UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

Form

(Amendment No. 1)

(Mark One)

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended

or

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number

(Exact Name of Registrant as Specified in Its Charter)

| (State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) |

(Address of Principal Executive Offices, Including Zip Code)

(

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading symbol(s) | Name of Each Exchange on Which Registered |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is

a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨

Indicate by check mark if the registrant

is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act Yes ¨

Indicate by check mark whether the registrant:

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding

12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing

requirements for the past 90 days.

Indicate by check mark whether the registrant

has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding

12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | ||

| x | Smaller reporting company | ||||

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbaney-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

Indicate by check mark whether the registrant

is a shell company (as defined in Rule 12b-2 of the Act). Yes

As of June 30, 2020 (the last business

day of the registrant’s second quarter of fiscal 2020), the aggregate market value of the registrant’s common stock held by

non-affiliates of the registrant was $

As of April 30, 2021, the number of shares of common stock, $0.01 par value, outstanding was shares.

Documents Incorporated by Reference

None.

Table of Contents

2

Explanatory Note

ION Geophysical Corporation (the “Company,” “ION,” “we,” “us,” or “our”) is filing this Amendment No. 1 on Form 10-K/A (“Form 10-K/A”) to amend our Annual Report on Form 10-K for the year ended December 31, 2020, originally filed with the Securities and Exchange Commission (the “SEC”) on February 12, 2021 (the “Original Form 10-K”), to include the information required by Items 10 through 14 of Part III of Form 10-K. This information was previously omitted from the Original Form 10-K in reliance on General Instruction G(3) to Form 10-K, which permits the information in the above referenced items to be incorporated in the Form 10-K by reference from our definitive proxy statement if such definitive proxy statement is filed no later than 120 days after our fiscal year-end. We are filing this Form 10-K/A to provide the information required in Part III of Form 10-K because a definitive proxy statement containing such information will not be filed by the Company within 120 days after the end of the fiscal year covered by the Original Form 10-K. This Form 10-K/A also deletes the incorporation by reference to portions of our definitive proxy statement from the cover page and Items 10 through 14 of Part III of the Original Form 10-K.

Pursuant to the rules of the SEC, Part IV, Item 15 has been amended to contain the currently dated certifications from the Company’s principal executive officer and principal financial officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. The certifications of the Company’s principal executive officer and principal financial officer are attached to this Form 10-K/A as Exhibit 31.3 and Exhibit 31.4, respectively. Because no financial statements have been included in this Form 10-K/A and this Form 10-K/A does not contain or amend any disclosure with respect to Items 307 and 308 of Regulation S-K, paragraphs 3, 4 and 5 of the certifications have been omitted.

Except as described above, this Form 10-K/A does not amend any other information set forth in the Original Form 10-K and we have not updated disclosures included therein to reflect any subsequent events. This Form 10-K/A should be read in conjunction with the Original Form 10-K and with our filings with the SEC subsequent to the Original Form 10-K. All capitalized terms used herein and not otherwise defined shall have the meanings ascribed to them in the Original 10-K.

3

PART III

Item 10. Directors, Executive Officers and Corporate Governance

DIRECTORS

Our Board currently consists of eight members (although as noted above, the holders of our New Notes have the right to appoint an additional two directors, although as of the date hereof they have not exercised that right). The Board is divided into three classes. Members of each class are elected for three-year terms and until their respective successors are duly elected and qualified, unless the director dies, resigns, retires, is disqualified or is removed. Our shareholders elect the directors in a designated class annually. Directors in Class I, which is the class of directors to be elected at the Annual Meeting, will serve on the Board until our annual meeting in 2024 (except in the case of any earlier death, resignation, retirement, disqualification or removal).

The current Class I directors are James M. Lapeyre, Jr. , Christopher T. Usher and Zhang ShaoHua, and their current terms will expire when their successors are elected and qualified at the Annual Meeting. On May 3, 2021, the Board is expected to approve the recommendation of the Governance Committee that Messrs. Lapeyre, Usher and Zhang ShaoHua be nominated to stand for reelection at the Annual Meeting to hold office until our 2024 Annual Meeting and until their successors are elected and qualified.

We have no reason to believe that any of the nominees will be unable or unwilling to serve if elected. However, if any nominee should become unable or unwilling to serve for any reason, proxies may be voted for another person nominated as a substitute by our Board, or our Board may reduce the number of directors.

The biographies of each nominee (each of whom is also a current director) contains information regarding the nominee’s service as a director, business experience, education, director positions and the experiences, qualifications, attributes or skills that caused the Governance Committee and our Board to determine that the person should serve as a director for the Company:

Class I Director—Nominees for Re-Election for Term Expiring In 2024

| JAMES M. LAPEYRE, JR. | Director since 1998 |

Mr. Lapeyre, age 68, served as Chairman of our Board from 1999 until January 1, 2012, and again from January 1, 2013 until present. During 2012, Mr. Robert P. Peebler held the role of Executive Chairman and Mr. Lapeyre served as Lead Independent Director. Mr. Lapeyre has been President and Manager of Laitram L.L.C., a privately-owned, New Orleans-based manufacturer of food processing equipment and modular conveyor belts, and its predecessors, since 1989. Mr. Lapeyre joined our Board when we bought the DigiCOURSE marine positioning products business from Laitram in 1998. Mr. Lapeyre is a member of the Audit, Compensation, Governance and Finance Committees of our Board. He holds a Bachelor of Art degree in history from the University of Texas and Master of Business Administration and Juris Doctorate degrees from Tulane University.

Mr. Lapeyre’s status as a significant shareholder of our Company enables our Board to have direct access to the perspective of our shareholders and ensures that the Board will take into consideration the interests of our shareholders in all Board decisions. In addition, Mr. Lapeyre has extensive knowledge regarding the marine products and technology that we acquired from Laitram in 1998.

| CHRISTOPHER T. USHER | Director since 2019 |

Mr. Usher, age 60, is our President and Chief Executive Officer. Mr. Usher joined ION in November 2012 as the Executive Vice President and Chief Operating Officer, GeoScience Division. Prior to joining our Company, Mr. Usher served as the Senior Vice President, Data Processing, Analysis and Interpretation and Chief Technology Officer (including significant merger and acquisitions responsibility) of Global Geophysical Services, Inc., a NYSE-listed seismic products and services company, since January 2010. Prior to joining Global, Mr. Usher served from October 2005 to January 2010 as Senior Director at Landmark Software and Services (including significant merger and acquisition responsibility), a division of Halliburton Company, an oilfield services company. From 2004 to 2005, he was Senior Corporate Vice President, Integrated Services, at Paradigm Geotechnology, an E&P software company. From 2000 to 2003, Mr. Usher served as President of the global data processing division of Petroleum Geo-Services (PGS), a marine geophysical contracting company. He began his career at Western Geophysical where he served in a number of roles over his 17-year tenure before becoming the Worldwide VP of Technology. Mr. Usher holds a Bachelor of Science degree in geology and geophysics from Yale University.

4

|

ZHANG SHAOHUA |

Director since 2021 |

Mr. Zhang ShaoHua, age 55, has been employed by BGP, the world’s largest land seismic contractor, and its affiliates, in various positions of increasing responsibility since 1991. BGP is a subsidiary of CNPC, China’s largest oil company. Mr. Zhang began his career at BGP in geophysics. From 2001-2018, he held three key technology Director roles running the Acquisition Technical Department, Science and Technology Department, and finally the R&D Center. In 2018, he was promoted to Chief Geophysicist of BGP, and in 2021, was further promoted to General Manager of BGP. He holds a Master’s degree in Geophysical Prospecting from Changchun College of Geology (presently Jilin University) and a Master’s of Business Administration degree from the University of South Alabama.

Mr. Zhang was appointed to our Board of Directors under the terms of the Company’s Investor Rights Agreement with BGP. Under the agreement, further discussed below, BGP is entitled to designate one individual to serve as a member of our Board unless BGP’s ownership of our Common Stock falls below 5%.

Class II Director—Term Expiring In 2022

| DAVID H. BARR | Director since 2010 |

From May 2011 until December 2012, Mr. Barr, age 71, served as the President and Chief Executive Officer of Logan International Inc., a Calgary-based Toronto Stock Exchange (TSX)-listed manufacturer and provider of oilfield tools and services. In 2009, Mr. Barr retired from Baker Hughes Incorporated, an oilfield services and equipment provider, after serving for 36 years in various manufacturing, marketing, engineering and product management functions. At the time of his retirement, Mr. Barr was Group President—Eastern Hemisphere, responsible for all Baker Hughes products and services for Europe, Russia/Caspian, Middle East, Africa and Asia Pacific. From 2007 to 2009, he served as Group President—Completion & Production, and from 2005 to 2007, as Group President—Drilling and Evaluation. Mr. Barr served as President of Baker Atlas, a division of Baker Hughes Inc., from 2000 to 2005, and served as Vice President, Supply Chain Management for the Cameron division of Cameron International Corporation from 1999 to 2000. Prior to 1999, he held positions of increasing responsibility within Baker Hughes Inc. and its affiliates, including Vice President—Business Process Development and various leadership positions with Hughes Tool Company and Hughes Christensen. Mr. Barr initially joined Hughes Tool Company in 1972 after graduating from Texas Tech University with a Bachelor of Science degree in mechanical engineering. He formerly served on the Board of Directors, Compensation Committee, and as Chairman of the Safety and Social Responsibility Committee of Enerplus Corporation (a NYSE- and TSX-listed independent oil and gas exploration and production (“E&P”) company), on the Board of Directors and Compensation Committee of Logan International Inc., and on the Board of Directors and Audit, Remuneration and Governance Committees of Hunting PLC, a London Stock Exchange-listed provider of energy services. Mr. Barr is the chairman of our Compensation Committee and a member of the Governance Committee of our Board.

Mr. Barr’s years of experience in the oilfield equipment and services industry provides a uniquely valuable industry perspective for our Board. While at Baker Hughes, Mr. Barr obtained experience within a wide range of company functions, from engineering to group President. His breadth of experience enables him to better understand and inform the Board regarding a range of issues and decisions involved in the operation of our business, including development of business strategy.

5

|

MICHAEL Y. MCGOVERN |

Director since 2019 |

Mr. McGovern, age 69, joined ION’s Board of Directors in June 2019 and is also a member of the Compensation Committee. He served as Chairman and CEO of Sherwood Energy, LLC, a private company focused on aggregating hydrocarbon reserves through ownership of working interests in oil and natural gas leases until the company sold its assets in 2020. Mr. McGovern serves on the boards of Cactus, Inc. (NYSE: WHD), a manufacturer and designer of wellheads and pressure control equipment; Nuverra Environmental Solutions (NYSE: NES), which provides delivery, recycling and disposal of materials generated in shale oil production; and Superior Energy Services, Inc., a private company that provides specialized oilfield services and equipment. From April of 2016 till June of 2019 he served on the board of Fibrant LLC, a private company that was a manufacturer of Caprolactam. He holds a Bachelor of Science degree in Business from Centenary College of Louisiana.

Mr. McGovern has extensive experience in oil and gas, and has served as a director and as an executive at multiple public and private companies. His energy and technology experience will be especially valuable as we execute on our long-term strategic vision, expand into new markets and continue to lead in delivering tools that empower data-driven decision making.

| S. JAMES NELSON, JR. | Director since 2004 |

Mr. Nelson, age 79, joined our Board in 2004. In 2004, Mr. Nelson retired from Cal Dive International, Inc. (now named Helix Energy Solutions Group, Inc.), a marine contractor and operator of offshore oil and gas properties and production facilities, where he was a founding shareholder, Chief Financial Officer (prior to 2000), Vice Chairman (from 2000 to 2004) and a Director (from 1990 to 2004). From 1985 to 1988, Mr. Nelson was the Senior Vice President and Chief Financial Officer of Diversified Energies, Inc., a NYSE-traded company with $1 billion in annual revenues and the former parent company of Cal Dive. From 1980 to 1985, Mr. Nelson served as Chief Financial Officer of Apache Corporation, an oil and gas E&P company. From 1966 to 1980, Mr. Nelson was employed with Arthur Andersen & Co. where, from 1976 to 1980, he was a partner serving on the firm’s worldwide oil and gas industry team. Mr. Nelson also currently serves on the Board of Directors and Audit Committees of Oil States International, Inc. (a NYSE-listed diversified oilfield services company) and W&T Offshore, Inc. (a NYSE-listed oil and natural gas E&P company), where he was appointed to the Governance Committee in late 2016. From 2010 until October 2012, Mr. Nelson also served on the Board of Directors and Audit and Compensation Committees of the general partner of Genesis Energy LP, an operator of oil and natural gas pipelines and provider of services to refineries and industrial gas users. From 2005 until the Company’s sale in 2008, he served as a member of the Board of Directors, a member of the Compensation Committee and Chair of the Audit Committee of Quintana Maritime, Ltd., a provider of dry bulk cargo shipping services based in Athens, Greece. Mr. Nelson, who is also a Certified Public Accountant, is Chairman of the Audit and Finance Committees of our Board. He holds a Bachelor of Science degree in accounting from Holy Cross College and a Master of Business Administration degree from Harvard University.

Mr. Nelson is an experienced financial leader with the skills necessary to lead our Audit Committee. His service as Chief Financial Officer of Cal Dive International, Inc., Diversified Energies, Inc. and Apache Corporation, as well as his years with Arthur Andersen & Co., make him a valuable asset to ION, both on our Board and as the Chairman of our Audit Committee, particularly with regard to financial and accounting matters. In addition, Mr. Nelson’s service on audit committees of other companies enables Mr. Nelson to remain current on audit committee best practices and current financial reporting developments within the energy industry.

6

Class III Director—Term Expiring In 2023

| JOHN N. SEITZ | Director since 2003 |

Mr. Seitz, age 69, has been Chairman and Chief Executive Officer of GulfSlope Energy, Inc., an OTC-listed independent E&P company exploring for oil and gas using advanced seismic imaging, since 2013. From 1977 to 2003, Mr. Seitz held positions of increasing responsibility at Anadarko Petroleum Company, serving most recently as a Director and as President and Chief Executive Officer. Mr. Seitz has served as a Trustee of the American Geological Institute Foundation. Mr. Seitz currently serves on the Investment Committee for Sheridan Production Company, LLC, a privately held oil & gas company with interests in Texas, Oklahoma and Wyoming. He formerly served on the Board of Directors for Endeavour International, Inc., Constellation Energy Partners LLC, and Gulf United Energy, Inc. Mr. Seitz is chairman of the Governance Committee and a member of the Compensation Committee and the Finance Committee of our Board. Mr. Seitz holds a Bachelor of Science degree in geology from the University of Pittsburgh, a Master of Science degree in geology from Rensselaer Polytechnic Institute and is a Certified Professional Geoscientist in Texas. He also completed the Advanced Management Program at the Wharton School of Business.

Mr. Seitz’ extensive experience as a leader of global E&P companies has proven to be an important resource for our Board when considering industry and customer issues. In addition, Mr. Seitz’ geology background and expertise assists the Board in better understanding industry trends and issues.

| TINA L. WININGER | Director since 2019 |

Ms. Wininger, age 52, joined ION’s Board of Directors in June 2019 and is also a member of the Audit Committee. She is the Vice President, Accounting and Administration at Next Wave Energy Partners, an independent energy company focused on midstream and downstream petrochemical and fuels assets. Since 2010, Ms. Wininger has also served as the CFO, a member of the Board of Directors and Chairman of the Finance committee for The Micah Project, a non-profit organization focused on at-risk young men in Honduras. From 2005 to 2010, Ms. Wininger was the Chief Accounting Officer and Vice President of Accounting of Plains All American Pipeline, a Fortune 100 company listed on the NYSE, which had approximately $25 billion in annual revenues and $4 billion of market cap during her tenure. She also served as their Controller from 2000 to 2005. From 1997 to 2000, Ms. Wininger lived in Venezuela and served as a consultant to Conoco de Venezuela S.A. on their exploration project in La Ceiba. From 1994 to 1997, she was the Controller of Plains Resources Inc., an oil and gas exploration and production company. From 1991 to 1994, she worked at Arthur Andersen & Co. in their oil and gas audit practice in New Orleans and the surrounding areas. She holds a Bachelor of Science degree in Management from Tulane University.

Ms. Wininger is a successful corporate executive with over 20 years’ experience in energy, spanning upstream, midstream and downstream sectors as well as petrochemicals. While her primary responsibility has been public company accounting and reporting, Ms. Wininger has also participated in establishing corporate vision, strategy and goals as a member of senior management, and been instrumental in realizing those goals in various ways including the integration of numerous acquired businesses and related capital raising activities. Ms. Wininger brings a wealth of industry knowledge, financial acumen and management experience to the team.

7

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

Governance Initiatives. ION is committed to excellence in corporate governance and maintains clear practices and policies that promote good corporate governance. We review our governance practices and update them, as appropriate, based upon Delaware law, rules and listing standards of the NYSE, SEC regulations and practices recommended by our outside advisors.

Examples of our corporate governance initiatives include the following:

| • | Seven of our eight Board members are independent of ION and its management. Christopher T. Usher, our President and Chief Executive Officer, is not independent because he is an employee of ION. |

| • | All members of the principal standing committees of our Board—the Audit Committee, the Governance Committee and the Compensation Committee—are independent. |

| • | The independent members of our Board and each of the principal committees of our Board meet regularly without the presence of management. The members of the Audit Committee meet regularly with representatives of our independent registered public accounting firm without the presence of management. The members of the Audit Committee also meet regularly with our Director of Internal Audit without the presence of other members of management. |

| • | Our Audit Committee has at least two members who qualify as a “financial expert” in accordance with Section 407 of the Sarbanes-Oxley Act of 2002. |

| • | The Board has adopted written Corporate Governance Guidelines to assist its members in fulfilling their responsibilities. |

| • | Under our Corporate Governance Guidelines, Board members are required to offer their resignation from the Board if they retire or materially change the position they held when they began serving as a director on the Board. |

| • | We comply with and operate in a manner consistent with regulations prohibiting loans to our directors and executive officers. |

| • | Members of our Disclosure Committee, consisting of management employees and senior finance and accounting employees, must review and confirm they have reviewed all quarterly and annual reports before filing with the SEC. |

| • | We have a dedicated hotline and website available to all employees to report ethics and compliance concerns, anonymously if preferred, including concerns related to accounting, accounting controls, financial reporting and auditing matters. The hotline and website are administered and monitored by an independent hotline monitoring company. The Board has adopted a policy and procedures for the receipt, retention and treatment of complaints and employee concerns received through the hotline or website. The policy is available on our website at https://www.iongeo.com/investor-relations/governance/. |

| • | On an annual basis, each director and each executive officer is obligated to complete a questionnaire that requires disclosure of any transactions with ION in which the director or executive officer, or any member of his or her immediate family, has a direct or indirect material interest. |

| • | We have included as Exhibits 31.1, 31.2, 31.3, and 31.4 to our Annual Report on Form 10-K for the fiscal year ended December 31, 2020, filed with the SEC, certificates of our Chief Executive Officer and Chief Financial Officer, respectively, certifying as to the quality of our public disclosure. In addition, in 2020, we submitted to the NYSE a certificate of our Chief Executive Officer certifying that he is not aware of any violation by ION of the NYSE corporate governance listing standards. |

8

| • | Our internal audit controls function maintains critical oversight over the key areas of our business and financial processes and controls, and provides reports directly to the Audit Committee. |

| • | We have a compensation recoupment (clawback) policy that applies to our current and former executive officers. The policy is available on our website at https://www.iongeo.com/investor-relations/governance/. |

| • | We have stock ownership guidelines for our non-employee directors and senior management. |

| • | Our employment contracts with our Chief Executive Officer and our Chief Financial Officer (these are the only executives who have employment contracts) do not contain a “single-trigger” change of control severance provision or entitle the employee to tax gross-up benefits. |

Majority Voting Procedure for Directors. Our Corporate Governance Guidelines require a mandatory majority voting, director resignation procedure. Any director nominee in an uncontested election who receives a greater number of votes “withheld” from his or her election than votes “for” such election is required to promptly tender to the Board his or her resignation following certification of the shareholder vote. Upon receipt of the resignation, the Governance Committee will consider the resignation offer and recommend to the Board whether to accept it. The Board will act on the Governance Committee’s recommendation within 120 days following certification of the shareholder vote. The Governance Committee and the Board may consider any factors they deem relevant in deciding whether to accept a director’s resignation. Thereafter, the Board will promptly disclose its decision whether to accept the director’s resignation offer (and the reasons for rejecting the resignation offer, if applicable) in a Current Report on Form 8-K furnished to the SEC.

Code of Ethics. We have adopted a Code of Ethics that applies to all members of our Board and all of our employees, including our principal executive officer, principal financial officer, principal accounting officer and all other senior members of our finance and accounting departments. The Code of Ethics requires that our employees avoid conflicts of interest, comply with all laws and other legal requirements, conduct business in an honest and ethical manner, promote full and accurate financial reporting and otherwise act with integrity and in ION’s best interest. Every year our senior management employees and senior finance and accounting employees affirm their compliance with our Code of Ethics and other principal compliance policies. New employees acknowledge receipt and compliance with Company policies through an online onboarding portal, after the employment offer has been accepted.

We have made our Code of Ethics, Corporate Governance Guidelines, charters for the principal standing committees of our Board and other information that may be of interest to investors available on the Investor Relations section of our website at https://www.iongeo.com/investor-relations/governance/. Copies of this information may also be obtained by writing to us at ION Geophysical Corporation, Attention: Corporate Secretary, 2105 CityWest Boulevard, Suite 100, Houston, Texas 77042-2855. Amendments to, or waivers from, our Code of Ethics will also be available on our website and reported as may be required under SEC rules; however, any technical, administrative or other non-substantive amendments to our Code of Ethics may not be posted.

Please note that the preceding Internet address and all other Internet addresses referenced in this Proxy Statement are for information purposes only and are not intended to be a hyperlink. Accordingly, no information found or provided at such Internet addresses or at our website in general is intended or deemed to be incorporated by reference herein.

9

Lead Independent Director. James M. Lapeyre, Jr. serves as our Chairman of the Board. Under NYSE corporate governance listing standards, Mr. Lapeyre has also been designated as our Lead Independent Director and presiding non-management director to lead non-management directors meetings of the Board. Our non-management directors meet at regularly scheduled executive sessions without management, over which Mr. Lapeyre presides. The powers and authority of the Lead Independent Director also include the following:

| • | Advise and consult with the Chief Executive Officer, senior management and the Chairperson of each Committee of the Board, as to the appropriate information, agendas and schedules of Board and Committee meetings; |

| • | Advise and consult with the Chief Executive Officer and senior management as to the quality, quantity and timeliness of the information submitted by the Company’s management to the independent directors; |

| • | Recommend to the Chief Executive Officer and the Board the retention of advisers and consultants to report directly to the Board; |

| • | Call meetings of the Board or executive sessions of the independent directors; |

| • | Develop the agendas for and preside over executive sessions of the Board’s independent directors; |

| • | Serve as principal liaison between the independent directors, and the Chief Executive Officer and senior management, on sensitive issues, including the review and evaluation of the Chief Executive Officer; and |

| • | Coordinate with the independent directors in respect of each of the foregoing. |

Certain of the duties and powers described above are to be conducted in conjunction with our Chairman of the Board if the Lead Independent Director is not also the Chairman of the Board.

Communications to Board and Lead Independent Director. Shareholders and other interested parties may communicate with the Board and our Lead Independent Director or non-management independent directors as a group by writing to “Chairman of the Board” or “Lead Independent Director,” c/o Corporate Secretary, ION Geophysical Corporation, 2105 CityWest Boulevard, Suite 100, Houston, Texas 77042-2855. Inquiries sent by mail will be reviewed by our Corporate Secretary and, if they pertain to the functions of the Board or committees of the Board or if the Corporate Secretary otherwise determines that they should be brought to the intended recipient’s attention, they will be forwarded to the intended recipient. Concerns relating to accounting, internal controls, auditing or compliance matters will be brought to the attention of our Audit Committee and handled in accordance with procedures established by the Audit Committee.

Our Corporate Secretary’s review of these communications will be performed with a view that the integrity of this process be preserved. For example, items that are unrelated to the duties and responsibilities of the Board, such as personal employee complaints, product inquiries, new product suggestions, resumes and other forms of job inquiries, surveys, service or product complaints, requests for donations, business solicitations or advertisements, may not be forwarded to the directors. In addition, material that is considered to be hostile, threatening, illegal or similarly unsuitable may not be forwarded. Except for these types of items, the Corporate Secretary will promptly forward written communications to the intended recipient. Within the above guidelines, the independent directors have granted the Corporate Secretary discretion to decide what correspondence should be shared with ION management and independent directors.

2020 Meetings of the Board and Shareholders. During 2020, the Board held a total of fourteen meetings (including regularly scheduled and special meetings) and the four standing committees of the Board held a total of fourteen meetings. The rate of attendance by our directors at all board meetings and committee meeting (for those committees on which a director served) was 97%. We do not require our Board members to attend our Annual Meeting of Shareholders; however, six out of eight of our directors were present at our Annual Meeting held in May 2020.

Each current director that was on the Board in 2020 attended more than seventy-five percent (75%) of the aggregate of the total number of meetings of the Board, and the total number of meetings held by all committees of the Board on which he or she served.

10

Independence. In determining independence, each year the Board determines whether directors have any “material relationship” with ION. When assessing the “materiality” of a director’s relationship with ION, the Board considers all relevant facts and circumstances, not merely from the director’s standpoint, but from that of the persons or organizations with which the director has an affiliation, and the frequency or regularity of the services, whether the services are being carried out at arm’s length in the ordinary course of business and whether the services are being provided substantially on the same terms to ION as those prevailing at the time from unrelated parties for comparable transactions. Material relationships can include commercial, banking, industrial, consulting, legal, accounting, charitable and familial relationships. Factors that the Board may consider when determining independence for purposes of this determination include (1) not being a current employee of ION or having been employed by ION within the last three years; (2) not having an immediate family member who is, or who has been within the last three years, an executive officer of ION; (3) not personally receiving or having an immediate family member who has received, during any 12-month period within the last three years, more than $120,000 per year in direct compensation from ION other than director and committee fees; (4) not being employed or having an immediate family member employed within the last three years as an executive officer of another company of which any current executive officer of ION serves or has served, at the same time, on that company’s compensation committee; (5) not being an employee of or a current partner of, or having an immediate family member who is a current partner of, a firm that is ION’s internal or external auditor; (6) not having an immediate family member who is a current employee of such an audit firm who personally works on ION’s audit; (7) not being or having an immediate family member who was within the last three years a partner or employee of such an audit firm and who personally worked on ION’s audit within that time; (8) not being a current employee, or having an immediate family member who is a current executive officer, of a company that has made payments to, or received payments from, ION for property or services in an amount that, in any of the last three fiscal years, exceeds the greater of $1 million or 2% of the other company’s consolidated gross revenues; or (9) not being an executive officer of a charitable organization to which, within the preceding three years, ION has made charitable contributions in any single fiscal year that has exceeded the greater of $1 million or 2% of such organization’s consolidated gross revenues.

Our Board has affirmatively determined that, with the exception of Christopher T. Usher, who is our President and Chief Executive Officer and an employee of ION, no director has a material relationship with ION within the meaning of the NYSE’s listing standards, and that each of our directors (other than Mr. Usher) is independent from management and from our independent registered public accounting firm, as required by NYSE listing standard rules regarding director independence.

Our Chairman and Lead Independent Director, Mr. Lapeyre, is an executive officer and significant shareholder of Laitram, L.L.C., a company with which ION has ongoing contractual relationships, and Mr. Lapeyre and Laitram together owned approximately 5.7% of our outstanding Common Stock as of April 30, 2021. Our Board has determined that these contractual relationships have not interfered with Mr. Lapeyre’s demonstrated independence from our management, and that the services performed by Laitram for ION are being provided at arm’s length in the ordinary course of business and substantially on the same terms to ION as those prevailing at the time from unrelated parties for comparable transactions. In addition, the services provided by Laitram to ION resulted in payments by ION to Laitram in an amount less than 1% of Laitram’s 2020 consolidated gross revenues. As a result of these factors, our Board has determined that Mr. Lapeyre, along with each of our other non-management directors, is independent within the meaning of the NYSE’s director independence standards. For an explanation of the contractual relationship between Laitram and ION, please see “—Certain Transactions and Relationships” below.

Our former director, Mr. Huasheng Zheng, was employed as Executive Vice President of BGP during his tenure. His successor, Mr. Zhang ShaoHua, is General Manager of BGP. For an explanation of the relationships between BGP and ION, please see “—Certain Transactions and Relationships” below.

11

Risk Oversight. Our Board oversees an enterprise-wide approach to risk management, designed to support the achievement of organizational objectives, including strategic objectives, to improve long-term organizational performance and enhance shareholder value. A fundamental part of risk management is not only understanding the risks a company faces and what steps management is taking to manage those risks, but also understanding what level of risk is appropriate for the Company. The involvement of the full Board in setting ION’s business strategy is a key part of its assessment of the Company’s appetite for risk and also a determination of what constitutes an appropriate level of risk for the Company. The Board also regularly reviews information regarding the Company’s credit, liquidity and operations, as well as the risks associated with each. While the Board has the ultimate oversight responsibility for the risk management process, various committees of the Board also have responsibility for risk management. In particular, the Audit Committee focuses on financial risk, including internal controls, and receives an annual risk assessment report from ION’s internal auditors. The Audit Committee is also responsible for overseeing cybersecurity-related risks. In addition, in setting compensation, the Compensation Committee strives to create incentives that encourage a level of risk-taking behavior consistent with ION’s business strategies. While each committee is responsible for evaluating certain risks and overseeing the management of such risks, the entire Board is regularly informed through committee reports about such risks.

Board Leadership. Our current Board leadership structure consists of a Chairman of the Board (who is not our current CEO), a Lead Independent Director (who is also our Chairman of the Board) and strong independent committee chairs. The Board believes this structure provides independent Board leadership and engagement and strong independent oversight of management while providing the benefit of having our Chairman and Lead Independent Director lead regular Board meetings as we discuss key business and strategic issues. Mr. Lapeyre, a non-employee independent director, serves as our Chairman of the Board and Lead Independent Director. Mr. Usher has served as our CEO since June 1, 2019. We separate the roles of CEO and Chairman of the Board in recognition of the differences between the two roles. The CEO is responsible for setting the strategic direction for the Company and the day-to-day leadership and performance of the Company, while the Chairman provides guidance to the CEO and sets the agenda for Board meetings and presides over the meetings of the full Board. Separating these positions allows our CEO to focus on our day-to-day business, while allowing the Chairman to lead the Board in its fundamental role of providing advice to, and independent oversight of, management. The Board recognizes the time, effort and energy that the CEO is required to devote to his position, as well as the commitment required to serve as our Chairman. The Board believes that having separate positions is the appropriate leadership structure for our Company at this time and demonstrates our commitment to good corporate governance.

Political Contributions and Lobbying. Our Code of Ethics prohibits company contributions to political candidates or parties. In addition, we do not advertise in or purchase political publications, allow company assets to be used by political parties or candidates, use corporate funds to purchase seats at political fund raising events, or allow company trademarks to be used in political or campaign literature. ION is a member of certain trade associations that may use a portion of their membership dues for lobbying and/or political expenditures.

Committees of the Board

The Board has established four standing committees to facilitate and assist the Board in the execution of its responsibilities. The four standing committees are the Audit Committee, the Compensation Committee, the Governance Committee and the Finance Committee. Each standing committee operates under a written charter, which sets forth the functions and responsibilities of the committee. A copy of the charter for each of the Audit Committee, the Compensation Committee and the Governance Committee can be obtained by writing to us at ION Geophysical Corporation, Attention: Corporate Secretary, 2105 CityWest Boulevard, Suite 100, Houston, Texas 77042-2855 and can also be viewed on our website at https://www.iongeo.com/investor-relations/governance/. The Audit Committee, Compensation Committee, Governance Committee and Finance Committee are composed entirely of non-employee directors. In addition, the Board establishes temporary special committees from time to time on an as-needed basis. During 2020, the Audit Committee met five times, the Compensation Committee met five times, and the Governance Committee met four times. The Finance Committee did not meet.

12

The current members of the four standing committees of the Board are identified below.

| Director | Compensation | Audit Committee | Governance Committee | Finance Committee | ||||

| James M. Lapeyre, Jr. | * | * | * | * | ||||

| David H. Barr | Chair | * | ||||||

| Michael Y. McGovern | * | |||||||

| S. James Nelson, Jr. | Chair | Chair | ||||||

| John N. Seitz | * | Chair | * | |||||

| Christopher T. Usher | ||||||||

| Tina Wininger | * | |||||||

| Zhang ShaoHua |

*Member

Audit Committee

The Audit Committee is a separately-designated standing audit committee as defined in Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Audit Committee oversees matters relating to financial reporting, internal controls, risk management and compliance. These responsibilities include appointing, overseeing, evaluating and approving the fees of our independent auditors, reviewing financial information that is provided to our shareholders and others, reviewing with management our system of internal controls and financial reporting processes, and monitoring our compliance program and system.

The Board has determined that each member of the Audit Committee is financially literate and satisfies the definition of “independent” as established under the NYSE corporate governance listing standards and Rule 10A-3 under the Exchange Act. In addition, the Board has determined that each of Mr. Nelson, the Chairman of the Audit Committee, and Ms. Wininger, is qualified as an audit committee financial expert within the meaning of SEC regulations, and that each has accounting and related financial management expertise within the meaning of the listing standards of the NYSE and Rule 10A-3.

Compensation Committee

General. The Compensation Committee has responsibility for the compensation of our executive officers, including our Chief Executive Officer, and the administration of our executive compensation and benefit plans. The Compensation Committee also has authority to retain or replace outside counsel, compensation and benefits consultants or other experts to provide it with independent advice, including the authority to approve the fees payable and any other terms of retention. All actions regarding named executive officer compensation require Compensation Committee approval. The Compensation Committee completes a comprehensive review of all elements of compensation at least annually. If it is determined that any changes to any executive officer’s total compensation are necessary or appropriate, the Compensation Committee obtains such input from management as it determines to be necessary or appropriate. All compensation decisions with respect to executives other than our Chief Executive Officer are determined in discussion with, and frequently based in part upon the recommendation of, our Chief Executive Officer. The Compensation Committee makes all determinations with respect to the compensation of our Chief Executive Officer, including, but not limited to, establishing performance objectives and criteria related to the payment of his compensation, and determining the extent to which such objectives have been established, obtaining such input from the Compensation Committee’s independent compensation advisors as it deems necessary or appropriate.

13

As part of its responsibility to administer our executive compensation plans and programs, the Compensation Committee, usually near the beginning of the calendar year, establishes the parameters of the annual incentive plan awards, including the performance goals relative to our performance that will be applicable to such awards and the similar awards for our other senior executives. It also reviews our performance against the objectives established for awards payable in respect of the prior calendar year, and confirms the extent, if any, to which such objectives have been obtained, and the amounts payable to each of our executive officers in respect of such achievement.

The Compensation Committee also determines the appropriate level and type of awards, if any, to be granted to each of our executive officers pursuant to our equity compensation plans, and approves the total annual grants to other key employees, to be granted in accordance with a delegation of authority to a corporate human resources officer or other Company officer.

The Compensation Committee reviews, and has the authority to recommend to the Board for adoption, any new executive compensation or benefit plans that are determined to be appropriate for adoption by ION, including those that are not otherwise subject to the approval of our shareholders. It reviews any contracts with current or former elected officers of the corporation. In connection with the review of any such contract, the Compensation Committee may seek from its independent advisors such advice, counsel and information as it determines to be appropriate in the conduct of such review. The Compensation Committee will direct such outside advisors as to the information it requires in connection with any such review, including data regarding competitive practices among the companies with which ION generally compares itself for compensation purposes.

Compensation Committee Interlocks and Insider Participation

The Board has determined that each member of the Compensation Committee satisfies the definition of “independent” as established under the NYSE corporate governance listing standards. No member of the Compensation Committee is, or was during 2020, an officer or employee of ION. Mr. Lapeyre is President and Manager and a significant equity owner of Laitram, L.L.C, which has had a business relationship with ION since 1999. During 2020, the Company paid Laitram and its affiliates $0.7 million, which consisted of manufacturing services and reimbursement of costs. In addition, the Company is currently subleasing approximately 47,800 square feet of office space to Laitram. See “Board of Directors and Corporate Governance — Certain Transactions and Relationships.”

During 2020:

| · | No executive officer of ION served as a member of the compensation committee of another entity, one of whose executive officers served as a director or on the Compensation Committee of ION; and |

| · | No executive officer of ION served as a director of another entity, one of whose executive officers served on the Compensation Committee of ION. |

Governance Committee

The Governance Committee functions as the Board’s nominating and corporate governance committee and advises the Board with regard to matters relating to governance practices and policies, management succession, and composition and operation of the Board and its committees, including reviewing potential candidates for membership on the Board and recommending to the Board nominees for election as directors of ION. In addition, the Governance Committee reviews annually with the full Board and our Chief Executive Officer the succession plans for senior executive officers and makes recommendations to the Board regarding the selection of individuals to occupy these positions. The Board has determined that each member of the Governance Committee satisfies the definition of “independent” as established under the NYSE corporate governance listing standards.

14

In identifying and selecting new director candidates, the Governance Committee considers the Board’s current and anticipated strengths and needs and a candidate’s experience, knowledge, skills, expertise, integrity, diversity, ability to make independent analytical inquiries, understanding of our Company’s business environment, willingness to devote adequate time and effort to Board responsibilities, and other relevant factors. The Governance Committee has not established specific minimum age, education, years of business experience, or specific types of skills for potential director candidates, but, in general, expects that qualified candidates will have ample experience and a proven record of business success and leadership. The Governance Committee also seeks an appropriate balance of experience and expertise in accounting and finance, technology, management, international business, compensation, corporate governance, strategy, industry knowledge and general business matters. In addition, the Governance Committee seeks diversity on our Board, including diversity of experience, professions, skills, geographic representation, and backgrounds. The committee may rely on various sources to identify potential director nominees, including input from directors, management and others the Governance Committee feels are reliable, and professional search firms.

Our Bylaws permit shareholders to nominate individuals for director for consideration at an annual shareholders’ meeting. A proper director nomination may be considered at our 2022 Annual Meeting only if the proposal for nomination is received by ION no later than January 14, 2022. All nominations should be directed to Corporate Secretary, ION Geophysical Corporation, 2105 CityWest Boulevard, Suite 100, Houston, Texas 77042-2855.

The Governance Committee will consider properly submitted recommendations for director nominations made by a shareholder or other sources (including self-nominees) on the same basis as other candidates. For consideration by the Governance Committee, a recommendation of a candidate must be submitted timely and in writing to the Governance Committee in care of our Corporate Secretary at our principal executive offices. The submission must include sufficient details regarding the qualifications of the potential candidate. In general, nominees for election should possess (1) the highest level of integrity and ethical character, (2) strong personal and professional reputation, (3) sound judgment, (4) financial literacy, (5) independence, (6) significant experience and proven superior performance in professional endeavors, (7) an appreciation for Board and team performance, (8) the commitment to devote the time necessary, (9) skills in areas that will benefit the Board and (10) the ability to make a long-term commitment to serve on the Board.

Finance Committee

From time to time, the Finance Committee reviews, with ION management, and has the power and authority to approve on behalf of the Board, ION’s strategies, plans, policies and actions related to corporate finance, including, but not limited to, (a) capital structure plans and strategies and specific equity or debt financings, (b) capital expenditure plans and strategies and specific capital projects, (c) strategic and financial investment plans and strategies and specific investments, (d) cash management plans and strategies and activities relating to cash flow, cash accounts, working capital, cash investments and treasury activities, including the establishment and maintenance of bank, investment and brokerage accounts, (e) financial aspects of insurance and risk management, (f) tax planning and compliance, (g) dividend policy, (h) plans and strategies for managing foreign currency exchange exposure and other exposures to economic risks, including plans and strategies with respect to the use of derivatives, and (i) reviewing and making recommendations to the Board with respect to any proposal by ION to divest any asset, investment, real or personal property, or business interest if such divestiture is required to be approved by the Board. The Finance Committee does not have oversight responsibility with respect to ION’s financial reporting, which is the responsibility of the Audit Committee. The Board has determined that each member of the Finance Committee (including its Chairman) satisfies the definition of “independent” as established under the NYSE corporate governance listing standards.

15

Stock Ownership Requirements

The Board has adopted stock ownership requirements for ION’s directors. The Board adopted these requirements in order to align the economic interests of the directors with those of our shareholders and further focus our emphasis on enhancing shareholder value. Under these requirements, each non-employee director is expected to own at least 7,500 shares of Common Stock, which, at the $2.43 closing price per share of our Common Stock on the NYSE on December 31, 2020 equates to approximately 50% of the $36,800 annual retainer fee we pay to our non-employee directors. Directors have three years to acquire and increase the director’s ownership of ION Common Stock to satisfy the requirements. The stock ownership requirements are subject to modification by the Board in its discretion. The Board has also adopted stock ownership requirements for senior management of ION. See “Executive Compensation—Compensation Discussion and Analysis—Elements of Compensation—Stock Ownership Requirements; Hedging Policy” below.

The Governance Committee and the Board regularly review and evaluate ION’s directors’ compensation program on the basis of current and emerging compensation practices for directors, emerging legal, regulatory and corporate compliance developments and comparisons with director compensation programs of other similarly-situated public companies.

16

EXECUTIVE OFFICERS

Our executive officers are as follows:

| Name | Age | Position with ION | ||

| Christopher T. Usher | 60 | President, Chief Executive Officer and Director | ||

| Michael L. Morrison | 50 | Executive Vice President and Chief Financial Officer | ||

| Dale J. Lambert | 62 | Executive Vice President, E&P Technology & Services | ||

| Matthew Powers | 45 | Executive Vice President, General Counsel and Corporate Secretary | ||

| Sheila M. Rodermund | 59 | Executive Vice President, Operations Optimization | ||

| Scott P. Schwausch | 46 | Vice President, Finance and Corporate Controller | ||

| Kenneth G. Williamson | 58 | Executive Vice President, Innovation and Strategic Marketing |

For a description of the business background of Mr. Usher, please see “Class I – Term Expiring in 2021” above.

Mr. Morrison is our Executive Vice President and Chief Financial Officer. Prior to his appointment as Executive Vice President and Chief Financial Officer, Mr. Morrison exceled in a variety of senior positions in finance and accounting, mostly recently as Vice President of Finance and Treasurer, serving in that role since April 2016. Prior to serving as Vice President of Finance and Treasurer, Mr. Morrison served as Vice President of Finance (May 2013 — April 2016), Vice President and Corporate Controller (January 2007—May 2013), Controller and Director of Accounting (November 2002 — January 2007) and Assistant Corporate Controller (June 2002 — November 2002). Since November 2016, Mr. Morrison has also served on the Board of Directors of INOVA Geophysical Equipment Limited, a joint venture between the Company and BGP, Inc., a subsidiary of China National Petroleum Corporation. Prior to joining the Company in 2002, Mr. Morrison was a Director of Accounting providing transaction support for an energy trading company and held a variety of positions at Deloitte & Touche, LLP, a public accounting firm. Mr. Morrison is a Certified Public Accountant. He is a graduate of Texas A&M University with a Bachelor of Business Administration.

Mr. Lambert is currently our Executive Vice President, E&P Technology & Services, having served in that role since February 2021. Prior to that (including throughout 2020), he was Executive Vice President, Operations Optimization. Mr. Lambert has over 30 years of multi-disciplinary engineering and management experience leading the development and commercialization of multi-million dollar offshore products and systems. He is a significant contributor to ION’s intellectual property portfolio, creating innovative solutions that meet the technical and business challenges of our clients. Mr. Lambert began his career at Thompson Equipment Company, where he held various engineering and management roles spanning a decade that culminated in an EVP position responsible for engineering, sales, marketing and manufacturing. There he was involved in many automation projects involving early implementations of artificial intelligence. Next he became Engineering Manager for DigiCOURSE, which ION acquired in 1998. He held engineering positions with increasing levels of responsibility between 1998-2014 in ION’s marine equipment group, where he oversaw R&D, product design and systems engineering. From 2015-2019, Mr. Lambert served as Senior Vice President and General Manager of ION’s Marine Systems group. In 2020, he was promoted to Executive Vice President of our Operations Optimization group, which includes P&L responsibility for our software and equipment businesses. Mr. Lambert is a graduate of the University of New Orleans with a Master’s in Engineering and Bachelor’s in Electrical Engineering. He is a registered Professional Engineer in both Electrical and Controls Engineering.

17

Mr. Powers joined ION in 2013 as Senior Legal Counsel and held that position until February 2016 when he was promoted to Deputy General Counsel. In September 2017, he was promoted to General Counsel and Corporate Secretary, and was further promoted to Executive Vice President in October 2017. Prior to joining ION, Mr. Powers held a variety of positions in the Houston offices of Mayer Brown LLP (beginning in 2005 and ending in 2012) and Sidley Austin LLP (beginning in 2012 and ending in 2013). Mr. Powers holds a Juris Doctor from the University of Chicago Law School and a Bachelor’s degree in Economics, summa cum laude, from the University of Colorado-Denver. He is licensed to practice in Texas.

Ms. Rodermund joined ION as Chief Digital Officer in November 2019 and was promoted to Executive Vice President, Operations Optimization in February 2021. Between 2005 and 2016, Ms. Rodermund was employed by Halliburton Company. While at Halliburton, Ms. Rodermund served as CIO and Vice President, Information Technology, from 2015 to 2016, and Sr. Director, Information Technology, from 2005 to 2015. Ms. Rodermund was Head of Global Infrastructure at Orica, USA from 2017 to 2019. Ms. Rodermund is a graduate of Texas A&M University - Mays Business School with a degree in Business Administration and Management, General and holds a Masters of Business Administration with Merit degree from the University of Liverpool.

Mr. Schwausch joined ION in 2006 as Assistant Controller and held that position until June 2010 when he became Director of Financial Reporting. In May 2012, he became Controller, Solutions Business Unit, and in May 2013 became Vice President and Corporate Controller. In February 2020, Mr. Schwausch became Vice President, Finance and Corporate Controller. Mr. Schwausch held a variety of positions at Deloitte & Touche, LLP, a public accounting firm, from 2000 until he joined ION. Mr. Schwausch is a Certified Public Accountant and a Certified Management Accountant. He received a Bachelor of Science degree in Accounting from Brigham Young University.

Mr. Williamson is our Executive Vice President, Innovation and Strategic Marketing, having served in that role since February 2021. Prior to that (including throughout 2020), he was Chief Operating Officer, E&P Technology & Services. Mr. Williamson originally joined ION as Vice President of our GeoVentures business unit in September 2006, became a Senior Vice President in January 2007, and became Executive Vice President and Chief Operating Officer, GeoVentures Division, in November 2012 and Executive Vice President and Chief Operating Officer of E&P Technology & Services in February of 2015. Between 1987 and 2006, Mr. Williamson was employed by Western Geophysical, which in 2000 became part of WesternGeco, a seismic solutions and technology subsidiary of Schlumberger, Ltd., a global oilfield and information services company. While at WesternGeco, Mr. Williamson served as Vice President, Marketing from 2001 to 2003, Vice President, Russia and Caspian Region, from 2003 to 2005 and Vice President, Marketing, Sales & Commercialization of WesternGeco’s electromagnetic services and technology division from 2005 to 2006. Mr. Williamson holds a Bachelor of Science degree in Geophysics from Cardiff University in Wales.

18

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires directors and certain officers of ION, and persons who own more than 10% of ION’s Common Stock, to file with the SEC and the NYSE initial statements of beneficial ownership on Form 3 and changes in such ownership on Forms 4 and 5. Based on our review of the copies of such reports, we believe that during 2020 our directors, executive officers and shareholders holding greater than 10% of our outstanding shares complied with all applicable filing requirements under Section 16(a) of the Exchange Act, and that all of their filings were timely made.

19

Item 11. Executive Compensation

COMPENSATION DISCUSSION AND ANALYSIS

This Compensation Discussion and Analysis (this “CD&A”) provides an overview of the Compensation Committee of the Company’s Board of Directors, a discussion of the background and objectives of our compensation programs for our senior executives, and a discussion of all material elements of the compensation of each of the executive officers identified in the following table, whom we refer to as our named executive officers (“NEOs”):

| Name | Title | |

| Christopher T. Usher | President, Chief Executive Officer and Director | |

| Michael L. Morrison | Executive Vice President and Chief Financial Officer (starting February 1, 2020) | |

| Steven A. Bate | Executive Vice President and Chief Financial Officer (until February 1, 2020) | |

| Dale J. Lambert | Executive Vice President, Operations Optimization | |

| Matthew R. Powers | Executive Vice President, General Counsel and Corporate Secretary | |

| Kenneth G. Williamson | Executive Vice President and Chief Operating Officer, E&P Technology & Services |

Executive Summary

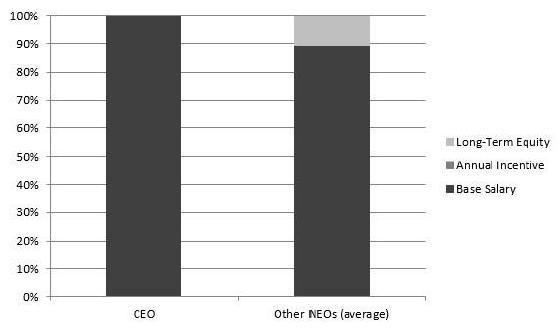

General. Annual compensation of our NEOs comprises three principal elements: base salary; performance-based annual non-equity incentive plan compensation (that is, annual cash bonuses); and long-term equity-based incentive awards (restricted stock, stock options, and cash-settled stock appreciation rights awards (“SARs”)). A significant portion of each NEOs’ total annual compensation is performance-based, at risk, and dependent upon our Company’s achievement of specific, measurable performance goals. Our performance-based pay closely aligns our NEOs’ interests with those of our shareholders and promotes the creation of shareholder value, without encouraging excessive risk-taking. In addition, our equity programs, combined with our executive share ownership requirements, are designed to reward long-term stock performance and encourage investment in the Company.

Annual Bonus Incentive Plan. No NEO received a bonus payment under our annual cash bonus incentive plan for 2020. Mr. Usher and the Compensation Committee felt strongly that the bonus plan pool should not be funded because, while the Company performed well on several strategic initiatives, the Company fell short of its cash-generation objectives, which are of paramount importance.

Base Salaries. Mr. Morrison received an increase in base pay in connection with his promotion to Executive Vice President and Chief Financial Officer in February of 2020; his annual salary increased from $255,393 to $300,000. No other NEO received an increase in base pay in 2020.

In April of 2020, all NEO’s (including Mr. Morrison) took a 20% cut in their annual salaries in light of the extreme market downturn due to the COVID-19 pandemic. These cuts remain in effect and, as of the date of this filing, NEO’s salaries are not scheduled for restoration.

Long-Term Stock-Based Incentive Compensation. Mr. Morrison received a grant of equity-based compensation in 2020, in connection with his promotion to Executive Vice President and Chief Financial Officer, which is described below. No other NEO received equity-based compensation in 2020.

Effect of Restructuring Transactions on Long-Term Equity-Based Incentive Awards. As a result of the consummation of the Restructuring Transactions, on April 19, 2021, the performance-based vesting restrictions (but not the time-based vesting restrictions) were removed from unvested SARs and restricted stock awards held by our NEOs at the time of the transaction. Each NEO, while not required to, waived his right to any removal of the time-based vesting restrictions that otherwise would have occurred as a result of the consummation of the Restructuring Transactions.

Transition of Chief Financial Officer. Mr. Bate served as Executive Vice President and Chief Financial Officer until February 1, 2020. He received certain payments pursuant to a negotiated severance agreement, which are detailed below in this filing.

20

Corporate Governance

Compensation Committee

The Compensation Committee of our Board reviews and approves, or recommends to the Board for approval, all salary and other remuneration for our NEOs, and oversees matters relating to our employee compensation and benefit programs. No member of the Compensation Committee is an employee of ION. The Board has determined that each member of the Compensation Committee satisfies the definition of “independent” as established in the NYSE corporate governance listing standards. In determining the independence of each member of the Compensation Committee, the Board considered all factors specifically relevant to determining whether the director has a relationship to our Company that is material to the director’s ability to be independent from management in the execution of his duties as a Compensation Committee member, including, but not limited to:

| • | the source of compensation of the director (including any consulting, advisory or other compensatory fee paid by us to the director); and |

| • | whether the director is affiliated with our Company, a subsidiary or affiliate. |

When considering the director’s affiliation with us for purposes of independence, the Board considered whether the affiliate relationship places the director under the direct or indirect control of our Company or its senior management, or creates a direct relationship between the director and members of senior management, in each case, of a nature that would impair the director’s ability to make independent judgments about our executive compensation.

The Compensation Committee operates pursuant to a written charter that sets forth its functions and responsibilities. A copy of the charter can be viewed on our website at https://www.iongeo.com/investor-relations/governance/. For a description of the responsibilities of the Compensation Committee, see “Item 1.—Election of Directors—Committees of the Board—Compensation Committee” above.

During 2020, the Compensation Committee met five times and took action by unanimous written consent one time.

Compensation Consultants

The Compensation Committee has the authority to engage and pay compensation consultants, independent legal counsel and other advisors in its discretion. Prior to retaining any such compensation consultant or other advisor, the Compensation Committee evaluates the independence of such advisor and evaluates whether such advisor has a conflict of interest.

Role of Management in Establishing and Awarding Compensation

On an annual basis, our Chief Executive Officer, with input from our Human Resources department, recommends to the Compensation Committee any proposed increases in base salary, bonus payments and equity awards for our NEOs (other than himself; no NEO is involved in determining his own salary increase, bonus payment or equity award). When making officer compensation recommendations, our Chief Executive Officer takes into consideration compensation benchmarks, which include data relating to the compensation of employees at comparable companies, the level of inherent importance and risk associated with the position and function, and the executive’s job performance over the previous year. See “—Objectives of Our Executive Compensation Programs—Benchmarking” and “—Elements of Compensation—Base Salary” below.

Our Chief Executive Officer, with assistance and input from senior management, also formulates and proposes to the Compensation Committee an employee bonus incentive plan for the ensuing year. For a description of our process for formulating the employee bonus incentive plan and the factors that we consider, see “—Elements of Compensation—Bonus Incentive Plan” below.

The Compensation Committee reviews and approves all compensation and awards to NEOs and all bonus incentive plans. With respect to equity compensation awarded to employees other than NEOs, the Compensation Committee reviews and approves all grants of restricted stock and stock options above 5,000 shares, generally based upon the recommendation of the Chief Executive Officer, and has delegated option and restricted stock granting authority to the Chief Executive Officer as permitted under Delaware law for grants to non-NEOs of up to 5,000 shares.

21

Of its own initiative, at least once a year, the Compensation Committee reviews the performance and compensation of our Chief Executive Officer and, following discussions with the Chief Executive Officer and other members of the Board, establishes his compensation level. Where it deems appropriate, the Compensation Committee will also consider market compensation information from independent sources. See “—Objectives of Our Executive Compensation Programs—Benchmarking” below.

Certain members of our senior management attend most meetings of the Compensation Committee, including our Chief Executive Officer and our General Counsel (who serves as meeting secretary). However, no member of management votes on items being considered by the Compensation Committee, and members of management are recused from meetings and portions of meetings where their personal compensation is discussed. The Compensation Committee and Board do solicit the views of our Chief Executive Officer on compensation matters, particularly as they relate to the compensation of the other NEOs and the other members of senior management reporting to the Chief Executive Officer. The Compensation Committee often conducts an executive session during meetings, during which members of management are not present.

Objectives of Our Executive Compensation Programs

General Compensation Philosophy and Policy

Through our compensation programs, we seek to:

| • | attract and retain qualified and productive executive officers and key employees by providing competitive total compensation; |

| • | encourage our executives and key employees to drive the Company’s financial and operational performance; |

| • | structure compensation to create meaningful links between corporate performance, individual performance and financial rewards; |

| • | align the interests of our executives with those of our shareholders by providing a significant portion of total pay in the form of equity-based incentives; |

| • | encourage long-term commitment to our Company; and |

| • | limit corporate perquisites to seek to avoid perceptions both within and outside of our Company of “soft” compensation. |

Our governing principles in establishing executive compensation have been:

Long-Term and At-Risk Focus. Compensation opportunities should be composed of long-term, at-risk pay to focus our management on the long-term interests of our Company.

Equity Orientation. Equity-based plans should comprise a major part of the at-risk portion of total compensation to instill ownership thinking and to link compensation to corporate performance and shareholder interests.

Competitive. We emphasize total compensation opportunities consistent on average with our peer group of companies. Competitiveness of annual base pay and annual bonuses is more independent of stock performance than equity-based compensation. However, overall competitiveness of total compensation is generally contingent on long-term, equity-based compensation programs. Base salary, annual bonuses and employee benefits should be close to competitive levels when compared to similarly situated companies.

Focus on Total Compensation. In making decisions with respect to any element of an NEO’s compensation, the Compensation Committee considers the total compensation that may be awarded to the NEO, including salary, annual cash bonus and long-term equity-based incentive compensation. The Compensation Committee analyzes all of these elements of compensation (including the compensation mix) as well as the aggregate total amount of actual and projected compensation. In its most recent review of total compensation, the Compensation Committee determined that annual compensation amounts for our Chief Executive Officer and our other NEOs remained generally consistent with the Compensation Committee’s expectations. However, the Compensation Committee reserves the right to make changes that it believes are warranted.

Internal Pay Equity. Our core compensation philosophy is to pay our NEOs competitive levels of compensation that best reflect their individual responsibilities and contributions to our Company, while providing incentives to achieve our business and financial objectives. While comparisons to compensation levels at other companies are helpful in assessing the overall competitiveness of our compensation program, we believe that our executive compensation program also must be internally consistent and equitable in order for our Company to achieve our corporate objectives. Over time, there have been variations in the comparative levels of compensation of NEOs and changes in the overall composition of the management team and the overall accountabilities of the individual NEOs; however, we are satisfied that total compensation received by NEOs reflects an appropriate differential for executive compensation.

22

These principles apply to compensation policies for all of our NEOs and key employees. We do not follow the principles in a mechanistic fashion; rather, we apply experience and judgment in determining the appropriate mix of compensation for each individual. This judgment also involves periodic review of discernible measures to determine the progress each individual is making toward agreed-upon goals and objectives.

Benchmarking