolio and do not protect Fund shares against market risk. |

| 4 | Bond prices are sensitive to changes in interest rates and a rise in interest rates can cause a decline in their prices. |

| 5 | Income may be subject to state taxes, local taxes and the AMT. |

| 6 | Investment-grade securities and noninvestment-grade securities may either be: (a) rated by a nationally recognized statistical ratings organization or rating agency; or (b) unrated securities that the Fund's investment adviser (“Adviser”) believes are of comparable quality. The rating agencies that provided the ratings for rated securities include Standard and Poor's, Moody's Investor Services, Inc. and Fitch Rating Service. When ratings vary, the highest rating is used. Credit ratings of “AA” or better are considered to be high credit quality; credit ratings of “A” are considered high or medium/good quality; and credit ratings of “BBB” are considered to be medium/good credit quality, and the lowest category of investment-grade securities; credit ratings of “BB” and below are lower-rated, noninvestment-grade securities or junk bonds; and credit ratings of “CCC” or below are noninvestment-grade securities that have high default risk. Any credit quality breakdown does not give effect to the impact of any credit derivative investments made by the Fund. Credit ratings are an indication of the risk that a security will default. They do not protect a security from credit risk. Lower-rated bonds typically offer higher yields to help compensate investors for the increased risk associated with them. Among these risks are lower creditworthiness, greater price volatility, more risk to principal and income than with higher-rated securities and increased possibilities of default. |

| 7 | Duration is a measure of a security's price sensitivity to changes in interest rates. Securities with longer durations are more sensitive to changes in interest rates than securities with shorter durations. For purposes of this Management Discussion of Fund Performance, duration is determined using a third-party analytical system. |

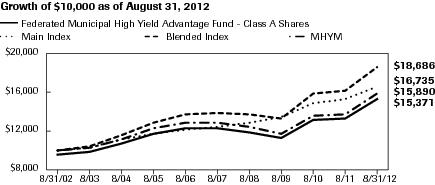

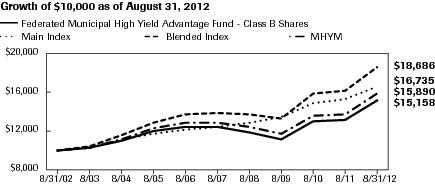

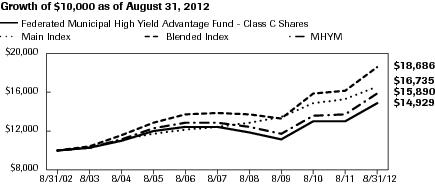

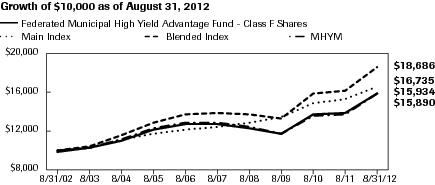

| Share Class | 1 Year | 5 Years | 10 Years |

| A | 9.38% | 3.55% | 4.39% |

| B | 8.22% | 3.42% | 4.25% |

| C | 12.72% | 3.75% | 4.09% |

| F | 12.48% | 4.28% | 4.77% |

| ■ | Total returns shown include the maximum sales charge of 4.50% ($10,000 investment minus $450 sales charge = $9,550). |

| ■ | Total returns shown include the maximum contingent deferred sales charge of 5.50% as applicable. |

| ■ | Total returns shown include the maximum contingent deferred sales charge of 1.00% as applicable. |

| ■ | Total returns shown include the maximum sales charge of 1.00% ($10,000 investment minus $100 sales charge = $9,900), and maximum contingent deferred sales charge of 1.00% as applicable. |

| 1 | Represents a hypothetical investment of $10,000 in the Fund after deducting applicable sales charges: For Class A Shares, the maximum sales charge of 4.50% ($10,000 investment minus $450 sales charge = $9,550); For Class B Shares, the maximum contingent deferred sales charge is 5.50% on any redemption less than one year from the purchase date; For Class C Shares, the maximum contingent deferred sales charge is 1.00% on any redemption less than one year from the purchase date; For Class F Shares, the maximum sales charge of 1.00% ($10,000 investment minus $100 sales charge = $9,900), and the contingent deferred sales charge is 1.00% on any redemption less than four years from the purchase date. The Fund's performance assumes the reinvestment of all dividends and distributions. The Main Index, Blended Index and MHYM have been adjusted to reflect reinvestment of dividends on securities in the indexes and the average. |

| 2 | Federated Municipal High Yield Advantage Fund, Inc. (“Predecessor Fund”) was reorganized into Federated Municipal High Yield Advantage Fund (“Fund”), a series of Federated Municipal Securities Income Trust, as of the close of business on November 10, 2006. Prior to the reorganization, the Fund had no investment operations. The Fund is the successor to the Predecessor Fund. The information presented for periods prior to the close of business on November 10, 2006, refers to the performance of the Predecessor Fund, which after the reorganization is the Fund's performance as a result of the reorganization. |

| 3 | The Main Index is a broad, comprehensive, market value-weighted index composed of approximately 55,000 bond issues that are exempt from U.S. federal income taxes or subject to AMT. Eligibility criteria for inclusion in the Main Index include, but are not limited to: the bond issuer must be a state (including the Commonwealth of Puerto Rico and U.S. territories) or a local government or a state or local government entity where interest on the bond is exempt from U.S. federal income taxes or subject to the AMT; the bond must be held by a mutual fund for which Standard & Poor's Securities Evaluations, Inc. provides prices; it must be denominated in U.S. dollars and have a minimum par amount of $2 million; and the bond must have a minimum term to maturity and/or call date greater than or equal to one calendar month. The Main Index is rebalanced monthly. The Main Index is not adjusted to reflect sales charges, expenses and other fees that the Securities and Exchange Commission (SEC) requires to be reflected in the Fund's performance. The Main Index is unmanaged, and, unlike the Fund, is not affected by cash flows. It is not possible to invest directly in an index. |

| 4 | The Blended Index is a custom blended index that represents, by market weighting, 25% of the A-rated and higher component of the Main Index, 25% of the BBB-rated component of the Main Index and 50% of the below investment grade (bonds with ratings of less than BBB-/Baa3) component of the Main Index, all with remaining maturities of three years or more. The Blended Index is not adjusted to reflect sales charges, expenses and other fees that the SEC requires to be reflected in the Fund's performance. The Blended Index is unmanaged, and, unlike the Fund, is not affected by cash flows. It is not possible to invest directly in an index. |

| 5 | Morningstar figures represent the average of the total returns reported by all the mutual funds designated by Morningstar as falling into the respective category indicated. Funds designated within the MHYM include those that invest at least 50% of assets in high-income municipal securities that are not rated or that are rated by a major agency such as Standard & Poor's or Moody's Investor Service at a level of BBB (considered part of the high-yield universe within the municipal industry) and below. They do not reflect sales charges. |

| Sector Composition | Percentage of Total Net Assets |

| Hospital | 15.2% |

| Senior Care | 11.5% |

| Industrial Development Bond/Pollution Control Revenue Bond | 11.1% |

| Special Tax | 10.4% |

| Education | 7.4% |

| Transportation | 7.1% |

| Electric & Gas | 6.5% |

| General Obligation-State | 5.9% |

| Water & Sewer | 5.3% |

| Tobacco | 4.8% |

| Derivative Contracts2,3 | (0.0)% |

| Other4 | 12.9% |

| Other Assets and Liabilities—Net5 | 1.9% |

| TOTAL | 100.0% |

| 1 | Sector classifications, and the assignment of holdings to such sectors, are based upon the economic sector and/or revenue source of the underlying obligor, as determined by the Fund's Adviser. For securities that have been enhanced by a third-party, including bond insurers and banks, such as a guarantor, sector classifications are based upon the economic sector and/or revenue source of the underlying obligor, as determined by the Fund's Adviser. Pre-refunded securities are those whose debt service is paid from escrowed assets, usually U.S. government securities. |

| 2 | Based upon net unrealized appreciation (depreciation) or value of the derivative contracts as applicable. Derivative contracts may consist of futures, forwards, options and swaps. The impact of a derivative contract on the Fund's performance may be larger than its unrealized appreciation (depreciation) or value may indicate. In many cases, the notional value or amount of a derivative contract may provide a better indication of the contract's significance to the portfolio. More complete information regarding the Fund's direct investments in derivative contracts, including unrealized appreciation (depreciation), value, and notional values or amounts of such contracts, can be found in the table at the end of the Portfolio of Investments included in this Report. |

| 3 | Represents less than 0.1%. |

| 4 | For purposes of this table, sector classifications constitute 85.2% of the Fund's total net assets. Remaining sectors have been aggregated under the designation “Other.” |

| 5 | Assets, other than investments in securities and derivative contracts, less liabilities. See Statement of Assets and Liabilities. |

| Principal Amount | Value | ||

| MUNICIPAL BONDS—96.8% | |||

| Alabama—1.8% | |||

| $2,000,000 | Alabama State Port Authority, Docks Facilities Revenue Bonds (Series 2010), 6.00% (Original Issue Yield: 6.25%), 10/1/2040 | $2,318,780 | |

| 2,000,000 | Courtland, AL IDB, Solid Waste Disposal Revenue Refunding Bonds (Series 2005B), 5.20% (International Paper Co.), 6/1/2025 | 2,066,000 | |

| 500,000 | Huntsville, AL Special Care Facilities Financing Authority, Retirement Facilities Revenue Bonds (Series 2011A), 7.50% (Redstone Village)/(Original Issue Yield: 7.625%), 1/1/2047 | 572,580 | |

| 1,500,000 | Huntsville, AL Special Care Facilities Financing Authority, Retirement Facility Revenue Bonds (Series 2007), 5.50% (Redstone Village)/(Original Issue Yield: 5.60%), 1/1/2043 | 1,500,450 | |

| 835,000 | Selma, AL IDB, Gulf Opportunity Zone Bonds (Series 2010A), 5.80% (International Paper Co.), 5/1/2034 | 930,432 | |

| 2,100,000 | Sylacauga, AL Health Care Authority, Revenue Bonds (Series 2005A), 6.00% (Coosa Valley Medical Center)/(Original Issue Yield: 6.05%), 8/1/2035 | 2,114,343 | |

| TOTAL | 9,502,585 | ||

| Alaska—0.7% | |||

| 1,000,000 | 1,2 | Alaska Industrial Development and Export Authority, Community Provider Revenue Bonds (Series 2007C), 6.00% (Boys & Girls Home & Family Services, Inc.), 12/1/2036 | 340,030 |

| 1,195,000 | Alaska Industrial Development and Export Authority, Power Revenue Bonds, 5.875% (Upper Lynn Canal Regional Power Supply System)/(Original Issue Yield: 6.00%), 1/1/2032 | 1,195,335 | |

| 2,000,000 | 3,4 | Koyukuk, AK, Revenue Bonds (Series 2011), 7.75% (Tanana Chiefs Conference Health Care)/(Original Issue Yield: 8.125%), 10/1/2041 | 2,189,760 |

| TOTAL | 3,725,125 | ||

| Arizona—1.9% | |||

| 410,000 | Apache County, AZ IDA, PCRBs (Series 2012A), 4.50% (Tucson Electric Power Co.), 3/1/2030 | 425,117 | |

| 4,000,000 | Maricopa County, AZ Pollution Control Corp., Refunding PCRBs (Series 2003A), 6.25% (Public Service Co., NM), 1/1/2038 | 4,258,520 | |

| 1,500,000 | Maricopa County, AZ Pollution Control Corp., Refunding PCRBs (Series 2009A), 7.25% (El Paso Electric Co.), 2/1/2040 | 1,794,990 | |

| 1,385,000 | Pima County, AZ IDA, PCRBs (Series 2009A), 4.95% (Tucson Electric Power Co.), 10/1/2020 | 1,534,538 | |

| 2,000,000 | Pima County, AZ IDA, Revenue Bonds (Series 2008B), 5.75% (Tucson Electric Power Co.), 9/1/2029 | 2,134,680 | |

| TOTAL | 10,147,845 |

| Principal Amount | Value | ||

| MUNICIPAL BONDS—continued | |||

| California—9.2% | |||

| $2,500,000 | 3,4 | California PCFA, Solid Waste Disposal Revenue Bonds (Series 2002B), 5.00% (Waste Management, Inc.), 7/1/2027 | $2,672,525 |

| 1,000,000 | 3,4 | California PCFA, Solid Waste Disposal Revenue Bonds (Series 2005A-2), 5.40% (Waste Management, Inc.), 4/1/2025 | 1,081,990 |

| 2,000,000 | California State Public Works Board, Lease Revenue Bonds (Series 2009I), 6.625%, 11/1/2034 | 2,461,400 | |

| 2,500,000 | California State, Various Purpose Refunding GO Bonds, 5.00%, 2/1/2038 | 2,754,275 | |

| 2,500,000 | California State, Various Purpose UT GO Bonds, 5.00%, 9/1/2041 | 2,740,850 | |

| 2,500,000 | California State, Various Purpose UT GO Bonds, 5.25%, 10/1/2029 | 2,854,775 | |

| 2,500,000 | California State, Various Purpose UT GO Bonds, 6.00% (Original Issue Yield: 6.10%), 4/1/2038 | 2,944,950 | |

| 2,225,000 | California Statewide CDA, (Kaiser Permanente), Revenue Bonds (Series 2012A), 5.000%, 04/01/2042 | 2,424,649 | |

| 1,170,000 | 3,4 | California Statewide CDA, MFH Revenue Bonds (Series 1999X), 6.65% (Magnolia City Lights Project), 7/1/2039 | 1,170,328 |

| 2,000,000 | Chula Vista, CA, COP, 5.50% (Original Issue Yield: 5.88%), 3/1/2033 | 2,185,960 | |

| 2,000,000 | Golden State Tobacco Securitization Corp., CA, Enhanced Tobacco Settlement Asset-Backed Bonds (Series 2005A), 5.00% (California State), 6/1/2045 | 2,040,500 | |

| 530,000 | Golden State Tobacco Securitization Corp., CA, Tobacco Settlement Asset-Backed Bonds (Series 2007A-1), 5.75%, 6/1/2047 | 448,937 | |

| 6,000,000 | Golden State Tobacco Securitization Corp., CA, Tobacco Settlement Asset-Backed Revenue Bonds (Series 2007A-1), 5.125% (Original Issue Yield: 5.27%), 6/1/2047 | 4,602,000 | |

| 2,000,000 | Los Angeles, CA Department of Water & Power (Water Works/System), Water System Revenue Bonds (Series 2012B), 5.00%, 7/1/2043 | 2,312,540 | |

| 2,500,000 | M-S-R Energy Authority, CA, Gas Revenue Bonds (Series 2009A), 7.00% (Citigroup, Inc. GTD), 11/1/2034 | 3,323,950 | |

| 980,000 | Oxnard, CA Community Facilities District No. 3, Special Tax Bonds (Series 2005), 5.00% (Seabridge at Mandalay Bay)/(Original Issue Yield: 5.22%), 9/1/2035 | 990,956 | |

| 500,000 | Poway, CA United School District, Special Tax Bonds (Series 2012), 5.00% (Community Facilities District No. 6 (4S Ranch)), 9/1/2033 | 537,040 | |

| 2,000,000 | Riverside County, CA Redevelopment Agency, Tax Allocation Bonds (Series 2010D), 6.00% (Desert Communities Redevelopment Project Area)/(Original Issue Yield: 6.02%), 10/1/2037 | 1,979,420 | |

| 1,500,000 | Riverside County, CA Redevelopment Agency, Tax Allocation Bonds (Series 2010E), 6.50% (Interstate 215 Corridor Redevelopment Project Area)/(Original Issue Yield: 6.53%), 10/1/2040 | 1,660,635 | |

| 349,000 | 1 | San Bernardino County, CA Housing Authority, Subordinated Revenue Bonds, 7.25% (Glen Aire Park & Pacific Palms), 4/15/2042 | 173,980 |

| Principal Amount | Value | ||

| MUNICIPAL BONDS—continued | |||

| California—continued | |||

| $1,250,000 | San Buenaventura, CA, Revenue Bonds (Series 2011), 8.00% (Community Memorial Health System), 12/1/2031 | $1,580,087 | |

| 1,000,000 | San Diego, CA Public Facilities Authority, Lease Revenue Refunding Bonds (Series 2010A), 5.25% (San Diego, CA)/(Original

Issue Yield: 5.37%), 3/1/2040 | 1,077,060 | |

| 1,000,000 | San Francisco, CA City & County Redevelopment Finance Agency, Tax Allocation Bonds (Series 2011C), 6.75% (Mission Bay North Redevelopment)/(Original Issue Yield: 6.86%), 8/1/2041 | 1,168,670 | |

| 2,000,000 | San Jose, CA Airport, Airport Revenue Bonds (Series 2011A-1), 6.25%, 3/1/2034 | 2,375,480 | |

| 1,000,000 | Western Hills Water District, CA, Special Tax Revenue Bonds, 6.875% (Diablo Grande Community Facilities No. 1)/(Original

Issue Yield: 6.954%), 9/1/2031 | 721,960 | |

| TOTAL | 48,284,917 | ||

| Colorado—4.8% | |||

| 2,000,000 | Beacon Point, CO Metropolitan District, Revenue Bonds (Series 2005A), 6.25% (Original Issue Yield: 6.375%), 12/1/2035 | 2,021,380 | |

| 536,000 | Castle Oaks, CO Metropolitan District, LT GO Bonds (Series 2005), 6.125%, 12/1/2035 | 472,446 | |

| 760,000 | Colorado Educational & Cultural Facilities Authority, Charter School Revenue Bonds (Series 2007A), 5.70% (Windsor Charter Academy)/(Original Issue Yield: 5.70%), 5/1/2037 | 759,932 | |

| 810,000 | Colorado Educational & Cultural Facilities Authority, Charter School Revenue Bonds (Series 2007A), 5.75% (Northeast Academy Charter School), 5/15/2037 | 730,191 | |

| 1,000,000 | Colorado Educational & Cultural Facilities Authority, Charter School Revenue Bonds (Series 2007A), 6.00% (Monument Academy Charter School), 10/1/2037 | 1,028,540 | |

| 1,610,000 | Colorado Educational & Cultural Facilities Authority, Revenue Refunding Bonds (Series A), 7.125% (Denver Academy)/(Original Issue Yield: 7.375%), 11/1/2028 | 1,641,797 | |

| 1,000,000 | Colorado Health Facilities Authority, Health & Residential Care Facilities Revenue Bonds (Series 2007), 5.30% (Volunteers of America Care Facilities), 7/1/2037 | 945,850 | |

| 1,100,000 | Colorado Health Facilities Authority, Revenue Bonds (Series 2010A), 6.25% (Total Longterm Care National Obligated Group), 11/15/2040 | 1,229,965 | |

| 2,000,000 | Colorado Springs Urban Renewal Authority, Tax Increment Revenue Bonds (Series 2007), 7.00% (University Village Colorado), 12/1/2029 | 1,345,380 | |

| 1,000,000 | Conservatory Metropolitan District, CO, LT GO Bonds, 7.55% (United States Treasury PRF 12/1/2013@102), 12/1/2032 | 1,108,210 | |

| 1,540,000 | Denver, CO City & County Department of Aviation, Airport System Revenue Bonds (Series 2011A), 5.25% (Original

Issue Yield: 5.35%), 11/15/2022 | 1,834,048 | |

| 450,000 | Eagle County, CO Air Terminal Corp., Airport Terminal Project Revenue Improvement Bonds (Series 2006B), 5.25%, 5/1/2020 | 451,215 |

| Principal Amount | Value | ||

| MUNICIPAL BONDS—continued | |||

| Colorado—continued | |||

| $750,000 | Eagle County, CO Air Terminal Corp., Revenue Refunding Bonds (Series 2011A), 6.00%, 5/1/2027 | $786,840 | |

| 1,000,000 | Granby Ranch, CO Metropolitan District, LT GO Bonds (Series 2006), 6.75%, 12/1/2036 | 1,009,990 | |

| 500,000 | Maher Ranch, CO Metropolitan District No. 4, LT GO Bonds (Series 2006), 7.00% (United States Treasury PRF 12/1/2013@102), 12/1/2036 | 549,690 | |

| 1,000,000 | Maher Ranch, CO Metropolitan District No. 4, LT GO Bonds, 7.875% (United States Treasury PRF 12/1/2013@102), 12/1/2033 | 1,109,920 | |

| 2,235,000 | Northwest, CO Metropolitan District No. 3, LT GO Bonds (Series 2005), 6.25%, 12/1/2035 | 2,186,523 | |

| 2,000,000 | Public Authority for Colorado Energy, Natural Gas Purchase Revenue Bonds (Series 2008), 6.25% (Merrill Lynch & Co., Inc. GTD)/(Original Issue Yield: 6.63%), 11/15/2028 | 2,395,280 | |

| 1,500,000 | Southlands, CO Metropolitan District No. 1, LT GO Bonds (Series 2004), 7.125% (United States Treasury PRF 12/1/2014@100)/(Original Issue Yield: 7.18%), 12/1/2034 | 1,724,865 | |

| 2,000,000 | Three Springs Metropolitan District No. 3, CO, Property Tax Supported Revenue Bonds (Series 2010), 7.75%, 12/1/2039 | 2,104,360 | |

| TOTAL | 25,436,422 | ||

| Connecticut—0.2% | |||

| 1,000,000 | Connecticut Development Authority, Airport Facility Revenue Bonds, 7.95% (Bombardier, Inc.), 4/1/2026 | 1,078,700 | |

| Delaware—0.4% | |||

| 1,905,000 | Delaware EDA, Gas Facilities Refunding Bonds, 5.40% (Delmarva Power and Light Co.), 2/1/2031 | 2,096,319 | |

| Florida—5.1% | |||

| 3,000,000 | Alachua County, FL, IDRB (Series 2007A), 5.875% (North Florida Retirement Village, Inc,), 11/15/2042 | 2,917,110 | |

| 1,380,000 | Arborwood, FL Community Development District, Capital Improvement Revenue Bonds (Series 2005A), 5.35%, 5/1/2036 | 1,095,692 | |

| 109,219 | 1 | Capital Trust Agency, FL, Housing Revenue Notes, 5.95% (Atlantic Housing Foundation Properties), 1/15/2039 | 21,831 |

| 785,000 | East Homestead, FL Community Development District, Special Assessment Revenue Bonds (Series 2005), 5.45%, 5/1/2036 | 795,723 | |

| 10,000 | Fishhawk Community Development District II, Special Assessment Revenue Bonds (Series 2004B), 7.04% (Original Issue Yield: 7.087%), 11/1/2014 | 9,870 | |

| 1,000,000 | Greater Orlando, FL Aviation Authority, Special Purpose Airport Facilities Revenue Bonds (Series 2005), 6.50% (Jet Blue Airways Corp.)/(Original Issue Yield: 6.811%), 11/15/2036 | 1,009,490 | |

| 990,000 | Lakes by the Bay South Community Development District, FL, Special Assessment Revenue Bonds (Series 2004A), 6.25% (Original Issue Yield: 6.277%), 5/1/2034 | 1,009,077 |

| Principal Amount | Value | ||

| MUNICIPAL BONDS—continued | |||

| Florida—continued | |||

| $2,000,000 | Lee County, FL IDA, Health Care Facilities Revenue Bond (Series A), 6.75% (Cypress Cove at Healthpark)/(Original Issue Yield: 6.98%), 10/1/2032 | $1,803,420 | |

| 2,000,000 | Martin County, FL Health Facilities Authority, Hospital Revenue Bonds (Series 2012), 5.50% (Martin Memorial Medical Center)/(Original Issue Yield: 5.53%), 11/15/2042 | 2,177,560 | |

| 500,000 | Miami Beach, FL Health Facilities Authority, Hospital Revenue Refunding Bonds (Series 2012), 5.00% (Mt. Sinai Medical Center, FL), 11/15/2029 | 543,715 | |

| 1,000,000 | Miami-Dade County, FL Water & Sewer Authority, Water & Sewer System Revenue Bonds (Series 2010), 5.00% (Original

Issue Yield: 5.05%), 10/1/2034 | 1,126,530 | |

| 1,000,000 | Midtown Miami, FL Community Development District, Special Assessment Bonds (Series 2004A), 6.25% (Original Issue Yield: 6.30%), 5/1/2037 | 1,021,910 | |

| 600,000 | Orlando, FL Urban Community Development District, Capital Improvement Revenue Bonds, 6.25%, 5/1/2034 | 592,230 | |

| 2,000,000 | 3,4 | Palm Beach County, FL, Tax-Exempt Revenue Bonds (Series 2005A), 6.75% (G-Star School of the Arts for Motion Pictures and Broadcasting Charter School), 5/15/2035 | 2,011,720 |

| 1,405,000 | Pinellas County, FL Educational Facilities Authority, Revenue Bonds (Series 2011A), 7.125% (Pinellas Preparatory Academy), 9/15/2041 | 1,574,682 | |

| 690,000 | Reunion East Community Development District, FL, Special Assessment Bonds (Series 2002A-1), 7.375%, 5/1/2033 | 703,959 | |

| 310,000 | 1,2 | Reunion East Community Development District, FL, Special Assessment Bonds (Series 2002A-1), 7.375%, 5/1/2033 | 152,300 |

| 1,000,000 | South Lake County, FL Hospital District, Revenue Bonds (Series 2009A), 6.25% (South Lake Hospital, Inc.)/(Original Issue Yield: 6.30%), 4/1/2039 | 1,149,640 | |

| 1,200,000 | South Lake County, FL Hospital District, Revenue Bonds, 6.625% (South Lake Hospital, Inc.), 10/1/2023 | 1,253,244 | |

| 1,570,000 | Tolomato Community Development District, FL, Special Assessment Revenue Bonds (Series 2006), 5.40%, 5/1/2037 | 1,523,057 | |

| 635,000 | 1,2 | Tolomato Community Development District, FL, Special Assessment Revenue Bonds (Series 2007), 6.55% (Original Issue Yield: 6.60%), 5/1/2027 | 286,048 |

| 55,000 | 5 | Tolomato Community Development District, FL, Special Assessment Revenue Bonds (Series A-2), 0.00% (Original Issue Yield: 6.61%), 5/1/2039 | 39,463 |

| 135,000 | 5 | Tolomato Community Development District, FL, Special Assessment Revenue Bonds (Series A-3), 0.00% (Original Issue Yield: 6.61%), 5/1/2040 | 77,760 |

| 70,000 | 5 | Tolomato Community Development District, FL, Special Assessment Revenue Bonds (Series A-4), 0.00% (Original Issue Yield: 6.61%), 5/1/2040 | 29,659 |

| Principal Amount | Value | ||

| MUNICIPAL BONDS—continued | |||

| Florida—continued | |||

| $200,000 | Tolomato Community Development District, FL, Special Assessment Revenue Bonds (Series A-1), 6.55% (Original Issue Yield: 6.60%), 5/1/2027 | $193,868 | |

| 930,000 | Verandah East, FL Community Development District, Capital Improvement Revenue Bonds (Series 2006A), 5.40%, 5/1/2037 | 553,443 | |

| 740,000 | Verandah West, FL Community Development District, Capital Improvement Revenue Bonds (Series 2003A), 6.625% (Original Issue Yield: 6.75%), 5/1/2033 | 748,673 | |

| 1,630,000 | Volusia County, FL Education Facility Authority, Educational Facilities Refunding Revenue Bonds (Series 2005), 5.00% (Embry-Riddle Aeronautical University, Inc.)/(Radian Asset Assurance, Inc. INS), 10/15/2025 | 1,673,472 | |

| 465,000 | Winter Garden Village at Fowler Groves Community Development District, FL, Special Assessment Bonds (Series 2006), 5.65%, 5/1/2037 | 483,335 | |

| TOTAL | 26,578,481 | ||

| Georgia—1.8% | |||

| 500,000 | Atlanta, GA Airport General Revenue, Revenue Bonds (Series 2012C), 5.00%, 1/1/2037 | 546,340 | |

| 4,000,000 | Atlanta, GA Water & Wastewater, Revenue Bonds (Series 2009A), 6.25% (Original Issue Yield: 6.38%), 11/1/2039 | 4,805,400 | |

| 770,000 | Atlanta, GA, Tax Allocation Bonds (Series 2005B), 5.60% (Eastside Tax Allocation District)/(Original Issue Yield: 5.65%), 1/1/2030 | 829,567 | |

| 1,695,000 | Augusta, GA HFA, MFH Refunding Revenue Bonds, 6.55% (Forest Brook Apartments), 12/1/2030 | 1,695,017 | |

| 750,000 | Fulton County, GA Residential Care Facilities, Revenue Bonds (Series 2004A), 6.00% (Canterbury Court), 2/15/2022 | 750,803 | |

| 1,000,000 | Medical Center Hospital Authority, GA, Revenue Refunding Bonds (Series 2007), 5.25% (Spring Harbor at Green Island), 7/1/2037 | 986,950 | |

| TOTAL | 9,614,077 | ||

| Guam—0.5% | |||

| 500,000 | Guam Government LO (Section 30), Bonds (Series 2009A), 5.75% (Original Issue Yield: 6.00%), 12/1/2034 | 561,250 | |

| 1,000,000 | Guam Government, GO Bonds (Series 2009A), 7.00% (Original Issue Yield: 7.18%), 11/15/2039 | 1,128,370 | |

| 1,000,000 | Guam Government, UT GO Bonds (Series 2007A), 5.25% (Original Issue Yield: 5.45%), 11/15/2037 | 1,015,150 | |

| TOTAL | 2,704,770 | ||

| Hawaii—1.3% | |||

| 3,660,000 | Hawaii State Department of Budget & Finance, Special Purpose Revenue Bonds (Series 2009), 6.50% (Hawaiian Electric Co., Inc.), 7/1/2039 | 4,280,772 | |

| 295,000 | Hawaii State Department of Budget & Finance, Special Purpose Revenue Bonds (Series A), 7.00% (Kahala Nui)/(United States Treasury COL)/(Original Issue Yield: 7.00%), 11/15/2012 | 296,971 |

| Principal Amount | Value | ||

| MUNICIPAL BONDS—continued | |||

| Hawaii—continued | |||

| $1,000,000 | Hawaii State Department of Budget & Finance, Special Purpose Revenue Bonds (Series A), 8.00% (Kahala Nui)/(United

States Treasury PRF 11/15/2013@100)/(Original Issue Yield: 8.175%), 11/15/2033 | $1,112,250 | |

| 1,000,000 | Hawaii State Department of Budget & Finance, Special Purpose Senior Living Revenue Bonds (Series A), 9.00% (15 Craigside)/(Original Issue Yield: 9.15%), 11/15/2044 | 1,203,790 | |

| TOTAL | 6,893,783 | ||

| Illinois—4.2% | |||

| 1,750,000 | Chicago, IL O'Hare International Airport, General Airport Third Lien Revenue Bonds (Series 2011A), 5.75% (Original

Issue Yield: 5.94%), 1/1/2039 | 2,060,065 | |

| 2,500,000 | Chicago, IL O'Hare International Airport, General Airport Third Lien Revenue Bonds (Series 2011C), 6.50%, 1/1/2041 | 3,095,025 | |

| 415,000 | DuPage County, IL, Special Tax Bonds (Series 2006), 5.625% (Naperville Campus LLC), 3/1/2036 | 414,195 | |

| 1,500,000 | Illinois Finance Authority, Charter School Refunding & Improvement Revenue Bonds (Series 2011A), 7.125% (Uno Charter School Network, Inc.), 10/1/2041 | 1,685,235 | |

| 1,000,000 | Illinois Finance Authority, MFH Revenue Bonds (Series 2007), 6.10% (Dekalb Supportive Living Facility), 12/1/2041 | 977,220 | |

| 1,000,000 | Illinois Finance Authority, Revenue Bonds (Series 2005A), 5.625% (Friendship Village of Schaumburg)/(Original Issue Yield: 5.70%), 2/15/2037 | 1,004,740 | |

| 1,250,000 | Illinois Finance Authority, Revenue Bonds (Series 2005A), 6.00% (Landing at Plymouth Place)/(Original Issue Yield: 6.04%), 5/15/2037 | 1,057,588 | |

| 1,500,000 | Illinois Finance Authority, Revenue Bonds (Series 2005A), 6.25% (Smith Village), 11/15/2035 | 1,530,585 | |

| 1,000,000 | Illinois Finance Authority, Revenue Bonds (Series 2010), 7.25% (Friendship Village of Schaumburg)/(Original Issue Yield: 7.375%), 2/15/2045 | 1,101,650 | |

| 489,189 | 1,2 | Illinois Finance Authority, Revenue Bonds (Series 2010B) (Clare at Water Tower)/(Original Issue Yield: 5.00%), 5/15/2050 | 9,794 |

| 1,253,288 | 1,2 | Illinois Finance Authority, Revenue Bonds (Series 2010A), 6.125% (Clare at Water Tower), 5/15/2041 | 25,091 |

| 1,000,000 | Illinois Finance Authority, Solid Waste Disposal Revenue Bonds, 5.05% (Waste Management, Inc.), 8/1/2029 | 1,060,790 | |

| 1,000,000 | Illinois Finance Authority, Water Facilities Revenue Bonds (Series 2009), 5.25% (American Water Capital Corp.), 10/1/2039 | 1,058,700 | |

| 2,250,000 | Illinois State, UT GO Bonds (Series 2006), 5.00%, 1/1/2027 | 2,342,970 | |

| 465,000 | Illinois State, UT GO Refunding Bonds (Series May 2012), 5.00%, 8/1/2025 | 519,986 | |

| 1,000,000 | Quad Cities, IL Regional EDA, MFH Revenue Bonds (Series 2006), 6.00% (Heritage Woods of Moline SLF), 12/1/2041 | 938,520 |

| Principal Amount | Value | ||

| MUNICIPAL BONDS—continued | |||

| Illinois—continued | |||

| $1,600,000 | Railsplitter Tobacco Settlement Authority, IL, Tobacco Settlement Revenue Bonds (Series 2010), 6.00% (Original Issue Yield: 6.10%), 6/1/2028 | $1,875,440 | |

| 1,500,000 | Will-Kankakee, IL Regional Development Authority, MFH Revenue Bonds (Series 2007), 7.00% (Senior Estates Supportive Living), 12/1/2042 | 1,552,230 | |

| TOTAL | 22,309,824 | ||

| Indiana—2.7% | |||

| 1,250,000 | Carmel, IN, Revenue Bonds (Series 2012A), 7.125% (Barrington of Carmel)/(Original Issue Yield: 7.20%), 11/15/2042 | 1,256,463 | |

| 1,000,000 | Carmel, IN, Revenue Bonds (Series 2012A), 7.125% (Barrington of Carmel)/(Original Issue Yield: 7.30%), 11/15/2047 | 997,930 | |

| 1,000,000 | Goshen, IN, Revenue Bonds (Series 1998), 5.75% (Greencroft Obligated Group)/(Original Issue Yield: 5.87%), 8/15/2028 | 999,900 | |

| 2,000,000 | Indiana Health Facility Financing Authority, Revenue Refunding Bonds (Series 1998), 5.625% (Greenwood Village South Project)/(Original Issue Yield: 5.802%), 5/15/2028 | 1,999,600 | |

| 1,305,000 | Indiana State Finance Authority (Environmental Improvement Bonds), Revenue Refunding Bonds (Series 2010), 6.00% (United States Steel Corp.), 12/1/2026 | 1,358,035 | |

| 1,335,000 | Indiana State Finance Authority, Midwestern Disaster Relief Revenue Bonds (Series 2012A), 5.00% (Ohio Valley Electric Corp.)/(Original Issue Yield: 5.05%), 6/1/2039 | 1,387,118 | |

| 1,000,000 | Jasper County, IN, PCR Refunding Bonds (Series 2003), 5.70% (Northern Indiana Public Service Company)/(AMBAC INS), 7/1/2017 | 1,148,970 | |

| 2,000,000 | Rockport, IN, Revenue Refunding Bonds (Series 2012-A), 7.00% (AK Steel Corp.), 6/1/2028 | 2,086,620 | |

| 1,000,000 | South Bend, IN, EDRBs (Series 1999A), 6.25% (Southfield Village)/(Original Issue Yield: 6.375%), 11/15/2029 | 1,000,130 | |

| 1,153,630 | 1,2 | St. Joseph County, IN Hospital Authority, Health Facilities Revenue Bonds (Series 2005), 5.375% (Madison Center Obligated Group), 2/15/2034 | 138,447 |

| 2,000,000 | Vigo County, IN Hospital Authority, Hospital Revenue Bond (Series 2007), 5.80% (Union Hospital)/(Original Issue Yield: 5.82%), 9/1/2047 | 2,063,960 | |

| TOTAL | 14,437,173 | ||

| Iowa—1.4% | |||

| 4,135,000 | Iowa Finance Authority, Midwestern Disaster Area Revenue Bonds (Series 2012), 4.75% (Alcoa, Inc.), 8/1/2042 | 4,146,537 | |

| 1,715,000 | Iowa Finance Authority, Senior Living Facility Revenue Refunding Bonds (Series 2007A), 5.50% (Deerfield Retirement Community, Inc.), 11/15/2037 | 1,562,742 |

| Principal Amount | Value | ||

| MUNICIPAL BONDS—continued | |||

| Iowa—continued | |||

| $1,785,000 | Wapello County, IA, Revenue Bonds, 6.25% (Ottumwa Regional Health Center)/(United States Treasury PRF 10/1/2012@100)/(Original Issue Yield: 6.40%), 10/1/2022 | $1,793,568 | |

| TOTAL | 7,502,847 | ||

| Kansas—1.5% | |||

| 2,000,000 | Kansas State Development Finance Authority, Revenue Bonds, 5.75% (Adventist Health System/Sunbelt Obligated Group)/(Original Issue Yield: 5.95%), 11/15/2038 | 2,339,800 | |

| 535,000 | Manhattan, KS IDRB, Industrial Revenue Bonds (Series 1999), 7.00% (Farrar Corp. Project), 8/1/2014 | 535,171 | |

| 1,000,000 | Manhattan, KS IDRB, Industrial Revenue Bonds (Series 2007), 5.50% (Farrar Corp. Project)/(Original Issue Yield: 5.55%), 8/1/2021 | 942,420 | |

| 2,015,000 | Norwich, KS, Industrial Revenue Bonds (Series 2006), 5.90% (Farrar Corp. Project), 8/1/2021 | 1,953,180 | |

| 2,000,000 | Olathe, KS, Senior Living Facility Revenue Bonds (Series 2006A), 6.00% (Catholic Care Campus, Inc.), 11/15/2038 | 2,076,380 | |

| 75,000 | Sedgwick & Shawnee Counties, KS, SFM Revenue Bonds (Series 1997A-1), 6.95% (GNMA Home Mortgage Program COL), 6/1/2029 | 75,569 | |

| TOTAL | 7,922,520 | ||

| Kentucky—0.7% | |||

| 1,990,000 | Kentucky EDFA, Hospital System Refunding Revenue Bonds, 5.875% (Appalachian Regional Health Center)/(Original Issue Yield: 5.92%), 10/1/2022 | 1,991,393 | |

| 1,250,000 | Kentucky EDFA, Revenue Bonds (Series 2011A), 7.375% (Miralea)/(Original Issue Yield: 7.40%), 5/15/2046 | 1,414,713 | |

| TOTAL | 3,406,106 | ||

| Louisiana—2.1% | |||

| 1,000,000 | DeSoto Parish, LA Environmental Improvement Authority, Revenue Bonds, Series A, 5.00% (International Paper Co.), 11/1/2018 | 1,063,710 | |

| 1,500,000 | Jefferson Parish, LA Hospital Service District No. 1, Hospital Revenue Refunding Bonds (Series 2011A), 6.00% (West Jefferson Medical Center)/(Original Issue Yield: 6.05%), 1/1/2039 | 1,681,380 | |

| 981,000 | 1,2 | Lakeshore Villages Master Community Development District, LA, Special Assessment Bonds (Series 2007), 5.25% (Original

Issue Yield: 5.378%), 7/1/2017 | 392,547 |

| 1,000,000 | Louisiana Public Facilities Authority, 6.50% (Ochsner Clinic Foundation)/(Original Issue Yield: 6.65%), 5/15/2037 | 1,194,370 | |

| 3,000,000 | Louisiana Public Facilities Authority, Revenue Bonds (Series 2010A), 5.00% (Entergy Gulf States Louisiana LLC), 9/1/2028 | 3,209,190 | |

| 2,000,000 | Louisiana State Citizens Property Insurance Corp., Assessment Revenue Bonds (Series 2006C), 6.125% (Assured Guaranty Corp. INS)/(Original Issue Yield: 6.33%), 6/1/2025 | 2,353,260 |

| Principal Amount | Value | ||

| MUNICIPAL BONDS—continued | |||

| Louisiana—continued | |||

| $1,175,000 | St. Charles Parish, LA Gulf Opportunity Zone, Revenue Bonds (Series 2010), 4.00% TOBs (Valero Energy Corp.), Mandatory Tender 6/1/2022 | $1,260,799 | |

| TOTAL | 11,155,256 | ||

| Maine—0.3% | |||

| 1,335,000 | Maine Health & Higher Educational Facilities Authority, Revenue Bonds (Series 2011), 7.50% (MaineGeneral Medical Center), 7/1/2032 | 1,658,337 | |

| Maryland—1.6% | |||

| 1,555,000 | Baltimore, MD, Special Obligation Revenue Bonds (Series 2008A), 7.00% (East Baltimore Research Park), 9/1/2038 | 1,675,310 | |

| 1,060,000 | Maryland State Economic Development Corp., Port Facilities Refunding Revenue Bonds (Series 2010), 5.75% (CONSOL Energy, Inc.), 9/1/2025 | 1,148,192 | |

| 2,385,000 | Maryland State Economic Development Corp., Revenue Bonds (Series B), 5.75% (Ports America Chesapeake, Inc. )/(Original Issue Yield: 5.875%), 6/1/2035 | 2,604,468 | |

| 395,000 | Maryland State Health & Higher Educational Facilities Authority, Revenue Bonds (Series 2007A), 5.25% (King Farm Presbyterian Retirement Community), 1/1/2027 | 385,646 | |

| 1,100,000 | Maryland State Health & Higher Educational Facilities Authority, Revenue Bonds (Series 2007A), 5.30% (King Farm Presbyterian Retirement Community)/(Original Issue Yield: 5.35%), 1/1/2037 | 1,024,342 | |

| 1,000,000 | Maryland State Health & Higher Educational Facilities Authority, Revenue Bonds (Series 2012), 5.00% (Mercy Medical Center), 7/1/2031 | 1,095,930 | |

| 500,000 | Maryland State IDFA, EDRBs (Series 2005A), 6.00% (Our Lady of Good Counsel High School), 5/1/2035 | 523,865 | |

| TOTAL | 8,457,753 | ||

| Massachusetts—1.4% | |||

| 1,063,562 | Massachusetts Development Finance Agency, Revenue Bonds (Series 2011 A-1), 6.25% (Linden Ponds, Inc.), 11/15/2046 | 791,067 | |

| 56,460 | Massachusetts Development Finance Agency, Revenue Bonds (Series 2011 A-2), 5.50% (Linden Ponds, Inc.), 11/15/2046 | 35,980 | |

| 280,825 | Massachusetts Development Finance Agency, Revenue Bonds (Series 2011B) (Linden Ponds, Inc.), 11/15/2056 | 1,466 | |

| 2,000,000 | Massachusetts Development Finance Agency, Revenue Bonds (Series 2011I), 7.25% (Tufts Medical Center), 1/1/2032 | 2,524,700 | |

| 500,000 | 3,4 | Massachusetts Development Finance Agency, Senior Living Facility Revenue Bonds (Series 2009A), 7.75% (The Groves in Lincoln)/(Original Issue Yield: 7.90%), 6/1/2039 | 260,760 |

| 1,000,000 | 3,4 | Massachusetts Development Finance Agency, Senior Living Facility Revenue Bonds (Series 2009A), 7.875% (The Groves in Lincoln)/(Original Issue Yield: 8.00%), 6/1/2044 | 521,390 |

| Principal Amount | Value | ||

| MUNICIPAL BONDS—continued | |||

| Massachusetts—continued | |||

| $2,000,000 | Massachusetts HEFA, Revenue Bonds (Series 1998D), 5.25% (Jordan Hospital)/(Original Issue Yield: 5.53%), 10/1/2023 | $2,001,300 | |

| 1,000,000 | Massachusetts HEFA, Revenue Bonds (Series 2003E), 6.75% (Jordan Hospital)/(Original Issue Yield: 7.00%), 10/1/2033 | 1,019,020 | |

| TOTAL | 7,155,683 | ||

| Michigan—4.4% | |||

| 1,000,000 | Dearborn, MI Economic Development Corp., Revenue Refunding Bonds, 7.125% (Henry Ford Village)/(Original Issue Yield: 7.25%), 11/15/2043 | 1,042,900 | |

| 1,000,000 | Detroit, MI City School District, School Building & Site Improvement Refunding Bonds (Series 2012A), 5.00% (Q-SBLF GTD), 5/1/2028 | 1,120,330 | |

| 1,000,000 | Detroit, MI City School District, School Building & Site Improvement Refunding Bonds (Series 2012A), 5.00% (Q-SBLF GTD), 5/1/2031 | 1,129,080 | |

| 1,500,000 | Detroit, MI Sewage Disposal System, Revenue Refunding Senior Lien Bonds (Series 2012A), 5.25% (Original Issue Yield: 5.30%), 7/1/2039 | 1,597,095 | |

| 4,000,000 | Detroit, MI Water Supply System, Second Lien Refunding Revenue Bonds (Series 2006C), 5.00% (Assured Guaranty Municipal Corp. INS), 7/1/2033 | 4,191,360 | |

| 1,000,000 | Iron River, MI Hospital Finance Authority, Hospital Revenue & Refunding Bonds (Series 2008), 6.50% (Iron County Community Hospitals, Inc.)/(Original Issue Yield: 6.61%), 5/15/2033 | 1,020,840 | |

| 2,500,000 | Kent Hospital Finance Authority, MI, Revenue Bonds (Series 2005A), 6.25% (Metropolitan Hospital), 7/1/2040 | 2,626,525 | |

| 1,250,000 | Kentwood, MI Public Economic Development Corp., LT Refunding Revenue Bonds (Series 2012), 5.625% (Holland Home Obligated Group)/(Original Issue Yield: 5.65%), 11/15/2041 | 1,286,613 | |

| 3,165,000 | Michigan State HFA, Refunding Revenue Bonds, 5.75% (Henry Ford Health System, MI)/(Original Issue Yield: 6.00%), 11/15/2039 | 3,625,729 | |

| 5,000,000 | Michigan Tobacco Settlement Finance Authority, Tobacco Settlement Asset-Backed Bonds (Series 2007A), 6.00% (Original

Issue Yield: 6.25%), 6/1/2048 | 4,136,600 | |

| 1,500,000 | Plymouth, MI Educational Center Charter School, Public School Academy Revenue Refunding Bonds, Series 2005, 5.625%, 11/1/2035 | 1,453,650 | |

| TOTAL | 23,230,722 | ||

| Minnesota—2.5% | |||

| 1,000,000 | Baytown Township, MN, Lease Revenue Bonds (Series 2008A), 7.00% (St. Croix Preparatory Academy)/(Original Issue Yield: 7.05%), 8/1/2038 | 1,065,760 | |

| 1,300,000 | Meeker County, MN, Gross Revenue Hospital Facilities Bonds (Series 2007), 5.75% (Meeker County Memorial Hospital), 11/1/2037 | 1,377,766 | |

| 1,000,000 | Pine City, MN Lease Revenue, Lease Revenue Bonds (Series 2006A), 6.25% (Lakes International Language Academy), 5/1/2035 | 1,020,190 | |

| 500,000 | Ramsey, MN, Lease Revenue Bonds (Series 2004A), 6.75% (Pact Charter School), 12/1/2033 | 518,355 |

| Principal Amount | Value | ||

| MUNICIPAL BONDS—continued | |||

| Minnesota—continued | |||

| $800,000 | St. Paul, MN Housing & Redevelopment Authority, Refunding Revenue Bonds (Series 2003A), 6.75% (Achieve Language Academy), 12/1/2022 | $808,120 | |

| 1,000,000 | St. Paul, MN Housing & Redevelopment Authority, Refunding Revenue Bonds (Series 2003A), 7.00% (Achieve Language Academy), 12/1/2032 | 1,007,080 | |

| 1,700,000 | St. Paul, MN Housing & Redevelopment Authority, Revenue Bonds (Series 2002B), 7.00% (Upper Landing Project)/(Original

Issue Yield: 7.05%), 3/1/2029 | 1,701,360 | |

| 665,000 | Tobacco Securitization Authority, MN, Minnesota Tobacco Settlement Revenue Bonds (Series 2011B), 5.25% (Original Issue Yield: 5.291%), 3/1/2031 | 750,340 | |

| 1,865,000 | Winona, MN Port Authority, Lease Revenue Bonds (Series 2007A), 6.00% (Bluffview Montessori School Project), 11/1/2027 | 1,878,148 | |

| 2,920,000 | Winona, MN Port Authority, Lease Revenue Bonds (Series 2007A), 6.15% (Bluffview Montessori School Project), 11/1/2037 | 2,935,505 | |

| TOTAL | 13,062,624 | ||

| Mississippi—0.2% | |||

| 945,000 | Warren County, MS Gulf Opportunity Zone, Gulf Opportunity Zone Bonds (Series 2011A), 5.375% (International Paper Co.), 12/1/2035 | 1,028,566 | |

| Missouri—1.8% | |||

| 1,000,000 | Kirkwood, MO IDA, Retirement Community Revenue Bonds (Series 2010A), 8.25% (Aberdeen Heights Project)/(Original Issue Yield: 8.40%), 5/15/2039 | 1,194,300 | |

| 3,000,000 | Kirkwood, MO IDA, Retirement Community Revenue Bonds (Series 2010A), 8.25% (Aberdeen Heights Project)/(Original Issue Yield: 8.50%), 5/15/2045 | 3,576,600 | |

| 3,000,000 | Missouri Development Finance Board, Infrastructure Facilities Revenue Bonds (Series 2005A), 5.00% (Branson, MO), 6/1/2035 | 3,092,190 | |

| 1,000,000 | St. Joseph, MO IDA, Healthcare Revenue Bonds, 7.00% (Living Community St. Joseph Project), 8/15/2032 | 1,013,750 | |

| 500,000 | West Plains, MO IDA, Hospital Revenue Bonds, 6.75% (Ozarks Medical Center)/(Original Issue Yield: 6.78%), 11/15/2024 | 500,690 | |

| TOTAL | 9,377,530 | ||

| Nebraska—0.5% | |||

| 2,500,000 | Central Plains Energy Project, Gas Project Revenue Bonds (Project No. 3) (Series 2012), 5.25% (Goldman Sachs & Co. GTD), 9/1/2037 | 2,664,250 | |

| Nevada—1.4% | |||

| 1,000,000 | Clark County, NV Improvement District, Special Assessment Revenue Refunding Bonds (Series 2006B), 5.30% (Southern Highlands SID No.121-B)/(Original Issue Yield: 5.33%), 12/1/2029 | 889,830 | |

| 4,000,000 | Clark County, NV School District, LT GO Building Bonds (Series 2008A), 5.00%, 6/15/2025 | 4,563,920 |

| Principal Amount | Value | ||

| MUNICIPAL BONDS—continued | |||

| Nevada—continued | |||

| $470,000 | Clark County, NV, Special Assessment Revenue Bonds (Series 2005), 5.00% (Summerlin-Mesa SID No. 151), 8/1/2025 | $375,826 | |

| 470,000 | Las Vegas, NV, Local Improvement Special Assessment Bonds (Series 2004), 6.00% (Providence SID No. 607), 6/1/2019 | 478,751 | |

| 900,000 | North Las Vegas, NV SID No. 60, Subordinate LT Obligation Refunding Bonds (Series 2006B), 5.10% (Aliante SID No. 60), 12/1/2022 | 898,794 | |

| TOTAL | 7,207,121 | ||

| New Jersey—2.1% | |||

| 1,490,000 | New Jersey EDA, Kapkowski Road Landfill Revenue Bonds, 6.50% (New Jersey Metromall Urban Renewal, Inc.)/(Original Issue Yield: 6.55%), 4/1/2018 | 1,654,615 | |

| 1,550,000 | New Jersey EDA, Revenue Bonds (Series 1997A), 5.875% (Host Marriott Corp.), 12/1/2027 | 1,550,217 | |

| 1,000,000 | New Jersey EDA, Special Facilities Revenue Bonds (Series 2000), 7.20% (Continental Airlines, Inc.)/(Original Issue Yield: 7.25%), 11/15/2030 | 1,003,830 | |

| 2,500,000 | New Jersey EDA, Special Facility Revenue Bonds (Series 1999), 5.25% (Continental Airlines, Inc.), 9/15/2029 | 2,544,900 | |

| 141,937 | 1,2 | New Jersey Health Care Facilities Financing Authority, Revenue Bonds, 6.50% (Pascack Valley Hospital Association)/(Original Issue Yield: 6.72%), 7/1/2023 | 2 |

| 2,000,000 | New Jersey Health Care Facilities Financing Authority, Revenue Bonds, 6.625% (Palisades Medical Center)/(Original

Issue Yield: 6.67%), 7/1/2031 | 2,019,180 | |

| 1,000,000 | New Jersey State EDA, Energy Facility Revenue Bonds (Series 2012A), 5.125% (UMM Energy Partners LLC)/(Original Issue Yield: 5.19%), 6/15/2043 | 1,014,150 | |

| 1,200,000 | New Jersey State Transportation Trust Fund Authority, Transportation System Bonds (Series 2011A), 6.00% (New Jersey State), 6/15/2035 | 1,479,384 | |

| TOTAL | 11,266,278 | ||

| New Mexico—0.6% | |||

| 850,000 | Bernalillo County, NM MFH, Refunding Housing Revenue Bonds (Series 2001C), 7.50% (Valencia Retirement)/(SunAmerica, Inc. GTD), 12/1/2021 | 850,289 | |

| 2,240,000 | Dona Ana County, NM, MFH Revenue Bonds (Series 2001A), 7.00% (Montana Meadows Apartments), 12/1/2030 | 2,252,589 | |

| TOTAL | 3,102,878 | ||

| New York—6.1% | |||

| 1,495,000 | Brooklyn Arena Local Development Corporation, NY, Pilot Revenue Bonds (Series 2009), 6.375% (Original Issue Yield: 6.476%), 7/15/2043 | 1,743,559 | |

| 1,285,000 | Hudson Yards Infrastructure Corp. NY, Hudson Yards Senior Revenue Bonds (Series 2012A), 5.75%, 2/15/2047 | 1,507,331 |

| Principal Amount | Value | ||

| MUNICIPAL BONDS—continued | |||

| New York—continued | |||

| $2,000,000 | Nassau County, NY IDA, Continuing Care Retirement Community Fixed Rate Revenue Bonds (Series 2007A), 6.70% (Amsterdam at Harborside), 1/1/2043 | $1,328,760 | |

| 1,000,000 | New York City, NY IDA, Special Facilities Revenue Bonds (Series 2006), 5.125% (Jet Blue Airways Corp.)/(Original Issue Yield: 5.35%), 5/15/2030 | 966,600 | |

| 1,500,000 | New York City, NY IDA, Special Facility Revenue Bonds (Series 2002), 7.625% (British Airways)/(Original Issue Yield: 7.976%), 12/1/2032 | 1,535,520 | |

| 5,500,000 | 2,6 | New York City, NY IDA, Special Facility Revenue Bonds (Series 2005), 8.00% (American Airlines, Inc.)/(Original Issue Yield: 8.095%), 8/1/2028 | 5,776,265 |

| 5,000,000 | New York City, NY Municipal Water Finance Authority, Water and Sewer System Second General Resolution Revenue Bonds (Series 2012AA), 5.00%, 6/15/2034 | 5,771,500 | |

| 1,820,000 | New York City, NY TFA, Future Tax Secured Subordinate Bonds (Series 2011C), 5.50%, 11/1/2035 | 2,197,104 | |

| 2,000,000 | New York Liberty Development Corporation, Liberty Revenue Bonds (Series 2011), 5.75% (4 World Trade Center), 11/15/2051 | 2,366,980 | |

| 1,645,000 | New York Liberty Development Corporation, Revenue Refunding Bonds (Series 2012 Class 2), 5.00% (7 World Trade Center LLC), 9/15/2043 | 1,798,939 | |

| 1,600,000 | New York Liberty Development Corporation, Revenue Refunding Bonds (Series 2012 Class 3), 5.00% (7 World Trade Center LLC), 3/15/2044 | 1,720,560 | |

| 1,120,000 | Newburgh, NY, UT GO Bonds (Series 2012A), 5.25% (Original Issue Yield: 5.40%), 6/15/2029 | 1,128,433 | |

| 1,185,000 | Newburgh, NY, UT GO Bonds (Series 2012A), 5.50%, 6/15/2030 | 1,209,162 | |

| 2,500,000 | Port Authority of New York and New Jersey, Special Project Bonds (Series 8), 6.00% (JFK International Air Terminal LLC)/(Original Issue Yield: 6.15%), 12/1/2042 | 2,897,725 | |

| TOTAL | 31,948,438 | ||

| North Carolina—0.8% | |||

| 2,335,000 | North Carolina Eastern Municipal Power Agency, Power System Revenue Bonds (Series 2009C), 5.00%, 1/1/2026 | 2,642,730 | |

| 500,000 | North Carolina Medical Care Commission, Health Care Facilities Revenue Bonds (Series 2005A), 5.65% (Pennybyrn at Maryfield)/(Original Issue Yield: 5.85%), 10/1/2025 | 485,450 | |

| 1,000,000 | North Carolina Medical Care Commission, Retirement Facilities First Mortgage Revenue Bonds (Series 2011A), 7.75% (Whitestone Project)/(Original Issue Yield: 8.00%), 3/1/2041 | 1,135,160 | |

| TOTAL | 4,263,340 | ||

| Ohio—3.6% | |||

| 2,000,000 | Akron, Bath & Copley, OH Joint Township Hospital District, Hospital Facilities Revenue Bonds (Series 2012), 5.00% (Akron General Health System), 1/1/2031 | 2,106,580 |

| Principal Amount | Value | ||

| MUNICIPAL BONDS—continued | |||

| Ohio—continued | |||

| $2,000,000 | Buckeye Tobacco Settlement Financing Authority, OH, Tobacco Settlement Asset-Backed Bonds (Series 2007A-2), 5.875% (Original Issue Yield: 5.95%), 6/1/2030 | $1,659,780 | |

| 3,655,000 | Buckeye Tobacco Settlement Financing Authority, OH, Tobacco Settlement Asset-Backed Bonds (Series A-2), 6.50%, 6/1/2047 | 3,236,905 | |

| 1,500,000 | Hamilton County, OH, Healthcare Revenue Bonds (Series 2011A), 6.625% (Life Enriching Communities)/(Original Issue Yield: 6.75%), 1/1/2046 | 1,678,425 | |

| 2,000,000 | Lucas County, OH, Revenue Bonds (Series 2011A), 6.00% (ProMedica Healthcare Obligated Group)/(Original Issue Yield: 6.22%), 11/15/2041 | 2,414,980 | |

| 2,910,000 | Ohio State Air Quality Development Authority, Revenue Bonds (Series 2009A), 5.70% (FirstEnergy Solutions Corp.), 8/1/2020 | 3,384,184 | |

| 2,355,000 | Ohio State Higher Educational Facility Commission, Hospital Facilities Revenue Bonds (Series 2010), 5.75% (Summa Health System)/(Original Issue Yield: 5.92%), 11/15/2040 | 2,637,412 | |

| 1,500,000 | Port Authority for Columbiana County, OH, Solid Waste Facility Revenue Bonds (Series 2004A), 7.25% (Apex Environmental LLC)/(Original Issue Yield: 7.30%), 8/1/2034 | 1,132,950 | |

| 750,000 | Southeastern Ohio Port Authority, OH, Hospital Facilities Revenue Refunding & Improvement Bonds (Series 2012), 6.00% (Memorial Health System, OH)/(Original Issue Yield: 6.02%), 12/1/2042 | 792,862 | |

| TOTAL | 19,044,078 | ||

| Oklahoma—0.8% | |||

| 1,000,000 | Oklahoma County, OK Finance Authority, Retirement Facility Revenue Bonds (Series 2005), 6.00% (Concordia Life Care Community)/(Original Issue Yield: 6.15%), 11/15/2038 | 1,018,820 | |

| 1,000,000 | Oklahoma County, OK Finance Authority, Retirement Facility Revenue Bonds (Series 2005), 6.125% (Concordia Life Care Community), 11/15/2025 | 1,036,890 | |

| 2,000,000 | Tulsa, OK Industrial Authority, Senior Living Community Revenue Bonds (Series 2010A), 7.25% (Montereau, Inc.)/(Original

Issue Yield: 7.50%), 11/1/2045 | 2,261,040 | |

| TOTAL | 4,316,750 | ||

| Oregon—0.4% | |||

| 1,000,000 | 3,4 | Cow Creek Band of Umpqua Tribe of Indians, Tax-Exempt Tax Revenue Bonds (Series 2006C), 5.625%, 10/1/2026 | 917,160 |

| 1,000,000 | Yamhill County, OR Hospital Authority, Revenue Bonds, 7.00% (Friendsview Retirement Community)/(United States Treasury PRF 12/1/2013@101)/(Original Issue Yield: 7.125%), 12/1/2034 | 1,092,250 | |

| TOTAL | 2,009,410 | ||

| Pennsylvania—6.0% | |||

| 1,600,000 | 3,4 | Allegheny County, PA IDA, Cargo Facilities Lease Revenue Bonds (Series 1999), 6.625% (AFCO Cargo PIT LLC Project)/(Original Issue Yield: 6.75%), 9/1/2024 | 1,458,672 |

| Principal Amount | Value | ||

| MUNICIPAL BONDS—continued | |||

| Pennsylvania—continued | |||

| $1,120,000 | Allegheny County, PA IDA, Charter School Revenue Bonds (Series 2004A), 7.50% (Propel Schools)/(Original Issue Yield: 7.75%), 12/15/2029 | $1,160,118 | |

| 865,000 | Allegheny County, PA IDA, Environmental Improvement Refunding Revenue Bonds (Series 2005), 5.50% (United States Steel Corp.), 11/1/2016 | 905,162 | |

| 2,000,000 | Allegheny County, PA IDA, Environmental Improvement Revenue Refunding Bonds (Series 2009), 6.875% (United States Steel Corp.), 5/1/2030 | 2,181,140 | |

| 1,715,000 | Allegheny County, PA Port Authority, Special Revenue Transportation Refunding Bonds (Series 2011), 5.75%, 3/1/2029 | 2,043,851 | |

| 1,500,000 | Centre County, PA Hospital Authority, Hospital Revenue Bonds, 6.25% (Mount Nittany Medical Center)/(Assured Guaranty Corp. INS)/(Original Issue Yield: 6.30%), 11/15/2044 | 1,580,520 | |

| 1,500,000 | Chartiers Valley, PA Industrial & Commercial Development Authority, First Mortgage Revenue Refunding Bonds (Series 1999), 6.375% (Asbury Health Center)/(Original Issue Yield: 6.52%), 12/1/2024 | 1,502,070 | |

| 1,500,000 | Chester County, PA IDA, Revenue Bonds (Series 2007A), 6.375% (Avon Grove Charter School)/(Original Issue Yield: 6.45%), 12/15/2037 | 1,560,420 | |

| 1,000,000 | Clairton Municipal Authority, PA, Sewer Revenue Bonds (Series 2012B), 5.00% (Original Issue Yield: 5.05%), 12/1/2042 | 1,020,110 | |

| 3,000,000 | Harrisburg, PA Authority, Water Revenue Refunding Bonds (Series 2008), 5.25% (Original Issue Yield: 5.35%), 7/15/2031 | 2,757,180 | |

| 1,500,000 | Monroe County, PA Hospital Authority, Hospital Revenue Bonds (Series 2007), 5.125% (Pocono Medical Center)/(Original

Issue Yield: 5.20%), 1/1/2037 | 1,553,160 | |

| 4,000,000 | Pennsylvania EDFA, Exempt Facilities Revenue Bonds (Series 2009), 7.00% (Allegheny Energy Supply Company LLC), 7/15/2039 | 4,779,040 | |

| 900,000 | Philadelphia Authority for Industrial Development, Senior Living Revenue Bonds (Series 2005A), 5.625% (PresbyHomes Germantown/Morrisville), 7/1/2035 | 905,400 | |

| 1,000,000 | Philadelphia, PA Authority for Industrial Development, Revenue Bonds (Series 2010), 6.375% (Global Leadership Academy Charter School), 11/15/2040 | 1,076,540 | |

| 705,000 | Philadelphia, PA Authority for Industrial Development, Revenue Bonds (Series 2012), 6.625% (New Foundations Charter School), 12/15/2041 | 766,152 | |

| 1,665,000 | Philadelphia, PA Hospitals & Higher Education Facilities Authority, Hospital Revenue Bonds (Series 2012A), 5.625%

(Temple University Health System Obligated Group)/(Original Issue Yield: 5.875%), 7/1/2042 | 1,746,252 | |

| 2,000,000 | Philadelphia, PA, GO Bonds (Series 2011), 6.50%, 8/1/2041 | 2,439,520 | |

| 1,500,000 | Reading Area Water Authority, PA, Water Revenue Bonds (Series 2011), 5.25% (Original Issue Yield: 5.27%), 12/1/2036 | 1,674,405 |

| Principal Amount | Value | ||

| MUNICIPAL BONDS—continued | |||

| Pennsylvania—continued | |||

| $660,000 | Washington County, PA Redevelopment Authority, Redevelopment Bonds (Series 2006A), 5.45% (Victory Centre Project-Tanger Outlet Development), 7/1/2035 | $675,695 | |

| TOTAL | 31,785,407 | ||

| Puerto Rico—1.4% | |||

| 2,000,000 | Puerto Rico Commonwealth Aqueduct & Sewer Authority, Senior Lien Revenue Bonds (Series 2012A), 5.25% (Original Issue Yield: 5.42%), 7/1/2042 | 2,009,000 | |

| 5,000,000 | Puerto Rico Public Building Authority, Government Facilities Revenue Refunding Bonds (Series 2012U), 5.25% (Commonwealth of Puerto Rico GTD)/(Original Issue Yield: 5.375%), 7/1/2042 | 5,076,400 | |

| TOTAL | 7,085,400 | ||

| Rhode Island—0.9% | |||

| 4,000,000 | Rhode Island State Health and Educational Building Corp., Hospital Financing Revenue Bonds (Series 2009A), 7.00% (Lifespan Obligated Group)/(Assured Guaranty Corp. INS), 5/15/2039 | 4,839,600 | |

| South Carolina—1.4% | |||

| 2,910,235 | Connector 2000 Association, Inc., SC, Capital Appreciation Senior Revenue Bonds (Series 2011A (Original Issue Yield: 6.50%), 1/1/2032 | 210,963 | |

| 4,887,047 | Connector 2000 Association, Inc., SC, Capital Appreciation Senior Revenue Bonds (Series 2011A (Original Issue Yield: 7.00%), 1/1/2042 | 180,772 | |

| 6,509,708 | Connector 2000 Association, Inc., SC, Capital Appreciation Senior Revenue Bonds (Series 2011A (Original Issue Yield: 7.50%), 7/22/2051 | 143,148 | |

| 1,440,000 | Connector 2000 Association, Inc., SC, Capital Appreciation Senior Revenue Bonds (Series 2011A (Original Issue Yield: 8.50%), 1/1/2032 | 64,771 | |

| 4,415,000 | Connector 2000 Association, Inc., SC, Capital Appreciation Senior Revenue Bonds (Series 2011A (Original Issue Yield: 9.00%), 7/22/2051 | 35,232 | |

| 70,394 | Connector 2000 Association, Inc., SC, Capital Appreciation Senior Revenue Bonds (Series 2011A) (Original Issue Yield: 4.75%), 1/1/2016 | 58,426 | |

| 95,235 | Connector 2000 Association, Inc., SC, Capital Appreciation Senior Revenue Bonds (Series 2011A) (Original Issue Yield: 5.00%), 1/1/2017 | 47,616 | |

| 105,248 | Connector 2000 Association, Inc., SC, Capital Appreciation Senior Revenue Bonds (Series 2011A) (Original Issue Yield: 5.50%), 1/1/2018 | 47,360 | |

| 114,579 | Connector 2000 Association, Inc., SC, Capital Appreciation Senior Revenue Bonds (Series 2011A) (Original Issue Yield: 5.75%), 1/1/2019 | 45,829 | |

| 124,628 | Connector 2000 Association, Inc., SC, Capital Appreciation Senior Revenue Bonds (Series 2011A) (Original Issue Yield: 5.75%), 1/1/2020 | 39,878 | |

| 147,824 | Connector 2000 Association, Inc., SC, Capital Appreciation Senior Revenue Bonds (Series 2011A) (Original Issue Yield: 6.00%), 1/1/2021 | 38,431 | |

| 156,322 | Connector 2000 Association, Inc., SC, Capital Appreciation Senior Revenue Bonds (Series 2011A) (Original Issue Yield: 6.00%), 1/1/2022 | 32,824 | |

| 700,000 | Lancaster County, SC, Assessment Revenue Bonds (Series 2006), 5.45% (Sun City Carolina Lakes Improvement District), 12/1/2037 | 670,341 |

| Principal Amount | Value | ||

| MUNICIPAL BONDS—continued | |||

| South Carolina—continued | |||

| $900,000 | Myrtle Beach, SC, Tax Increment Bonds (Series 2006A), 5.25% (Myrtle Beach Air Force Base Redevelopment Project Area)/(Original Issue Yield: 5.27%), 10/1/2026 | $812,565 | |

| 750,000 | Myrtle Beach, SC, Tax Increment Bonds (Series 2006A), 5.30% (Myrtle Beach Air Force Base Redevelopment Project Area)/(Original Issue Yield: 5.325%), 10/1/2035 | 643,125 | |

| 2,000,000 | South Carolina Jobs-EDA, Refunding & Improvement Revenue Bonds (Series 2009), 5.75% (Palmetto Health

Alliance)/(Original Issue Yield: 5.90%), 8/1/2039 | 2,226,180 | |

| 2,000,000 | South Carolina Jobs-EDA, Refunding Revenue Bonds (Series 2003A), 6.25% (Palmetto Health Alliance)/(Original Issue Yield: 6.47%), 8/1/2031 | 2,123,780 | |

| TOTAL | 7,421,241 | ||

| South Dakota—0.5% | |||

| 2,605,000 | Educational Enhancement Funding Corp., SD, Tobacco Revenue Bonds (Series 2002B), 6.50%, 6/1/2032 | 2,683,410 | |

| Tennessee—1.1% | |||

| 1,000,000 | Johnson City, TN Health & Education Facilities Board, Hospital Refunding Bonds (Series 2010A), 5.625% (Mountain States Health Alliance)/(Original Issue Yield: 5.90%), 7/1/2030 | 1,121,870 | |

| 1,500,000 | Johnson City, TN Health & Education Facilities Board, Hospital Revenue Bonds (Series 2010), 6.50% (Mountain States Health Alliance), 7/1/2038 | 1,786,635 | |

| 2,725,000 | Tennessee Energy Acquisition Corp., Gas Revenue Bonds (Series 2006A), 5.25% (Goldman Sachs & Co. GTD), 9/1/2023 | 2,995,211 | |

| TOTAL | 5,903,716 | ||

| Texas—8.9% | |||

| 1,000,000 | Austin, TX Convention Center Enterprises, Inc., Convention Center Hotel Second Tier Revenue Refunding Bonds (Series 2006B), 5.75%, 1/1/2024 | 1,057,110 | |

| 1,000,000 | Austin, TX Convention Center Enterprises, Inc., Convention Center Hotel Second Tier Revenue Refunding Bonds (Series 2006B), 5.75%, 1/1/2034 | 1,023,350 | |

| 2,000,000 | Austin, TX Water and Wastewater System, Revenue Refunding Bonds (Series 2012), 5.00%, 11/15/2042 | 2,318,800 | |

| 755,000 | Bexar County, Health Facilities Development Corp., Revenue Bonds (Series 2010), 6.20% (Army Retirement Residence Foundation), 7/1/2045 | 843,108 | |

| 2,000,000 | Cass County, TX IDC, Environmental Improvement Revenue Bonds (Series 2009A), 9.50% (International Paper Co.), 3/1/2033 | 2,602,460 | |

| 1,000,000 | Central Texas Regional Mobility Authority, Senior Lien Revenue Bonds (Series 2011), 6.00% (Original Issue Yield: 6.13%), 1/1/2041 | 1,162,810 | |

| 1,000,000 | Central Texas Regional Mobility Authority, Senior Lien Revenue Bonds (Series 2011), 6.25% (Original Issue Yield: 6.30%), 1/1/2046 | 1,164,990 |

| Principal Amount | Value | ||

| MUNICIPAL BONDS—continued | |||

| Texas—continued | |||

| $750,000 | Clifton Higher Education Finance Corporation, TX, Education Revenue Bonds (Series 2011), 5.75% (Idea Public Schools)/(Original Issue Yield: 6.00%), 8/15/2041 | $821,933 | |

| 500,000 | Clifton Higher Education Finance Corporation, TX, Education Revenue Bonds (Series 2012), 5.00% (Idea Public Schools ), 8/15/2042 | 522,690 | |

| 2,000,000 | Dallas-Fort Worth, TX International Airport, Joint Revenue Improvement Bonds (Series 2012D), 5.00%, 11/1/2038 | 2,155,300 | |

| 2,000,000 | Dallas-Fort Worth, TX International Airport, Joint Revenue Refunding Bonds (Series 2012B), 5.00%, 11/1/2035 | 2,235,500 | |

| 2,000,000 | Decatur, TX Hospital Authority, Hospital Revenue Bonds (Series 2004A), 7.125% (Wise Regional Health System), 9/1/2034 | 2,130,500 | |

| 2,000,000 | Harris County, TX HFDC, Hospital Revenue Refunding Bonds (Series 2008B), 7.25% (Memorial Hermann Healthcare System)/(Original Issue Yield: 7.30%), 12/1/2035 | 2,497,820 | |

| 765,000 | HFDC of Central Texas, Inc., Retirement Facility Revenue Bonds (Series 2006A), 5.50% (Village at Gleannloch Farms, Inc.), 2/15/2027 | 696,640 | |

| 1,265,000 | HFDC of Central Texas, Inc., Retirement Facility Revenue Bonds (Series 2006A), 5.50% (Village at Gleannloch Farms, Inc.), 2/15/2037 | 1,067,609 | |

| 1,000,000 | HFDC of Central Texas, Inc., Retirement Facility Revenue Bonds (Series 2006A), 5.75% (Legacy at Willow Bend), 11/1/2036 | 1,003,580 | |

| 1,500,000 | Houston, TX Airport System, Special Facilities Revenue & Refunding Bonds (Series 2011), 6.625% (Continental Airlines, Inc.)/(Original Issue Yield: 6.875%), 7/15/2038 | 1,670,565 | |

| 1,000,000 | Houston, TX Airport System, Special Facilities Revenue Bonds (Series 2001), 7.00% (Continental Airlines, Inc.), 7/1/2029 | 1,004,310 | |

| 1,000,000 | Houston, TX Airport System, Subordinate Lien Revenue Refunding Bonds (Series 2012A), 5.00%, 7/1/2032 | 1,113,270 | |

| 535,000 | Houston, TX Higher Education Finance Corp., Education Revenue Bonds (Series 2011A), 6.875% (Cosmos Foundation, Inc.), 5/15/2041 | 651,496 | |

| 2,000,000 | Kerrville, TX HFDC, Hospital Revenue Bonds, 5.375% (Sid Peterson Memorial Hospital), 8/15/2035 | 2,047,680 | |

| 2,000,000 | Love Field Airport Modernization Corporation, TX, Special Facilities Revenue Bonds (Series 2012), 5.00% (Southwest Airlines Co.), 11/1/2028 | 2,145,900 | |

| 2,000,000 | Lufkin, TX HFDC, Revenue Refunding and Improvement Bonds (Series 2009), 6.25% (Memorial Health System of East Texas)/(Original Issue Yield: 6.50%), 2/15/2037 | 2,173,160 | |

| 1,000,000 | Matagorda County, TX Navigation District No. 1, PCRBs (Series 2001A), 6.30% (AEP Texas Central Co.), 11/1/2029 | 1,160,670 | |

| 2,000,000 | North Texas Education Finance Corp., Education Revenue Bonds (Series 2012A), 5.25% (Uplift Education), 12/1/2047 | 2,117,200 | |

| 1,500,000 | North Texas Tollway Authority, Special Projects System Revenue Bonds (Series 2011), 6.00% (North Texas Toll Authority Special Projects System), 9/1/2041 | 1,870,065 |

| Principal Amount | Value | ||

| MUNICIPAL BONDS—continued | |||

| Texas—continued | |||

| $1,000,000 | San Juan Higher Education Finance Authority, TX, Education Revenue Bonds (Series 2010A), 6.70% (Idea Public Schools), 8/15/2040 | $1,157,310 | |

| 2,000,000 | 1,2 | Tarrant County, TX Cultural Education Facilities Finance Corp., Hospital Revenue Bonds (Series 2006), 6.375% (Doctors Hospital)/(Original Issue Yield: 6.60%), 11/1/2036 | 699,580 |

| 200,000 | Tarrant County, TX Cultural Education Facilities Finance Corp., Revenue Bonds, Series 2006A, 6.00% (Northwest Senior Housing Corp. Edgemere Project), 11/15/2026 | 213,732 | |

| 1,150,000 | Tarrant County, TX Cultural Education Facilities Finance Corp., Revenue Bonds, Series 2006A, 6.00% (Northwest Senior Housing Corp. Edgemere Project), 11/15/2036 | 1,222,128 | |

| 2,000,000 | Texas State Public Finance Authority Charter School Finance Corporation, Education Revenue Bonds (Series 2010A), 6.20% (Cosmos Foundation, Inc.), 2/15/2040 | 2,289,520 | |

| 2,000,000 | Travis County, TX HFDC., First Mortgage Revenue Refunding Bonds (Series 2012A), 7.125% (Longhorn Village)/(Original

Issue Yield: 7.40%), 1/1/2046 | 2,095,300 | |

| TOTAL | 46,936,086 | ||

| Utah—0.7% | |||

| 800,000 | Spanish Fork City, UT, Charter School Revenue Bonds (Series 2006), 5.55% (American Leadership Academy), 11/15/2026 | 809,480 | |

| 1,750,000 | Spanish Fork City, UT, Charter School Revenue Bonds (Series 2006), 5.70% (American Leadership Academy), 11/15/2036 | 1,760,868 | |

| 1,315,000 | 3,4 | Utah State Charter School Finance Authority, Charter School Revenue Bonds (Series 2007A), 6.00% (Channing Hall), 7/15/2037 | 1,296,511 |

| TOTAL | 3,866,859 | ||

| Virginia—3.4% | |||

| 555,000 | Broad Street CDA, VA, Revenue Bonds, 7.10% (United States Treasury PRF 6/1/2013@102)/(Original Issue Yield: 7.15%), 6/1/2016 | 591,969 | |

| 800,000 | Broad Street CDA, VA, Revenue Bonds, 7.50% (United States Treasury PRF 6/1/2013@102)/(Original Issue Yield: 7.625%), 6/1/2033 | 855,632 | |

| 1,500,000 | Chesterfield County, VA EDA, Refunding PCRBs (Series 2009A), 5.00% (Virginia Electric & Power Co.), 5/1/2023 | 1,752,690 | |

| 1,380,000 | Mosaic District CDA, VA, Revenue Bonds (Series 2011A), 6.875% (Original Issue Yield: 6.93%), 3/1/2036 | 1,539,197 | |

| 1,500,000 | Peninsula Port Authority, VA, Residential Care Facility Revenue Bonds (Series 2003A), 7.375% (Virginia Baptist Homes Obligated Group)/(United States Treasury PRF 12/1/2013@100)/(Original Issue Yield: 7.625%), 12/1/2032 | 1,631,835 | |

| 1,500,000 | Peninsula Town Center CDA, VA, Special Obligation Bonds (Series 2007), 6.35%, 9/1/2028 | 1,589,970 | |

| 1,000,000 | Peninsula Town Center CDA, VA, Special Obligation Bonds (Series 2007), 6.45%, 9/1/2037 | 1,054,870 |

| Principal Amount | Value | ||

| MUNICIPAL BONDS—continued | |||

| Virginia—continued | |||

| $4,250,000 | Tobacco Settlement Financing Corp., VA, Tobacco Settlement Asset-Backed Bonds (Series 2007B-1), 5.00% (Original Issue Yield: 5.12%), 6/1/2047 | $3,037,517 | |

| 3,000,000 | Virginia Small Business Financing Authority, Senior Lien Revenue Bonds (Series 2012), 5.00% (95 Express Lanes LLC), 1/1/2040 | 3,131,700 | |

| 2,500,000 | Virginia Small Business Financing Authority, Senior Lien Revenue Bonds (Series 2012), 6.00% (Elizabeth River Crossings Opco, LLC), 1/1/2037 | 2,863,625 | |

| TOTAL | 18,049,005 | ||

| Washington—1.1% | |||

| 3,000,000 | Tobacco Settlement Authority, WA, Tobacco Settlement Asset-Backed Revenue Bonds, 6.625% (Original Issue Yield: 6.875%), 6/1/2032 | 3,114,090 | |

| 1,500,000 | 3,4 | Washington State Health Care Facilities Authority, Revenue Bonds (Series 2007A), 6.25% (Virginia Mason Medical Center)/(Original Issue Yield: 6.375%), 8/15/2042 | 1,651,740 |

| 770,000 | Washington State Health Care Facilities Authority, Revenue Bonds (Series 2012), 5.00% (Kadlec Regional Medical Center), 12/1/2042 | 783,067 | |

| TOTAL | 5,548,897 | ||

| West Virginia—0.5% | |||

| 640,000 | Ohio County, WV County Commission, Special District Excise Tax Revenue Refunding & Improvement Bonds (Series 2006A), 5.625% (Fort Henry Economic Opportunity Development District), 3/1/2036 | 671,949 | |

| 1,000,000 | Ohio County, WV County Commission, Tax Increment Revenue Bonds (Series 2005A), 5.625% (Fort Henry Centre Tax Increment Financing District No. 1), 6/1/2034 | 1,016,830 | |

| 1,000,000 | Ohio County, WV County Commission, Tax Increment Revenue Bonds (Series 2007A), 5.85% (Fort Henry Centre Tax Increment Financing District No. 1), 6/1/2034 | 1,032,050 | |

| TOTAL | 2,720,829 | ||

| Wisconsin—2.1% | |||

| 750,000 | Milwaukee, WI Redevelopment Authority, Redevelopment Education Revenue Bonds (Series 2005A), 5.75% (Milwaukee Science Education Consortium, Inc.)/(Original Issue Yield: 5.93%), 8/1/2035 | 750,285 | |

| 5,335,000 | Wisconsin State General Fund Appropriation, Revenue Bonds (Series 2009A), 5.75% (Wisconsin State)/(Original Issue Yield: 5.950%), 5/1/2033 | 6,364,548 | |

| 1,400,000 | Wisconsin State HEFA, Revenue Bonds (Series 2004), 6.125% (Eastcastle Place, Inc.)/(Original Issue Yield: 6.25%), 12/1/2034 | 774,858 | |

| 1,000,000 | Wisconsin State HEFA, Revenue Bonds (Series 2004A), 6.75% (Beaver Dam Community Hospitals, Inc.)/(Original Issue Yield: 6.95%), 8/15/2034 | 1,029,930 | |

| 500,000 | Wisconsin State HEFA, Revenue Bonds, 6.625% (Tomah Memorial Hospital, Inc.)/(United States Treasury PRF 7/1/2013@100)/(Original Issue Yield: 6.875%), 7/1/2028 | 524,825 |

| Principal Amount | Value | ||

| MUNICIPAL BONDS—continued | |||

| Wisconsin—continued | |||

| $1,500,000 | Wisconsin State Public Finance Authority, Senior Airport Facilities Revenue Refunding Bonds (Series 2012B), 5.00% (TrIPs Obligated Group)/(Original Issue Yield: 5.15%), 7/1/2042 | $1,505,100 | |

| TOTAL | 10,949,546 | ||

| TOTAL MUNICIPAL BONDS (IDENTIFIED COST $490,932,362) | 510,380,504 | ||

| CORPORATE BOND—0.5% | |||

| Multi State—0.5% | |||

| 4,000,000 | 3 | Non-Profit Preferred Funding Trust I, Partnership, 9/15/2037 (IDENTIFIED COST $3,989,000) | 2,534,720 |

| SHORT-TERM MUNICIPALS—0.8%7 | |||

| Georgia—0.3% | |||

| 1,900,000 | Monroe County, GA Development Authority, (First Series 2008) Daily VRDNs (Georgia Power Co.), 0.250%, 9/3/2012 | 1,900,000 | |

| Texas—0.5% | |||

| 2,500,000 | Harris County, TX Education Facilities Finance Corp., (Series 2008E) Daily VRDNs (Young Men's Christian Association of the Greater Houston Area)/(JPMorgan Chase Bank, N.A. LOC), 0.190%, 9/3/2012 | 2,500,000 | |

| TOTAL SHORT-TERM MUNICIPALS (AT AMORTIZED COST) | 4,400,000 | ||

| TOTAL MUNICIPAL INVESTMENTS—98.1% (IDENTIFIED COST $499,321,362)8 | 517,315,224 | ||

| OTHER ASSETS AND LIABILITIES - NET—1.9%9 | 10,070,076 | ||

| TOTAL NET ASSETS—100% | $527,385,300 |

| Description | Number of Contracts | Notional Value | Expiration Date | Unrealized Depreciation |

| 1U.S. Treasury Notes, 10-Year Short Futures | 100 | $13,371,875 | December 2012 | $(120,253) |

Liabilities—Net.”

| 1 | Non-income producing security. |

| 2 | Security in default. |

| 3 | Denotes a restricted security that either: (a) cannot be offered for public sale without first being registered, or being able to take advantage of an exemption from registration, under the Securities Act of 1933; or (b) is subject to a contractual restriction on public sales. At August 31, 2012, these restricted securities amounted to $17,767,276, which represented 3.4% of total net assets. |

| 4 | Denotes a restricted security that may be resold without restriction to “qualified institutional buyers” as defined in Rule 144A under the Securities Act of 1933 and that the Fund has determined to be liquid under criteria established by the Fund's Board of Trustees (the “Trustees”). At August 31, 2012, these liquid restricted securities amounted to $15,232,556, which represented 2.9% of total net assets. |

| 5 | Zero coupon bond. |

| 6 | Obligor has filed for bankruptcy protection. |

| 7 | Current rate and next reset date shown for Variable Rate Demand Notes. |

| 8 | The cost of investments for federal tax purposes amounts to $500,992,081. |

| 9 | Assets, other than investments in securities, less liabilities. See Statement of Assets and Liabilities. |

| Valuation Inputs | ||||

| Level 1— Quoted Prices and Investments in Mutual Funds | Level 2— Other Significant Observable Inputs | Level 3— Significant Unobservable Inputs | Total | |

| Debt Securities: | ||||

| Municipal Bonds | $— | $510,380,5041 | $— | $510,380,504 |

| Corporate Bond | — | 2,534,720 | — | 2,534,720 |

| Short-Term Municipals | — | 4,400,000 | — | 4,400,000 |

| TOTAL SECURITIES | $— | $517,315,224 | $— | $517,315,224 |

| OTHER FINANCIAL INSTRUMENTS2 | $(120,253) | $— | $— | $(120,253) |

| 1 | Includes $916,133 of securities transferred from Level 3 to Level 2 because the securities no longer required the use of unobservable inputs in determining their value. Transfer shown represents the value of the securities at the beginning of the period. |

| 2 | Other financial instruments include futures contracts. |

| AMBAC | —American Municipal Bond Assurance Corporation |

| CDA | —Community Development Authority |

| COL | —Collateralized |

| COP | —Certificate of Participation |

| EDA | —Economic Development Authority |

| EDFA | —Economic Development Finance Authority |

| EDRBs | —Economic Development Revenue Bonds |

| GNMA | —Government National Mortgage Association |

| GO | —General Obligation |

| GTD | —Guaranteed |

| HEFA | —Health and Education Facilities Authority |

| HFA | —Housing Finance Authority |

| HFDC | —Health Facility Development Corporation |

| IDA | —Industrial Development Authority |

| IDB | —Industrial Development Bond |

| IDC | —Industrial Development Corporation |

| IDFA | —Industrial Development Finance Authority |

| IDRB | —Industrial Development Revenue Bond |

| INS | —Insured |

| LO | —Limited Obligation |

| LOC | —Letter of Credit |

| LT | —Limited Tax |

| MFH | —Multi-Family Housing |

| PCFA | —Pollution Control Finance Authority |

| PCR | —Pollution Control Revenue |

| PCRBs | —Pollution Control Revenue Bonds |

| PRF | —Pre-refunded |

| Q-SBLF | —Qualified School Bond Loan Fund |

| SFM | —Single Family Mortgage |

| SID | —Special Improvement District |

| TFA | —Transitional Finance Authority |

| TOBs | —Tender Option Bonds |

| UT | —Unlimited Tax |

| VRDNs | —Variable Rate Demand Notes |

| Year Ended August 31 | 2012 | 2011 | 20101 | 2009 | 2008 |

| Net Asset Value, Beginning of Period | $8.21 | $8.59 | $7.76 | $8.72 | $9.58 |

| Income From Investment Operations: | |||||

| Net investment income | 0.42 | 0.45 | 0.49 | 0.49 | 0.50 |

| Net realized and unrealized gain (loss) on investments, futures contracts and swap contracts | 0.74 | (0.36) | 0.83 | (0.96) | (0.86) |

| TOTAL FROM INVESTMENT OPERATIONS | 1.16 | 0.09 | 1.32 | (0.47) | (0.36) |

| Less Distributions: | |||||

| Distributions from net investment income | (0.42) | (0.47) | (0.49) | (0.49) | (0.50) |

| Net Asset Value, End of Period | $8.95 | $8.21 | $8.59 | $7.76 | $8.72 |

| Total Return2 | 14.58% | 1.29% | 17.42% | (4.87)% | (3.86)% |

| Ratios to Average Net Assets: | |||||

| Net expenses | 0.89% | 0.85% | 0.77% | 0.79%3 | 0.81%3,4 |

| Net investment income | 4.88% | 5.57% | 5.93% | 6.65% | 5.50% |

| Expense waiver/reimbursement5 | 0.15% | 0.22% | 0.28% | 0.29% | 0.28% |

| Supplemental Data: | |||||

| Net assets, end of period (000 omitted) | $239,911 | $190,003 | $229,217 | $180,422 | $208,302 |

| Portfolio turnover | 14% | 28% | 18% | 24% | 34% |

| 1 | Beginning with the year ended August 31, 2010, the Fund was audited by KPMG LLP. The previous years were audited by another independent registered public accounting firm. |

| 2 | Based on net asset value, which does not reflect the sales charge, redemption fee or contingent deferred sales charge, if applicable. |

| 3 | The net expense ratio is calculated without reduction for expense offset arrangements. The net expense ratios are 0.79% and 0.81% for the years ended August 31, 2009 and 2008, respectively, after taking into account these expense reductions. |

| 4 | Includes interest and trust expenses related to the Fund's participation in certain inverse floater structures of 0.03% for the year ended August 31, 2008. |

| 5 | This expense decrease is reflected in both the net expense and net investment income ratios shown above. |

| Year Ended August 31 | 2012 | 2011 | 20101 | 2009 | 2008 |

| Net Asset Value, Beginning of Period | $8.21 | $8.59 | $7.75 | $8.71 | $9.57 |

| Income From Investment Operations: | |||||

| Net investment income | 0.36 | 0.41 | 0.44 | 0.45 | 0.44 |

| Net realized and unrealized gain (loss) on investments, futures contracts and swap contracts | 0.74 | (0.38) | 0.82 | (0.97) | (0.87) |

| TOTAL FROM INVESTMENT OPERATIONS | 1.10 | 0.03 | 1.26 | (0.52) | (0.43) |

| Less Distributions: | |||||

| Distributions from net investment income | (0.36) | (0.41) | (0.42) | (0.44) | (0.43) |